UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

Form 10-K

Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the fiscal year ended January 31, 2010

Commission file number 000-25349

HOOKER FURNITURE CORPORATION

(Exact name of registrant as specified in its charter)

| Virginia | 54-0251350 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification Number) |

440 East Commonwealth Boulevard, Martinsville, VA 24112

(Address of principal executive offices, Zip Code)

(276) 632-0459

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | Name of Each Exchange |

| Title of Each Class | on Which Registered |

| Common Stock, no par value | NASDAQ Global Select Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated Filer o | Accelerated Filer x |

Non-accelerated Filer o | Smaller reporting company o |

| | (Do not check if a smaller reporting company) |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No x

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter: $141.8 million.

Indicate the number of shares outstanding of each of the registrant’s classes of common stock as of April 12, 2010:

| Common stock, no par value | 10,774,743 |

| (Class of common stock) | (Number of shares) |

Documents incorporated by reference: Portions of the registrant’s definitive Proxy Statement for its Annual Meeting of Shareholders scheduled to be held June 8, 2010 are incorporated by reference into Part III.

Hooker Furniture Corporation

| Part I | Page |

| | | |

| Item 1. | | 3 |

| Item 1A. | | 11 |

| Item 1B. | | 13 |

| Item 2. | | 14 |

| Item 3. | | 14 |

| Item 4. | | 14 |

| | | 15 |

| | | |

| Part II | |

| | | |

| Item 5. | | 16 |

| Item 6. | | 18 |

| Item 7. | | 19 |

| Item 7A. | | 33 |

| Item 8. | | 34 |

| Item 9. | | 34 |

| Item 9A. | | 34 |

| Item 9B. | | 35 |

| | | |

| | | |

| Part III | |

| | | |

| Item 10. | | 36 |

| Item 11. | | 36 |

| Item 12. | | 36 |

| Item 13. | | 36 |

| Item 14. | | 36 |

| | | |

| Part IV | | |

| | | |

| Item 15. | | 37 |

| | | |

| 38 |

| | | |

| F-1 |

Hooker Furniture Corporation

Part I

General

Incorporated in Virginia in 1924 and celebrating our 85th anniversary in 2009, Hooker Furniture Corporation (“Company”, “we”, “us”, and “our”) is ranked among the nation’s top 10 largest publicly traded furniture sources, based on 2008 shipments to U.S. retailers, according to Furniture/Today, a leading trade publication. We are a key resource for residential wood, metal and upholstered furniture. Our major wood furniture product categories include home entertainment, home office, accent, dining, bedroom and bath furniture under the Hooker Furniture brand, and youth furniture sold under the Opus Designs by Hooker brand. &# 160;Our residential upholstered seating companies include Cherryville, N.C.-based Bradington-Young, LLC, a specialist in upscale motion and stationary leather furniture, and Bedford, Va.-based Sam Moore Furniture LLC, a specialist in upscale occasional chairs with an emphasis on cover-to-frame customization. An extensive selection of designs and formats along with finish and cover options in each of these product categories makes us a comprehensive resource for retailers primarily targeting the upper-medium price range. Our principal customers are retailers of residential home furnishings who are broadly dispersed throughout North America. Customers include independent furniture stores, specialty retailers, department stores, catalog merchants, interior designers and national and regional chains.

We market wood and metal furniture under the Hooker Furniture, Envision and Opus Designs by Hooker brand names, and upholstered furniture under the Bradington-Young, Sam Moore and Envision brand names. Furniture is designed and marketed as stand-alone products or products within small multi-piece groups or broader collections offering a unifying style, design theme and finish. Examples of Hooker Furniture collections include Beladora, North Hampton and Kensington. Products also are marketed by product category, such as The Great Entertainers, SmartWorks Home Office and Opus Designs Youth Furniture by Hooker. Our wood and metal furniture is typically designed for and marketed in the medium to high price range. Under the Bradington-Young upholstery brand, we offer a broad variety of residential leather and fabric upholstered furniture and specialize in leather reclining and motion chairs, sofas, club chairs and executive desk chairs. Under the Sam Moore upholstery brand, we offer upscale occasional chairs with an emphasis on fabric-to-frame customization in the upper-medium to high-end price niches. Domestically produced upholstered furniture is targeted at the upper-medium and upper price ranges, while imported upholstered furniture is targeted at the medium and upper-medium price ranges. Hooker is a full-line resource for retailers, offering furniture collections and products for virtually every room of the home.

We have transformed our company from a predominantly wood furniture manufacturer to a product design, global sourcing, logistics and marketing company for residential wood and upholstered furniture. Prior to 2003, nearly seventy percent of our net sales were derived from the sale of domestically produced wood furniture; subsequently, sales of our better valued imported wood furniture rapidly overtook, and have now replaced sales of our domestically made furniture. We systematically closed our domestic wood furniture plants as our product mix increasingly shifted toward imported wood and metal furniture. In March 2007, we closed our Martinsville, Va. wood furniture production facility, the last of our domestic wood furniture plants, marking our exit from domestic wood furniture manufacturing. This completed our transformation from a wood furniture manufacturer to a company that both markets high-value wood, metal and upholstered furniture sourced globally and manufactures upholstered furniture.

Our goal to expand our offerings to furniture retailers led to the acquisitions of Bradington-Young in January 2003 and Sam Moore Furniture in April 2007. These acquisitions provided Hooker’s customers with a broad array of upholstered seating options to complement our wood and metal furniture offerings. In December 2007, we acquired certain assets of Opus Designs Furniture, a specialist in moderately-priced youth furniture. The Opus Designs acquisition provides us with expanded product offerings in a previously under-developed niche. In order to meet the needs of a younger and less affluent consumer, we introduced our Envision product line in April 2009.

With our exit from domestic wood furniture manufacturing, and the addition of upholstery, expanded bedroom offerings, and a product line focused on meeting the needs of a younger and less affluent consumer, Hooker Furniture’s transition to a design, marketing, logistics and global sourcing business model focused on imported wood and metal and domestically produced and imported upholstered home furnishings is complete.

Strategy and Mission

Our mission is to “enrich the lives of the people we touch,” using the following strategy:

| § | To offer world-class style, quality and product value as a complete residential wood, metal and upholstered furniture resource through excellence in product design, manufacturing, global sourcing, marketing, logistics, sales, and customer service. |

| § | To be an industry leader in sales growth and profitability performance, providing an outstanding investment for our shareholders and contributing to the well-being of our employees, customers, suppliers and community neighbors. |

| § | To nurture the relationship-focused, team-oriented and honor-driven corporate culture that has distinguished our company for over 85 years. |

Home furnishings account for all of Hooker’s net sales. The percentages of net sales provided by each of our major product sub-categories for the fifty-two week fiscal year that ended January 31, 2010, the fifty-two week fiscal year that ended February 1, 2009, and the fifty-three week fiscal year that ended February 3, 2008, were as follows:

| | | 2010 | | | 2009 | | | 2008 | |

| Wood and metal furniture products | | | 69 | % | | | 72 | % | | | 75 | % |

| Upholstered furniture products | | | 31 | % | | | 28 | % | | | 25 | % |

| Total | | | 100 | % | | | 100 | % | | | 100 | % |

Product Design, Product Collections and Styles

Our product lines cover most major style categories, including European and American traditional, transitional, urban, country, casual and cottage designs. We offer furniture in a variety of materials, such as various types of wood, metal, leather and fabric, as well as veneer and rattan, often accented with marble, stone, slate, ceramic, glass, brass and/or hand-painted finishes. Products are designed to be attractive to consumers both as individual furniture pieces and as pieces within whole-home collections. We believe our wide variety of product categories, styles and finishes enables us to anticipate and respond quickly to changing consumer preferences.

We offer retailers a comprehensive furniture resource, particularly in the upper-medium price point, which has been our historical price niche. In an effort to broaden the appeal of our line to both consumers and retailers, over the past year we have offered a good-better-best merchandising assortment. Broadening our merchandising price range makes us a more complete resource for our established dealers and increases the scope of our offerings to additional retailers who are positioned below or above our core upper-medium price point range.

