0001089113ifrs-full:LifetimeExpectedCreditLossesMemberhsbc:LoansAndAdvancesToBanksAndCustomersIncludingLoanCommitmentsAndFinancialGuaranteesMemberifrs-full:FinancialInstrumentsNotCreditimpairedMemberifrs-full:AccumulatedImpairmentMember2020-12-310001089113ifrs-full:LifetimeExpectedCreditLossesMemberifrs-full:FinancialGuaranteeContractsMemberifrs-full:GrossCarryingAmountMemberifrs-full:FinancialInstrumentsNotCreditimpairedMemberhsbc:IFRS9Member2020-12-310001089113ifrs-full:Level3OfFairValueHierarchyMemberhsbc:NetIncomeFromFinancialInstrumentsHeldForTradingOrManagedOnAFairValueBasisMemberifrs-full:RecurringFairValueMeasurementMemberifrs-full:FinancialLiabilitiesAtFairValueThroughProfitOrLossThatMeetDefinitionOfHeldForTradingCategoryMember2020-07-012020-12-31

FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Private Issuer

Pursuant to Rule 13a - 16 or 15d - 16 of

the Securities Exchange Act of 1934

For the month of August 2021

Commission File Number: 001-14930

HSBC Holdings plc

42nd Floor, 8 Canada Square, London E14 5HQ, England

(Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F).

Form 20-F X Form 40-F ......

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ______

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ______

This Report on Form 6-K with respect to our interim results for the first half of 2021 is hereby incorporated by reference in HSBC Holdings plc’s registration statement on Form F-3 (333-253632).

Neither our website referred to herein, nor any of the information contained on our website, is incorporated by reference in the Form 6-K.

Contents

Overview

1a Cautionary statement regarding forward-looking statements

1b Certain defined terms

2 Highlights

4 Group Chief Executive’s review

8 Our strategy

10 How we do business

12 Financial overview

16 Global businesses

23 Risk overview

Interim management report

27 Financial summary

34 Global businesses

42 Geographical regions

52 Reconciliation of alternative performance measures

55 Risk

55 – Key developments in the first half of 2021

55 – Areas of special interest

59 – Credit risk

86 – Treasury risk

94 – Market risk

96 – Insurance manufacturing operations risk

Interim condensed financial statements

98 Interim condensed financial statements

104 Notes on the interim condensed financial statements

Additional information

125 Shareholder information

131 Abbreviations

A reminder

The currency we report in is US dollars.

Adjusted measures

We supplement our IFRSs figures with non-IFRSs measures used by management internally that constitute alternative performance measures under European Securities and Markets Authority guidance and non-GAAP financial measures defined in and presented in accordance with US Securities and Exchange Commission rules and regulations. These measures are highlighted with the following symbol: <>

Further explanation may be found on page 14.

In this document we use the following abbreviations to refer to reporting periods:

1H21 First half of 2021 2Q21 Second quarter of 2021

2H20 Second half of 2020 1Q21 First quarter of 2021

1H20 First half of 2020 2Q20 Second quarter of 2020 1Q20 First quarter of 2020

None of the websites referred to in this Interim Report on Form 6-K for the half-year ended June 30, 2020 (the ‘Form 6-K’), including where a link is provided, nor any of the information contained on such websites is incorporated by reference in the Form 6-K.

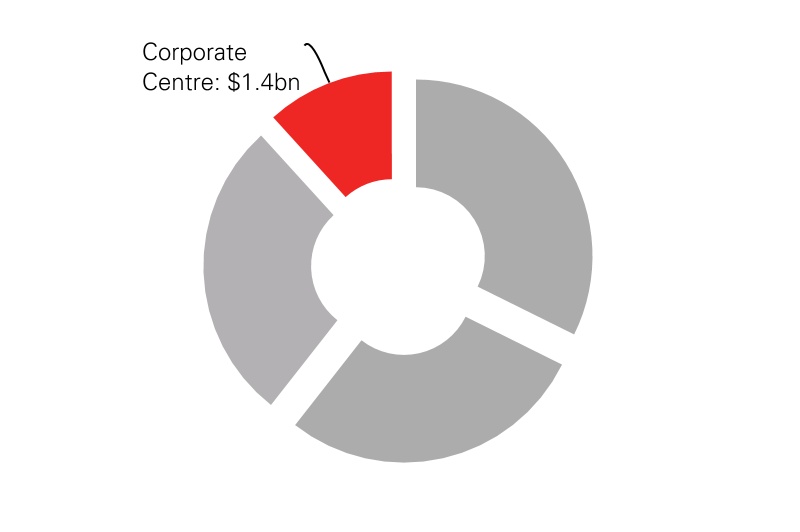

Our global businesses

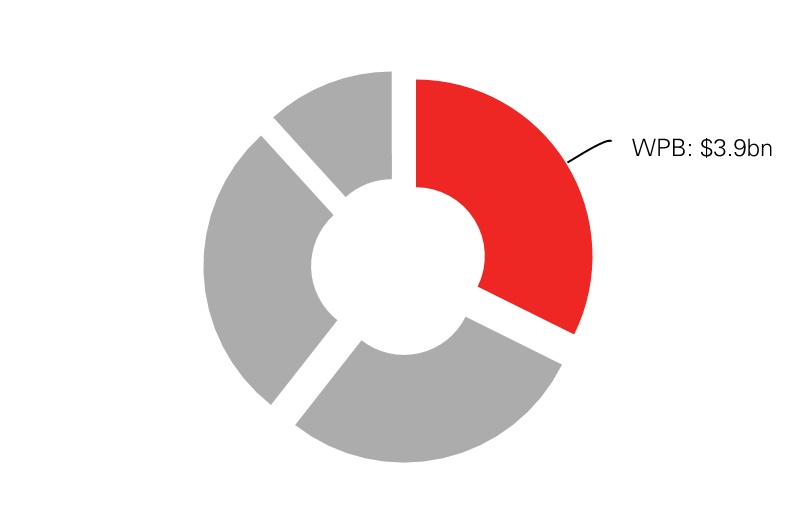

We serve customers through three global businesses. On pages 16 to 22 we provide an overview of our performance in the first half of 2021 for each of the global businesses, as well as our Corporate Centre.

Wealth and Personal Banking (’WPB’)

We help millions of our customers look after their day-to-day finances and manage, protect and grow their wealth.

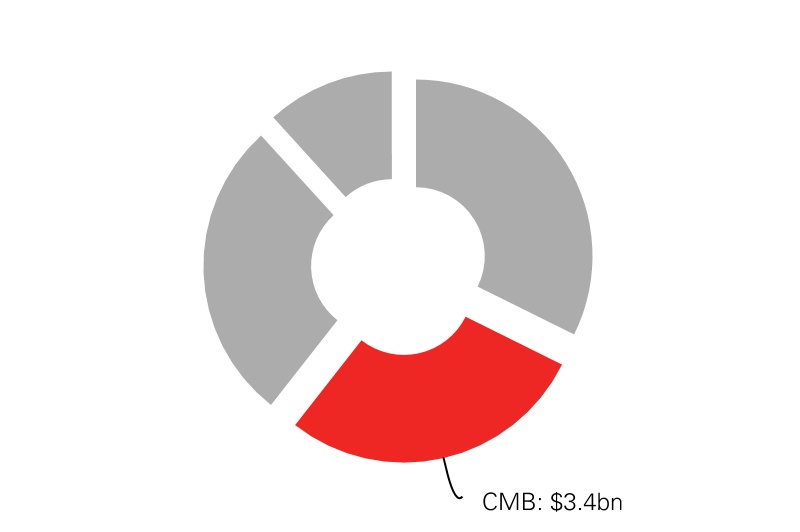

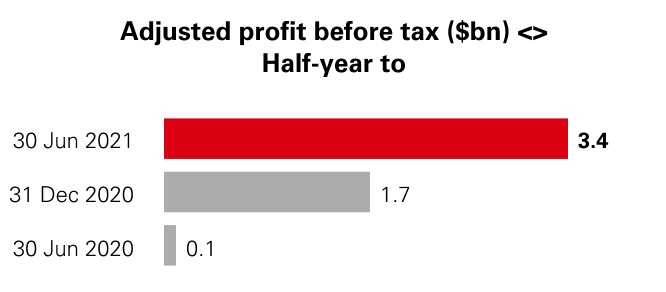

Commercial Banking (‘CMB’)

Our global reach and expertise help domestic and international businesses around the world unlock their potential.

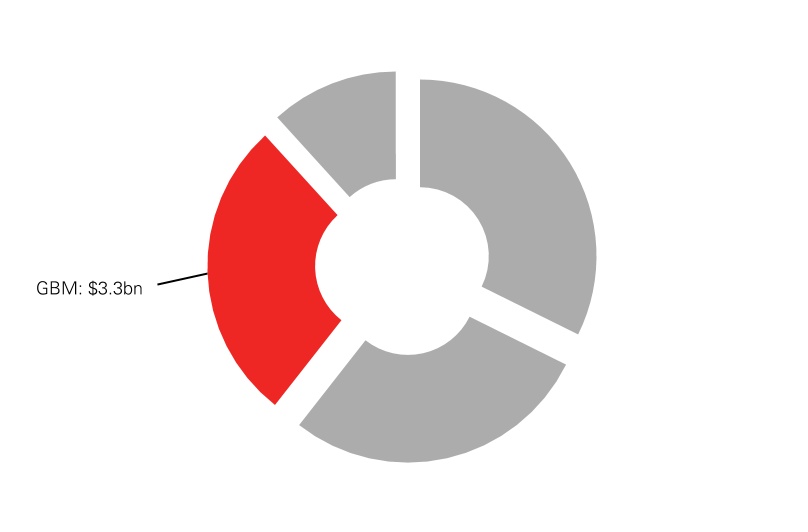

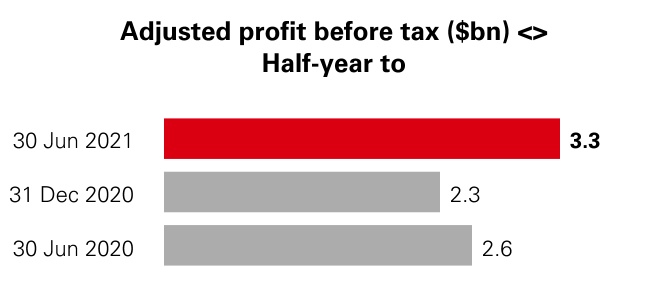

Global Banking and Markets (’GBM’)

We provide a comprehensive range of financial services and products to corporates, governments and institutions.

