UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________________________________________

FORM 10-K

_______________________________________________

FOR ANNUAL AND TRANSITION REPORTS PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

(Mark One)

| | | | | |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2024

OR

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 001-35591

_______________________________________________

BGC Group, Inc.

(Exact Name of Registrant as Specified in Its Charter)

_______________________________________________

| | | | | | | | | | | | | | | | | | | | |

| Delaware | | 86-3748217 |

(State or Other Jurisdiction of

Incorporation or Organization) | | (I.R.S. Employer

Identification No.) |

| | | | | | | |

| 499 Park Avenue | , | New York | , | NY | | 10022 |

| (Address of Principal Executive Offices) | | (Zip Code) |

(212) 610-2200

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading

Symbol(s) | | Name of each exchange on which registered |

| Class A Common Stock, $0.01 par value | | BGC | | The Nasdaq Stock Market, LLC |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large Accelerated Filer | ☒ | Accelerated Filer | ☐ |

| Non-accelerated Filer | ☐ | Smaller Reporting Company | ☐ |

| Emerging growth company | ☐ | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to § 240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of voting common equity held by non-affiliates of the registrant, based upon the closing price of the Class A common stock on June 30, 2024 as reported on Nasdaq, was approximately $4,622,726,641.

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date.

On February 27, 2025, the registrant had 373,430,578 shares of Class A common stock, $0.01 par value, and 109,452,953 shares of Class B common stock, $0.01 par value, outstanding.

_______________________________________________

DOCUMENTS INCORPORATED BY REFERENCE.

Portions of the registrant’s definitive proxy statement for its 2025 annual meeting of stockholders (the “2025 Proxy Statement”) are incorporated by reference in Part III of this Annual Report on Form 10‑K. We anticipate that we will file the 2025 Proxy Statement with the SEC on or before April 30, 2025.

BGC Group, Inc.

2024 FORM 10‑K ANNUAL REPORT

TABLE OF CONTENTS

Except as otherwise indicated or the context otherwise requires, as used herein, the terms “BGC,” the “Company,” “we,” “our,” and “us” refer to: (i) following the closing of the Corporate Conversion, effective July 1, 2023, BGC Group and its consolidated subsidiaries, including BGC Partners; and (ii) prior to the effective time of the Corporate Conversion, BGC Partners and its consolidated subsidiaries. See Note 1—“Organization and Basis of Presentation” to the Consolidated Financial Statements herein for more information regarding the Corporate Conversion, and refer to the “Glossary of Terms, Abbreviations and Acronyms” for the definitions of terms used above and throughout the remainder of this Annual Report on Form 10-K.

GLOSSARY OF TERMS, ABBREVIATIONS AND ACRONYMS

The following terms, abbreviations and acronyms are used to identify frequently used terms and phrases that may be used in this report:

| | | | | |

| TERM | DEFINITION |

| 2019 Form S-4 Registration Statement | On September 13, 2019, BGC filed a registration statement on Form S-4 with respect to the offer and sale of up to 20.0 million shares of BGC Class A common stock in connection with business combination transactions, including acquisition of other businesses, assets, properties or securities |

| |

| 2023 Deed of Amendment | On July 12, 2023, Sean Windeatt executed a Deed of Amendment amending his existing Deed of Adherence with the U.K. Partnership regarding his employment |

| |

| ACER | Agency for the Cooperation of Energy Regulators |

| |

| Adjusted Earnings | A non-GAAP financial measure used by the Company to evaluate financial performance, which primarily excludes (i) certain non-cash items and other expenses that generally do not involve the receipt or outlay of cash and do not dilute existing stockholders, and (ii) certain gains and charges that management believes do not best reflect the ordinary results of BGC |

| |

| ADV | Average daily volume |

| |

| Americas | United States and other countries included in North America and South America |

| |

| APAC | Asia-Pacific |

| |

| API | Application Programming Interface |

| |

| April 2008 distribution rights shares | Cantor’s deferred stock distribution rights provided to current and former Cantor partners on April 1, 2008 |

| |

| Aqua | Aqua Securities L.P., an alternative electronic trading platform, which offers new pools of block liquidity to the global equities markets and is a 49%-owned equity method investment of the Company and 51% owned by Cantor |

| |

| ASC | Accounting Standards Codification |

| |

| ASU | Accounting Standards Update |

| |

| Audit Committee | Audit Committee of the Board |

| |

| August 2022 Sales Agreement | CEO Program sales agreement, by and between the Company and CF&Co, dated August 12, 2022, pursuant to which the Company could offer and sell up to an aggregate of $300.0 million of shares of BGC Class A common stock |

| |

| Aurel | The Company’s French subsidiary, Aurel BGC SAS |

| |

| Besso | Besso Insurance Group Limited, formerly a wholly owned subsidiary of the Company, acquired on February 28, 2017. Sold to The Ardonagh Group on November 1, 2021 as part of the Insurance Business Disposition |

| |

| BGC | (i) Following the closing of the Corporate Conversion, BGC Group and, where applicable, its consolidated subsidiaries, including BGC Partners, and (ii) prior to the closing of the Corporate Conversion, BGC Partners and, where applicable, its consolidated subsidiaries |

| |

| BGC Class A common stock or our Class A common stock | BGC Class A common stock, par value $0.01 per share |

| |

| BGC Class B common stock or our Class B common stock | BGC Class B common stock, par value $0.01 per share |

| |

| | | | | |

| TERM | DEFINITION |

| BGC Credit Agreement | Agreement between BGC Partners and Cantor, dated March 19, 2018, that permits each party or its subsidiaries to borrow up to $250.0 million, as amended on August 6, 2018, assumed by BGC Group on October 6, 2023, and further amended March 8, 2024, to increase the facility to $400.0 million at a rate equal to 25 basis points less than the applicable borrower’s borrowing rate under such borrower’s revolving credit agreement with unaffiliated third parties as administrative agent and lenders as may be in effect from time to time. On June 7, 2024, the agreement was amended a third time to permit BGC Group and its subsidiaries and Cantor and its subsidiaries to borrow from each other up to $400.0 million pursuant to a new category of “FICC-GSD Margin Loans” |

| |

| BGC Derivative Markets | BGC Derivative Markets L.P. |

| |

| BGC Entity Group | BGC Partners, BGC Holdings, BGC U.S. OpCo and their respective subsidiaries (other than, prior to the Spin-Off, the Newmark Group), collectively, and in each case as such entities existed prior to the Corporate Conversion |

| |

| BGCF | BGC Financial, L.P. |

| |

| BGC Global OpCo | BGC Global Holdings, L.P., an operating partnership, which holds the non-U.S. businesses of BGC and which is indirectly wholly owned, following the closing of the Corporate Conversion, by BGC Group |

| |

| BGC Group | BGC Group, Inc., and where applicable its consolidated subsidiaries |

| |

| BGC Group 3.750% Senior Notes | $255.5 million principal amount of 3.750% senior notes which matured on October 1, 2024 and were issued on October 6, 2023 in connection with the Exchange Offer |

| |

| BGC Group 4.375% Senior Notes | $288.2 million principal amount of 4.375% senior notes maturing on December 15, 2025 and issued on October 6, 2023 in connection with the Exchange Offer |

| |

| BGC Group 6.600% Senior Notes | $500.0 million principal amount of 6.600% senior notes maturing on June 10, 2029 and issued on June 10, 2024 |

| |

| BGC Group 8.000% Senior Notes | $347.2 million principal amount of 8.000% senior notes maturing on May 25, 2028 and issued on October 6, 2023 in connection with the Exchange Offer |

| |

| BGC Group Equity Plan | BGC Partners Equity Plan, as amended and restated and renamed the “BGC Group, Inc. Long Term Incentive Plan” and assumed by BGC Group in connection with the Corporate Conversion |

| |

| BGC Group Incentive Plan | Second Amended and Restated BGC Partners Incentive Bonus Compensation Plan, as amended and restated and renamed the “BGC Group, Inc. Incentive Bonus Compensation Plan” and assumed by BGC Group in connection with the Corporate Conversion |

| |

| BGC Group Notes | BGC Group 3.750% Senior Notes, BGC Group 4.375% Senior Notes, BGC Group 6.600% Senior Notes and BGC Group 8.000% Senior Notes issued by BGC Group |