At the Hooker, Bradington-Young and Sam Moore divisions, we have addressed the medium price points through our new Envision line, products of more casual styles in moderate scaling and more affordable price points aimed at younger shoppers aged 25 to 44 with household incomes of $75,000 and below. We have addressed the “best” price points and styling at Hooker through collections such as Beladora and Sanctuary.

Based on sales and market acceptance, we believe our products represent good value, and the style and quality of our furniture compares favorably with more premium-priced products.

The product life cycle for furniture continues to shorten as consumers demand innovative new features, functionality, style, finishes and fabrics that will enhance their lifestyle while providing value and durability. We believe our distinctive product design, development and market-launch process provides us with a competitive advantage. New styles in each of our product categories are designed and developed semi-annually to replace discontinued products and collections, and in some cases, to enter new product categories. Our collaborative product design process begins with the marketing team identifying customer needs and trends and conceptualizing product ideas and features. A variety of sketches are produced, usually by independent designers, from which prototype furniture pieces are buil t. We invite some of our independent sales representatives and a representative group of dealers to view and critique the prototypes. Based on this input, we may modify the designs and then prepare samples for full-scale production. We generally introduce new product styles at the International Home Furnishings Market (“the Market”) held each Fall and Spring in High Point, North Carolina, and support new product launches with promotions, public relations, product brochures, online marketing and point-of-purchase consumer materials. The flexibility of our global sourcing business model gives us the ability to offer a wide range of styles, materials and price points to a variety of retailers serving a range of consumer markets.

We continue to strive for innovation in the home office and home entertainment furniture categories, where we believe we are perceived as an industry leader.

Our approach to the home entertainment category is to offer presentation formats for TV sizes from 32” up to 73” in a variety of sizes and styles. Our stacking console program offers three sizes of consoles that may be displayed on retail floors in a pyramid formation to help the retailer maximize sales per square foot, while helping the consumer to easily evaluate size options. The smallest consoles in the stacking console program take 32” to 42” TVs; the middle size consoles take 50” to 55” TVs, and the largest consoles take 60” and up TVs. Sales of consoles with hutches also continue to grow, both with larger units that have back panels for mounting the TV and smaller units that include stands for 55” and smaller monitors on stands. This year, we are developing a new category within home entertainment for gaming consoles. Gaming consoles are designed to accommodate gaming stations like the Sony PlayStation®, Microsoft X-Box®, and the Nintendo Wii®. These units are more casual in design to fit in family rooms, take up to 65” monitors, and feature media storage drawers and a speaker compartment.

In the home theater and wall unit category, sales of large units designed for rooms with 10- and 12- foot ceilings have cooled off somewhat, but are still a substantial business. They can accommodate up to 73” TV’s, and we offer several styles that fit into the large atrium family rooms in suburban homes. We have had success in moving to some smaller scaled transitional designs to appeal to a more urban, younger customer. Our new lower priced Envision product has a retail price point that is 1/3 less than most Hooker products.

In home office, Hooker continues to offer full sized executive office solutions. We are also focusing on smaller-scaled executive desks and credenza/hutches at 66” wide (compared to widths of 72” and up) to fit smaller scaled homes. Modular home office introductions also fit these smaller spaces, and we had several new styles and formats this year, including one that is at a 36” height so consumers can work from a taller chair or standing up. We have also augmented the home office modular segment with a lower priced product from our “Kendra” collection in the Envision line, again aimed at the younger, more urban consumer.

Bradington -Young continues to focus on strengthening the value proposition of the domestic and import leather upholstery product lines through the introduction of innovative products and programs. On the domestic side of the business, the continuing implementation of Lean Manufacturing process improvement technology is contributing to increasing value to the consumer through the reduction of non-value added costs and improved service to our customers. Following the success of Hooker and Sam Moore at this past October 2009 Market, Bradington-Young launched a new lifestyle upholstery product line under the Envision brand. Envision targets a younger consumer desiring high quality transitional styling in a more moderate price range. The introduction of Envision was highly successful and will be produced in domestic factories. Bradington-Young has also created a brand positioning statement from which to build on: "Comfort Never Looked So Good." This brand positioning statement will be used for all communications to dealers, consumers and employees. Lastly, Bradington-Young continues to expand its dealer base through aggressive merchandising and marketing initiatives targeting the Top 100 home furnishings dealers.

Sam Moore’s product offerings fill several niches in the occasional chair category, offering exposed wood as well as fully upholstered seating. Sam Moore’s occasional seating covers multiple styles that include upholstered swivel rockers, club chairs, wings, chaises, benches, ottomans, office chairs, settees, dining chairs and barstools in 18th Century, French, traditional, transitional, and contemporary styles. Most chair styles are available in a choice of either fabric or leather.

Sam Moore has a modern finishing facility that offers a choice of 30 different finishes for any exposed wood chair selection. Over one-half of the styles shipped are custom ordered with the customer’s choice of leather, fabric and finish. In addition, Sam Moore customers may provide their own fabric (customer’s own material “COM”) to be applied to a chair. In fact, COM is the most popular fabric application choice of customers.

At the April High Point Market, the Sam Moore showroom was relocated to a new space that is contiguous to the Bradington-Young showroom, with a combined lobby/reception function. As a result, customer visits and new account additions were significantly increased for both companies. Also at that market, Sam Moore introduced Envision by Sam Moore, a new collection of more moderately priced chairs, styled to appeal to younger, more lifestyle oriented consumers. Along with more fashion forward fabrics and frame designs in the core product line, Sam Moore’s product line is now more updated for today’s consumers and marketplace.

It is Sam Moore’s goal to be “America’s Premier Chair Specialist” by offering a quality product from a complete selection of chairs in fresh leathers and fabrics with exceptional wood finishes.

During fiscal year 2010, we focused on updating product offerings for Opus Designs by Hooker Furniture, a specialist in moderately priced youth furniture, which we acquired in December 2007. Since that time, the sales, marketing, merchandising and operations of Opus Designs have been successfully integrated into our company, and the line positioned itself for growth by gaining floor placements with approximately 600 new retail customers. Despite a double-digit sales downturn in the furniture industry, sales of Opus Designs products increased slightly during fiscal 2009, but decreased by $1 million in fiscal year 2010. Opus Designs by Hooker is poised to introduce several new groups in 2010 to expand its appeal. Focusing on upscale finishes, cleaner lines, superior quality and more transitiona l styling, the groups will reflect the changing tastes of the youth furniture consumer.

Sourcing

Hooker Furniture has the capability, resources, longstanding business relationships and experience to efficiently and cost effectively source our wood, metal and upholstered furniture.

Imported Products

We have sourced products from foreign manufacturers since 1988. We have imported finished furniture in a variety of styles, materials and product lines. We believe the best way to leverage our financial strength and differentiate our import business from the industry is through innovative and collaborative design, outstanding products, great value, consistent quality, easy ordering, and quick delivery through world-class global logistics and distribution systems. Imported wood, metal and upholstered furniture accounted for approximately 76% of net sales in fiscal 2010, 77% of net sales in fiscal 2009 and 76% of net sales in fiscal 2008.

Hooker imports products primarily from China, the Philippines, Indonesia, Vietnam, and Thailand through direct relationships with factories and with agents representing other factories. Because of the large number and diverse nature of the foreign factories from which we source our imported products, we have significant flexibility in the placement of products in any particular factory or country. Factories located in China are our primary resource for imported furniture. In fiscal 2010, imported products sourced from China accounted for approximately 94% of import purchases; and the factory in China from which we directly source the most product accounted for approximately 42% of our worldwide purchases of imported product. A sudden disruption in our supply chain from this factory, or from C hina in general, could significantly compromise our ability to fill customer orders for products manufactured at that factory or in that country. If such a disruption were to occur, we believe that we would have sufficient inventory to adequately meet demand for approximately four months. Also, with the broad spectrum of product we offer, we believe that, in some cases, buyers could be offered similar product available from alternative sources. We believe that we could, most likely at higher cost, source most of the products currently sourced in China from factories in other countries and could produce certain upholstered products domestically at our own factories. However, supply disruptions and delays on selected items could occur for up to six months. If we were to be unsuccessful in obtaining those products from other sources or at a comparable cost, then a sudden disruption in our supply chain from our largest import furniture supplier, or from Chin a in general, could have a short-term material adverse effect on our results of operations. Given the capacity available in China and other low-cost producing countries, we believe the risks from these potential supply disruptions are manageable.

