UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| |

þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2008

OR

| |

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File No. 000-30334

Angiotech Pharmaceuticals, Inc.

(Exact Name of Registrant as Specified in its Charter)

| | |

British Columbia, Canada | | 98-0226269 |

(State or Other Jurisdiction of Incorporation or Organization) | | (I.R.S. Employer Identification No.) |

| | |

1618 Station Street, Vancouver, BC, Canada | | V6A 1B6 |

(Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (604) 221-7676

Securities registered pursuant to Section 12(b) of the Act:

| | |

Title of each class | | Name of each exchange on which registered |

Common shares, without par value | | The NASDAQ Global Select Market |

Class I preference shares, without par value | | The NASDAQ Global Select Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes o No þ

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes o No þ

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ¨

Accelerated filer x

Non-accelerated filer ¨ (Do not check if a smaller reporting company)

Smaller reporting company¨

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes o No þ

The aggregate market value of the common shares held by non-affiliates as of June 30, 2008 of the registrant (based on the last reported sale price of the common shares of U.S. $2.98, as reported on The NASDAQ Global Select Market) was approximately U.S. $253,663,509.

As of March 12, 2009 the registrant had 85,121,983 outstanding common shares.

DOCUMENTS INCORPORATED BY REFERENCE

Part III of this Annual Report on Form 10-K incorporates by reference information from the definitive Proxy Statement for the registrant’s 2009 annual general meeting of shareholders.

ANGIOTECH PHARMACEUTICALS INC.

TABLE OF CONTENTS

ANNUAL REPORT ON FORM 10K FOR THE YEAR ENDED DECEMBER 31, 2008

| | | |

PART I |

| |

| Item 1. | BUSINESS | 4 |

| Item 1A. | RISK FACTORS | 14 |

| Item 1B. | UNRESOLVED STAFF COMMENTS | 29 |

| Item 2 | PROPERTIES | 30 |

| Item 3. | LEGAL PROCEEDINGS | 31 |

| Item 4. | SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS | 32 |

| |

| |

PART II |

| |

| Item 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER | |

| | MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES | 33 |

| Item 6. | SELECTED FINANCIAL DATA | 35 |

| Item 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND | |

| | RESULTS OF OPERATIONS | 38 |

| Item 7A. | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | 58 |

| Item 8. | FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA | 59 |

| Item 9. | CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND | |

| | FINANCIAL DISCLOSURE | 59 |

| Item 9A. | CONTROLS AND PROCEDURES | 59 |

| Item 9B. | OTHER INFORMATION | 60 |

| |

| |

PART III |

| |

| Item 10. | DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE | 61 |

| Item 11. | EXECUTIVE COMPENSATION | 61 |

| Item 12. | SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND | |

| | RELATED STOCKHOLDER MATTERS | 61 |

| Item 13. | CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR | |

| | INDEPENDENCE | 61 |

| Item 14. | PRINCIPAL ACCOUNTANT FEES AND SERVICES | 61 |

| |

| |

PART IV |

| |

| Item 15. | EXHIBITS AND FINANCIAL STATEMENT SCHEDULES | 62 |

| |

| |

| SIGNATURES | 63 |

- 2 -

In this Annual Report on Form 10-K, references to “the Company”, “Angiotech”, “us” or “we” are to Angiotech Pharmaceuticals, Inc. and all of its subsidiaries as a whole, except where it is clear that these terms only refer to Angiotech Pharmaceuticals, Inc.

Accounting Standards

In this Annual Report on Form 10-K, all dollar amounts are in U.S. dollars, except where otherwise stated and financial reporting is made in accordance with U.S. generally accepted accounting principles (“U.S. GAAP”).

Currency and Exchange Rates

We use the U.S. dollar as our reporting currency, while the Canadian dollar is the functional currency for Angiotech Pharmaceuticals, Inc. and its Canadian subsidiaries, the U.K pound is the functional currency of our U.K subsidiary, Pearsalls Limited, the Danish Kroner is the functional currency of our Danish subsidiary, PBN Medicals Denmark A/S, and the U.S. dollar is the functional currency for all other subsidiaries.

NOTICE REGARDING WEBSITE ACCESS TO COMPANY REPORTS

We file electronically with the Securities and Exchange Commission our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 (“the Exchange Act”). You may obtain a free copy of our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, and any amendments to those reports, on the day of filing with the SEC and on our website at: www.angiotech.com. Our website and the information on our website is not part of this Annual Report on Form 10-K.

- 3 -

PART I

Item 1.

BUSINESS

Summary

We are a specialty pharmaceutical and medical device company that discovers, develops and markets innovative technologies primarily focused on acute and surgical applications. We generate our revenue through our sales of medical products and components, as well as from royalties derived from sales by our partners of products utilizing certain of our proprietary technologies. For the year ended December 31, 2008, we recorded $190.8 million in direct sales of our various medical products and $92.5 million in royalties and license fees received from our partners.

Our research and development efforts focus on understanding and characterizing biological conditions that often occur concurrent with medical device implantation, surgery or acute trauma, including scar formation and inflammation, cell proliferation, bleeding and coagulation, infection, and tumor tissue overgrowth. Our strategy is to utilize our various technologies in the areas of drugs, drug delivery, surface modification, biomaterials and medical devices to create and commercialize novel, proprietary medical products that reduce surgical procedure side effects, improve surgical outcomes, shorten hospital stays, or are easier or safer for a physician to use.

We develop our products using a proprietary and systematic discovery approach. We use our drug screening capabilities to identify new uses for known pharmaceutical compounds. We look for compounds that address the underlying biological causes of conditions that can occur with medical device implantation, surgery or acute trauma. Once appropriate drugs have been identified, we work to formulate the drug, or a combination of drugs, with our portfolio of drug, drug delivery and surface modification technologies and biomaterials to develop a novel surgical implant or medical device. We have patent protected, or have filed patent applications for, certain of our technology and many of our products and potential product candidates.

In March 2007, due to declines in the amount of royalties received from sales of TAXUS by Angiotech's partners, the high levels of cash interest payable on Angiotech's outstanding debt and the capital-intensive nature of Angiotech’s business, Angiotech determined that its balance sheet was not supported by its existing business model and that a restructuring was necessary. Although Angiotech believes it has developed planned courses of action and identified other opportunities to mitigate these operating and liquidity risks, there can be no assurance that Angiotech will be able to achieve any or all of these plans.

In 2008, TAXUS royalties declined more significantly than anticipated and Angiotech’s stock price declined precipitously, such that the market value of the company became significantly less than the outstanding principal amount of its indebtedness. During this time, Angiotech continued to unsuccessfully explore various financial and strategic alternatives. In September 2008, Angiotech announced a restructuring effort to address its liquidity concerns, which included efforts to reduce operating costs through significant cuts to its operating budget and efforts to focus its business on its more promising Medical Devices product segment and away from its Pharmaceutical Technologies segment.

In March 2009, we announced that it had entered into a new secured credit facility, which is intended to provide the company additional near-term liquidity and enable the company to continue the evaluation and exploration of various financial and strategic alternatives that may reduce our total outstanding debt obligations and provide the Company with greater financial flexibility.

Business Strategy

Our strategy is to apply our various technologies to develop and commercialize novel, proprietary medical device, surgical implant and pharmaceutical products that address the most frequent problems or complications observed in connection with medical device use or surgical procedures. Specific elements of our strategy include:

•

Identifying and Prioritizing Market Opportunities. We begin our product development process by identifying medical devices or surgical procedures where problems or complications arise soon after device implantation or the initial procedure, and where re-intervention is expensive, potentially harmful for patients or difficult to perform. We target areas where we have previously developed successful technologies, such as the treatment of scar formation and cell proliferation with paclitaxel and its analogues or derivatives, or where we have particular scientific focus or expertise. For example, numerous human trials have indicated that paclitaxel dramatically improves the clinical performance of stents used to treat patients with coronary artery disease, which has led to improved patient outcomes, premium pricing and growth of the stent market. We believe other medical devices and surgical implants could be similarly affected through the proprietary addition of locally-delivered therapeutics.

- 4 -

•

Developing Novel, Proprietary Product Candidates. After prioritizing opportunities, we identify the biology that may contribute to complications or failures of a device or procedure. We then screen and select a potential drug or drugs to combine with our biomaterial or drug delivery technologies to create proprietary, locally-delivered drug formulation or drug-device combination product candidates. We continually assess and study applications of our technology, including analyzing the biology pertaining to the failure of certain medical devices and surgical implants, and determining the therapeutic drug selection, concentration, total dose and drug release characteristics required to enhance medical device and surgical implant performance. We believe this approach may allow us to create additional novel drug-eluting medical devices and surgical implants that achieve better clinical results than drugs, medical devices or surgical implants may achieve independently.

•

Establishing and Developing Intellectual Property Portfolio. After identifying potentially useful technologies or developing novel product candidates, we incorporate these elements into new patent filings or our existing patent portfolio, and we attempt to develop and establish new intellectual property in jurisdictions throughout the world. We believe we are among the first companies to develop an extensive intellectual property portfolio of products combining approved pharmaceutical agents, such as paclitaxel, with medical devices and surgical implants. Recognizing the importance of intellectual property in our industry, we plan to continue to pursue patent protection in the United States, the European Union and other significant markets, as well as to protect trade secrets and know-how as our research and development activities uncover additional important medical product and therapeutic opportunities.

•

Selecting Commercialization Path. Once we reach a certain stage with a technology or product candidate, we select a development and commercialization path. Where we have a distribution channel, we may elect to fully develop a product ourselves, or in selected cases where product opportunities may not fit our commercial capabilities, we will license certain of our products, technologies or product candidates to be developed, manufactured or commercialized by partners.

•

Pursuing Selective Strategic Acquisitions and Licenses. To support our product development and commercialization activities, we have pursued, and will continue to selectively pursue, acquisitions or licenses to obtain proprietary pharmaceutical compounds or compound classes, formulation technologies, medical device technologies and intellectual property or other commercial assets.

Business Overview

We currently operate in two segments: Pharmaceutical Technologies and Medical Products.

Pharmaceutical Technologies

Our Pharmaceutical Technologies segment focuses primarily on establishing product development and marketing partnerships with major medical device, pharmaceutical or biomaterials companies and to date has derived the majority of its revenue from royalties due from partners that develop, market and sell products incorporating our technologies. Currently our principal revenues in this segment are from royalties derived from sales by Boston Scientific Corporation (“BSC”) of TAXUS® coronary stent systems incorporating the drug paclitaxel.

TAXUS Drug-Eluting Stents

The most significant commercial products containing technology developed and licensed by our Pharmaceutical Technologies segment are the TAXUS Express and TAXUS Liberté coronary stent systems. These products are sold by BSC, our exclusive licensee in the coronary paclitaxel-eluting stent field. We derive royalty revenue from sales by BSC of TAXUS coronary stent systems. Royalty revenue received from BSC was $84.1 million for the year ended December 31, 2008.

BSC commenced sales of the TAXUS Express paclitaxel-eluting coronary stent system in January 2003 in the European Union and other countries outside of the United States, and in March 2004 in the United States. BSC announced the completion of the initial launch of the TAXUS Liberté paclitaxel-eluting coronary stent system in 18 countries in January 2005 and in Europe in September 2005, and commenced sales of TAXUS Liberté in the United States in October of 2008. The TAXUS Liberté stent system represents BSC’s next generation product incorporating our research, technology and intellectual property related to the use of paclitaxel to treat restenosis and other local inflammatory diseases. The TAXUS Liberté stent has been designed by BSC to further enhance coronary stent deliverability and blood vessel conformability, particularly in challenging coronary lesions. In addition, in September 2008 BSC received approval to mark et and sell the Taxus Express2 Atom™ Paclitaxel-Eluting Coronary Stent System in the United States. The TAXUS Express 2 Atom stent system is the only drug-eluting stent available that is specifically designed to treat lesions with diameters as small as 2.25 millimeters. We are entitled to receive royalties based on the commercial sale of all of BSC’s various TAXUS products.

- 5 -

BSC has concluded several clinical trials of paclitaxel-eluting coronary stents that have demonstrated positive results, including six separate clinical studies, with a total of over 31,000 patients studied over a five-year period, designed to evaluate the near and long-term safety and efficacy of both the slow and moderate drug release versions of the TAXUS Express coronary stent system. These various studies have universally indicated that paclitaxel-eluting coronary stents significantly reduce the incidence of restenosis and the need for repeat surgical procedures at the treated lesion site in coronary artery disease patients.

Certain clinicians have suggested that the use of drug-eluting stents may cause an increased rate of late thrombosis (the formation of blood clots in the stent long after the initial stent implantation) and in turn, potentially lead to an increased rate of myocardial infarctions (heart attacks) or deaths as compared to bare metal stents. These suggestions led to a significant decrease in the use of drug-eluting stents, beginning in the second half of 2006 and continuing through 2008. A meta-analysis of a majority of the previous clinical trials of TAXUS is comprised of five-year follow up data. The overall thrombosis rate indicated by this analysis is no different between the drug-eluting stent arm of the studies and the bare metal stent arm of the studies. Death rates and myocardial infarction rates also show no difference at the end of five years, while the target lesion revascularization rate continues to maintain a statistically sign ificant benefit for the patients receiving the drug-eluting paclitaxel stent as compared to those patients who received a bare metal stent (TLR 12.1% vs 21.0%, p<0.001).

CoSealTM Surgical Sealant

CoSeal surgical sealant is a commercially approved, surgical biomaterial product and was obtained as part of our acquisition of Angiotech BioMaterials Corp. (formerly known as Cohesion Technologies, Inc.) in 2003. CoSeal is the first fully synthetic vascular sealing agent approved by the United States Food and Drug Administration (“FDA”), and has been sold in the United States since February 2002. CoSeal is approved for use in the United States and the European Union to achieve adjunctive hemostasis in vascular reconstruction by mechanically sealing areas of leakage. CoSeal is designed to rapidly seal tissue surfaces, suture lines and synthetic grafts during surgery. A premixed configuration of CoSeal received both FDA and European CE Mark approval in February 2003 and April 2003 respectively, and received Health Canada approval in October 2003. The premixed configuration of CoSeal is simpler to use, can be stored at room temperature and has a two-hour lifespan once activated.

On February 25, 2003, we entered into a strategic alliance with Baxter Healthcare Corporation (“Baxter”), which provides Baxter with worldwide (excluding Japan) sales, marketing and distribution rights of our CoSeal surgical sealant product. This alliance also gives Baxter an option for distribution rights in Japan. In April 2003, we broadened the strategic alliance to provide Baxter with worldwide manufacturing rights for CoSeal. As a result of these transactions, we receive royalties on the end-user sales of CoSeal by Baxter. We have retained all development and commercial rights for drug-loaded versions of CoSeal.

Medical Products

Our Medical Products segment manufactures and markets a wide range of single-use specialty medical products, primarily medical device products and medical device components. These products are sold directly to end users or other third party medical device manufacturers. This segment contains two specialized direct sales and distribution organizations as well as significant manufacturing capabilities. Many of our medical products are made using our proprietary manufacturing processes, or are protected by our intellectual property. Our Medical Products segment may apply certain of our proprietary technologies to its products to create novel, next generation medical products to market directly to end users or medical products distributors.

Interventional Radiology and Biopsy Products

We offer a variety of products targeted at the interventional radiology and biopsy markets. We currently sell the majority of these products in finished form, either directly to or through distributors. We also sell selected biopsy needles and related components to other third-party medical device suppliers that compete in various general surgery markets. Some of our more significant commercial products in this area include:

·

SKATERTM Drainage Catheters – the SKATER catheter line is used to facilitate drainage of fluid from wounds, infectious tissues or surgical sites, and features larger lumens and drainage holes, kink resistance, resistance to encrustation and high radiopacity.

·

V+PadTMHemostatic Pad – the V+Pad product is a hydrophilic wound dressing that is intended for use in the local management of bleeding wounds such as vascular access sites (percutaneous catheters or tubes), surgical debridement and lacerations. The V+Pad promotes rapid control of bleeding in patients on anticoagulation therapy and in patients following hemodialysis. We are the exclusive distributor of V+Pad in the United States.

·

Soft Tissue Biopsy Needles – we offer a wide range of soft tissue biopsy needles, both disposable and re-usable for use in different types of breast, lung, spinal and bone marrow biopsies. Some key features of our biopsy needles include: an echogenic tip for placement under ultrasound guidance, numerically ordered centimeter markings to facilitate precise depth placement, and adjustable needle stops allowing the restriction of forward movement and localizing the needle to the biopsy site.

- 6 -

·

BioPinceTM Full Core Biopsy Devices – BioPince is our biopsy instrument product line featuring a proprietary tri-axial “Cut and Trap” cannula system. This system allows the device to deliver cylindrical, full-length biopsy specimens that are complete and largely undamaged, which we believe significantly improves the diagnostic value of the sample.

·

T-LockTM Bone Marrow Biopsy Device – our bone marrow biopsy device, the T-Lock, has an ergonomically designed twist-lock handle, which improves a clinician’s ability to penetrate hard bone to obtain the biopsy sample. An adjustable needle stop to control the depth of penetration allows the clinician to safely aspirate at the sternum of the patient.

·

HemoStreamTM Dialysis Catheter –our HemoStream product is used for short-term vascular access for patients undergoing hemodialysis. HemoStream has a novel triple outflow lumen that is designed to prevent the common complication of “sidewalling”, which occurs when the catheter is drawn next to the vessel wall during dialysis. This is a common problem with dialysis catheters. We are the exclusive distributor of the HemoStream dialysis catheter line.

·

Bio-Seal™Lung Biopsy Tract Plug System – Bio-Seal is our biopsy system containing a proprietary hydrogel plug designed to prevent air leaks in patients having lung biopsies. On contact with moist tissue, the hydrogel plug absorbs fluids and expands to fill the void created by the biopsy needle puncture. The plug is absorbed into the body after healing of the puncture site has occurred. We are the exclusive worldwide manufacturer and distributor of the Bio-Seal Lung Biopsy Tract Plug System, which has received CE Mark approval and is currently marketed and sold in the European Union. BioSeal has undergone a human clinical trial in the United States. and is not yet commercially available in the United States or other markets outside of the European Union.

·

Other Selected Products – other selected products for the interventional radiology and biopsy markets include fixation pins, tunneling stylets and surgical tunnelers and isotope seed spacers and needles for prostate cancer treatment.

General Surgery Products

We offer a variety of products targeted at various surgical disciplines for wound closure, wound healing and general surgery. We currently sell the majority of these products in finished form, either directly or through distributors. We also sell selected surgical needles, suture products and wound closure product components to other third-party medical device suppliers that compete in various general surgery markets. Our most significant commercial products in this market area include:

·

QuillTM SRS – our Quill SRS product is a suture material that contains proprietary patterns of tiny barbs, which can eliminate the need for surgeons to tie knots when closing certain wound types. We believe that use of Quill SRS may lead to faster surgical times, improved wound cosmesis and lower wound infection and complication rates.

·

SharpointTM Specialty Microsurgical Products – our Sharpoint microsurgical sutures include specialized suture configurations and materials that are complex to manufacture, as well as needles that are manufactured from specialty stainless steel wire that has been tempered to a specific balance of hardness and tensile strength, which allows a fine edge that resists bending as the surgeon applies pressure.

·

Silk and Polyester Braided and Monofilament Suture Materials – we manufacture a wide array of configurations of non-absorbable and absorbable sutures. Our suture configurations vary in diameter size, length, and material.

·

Drilled End and Channel Needles – we manufacture a wide array of surgical needles for our own surgical product lines, as well as for other manufacturers of wound closure products. Our product line includes drilled end suture needles, which have a precisely drilled butt end for maximum suture holding strength and are adequately tempered for securing strong attachment of the suture, and channel needles, which have a channel with an underlying receptacle for attachment of the suture.

·

Lifespan™ ePTFE Vascular Grafts – we manufacture reinforced ePTFE synthetic vascular graft for use in bypass or reconstruction of diseased or occluded blood vessels or to provide arteriovenous shunts for blood access in hemodialysis patients. Our ePTFE product line has over 75 product iterations and includes vascular grafts of various sizes and lengths.

·

Surgical Blades Used in Cataract Surgery – we have a wide range of surgical blades for cataract surgery, including clear corneal knives, standard implant knives, pilot tip implant knives, precision depth knives, sharptone crescent knives, spoon knives, stab knives, vitrectomy knives to create small, precise incisions, sub-2mm series knives, and a variety of slit and specialty knives.

Research and Product Development

We, or our partners, are evaluating several new product candidates that incorporate our proprietary technologies and capabilities, including a significant number of product candidates undergoing human clinical testing conducted both by us and by our partners. We also maintain several pre-clinical, or research stage, programs, as well as conduct various product and process improvement initaitives with respect to our currently marketed products and within our manufacturing facilities. The following discussion outlines our most advanced product candidates and their stage of development, and summarizes our most recently concluded or terminated clinical development programs.

- 7 -

Ongoing Clinical Programs

·

TAXUS Element™ Platinum Chromium Paclitaxel-Eluting Coronary Stent System. The TAXUS Element paclitaxel-eluting coronary stent system is the third generation BSC coronary stent platform that incorporates our research, technology and intellectual property related to the use of paclitaxel. The TAXUS Element stent features BSC’s proprietary platinum chromium alloy, which is designed to enable thinner stent struts, increased flexibility and a lower stent profile while improving radial strength, recoil and radiopacity. In addition, the TAXUS Element stent platform incorporates new balloon technology intended to improve upon BSC’s market-leading Maverick® Balloon Catheter technology.

On October 10, 2008, we announced that BSC had completed enrollment in the PERSEUS clinical trial, designed to evaluate the third-generation TAXUS Element paclitaxel-eluting coronary stent. The PERSEUS clinical program has enrolled nearly 1,500 patients at 100 U.S. and international centers since July 2007, and will compare the TAXUS Element stent to the prior-generation TAXUS Express2 stent marketed in this United States since 2004.

·

TAXUS Petal™ Bifurcation Paclitaxel-Eluting Coronary Stent System. The TAXUS Petal bifurcation paclitaxel-eluting coronary stent system, which is under evaluation in clinical trials being conducted by BSC, represents a novel BSC coronary stent product candidate that incorporates our research, technology and intellectual property related to the use of paclitaxel. Conventional coronary stents were designed to treat tubular arteries, and are considered less than optimal for the y-shaped anatomy of a bifurcated area of the coronary arteries. The TAXUS Petal is a specialized coronary stent designed to treat both the main branch and the side branch of a bifurcation by incorporating an innovative side structure (the Petal strut) in the middle of the stent that opens into a side branch.

On July 18, 2007, BSC initiated the TAXUS PETAL I First Human Use (FHU) trial, which is expected to enroll a total of 45 patients in New Zealand, France and Germany. The trial is a non-randomized study with an initial assessment of acute performance and safety (including rates of death, myocardial infarction and target vessel revascularization) at 30 days and six months, with continued annual follow-up to occur for five years. Upon successful completion of this study, BSC has indicated that it intends to begin a pivotal trial which if successful would provide a basis for United States and international approvals for the commercialization of the TAXUS Petal stent.

·

ZILVER PTX Paclitaxel-Eluting Peripheral Vascular Stent System. The ZILVER PTX paclitaxel-eluting peripheral vascular stent, which is under evaluation in clinical trials being conducted by our partner Cook Medical, Inc (“Cook”) is a specialized stent product incorporating our proprietary paclitaxel technology and is designed for placement in diseased arteries in the limbs to restore blood flow. Cook is a co-exclusive licensee, together with BSC, of our proprietary paclitaxel technology to reduce restenosis following stent placement in peripheral artery disease. The ZILVER PTX paclitaxel-eluting peripheral stent is designed to reduce restenosis following placement of a stent in PAD patients.

The ZILVER PTX is currently undergoing multiple human clinical trials in the United States, Japan, the European Union and selected other countries to assess product safety and efficacy. In January 2007, Cook released nine-month data from its EU clinical study. The preliminary data presented by Cook on the first 60 patients in the randomized trial, which is examining the safety of using Cook's ZILVER PTX paclitaxel-eluting stent to treat blockages, or lesions, of the superficial femoral artery (“SFA”) above the knee, indicated that the ZILVER PTX stent showed an equal adverse event rate to conventional angioplasty for treating SFA lesions. The ZILVER PTX stent also displayed a zero-percent fracture rate for 41 lesions at six months and 18 lesions at one year.

On June 11, 2008, Cook reported positive interim results from the registry arm of a clinical study designed to measure the efficacy of the ZILVER PTX in treating PAD patients, specifically in the treatment of blockages in the femoropopliteal artery. The results were reported by trial investigators at the 2008 SVS Vascular Annual Meeting, and revealed clinical improvement, excellent durability and fracture resistance, high rates of event-free survival (“EFS”) and freedom from target lesion revascularization (“TLR”). Interim data was compiled at six and 12 months using 435 patients and 200 patients, respectively. The corresponding EFS rates were 94 percent and 84 percent, and freedom from TLR was 96 percent and 88 percent. Evaluation of stent x-rays is ongoing, and currently suggests stent fractures in approximately one percent of cases at six months and less than two percent of cases at 12 months. In addition, the ZILVER PTX stent exhibited no safety concerns and results were better than expected for Trans-Atlantic Inter-Society Consensus class C and D lesions, occlusions, in-stent restenosis and lesions greater than seven centimeters. Follow-up to the registry arm of the study will continue through two years.

On July 16, 2007 Cook announced that the first U.S. patients in a randomized pivotal human clinical trial of ZILVER PTX were treated at Tri-City Medical Center in Oceanside, CA. The trial is designed to randomize patients to receive either the ZILVER PTX stent or balloon angioplasty. Data from this clinical trial is intended to be used to support submission to the FDA for approval in the U.S. to market the device. In addition, data collected on Japanese and United States patients is expected to be combined for the final evaluation of the device and used for regulatory submissions in both markets for approval.

- 8 -

On September 10, 2008 Cook announced it had completed enrollment in its pivotal human clinical trial for the ZILVER PTX. The 420 patients enrolled in Cook’s randomized trial include peripheral artery disease patients treated in Germany, the United States and Japan. Based on a release by Cook on September 10, 2008, Cook had enrolled an additional 780 patients in the European Union, Canada and Korea in a clinical registry to evaluate the safety of the ZILVER PTX device. The data from such trials have been used for submission in Europe for CE Mark approval to market the device there, with additional regulatory submissions pending in additional markets.

·

Bio-Seal™ Lung Biopsy Tract Plug System. Bio-Seal is a novel technology designed to prevent air leaks in patients having lung biopsies by plugging the biopsy track with an expanding hydrogel plug. On contact with moist tissue, the hydrogel plug absorbs fluids and expands to fill the void created by the biopsy needle puncture. The seal is airtight and the plug is absorbed into the body after healing of the puncture site has occurred.

Bio-Seal has undergone a human clinical trial in the United States which was designed to assess the safety and efficacy of Bio-Seal, with the primary endpoint being reduction in rates of pneumothorax in patients undergoing lung biopsy procedures. The clinical trial was a prospective randomized multi-centered safety and efficacy evaluation. The trial enrolled its first patient in October 2005 and completed enrolment in June 2008. The study was designed to provide a basis for U.S. clearance for the commercialization of Bio-Seal. Data from this clinical trial study has been submitted to the FDA. The FDA has responded to our submission with additional questions about the study. We have responded to the FDA, and upon further review by the FDA we may either receive 510(k) clearance to market Bio-Seal in the United States or be required to respond to additional questions or conduct additional clinical studies f or this product candidate. Upon receiving such further information from the FDA, we will determine the timing of product launch or any further development work necessary to achieve approval should we choose to continue the development of this product candidate. The complete data for the Bio-Seal study was presented at the 2009 Society of Interventional Radiology in San Diego, CA on March 9, 2009. The trial hit its primary end point with clinical success in 85% of the treatment patients compared to 69% for the control patients (p=0.002). The product has already received CE Mark approval.

·

Option™ Vena Cava Filter. The Option™ Vena Cava Filter, which we licensed in March 2008 from our partner Rex Medical L.P., is under evaluation in a pivotal human clinical trial. We believe this vena cava filter may have a number of potential benefits, which include unique filter apex and retention anchors, insertion through either the femoral or jugular route, and non-thrombogenic material. The purpose of the United States multi-center prospective clinical trial is to evaluate the device’s safety and efficacy in preventing pulmonary emboli, and to assess the ability to retrieve the device from the body up to 175 days following implantation. Interim results of the pivotal trial were presented at the AIM/Veith Meeting in New York in November 2008. The complete results, representing a total of 100 patients, were presented at the the 2009 Society of Interventional Radiology in San Diego, CA. The clinical data from this trial has been submitted to the FDA. The FDA has responded to our submission with additional questions about the study and we are preparing a response.

·

Anti- Infective HemoStreamTM Dialysis Catheter. We have an FDA-approved dialysis catheter, HemoStream, that we sell through our direct sales force. A dialysis catheter is used for exchanging blood between a hemodialysis machine and a patient. Some common malfunctions of dialysis catheters include clotting, infection, and kinking. Through our proprietary drug identification strategy, we have identified 5-Fluorouracil (“5-FU”), a drug previously approved by the FDA for treatment of various types of cancer, as a compound that may help to prevent certain types of infection in patients receiving selected types of implantable devices, including certain dialysis catheters. We are currently developing this 5-FU anti-infective technology for our HemoStream dialysis catheter line, and we currently anticipate f iling in 2009 for a 510(k) clearance to market this product candidate in the U.S.

·

MultiStem® Stem Cell Therapy. The MultiStem stem cell therapy is under evaluation in clinical trials being conducted together with our partner Athersys, Inc. (“Athersys”) for the treatment of acute myocardial infarction. MultiStem stem cells are proprietary adult stem cells derived from bone marrow, which have demonstrated the ability in laboratory experiments to form a wide range of cell types. MultiStem may work through several mechanisms, but a primary mechanism appears to be the production of multiple therapeutic molecules produced in response to inflammation and tissue damage. We and Athersys believe that MultiStem may represent a unique “off the shelf” stem cell product candidate, based on its potential ability to be used without tissue matching or immunosupression, and its potential capacity for large scale production. We entered an agreement with Athersys in May 2006 to co-develo p and commercialize MultiStem for use in the indications of acute myocardial infarction and peripheral vascular disease. On December 20, 2007, we and Athersys announced we had received authorization from the FDA to commence a phase I human clinical trial to evaluate the safety of MultiStem in the treatment of acute myocardial infarction. Upon completion of a phase I human clinical trial currently being conducted by Athersys, we may assume lead responsibility for further clinical development. We currently own marketing and commercialization rights with respect to this product candidate. On September 22, 2008, as part of certain cost reduction initiatives, we announced a potential amendment of, and reduction in, cash outlays related to our collaboration with Athersys. The final terms of such amendment to our collaboration with Athersys may have an impact on our expected future expenditures for research and development of MultiStem, and the extent of our future financial and commercial commitments a nd rights relating to this product candidate.

- 9 -

Completed or Suspended Clinical Programs

·

Anti-infective Central Venous Catheter. Central venous catheters (“CVC”) are usually inserted into critically ill patients for extended periods of time to administer fluids, drugs, and nutrition, as well as facilitate frequent blood draws. We have elected to evaluate 5-FU as a compound that may help to prevent certain types of infection in patients receiving a CVC. We recently completed a human clinical trial in the United States designed to assess the safety and efficacy of our 5-FU-eluting CVC in preventing various types of catheter related infections. The study was a randomized, single-blind, 960-patient, 25-center study and was designed to evaluate whether our 5-FU-eluting CVC prevents bacterial colonization at least as well as the market leading anti-infective CVC. On July 10, 2007, we announced that we had comp leted enrolment of the study, and on October 9, 2007 we announced this study had met its primary statistical endpoint of non-inferiority as compared to the market leading anti-infective CVC (a chlorhexidine / silver sulfadiazine (CH-SS) coated CVC) and indicated an excellent safety profile. In March 2008, we presented the clinical trial data at the 28th International Symposium on Intensive Care and Emergency Medicine (ISICEM) in Brussels, Belgium. Based on the clinical trial data, the investigators concluded that our 5-FU CVC met the primary endpoint of the study, specifically that our 5-FU CVC product candidate was non-inferior in its ability to prevent bacterial colonization of the catheter tip when compared to catheters coated with CH-SS. There were no statistically significant differences in the rate of adverse events related to the study devices, or in the rates of catheter-related bloodstream infections. Additionally, there was no evidence for acquired resistance to 5-FU in clinical isolate s exposed to the drug for a second time. Based on the positive results achieved in the study, in December 2007 we filed a request for 510(k) clearance from the FDA to market and sell the CVC in the United States and on April 17, 2008, we announced that we had received 510(k) clearance from the FDA to market our 5-FU CVC in the United States but we have not commercially launched the product.

·

TAXUS Liberté™ paclitaxel-eluting coronary stent system. The TAXUS Liberté paclitaxel-eluting coronary stent system is BSC’s second generation coronary stent system platform that incorporates our research, technology and intellectual property related to the use of paclitaxel to prevent restenosis. The TAXUS Liberté stent system has been designed to further enhance coronary stent deliverability and blood vessel conformability, particularly in challenging coronary lesions. To date, BSC has only commenced sales of the TAXUS Liberté in countries outside of the United States. On October 10, 2008, we announced that BSC had received approval from the FDA to market and sell the TAXUS Liberte in the United States.

·

Vascular Wrap™ Our paclitaxel-eluting mesh surgical implant, or Vascular Wrap, is designed to treat complications, including graft stenosis or restenosis, that may occur in connection with vascular graft implants in hemodialysis patients or in patients that have peripheral artery disease. Vascular grafts are implanted in patients in order to bypass diseased blood vessels, or to provide access to the vascular system of kidney failure patients in order to facilitate the process of hemodialysis. In many cases, these vascular grafts fail due to proliferation of cells or scar into the graft (graft stenosis or restenosis), which can negatively impact blood flow through the vascular graft.

In April 2008, we elected to suspend enrollment in our U.S. and EU human clinical trials for our Vascular Wrap product candidate in patients undergoing surgery for hemodialysis access, pending a safety review to evaluate an imbalance of infections observed between the two study groups. As a result of these observations, we elected to notify physicians to suspend further enrolment in the trials, pending a full review of the potential cause of the implant site infections. There are currently no plans to resume enrollment in these clinical trials, and we are continuing to evaluate alternatives for this program,including potential collaborations, partnerships, divestitures or future clinical development initiatives.

Patents, Proprietary Rights and Licenses

Patents and other proprietary rights are essential to our business. We file patent applications to protect technology, inventions and improvements to inventions that are considered important to our business. We also rely upon trade secrets, continuing technological innovations and licensing opportunities to develop and maintain our competitive position. Furthermore, we endeavor to extend our intellectual property portfolio by exclusively licensing patents and patent applications from others and initiating research collaborations with outside sources.

Our patents and patent applications relate to, among other things:

•

the use of paclitaxel and other agents for the treatment of chronic inflammatory diseases, such as restenosis (including as a stent component);

•

compositions of and use of pharmacologic agents as medical device coatings and drug-eluting biomaterials;

•

hybrid polymer systems designed for localized delivery of bioactive agents and controlled elution of drugs from medical device surfaces;

- 10 -

•

non-reactive hydrophilic/hydrophobic polymer matrix, which can be varied to optimize performance characteristics such as lubricity, flexibility and hydration;

•

biocompatible surface treatments used in ultrasound imaging technology to cause medical devices to shine brightly in ultrasound images providing greater echogenicity, or visibility;

•

hemostatic and sealant compositions, as well as broad intellectual property rights relating to collagen;

•

drug delivery compositions, such as our proprietary systemic formulation, medical device coatings and other local drug delivery systems; and

•

methods of administration.

As part of our patent strategy, we have filed a variety of patent applications internationally. Oppositions have been filed against various granted patents that we either own or license and which are related to certain of our technologies. See “― Legal Proceedings” elsewhere in this Annual Report on Form 10-K for a discussion of the proceedings related to certain of such oppositions. An adverse decision by an Opposition Division in any country, or subsequently, by a Board of Appeal, could result in revocation of our patent or a narrowing of the scope of protection afforded by the patent. The ultimate outcomes of the pending oppositions, including appeals, are uncertain at this time. We do not know whether the patents that we have received or licensed, or those we may be able to obtain or license in the future, would be held valid or enforceable by a court or whether our patents would be found to infringe a competitor’s patents related to its technology or product. Further, we have no assurance that third parties will not (whether pursuant to or in breach of the terms) modify or terminate any license they have granted to us.

Regulatory

The research and development, manufacture, labeling, advertising, sale and marketing of our drug and medical device products and those of our collaborators are subject to extensive regulation by the FDA and comparable regulatory agencies in state and local jurisdictions and in foreign countries. Because we focus on combining pharmaceutical compounds with medical devices and biomaterials, we are subject to both drug and device regulations depending upon the categorization of the commercial product or potential product candidate.

Drug and device licensing laws require registration of manufacturing facilities, carefully controlled research and testing of products, government review and approval or clearance of results prior to marketing of products, adherence to current Good Manufacturing Practices (“cGMPs”), during production and processing of products, and compliance with comprehensive post-marketing requirements including restrictions on advertising and promotion and requirements for reporting adverse events to the FDA in the United States and other regulatory authorities abroad. In the United States, these activities are subject to rigorous regulation by the FDA. Similar regulations apply in the European Union and other markets.

Our success is ultimately dependent upon our and our collaborators obtaining marketing approval or clearance for potential product candidates currently under development and will depend on our and our collaborators’ ability to comply with FDA and other market regulations governing the manufacturing, quality control, pre-clinical evaluation, and clinical testing of those candidates. If we or our present or future collaborators are not able to comply with the continuing FDA regulations that accompany FDA approval, the FDA may halt our clinical trials, require us to recall a drug from distribution, or withdraw approval of the new drug application for the relevant drug or the 510(k) or Premarket Approval for the relevant device. Depending on the circumstances surrounding the clinical evaluation of a product, we may sponsor clinical trials, contract clinical trial activities to contract research organizations (“CROs”) or rely upon our corporate collab orators to sponsor such clinical development. There can be no assurance that any of our and our collaborators’ clinical trials or product development activities will provide favorable data or that the data will be acceptable to any government regulatory agency to provide us with approval to market and sell our products or product candidates. Moreover, even if we and our collaborators believe the results of our product development activities are favorable, regulatory authorities may interpret the results differently than we do.

We have significant medical device component engineering and manufacturing, as well as finished goods and packaging manufacturing operations. The manufacturing processes used in the production of finished medical devices are subject to FDA regulatory inspection, and must comply with FDA regulations, including its Quality Systems Regulation, (“QSR”), which sets forth the cGMP requirements for medical devices. The QSR requires manufacturers of finished medical devices to follow elaborate design, testing, control, documentation and other quality assurance procedures during the finished device manufacturing process. Our FDA registered facilities are subject to FDA inspection at any time for compliance with the QSR and other FDA regulatory requirements. Failure to comply with these regulatory requirements and similar foreign requirements may result in civil and criminal enforcement actions, including financial penalties, seizures, injunctions or other meas ures. In some cases, failure to comply with the QSR could prevent us or our customers from marketing products or gaining clearance to market additional products. Our products must also comply with state and foreign regulatory requirements.

- 11 -

Manufacturing and Distribution

We have significant manufacturing capabilities for our medical devices. Our medical device manufacturing capabilities include polymer handling and extrusion, metals, plastics, textiles and packaging and assembly. Our suture manufacturing capabilities include the ability to make and handle various approved polymer materials in multiple lengths, diameters and configurations. Our metal manufacturing capabilities include bending, grinding, drilling, polishing, chemical etching, thermal curing and wire winding. Our plastics manufacturing capabilities include injection molding, insert molding and wire coating. Our textile manufacturing capabilities include braiding and embroidery of selected suture materials, including silk. Our assembly and packaging capabilities include small lot assembly, suture attachment and kit assembly. We also maintain manufacturing capabilities for certain of our biomaterials and coating technologies, including dedicated resources and te chnology to process and manufacture certain types of drug-eluting medical devices.

We devote resources to develop procedures and process controls for our products and product candidates to ensure successful technology transfer for commercial scale manufacturing. We expect that process and assay development performed during pre-clinical and clinical stages of manufacturing will result in products with the desired use and stability. These activities include scaling up production methods, developing quality control systems, optimizing batch-to-batch reproducibility, testing sterilization methods and establishing reliable sources of raw materials for synthesizing proprietary products.

Sales and Marketing

We market and sell various medical device products through two specialty direct sales organizations. In order to augment these capabilities in certain areas and to allow our direct sales forces to focus on our most critical growth opportunities, we also sell certain of our medical devices and medical device components through a network of independent sales representatives and independent distributors.

Our direct sales teams comprised of about 120 individuals as of December 2008. The majority of our direct sales teams are based in the United States and focus primarily on selling certain of our product lines to interventional radiologists, general surgeons, orthopaedic surgeons, aesthetic surgeons and ophthalmologists.

These sales forces target hospital-based physician customers, as well as alternate site health care providers such as ambulatory surgery centers or urgent care centers. The primary goal of our sales team is to increase market share of our highest margin products into markets that we believe are not as well served by our larger competitors. These competitors often sell their products to larger hospitals or large group purchasing organizations based on contracts for a range of products and in some cases do not employ direct sales professionals targeting our key market segments.

Competition

We expect to face competition from companies utilizing and developing technologies that target the same diseases and clinical indications that our technologies target. Some of the companies developing these technologies have substantially greater product development capabilities and financial, scientific, manufacturing, sales and marketing resources and experience than we do.

The medical device, biotechnology and pharmaceutical industries are subject to rapid and substantial technological change. There can be no assurance that developments by others will not render obsolete our products or technologies or that we will be able to keep pace with technological developments. Some competitive products have an entirely different approach or means to accomplish the desired therapeutic effect than our product candidates. These competitive products, including any enhancements or modifications made to such products in the future, could be more effective and/or less costly than our products, technologies or our product candidates.

There are a number of companies that are marketing or developing competing drug-eluting coronary stents or other treatments for restenosis that may be considered to be directly competitive with our technology. Certain of our competitors have developed and commercialized coronary drug- eluting stents that compete with BSC’s TAXUS stents and which have been approved for use in the United States, European Union and certain other countries. The launch of these competing products has had a significant impact on BSC’s sales of TAXUS, and has resulted in a decline in our royalty revenue received from BSC. The continued successful commercialization of any of these or other technologies to treat restenosis following angioplasty or stent placement could have a material adverse impact on our business.

We compete with a number of additional large companies across various of our product lines. These competitors have substantially greater business and financial resources than we do. These competitors include the Ethicon division Johnson & Johnson and the U.S. Surgical division of Covidien, Inc. in surgical sutures and wound closure devices; C.R. Bard Inc., the Allegiance division of Cardinal Health, Inc. and the Sherwood, Davis & Geck division of Covidien, Inc. in biopsy needle devices; and Alcon, Inc., Allergan, Inc. and the Allegiance division of Cardinal Health, Inc. in ophthalmology products.

- 12 -

Employees

As of December 31, 2008, on a worldwide basis, we have approximately 1,450 employees, including 900 in manufacturing, 100 in R&D, 200 in sales and marketing and 250 in administration. In addition, we have contractual arrangements with scientists at various research and academic institutions. All personnel or their management companies execute confidentiality agreements with us. While we will continue to seek to hire highly qualified employees, we believe that we have employed sufficiently qualified personnel.

Reimbursement

In the United States, health care providers generally rely on third-party payers, including both private health insurance plans and governmental payers, such as Medicare and Medicaid, to cover and reimburse all or part of the cost of a medical device and the procedures in medical devices that are used. Our ability to commercialize human therapeutic products and product candidates successfully will depend in part on the extent to which coverage and reimbursement for such products and related treatments will be available from government health administration authorities, private health insurers and other third-party payers or supported by the market for these products. Third-party payers are increasingly challenging the price of medical products and services and instituting cost containment measures to control or significantly influence the purchase of medical products and services. These cost containment measures, if instituted in a manner affecting the coverage for or paymen t of our products, could have a material adverse effect on our ability to operate profitably.

There can be no assurance that third-party payers’ coverage and reimbursement will be available or sufficient for our current products or the products we might develop. We believe that recommendations and endorsements by physicians are essential for market acceptance of our products, and we do not know whether these recommendations or endorsements will be obtained. We also believe that surgeons will not use these products unless they determine, based on clinical data and other factors, that the clinical benefits to patients and cost savings achieved through use of these products outweigh their cost. Acceptance among physicians may also depend upon the ability to train surgeons and other potential users of our products and the willingness of such users to learn new techniques.

In the United States, there have been and we expect there will continue to be a number of legislative and regulatory proposals to change the healthcare system in ways that could significantly affect our business. Efforts by governmental and third-party payers to reduce healthcare costs or the announcement of legislative proposals or reforms to implement government controls could cause a reduction in sales or in the selling price of our products, which could seriously harm our business. We cannot predict the impact on our business of any legislation or regulations related to the healthcare system that may be enacted or adopted in the future.

Environmental

Our business is subject to a broad range of government regulation and requirements, including federal, state, local and foreign environmental laws and regulations governing, among other matters, air emissions, wastewater discharges, workplace health and safety as well as the use, handling, storage and disposal of hazardous materials and remediation of contamination associated with the release of these materials at or from our facilities or off-site disposal locations. Some of these laws can impose liability for remediation costs on a party regardless of fault or the lawfulness of its conduct. Many of our manufacturing processes involve the use and subsequent regulated disposal of hazardous materials. To date, such matters have not had a material adverse impact on our business or financial condition. We cannot assure you, however, that such matters will not have such an effect in the future.

- 13 -

Item 1A.

RISK FACTORS

You should consider carefully the following information about these risks, together with all of the other information contained within this document. Additional risks and uncertainties not currently known to us or that we currently deem immaterial may impair our business operations. If any of the following risks actually occur, our business, results of operations and financial condition could be harmed.

Risks Related to Our Business

We were not profitable for the quarter and the year ended December 31, 2008 and may not be able to regain and maintain profitability.

We began operations in 1992 and have incurred a loss from operations in each of the years of our existence except for fiscal years 2004 and 2006. As of December 31, 2008, our accumulated deficit was $843.7 million. Our ability to become profitable again will depend on, among other things, the amounts of royalty revenue we receive from our corporate partners; our ability to restructure our existing indebtedness; our ability to maintain and improve sales of our existing product lines; our ability to successfully market and sell certain new products and technologies; our ability to research, develop and successfully launch new products and technologies; our ability to improve our gross profit margins through realization of lower manufacturing costs and efficiencies or improved product sales mix; our ability to effectively control our various operating costs; and foreign currency fluctuations.

Our working capital and funding needs may vary significantly depending upon a number of factors including, but not limited to, the level of royalty revenue we receive from corporate partners; our levels of sales and gross profit; costs associated with our manufacturing operations, including capital expenditures, labour and raw materials costs, and our ability to realize manufacturing efficiencies from our various operations; fluctuations in certain working capital items, including inventory and accounts receivable, that may be necessary to support the growth of our business or new product introductions; progress of our research and development programs and costs associated with completing clinical studies and the regulatory process; collaborative and license arrangements with third parties; the cost of filing, prosecuting and enforcing our patent claims and other intellectual property rights; expenses associated with litigation; opportunities to in-license complementary te chnologies or potential acquisitions; potential milestone or other payments we may make to licensors or corporate partners; and technological and market developments that impact our royalty revenue, sales levels or competitive position in the marketplace.

The sharp reduction in TAXUS royalty payments from BSC, the large amount of our outstanding indebtedness and the related cash interest payments due on such indebtedness, the current economic conditions affecting our and our partners’ financial stability, as well as the capital expenditures required to develop the medical products segment of our business, among other factors, have magnified our working capital needs and funding shortages. As described below, on March 2, 2009, we announced that we had entered into a senior secured credit facility to provide enhanced liquidity in the near term and to provide us with the flexibility and time to explore longer-term options for our overall capital structure and working capital needs. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources—New Senior Secured Credit Facilities” in this Annual Report on Form 10-K. These longer-term options include one or more financ ial and strategic alternatives, including a capital influx from one or more new investors and the restructuring of our outstanding indebtedness, but such efforts have not been successful to date due to our significant debt burden. Due to numerous factors that may impact our future cash position, working capital and liquidity as discussed below and the significant cash that will be necessary to continue to service our current level of debt obligations, there can be no assurances that we will have adequate liquidity and capital resources to satisfy our financial obligations beyond 2009. If our cash flows are worse than expected, we may require additional funds in order to meet the funding requirements of our commercial operations for our research and development programs, to satisfy certain contractual obligations, for other operating and capital requirements, for potential acquisitions or in-licensing of technologies, to satisfy milestone or other payment obligations due to licensors or corporate partners, or to repay or refinance our indebtedness. Financing in addition to our new credit facility may not be available, and even if available, may not be available on attractive or acceptable terms due to difficult credit markets and other factors.

Our obligation to pay cash interest on our existing debt has had, and we expect will continue to have, an adverse effect on our liquidity.

We currently have outstanding $325 million aggregate principal amount of Senior Floating Rate Notes due 2013 (the “Floating Rate Notes”) and $250 million aggregate principal amount of Senior Subordinated Notes due 2014 (the “Subordinated Notes”). We are obligated to make periodic cash interest payments on both the Floating Rate Notes and the Subordinated Notes. Using current interest rates, the annual combined cash interest cost of these notes is $43.1 million.

As a result of the cash interest payments we are obligated to make on our outstanding notes, we have had significant liquidity issues. If our cash flows are worse than expected, an inability to access additional sources of liquidity to fund our cash needs beyond 2009, or to refinance our outstanding notes, could further adversely affect our financial condition or results of operations and our ability to make payments on our debt, and could force us to seek the protection of the bankruptcy laws.

- 14 -

During 2008, we commenced certain cost reductions with the goal of achieving positive consolidated free cash flow (after the incurrence of net interest expense). These efforts may not be sufficient to achieve our goal. If further cost reductions beyond those that are currently scheduled become necessary, our future prospects may be adversely impacted.

In September 2008 we announced that we were pursuing various initiatives to reduce operating costs and focus our business efforts on our most promising near term product opportunities. We believe certain cost reduction measures, in addition to a potential financial or strategic transaction of significant magnitude, are concurrently necessary to address potential liquidity issues likely to arise in the near term relating to our current balance sheet structure.

We have implemented, and we expect to continue to implement, operating cost reductions across all functions in the company, including in research and development and general and administrative functions, with more limited reduction initiatives in sales and marketing. The cost reduction efforts are designed to reduce certain expenses while maintaining support for the sales our existing marketed product lines. Our remaining resources subsequent to these changes will be focused primarily on our existing Medical Products business, and on selected new products that have recently launched or are expected to be launched in the near future, including Quill SRS, the HemoStream™ Chronic Dialysis Catheter and the Bio-Seal™ Lung Biopsy System. Selected actions that have been taken, or that we expect to take, with respect to the reorganization include postponement of the scheduled launch of our 5-fluorouracil-eluting central venous catheter (5-FU CVC); closure of our resear ch and manufacturing facility in Rochester, New York; postponement of certain pre-clinical-stage research activities, pending the completion of partnering or other funding activities that would offset direct costs and personnel costs associated with such programs; reduction of certain financial and personnel contributions relating to our joint venture with Genzyme Corporation; potential amendment of and reduction in cash outlays related to our collaboration with Athersys, Inc.; rationalization or elimination of office and laboratory space in Vancouver, British Columbia, North Bend, Washington and Herndon, Virginia; rationalization of selected pending and issued intellectual property; elimination of certain expenses and reductions in personnel in all general and administrative and in research and development departments; selective reduction in certain sales and marketing investments personnel and in medical affairs; and postponement of selected planned capital expenditures.

Failure to achieve cost reductions through the above or other measures at the rate or levels we expect could adversely affect our ability to achieve our previously stated goal of achieving positive consolidated free cash flow (after the incurrence of net interest expense). If we are required to make further reductions to our expense levels beyond those that are ongoing or currently contemplated, our future business prospects may be adversely impacted.

We depend on BSC for a significant amount of our future revenues and development of TAXUS.

Although the acquisition of our Medical Products segment has diversified our revenue, we anticipate that a significant amount of our revenue for the next few years will be derived from and dependent upon royalty revenues from BSC. We do not have control over the sales and marketing efforts, stent pricing, production volumes, distribution or regulatory environment related to BSC’s paclitaxel-eluting coronary stent program. Our involvement is limited to the terms of our 1997 License Agreement (as amended) with BSC and Cook, which provides for the receipt of royalty revenue based on the net sales of TAXUS and specifies the applicable royalty rates.

Royalty revenue from BSC for the quarter and year ended December 31, 2008 decreased by 46% and 24% respectively from the same periods in 2007, which BSC has attributed to a decline in the number of angioplasty procedures in the United States and is expected to decline further during the year ending December 31, 2009. If BSC is impaired in its ability to market and distribute TAXUS, whether for this reason or due to a failure to comply with applicable regulatory requirements, discovery of a defect in the device, increased incidence of adverse events or identification of other safety issues, or previously-unknown problems with the manufacturing operations for TAXUS (any of which could, under certain circumstances, result in a manufacturing injunction), our revenues could be further significantly reduced. BSC’s failure to resolve these issues in a timely manner and to the satisfaction of the FDA and other regulatory authorities, or the occurrence of similar problem s in the future, could delay the launch of TAXUS Liberté in the United States and could have a significant impact on our royalty revenue from sales of TAXUS.

Additionally, BSC may terminate our 1997 License Agreement under certain circumstances, including, if BSC is unable to acquire a supply of paclitaxel at a commercially reasonable price, if BSC reasonably determines that the paclitaxel-eluting coronary stent is no longer commercially viable, or if our license agreement with the National Institutes of Health (“NIH”), certain rights under which are sublicensed to BSC, terminates. During the year ended December 31, 2008, revenue from BSC represented approximately 30% of our total revenue from continuing operations, compared to 37% in 2007.

The amounts payable by BSC to us vary from 1% to 9% of net sales depending on various factors, including volume of sales from time to time and patent protection laws in the country of sale. From these amounts, we must pay certain royalties to our licensors, including the NIH and the University of British Columbia (“UBC”), under license agreements. For the year ended December 31, 2008, the average gross royalty rate earned was 7.1% for sales in the United States and 6.4% for sales in other countries. For the year ended December 31, 2007, the average gross royalty rate earned was 7.6% for sales in the United States and 5.6% for sales in other countries. There is no guarantee that royalty payments under our 1997 License Agreement will continue, and demand for BSC’s paclitaxel-eluting coronary stent products could continue to decline as a result of the factors stated above, as well as competition, technological change, reimbursement or other factors. Also, the royalty rate payable by BSC could decline if and when patent protection expires, or no longer exists as defined by our 1997 License Agreement, in certain jurisdictions.

- 15 -

Boston Scientific may be enjoined from the selling, or otherwise become subject to limitations applicable to its ability to sell, TAXUS in the United States.

Our royalty revenue derived from the sale of paclitaxel-eluting coronary stents depends on BSC’s ability to continue to sell its TAXUS Express 2 stent and to launch next generation paclitaxel-eluting stents, including the TAXUS Liberté stent, in the United States. Historically, stent manufacture and sale is the subject of a substantial amount of U.S. patent litigation, and we anticipate that our licensees, including BSC and others, may be involved in material legal proceedings related to paclitaxel-eluting stents.

Many of the products we are depending on to grow our business are not yet ready for sale or have only recently been introduced for sale.

Many of the products we are depending on to drive future growth are not yet ready for sale or have only recently been introduced for sale. For example, our Option IVC filter has not yet been approved for sale in the U.S, our 5-FU CVC has been approved for sale but has not yet been commercially launched, and our Quill SRS and HemoStream Chronic Dialysis Catheter products have only recently become available for sale. If any of these or our other products are not approved for sale or do not achieve market acceptance, our ability to generate revenues will be adversely affected.

If our products are alleged to be harmful, we may not be able to sell them, we may be subject to product liability claims not covered by insurance and our reputation could be damaged.

The nature of our business exposes us to potential liability risks inherent in the testing, manufacturing and marketing of pharmaceutical products and medical devices. Using our drug candidates or devices in clinical trials may expose us to product liability claims. These risks will expand with respect to drugs or devices, if any, that receive regulatory approval for commercial sale. In addition, some of the products we manufacture and sell are designed to be implanted in the human body for varying periods of time. Even if a drug or device were approved for commercial use by an appropriate governmental agency, there can be no assurance that users will not claim that effects other than those intended may have resulted from our products. Component failures, manufacturing flaws, quality system failures, design defects, inadequate disclosure of product-related risks or product-related information or other safety issues with respect to these or other products we manufacture or sell could result in an unsafe condition or injury to, or death of, a patient. In addition, although many of our products are subject to review and approval by the FDA or other regulatory agencies, under the current state of law, any approval of our products by such agencies will not prohibit products liability lawsuits from being brought against us in the event that our products are alleged to be defective, even if such products have been used for their approved indications and appropriate labels have been included.

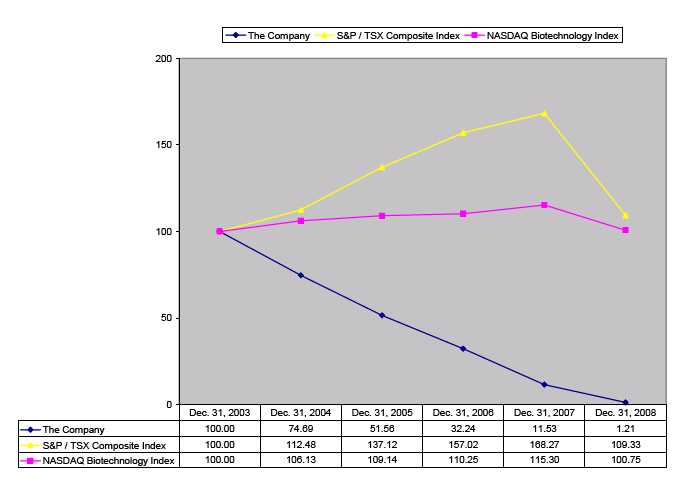

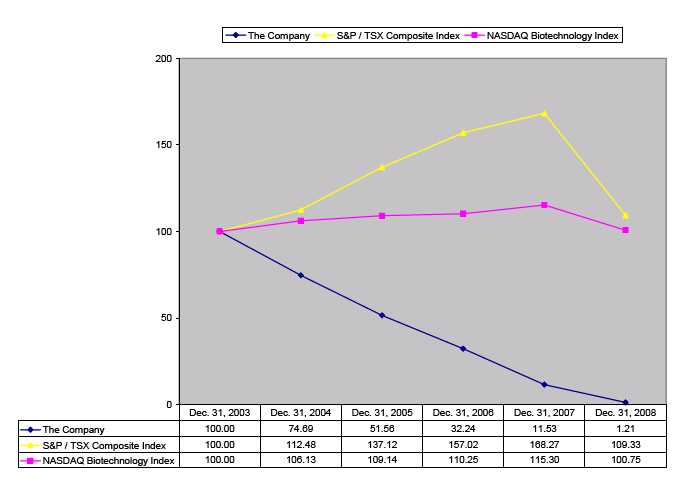

In the event that anyone alleges that any of our products are harmful, we may experience reduced consumer demand for our products or our products may be recalled from the market. In addition, we may be forced to defend individual or class action lawsuits and, if unsuccessful, to pay a substantial amount in damages. A recall of some of our products could result in exposure to additional product liability claims, lost sales and significant expense to perform the recall. The outcome of litigation, particularly class action lawsuits, is difficult to assess or quantify. Plaintiffs in these types of lawsuits often seek recovery of very large or indeterminate amounts, including not only actual damages, but also punitive damages. The magnitude of the potential loss relating to these types of lawsuits may remain unknown for substantial periods of time. In addition, the cost to defend against any future litigation may be significant.