UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| | x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) |

| | | OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | | For the Fiscal Year Ended: December 31, 2012 |

| | ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) |

| | | OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | | For the Transition Period from to |

Commission file number 001-34702

SPS COMMERCE, INC.

(Exact Name of Registrant as Specified in its Charter)

| | |

| Delaware | | 41-2015127 |

(State or Other Jurisdiction of Incorporation or Organization) | | (I.R.S. Employer Identification No.) |

333 South Seventh Street, Suite 1000, Minneapolis, MN 55402

(Address of Principal Executive Offices, Including Zip Code)

(612) 435-9400

(Registrant’s Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Act:

| | |

(Title of each class) | | (Name of each exchange on which registered) |

| Common stock, par value $0.001 per share | | The Nasdaq Stock Market LLC (Nasdaq Global Market) |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| | | | | | |

| Large Accelerated Filer ¨ | | Accelerated Filer x | | Non-Accelerated Filer ¨ | | Smaller Reporting Company ¨ |

| | (Do not check if a smaller reporting company) |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

As of June 30, 2012, the last business day of the registrant’s most recently completed second fiscal quarter, the aggregate market value of shares of the registrant’s common stock held by non-affiliates of the registrant (based upon the closing sale price of $30.38 per share on the Nasdaq Global Market on such date) was approximately $373.6 million.

The number of shares of the registrant’s common stock, par value $0.001 per share, outstanding as of February 22, 2013 was 14,918,384 shares.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Company’s definitive Proxy Statement for the Annual Meeting of Stockholders to be held on May 15, 2013 (the “2013 Proxy Statement”), which is expected to be filed within 120 days after the end of the fiscal year covered by this Annual Report on Form 10-K, are incorporated by reference in Part III of this Annual Report on Form 10-K.

SPS COMMERCE, INC.

ANNUAL REPORT ON FORM 10-K

Table of Contents

SPECIAL NOTE REGARDING FORWARD-LOOKING INFORMATION

This Annual Report on Form 10-K contains forward-looking statements regarding us, our business prospects and our results of operations that are subject to certain risks and uncertainties posed by many factors and events that could cause our actual business, prospects and results of operations to differ materially from those that may be anticipated by such forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those described under the heading“Risk Factors” included in this Annual Report on Form 10-K. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this report. In some cases, you can identify forward-looking statements by the following words: “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “ongoing,” “plan,” “potential,” “predict,” “project,” “should,” “will,” “would,” or the negative of these terms or other comparable terminology, although not all forward-looking statements contain these words. We expressly disclaim any intent or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Readers are urged to carefully review and consider the various disclosures made by us in this report and in our other reports filed with the Securities and Exchange Commission that advise interested parties of the risks and factors that may affect our business.

2

PART I

Overview

We are a leading provider of on-demand supply chain management solutions and the Retail Universe community, providing integration, collaboration, connectivity, visibility and data analytics to thousands of customers worldwide. We provide our solutions through the SPS Commerce platform, a cloud-based software suite that improves the way suppliers, retailers, distributors and other customers manage and fulfill orders. Implementing and maintaining supply chain management software is resource intensive and not a core competency for most businesses. The SPS Commerce platform utilizes pre-built trading partner integrations to eliminate the need for on-premise software and support staff, which enables our supplier customers to shorten supply cycle times, optimize inventory levels, reduce costs and satisfy retailer requirements. As of December 31, 2012, we had approximately 18,000 customers with contracts to pay us monthly fees, which we refer to as recurring revenue customers. We have also generated revenues by providing our cloud-based supply chain management solutions to an additional 32,000 organizations that, together with our recurring revenue customers, we refer to as our customers. Once connected to our platform, our customers often require integrations to new organizations that represent an expansion of our platform and new sources of revenues for us.

We deliver our solutions to our customers over the Internet using a Software-as-a-Service model. This model enables our customers to easily interact with their trading partners around the world without the local implementation and servicing of software that traditional on-premise solutions require. Our delivery model also enables us to offer greater functionality, integration and reliability with less cost and risk than traditional solutions.

In August 2012, we purchased substantially all of the assets of Edifice Information Management Systems, Inc., a privately-held information services company specializing in the collection, analysis and distribution of point-of-sale data used by retailers and suppliers to improve their supply chain efficiencies. This acquisition increased our point-of-sale analytic offerings, expanded our base of recurring revenue customers and added suppliers to our network.

For 2012, 2011 and 2010, we generated revenues of $77.1 million, $58.0 million and $44.6 million. Our fiscal quarter ended December 31, 2012 represented our 48th consecutive quarter of increased revenues. Recurring revenues from recurring revenue customers accounted for 88%, 85% and 83% of our total revenues for 2012, 2011 and 2010. No customer represented over 2% of our revenues for 2012, 2011 or 2010.

Our Industry

Supply Chain Management Industry Background

The supply chain management industry serves thousands of retailers around the world supplied with goods from tens of thousands of suppliers. Additional participants in this market include distributors, third-party logistics providers, manufacturers, fulfillment and warehousing providers and sourcing companies. Supply chain management involves communicating data related to the exchange of goods among these trading partners. At every stage of the supply chain there are inefficient, labor-intensive processes between trading partners with significant documentation requirements, such as the counting, sorting and verifying of goods before shipment, while in transit and upon delivery. Supply chain management solutions must address trading partners’ needs for integration, collaboration, connectivity, visibility and data analytics to improve the speed, accuracy and efficiency with which goods are ordered and supplied.

The pervasiveness of the Internet, along with the dramatic declines in the pricing of computing technology and network bandwidth, have enabled companies to adopt on-demand applications at an increasing rate. As familiarity and acceptance of on-demand solutions continues to accelerate, we believe companies, both large and

3

small, will continue to turn to on-demand delivery methods similar to ours for their supply chain integration needs, as opposed to traditional on-premise software deployment. Our target market, supply chain integration solutions delivered on a Software-as-a-Service platform, is one of many which comprise the global Software-as-a-Service market.

The Rule Books — Integration Between Retailers and Suppliers

Retailers impose specific work-flow rules and standards on their trading partners for electronically communicating supply chain information. These “rule books” include specific business processes for suppliers to exchange data and documentation requirements such as invoices, purchase orders and advance shipping notices. Rule books can be hundreds of pages, and retailers frequently have multiple rule books for international requirements or specific fulfillment models. Suppliers working with multiple retailers need to accommodate different rule books for each retailer. These rule books are not standardized between retailers, but vary based on a retailer’s size, industry and technological capabilities. The responsibility for creating information “maps,” which are integration connections between the retailer and the supplier that comply with the retailer’s rule books, resides primarily with the supplier. The cost of noncompliance can be refusal of delivered goods, fines and ultimately a termination of the supplier’s relationship with the retailer. The complexity of retailers’ requirements and consequences of noncompliance create growing demand for specialized supply chain management solutions.