| |

| BGC Holdings | BGC Holdings, L.P., an entity which, prior to the Corporate Conversion, was owned by Cantor, Founding Partners, BGC employee partners and, after the Separation, Newmark employee partners |

| |

| BGC Holdings Distribution | Pro-rata distribution, pursuant to the Separation and Distribution Agreement, by BGC Holdings to its partners of all of the exchangeable limited partnership interests of Newmark Holdings owned by BGC Holdings immediately prior to the distribution, completed on the Distribution Date |

| |

| BGC Holdings Limited Partnership Agreement | Second Amended and Restated BGC Holdings Limited Partnership Agreement |

| |

| BGC OpCos | BGC U.S. OpCo and BGC Global OpCo, collectively |

| |

| BGC Partners | BGC Partners, Inc. and, where applicable, its consolidated subsidiaries |

| |

| BGC Partners 3.750% Senior Notes | $300.0 million principal amount of 3.750% senior notes which matured on October 1, 2024 and were issued on September 27, 2019. Following the Exchange Offer on October 6, 2023, $44.5 million aggregate principal amount of the BGC Partners 3.750% Senior Notes remained outstanding |

| |

| BGC Partners 4.375% Senior Notes | $300.0 million principal amount of 4.375% senior notes maturing on December 15, 2025 and issued on July 10, 2020. Following the Exchange Offer on October 6, 2023 $11.8 million aggregate principal amount of the BGC Partners 4.375% Senior Notes remain outstanding |

| |

| | | | | |

| TERM | DEFINITION |

| BGC Partners 5.375% Senior Notes | $450.0 million principal amount of 5.375% senior notes which matured on July 24, 2023 and were issued on July 24, 2018 |

| |

| BGC Partners 8.000% Senior Notes | $350.0 million principal amount of 8.000% senior notes maturing on May 25, 2028 and issued on May 25, 2023. Following the Exchange Offer on October 6, 2023, $2.8 million aggregate principal amount of the BGC Partners 8.000% Senior Notes remained outstanding |

| |

| BGC Partners Equity Plan | Eighth Amended and Restated Long Term Incentive Plan, approved by BGC Partners’ stockholders at the annual meeting of stockholders on November 22, 2021 |

| |

| BGC Partners Incentive Plan | BGC Partners’ Second Amended and Restated Incentive Bonus Compensation Plan, approved by BGC Partners’ stockholders at the annual meeting of stockholders on June 6, 2017 |

| |

| BGC Partners Notes | BGC Partners 3.750% Senior Notes, BGC Partners 4.375% Senior Notes, BGC Partners 5.375% Senior Notes and BGC Partners 8.000% Senior Notes issued by BGC Partners |

| |

| BGC U.S. OpCo | BGC Partners, L.P., an operating partnership, which holds the U.S. businesses of BGC and which is indirectly wholly owned, following the closing of the Corporate Conversion, by BGC Group |

| |

| Board | Board of Directors of the Company |

| |

| Brexit | Exit of the U.K. from the EU |

| |

| Cantor | Cantor Fitzgerald, L.P. and, where applicable, its consolidated subsidiaries |

| |

| Cantor group | Cantor and its subsidiaries other than BGC, including Newmark |

| |

| Cantor units | Limited partnership interests, prior to the Corporate Conversion, of BGC Holdings, held by the Cantor group, which BGC Holdings units were exchangeable into shares of BGC Class A common stock or BGC Class B common stock, as applicable |

| |

| Capitalab | Capitalab Limited, which was part of the Company’s post-trade business. On December 3, 2024, the Company announced the sale of Capitalab Limited to Capitolis |

| |

| CCRE | Cantor Commercial Real Estate Company, L.P. |

| |

| CECL | Current Expected Credit Losses |

| |

| CEO Program | Controlled equity offering program |

| |

| CF&Co | Cantor Fitzgerald & Co., a wholly owned broker-dealer subsidiary of Cantor |

| |

| CFGM | CF Group Management, Inc., the general partner of Cantor |

| |

| CFTC | Commodity Futures Trading Commission |

| |

| Charity Day | BGC’s annual event held on September 11th where employees of the Company raise proceeds for charity |

| |

| CIO | Chief Information Officer |

| |

| CISO | Chief Information Security Officer |

| |

| Clawback Policy | Compensation recovery policy |

| |

| Clearing Capital Agreement | Agreement dated November 5, 2008, between BGC Partners and Cantor regarding clearing capital, as amended from time to time and assumed by BGC Group on June 7, 2024. On June 7, 2024, the agreement was amended to modify the rate charged by Cantor for posting margin in respect of trades cleared on behalf of the Company to a rate equal to Cantor’s cost of funding such margin through a draw on a third party credit facility provided to Cantor for which the use of proceeds is to finance clearinghouse margin deposits and related transactions |

| |

| | | | | |

| TERM | DEFINITION |

| Clearing Services Agreement | Agreement dated May 9, 2006, between CF&Co and BGCF pursuant to which certain clearing services are provided to BGC and its subsidiaries from Cantor and its subsidiaries, in exchange for payment by BGC and its subsidiaries of third-party clearing costs and allocated costs. On June 7, 2024, the agreement was amended to modify the rate charged by CF&Co for posting margin in respect of trades cleared on behalf of BGCF to a rate equal to CF&Co’s cost of funding such margin through a draw on a third party credit facility provided to CF&Co for which the use of proceeds is to finance clearinghouse margin deposits and related transactions |

| |

| CME | CME Group Inc. a leading derivatives marketplace, made up of four exchanges: CME, CBOT, NYMEX and COMEX |

| |

| Company | Refers to (i) from after the effective time of the Corporate Conversion, BGC Group and its consolidated subsidiaries, including BGC Partners; and (ii) prior to the effective time of the Corporate Conversion, BGC Partners and its consolidated subsidiaries |

| |

| Company Debt Securities | The BGC Group Notes, the BGC Partners Notes and any future debt securities issued by the Company or its subsidiaries |

| |

| Company Equity Securities | BGC Group stock or other equity securities |

| |

| Compensation Committee | Compensation Committee of the Board |

| |

| ContiCap | ContiCap SA, a wholly owned subsidiary of the Company, acquired on November 1, 2023 |

| |

| Contribution Ratio | Equal to a BGC Holdings limited partnership interest multiplied by one, divided by 2.2 (or 0.4545) |

| |

| Corporate Conversion | A series of mergers and related transactions pursuant to which, effective at 12:02 AM Eastern Time on July 1, 2023, BGC Partners and BGC Holdings became wholly owned subsidiaries of BGC Group, transforming the organizational structure of the BGC businesses from an “Up-C” structure to a simplified “Full C-Corporation” structure |

| |

| Corporate Conversion Agreement | The Corporate Conversion Agreement entered into on November 15, 2022, and as amended on March 29, 2023, by and among BGC Partners, BGC Holdings, BGC Group and other affiliated entities, and, solely for the purposes of certain provisions therein, Cantor, that provides for the Corporate Conversion of the BGC businesses |

| |

| Corporate Conversion Mergers | The Holdings Reorganization Merger, the Corporate Merger, and the Holdings Merger, collectively |

| |

| Corporate Merger | The merger of Merger Sub 1 with and into BGC Partners on July 1, 2023 |

| |

| COVID-19 | Coronavirus Disease 2019 |

| |

| |

| |

| Credit Facility | A $150.0 million credit facility between BGC Group and an affiliate of Cantor entered into on April 21, 2017, which was terminated on March 19, 2018 |

| |

| DCM | Designated Contract Market |

| |

| DCO | Derivatives Clearing Organization |

| |

| Deed | Mr. Windeatt’s Deed of Adherence, as amended, with the U.K. Partnership regarding the terms of employment |

| |

| DGCL | Delaware General Corporation Law |

| |

| Distribution Date | November 30, 2018, the date that BGC Partners and BGC Holdings completed the Spin-Off and the BGC Holdings Distribution, respectively |

| |

| Dodd-Frank Act | Dodd-Frank Wall Street Reform and Consumer Protection Act |

| |

| DRIP | Dividend Reinvestment and Stock Purchase Plan |

| |

| DRIP Registration Statement | Registration statement on Form S-3 with respect to the offer and sale of up to 10.0 million shares of BGC Class A common stock under the DRIP |