Our imported furniture business is subject to the usual risks inherent in importing products manufactured abroad, including, but not limited to, supply disruptions and delays, currency exchange rate fluctuations, economic and political developments and instability, as well as the laws, policies, and actions of foreign governments and the United States affecting trade, including tariffs.

For imported products, Hooker generally negotiates firm pricing with its foreign suppliers in U.S. Dollars, typically for a term of at least one year. We accept the exposure to exchange rate movements beyond these negotiated periods. We do not use derivative financial instruments to manage this risk. Since we transact our imported product purchases in U.S. Dollars, a relative decline in the value of the U.S. Dollar could increase the price we pay for imported products beyond the negotiated periods. We generally expect to reflect substantially all of the effects of any price increases from suppliers in the prices we charge for imported products. These price changes could adversely impact sales volume and profit margin during affected periods. Conversely, a relative increa se in the value of the U.S. Dollar could decrease the cost of imported products and favorably impact net sales and profit margins during affected periods. See also “Item 7A. Quantitative and Qualitative Disclosures about Market Risk.”

Manufacturing and Raw Materials

At January 31, 2010, Hooker Furniture operated approximately 615,000 square feet of manufacturing and supply plant capacity in North Carolina and Virginia for its domestic upholstered furniture production. We consider the machinery and equipment at these locations generally to be modern and well-maintained.

We believe that there is a viable future for domestically produced upholstery, which, as an industry, has been less affected by import competition over the last five years than wood furniture production. Domestic seating companies with strong positions in the upper-medium to high-end price point have been the domestic furniture manufacturers least impacted by lower cost imports. In addition, domestic upholstery manufacturers have two key competitive advantages compared to imported upholstery manufacturers:

| · | offering customized cover-to-frame and fabric-to-frame combinations to the upscale consumer and interior design trade; and, |

| · | offering quick four- to six-week product delivery of custom products. |

Due to these and other competitive advantages, we remain committed to maintaining domestic production of upholstered furniture.

Bradington-Young’s strategy for its upholstered furniture production operation is to be a comprehensive leather resource for retailers positioned in the upper and upper-medium price ranges. Bradington-Young offers a broad selection of approximately 273 leather covers for domestically produced upholstered furniture. The motion category comprises approximately 56% of Bradington-Young’s domestic production. The upholstery manufacturing process begins with the cutting of leather or fabric and the cutting and precision machining of frames. Precision frames are important for motion furniture to operate properly and to provide durable service over the life of the products. Finally, the cut leather or fabric upholstery, frames, foam and other materials are assembled to build re clining chairs, executive seating, stationary seating and multiple-seat reclining furniture.

Sam Moore’s strategy for its upholstery production operation is to be a complete source of fashionable upholstered chairs for all rooms of the home and other upholstered accent pieces, such as decorative upholstered headboards. Sam Moore offers a diverse range of approximately 200 different styles of upholstered products in over 550 fabric choices and over 100 leather choices. Sam Moore produces 95% of its products domestically at its single, large manufacturing facility in Bedford, Va.

Significant materials used in manufacturing upholstered furniture products include leather or fabric, foam, wooden frames and metal mechanisms. Most of the leather is imported from Italy, South America and China. Leather is purchased as full hides, which Bradington-Young and Sam Moore then cut and sew, and as pre-cut and sewn hides processed by the vendor to pattern specifications.

Costs for leather and leather products from Asia decreased modestly during fiscal 2010 due to economic pressures. As a result, Bradington-Young dealer prices were unchanged at the Fall Market. Late in the year, upward price pressure increased due to hide shortage and increased demand.

We believe that our sources for raw materials are adequate and that we are not dependent on any one supplier. Hooker’s five largest suppliers accounted for approximately 31% of our raw materials supply purchases for domestic upholstered furniture manufacturing operations in fiscal 2010. Two suppliers accounted for more than 10% of our raw material purchases at 14% and 11% of total raw materials purchases, respectively. Should disruptions with either of these suppliers occur, we believe that we could successfully source these products from other suppliers without significant disruptions to our operations.

Distribution

Hooker companies utilize 95,000 square feet of showroom space in High Point, N.C. to introduce new products and collections and increase sales of existing products during the industry’s Spring and Fall Pre-Markets and Markets. The Company also works directly with several large customers to develop proprietary products exclusively for those customers.

We sell our furniture through over 75 independent sales representatives to retailers of residential home furnishings, who are broadly dispersed throughout North America, including:

| · | independent furniture retailers such as Furnitureland South of Jamestown/High Point, N.C., Mathis Brothers of Oklahoma and California, Baer’s Furniture of South Florida, and Berkshire Hathaway-owned companies Star Furniture, Jordan’s Furniture, Nebraska Furniture Mart and R.C. Willey; |

| · | department stores such as Macy’s and Dillard’s; |

| · | regional chain stores such as Raymour & Flanigan and Haverty’s; |

| · | national chain stores such as Z Gallerie and Crate & Barrel; and |

| · | catalog merchandisers such as Frontgate and the Horchow Collection, a unit of Neiman Marcus. |

Hooker sold to more than 4,100 customers during fiscal 2010. No single customer accounted for more than 4% of our net sales in 2010. No significant part of our business is dependent upon a single customer, the loss of which would have a material effect on our business. However, the loss of several of our major customers could have a material impact on our business. In addition to our broad domestic customer base, approximately 4% of our net sales in 2010 were to international customers.

We believe this broad network of retailers and independent sales representatives reduces our exposure to regional recessions and allows us to capitalize on emerging trends in channels of distribution.

Hooker offers tailored merchandising programs, such as our SmartLiving ShowPlace in-store galleries, Seven Seas Treasures boutiques and Home Entertainment and SmartWorks Home Office galleries, to address each channel of distribution. These galleries are currently dedicated principally to furniture groups and whole-home collections under the Hooker, Bradington-Young, Sam Moore, and Opus Designs by Hooker Furniture brands, with plans to increase the number of galleries that carry our brands. These galleries typically comprise 3,500 to 8,000 square feet of retail space. The mission of the SmartLiving program is to develop progressive partnerships with retailers by providing a merchandising and marketing plan to drive increased sales and profitability and positively influence consumers’ purchase decis ions, satisfaction and loyalty through an enhanced shopping experience.

Currently, we have approximately 60 SmartLiving Showplace Galleries established throughout the country. There are approximately 340 dealers who dedicate space in their stores to display our Seven Seas Treasures line of imported upscale and casual dining room furniture, metal beds, occasional tables and functional accents, including hand-painted furniture, carved writing desks, tables and chests. In the home entertainment and home office categories, in which we are recognized as an industry leader, we have well-developed product specialty gallery programs supported by semi-annual national sales promotions, a special website dealer locator and point-of-purchase collateral materials. Over 280 dealers have Home Entertainment by Hooker galleries an d more than 200 dealers have SmartWorks Home Office galleries in their retail stores There are more than 130 Opus Designs by Hooker Furniture youth furniture galleries around the country. In addition, over 1,450 retailers offer Bradington-Young leather upholstery products and over 1,500 retailers offer Sam Moore Furniture occasional seating products.

