UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO.1 TO

FORM 10

GENERAL FORM FOR REGISTRATION OF SECURITIES

Pursuant to Section 12(b) or (g) of the Securities Exchange Act of 1934

Aclor International, Inc.

(Exact name of registrant as specified in its charter)

Formerly known as ‘Metiscan Inc.”

| | | |

| Delaware | | 26-3613222 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | | |

| | | |

11204 Mcpherson Road, Suite#116 Laredo, TX 78041 | | |

| (Address of principal executive offices) | | |

With copy to:

Bernard & Yam, LLP

Attn: Man Yam, Esq.

401 Broadway, Suite 1708

New York, NY 10013

Phone: 212-219-7783

Fax: 212-219-3604

Registrant’s telephone number, including area code: (678) 315 - 5592

Securities to be registered pursuant to Section 12(b) of the Act: None

| | | |

Securities to be registered pursuant to Section 12(g) of the Act: | | Common Stock, Par Value $ 0.0001 |

| | | (Title of Class) |

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large filer [ ] Accelerated filer [ ] Non-accelerated filer [ ] Smaller reporting company [X]

| | | | | (Do not check if a smaller reporting company) | | |

TABLE OF CONTENTS

| | | | | |

| | | | | |

| | | | PAGE | |

| Item 1. | | Business | 3 | |

| Item 1A. | | Risk Factors | 8 | |

| Item 2. | | Management’s Discussion and Analysis and Results of Operation | 12 | |

| Item 3. | | Properties | 21 | |

| Item 4. | | Security Ownership of Certain Beneficial Owners and Management | 21 | |

| Item 5. | | Directors and Executive Officers | 23 | |

| Item 6. | | Executive Compensation | 24 | |

| Item 7. | | Certain Relationships and Related Transactions, and Director Independence | 24 | |

| Item 8. | | Legal Proceedings | 24 | |

| Item 9. | | Market Price of and Dividends on Common Equity and Related Stockholder Matters | 25 | |

| Item 10. | | Recent Sales of Unregistered Securities | 25 | |

| Item 11. | | Description of Registrant’s Securities to be Registered | 28 | |

| Item 12. | | Indemnification of Directors and Officers | 30 | |

| Item 13. | | Financial Statements and Supplementary Data | 30 | |

| Item 14. | | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 30 | |

| Item 15. | | Financial Statements and Exhibits | 30 | |

ITEM 1. BUSINESS

CAUTION REGARDING FORWARD LOOKING STATEMENTS

This registration contains forward-looking statements. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends affecting the financial condition of our business. These forward-looking statements are subject to a number of risks including those discussed in Item 1A, uncertainties and assumptions, including, among other things:

the ability to successfully develop our business;

the ability to retain certain members of management;

our expectations regarding general and administrative expenses;

our expectations regarding cash availability and balances, capital requirements, anticipated revenue and expenses; and

other factors detailed from time to time in filings with the SEC.

In addition, in this registration, we use words such as “anticipate,” “believe,” “plan,” “expect,” “future,” “intend,” and similar expressions to identify forward-looking statements.

We undertake no obligation to update publicly or revise any forward-looking statements, whether as a result of new information, future events or otherwise after the date of this registration. In light of these risks and uncertainties, the forward-looking events and circumstances discussed in this registration may not occur and actual results could differ materially from those anticipated or implied in the forward-looking statements.

HISTORY

Metiscan, Inc. (“we”, “us” or “our”) was originally incorporated on February 27, 1997 pursuant to the laws of the State of Florida, using the name OSCM-One Stop.com, Inc. On September 25, 2008, pursuant to the consent of the Stockholders and the Board of Directors, we merged into a newly formed wholly-owned subsidiary which had been incorporated pursuant to the laws of the State of Delaware on September 9, 2008, called “Metiscan, Inc.” We were the surviving entity in such transaction.

From 1999 to 2008,, we provided Internet and communication technologies.

On August 8, 2008, we acquired Metiscan Technologies, Inc. (Technologies) in a stock-for-stock transaction. As a result, Technologies became our wholly owned subsidiary. Pursuant to the acquisition agreement, (the “Agreement”), we issued a total of 157,000,000 shares of our common stock in exchange for 100% of the issued and outstanding shares of Technologies. The Agreement provided for 32,000,000 shares to be issued upon closing and 125,000,000 to be issued as soon as possible after we filed an amendment to increase our authorized shares, which we did on August 15, 2008. On August 8, 2008, the 32,000,000 shares were issued. On August 21, 2008, the 125,000,000 shares were issued.

On November 13, 2008, we formed Taptopia, Inc., a wholly owned subsidiary that provides technology utilizing Smartphones to event organizers, convention centers, and their related vendors.

On November 13, 2008, we formed Shoreline Employment Services, Inc., an employment services company which provides part-time, full time, and contract employees. December 31, 2008, we completed the acquisition of two diagnostic imaging facilities, Schuylkill Open MRI, Inc. (SOMRI) located in Pottsville, Pennsylvania and Metiscan-CC, Inc. (Corpus), located in Corpus Christi, Texas in stock-for-stock transactions. As a result, Corpus became our wholly owned subsidiary and SOMRI became our majority-owned subsidiary. Pursuant to the same Agreement the Company agreed to issue a total of 9,000,000,000 shares (the “Imaging Shares”) of its common stock in exchange for 100% of the issued and outstanding shares of Corpus and a majority ownership of SOMRI. Pursuant to an ancillary letter agreement dated December 31, 2008, Metiscan agreed to issue the Imaging Shares on or before March 31, 2009. The Imaging Shares were issued as 900,000 shares of Series “C” Preferred Stock on May 7, 2009, which is convertible into 9,000,000,000 shares of the Company’s common stock.

On November 14, 2008, we formed FirstView EHR, Inc (“FirstView”), a Delaware corporation. FirstView provided healthcare information technology (“Healthcare IT”) services for diagnostic imaging facilities, including, but not limited to, web-based electronic healthcare records (EHR), long-term archiving and professional “Healthcare IT” services. FirstView was providing Software-as-a-Service (SaaS) to its imaging center clients. FirstView helped its clients manage, distribute, interpret and archive digital images efficiently and cost effectively. SaaS, sometimes referred to as “software on demand”, is software which is utilized by clients over the internet and/or is deployed to run behind a firewall on a local area network or personal computer. With SaaS, a provider licenses an application to customers as a service on demand, either based upon a subscription or on a “pay-as-you-go” basis. FirstView’s primary product is a web-based radiology information system which interfaced a Radiology Information System (RIS), Teleradiology and a PACS (Picture Archiving and Communication System) for its clients. FirstView also provided information management and IT operations support for diagnostic imaging facilities.

On November 15, 2010 FirstView ceased its operations.

On February 26, 2009 Technologies merged into Corpus pursuant to the consent of the Stockholders and the Board of Directors of each of the respective companies. Corpus was the surviving entity in such transaction.

On June 24, 2009, we announced that we had determined to become a holding company focused upon growing our organization by making key acquisitions of companies, which focus on developing new technologies.

On October 16, 2009, Corpus filed a petition for relief under Chapter 7 of the Bankruptcy Code. We have written off the assets and liabilities of Corpus and described the operating results from Corpus in this registration statement as discontinued operations.

On February 11, 2010, Taptopia entered into a joint venture with ConvExx, LLC to form Appcon, LLC (Appcon), which was formed under the laws of the State of Nevada. Pursuant to the Operating Agreement, each of Taptopia and ConvExx own a 50% interest in Appcon, which was created to function as a trade show organizer for mobile application trade shows to be held in the future.

On June 30th, 2011 the Company acquired 60% of the outstanding common shares of Aclor, Inc. (“Aclor”) through a share-for-share exchange. Simultaneously with the closing, all of Metiscan's equity ownership in Taptopia, Shoreline Employment Services, FirstView and SOMRI were divested to the Company's majority shareholder, Metiscan Holdings, Inc., in exchange for it returning 100% of its Series C Preferred Shares (7,500,000,000 common shares) to Metiscan's treasury. Lastly, Metiscan's board of directors and officers resigned.

On July 29, 2011, we issued 1,480,000,000 shares of common stock to acquire the remaining 40% ownership of Aclor and Aclor became our wholly owned subsidiary. Upon the completion of acquisition of Aclor, our business operations are mainly carried out through Aclor.

Founded, November 2, 2007, Aclor, Inc. (“Aclor”) is a Laredo, Texas based Company that manufactures and sells private label three ring binders and paper to support the consumer and office supplies market primarily in the United States. Aclor has offices in Laredo, Texas, and Monterrey, Nuevo Leon, Mexico, as well as a manufacturing facility leased by Aclor’s wholly owned subsidiary, Aclor Servicios Administrativos, S. de R.L., in Nuevo Laredo, Tamaulipas, Mexico. Aclor’s headquarter office is located in 11204 Mcpherson Road, Suite#116, Laredo, TX 78041.