| |

| DTCC | Depository Trust & Clearing Corporation |

| |

| | | | | |

| TERM | DEFINITION |

| ECB | European Central Bank |

| |

| ECS | Energy, Commodities, and Shipping |

| |

| Ed Broking | Ed Broking Group Limited, formerly a wholly owned subsidiary of the Company, acquired on January 31, 2019 and sold to The Ardonagh Group on November 1, 2021 as part of the Insurance Business Disposition |

| |

| EMEA | Europe, Middle East, and Africa |

| |

| EMIR | European Market Infrastructure Regulation |

| |

| EPS | Earnings Per Share |

| |

| ESG | Environmental, Social and Governance, including sustainability or similar items |

| |

| ESG Committee | Environmental, Social and Governance Committee of the Board |

| |

| eSpeed | Various assets comprising the Fully Electronic portion of the Company’s former benchmark on-the-run U.S. Treasury brokerage, market data and co-location service businesses, sold to Nasdaq on June 28, 2013 |

| |

| EU | European Union |

| |

| Exchange Act | Securities Exchange Act of 1934, as amended |

| |

| Exchange Agreement | A letter agreement by and between BGC Partners, Cantor and CFGM, dated June 5, 2015, that, prior to the Corporate Conversion, granted Cantor and CFGM the right to exchange shares of BGC Class A common stock into shares of BGC Class B common stock on a one-to-one basis up to the limits described therein, which agreement was terminated in connection with the Corporate Conversion |

| |

| Exchange Offer | Consent solicitations and offers to exchange the BGC Partners 3.750% Senior Notes, BGC Partners 4.375% Senior Notes and BGC Partners 8.000% Senior Notes issued by BGC Partners for the BGC Group 3.750% Senior Notes, BGC Group 4.375% Senior Notes and BGC Group 8.000% Senior Notes issued by BGC Group, in each case with substantially similar terms to the corresponding series of BGC Partners Notes, completed on October 6, 2023 |

| |

| Exchange Ratio | Ratio by which a Newmark Holdings limited partnership interest can be exchanged for shares of Newmark Class A or Class B common stock |

| |

| FASB | Financial Accounting Standards Board |

| |

| FCA | Financial Conduct Authority of the U.K. |

| |

| FCM | Futures Commission Merchant |

| |

| FDIC | Federal Deposit Insurance Corporation |

| |

| February 2012 distribution rights shares | Cantor’s deferred stock distribution rights provided to current and former Cantor partners on February 14, 2012 |

| |

| |

| Fenics | BGC’s group of electronic brands, offering a number of market infrastructure and connectivity services, Fully Electronic marketplaces, and the Fully Electronic brokerage of certain products that also may trade via Voice and Hybrid execution, including market data and related information services, Fully Electronic brokerage, connectivity software, compression and other post-trade services, analytics related to financial instruments and markets, and other financial technology solutions; includes Fenics Growth Platforms and Fenics Markets |

| |

| Fenics Growth Platforms | Consists of FMX UST, Fenics GO, Lucera, FMX FX and other newer standalone platforms, including FMX Futures Exchange |

| |

| Fenics Integrated | Represents Fenics businesses that utilize sufficient levels of technology such that significant amounts of their transactions can be, or are, executed without broker intervention and have expected pre-tax margins of at least 25% |

| |

| Fenics Markets | Consists of the Fully Electronic portions of BGC’s brokerage businesses, data, network and post-trade revenues that are unrelated to Fenics Growth Platforms, as well as Fenics Integrated revenues |

| |

| | | | | |

| TERM | DEFINITION |

| FICC | Fixed Income Clearing Corporation |

| |

| FICC-GSD Margin Loans | Loans made by a party under the BGC Credit Agreement, the use of proceeds of which will be to directly or indirectly (i) post margin at any clearinghouse, including without limitation the Government Securities Division of the FICC, (ii) keep funds available for the purpose of posting such margin or (iii) otherwise facilitate the clearing and settlement of trades |

| |

| FINRA | Financial Industry Regulatory Authority |

| |

| FMX | Fenics Markets Exchange, LLC, which holds BGC’s business of providing a fully electronic neutral forum in which all participants enter into electronic transactions with respect to U.S. Treasuries, U.S. treasury futures, U.S. SOFR futures and other select products |

| |

| FMX Equity Partners | Bank of America, Barclays, Citadel Securities, Citi, Goldman Sachs, J.P. Morgan, Jump Trading Group, Morgan Stanley, Tower Research Capital, and Wells Fargo, being the banks which contributed $172 million between April 23, 2024 and April 24, 2024 into FMX in exchange for a 25.75% ownership interest in FMX at a post-money equity valuation of $667 million. The FMX Equity Partners received an additional 10.3% of equity ownership subject to driving trading volumes and meeting certain volume targets across the FMX ecosystem |

| |

| FMX Futures Exchange | FMX Futures Exchange, L.P., which is wholly owned by FMX, and received approval from the CFTC to operate an exchange for U.S. treasury futures and U.S. SOFR futures |

| |

| FMX Separation | On April 23, 2024, BGC and FMX entered into a separation agreement pursuant to which BGC contributed the assets and liabilities related to FMX’s business to FMX, and pursuant to which BGC and FMX agreed to certain restrictions in the operations of their respective businesses |

| |

| Founding Partners | Individuals who became limited partners of BGC Holdings in the mandatory redemption of interests in Cantor in connection with the 2008 separation and merger of Cantor’s BGC division with eSpeed, Inc. (provided that members of the Cantor group and Howard W. Lutnick (including any entity directly or indirectly controlled by Mr. Lutnick or any trust with respect to which he is a grantor, trustee or beneficiary) are not founding partners) and became limited partners of Newmark Holdings in the Separation |

| |

| Founding/Working Partners | Holders of FPUs |

| |

| FPUs | Founding/Working Partners units, in BGC Holdings, prior to the Corporate Conversion, or Newmark Holdings, generally redeemed upon termination of employment |

| |

| Freedom | Freedom International Brokerage Company, a 45% voting interest ownership equity method investment of the Company |

| |

| FTP | File Transfer Protocol |

| |

| Fully Electronic | Broking transactions intermediated on a solely electronic basis rather than by Voice or Hybrid broking |

| |

| Futures Exchange Group | A wholly owned subsidiary of the Company made up of the following entities: CFLP CX Futures Exchange Holdings, LLC, CFLP CX Futures Exchange Holdings, L.P., CX Futures Exchange Holdings, LLC, CX Clearinghouse Holdings, LLC, FMX Futures Exchange and CX Clearinghouse, L.P. |

| |

| FX | Foreign exchange |

| |

| G20 | A forum for the world’s major economies to discuss economic, social, and development issues |

| |

| GDPR | General Data Protection Regulation |

| |

| GFI | GFI Group Inc., a wholly owned subsidiary of the Company, acquired on January 12, 2016 |

| |

| GILTI | Global Intangible Low-Taxed Income |

| |

| Ginga Petroleum | Ginga Petroleum (Singapore) Pte Ltd, a wholly owned subsidiary of the Company, acquired on March 12, 2019 |

| |

| GSD | Government Securities Division |

| |

| | | | | |

| TERM | DEFINITION |

| GUI | Graphical User Interface |

| |

| HDUs | LPUs with capital accounts, which were liability awards recorded in “Accrued compensation” in the Company’s Consolidated Statements of Financial Condition |

| |

| Holdings Merger | The merger of Merger Sub 2 with and into Holdings Merger Sub |

| |

| Holdings Merger Sub | BGC Holdings Merger Sub, LLC, a Delaware limited liability company, wholly owned subsidiary of the Company, and successor to BGC Holdings |

| |

| Holdings Reorganization Merger | The reorganization of BGC Holdings from a Delaware limited partnership into a Delaware limited liability company through a merger with and into Holdings Merger Sub |

| |

| Hybrid | Broking transactions executed by brokers and involving some element of Voice broking and electronic trading |

| |

| ICAP | ICAP plc, a part of TP ICAP group, and a leading markets operator and provider of execution and information services |

| |

| ICE | Intercontinental Exchange |

| |

| Incentive-Based Compensation | Compensation received by the Company’s executive officers that results from the attainment of a financial reporting measure based on or derived from financial information |

| |

| Insurance brokerage business | The insurance brokerage business of BGC, including Corant, Ed Broking, Besso, Piiq Risk Partners, Junge, Cooper Gay, Global Underwriting and Epsilon, which business was sold to The Ardonagh Group on November 1, 2021 |

| |

| Insurance Business Disposition | The sale of the Insurance brokerage business for $534.9 million in gross cash proceeds after closing adjustments, subject to limited post-closing adjustments, completed on November 1, 2021 |

| |

| Investment Company Act | Investment Company Act of 1940, as amended |

| |

| IR Act | Inflation Reduction Act of 2022 |

| |

| July 2023 Sales Agreement | CEO Program sales agreement, by and between the Company and CF&Co, dated July 3, 2023, pursuant to which the Company can offer and sell up to an aggregate of $300.0 million of shares of BGC Class A common stock |

| |

| LCH | London Clearing House |

| |

| LGD | Loss Given Default |

| |

| LIBOR | London Interbank Offering Rate |

| |

| Liquidity | A non-GAAP financial measure, comprised of the sum of Cash and cash equivalents, Reverse Repurchase Agreements, and Financial instruments owned, at fair value, less Securities loaned and Repurchase Agreements |

| |

| LPUs | Certain limited partnership units of BGC Holdings prior to the Corporate Conversion, or Newmark Holdings, held by certain employees of BGC and Newmark and other persons who have provided services to BGC or Newmark, which units may include APSIs, APSUs, AREUs, ARPSUs, HDUs, U.K. LPUs, N Units, PLPUs, PPSIs, PPSUs, PSEs, PSIs, PSUs, REUs, and RPUs, along with future types of limited partnership units in Newmark Holdings |

| |

| LSEG | London Stock Exchange Group |

| |

| Lucera | A wholly owned subsidiary of the Company, also known as “LFI Holdings, LLC” or “LFI,” which is a software defined network offering the trading community direct connectivity |

| |

| March 2021 Form S-3 Registration Statement | CEO Program shelf Registration Statement on Form S-3 filed on March 8, 2021 |

| |

| MarketAxess | MarketAxess Holdings Inc. |

| |

| | | | | |

| TERM | DEFINITION |

| Merger Sub 1 | BGC Partners II, Inc., a Delaware corporation and wholly owned subsidiary of BGC Group |

| |

| Merger Sub 2 | BGC Partners II, LLC, a Delaware limited liability company and wholly owned subsidiary of BGC Group |

| |

| MiFID II | Markets in Financial Instruments Directive II, a legislative framework instituted by the EU to regulate financial markets and improve protections for investors by increasing transparency and standardizing regulatory disclosures |

| |

| Mint Brokers | A wholly owned subsidiary of the Company, acquired on August 19, 2010, registered as an FCM with both the CFTC and the NFA |

| |

| Nasdaq | Nasdaq, Inc., formerly known as NASDAQ OMX Group, Inc. |

| |

| NDF | Non-deliverable forwards |

| |

| Newmark | Newmark Group, Inc. (Nasdaq symbol: NMRK), a publicly traded and former majority-owned subsidiary of BGC Partners until the Distribution Date, and, where applicable, its consolidated subsidiaries |

| |

| Newmark Class A common stock | Newmark Class A common stock, par value $0.01 per share |

| |

| Newmark Class B common stock | Newmark Class B common stock, par value $0.01 per share |

| |

| Newmark Group | Newmark, Newmark Holdings, and Newmark OpCo and their respective consolidated subsidiaries, collectively |

| |

| Newmark Holdings | Newmark Holdings, L.P. |

| |

| Newmark IPO | Initial public offering of 23 million shares of Newmark Class A common stock by Newmark at a price of $14.00 per share in December 2017 |

| |

| Newmark OpCo | Newmark Partners, L.P., an operating partnership, which is owned jointly by Newmark and Newmark Holdings and holds the businesses of Newmark |

| |

| NFA | National Futures Association |

| |

| Non-GAAP | A financial measure that differs from the most directly comparable measure calculated and presented in accordance with U.S. GAAP, such as Adjusted Earnings and Liquidity |

| |

| N Units | Non-distributing partnership units, of BGC Holdings, prior to the Corporate Conversion, or Newmark Holdings, that may not be allocated any item of profit or loss, and may not be made exchangeable into shares of Class A common stock, including NREUs, NPREUs, NLPUs, NPLPUs, NPSUs, and NPPSUs |

| |

| OCC | Options Clearing Corporation |

| |

| Open Energy Group | Open Energy Group Inc., a wholly owned subsidiary of the Company, acquired on November 1, 2023 |

| |

| OTC | Over-the-counter |

| |

| OTC Global | OTC Global Holdings, LP |

| |

| OTF | Organized Trading Facility, a regulated execution venue category introduced by MiFID II |

| |

| PD | Probability of default |

| |

| Period Cost Method | Treatment of taxes associated with the GILTI provision as a current period expense when incurred rather than recording deferred taxes for basis differences |

| |

| Peer Group | BGC’s peer group for purposes of Item 201(e) of Regulation S-K, which consists of Compagnie Financière Tradition SA and TP ICAP plc |

| |

| | | | | |

| TERM | DEFINITION |

| Poten & Partners | Poten & Partners Group, Inc., a wholly owned subsidiary of the Company, acquired on November 15, 2018 |

| |

| Predecessor | Refers to BGC Partners Inc. being the parent company prior to the Corporate Conversion. |

| |

| Preferred Distribution | Allocation of net profits of BGC Holdings (prior to the Corporate Conversion) or Newmark Holdings to holders of Preferred Units, at a rate of either 0.6875% (i.e., 2.75% per calendar year) or such other amount as set forth in the award documentation |

| |

| Preferred Return | The lesser of the two-year treasury bond rate or 2.75% annually, as calculated on the determination amount applicable to certain RSU Tax Account awards, which may be adjusted or otherwise determined by management from time to time |

| |

| Preferred Units | Preferred partnership units of BGC Holdings, prior to the Corporate Conversion, or Newmark Holdings, such as PPSUs, which are settled for cash, rather than made exchangeable into shares of Class A common stock, are only entitled to a Preferred Distribution, and are not included in BGC’s or Newmark’s fully diluted share count |

| |

| Quantile | Quantile Group Limited |

| |

| Real GDP | Real Gross Domestic Product is a macroeconomic measure of the value of economic output adjusted for price changes (i.e., inflation or deflation), which transforms the money-value measure, nominal GDP, into an index for quantity of total output |

| |

| Record Date | Close of business on November 23, 2018, in connection with the Spin-Off |

| |

| REMIT | Regulation on Wholesale Energy Markets Integrity and Transparency |

| |

| Repurchase Agreements | Securities sold under agreements to repurchase that are recorded at contractual amounts, including interest, and accounted for as collateralized financing transactions |

| |

| Reverse Repurchase Agreements | Agreements to resell securities, with such securities recorded at the contractual amount, including accrued interest, for which the securities will be resold, and accounted for as collateralized financing transactions |

| |

| Revolving Credit Agreement | BGC Group’s unsecured senior revolving credit agreement with Bank of America, N.A., as administrative agent, and a syndicate of lenders, dated as of November 28, 2018 and most recently amended and restated on April 26, 2024 and amended on December 6, 2024. The Revolving Credit Agreement provides for a maximum revolving loan balance of $700.0 million bearing interest at either SOFR or a defined base rate plus additional margin, and has a maturity date of April 26, 2027 |

| |

| ROU | Right-of-use |

| |

| RSUs | BGC or Newmark restricted stock units, payable in shares of BGC Class A common stock or Newmark Class A common stock, respectively, held by certain employees of BGC or Newmark and other persons who have provided services to BGC or Newmark, or issued in connection with certain acquisitions |

| |

| RSU Tax Account | RSU Tax Accounts were issued by BGC in connection with the Corporate Conversion in the place of certain non-exchangeable Preferred Units. The RSU Tax Accounts are settled for cash, rather than vesting into shares of Class A common stock, may be entitled to a Preferred Return, and are not included in BGC’s fully diluted share count. The RSU Tax Accounts were issued in connection with RSUs and are to cover any withholding taxes to be paid when the RSUs vest into shares of BGC Class A common stock |

| |

| Russia’s Invasion of Ukraine | Russia’s invasion of Ukraine, which led to imposed sanctions by the U.S., U.K., EU, and other countries on Russian counterparties |

| |

| Sage | Sage Energy Partners, LP, an energy and environmental brokerage firm that the Company announced acquired on October 10, 2024 |

| |

| SBSEF | Security-based Swap Execution Facility |

| |

| SEC | U.S. Securities and Exchange Commission |

| |

| Securities Act | Securities Act of 1933, as amended |

| |

| | | | | |

| TERM | DEFINITION |

| SEF | Swap Execution Facility |

| |

| |

| Separation | Principal corporate transactions pursuant to the Separation and Distribution Agreement, by which BGC Partners, BGC Holdings and BGC U.S. OpCo and their respective subsidiaries (other than the Newmark Group) transferred to Newmark, Newmark Holdings and Newmark OpCo and their respective subsidiaries the assets and liabilities of the BGC Entity Group relating to BGC’s real estate services business, and related transactions, including the distribution of Newmark Holdings units to holders of units in BGC Holdings and the assumption and repayment of certain BGC indebtedness by Newmark |

| |

| Separation and Distribution Agreement | Separation and Distribution Agreement, by and among the BGC Entity Group, the Newmark Group, Cantor and BGC Global OpCo, originally entered into on December 13, 2017, as amended on November 8, 2018 and amended and restated on November 23, 2018 |

| |

| SMCR | Senior Managers Certification Regime |

| |

| SOFR | Secured Overnight Financing Rate |

| |

| SPAC | Special Purpose Acquisition Company |

| |

| SPAC Investment Banking Activities | Aurel’s investment banking activities with respect to SPACs |

| |

| Spin-Off | Pro-rata distribution, pursuant to the Separation and Distribution Agreement, by BGC to its stockholders of all the shares of common stock of Newmark owned by BGC Partners immediately prior to the Distribution Date, with shares of Newmark Class A common stock distributed to the holders of shares of BGC Class A common stock (including directors and executive officers of BGC Partners) of record on the Record Date, and shares of Newmark Class B common stock distributed to the holders of shares of BGC Class B common stock (Cantor and CFGM) of record on the Record Date, completed on the Distribution Date |

| |

| Standing Policy | In December 2010, as amended in 2013 and in 2017 and adopted by BGC Group in connection with the Corporate Conversion, the Audit Committee and the Compensation Committee approved Mr. Lutnick’s right, subject to certain conditions, to accept or waive opportunities offered to other executive officers to monetize or otherwise provide liquidity with respect to some or all of their limited partnership units of BGC Holdings or to accelerate the lapse of or eliminate any restrictions on equity awards |

| |

| STP | Straight-Through Processing |

| |

| Successor | Referring to BGC Group as the parent company for the period following the Corporate Conversion |

| |

| Tax Act | Tax Cuts and Jobs Act enacted on December 22, 2017 |

| |

| TDRs | Troubled Debt Restructurings |

| |

| The Ardonagh Group | The Ardonagh Group Limited; the U.K.’s largest independent insurance broker and purchaser of BGC’s Insurance brokerage business completed on November 1, 2021 |

| |

| Tower Bridge | Tower Bridge International Services L.P., a subsidiary of the Company, which is 52%-owned by the Company and 48%-owned by Cantor |

| |

| TP ICAP | TP ICAP plc, an entity formed in December 2016, formerly known as Tullett |

| |

| Tradeweb | Tradeweb Markets, Inc. |

| |

| Tradition | Compagnie Financière Tradition SA, a Swiss based inter-dealer broker |

| |

| Trident | Trident Brokerage Service LLC, a wholly owned subsidiary of the Company, acquired on February 28, 2023 |

| |

| Tullett | Tullett Prebon plc, a part of TP ICAP group and an interdealer broker, primarily operating as an intermediary in the wholesale financial and energy sectors |

| |

| U.K. | United Kingdom |

| |

| | | | | |

| TERM | DEFINITION |

| U.K. Partnership | BGC Services (Holdings) LLP, a wholly owned subsidiary of the Company |

| |

| U.S. GAAP or GAAP | Generally Accepted Accounting Principles in the United States of America |

| |

| UBT | Unincorporated Business Tax |

| |

| VIE | Variable Interest Entity |

| |

| Voice | Voice-only broking transactions executed by brokers over the telephone |

SPECIAL NOTE ON FORWARD-LOOKING INFORMATION

This Annual Report on Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act. Any statements contained herein that are not statements of historical fact may be deemed to be forward-looking statements. For example, words such as “may,” “will,” “should,” “estimates,” “predicts,” “possible,” “potential,” “continue,” “strategy,” “believes,” “anticipates,” “plans,” “expects,” “intends,” and similar expressions are intended to identify forward-looking statements. The information included herein is given as of the filing date of this Annual Report on Form 10-K with the SEC, and future results or events could differ significantly from these forward-looking statements. Such statements are based upon current expectations that involve risks and uncertainties. Factors that could cause future results or events to differ from those expressed in these forward-looking statements include, but are not limited to, the risks and uncertainties described or referenced in this Form 10-K under the headings “Item 1A—Risk Factors,” “Item 7—Management’s Discussion and Analysis of Financial Condition and Results of Operations—Forward-Looking Cautionary Statements” and “Item 7A—Quantitative and Qualitative Disclosures About Market Risk.” Except to the extent required by applicable law or regulation, the Company does not undertake to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise.

RISK FACTOR SUMMARY

The following is a summary of material risks that could affect our business, each of which may have a material adverse effect on our business, financial condition, results of operations and prospects. This summary may not contain all of our material risks, and it is qualified in its entirety by the more detailed risk factors set forth in Item 1A “Risk Factors.”

•Our business, financial condition, results of operations and prospects have been and may continue to be affected both positively and negatively by conditions in the global economy and financial markets generally.

•Actions taken by central banks in major global economies, including with regards to interest rates, may have a material negative impact on our businesses.

•We may pursue opportunities including new business initiatives, strategic alliances, acquisitions, mergers, investments, dispositions, joint ventures or other growth opportunities or transformational transactions (including hiring new brokers and salespeople), which could present unforeseen integration obstacles or costs and could dilute our stockholders. We may also face competition in our acquisition strategy or new business plans, and such competition may limit such opportunities.

•We are subject to certain risks relating to our indebtedness, including constraints on our ability to raise additional capital, declines in our credit ratings and limitations on our financial flexibility to react to changes in the economy or the financial services industry. We may need to incur additional indebtedness to finance our growth strategy, including in connection with the re-positioning of aspects of our business to adapt to changes in market conditions in the financial services industry.

•We may not be able to protect our intellectual property rights or may be prevented from using intellectual property necessary for our business.

•Malicious cyber-attacks and other adverse events affecting our operational systems or infrastructure, or those of third parties, could disrupt our business, result in the disclosure of confidential information, damage our reputation and cause losses or regulatory penalties.

•We may use artificial intelligence in our business, and challenges with properly managing its use could result in competitive harm, regulatory action, legal liability and brand or reputational harm.

•Leadership changes and the resulting transition following Howard Lutnick’s confirmation as the U.S. Secretary of Commerce could have an adverse effect on our business.

•The loss of one or more of our key executives, the development of future talent and the ability of certain key employees to devote adequate time and attention to us are a key part of the success of our businesses, and failure to continue to employ and have the benefit of these executives, may adversely affect our businesses and prospects.

•If we fail to implement and maintain an effective internal control environment, our operations, reputation, and stock price could suffer, we may need to restate our financial statements, and we may be delayed or prevented from accessing the capital markets.

•The financial services industry in general faces potential regulatory, litigation and/or criminal risks that may result in damages or fines or other penalties as well as costs, and we may face damage to our professional reputation and legal liability if our products and services are not regarded as satisfactory, our employees do not adhere to all applicable legal and professional standards, or for other reasons, all of which could have a material adverse effect on our businesses, financial condition, results of operations and prospects.

•Because competition for the services of brokers, salespeople, managers, technology professionals and other front-office personnel, in the financial services industry is intense, it could affect our ability to attract and retain a sufficient number of highly skilled brokers or other professional services personnel, in turn adversely impacting our revenues, resulting in a material adverse effect on our businesses, financial condition, results of operations and prospects.

•Consolidation and concentration of market share in the banking, brokerage, exchange and financial services industries could materially adversely affect our business, financial condition, results of operations and prospects because we may not be able to compete successfully.

•We are subject to risks inherent in doing business in international financial markets, international expansion and international operations, including regulatory risks, political risks, and foreign currency risks.

•Our activities are subject to credit and performance risks, which could result in us incurring significant losses that could materially adversely affect our business, financial condition, results of operations and prospects.

•If we were deemed an “investment company” under the Investment Company Act, the Investment Company Act’s restrictions could make it impractical for us to continue our business.

•We are a holding company, and accordingly are dependent upon distributions from BGC U.S. OpCo and BGC Global OpCo to pay dividends, taxes and indebtedness and other expenses and to make repurchases.

•In connection with his confirmation as U.S. Secretary of Commerce, Mr. Howard Lutnick has stated his intention to divest his interests in us, Cantor and CFGM to comply with U.S. government ethics rules. We cannot predict the consequences of this divestiture.

•Our Class B common stock is held by Cantor and CFGM, whose interests may conflict with ours, and may exercise their control in a way that favors their interests to our detriment, including in competition with us for acquisitions or other business opportunities.

•Purchasers, as well as existing stockholders, may experience significant dilution as a result of offerings of shares of our Class A common stock. Our management will have broad discretion as to the timing and amount of sales of our Class A common stock, as well as the application of the net proceeds of any such sales.

•Ongoing scrutiny and changing expectations from stockholders, clients and customers with respect to the Company’s corporate responsibility or ESG practices may result in additional costs or risks.

PART I

ITEM 1. BUSINESS

Throughout this document, the terms the “Company,” “BGC,” “we,” “our,” and “us,” refer to: (i) following the closing of the Corporate Conversion, effective at 12:02 am Eastern Time on July 1, 2023, BGC Group, Inc. and its consolidated subsidiaries, including BGC Partners, Inc.; and (ii) prior to the closing of the Corporate Conversion, BGC Partners, Inc. and its consolidated subsidiaries.

Our Business

We are a leading global marketplace, data, and financial technology company that specializes in the trade execution of a broad range of products, including fixed income securities such as government bonds, corporate bonds, and other debt instruments, as well as related interest rate derivatives and credit derivatives. Additionally, we provide brokerage services across foreign exchange, energy, commodities, shipping, equities, and futures and options. Our business also provides network and connectivity solutions, market data and related information services, and post-trade services.

Our integrated platform is designed to provide flexibility to customers with regard to price discovery, trade execution and transaction processing, as well as accessing liquidity through our platforms, for transactions executed either OTC or through an exchange. Through our electronic brands, we offer several trade execution, market infrastructure and connectivity services, as well as post-trade services.

Our clients include many of the world’s largest banks, broker-dealers, trading firms, hedge funds, governments, corporations, investment firms, commodity trading firms and end users, such as producers and consumers. BGC is a global operation with offices across all major geographies, including New York and London, as well as in Bahrain, Beijing, Bogota, Brisbane, Cape Town, Chicago, Copenhagen, Dubai, Dublin, Frankfurt, Geneva, Hong Kong, Houston, Johannesburg, Madrid, Manila, Melbourne, Mexico City, Miami, Milan, Monaco, Nyon, Paris, Perth, Rio de Janeiro, Santiago, São Paulo, Seoul, Shanghai, Singapore, Sydney, Tel Aviv, Tokyo, Toronto, Wellington and Zurich.

As of December 31, 2024, we had 2,161 brokers, salespeople, managers, technology professionals and other front-office personnel across our businesses.

Our History

Our business originated from Cantor, one of the oldest and most established inter-dealer and wholesale brokerage franchises in the financial intermediary industry. Cantor started our wholesale intermediary brokerage operations in 1972. In 1996, Cantor launched its eSpeed system, which revolutionized the way government bonds are traded in the inter-dealer market by providing a Fully Electronic trading marketplace. eSpeed completed an initial public offering and began trading on Nasdaq in 1999.

Cantor subsequently continued to operate its inter-dealer Voice and Hybrid brokerage businesses separately from eSpeed.

Prior to the events of September 11, 2001, our financial brokerage business was widely recognized as one of the leading full-service wholesale financial brokers in the world, with a rich history of developing innovative technological and financial solutions.

After September 11, 2001, and the loss of the majority of our U.S.-based employees, our Voice financial brokerage business operated primarily in Europe.

In August 2004, Cantor announced the reorganization and separation of its inter-dealer Voice and Hybrid brokerage businesses into a subsidiary called “BGC,” in honor of B. Gerald Cantor, the pioneer in screen brokerage services and fixed income market data products.

In April 2008, BGC and certain other Cantor assets merged with and into eSpeed, and the combined company began operating under the name “BGC Partners, Inc.” In June 2013, we sold certain assets relating to our U.S. Treasury benchmark business and the name “eSpeed” to Nasdaq. In 2011, we also acquired and built up a commercial real estate services business called “Newmark,” which we spun-off to BGC’s stockholders in November 2018. In addition, we acquired and built-up an insurance brokerage business, which we sold in November 2021. We also acquired the Futures Exchange Group from Cantor in July 2021, which represents our futures exchange and related clearinghouse.

We have rebuilt our U.S. presence and have continued to expand our global footprint through the acquisition and integration of established brokerage companies and the hiring of experienced brokers. Through these actions, we have been able to expand our presence in key markets and position our business for sustained growth. Since 2015, our acquisitions have included GFI, Sunrise Brokers, Poten & Partners, Ginga Petroleum, the Futures Exchange Group, Trident, ContiCap, and Sage.

Since the founding of eSpeed, we have continued to pioneer advances in electronic trading, market data, network and post-trade services across the wholesale capital markets. Fenics, BGC’s higher-margin technology-driven business, has grown significantly, supported by our investment in new trading technologies and platforms, as well as from trends of proliferating electronic execution across the capital markets and the demand for data services.

Fenics is the foundation for our Fully Electronic and associated Hybrid transactions across all asset classes. Fenics’ offerings include Fully Electronic brokerage products and services, as well as offerings in data, network and post-trade services across the Company. Our Fully Electronic standalone platforms include FMX UST, FMX FX, PortfolioMatch, and Fenics GO, among others. Going forward, we expect Fenics to become an even more valuable part of BGC as it continues to grow.

On November 3, 2021, we announced FMX, which combined Fenics’ U.S. Treasury business with a state-of-the-art U.S. Rates futures platform. On January 22, 2024, FMX received CFTC approval to operate an exchange for U.S. Treasury and SOFR futures. On April 25, 2024, we announced that Bank of America, Barclays, Citi, Goldman Sachs, J.P. Morgan, Jump Trading Group, Morgan Stanley, Tower Research Capital, and Wells Fargo became minority equity owners of FMX and collectively invested $171.7 million in exchange for a 25.75% ownership interest at a post-money equity valuation of $666.7 million. The FMX Equity Partners received an additional 10.3% of equity ownership subject to driving trading volumes and meeting certain volume targets across the FMX ecosystem. On September 23, 2024, FMX Futures Exchange launched the trading of SOFR futures, the largest notional futures contract in the world.

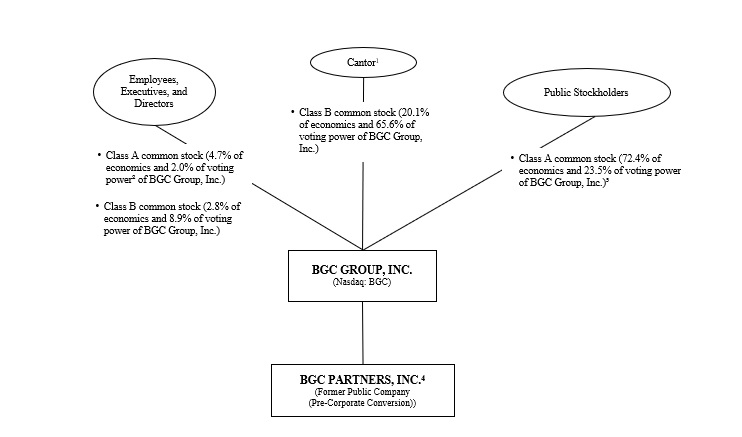

Corporate Conversion

On July 1, 2023, BGC Partners completed its conversion from an Umbrella Partnership C-Corporation to a Full C-Corporation in order to reorganize and simplify its organizational structure. As a result of the Corporate Conversion, BGC Group became the public holding company for, and successor to, BGC Partners, and its Class A common stock began trading on Nasdaq under the ticker symbol “BGC” in place of BGC Partners’ Class A common stock. Upon completion of the Corporate Conversion, the former stockholders of BGC Partners and the former limited partners of BGC Holdings now participate in the economics of the BGC businesses through BGC Group. The Corporate Conversion was intended to improve transparency and reduce operational complexity across our business.

As a result of the Corporate Conversion, BGC Partners became a wholly owned subsidiary of BGC Group and BGC Holdings reorganized from a Delaware limited partnership into a Delaware limited liability company through a merger with and into Holdings Merger Sub, with Holdings Merger Sub continuing as a wholly owned subsidiary of BGC Group. Each outstanding share of BGC Partners Class A common stock and BGC Partners Class B common stock was converted into one share of BGC Group Class A common stock and BGC Group Class B common stock, respectively. Non-exchangeable limited partnership units of BGC Holdings were converted into equity awards denominated in cash, restricted stock and/or RSUs of BGC Group. Exchangeable limited partnership units of BGC Holdings were exchanged for shares of BGC Partners Class A common stock prior to the Corporate Conversion and were converted into shares of BGC Group Class A common stock at the closing of the Corporate Conversion. 64.0 million Cantor units were converted into shares of BGC Group Class B common stock, subject to the terms and conditions of the Corporate Conversion Agreement, provided that a portion of the 64.0 million shares of BGC Group Class B common stock issued to Cantor will exchange into BGC Group Class A common stock in the event that BGC Group does not issue at least $75,000,000 in shares of BGC Group Class A common stock or BGC Group Class B common stock in connection with certain acquisition transactions prior to the seventh anniversary of the Corporate Conversion. BGC Group assumed all BGC Partners RSUs, RSU Tax Accounts or restricted stock awards outstanding as of June 30, 2023.

Please refer to “Management’s Discussion and Analysis of Financial Condition and Results of Operation—Overview and Business Overview—Corporate Conversion” for more information regarding the Corporate Conversion.

Recent Board of Directors and Executive Officers Changes

On February 18, 2025, Howard W. Lutnick was confirmed by the United States Senate as the 41st Secretary of Commerce. Following his confirmation, on February 18, 2025, Mr. Howard Lutnick stepped down as Chairman of the Board and Chief Executive Officer of the Company. On February 18, 2025, the Company appointed Brandon Lutnick, son of Mr. Howard Lutnick, to serve as a member of the Board. Additionally, on February 18, 2025, the Company appointed Mr. Merkel to serve as a member of the Board and as Chairman of the Board. On February 18, 2025, the Company appointed John A. Abularrage, JP Aubin, and Sean A. Windeatt as Co-Chief Executive Officers of the Company and as the Principal Executive Officers of the Company. Mr. Howard Lutnick has agreed to divest his interests in BGC to comply with U.S. government ethics rules, which is expected to occur within 90 days following his confirmation, and does not expect any arrangement which involves selling shares on the open market.

Recent Developments

On March 18, 2024, the Company joined the S&P SmallCap 600 Index. The S&P SmallCap 600 is designed to track the performance of the small-cap sector of the U.S. stock market.

Overview of Our Products and Services

Financial Brokerage

While Voice and Hybrid brokerage revenues still represent the majority of BGC’s overall revenues, we continue to convert our Voice and Hybrid brokerage business to our higher margin, technology-driven Fenics business, which has grown to represent 25% of total BGC revenues during the fourth quarter and the year ended 2024. Over the past several years, we have invested in, and developed, new state-of-the-art trading platforms, including FMX UST, FMX FX, FMX Futures Exchange, PortfolioMatch, and Fenics GO, across Rates, FX, Equities, and Credit, respectively. We have also invested in, and deployed, trading technology solutions across our entire business, including our Voice and Hybrid brokerage desks, with an aim to increase our broker productivity and to accelerate trends of electronic conversion. Underpinning our efforts to automate and electronify our overall brokerage business are macro trends across the capital markets, where the adoption of electronic trading has accelerated in recent years.

We categorize our Fenics business as Fenics Markets and Fenics Growth Platforms as follows:

• Fenics Markets includes the Fully Electronic portion of BGC’s brokerage business, data, network and post-trade revenues that are unrelated to Fenics Growth Platforms, as well as Fenics Integrated revenues. Fenics Integrated seamlessly integrates hybrid liquidity with customer electronic orders either by GUI and/or API. Desks are categorized as “Fenics Integrated” if they utilize sufficient levels of technology such that significant amounts of their transactions can be or are executed without broker intervention and have expected pre-tax margins of at least 25%.

• Fenics Growth Platforms includes FMX UST, FMX FX, FMX Futures Exchange, Lucera, PortfolioMatch, Fenics GO, and our other newer standalone platforms. Revenues generated from data, network and post-trade attributable to Fenics Growth Platforms are included within their related businesses.

We leverage our platforms to provide real-time product and price discovery information and straight-through processing to our customers for an increasing number of products. Our end-to-end solution includes real-time and auction-based transaction processing, credit and risk management tools, and back-end processing and billing systems. Customers can access our trading application through our privately managed global high speed data network, over the Internet, or through third-party communication networks.

FMX provides fully electronic trading in cash treasuries, foreign exchange and U.S. interest rate futures by combining FMX’s U.S. Treasury business with our state-of-the-art FMX Futures Exchange. For more information about FMX, see “Item 7—Management’s Discussion and Analysis of Financial Condition and Results of Operations – Overview and Business Environment.”

ECS Brokerage

We provide brokerage services for most widely traded energy and commodities products, including futures and OTC products covering refined and crude oil, power and electricity, natural gas, liquefied natural gas, environmental and emissions products, weather derivatives, base metals, coal and soft commodities. We also provide brokerage services associated with the shipping of certain energy and commodities products.

Over the past few years, we have expanded our ECS business through strategic acquisitions, hires, and organic growth.

In March 2019, we acquired Ginga Petroleum, which provides a comprehensive range of brokerage services for physical and derivative energy products including naphtha, liquefied petroleum gas, fuel oil, biofuels, middle distillates, petrochemicals and gasoline.

In November 2019, we expanded our shipping brokerage services through our acquisition of Poten & Partners, a leading shipping brokerage, consulting and business intelligence firm specializing in liquefied natural gas, tanker and liquefied petroleum gas markets. Founded over 80 years ago and with 160 employees worldwide, Poten & Partners provides its clients with valuable insight into the international oil, gas and shipping markets.

In February 2023, we acquired Trident, which specializes in environmental products and OTC and exchange traded energy products. Trident bolsters our leading environmental brokerage business and complements our existing energy brokerage offerings.

In 2023, we announced the launch of our Weather Derivatives business, expanding BGC’s brokerage business into the weather and climate space. The Weather Derivatives business helps market participants analyze climate-related risks and mitigate their financial exposure. We are providing liquidity to these increasingly important markets as the role of weather and climate change impacts the way risk is managed. The launch of this business highlights BGC’s commitment to expand and explore new opportunities across the global energy and commodities space.

In October 2024, we acquired Sage, an energy and environmental brokerage firm, and announced we entered into a definitive agreement to acquire OTC Global, the largest global independent institutional energy and commodities brokerage firm.

Brokerage Categories

The following table identifies some of the key products that we broker, inclusive of those discussed above:

| | | | | | | | |

| Category | | Product Type |

| | |

| Rates | | Interest Rate Swaps, Interest Rate Options, Listed Rates Products, U.S. Treasuries, European Government Bonds, Other Global Government Bonds, Repurchase Agreements, Money Markets, Agency Fixed Income |

| | |

| Credit | | Corporate Bonds, High Yield Bonds, Emerging Market Bonds, Index CDS, Single Name CDS, Exotic Credit Derivatives, Asset-Backed Securities, Loans, Structured Products |

| | |

| Foreign Exchange | | Foreign Exchange Options, Spot FX, FX Forward, Non-Deliverable Forwards, Precious Metals |

| | |

| ECS | | Environmental/Emission Products, Weather Derivatives, Energy & Petrochemical Consulting, Shipping Brokerage, Power, Liquefied Natural Gas, Natural Gas, Base Metals, Dry Bulk (Coal & Iron Ore), Oil, Soft & Agricultural Products |

| | |

| Equities | | OTC Equity Derivatives, Listed Equity Futures & Options, Delta One Product, Convertibles, Cash Equities |

Certain trades in these key product types settle for clearing purposes with CF&Co, one of our affiliates. CF&Co is a member of FINRA and the FICC, a subsidiary of the DTCC. In addition, certain affiliated entities are subject to regulation by the CFTC, including CF&Co and BGCF. For certain products, we, BGCF and other affiliates act in a matched principal or principal capacity in markets by posting and/or acting upon quotes for our account. Such activity is intended, among other things, to assist us and other affiliates in managing proprietary positions (including, but not limited to, those established as a result of combination of trades and errors), facilitating transactions, framing markets, adding liquidity, increasing commissions and attracting order flow.

Technology Offerings

Our data, network and post-trade offerings provide a range of trade lifecycle services which include market data and analytics services, infrastructure and connectivity solutions, and post-trade services, such as risk mitigation, matching, and other data, network and post-trade optimization services. These businesses have highly recurring and compounding revenue bases, which are reported within our Fenics business.

Fenics Market Data™ is a supplier of real-time, tradable, indicative, end-of-day and historical market data. Our market data product suite includes fixed income, interest rate derivatives, credit derivatives, foreign exchange and money markets, energy and commodities, equity derivatives and regulatory solution market data products and services. The data is sourced from the Voice, Hybrid and Fully Electronic brokerage operations and made available to financial professionals, research analysts, compliance and surveillance departments, and other market participants via direct data feeds and BGC-hosted FTP environments, as well as via information platforms such as Bloomberg, LSEG Data & Analytics, ICE Data Services and other select specialist vendors.

Through our network business, we provide customized screen-based market solutions to both related and unrelated parties. Our clients are able to develop a marketplace, trade with their customers and access our network and our intellectual property. We can add advanced functionality to enable our customers to distribute branded products to their customers through online offerings and auctions, including private and reverse auctions, via our trading platform and global network.

As part of our network business, our Lucera® brand delivers high-performance technology solutions designed to be secure and scalable and to power demanding financial applications across several offerings: LumeFX® (distributed FX platform with managed infrastructure and software stack), LumeMarkets™ (multi-asset class aggregation platform), Connect™ (global SDN for rapid provisioning of connectivity to counter-parties), and Compute™ (on-demand, co-located compute services in key financial data centers).

Through kACE2, our analytics brand, we offer derivative price discovery, pricing analysis, risk management and trading software used by approximately 227 client sites in over 23 countries. Our clients include mid-tier banks, financial institutions and corporate clients. Our Gateway module links our client base with their counterparties, trading venues and regulators, and provides automated order flow, straight through processing, data distribution and regulatory reporting.

Our post-trade services include post-trade risk mitigation services that are designed to bring greater capital and operational efficiency to the global derivatives market. Our post-trade services assist clients in managing the growing cost of holding derivatives, while helping them to meet their regulatory mandates and promote sustainable growth and lower systemic risk and to improve resiliency in the industry.

Industry Recognition

Our businesses have consistently won global industry awards and accolades in recognition of their performance and achievements. Recent examples include:

•Fenics Market Data named Americas Data and Analytics Vendor of the Year at the GlobalCapital Americas Derivatives Awards 2024

•Fenics Market Data named Best Provider of Broker Market Data at the TradingTech Insight Awards Europe and USA 2024 for the second consecutive year

•Fenics Market Data named Best Market Data Provider (Broker) at the Inside Market Data & Inside Reference Data Awards 2024 for the third year in a row

•Fenics Market Data named Best Market Data Provider at the FX Markets Asia Awards 2024

•Fenics GO named OTC Trading Venue of the Year at the GlobalCapital Americas Derivatives Awards 2024

•Fenics GO named OTC Trading Venue of the Year at the Global and Americas Derivatives Awards 2024

•BGC Group named OTC Trading Venue of the Year at the GlobalCapital Americas Derivatives Awards 2024

•BGC Group named Interdealer Broker of the Year Europe and Asia at Global and Americas Derivatives Awards 2024

Customers and Clients

We primarily serve the wholesale financial and energy, commodity, and shipping markets, with clients including many of the world’s largest banks, brokerage houses, investment firms, hedge funds, investment banks, commodity trading firms and end users, such as producers and consumers. Customers using our products and services also include professional trading firms, futures commission merchants, and other professional market participants and financial institutions. Our market data products and services are available through many platforms and are available to a wide variety of capital market participants, including banks, brokerage firms, asset managers, hedge funds, investment analysts, compliance and surveillance professionals and financial advisors. For the year ended December 31, 2024, our top ten customers, collectively, accounted for approximately 27.1% of our total revenue on a consolidated basis, and our largest customer accounted for approximately 4.8% of our total revenue on a consolidated basis.

Sales and Marketing

Our brokers and salespeople are our primary marketing and sales resources, and utilize a combination of sales, marketing and co-marketing/co-branding campaigns. Our sales and marketing programs are aimed at enhancing the ability of our brokers to cross-sell effectively in addition to informing our customers about our product and service offerings. We leverage our customer relationships through a variety of direct marketing and sales initiatives and build and enhance our brand image through marketing and communications campaigns targeted at a diverse audience, including traders, potential partners and the investor and media communities.

Our brokerage product team is composed of product managers who are each responsible for a specific part of our brokerage business. The product managers seek to ensure that our brokers, across all regions, have access to technical expertise, support and multiple execution methods to grow and market their business.

Our team of business development professionals is responsible for growing our global footprint through raising awareness of our products and services. The business development team markets our products and services to new and existing customers. As part of this process, they analyze existing levels of business with these entities in order to identify potential areas of growth and also to cross-sell our multiple offerings.

Our Trading Technology

Pre-Trade Technology. Our financial brokers use a suite of pricing and analytical tools that have been developed both in-house and in cooperation with specialist software suppliers. The pre-trade software suite combines proprietary market data, pricing and calculation libraries, together with those outsourced from external providers. The tools in turn publish to a normalized, global market data distribution platform, allowing prices and rates to be distributed to our proprietary network, data vendor pages, secure websites and trading applications as indicative pricing.

Inter-Dealer and Wholesale Trading Technology. We utilize sophisticated proprietary electronic trading platforms to provide execution and market data services to our customers. The services are available through our proprietary API, FIX and a multi-asset proprietary trading platforms, operating under brands including BGC Trader™, CreditMatch®, Fenics®, FMX™, GFI ForexMatch®, BGCForex™, BGCCredit™, BGCRates™, FMX FX™, FMX UST™, FMX NDF™, FMX Repo™, FenicsDirect™, Fenics GO®, MidFX™, and GBX®. These platforms support a wide and constantly expanding range of products and services, which include U.S. Treasuries and other government bonds, Repos, OTC interest rate derivatives in multiple currencies, spot FX, NDFs, FX options, corporate bonds, credit derivatives and other products. Every product on the platforms is supported in either view-only, Hybrid/managed or Fully Electronic mode, and can be transitioned from one mode to the next in response to market demands. The flexible BGC technology stack is designed to support feature-rich workflows required by the Hybrid mode as well as delivering high throughput and low transaction latency required by the Fully Electronic mode. Trades executed by our customers in any mode are, when applicable, eligible for immediate electronic confirmation through direct STP links as well as STP hubs. The BGC trading platform services are operated out of several globally distributed data centers and delivered to customers over BGC’s global private network, third-party connectivity providers as well as the Internet. BGC’s proprietary graphical user interfaces and the API/FIX connectivity are deployed at hundreds of major banks and institutions and service thousands of users.

Post-Trade Straight Through Processing Technology. Our platform automates transaction processing, confirmation and other functions, substantially improving and reducing the cost of many of our customers’ back offices and enabling STP. In addition to our own system, confirmation and trade processing is also available through third-party hubs, including MarkitWIRE, ICElink, Reuters RTNS, and STP in FIX for various banks.