During fiscal 2010, we hired a seasoned international furniture sales specialist as our Vice President of International Sales. We believe that our broad array of product across price points and covering both wood furniture and upholstery, makes us an attractive supplier to the international marketplace. With the variety of product our suppliers can deliver, we are able to design product catering to the needs of a particular geographic region. We believe that, over a few years, we can grow our international sales to a much more meaningful part of our business. Subsequent to the fiscal 2010 year-end, we hired an executive, who had previously served as a third generation independent sales representative for Hooker, as our Director of National Accounts in order to focus on growing our business at targeted national and regional k ey accounts. We believe we can significantly grow our business with this important group of dealers through this focused attention.

Warehousing, Inventory and Supply Chain Management

During fiscal year 2010, we continued to refine our supply chain and sourcing operations via systems enhancements and personnel additions in both the U.S. and China. Investments made in a new Global Purchasing System and a web-based Global Sourcing Management System, coupled with upgrades to current demand and inventory planning platforms, should help improve order fulfillment rates.

We distribute furniture to retailers from our distribution centers and warehouses in Virginia and North Carolina, as well as directly from Asia via our Container Direct Program. We have warehousing and distribution arrangements in China with two of our largest suppliers of imported products. The warehouse and distribution facilities are owned by the suppliers and operated by those suppliers and a third party utilizing a global warehouse management system that updates daily our central inventory management and order processing systems. Under the Container Direct Program, we offer directly to retailers in the U.S. a focused mix of over 1,400 of our best selling items sourced from these three suppliers. The program features an internet-based product ordering system and a delivery not ification system that is easy to use and available to our pre-registered dealers. In addition, we also ship containers directly from a variety of other suppliers in Asia. We are committed to exploring ways to continually improve our distinctive, value-added Container Direct Program through additional warehouses at key vendors, product consolidation and routing strategies aimed at shortening delivery times and providing significant cost savings for retailers.

Seven Seas Seating, Bradington-Young’s line of imported upholstered furniture, experienced rapid growth from its introduction in the 2003 fourth quarter through fiscal year 2008. In fiscal year 2009, net sales of Seven Seas Seating declined by $1.3 million, or 9.2% to $12.9 million as compared to $14.2 million in fiscal 2008. Fiscal year 2010 sales were essentially flat at $12.7 million. Unlike domestic upholstered production, Seven Seas Seating products are purchased based on a forecast of product demand and shipped out of inventory from 109,000 square feet of leased warehouse space in Cherryville, N.C. Seven Seas Seating may also be purchased under the Container Direct Program, and a container order can include any of the product produced at a given supply plant.

In April 2009 Sam Moore introduced its Paris Flea Market line of imports. The line is a diverse product mix including ottomans, benches, chairs, loveseats, and sofas. There are 63 styles in the line produced by 3 factories in China. Sam Moore warehouses these styles and orders mixed containers according to rate of sale. Orders are shipped from their facility in Bedford, Va. In addition to Paris Flea Market, Sam Moore also imports one club chair and ottoman set and a recliner. They are ordered by container from an additional supplier in China and shipped from the Bedford, Va. facility. All styles can be ordered and shipped directly to the customer in full containers. Sam Moore also imports one style chair from yet another factory in China that is shipped directly to the customer in container load quantities.

Hooker Furniture schedules purchases of imported furniture and production of domestically manufactured upholstered furniture based upon actual and anticipated orders and product acceptance at the Spring and Fall Markets. We strive to provide imported and domestically produced furniture on-demand for our dealers. During fiscal year 2010, we shipped 77% of all wood and metal furniture orders and 68% of all upholstery orders within 30 days of order receipt. It is our policy and industry practice to allow order cancellation for wood and metal furniture up to the time of shipment; therefore, customer orders for wood and metal furniture are not firm. However, domestically produced upholstered product orders are predominantly custom-built and shipped within six weeks after the order is received and consequently, cannot be cancelled once the leather or fabric is cut.

Our backlog of unshipped orders for all of our products amounted to $29.2 million or approximately 7 weeks of sales as of January 31, 2010. For the last three years, over 95% of all orders booked were ultimately shipped. Management considers orders and backlogs to be one helpful indicator of sales for the upcoming 30-day period, but because of our quick delivery and our cancellation policy, management does not consider order backlogs to be a reliable indicator of expected long-term business.

Competition

The furniture industry is highly competitive and includes a large number of foreign and domestic manufacturers and importers, none of which dominates the market. While the markets in which Hooker competes include a large number of relatively small and medium-sized manufacturers, certain competitors have substantially greater sales volumes and financial resources than we do. U.S. imports of furniture produced overseas, such as from China, have stabilized in recent years, and some overseas companies have increased both their presence through wholesale distributors based in the United States and their shipments directly to U.S. retailers during that period.

The primary competitive factors for home furnishings in our price points include price, style, availability, service, quality and durability. We believe that our design capabilities, ability to import and/or manufacture upholstered furniture, product value, longstanding customer and supplier relationships, significant distribution and inventory capabilities, ease of ordering, financial strength, experienced management and customer support are significant competitive advantages.

In November 2004 and January 2005, the U.S. Department of Commerce found that certain Chinese furniture manufacturers were dumping bedroom products into the U.S. market and imposed tariffs on Chinese companies for wood bedroom products exported to the U.S. The tariff rates were approved in a subsequent action by the International Trade Commission, based on measured damage to the U.S. furniture manufacturing industry caused by illegal dumping. Tariffs on imported bedroom furniture have not and are not expected to have a material adverse effect on our results of operations.

Employees

As of January 31, 2010, we had approximately 768 permanent employees. None of our employees are represented by a labor union. We consider our relations with our employees to be good.

Patents and Trademarks

The Hooker Furniture, Bradington-Young, Sam Moore and Opus Designs by Hooker Furniture trade names represent many years of continued business. We believe these trade names are well-recognized and associated with quality and service in the furniture industry. We also own a number of patents and trademarks, none of which are considered to be material.

Hooker, the “H” logo, Bradington-Young, the “B-Y” logo, Sam Moore, Sam Moore Furniture Industries, Sam Moore Furniture, LLC, America’s Premier Chair Specialist, Opus Designs by Hooker Furniture, Forever Young, Envision Lifestyle Collections by Hooker Furniture, Albany Park, Abbott Place, Beladora, Belle Vista, Benetton, Casablanca, North Hampton, Kinston, Kemperton, Kendra, Legends, Summerglen, Vineyard, Villagio, Chatham, Brookhaven, Belle Grove, Villa Grande, Villa Florence, Fairview, Mirabel, Danforth, Small Office Solutions, Preston Ridge, Sanctuary, Sectional Sofas by Design, Seven Seas, Seven Seas Seating, SmartLiving ShowPlace, SmartWorks Home Office, SmartWorks Home Center, The Great Entertainers, Wexford Square and Waverly Place are registered trademarks of Ho oker Furniture Corporation.

Governmental Regulations

Our company is subject to federal, state, and local laws and regulations in the areas of safety, health, environmental pollution controls and importing. Compliance with these laws and regulations has not in the past had any material effect on our earnings, capital expenditures, or competitive position; however, the effect of compliance in the future cannot be predicted. We believe that we are in material compliance with applicable federal, state and local safety, health, environmental and importing regulations.

Additional Information

You may visit us online at www.hookerfurniture.com, www.bradington-young.com, www.opusdesigns.net, www.sammoore.com, and www.envisionfurniture.com. Hooker makes available, free of charge through our website, our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and other documents as soon as practical after they are filed with or furnished to to the Securities and Exchange Commission. A free copy of our Form 10-K may also be obtained by contacting Robert W. Sherwood, Vice President - Credit, Secretary and Treasurer at our corporate offices.

