UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2013

OR

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number: 001-14625 (Host Hotels & Resorts, Inc.)

0-25087 (Host Hotels & Resorts, L.P.)

HOST HOTELS & RESORTS, INC.

HOST HOTELS & RESORTS, L.P.

(Exact Name of Registrant as Specified in Its Charter)

Maryland (Host Hotels & Resorts, Inc.) Delaware (Host Hotels & Resorts, L.P.) |

| 53-0085950 (Host Hotels & Resorts, Inc.) 52-2095412 (Host Hotels & Resorts, L.P.) |

(State or Other Jurisdiction of Incorporation or Organization) |

| (I.R.S. Employer Identification No.) |

|

| |

6903 Rockledge Drive, Suite 1500 Bethesda, Maryland |

| 20817 |

(Address of Principal Executive Offices) |

| (Zip Code) |

(240) 744-1000

(Registrant’s Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Act:

|

| Title of Each Class |

| Name of Each Exchange on Which Registered |

Host Hotels & Resorts, Inc. |

| Common Stock, $.01 par value (756,740,181 shares outstanding as of February 21, 2014) |

| New York Stock Exchange |

Host Hotels & Resorts, L.P. |

| None |

| None |

Securities registered pursuant to Section 12(g) of the Act:

Host Hotels & Resorts, Inc. |

| None |

Host Hotels & Resorts, L.P. |

| Units of limited partnership interest (750,325,094 units outstanding as of February 21, 2014) |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Host Hotels & Resorts, Inc. |

| Yes x |

| No ¨ |

Host Hotels & Resorts, L.P. |

| Yes ¨ |

| No x |

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Host Hotels & Resorts, Inc. |

| Yes ¨ |

| No x |

Host Hotels & Resorts, L.P. |

| Yes ¨ |

| No x |

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Host Hotels & Resorts, Inc. |

| Yes x |

| No ¨ |

Host Hotels & Resorts, L.P. |

| Yes x |

| No ¨ |

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Host Hotels & Resorts, Inc. |

| Yes x |

| No ¨ |

Host Hotels & Resorts, L.P. |

| Yes x |

| No ¨ |

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Host Hotels & Resorts, Inc.

Large accelerated filer |

| x |

| Accelerated filer |

| ¨ |

|

|

|

| |||

Non-accelerated filer |

| (Do not check if a smaller reporting company) ¨ |

| Smaller reporting company |

| ¨ |

Host Hotels & Resorts, L.P.

Large accelerated filer |

| ¨ |

| Accelerated filer |

| ¨ |

|

|

|

| |||

Non-accelerated filer |

| (Do not check if a smaller reporting company) x |

| Smaller reporting company |

| ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Host Hotels & Resorts, Inc. |

| Yes ¨ |

| No x |

Host Hotels & Resorts, L.P. |

| Yes ¨ |

| No x |

The aggregate market value of common shares held by non-affiliates of Host Hotels & Resorts, Inc. (based on the closing sale price on the New York Stock Exchange) on June 28, 2013 was $12,310,903,149.

Documents Incorporated by Reference

Portions of Host Hotels & Resorts, Inc.’s definitive proxy statement to be filed with the Securities and Exchange Commission and delivered to stockholders in connection with its annual meeting of stockholders to be held on May 14, 2014 are incorporated by reference into Part III of this Form 10-K.

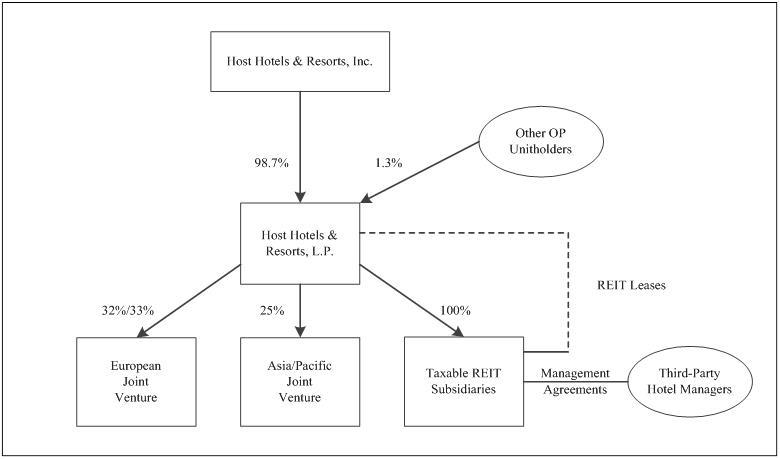

EXPLANATORY NOTE

This report combines the annual reports on Form 10-K for the fiscal year ended December 31, 2013 of Host Hotels & Resorts, Inc. and Host Hotels & Resorts, L.P. Unless stated otherwise or the context otherwise requires, references to “Host Inc.” mean Host Hotels & Resorts, Inc., a Maryland corporation, and references to “Host L.P.” mean Host Hotels & Resorts, L.P., a Delaware limited partnership, and its consolidated subsidiaries. We use the terms “we” or “our” or “the company” to refer to Host Inc. and Host L.P. together, unless the context indicates otherwise. We use the term Host Inc. to specifically refer to Host Hotels & Resorts, Inc. and the term Host L.P. to specifically refer to Host Hotels & Resorts, L.P. (and its consolidated subsidiaries) in cases where it is important to distinguish between Host Inc. and Host L.P. Host Inc. owns properties and conducts operations through Host L.P., of which Host Inc. is the sole general partner and of which it holds approximately 98.7% of the partnership interests (“OP units”) as of December 31, 2013. The remaining approximate 1.3% partnership interests are owned by various unaffiliated limited partners. As the sole general partner of Host L.P., Host Inc. has the exclusive and complete responsibility for Host L.P.’s day-to-day management and control.

We believe combining the annual reports on Form 10-K of Host Inc. and Host L.P. into this single report results in the following benefits:

— | enhances investors’ understanding of Host Inc. and Host L.P. by enabling investors to view the business as a whole in the same manner as management views and operates the business; |

— | eliminates duplicative disclosure and provides a more streamlined presentation, since a substantial portion of our disclosure applies to both Host Inc. and Host L.P.; and |

— | creates time and cost efficiencies through the preparation of one combined report instead of two separate reports. |

Management operates Host Inc. and Host L.P. as one enterprise. The management of Host Inc. consists of the same members who direct the management of Host L.P. The executive officers of Host Inc. are appointed by Host Inc.’s board of directors, but are employed by Host L.P. Host L.P. employs everyone who works for Host Inc. or Host L.P. As general partner with control of Host L.P., Host Inc. consolidates Host L.P. for financial reporting purposes, and Host Inc. does not have significant assets other than its investment in Host L.P. Therefore, the assets and liabilities of Host Inc. and Host L.P. are the same on their respective financial statements.

There are a few differences between Host Inc. and Host L.P., which are reflected in the disclosure in this report. We believe it is important to understand the differences between Host Inc. and Host L.P. in the context of how Host Inc. and Host L.P. operate as an interrelated consolidated company. Host Inc. is a real estate investment trust, or REIT, and its only material asset is its ownership of partnership interests of Host L.P. As a result, Host Inc. does not conduct business itself, other than acting as the sole general partner of Host L.P., and issuing public equity from time to time, the proceeds from which are contributed to Host L.P. in exchange for OP units. Host Inc. itself does not issue any indebtedness and does not guarantee the debt or obligations of Host L.P. Host L.P. holds substantially all of our assets and holds the ownership interests in our joint ventures. Host L.P. conducts the operations of the business and is structured as a limited partnership with no publicly traded equity. Except for net proceeds from public equity issuances by Host Inc., Host L.P. generates the capital required by our business through Host L.P.’s operations, by Host L.P.’s direct or indirect incurrence of indebtedness, or through the issuance of OP units.