Traditional Supply Chain Management Solutions

Traditional supply chain management solutions range from non-automated paper or fax solutions to electronic solutions implemented using on-premise licensed software. On-premise licensed software provides connectivity between only one organization and its trading partners and typically requires significant time and technical expertise to configure, deploy and maintain. These software providers primarily link retailers and suppliers through the Electronic Data Interchange protocol that enables the structured electronic transmission of data between organizations. Because of set-up and maintenance costs, technical complexity and a growing volume of requirements from retailers, the traditional software model is not well suited for many suppliers, especially those small and medium in size.

Need for Effective Analysis of Data for Intelligent Decision Making

Integrating retailers and suppliers is a first step in addressing the complexities in the supply chain ecosystem. As the number and geographic dispersion of trading partners has grown, so too has the volume of data produced by the supply chain. As a result, trading partners want a solution to effectively consolidate, distill and channel information to managers and decision-makers who can use the information to drive efficiency, revenue growth and profitability. The abundance of data produced by these processes, including data for fulfillment, sales and inventory levels, is often inaccessible to trading partners for analysis. The data and related analytics are essential for optimizing the inventory and fulfillment process and will continue to drive demand for supply chain management solutions.

Software-as-a-Service Solutions Provide Flexibility and Effective Management Across the Supply Chain

A Software-as-a-Service model is well suited for providing supply chain management solutions. On-demand solutions are able to continue utilizing standard connectivity protocols, such as Electronic Data Interchange, but also are able to support other protocols, such as XML, as retailers require. These on-demand solutions connect suppliers and retailers more efficiently than traditional on-premise software solutions by leveraging the integrations created for a single supplier across all participating suppliers.

Software-as-a-Service solutions also allow an organization to connect across the supply chain ecosystem, addressing increased retailer demands, globalization and increased complexity affecting the supply chain. In addition, Software-as-a-Service solutions can integrate supply chain management applications with organizations’ existing enterprise resource planning systems.

4

Our Platform

We operate one of the largest trading partner integration centers through a cloud-based software suite that improves the way suppliers, retailers, distributors and other trading partners manage and fulfill orders. More than 50,000 customers across more than 40 countries have used our platform to enhance their trading relationships. Our platform fundamentally changes how organizations use electronic communication to manage their supply chains by replacing the collection of traditional, custom-built, point-to-point integrations with a “hub-and-spoke” model whereby a single integration to our platform allows an organization to connect seamlessly to the entire SPS Commerce network of trading partners.

Our platform combines integrations that comply with numerous rule books for retailers, grocers and distributors with whom we and our customers have done business. Our platform does this through a multi-tenant architecture and provides ancillary support services that deliver a comprehensive set of supply chain management solutions to customers. By maintaining current integrations with retailers, our platform obviates the need for suppliers to continually stay up-to-date with the rule book changes required by retailers. Moreover, by leveraging an on-demand delivery model, we eliminate or greatly reduce the burden on suppliers to support and maintain an on-premise software application, thereby reducing ongoing operating costs. As the communication hub for trading partners, we also are able to provide increased visibility and data analytics capabilities for retailers and suppliers across their supply chains, each of which is difficult to gain from traditional, point-to-point integration solutions.

Our platform delivers suppliers and retailers the following solutions:

| | • | | Trading Partner Integration. Our Trading Partner Integration solution replaces or augments an organization’s existing trading partner electronic communication infrastructure, enabling suppliers to comply with retailers’ rule books and allowing for the electronic exchange of information among numerous trading partners through various protocols. |

| | • | | Trading Partner Enablement. Our Trading Partner Enablement solution helps organizations, typically large retailers, implement new integrations with trading partners to drive automation and electronic communication across their supply chains. |

| | • | | Trading Partner Intelligence. Our Trading Partner Intelligence solution consists of data analytics applications and allows our customers to improve their visibility across, and analysis of, their supply chains. Retailers improve their visibility into supplier performance and their understanding of product sell-through. |

| | • | | Other Trading Partner Solutions. We provide a number of peripheral solutions such as barcode labeling and our scan and pack application, which helps trading partners process information to streamline the picking and packaging process. |

Our Customer and Sales Sources

As one of the largest on-demand supply chain management solutions providers, the trading partner relationships that we enable among our retailer, supplier and fulfillment customers naturally lead to new customer acquisition opportunities.

“Network Effect”

Once connected to our network, trading partners can exchange electronic supply chain information with each other. Through our platform, we helped over 50,000 customers to communicate electronically with their trading partners. The value of our platform increases with the number of trading partners connected to the platform. The addition of each new customer to our platform allows that new customer to communicate with our existing customers and allows our existing customers to route orders to the new customer. This “network effect” of adding an additional customer to our platform creates a significant opportunity for existing customers to realize incremental sales by working with our new trading partners and vice versa. As a result of this increased volume of activity amongst our network participants, we earn additional revenues from these participants.

5

Customer Acquisition Sources

Trading Partner Enablement. When a retailer decides to change the workflow or protocol by which it interacts with its suppliers, the retailer may engage us to work with its supplier base to communicate and test the change in procedure. Performing these programs on behalf of retailers often generates supplier sales leads for us.

Referrals from Trading Partners. We also receive sales leads from our customers seeking to communicate electronically with their trading partners. For example, a supplier may refer to us its third-party logistics provider or manufacturer which is not in our network.

Channel Partners. In addition to the customer acquisition sources identified above, we market and sell our solutions through a variety of channel partners including software providers, resellers, system integrators and logistics partners. For example, software partners such as NetSuite and their business partner communities generate sales for us as part of broader enterprise resource planning, warehouse management system and/or transportation management system sales efforts. Our logistics partners also drive new sales both by providing leads and by embedding our solutions as part of their service offerings. For example, we have a contractual relationship with a leading global logistics provider where we private label our solutions, which are in turn sold as that company’s branded solution.

Our Sales Force

We also sell our solutions through a direct sales force which is organized as follows:

| | • | | Retailer Sales. We employ a team of sales professionals who focus on selling our Trading Partner Enablement solution to retailers, grocers and distributors. |

| | • | | Supplier Sales. We employ a team of supplier sales representatives based in North America. We also maintain sales offices in China, Hong Kong and Australia. |

| | • | | Business Development Efforts. Our business development organization is tasked with finding new sources of revenue and development of new business opportunities through channel partners, new solutions, geographic expansion and other areas that present opportunity for growth. |

Our Growth Strategy

Our objective is to be the leading global provider of supply chain management solutions. Key elements of our strategy include:

| | • | | Further Penetrate Our Current Market. We believe the global supply chain management market is underpenetrated and, as the supply chain ecosystem becomes more complex and geographically dispersed, the demand for supply chain management solutions will increase, especially among small- and medium-sized businesses. We intend to continue leveraging our relationships with customers and their trading partners to obtain new sales leads. |

| | • | | Increase Revenues from Our Customer Base. We believe our overall customer satisfaction is strong and will lead our customers to further utilize our current solutions as their businesses grow, generating additional revenues for us. We also expect to introduce new solutions to sell to our customers. We believe our position as the incumbent supply chain management solution provider to our customers, our integration into our recurring revenue customers’ business systems and the modular nature of our platform are conducive to deploying additional solutions with customers. |

| | • | | Expand Our Distribution Channels. We intend to grow our business by expanding our network of direct sales representatives to gain new customers. We also believe there are valuable opportunities to promote and sell our solutions through collaboration with other providers. |

6

| | • | | Expand Our International Presence. We believe our presence in China represents a significant competitive advantage. We plan to increase our international sales efforts to obtain new supplier customers around the world. We intend to leverage our current international presence to increase the number of integrations we have with retailers in foreign markets to make our platform more valuable to suppliers based overseas. |

| | • | | Enhance and Expand Our Platform. We intend to further improve and develop the functionality and features of our platform, including developing new solutions and applications. |

| | • | | Selectively Pursue Strategic Acquisitions. The fragmented nature of our market provides opportunity for selective acquisitions. In 2012, we purchased substantially all of the assets of Edifice Information Management Systems, Inc., a privately-held information services company specializing in the collection, analysis and distribution of point-of-sale data used by retailers and suppliers to improve their supply chain efficiencies. This acquisition increased our point-of-sale analytic offerings, expanded our base of recurring revenue customers and added suppliers to our network. In 2011, we purchased substantially all of the assets of Direct EDI LLC, a privately-held provider of cloud-based integration solutions for electronic data interchange, which expanded our base of recurring revenue customers. To complement and accelerate our internal growth, we may pursue acquisitions of other supply chain management companies to add customers. We plan to evaluate potential acquisitions of other supply chain management companies primarily based on the number of customers and revenue the acquisition would provide relative to the purchase price. We also may pursue acquisitions that allow us to expand into regions where we do not have a significant presence or to offer new functionalities we do not currently provide. We plan to evaluate potential acquisitions to expand into new regions or offer additional functionalities primarily based on the anticipated growth the acquisition would provide, the purchase price and our ability to integrate and operate the acquired business. |

Technology, Development and Operations

Technology

We were an early provider of Software-as-a-Service solutions to the supply chain management industry, launching the first version of our platform in 1997. We use commercially available hardware and a combination of proprietary and commercially available software.

The software we license from third parties is typically licensed to us pursuant to a multi-year or perpetual license that includes a multi-year support services agreement with the third party. Our ability to access upgrades to certain software is conditioned upon our continual maintenance of a support services agreement with the third party between the date of the initial license and the date on which we seek or are required to upgrade the software. Although we believe we could replace the software we currently license from third parties with alternative software, doing so could take time, could result in the temporary unavailability of our platform and increase our costs of operations.

Our scalable, on-demand platform treats all customers as logically separate tenants in a central infrastructure. As a result, we spread the cost of delivering our solutions across our customer base. Because we do not manage thousands of distinct applications with their own business logic and database schemes, we believe that we can scale our business faster than traditional software vendors, even those that modified their products to be accessible over the Internet.

Development

Our research and development efforts focus on improving and enhancing our existing solutions, as well as developing new solutions and applications. Because of our multi-tenant architecture, we provide our customers with a single version of our platform, which we believe allows us to maintain relatively low research and development expenses compared to traditional on-premise licensed software solutions that support multiple versions.

7

Operations

We host production and back-up servers in third-party data centers located in Minnesota and New Jersey. We operate all of the hardware on which our applications run in the data centers.

We have monitoring software that continually checks our platform and key underlying components at regular intervals for availability and performance, ensuring our platform is available and providing adequate response. We also have a technology operations team that provides system provisioning, management, maintenance, monitoring and back-up.

To facilitate high availability, we operate a multi-tiered system configuration with load-balanced web server pools, replicated database servers and fault-tolerant storage devices. Databases leverage third-party features for near real-time replication across sites.

Our Customers

As of December 31, 2012, we had approximately 18,000 recurring revenue customers and over 50,000 total customers. Our primary source of revenue is from small- to mid-sized suppliers in the consumer packaged goods industry. We also generate revenues from other members of the supply chain ecosystem, including retailers, grocers, distributors, third-party logistics providers and other trading partners. No customer represented over 2% of our revenues in 2012, 2011 or 2010.

Competition

Vendors in the supply chain management industry offer solutions through three delivery methods: on demand, traditional on-premise software and managed services.

The market for on-demand supply chain management solutions is fragmented and rapidly evolving. Software-as-a-Service vendors compete directly with each other based on the following:

| | • | | breadth of pre-built connections to retailers, third-party logistics providers and other trading partners; |

| | • | | history of establishing and maintaining reliable integration connections with trading partners; |

| | • | | reputation of the Software-as-a-Service vendor in the supply chain management industry; |

| | • | | specialization in a customer market segment; |

| | • | | speed and quality with which the Software-as-a-Service vendor can integrate its customers to their trading partners; |

| | • | | functionality of the Software-as-a-Service solution, such as the ability to integrate the solution with a customer’s business systems; |

| | • | | breadth of complementary supply chain management solutions the Software-as-a-Service vendor offers; and |

| | • | | training and customer support services provided during and after a customer’s initial integration. |

We expect to encounter new and increased competition as this market segment consolidates and matures. Consolidation among Software-as-a-Service vendors could create a direct competitor that is able to compete with us more effectively than the numerous, smaller vendors currently offering Software-as-a-Service supply chain management solutions. Increased competition from Software-as-a-Service vendors could reduce our market share, revenues and operating margins or otherwise adversely affect our business.

8

Software-as-a-Service vendors also compete with traditional on-premise software companies and managed service providers. Traditional on-premise software companies focused on supply chain integration management include Sterling Commerce, a subsidiary of IBM, GXS Corporation, Extol International and Seeburger. These companies offer a “do-it-yourself” approach in which customers purchase, install and manage specialized software, hardware and value-added networks for their supply chain integration needs. This approach requires customers to invest in staff to operate and maintain the software. Traditional on-premise software companies use a single-tenant approach in which information maps to retailers are built for and used by one supplier, as compared to Software-as-a-Service solutions that allow multiple customers to share information maps with a retailer.

Managed service providers focused on the supply chain management market include Sterling Commerce and GXS. These companies combine traditional on-premise software, hardware and value-added networks with professional information technology services to manage these resources. Like traditional on-premise software companies, managed service providers use a single-tenant approach.

Customers of traditional on-premise software companies and managed service providers typically make significant upfront investments in the supply chain management solutions these competitors provide, which can decrease the customers’ willingness to abandon their investments in favor of a Software-as-a-Service solution. Software-as-a-Service supply chain management solutions also are at a relatively early stage of development compared to traditional on-premise software and managed service providers. Software-as-a-Service vendors compete with these better established solutions based on total cost of ownership and flexibility. If suppliers do not perceive the benefits of Software-as-a-Service solutions, or if suppliers are unwilling to abandon their investments in other supply chain management solutions, our business and growth may suffer. In addition, many traditional on-premise software companies and managed service providers have larger customer bases and may be better capitalized than we are, which may provide them with an advantage in developing, marketing or servicing solutions that compete with ours.

Intellectual Property and Proprietary Content

We rely on a combination of copyright, trademark and trade secret laws as well as confidentiality procedures and contractual provisions to protect our proprietary technology and our brand. We enter into confidentiality and proprietary rights agreements with our employees, consultants and other third parties and control access to software, documentation and other proprietary information. We registered the marks Retail Universe, SPSCommerce.net, SPS Commerce, and the SPS Commerce logo in the United States. We do not have any patents but we have one pending patent application. Our trade secrets consist primarily of the software we have developed for our SPSCommerce.net integration center. Our software is also protected under copyright law, but we do not have any registered copyrights.

Employees

As of December 31, 2012, we had 631 employees. We also employ independent contractors to support our operations. We believe that our continued success will depend on our ability to continue to attract and retain skilled technical and sales personnel. We have never had a work stoppage, and none of our employees are represented by a labor union. We believe our relationship with our employees is good.

Company Information

We were originally incorporated as St. Paul Software, Inc., a Minnesota corporation, on January 28, 1987. On May 30, 2001, we reincorporated in Delaware under our current name, SPS Commerce, Inc. Our principal executive offices are located at 333 South Seventh Street, Suite 1000, Minneapolis, Minnesota 55402, and our telephone number is (612) 435-9400. Our website address iswww.spscommerce.com. Information on our website does not constitute part of this Annual Report on Form 10-K or any other report we file or furnish with the

9

Securities and Exchange Commission (“SEC”). We provide free access to various reports that we file with or furnish to the SEC through our website as soon as reasonably practicable after they have been filed or furnished. These reports include, but are not limited to, our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and any amendments to these reports. Our SEC reports can be accessed through the investor relations section of our website or through the SEC’s website atwww.sec.gov. Stockholders may also request copies of these documents from:

SPS Commerce, Inc.

Attention: Investor Relations

333 South Seventh Street

Suite 1000

Minneapolis, MN 55402

Executive Officers

Set forth below are the names, ages and titles of the persons serving as our executive officers.

| | | | | | |

Name | | Age | | | Position |

Archie C. Black | | | 50 | | | Chief Executive Officer and President |

Kimberly K. Nelson | | | 45 | | | Executive Vice President and Chief Financial Officer |

James J. Frome | | | 48 | | | Executive Vice President and Chief Operating Officer |

Archie C. Black has served as our President and Chief Executive Officer and a director since 2001. Previously, Mr. Black served as our Senior Vice President and Chief Financial Officer from 1998 to 2001. Prior to joining us, Mr. Black was a Senior Vice President and Chief Financial Officer at Investment Advisors, Inc. in Minneapolis, Minnesota and also spent three years at Price Waterhouse.

Kimberly K. Nelson has served as our Executive Vice President and Chief Financial Officer since November 2007. Prior to joining us, Ms. Nelson served as the Finance Director, Investor Relations for Amazon.com, from June 2005 through November 2007, and as the Finance Director, Worldwide Application for Amazon.com’s Technology group, from April 2003 until June 2005. Ms. Nelson also served as Amazon.com’s Finance Director, Financial Planning and Analysis from December 2000 until April 2003.

James J. Frome has served as our Executive Vice President and Chief Operating Officer since August 2012. Previously, Mr. Frome served as our Executive Vice President and Chief Strategy Officer, from March 2001 to August 2012, and our Vice President of Marketing, from July 2000 to March 2001. Prior to joining us, Mr. Frome served as a Divisional Vice President of Marketing at Sterling Software, Inc., from 1999 to 2000, and as a Senior Product Manager and Director of Product Management at Information Advantage, Inc., from 1993 to 1999.

10

Set forth below and elsewhere in this Annual Report on Form 10-K, and in other documents we file with the Securities and Exchange Commission, are risks and uncertainties that could cause our actual results to differ materially from the results contemplated by the forward-looking statements contained in this Annual Report on Form 10-K and in other written and oral communications from time to time. Our business could be harmed by any of these risks. The trading price of our common stock could decline due to any of these risks. In assessing these risks, you should also refer to the other information contained in this Annual Report on Form 10-K, including our financial statements and related notes.

The market for on-demand supply chain management solutions is at an early stage of development. If this market does not develop or develops more slowly than we expect, our revenues may decline or fail to grow and we may incur operating losses.

We derive, and expect to continue to derive, substantially all of our revenues from providing on-demand supply chain management solutions to suppliers. The market for on-demand supply chain management solutions is in an early stage of development, and it is uncertain whether these solutions will achieve and sustain high levels of demand and market acceptance. Our success will depend on the willingness of suppliers to accept our on-demand supply chain management solutions as an alternative to traditional licensed hardware and software solutions.

Some suppliers may be reluctant or unwilling to use our on-demand supply chain management solutions for a number of reasons, including existing investments in supply chain management technology. Supply chain management functions traditionally have been performed using purchased or licensed hardware and software implemented by each supplier. Because this traditional approach often requires significant initial investments to purchase the necessary technology and to establish systems that comply with retailers’ unique requirements, suppliers may be unwilling to abandon their current solutions for our on-demand supply chain management solutions.

Other factors that may limit market acceptance of our on-demand supply chain management solutions include:

| | • | | our ability to maintain high levels of customer satisfaction; |

| | • | | our ability to maintain continuity of service for all users of our platform; |

| | • | | the price, performance and availability of competing solutions; and |

| | • | | our ability to assuage suppliers’ confidentiality concerns about information stored outside of their controlled computing environments. |

If suppliers do not perceive the benefits of our on-demand supply chain management solutions, or if suppliers are unwilling to accept our platform as an alternative to the traditional approach, the market for our solutions might not continue to develop or might develop more slowly than we expect, either of which would significantly adversely affect our revenues and growth prospects.

We do not have long-term contracts with our recurring revenue customers, and our success therefore depends on our ability to maintain a high level of customer satisfaction and a strong reputation in the supply chain management industry.

Our contracts with our recurring revenue customers typically allow the customer to cancel the contract for any reason with 30 days prior notice. Our continued success therefore depends significantly on our ability to meet or exceed our recurring revenue customers’ expectations because most recurring revenue customers do not make long-term commitments to use our solutions. In addition, if our reputation in the supply chain management industry is harmed or diminished for any reason, our recurring revenue customers have the ability to terminate

11

their relationship with us on short notice and seek alternative supply chain management solutions. If a significant number of recurring revenue customers seek to terminate their relationship with us, our business, results of operations and financial condition can be adversely affected in a short period of time.

Continued economic weakness and uncertainty could adversely affect our revenue, lengthen our sales cycles and make it difficult for us to forecast operating results accurately.

Our revenues depend significantly on general economic conditions and the health of retailers. Economic weakness and constrained retail spending adversely affected revenue growth rates in late 2008 and similar circumstances may result in slower growth, or reductions, in revenues and gross profits in the future. We have experienced, and may experience in the future, reduced spending in our business due to financial turmoil affecting the U.S. and global economy, and other macroeconomic factors affecting spending behavior. Uncertainty about future economic conditions makes it difficult for us to forecast operating results and to make decisions about future investments. In addition, economic conditions or uncertainty may cause customers and potential customers to reduce or delay technology purchases, including purchases of our solutions. Our sales cycle may lengthen if purchasing decisions are delayed as a result of uncertain information technology or development budgets or contract negotiations become more protracted or difficult as customers institute additional internal approvals for information technology purchases. Delays or reductions in information technology spending could have a material adverse effect on demand for our solutions, and consequently our results of operations, prospects and stock price.

If we are unable to attract new customers, or sell additional solutions, or if our customers do not increase their use of our solutions, our revenue growth and profitability will be adversely affected.

To increase our revenues and achieve and maintain profitability, we must regularly add new customers, sell additional solutions and our customers must increase their use of the solutions for which they currently subscribe. We intend to grow our business by hiring additional sales personnel, developing strategic relationships with resellers, including resellers that incorporate our applications in their offerings, and increasing our marketing activities. If we are unable to hire or retain quality sales personnel, convert companies that have been referred to us by our existing network into paying customers, ensure the effectiveness of our marketing programs, or if our existing or new customers do not perceive our solutions to be of sufficiently high value and quality, we might not be able to increase sales and our operating results will be adversely affected. In addition, we derived more than 85% of our revenues in 2012, and more than 90% of our revenues in 2011 and 2010, from our Trading Partner Integration solution. If we fail to sell our new solutions to existing or new customers, we will not generate anticipated revenues from these solutions, our operating results will suffer and we might be unable to grow our revenues or achieve or maintain profitability.

Our quarterly results of operations may fluctuate in the future, which could result in volatility in our stock price.

Our quarterly revenues and results of operations have varied in the past and may fluctuate as a result of a variety of factors, including the success of our new offerings such as our Trading Partner Intelligence solution. If our quarterly revenues or results of operations fluctuate, the price of our common stock could decline substantially. Fluctuations in our results of operations may be due to a number of factors, including, but not limited to, those listed below and identified throughout this “Risk Factors” section:

| | • | | our ability to retain and increase sales to customers and attract new customers, including our ability to maintain and increase our number of recurring revenue customers; |

| | • | | the timing and success of introductions of new solutions or upgrades by us or our competitors; |

| | • | | the strength of the economy, in particular as it affects the retail sector; |

| | • | | changes in our pricing policies or those of our competitors; |

12

| | • | | competition, including entry into the industry by new competitors and new offerings by existing competitors; |

| | • | | the amount and timing of our expenses, including stock-based compensation and expenditures related to expanding our operations, supporting new customers, performing research and development, or introducing new solutions; and |

| | • | | changes in the payment terms for our solutions. |

Due to the foregoing factors, and the other risks discussed in this Annual Report on Form 10-K, you should not rely on comparisons of our results of operations as an indication of our future performance.

We have incurred operating losses in the past and may incur operating losses in the future.

We began operating our supply chain management solution business in 1997. Throughout most of our history, we have experienced net losses and negative cash flows from operations. As of December 31, 2012, we had an accumulated deficit of $47.8 million. We expect our operating expenses to continue to increase in the future as we expand our operations. If our revenues do not continue to grow to offset these increased expenses, we may not be profitable. We cannot assure you that we will be able to maintain profitability. You should not consider recent revenue growth as indicative of our future performance. In fact, in future periods, we may not have any revenue growth, or our revenues could decline.

Our inability to adapt to rapid technological change could impair our ability to remain competitive.

The industry in which we compete is characterized by rapid technological change, frequent introductions of new products and evolving industry standards. Our ability to attract new customers and increase revenues from customers will depend in significant part on our ability to anticipate industry standards and to continue to enhance existing solutions or introduce or acquire new solutions on a timely basis to keep pace with technological developments. The success of any enhancement or new solution depends on several factors, including the timely completion, introduction and market acceptance of the enhancement or solution. Any new solution we develop or acquire might not be introduced in a timely or cost-effective manner and might not achieve the broad market acceptance necessary to generate significant revenues. If any of our competitors implements new technologies before we are able to implement them, those competitors may be able to provide more effective solutions than ours at lower prices. Any delay or failure in the introduction of new or enhanced solutions could adversely affect our business, results of operations and financial condition.

We may experience service failures or interruptions due to defects in the hardware, software, infrastructure, third party components or processes that comprise our existing or new solutions, any of which could adversely affect our business.

Technology solutions as complex as ours may contain undetected defects in the hardware, software, infrastructure, third party components or processes that are part of the solutions we provide. If these defects lead to service failures, we could experience delays or lost revenues during the period required to correct the cause of the defects. We cannot be certain that defects will not be found in new solutions or upgraded solutions, resulting in loss of, or delay in, market acceptance, which could have an adverse effect on our business, results of operations and financial condition.

Because customers use our on-demand supply chain management solutions for critical business processes, any defect in our solutions, any disruption to our solutions or any error in execution could cause recurring revenue customers to cancel their contracts with us, prevent potential customers from joining our network and harm our reputation. Although most of our contracts with our customers limit our liability to our customers for these defects, disruptions or errors, we nonetheless could be subject to litigation for actual or alleged losses to our customers’ businesses, which may require us to spend significant time and money in litigation or arbitration or to

13

pay significant settlements or damages. We do not currently maintain any warranty reserves. Defending a lawsuit, regardless of its merit, could be costly and divert management’s attention and could cause our business to suffer.

The insurers under our existing liability insurance policy could deny coverage of a future claim that results from an error or defect in our technology or a resulting disruption in our solutions, or our existing liability insurance might not be adequate to cover all of the damages and other costs of such a claim. Moreover, we cannot assure you that our current liability insurance coverage will continue to be available to us on acceptable terms or at all. The successful assertion against us of one or more large claims that exceeds our insurance coverage, or the occurrence of changes in our liability insurance policy, including an increase in premiums or imposition of large deductible or co-insurance requirements, could have an adverse effect on our business, financial condition and operating results. Even if we succeed in litigation with respect to a claim, we are likely to incur substantial costs and our management’s attention will be diverted from our operations.

Interruptions or delays from third-party data centers could impair the delivery of our solutions and our business could suffer.

We use third-party data centers, located in Minnesota and New Jersey, to conduct our operations. All of our solutions reside on hardware that we own and operate in these locations. Our operations depend on the protection of the equipment and information we store in these third-party centers against damage or service interruptions that may be caused by fire, flood, severe storm, power loss, telecommunications failures, unauthorized intrusion, computer viruses and disabling devices, denial of service attacks, natural disasters, war, criminal act, military action, terrorist attack and other similar events beyond our control. A prolonged service disruption affecting our solutions for any of the foregoing reasons could damage our reputation with current and potential customers, expose us to liability, cause us to lose recurring revenue customers or otherwise adversely affect our business. We may also incur significant costs for using alternative equipment or taking other actions in preparation for, or in reaction to, events that damage the data centers we use.

Our on-demand supply chain management solutions are accessed by a large number of customers at the same time. As we continue to expand the number of our customers and solutions available to our customers, we may not be able to scale our technology to accommodate the increased capacity requirements, which may result in interruptions or delays in service. In addition, the failure of our third-party data centers to meet our capacity requirements could result in interruptions or delays in our solutions or impede our ability to scale our operations. In the event that our data center arrangements are terminated, or there is a lapse of service or damage to such facilities, we could experience interruptions in our solutions as well as delays and additional expense in arranging new facilities and services.

A failure to protect the integrity and security of our customers’ information could expose us to litigation, materially damage our reputation and harm our business, and the costs of preventing such a failure could adversely affect our results of operations.

Our business involves the collection and use of confidential information of our customers and their trading partners. We cannot assure you that our efforts to protect this confidential information will be successful. If any compromise of this information security were to occur, we could be subject to legal claims and government action, experience an adverse effect on our reputation and need to incur significant additional costs to protect against similar information security breaches in the future, each of which could adversely affect our financial condition, results of operations and growth prospects. In addition, because of the critical nature of data security, any perceived breach of our security measures could cause existing or potential customers not to use our solutions and could harm our reputation.

14

Evolving regulation of the Internet may increase our expenditures related to compliance efforts, which may adversely affect our financial condition.

As Internet commerce continues to evolve, increasing regulation by federal, state or foreign agencies becomes more likely. We are particularly sensitive to these risks because the Internet is a critical component of our on-demand business model. For example, we believe that increased regulation is likely in the area of data privacy, and laws and regulations applying to the solicitation, collection, processing or use of personal or consumer information could affect our customers’ ability to use and share data, potentially reducing demand for solutions accessed via the Internet and restricting our ability to store, process and share data with our clients via the Internet. In addition, taxation of services provided over the Internet or other charges imposed by government agencies or by private organizations for accessing the Internet may be imposed. Any regulation imposing greater fees for Internet use or restricting information exchange over the Internet could result in a decline in the use of the Internet and the viability of Internet-based services, which could harm our business.

If we fail to protect our intellectual property and proprietary rights adequately, our business could be adversely affected.

We believe that proprietary technology is essential to establishing and maintaining our leadership position. We seek to protect our intellectual property through trade secrets, copyrights, confidentiality, non-compete and nondisclosure agreements, trademarks, domain names and other measures, some of which afford only limited protection. We do not have any patents or registered copyrights. We have one pending patent application. Despite our efforts to protect our proprietary rights, unauthorized parties may attempt to copy aspects of our technology or to obtain and use information that we regard as proprietary. We cannot assure you that our means of protecting our proprietary rights will be adequate or that our competitors will not independently develop similar or superior technology or design around our intellectual property. In addition, the laws of some foreign countries do not protect our proprietary rights to as great an extent as the laws of the United States. Intellectual property protections may also be unavailable, limited or difficult to enforce in some countries, which could make it easier for competitors to capture market share. Our failure to protect adequately our intellectual property and proprietary rights could adversely affect our business, financial condition and results of operations.

An assertion by a third party that we are infringing its intellectual property could subject us to costly and time-consuming litigation or expensive licenses and our business might be harmed.

The Internet supply chain management and technology industries are characterized by the existence of a large number of patents, copyrights, trademarks and trade secrets and by frequent litigation based on allegations of infringement or other violations of intellectual property rights. As we seek to extend our solutions, we could be constrained by the intellectual property rights of others.

We might not prevail in any intellectual property infringement litigation given the complex technical issues and inherent uncertainties in such litigation. Defending such claims, regardless of their merit, could be time-consuming and distracting to management, result in costly litigation or settlement, cause development delays, or require us to enter into royalty or licensing agreements. If our solutions violate any third-party proprietary rights, we could be required to withdraw those solutions from the market, re-develop those solutions or seek to obtain licenses from third parties, which might not be available on reasonable terms or at all. Any efforts to re-develop our solutions, obtain licenses from third parties on favorable terms or license a substitute technology might not be successful and, in any case, might substantially increase our costs and harm our business, financial condition and operating results. Withdrawal of any of our solutions from the market might harm our business, financial condition and operating results.

In addition, we incorporate open source software into our platform. Given the nature of open source software, third parties might assert copyright and other intellectual property infringement claims against us based on our use of certain open source software programs. The terms of many open source licenses to which we are subject have not been interpreted by U.S. or foreign courts, and there is a risk that those licenses could be

15

construed in a manner that imposes unanticipated conditions or restrictions on our ability to commercialize our solutions. In that event, we could be required to seek licenses from third parties in order to continue offering our solutions, to re-develop our solutions or to discontinue sales of our solutions, or to release our proprietary software code under the terms of an open source license, any of which could adversely affect our business.

We rely on third party hardware and software that could take a significant time to replace or upgrade.

We rely on hardware and software licensed from third parties to offer our on-demand supply chain management solutions. This hardware and software, as well as maintenance rights for this hardware and software, may not continue to be available to us on commercially reasonable terms, or at all. If we lose the right to use or upgrade any of these licenses, our customers could experience delays or be unable to access our solutions until we can obtain and integrate equivalent technology. There might not always be commercially reasonable hardware or software alternatives to the third-party hardware and software that we currently license. Any such alternatives could be more difficult or costly to replace than the third-party hardware and software we currently license, and integration of the alternatives into our platform could require significant work and substantial time and resources. Any delays or failures associated with our platform could injure our reputation with customers and potential customers and result in an adverse effect on our business, results of operations and financial condition.

Our new products and changes to existing products could fail to attract or retain users or generate revenue.

Our ability to retain, increase and engage our customers and to increase our revenues will depend heavily on our ability to create successful new products. We may introduce significant changes to our existing products or develop and introduce new and unproven products which include or use technologies with which we have little or no prior development or operating experience. If new or enhanced products fail to engage customers, we may fail to attract or retain customers or to generate sufficient revenues, operating margin, or other value to justify our investments and our business may be adversely affected. In the future, we may invest in new products and initiatives to generate revenue, but there is no guarantee these approaches will be successful. If we are not successful with new approaches to monetization, we may not be able to maintain or grow our revenues as anticipated or recover any associated development costs, and our financial results could be adversely affected.

Our business is dependent on our ability to maintain and scale our technical infrastructure, and any significant disruption in our service could damage our reputation, result in a potential loss of users and engagement, and adversely affect our financial results.

Our reputation and ability to attract, retain and serve our customers is dependent upon the reliable performance of our platform and our underlying technical infrastructure. As our user base and the amount and types of information shared on our platform continue to grow, we will need an increasing amount of technical infrastructure, including network capacity and computing power, to continue to satisfy the needs of our users. It is possible that we may fail to effectively scale and grow our technical infrastructure to accommodate these increased demands.

Our software is highly technical, and if it contains undetected errors, our business could be adversely affected.

Our products incorporate software that is highly technical and complex. Our software has contained, and may now or in the future contain, undetected errors, bugs or vulnerabilities. Some errors in our software code may only be discovered after the code has been released. Any errors, bugs or vulnerabilities discovered in our code after release could result in damage to our reputation, loss of customers, loss of revenue or liability for damages, any of which could adversely affect our business and financial results.

16

Computer malware, viruses, hacking and phishing attacks, and spamming could harm our business and results of operations.

Computer malware, viruses, and computer hacking and phishing attacks have become more prevalent in our industry, have occurred on our systems in the past, and may occur on our systems in the future. Because of our significant presence in the retail industry, we believe that we are a particularly attractive target for such attacks. Though it is difficult to determine what, if any, harm may directly result from any specific interruption or attack, any failure to maintain performance, reliability, security and availability of our products and technical infrastructure to the satisfaction of our users may harm our reputation and our ability to retain existing customers and attract new customers.

We may pursue acquisitions and our potential inability to successfully integrate newly acquired companies or businesses could adversely affect our financial results.

We may pursue acquisitions of other companies or their businesses in the future. If we complete acquisitions, we face many risks commonly encountered with growth through acquisitions. These risks include:

| | • | | incurring significantly higher than anticipated capital expenditures and operating expenses; |

| | • | | failing to assimilate the operations and personnel of the acquired company or business; |

| | • | | disrupting our ongoing business; |

| | • | | dissipating our management resources; |

| | • | | failing to maintain uniform standards, controls and policies; and |

| | • | | impairing relationships with employees and customers as a result of changes in management. |

Fully integrating an acquired company or business into our operations may take a significant amount of time. We cannot assure you that we will be successful in overcoming these risks or any other problems encountered with acquisitions. To the extent we do not successfully avoid or overcome the risks or problems related to any acquisitions, including our recent acquisitions of Edifice and Direct EDI, our results of operations and financial condition could be adversely affected. Future acquisitions also could impact our financial position and capital needs, and could cause substantial fluctuations in our quarterly and yearly results of operations. Acquisitions could include significant goodwill and intangible assets, which may result in future impairment charges that would reduce our stated earnings.

Our ability to use our U.S. net operating loss carryforwards might be limited.

As of December 31, 2012, we had net operating loss carryforwards of $56.9 million for U.S. federal tax purposes and $23.9 million of various state net operating loss carryforwards. These loss carryforwards will expire between 2013 and 2032 if not utilized. To the extent these net operating loss carryforwards are available, we intend to use them to reduce the corporate income tax liability associated with our operations. Section 382 of the U.S. Internal Revenue Code generally imposes an annual limitation on the amount of net operating loss carryforwards that might be used to offset taxable income when a corporation has undergone significant changes in stock ownership. We have performed a Section 382 analysis for the time period from our inception through December 8, 2010. During this time period it was determined that we had six separate ownership changes under Section 382. We have not updated the Section 382 analysis subsequent to December 8, 2010; however, we believe there have not been any events subsequent to that date that would materially impact the analysis. We believe that approximately $17.6 million of federal losses and $13.0 million of state losses will expire unused due to Section 382 limitations. The maximum annual limitation of federal net operating losses under Section 382 is approximately $990,000. This limitation could be further restricted if ownership changes occur in future years. To the extent our use of net operating loss carryforwards is significantly limited, our taxable income could be subject to corporate income tax earlier than it would if we were able to use net operating loss carryforwards, which could result in lower profits.

17

The markets in which we participate are highly competitive, and our failure to compete successfully would make it difficult for us to add and retain customers and would reduce or impede the growth of our business.

The markets for supply chain management solutions are increasingly competitive and global. We expect competition to increase in the future both from existing competitors and new companies that may enter our markets. Increased competition could result in pricing pressure, reduced sales, lower margins or the failure of our solutions to achieve or maintain broad market acceptance. We face competition from:

| | • | | Software-as-a-Service providers that deliver business-to-business information systems using a multi-tenant approach; |

| | • | | traditional on-premise software providers; and |

| | • | | managed service providers that combine traditional on-premise software with professional information technology services. |

To remain competitive, we will need to invest continuously in software development, marketing, customer service and support and product delivery infrastructure. However, we cannot assure you that new or established competitors will not offer solutions that are superior to or lower in price than ours. We may not have sufficient resources to continue the investments in all areas of software development and marketing needed to maintain our competitive position. In addition, some of our competitors are better capitalized than us, which may provide them with an advantage in developing, marketing or servicing new solutions. Increased competition could reduce our market share, revenues and operating margins, increase our costs of operations and otherwise adversely affect our business.

Mergers or other strategic transactions involving our competitors could weaken our competitive position, which could harm our operating results.

Our industry is highly fragmented, and we believe it is likely that our existing competitors will continue to consolidate or will be acquired. In addition, some of our competitors may enter into new alliances with each other or may establish or strengthen cooperative relationships with systems integrators, third-party consulting firms or other parties. Any such consolidation, acquisition, alliance or cooperative relationship could lead to pricing pressure and our loss of market share and could result in a competitor with greater financial, technical, marketing, service and other resources, all of which could have a material adverse effect on our business, operating results and financial condition.

If we fail to retain our Chief Executive Officer and other key personnel, our business would be harmed and we might not be able to implement our business plan successfully.

Given the complex nature of the technology on which our business is based and the speed with which such technology advances, our future success is dependent, in large part, upon our ability to attract and retain highly qualified managerial, technical and sales personnel. Competition for talented personnel is intense, and we cannot be certain that we can retain our managerial, technical and sales personnel or that we can attract, assimilate or retain such personnel in the future. Our inability to attract and retain such personnel could have an adverse effect on our business, results of operations and financial condition.

Our continued growth could strain our personnel resources and infrastructure, and if we are unable to implement appropriate controls and procedures to manage our growth, we will not be able to implement our business plan successfully.

We have experienced a period of rapid growth in our headcount and operations. To the extent that we are able to sustain such growth, it will place a significant strain on our management, administrative, operational and financial infrastructure. Our success will depend in part upon the ability of our senior management to manage this growth effectively. To do so, we must continue to hire, train and manage new employees as needed. If our

18

new hires perform poorly, or if we are unsuccessful in hiring, training, managing and integrating these new employees, or if we are not successful in retaining our existing employees, our business would be harmed. To manage the expected growth of our operations and personnel, we will need to continue to improve our operational, financial and management controls and our reporting systems and procedures. The additional headcount we are adding will increase our cost base, which will make it more difficult for us to offset any future revenue shortfalls by reducing expenses in the short term. If we fail to successfully manage our growth, we will be unable to execute our business plan.

Our failure to maintain adequate internal control over financial reporting in accordance with Section 404 of the Sarbanes-Oxley Act of 2002 or to prevent or detect material misstatements in our annual or interim financial statements in the future could result in inaccurate financial reporting, or could otherwise harm our business.

Ensuring that we have internal financial and accounting controls and procedures adequate to produce accurate financial statements on a timely basis is a costly and time-consuming effort that needs to be re-evaluated frequently. The Sarbanes-Oxley Act requires, among other things, that we maintain effective internal control over financial reporting and disclosure controls and procedures. In particular, we are required to perform annual system and process evaluation and testing of our internal control over financial reporting to allow management and our independent registered public accounting firm to report on the effectiveness of our internal control over financial reporting, as required by Section 404 of the Sarbanes-Oxley Act. As previously reported under “Item 4 — Controls and Procedures” in our Quarterly Report on Form 10-Q for the quarter ended September 30, 2012, our management concluded that our disclosure controls and procedures were not effective as of September 30, 2012 solely because we identified a material weakness in internal control over financial reporting related to modifications of contract information in our recently implemented Enterprise Resource Planning (“ERP”) system upgrade. We have remediated this material weakness since the filing of that report; however, there can be no assurance that material weaknesses will not be identified in the future. Furthermore, implementing any appropriate future changes to our internal control over financial reporting may entail substantial costs in order to modify our existing accounting systems, may take a significant period of time to complete and may distract our officers, directors and employees from the operation of our business. If we are not able to comply with the requirements of Section 404 in the future, or if material weaknesses are identified, the market price of our common stock could decline.

Our failure to raise additional capital or generate cash flows necessary to expand our operations and invest in new technologies could reduce our ability to compete successfully and adversely affect our results of operations.

We may need to raise additional funds, and we may not be able to obtain additional debt or equity financing on favorable terms, if at all. If we raise additional equity financing, our security holders may experience significant dilution of their ownership interests and the value of shares of our common stock could decline. If we engage in debt financing, we may be required to accept terms that restrict our ability to incur additional indebtedness, force us to maintain specified liquidity or other ratios or restrict our ability to pay dividends or make acquisitions. If we need additional capital and cannot raise it on acceptable terms, we may not be able to, among other things:

| | • | | develop and enhance our solutions; |

| | • | | continue to expand our technology development, sales and marketing organizations; |

| | • | | hire, train and retain employees; or |

| | • | | respond to competitive pressures or unanticipated working capital requirements. |

Our inability to do any of the foregoing could reduce our ability to compete successfully and adversely affect our results of operations.

19

Because our long-term success depends, in part, on our ability to expand the sales of our solutions to customers located outside of the United States, our business will be susceptible to risks associated with international operations.

We have limited experience operating in foreign jurisdictions. Customers in countries outside of North America accounted for 2% of our revenues for 2012, 2011 and 2010. We also undertake software development activities in the Ukraine. Our inexperience in operating our business outside of North America increases the risk that our current and any future international expansion efforts will not be successful. Conducting international operations subjects us to new risks that, generally, we have not faced in the United States, including:

| | • | | fluctuations in currency exchange rates; |

| | • | | unexpected changes in foreign regulatory requirements; |

| | • | | longer accounts receivable payment cycles and difficulties in collecting accounts receivable; |

| | • | | difficulties in managing and staffing international operations; |

| | • | | potentially adverse tax consequences, including the complexities of foreign value added tax systems and restrictions on the repatriation of earnings; |

| | • | | localization of our solutions, including translation into foreign languages and associated expenses; |

| | • | | the burdens of complying with a wide variety of foreign laws and different legal standards, including laws and regulations related to privacy; |

| | • | | increased financial accounting and reporting burdens and complexities; |

| | • | | political, social and economic instability abroad, terrorist attacks and security concerns in general; and |

| | • | | reduced or varied protection for intellectual property rights in some countries. |

The occurrence of any one of these risks could negatively affect our international business and, consequently, our results of operations generally. Additionally, operating in international markets also requires significant management attention and financial resources. We cannot be certain that the investment and additional resources required in establishing, acquiring or integrating operations in other countries will produce desired levels of revenues or profitability.

Our stock price may be volatile.

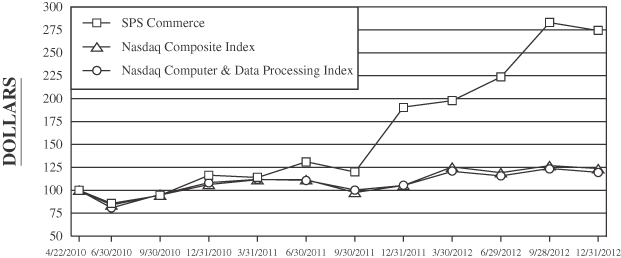

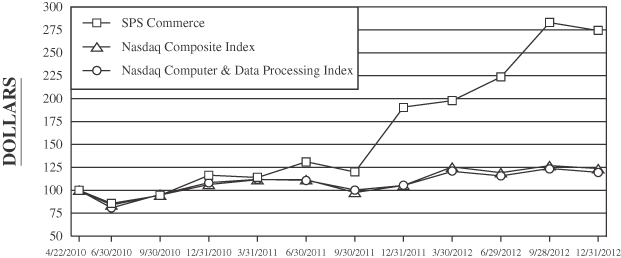

Shares of our common stock were sold in our April 2010 initial public offering at a price of $12.00 per share and, through December 31, 2012, our common stock has traded as high as $41.32 per share and as low as $8.45 per share. An active, liquid and orderly market for our common stock may not develop or be sustained, which could depress the trading price of our common stock. Some of the factors that may cause the market price of our common stock to fluctuate include:

| | • | | fluctuations in our quarterly financial results or the quarterly financial results of companies perceived to be similar to us; |

| | • | | fluctuations in our recorded revenue, even during periods of significant sales order activity; |

| | • | | changes in estimates of our financial results or recommendations by securities analysts; |

| | • | | failure of any of our solutions to achieve or maintain market acceptance; |

| | • | | changes in market valuations of similar companies; |

| | • | | success of competitive products or services; |

| | • | | changes in our capital structure, such as future issuances of securities or the incurrence of debt; |

| | • | | announcements by us or our competitors of significant solutions, contracts, acquisitions or strategic alliances; |

20

| | • | | regulatory developments in the United States, foreign countries or both; |

| | • | | litigation involving our company, our general industry or both; |

| | • | | additions or departures of key personnel; |

| | • | | investors’ general perception of us; and |

| | • | | changes in general economic, industry and market conditions. |

In addition, if the market for software stocks or the stock market in general experiences a loss of investor confidence, the trading price of our common stock could decline for reasons unrelated to our business, financial condition or results of operations. If any of the foregoing occurs, it could cause our stock price to fall and may expose us to class action lawsuits that, even if unsuccessful, could be costly to defend and a distraction to management.

Future sales of our common stock by our existing stockholders could cause our stock price to decline.