Forward-Looking Statements

Certain statements made in this report, including under “Item 1 - Business” and “Item 7 - Management’s Discussion and Analysis of Financial Condition and Results of Operations,” are not based on historical facts, but are forward-looking statements. These statements reflect our reasonable judgment with respect to future events and typically can be identified by the use of forward-looking terminology such as “believes,” “expects,” “projects,” “intends,” “plans,” “may,” “will,” “should,” “would,” “could” or “anticipates,” or the negative thereof, or other variations thereon, or comparable terminology, or by discussions of strategy. Forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those in the forward-looking statements. Those risks and uncertainties include but are not limited to:

| · | current economic conditions and instability in the financial and credit markets including their potential impact on our (i) sales and operating costs and access to financing, (ii) customers and suppliers and their ability to obtain financing or generate the cash necessary to conduct their business; |

| · | general economic or business conditions, both domestically and internationally; |

| · | price competition in the furniture industry; |

| · | changes in domestic and international monetary policies and fluctuations in foreign currency exchange rates affecting the price of our imported products and raw materials; |

| · | the cyclical nature of the furniture industry, which is particularly sensitive to changes in consumer confidence, the amount of consumers’ income available for discretionary purchases, and the availability and terms of consumer credit; |

| · | risks associated with the cost of imported goods, including fluctuation in the prices of purchased finished goods and transportation and warehousing costs; |

| · | supply, transportation and distribution disruptions, particularly those affecting imported products; |

| · | adverse political acts or developments in, or affecting, the international markets from which we import products, including duties or tariffs imposed on those products; |

| · | risks associated with domestic manufacturing operations, including fluctuations in capacity utilization and the prices of key raw materials, transportation and warehousing costs, domestic labor costs and environmental compliance and remediation costs; |

| · | our ability to successfully implement our business plan to increase sales and improve financial performance; |

| · | achieving and managing growth and change, and the risks associated with acquisitions, restructurings, strategic alliances and international operations; |

| · | risks associated with distribution through retailers, such as non-binding dealership arrangements; |

| · | capital requirements and costs; |

| · | competition from non-traditional outlets, such as catalogs, internet and home improvement centers; |

| · | changes in consumer preferences, including increased demand for lower quality, lower priced furniture due to declines in consumer confidence and/or discretionary income available for furniture purchases and the availability of consumer credit; and |

| · | higher than expected costs associated with product quality and safety, including regulatory compliance costs related to the sale of consumer products and costs related to defective products. |

Any forward looking statement that we make speaks only as of the date of that statement, and we undertake no obligation to update any forward-looking statements whether as a result of new information, future events, or otherwise.

Our business is subject to a variety of risks. The risk factors detailed below should be considered in conjunction with the other information contained in this annual report on Form 10-K. If any of these risks actually materialize, our business, financial condition and future prospects could be negatively impacted. These risks are not the only ones we face. There may be additional risks that are presently unknown to us or that we currently believe to be immaterial that could affect our business.

An economic downturn could result in a decrease in sales and earnings.

The furniture industry is subject to cyclical variations in the general economy and to uncertainty regarding future economic prospects. Home furnishings are generally considered a postponeable purchase by most consumers. Economic downturns could affect consumer spending habits by decreasing the overall demand for home furnishings. These events could also impact retailers, Hooker’s primary customers, possibly resulting in a decrease in our sales or earnings. Changes in interest rates, consumer confidence, new housing starts, existing home sales, and geopolitical factors have particular significant effects on our Company. A recovery in the Company’s sales could lag significantly behind a general recovery in the economy after an economic downturn due to the postponeable nature and re latively significant cost of home furnishings purchases.

We may lose market share due to competition, which would decrease future sales and earnings.

The furniture industry is very competitive and fragmented. Hooker competes with many domestic and foreign manufacturers. Some competitors have greater financial resources than we have and often offer extensively advertised, well-recognized, branded products. Competition from foreign producers has increased dramatically over the past decade. We may not be able to meet price competition or otherwise respond to competitive pressures, including increases in supplier and production costs. Also, due to the large number of competitors and their wide range of product offerings, we may not be able to continue to differentiate our products (through styling, finish and other construction techniques) from those of our competitors. In addition, large retail furniture dealers have the ability and could at any time begin to obtain offshore sourcing on their own. As a result, we are continually subject to the risk of losing market share, which may lower sales and earnings.

Failure to anticipate or timely respond to changes in fashion and consumer tastes could adversely impact our business and decrease sales and earnings.

Furniture is a styled product and is subject to rapidly changing fashion trends and consumer tastes, as well as to increasingly shorter product life cycles. If we fail to anticipate or promptly respond to these changes we may lose market share or be faced with the decision of whether to sell excess inventory at reduced prices. This could result in lower sales and earnings.

A loss of several large customers through business consolidations, failures or other reasons could result in a decrease in future sales and earnings.

The loss of several of our major customers through business consolidations, failures or otherwise, could materially adversely affect our sales and earnings. Lost sales may be difficult to replace. Amounts owed to Hooker by a customer whose business fails, or is failing, may become uncollectible.

Our ability to grow sales and earnings depends on the successful execution of our business strategies.

We are primarily a residential furniture design, sourcing, marketing and logistics company with domestic upholstery manufacturing capabilities. Our ability to maintain and grow sales and earnings depends on the continued correct selection and successful execution and refinement of our overall business strategies and business systems for designing, marketing, sourcing, distributing and servicing our products. We must also make good decisions about product mix and inventory availability targets. Since we have exited domestic manufacturing of wood furniture and are now completely dependent on offshore suppliers for wood and metal furniture products, we must continue to enhance relationships and business systems that allow us to continue to work more efficiently and effectively with our global sourcing supp liers. We must also continue to evaluate the appropriate mix between domestic manufacturing and foreign sourcing for upholstered products. All of these factors affect our ability to grow sales and earnings.

We depend on suppliers in China for a very high proportion of our imported furniture products, and a disruption in supply from China or from our most significant Chinese supplier could undermine our ability to timely fill customer orders for these products and adversely affect our sourcing costs.

In fiscal 2010, imported products sourced from China accounted for approximately 94% of our import purchases and the factory in China from which we directly source the largest portion of our import products accounted for approximately 42% of our worldwide purchases of imported products. A sudden disruption in our supply chain from this factory, or from China in general, could significantly impact our ability to fill customer orders for products manufactured at that factory or in that country. If such a disruption were to occur, we believe that we would have sufficient inventory to adequately meet demand for approximately four months. We believe that we could, most likely at higher cost, source most of the products currently sourced in China from factories in other countries and could produce certain upholstered products domestically at our own factories. However, supply disruptions and delays on selected items could occur for up to six months before remedial measures could be implemented. If we were to be unsuccessful in obtaining those products from other sources or at comparable cost, then a sudden disruption in our supply chain from our largest import furniture supplier, or from China in general, could have a short-term material adverse effect on our results of operations.

Changes in the value of the U.S. Dollar compared to the currencies for the countries from which we obtain our products could adversely affect net sales and profit margins.

For imported products, we generally negotiate firm pricing with our foreign suppliers in U.S. Dollars, typically for periods of at least one year. We accept the exposure to exchange rate movements beyond these negotiated periods. We do not use derivative financial instruments to manage this risk. Since we transact our imported product purchases in U.S. Dollars, a relative decline in the value of the U.S. Dollar could increase the price we must pay for imported products beyond the negotiated periods. These price changes could adversely impact net sales and profit margins during affected periods.

Our dependence on offshore suppliers could, over time, adversely affect our ability to service customers, which could lower future sales and earnings.

We rely exclusively on offshore suppliers for our wood and metal furniture products. Our offshore suppliers may not provide goods that meet our quality, design or other specifications in a timely manner and at a competitive price. If our suppliers do not meet our specifications, we may need to find alternative vendors, potentially at a higher cost, or may be forced to discontinue products. Also, delivery of goods from offshore vendors may be delayed for reasons not typically encountered for domestically manufactured wood and metal furniture, such as shipment delays caused by customs or labor issues. Our failure to fill customer orders during an extended business interruption by a major offshore supplier could negatively impact existing customer relationships resulting in decreased sales and e arnings.

We rely on offshore sourcing for all of our wood and metal products, and for some of our upholstered products. We are subject to changes in local government regulations, which could result in a decrease in earnings.