The substantive difference between the filings of Host Inc. and Host L.P. is that Host Inc. is a REIT with public stock, while Host L.P. is a partnership with no publicly traded equity. In the financial statements, this difference primarily is reflected in the equity (or partners’ capital for Host L.P.) section of the consolidated balance sheets and in the consolidated statements of equity (or partners’ capital) and in the consolidated statements of operations and comprehensive income (loss) with respect to the manner in which income is allocated to non-controlling interests. Income allocable to the holders of approximately 1.3% of the OP units is reflected as income allocable to non-controlling interests at Host Inc. and within net income at Host L.P. Also, earnings per share generally will be slightly less than the earnings per OP unit, as each Host Inc. common share is the equivalent of .97895 OP units (instead of 1 OP unit). Apart from these differences, the financial statements of Host Inc. and Host L.P. are nearly identical.

i

To help investors understand the differences between Host Inc. and Host L.P., this report presents the following separate sections or portions of sections for each of Host Inc. and Host L.P.:

— | Part II Item 5 - Market for Registrant’s Common Stock, Related Stockholder Matters and Issuer Purchases of Equity Securities for Host Inc. / Market for Registrant’s Common Units, Related Unitholder Matters and Issuer Purchases of Equity Securities for Host L.P.; |

— | Part II Item 6 - Selected Financial Data; |

— | Part II Item 7 - Management’s Discussion and Analysis of Financial Condition and Results of Operations is combined, except for a separate discussion of material differences, if any, in the liquidity and capital resources between Host Inc. and Host L.P.; |

— | Part II Item 7A - Quantitative and Qualitative Disclosures about Market Risk is combined, except for separate discussions of material differences, if any, between Host Inc. and Host L.P.; and |

— | Part II Item 8 - Consolidated Financial Statements and Supplementary Data. While the financial statements themselves are presented separately, the notes to the financial statements generally are combined, except for separate discussions of differences between equity of Host Inc. and capital of Host L.P. |

This report also includes separate Item 9A. Controls and Procedures sections and separate Exhibit 31 and 32 certifications for each of Host Inc. and Host L.P. in order to establish that the Chief Executive Officer and the Chief Financial Officer of Host Inc. and the Chief Executive Officer and the Chief Financial Officer of Host Inc. as the general partner of Host L.P. have made the requisite certifications and that Host Inc. and Host L.P. are compliant with Rule 13a-15 or Rule 15d-15 of the Securities Exchange Act of 1934 and 18 U.S.C. §1350.

ii

HOST HOTELS & RESORTS, INC. AND HOST HOTELS & RESORTS, L.P.

|

| Page |

|

|

|

| Part I |

|

|

|

|

Item 1. | 1 | |

Item 1A. | 16 | |

Item 1B. | 30 | |

Item 2. | 30 | |

Item 3. | 30 | |

Item 4. | 30 | |

|

|

|

| Part II |

|

|

|

|

Item 5. | 32 | |

| 34 | |

Item 6. | 35 | |

| 36 | |

Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 37 |

Item 7A. | 84 | |

Item 8. | 88 | |

Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 137 |

Item 9A. | 137 | |

Item 9B. | 137 | |

|

|

|

| Part III |

|

|

|

|

Item 10. | 138 | |

Item 11. | 138 | |

Item 12. | 138 | |

Item 13. | Certain Relationships and Related Transactions, and Director Independence | 138 |

Item 14. | 138 | |

|

|

|

| Part IV |

|

|

|

|

Item 15. | 139 |

iii

PART I

Forward Looking Statements

Our disclosure and analysis in this 2013 Form 10-K and in Host Inc.’s 2013 Annual Report to stockholders contain some forward-looking statements that set forth anticipated results based on management’s plans and assumptions. From time to time, we also provide forward-looking statements in other materials we release to the public. Such statements give our current expectations or forecasts of future events; they do not relate strictly to historical or current facts. We have tried, wherever possible, to identify each such statement by using words such as “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,” “believe,” “will,” “target,” “forecast” and similar expressions in connection with any discussion of future operating or financial performance. In particular, these forward-looking statements include those relating to future actions, future acquisitions or dispositions, future capital expenditure plans, future performance or results of current and anticipated expenses, interest rates, foreign exchange rates or the outcome of contingencies, such as legal proceedings.

We cannot guarantee that any future results discussed in any forward-looking statements will be realized, although we believe that we have been prudent in our plans and assumptions. Achievement of future results is subject to risks, uncertainties and potentially inaccurate assumptions, including those discussed in Item 1A “Risk Factors.” Should known or unknown risks or uncertainties materialize, or should underlying assumptions prove inaccurate, actual results could differ materially from past results and those results anticipated, estimated or projected. You should bear this in mind as you consider forward-looking statements.

We undertake no obligation to publicly update forward-looking statements, whether as a result of new information, future events or otherwise. You are advised, however, to consult any further disclosures we make or related subjects in our reports on Form 10-Q and Form 8-K that we file with the Securities and Exchange Commission (“SEC”). Also note that, in our risk factors, we provide a cautionary discussion of risks, uncertainties and possibly inaccurate assumptions relevant to our business. These are factors that, individually or in the aggregate, we believe could cause our actual results to differ materially from past results and those results anticipated, estimated or projected. We note these factors for investors as permitted by the Private Securities Litigation Reform Act of 1995. It is not possible to predict or identify all such risk factors. Consequently, you should not consider the discussion of risk factors to be a complete discussion of all of the potential risks or uncertainties that could affect our business.

Host Inc. was incorporated as a Maryland corporation in 1998 and operates as a self-managed and self-administered REIT. Host Inc. owns properties and conducts operations through Host L.P., of which Host Inc. is the sole general partner and in which it holds approximately 98.7% of the partnership interests (“OP units”) as of December 31, 2013. The remaining partnership interests are owned by various unaffiliated limited partners. Host Inc. has the exclusive and complete responsibility for Host L.P.’s day-to-day management and control.

As of February 14, 2014, our consolidated lodging portfolio consists of 114 primarily luxury and upper-upscale hotels containing approximately 60,000 rooms, with the majority located in the United States, and with 15 of the properties located outside of the U.S. in Canada, New Zealand, Chile, Australia, Mexico and Brazil. We also are developing two hotels in Rio de Janeiro, Brazil. In addition, we own non-controlling interests in two international joint ventures: a joint venture in Europe, which owns 19 luxury and upper upscale hotels with approximately 6,400 rooms in France, Italy, Spain, The Netherlands, the United Kingdom, Belgium, Poland, Germany and Sweden; and a joint venture in Asia/Pacific, which owns one upscale hotel in Australia and minority interests in two operating hotels, one upscale and one midscale, in India and five additional hotels in India currently under development. We also hold non-controlling investments in the 255-room Hyatt Place Nashville Downtown in Tennessee, a 131–unit vacation ownership project under development adjacent to our Hyatt Regency Maui Resort & Spa and the Philadelphia Marriott Downtown in which we sold an 89% ownership interest in January 2014.

The Lodging Industry

The lodging industry in the United States consists of private and public entities that operate in an extremely diversified market under a variety of brand names. The lodging industry has several key participants:

— | Owners—own the hotel and typically enter into an agreement for an independent third party to manage the hotel. These properties may be branded and operated under the manager’s brand or branded under a franchise agreement and operated by the franchisee or by an independent hotel manager. The properties also may be operated as an independent hotel by an independent hotel manager. |

— | Owner/Managers—own the hotel and operate the property with their own management team. These properties may be branded under a franchise agreement, operated as an independent hotel or operated under the owner’s brand. We are prohibited from operating and managing hotels under applicable REIT rules. |

1

— | Franchisors—own a brand or brands and strive to grow their revenues by expanding the number of hotels in their franchise system. Franchisors provide their hotels with brand recognition, marketing support and centralized reservation systems for the franchised hotels. |

— | Franchisor/Managers—own a brand or brands and also operate hotels on behalf of the hotel owner or franchisee. |

— | Managers—operate hotels on behalf of the hotel owner, but do not, themselves, own a brand. The hotels may be operated under a franchise agreement or as an independent hotel. |

The hotel manager is responsible for the day-to-day operation of the hotel, including the employment of hotel staff, the determination of room rates, the development of sales and marketing plans, the preparation of operating and capital expenditure budgets and the preparation of financial reports for the owner. They typically receive fees based on the revenues and profitability of the hotel.

The lodging industry is viewed as consisting of six different segments, each of which caters to a discrete set of customer tastes and needs: luxury, upper upscale, upscale, midscale (with and without food and beverage service) and economy. Our portfolio primarily consists of luxury and upper upscale properties that are located in the central business districts of major cities, near airports and resort/conference destinations, which are operated under internationally recognized brand names such as Marriott, Hyatt, Starwood and Accor (see – “Our Hotel Portfolio”). Revenues earned at our hotels consist of three broad categories: rooms, food and beverage, and other revenues. While approximately 65% of our revenue is generated from room sales, many of our properties feature a variety of amenities that help drive demand and profitability. Our hotels typically include meeting and banquet facilities, a variety of restaurants and lounges, swimming pools, exercise facilities and/or spas, gift shops and parking facilities, the combination of which enable them to serve business, leisure and group travelers.

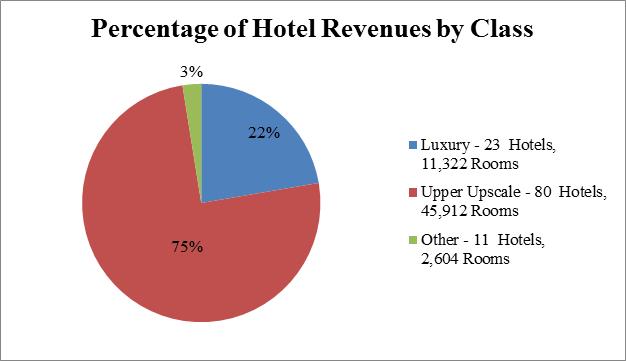

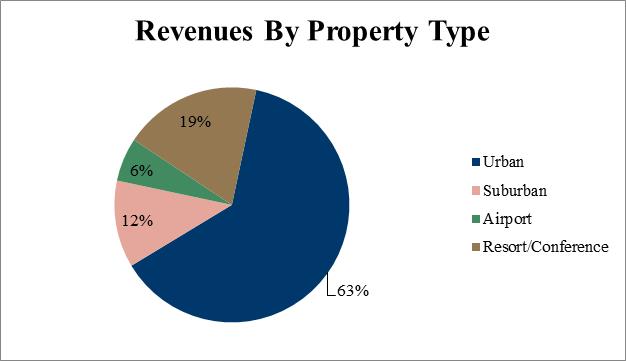

The following graphs summarize the composition of the 114 hotels in our consolidated portfolio based on the percentage of revenues represented by our luxury, upper upscale and other categories and by property type:

2

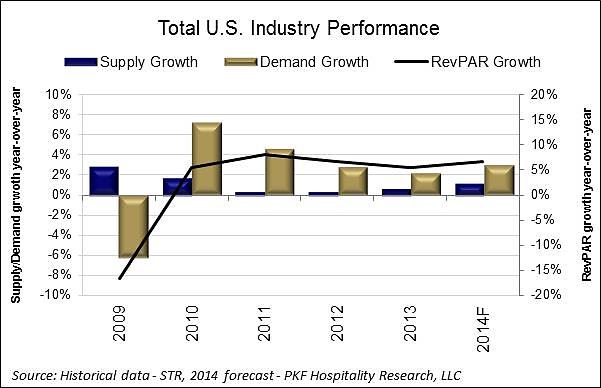

Our industry is influenced by the cyclical relationship between the supply of and demand for hotel rooms. Lodging demand growth typically is related to the vitality of the overall economy, in addition to local market factors that stimulate travel to specific destinations. In particular, economic indicators such as GDP growth, business investment and employment growth are some of the primary drivers of lodging demand. The global recession of 2008 and 2009 resulted in a considerable decline both in consumer and business spending and a severe decline in demand within the lodging industry. Beginning in 2010, as economic conditions gradually have stabilized and strengthened, lodging demand has improved steadily, driven by moderate GDP growth in the U.S. coupled with increasing business investment. The primary demand driver has been transient demand from business and leisure travelers and, to a much lesser degree, group business. We expect demand to continue to improve in 2014, as the potential for growth in group business, and expected continued growth in transient business, could lead to further RevPAR improvements. However, several economic headwinds may hamper lodging demand, including the expected tapering of the U.S. federal reserve bond-buying program known as quantitative easing, the tenuous nature of the Euro Zone recovery, the slow-down in growth in China and general instability in emerging markets.

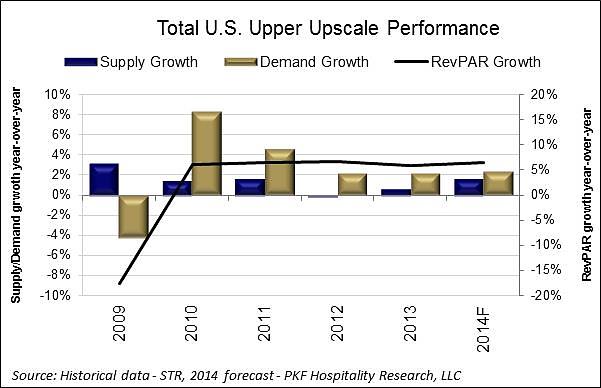

Lodging supply growth generally is driven by overall lodging demand, as extended periods of strong demand growth tend to encourage new development. However, the rate of supply growth also is influenced by a number of additional factors, including the availability of capital, interest rates, construction costs and unique market considerations. The relatively long lead-time required to complete the development of hotels makes supply growth easier to forecast than demand growth, but increases the volatility of the cyclical behavior of the lodging industry. As illustrated in the charts below for the U.S. lodging industry, at different points in the cycle, demand may increase when there is no new supply or supply may grow when demand is declining. The decline in lodging demand during the recession of 2008 through 2009 and the lack of available financing for new hotel construction caused a significant reduction in hotel development. As a result, supply growth was relatively low in 2010 through 2013. Overall, we expect domestic supply growth to remain constrained in 2014, at approximately 1.5%, which still is below the historical average of approximately 2%. Additionally, we believe that the average supply growth for upper upscale hotels in our markets will be approximately 0.9% in 2014. However, New York City and Washington, D.C. are expected to experience above average growth in supply, which will increase competition in these markets.

We anticipate that demand growth will exceed supply growth in the near term, resulting in continued growth in revenue per available room (“RevPAR”), which is consistent with analysis prepared by PKF Hospitality Research. RevPAR is a commonly used operational measure of hotel performance in the lodging industry calculated as the product of average room rate and occupancy percentage. Occupancy levels in the upper-upscale market currently are above their 15-year average. Therefore, while there is potential for occupancy growth, we believe RevPAR growth primarily will be driven by increases in average room rate. However, there can be no assurance that any increases in hotel revenues or earnings at our properties or improvement in margins will continue for any number of reasons, including those discussed above.

3

Our portfolio primarily consists of upper upscale hotels and, accordingly, its performance is best understood in comparison to the upper upscale segment rather than the entire industry. The charts below detail the historical supply, demand and RevPAR growth for the U.S. lodging industry and for the U.S. upper upscale segment for 2009 to 2013 and forecast data for 2014:

U.S. Lodging Industry Supply, Demand and RevPAR Growth

U.S. Upper Upscale Supply, Demand and RevPAR Growth

Business Strategy

Our primary long-term business objective is to provide superior total returns to our equity holders through a combination of appreciation in asset values, growth in earnings and dividend distributions. To achieve this objective, we seek to:

— | drive operating results at our properties through aggressive asset management; |

— | acquire properties in urban and resort/conference destinations. We will continue to focus on target markets in gateway domestic cities such as New York, Washington, D.C., Boston, Miami, Chicago, Los Angeles, San Francisco, San Diego, Seattle and Hawaii and international cities, such as London, Paris, Munich, Berlin, Madrid, Barcelona, Stockholm, |

4

Sydney, Tokyo, Rio de Janeiro, São Paulo and Mexico City, which we believe have strong demand generators that appeal to multiple customer segments and have high barriers to entry that limit new supply. While our focus will remain primarily on luxury and upper upscale properties, we will remain opportunistic and may acquire or develop hotels in other lodging segments or markets; |

— | wherever possible, match each property with the appropriate manager and brand affiliation. For the majority of our portfolio, we seek properties that are franchised or operated by leading management companies as we believe their wide-spread brand recognition and brand loyalty programs can maximize demand. We will also look for opportunities to enhance flexibility in our management agreements which can increase the market value of the property; |

— | strategically invest in major redevelopment and return on investment (“ROI”) projects in order to maximize the inherent value in our portfolio; |

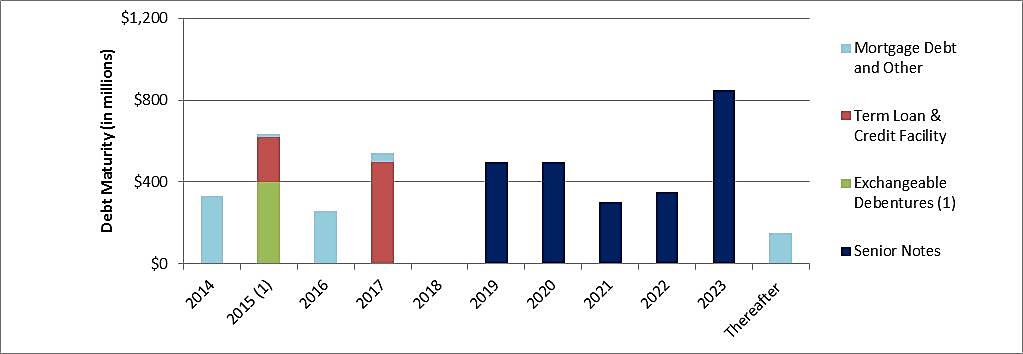

— | maintain a strong balance sheet with a low leverage level and balanced debt maturities in order to minimize our cost of capital and to maximize our financial flexibility in order to take advantage of opportunities throughout the lodging cycle; |

— | expand our global portfolio holdings and revenue sources through joint ventures or direct acquisitions that diversify our investments; and |

— | recycle capital through the disposition of assets to better align our portfolio within our target gateway markets. We also may opportunistically dispose of hotels to take advantage of market conditions or in situations where the hotels are at a competitive risk. |

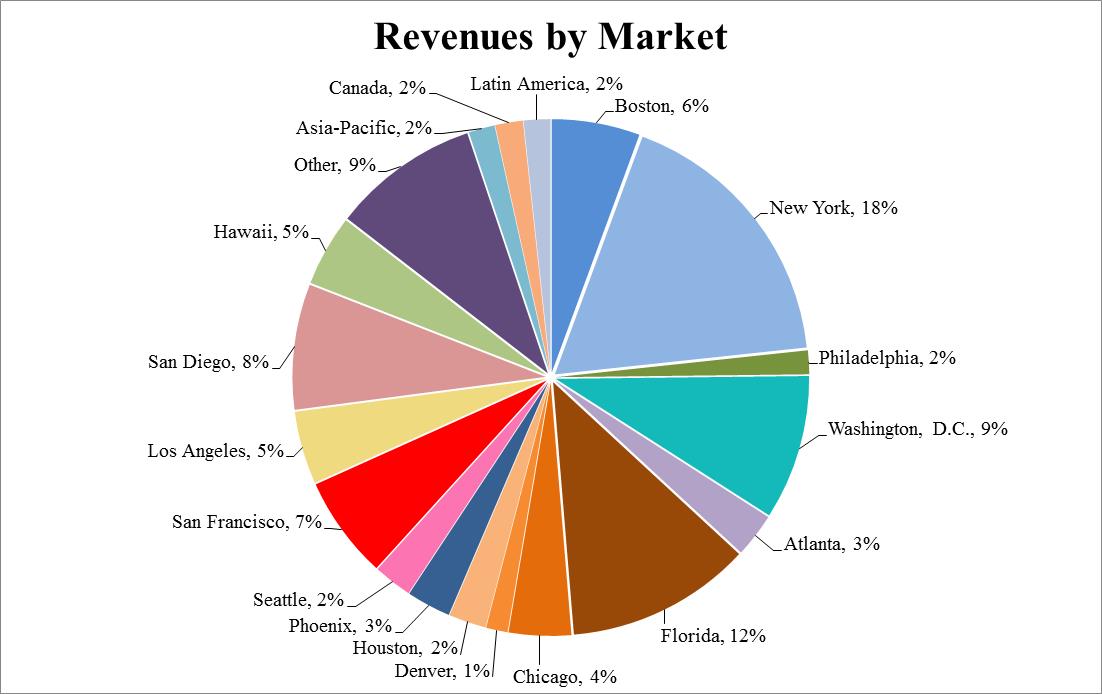

Since 2002, the percentage of revenues from our target markets in the U.S. and internationally has increased from approximately 55% to 75%. The following graph summarizes the composition of our consolidated hotels by market based on percentage of revenues (which excludes properties owned by our European and Asia/Pacific joint ventures):

Acquisitions and Development. Our acquisition strategy focuses on acquiring hotels at attractive yields that exceed our cost of capital in our target markets. As discussed above, these markets consist of gateway cities in the U.S. and in key international cities that are positioned to attract premium corporate, leisure and international travelers, and have significant barriers to entry. Based on historical trends, we believe these markets will have favorable long-term supply and demand dynamics and consequently better potential for revenue growth. In the U.S., we will focus primarily on acquiring upper upscale and luxury hotels at prices below replacement cost and, secondarily, developing midscale and upscale hotels with strategic partners, in target markets. Our efforts in Europe will include the acquisition of upper upscale and luxury hotels in our target markets through our European joint venture. In the

5

Asia/Pacific and Latin America regions, we will concentrate both on the acquisition of upper upscale and luxury hotels and the development of midscale and upscale hotels in our target markets, which we may look to acquire directly or through joint ventures with strategic partners. We may acquire additional properties through various structures, including transactions involving single assets, portfolios, joint ventures and acquisitions of the securities or assets of other REITs.

Value Enhancement Initiatives. We look to enhance the value of our portfolio by identifying and executing strategies designed to achieve the highest and best use of our properties. These projects have included the development of timeshare, office space or condominium units on excess land, redevelopment or expansion of existing retail space, the purchase or extension of ground leases, the acquisition of air rights or development entitlements or the restructuring of management agreements. We believe that the successful execution of these projects will create significant value for the company.

Redevelopment and Return on Investment Projects. We pursue opportunities to enhance asset value by completing select capital improvements outside the scope of recurring renewal and replacement capital expenditures. These projects are designed to take advantage of changing market conditions and the favorable location of our properties to increase profitability and enhance customer satisfaction. We also evaluate our capital expenditures projects based on their environmental impact. In collaboration with our hotel managers, we evaluate new products and systems designed to optimize energy performance and reduce water consumption. Many of these sustainability projects include the renewal and replacement of systems and equipment reaching the end of its life cycle with more efficient solutions and incorporating sustainable materials and construction practices within renovation projects. We also invest in building infrastructure projects that mitigate potential risks associated with extreme weather events or climate change. Our capital expenditures projects generally fall into the following categories:

Redevelopment projects. These projects are designed to optimally position our hotels within their markets and competitive set. Redevelopment projects include extensive renovations of guest rooms, including bathrooms, lobbies, food and beverage outlets, expanding ballroom and meeting rooms, and major mechanical system upgrades.

Targeted Return on Investment projects. These ROI projects often are smaller and focused on specific areas, such as converting unprofitable or underutilized space into meeting space, adding guestrooms or implementing a building automation system.

Acquisition Capital Expenditures Projects. In connection with the acquisition of a property, we prepare capital and operational improvement plans designed to improve profitability and enhance the guest experience. These projects may include required renewal and replacement projects, significant redevelopment and even re-branding of the property and represent a key component of our decision to invest in a hotel and typically are completed within two to three years of acquisition.

Renewal and Replacement Capital Expenditures. We work closely with our managers to ensure that renewal and replacement capital expenditures are spent efficiently in order to maximize the profitability of the hotel, while minimizing disruption to operations. Typically, room renovations occur at intervals of approximately seven years, but the timing may vary based on the type of property and equipment being replaced. These refurbishments generally are divided into the following types: soft goods, case goods, bathroom and infrastructure. Soft goods include items such as carpeting, bed spreads, curtains and wall vinyl and may require more frequent updates in order to maintain brand quality standards. Case goods include items such as dressers, desks, couches, restaurant and meeting room chairs and tables and generally are not replaced as frequently. Bathroom renovations include the replacement of tile, vanity, lighting and plumbing fixtures. Infrastructure includes the physical plant of the hotel, including the roof, elevators, façade and fire systems.

Asset Management. As the owner of a diverse portfolio of properties, we are in a unique position to work with our managers to maximize revenues, while minimizing operating costs. The size and composition of our portfolio and our affiliation with most of the leading operators and brands in the industry allow us to benchmark similar hotels and identify best practices and efficiencies that can improve the long-term profitability of our hotels by driving group business which allows our operators to shift the mix of business to the higher-rated transient segments. We also carefully evaluate our management and franchise agreements prior to the acquisition of a new hotel or upon termination of an existing contract. This may include obtaining franchise rights for hotels and hiring an independent operator to manage the hotel, which may be more efficient for some hotels, while still maintaining the brand recognition of the existing manager. See “—Operational Agreements” for further discussion.

Capital structure and liquidity profile. In order to maintain its qualification as a REIT, Host Inc. is required to distribute 90% of its taxable income (other than net capital gain) to its stockholders and, as a result, generally relies on external sources of capital, as well as cash from operations, to finance growth. We use a variety of debt and equity instruments to fund our external growth, including senior notes and mortgage debt, exchangeable debentures, common and preferred stock offerings, issuances of OP units and joint ventures/limited partnerships to take advantage of the prevailing market conditions. While we may issue debt at any time, management believes it is prudent, over time, to target a leverage ratio of approximately 3.0x debt-to-EBITDA. We believe that lower leverage reduces our overall cost of capital and our earnings volatility and increases our access to capital, thereby providing us with

6

the necessary flexibility to take advantage of opportunities throughout the lodging cycle, which we consider a key competitive advantage.

We also seek to structure our debt profile to allow us to access different forms of financing, primarily senior notes and exchangeable debentures, as well as mortgage debt (particularly outside of the U.S. when debt is priced reasonably and can be denominated in the local currency). Generally, this means we look to minimize the number of assets that are encumbered by mortgage debt, minimize near-term maturities and maintain a balanced maturity schedule.

Joint Ventures. We expect to continue to utilize joint ventures to finance external growth. We believe joint ventures provide a significant means to access external capital and spread the inherent risk of hotel ownership. Our primary focus for joint ventures is in international markets, which helps to diversify exposure to market risk.

Dispositions. Our disposition strategy is aligned with our overall portfolio focus to reallocate our investments to target gateway markets. Generally, our dispositions will be focused on secondary or tertiary markets, or as part of our strategy to limit our total investment within individual markets. We may dispose of assets in our target markets through direct sales or through the creation of joint ventures when we have the opportunity to capitalize on value enhancement strategies and apply the proceeds to other business objectives. Additionally, we will dispose of properties where we believe the potential for growth is constrained or on properties with significant capital expenditure requirements where we do not believe we would generate a significant return on the investment. Proceeds from dispositions are deployed to repay debt or fund acquisitions and ROI/redevelopment projects.

Corporate Responsibility

Host’s corporate responsibility strategy integrates fiscal, environmental and social elements at both the corporate and portfolio levels. Our corporate responsibility program focuses on the following themes and objectives:

— | Responsible Investment: invest in proven sustainability practices that create and drive value; |

— | Environmental Stewardship: monitor and improve the resource efficiency and environmental footprint of our properties; and |

— | Corporate Citizenship: strengthen local communities through financial support, community engagement and volunteer service. |

Management and Governance. Our corporate responsibility program is managed by our Corporate Responsibility team and governed by the Nominating and Corporate Governance Committee of the Board of Directors.

Operating Structure

Host Inc. operates through an umbrella partnership structure in which substantially all of its assets are held by Host L.P., of which Host Inc. is the sole general partner and holds approximately 98.7% of the OP units as of December 31, 2013. A REIT is a corporation that has elected to be treated as a REIT under the Internal Revenue Code of 1986, as amended (the “Code”), and that meets certain ownership, organizational and operating requirements set forth under the Code. In general, through payments of dividends to stockholders, a REIT is permitted to reduce or eliminate federal income taxes at the corporate level. Each OP unit owned by holders other than Host Inc. is redeemable, at the option of the holder, for an amount of cash equal to the market value of one share of Host Inc. common stock multiplied by a factor of 1.021494 (rather than a conversion factor of 1 share/OP unit that existed prior to the December 2009 stock dividend). Host Inc. has the right to acquire any OP unit offered for redemption directly from the holder in exchange for 1.021494 shares of Host Inc. common stock instead of Host L.P. redeeming such OP unit for cash. Additionally, for every share of common stock issued by Host Inc., Host L.P. will issue .97895 OP units to Host Inc. As of December 31, 2013, non-controlling limited partners held 9.5 million OP units, which were convertible into 9.7 million Host Inc. common shares. Assuming that all OP units held by non-controlling limited partners were converted into common shares, there would have been 764.5 million common shares of Host Inc. outstanding at December 31, 2013.

7

Our operating structure is as follows:

Because Host Inc. has elected to be treated as a REIT, certain tax laws limit the amount of “non-qualifying” income that Host Inc. and Host L.P. can earn, including income derived directly from the operation of hotels. As a result, we lease substantially all of our consolidated properties to certain of our subsidiaries designated as taxable REIT subsidiaries (“TRS”) for federal income tax purposes or to third party lessees. Our TRS are subject to income tax and are not limited as to the amount of non-qualifying income they can generate. Our TRS enter into agreements with third parties to manage the operations of the hotels. Our TRS also may own assets engaging in other activities that produce non-qualifying income, such as the development of timeshare or condominium units, subject to certain restrictions. The difference between the hotels’ net operating cash flow and the aggregate rents paid to Host L.P. is retained by our TRS as taxable income. Accordingly, the net effect of the TRS leases is that, while, as a REIT, Host Inc. generally is exempt from federal income tax to the extent that it meets specific distribution requirements, among other REIT requirements, a portion of the net operating cash flow from our properties is subject to federal, state and, if applicable, foreign income tax.

Our Hotel Portfolio

As of February 14, 2014, we owned a portfolio of 114 hotel properties, of which 99 are located in the United States and 15 are located in Australia, Brazil, Canada, Chile, Mexico and New Zealand. Our consolidated hotels located outside the United States collectively contain approximately 3,826 rooms. Approximately 5% of our revenues were attributed to the operations of these foreign properties in each of 2013, 2012 and 2011, respectively. We also are developing two hotel properties in Brazil.

Our consolidated hotels primarily consist of luxury and upper upscale properties. All of our hotels generally are located in the central business districts of major cities, near airports or in resort/conference destinations that, because of their locations, typically benefit from barriers to entry for new supply. Thirty-nine of our owned hotels, representing approximately 63% of our revenues, have in excess of 500 rooms. The average age of our properties is 30 years, although substantially all of the properties have benefited from significant renovations or major additions, as well as regularly scheduled renewal and replacement and other capital improvements.

8

By Brand. The following table details our consolidated hotel portfolio by brand as of February 14, 2014:

|

| Number |

|

|

|

|

|

| Percentage of |

| ||

Brand |

| of Hotels |

|

| Rooms |

|

| Revenues (1) |

| |||

Marriott |

|

| 57 |

|

|

| 31,431 |

|

|

| 49.2 | % |

Ritz-Carlton |

|

| 7 |

|

|

| 2,684 |

|

|

| 7.2 |

|

Starwood: |

|

|

|

|

|

|

|

|

|

|

|

|

Westin |

|

| 13 |

|

|

| 6,900 |

|

|

| 11.2 |

|

Sheraton |

|

| 8 |

|

|

| 6,044 |

|

|

| 9.7 |

|

W |

|

| 3 |

|

|

| 1,390 |

|

|

| 3.2 |

|

St. Regis |

|

| 1 |

|

|

| 232 |

|

|

| 0.6 |

|

The Luxury Collection |

|

| 1 |

|

|

| 139 |

|

|

| 0.1 |

|

Hyatt |

|

| 9 |

|

|

| 6,809 |

|

|

| 11.9 |

|

Hilton/Embassy Suites |

|

| 3 |

|

|

| 1,041 |

|

|

| 1.6 |

|

Swissôtel |

|

| 1 |

|

|

| 661 |

|

|

| 1.1 |

|

Four Seasons |

|

| 1 |

|

|

| 364 |

|

|

| 1.0 |

|

Fairmont |

|

| 1 |

|

|

| 450 |

|

|

| 1.8 |

|

Delta |

|

| 1 |

|

|

| 374 |

|

|

| 0.4 |

|

Accor: |

|

|

|

|

|

|

|

|

|

|

|

|

ibis |

|

| 3 |

|

|

| 455 |

|

|

| 0.3 |

|

Novotel |

|

| 4 |

|

|

| 713 |

|

|

| 0.6 |

|

Other |

|

| 1 |

|

|

| 151 |

|

|

| 0.1 |

|

|

|

| 114 |

|

|

| 59,838 |

|

|

| 100 |

|

|

(1) | Percentage of revenues is based on forecast 2014 revenues. No individual property contributed more than 7% of total revenues in 2013. |

9

By Location. The following table details the location and number of rooms at our consolidated hotels as of February 14, 2014:

Location |

| Rooms |

|

| Location |

| Rooms |

| ||

Arizona |

|

|

|

|

| Illinois |

|

|

|

|

Scottsdale Marriott Suites Old Town |

|

| 243 |

|

| Chicago Marriott Suites Downers Grove |

|

| 254 |

|

Scottsdale Marriott at McDowell Mountains |

|

| 266 |

|

| Chicago Marriott O'Hare |

|

| 470 |

|

The Ritz-Carlton, Phoenix |

|

| 281 |

|

| Chicago Marriott Suites O’Hare |

|

| 256 |

|

The Westin Kierland Resort & Spa |

|

| 732 |

|

| Courtyard Chicago Downtown/River North |

|

| 337 |

|

California |

|

|

|

|

| Embassy Suites Chicago- |

|

|

|

|

Coronado Island Marriott Resort & Spa (1) |

|

| 300 |

|

| Downtown/Lakefront |

|

| 455 |

|

Costa Mesa Marriott |

|

| 253 |

|

| Swissôtel Chicago |

|

| 661 |

|

JW Marriott Desert Springs Resort & Spa |

|

| 884 |

|

| The Westin Chicago River North |

|

| 424 |

|

Hyatt Regency San Francisco Airport |

|

| 789 |

|

| Indiana |

|

|

|

|

Manchester Grand Hyatt San Diego (1) |

|

| 1,628 |

|

| Sheraton Indianapolis Hotel at Keystone |

|

|

|

|

Manhattan Beach Marriott (1) |

|

| 385 |

|

| Crossing (1) |

|

| 395 |

|

Marina del Rey Marriott (1) |

|

| 370 |

|

| The Westin Indianapolis |

|

| 573 |

|

Newport Beach Marriott Hotel & Spa |

|

| 532 |

|

| Louisiana |

|

|

|

|

Newport Beach Marriott Bayview |

|

| 254 |

|

| New Orleans Marriott |

|

| 1,329 |

|

San Diego Marriott Marquis & Marina (1) |

|

| 1,360 |

|

| Maryland |

|

|

|

|

San Diego Marriott Mission Valley |

|

| 350 |

|

| Gaithersburg Marriott Washingtonian Center |

|

| 284 |

|

San Francisco Marriott Fisherman’s Wharf |

|

| 285 |

|

| Massachusetts |

|

|

|

|

San Francisco Marriott Marquis (1) |

|

| 1,500 |

|

| Boston Marriott Copley Place |

|

| 1,144 |

|

San Ramon Marriott (1) |

|

| 368 |

|

| Hyatt Regency Cambridge, Overlooking Boston |

|

| 470 |

|

Santa Clara Marriott (1) |

|

| 759 |

|

| Sheraton Boston Hotel |

|

| 1,220 |

|

Sheraton San Diego Hotel & Marina (1) |

|

| 1,053 |

|

| Sheraton Needham Hotel |

|

| 247 |

|

The Powell Hotel |

|

| 151 |

|

| The Westin Waltham-Boston |

|

| 346 |

|

The Ritz-Carlton, Marina del Rey (1) |

|

| 304 |

|

| Minnesota |

|

|

|

|

The Westin Los Angeles Airport (1) |

|

| 740 |

|

| Minneapolis Marriott City Center (1) |

|

| 583 |

|

The Westin Mission Hills Resort & Spa |

|

| 512 |

|

| Missouri |

|

|

|

|

The Westin South Coast Plaza, Costa Mesa (2) |

|

| 390 |

|

| Kansas City Airport Marriott (1) |

|

| 384 |

|

Colorado |

|

|

|

|

| New Jersey |

|

|

|

|

Denver Marriott Tech Center Hotel |

|

| 628 |

|

| Newark Liberty International Airport Marriott (1) |

|

| 591 |

|

Denver Marriott West (1) |

|

| 305 |

|

| Park Ridge Marriott (1) |

|

| 289 |

|

The Westin Denver Downtown |

|

| 430 |

|

| Sheraton Parsippany Hotel |

|

| 370 |

|

Florida |

|

|

|

|

| New York |

|

|

|

|

Tampa Airport Marriott (1) |

|

| 298 |

|

| New York Marriott Downtown |

|

| 497 |

|

Harbor Beach Marriott Resort & Spa (1)(3) |

|

| 650 |

|

| New York Marriott Marquis |

|

| 1,957 |

|

Hilton Singer Island Oceanfront Resort |

|

| 222 |

|

| Sheraton New York Times Square Hotel |

|

| 1,780 |

|

Miami Marriott Biscayne Bay (1) |

|

| 600 |

|

| The Westin New York Grand Central |

|

| 774 |

|

Orlando World Center Marriott |

|

| 2,000 |

|

| W New York |

|

| 696 |

|

Tampa Marriott Waterside Hotel & Marina |

|

| 719 |

|

| W New York – Union Square (3) |

|

| 270 |

|

The Ritz-Carlton, Amelia Island |

|

| 446 |

|

| North Carolina |

|

|

|

|

The Ritz-Carlton, Naples |

|

| 450 |

|

| Greensboro-High Point Marriott Airport (1) |

|

| 299 |

|

The Ritz-Carlton Golf Resort, Naples |

|

| 295 |

|

| Ohio |

|

|

|

|

Georgia |

|

|

|

|

| Dayton Marriott |

|

| 399 |

|

Atlanta Marriott Suites Midtown (1) |

|

| 254 |

|

| The Westin Cincinnati (1) |

|

| 456 |

|

Atlanta Marriott Perimeter Center |

|

| 341 |

|

| Pennsylvania |

|

|

|

|

Grand Hyatt Atlanta in Buckhead |

|

| 439 |

|

| Four Seasons Hotel Philadelphia |

|

| 364 |

|

JW Marriott Atlanta Buckhead |

|

| 371 |

|

| Philadelphia Airport Marriott (1) |

|

| 419 |

|

The Ritz-Carlton, Buckhead |

|

| 510 |

|

| Tennessee |

|

|

|

|

The Westin Buckhead Atlanta |

|

| 365 |

|

| Sheraton Memphis Downtown |

|

| 600 |

|

Hawaii |

|

|

|

|

| Texas |

|

|

|

|

Hyatt Regency Maui Resort & Spa |

|

| 806 |

|

| Houston Airport Marriott at George Bush |

|

|

|

|

The Fairmont Kea Lani, Maui |

|

| 450 |

|

| Intercontinental (1) (3) |

|

| 565 |

|

Hyatt Place Waikiki Beach |

|

| 426 |

|

| Houston Marriott at the Texas Medical Center (1) |

|

| 394 |

|

|

|

|

|

|

|

|

|

|

|

|

10

Location |

| Rooms |

|

| Location |

| Rooms |

| ||

Texas (continued) |

|

|

|

|

| Australia |

|

|

|

|

JW Marriott Houston |

|

| 515 |

|

| Hilton Melbourne South Wharf (1) (3) |

|

| 364 |

|

San Antonio Marriott Rivercenter (1) |

|

| 1,001 |

|

| Brazil |

|

|

|

|

San Antonio Marriott Riverwalk (1) |

|

| 512 |

|

| JW Marriott Hotel Rio de Janeiro |

|

| 245 |

|

The St. Regis Houston |

|

| 232 |

|

| Canada |

|

|

|

|

Virginia |

|

|

|

|

| Calgary Marriott |

|

| 384 |

|

Hyatt Regency Reston |

|

| 518 |

|

| Delta Meadowvale Hotel & Conference Centre |

|

| 374 |

|

Key Bridge Marriott (1) |

|

| 582 |

|

| Toronto Marriott Downtown Eaton Centre Hotel (1) |

|

| 461 |

|

Residence Inn Arlington Pentagon City |

|

| 299 |

|

| Chile |

|

|

|

|

The Ritz-Carlton, Tysons Corner (1) |

|

| 398 |

|

| San Cristobal Tower, Santiago |

|

| 139 |

|

Washington Dulles Airport Marriott (1) |

|

| 368 |

|

| Sheraton Santiago Hotel & Convention Center |

|

| 379 |

|

Westfields Marriott Washington Dulles |

|

| 336 |

|

| Mexico |

|

|

|

|

Washington |

|

|

|

|

| JW Marriott Hotel Mexico City (3) |

|

| 312 |

|

Seattle Airport Marriott |

|

| 459 |

|

| New Zealand |

|

|

|

|

The Westin Seattle |

|

| 891 |

|

| Novotel Auckland Ellerslie |

|

| 147 |

|

W Seattle |

|

| 424 |

|

| ibis Ellerslie |

|

| 100 |

|

Washington, D.C. |

|

|

|

|

| Novotel Wellington |

|

| 139 |

|

Grand Hyatt Washington |

|

| 897 |

|

| ibis Wellington |

|

| 200 |

|

Hyatt Regency Washington on Capitol Hill |

|

| 836 |

|

| Novotel Queenstown Lakeside |

|

| 273 |

|

JW Marriott Washington D.C. |

|

| 772 |

|

| Novotel Christchurch Cathedral Square (1) |

|

| 154 |

|

The Westin Georgetown, Washington, D.C. |

|

| 267 |

|

| ibis Christchurch (1) |

|

| 155 |

|

Washington Marriott at Metro Center |

|

| 459 |

|

| Total |

|

| 59,838 |

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) | The land on which this hotel is built is leased from a third party under one or more lease agreements. |

(2) | The land, building and improvements are leased from a third party under a long-term lease agreement. |

(3) | This property is not wholly owned. |

Other Real Estate Interests

In addition to our consolidated hotel portfolio, we also own non-controlling interests in several entities that, as of February 14, 2014, owned, or owned an interest in, 24 hotel properties, as detailed below. The operations of the properties owned by these entities are not consolidated and are included in equity in earnings in our consolidated results of operations.

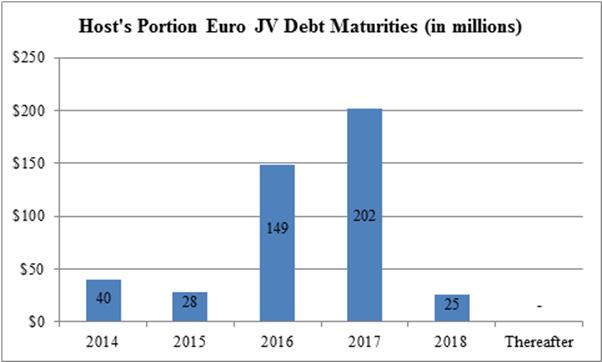

European Joint Venture. We own a general and limited partnership interest in a joint venture in Europe (“Euro JV”) with APG Strategic Real Estate Pool NV, an affiliate of a Dutch Pension Fund, and Jasmine Hotels Pte Ltd, an affiliate of the real estate investment company of the Government of Singapore Investment Corporation Pte Ltd (“GIC RE”). The Euro JV consists of two funds, which we refer to as Euro JV Fund I and Euro JV Fund II. We hold a 32.0% limited partner interest and a 0.1% general partner interest in Euro JV Fund I and a 33.3% limited partner interest and a 0.1% general partner interest in Euro JV Fund II. A subsidiary of Host L.P. acts as the asset manager for the hotels owned by the Euro JV, as well as for one hotel in Paris, France, in exchange for a fee. As of February 14, 2014, the Euro JV owns the following hotels:

Hotel |

| City |

| Country |

| Rooms/Units |

| |

Fund I: |

|

|

|

|

|

|

|

|

Hotel Arts Barcelona |

| Barcelona |

| Spain |

|

| 483 |

|

The Westin Palace, Madrid |

| Madrid |

| Spain |

|

| 467 |

|

Sheraton Roma Hotel & Conference Center |

| Rome |

| Italy |

|

| 640 |

|

The Westin Palace, Milan |

| Milan |

| Italy |

|

| 227 |

|

The Westin Europa & Regina |

| Venice |

| Italy |

|

| 185 |

|

Renaissance Brussels Hotel |

| Brussels |

| Belgium |

|

| 262 |

|

Brussels Marriott Hotel |

| Brussels |

| Belgium |

|

| 221 |

|

Marriott Executive Apartments |

| Brussels |

| Belgium |

|

| 56 |

|

Crowne Plaza Hotel Amsterdam City Centre |

| Amsterdam |

| The Netherlands |

|

| 270 |

|

Sheraton Skyline Hotel & Conference Centre |

| Hayes |

| United Kingdom |

|

| 350 |

|

Sheraton Warsaw Hotel & Towers |

| Warsaw |

| Poland |

|

| 350 |

|

Fund I total rooms |

|

|

|

|

|

| 3,511 |

|

|

|

|

|

|

|

|

|

|

11

Hotel |

| City |

| Country |

| Rooms/Units |

| |

Fund II: |

|

|

|

|

|

|

|

|

Paris Marriott Rive Gauche Hotel & Conference Center |

| Paris |

| France |

|

| 757 |

|

Pullman Bercy Paris |

| Paris |

| France |

|

| 396 |

|

Renaissance Paris La Defense Hotel |

| Paris |

| France |

|

| 327 |

|

Renaissance Paris Vendome Hotel |

| Paris |

| France |

|

| 97 |

|

Renaissance Amsterdam Hotel |

| Amsterdam |

| The Netherlands |

|

| 402 |

|

Le Méridien Piccadilly |

| London |

| United Kingdom |

|

| 280 |

|

Le Méridien Grand Hotel Nuremberg |

| Nuremberg |

| Germany |

|

| 192 |

|

Sheraton Stockholm Hotel |

| Stockholm |

| Sweden |

|

| 465 |

|

Fund II total rooms |

|

|

|

|

|

| 2,916 |

|

Total European joint venture rooms |

|

|

|

|

|

| 6,427 |

|

|

|

|

|

|

|

|

|

|

Asia/Pacific Joint Venture. We own a 25% interest in a joint venture (the “Asia/Pacific JV”) with RECO Hotels JV Private Limited, an affiliate of GIC RE. Our Asia/Pacific JV owns the 278-room Four Points by Sheraton Perth in Perth, Australia and a 36% non-controlling interest in a joint venture in India with Accor S.A. and InterGlobe Enterprises Limited that owns two hotels, with an additional five hotels under development, totaling 1,750 rooms. The seven hotels in India will be operated under the Pullman, Novotel and ibis brands.

Other U.S. Real Estate Investments. Our other domestic real estate investments include the following:

— | We have a non-controlling 50% interest in a joint venture with White Lodging Services that developed and owns the 255-room Hyatt Place Nashville Downtown in Tennessee. The hotel opened in November 2013. |

— | We have a non-controlling 67% interest in a joint venture with Hyatt Residential Group to develop, sell and operate a 131-unit vacation ownership project in Maui, Hawaii adjacent to our Hyatt Regency Maui Resort & Spa. The project is expected to open in late 2014. |

— | We have a non-controlling 11% interest in a joint venture that owns the Philadelphia Marriott Downtown following our January 10, 2014 sale of an 89% interest in the property based on a market value of $303 million. The property is subject to a mortgage loan of $230 million. |

Competition

The lodging industry is highly competitive. Competition often is specific to individual markets and is based on a number of factors, including location, brand, guest facilities and amenities, level of service, room rates and the quality of accommodations. The lodging industry is viewed as consisting of six different segments, each of which caters to a discrete set of customer tastes and needs: luxury, upper upscale, upscale, midscale (with and without food and beverage service) and economy. The classification of a property is based on lodging industry standards, which take into consideration many factors such as guest facilities and amenities, level of service and quality of accommodations. Most of our hotels operate in urban and resort markets either as luxury properties under such brand names as Fairmont®, Four Seasons®, Grand Hyatt®, JW Marriott®, Ritz-Carlton®, St. Regis®, The Luxury Collection® and W®, or as upper upscale properties under such brand names as Embassy Suites®, Hilton®, Hyatt®, Le Méridien®, Marriott Executive Apartments®, Marriott Marquis®, Marriott Suites®, Pullman®, Renaissance®, Sheraton®, Swissôtel® and Westin®. We also may selectively invest in upscale and midscale properties such as Courtyard by Marriott®, Crowne Plaza®, Four Points by Sheraton®, Hyatt Place®, ibis®, Novotel® or Residence Inn by Marriott®, particularly in international markets.1 While our hotels primarily compete with other hotels in the luxury and upper upscale segments, they also may compete with hotels in other lower-tier segments. In addition, many management contracts for our hotels do not prohibit our managers from converting, franchising or developing other hotel properties in our markets. As a result, our hotels compete with other hotels that our managers may own, invest in, manage or franchise.

We believe our properties enjoy competitive advantages associated with the hotel brands under which they operate. The international marketing programs and reservation systems of these brands, combined with the strong management systems and expertise they provide, should enable our properties to perform favorably in terms of both occupancy and room rates. In addition, repeat guest business is enhanced by guest reward or guest recognition programs offered by most of these brands.

1 This annual report contains registered trademarks that are the exclusive property of their respective owners, which are companies other than us. None of the owners of these trademarks, their affiliates or any of their respective officers, directors, agents or employees, has or will have any responsibility or liability for any information contained in this annual report

12

We also compete with other REITs and other public and private investors for the acquisition of new properties and investment opportunities, both in domestic and international markets, as we attempt to position our portfolio to take best advantage of changes in markets and travel patterns of our customers.

Seasonality

Our hotel sales traditionally have experienced moderate seasonality, which varies based on the individual property and the region. Hotel sales for our consolidated portfolio averaged approximately 24%, 27%, 23% and 26% for the first, second, third and fourth calendar quarters, respectively, in 2013.

Environmental and Regulatory Matters

Under various federal, state and local environmental laws, ordinances and regulations, a current or previous owner or operator of real property may be liable for the costs of removal or remediation of hazardous or toxic substances. These laws may impose liability whether or not the owner or operator knew of, or was responsible for, the presence of such hazardous or toxic substances. In addition, certain environmental laws and common law principles could be used to impose liability for release of hazardous or toxic materials, and third parties may seek recovery from owners or operators of real properties for personal injury associated with exposure to released hazardous or toxic materials. Environmental laws also may impose restrictions on the manner in which property may be used or businesses may be operated, and these restrictions may require corrective or other expenditures. In connection with our current or prior ownership or operation of hotels, we potentially may be liable for various environmental costs or liabilities. Although currently we are not aware of any material environmental claims pending or threatened against us, we can offer no assurance that a material environmental claim will not be asserted against us in the future.

Operational Agreements

All of our hotels are managed by third parties pursuant to management or operating agreements, with some of such hotels also subject to separate license agreements addressing matters pertaining to operation under the designated brand. Under these agreements, the managers generally have sole responsibility and exclusive authority for all activities necessary for the day-to-day operation of the hotels, including establishing room rates, securing and processing reservations, procuring inventories, supplies and services, providing periodic inspection and consultation visits to the hotels by the managers’ technical and operational experts and promoting and publicizing the hotels. The managers provide all managerial and other employees for the hotels, review the operation and maintenance of the hotels, prepare reports, budgets and projections, and provide other administrative and accounting support services to the hotels. These support services include planning and policy services, divisional financial services, product planning and development, employee staffing and training, corporate executive management and certain in-house legal services. We have certain approval rights over budgets, capital expenditures, significant leases and contractual commitments, and various other matters.

General Terms and Provisions – Agreements governing the management and operation of our hotels typically include the terms described below:

— | Term and fees for operational services. The initial term of our management and operating agreements generally is 15 to 25 years, with one or more renewal terms at the option of the manager. The majority of our management agreements condition the manager’s right to exercise options for specified renewal terms upon the satisfaction of specified economic performance criteria. The manager typically receives compensation in the form of a base management fee, which is calculated as a percentage (generally 2-3%) of annual gross revenues, and an incentive management fee, which typically is calculated as a percentage (generally 10-20%) of operating profit after the owner has received a priority return on its investment in the hotel. In the case of our Starwood-managed hotels, the base management fee is only 1% of annual gross revenues, but that amount is supplemented by license fees payable to Starwood under a separate license agreement (as described below). |

— | License services. In the case of our Starwood-managed hotels, the operation of the hotels is subject to separate license agreements addressing matters pertaining to the designated brand, including rights to use trademarks, service marks and logos, matters relating to compliance with certain brand standards and policies, and the provision of certain system programs and centralized services. Although the term of these license agreements with Starwood generally is coterminous with the corresponding operating agreements, the license agreements contemplate the potential for continued brand affiliation even in the event of a termination of the operating agreement. As noted above, the Starwood licensors receive compensation in the form of license fees (generally 5% of gross revenues attributable to room sales and 2% of gross revenues attributable to food and beverage sales), which amounts supplement the lower base management fee of 1% of gross revenues received by Starwood under the operating agreements. |

— | Chain or system programs and services. Managers are required to provide chain or system programs and services generally that are furnished on a centralized basis. Such services include the development and operation of certain computer systems |

13

and reservation services, regional or other centralized management and administrative services, marketing and sales programs and services, training and other personnel services, and other centralized or regional services as may be determined to be more efficiently performed on a centralized, regional or group basis rather than on an individual hotel basis. Costs and expenses incurred in providing these chain or system programs and services generally are allocated on a cost reimbursement basis among all hotels managed by the manager or its affiliates or that otherwise benefit from these services. |

— | Working capital and fixed asset supplies. We are required to maintain working capital for each hotel and to fund the cost of certain fixed asset supplies (for example, linen, china, glassware, silver and uniforms). We also are responsible for providing funds to meet the cash needs for hotel operations if at any time the funds available from working capital are insufficient to meet the financial requirements of the hotels. For certain hotels, the working capital accounts which would otherwise be maintained by the managers for each of such hotels are maintained on a pooled basis, with managers being authorized to make withdrawals from such pooled account as otherwise contemplated with respect to working capital in accordance with the provisions of the management or operating agreements. |

— | Furniture, fixtures and equipment replacements. We are required to provide the managers with all furniture, fixtures and equipment (“FF&E”) necessary for the operation of the hotels (including funding any required FF&E replacements). On an annual basis, the managers prepare budgets for FF&E to be acquired and certain routine repairs and maintenance to be performed in the next year and an estimate of the necessary funds, which budgets are subject to our review and approval. For purposes of funding such expenditures, a specified percentage (typically 5%) of the gross revenues of each hotel is deposited by the manager into an escrow or reserve account in our name, to which the manager has access. In the case of our Starwood-managed hotels, our operating agreements contemplate that this reserve account also may be used to fund the cost of certain major repairs and improvements affecting the hotel building (as described below). For certain of our Marriott-managed hotels, we have entered into an agreement with Marriott to allow for such expenditures to be funded from one pooled reserve account, rather than funds being deposited into separate reserve accounts at each hotel, with the minimum required balance maintained on an ongoing basis in that pooled reserve account being significantly below the amount that otherwise would have been maintained in such separate hotel reserve accounts. For certain of our Starwood-managed hotels, the periodic reserve fund contributions, which otherwise would be deposited into reserve accounts maintained by managers for each hotel, are distributed to us and, as to this pool of hotels, we are responsible for providing funding of expenditures which otherwise would be funded from reserve accounts for each of the subject hotels. |

— | Building alterations, improvements and renewals. The managers are required to prepare an annual estimate of the expenditures necessary for major repairs, alterations, improvements, renewals and replacements to the structural, mechanical, electrical, heating, ventilating, air conditioning, plumbing and elevators of each hotel, along with alterations and improvements to the hotel as are required, in the manager’s reasonable judgment, to keep the hotel in a competitive, efficient and economical operating condition that is consistent with brand standards. We generally have approval rights as to such budgets and expenditures, which we review and approve based on our manager’s recommendations and on our judgment. Expenditures for these major repairs and improvements affecting the hotel building typically are funded directly by owners, although (as noted above) our agreements with Starwood contemplate that certain such expenditures may be funded from the reserve account. |

— | Treatment of additional owner funding. As additional owner funding becomes necessary either for expenditures generally funded from the FF&E replacement funds, or for any major repairs or improvements to the hotel building which may be required to be funded directly by owners, most of our agreements provide for an economic benefit to us through an impact on the calculation of incentive management fees payable to our managers. One approach frequently utilized at our Marriott-managed hotels is to provide such owner funding through loans which are repaid, with interest, from operational revenues, with the repayment amounts reducing operating profit available for payment of incentive management fees. Another approach that is used at our Starwood-managed hotels, as well as with certain expenditures projects at our Marriott-managed hotels, is to treat such owner funding as an increase to our investment in the hotel, resulting in an increase to owner’s priority return with a corresponding reduction to the amount of operating profit available for payment of incentive management fees. For our Starwood-managed hotels that are subject to the pooled arrangement described above, the amount of any additional reserve account funding is allocated to each of such hotels on a pro rata basis, determined with reference to the net operating income of each hotel and the total net operating income of all such pooled hotels for the most recent operating year. |

— | Territorial protections. Certain management and operating agreements impose restrictions for a specified period which limit the manager and its affiliates from owning, operating or licensing a hotel of the same brand within a specified area. The area restrictions vary with each hotel, from city blocks in urban areas to up to a multi-mile radius from the hotel in other areas. |

— | Sale of the hotel. Subject to specific agreements as to certain hotels (see below under ‘Special Termination Rights’), we generally are limited in our ability to sell, lease or otherwise transfer the hotels by the requirement that the transferee assume the related management agreements and meet specified other conditions, including the condition that the transferee not be a competitor of the manager. |

14

— | Performance Termination Rights. In addition to any right to terminate that may arise as a result of a default by the manager, most of our management and operating agreements include reserved rights by us to terminate management or operating agreements on the basis of the manager’s failure to meet certain performance-based metrics, typically including a specified threshold return on owner’s investment in the hotel, along with a failure of the hotel to achieve a specified RevPAR performance threshold established with reference to other competitive hotels in the market. Typically, such performance-based termination rights arise in the event the operator fails to achieve specified performance thresholds over a consecutive two-year period, and are subject to the manager’s ability to ‘cure’ and avoid termination by payment to us of specified deficiency amounts (or, in some instances, waiver of the right to receive specified future management fees). We have agreed in the past, and may agree in the future, to waive certain of these termination rights in exchange for consideration from a manager or its affiliates, which consideration may include cash compensation or amendments to management agreements. |

— | Special Termination Rights. In addition to any performance-based or other termination rights set forth in our management and operating agreements, we have specific negotiated termination rights as to certain management and operating agreements. With respect to our Marriott portfolio, subject to certain timing and other limitations, these rights include termination rights applicable to 16 properties. With respect to our Starwood portfolio, subject to certain timing and other limitations, these rights include termination rights applicable to 8 properties. We also have similar termination rights applicable to 8 other properties. While the brand affiliation of a property may increase the value of a hotel, the ability to dispose of a property unencumbered by a management agreement, or even brand affiliation, also can increase the value for prospective purchasers. These termination rights can take a number of different forms, including termination of agreements upon sale that leave the property unencumbered by any agreement; termination upon sale provided that the property continues to be operated under a license or franchise agreement with continued brand affiliation; as well as termination without sale or other condition, which may require payment of a fee. These termination rights also may restrict the number of agreements that may be terminated over any annual or other period; impose limitations on the number of agreements terminated as measured by EBITDA; require that a certain number of properties continue to maintain the brand affiliation; or be restricted to a specific pool of assets. |

Employees