UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(mark one)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2006

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 000-51595

Website Pros, Inc.

(Exact name of registrant as specified in its charter)

| | |

| Delaware | | 94-3327894 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | |

| 12735 Gran Bay Parkway West, Building 200, Jacksonville, FL | | 32258 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (904) 680-6600

Securities registered pursuant to Section 12(b) of the Act: None.

Securities registered pursuant to section 12(g) of the Act:

Common Stock, $0.001 par value

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ¨ Yes x No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ¨ Yes x No

Indicate by checkmark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x Yes ¨ No

Indicate by checkmark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K(§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

| | | | |

Large accelerated filer ¨ | | Accelerated filer x | | Non-accelerated filer ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). ¨ Yes x No

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant was approximately $103,340,587 as of June 30, 2006, based upon the closing sale price of the common stock as quoted by the NASDAQ Global Market reported for such date. Shares of common stock held by each executive officer and each director and by each person who is known by the registrant to own 5% or more of the outstanding common stock have been excluded from this calculation as such persons may be deemed affiliates. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

As of February 28, 2007, the registrant had 17,382,616 shares of common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Parts of the Proxy Statement for the registrant’s 2007 Annual Meeting of Stockholders, to be filed with the Securities and Exchange Commission pursuant to Regulation 14A not later than 120 days after the end of the fiscal year covered by this Form 10-K, are incorporated by reference in Part III of this Form 10-K.

TABLE OF CONTENTS

PART I

Item 1. Business.

This Form 10-K and the documents incorporated herein by reference contain forward-looking statements that involve risks and uncertainties. Actual results may differ materially from those expressed in forward-looking statements. See Item 1A of Part I—“Risk Factors.”

Website Pros, Inc. (“we,” “Website Pros” or the “Company”) believe we are a leading provider, based on our number of subscribers, of Do-It-For-Me Web services and lead generation products that enable small and medium-sized businesses to establish, maintain, promote, and optimize their Internet presence. Our primary service offerings, eWorks! XL and SmartClicks, are comprehensive performance-based packages that include Website design and publishing, Internet marketing and advertising, search engine optimization, search engine submission, lead generation and easy-to-understand Web analytics. As an application service provider, or ASP, we offer our customers a full range of Web services and products on an affordable subscription basis. In addition to our primary service offerings, we provide a variety of premium services to customers who desire more advanced capabilities; such as e-commerce solutions and other sophisticated Internet marketing services and online lead generation. The breadth and flexibility of our offerings allow us to address the Web services needs of a wide variety of customers, ranging from those just establishing their Websites to those that want to enhance their existing Internet presence with more sophisticated marketing and lead generation services. Additionally, as the Internet continues to evolve, we will refine and expand our service offerings to keep our customers at the forefront.

Through the combination of our proprietary Website publishing and management software, automated workflow processes, and specialized workforce development and management techniques, we believe we achieve production efficiencies that enable us to offer sophisticated Web services at affordable rates. Our technology automates many aspects of creating, maintaining, enhancing, and marketing semi-custom Websites on behalf of our customers. With approximately 74,000 subscribers to our eWorks! XL, SmartClicks, and premium subscription-based services as of December 31, 2006, we believe we are one of the industry’s largest providers of affordable Web services and products that enable small and medium-sized businesses to have an effective Internet presence.

We sell our Web services and products to customers identified primarily through strategic marketing relationships with established brand name companies that have large numbers of small and medium-sized business customers, including Discover Financial Services, LLC, or Discover. We have a direct sales force that utilizes leads generated by our strategic marketing relationships to acquire new customers at our sales centers in Spokane, Washington; Jacksonville, Florida; Manassas, Virginia; Norton, Virginia; and Halifax, Nova Scotia. Our sales force specializes in selling to small and medium-sized businesses across a wide variety of industries throughout the United States.

In September 2006, we acquired substantially all of the assets of, and assumed certain liabilities from 1ShoppingCart.com Canada Corp. and 1ShoppingCart.com Corp. (together, “1ShoppingCart.com”), a leading provider of shopping cart, internet marketing and eCommerce/eBusiness solutions and services based in Barrie, Ontario in exchange for approximately $12.5 million in cash. We believe that the 1ShoppingCart.com acquisition brings a strong group of private-labeled resellers and affiliates that will enable cross- and up-sell opportunities for our complementary Web services, internet marketing and eCommerce solutions, which are all geared to satisfying the needs of small and medium-sized businesses.

In September 2006, we acquired substantially all of the assets of, and assumed certain liabilities from Renex, Inc. (“Renex”) an online lead generation marketplace for contractors and homeowners based in Halifax, Nova Scotia in exchange for $7.0 million in cash. In connection with the transaction if certain requirements are met, we also agreed to issue 277,496 shares of our common stock valued at approximately $3.0 million to Renex to be equally distributed on September 30, 2007 and September 30, 2008 as additional consideration for the acquired assets. In

1

addition, if certain other requirements are met during the twelve months following September 30, 2006, we will pay Renex contingent consideration up to an additional $1.0 million. We believe that the Renex acquisition will enhance our ability to provide a one-stop shop for comprehensive, affordable Website and online advertising solutions for small and medium-sized businesses and is in line with our long-term strategic direction of providing targeted, high value solutions to customers in specific vertical markets.

Our Approach and Solution

We have built our business around a subscription-based ASP model that allows small and medium-sized businesses to affordably outsource their Web service needs to us. The key elements of our business model and approach are:

Providing Comprehensive Solutions for Small and Medium-Sized Businesses. Our goal is to enable small and medium-sized businesses to outsource their Web services needs to us. Our experience is that many small and medium-sized businesses do not have the in-house expertise to effectively design an Internet presence that will generate adequate traffic to their Websites and increase direct consumer interaction. As a result, our customers look to us to provide these services. Our Web services include, among other features, Website design and publishing, local, regional, and national Internet marketing and advertising, search engine optimization, search engine submission, lead generation and Web analytics. We believe this combination provides our customers with a comprehensive solution to their Web services needs.

Offering Affordable Subscription-Based Solutions. Because our customer base is value-driven, we provide our Web services on an affordable subscription basis. Our eWorks! XL and SmartClicks customers typically pay a recurring monthly fee ranging from approximately $60 to over $100, depending on which services and products they purchase. Additionally, we offer a premium Internet marketing service targeted at businesses with significant spending on local print yellow pages advertising. This service is priced at an average of approximately $300 per month, which we believe is significantly less than the typical cost of traditional campaigns such as half- or full-page print yellow pages advertisements. We offer 1ShoppingCart.com eCommerce and online marketing solutions typically on a recurring monthly fee ranging from approximately $29 to $79 per month. Through Renex, we target contractors in the home services businesses with lead packages ranging in price from $50 to $1500, based on the specific trade vertical and geographic area.