Changes in political, economic, and social conditions, as well as laws and regulations in the foreign countries where we source our products could have an adverse impact on our performance. These changes could make it more difficult to provide products and service to customers. International trade policies of the United States and the countries from which we source finished products could adversely affect us. Imposition of trade sanctions relating to imports, taxes, import duties and other charges on imports could increase our costs and decrease our earnings. For example beginning in 2004, the U.S. Department of Commerce has imposed tariffs on wooden bedroom furniture coming into the United States from China. In this case, none of the rates imposed were of sufficient magnitude to a lter our import strategy in any meaningful way; however, these tariffs are subject to review and could be increased in the future.

If demand for our domestically manufactured upholstered furniture declines and we respond by realigning manufacturing, our near-term earnings could decrease.

Our domestic manufacturing operations make only upholstered furniture. A decline in demand for our domestically produced upholstered furniture could result in the realignment of domestic manufacturing operations and capabilities and the implementation of cost savings programs. These programs could include the consolidation and integration of facilities, functions, systems and procedures. We may decide to source certain products from offshore suppliers, instead of continuing to manufacture them domestically. These realignments and cost savings programs typically involve initial upfront costs and could result in decreases in our near-term earnings before the expected cost reductions from realignment are realized. We may not always accomplish these actions as quickly as anticipated an d may not fully achieve the expected cost reductions.

Fluctuations in the price, availability or quality of raw materials for our domestically manufactured upholstered furniture could cause manufacturing delays, adversely affect our ability to provide goods to our customers or increase costs, any of which could decrease our sales or earnings.

We use various types of wood, leather, fabric, foam and other filling material, high carbon spring steel, bar and wire stock and other raw materials in manufacturing upholstered furniture. We depend on outside suppliers for raw materials and must obtain sufficient quantities of quality raw materials from these suppliers at acceptable prices and in a timely manner. We do not have long-term supply contracts with our suppliers. Unfavorable fluctuations in the price, quality or availability of required raw materials could negatively affect our ability to meet the demands of our customers. The inability to meet customers’ demands could result in the loss of future sales. We may not always be able to pass along price increases in raw materials to our customers due to competition an d market pressures.

We may experience impairment of our long-lived assets, which would decrease earnings and net worth.

Accounting rules require that long-lived assets be tested for impairment when circumstances indicate, but at least annually. We have $22.7 million in net long-lived assets, consisting primarily of property, plant and equipment, trademarks and trade names, which based upon the outcome of the annual test, could result in the write-down of all or a portion of these assets. A write-down of our assets would, in turn, reduce our earnings and net worth. Over the past three fiscal years, we have written down $6.2 million in long lived assets. It is possible that we will have additional write-downs in the future, resulting in additional reductions to our earnings and net worth. Factors which may lead to additional write-downs of our long lived assets include:

| § | A significant decrease in the market value of the long-lived asset; |

| § | A significant adverse change in the extent or manner in which a long-lived asset group is being used, or in its physical condition; |

| § | A significant adverse change in the legal factors or in the business climate that could affect the value of a long-lived asset, including an adverse action or assessment by a regulator; |

| § | An accumulation of costs significantly in excess of the amount originally expected to acquire or construct a long-lived asset; |

| § | A current period operating or cash flow loss or a projection or forecast that demonstrates continuing losses associated with the long-lived assets use; or |

| § | A current expectation that more-likely-than-not, a long-lived asset will be sold or otherwise disposed of significantly before the end of its previously estimated useful life |

We may engage in acquisitions and investments in companies, which could disrupt our business, dilute our earnings per share and decrease the value of our common stock.

We may acquire or invest in businesses that offer complementary products and that we believe offer competitive advantages. However, we may fail to identify significant liabilities or risks that negatively affect us or result in our paying more for the acquired company or assets than they are worth. We may also have difficulty assimilating the operations and personnel of an acquired business into our current operations. Acquisitions may disrupt or distract management from our ongoing business. We may pay for future acquisitions using cash, stock, the assumption of debt, or a combination of these. Future acquisitions could result in dilution to existing shareholders and to earnings per share.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

Set forth below is information with respect to our principal properties. We believe all of these properties are well-maintained and in good condition. We believe our manufacturing facilities are efficiently utilized. During fiscal 2010, we estimate our upholstery plants operated at approximately 75% of capacity on a one-shift basis. All our production facilities are equipped with automatic sprinkler systems. All facilities maintain modern fire and spark detection systems, which we believe are adequate. We have leased certain warehouse facilities for our distribution and imports operation on a short and medium-term basis. We expect that we will be able to renew or extend these leases or find alternative facilities to meet our warehousing and distribution needs at a reasonable cost. All facilities set forth below are active and operational and represent approximately 2.0 million square feet of owned or leased space.

| Location | Primary Use | | Approximate Size in Square Feet | | Owned or Leased |

| Martinsville, Va. | Corporate Headquarters | | | 43,000 | | Owned |

| Martinsville, Va. | Distribution and Imports | | | 580,000 | | Owned |

| Martinsville, Va. | Distribution | | | 189,000 | | Owned |

| Martinsville, Va. | Customer Support Center | | | 146,000 | | Owned |

| Martinsville, Va. | Distribution | | | 200,000 | | Leased (1) |

| High Point, N.C. | Showroom | | | 95,000 | | Leased (2) |

| Cherryville, N.C. | Manufacturing and Offices | | | 144,000 | | Owned (3) |

| Cherryville, N.C. | Manufacturing Supply Plant | | | 53,000 | | Owned (3) |

| Cherryville, N.C. | Distribution and Imports | | | 74,000 | | Leased (3) (4) |

| Cherryville, N.C. | Distribution and Imports | | | 35,000 | | Leased (3) (5) |

| Hickory, N.C. | Manufacturing | | | 91,000 | | Owned (3) |

| Bedford, Va. | Manufacturing and Offices | | | 327,000 | | Owned (6) |

| | | | | | | |

| (1) Lease expires December 31, 2010 | | | | | |

| (2) Lease expires April 30, 2014 | | | | | |

| (3) Comprise the principal properties of Bradington-Young | | |

| (4) Lease expires June 30, 2010 and provides for a one year extension, at our election. | | |

| (5) Lease expires June 30, 2010. | | | | | |

| (6) Comprise the principal properties of Sam Moore Furniture LLC | | |

| |

Set forth below is information regarding principal properties we utilize that are owned and operated by third parties.

| Location | | Primary Use | | Approximate Size in Square Feet |

| Guangdong, China | | Distribution | | 210,000 (1) |

| Guangdong, China | | Distribution | | 35,000 (2) |

(1) This property is subject to an operating agreement that expires on July 31, 2010 and automatically renews for one year on its anniversary date unless notification of termination is provided 120 days prior to such anniversary.

(2) This property is subject to an operating agreement that expires on May 31, 2010 and automatically renews for one year on its anniversary date.

ITEM 3. LEGAL PROCEEDINGS

None

HOOKER FURNITURE CORPORATION

Hooker Furniture’s executive officers and their ages as of April 15, 2010 and the year each joined the company are as follows:

| Name | | Age | | Position | | Year Joined Company |

| Paul B. Toms, Jr. | | 55 | | Chairman, President and Chief Executive Officer | | 1983 |

| E. Larry Ryder | | 62 | | Executive Vice President - Finance and Administration, | | 1977 |

| | | | | Assistant Secretary and Assistant Treasurer | | |

| Alan D. Cole | | 60 | | President and Chief Executive Officer - Upholstery | | 2007 |

| Bruce R. Cohenour | | 52 | | Executive Vice President - Marketing | | 2007 |

| Raymond T. Harm | | 60 | | Senior Vice President - Sales | | 1999 |

| Arthur G. Raymond, Jr. | | 62 | | Senior Vice President - Operations | | 2010 |

Paul B. Toms, Jr. has been Chairman and Chief Executive Officer since December 2000 and President since November 2006. Mr. Toms was President and Chief Operating Officer from December 1999 to December 2000, Executive Vice President - Marketing from 1994 to December 1999, Senior Vice President - Sales and Marketing from 1993 to 1994, and Vice President - Sales from 1987 to 1993. Mr. Toms joined the Company in 1983 and has been a Director since 1993.