Cautionary statement regarding forward-looking statements

This Form 6-K contains certain forward-looking statements with respect to HSBC’s: financial condition; results of operations and business, including the strategic priorities; financial, investment and capital targets; and ESG targets/commitments described herein.

Statements that are not historical facts, including statements about HSBC’s beliefs and expectations, are forward-looking statements. Words such as ‘will’, ‘should’, ‘expects’, ‘targets’, ‘anticipates’, ‘intends’, ‘plans’, ‘believes’, ‘seeks’, ‘estimates’, ‘potential’ and ‘reasonably possible’, variations of these words and similar expressions are intended to identify forward-looking statements. These statements are based on current plans, information, data, estimates and projections, and therefore undue reliance should not be placed on them. Forward-looking statements speak only as of the date they are made. HSBC makes no commitment to revise or update any forward-looking statements to reflect events or circumstances occurring or existing after the date of any forward-looking statements.

Written and/or oral forward-looking statements may also be made in the periodic reports to the US Securities and Exchange Commission, summary financial statements to shareholders, proxy statements, offering circulars and prospectuses, press releases and other written materials, and in oral statements made by HSBC’s Directors, officers or employees to third parties, including financial analysts.

Forward-looking statements involve inherent risks and uncertainties. Readers are cautioned that a number of factors could cause actual results to differ, in some instances materially, from those anticipated or implied in any forward-looking statement. These include, but are not limited to:

•changes in general economic conditions in the markets in which we operate, such as continuing or deepening recessions and fluctuations in employment and creditworthy customers beyond those factored into consensus forecasts (including, without limitation, as a result of the Covid-19 pandemic); the Covid-19 pandemic, which is expected to continue to have adverse impacts on our income due to lower lending and transaction volumes, lower wealth and insurance manufacturing revenue, and lower or negative interest rates in markets where we operate, as well as, more generally, the potential for material adverse impacts on our financial condition, results of operations, prospects, liquidity, capital position and credit ratings; deviations from the market and economic assumptions that form the basis for our ECL measurements (including, without limitation, as a result of the Covid-19 pandemic); potential changes in HSBC’s dividend policy; changes in foreign exchange rates and interest rates, including the accounting impact resulting from financial reporting in respect of hyperinflationary economies; volatility in equity markets; lack of liquidity in wholesale funding or capital markets, which may affect our ability to meet our obligations under financing facilities or to fund new loans, investments and businesses; geopolitical tensions or diplomatic developments producing social instability or legal uncertainty, such as the developments in Hong Kong and the South China Sea, the US’s approach to strategic competition with China, supply chain restrictions, claims of human rights violations, diplomatic tensions between China and the UK, the EU, Australia and India, and other potential areas of tension, which may affect HSBC by creating regulatory, reputational and market risks; the efficacy of government, customer and HSBC’s actions in managing and mitigating climate change and in supporting the global transition to net zero carbon emissions, which may cause both idiosyncratic and systemic risks resulting in potential financial and non-financial impacts; illiquidity and downward price pressure in national real estate markets; adverse changes in central banks’ policies with respect to the provision of liquidity support to financial markets; heightened market concerns over sovereign creditworthiness in over-indebted countries; adverse changes in the funding status of public or private defined benefit pensions; societal shifts in customer financing and investment needs, including consumer perception as to the continuing availability of credit; exposure to counterparty risk, including third parties using us as a conduit for illegal activities without our knowledge; the expected discontinuation of certain key Ibors and the development of near risk-free benchmark rates, as well as the transition of legacy Ibor contracts to near risk-free benchmark rates, which exposes HSBC to material execution risks, and increases some financial and non-financial risks; and price competition in the market segments we serve;

•changes in government policy and regulation, including the monetary, interest rate and other policies of central banks and other regulatory authorities in the principal markets in which we operate and the consequences thereof (including, without limitation, actions taken as a result of the Covid-19 pandemic); initiatives to change the size, scope of activities and interconnectedness of financial institutions in connection with the implementation of stricter regulation of financial institutions in key markets worldwide; revised capital and liquidity benchmarks, which could serve to deleverage bank balance sheets and lower returns available from the current business model and portfolio mix; changes to tax laws and tax rates applicable to HSBC, including the imposition of levies or taxes designed to change business mix and risk appetite; the practices, pricing or responsibilities of financial institutions serving their consumer markets; expropriation, nationalisation, confiscation of assets and changes in legislation relating to foreign ownership; the future of the UK’s relationship with the EU following the UK’s withdrawal from the EU, which may continue to be characterised by uncertainty despite the signing of the Trade and Cooperation Agreement between the UK and the EU; passage of the Hong Kong national security law and restrictions on telecommunications, as well as the US Hong Kong Autonomy Act, which have caused tensions between China, the US and the UK; general changes in government policy that may significantly influence investor decisions; the costs, effects and outcomes of regulatory reviews, actions or litigation, including any additional compliance requirements; and the effects of competition in the markets where we operate including increased competition from non-bank financial services companies; and

•factors specific to HSBC, including our success in adequately identifying the risks we face, such as the incidence of loan losses or delinquency, and managing those risks (through account management, hedging and other techniques); our ability to achieve our financial,

investment, capital and ESG targets/commitments, which may result in our failure to achieve any of the expected benefits of our strategic priorities; model limitations or failure, including, without limitation, the impact that the consequences of the Covid-19 pandemic have had on the performance and usage of financial models, which may require us to hold additional capital, incur losses and/or use compensating controls, such as judgemental post-model adjustments, to address model limitations; changes to the judgements, estimates and assumptions we base our financial statements on; changes in our ability to meet the requirements of regulatory stress tests; a reduction in the credit ratings assigned to us or any of our subsidiaries, which could increase the cost or decrease the availability of our funding and affect our liquidity position and net interest margin; changes to the reliability and security of our data management, data privacy, information and technology infrastructure, including threats from cyber-attacks, which may impact our ability to service clients and may result in financial loss, business disruption and/ or loss of customer services and data; changes in insurance customer behaviour and insurance claim rates; our dependence on loan payments and dividends from subsidiaries to meet our obligations; changes in accounting standards, which may have a material impact on the way we prepare our financial statements; changes in our ability to manage third-party, fraud and reputational risks inherent in our operations; employee misconduct, which may result in regulatory sanctions and/or reputational or financial harm; changes in skill requirements, ways of working and talent shortages, which may affect our ability to recruit and retain senior management and diverse and skilled personnel; and changes in our ability to develop sustainable finance products and our capacity to measure the climate impact from our financing activity, which may affect our ability to achieve our climate ambition. Effective risk management depends on, among other things, our ability through stress testing and other techniques to prepare for events that cannot be captured by the statistical models it uses; our success in addressing operational, legal and regulatory, and litigation challenges; and other risks and uncertainties we identify in ‘Top and emerging risks’ on pages 25 to 26.

Certain defined terms

Unless the context requires otherwise, ‘HSBC Holdings’ means HSBC Holdings plc and ‘HSBC’, the ‘Group’, ‘we’, ‘us’ and ‘our’ refer to HSBC Holdings together with its subsidiaries. Within this document the Hong Kong Special Administrative Region of the People’s Republic of China is referred to as ‘Hong Kong’. When used in the terms ‘shareholders’ equity’ and ‘total shareholders’ equity’, ‘shareholders’ means holders of HSBC Holdings ordinary shares and those preference shares and capital securities issued by HSBC Holdings classified as equity. The abbreviations ‘$m’, ‘$bn’ and ‘$tn’ represent millions, billions (thousands of millions) and trillions of US dollars, respectively.

Opening up a world of opportunity

Our ambition is to be the preferred international financial partner for our clients.

In February 2021, we refined our purpose, ambition and values to reflect our strategy and to support our focus on execution.

Read more on our purpose and values on page 16 of our Annual Report and Accounts 2020.

Our values

Our values help define who we are as an organisation, and are key to our long-term success.

We value difference

Seeking out different perspectives

We succeed together

Collaborating across boundaries

We take responsibility

Holding ourselves accountable and taking the long view

We get it done

Moving at pace and making things happen

For further details on how we are embedding our values, see page 10.

Key themes

Global performance

Performance demonstrated our continued strength in Asia and a material recovery in profitability in our other regions, which benefited from net ECL releases. All of our regions were profitable for the first time since 1H18.

Read more on page 12.

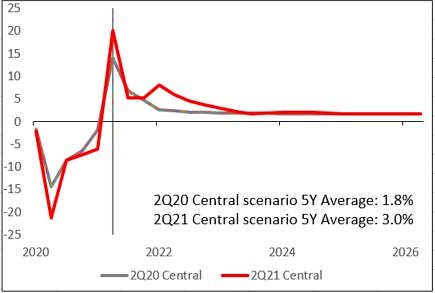

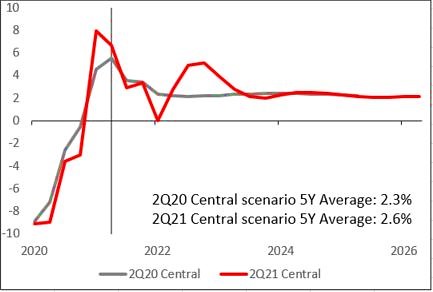

Economic outlook

Economic forecasts have improved as countries emerge from the Covid-19 pandemic, although uncertainties remain as countries respond at different speeds, government support measures unwind and new virus strains test the efficacy of vaccination programmes.

Read more on page 2.

Growth signals

While the impacts of low global interest rates and the Covid-19 pandemic are expected to provide headwinds to improved profitability and returns, there are emerging signs of unsecured personal lending and commercial lending growth.

Read more on page 8.

Progress in key areas

Growth and transformation

We have made good progress in areas of strength and expanded our digital capabilities. In addition, we are improving the way we work to energise the organisation for growth.

Read more on page 8.

Strategic transactions

We have announced the potential sale of our retail banking business in France, as well as the exit of domestic mass market retail banking in the US.

Read more on page 8.

Climate

We continue to make progress with our environmental, social and governance (‘ESG’) agenda, including towards the climate commitments we announced in October 2020.

Read more on page 10.

Performance in 1H21

Reported profit after tax

$8.4bn

(1H20: $3.1bn)

Basic earnings per share

$0.36

(1H20: $0.10)

Gender diversity

31.1%

Women in senior leadership roles.

Target: 35% by 2025.

(31 December 2020: 30.3%)

Sustainable finance and investments

$87.4bn

Cumulative total provided and facilitated since 1 January 2020. Target: $750bn to $1tn by end-2030.

(31 December 2020: $44.1bn)

Read more on our financial overview on page 12.

Our data dictionary, which includes a definition of sustainable finance and investments, can be found at www.hsbc.com/who-we-are/esg-and-responsible-business/esg-reporting-centre.

Highlights

Performance in the first half of 2021 reflected an improvement in global economic conditions. While uncertainties remain, the outlook is more positive with evidence of growth in strategic areas.

Financial performance (1H21 vs 1H20)

•Reported profit after tax increased by $5.3bn to $8.4bn and reported profit before tax increased by $6.5bn to $10.8bn. A fall in revenue reflected 2020 interest rate reductions and lower Markets and Securities Services (‘MSS’) revenue relative to a strong 1H20. This was more than offset by releases in our expected credit losses and other credit impairment charges (‘ECL’). Reported profit in 1H20 included an impairment of software intangibles of $1.2bn, mainly in Europe.

•All regions profitable in 1H21, notably HSBC UK Bank plc reported profit before tax of over $2.1bn in the period. Despite interest rate headwinds, there was continued strength in Asia and a material recovery in profitability in all other regions, reflecting a net release in ECL as the economic outlook improved.

•Reported revenue down 4% to $25.6bn, primarily reflecting 2020 interest rate reductions and lower MSS revenue in Global Banking and Markets (‘GBM’). These reductions were partly offset by net favourable movements in market impacts in life insurance manufacturing and valuation adjustments in GBM.

•In 1H21, lending increased by $21.5bn on a reported basis, reflecting growth in Wealth and Personal Banking (‘WPB’) and Commercial Banking (‘CMB’). Deposits grew by $26.3bn on a reported basis, with increases in all global businesses.

•Net interest margin (‘NIM’) of 1.21% in 1H21, down 22 basis points (‘bps’) from 1H20. NIM in 2Q21 of 1.20% remained stable compared with 1Q21.

•Reported ECL were a net release of $0.7bn, compared with a $6.9bn charge in 1H20. The net release in 1H21 primarily reflected an improvement in the economic outlook since 2020. The reduction also reflected low levels of stage 3 charges in 1H21, as well as the non-recurrence of a large charge in 1H20 related to a corporate exposure in Singapore.

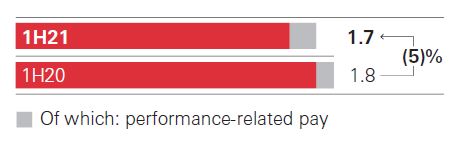

•Reported and adjusted operating expenses increased 3%, primarily due to a higher performance-related pay accrual as profitability improved, as well as continued investment, partly offset by the impact of our cost-saving initiatives.

•Return on average tangible equity (‘RoTE‘) (annualised) of 9.4%, up 5.6 percentage points compared with 1H20.

•Common equity tier 1 (‘CET1’) ratio of 15.6%, down 0.3 percentage points from 31 December 2020, reflecting an increase in RWAs from lending growth and a decrease in CET1 capital including the impact of foreseeable dividends.

•The Board has announced an interim dividend for 1H21 of $0.07 per ordinary share, to be paid in cash with no scrip alternative.

Financial performance (2Q21 vs 2Q20)

•Reported profit after tax up $3.2bn to $3.9bn and reported profit before tax up $4.0bn to $5.1bn. Reported revenue was down 4%, mainly due to lower revenue in MSS, as well as the impact of lower interest rates. This was more than offset by net releases in reported ECL and lower reported operating expenses.

Outlook for 2021

•The execution of our strategy continues at pace, including the announcement of transactions in relation to our retail operations in France and mass market retail operations in the US.

•Despite continued revenue headwinds, notably in fixed income markets relative to strong comparative periods, as well as low interest rates and Covid-19 impacts, there are emerging signs of unsecured personal lending and commercial lending growth. We expect mid-single-digit lending growth for the full year, which is expected to translate into low-single-digit RWA growth as we progress with our RWA reduction actions.

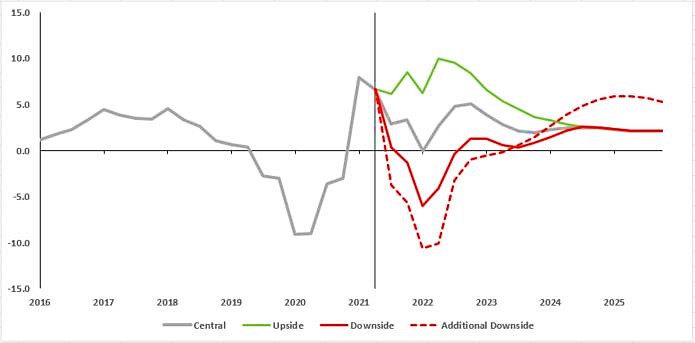

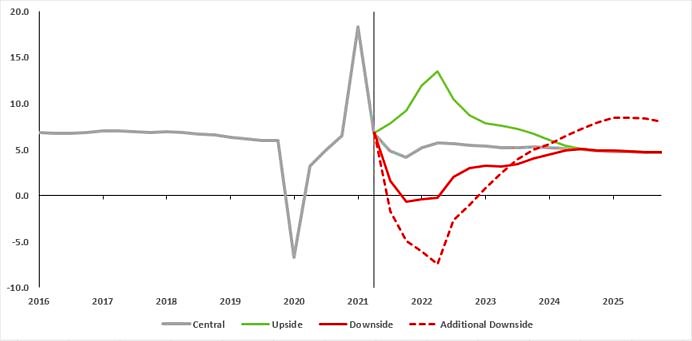

•Given current consensus economics and default experience, ECL charges for 2021 are expected to be materially lower than our medium-term range of 30bps to 40bps of average loans and possibly a net release for the year. Uncertainty remains as countries emerge from the pandemic at different speeds, government support measures unwind and new virus strains test the efficacy of vaccination programmes. To reflect this uncertainty, at 30 June 2021 around $2.4bn remained of the stage 1 and stage 2 ECL allowance uplift we made during 2020. For further details, see ‘Measurement uncertainty and sensitivity analysis of ECL estimates’ on page 62.

•Our cost reduction programme remains on track. We expect adjusted operating expenses for 2021 to be broadly in line with 2020, excluding the benefit from a reduced bank levy. This remains subject to final decisions on performance-related pay, which will primarily reflect the performance of the Group.

•The Group maintains a strong capital position and is well placed to fund growth and step up capital returns. Reflecting the current improved economic outlook and operating environment in many of our markets, we now expect to move to within our target dividend payout ratio range of 40% to 55% of reported earnings per ordinary share in 2021.

Delivery against our financial targets

Return on average tangible equity (annualised) <>

9.4%

Target: ≥10% in the medium term.

(1H20: 3.8%)

Adjusted operating expenses <>

$16.2bn

Target: ≤$31bn in 2022 (based on average December 2020 FX rates).

(1H20: $15.7bn)

Gross risk-weighted asset (‘RWA’) reduction

$84.5bn

Updated target: $110bn by end-2022.

CET1 capital ratio

15.6%

Target: >14%, managing in range of 14% to 14.5% in medium term.

(31 December 2020: 15.9%)

Interim dividend per ordinary share for 1H21

$0.07

Further explanation of performance against Group financial targets may be found on page 12.

Key financial metrics

| | | | | | | | | | | |

| Half-year to |

| Reported results | 30 Jun 2021 | 30 Jun 2020 | 31 Dec 2020 |

| Reported revenue ($m) | 25,551 | | 26,745 | | 23,684 | |

| Reported profit before tax ($m) | 10,839 | | 4,318 | | 4,459 | |

| Reported profit after tax ($m) | 8,422 | | 3,125 | | 2,974 | |

| Profit attributable to the ordinary shareholders of the parent company ($m) | 7,276 | | 1,977 | | 1,921 | |

| Cost efficiency ratio (%) | 66.9 | | 61.8 | | 75.6 | |

| Basic earnings per share ($) | 0.36 | | 0.10 | | 0.10 | |

| Diluted earnings per share ($) | 0.36 | | 0.10 | | 0.09 | |

Net interest margin (%)1 | 1.21 | | 1.43 | | 1.32 | |

| | | |

Alternative performance measures <> | | | |

| Adjusted revenue ($m) | 25,797 | | 27,597 | | 24,523 | |

| Adjusted profit before tax ($m) | 11,950 | | 5,654 | | 6,680 | |

| | | |

| Adjusted cost efficiency ratio (%) | 62.9 | | 56.9 | | 69.1 | |

| Annualised expected credit losses and other credit impairment charges (‘ECL’) as a % of average gross loans and advances to customers (%) | (0.14) | | 1.34 | | 0.38 | |

| Return on average ordinary shareholders’ equity (annualised) (%) | 8.4 | | 2.4 | | 2.3 | |

Return on average tangible equity (annualised) (%)1,2 | 9.4 | | 3.8 | | 3.1 |

| | | |

| | At | |

| Balance sheet | 30 Jun 2021 | 30 Jun 2020 | 31 Dec 2020 |

| Total assets ($m) | 2,976,005 | | 2,922,798 | | 2,984,164 | |

| Net loans and advances to customers ($m) | 1,059,511 | | 1,018,681 | | 1,037,987 | |

| Customer accounts ($m) | 1,669,091 | | 1,532,380 | | 1,642,780 | |

Average interest-earning assets ($m)1 | 2,188,991 | | 2,034,939 | | 2,092,900 | |

| Loans and advances to customers as % of customer accounts (%) | 63.5 | | 66.5 | | 63.2 | |

| Total shareholders’ equity ($m) | 198,218 | | 187,036 | | 196,443 | |

| Tangible ordinary shareholders’ equity ($m) | 157,985 | | 147,879 | | 156,423 | |

Net asset value per ordinary share at period end ($)3 | 8.69 | | 8.17 | | 8.62 | |

| Tangible net asset value per ordinary share at period end ($) | 7.81 | | 7.34 | | 7.75 | |

| | | |

| Capital, leverage and liquidity | | | |

Common equity tier 1 capital ratio (%)4 | 15.6 | | 15.0 | | 15.9 | |

Risk-weighted assets ($m)4 | 862,292 | | 854,552 | | 857,520 | |

Total capital ratio (%)4 | 21.0 | | 20.7 | | 21.5 | |

Leverage ratio (%)4 | 5.3 | | 5.3 | | 5.5 | |

| High-quality liquid assets (liquidity value) ($bn) | 659 | | 654 | | 678 | |

| Liquidity coverage ratio (%) | 134 | | 148 | | 139 | |

| | | |

| Share count | | | |

| Period end basic number of $0.50 ordinary shares outstanding (millions) | 20,223 | | 20,162 | | 20,184 | |

| Period end basic number of $0.50 ordinary shares outstanding and dilutive potential ordinary shares (millions) | 20,315 | | 20,198 | | 20,272 | |

| Average basic number of $0.50 ordinary shares outstanding (millions) | 20,211 | | 20,162 | | 20,176 | |

| Dividend per ordinary share (in respect of the period) ($) | 0.07 | | — | | 0.15 | |

For reconciliations of our reported results to an adjusted basis, including lists of significant items, see page 35. Definitions and calculation of other alternative performance measures are included in our ‘Reconciliation of alternative performance measures’ on page 52.

1 For these metrics, half-year to 31 December 2020 is calculated on a full-year basis and not a 2H20 basis.

2 Profit attributable to ordinary shareholders, excluding impairment of goodwill and other intangible assets and changes in present value of in-force insurance contracts (‘PVIF’) (net of tax), divided by average ordinary shareholders’ equity excluding goodwill, PVIF and other intangible assets (net of deferred tax).

3 The definition of net asset value per ordinary share is total shareholders’ equity less non-cumulative preference shares and capital securities, divided by the number of ordinary shares in issue excluding shares the company has purchased and are held in treasury.

4 Unless otherwise stated, regulatory capital ratios and requirements are based on the transitional arrangements of the Capital Requirements Regulation in force at the time. These include the regulatory transitional arrangements for IFRS 9 ‘Financial Instruments’, which are explained further on page 89. Leverage ratios are calculated using the end point definition of capital and the IFRS 9 regulatory transitional arrangements. Following the end of the transition period after the UK’s withdrawal from the EU, any reference to EU regulations and directives (including technical standards) should be read as a reference to the version onshored into UK law under the European Union (Withdrawal) Act 2018, as amended.

Group Chief Executive’s review

We are implementing our growth and transformation plans with pace and purpose, building on the progress of 2020 with the aim of delivering a world-leading service to our customers and strong returns for our investors.

In February this year, we launched an updated purpose for HSBC. ‘Opening up a world of opportunity’ was the product of wide consultation with our colleagues and customers around the world. Since then, I have spoken with thousands of my colleagues across HSBC to discuss how we live that purpose every day.

I have been excited by the energy of those conversations. Our purpose and the values that underpin it – we value difference, we succeed together, we take responsibility, and we get it done – have resonated strongly, not just as a means of guiding our behaviour, but in articulating what our people want us to be as a business. Many expressed great pride in our heritage and culture, but also belief in the need to adapt to meet present and future challenges. Above all though, there was a strong desire to learn from and embed the lessons of the past 18 months, which is a conviction that my senior management team and I all share.

This spirit was evident in a good first-half performance. The customer-centricity that characterised our response to the Covid-19 pandemic remained to the fore, driven by increased collaboration and the benefits of our continued digital investment. This enabled us not just to better serve our existing customers, but also to attract new clients, win new mandates and strengthen our lending pipelines. We also generated strong momentum behind our growth and transformation plans, with good delivery against all four pillars – focus on our strengths, digitise at scale, energise for growth, and transition to net zero.

Our biggest challenge has remained the Covid-19 pandemic, which continues to threaten our customers, colleagues and communities. This was especially true in India, where the devastating spread of the Delta variant was a stark reminder of the danger that the virus continues to pose. India is both a growth market and an important service hub for the Group, and around 39,000 of our people are based there. While measures were already in place to enable a large majority of these colleagues to work from home, we took urgent steps to help them and their dependants to receive a vaccine, and provided financial support to local organisations delivering the relief effort on the ground. Operationally, we were able to maintain an unbroken service due to the continuity measures in place since March 2020. This was a testament both to the extraordinary efforts of our people, and the resilience of our systems and processes.

We received a strong endorsement of our recent progress in May, through the upgrade of our MSCI ESG rating from ‘average’ to ‘leader’. Among other things, MSCI recognised the significant increase in our employee engagement and talent development scores during 2020; the extensive involvement of our Board in incorporating climate considerations into our business strategy; our strong performance in customer complaints handling and financial education; and our achievement of the highest possible rating for corporate governance. We will work hard to maintain this rating in the coming quarters.

“Our purpose and the values that underpin it have resonated strongly, not just as a means of guiding our behaviour, but in articulating what our people want us to be as a business.“

Financial performance

Recovering economic growth in many of our main markets had a positive impact on our first-half financial performance. The improved economic outlook enabled us to begin releasing expected credit losses, which was the main driver of our improved profitability. The adverse impact of central bank interest rate cuts in 2020 continued to flow through to our interest-rate sensitive business lines, although our net interest income has now stabilised. A combination of increased fee income and cost-programme savings helped to compensate for the resulting reduction in revenue, and we strengthened our lending pipelines in our retail and wholesale businesses in the first half of the year.

As a consequence, the Group delivered $10.8bn of reported profit before tax, up 151% on the first half of 2020, and $12bn of adjusted profits, up 111%. We were profitable in every region in the first six months of the year.

Adjusted revenue was 7% lower than the same period last year. This was due mainly to the impact of interest rate cuts during 2020 on our deposit franchises in all three global businesses. However, our lending pipeline began to translate into business growth in the second quarter and we further strengthened that pipeline during the half-year.

Our cost reduction programmes continued to mitigate the cost of increased technology investment, although our adjusted operating expenses rose by 3% due to an increase in performance-related pay. We spent around $3.0bn on technology in the first half of the year, up 4% on the same period last year.

Our funding, liquidity and capital remain strong. We grew deposits by $27bn on a constant currency basis, with growth in all three global businesses. Our common equity tier one ratio was 15.6% on 30 June 2021. As a consequence, we are able to pay an interim dividend of $0.07 per ordinary share for the first half of the year.

Focus on our strengths

We made good progress in restructuring our portfolio of businesses in the first half of the year, investing in businesses that we intend to grow and withdrawing from areas in which we lack the scale to compete.

In particular, we took firm steps to resolve the future of our businesses in the US and continental Europe. In the US, we entered into agreements to sell our mass market retail business in the country, and in continental Europe, we entered into a memorandum of understanding with My Money Group aimed at selling our retail banking activities in France. Both of these followed a period of extensive strategic review, and are important milestones in the transformation of the Group. They will help enable both our US and continental Europe businesses to become more focused, simpler and sustainably profitable, and to better serve the international needs of our wholesale and wealth management customers.

In Asia, we continued to put in place the building blocks for future growth. We further grew our Pinnacle digital wealth management business in mainland China, recruiting more than 350 new wealth managers and accelerating our coverage expansion to five cities – Beijing, Shanghai, Guangzhou, Shenzhen and Hangzhou. We also improved our ability to serve the wealth needs of customers in Asia and the Asian diaspora by expanding our digital wealth capabilities in Hong Kong, Malaysia and Singapore, and reorganising our wealth businesses in continental Europe and the US to better connect international customers to the global wealth opportunity. The benefits of our investment in Asia wealth were evident in the first six months of 2021 through strong customer acquisition, increased fee income and significant growth in wealth balances.

“We are seeking to energise HSBC for growth through a strong sense of purpose and simpler ways of working, and by equipping our colleagues with the future skills they need.“

Digitise at scale

Our technology investment continues to improve the experiences of our customers and colleagues, and to boost efficiency while reducing our cost base. In the first half of the year, we launched a number of new, scalable digital capabilities for our customers and rolled out more of our existing capabilities to new markets.

For our personal customers, our digital Global Money Account allows our international customers to hold, manage and send funds in various currencies without paying any fees. Having launched this successfully in the US in 2020, we expanded it successfully into the UAE and Singapore in the first half of the year, with more to follow during 2021.

For our business customers, we launched HSBC Global Wallet, a new multi-currency digital wallet which allows businesses to hold, send and receive cash in multiple currencies using a single global account. Launched initially for customers in Singapore, the UK and the US, we intend to roll out new features and currencies to the platform in the second half of the year.

We also launched HSBC Kinetic for business customers in the UK. Kinetic is designed to be a truly mobile-first banking service, as opposed to a bank account with mobile features. Built on insights from more than 3,000 small business owners, it allows customers to manage their finances entirely through their smartphone. More than 10,000 businesses have now signed up, benefiting from online onboarding in 15 minutes, the ability to apply for lending products with instant lending decisions, and a number of critical insight capabilities.

Energise for growth

We are seeking to energise HSBC for growth through a strong sense of purpose and simpler ways of working, and by equipping our colleagues with the future skills they need. This includes embedding the lessons of the past 18 months to help build a dynamic, entrepreneurial and inclusive culture.

We are moving to a hybrid working model wherever possible, giving our people the flexibility to work in a way that suits both them and their customers. We will need less office space as a result, and we have plans to reduce our global office footprint by more than 3.6 million square feet – or around 20% – by the end of 2021. We are also relocating three of our global business CEOs to Asia on a permanent basis, taking them closer to our customers and to the core of our business.

We continue to simplify the organisation wherever we can. In the first half, we reduced the number of full-time equivalent employees by around 3,500. We also announced changes to our senior leadership bands to help ensure clarity of scope and accountability, and to empower our leaders to make decisions to accelerate our transformation and drive growth.

I am conscious that our current operating environment remains challenging for many colleagues and their families. While our employee engagement scores have remained above pre-pandemic levels, we have continued to see a rise in fatigue and anxiety among employees. To

help tackle this, we have provided a variety of well-being resources to support our people, including mindfulness training. This is something that I continue to monitor closely, particularly as our people adapt to our new hybrid working model.

Transition to net zero

We took a number of important steps towards our net zero ambitions in the first half of the year, and strengthened our position as a market leader of sustainable finance.

I was particularly pleased that 99.7% of our shareholders backed our special resolution on climate change at our AGM in May. This was a strong endorsement of our climate strategy, which has at its core a commitment to support our customers on their transitions to a low-carbon future. The resolution commits us to setting out the next steps in our transition, including through short- and medium-term sector-based targets; to phasing out financing of coal power and thermal coal mining by 2030 in EU and OECD countries, and by 2040 globally; and to reporting annually on our progress. Above all, it signals a unity of purpose between our business and our investors, which is vital as we confront the shared challenge of the low-carbon transition.

I have always said that partnership lies at the heart of the low-carbon transition. Part of our approach has been to attempt to forge new partnerships to find new solutions and accelerate progress, whether with our customers, governments or our peers in the banking sector. In April, we became a founding member of the Net-Zero Banking Alliance (‘NZBA’), which aims to deliver the banking sector’s ambition to align its climate commitments with the Paris Agreement goals in a collaborative, rigorous and transparent way. Through the NZBA, we also joined the Glasgow Financial Alliance for Net Zero, which combines the leading initiatives across the financial system to accelerate the transition to net zero emissions by 2050 at the latest.

In May, we launched a five-year partnership with World Resources Institute and WWF, backed by $100m of philanthropic funding from HSBC. The Climate Solutions Partnership seeks to unlock barriers to finance for companies and projects that tackle climate change, bringing emerging climate solutions to commercial viability and scale. By combining our resources, knowledge and insight with our partners on the ground, we are aiming to make a real-world impact in a targeted way, with a focus on scaling up climate innovation and nature-based solutions, and helping to transition the energy sector in Asia towards renewables.

We strengthened our position in the ESG bond market in the first half, participating in more issuances than in the whole of 2020. First-half mandates included the world’s first sovereign sustainable sukuk bond; the first sovereign green bonds issued by the UK and Canada; and a pioneering sustainability-linked bond for an energy company with the cost of financing tied to the reduction of its entire carbon footprint, including the emissions of products sold.

Our people

None of the achievements of the last six months would have been possible without the commitment and hard work of my colleagues. I do not underestimate the challenges that many still face as a consequence of the Covid-19 pandemic, which remains a presence in all of our lives. I am especially grateful to my colleagues in parts of the world where Covid-19 remains prevalent, and who have continued to go to extraordinary lengths for their customers and colleagues in extremely challenging circumstances.

We have had a good start to the year, but there is much more to do to deliver our ambitions for HSBC. We have a firm platform on which to build over the remainder of 2021.

Noel Quinn

Group Chief Executive

2 August 2021

Our strategy

We are implementing our strategy across the four strategic pillars aligned to our purpose, values and ambition announced in February 2021.

Progress on our 2021 commitments

In February 2021, we refreshed our strategy, in recognition of the fundamental shifts in the operating environment and to help achieve our ambition to be the preferred international financial partner for our clients. We have since made good progress across our four strategic pillars: focus on our areas of strength; digitise at scale to adapt our operating model for the future; energise our organisation for growth; and support the transition to a net zero global economy.

In the first half of 2021, we put in place strong building blocks for future growth, primarily in Asia, in terms of the reallocation of resources, growth in lending balances and our client pipeline. At the same time, we have accelerated the pace of execution of our strategy, with the announcements of the exit of domestic mass market retail banking in the US, as well as the potential sale of our retail banking business in France.

Focus on our strengths

In our global businesses

In each of our global businesses, we focus on delivering growth in areas where we have distinctive capabilities and have significant opportunities.

Wealth and Personal Banking

We expanded our Wealth franchise, with a particular focus on Asia. In 1H21, our reported global wealth balances grew to approximately $1.7tn, an 18% increase compared with 1H20, with client assets and funds under management growing by 23%. In 1H21, our Asia wealth balances reached $810bn. We recruited approximately 600 Asia wealth front-line FTEs, and our Asia affluent and high net worth customer base grew 7%, compared with 1H20, to 1.7 million customers. Wealth revenue in Asia increased by 26% compared with 1H20, including the benefit of $359m of insurance market impacts, and we also rolled out Pinnacle, our digital financial planning wealth platform, to five cities in mainland China with more locations in the pipeline.

Commercial Banking

A strong lending pipeline and investment in digital solutions have started to translate into growth. Customer lending grew by 2% during 1H21 to $351bn, largely driven by an increase of 8% in Asia, with $6.7bn of net adjusted lending growth in trade finance, primarily in Hong Kong and mainland China. In Asia, lending approval limits, which includes renewal and refinancing activity, have also doubled since 2H20. Furthermore, we have invested heavily in digital services and platforms. We introduced Global Wallet, a digital wallet that allows businesses to hold, send and receive cash in multiple currencies, in Singapore, the UK and the US.

Global Banking and Markets

We made good progress on capital repositioning to drive growth. At 30 June 2021, overall reported RWAs were 8% lower than at 30 June 2020, driven by a reduction in products and domestic clients not aligned to our strategy. In the same period, RWAs allocated to Asia increased by 6%. This supports our focus on serving international clients into and within these high-growth regions. In 1H21, we also delivered $184m of cost saves, as part of the Group-wide cost reduction programme. We have increased collaboration revenue with our other global businesses by 6% compared with 1H20, with approximately $0.8bn generated with WPB, and approximately $1.3bn with CMB.

Reshaping our portfolio

To help create capacity for growth, we are refocusing our US business and HSBC Bank plc, our UK non-ring-fenced bank and Europe. In May 2021, we announced the exit of the domestic mass market retail business, including branches, in the US, and the potential sale of our retail banking business in France. We have seen rebounds in profits in both markets even as we reshape our portfolio.

Our US business

The transformation of the US business has continued at pace, with reported profit before tax of $0.4bn in 1H21, compared with a loss before tax of $0.1bn in 1H20, and adjusted profit before tax of $0.5bn in 1H21, up from $0.1bn in 1H20. We have reduced reported RWAs by $15bn or 16% since 30 June 2020, and completed the migration of our Fixed Income derivatives trading book from New York to London. We also delivered approximately $100m of cost saves in 1H21, achieving a total of $450m cost reduction since 2020, to operate under a simpler, leaner model. Furthermore, we announced the sale of our mass market retail banking business, subject to regulatory approval, to focus on our international corporate and wealth business. This sale would include approximately 1 million clients and 90 out of our existing 148 branches.

US adjusted costs <>

$bn

HSBC Bank plc (UK non-ring-fenced bank and Europe)

We saw progress in our transformation programme, with $1.1bn of reported profit before tax in 1H21, compared with a loss before tax of $1.6bn in 1H20, and adjusted profit before tax of $1.4bn, an uplift from a loss before tax of $0.6bn in 1H20. We also saw a reduction of approximately 16% of adjusted RWAs and 3% of the adjusted cost base compared with 1H20. We are on track to simplify our continental European operating model into an integrated business, and have refocused our wholesale client portfolio to align to our ambition to be the leading international wholesale bank in Europe, with a particular focus on the East, and to better serve our targeted customers. We signed a memorandum of understanding, relating to the potential sale of our retail banking operations in France, marking a significant step in the transformation of our European franchise.

HSBC Bank plc adjusted RWAs <>

$bn

1 Reported RWAs at 30 June 2020 were $171bn with foreign currency translation differences of $11bn.

Digitise at scale

Investing in technology

We continued to invest in technology to help deliver excellent customer service and improve productivity across our organisation. In 1H21, we spent $3bn on technology, an increase of 18% since 1H18.

To improve our operational proficiency, we are increasingly using the Cloud in our back-office functions, which helps to increase resilience and reduce maintenance costs, through partnerships with big technology firms such as Google and Amazon. The number of live services processed on the Cloud has approximately doubled from 1H20 to 1H21. For our customers, we reduced manual intervention in our payments processing, with the straight-through-processing rate increasing to 96.7%. We also enhanced the First Direct customer journey by improving the account opening speed from 10 days to 10 minutes.

During 1H21, we accelerated the roll-out of our digital services. In 1H21, Kinetic, our digital business banking platform, reached 10,000 customers and received a 4.8 out of 5.0 iOS app store rating in the UK. Global Money, our multi-currency account for retail customers, has expanded into Singapore and the UAE, following the US launch in 4Q20. As of July 2021, Global Money served approximately 45,000 users across the UAE and the US. We also continue to invest in transforming our trade platform to drive growth and improve customer experience.

Technology spend (adjusted) <>

$bn

Energise for growth

Since we launched our refreshed purpose and values in February 2021, we have been applying our values in how we work across the organisation. Our most recent all-employee survey in June showed employee engagement decreased slightly after significant gains in 2020, but has remained above 2019 levels. We are moving towards a more hybrid way of working. Since the start of 2020, we have exited or downsized 77 buildings, resulting in a 10% reduction in our global office footprint. We are also progressing well against our aspirational target of 35% women in senior leadership roles by 2025, reaching 31.1% in 1H21. In addition, we are the founding member of the World Economic Forum’s Partnering for Racial Justice in Business, and a signatory to the United Nations LGBTI Standards of Conduct for Business.

We are growing our Asia talent base and cementing our leadership in the region to accelerate the execution of our strategy. We commenced the relocation of key executives to Hong Kong, including the CEOs of WPB, CMB and Asset Management, and a co-CEO of GBM. We appointed new co-CEOs of Asia-Pacific, bringing in a breadth of regional experience, to support our leadership’s strategic focus on geographies where we want to grow, including Greater China, the ASEAN region and India. For recruiting plans, we hired more than 650 new graduates – comprising 52% women and representing 48 different nationalities – in 17 markets.

Transition to net zero

Becoming a net zero bank

Within the wider financial services sector, we joined various initiatives, including the Net-Zero Banking Alliance as a founding member, the Glasgow Financial Alliance for Net Zero, Sustainable Markets Initiative, and the Partnership for Carbon Accounting Financials. Within our organisation, we are developing climate stress testing capabilities and are actively participating in the Bank of England’s climate change biennial exploratory scenario exercise. We invited suppliers representing 60% of our total supplier spend to participate in CDP (formerly the Carbon Disclosure Project). For our colleagues, we expanded our network of employee-led sustainability champions, with more than 30,000 colleagues across 70 teams, and included a sustainability module in our mandatory learning.

Supporting our customers

Our aim is to provide $750bn to $1tn of sustainable finance and investments by 2030 to help our customers transition to lower carbon emissions. Since 1 January 2020, cumulatively we have provided and facilitated $87.4bn of sustainable finance and investments. In 1H21, we also participated in carrying out more green, social, sustainability and sustainability-linked bonds for clients than we did in the whole of 2020. We were named the joint structuring adviser for the UK’s and Canada’s inaugural sovereign green bond issuances, and were awarded Euromoney’s Best Bank for Sustainable Finance in Asia and the Middle East in July 2021.

Unlocking new climate solutions

In May 2021, we formed the Climate Solutions Partnership with the World Resources Institute and WWF, backed by $100m of our philanthropic capital to accelerate support for innovative solutions tackling climate change. We launched our first in-market green mortgage product in the UAE, and a lower carbon bond fund in mainland China and Taiwan. To promote client engagement, we launched a Business Plan for the Planet campaign globally, to help businesses transition to a sustainable model, and published a guide to net zero for companies in the UK.

How we do business

We conduct our business intent on opening up opportunities to ensure the sustained success of our customers, people and other stakeholders.

Our approach

Our purpose, ‘Opening up a world of opportunity’, explains why we exist and guides us in what we do every day. In the first half of 2021, we encouraged all our colleagues to explore what ‘Opening up a world of opportunity’ meant to them personally and how it can help us collectively contribute to delivering our strategy.

Our refreshed values define the principles that guide our individual and organisational behaviours. They influence the way we work together and the choices we make. We are embedding the values throughout our organisation, and our leaders and colleagues are regularly encouraged to reflect on what our values mean in day-to-day actions and decisions. This was most clearly demonstrated when many of our colleagues in India volunteered their own time to support each other and their families during the second wave of the Covid-19 pandemic in India (see below).

We recognise the important role we play in ‘Opening up a world of opportunity’ for our customers, investors, our people and communities, and in building a more sustainable, inclusive world.

Fair outcomes

We continued to promote and encourage good conduct through our people's behaviour and the decisions that we take. We also launched our simplified conduct approach to align to the Group’s new purpose and values, in particular the value ‘We take responsibility’. Our new conduct approach encourages colleagues to recognise the impact each of us has on our customers and the financial markets in which we operate, and sets out a number of conduct outcomes to be achieved. As we implement our new approach during 2021, we will continue to enhance our existing policies, frameworks and governance approach. Further details on our conduct approach are available at www.hsbc.com/who-we-are/esg-and-responsible-business/our-conduct.

Bringing together diverse people, ideas and perspectives helps us open up opportunities and build a more inclusive company. We are working to accelerate the development and progression of women and ethnically diverse employees into more senior roles. We are progressing well against our aspirational target of 35% women in senior leadership roles by 2025. We are also building the foundations that will help enable us to accelerate towards our goal to at least double the number of Black senior leaders globally by 2025. In early 2021, we made it possible for 91% of our global workforce to be able to declare their ethnicity in our HR information system. We are now using this data to uncover areas of largest opportunity.

Our climate ambition

The Board provided further details on our ambition to become a net zero bank with a special resolution on climate change at our Annual General Meeting (‘AGM’) in May, which was approved by 99.7% of shareholders. The resolution commits the Group to set, disclose and implement a strategy with short- and medium-term targets to align its provision of finance across all sectors, starting in 2021 with oil and gas, and power and utilities, with the goals and timelines of the Paris Agreement. We also committed to publish and implement a policy to phase out the financing of coal-fired power and thermal coal mining by 2030 in EU and OECD countries, and by 2040 in other markets. For the purposes of the resolution, ‘finance’ and ‘financing’ means providing project finance or direct lending to, or underwriting capital markets transactions for, corporate clients of our Global Banking and Commercial Banking businesses. Our progress against our commitments will be reported annually, including a summary of the methodology, scenarios and core assumptions used.

We recognise the critical need for industry collaboration to accelerate climate action and lower global emissions. As part of our efforts, the Group Chief Executive, Noel Quinn, chairs the Financial Services Task Force (‘FSTF’), part of HRH The Prince of Wales’ Sustainable Markets Initiative. The FSTF brings together 11 of the world’s largest banks to amplify and accelerate action on climate-related initiatives.

We became a founding signatory of the Net-Zero Banking Alliance, convened by the United Nations Environment Programme Finance Initiative and co-launched by the FSTF. The members of the alliance are committed to aligning their lending and investment portfolios with net zero emissions by 2050, and setting an intermediate target for 2030 or sooner using robust, science-based guidelines. Net-Zero Banking Alliance is a member alliance of the Glasgow Financial Alliance for Net Zero, which combines the leading initiatives across the financial system to accelerate the transition to net zero emissions by 2050. We also joined the Partnership for Carbon Accounting Financials to help us measure our financed emissions and provide transparent and comparable disclosures.

Living our values – We succeed together

We set up a Covid-19 taskforce to help colleagues and their families who needed critical support during the second wave of the pandemic in India. Many colleagues volunteered, using the collective energy of our network to assist a wider group of people in this time of crisis. The taskforce provided 24/7 support and worked in collaboration with partners to mobilise resources to provide hospital beds, oxygen and medicines. Our offices were set up to manage vaccination drives for employees and their families. The volunteers played a critical role, providing moral support and counsel to colleagues during a period of anxiety and national emergency. In addition to the actions of our people, we pledged financial assistance of around $10m for the ongoing Covid-19 relief efforts in India.

Delivering for our stakeholders

Having a clear purpose and strong values has never been more important, with the pandemic testing us all in ways we could never have anticipated. As the world changed over the course of the past 18 months, we adapted to new ways of working and endeavoured to provide support to our customers during this challenging period.

We recognise that the world is at different stages of the pandemic, with some countries going through a peak while others are on a trajectory to recovery. We look to support our stakeholders, taking this into account.

In the adjacent table, we set out how we have supported our stakeholders – our customers, employees, investors, communities, governments and regulators, and suppliers – during the first half of 2021.

| | | | | |

| |

| Customers | •Our provision of financial relief to our customers to support them during the pandemic reduced during the first half of 2021, as forbearance programmes began to come to an end (for further details of our customer relief programmes, see page 75). We have put a contact and communications strategy in place in all of our markets to engage with customers to help them understand and decide on their options following the expiry of their Covid-19 relief measures.

•We remain committed to removing barriers to financial services to help more people access opportunities. In the UK, we launched a campaign to raise awareness of our No Fixed Address service, which offers financial support to those who are homeless, in partnership with the charity Shelter. In Hong Kong, we launched basic banking services for ethnic minority groups who do not understand English or Chinese. |

|

| Employees | •Our most recent all-employee survey in June showed employee engagement decreased slightly after significant gains in 2020, but remained above 2019 levels. We have continued to see a rise in fatigue and anxiety among employees and in response, provided a variety of well-being resources including mindfulness training. We continued to monitor our colleagues’ preferences for returning to office and branch locations, including increasing support for a more flexible, hybrid approach in the future. •We continue to focus on managing change well for our people, providing targeted career transition support and a service through which in 1H21 we redeployed approximately 25% of employees who were impacted by our business change programme.

•In support of our programme to build skills for the future, our learning experience platform is now live to more than 70,000 employees and we have launched a trial of our Talent Marketplace for 10,300 employees in India, with plans to grow both. |

|

| Investors | •We continue to engage investors virtually, but will endeavour to accommodate in-person meetings once it is safe to do so. In May, we were able to offer a hybrid AGM, with both in-person and virtual attendees. •We were encouraged by the constructive engagement with ShareAction, the Investor Forum and our institutional shareholders, to help develop our AGM resolution on climate change, and we were extremely pleased that 99.7% of our shareholders voted in favour of the climate change resolution. •We were also pleased to reinstate the $0.15 interim dividend for 2020, paid in April 2021. We acknowledge that dividends are important to all of our shareholders, and announced an updated dividend policy based on a payout ratio approach in February 2021. Reflecting the current improved economic outlook and operating environment in many of our markets, we now intend to transition towards a target payout ratio of between 40% and 55% of our reported earnings per share from 2021 onwards while retaining the flexibility to adjust for non-cash significant items. Should we achieve our targets, the dividend is expected to progressively increase over the coming years, in line with growth in our earnings per share. The Board has announced an interim dividend for the first half of 2021 of $0.07 per ordinary share. |

|

| Communities | •During 2021 we announced a donation of $10m towards Covid-19 relief efforts in India, as well as $1.5m to UNICEF supporting work to deliver vaccines to countries on behalf of the Covax facility. This is in addition to the $25m that we donated to support relief and recovery efforts around the world during 2020. |

|

| Governments and regulators | •We continue to work closely with governments in our major markets to ensure a sustainable economic recovery. We have participated in a number of government-backed Covid-19 support schemes, providing vital funds to businesses and households affected by the pandemic. We have also provided support to governments seeking to raise revenue through bond issuance programmes. We continue to engage with our regulators regarding their supervisory and policy objectives. |

|

| Suppliers | •We invited companies representing 60% of our total spend on suppliers to participate in the CDP (formerly the Carbon Disclosure Project) supply chain programme, which helps to improve our understanding of their carbon emissions and zero carbon ambitions. |

|

Financial overview

In assessing the Group’s financial performance, management uses a range of financial measures that focus on the delivery of sustainable returns for our shareholders and maintaining our financial strength.

Executive summary

Performance in the first half of 2021 benefited from the improved economic outlook and resultant release in ECL allowances, which significantly improved our profitability. While the low interest-rate environment continued to impact revenue, net interest margin remained broadly stable in the last quarter and we are starting to see the positive impact of our strategy.

Reported profit before tax of $10.8bn increased by $6.5bn compared with 1H20, and our annualised return on average tangible equity (‘RoTE’) for 1H21 was 9.4%, compared with 3.8% in 1H20. The increase in reported profit was driven by a net release of reported ECL and included the non-recurrence of a $1.2bn impairment of capitalised software in 1H20. Reported revenue fell, reflecting the full impact of 2020 interest rate reductions, as well as lower revenue in GBM, notably in Markets and Securities Services (‘MSS’), relative to a strong 1H20. Adjusted profit before tax of $12.0bn increased by $6.3bn.

In 1H21, all of our regions were profitable. Despite the impact of lower global interest rates, our operations in Asia continued to deliver a strong performance. In addition, there was a material recovery in profitability in all other regions, primarily reflecting a net release in ECL following the improved economic outlook.

The Group maintained its strong capital position, with a CET1 ratio of 15.6% at 30 June 2021, and continued to grow both lending and deposit balances. In respect of 1H21, the Board has announced an interim dividend of $0.07 per ordinary share.

Delivery against Group financial targets

Return on average tangible equity (%) <>

9.4%

(1H20: 3.8%)

In February 2021, we updated our reported annualised RoTE target following the significant changes to the operating environment in 2020. The Group is now targeting a RoTE of greater than or equal to 10% in the medium term.

In 1H21, we achieved a RoTE (annualised) of 9.4%, compared with 3.8% in 1H20. The improvement in RoTE was driven by the favourable impact of lower ECL.

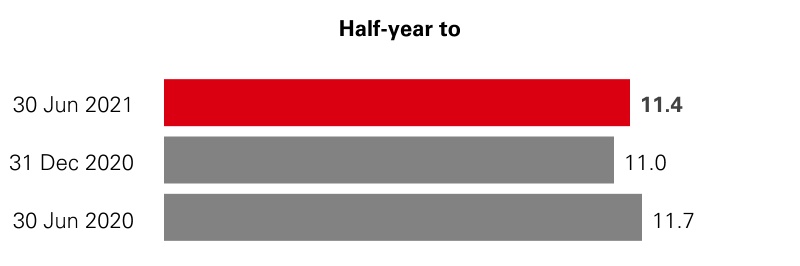

Adjusted operating expenses <>

$16.2bn

(1H20: $15.7bn)

The Group is targeting an adjusted cost base of $31bn or less in 2022 (based on average December 2020 rates of foreign exchange, or $31.5bn based on average June 2021 rates). In 1H21, adjusted operating expenses were $16.2bn, an increase of 3% compared with 1H20, primarily due to a higher performance-related pay accrual.

Our cost reduction programme is on track to deliver cost saves of between $5bn and $5.5bn in the period from 2020 to 2022 and expect to spend around $7bn in costs to achieve.

Cumulatively, our cost programmes have generated savings of $2.0bn, with costs to achieve of $2.7bn.

Gross RWA reductions

$84.5bn

In February 2020, we announced our intention to improve our return profile through a targeted gross RWA reduction of $100bn by 2022, mainly in low-returning parts of the Group. During 1H21, we updated the list of clients we are remediating and also implemented other methodology changes to better align the tracking and reporting of reductions to how the RWA reduction programme is managed. In line with these changes, we have also increased our gross RWA reduction target to $110bn by 2022. We intend to update executive scorecards accordingly.

At 30 June 2021, the Group had delivered cumulative gross RWA reductions of $84.5bn, including accelerated saves of $9.6bn made in 2019.

Capital and dividends

We intend to maintain a CET1 ratio in excess of 14%, managing in the range of 14% to 14.5% in the medium term. We will seek to manage this range down in the longer term.

At 30 June 2021, our CET1 ratio was 15.6%, down 0.3 percentage points from 31 December 2020. This reflected an increase in RWAs from lending growth and a decrease in CET1 capital, including the impact of foreseeable dividends on ordinary shares of $3.5bn. This dividend accrual, equal to 47.5% of 1H21 basic earnings per ordinary share (‘EPS’) of $0.36, is not a forecast and represents the mid-point of our target payout ratio of 40% to 55% of reported EPS. The Group’s strong capital position means it is well placed to fund growth and step up capital returns. Our dividend policy aims to deliver sustainable cash dividends, while retaining the flexibility to invest and grow the business in the future, supplemented by additional shareholder distributions, if appropriate. Reflecting the current improved economic outlook and operating environment in many of our markets, we now expect to move to within our target payout ratio in 2021. In line with our dividend policy, we will retain the flexibility to adjust EPS for non-cash significant items. Additionally, in 2022, we intend to adjust EPS to exclude the forecast loss on the sale of our retail banking operations in France.

The Board has announced an interim dividend for 1H21 of $0.07 per ordinary share, to be paid in cash with no scrip alternative.

CET1 ratio

15.6%

Interim dividend per ordinary share for 1H21

$0.07

*Medium term is three to four years; long term is five to six years.

Reported results

| | | | | | | | | | | | | | | | | | | | |

| Half-year to | Quarter ended |

| Reported results | 30 Jun 2021 $m | 30 Jun 2020 $m | 31 Dec 2020 $m | 30 Jun 2021 $m | 30 Jun 2020 $m | 31 Mar 2021 $m |

| Net operating income before change in expected credit losses and other credit impairment charges (‘revenue’) | 25,551 | | 26,745 | | 23,684 | | 12,565 | | 13,059 | | 12,986 | |

| ECL | 719 | | (6,858) | | (1,959) | | 284 | | (3,832) | | 435 | |

| Net operating income | 26,270 | | 19,887 | | 21,725 | | 12,849 | | 9,227 | | 13,421 | |

| Total operating expenses | (17,087) | | (16,527) | | (17,905) | | (8,560) | | (8,675) | | (8,527) | |

| Operating profit/(loss) | 9,183 | | 3,360 | | 3,820 | | 4,289 | | 552 | | 4,894 | |

| Share of profit in associates and joint ventures | 1,656 | | 958 | | 639 | | 771 | | 537 | | 885 | |

| Profit before tax | 10,839 | | 4,318 | | 4,459 | | 5,060 | | 1,089 | | 5,779 | |

| Tax expense | (2,417) | | (1,193) | | (1,485) | | (1,206) | | (472) | | (1,211) | |

| Profit/(loss) after tax | 8,422 | | 3,125 | | 2,974 | | 3,854 | | 617 | | 4,568 | |

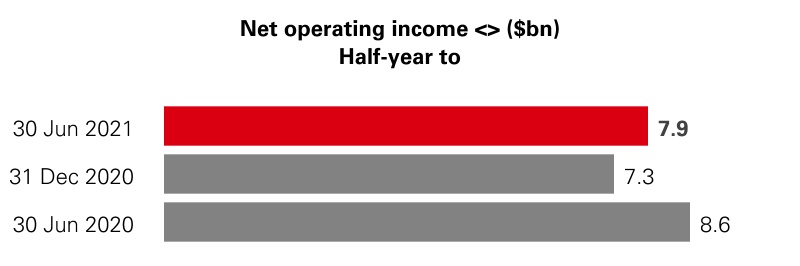

Reported performance - 1H21 vs 1H20

Reported profit

Reported profit after tax of $8.4bn in 1H21 was $5.3bn higher than in 1H20.

Reported profit before tax of $10.8bn was $6.5bn higher than in 1H20. Reported revenue fell, reflecting the continued impact of lower global interest rates and a decline in revenue in GBM’s MSS business following lower market volatility and client activity in 1H21, compared with a notably strong 1H20. These decreases were partly offset by the favourable impact on certain volatile items in WPB and GBM.

The reduction in reported revenue was more than offset by a net release of reported ECL in 1H21 due to an improvement in the forward economic outlook, notably in the UK, compared with the significant build-up of stage 1 and stage 2 allowances in 1H20. In addition, our reported share of profit from associates and joint ventures in Corporate Centre increased. Reported operating expenses increased, primarily from a higher performance-related pay accrual, continued investment in our digital capabilities and higher restructuring and other related costs, which more than offset a reduction due to the non-recurrence of a 1H20 impairment of $1.2bn of capitalised software related principally to businesses within HSBC Bank plc.

In 1H21, all of our regions were profitable. Despite the impact of lower global interest rates, our Asia business continued to deliver a strong performance. In addition, there was a material recovery in profitability in all other regions, primarily reflecting a net release in ECL as the economic outlook improved, notably in HSBC UK Bank plc, where reported profit before tax increased to over $2.1bn.

The net favourable mark-to-market movements on certain volatile items discussed above resulted from the following:

•In WPB, favourable market impacts in life insurance manufacturing of $413m compared with adverse movements in 1H20 of $334m.

•In GBM, MSS included favourable credit and funding valuation adjustments of $35m (1H20: $355m adverse). In Principal Investments, valuation gains of $237m compared with losses of $12m in 1H20.

These were partly offset:

•In Corporate Centre, 1H21 included adverse fair value movements on our long-term debt and associated swaps of $54m (1H20: $195m favourable).

IFRS 17 ‘Insurance Contracts’ sets the requirements that an entity should apply in accounting for insurance contracts it issues and reinsurance contracts it holds. IFRS 17 is effective from 1 January 2023 and could have a significant impact on the revenue of our insurance business. For further details, see ‘Future accounting developments’ on page 289 of the Annual Report and Accounts 2020.

Reported revenue

Reported revenue of $25.6bn was $1.2bn or 4% lower than in 1H20. The reduction primarily reflected a fall in net interest income as a result of the impact of lower global interest rates, notably affecting our deposit franchises in WPB and in Global Liquidity and Cash Management ('GLCM') in CMB and GBM. While we grew average interest-earning assets, interest-bearing liabilities also increased, resulting in continued downward pressure on NIM. In GBM’s MSS business, revenue decreased in Global Foreign Exchange and Global Debt Markets, as trading volatility and client activity in 1H21 was lower, although activity increased in Equities and Securities Services. There were also favourable movements in credit and funding valuation adjustments.

The reduction in revenue was partly offset by favourable market impacts in life insurance manufacturing, which compared with adverse movements in 1H20, as discussed above. GBM revenue also benefited from valuation gains in Principal Investments, compared with small losses in 1H20.

The reduction in reported revenue also included adverse fair value movements on financial instruments of $0.5bn, which were more than offset by favourable foreign currency translation differences of $1.1bn.

Reported ECL

Reported ECL were a net release of $0.7bn in 1H21, compared with a charge of $6.9bn in 1H20. The net release in 1H21 reflected an improvement in the economic outlook, notably in the UK. This compared with the significant build-up of stage 1 and stage 2 allowances in 1H20 due to the worsening economic outlook at the onset of the Covid-19 outbreak. The reduction in ECL also reflected low levels of stage 3 charges, as well as the non-recurrence of a significant charge in 1H20 related to a corporate exposure in Singapore.

Given current consensus economics and default experience, ECL charges for 2021 are expected to be materially lower than our medium-term range of 30bps to 40bps of average loans and possibly a net release for the year. Uncertainty remains as countries emerge from the pandemic at different speeds, government support measures unwind and new virus strains test the efficacy of vaccination programmes.

For further details on the calculation of ECL, including the measurement uncertainties and significant judgements applied to such calculations, the impact of alternative/additional scenarios and post-model adjustments, see pages 63 to 71.

Reported operating expenses

Reported operating expenses of $17.1bn were $0.6bn or 3% higher than in 1H20. This primarily reflected higher performance-related pay of $0.9bn, which is accrued based on the profile of our expected profit performance. In addition, investment in technology, including investments in our digital capabilities, increased by $0.3bn. Our Asia wealth investment also rose by $0.1bn. These increases were partly offset by a $0.9bn impact of our cost-saving initiatives.

The increase in reported operating expenses also included adverse foreign currency translation differences of $0.9bn and an increase in restructuring and other related costs of $0.3bn, of which $0.1bn related to severance payments. However, these items were broadly offset by the non-recurrence of a $1.2bn impairment of intangible assets in Europe in 1H20, of which $0.2bn was within restructuring and other related costs.

Reported share of profit in associates and joint ventures

Reported share of profit in associates of $1.7bn was $0.7bn or 73% higher, primarily reflecting an increased share of profit from Bank of Communications Co., Limited ('BoCom'), a recovery in asset valuations of a UK associate relative to 1H20, and a higher share of profit from The Saudi British Bank (‘SABB’).

In relation to BoCom, we continue to be subject to a risk of impairment in the carrying value of our investment. For further details of our impairment review process, see Note 10 on the interim condensed financial statements.

Tax expense

The effective tax rate for 1H21 of 22.3% was lower than the 27.6% for 1H20. The effective tax rate for 1H21 was increased due to the impact of substantively enacted legislation to increase the UK statutory tax rate from 1 April 2023. The 1H20 effective tax rate was high, due mainly to the non-recognition of deferred tax on losses in the UK.

Reported performance - 2Q21 vs 2Q20

Reported profit

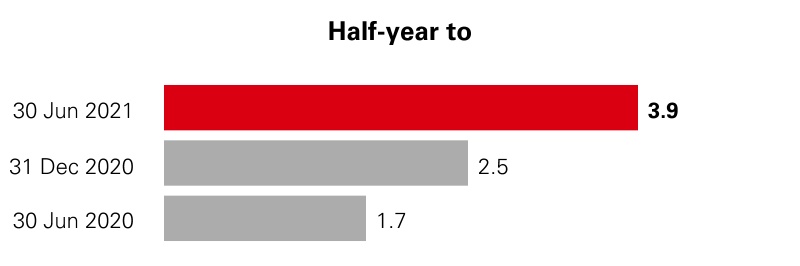

Reported profit after tax of $3.9bn in 2Q21 was $3.2bn higher than in 2Q20.

Reported profit before tax of $5.1bn was $4.0bn higher. This rise reflected a net release of reported ECL provisions and included the non-recurrence of a $1.2bn impairment in 2Q20 of capitalised software intangibles in Europe. These factors were partly offset by lower reported revenue.

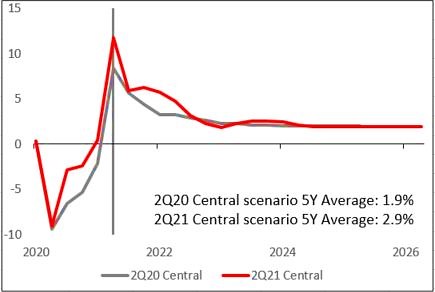

Reported revenue of $12.6bn was $0.5bn or 4% lower, driven by a decrease in GBM, notably in MSS, reflecting lower market volatility and client activity compared with a strong 2Q20, and a fall in Principal Investments revenue due to the non-recurrence of revaluation gains recognised in 2Q20. These were compounded by the impact of interest rate reductions adversely affecting our deposit franchises within WPB and in the GLCM business in CMB and GBM.