OUR COMPANY

Summary

Upon the completion of acquisition of Aclor Inc in July 2011, our main business operations are carried out through Aclor Inc. We manufacture and sell private label three ring binders and paper to support the consumer and office supplies market primarily in the United States. We have offices in Laredo, Texas and Monterrey, Nuevo Leon, Mexico, as well as a manufacturing facility in Nuevo Laredo, Tamaulipas, Mexico.

We have proprietary and competitive advantage with our proprietary equipment and our manufacturing location in Nuevo Laredo, Mexico. Given our location, the Company can deliver orders within 14 days as opposed to the two to three months it takes our competition, primarily based in Asia, India and South America, to deliver.

Our Products

We currently make and sell two main categories:

| (1) | Converted Paper Products, including notebooks, composition books, spiral notebooks, and filler paper, lined paper, etc. We convert large rolls of raw paper and convert them into these consumable paper products. Converted paper products are our long-lasting main products which generates approximately 95% of our revenues. |

| (2) | Paper Binders: We convert large panel of plastic material into binders for notebooks, calendars, and journals. Paper binders are relatively new products. We have started to receive purchase orders for our plastic vinyl binders, however, the revenues generated by plastic vinyl binders so far are still minimal 4%) |

In addition to the above two main products, we also sell some other misdemeanor stationery products such as pencil box, book bag and totes. We listed these misdemeanor products on our website as a method of promoting market awareness of our brand and products. The sale revenues from these products only constitute approximately 1% of our total revenues and we sell these products as part of our marketing and branding strategy in increase the market awareness of our brand name and main products. We do not plan to increase the sales of these products.

Market/Industry Overview

The paper products industry is made up of over 3,500 companies with roughly a combined $175 billion in revenue, and according to our internal research, is expected to grow at an annual rate of 5% through 2013. Major companies include Georgia‐Pacific, International Paper, Kimberly‐Clark, MeadWestvaco, and Neenah Paper. The industry as a whole is concentrated in specific product segments, in which the largest 50 companies generate up to 65 percent of the segment revenue.

Paper converting is the process of taking large rolls of raw paper, and converting those rolls into consumable products such as notebooks, composition books, spiral notebooks, and filler paper, lined paper, etc. Prior to 1999, Mead, Norcom, and Top Flight controlled roughly 70% of the market share of this segment within the United States paper products manufacturing industry. These companies, and their local suppliers, utilized fully automatic machines to produce the end product. In 1999, key suppliers in the market closed much of their capacity and became “marketing companies” sourcing their product from China, India, Brazil and Indonesia, and selling to distributors and retailers in the U.S., Canada, and Mexico. For example, according to our own research, MeadWestvaco Corporation used to have nine manufacturing facilities in the US and it has closed down most of their manufacturing facilities and sourced all their products from outside manufacturers in China, India, Brazil and Indonesia.

This trend to sourcing finished products from international markets created a boom for Chinese manufacturers that were flexible and set up to support multiple products for key customers, whom were the suppliers for the retailers, at a much lower cost than could be obtained from converter plants located in the United States and Canada.

Paper converting plants operate under two (2) production methods, Web‐to‐ Finish, and Step‐and‐Repeat. The Web‐to‐Finish model contains large, expensive manufacturing machinery, which can produce very large quantities of a single product very efficiently. The Step‐and‐Repeat model contains several smaller machines that can produce many different paper products in a batch process, and can produce small quantities if needed efficiently.

According to our internal research, most of the domestic manufacturers do not have the equipments that we have purchased and designed which enable us to customize small quantity orders. Our machines have more “step and repeat” function so that they provide us with more flexibility to accommodate the demands from retailers. More and more retailers in US nowadays are carrying their own private labels which require a lot more customization and flexibility in production. Since most of the manufacturers in US do not have the flexibility we have, they usually are not able to supply to the retailers who carry private labels.

Our Competitive Strength

The paper products industry is highly competitive as it is generally low margins, and is subject to commodity price changes as well as economic demand. Companies differentiate themselves on reliability, quality, and service. Retailers continue to pressure suppliers to offer private label products and enable the retailer to manage inventory through just in time delivery so to minimize working capital and storage cost. Given the price point and FOB value of the inventory, shipping cost from overseas have continually increased as a percentage of the value of the inventory. In the past, shipping costs were roughly $2,500 per container and have risen to over $5,000 per container. According to our internal research, due to oil price increase, the cost of shipping from overseas has been increased by 10% in the past five years. For paper products, the 10% increase in shipping cost amounts to 2% of the overall inventory value.

We offer high quality paper and paper products, and given our location in Nuevo Laredo, Mexico, we are able to supply United States customers in a just in time fashion and eliminate both the extra shipping cost as well as lead time necessary for orders placed overseas. We are able to deliver an order within 8 to 14 days of the order being placed, compared to 90‐120 days for our overseas competitors. Furthermore, our relationships with large customers, helps mitigate the commodity price fluctuations for our raw materials, as we can utilize our large customer’s purchasing power in price negotiations, if needed, on raw materials. Our major material cost is the cost of roll paper, which we always purchase from a large paper mill called Domtar. Domtar is also a large supplier of copy paper for a large number of retailer in the U.S. Normally our retailer customers can help us negotiate the price of roll paper with supplier and combine our order volume to get better deal from suppliers. However, in year 2010 when the price of roll paper became so high that our major customers sourced their products from other countries since the US roll paper cost was much higher than other countries. This factor caused us to lose sales in year 2010.

We have proprietary and competitive advantage with our proprietary equipments. We are able to design and build our manufacturing equipment to accommodate the special needs and requirements of our customers while keeping the costs under control. Our machines have more “step and repeat” function so that they provide us with more flexibility to accommodate the demands from retailers. Therefore, our customers are able to order small quantities on different products and still keep the cost down. Although a lot of oversea competitors are also able to customize small quantity orders from these customers, however, due to the fact we are able to fulfill the orders in very short lead time (8-14 days), we are positioned at the more advantageous position compared to those oversea competitors who typically need 120 days lead time to fulfill the orders.

Our Mexican factory is close to the Texas border. We purchased raw paper and most of our other materials from US and shipped to our Mexican factory for manufacturing. We are able to manufactures the products from any order within 14 days from the date the order is placed. Since all our customers are located in the US, we use trucks to pick up the shipments from our factory and deliver to our customers. Due to proximity of our factory to US border, it normally takes 4 days for us to deliver products to any distribution centers in the US. It is much more efficient compared to those oversea manufacturers because they need to deliver the products via ships which will take two or three months to reach customers.

In addition to the efficiency on shipment delivery, we also benefit from the North America Free Trade Zone because our products manufactured in Mexico are free of duty when shipped to the US, while the oversea manufacturers usually need to pay duty on their products.

Research & Development

We have developed proprietary machinery to enable us to produce multiple paper supply products utilizing the same group of machines. We stored flat panel cover of binders in our facility in Mexico. When we receive the orders from retailers, we can put those flat panel in riveting machine to automatic assembly and ship at the same day, it will save lots of storage space and cost in shipping compared to our competitors who bring completed binders from overseas.

Our Growth Strategy

In order to fulfill the orders from our large customers, we plan to purchase more equipment and increase our inventory. We also plan to expand our operation to a much larger facility to increase our paper product capacity as well as support binder manufacturing.

We plan to purchase $1,000,000 worth of equipments and increase our inventory by 30% in year 2012 in order to carry out our business plan. On January 09, 2012, we have entered Unit Subscription Agreement with a group of investors who will invest up to $ $ 20,896,500 in us. As of the date of this registration statement, we have not closed the transaction underlying such Unit Subscription Agreement. We will also talk to banks, venture capital investors, and private investors to seek funding for our growth, however, there is no guarantee that we will raise sufficient funding to execute our plans.

Sources and Availability of Raw Material

We purchase raw materials and components from multiple sources, none of which may be considered a principal or material supplier. If necessary, we could replace these suppliers with minimal effect on our business operations. Our major material cost is the cost of roll paper, which we always purchase from a large paper mill called Domtar. We do not have contract with Domtar, and we can buy from another supplier. The step to ensure the availability of raw material is to maintain the relationship, and we always keep door open to source any other supplier. Domtar has an agent company to help Aclor to sourcing in different resource in the US or other countries Domtar is also a large supplier of copy paper for a large number of retailer in the U.S. Normally our retailer customers can help us negotiate the price of roll paper with supplier and combine our order volume to get better deal from suppliers. However, in year 2010 when the price of roll paper became so high that our major customers sourced their products from other countries since the US roll paper cost was much higher than other countries. This factor caused us to lose sales in year 2010.

Dependence on one major customer

During 2011, we had one customer that represented 100% of our total sales. We do not have any agreement with such customer. We simply receive regular purchase orders from them.

Our Regulatory Environment

Because we operate Aclor’s wholly owned subsidiary, Aclor Servicios Administrativos, S. de R.L., in Nuevo Laredo, Tamaulipas, Mexico, our manufacturing facility, we are subject to various United States and Mexican federal, state and local laws and regulations that are administered by numerous agencies and that relate to, among other things, the protection of the environment, including those governing the discharge or disposal of pollutants and hazardous materials.

We are authorized to operate our manufacturing facility in Mexico as a Maquiladora by the Ministry of Economy of Mexico. This Maquiladora status allows us to import items into Mexico duty free, provided that such items, after processing, are re-exported from Mexico within 18 months. Our Maquiladora status is subject to various restrictions and requirements, including compliance with the terms of the Maquiladora authorization program; proper utilization of imported materials; hiring and training of Mexican personnel; compliance with tax, labor, exchange control and notice provisions and regulations; and compliance with local and national constraints. Under our Maquiladora authorization program, our Nuevo Laredo, Mexico facility is not subject to any mandatory periodic audits or inspections or any periodic evaluations of our Maquiladora status. However, various Mexican government agencies, particularly Mexico’s Ministry of Economy and Mexico’s Ministry of Treasury, which are primarily responsible for the oversight and regulation of Mexico’s Maquiladora programs, have a statutory right to conduct inspections and evaluations of our Nuevo Laredo, Mexico operations at their discretion to ensure our compliance with the Maquiladora authorization program.

Employees

As of November 10, 2011, we have 2 full-time employees including management and 1 part-time employee in the United States and 5 full-time employees in China that are employed by Aclor Inc. In addition, we have 275 full-time employees in Mexico and 2 part-time employees in the United States that work for Aclor’s wholly owned subsidiary, Aclor Servicios. We do not have sales or manufacturing in China. Our employees in China mainly focus on designing and sampling.

ITEM 1A. RISK FACTORS

RISK FACTORS

An investment in our common stock is highly speculative, involves a high degree of risk, and should be made only by investors who can afford a complete loss. You should carefully consider the following risk factors, together with the other information in this registration, including our financial statements and the related notes, before you decide to buy our common stock. If any of the following risks actually occur, our business, financial condition, or results of operations could be materially adversely affected, the trading of our common stock could decline, and you may lose all or part of your investment therein.

Risks Related to our Common Stock

Our common stock is traded on Pink Sheets and the market price for our common stock may be volatile.

Our common stock is quoted on Pink Sheets. The Pink Sheets is not a formal stock exchange, regulator or a broker-dealer. It describes itself as an “electronic quotation and trading system” for over-the-counter securities market and operates an “inter-dealer quotation service. It facilitates secondary trading only between broker-dealers. The requirements for “listing” on the Pink Sheets have historically been extremely loose and as a result, the system has garnered a reputation as a high-risk investment environment, both for the listing companies and their investors. Some of the listing companies are SEC reporting companies, but most are not. There is a high degree of volatility in the stock price of Pink Sheets- listed companies.

The market price for our common stock is highly volatile and subject to wide fluctuations in response to factors including the following: actual or anticipated fluctuations in our quarterly operating results, changes in the economic performance or market valuations of other companies involved in the same industry, announcements by our competitors of significant acquisitions, strategic partnerships, joint ventures or capital commitments, additions or departures of key personnel, potential litigation, or conditions in the market.

In addition, the securities markets from time to time experience significant price and volume fluctuations that are not related to the operating performance of particular companies. These market fluctuations may also materially and adversely affect the market price of our common stock.

Shareholders could experience substantial dilution.

We may issue additional shares of our capital stock to raise additional cash for working capital. If we issue additional shares of our capital stock, our shareholders will experience dilution in their respective percentage ownership in the company.

A large portion of our common stock is controlled by a small number of shareholders.

A large portion of our common stock is held by a small number of shareholders. Zuoru He owns 740,000 shares of common stock, representing 21.66% of the total issued and outstanding common stock. Goodfuture Limited owns 581,875 share of common stock, representing 17.03% of the total issued and outstanding common stock. Sunbell Limited owns581,875 share of common stock, representing 17.03% of the total issued and outstanding common stock. As a result, these shareholders are able to influence the outcome of shareholder votes on various matters, including the election of directors and extraordinary corporate transactions including business combinations. In addition, the occurrence of sales of a large number of shares of our common stock, or the perception that these sales could occur, may affect our stock price and could impair our ability to obtain capital through an offering of equity securities. Furthermore, the current ratios of ownership of our common stock reduce the public float and liquidity of our common stock which can in turn affect the market price of our common stock.

We may be subject to “penny stock” regulations.

The Securities and Exchange Commission, or SEC, has adopted rules that regulate broker-dealer practices in connection with transactions in “penny stocks.” Penny stocks generally are equity securities with a price of less than $5.00 (other than securities registered on certain national securities exchanges, provided that current price and volume information with respect to transactions in such securities is provided by the exchange or system). Penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from those rules, to deliver a standardized risk disclosure document prepared by the SEC, which specifies information about penny stocks and the nature and significance of risks of the penny stock market. A broker-dealer must also provide the customer with bid and offer quotations for the penny stock, the compensation of the broker-dealer, and our sales person in the transaction, and monthly account statements indicating the market value of each penny stock held in the customer’s account. In addition, the penny stock rules require that, prior to a transaction in a penny stock not otherwise exempt from those rules, the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. These disclosure requirements may have the effect of reducing the trading activity in the secondary market for stock that becomes subject to those penny stock rules. These additional sales practice and disclosure requirements could impede the sale of our securities. Whenever any of our securities become subject to the penny stock rules, holders of those securities may have difficulty in selling those securities.

Risks Related to Our Business Operations

Our auditor has expressed substantial doubt about our ability to continue as a going concern

Our auditor has expressed substantial doubt about our ability to continue as a going concern. We are likely to have a continually increasing net operating loss until we successfully increase our customer base and level our selling, general and administrative expenses. We cannot guarantee that we will be able to increase our customer base and revenues to the extent necessary to generate sufficient revenue to cover our operating expenses. We expect negative cash flow from operations to continue, at least for the foreseeable future, as we continue to develop our businesses. If cash generated by operations is insufficient to satisfy our liquidity requirements, we may be required to sell debt or additional equity securities. The sale of additional equity or convertible debt securities would result in additional dilution to our stockholders. Further, there can be no assurance that we will be able to successfully sell our securities in order to obtain additional capital. If we are unable to obtain financing from other source, we may be unable to continue as a going concern.

Our heavy reliance on the experience and expertise of our management may cause adverse impacts on us if a management member departs.

We depend on key personnel for the success of our business. Our business may be severely disrupted if we lose the services of our key executives and employees or fail to add new senior and middle managers to our management.

Our future success is heavily dependent upon the continued service of our key executives. We also rely on a number of key staff for the operation of our company. Our future success is also dependent upon our ability to attract and retain qualified senior and middle managers to our management team. If one or more of our current or future key executives or employees are unable or unwilling to continue in their present positions, we may not be able to easily replace them, and our business may be severely disrupted. In addition, if any of these key executives or employees joins a competitor or forms a competing company, we could lose customers and suppliers and incur additional expenses to recruit and train personnel.

We may need more capital for the operation and failure to raise the capital we need may delay the development plan and reduce the profits.

We plan to purchase $1,000,000 worth of equipments and increase our inventory by 30% in year 2012 in order to carry out our business plan. On January 09, 2012, we have entered Unit Subscription Agreement with a group of investors who will invest up to $ $ 20,896,500 in us. As of the date of this registration statement, we have not closed the transaction underlying such Unit Subscription Agreement. We will also talk to banks, venture capital investors, and private investors to seek funding for our growth, however, there is no guarantee that we will raise sufficient funding to execute our plansIf we don’t have adequate income or our capital can’t meet the requirement for expansion of operations, we will need to seek financing to continue our business development. If we fail to acquire adequate financial resources at acceptable terms, we might have to postpone our proposed business development plans and reduce projections of our future incomes.

If we don’t have adequate income or our capital can’t meet the requirement for expansion of operations, we will need to seek financing to continue our business development. If we fail to acquire adequate financial resources at acceptable terms, we might have to postpone our proposed business development plans and reduce projections of our future incomes.

We may have difficulty raising additional capital, which could deprive us of necessary resources.

In order to support the business operations, we may need to raise additional funds through public or private debt or equity financing, collaborative relationships or other arrangements. Our ability to raise additional financing depends on many factors beyond our control, including the state of capital markets, the market price of our common stock and the development or prospects for development of our competitors. Sufficient additional financing may not be available to us or may be available only on terms that would result in further dilution to the current owners of our common stock.

Competition from existing or new companies in the consumer and office paper converter industry supporting private label products for mass retailers could cause us to experience downward pressure on prices, fewer customer orders, reduced margins, the inability to take advantage of new business opportunities and the loss of market share.

We operate in a highly competitive industry. We compete against many domestic and foreign companies, some of which have substantially greater manufacturing, financial, research and development and marketing resources than we do. Some of our competitors have broader geographic breadth and range of services than we do. In addition, some of our competitors may have more developed relationships with our existing customers than we do. We also face constant scrutiny from our current and potential customers, who continually evaluate the benefits of domestic sourcing versus overseas sourcing.

Long-term contracts are not typical in our industry, and reductions, cancellations or delays in customer orders would adversely affect our operating results.

As is typical in the paper converter industry, we do not usually obtain long-term purchase orders or commitments from our customers. Instead, we work closely with our customers to develop non-binding forecasts of the future volume of orders. Customers may cancel their orders, change production quantities from forecasted volumes or delay production for a number of reasons beyond our control. Significant or numerous cancellations, reductions or delays in orders by our customers would reduce our net sales. In addition, because many of our costs are fixed, a reduction in net sales could have a disproportionate adverse effect on our operating results. From time to time we make capital investments in anticipation of future business opportunities. There can be no assurance that we will receive the anticipated business. If we are unable to obtain the anticipated business, our operating results and financial condition may be harmed.

Because our sales are from one customer that predominantly order back-to-school products our business is seasonal.

So far we depend on one customer for a large portion of our business (100% of the revenue for year 2011 and 90% of the revenue for year 2010) which predominately orders products that are for the back-to-school season. Therefore we must scale our resources appropriately. If our customer order patterns change, this can have a significant impact on our operating results.

If our major customer requests an order that significantly reduces the amount of business it does with us, there would be an adverse impact on our operating results.

So far we depend on one customer for a large portion of our business (100% of the revenue for year 2011 and 90% of the revenue for year 2010) which predominately orders products that are for the back-to-school season. Therefore we must scale our resources appropriately. If such customer requests an order that significantly reduces the amount of business it does with us, there would be an adverse impact on our operating results.

We depend on our suppliers, some of which are the sole source for our raw materials, and our production would be substantially curtailed if these suppliers are not able to meet our demands and alternative sources are not available.

We order raw materials and components to complete our customers' orders, and some of these raw materials and components are ordered from sole-source suppliers. Our major material cost is the cost of roll paper, which we always purchase from a large paper mill called Domtar. Domtar is also a large supplier of copy paper for a large number of retailers in the U.S. Although we work with our customers and suppliers to minimize the impact of shortages in raw materials and components, we sometimes experience short-term adverse effects due to price fluctuations and delayed shipments. In the past, there have been industry-wide shortages of paper rolls, particularly pulp. If a significant shortage of raw materials or components were to occur, we may have to delay shipments, and our operating results would be adversely affected. In some cases, supply shortages of particular components will substantially curtail production of products using these components. While most of our significant customer contracts permit quarterly or other periodic reviews of pricing based on decreases and increases in the prices of raw materials and components, we are not always able to pass on price increases to our customers. Accordingly, some raw material and component price increases could adversely affect our operating results. We also depend on a small number of suppliers for many of the other raw materials and components that we use in our business. If we were unable to continue to purchase these raw materials and components from our suppliers, our operating results would be adversely affected. Because many of our costs are fixed, our margins depend on our volume of output at our facilities and a reduction in volume will adversely affect our margins.

Because we have significant operations in Mexico, our operating results could be harmed by economic, political, regulatory and other factors existing in this foreign country in which we operate.

We have substantial manufacturing operations in Mexico. These operations are subject to inherent risks, which may adversely affect us, including:

- political and economic instability;

- fluctuations in the value of Mexico’s currency;

- inflation;

- changes in labor conditions and difficulties in staffing and managing our factory in Mexico;

- burdens and costs of our compliance with a variety of foreign laws;

- increases in the duties and taxes we pay; and

- imposition of restrictions on currency conversion or the transfer of funds.

Any significant and sustained appreciation of the Mexican peso against the U.S. dollar may materially increase our costs and expenses.

We report our financial statements in U.S. dollars. A portion of our costs and expenses are incurred in Mexican pesos. We use Mexican peso to pay worker wages, utilities, taxes and equipment maintenance and parts, etc., in Mexico. As a result, any significant and sustained appreciation of the Mexican peso against the U.S. dollar may materially increase our costs and expenses.

Because we operate a Maquiladora in Nuevo, Laredo we are subject to various restrictions and requirements that are regulated by various Mexican government agencies, particularly Mexico’s Ministry of Economy and Mexico’s Ministry of Treasury. Our inability to meet these restrictions and requirements may negatively affect our operations.

Our Maquiladora status is subject to various restrictions and requirements, including compliance with the terms of the Maquiladora authorization program; proper utilization of imported materials; hiring and training of Mexican personnel; compliance with tax, labor, exchange control and notice provisions and regulations; and compliance with local and national constraints. Under our Maquiladora authorization program, our Nuevo Laredo, Mexico facility is not subject to any mandatory periodic audits or inspections or any periodic evaluations of our Maquiladora status. However, various Mexican government agencies, particularly Mexico’s Ministry of Economy and Mexico’s Ministry of Treasury, which are primarily responsible for the oversight and regulation of Mexico’s Maquiladora programs, have a statutory right to conduct inspections and evaluations of our Nuevo Laredo, Mexico operations at their discretion to ensure our compliance with the Maquiladora authorization program.

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS AND PLAN OF OPERATION

Forward Looking Statements

This registration statement contains forward-looking statements that involve risks and uncertainties. These statements relate to future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology including "could", "may", "should", "expect", "plan", "anticipate", "believe", "estimate", "predict", "potential" and the negative of these terms or other comparable terminology. These statements are only predictions. Actual events or results may differ materially.

While these forward-looking statements, and any assumptions upon which they are based, are made in good faith and reflect our current judgment regarding the direction of our business, actual results will almost always vary, sometimes materially, from any estimates, predictions, projections, assumptions or other future performance suggested in this report.

Overview

Founded November 2, 2007, Aclor, Inc. (“Aclor”) is a Laredo, Texas based Company that manufactures and sells private label three ring binders and paper to support the consumer and office supplies market primarily in the United States. Aclor has offices in Laredo, Texas, and Monterrey, Nuevo Leon, Mexico, as well as a manufacturing facility leased by Aclor’s subsidiary, Aclor Servicios Administrativos, S. de R.L., in Nuevo Laredo, Tamaulipas, Mexico. Aclor’s headquarter office is located in 11204 Mcpherson Road, Suite#116, Laredo, TX 78041.

Results of Operations

RESULTS OF OPERATIONS FOR THE THREE MONTHS ENDED SEPTEMBER 30, 2011 AND 2010

METISCAN, INC’S SUBSIDIARY ACLOR INC AND ITS SUBSIDIARIES

| | | For the Three Months Ended | |

| | | Sept 30, 2011 | | | Sept 30, 2010 | |

| Statement of Operations Data | | | | | | |

| | | | | | | |

| Total Revenue | | | $3,481,570 | | | | $5,326,197 | |

| Operating Income( loss) | | | $(18,290 | ) | | | $(3,309,201 | ) |

| Net income (loss) after taxes | | | $1,627,558 | | | | $(3,680,724 | ) |

| Net income (loss) per share | | | $16.28 | | | | $(36.81 | ) |

| | | | | | | | | |

| Balance Sheet Data | | | | | | | | |

| | | | | | | | | |

| Total assets | | | $11,487,509 | | | | $12,284,578 | |

| Total liabilities | | | $5,687,051 | | | | $13,669,563 | |

| Stockholders’ equity (deficit) | | | $5,800,458 | | | | $(1,384,985 | ) |

Sales for the three months ended September 30, 2011 was $ 3,481,570 as compared to $ 5,326,197 for the same period a year ago. This decrease of 34.63% or $1,844,627 is attributed to sales are recognized in different time period. The main products produced by Aclor, Inc. are notebooks and school supplies. Its production period peaks during the months of April thru August. Additionally, due to the fact that merchandise orders pick up varies from month to month this contributes to the variance in our sale to recognition period.

The Company's gross profit (loss) for the three months ended September 30, 2011 was $416,490 compared to $(2,724,387) for the same period one year ago. The significant losses in 2010 were attributed to old inventory write-offs $2,358,489, and some of our item sales price drops around 13 person in 2011..

Selling, general and administrative expenses for the three months ended September 30, 2011 was $ 434,780,as compared to $584,814 during the same period one year ago. This decrease of 25.65% is attributed to decrease Marking & consultant fee $51,606, Depreciation $30,445 and Professional fee $19,219 General and administrative expenses include executive management, accounting, office telephone, repairs and maintenance, management information systems, salaries and employee benefits.

Interest expense, net for the three months ended September 30, 2011 was $53,422 as compared to $58,637 for the same period a year ago.

Net profit was $1,627,558 or $16.28 per share for the three months ended September 30, 2011 as compared to $(3,680,724) or $(36.81) per share for the same period a year ago. This increase of 144% or $53.09 per share is primarily attributed to Chinatrust Bank loan settlement income $2,108,332 in 2011, and old inventory write-offs $(2,358,489) in 2010.

RESULTS OF OPERATIONS FOR THE NINE MONTHS ENDED SEPTEMBER 30, 2011 AND 2010

METISCAN, INC’S SUBSIDIARY ACLOR INC AND ITS SUBSIDIARIES

| | | For the Nine Months Ended | |

| | | Sept 30, 2011 | | | Sept 30, 2010 | |

| Statement of Operations Data | | | | | | |

| | | | | | | |

| Total Revenue | | $ | 12,048,146 | | | $ | 12,284,606 | |

| Operating Loss | | $ | (489,355 | ) | | $ | (3,797,241 | ) |

| Net income (loss) after taxes | | $ | 1,094,751 | | | $ | (3,124,600 | ) |

| Net income (loss) per share | | $ | 10.94 | | | $ | (31.25 | ) |

| | | | | | | | | |

| Balance Sheet Data | | | | | | | | |

| | | | | | | | | |

| Total assets | | $ | 11,487,509 | | | $ | 12,284,578 | |

| Total liabilities | | $ | 5,687,051 | | | $ | 13,669,563 | |

| Stockholders’ equity (deficit) | | $ | 5,800,458 | | | $ | (1,384,985 | ) |

Sales for the nine months ended September 30, 2011 was $12,048,146 as compared to $12,284,606 for the same period a year ago. This decrease of 1.92% or $236,460 is attributed to sales are reduced in Mexico because our main customer in Mexico filed bankruptcy.

The Company's gross profit (loss) for the nine months ended September 30, 2011 was $762,703 compared to $(1,859,629) for the same period a year ago. This increase of 141% or $2,622,332 is attributed to old inventory write-offs $(2,358,489) in 2010, and we increase some item’s price around 5 present.

Selling, general and administrative expenses for the nine months ended September 30, 2011 was $1,252,058, as compared to $1,757,006 for the same period one year ago. This decrease of 28.73% or $504,948 is attributed to Depreciation expenses decrease $86,313, sales commission decrease $25,000, payroll expenses decrease $71,236, consultant fee decrease $78,666 and marketing and designer fee decrease $141,570, bank service charges decrease $18,668, and travel expenses decrease $34,144. General and administrative expenses include executive management, accounting, office telephone, repairs and maintenance, management information systems, salaries and employee benefits.

Interest expense, net for the nine months ended September 30, 2011 was $226,932 as compared to $228,161 for the same period a year ago.

Net profit (loss) was $1,094,751or $10.94 per share for the nine months ended September 30, 2011 as compared to $(3,124,600) or $(31.25) per share for the same period a year ago. This increase of 135% or $4,219351 is attributed to Chinatrust Bank loan settlement income $2,108,332, and the significant losses in 2010 were attributed to old inventory ($2,358,489) write-offs.

RESULTS OF OPERATIONS FOR THE TWELVE MONTHS ENDED DECEMBER 31, 2010 AND 2009

METISCAN, INC’S SUBSIDIARY ACLOR INC AND ITS SUBSIDIARIES

| | | For the Twelve Months Ended | |

| | | Dec 31, 2010 | | | Dec 31, 2009 | |

| Statement of Operations Data | | | | | | |

| | | | | | | |

| Total Revenue | | $ | 13,150,482 | | | $ | 19,436,800 | |

| Operating Profit (loss) | | $ | (3,154,388 | ) | | $ | 796,297 | |

| Net income (loss) after taxes | | $ | (2,197,121 | ) | | $ | (211,849 | ) |

| Net income (loss) per share | | $ | (21.97 | ) | | $ | (2.12 | ) |

| | | | | | | | | |

| Balance Sheet Data | | | | | | | | |

| | | | | | | | | |

| Total assets | | $ | 12,568,377 | | | $ | 15,310,347 | |

| Total liabilities | | $ | 12,988,162 | | | $ | 13,570,732 | |

| Stockholders’ equity (deficit) | | $ | (419,606 | ) | | $ | 1,739,615 | |

Sales for the twelve months ended December 31, 2010 was $13,150,482 as compared to $19,436,800 for the same period during 2009. This decrease of 32.34% or $6,286,318 was primarily attributed to lost sales volume related to a 13% price adjustment in raw materials, and one item of the product had no profit so we decided not to take the order from our customer.

The Company's Gross Profit( Loss) for the twelve months ended December 31, 2010 was $(1,044,018) as compared to the Operating profit of $2,977,466 for the same period during 2009. The significant losses in 2010 were attributed to old inventory write-offs $2,358,489 and price decrease around 13%, but we cannot pass all the cost to our vendor.

Inventory policies: Inventories are stated at the lower of cost (weighted-average) or market value. The market value of raw materials is determined on the basis of replacement cost. Market values of finished goods, merchandise, and work in process are determined on the basis of net realizable value. We are using "first in first out" FIFO to manage our inventory. If the inventory is made for private label (specific customer) and has not used for 3 years, or we confirm with the customer the product will not continue, or the inventory is not in good condition. Then we identify the inventory is excess or obsolete inventory.

Selling, general and administrative expenses for the twelve months ended December 31, 2010 was $ 2,110,370as compared to $1,890,700during the same period during 2009. This increase of $219,670 or 11.62% was predominately attributed to an increase in Marketing and Consulting Fees $311,683, and the main reason of this expenses increase was that we out sourcing our Mexico plant management team, a decrease of depreciation expenses $78,992, an increase in Sales Commissions and an increase in Bad Debt. General and administrative expenses include executive management, accounting, office telephone, repairs and maintenance, management information systems, salaries and employee benefits.

Interest expense, net for the twelve months ended December 31, 2010 was $(639,025) as compared to $(387,042) for the same period during 2009. The increase in interest expense was attributed to an increase in interest rates owed to private lenders.

Net loss increased to $(2,197,121) or $(21.97) per share for the twelve months ended December 31, 2010 as compared to $(211,849) or $(2.12) per share for the same period during 2009. The significant losses in 2010 were attributed to old inventory write-offs $2,358,482.

Liquidity and Capital Resources

Trade Receivables at December 31, 2010 was $1,143,566 as compared to $2,136,092 at December 31, 2009, and at September 30, 2011 was 864,135 as compared to $1,100,876 at September 30, 2010..

As of December 31, 2010 and September 30, 2011 the Company had no material commitments for capital expenditures or inventory purchases other than purchase orders issued in the normal course of business.

The Company’s growth, whether internal or through acquisitions, requires significant capital investment infrastructure.

For the remainder of 2011 and 2012, the Company’s business strategy is to continue to focus on increasing stockholder value by increasing sales volume, raising capital, finding additional strategic assets to acquire and expanding operations to produce new product lines. Such transactions will result in substantial capital requirements for which additional financing may be required. No assurance can be given that such additional financing would be available on terms satisfactory to the Company.

Related Party Loans

Two related parties provided financing for the Company’s operation in the nine months ended September 30, 2011, and September 30, 2010. One related party (Watanabe company - Zuoru He $2,564,938.74 and Chung Hsin Wu $300,000) did not charge interest for the financing and the ending balance of the loan from the related party is $2,864,938.74 as of September 30, 2011 and September 30, 2010. The other related party (Go Right Holding Limited $1,130,187.50 and Ever Thrive Limited $1,130,187.50) charged 6% interest rate for the financing and the ending balance of the loan from the related party as of September 30, 2011 is $2,260,394 and as of September 30, 2010 is 1,438,799. The above two related parties have agreed that the financing ending balance $5,125,313 to convert to Preferred stock on October 28, 2011.

October 28, 2011 Debt Conversion

On September 30, 2011, we entered separate debt conversion agreements with Zuoru He, Chung Hsin Wu (Forth Wu), Ever Thrive Limited and Go Right Holding Limited to convert the debts that Aclor Inc owed to into shares of stock. Pursuant these debt conversion agreements, on October 28, 2011, we authorized the issuance of 287,500 shares of Series G Non-Convertible Preferred Stock, Par Value $ 0.0001 and 287,500 Shares of Series H Convertible Preferred Stock, Par Value $ 0.0001 to Zuoru He to convert $ 2,564,938.74 debts owed by Aclor Inc to him. We authorized the issuance of 37,500 Shares of Series G Non-Convertible Preferred Stock, Par Value $ 0.0001 and 37,500 Shares of Series H Convertible Preferred Stock, Par Value $ 0.0001 to Chung Hsin Wu (Forth Wu) to convert $ 300,000 debts owed by Aclor. We authorized the issuance of 376,730 Shares of Series G Non-Convertible Preferred Stock, Par Value $ 0.0001 376,730 Shares of Series H Convertible Preferred Stock, Par Value $ 0.0001 to Ever Thrive Limited to convert $ 1,130,187.50 debts owed by Aclor, Inc. We authorized the issuance of 376,730 Shares of Series G Non-Convertible Preferred Stock, Par Value $ 0.0001 376,730 Shares of Series H Convertible Preferred Stock, Par Value $ 0.0001 to Go Right Holding Limited to convert $ 1,130,187.50 debts owed by Aclor, Inc.

Outstanding credit facilities

Aclor Inc received credit approval up to $ 3.5 Million from HuaNan Commercial Bank, Ltd. on August 15, 2011. The terms of credit facilities with HuaNan Commercial Bank is as follows:

| Type of Loans | Facility Amount | Maturity or Term | Collateral & Other |

| (1) L/C issuance | USD 2,000,000.00 | 1 Year | 1.(1)+(2) Total limit of USD2.5 million within. |

| (2) Short Term Unsecured Loan | USD 1,000,000.00 | 1 Year | 2.Provide 35% of the deposit. |

| (3) Negotiation of L/C | USD 1,000,000.00 | 1 Year | Shipping documents Under L/C |

| Total Amount | USD 3,500,000.00 | | |

| Collateral |

| |

| ■ Deposit 35% |

| □ |

| □ |

| □ | |

| Interest Rate | According to 『(6M Libor plus 2%)÷0.9445』. (LIBOR i.e. 『the London InterBank Offered Rate』 |

Aclor, Inc. entered in to a continuation agreement with HSBC to run from March 15, 2010 to February 15, 2012. The terms of the agreement amended the previous agreement are as follows:

| | | New | | Previously |

Combined Manufacturers Advance, Packing Credit, Export and Clean Export Loan Facilities (previously combined manufacturers Advance and Packing Credit Facilities) | | USD2,000,000.- | | USD1,000,000.- |

- For Manufacturers Advanced Facility up to maximum of Advances under your Manufacturers Advance facility will be utilized to finance purchase of raw materials, manufacture of goods and/or packing expenses prior to export shipment. The Manufacturers Advance loan period will be up to a maximum of 90 days before the latest shipment date of confirmed purchase orders from approved buyer. In addition, maximum advance under manufacturing advance facilities will be no more than 70% of the confirmed purchase order deposited with us in respect of such advance is made. | | (USD2,000,000.-) | | (USD1,000,000.-) |

- For Packing Credit up to maximum of Maximum 90 days before shipment and up to 70% of valid export Documentary Credits in your favour deposited with us. | | (USD1,000,000.-) | | (USD1,000,000.-) |

- For Export Facilities up to a maximum of Negotiation of discrepant export bills from approved buyer up to 30 days drawn under Export Documentary Credit. | | (USD1,000,000.-) | | NIL |

- For Clean Export Loan up to a maximum of Drawdown is allowed on the condition that:- a) Clean Export Loan is foreign currency for up to 30 days. b) Transactions are supported by copies of invoices and transport documents. c) The proceeds will be used to retire the relative pre-shipment finance, packing loans or manufacturers advance loans. | | (USD2,000,000.-) | | NIL |

Combined Clean Export Loan and Export Facilities | | NIL | | USD1,000,000.- |

- For Export Facilities up to a maximum of | | NIL | | (USD1,000,000.-) |

- For Clean Export Loan up to a maximum of | | NIL | | (USD1,000,000.-) |

Interest will be charged on a daily basis at 1.5% annum over the prevailing interest rate published by HSBC as Trade Finance Rates.

HSBC will also charge a commission rate of 0.25% for Commission in lieu of Exchange/ Export bill handling commission and 0.125% for Manufacturing Advance and Parking Credit handling commission.

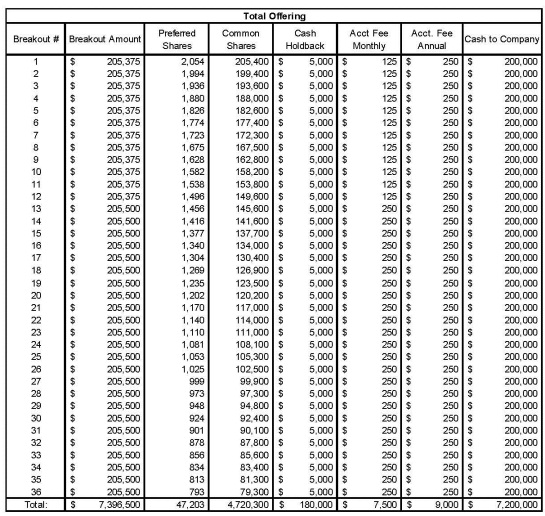

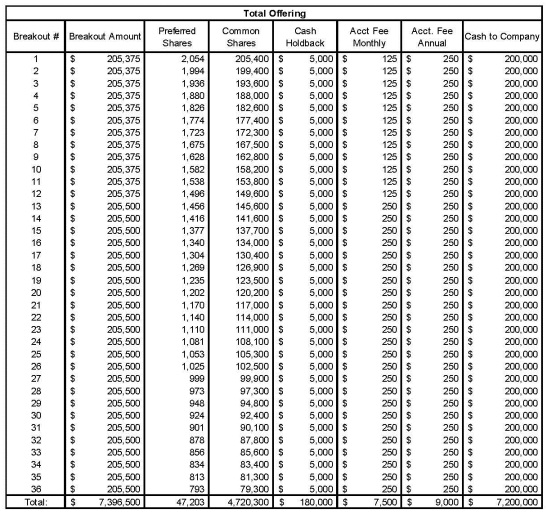

On October 17, 2011, we entered a Unit Subscription Agreement and an Account Management Agreement with nine oversea investors. Under the Unit Subscription Agreement, we will issue a total of 47,203 shares of preferred stock, which are convertible to common stock at the conversion rate of 1 for 100, and a total of 5,341,368 common stock warrants to nine investors for a total investment of $ 7,396,500. The common stock warrants are exercisable at the price of $ 2.89 per common share. Under the Account Management Agreement, investors under the Unit Subscription Agreement and Company will appoint Elco Securities, Ltd. as intermediary to monitor and enforce the Use of Proceeds to ensure that it meets the projected Use of Proceeds as follows:

The transactions underlying the above described USA and AMA have not been closed as of the date of this Form 10 Registration Statement.

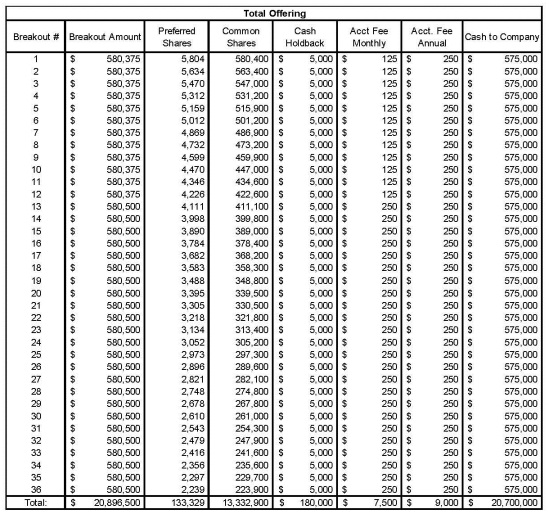

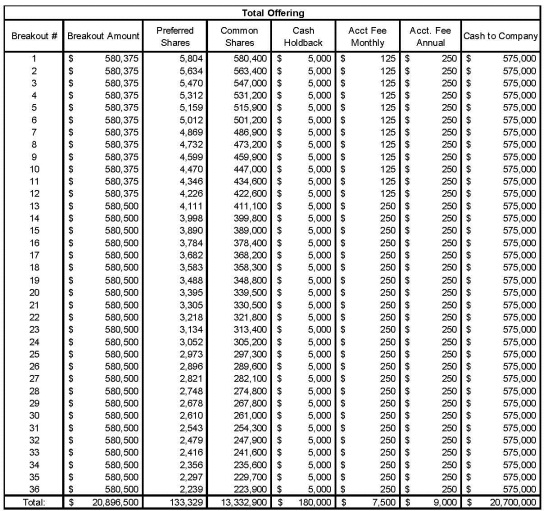

On January 09, 2012, we and the same investors revised the Unit Subscription Agreement and an Account Management Agreement entered on October 17, 2011. Under the revised Unit Subscription Agreement, we will issue a total of 133,329 shares of preferred stock, which are convertible to common stock at the conversion rate of 1 for 100, and a total of 15,090,850 common stock warrants to nine investors for a total investment of $ 20,896,500. The common stock warrants are exercisable at the price of $ 2.89 per common share. Under the revised Account Management Agreement, investors under the Unit Subscription Agreement and Company will appoint Elco Securities, Ltd. as intermediary to monitor and enforce the Use of Proceeds to ensure that it meets the projected Use of Proceeds as follows:

As of the date of this Form 10 Registration Statement, the transactions underlying the above described Unit Subscription Agreement and an Account Management Agreement have not been closed.

Off-Balance Sheet Arrangements

None.

FINANCIAL CONDITION, LIQUIDITY AND CAPITAL RESOURCES

Access to Future Capital

The Company's ability to access borrowings and generate investments in the company and to meet its debt service and other obligations will be dependent upon its future performance and its cash flows from operations, which will be subject to financial, business and other factors, certain of which are beyond the Company's control, such as prevailing economic conditions. The Company cannot assure that, in the event it was to require additional financing, such additional financing would be available on terms permitted by agreements relating to existing indebtedness or otherwise satisfactory to it.

Effects of Inflation

We do not believe that inflation has had a material impact on our business.

Critical Accounting Estimates and Policies

The preparation of financial statements in conformity with generally accepted accounting principles (GAAP) requires management to make estimates and assumptions that affect the amounts reported in the consolidated financial statements and judgments related to the application of certain accounting policies.

While we base our estimates on historical experience, current information and other factors deemed relevant, actual results could differ from those estimates.

We consider accounting estimates to be critical to our reported financial results if (i) the accounting estimate requires us to make assumptions about matters that are uncertain and (ii) different estimates that we reasonably could have used for the accounting estimate in the current period, or changes in the accounting estimate that are reasonably likely to occur from period to period, would have material impact on our consolidated financial statements.

Inventory policies: Inventories are stated at the lower of cost (weighted-average) or market value. The market value of raw materials is determined on the basis of replacement cost. Market values of finished goods, merchandise, and work in process are determined on the basis of net realizable value. We are using "first in first out" FIFO to manage our inventory. If the inventory is made for private label (specific customer) and has not used for 3 years, or we confirm with the customer the product will not continue, or the inventory is not in good condition. Then we identify the inventory is excess or obsolete inventory.

ITEM 3. PROPERTIES

We lease a 3,360 square feet office and warehouse space at 11204 McPherson Road, Suite 116, Laredo, TX 78405 and the annual rent is $ 35,952. The lease term is 25 months and expires on June 14, 2013.

We also lease a 94,55 square feet manufacturing facility located at Ave. Industrias 6024 Parque Ind. FINSA Nuevo Laredo, Tamaulipas, Mexico and the annual rent is $ 438,893. The lease term is one year and expires on March 31, 2012.

ITEM 4. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information regarding the beneficial ownership of our Common Stock by each of our named Executive Officers and Board of Directors, and each shareholder who is known by us to own beneficially five percent (5%) or more of the outstanding stock of Common Stock. On January 04, 2012, we undertook a 2,000 for 1 reverse stock split of our common stock. There are 6,832,150,554 shares of Common Stock issued and outstanding as of January 03, 2012 immediately prior to the 2,000 for 1 reverse stock split and 3,416,453 shares of Common Stock issued and outstanding as of January 5, 2012 immediately after the 2,000 for 1 reverse stock split.

Name and Address of Beneficial Owners (a) | Amount and Nature of Beneficial Ownership (As of January 3, 2012 immediately prior to the 2,000 for 1 reverse stock split) | Amount and Nature of Beneficial Ownership (As of January 5, 2012 immediately after the 2,000 for 1 reverse stock split) | Percent of Class (b) |

Directors and Officers | | | |

Curtis Gung Director, President, CEO, Acting CFO 11204 Mcpherson Road, Suite#116 Laredo, TX 78041 | 1,163,750,000 (Indirect Ownership) ( c) | 581,875 (Indirect Ownership) ( c) | 17.03% |

Midori Chiu Director 11204 Mcpherson Road, Suite#116 Laredo, TX 78041 | | | |

Peter Yang COO 11204 Mcpherson Road, Suite#116 Laredo, TX 78041 | | | |

| Directors and Officers as group | 1,163,750,000 (Indirect Ownership) ( c) | 581,875 (Indirect Ownership) ( c) | 17.03% |

5% or more Shareholders | | | |

Goodfuture Limited (c ) 11204 Mcpherson Road, Suite#116 Laredo, TX 78041 | 1,163,750,000 | 581,875 | 17.03% |

Sunbell Limited11204 Mcpherson Road, Suite#116 Laredo, TX 78041 | 1,163,750,000 | 581,875 | 17.03% |

Metiscan Holdings 12225 Greenville Ave. Suite 700 Dallas, TX 75243 | 580,658,000 | 290,329 | 8.50% |

Zuoru He 89 Huatian Road, Shenzhen, China | 1,480,000,000 | 740,000 | 21.66% |

| 5% or more Shareholders as a Group | 4,388,158,000 | 2,194,079 | 64.22% |

(a) Pursuant to Rule 13d-3 under the Exchange Act, a person has beneficial ownership of any securities as to which such person, directly or indirectly, through any contract, arrangement, undertaking, relationship or otherwise has or shares voting power and/or investment power or as to which such person has the right to acquire such voting and/or investment power within 60 days.

(b) Unless otherwise stated, each beneficial owner has sole power to vote and dispose of the shares. Based on 6,832,150,554 shares of Common Stock issued and outstanding as of January 03, 2012 immediately prior to the 2,000 for 1 reverse stock split and 3,416,453 shares of Common Stock issued and outstanding as of January 5, 2012 immediately after the 2,000 for 1 reverse stock split.

(c) Prior to December 16, 2011, Curtis Gung, our President and CEO, are the sole shareholder of Goodfuture Limited and therefore is the indirect beneficial owner of the shares owned by Goodfuture Limited. On December 16, 2011, Curtis Gung transferred his ownership in Goodfuture Limited to Jennifer Chen.

ITEM 5. DIRECTORS AND EXECUTIVE OFFICERS.

DIRECTORS AND EXECUTIVE OFFICERS

The names, ages, positions and dates appointed of our current directors and executive officers are set forth in the table below:

| Name | Age | Position | Date of Appointment |

| Curtis Gung | 45 | President, Chief Executive Officer, Acting Chief Financial Officer, Director | July 20, 2011 as CEO, President and Director November 29, 2011 as Acting CFO |

| Peter Yang | 51 | Chief Operation Officer | July 20, 2011 |

| Midori Chiu | 40 | Director | July 20, 2011 |

Curtis Gung, our president, Chief Executive Officer, Acting Chief Financial Officer and Director, 45 years old, earned a degree in Business Administration from Feng Chia University and a MBA from Cleveland State University. From October 1997 to December 2001, he was the sales manager of Tayun Stationery Industrial, from January 2001 to January 2009, he was the General Manager of Apogo Inc and from January 2009 to present, he is the Chief Executive Officer of Aclor, Inc.

Peter Yang, our Chief Operating Officer, 51 years old, earned a degree in Business Administration from Feng Chia University. From September 2007 to December 2009, he served as Sales Director at Danny& Hudson Inc.From January 2010 to August 2010, he was in charge ofoperating management of Aclor Servicios. From August 2010 to June 2011, he was the managing director of Smart Fortune International Ltd. From July 2011 to present, he was the chief operating officer of both Aclor Inc and Metiscan Inc.

Midori Chiu, 40 years old, our Director, earned an Associate of Science, International Business from China University of Technology. From June 1994 to May 2003, she was the Senior Accountant for Chengloong Corp, from May 2003 to January 2004, she was the Assistant Accounting Manager for Gloria Prince Hotel. From March 2004 to December 2009, she was helping family business and being a house wife. From January 2010 to present, she was the Senior Accountant for Aclor Inc. Midori Chiu was Metiscan Inc’s Chief Financial Officer from July 20, 2011 to November 29, 2011. She resigned from the position of Chief Financial Officer on November 29, 2011 due to personal and health issues.

ITEM 6. EXECUTIVE COMPENSATION

Executive Compensation

Summary Compensation Table.

The following table sets forth certain information concerning the annual and long-term compensation of our Chief Executive Officer and our other executive officers during the last two fiscal years.

Current Officers Name & Principal Position | | Year | | Salary ($) | | | Bonus ($) | | | Stock Awards (S) | | | All Other Compensation ($) | | | Option Awards ($) | | | Total ($) | |

Curtis Gung | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Executive Officer | | 2009 | | $ | 65,000 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 65,000 | |

| Acting Chief Financial Officer | | 2010 | | $ | 65,000 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 65,000 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Midori Chiu | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Former Chief Financial Officer | | 2009 | | $ | - | | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | - | |

| (From July 20, 2011 to November 29, 2011) | | 2010 | | $ | 27,913 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 27,913 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Peter Yang | | 2009 | | $ | - | | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | - | |

| Chief Operation Officer | | 2010 | | $ | 18,000 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 18,000 | |

Employment Agreements:

We do not have employment agreements with our executive officers.

Outstanding Equity Awards at December 31, 2010

None.

Compensation of the Board of Directors

None.

ITEM 7. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE RELATED PARTY TRANSACTIONS

Our Board of Directors (excluding any interested director) is charged with reviewing and approving all related-person transactions. considering related-person transactions, our Board of Directors takes into account all relevant available facts and circumstances.

ITEM 8. LEGAL PROCEEDINGS.

A civil lawsuit was filed by China Trust Bank (U.S.A.) against Aclor, Inc., the subsidiary of Company, in California state court on November 01, 2010. The case was removed to United States District Court Northern District of California on December 06, 2010. The total amount of claims alleged by China Trust Bank (U.S.A.) was $3,833,000.00. On November 3, 2011, Aclor, Inc. and China Trust Bank (U.S.A) have reached a settlement agreement and the total settlement amount is $ 1,000,000. Aclor has paid $ 1,000,000 to China Trust Bank (U.S.A).

ITEM 9. MARKET PRICE OF AND DIVIDENDS ON THE REGISTRANT’S COMMON EQUITY AND RELATED STOCKHOLDER MATTERS DIVIDENDS

We have not paid any dividends on our common stock and do not anticipate paying cash dividends in the foreseeable future. We intend to retain any earnings to finance the growth of our business. We cannot assure you that we will ever pay cash dividends. Whether we pay cash dividends in the future will be at the discretion of our Board of Directors and will depend upon our financial condition, results of operations, capital requirements and any other factors that the Board of Directors decides are relevant. See Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Our common stock is currently traded on the OTC Pink Marketplace (the “Pink Sheets”). The following table represents the high and low bid information for our common stock for each quarterly period within the two most recent fiscal years and the subsequent interim period, as regularly quoted on the Pink Sheets. Such over-the-counter market quotations reflect inter-dealer prices, without retail mark-up, mark-down or commissions, and may not necessarily represent actual transactions.

According to the records of our transfer agent, as of October 24, 2011, there were approximately 211shareholders of record of our common stock.

| | Bid Prices |

| | High | Low |

| 2009 | | |

| Q1 | $0.035 | $0.0070 |

| Q2 | $0.033 | $0.0040 |

| Q3 | $0.010 | $0.0030 |

| Q4 | $0.010 | $0.0024 |

| 2010 | | |

| Q1 | $0.0055 | $0.0013 |

| Q2 | $0.0016 | $0.0006 |

| Q3 | $0.0023 | $0.0005 |

| Q4 | $0.0014 | $0.0004 |

| 2011 | | |

| Q1 | $0.0013 | $0.0006 |

| Q2 | $0.0012 | $0.0005 |

| Q3 | $0.0051 | $0.0004 |

ITEM 10. RECENT SALES OF UNREGISTERED SECURITIES.

On July 20, 2011, we issued 1,163,750,000 shares of common stock to Goodfuture Limited and 1,163,750,000 shares of common stock to Sunbell Limited to acquire 60% of the ownership of Aclor Inc. pursuant to the exemption from registration provided by Section 4(2) of the Securities Act of 1933. We also issued 200,000,000 shares of common stock to Mintz & Fraade PC as consideration for it to waive the legal fee owed by us. On October 28, 2011, as part of the consideration for the acquisition of Aclor, Inc, we authorized the issuance of 750,000 shares of Series H Convertible Preferred Stock to Goodfuture Limited and 750,000 shares of Series H Convertible Preferred Stock to Sunbell Limited pursuant to the exemption from registration provided by Section 4(2) of the Securities Act of 1933.

On August 26, 2011, we issued 100,000,000 shares of common stock to Haiping Zhou for $ 100,000 pursuant to the exemption from registration provided by Section 4(2) of the Securities Act of 1933.

On September 30, 2011, we issued 1,480,000,000 shares of common stock to Zuoru He to acquire the remaining 40% of the ownership of Aclor Inc pursuant to the exemption from registration provided by Section 4(2) of the Securities Act of 1933.

On October 17, 2011, we entered a Unit Subscription Agreement and an Account Management Agreement with nine oversea investors. Under the Unit Subscription Agreement, we will issue a total of 47,203 shares of preferred stock, which are convertible to common stock at the conversion rate of 1 for 100, and a total of 5,341,368 common stock warrants to nine investors for a total investment of $ 7,396,500. The common stock warrants are exercisable at the price of $ 2.89 per common share. Under the Account Management Agreement, investors under the Unit Subscription Agreement and Company will appoint Elco Securities, Ltd. as intermediary to monitor and enforce the Use of Proceeds to ensure that it meets the projected Use of Proceeds as follows:

The transactions underlying the above described USA and AMA have not been closed as of the date of this Form 10 Registration Statement.

On January 09, 2012, we and the same investors revised the Unit Subscription Agreement and an Account Management Agreement entered on October 17, 2011. Under the revised Unit Subscription Agreement, we will issue a total of 133,329 shares of preferred stock, which are convertible to common stock at the conversion rate of 1 for 100, and a total of 15,090,850 common stock warrants to nine investors for a total investment of $ 20,896,500. The common stock warrants are exercisable at the price of $ 2.89 per common share. Under the revised Account Management Agreement, investors under the Unit Subscription Agreement and Company will appoint Elco Securities, Ltd. as intermediary to monitor and enforce the Use of Proceeds to ensure that it meets the projected Use of Proceeds as follows:

As of the date of this Form 10 Registration Statement, the transactions underlying the above described Unit Subscription Agreement and an Account Management Agreement have not been closed.

The issuance and offering of stock pursuant to the above described revised Unit Subscription Agreement and an Account Management Agreement are pursuant to the exemption from registration provided by Section 4(2) of the Securities Act of 1933 because there are only 9 investors that will acquire stock of the Company.

On October 28, 2011, we authorized the issuance of 287,500 shares of Series G Non-Convertible Preferred Stock, Par Value $ 0.0001 and 287,500 Shares of Series H Convertible Preferred Stock, Par Value $ 0.0001 to Zuoru He to convert $ 2,564,938.74 debts owed by Aclor Inc to him. We authorized the issuance of 37,500 Shares of Series G Non-Convertible Preferred Stock, Par Value $ 0.0001 and 37,500 Shares of Series H Convertible Preferred Stock, Par Value $ 0.0001 to Chung Hsin Wu (Forth Wu) to convert $ 300,000 debts owed by Aclor. We authorized the issuance of 376,730 Shares of Series G Non-Convertible Preferred Stock, Par Value $ 0.0001 376,730 Shares of Series H Convertible Preferred Stock, Par Value $ 0.0001 to Ever Thrive Limited to convert $ 1,130,187.50 debts owed by Aclor, Inc. We authorized the issuance of 376,730 Shares of Series G Non-Convertible Preferred Stock, Par Value $ 0.0001 376,730 Shares of Series H Convertible Preferred Stock, Par Value $ 0.0001 to Go Right Holding Limited to convert $ 1,130,187.50 debts owed by Aclor, Inc. All these issuances were pursuant to the exemption from registration provided by Section 4(2) of the Securities Act of 1933.

ITEM 11. DESCRIPTION OF REGISTRANT’S SECURITIES TO BE REGISTERED AUTHORIZED CAPITAL STOCK

Our authorized capital stock consists of 10,010,000,000 shares, of which 10,000,000,000 shares are common stock, par value of $.0001 per share, and 10,000,000 shares are preferred stock, par value of $.0001 per share.