E. Larry Ryder has been Executive Vice President - Finance and Administration and Chief Financial Officer since December 2000, Assistant Treasurer since 1998, and Assistant Secretary since 1990. Mr. Ryder was Senior Vice President - Finance and Administration and Chief Financial Officer from December 1987 to December 2000, Treasurer from 1989 to 1998, and Vice President - Finance and Administration from 1983 to 1987. Prior to 1983, Mr. Ryder served in various financial management positions. Mr. Ryder joined the Company in 1977 and was a Director from 1987 until 2003.

Alan D. Cole has been President and Chief Executive Officer - Upholstery since August 2008. Mr. Cole joined the Company in April 2007 as Executive Vice President – Upholstery Operations. Prior to joining the Company, Mr. Cole was President and Chief Executive Officer of Schnadig Corporation, a manufacturer and marketer of a full line of medium-priced home furnishings from 2004 to 2006. Mr. Cole has been President of Parkwest LLC, a real estate development firm from 2002 to the present. Mr. Cole also served as a member of the Company’s Board of Directors in 2003.

Bruce R. Cohenour has been Executive Vice President – Marketing since May 2009. Mr. Cohenour joined the Company in February 2007 as Senior Vice President of National Accounts and Business Development. Prior to joining the Company, Mr. Cohenour served as an independent sales representative for the Company from 1995 to 2006.

Raymond T. Harm has been Senior Vice President - Sales since joining the Company in 1999. Prior to joining the Company, Mr. Harm served as Vice President - Sales for The Barcalounger Company, a manufacturer of upholstered motion furniture from 1992 to 1999.

Arthur G. Raymond, Jr. has been Senior Vice-President of Operations since joining the Company in 2010. Prior to joining the Company, Mr. Raymond served as President of A.G. Raymond & Company, Inc., a management and technical consulting firm serving the furniture industry, from 1980 through 2010.

Hooker Furniture Corporation

Part II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED SHAREHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Our stock is traded on the NASDAQ Global Select Market under the symbol “HOFT”. The table below sets forth the high and low sales prices per share for our common stock and the dividends per share we paid with respect to our common stock for the periods indicated.

| | | Sales Price Per Share | | | Dividends | |

| | | High | | | Low | | | Per Share | |

| November 2, 2009 - January 31, 2010 | | $ | 13.67 | | | $ | 10.94 | | | $ | 0.10 | |

| August 3 - November 1, 2009 | | | 14.44 | | | | 12.38 | | | | 0.10 | |

| May 4 - August 2, 2009 | | | 14.11 | | | | 11.06 | | | | 0.10 | |

| February 2 - May 3, 2009 | | | 12.17 | | | | 5.11 | | | | 0.10 | |

| | | | | | | | | | | | | |

| November 3, 2008 - February 1, 2009 | | | 10.09 | | | | 5.64 | | | | 0.10 | |

| August 4 - November 2, 2008 | | | 20.59 | | | | 8.35 | | | | 0.10 | |

| May 5 - August 3, 2008 | | | 21.94 | | | | 15.80 | | | | 0.10 | |

| February 4 - May 4, 2008 | | | 24.00 | | | | 19.20 | | | | 0.10 | |

As of January 31, 2010, we had approximately 1,847 beneficial shareholders. We pay dividends on our common stock on or about the last day of February, May, August and November, when declared by the Board of Directors, to shareholders of record approximately two weeks earlier. Although we presently intend to continue to declare cash dividends on a quarterly basis for the foreseeable future, the determination as to the payment and the amount of any future dividends will be made by the Board of Directors from time to time and will depend on our then-current financial condition, capital requirements, results of operations and any other factors then deemed relevant by the Board of Directors.

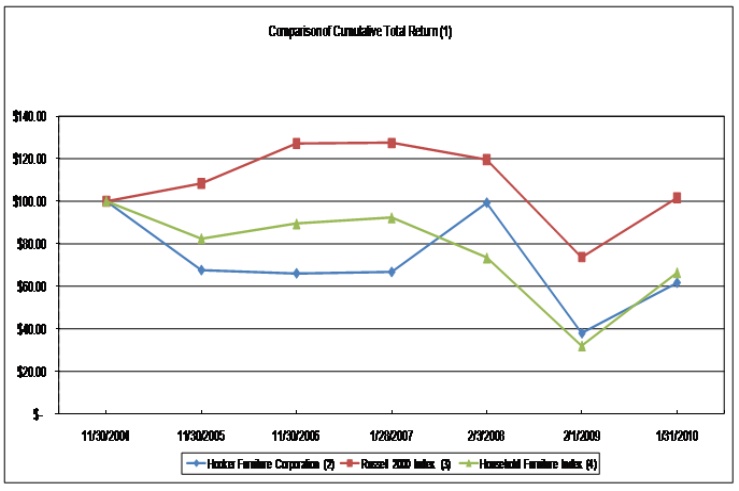

Performance Graph

The following graph compares cumulative total shareholder return for the Company with a broad performance indicator, the Russell 2000® Index, and an industry index, the Household Furniture Index, for the period from November 30, 2004 to January 31, 2010. The Household Furniture Index combines all home furnishings companies whose securities are registered with the SEC under the Securities Exchange Act of 1934.

| (1) | The graph shows the cumulative total return on $100 invested at the beginning of the measurement period in the Company’s Common Stock or the specified index, including reinvestment of dividends. |

| (2) | On August 29, 2006, we approved a change in our fiscal year. After the fiscal year ended November 30, 2006, our fiscal year ends on the Sunday nearest to January 31. Information regarding the change in the Company’s fiscal year is available in the Company’s Form 8-K filed September 1, 2006. In making the transition to a new fiscal year, the Company completed a two-month transition period that began December 1, 2006 and ended January 28, 2007. The Company’s fiscal years ended January 31, 2010, February 1, 2009, February 3, 2008 and the transition period are reflected in the Performance Graph. |

(3) | The Russell 2000® Index, prepared by Frank Russell Company, measures the performance of the 2,000 smallest companies out of the 3,000 largest U.S. companies based on total market capitalization. |

| (4) | The Household Furniture Index (SIC Codes 2510 and 2511) as prepared by Zack’s Investment Research. On March 9, 2010, Zacks Investment Research reported that the Household Furniture Index consisted of: Bassett Furniture Industries, Inc., Chromcraft Revington, Inc., Ethan Allen Interiors Inc., Flexsteel Industries, Inc., Furniture Brands International, Inc., Hooker Furniture Corporation, La-Z-Boy Incorporated, Natuzzi S.p.A, Tempur Pedic International, Inc., Leggett and Platt, Inc., Sealy Corp., Select Comfort Corp. and Stanley Furniture Company, Inc. |

ITEM 6. SELECTED FINANCIAL DATA

The following selected financial data for each of our last five fiscal years and for the two-month transition period ended January 28, 2007 has been derived from our audited, consolidated financial statements. The selected financial data should be read in conjunction with the Consolidated Financial Statements, including the related Notes, and Management’s Discussion and Analysis of Financial Condition and Results of Operations included elsewhere in this report.

