AS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION ON JULY 8, 2024

1933 Act No. 333-279910

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

FORM N-14

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

Pre-Effective Amendment No. [3]

Post-Effective Amendment No. [ ]

(Check appropriate box or boxes)

ALLSPRING FUNDS TRUST

(Exact Name of Registrant as Specified in Charter)

1415 Vantage Park Drive, 3rd Floor

Charlotte, North Carolina 28203

(Address of Principal Executive Offices)

(800) 222-8222

(Registrant’s Telephone Number)

Matthew Prasse

Allspring Funds Management, LLC

1415 Vantage Park Drive, 3rd Floor

Charlotte, North Carolina 28203

(Name and Address of Agent for Service)

With a copy to:

Jason F. Monfort

Kirkland & Ellis LLP

1301 Pennsylvania Avenue, N.W.

Washington, DC 20004

No filing fee is required under the Securities Act of 1933 because an indefinite number of shares of beneficial interest in the Registrant has previously been registered pursuant to Rule 24f-2 under the Investment Company Act of 1940, as amended.

1

Prospectus/Information Statement | | |

Important merger information | |

July 9, 2024

Dear Shareholder,

On May 28-30, 2024, the Board of Trustees (the “Board”) of Allspring Funds Trust (the “Trust”) approved the mergers outlined in the table below (the “Mergers”) and the related Agreement and Plan of Reorganization. The Mergers do not require approval by Target Fund shareholders. We are not asking you for a proxy and you are requested not to send us a proxy.

Target Fund | Acquiring Fund |

Allspring Discovery All Cap Growth Fund | Allspring Growth Fund |

Allspring Discovery Large Cap Growth Fund | Allspring Large Cap Growth Fund |

In each Merger, the Target Fund will transfer all of its assets and liabilities to the respective Acquiring Fund noted above in exchange for the same class of shares of the Acquiring Fund.

The Mergers are scheduled to take place on or about July 26, 2024. The Mergers are expected to be tax-free reorganizations for U.S. federal income tax purposes. Immediately following the Mergers of your respective Target Fund into the corresponding Acquiring Fund, you will hold shares of the Acquiring Fund with a dollar value equal to the dollar value of the Target Fund shares you previously held. You will not incur any sales charges or similar transaction charges as a result of the Merger.

Details about your Target Fund’s and its corresponding Acquiring Fund’s investment objectives, principal investment strategies, management, past performance, principal risks, fees, and expenses, along with additional information about the Merger, are contained in the attached Prospectus/Information Statement. Please read it carefully. If you have any questions about the Mergers or related Merger materials, please call your investment professional, trust officer, or the Allspring Funds at 1-800-222-8222.

Thank you for choosing to invest with Allspring Funds. We appreciate your confidence in us and remain committed to helping you meet your financial needs.

Sincerely,

Andrew Owen

President

Allspring Funds

ALLSPRING FUNDS TRUST

1415 VANTAGE PARK DRIVE, 3RD FLOOR, CHARLOTTE, NC 28203

1-800-222-8222

July 9, 2024

PROSPECTUS/INFORMATION STATEMENT

This Prospectus/Information Statement contains information you should know about the mergers of each Target Fund into the Acquiring Fund as set forth and defined in the table below, each of which is a series of Allspring Funds Trust (the “Trust”), a registered open-end management investment company (each a “Merger”, together the “Mergers”). The Mergers will result in shareholders receiving shares of the Acquiring Fund in exchange for their shares of the Target Fund. The Target Funds and Acquiring Funds listed below are collectively referred to as the “Funds.”

Target Fund | Acquiring Fund |

Allspring Discovery All Cap Growth Fund | Allspring Growth Fund |

Allspring Discovery Large Cap Growth Fund | Allspring Large Cap Growth Fund |

Please read this Prospectus/Information Statement carefully and retain it for future reference. Additional information concerning each Fund has been filed with the Securities and Exchange Commission (the “SEC”).

The prospectuses, statements of additional information, annual reports and semi-annual reports of each Target Fund and Acquiring Fund are incorporated into this document by reference and are legally deemed to be part of this Prospectus/Information Statement, per the table that follows.

Fund |

|

|

|

Allspring Discovery All Cap Growth Fund | |||

Allspring Discovery Large Cap Growth Fund | |||

Allspring Growth Fund | |||

Allspring Large Cap Growth Fund |

Copies of these documents are available upon request without charge by writing to Allspring Funds, PO Box 219967, Kansas City, MO 64121-99676, calling 1.800.222.8222 or visiting the Allspring Funds website at allspringglobal.com. You may also view or obtain these documents from the SEC: by phone at 1.800.SEC.0330 (duplicating fee required); in person or by mail at Public Reference Section, Securities and Exchange Commission, 100 F Street, N.E., Washington, D.C. 20549-0213 (duplicating fee required); by email at publicinfo@sec.gov (duplicating fee required); or by internet at www.sec.gov.

The SEC has not approved or disapproved these securities or determined if this Prospectus/Information Statement is truthful or complete. Any representation to the contrary is a criminal offense.

The shares offered by this Prospectus/Information Statement are not deposits of a bank, are not insured, endorsed or guaranteed by the FDIC or any government agency and involve investment risk, including possible loss of your original investment.

This section summarizes the primary features and consequences of each Merger. This summary is qualified in its entirety by reference to the information contained elsewhere in this Prospectus/Information Statement, in the Merger SAI, in each Fund’s prospectus, financial statements contained in its annual report, SAI, and in the related Agreement and Plan of Reorganization (the “Plan”), a form of which is attached as Exhibit A hereto.

KEY FEATURES OF THE MERGERS

The Plan sets forth the key features of the Mergers covered thereby and generally provides for the following:

| ■ | the transfer of all of the assets and liabilities of the Target Fund to the corresponding Acquiring Fund in exchange for new shares of the Acquiring Fund; |

| ■ | the assumption by the Acquiring Fund of all of the assets and liabilities of the corresponding Target Fund; |

| ■ | the liquidation of the Target Fund by distributing the shares of the corresponding Acquiring Fund to the Target Fund’s shareholders; and |

| ■ | the assumption of the cost of the Mergers by Allspring Funds Management, LLC ( the “Manager” or “Allspring Funds Management”) or one of its affiliates. |

The Mergers are scheduled to take place on or about July 26, 2024 (the “Closing Date”). For a more complete description of the Mergers, see the section entitled “Merger Information - Agreement and Plan of Reorganization,” as well as Exhibit A. The costs of the Mergers, including printing and mailing this Prospectus/Information Statement, (other than brokerage and transaction costs associated with the sale or purchase of portfolio securities in connection with the Mergers) will be paid by Allspring Funds Management or one of its affiliates, and so will not be borne by shareholders of any Fund. Allspring Funds Management or one of its affiliates will bear these costs even if the Mergers can not be completed.

REASONS FOR THE MERGER AND BOARD OF TRUSTEES APPROVAL

At a meeting of the Board of Trustees (the “Board” or “Trustees”) of the Trust held on May 28-30, 2024 (the “Meeting”), the Trustees, all of whom are not “interested persons,” as defined in the Investment Company Act of 1940 (the “1940 Act”) (the “Independent Trustees”), considered and unanimously approved each Merger.

Prior to approving each Merger, the Board received the recommendation that each Merger be approved from the Manager. The Manager proposed each Merger after reviewing the growth fund lineup in the Allspring Fund family in light of expected changes to the growth equity portfolio management team at Allspring Global Investments, LLC (“Allspring Global Investments”), the sub-adviser to the Funds. In particular, the Manager considered that Allspring Global Investments would be combining two growth equity portfolio management teams, which would result in an expanded team for the Acquiring Funds in each Merger. The expected expansion of the portfolio management team for the Acquiring Funds is expected to result in shareholders having the potential for better performance due to increased research capabilities and resources. In recommending the approval of the Mergers to the Board, the Manager noted that it considered various factors, including the overlap in portfolio management and matching investment objectives, and the similarities between the strategies of the respective Target Funds and Acquiring Funds.

Before approving the Mergers, the Board reviewed information about the Funds and the Mergers. This included, among other things, a comparison of various factors, such as the planned portfolio manager changes, the relative sizes of the Funds, the performance records of the Funds, and the expenses of the Funds (including pro forma expense information of each Acquiring Fund following the Mergers), as well as the similarities and differences between the Funds’ investment objectives, principal investment strategies and specific portfolio characteristics.

The Board has concluded that each Merger would be in the best interests of each Target Fund and each Acquiring Fund, and that existing shareholders’ interests will not be diluted as a result of the Mergers. The Board has also approved the Plan on behalf of each Acquiring Fund. For further information about the considerations of the Board, please see the section entitled “Board Considerations.”

1 |

For each Merger, the following section provides a comparison of the Funds’ investment objectives, principal investment strategies, fundamental investment policies, risks, performance records, and expenses. It also provides information about what the management and share class structure of each Acquiring Fund will be after the Merger. The information below is only a summary; for more detailed information, please see the rest of this Prospectus/Information Statement and each Fund’s prospectus(es) and SAI.

ALLSPRING DISCOVERY ALL CAP GROWTH FUND INTO ALLSPRING GROWTH FUND

Share Class Information

The following table illustrates the share class of the Acquiring Fund you will receive in exchange for your Target Fund shares as a result of the Merger. The Acquiring Fund share class to be received in exchange for the applicable Target Fund share class was chosen based on a consideration of expense structure and shareholder eligibility similarities.

If you own this class of shares of the Allspring Discovery All Cap Growth Fund (Target Fund): | You will receive this class of shares of the Allspring Growth Fund (Acquiring Fund)1: |

Class A | Class A |

Class C | Class C |

Administrator Class | Administrator Class |

Institutional Class | Institutional Class |

| 1. | The Acquiring Fund also offers Class R6 shares. This class is not involved in the Merger. |

The Acquiring Fund shares you will receive as a result of the Merger will have the same dollar value as your Target Fund shares as of the close of business on the business day immediately prior to the Merger.

The procedures for buying, selling and exchanging shares of the Funds are identical. For additional information on how you can buy, sell or exchange shares of the Acquiring Fund see the section entitled “Account Information.” Additional information on how you can buy, sell or exchange shares of the Target Fund is available in the Target Fund’s prospectus and SAI. In addition, the distribution policies for the Funds are the same.

Investment Objective and Strategy Comparison

The following section compares the investment objectives and principal investment strategies of the Funds. The investment objectives of the Funds may be changed without shareholder approval.

The Funds have identical investment objectives and substantially similar principal investment strategies, that differ primarily with respect to the stock selection process and sell discipline of the Funds’ respective portfolio management teams. While the stock selection style for both Funds focuses on growth companies, the Target Fund seeks to identify innovative companies in their respective industries while the Acquiring Fund views growth characteristics more generally.

Allspring Discovery All Cap Growth Fund (Target Fund) | Allspring Growth Fund (Acquiring Fund) |

INVESTMENT OBJECTIVES | INVESTMENT OBJECTIVES |

The Fund seeks long-term capital appreciation. | The Fund seeks long-term capital appreciation. |

PRINCIPAL INVESTMENT STRATEGIES | PRINCIPAL INVESTMENT STRATEGIES |

Under normal circumstances, ■ the Fund invests at least 80% of its total assets in equity securities; and ■ may invest up to 25% of its total assets in equity securities of foreign issuers, including ADRs and similar investments.. | Under normal circumstances, we invest: ■ at least 80% of the Fund’s total assets in equity securities; and ■ up to 25% of the Fund’s total assets in equity securities of foreign issuers through ADRs and similar investments. |

We may invest in the equity securities of companies of any market capitalization. | We invest principally in equity securities of companies that we believe have prospects for robust and sustainable growth of revenues and earnings. We may invest in the equity securities of companies of any market capitalization. We may also invest in equity securities of foreign issuers through ADRs and similar investments. |

| 2

Allspring Discovery All Cap Growth Fund (Target Fund) | Allspring Growth Fund (Acquiring Fund) |

We seek to identify companies that have the prospect for strong sales and earnings growth rates, that enjoy a competitive advantage (for example, dominant market share) and that we believe have effective management with a history of making investments that are in the best interests of shareholders (for example, companies with a history of earnings and sales growth that are in excess of total asset growth). Furthermore, we seek to identify companies that embrace innovation and foster disruption using technology to maximize efficiencies, gain pricing advantages, and take market share from competitors. We view innovative companies as those that, among other characteristics, have the ability to advance new products or services through investment in research and development, that operate a business model that is displacing legacy industry incumbents, that are pursuing a large unmet need or total available market. We believe innovation found in companies on the “right side of change” is often mispriced in today’s public equity markets and is a frequent signal or anomaly that we seek to exploit through our investment process. An important criteria for “right side of change” companies is that they are benefiting from changes in technological, demographic, lifestyle, or environmental trends We pay particular attention to how management teams allocate capital in order to drive future cash flow. This includes the allocation of human capital, financial capital, and social capital. We believe successful allocation of such resources has a correlation with key indicators of future performance. Price objectives are determined based on industry-specific valuation methodologies, including relative price-to-earnings multiples, price-to-book value, operating profit margin trends, enterprise value to EBITDA (earnings before interest, taxes, depreciation and amortization) and free cash flow yield. In addition to meeting with management, we take a surround the company approach by surveying a company’s vendors, distributors, competitors and customers to obtain multiple perspectives that help us make better investment decisions. Portfolio holdings are continuously monitored for changes in fundamentals. The team seeks a favorable risk/reward relationship to fair valuation, which we define as the value of the company (i.e., our price target for the stock) relative to where the stock is currently trading. We may invest in any sector, and at times the Fund may emphasize one or more particular sectors. We may choose to sell a holding when it no longer offers favorable growth prospects, reaches our target price, or to take advantage of a better investment opportunity. | We focus on companies that dominate their market, are establishing new markets or are undergoing dynamic change. We believe earnings and revenue growth relative to expectations are critical factors in determining stock price movements. Thus, our investment process is centered around finding companies with under-appreciated prospects for robust and sustainable growth in earnings and revenue. To find that growth, we use bottom-up research, emphasizing companies whose management teams have a history of successfully executing their strategy and whose business models have sufficient profit potential. We forecast revenue and earnings revision opportunities, along with other key financial metrics to assess investment potential. We also believe that strong ESG policies and practices contribute to a company’s long-term sustainability of growth and therefore look for companies that are perceived as strong ESG performers or that have under appreciated ESG characteristics that we believe can drive future growth consistent with our forward-looking expectations. We combine our company-specific analysis with our assessment of secular and timeliness trends to form a buy/sell decision about a particular stock. We may invest in any sector, and at times we may emphasize one or more particular sectors. We sell a company’s securities when we see deterioration in fundamentals that leads us to become suspicious of a company’s prospective growth profile or the profitability potential of its business model, as this often leads to lower valuation potential. We may also sell or trim a position when we need to raise money to fund the purchase of a better investment opportunity or when valuation is extended beyond our expectations. |

Fundamental Investment Policy Comparison

The fundamental investment policies of the Funds, which may only be changed with shareholder approval, are identical. For a chart of the Funds’ fundamental investment policies, please see Exhibit B.

Principal Risk Comparison

The principal risks of the Target Fund are identical to those of the Acquiring Fund due to the similarity of the Funds’ investment objectives and principal investment strategies, as noted above. The table below compares the principal risk factors of the Target Fund with those of the Acquiring Fund. These risks are described in the section entitled “Risk Descriptions.”

Allspring Discovery All Cap Growth Fund (Target Fund) | Allspring Growth Fund (Acquiring Fund) |

Equity Securities Risk | Equity Securities Risk |

Foreign Investment Risk | Foreign Investment Risk |

Growth/Value Investing Risk | Growth/Value Investing Risk |

3 |

Allspring Discovery All Cap Growth Fund (Target Fund) | Allspring Growth Fund (Acquiring Fund) |

Management Risk | Management Risk |

Market Risk | Market Risk |

Smaller Company Securities Risk | Smaller Company Securities Risk |

The Funds have other investment policies, practices and restrictions which, together with their related risks, are set forth in each Fund’s prospectuses and SAI.

Fund Performance Comparison

The following bar charts and tables illustrate how each Fund’s returns have varied from year to year and compare each Fund’s returns with those of one or more broad-based securities indexes. Past performance (before and after taxes) is not necessarily an indication of future results. Current month-end performance information is available for the Funds on the Allspring Funds website at allspringglobal.com. Following the Merger, the Acquiring Fund will be the accounting and performance survivor.

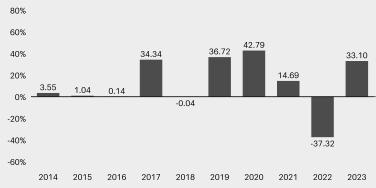

Calendar Year Total Returns for Class A Shares (%) for the Allspring Discovery All Cap Growth Fund

(Returns do not reflect sales charges and would be lower if they did)

|

Highest Quarter: June 30, 2020 | +31.15% |

Lowest Quarter: June 30, 2022 | -26.09% |

Year-to-date total return as of June 30, 2024 is +12.86% |

|

Average Annual Total Returns for the periods ended 12/31/2023 for the Allspring Discovery All Cap Growth Fund (returns reflect applicable sales charges) | ||||

| Inception Date of Share Class | 1 Year | 5 Year | 10 Year |

Class A (before taxes) | 4/29/1968 | 25.45% | 11.98% | 9.49% |

Class A (after taxes on distributions) | 4/29/1968 | 23.91% | 9.95% | 7.18% |

Class A (after taxes on distributions and the sale of Fund Shares) | 4/29/1968 | 16.10% | 9.50% | 7.16% |

Class C (before taxes) | 8/2/1993 | 31.10% | 12.54% | 9.52% |

Administrator Class (before taxes) | 1/13/1997 | 33.29% | 13.50% | 10.35% |

Institutional Class (before taxes) | 7/30/2010 | 33.61% | 13.78% | 10.62% |

Russell 3000® Index (reflects no deduction for fees, expenses, or taxes) |

| 25.96% | 15.16% | 11.48% |

Russell 3000® Growth Index (reflects no deduction for fees, expenses, or taxes) |

| 41.21% | 18.85% | 14.33% |

| 4

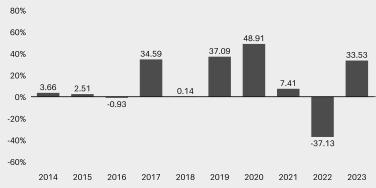

Calendar Year Total Returns for Class A Shares (%) for the Allspring Growth Fund

(Returns do not reflect sales charges and would be lower if they did)

|

Highest Quarter: June 30, 2020 | +34.57% |

Lowest Quarter: June 30, 2022 | -24.02% |

Year-to-date total return as of June 30, 2024 is +21.46% |

|

Average Annual Total Returns for the periods ended 12/31/2023 for the Allspring Growth Fund (returns reflect applicable sales charges) | ||||

| Inception Date of Share Class | 1 Year | 5 Year | 10 Year |

Class A (before taxes) | 2/24/2000 | 25.86% | 11.65% | 9.43% |

Class A (after taxes on distributions) | 2/24/2000 | 22.71% | 8.34% | 5.49% |

Class A (after taxes on distributions and the sale of Fund Shares) | 2/24/2000 | 17.41% | 9.22% | 6.72% |

Class C (before taxes) | 12/26/2002 | 31.53% | 12.57% | 9.57% |

Administrator Class (before taxes) | 8/30/2002 | 33.78% | 13.18% | 10.29% |

Institutional Class (before taxes) | 2/24/2000 | 34.04% | 13.42% | 10.52% |

Russell 3000® Index (reflects no deduction for fees, expenses, or taxes) |

| 25.96% | 15.16% | 11.48% |

Russell 3000® Growth Index (reflects no deduction for fees, expenses, or taxes) |

| 41.21% | 18.85% | 14.33% |

Shareholder Fee and Fund Expense Comparison

This section compares the fees and expenses you pay if you buy, hold, and sell shares of the Target Fund and the Acquiring Fund. For information about the share class of the Acquiring Fund that you will receive in connection with the Merger, please see the section entitled “Share Class Information” above.

The first table entitled “Shareholder Fees” allows you to compare the maximum sales charges of the Funds and includes a Pro Forma column that shows you what the sales charges following the Merger. The sales charges for each class of shares of the Target Fund are identical to those of the corresponding class of shares of the Acquiring Fund. The Target Fund shareholders will not pay any front-end or deferred sales charges in connection with the Merger.

The second table entitled “Annual Fund Operating Expenses” allows you to compare the annual operating expenses of the Funds. The total annual fund operating expenses for both Funds set forth in the following table are based on the actual expenses incurred for each Fund’s fiscal year ended July 31, 2023. The pro forma expense column shows you what the total annual fund operating expenses (before and after waiver) would have been for the Acquiring Fund for the twelve-month period ended July 31, 2023, assuming the Merger had taken place at the beginning of that period. As illustrated in more detail below, the Target Fund’s gross and net expenses across all classes are higher than that of the

5 |

Acquiring Fund (both before and after the Merger). The investment management fee schedules for both Funds are identical but the current effective management fee rate is lower for the Acquiring Fund than the Target Fund.

Shareholder Fees (fees paid directly from your investment) | |||

| Allspring Discovery All Cap Growth Fund (Pre-Merger) | Allspring Growth Fund (Pre-Merger) | Allspring Growth Fund (Pro Forma) |

Class A |

|

|

|

Maximum sales charge (load) imposed on purchases (as a percentage of the offering price) | 5.75% | 5.75% | 5.75% |

Maximum deferred sales charge (load) (as a percentage of the offering price) | None1 | None1 | None1 |

Class C |

|

|

|

Maximum sales charge (load) imposed on purchases (as a percentage of the offering price) | None | None | None |

Maximum deferred sales charge (load) (as a percentage of the offering price) | 1.00% | 1.00% | 1.00% |

Administrator Class |

|

|

|

Maximum sales charge (load) imposed on purchases (as a percentage of the offering price) | None | None | None |

Maximum deferred sales charge (load) (as a percentage of the offering price) | None | None | None |

Institutional Class |

|

|

|

Maximum sales charge (load) imposed on purchases (as a percentage of the offering price) | None | None | None |

Maximum deferred sales charge (load) (as a percentage of the offering price) | None | None | None |

| 1. | Investments of $1 million or more are not subject to a front-end sales charge, but will be subject to a deferred sales charge of 1.00% if you sell the shares within eighteen months from the date of purchase. |

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment)1 | |||

| Allspring Discovery All Cap Growth Fund (Pre-Merger) | Allspring Growth Fund (Pre-Merger) | Allspring Growth Fund (Proforma) |

Class A |

|

|

|

Management Fees | 0.79% | 0.71% | 0.71% |

Distribution (12b-1) Fees | 0.00% | 0.00% | 0.00% |

Other Expenses | 0.49% | 0.47% | 0.47% |

Total Annual Fund Operating Expenses | 1.28% | 1.18% | 1.18% |

Waiver of Fund Expenses | (0.04)% | (0.03)% | (0.03)% |

Total Annual Fund Operating Expenses After Waiver Fee Waiver | 1.24%2 | 1.15%3 | 1.15%3 |

Class C |

|

|

|

Management Fees | 0.79% | 0.71% | 0.71% |

Distribution (12b-1) Fees | 0.75% | 0.75% | 0.75% |

Other Expenses | 0.49% | 0.47% | 0.47% |

Total Annual Fund Operating Expenses | 2.03% | 1.93% | 1.93% |

| 6

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment)1 | |||

| Allspring Discovery All Cap Growth Fund (Pre-Merger) | Allspring Growth Fund (Pre-Merger) | Allspring Growth Fund (Proforma) |

Waiver of Fund Expenses | (0.04)% | (0.03)% | (0.03)% |

Total Annual Fund Operating Expenses After Waiver Fee Waiver | 1.99%2 | 1.90%3 | 1.90%3 |

Administrator Class |

|

|

|

Management Fees | 0.79% | 0.71% | 0.71% |

Distribution (12b-1) Fees | 0.00% | 0.00% | 0.00% |

Other Expenses | 0.42% | 0.40% | 0.40% |

Total Annual Fund Operating Expenses | 1.21% | 1.11% | 1.11% |

Waiver of Fund Expenses | (0.11)% | (0.15)% | (0.15)% |

Total Annual Fund Operating Expenses After Waiver Fee Waiver | 1.10%4 | 0.96%5 | 0.96%5 |

Institutional Class |

|

|

|

Management Fees | 0.79% | 0.71% | 0.71% |

Distribution (12b-1) Fees | 0.00% | 0.00% | 0.00% |

Other Expenses | 0.17% | 0.15% | 0.15% |

Total Annual Fund Operating Expenses | 0.96% | 0.86% | 0.86% |

Waiver of Fund Expenses | (0.11)% | (0.11)% | (0.11)% |

Total Annual Fund Operating Expenses After Waiver Fee Waiver | 0.85%6 | 0.75%7 | 0.75%7 |

| 1. | Expenses have been adjusted as necessary from amounts incurred during the Fund’s most recent fiscal year to reflect current fees and expenses. |

| 2. | The Manager has contractually committed through November 30, 2024, to waive fees and/or reimburse expenses to the extent necessary to cap Total Annual Fund Operating Expenses After Fee Waivers at 1.24% for Class A and 1.99% for Class C. Brokerage commissions, stamp duty fees, interest, taxes, acquired fund fees and expenses (if any), and extraordinary expenses are excluded from the expense cap. Prior to or after the commitment expiration date, the cap may be increased or the commitment to maintain the cap may be terminated only with the approval of the Board of Trustees. |

| 3. | The Manager has contractually committed through November 30, 2025, to waive fees and/or reimburse expenses to the extent necessary to cap Total Annual Fund Operating Expenses After Fee Waivers at 1.15% for Class A and 1.90% for Class C. Brokerage commissions, stamp duty fees, interest, taxes, acquired fund fees and expenses (if any), and extraordinary expenses are excluded from the expense cap. Prior to or after the commitment expiration date, the cap may be increased or the commitment to maintain the cap may be terminated only with the approval of the Board of Trustees. |

| 4. | The Manager has contractually committed through November 30, 2024, to waive fees and/or reimburse expenses to the extent necessary to cap Total Annual Fund Operating Expenses After Fee Waiver at 1.10% for Administrator Class. Brokerage commissions, stamp duty fees, interest, taxes, acquired fund fees and expenses (if any), and extraordinary expenses are excluded from the expense cap. Prior to or after the commitment expiration date, the cap may be increased or the commitment to maintain the cap may be terminated only with the approval of the Board of Trustees. |

| 5. | The Manager has contractually committed through November 30, 2025, to waive fees and/or reimburse expenses to the extent necessary to cap Total Annual Fund Operating Expenses After Fee Waiver at 0.96% for Administrator Class. Brokerage commissions, stamp duty fees, interest, taxes, acquired fund fees and expenses (if any), and extraordinary expenses are excluded from the expense cap. Prior to or after the commitment expiration date, the cap may be increased or the commitment to maintain the cap may be terminated only with the approval of the Board of Trustees. |

| 6. | The Manager has contractually committed through November 30, 2024, to waive fees and/or reimburse expenses to the extent necessary to cap Total Annual Fund Operating Expenses After Fee Waiver at 0.85% for Institutional Class. Brokerage commissions, stamp duty fees, interest, taxes, acquired fund fees and expenses (if any), and extraordinary expenses are excluded from the expense cap. Prior to or after the commitment expiration date, the cap may be increased or the commitment to maintain the cap may be terminated only with the approval of the Board of Trustees. |

| 7. | The Manager has contractually committed through November 30, 2025, to waive fees and/or reimburse expenses to the extent necessary to cap Total Annual Fund Operating Expenses After Fee Waiver at 0.75% for Institutional Class. Brokerage commissions, stamp duty fees, interest, taxes, acquired fund fees and expenses (if any), and extraordinary expenses are excluded from the expense cap. Prior to or after the commitment expiration date, the cap may be increased or the commitment to maintain the cap may be terminated only with the approval of the Board of Trustees. |

Example of Fund Expenses. The examples below are intended to help you compare the costs of investing in the Target Fund with the costs of investing in the Acquiring Fund, both before and after the Merger, and are for illustration only. The examples assume a $10,000 initial investment, 5% annual total return, and that operating expenses remain the same, as in the tables above. To the extent that the Manager is waiving fees or reimbursing expenses, the examples assume that such waivers or reimbursements will only be in place through the dates indicated in the footnotes

7 |

above (both pre-merger and pro forma). Although your actual costs may be higher or lower, based on these assumptions, your costs would be:

Allspring Discovery All Cap Growth Fund (Pre-Merger) | ||||

Assuming you sold your shares, you would pay: | After 1 Year | After 3 Years | After 5 Years | After 10 Years |

Class A | $694 | $954 | $1,233 | $2,028 |

Class C | $302 | $633 | $1,089 | $2,355 |

Administrator Class | $112 | $373 | $654 | $1,456 |

Institutional Class | $87 | $295 | $520 | $1,168 |

Assuming you held your shares, you would pay: | After 1 Year | After 3 Years | After 5 Years | After 10 Years |

Class C | $202 | $633 | $1,089 | $2,355 |

Allspring Growth Fund (Pre-Merger) | ||||

Assuming you sold your shares, you would pay: | After 1 Year | After 3 Years | After 5 Years | After 10 Years |

Class A | $685 | $922 | $1,181 | $1,919 |

Class C | $293 | $600 | $1,036 | $2,249 |

Administrator Class | $98 | $322 | $582 | $1,324 |

Institutional Class | $77 | $252 | $455 | $1,040 |

Assuming you held your shares, you would pay: | After 1 Year | After 3 Years | After 5 Years | After 10 Years |

Class C | $193 | $600 | $1,036 | $2,249 |

Allspring Growth Fund (Proforma) | ||||

Assuming you sold your shares, you would pay: | After 1 Year | After 3 Years | After 5 Years | After 10 Years |

Class A | $685 | $922 | $1,181 | $1,919 |

Class C | $293 | $600 | $1,036 | $2,249 |

Administrator Class | $98 | $322 | $582 | $1,324 |

Institutional Class | $77 | $252 | $455 | $1,040 |

Assuming you held your shares, you would pay: | After 1 Year | After 3 Years | After 5 Years | After 10 Years |

Class C | $193 | $600 | $1,036 | $2,249 |

Each Fund has a shareholder servicing fee of up to 0.25% for Class A and Administrator Class shares. Class C shares of each Fund have a shareholder servicing fee of 0.25% and a distribution fee (12b-1 fee) of 0.75%. Institutional Class shares of each Fund do not pay a distribution fee (12b-1 fee) or a shareholder servicing fee.

Fund Management Information

The following table identifies the manager, sub-adviser and portfolio managers for the Acquiring Fund. Further information about the management of the Acquiring Fund can be found under the section entitled “Management of the Funds.”

Allspring Growth Fund | |

Investment Manager | Allspring Funds Management, LLC |

Investment Sub-adviser | Allspring Global Investments, LLC |

Portfolio Manager, Title/Managed Since | Robert Gruendyke, CFA, Portfolio Manager / 2020 |

| 1. | Thomas C. Ognar, CFA has announced his intention to retire from Allspring Global Investments, LLC in August 2025. He will continue to serve as a portfolio manager of the Fund until July 26, 2024. After July 26, 2024, all references to Thomas C. Ognar, CFA in the Fund’s Prospectuses and Statement of Additional Information are hereby removed. |

| 8

Tax Information

It is expected that, for U.S. federal income tax purposes and under currently applicable U.S. federal income tax law, the Merger will be treated as a “reorganization” within the meaning of Section 368(a) of the Internal Revenue Code of 1986, as amended (the “Internal Revenue Code”). A receipt of an opinion substantially to that effect from Kirkland & Ellis LLP, tax counsel to the Acquiring Fund, is a condition to the obligation of the Funds to consummate the Merger. As a tax-free reorganization, the Merger will generally not be taxable to the Acquiring Fund, the Target Fund or their shareholders for U.S. federal income tax purposes. Even though the Merger is expected to be tax-free, because the Merger will end the tax year of the Target Fund, the Merger may accelerate taxable distributions from the Target Fund to its shareholders.

The remainder of this discussion assumes that the Merger will be treated as a “reorganization” under Section 368(a) of the Internal Revenue Code.

The cost basis and holding period of the Target Fund shares will carry over to the shares of the Acquiring Fund you receive as a result of the Merger, in each case for U.S. federal income tax purposes. At any time prior to the consummation of the Merger, a shareholder may redeem shares, generally resulting in recognition of a gain or loss for U.S. federal income tax purposes to the redeeming shareholder.

A Fund’s net capital losses realized are permitted to be carried forward indefinitely to offset future capital gain.

The Target Fund does not expect to sell any of its portfolio securities in connection with repositioning its portfolio in anticipation of the Merger.

Certain other U.S. federal income tax consequences are discussed below under “Material U.S. Federal Income Tax Consequences of the Merger.”

ALLSPRING DISCOVERY LARGE CAP GROWTH FUND INTO ALLSPRING LARGE CAP GROWTH FUND

Share Class Information

The following table illustrates the share class of the Acquiring Fund you will receive in exchange for your Target Fund shares as a result of the Merger. The Acquiring Fund share class to be received in exchange for the applicable Target Fund share class was chosen based on a consideration of expense structure and shareholder eligibility similarities.

If you own this class of shares of the Allspring Discovery Large Cap Growth Fund(Target Fund): | You will receive this class of shares of the Allspring Large Cap Growth Fund(Acquiring Fund): |

Class A | Class A |

Class C | Class C |

Class R6 | Class R6 |

Administrator Class | Administrator Class |

Institutional Class | Institutional Class |

The Acquiring Fund shares you will receive as a result of the Merger will have the same dollar value as your Target Fund shares as of the close of business on the business day immediately prior to the Merger.

The procedures for buying, selling and exchanging shares of the Funds are identical. For additional information on how you can buy, sell or exchange shares of the Acquiring Fund see the section entitled “Account Information.” Additional information on how you can buy, sell or exchange shares of the Target Fund is available in the Target Fund’s prospectus and SAI. In addition, the distribution policies for the Funds are the same.

Investment Objective and Strategy Comparison

The following section compares the investment objectives and principal investment strategies of the Funds. The investment objectives of the Funds may be changed without shareholder approval.

The Funds have identical investment objectives and substantially similar principal investment strategies, that differ primarily with respect to the stock selection process and sell discipline of the Funds’ respective portfolio management teams as well as the number of companies in which the Target Fund invests.

9 |

Allspring Discovery Large Cap Growth Fund (Target Fund) | Allspring Large Cap Growth Fund (Acquiring Fund) |

INVESTMENT OBJECTIVES | INVESTMENT OBJECTIVES |

The Fund seeks long-term capital appreciation. | The Fund seeks long-term capital appreciation. |

PRINCIPAL INVESTMENT STRATEGIES | PRINCIPAL INVESTMENT STRATEGIES |

Under normal circumstances, we invest: ■ at least 80% of the Fund’s total assets in large cap equity securities; and ■ up to 25% of the Fund’s total assets in equity securities of foreign issuers through ADRs and similar investments. | Under normal circumstances, we invest: ■ at least 80% of the Fund’s net assets in equity securities of large-capitalization companies; and ■ up to 25% of the Fund’s total assets in equity securities of foreign issuers, through ADRs and similar investments. |

We invest principally in the equity securities of approximately 30 to 40 large capitalization companies that we believe offer the potential for capital growth. We define large-capitalization companies as those with market capitalizations within the range of the Russell 1000® Index at the time of purchase. The market capitalization range of the Russell 1000® Index was approximately $452 million to $2.66 trillion, as of October 31, 2023, and is expected to change frequently. We may also invest in equity securities of foreign issuers through ADRs and similar investments. | We invest principally in equity securities of large-capitalization companies that we believe have prospects for robust and sustainable growth of revenues and earnings. We define large-capitalization companies as those with market capitalizations within the range of the Russell 1000® Index at the time of purchase. The market capitalization range of the Russell 1000® Index was approximately $452 million to $2.66 trillion, as of October 31, 2023, and is expected to change frequently. We may also invest in equity securities of foreign issuers, through ADRs and similar investments. |

| 10

Allspring Discovery Large Cap Growth Fund (Target Fund) | Allspring Large Cap Growth Fund (Acquiring Fund) |

We seek to identify companies that have the prospect for strong sales and earnings growth rates, that enjoy a competitive advantage (for example, dominant market share) and that we believe have effective management with a history of making investments that are in the best interests of shareholders (for example, companies with a history of earnings and sales growth that are in excess of total asset growth). Furthermore, we seek to identify companies that embrace innovation and foster disruption using technology to maximize efficiencies, gain pricing advantages, and take market share from competitors. We view innovative companies as those that, among other characteristics, have the ability to advance new products or services through investment in research and development, that operate a business model that is displacing legacy industry incumbents, that are pursuing a large unmet need or total available market. We believe innovation found in companies on the “right side of change” is often mispriced in today’s public equity markets and is a frequent signal or anomaly that we seek to exploit through our investment process. An important criteria for “right side of change” companies is that they are benefiting from changes in technological, demographic, lifestyle, or environmental trends We pay particular attention to how management teams allocate capital in order to drive future cash flow. This includes the allocation of human capital, financial capital, and social capital. We believe successful allocation of such resources has a correlation with key indicators of future performance. Price objectives are determined based on industry-specific valuation methodologies, including relative price-to-earnings multiples, price-to-book value, operating profit margin trends, enterprise value to EBITDA (earnings before interest, taxes, depreciation and amortization) and free cash flow yield. In addition to meeting with management, we take a surround the company approach by surveying a company’s vendors, distributors, competitors and customers to obtain multiple perspectives that help us make better investment decisions. Portfolio holdings are continuously monitored for changes in fundamentals. The team seeks a favorable risk/reward relationship to fair valuation, which we define as the value of the company (i.e., our price target for the stock) relative to where the stock is currently trading. We may invest in any sector, and at times the Fund may emphasize one or more particular sectors. We may choose to sell a holding when it no longer offers favorable growth prospects, reaches our target price, or to take advantage of a better investment opportunity. | We focus on companies that dominate their market, are establishing new markets or are undergoing dynamic change. We believe earnings and revenue growth relative to expectations are critical factors in determining stock price movements. Thus, our investment process is centered around finding companies with under-appreciated prospects for robust and sustainable growth in earnings and revenue. To find that growth, we use bottom-up research, emphasizing companies whose management teams have a history of successfully executing their strategy and whose business models have sufficient profit potential. We forecast revenue and earnings revision opportunities, along with other key financial metrics to assess investment potential. We also believe that strong ESG policies and practices contribute to a company’s long-term sustainability of growth and therefore look for companies that are perceived as strong ESG performers or that have underappreciated ESG characteristics that we believe can drive future growth consistent with our forward-looking expectations. We combine our company-specific analysis with our assessment of secular and timeliness trends to form a buy/sell decision about a particular stock. We may invest in any sector, and at times we may emphasize one or more particular sectors. We sell a company’s securities when we see deterioration in fundamentals that leads us to become suspicious of a company’s prospective growth profile or the profitability potential of its business model, as this often leads to lower valuation potential. We may also sell or trim a position when we need to raise money to fund the purchase of a better investment opportunity or when valuation is extended beyond our expectations. |

Fundamental Investment Policy Comparison

The fundamental investment policies of the Funds, which may only be changed with shareholder approval, are identical. For a chart of the Funds’ fundamental investment policies, please see Exhibit B.

Principal Risk Comparison

The principal risks of the Target Fund are substantially similar to those of the Acquiring Fund due to the similarity of the Funds’ investment objectives and principal investment strategies, as noted above. The principal difference relates to the Target Fund being subject to Focused Portfolio Risk due to its investment strategy to invest in between 30 and 40 securities. The Acquiring Fund is not subject to this risk as it does not have a matching investment strategy. The table below compares the principal risk factors of the Target Fund with those of the Acquiring Fund. These risks are described in the section entitled “Risk Descriptions.”

Allspring Discovery Large Cap Growth Fund (Target Fund) | Allspring Large Cap Growth Fund (Acquiring Fund) |

Equity Securities Risk | Equity Securities Risk |

Focused Portfolio Risk | Not a risk of the Fund. |

11 |

Allspring Discovery Large Cap Growth Fund (Target Fund) | Allspring Large Cap Growth Fund (Acquiring Fund) |

Foreign Investment Risk | Foreign Investment Risk |

Growth/Value Investing Risk | Growth/Value Investing Risk |

Management Risk | Management Risk |

Market Risk | Market Risk |

The Funds have other investment policies, practices and restrictions which, together with their related risks, are set forth in each Fund’s prospectuses and SAI.

Fund Performance Comparison

The following bar charts and tables illustrate how each Fund’s returns have varied from year to year and compare each Fund’s returns with those of one or more broad-based securities indexes. Past performance (before and after taxes) is not necessarily an indication of future results. Current month-end performance information is available for the Funds on the Allspring Funds website at allspringglobal.com. Following the Merger, the Acquiring Fund will be the accounting and performance survivor.

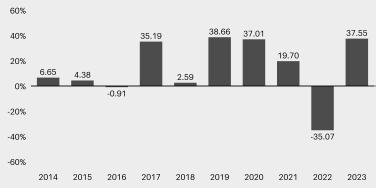

Calendar Year Total Returns for Class A Shares (%) for the Allspring Discovery Large Cap Growth Fund

(Returns do not reflect sales charges and would be lower if they did)

|

Highest Quarter: June 30, 2020 | +27.32% |

Lowest Quarter: June 30, 2022 | -24.50% |

Year-to-date total return as of June 30, 2024 is +12.85% |

|

Average Annual Total Returns for the periods ended 12/31/2023 (returns reflect applicable sales charges) | ||||

| Inception Date of Share Class | 1 Year | 5 Year | 10 Year |

Class A (before taxes) | 12/29/2000 | 29.57% | 13.87% | 11.34% |

Class A (after taxes on distributions) | 12/29/2000 | 27.36% | 10.99% | 6.94% |

Class A (after taxes on distributions and the sale of Fund Shares) | 12/29/2000 | 19.02% | 10.87% | 7.74% |

Class C (before taxes) | 12/29/2000 | 35.38% | 14.33% | 11.33% |

Class R6 (before taxes) | 9/20/2019 | 38.16% | 15.69% | 12.46% |

Administrator Class (before taxes) | 4/8/2005 | 37.63% | 15.37% | 12.20% |

Institutional Class (before taxes) | 4/8/2005 | 37.92% | 15.58% | 12.40% |

Russell 3000® Index (reflects no deduction for fees, expenses, or taxes) |

| 25.96% | 15.16% | 11.48% |

| 12

Average Annual Total Returns for the periods ended 12/31/2023 (returns reflect applicable sales charges) | ||||

| Inception Date of Share Class | 1 Year | 5 Year | 10 Year |

Russell 1000® Growth Index (reflects no deduction for fees, expenses, or taxes) |

| 42.68% | 19.50% | 14.86% |

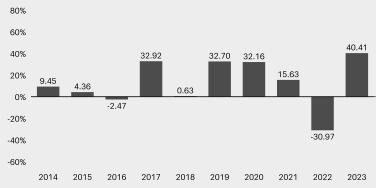

Calendar Year Total Returns for Class A Shares (%) for the Allspring Large Cap Growth Fund

(Returns do not reflect sales charges and would be lower if they did)

|

Highest Quarter: June 30, 2020 | +28.79% |

Lowest Quarter: June 30, 2022 | -22.07% |

Year-to-date total return as of June 30, 2024 is +23.81% |

|

Average Annual Total Returns for the periods ended 12/31/2023 (returns reflect applicable sales charges) | ||||

| Inception Date of Share Class | 1 Year | 5 Year | 10 Year |

Class A (before taxes) | 7/30/2010 | 32.34% | 13.12% | 10.69% |

Class A (after taxes on distributions) | 7/30/2010 | 26.89% | 9.71% | 7.51% |

Class A (after taxes on distributions and the sale of Fund Shares) | 7/30/2010 | 22.84% | 10.19% | 8.04% |

Class C (before taxes) | 7/30/2010 | 38.32% | 13.60% | 10.67% |

Class R6 (before taxes) | 11/30/2012 | 41.02% | 14.94% | 11.82% |

Administrator Class (before taxes) | 7/30/2010 | 40.60% | 14.60% | 11.47% |

Institutional Class (before taxes) | 7/30/2010 | 40.84% | 14.82% | 11.71% |

Russell 3000® Index (reflects no deduction for fees, expenses, or taxes) |

| 25.96% | 15.16% | 11.48% |

Russell 1000® Growth Index (reflects no deduction for fees, expenses, or taxes) |

| 42.68% | 19.50% | 14.86% |

Shareholder Fee and Fund Expense Comparison

This section compares the fees and expenses you pay if you buy, hold, and sell shares of the Target Fund and the Acquiring Fund. For information about the share class of the Acquiring Fund that you will receive in connection with the Merger, please see the section entitled “Share Class Information” above.

The first table entitled “Shareholder Fees” allows you to compare the maximum sales charges of the Funds and includes a Pro Forma column that shows you what the sales charges following the Merger. The sales charges for each

13 |

class of shares of the Target Fund are identical to those of the corresponding class of shares of the Acquiring Fund. The Target Fund shareholders will not pay any front-end or deferred sales charges in connection with the Merger.

The second table entitled “Annual Fund Operating Expenses” allows you to compare the annual operating expenses of the Funds. The total annual fund operating expenses for both Funds set forth in the following table are based on the actual expenses incurred for each Fund’s fiscal year ended July 31, 2023. The pro forma expense column shows you what the total annual fund operating expenses (before and after waiver) would have been for the Acquiring Fund for the twelve-month period ended July 31, 2023, assuming the Merger had taken place at the beginning of that period. As illustrated in more detail below, the Target Fund’s gross expenses across all classes are higher than that of the Acquiring Fund (both before and after the Merger). The net expenses of the Target Fund and Acquiring Fund (both before and after the Merger) are identical. The investment management fee schedules for both Funds are identical but the current effective management fee rate is lower for the Acquiring Fund than the Target Fund.

Shareholder Fees (fees paid directly from your investment) | |||

| Allspring Discovery Large Cap Growth Fund (Pre-Merger) | Allspring Large Cap Growth Fund (Pre-Merger) | Allspring Large Cap Growth Fund (Pro Forma) |

Class A |

|

|

|

Maximum sales charge (load) imposed on purchases (as a percentage of the offering price) | 5.75% | 5.75% | 5.75% |

Maximum deferred sales charge (load) (as a percentage of the offering price) | None1 | None1 | None1 |

Class C |

|

|

|

Maximum sales charge (load) imposed on purchases (as a percentage of the offering price) | None | None | None |

Maximum deferred sales charge (load) (as a percentage of the offering price) | 1.00% | 1.00% | 1.00% |

Class R6 |

|

|

|

Maximum sales charge (load) imposed on purchases (as a percentage of the offering price) | None | None | None |

Maximum deferred sales charge (load) (as a percentage of the offering price) | None | None | None |

Administrator Class |

|

|

|

Maximum sales charge (load) imposed on purchases (as a percentage of the offering price) | None | None | None |

Maximum deferred sales charge (load) (as a percentage of the offering price) | None | None | None |

Institutional Class |

|

|

|

Maximum sales charge (load) imposed on purchases (as a percentage of the offering price) | None | None | None |

Maximum deferred sales charge (load) (as a percentage of the offering price) | None | None | None |

| 1. | Investments of $1 million or more are not subject to a front-end sales charge, but will be subject to a deferred sales charge of 1.00% if you sell the shares within eighteen months from the date of purchase. |

| 14

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment)1 | |||

| Allspring Discovery Large Cap Growth Fund (Pre-Merger) | Allspring Large Cap Growth Fund (Pre-Merger) | Allspring Large Cap Growth Fund (Proforma) |

Class A |

|

|

|

Management Fees | 0.70% | 0.69% | 0.69% |

Distribution (12b-1) Fees | 0.00% | 0.00% | 0.00% |

Other Expenses | 0.59% | 0.49% | 0.48% |

Total Annual Fund Operating Expenses | 1.29% | 1.18% | 1.17% |

Waiver of Fund Expenses | (0.27)% | (0.16)% | (0.15)% |

Total Annual Fund Operating Expenses After Waiver Fee Waiver | 1.02%2 | 1.02%3 | 1.02%3 |

Class C |

|

|

|

Management Fees | 0.70% | 0.69% | 0.69% |

Distribution (12b-1) Fees | 0.75% | 0.75% | 0.75% |

Other Expenses | 0.59% | 0.49% | 0.48% |

Total Annual Fund Operating Expenses | 2.04% | 1.93% | 1.92% |

Waiver of Fund Expenses | (0.27)% | (0.16)% | (0.15)% |

Total Annual Fund Operating Expenses After Waiver Fee Waiver | 1.77%2 | 1.77%3 | 1.77%3 |

Class R6 |

|

|

|

Management Fees | 0.70% | 0.69% | 0.69% |

Distribution (12b-1) Fees | 0.00% | 0.00% | 0.00% |

Other Expenses | 0.17% | 0.07% | 0.06% |

Total Annual Fund Operating Expenses | 0.87% | 0.76% | 0.75% |

Waiver of Fund Expenses | (0.27)% | (0.16)% | (0.15)% |

Total Annual Fund Operating Expenses After Waiver Fee Waiver | 0.60%4 | 0.60%5 | 0.60%5 |

Administrator Class |

|

|

|

Management Fees | 0.70% | 0.69% | 0.69% |

Distribution (12b-1) Fees | 0.00% | 0.00% | 0.00% |

Other Expenses | 0.52% | 0.42% | 0.41% |

Total Annual Fund Operating Expenses | 1.22% | 1.11% | 1.10% |

Waiver of Fund Expenses | (0.28)% | (0.17)% | (0.16)% |

Total Annual Fund Operating Expenses After Waiver Fee Waiver | 0.94%6 | 0.94%7 | 0.94%7 |

Institutional Class |

|

|

|

Management Fees | 0.70% | 0.69% | 0.69% |

Distribution (12b-1) Fees | 0.00% | 0.00% | 0.00% |

Other Expenses | 0.27% | 0.17% | 0.16% |

Total Annual Fund Operating Expenses | 0.97% | 0.86% | 0.85% |

Waiver of Fund Expenses | (0.27)% | (0.16)% | (0.15)% |

Total Annual Fund Operating Expenses After Waiver Fee Waiver | 0.70%8 | 0.70%9 | 0.70%9 |

| 1. | Expenses have been adjusted as necessary from amounts incurred during the Fund’s most recent fiscal year to reflect current fees and expenses. |

| 2. | The Manager has contractually committed through November 30, 2024, to waive fees and/or reimburse expenses to the extent necessary to cap Total Annual Fund Operating Expenses After Fee Waivers at 1.02% for Class A and 1.77% for Class C. Brokerage commissions, stamp duty fees, interest, taxes, acquired fund fees and expenses (if any), and extraordinary expenses are excluded from the expense cap. Prior to or after the commitment expiration date, the cap may be increased or the commitment to maintain the cap may be terminated only with the approval of the Board of Trustees. |

| 3. | The Manager has contractually committed through November 30, 2025, to waive fees and/or reimburse expenses to the extent |

15 |

| necessary to cap Total Annual Fund Operating Expenses After Fee Waivers at 1.02% for Class A and 1.77% for Class C. Brokerage commissions, stamp duty fees, interest, taxes, acquired fund fees and expenses (if any), and extraordinary expenses are excluded from the expense cap. Prior to or after the commitment expiration date, the cap may be increased or the commitment to maintain the cap may be terminated only with the approval of the Board of Trustees. |

| 4. | The Manager has contractually committed through November 30, 2024, to waive fees and/or reimburse expenses to the extent necessary to cap Total Annual Fund Operating Expenses After Fee Waiver at 0.60% for Class R6. Brokerage commissions, stamp duty fees, interest, taxes, acquired fund fees and expenses (if any), and extraordinary expenses are excluded from the expense cap. Prior to or after the commitment expiration date, the cap may be increased or the commitment to maintain the cap may be terminated only with the approval of the Board of Trustees. |

| 5. | The Manager has contractually committed through November 30, 2025, to waive fees and/or reimburse expenses to the extent necessary to cap Total Annual Fund Operating Expenses After Fee Waiver at 0.60% for Class R6. Brokerage commissions, stamp duty fees, interest, taxes, acquired fund fees and expenses (if any), and extraordinary expenses are excluded from the expense cap. Prior to or after the commitment expiration date, the cap may be increased or the commitment to maintain the cap may be terminated only with the approval of the Board of Trustees. |

| 6. | The Manager has contractually committed through November 30, 2024, to waive fees and/or reimburse expenses to the extent necessary to cap Total Annual Fund Operating Expenses After Fee Waiver at 0.94% for Administrator Class. Brokerage commissions, stamp duty fees, interest, taxes, acquired fund fees and expenses (if any), and extraordinary expenses are excluded from the expense cap. Prior to or after the commitment expiration date, the cap may be increased or the commitment to maintain the cap may be terminated only with the approval of the Board of Trustees. |

| 7. | The Manager has contractually committed through November 30, 2025, to waive fees and/or reimburse expenses to the extent necessary to cap Total Annual Fund Operating Expenses After Fee Waiver at 0.94% for Administrator Class. Brokerage commissions, stamp duty fees, interest, taxes, acquired fund fees and expenses (if any), and extraordinary expenses are excluded from the expense cap. Prior to or after the commitment expiration date, the cap may be increased or the commitment to maintain the cap may be terminated only with the approval of the Board of Trustees. |

| 8. | The Manager has contractually committed through November 30, 2024, to waive fees and/or reimburse expenses to the extent necessary to cap Total Annual Fund Operating Expenses After Fee Waiver at 0.70% for Institutional Class. Brokerage commissions, stamp duty fees, interest, taxes, acquired fund fees and expenses (if any), and extraordinary expenses are excluded from the expense cap. Prior to or after the commitment expiration date, the cap may be increased or the commitment to maintain the cap may be terminated only with the approval of the Board of Trustees. |

| 9. | The Manager has contractually committed through November 30, 2025, to waive fees and/or reimburse expenses to the extent necessary to cap Total Annual Fund Operating Expenses After Fee Waiver at 0.70% for Institutional Class. Brokerage commissions, stamp duty fees, interest, taxes, acquired fund fees and expenses (if any), and extraordinary expenses are excluded from the expense cap. Prior to or after the commitment expiration date, the cap may be increased or the commitment to maintain the cap may be terminated only with the approval of the Board of Trustees. |

Example of Fund Expenses. The examples below are intended to help you compare the costs of investing in the Target Fund with the costs of investing in the Acquiring Fund, both before and after the Merger, and are for illustration only. The examples assume a $10,000 initial investment, 5% annual total return, and that operating expenses remain the same, as in the tables above. To the extent that the Manager is waiving fees or reimbursing expenses, the examples assume that such waivers or reimbursements will only be in place through the dates indicated in the footnotes above (both pre-merger and pro forma). Although your actual costs may be higher or lower, based on these assumptions, your costs would be:

| 16

Allspring Discovery Large Cap Growth Fund (Pre-Merger) | ||||

Assuming you sold your shares, you would pay: | After 1 Year | After 3 Years | After 5 Years | After 10 Years |

Class A | $673 | $935 | $1,217 | $2,020 |

Class C | $280 | $614 | $1,073 | $2,347 |

Class R6 | $61 | $251 | $456 | $1,048 |

Administrator Class | $96 | $359 | $643 | $1,452 |

Institutional Class | $72 | $282 | $510 | $1,165 |

Assuming you held your shares, you would pay: | After 1 Year | After 3 Years | After 5 Years | After 10 Years |

Class C | $180 | $614 | $1,073 | $2,347 |

Allspring Large Cap Growth Fund (Pre-Merger) | ||||

Assuming you sold your shares, you would pay: | After 1 Year | After 3 Years | After 5 Years | After 10 Years |

Class A | $673 | $898 | $1,157 | $1,897 |

Class C | $280 | $574 | $1,011 | $2,227 |

Class R6 | $61 | $210 | $390 | $911 |

Administrator Class | $96 | $318 | $578 | $1,320 |

Institutional Class | $72 | $242 | $445 | $1,030 |

Assuming you held your shares, you would pay: | After 1 Year | After 3 Years | After 5 Years | After 10 Years |

Class C | $180 | $574 | $1,011 | $2,227 |

Allspring Large Cap Growth Fund (Proforma) | ||||

Assuming you sold your shares, you would pay: | After 1 Year | After 3 Years | After 5 Years | After 10 Years |

Class A | $673 | $897 | $1,154 | $1,888 |

Class C | $280 | $573 | $1,008 | $2,218 |

Class R6 | $61 | $209 | $387 | $901 |

Administrator Class | $96 | $317 | $574 | $1,311 |

Institutional Class | $72 | $240 | $441 | $1,020 |

Assuming you held your shares, you would pay: | After 1 Year | After 3 Years | After 5 Years | After 10 Years |

Class C | $180 | $573 | $1,008 | $2,218 |

Each Fund has a shareholder servicing fee of up to 0.25% for Class A and Administrator Class shares. Class C shares of each Fund have a shareholder servicing fee of 0.25% and a distribution fee (12b-1 fee) of 0.75%. Class R6 and Institutional shares of each fund do not pay a distribution fee (12b-1 fee) or a shareholder servicing fee.

Fund Management Information

The following table identifies the manager, sub-adviser and portfolio managers for the Acquiring Fund. Further information about the management of the Acquiring Fund can be found under the section entitled “Management of the Funds.”

Allspring Large Cap Growth Fund | |

Investment Manager | Allspring Funds Management, LLC |

Investment Sub-adviser | Allspring Global Investments, LLC |

Portfolio Manager, Title/Managed Since | Robert Gruendyke, CFA, Portfolio Manager / 2020 |

| 1. | Thomas C. Ognar, CFA has announced his intention to retire from Allspring Global Investments, LLC in August 2025. He will continue to serve as a portfolio manager of the Fund until July 26, 2024. After July 26, 2024, all references to Thomas C. Ognar, CFA in the Fund’s Prospectuses and Statement of Additional Information are hereby removed. |

17 |

Tax Information

It is expected that, for U.S. federal income tax purposes and under currently applicable U.S. federal income tax law, the Merger will be treated as a “reorganization” within the meaning of Section 368(a) of the Internal Revenue Code. A receipt of an opinion substantially to that effect from Kirkland & Ellis LLP, tax counsel to the Acquiring Fund, is a condition to the obligation of the Funds to consummate the Merger. As a tax-free reorganization, the Merger will generally not be taxable to the Acquiring Fund, the Target Fund or their shareholders for U.S. federal income tax purposes. Even though the Merger is expected to be tax-free, because the Merger will end the tax year of the Target Fund, the Merger may accelerate taxable distributions from the Target Fund to its shareholders.

The remainder of this discussion assumes that the Merger will be treated as a “reorganization” under Section 368(a) of the Internal Revenue Code.

The cost basis and holding period of the Target Fund shares will carry over to the shares of the Acquiring Fund you receive as a result of the Merger, in each case for U.S. federal income tax purposes. At any time prior to the consummation of the Merger, a shareholder may redeem shares, generally resulting in recognition of a gain or loss for U.S. federal income tax purposes to the redeeming shareholder.

A Fund’s net capital losses realized are permitted to be carried forward indefinitely to offset future capital gain.

The Target Fund does not expect to sell any of its portfolio securities in connection with repositioning its portfolio in anticipation of the Merger.

Certain other U.S. federal income tax consequences are discussed below under “Material U.S. Federal Income Tax Consequences of the Merger.”

An investment in each Acquiring Fund is subject to certain risks. There is no assurance that the return of an Acquiring Fund will be positive or that an Acquiring Fund will meet its investment objective. An investment in an Acquiring Fund is not a deposit of a bank or its affiliates; is not insured, or guaranteed by the Federal Deposit Insurance Corporation or any other government agency; and is subject to investment risks, including possible loss of your original investment. Like most investments, your investment in an Acquiring Fund could result in a loss of money. The following provides additional information regarding the various risks (in alphabetical order) of investing in an Acquiring Fund as referenced in the section entitled “Merger Summary - Principal Risk Comparison”.

Equity Securities Risk. The values of equity securities may experience periods of substantial price volatility and may decline significantly over short time periods. In general, the values of equity securities are more volatile than those of debt securities. Equity securities fluctuate in value and price in response to factors specific to the issuer of the security, such as management performance, financial condition, and market demand for the issuer’s products or services, as well as factors unrelated to the fundamental condition of the issuer, including general market, economic and political conditions. Investing in equity securities poses risks specific to an issuer, as well as to the particular type of company issuing the equity securities. For example, investing in the equity securities of small- or mid-capitalization companies can involve greater risk than is customarily associated with investing in stocks of larger, more-established companies. Different parts of a market, industry and sector may react differently to adverse issuer, market, regulatory, political, and economic developments. Negative news or a poor outlook for a particular industry or sector can cause the share prices of securities of companies in that industry or sector to decline. This risk may be heightened for a Fund that invests a substantial portion of its assets in a particular industry or sector.

Foreign Investment Risk. Foreign investments may be subject to lower liquidity, greater price volatility and risks related to adverse political, regulatory, market or economic developments. Foreign companies may be subject to significantly higher levels of taxation than U.S. companies, including potentially confiscatory levels of taxation, thereby reducing the earnings potential of such foreign companies. Foreign investments may involve exposure to changes in foreign currency exchange rates. Such changes may reduce the U.S. dollar value of the investments. Foreign investments may be subject to additional risks, such as potentially higher withholding and other taxes, and may also be subject to greater trade settlement, custodial, and other operational risks than domestic investments. Certain foreign markets may also be characterized by less stringent investor protection and disclosure standards.

Growth/Value Investing Risk. Securities that exhibit certain characteristics, such as growth characteristics or value characteristics, tend to perform differently and shift into and out of favor with investors depending on changes in

| 18

market and economic sentiment and conditions. As a result, a Fund’s performance may at times be worse than the performance of other mutual funds that invest more broadly or in securities that exhibit different characteristics.

Management Risk. Investment decisions, techniques, analyses or models implemented by a Fund’s manager or sub-adviser in seeking to achieve the Fund’s investment objective may not produce the returns expected, may cause the Fund’s shares to lose value or may cause the Fund to underperform other funds with similar investment objectives.

Market Risk. The values of, and/or the income generated by, securities held by a Fund may decline due to general market conditions or other factors, including those directly involving the issuers of such securities. Securities markets are volatile and may decline significantly in response to adverse issuer, regulatory, political, or economic developments. Different sectors of the market and different security types may react differently to such developments. Political, geopolitical, natural and other events, including war, terrorism, trade disputes, government shutdowns, market closures, inflation, natural and environmental disasters, epidemics, pandemics and other public health crises and related events have led, and in the future may lead, to economic uncertainty, decreased economic activity, increased market volatility and other disruptive effects on U.S. and global economies and markets. Such events may have significant adverse direct or indirect effects on a Fund and its investments. In addition, economies and financial markets throughout the world are becoming increasingly interconnected, which increases the likelihood that events or conditions in one country or region will adversely impact markets or issuers in other countries or regions.

The following provides additional information regarding the manager and sub-adviser of each Acquiring Fund as referenced in the section entitled “Merger Summary” and also provides expenses related to the operation of the Acquiring Funds.

MANAGER

Allspring Funds Management, headquartered at 1415 Vantage Park Drive, 3rd Floor, Charlotte, NC 28203, provides advisory and fund-level administrative services to each Acquiring Fund pursuant to an investment management agreement. Allspring Funds Management is a wholly owned subsidiary of Allspring Global Investments Holdings, LLC, a holding company indirectly owned by certain private funds of GTCR LLC and Reverence Capital Partners, L.P. Allspring Funds Management is a registered investment adviser that provides advisory services for registered mutual funds, closed-end funds and other funds and accounts.

SUB-ADVISER

Allspring Investments is a registered investment adviser located at 1415 Vantage Park Drive, 3rd Floor, Charlotte, NC 28203. Allspring Investments, an affiliate of Allspring Funds Management and wholly owned subsidiary of Allspring Global Investments Holdings, LLC, is a multi-boutique asset management firm committed to delivering superior investment services to institutional clients, including mutual funds.

MANAGEMENT AND SUB-ADVISORY FEES

As compensation for the investment management services Allspring Funds Management provides to Acquiring Funds, Allspring Funds Management is entitled to receive a monthly fee at the annual rates indicated below, as a percentage of each Acquiring Fund’s average daily net assets.

Fund |

| Management Fee | |

Growth Fund |

| First $500M | 0.800% |

19 |

Fund |

| Management Fee | |

Large Cap Growth Fund |

| First $500M | 0.700% |

For providing investment sub-advisory services to the Acquiring Funds, Allspring Investments is entitled to receive monthly fees at the annual rates indicated below, which are stated as a percentage of the Acquiring Fund’s average daily net assets. Allspring Investments is compensated for its services by Allspring Funds Management from the fees Allspring Funds Management receives for its services as investment manager to each Acquiring Fund.

Fund | Sub-Adviser | Sub-Advisory Fee | |

Growth Fund | Allspring Investments | First $100M | 0.450% |

Large Cap Growth Fund | Allspring Investments | First $100M | 0.300% |

For the Acquiring Fund’s most recent fiscal year, the management fee paid to Allspring Funds Management, net of any applicable waivers and reimbursement was as follows:

Management Fees Paid | |

| As a % of average daily net assets |

Growth Fund | 0.68% |

Large Cap Growth Fund | 0.60% |

For a discussion regarding the basis for the approval of each Acquiring Fund’s Management Agreement and Sub-Advisory Agreement by the Board, please see the Acquiring Fund’s annual report for the year ended July 31, 2023.

MULTI-MANAGER ARRANGEMENT

The Funds and Allspring Funds Management have obtained an exemptive order from the SEC that permits Allspring Funds Management, subject to Board approval, to select certain sub-advisers and enter into or amend sub-advisory agreements with them, without obtaining shareholder approval. The SEC order extends to sub-advisers that are not otherwise affiliated with Allspring Funds Management or the Funds, as well as sub-advisers that are wholly-owned subsidiaries of Allspring Funds Management or of a company that wholly owns Allspring Funds Management. In addition, the SEC staff, pursuant to no-action relief, has extended multi-manager relief to any affiliated sub-adviser,such as affiliated sub-advisers that are not wholly-owned subsidiaries of Allspring Funds Management or of a company that wholly owns Allspring Funds Management, provided certain conditions are satisfied (all such sub-advisers covered by the order or relief, “Multi-Manager Sub-Advisers”).

As such, Allspring Funds Management, with Board approval, may hire or replace Multi-Manager Sub-Advisers for each Fund that is eligible to rely on the order or relief. Allspring Funds Management, subject to Board oversight, has the responsibility to oversee Multi-Manager Sub-Advisers and to recommend their hiring, termination and replacement. If anew sub-adviser is hired for a Fund pursuant to the order or relief, the Fund is required to notify shareholders within 90days. The Funds are not required to disclose the individual fees that Allspring Funds Management pays to a Multi-Manager Sub-Adviser.

| 20

ADDITIONAL INFORMATION REGARDING THE EXPENSES OF THE FUNDS

The Target Fund and the Acquiring Fund each pay Allspring Funds Management a class-level administrative fee. The class-level administrative fee is applied on a class-by-class basis and at rates that differ among classes. Allspring Funds Management provides or obtains transfer agency services for the Target Fund and the Acquiring Fund as part of its class-level administrative service, and the administrative fee paid on a class-by-class basis is intended in part to compensate Allspring Funds Management for providing or obtaining those transfer agency services. The Target Fund’s and the Acquiring Fund’s SAI contains more information regarding the administration and transfer agency service fees borne by the Target Fund and the Acquiring Fund.

BOARD CONSIDERATIONS

ALLSPRING DISCOVERY ALL CAP GROWTH FUND INTO ALLSPRING GROWTH FUND