Streamlining Operations for Customer Acquisition, Fulfillment, and Support. We utilize proprietary workflow processes and customer relationship management systems, together with a combination of integrated template-driven and specialized Website design tools, to sell, design, and support our Web services and products. We believe this integrated infrastructure has enabled us to significantly reduce the time from initial customer contact to site completion. Our goal is to design a Website and have it complete and visible on the Internet within 72 hours from the time we receive initial information from the customer. Additionally, we have extensive experience promoting, selling, and supporting our Web services and products to small and medium-sized businesses.

Forming and Enhancing Strategic Marketing Relationships. We focus on forming strategic marketing relationships with companies that have large customer bases of small and medium-sized businesses. These companies generate leads for us by providing lists of their customers, conducting e-mail marketing campaigns about our Web services and products, advertising our Web services and products on the Internet, and using other forms of both direct and indirect solicitation. These companies filter the customer lists they provide to us using a number of criteria that we believe indicate when a small or medium-sized business is likely to understand the value of our Web services and products. Our most productive strategic marketing relationship is with Discover.

1ShoppingCart.com and Renex provide additional sales channels for our core Web services products. 1ShoppingCart.com has a network of affiliate and private-label resellers that are prospects for our other services and that can be leveraged to offer our services to their customers. Renex’s growing network of home services contractors is also a source of prospective customers for Website and online promotional services.

2

Our Strategy

Our objective is to enhance our position as a leading provider of Web services and products for small to medium-sized businesses. Key elements of our strategy include:

Continuing to Target the Small and Medium-Sized Business Market Segment. We believe the small and medium-sized business market offers us the best opportunity to continue building a leading national Web services company. We believe this is an attractive market because it is large and because these businesses need a comprehensive, affordable solution to their Web services requirements. Our Web services meet critical business needs of these businesses that they often do not have the time, resources, or technical skills to fulfill themselves.

Developing or Acquiring Complementary Services and Technologies. We sell Web services and products that are essential to an effective Internet presence such as local and regional lead generation, search engine optimization, Website search tools, affiliate marketing networks, and Web analytics. While we currently provide many of these services through our relationships and agreements with other vendors, we will seek opportunities either to internally develop some or all of these services and products or acquire businesses that provide them. Additionally, we may seek to acquire companies with existing customer bases in our target market into which we can cross-sell our Web services and products.

Expanding our Distribution Channels. To sell our Web services and products cost efficiently, we capitalize on the connection those organizations, with which we have strategic marketing relationships, have with their small and medium-sized business customers. We plan both to expand the scope of our current strategic marketing relationships, as well as to develop additional strategic marketing relationships with organizations that have strong brand recognition with small and medium-sized businesses. We also expect to increase our marketing and sales activities so that a larger proportion of our customers are acquired through increased direct sales and new reseller programs. 1ShoppingCart.com and Renex also provide additional opportunities to expand and diversify our distribution channels.

Selling Additional Services and Products to Existing Customers. As of December 31, 2006, we had approximately 74,000 subscribers to our eWorks! XL, SmartClicks, and premium subscription-based services. As customers build their Internet presence, we believe that we can demonstrate the value of the additional premium services and products we offer, which can increase our average revenue per customer and improve our revenue growth. For example, we can provide paid search and e-commerce capabilities to our current customers’ Websites, enabling additional sources of revenue for them while also contributing to a measurable return on their investment.

Strengthening Customer Retention. We are dedicated to enhancing customer retention and building lasting relationships with our customers. We believe it is critical to customer retention to target small and medium-sized businesses that already understand the value of the Internet to their success. Improving customer retention also requires maximizing customer loyalty. Therefore, we are focused on customer satisfaction, consistent communication, Web service and product enhancements, and high quality customer service. Additionally, we believe that by educating our existing and prospective customers about the value of our services to their businesses we can build lasting customer relationships.

Extending Our Position as an Affordable ASP. Through the combination of our operational scale and geographical locations, we believe that we have been able to minimize the cost of delivering our Web services and products. Our template-driven processes enable us to handle orders efficiently. We have strategically located our primary sales and fulfillment facilities in the lower-cost areas of Jacksonville, Florida; Spokane, Washington; and Norton, Virginia, which helps us to better manage our cost of operations even as we expand. In the future, we may look to new international labor markets to further reduce the cost of providing our Web services and products.

3

Our Services and Products

Our goal is to provide a broad range of Web services and products that enable small and medium-sized businesses to establish, maintain, promote, and optimize their Internet presence. By providing a comprehensive performance-based offering, we are able to sell to customers whether or not they have already established an Internet presence. Our Web services and products can be categorized into the following offerings:

eWorks! XL Subscription-Based Services

Using our proprietary software and workflow enabled processes, we develop and support subscription Web service packages that include a 5, 10, 20, or 40 page semi-custom Website and related services. These comprehensive packages include the tools and functionality necessary for a business to create, maintain, enhance, and market a successful and effective online presence. We build, test, and publish the Websites and provide related services for our customers. We also provide tutorials and tools for customers to edit and manage their sites. Alternatively, customers can select from one of several levels of support programs for ongoing management and maintenance of their Websites.

Our primary subscription offering is eWorks! XL, a comprehensive Website design and publishing package targeted at getting small and medium-sized businesses online quickly, effectively, and affordably when they have no Internet presence, or a limited one. The package includes a five-page semi-custom Website built on our proprietary self-editing tool, which allows for easy maintenance by the customer. By using our comprehensive, performance-based package of services, customers eliminate the need to buy, install, or maintain hardware or software to manage their Internet presence. This offering includes a broad set of configuration and customization options using a Web browser.

We build the initial Website for the customer using the content and design information the customer provides. Our goal is to have a customer’s Website visible on the Internet within 72 hours from the time we receive initial information from the customer.

eWorks! XL includes:

| | • | | Initial Site Design. One of our design specialists begins the process by interviewing the customer and collecting data about the customer’s business. Using our NetObjects MatrixBuilder software, we then create a unique Website tailored to the customer’s specific needs using one of our templates. Every site we build goes through an extensive quality review and assurance process prior to being published on the Internet. Additionally, every site undergoes a thorough Website optimization process to enhance search engine placement. |

| | • | | Online Marketing. We offer our customers online marketing capabilities that cost-effectively promote their Websites on a local and national basis. The package includes initial submission and ongoing submissions on a regular basis of the customers’ Websites to many popular search engines. Additionally, eWorks! XL includes listings in online yellow page directories, banner advertisements, search engine optimization tools, and educational guides targeted to small businesses. |

| | • | | Performance Scorecard. Customers receive a detailed report of their Website traffic, including visitors generated through the online marketing and advertising services provided in their eWorks! XL package. |

| | • | | Unique 800 Telephone Number. Customers receive a unique 800 number that is forwarded to their business telephone line. Information about the calls received through the 800 number are tracked and reported on the Performance Scorecard. |

| | • | | E-mail Marketing. We provide an e-mail marketing tool that enables our customers to easily communicate with their customers and prospects. To assist our customers in collecting e-mail addresses, every Website includes a subscription sign-up box for site visitors to provide their e-mail information. |

4

| | • | | Webmail. Every customer receives three e-mail boxes tied to its domain name. Webmail is compatible with Microsoft Outlook and features advanced filtering and search capabilities and automatic mail forwarding and responding. |

| | • | | Online Web Tools. eWorks! XL includes advanced online tools such as a forms manager, polling and survey capabilities, a guest book, and site search features that offer interactive Website management capabilities. |

| | • | | Modifications and Redesign Service. Customers can choose between several different levels of support, which range from having us make ongoing changes to using the self-edit tools we provide. The basic service included with eWorks! XL includes 30 minutes per month of free modification and phone consultation with one of our Web designers. |

| | • | | Domain Name Registration. We obtain, purchase, and register a domain name appropriate for the business selected by the customer. |

| | • | | Hosting and Technical Support. Our hosting platform offers technology and security designed to ensure the reliable daily operation of a customer’s Website. Our secure Web hosting includes disk storage, daily backups, and a monthly data transfer allotment. We also offer technical support, including services to our customers to provide the information and consultation they need to build and manage an effective online presence. |

SmartClicks Subscription-Based Services

In February 2006, we introduced SmartClicks, which is a performance-based service with a higher subscription fee than our eWorks! XL offering. Our SmartClicks offering is targeted at customers that want additional online advertising in their local service areas. SmartClicks includes all of the benefits provided in the eWorks! XL bundle and the added benefit of guaranteed pay-per-click advertising in Google and other major search engines.

SmartClicks customers are guaranteed a minimum of 20 clicks per month through Google pay-per-click advertising. 50-click bundles are also available for certain business categories and geographical markets. An added value of the SmartClicks package is the advertising management function Website Pros performs for these customers. We create the pay-per-click ads, buy appropriate keywords and monitor the programs’ performance.

Premium Subscription-Based Services

In addition to our eWorks! XL and SmartClicks subscription-based Web services, we offer a number of premium subscription-based services and functionalities for an additional fee. These premium subscription-based services are available to our eWorks! XL customers, to customers of our custom Website design services and, in most cases, to customers for whom we have not built a Website but who otherwise require these Web services. These premium subscription-based services include:

| | • | | E-Commerce Solutions. We offer a comprehensive set of services that enable businesses to sell their services and products online. Our service offering includes creating the online store catalog and secure shopping cart, establishing an online merchant account and assisting in setting up online payment and order processing. |

| | • | | Power Marketing Bundles. Our Power Marketing package is an array of services and products we sell to customers that want increased local or national exposure on the Internet. Options include geographically targeted banner advertisements, additional online yellow page listings, and search engine submission tools. |

| | • | | Visibility Online. We bundle a number of different services contained in our eWorks! XL package into our Visibility Online offering, which is designed to enhance the effectiveness of an online marketing program for our non-eWorks! XL customers. These services include initial search engine optimization, |

5

| | search engine inclusion, Yahoo! Site Match paid inclusion, listing in Yahoo! Yellow Pages, AOL Yellow Pages Promotional listing, site submission to many popular search engines, banner advertisements, and search submission tools. |

| | • | | Internet Yellow Pages. We work with customers to design an advertising program using several Internet yellow page directories. This provides our customers the ability to target specific buyers for their own services and products locally, regionally, or nationally. |

| | • | | LEADS.com Total Coverage. We create custom-designed local Internet advertising campaigns for businesses that want to generate business leads in one or more local markets. These Total Coverage campaigns appear on leading local sites such as Yahoo! Yellow Pages, Yahoo! Local Search, Google, Google Local, Switchboard, and Looksmart. |

| | • | | Custom Design Extras. We offer several custom design features and services, including map and directions pages, external links pages, the ability to increase the number of products listed on a customer’s Website, more advanced Website statistics, database applications, password security, expanded e-mail services, and premium hosting services. |

Custom Web Design

We offer complete custom Website design services that provide sophisticated functionality and interactivity beyond those available under eWorks! XL and SmartClicks. These sites are typically built for larger, more established customers that have had an Internet presence in the past, or that are designing the first Website with unique specifications. Customers work directly with our experienced Web designers to build a fully customized Website. Additionally, we are able to sell any of our subscription-based Web services and products to our custom Web design customers.

Our team of custom design professionals includes experienced Web designers, programmers, copywriters, and search engine optimization experts who work together to ensure that the customer’s online business objectives are met. Custom sites are built on our NetObjects Fusion software or other sophisticated design tools that provide the flexibility and functionality to meet advanced business needs. Custom sites can include flash, animation, e-commerce solutions, sophisticated interactivity and database functionality.

Web Authoring Software

We offer NetObjects Fusion, our desktop Web authoring software, for businesses that want to design Websites either for themselves or for others. Combining easy-to-use wizards, drag-and-drop simplicity, and design tools, NetObjects Fusion offers the flexibility to be an intuitive Website building software for novices, as well as an advanced tool for Website development professionals. NetObjects Fusion offers features that allow Website professionals to build Websites quickly, while still enabling these professionals to offer the flexibility and functionality their clients often require. NetObjects Fusion includes e-commerce capabilities, database functionality, and image manipulation tools that Website professionals find useful in building clients’ sites.

Online Business Automation

Through 1ShoppingCart.com, we offer a robust set of sales and marketing tools for businesses selling products and services online. 1ShoppingCart.com offers an ASP, subscription-based shopping cart solution with add-on modules that allow small and medium-sized businesses to create, promote and manage their online presence. Services include a comprehensive affiliate management program, email marketing, auto-responders and ad trackers.

Lead Generation

We offer targeted lead generation services for various business categories through Renex and LEADS.com. Renex is a competitive marketplace that matches homeowners in need of remodeling services with qualified

6

contractors in their local area. Through a subscription-based model, contractors purchase these leads, giving them the opportunity to bid on the homeowner’s project. LEADS.com offers leads in other home services categories such as plumbers, landscapers, roofers and painters.

Operations

We have invested significant time and capital resources in a set of internal processes and proprietary technologies designed to enable high-scale, high-quality mass customization of our Web services.

eWorks! XL

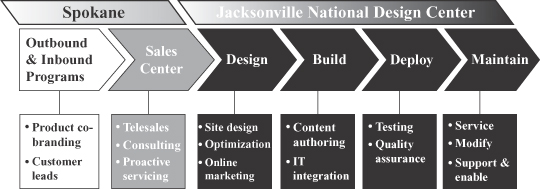

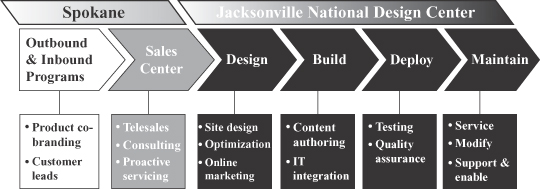

The workflow of our sales and fulfillment process for eWorks! XL is illustrated below.

Utilizing leads provided by our strategic marketing relationships, we identify potential customers through a combination of our outbound and inbound telesales programs. Once our sales specialists have determined that a lead is a potential customer, the customer call is transferred directly to a Web services consultant. In most cases, this transfer takes place immediately so that customer contact is not interrupted. The Web services consultant conducts a Web design interview during which we collect information about the customer, request customer-specific content, and proactively help the customer design an effective Internet presence based on the goals for its business. Several discrete quality checks on each sale help us maximize the quality of the sale.

Using our proprietary workflow process and customer relationship management software, the interview notes and content gathered by our Web services consultants are then transmitted to our national design center. At this point, our design specialists use the notes and content collected, our proprietary design tool and one of hundreds of design templates that can be modified using a wide variety of color themes and graphics to design a semi-custom Website for the customer. After completion of the Website, a separate quality assurance process is automatically triggered by our proprietary workflow process and customer relationship management software. This quality assurance process includes testing of the Website, reviewing notes and customer-supplied content, confirming appropriateness of styles used, and generally ensuring that the quality of the resulting Internet presence is consistent with our high standards. Following quality assurance, the Website is published and hosted, and the customer is notified that the Website is complete.

By utilizing our proprietary workflow process and customer relationship management software, specialized design tools, a large database of design templates, and several years of experience, we have been able to decrease the time of development and increase the utilization rate of our sales, design, and support staff. Our goal is to complete this process, from customer call to initial Website deployment, within 72 hours. After the Website is available on the Internet, we help our customers maintain, modify, and upgrade their Internet presence.

For all of our customers, we also provide periodic newsletters and other informational items to increase our number of customer contact events. We actively seek to interact with our customers at a variety of times during

7

the customer life cycle through different media. Through experience and testing, we have found increased contact with customers helps to improve customer loyalty and enhance their understanding of the value of our services and products. We have also initiated several programs to foster customer loyalty, including numerous customer surveys that measure the quality of our service and the effectiveness of our products, a dedicated customer satisfaction team that follows up telephonically with every customer responding negatively to any of our surveys, segmented design experts for handling design changes quickly and professionally, and the introduction of an intensive training curriculum required for all customer care agents.

We maintain two data centers located in Jacksonville, Florida and Spokane, Washington, for most of our internal operations. Servers that provide our customers’ Website data to the Internet are located within a third-party co-location facility located in Jacksonville, Florida. This co-location facility has a secured network infrastructure including intrusion detection at the router level. Our contract obligates our co-location provider to provide us a secured space within their overall data center. The facility is secured through card-key numeric entry and biometric access. Infrared detectors are used throughout the facility. In addition, the co-location facility is staffed 24 hours a day, 7 days a week, with experts to manage and monitor the carrier networks and network access. The co-location facility staff provides 24-hour security through camera-controlled views of our equipment. The co-location facility provides multiple Internet carriers to help ensure bandwidth availability to our customers. The availability of electric power at the co-location facility is provided through multiple uninterruptible power supply and generator systems should power supplied by the Jacksonville Electric Authority fail. We plan to renew our agreement with the co-location facility, which expires on May 1, 2008.

Customer data is redundant through the use of multiple application and Web servers. Customer data is backed up to other disk arrays with fail-over to help ensure high availability. Customer data is also maintained at our national design center and can be republished from archival data at any time through our Oracle 9i database system. Currently, this process could take approximately 24 hours. Our financial system reporting also uses our redundant Oracle systems and can be reconstituted in approximately 12 hours.

We are currently working with our co-location provider to establish a disaster recovery backup operation at one of the provider’s alternative locations. This would provide a working fail-over site to prevent a disruption of our customers’ Websites should the Jacksonville co-location site become unavailable. The facilities are connected by fiber-optic rings to our co-location provider’s other centers.

LEADS.com Internet Marketing Packages and Lead Generation

Potential customers for our Internet Marketing packages are identified primarily using an outbound telesales program based in Manassas, Virginia. This program targets businesses with established traditional print yellow pages advertising campaigns. Customers who purchase our Internet Marketing package offering are interviewed and advertising information is entered into our proprietary publishing system. Local advertisements are then customized for several distribution platforms, such as Yahoo! Yellow Pages and Google search, and then published to these platforms. Customers receive a monthly report that tracks the number of impressions, clicks, and calls generated by each advertisement that we place on their behalf. LEADS.com also offers lead generation products through their outbound telesales efforts to small businesses in a variety of industries including home services. In addition to selling Internet Marketing packages and lead generation, the LEADS.com sales force sells eWorks! XL Websites to their customer base.

1ShoppingCart.com Integrated E-commerce Solution

Prospects for our 1ShoppingCart.com eCommerce product are typically small business customers that are interested in establishing an online business. Our eCommerce engine integrates a variety of marketing and advertising modules that can be purchased as a bundle, or sold individually. In addition to establishing their business online, our customers can market their services through our email marketing system and auto-responders, track the effectiveness of their advertising and marketing efforts and establish, manage and maintain a robust affiliate program.

8

Potential customers can also test our services through a paid online trial. Once a customer downloads the trial of our software, we contact them through a series of email communications and auto-responders to encourage conversion of the trial to a paid subscription and to upsell other services.

Our customer data is stored on systems that are compliant and certified to meet Visa International’s Payment Card Industry Data Standards. We have a highly available redundant infrastructure, which provides disaster recovery backup to prevent a disruption of our customers’ eCommerce presence.

Renex Lead Generation Services

We market our Renex services to homeowners through targeted television and online advertising. Homeowners complete a brief online form describing their remodeling need and their approximate budget. Renex receives the online lead and sends it to up to 60 local contractors in the Renex database. The first 4 qualified contractors that respond are provided the homeowner’s contact information and then work directly with the homeowner to scope the project and provide cost estimates to the homeowner. Renex will also provide the homeowner with financial leads if the homeowner wishes to borrow money to fund the project.

Our services are marketed to contractors online and through our outbound telesales program in Halifax, Nova Scotia. We also offer a Customer Relationship Lead Management system (CRM system) to contractors, free of charge that allows them to manage all of their leads and projects in a comprehensive, easy-to-use system. Contractors utilizing the free CRM system are prime prospects for lead generation services.

Technology

Our hardware and software infrastructure provides an advanced set of integrated tools for design, service, modifications, and billing. NetObjects MatrixBuilder enables Website design, end user modification and administration, and includes a variety of other tools accessible by our customers. Our Oracle-based proprietary workflow processes and customer relationship management software, which we developed internally, helps ensure that our production staff provides timely and efficient design services and helps us to efficiently and cost-effectively manage our customer base.

Our proprietary workflow processes and customer relationship management software enables us to build, maintain, and track large numbers of customer Websites. The configuration of software and hardware includes six key modules:

| | • | | Account Management. The account management module facilitates the creation and maintenance of a customer account and the consolidation, either manually or electronically through external submission, of pertinent customer demographics, product specifics, and billing information. We track critical aspects of customer activity, which allows customer service representatives to have immediate access to a customer’s complete account history. |

| | • | | Design Tool. Our design tool, NetObjects MatrixBuilder, is browser based, supports major Web services standards, and can be easily co-branded or private labeled for an organization with which we have a strategic relationship. NetObjects MatrixBuilder is template-based, yet can provide thousands of different Website styles by using hundreds of design templates that can be modified using a wide variety of color themes and graphics. The design tool generates the HTML code, so that manual coding is not required, and facilitates the generation of domain name registration, an e-commerce storefront, and a number of other extended and value added services that our customers can access from any Web browser. |

| | • | | Workflow Module. The workflow module expedites service and product delivery by automatically determining the required production path, such as design, quality control, or submission to search engines, based on the specific attributes of the customer or service. The workflow module also controls |

9

| | production flow through our organization, enabling our design and customer support staff to individually service our Website customers either by routing their work automatically to the correct department or handling the request themselves. |

| | • | | Billing Module. The billing module enables us to bill our subscription and custom design customers directly or to bill a third party in the aggregate for its end users. The billing module is integrated with a number of transaction processing tools enabling support for many different payment types. |

| | • | | LEADS.com Publishing and Tracking System. We operate a proprietary publishing and tracking system that allows the automated building, publishing, and tracking of advertisement campaigns. These campaigns currently are published on Yahoo!, Google, Idearc (formerly Verizon Superpages), Switchboard, Looksmart and other sites affiliated with these providers. |

| | • | | Renex Telephony Software. Our proprietary software application enables us to systematically manage the relationships and interactions with homeowners and contractors in Renex’s database, enhancing the efficiency and productivity of our sales and account management teams. |

Sales Channels

Sales of Subscription Services

Our sales organization for our subscription Web services and products comprises several distinct sales channels, including:

Outbound Telesales. The organizations with which we have strategic marketing relationships provide us with lists of their small and medium-sized business clients who meet a broad set of criteria. We analyze these customer lists to determine which of these customers best match our criteria for long-term clients. Our sales specialists call these prospective customers during regular business hours to discuss their Web services needs. We believe the brand and affinity relationship these prospective customers have with the parties with which we have strategic marketing relationships enhances our ability to reach a decision maker, make a presentation, have our offer considered, and close the sale during the initial call.

As of December 31, 2006, we had 128 employees in our outbound telesales unit located in our national sales center in Spokane, Washington. Additionally, we had 18, 29 and 10 employees in our outbound LEADS.com telesales units located in Manassas and Norton, Virginia and Jacksonville, Florida, respectively, and 4 employees in our outbound Renex telesales unit in Halifax, Nova Scotia. With the benefit of having conducted several years of outbound telesales activities, we have significant management, business process, training, and product expertise within our sales team. Additionally, we employ practices designed to optimize the management of our employees and increase their sales performance.

Inbound Telesales. We maintain a separate team of sales specialists specifically focused on responding to inbound inquiries generated by programs initiated by us and the organizations with which we have strategic marketing relationships. We and these organizations employ a mix of e-mail, direct mail, Website, and other marketing efforts to help promote our services to prospective clients. As of December 31, 2006, we had 104 employees in our inbound telesales unit.

Reseller Program. Several of the parties with which we have strategic marketing relationships have their own direct sales organizations. We have worked closely with these resellers to develop sales support and fulfillment processes that integrate with the resellers’ sales, service, support, and billing practices. Additionally, we provide these resellers with training and sales materials to support the Web services being offered. Companies that currently resell our services and products through their sales organizations include Yahoo!, Earthlink and Register.com.

Online Channel. We promote our services through the websitepros.com, LEADS.com, RenovationExperts.com and 1ShoppingCart.com Websites. To drive prospects to our sites, we engage in online marketing and advertising

10

campaigns, conduct targeted television campaigns to reach homeowners for Renex and participate in seminars targeting small businesses that wish to sell their services online. Our partners also promote our services by including our products on their Websites and by including our services in their ongoing marketing and promotional efforts with their customers.

Affiliate Network and Private Label Partners. We sell our shopping cart and business automation solutions through direct online channels and through approximately 3,000 affiliate and private-label partners that market our services on our behalf. These partners are provided with ongoing marketing and technical support to ensure a positive customer experience for their end customers.

Sales of NetObjects Fusion

We sell NetObjects Fusion through direct sales, original equipment manufacturers, or OEMs, software bundles, and retail and reseller distribution.

Direct Sales. We sell NetObjects Fusion through strategic e-mail marketing campaigns aimed at users of prior versions of the software, people that use the product on a trial basis, newsletter subscribers, and Website visitors. In Europe, we also utilize magazine covermounts, which European magazines utilize to differentiate themselves. With a covermount, a copy of an older version of NetObjects Fusion is provided free with the purchase of the magazine. We require the recipient of the free version to register with us directly to be able to use the free copy of the software. The new user of the software becomes a prospect for new versions of NetObjects Fusion and for the other software products we offer.

OEM Software Bundles. A number of OEMs are offering NetObjects Fusion as part of their packaged product offerings. As needed, we customize the NetObjects Fusion application to meet the OEM’s specifications and to feature the OEM’s products and brands within the software. Typically, an older version of NetObjects Fusion is offered through OEM bundles, which we believe facilitates later sales of newer versions to these users. The OEMs with which we currently work include Avanquest Deutschland GmbH and Deutsche Telekom AG.

Retail and Reseller Distribution. We work with resellers in the United States, Europe and Australia to sell NetObjects Fusion. These distributors supply smaller resellers, retailers and value added resellers in their markets with NetObjects Fusion.

Strategic Marketing Relationships

A key part of our sales strategy is to leverage the brand and distribution of organizations with which we have strategic marketing relationships to sell our Web services and products. We have developed strategic marketing relationships with well-known, brand name companies, such as Discover. We create sales material with each of these organizations, highlighting our Web services and products while also leveraging their brand. Then, on behalf of these companies, we initiate programs where our sales representatives directly contact their small and medium-sized business customers using telesales solicitation, direct mail, and online contact.

Pursuant to our agreement with Discover, they provide us with customer lists and related billing services, and we share revenue derived from sales of our Web services and products to customers derived from Discover’s lists. Our agreement with Discover is terminable by them or us on short notice, and expires pursuant to its terms in November 2007.

Customers attributable to our strategic marketing relationship with Discover represented approximately 51% of our total revenue during the year ended December 31, 2006. VistaPrint, another strategic marketing partner, also provides customer lists of small businesses in need of Web services. IBM historically has been a key reference for us and has facilitated other strategic marketing relationships, in addition to making its customer list available to us for a sales program.

11

We offer a number of benefits to the companies with whom we have established strategic marketing relationships. First, they are able to increase their revenue through the marketing fees paid by us. Second, we allow these companies to offer a comprehensive solution for delivering Web services to their small and medium-sized business customers. This can result in increased loyalty of their customer base and an overall strengthening of their customer relationships. Third, by providing our Web services to their customers through us, we enable them to differentiate their offering from that of their competitors.

Marketing

We engage in a variety of marketing activities to increase awareness of our services and products, to sell additional services and products to our existing customer base, and to enhance the value we provide to small and medium-sized business entities. Our marketing activities include:

| | • | | Targeted e-mail and direct response campaigns to prospects and customers; |

| | • | | Search engine and other online advertising; |

| | • | | Electronic customer newsletters; |

| | • | | Website Pros, LEADS.com, NetObjects Fusion, 1ShoppingCart and Renex Websites; |

| | • | | Online customer tutorials; and |

Customers

We generally target small and medium-sized businesses having fewer than 100 employees. These customers normally are focused on regional or local markets. We seek to create long-term relationships with our customers, who cover a diverse set of industries and geographies in the United States. Our customers fall into over 80 discrete industry classification categories. As of December 31, 2006, the ten largest categories consisted of restaurants, automobile repair and services, clothing accessories and footwear, salons and barbershops, business and professional services, gift, novelty and promotional items, plumbing and HVAC, health foods and supplements, construction, and jewelry and timepieces. As of December 31, 2006, we had approximately 74,000 subscribers to our eWorks! XL, SmartClicks, and premium subscription-based services.

We also target small and medium-sized businesses with significant monthly spending on local print yellow pages advertising. We seek to create long-term relationships with these businesses by helping them locate new customers at a significantly lower cost per lead compared to traditional print yellow pages marketing campaigns.

12

Third-Party Providers

We offer some of our services to our customers through third-party technology vendors, which helps us to expand our services and create additional revenue opportunities. Some of our current third-party providers are:

| | |

Company | | Technology or Service |

| |

Amacai | | Internet yellow pages |

| |

AOL (Mapquest) | | Mapping services |

| |

Constant Contact | | E-mail marketing |

| |

eBay (Kurant) | | E-commerce storefront software |

| |

eBay (PayPal) | | E-commerce payment systems |

| |

eStara | | 800 telephone numbers |

| |

Google | | Local and national search engine marketing and submission |

| |

Google (Urchin) | | Website analytics |

| |

Network Solutions | | Domain name services and security certificate services |

| |

Switchboard | | Online directory / yellow pages |

| |

Yahoo! | | Yahoo!’s Internet yellow pages and local and national search engine marketing |

| |

Yahoo! (Overture) | | Search engine submission services (Alltheweb, AltaVista, Excite) |

We do not have long-term contracts with any of these third parties. Accordingly, we or any of these providers can terminate the relationship at any time, for any reason or no reason, on short notice, often as little as 30 days. If any of these relationships terminate, we may need to seek an alternative provider of services or develop the covered services independently.

Competition

The market for Web services is highly competitive and evolving. We expect competition to increase from existing competitors as well as new market entrants. Most existing competitors typically offer a limited number of specialized solutions and services, but may provide a more comprehensive set of services in the future. These competitors include, among others, Website designers, Internet service providers, Internet search engine providers, local business directory providers, Website domain name registrars, eCommerce service providers, lead generation companies and hosting companies. These competitors may have greater resources, more brand recognition, and larger installed bases of customers than we do, and we cannot ensure that we will be able to compete favorably against them. Our NetObjects Fusion software has two principal competitors: Macromedia Dreamweaver and Adobe GoLive.

We believe the principal competitive factors in the small and medium-sized business segment of the Web services and online marketing and lead generation industry include:

| | • | | Ability to reference strategic partners; |

| | • | | Value and flexibility of the service offerings; |

| | • | | Brand name and reputation; |

| | • | | Quality of customer support; |

| | • | | Speed of customer service; |

| | • | | Ease of implementation, use, and maintenance; and |

| | • | | Industry expertise and focus. |

13

Intellectual Property

Our success and ability to compete is dependent in significant part on our ability to develop and maintain the proprietary aspects of our technology and operate without infringing upon the proprietary rights of others. We do not own any patents. We currently rely primarily on a combination of copyright, trade secret and trademark laws, confidentiality procedures, contractual provisions, and other similar measures to protect our proprietary information. Due to the rapidly changing nature of applicable technologies, we believe that the improvement of existing offerings, reliance upon trade secrets and unpatented proprietary know-how and development of new offerings generally will continue to be our principal source of proprietary protection. While we have hired third party contractors to help develop our software and to design Websites, we own the intellectual property created by these contractors. Our software is not substantially dependent on any third party software, although our software does utilize open source code. Notwithstanding the use of this open source code, we do not believe our usage requires public disclosure of our own source code nor do we believe the use of open source code is material to our business.

We also have an ongoing service mark and trademark registration program pursuant to which we register some of our product names, slogans and logos in the United States and in some foreign countries. License agreements for our software include restrictions intended to protect our intellectual property. These licenses are generally non-transferable and are perpetual. In addition, we require all of our employees, contractors and many of those with whom we have business relationships to sign non-disclosure and confidentiality agreements and to assign to us in writing all inventions created while working for us. Some of our products also include third-party software that we obtain the rights to use through license agreements. In such cases, we have the right to distribute or sublicense the third-party software with our products.

Employees

As of December 31, 2006, we had a total of 637 full-time employees and 2 part-time employees. Of our full-time employees, 310 are in direct sales, of which 189 are in outbound telesales, 100 are in inbound telesales, and 23 are in management and support functions. In addition, there are two part-time employees in outbound telesales function. Of the remaining full-time employees, 6 are in channel business development, 14 are in marketing and product management, 47 are in general and administration, 55 are in engineering and product development, and 205 are in customer care and Web services production. In addition to our full-time employees, we also had 19 contracted offshore developers and 23 contracted Web services designers and editors. None of our employees are represented by unions. We consider the relationship with our employees to be good and have not experienced interruptions of operations due to labor disagreements.

Corporate Information

Website Pros, Inc. was incorporated under the General Corporate Law of the State of Delaware on March 2, 1999. Our principal offices are located at 12735 Gran Bay Parkway West, Building 200, Jacksonville, Florida 32258. Our telephone number is (904) 680-6600 and our Website is located at www.websitepros.com. Our Website and the information contained therein or connected thereto shall not be deemed to be incorporated into this Form 10-K.

We make available free of charge on or through our Internet Website our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and all amendments to those reports as soon as reasonably practicable after such material is electronically filed with or furnished to the Securities Exchange Commission (SEC).

You may read and copy this Form 10-K at the SEC’s public reference room at 450 Fifth Street, NW, Washington D.C. 20549. Information on the operation of the public reference room can be obtained by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site that contains reports, proxy and information statements and other information regarding our filings at www.sec.gov.

14

Item 1A. Risk Factors.

We depend primarily on a small number of strategic marketing relationships—and one key strategic marketing relationship in particular—to identify prospective customers. The loss of one or more of our strategic marketing relationships, or a reduction in the referrals and leads they generate, would significantly reduce our future revenue and increase our expenses.

As a key part of our strategy, we have entered into agreements with a number of companies pursuant to which these parties provide us with access to their customer lists and allow us to use their names in marketing our Web services and products. Approximately 90% and 93% of our new customers in the years ended December 31, 2006 and 2005, respectively, were identified through our strategic marketing relationships. We believe these strategic marketing relationships are critical to our business because they enable us to penetrate our target market with a minimum expenditure of resources. If these strategic marketing relationships are terminated or otherwise fail, our revenue would likely decline significantly and we could be required to devote additional resources to the sale and marketing of our Web services and products. We have no long-term contracts with these organizations, and these organizations are generally not restricted from working with our competitors. Accordingly, our success will depend upon the willingness of these organizations to continue these strategic marketing relationships.

Our strategic marketing relationship with Discover is particularly important to us and accounted for approximately 60% and 73% of our new customers in the years ended December 31, 2006 and 2005, respectively. Customers attributable to our relationship with Discover represented approximately 51% and 57% of our total revenue during the years ended December 31, 2006 and 2005, respectively. We expect that customer relationships enabled by our strategic marketing relationship with Discover will continue to account for a significant portion of our new customers and our revenue in the future. Discover is under no obligation to continue to contract with us or continue this strategic marketing relationship, and either Discover or we can terminate our agreement with short notice and no penalty. Additionally, this agreement expires pursuant to its terms in November 2007, and we cannot ensure that the agreement will be extended or renewed. We therefore cannot ensure that we will continue to have a relationship with Discover. If our strategic marketing relationship with Discover ends, we will need to take remedial measures to generate customer leads, which could be expensive, and if such efforts fail, our business would be materially harmed.

To successfully execute our business plan, we must also establish new strategic marketing relationships with additional organizations that have strong relationships with small and medium-sized businesses that would enable us to identify additional prospective customers. If we are unable to diversify and extend our strategic marketing relationships, our ability to grow our business may be compromised.

Most of our Web services are sold on a month-to-month basis, and if our customers either are unable or choose not to subscribe to our Web services, our revenue may decrease.

Typically, our Web service offerings are sold pursuant to month-to-month subscription agreements, and our customers can generally cancel their subscriptions to our Web services at any time with little or no penalty.

Historically, we have experienced a high turnover rate in our customer base. For the years ended December 31, 2006 and 2005, 47% and 52%, respectively, of our subscribers who were customers at the beginning of the respective year were no longer subscribers at the end of the respective year. Customer turnover does not include the acquisitions of 1ShoppingCart.com and Renex, since they were purchased at the end of the third quarter. While we cannot determine with certainty why our subscription renewal rates are not higher, we believe there are a variety of factors, which have in the past led, and may in the future lead, to a decline in our subscription renewal rates. These factors include the cessation of our customers’ businesses, the overall economic environment in the United States and its impact on small and medium-sized businesses, the services and prices offered by us and our competitors, and the evolving use of the Internet by small and medium-sized businesses. If our renewal rates are low or decline for any reason, or if customers demand renewal terms less favorable to us, our revenue may decrease, which could adversely affect our stock price.

15

If economic or other factors negatively affect the small and medium-sized business sector, our customers may become unwilling or unable to purchase our Web services and products, which could cause our revenue to decline and impair our ability to operate profitably.

Our existing and target customers are small and medium-sized businesses. These businesses are more likely to be significantly affected by economic downturns than larger, more established businesses. Additionally, these customers often have limited discretionary funds, which they may choose to spend on items other than our Web services and products. If small and medium-sized businesses experience economic hardship, they may be unwilling or unable to expend resources to develop their Internet presences, which would negatively affect the overall demand for our services and products and could cause our revenue to decline.

Our growth will be adversely affected if we cannot continue to successfully retain, hire, train, and manage our key employees, particularly in the telesales and customer service areas.

Our ability to successfully pursue our growth strategy will depend on our ability to attract, retain, and motivate key employees across our business. We have many key employees throughout our organization that do not have non-competition agreements and may leave to work for a competitor at any time. In particular, we are substantially dependent on our telesales and customer service employees to obtain and service new customers. Competition for such personnel and others can be intense, and there can be no assurance that we will be able to attract, integrate, or retain additional highly qualified personnel in the future. In addition, our ability to achieve significant growth in revenue will depend, in large part, on our success in effectively training sufficient personnel in these two areas. New hires require significant training and in some cases may take several months before they achieve full productivity if they ever do. Our recent hires and planned hires may not become as productive as we would like, and we may be unable to hire sufficient numbers of qualified individuals in the future in the markets where we have our facilities. If we are not successful in retaining our existing employees, or hiring, training and integrating new employees, or if our current or future employees perform poorly, growth in the sales of our services and products may not materialize and our business will suffer.

We may expand through acquisitions of, or investments in, other companies or technologies, which may result in additional dilution to our stockholders and consume resources that may be necessary to sustain our business.

One of our business strategies is to acquire complementary services, technologies or businesses. In connection with one or more of those transactions, we may:

| | • | | issue additional equity securities that would dilute our stockholders; |

| | • | | use cash that we may need in the future to operate our business; and |

| | • | | incur debt that could have terms unfavorable to us or that we might be unable to repay. |

Business acquisitions also involve the risk of unknown liabilities associated with the acquired business. In addition, we may not realize the anticipated benefits of any acquisition, including securing the services of key employees. Incurring unknown liabilities or the failure to realize the anticipated benefits of an acquisition could seriously harm our business.

We may find it difficult to integrate recent and potential future business combinations, which could disrupt our business, dilute stockholder value, and adversely affect our operating results.

During the course of our history, we have completed several acquisitions of other businesses, and a key element of our strategy is to continue to acquire other businesses in the future. In particular, we completed the 1ShoppingCart.com and Renex acquisitions in September 2006. Integrating these recently acquired businesses and assets and any businesses or assets we may acquire in the future could add significant complexity to our business and additional burdens to the substantial tasks already performed by our management team. In the

16

future, we may not be able to identify suitable acquisition candidates, and if we do, we may not be able to complete these acquisitions on acceptable terms or at all. In connection with our recent and possible future acquisitions, we may need to integrate operations that have different and unfamiliar corporate cultures. Likewise, we may need to integrate disparate technologies and Web service and product offerings, as well as multiple direct and indirect sales channels. The key personnel of the acquired company may decide not to continue to work for us. These integration efforts may not succeed or may distract our management’s attention from existing business operations. Our failure to successfully manage and integrate 1ShoppingCart.com and Renex, or any future acquisitions could seriously harm our business.

Accounting for acquisitions under generally accepted accounting principles could adversely affect our reported financial results.

Under generally accepted accounting principles in the United States, we could be required to record charges for in-process research and development or other charges in connection with future acquisitions, which would reduce any future reported earnings or increase any future reported loss. Acquisitions could also require us to record substantial amounts of goodwill and other intangible assets. For example, in connection with our recent acquisitions of 1ShoppingCart.com and Renex, we recorded $17.9 million of goodwill. Any future impairment of this goodwill, and the ongoing amortization of other intangible assets, could adversely affect our reported financial results.

We have only recently become profitable and may not maintain our level of profitability.

Although we generated net income for the years ended December 31, 2006, 2005 and 2004, we have not historically been profitable and may not be profitable in future periods. As of December 31, 2006, we had an accumulated deficit of approximately $59.2 million. We expect that our expenses relating to the sale and marketing of our Web services, technology improvements and general and administrative functions, as well as the costs of operating and maintaining our technology infrastructure, will increase in the future. Accordingly, we will need to increase our revenue to be able to maintain our profitability. We may not be able to reduce in a timely manner or maintain our expenses in response to any decrease in our revenue, and our failure to do so would adversely affect our operating results and our level of profitability.

Our operating results are difficult to predict and fluctuations in our performance may result in volatility in the market price of our common stock.

Due to our limited operating history, our evolving business model, and the unpredictability of our emerging industry, our operating results are difficult to predict. We expect to experience fluctuations in our operating and financial results due to a number of factors, such as:

| | • | | our ability to retain and increase sales to existing customers, attract new customers, and satisfy our customers’ requirements; |

| | • | | the renewal rates for our services; |

| | • | | changes in our pricing policies; |

| | • | | the introduction of new services and products by us or our competitors; |

| | • | | our ability to hire, train and retain members of our sales force; |

| | • | | the rate of expansion and effectiveness of our sales force; |

| | • | | technical difficulties or interruptions in our services; |

| | • | | general economic conditions; |

| | • | | additional investment in our services or operations; |

17

| | • | | bulk licenses of our software; and |

| | • | | our success in maintaining and adding strategic marketing relationships. |

These factors and others all tend to make the timing and amount of our revenue unpredictable and may lead to greater period-to-period fluctuations in revenue than we have experienced historically.

As a result of these factors, we believe that our quarterly revenue and results of operations are likely to vary significantly in the future and that period-to-period comparisons of our operating results may not be meaningful. The results of one quarter may not be relied on as an indication of future performance. If our quarterly revenue or results of operations fall below the expectations of investors or securities analysts, the price of our common stock could decline substantially.

Our business depends in part on our ability to continue to provide value-added Web services and products, many of which we provide through agreements with third parties, and our business will be harmed if we are unable to provide these Web services and products in a cost-effective manner.

A key element of our strategy is to combine a variety of functionalities in our Web service offerings to provide our customers with comprehensive solutions to their Internet presence needs, such as Internet search optimization, local yellow pages listings, and e-commerce capability. We provide many of these services through arrangements with third parties, and our continued ability to obtain and provide these services at a low cost is central to the success of our business. For example, we currently have agreements with several service providers that enable us to provide, at a low cost, Internet yellow pages advertising. However, these agreements may be terminated on short notice, typically 60 to 90 days, and without penalty. If any of these third parties were to terminate their relationships with us, or to modify the economic terms of these arrangements, we could lose our ability to provide these services at a cost-effective price to our customers, which could cause our revenue to decline or our costs to increase.

Our systems, and those of our co-location provider, are vulnerable to natural disasters and other unexpected problems that could lead to interruptions, delays, loss of data, or the inability to accept and fulfill customer subscriptions.

Our network operating center, containing substantially all of our communications hardware, nearly all of our non-sales staff, and much of our other computer hardware operations is located in Jacksonville, Florida. Likewise, the facilities of our third-party co-location provider are located in Jacksonville, Florida. Additionally, one of our sales centers, from which the majority of our sales are made, is located in Spokane, Washington. Hurricanes, fire, floods, earthquakes, power loss, telecommunications failures, break-ins, computer sabotage, and similar events could damage or destroy these systems and facilities and temporarily stop a majority of our business activities in fulfilling customer orders and in securing new customers. Our business could be seriously harmed, our revenues could decline and we could be required to make significant expenditures if our systems were damaged or destroyed, or if our customer fulfillment were delayed or stopped, by any of these occurrences.

We rely heavily on the reliability, security, and performance of our internally developed systems and operations, and any difficulties in maintaining these systems may result in service interruptions, decreased customer service, or increased expenditures.

The software and workflow processes that underlie our ability to deliver our Web services and products have been developed primarily by our own employees. The reliability and continuous availability of these internal systems are critical to our business, and any interruptions that result in our inability to timely deliver our Web services or products, or that materially impact the efficiency or cost with which we provide these Web services and products, would harm our reputation, profitability, and ability to conduct business. In addition, many of the software systems we currently use will need to be enhanced over time or replaced with equivalent commercial

18

products, either of which could entail considerable effort and expense. If we fail to develop and execute reliable policies, procedures, and tools to operate our infrastructure, we could face a substantial decrease in workflow efficiency and increased costs, as well as a decline in our revenue.

We face intense and growing competition. If we are unable to compete successfully, our business will be seriously harmed.

The market for our Web services and products is competitive and has relatively low barriers to entry. Our competitors vary in size and in the variety of services they offer. We encounter competition from a wide variety of company types, including:

| | • | | Website design and development service and software companies; |

| | • | | Internet service providers and application service providers; |

| | • | | Internet search engine providers; |

| | • | | Local business directory providers; and |

| | • | | Website domain name providers and hosting companies. |

In addition, due to relatively low barriers to entry in our industry, we expect the intensity of competition to increase in the future from other established and emerging companies. Increased competition may result in price reductions, reduced gross margins, and loss of market share, any one of which could seriously harm our business. We also expect that competition will increase as a result of industry consolidations and formations of alliances among industry participants.

Many of our current and potential competitors have longer operating histories, significantly greater financial, technical, marketing and other resources, greater brand recognition and, we believe, a larger installed base of customers. These competitors may be able to adapt more quickly to new or emerging technologies and changes in customer requirements. They may also be able to devote greater resources to the promotion and sale of their services and products than we can. If we fail to compete successfully against current or future competitors, our revenue could increase less than anticipated or decline, and our business could be harmed.

Our failure to build brand awareness quickly could compromise our ability to compete and to grow our business.

As a result of the anticipated increase in competition in our market, and the likelihood that some of this competition will come from companies with established brands, we believe brand name recognition and reputation will become increasingly important. Our strategy of relying significantly on third-party strategic marketing relationships to find new customers may impede our ability to build brand awareness, as our customers may wrongly believe our Web services and products are those of the parties with which we have strategic marketing relationships. If we do not continue to build brand awareness quickly, we could be placed at a competitive disadvantage to companies whose brands are more recognizable than ours.

If our security measures are breached, our services may be perceived as not being secure, and our business and reputation could suffer.

Our Web services involve the storage and transmission of our customers’ proprietary information. Although we employ data encryption processes, an intrusion detection system, and other internal control procedures to assure the security of our customers’ data, we cannot guarantee that these measures will be sufficient for this purpose. If our security measures are breached as a result of third-party action, employee error or otherwise, and as a result our customers’ data becomes available to unauthorized parties, we could incur liability and our reputation would be damaged, which could lead to the loss of current and potential customers. If we experience any breaches of our network security or sabotage, we might be required to expend significant capital and other resources to

19