| | | For The | | | For the 53 | | | For the Two | | | | |

| | | 52 Weeks Ended (8) | | | Weeks Ended (8) | | | Months Ended (8) | | | For the Twelve Months Ended (8) | |

| | | January 31, | | | February 1, | | | February 3, | | | January 28, | | | Nov. 30, | | | Nov. 30, | |

| | | 2010 (1)(2) | | | 2009 (1)(2) | | | 2008 (1)(2) | | | 2007 | | | 2006 | | | 2005 | |

| | | (In thousands, except per share data) | |

| Income Statement Data: | | | | | | | | | | | | | | | | | | |

| Net sales | | $ | 203,347 | | | $ | 261,162 | | | $ | 316,801 | | | $ | 49,061 | | | $ | 350,026 | | | $ | 341,775 | |

| Cost of sales | | | 154,931 | | | | 200,878 | | | | 235,057 | | | | 37,876 | | | | 269,681 | | | | 265,051 | |

| Gross profit | | | 48,416 | | | | 60,284 | | | | 81,744 | | | | 11,185 | | | | 80,345 | | | | 76,724 | |

| Selling and adminstrative expenses | | | 41,956 | | | | 45,980 | | | | 51,738 | | | | 7,028 | | | | 50,680 | | | | 50,319 | |

| ESOP termination compensation charge (3) | | | - | | | | - | | | | - | | | | 18,428 | | | | - | | | | - | |

| Restructuring (credits) charges (4) | | | - | | | | (951 | ) | | | 309 | | | | 2,973 | | | | 6,881 | | | | 5,250 | |

| Goodwill and intangible asset impairment charges (5) | | | 1,274 | | | | 4,914 | | | | - | | | | - | | | | - | | | | - | |

| Operating income (loss) | | | 5,186 | | | | 10,341 | | | | 29,697 | | | | (17,244 | ) | | | 22,784 | | | | 21,155 | |

| Other (expense) income, net | | | (99 | ) | | | 323 | | | | 1,472 | | | | 129 | | | | (77 | ) | | | (646 | ) |

| Income (loss) before income taxes | | | 5,087 | | | | 10,664 | | | | 31,169 | | | | (17,115 | ) | | | 22,707 | | | | 20,509 | |

| Income taxes | | | 2,079 | | | | 3,754 | | | | 11,514 | | | | 1,300 | | | | 8,569 | | | | 8,024 | |

| Net income (loss) | | | 3,008 | | | | 6,910 | | | | 19,655 | | | | (18,415 | ) | | | 14,138 | | | | 12,485 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Per Share Data: | | | | | | | | | | | | | | | | | | | | | | | | |

| Basic and diluted earnings per share (5) | | $ | 0.28 | | | $ | 0.62 | | | $ | 1.58 | | | $ | (1.52 | ) | | $ | 1.18 | | | $ | 1.06 | |

| Cash dividends per share | | | 0.40 | | | | 0.40 | | | | 0.40 | | | | - | | | | 0.31 | | | | 0.28 | |

| Net book value per share (6) | | | 11.86 | | | | 12.06 | | | | 12.18 | | | | 12.23 | | | | 13.49 | | | | 12.50 | |

| Weighted average shares outstanding (basic) | | | 10,753 | | | | 11,060 | | | | 12,442 | | | | 12,113 | | | | 11,951 | | | | 11,795 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance Sheet Data: | | | | | | | | | | | | | | | | | | | | | | | | |

| Cash and cash equivalents | | $ | 37,995 | | | $ | 11,804 | | | $ | 33,076 | | | $ | 47,085 | | | $ | 31,864 | | | $ | 16,365 | |

| Trade accounts receivable | | | 25,894 | | | | 30,261 | | | | 38,229 | | | | 37,744 | | | | 45,444 | | | | 43,993 | |

| Inventories | | | 36,176 | | | | 60,248 | | | | 50,560 | | | | 62,803 | | | | 68,139 | | | | 68,718 | |

| Assets held for sale (7) | | | - | | | | - | | | | - | | | | 3,475 | | | | - | | | | 1,656 | |

| Working capital | | | 87,894 | | | | 91,261 | | | | 102,307 | | | | 127,193 | | | | 124,028 | | | | 110,421 | |

| Total assets | | | 149,099 | | | | 153,467 | | | | 175,232 | | | | 202,463 | | | | 201,299 | | | | 189,576 | |

| Long-term debt (including current maturites) | | | - | | | | 5,218 | | | | 7,912 | | | | 10,415 | | | | 11,012 | | | | 13,295 | |

| Shareholders' equity | | | 127,592 | | | | 129,710 | | | | 140,826 | | | | 162,310 | | | | 162,536 | | | | 148,612 | |

| (1) | On April 28, 2007, we acquired substantially all of the assets of Bedford, Va.-based fabric upholstered seating specialist Sam Moore Furniture. Shipments of Sam Moore upholstered furniture products accounted for $22.2 million in net sales for fiscal 2010, $25.4 million in net sales for fiscal 2009 and for $20.8 million in net sales for fiscal 2008 following the acquisition. |

| (2) | On December 14, 2007, we acquired the assets of Opus Designs Furniture, LLC, a specialist in imported moderately-priced youth bedroom furniture. Shipments of Opus youth bedroom furniture products accounted for $4.6 million in net sales for fiscal 2010, $5.6 million in net sales for fiscal 2009 and for $636,000 in net sales for fiscal 2008 following the acquisition. |

| (3) | On January 26, 2007, we terminated our Employee Stock Ownership Plan (ESOP.) The termination resulted in an $18.4 million non-cash, non-tax deductible charge to earnings in January 2007. |

| (4) | We have closed facilities in order to reduce and ultimately eliminate our domestic wood furniture manufacturing capacity. As a result, we recorded restructuring charges and credits, principally for severance and asset impairment, as follows: |

| a) | in fiscal 2009 we recorded credits of $951,000 ($592,000 after tax), or $0.05 per share related to previously accrued employee benefits and environmental costs not expected to be paid; |

| b) | in fiscal 2008, we recorded charges of $309,000 ($190,000 after tax), or $0.02 per share, principally related to the March 2007 closing and sale of our Martinsville, Va. manufacturing facility; |

| c) | in the 2007 two-month transition period, we recorded charges of $3.0 million ($1.8 million after tax), or $0.15 per share, principally for severance and related benefits for salaried and hourly employees related to the planned closing of our Martinsville, Va. manufacturing facility; |

| d) | in fiscal 2006, we recorded charges of $6.9 million ($4.3 million after tax), or $0.36 per share, principally related to the planned closing of our Martinsville, Va. manufacturing facility and the closing of our Roanoke, Va. facility; and |

| e) | in fiscal 2005, we recorded charges of $5.3 million ($3.3 million after tax), or $0.28 per share, principally related to the closing of our Pleasant Garden, N.C. facility. |

| (5) | In 2010, based on our impairment assessments of goodwill and other intangible assets, we recorded asset impairment charges of $661,000 ($412,000, after tax) or $0.04 per share on our Opus Designs trade name and $613,000 ($382,000, pretax) or $0.04 per share on our Bradington-Young trade name. In fiscal 2009, we recorded asset impairment charges of $3.8 million ($2.5 million, after tax), or $0.22 per share, primarily related to the write-off of goodwill resulting from the acquisition of Opus Designs in 2007 and of Bradington-Young in 2003, and $1.1 million ($685,000 after tax) or $0.06 per share to write down the Bradington-Young trade name. |

| (6) | Net book value per share is derived by dividing (a) “shareholders’ equity” by (b) the number of common shares issued and outstanding, excluding unearned ESOP and restricted shares, all determined as of the end of each fiscal period. |

| (7) | In connection with the closings of the Martinsville, Va. plant in March 2007, the Roanoke, Va. plant in August 2006, the Pleasant Garden, N.C. plant in October 2005 and the Maiden, N.C. plant in October 2004, we reclassified substantially all of the related property, plant and equipment to “assets held for sale.” The carrying value of these assets approximated fair value less anticipated selling expenses. We completed the sale of the assets located in Martinsville, Va. in December 2007, the assets located in Roanoke, Va. in October 2006, the assets located in Pleasant Garden, N.C. in May 2006 and the assets located in Maiden, N.C. in January 2005. |

| (8) | On August 29, 2006, we approved a change in our fiscal year. After the fiscal year that ended November 30, 2006, our fiscal years will end on the Sunday closest to January 31. In connection with the change in our fiscal year, we had a two-month transition period that ended January 28, 2007. |

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS