UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-09729

iShares Trust

(Exact name of registrant as specified in charter)

c/o: BNY Mellon Investment Servicing (US) Inc.

301 Bellevue Parkway, Wilmington, DE 19809

(Address of principal executive offices) (Zip code)

The Corporation Trust Company

1209 Orange Street, Wilmington, DE 19801

(Name and address of agent for service)

Registrant’s telephone number, including area code: (415) 670-2000

Date of fiscal year end: March 31, 2023

Date of reporting period: March 31, 2023

Item 1. Reports to Stockholders.

(a) The Report to Shareholders is attached herewith.

| | |

| | MARCH 31, 2023 |

iShares Trust

| | |

· | | iShares S&P 100 ETF | OEF | NYSE Arca |

· | | iShares S&P 500 Growth ETF | IVW | NYSE Arca |

· | | iShares S&P 500 Value ETF | IVE | NYSE Arca |

· | | iShares S&P Small-Cap 600 Value ETF | IJS | NYSE Arca |

The Markets in Review

Dear Shareholder,

Significant economic headwinds emerged during the 12-month reporting period ended March 31, 2023, as investors navigated changing economic conditions and volatile markets. The U.S. economy shrank in the first half of 2022 before returning to modest growth in the second half of the year, marking a shift to a more challenging post-reopening economic environment. Changes in consumer spending patterns and a tight labor market led to elevated inflation, which reached a 40-year high before beginning to moderate.

Equity prices fell as interest rates rose, particularly during the first half of the reporting period. Both large- and small-capitalization U.S. stocks declined, although equities began to recover in the second half of the period as inflation eased and economic growth resumed. Emerging market stocks and international equities from developed markets declined overall, pressured by rising interest rates and volatile commodities prices.

The 10-year U.S. Treasury yield rose during the reporting period, driving its price down, as investors reacted to fluctuating inflation data and attempted to anticipate its impact on future interest rate changes. The corporate bond market also faced inflationary headwinds, and higher interest rates led to rising borrowing costs for corporate issuers.

The U.S. Federal Reserve (the “Fed”), acknowledging that inflation has been more persistent than expected, raised interest rates eight times. Furthermore, the Fed wound down its bond-buying programs and accelerated the reduction of its balance sheet.

Restricted labor supply kept inflation elevated even as other inflation drivers, such as goods prices and energy costs, moderated. While economic growth slowed in the last year, we believe that taming inflation requires a more substantial decline that lowers demand to a level more in line with the economy’s productive capacity. Although the Fed has decelerated the pace of interest rate hikes, we believe that it still seems determined to get inflation back to target. With this in mind, we believe the possibility of a U.S. recession in the near-term is high, but the dimming economic outlook has not yet been fully reflected in current market prices. We believe investors should expect a period of higher volatility as markets adjust to the new economic reality and policymakers attempt to adapt to rapidly changing conditions. Turmoil in the banking sector late in the period highlighted the potential for the knock-on effects of substantially higher interest rates to disrupt markets with little warning.

While we favor an overweight to equities in the long term, we prefer an underweight stance on equities overall in the near term. Expectations for corporate earnings remain elevated, which seems inconsistent with the possibility of a recession. Nevertheless, we are overweight on emerging market stocks as we believe a weakening U.S. dollar provides a supportive backdrop. We also see long-term opportunities in credit, where we believe that valuations are appealing and higher yields provide attractive income, although we are neutral on credit in the near term, as we’re concerned about tightening credit and financial conditions. However, we believe there are still some strong opportunities for a six- to twelve-month horizon, particularly short-term U.S. Treasuries, global inflation-linked bonds, and emerging market bonds denominated in local currency.

Overall, our view is that investors need to think globally, position themselves to be prepared for a decarbonizing economy, and be nimble as market conditions change. We encourage you to talk with your financial advisor and visit iShares.com for further insight about investing in today’s markets.

Sincerely,

Rob Kapito

President, BlackRock, Inc.

Rob Kapito

President, BlackRock, Inc.

| | | | | | | | | | |

| Total Returns as of March 31, 2023 |

| | | |

| | | 6-Month

| | 12-Month

|

| | |

U.S. large cap equities (S&P 500® Index) | | | | 15.62 | % | | | | (7.73 | )% |

| | |

U.S. small cap equities (Russell 2000® Index) | | | | 9.14 | | | | | (11.61 | ) |

| | |

International equities (MSCI Europe, Australasia, Far East Index) | | | | 27.27 | | | | | (1.38 | ) |

| | |

Emerging market equities (MSCI Emerging Markets Index) | | | | 14.04 | | | | | (10.70 | ) |

| | |

3-month Treasury bills (ICE BofA 3-Month U.S. Treasury Bill Index) | | | | 1.93 | | | | | 2.52 | |

| | |

U.S. Treasury securities (ICE BofA 10-Year U.S. Treasury Index) | | | | 4.38 | | | | | (6.90 | ) |

| | |

U.S. investment grade bonds (Bloomberg U.S. Aggregate Bond Index) | | | | 4.89 | | | | | (4.78 | ) |

| | |

Tax-exempt municipal bonds (Bloomberg Municipal Bond Index) | | | | 7.00 | | | | | 0.26 | |

| | |

U.S. high yield bonds (Bloomberg U.S. Corporate High Yield 2% Issuer Capped Index) | | | | 7.88 | | | | | (3.35 | ) |

|

Past performance is not an indication of future results. Index performance is shown for illustrative purposes only. You cannot invest directly in an index. | |

| | |

| 2 | | T H I S P A G E I S N O T P A R T O F Y O U R F U N D R E P O R T |

Table of Contents

Market Overview

iShares Trust

Domestic Market Overview

U.S. stocks declined for the 12 months ended March 31, 2023 (“reporting period”), when the Russell 3000® Index, a broad measure of U.S. equity market performance, returned -8.58%. Elevated inflation and rapid tightening of monetary policy dampened growth and weighed on equities. Higher interest rates drove bond yields higher and increased borrowing costs for businesses and consumers. Equities began to recover in the second half of the reporting period, as the broader economy remained resilient and the pace of inflation declined. In March 2023, two banks suddenly failed, representing the second and third largest bank failures in U.S. history by asset value. This drove concern among investors about the resiliency of the financial system in the face of rapidly rising interest rates. However, government agencies acted swiftly to organize a sale of the failed banks’ assets and inject liquidity, and equity prices recovered.

Inflation was a significant driver of the economic outlook. As the reporting period began, the consumer price index, a widely followed measure of inflation, stood at multi-decade highs. Strong consumer spending and a tight labor market, along with continued supply chain disruptions in Asia, combined to drive prices higher. But the rate of inflation began to decline as the reporting period wore on, decelerating for nine consecutive months beginning in July 2022. Nonetheless, inflation remained elevated by historic standards, and higher prices negatively impacted both consumers and businesses.

The U.S. economy recovered from a decline in the first half of 2022 to post modest growth in the third and fourth quarters of 2022. Consumers continued to power the economy with growing spending, despite higher prices for many consumer goods and services. The strong labor market supported spending, as unemployment remained very low, at one point dropping to the lowest recorded level since 1969. Furthermore, the labor force participation rate—which measures the total proportion of employed persons of working age—rose, indicating that more people were being drawn into the labor force. Amid tightening labor supply, wages rose significantly, with the largest gains at the lower end of the wage spectrum.

To contain inflation, the U.S. Federal Reserve (“Fed”) tightened monetary policy rapidly, raising short-term interest rates eight times over the course of the reporting period. The pace of tightening accelerated as the Fed twice stepped up the increment of increase before reducing it again as inflation began to subside. The Fed also started to reduce the size of its balance sheet by reducing the store of U.S. Treasuries it had accumulated to stabilize markets in the early phases of the coronavirus pandemic. While the Fed indicated that more tightening could be needed to achieve its long-term inflation goal, it sounded a more cautious note about the potential for further interest rate increases near the end of the reporting period.

Despite economic headwinds, corporate profits remained robust, and many companies were able to sufficiently raise prices to preserve profit margins even in the face of rising labor and input costs. Nonetheless, profits declined overall in the fourth quarter of 2022, and the yield curve (a graphical representation of U.S. Treasury rates at different maturities) inverted, a sign that markets were concerned about the impact of higher borrowing costs on the economy. Furthermore, dwindling personal savings and rising household debt raised questions about the sustainability of consumer spending as an engine of economic growth.

| | |

| 4 | | 2 0 2 3 I S H A R E S A N N U A L R E P O R T T O S H A R E H O L D E R S |

| | |

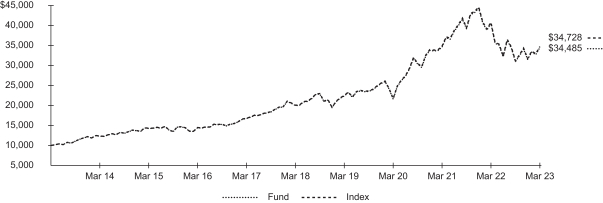

| Fund Summary as of March 31, 2023 | | iShares® S&P 100 ETF |

Investment Objective

The iShares S&P100 ETF(the “Fund”) seeks to track the investment results of an index composed of 100 large-capitalization U.S. equities, as represented by the S&P 100® (the “Index”). The Fund invests in a representative sample of securities included in the Index that collectively has an investment profile similar to the Index. Due to the use of representative sampling, the Fund may or may not hold all of the securities that are included in the Index.

Performance

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Average Annual Total Returns | | | Cumulative Total Returns | |

| | | | | | |

| | | 1 Year | | | 5 Years | | | 10 Years | | | 1 Year | | | 5 Years | | | 10 Years | |

| | | | | | |

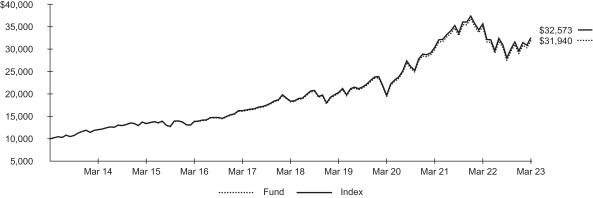

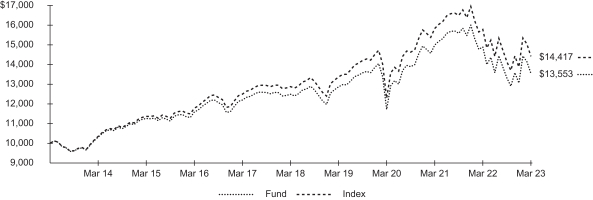

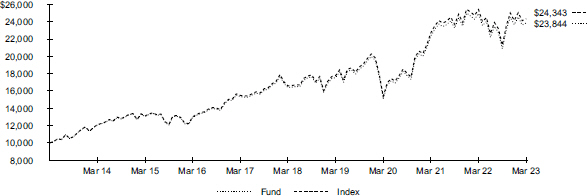

Fund NAV | | | (8.80 | )% | | | 11.88 | % | | | 12.31 | % | | | (8.80 | )% | | | 75.32 | % | | | 219.40 | % |

| | | | | | |

Fund Market | | | (8.93 | ) | | | 11.87 | | | | 12.32 | | | | (8.93 | ) | | | 75.21 | | | | 219.64 | |

| | | | | | |

Index | | | (8.62 | ) | | | 12.11 | | | | 12.53 | | | | (8.62 | ) | | | 77.14 | | | | 225.73 | |

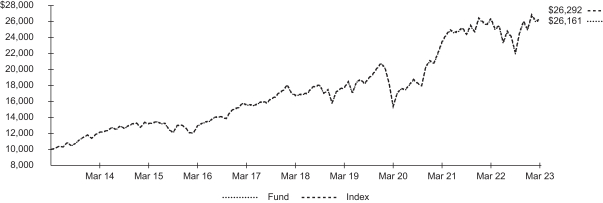

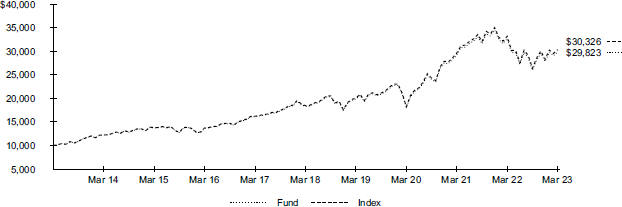

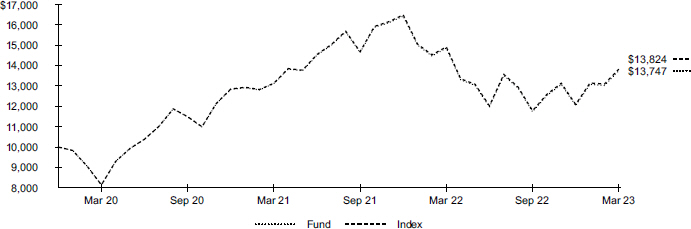

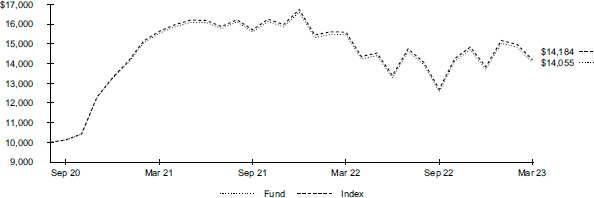

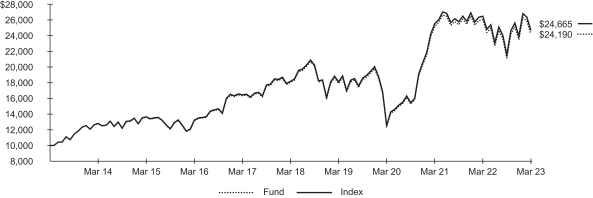

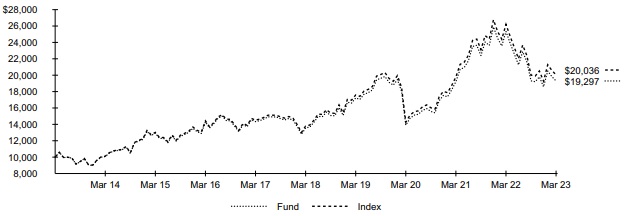

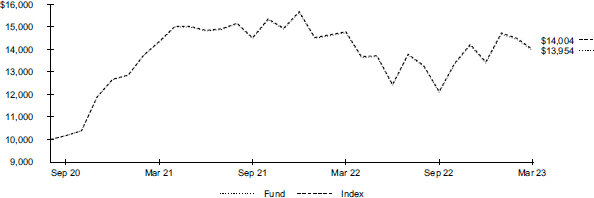

GROWTH OF $10,000 INVESTMENT

(AT NET ASSET VALUE)

Past performance is not an indication of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of sale of fund shares. See “About Fund Performance” for more information.

Expense Example

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Actual | | | | | | Hypothetical 5% Return | | | | |

| | | | | | | | | | | | | | |

| Beginning

Account Value

(10/01/22) |

| |

| Ending

Account Value

(03/31/23) |

| |

| Expenses

Paid During

the Period |

(a) | | | | | |

| Beginning

Account Value

(10/01/22) |

| |

| Ending

Account Value

(03/31/23) |

| |

| Expenses

Paid During

the Period |

(a) | |

| Annualized

Expense

Ratio |

|

$ | 1,000.00 | | | $ | 1,161.80 | | | $ | 1.08 | | | | | | | $ | 1,000.00 | | | $ | 1,023.93 | | | $ | 1.01 | | | | 0.20 | % |

| (a) | Expenses are equal to the annualized expense ratio, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period shown). Other fees, such as brokerage commissions and other fees to financial intermediaries, may be paid which are not reflected in the tables and examples above. See “Disclosure of Expenses” for more information. | |

| | |

| Fund Summary as of March 31, 2023 (continued) | | iShares® S&P 100 ETF |

Portfolio Management Commentary

Mega-capitalization U.S. stocks declined for the reporting period, as high inflation and tighter financial conditions impeded economic growth and weighed on equities. The consumer discretionary sector detracted the most from the Index’s return for the reporting period. While consumer spending continued to grow, rising inflation drove up companies’ costs, and consumers increasingly sought bargains as higher prices eroded personal spending power.

Within the sector, the internet and direct marketing retail industry detracted significantly from the Index’s performance. The sharp rise in e-commerce, which boosted the industry early in the pandemic, waned as more workers returned to the office and brick-and-mortar retailers gained market share. Overbuilding of warehouses during the online shopping surge created excess capacity, which weighed on industry cash flow. Slowing revenue growth from data cloud services further pressured the industry’s profitability. The automobiles industry also declined amid concerns about the market for electric vehicles (“EVs”) in the weakening economy. While EV sales continued to grow, production did not meet analysts’ expectations, and price discounts on some new models negatively impacted revenues. Increased competition from both domestic and international manufacturers also weighed on the industry, as more automakers expanded their EV offerings.

The communication services sector also detracted, as the rising interest rate environment negatively impacted the interactive media and services industry, particularly high-valuation stocks with growth prospects. Demand for online advertisements slowed during the reporting period, as businesses cut back on marketing expenditures in a more challenging economic environment. Stiff competition among companies producing disruptive new artificial intelligence products also pressured the industry.

On the upside, energy sector stocks contributed to the Index’s return. Relatively high average prices of energy commodities following Russia’s invasion of Ukraine supported profitability in the oil, gas, and consumable fuels industry.

Portfolio Information

SECTOR ALLOCATION

| | | | |

Sector | |

| Percent of

Total Investments |

(a) |

Information Technology | | | 31.6 | % |

Health Care | | | 13.4 | |

Financials | | | 12.4 | |

Consumer Discretionary | | | 11.4 | |

Communication Services | | | 11.2 | |

Consumer Staples | | | 7.9 | |

Industrials | | | 5.3 | |

Energy | | | 3.8 | |

Utilities | | | 1.5 | |

Other (each representing less than 1%) | | | 1.5 | |

| (a) | Excludes money market funds. |

TEN LARGEST HOLDINGS

| | | | |

Security | |

| Percent of

Total Investments |

(a) |

Apple Inc. | | | 10.8 | % |

Microsoft Corp. | | | 9.4 | |

Amazon.com, Inc. | | | 4.1 | |

NVIDIA Corp. | | | 3.0 | |

Alphabet, Inc., Class A | | | 2.7 | |

Tesla, Inc. | | | 2.5 | |

Berkshire Hathaway, Inc., Class B | | | 2.4 | |

Alphabet, Inc., Class C, NVS | | | 2.4 | |

Meta Platforms, Inc., Class A | | | 2.1 | |

Exxon Mobil Corp. | | | 2.0 | |

| | |

| 6 | | 2 0 2 3 I S H A R E S A N N U A L R E P O R T T O S H A R E H O L D E R S |

| | |

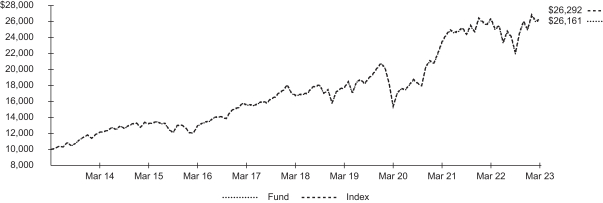

| Fund Summary as of March 31, 2023 | | iShares® S&P 500 Growth ETF |

Investment Objective

The iShares S&P 500 Growth ETF (the “Fund”) seeks to track the investment results of an index composed of large-capitalization U.S. equities that exhibit growth characteristics, as represented by the S&P 500 Growth Index™ (the “Index”). The Fund invests in a representative sample of securities included in the Index that collectively has an investment profile similar to the Index. Due to the use of representative sampling, the Fund may or may not hold all of the securities that are included in the Index.

Performance

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Average Annual Total Returns | | | | | | Cumulative Total Returns | |

| | | | | | | | | | | | |

| | | | | | | |

| | | 1 Year | | | 5 Years | | | 10 Years | | | | | | 1 Year | | | 5 Years | | | 10 Years | |

| | | | | | | |

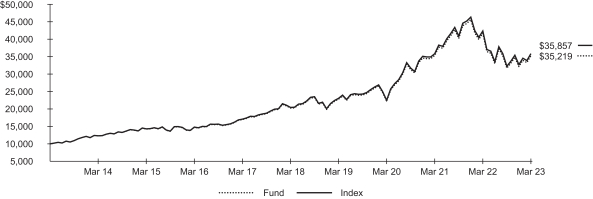

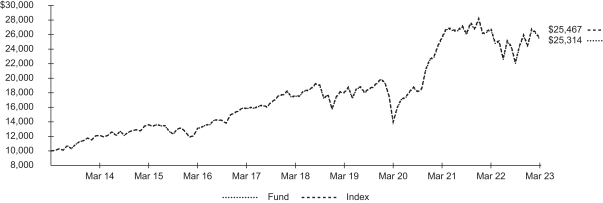

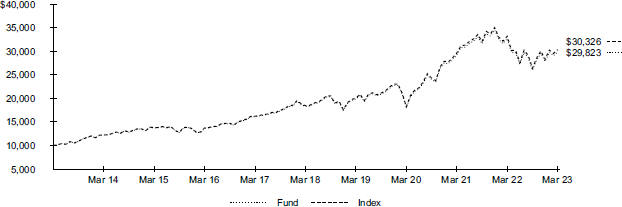

Fund NAV | | | (15.48 | )% | | | 11.70 | % | | | 13.42 | % | | | | | | | (15.48 | )% | | | 73.89 | % | | | 252.19 | % |

| | | | | | | |

Fund Market | | | (15.56 | ) | | | 11.68 | | | | 13.42 | | | | | | | | (15.56 | ) | | | 73.72 | | | | 252.36 | |

| | | | | | | |

Index | | | (15.33 | ) | | | 11.90 | | | | 13.62 | | | | | | | | (15.33 | ) | | | 75.42 | | | | 258.57 | |

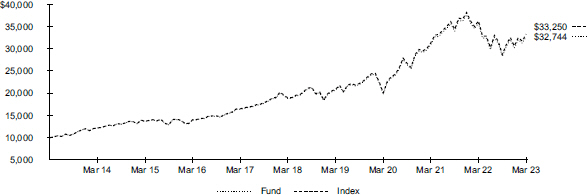

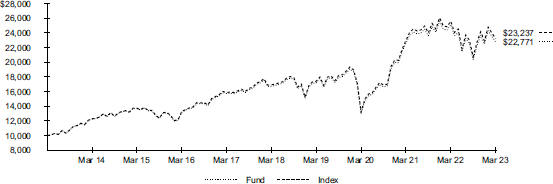

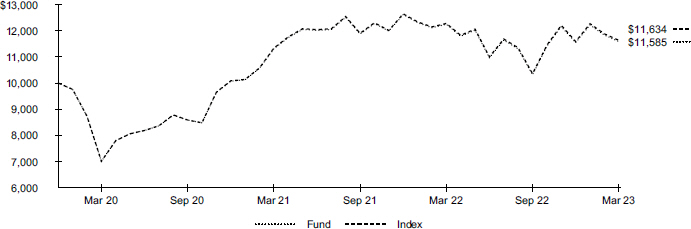

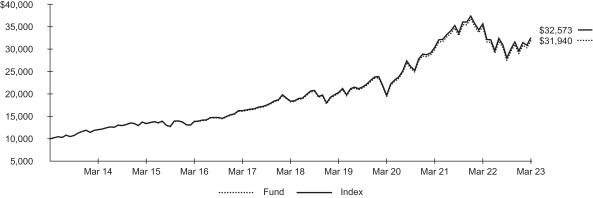

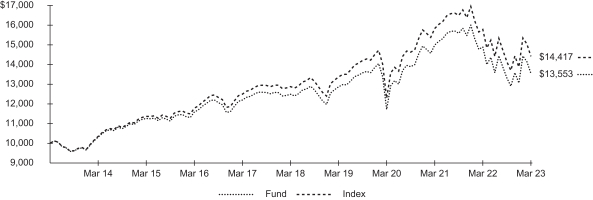

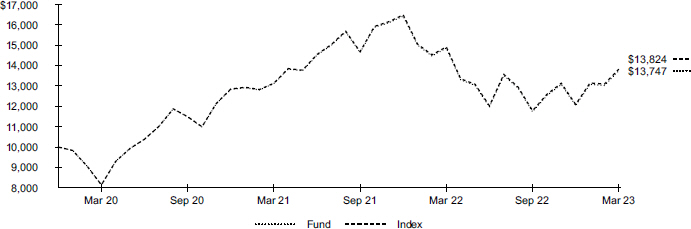

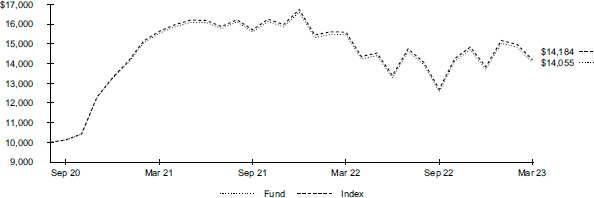

GROWTH OF $10,000 INVESTMENT

(AT NET ASSET VALUE)

Past performance is not an indication of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of sale of fund shares. See “About Fund Performance” for more information.

Expense Example

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | |

Actual | | | | | | Hypothetical 5% Return | | | | |

| | | | | | | | | | | | | | |

| | | | | | | |

| Beginning

Account Value

(10/01/22) |

| |

| Ending

Account Value

(03/31/23) |

| |

| Expenses

Paid During

the Period |

(a) | | | | | |

| Beginning

Account Value

(10/01/22) |

| |

| Ending

Account Value

(03/31/23) |

| |

| Expenses

Paid During

the Period |

(a) | |

| Annualized

Expense

Ratio |

|

| | | | | | | |

$ | 1,000.00 | | | $ | 1,111.20 | | | $ | 0.95 | | | | | | | $ | 1,000.00 | | | $ | 1,024.03 | | | $ | 0.91 | | | | 0.18 | % |

| (a) | Expenses are equal to the annualized expense ratio, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period shown). Other fees, such as brokerage commissions and other fees to financial intermediaries, may be paid which are not reflected in the tables and examples above. See “Disclosure of Expenses” for more information. | |

| | |

| Fund Summary as of March 31, 2023 (continued) | | iShares® S&P 500 Growth ETF |

Portfolio Management Commentary

Growth-oriented large-capitalization U.S. stocks declined for the reporting period, as high inflation and tighter financial conditions impeded economic growth and weighed on equities. Large-capitalization growth stocks, which derive a significant portion of their price from investors’ expectations of future growth, faced significant headwinds relative to other equities. Growth stocks are particularly sensitive to interest rates, which rose notably as the Fed sharply tightened monetary policy.

The consumer discretionary sector detracted the most from the Index’s return, particularly the internet and direct marketing retail industry. The sharp rise in e-commerce, which boosted the industry early in the pandemic, waned as more workers returned to the office and brick-and-mortar retailers gained market share. Excess warehouse capacity weighed on industry cash flow, and slowing revenue growth from data cloud services pressured profitability. The automobiles industry also declined amid concerns about the market for electric vehicles (“EVs”) in the weakening economy. While EV sales increased, production did not meet analysts expectations.

The information technology sector also detracted significantly from the Index’s return, as sharply higher interest rates reduced the current value of future earnings. Furthermore, increased concerns about economic growth tempered investors’ growth expectations for information technology stocks. The software and services industry declined notably amid high inflation and slow growth, as cuts to corporate information technology budgets reduced revenue growth. Slowing growth in cloud-based software sales further constrained earnings.

The communication services sector also detracted, as the rising interest rate environment negatively impacted the interactive media and services industry, particularly high-valuation stocks with growth prospects. Demand for online advertisements slowed, as businesses cut back on marketing expenditures in a more challenging economic environment. Stiff competition among companies producing disruptive new artificial intelligence products also pressured the industry.

Portfolio Information

| | | | |

|

| SECTOR ALLOCATION | |

| |

| Sector | |

| Percent of

Total Investments |

(a) |

| |

Information Technology | | | 33.9 | % |

| |

Health Care | | | 18.7 | |

| |

Consumer Discretionary | | | 9.8 | |

| |

Financials | | | 7.3 | |

| |

Energy | | | 7.3 | |

| |

Consumer Staples | | | 7.1 | |

| |

Communication Services | | | 7.0 | |

| |

Industrials | | | 5.4 | |

| |

Materials | | | 2.2 | |

| |

Other (each representing less than 1%) | | | 1.3 | |

| | | | |

|

| TEN LARGEST HOLDINGS | |

| |

| Security | |

| Percent of

Total Investments |

(a) |

| |

Apple Inc. | | | 13.4 | % |

| |

Microsoft Corp. | | | 6.8 | |

| |

NVIDIA Corp. | | | 3.7 | |

| |

Alphabet, Inc., Class A | | | 3.4 | |

| |

Tesla, Inc. | | | 3.1 | |

| |

Alphabet, Inc., Class C, NVS | | | 3.0 | |

| |

Exxon Mobil Corp. | | | 2.5 | |

| |

UnitedHealth Group, Inc. | | | 2.4 | |

| |

Amazon.com, Inc. | | | 2.3 | |

| |

Visa, Inc., Class A | | | 2.0 | |

| (a) | Excludes money market funds. | |

| | |

| 8 | | 2 0 2 3 I S H A R E S A N N U A L R E P O R T T O S H A R E H O L D E R S |

| | |

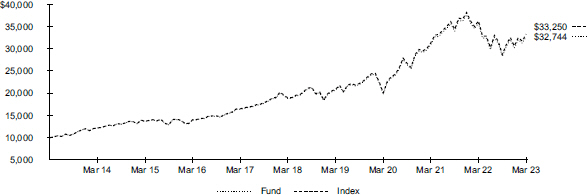

| Fund Summary as of March 31, 2023 | | iShares® S&P 500 Value ETF |

Investment Objective

The iShares S&P 500 Value ETF (the “Fund”) seeks to track the investment results of an index composed of large-capitalization U.S. equities that exhibit value characteristics, as represented by the S&P 500 Value Index™ (the “Index”). The Fund invests in a representative sample of securities included in the Index that collectively has an investment profile similar to the Index. Due to the use of representative sampling, the Fund may or may not hold all of the securities that are included in the Index.

Performance

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Average Annual Total Returns | | | | | | Cumulative Total Returns | |

| | | 1 Year | | | 5 Years | | | 10 Years | | | | | | 1 Year | | | 5 Years | | | 10 Years | |

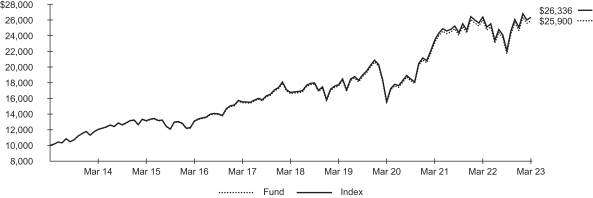

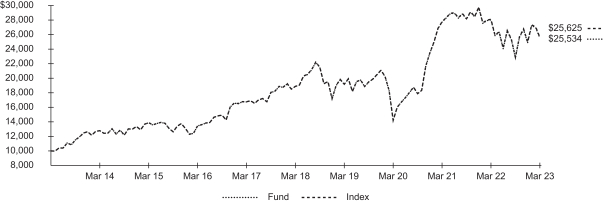

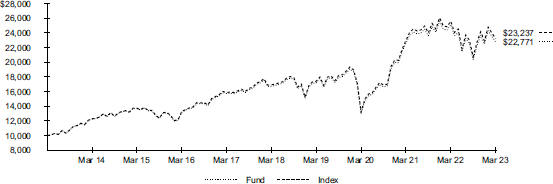

Fund NAV | | | (0.35 | )% | | | 9.29 | % | | | 9.98 | % | | | | | | | (0.35 | )% | | | 55.90 | % | | | 159.00 | % |

Fund Market | | | (0.43 | ) | | | 9.28 | | | | 9.99 | | | | | | | | (0.43 | ) | | | 55.87 | | | | 159.15 | |

Index | | | (0.16 | ) | | | 9.47 | | | | 10.17 | | | | | | | | (0.16 | ) | | | 57.19 | | | | 163.36 | |

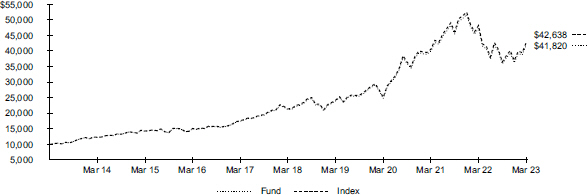

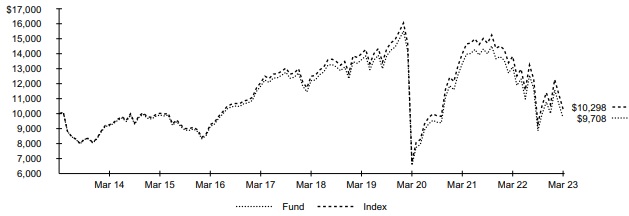

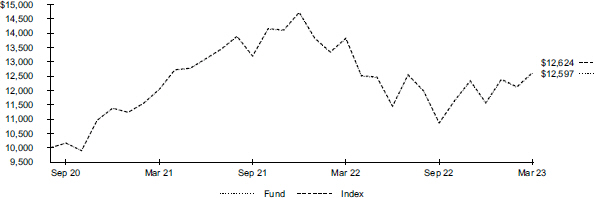

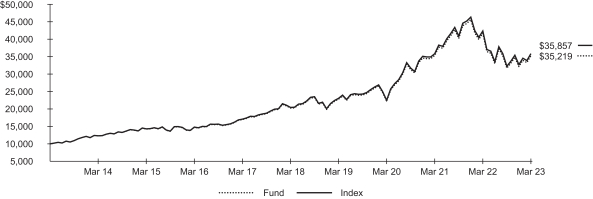

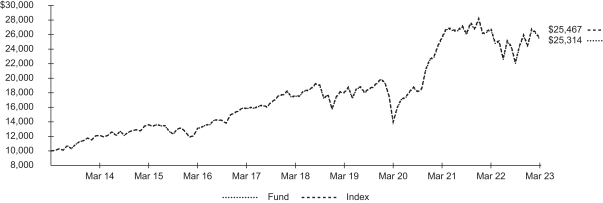

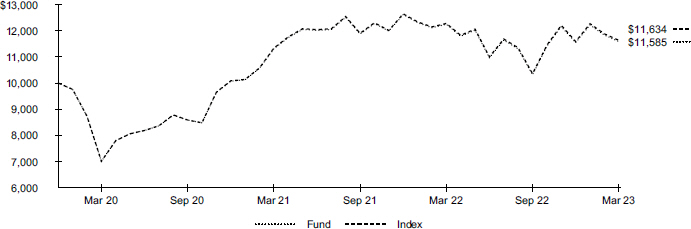

GROWTH OF $10,000 INVESTMENT

(AT NET ASSET VALUE)

Past performance is not an indication of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of sale of fund shares. See “About Fund Performance” for more information.

Expense Example

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Actual | | | | | | Hypothetical 5% Return | | | | |

| | | | | | | | | | | | | | |

| Beginning

Account Value

(10/01/22) |

| |

| Ending

Account Value

(03/31/23) |

| |

| Expenses

Paid During

the Period |

(a) | | | | | |

| Beginning

Account Value

(10/01/22) |

| |

| Ending

Account Value

(03/31/23) |

| |

| Expenses

Paid During

the Period |

(a) | |

| Annualized

Expense

Ratio |

|

$ | 1,000.00 | | | $ | 1,193.70 | | | $ | 0.98 | | | | | | | $ | 1,000.00 | | | $ | 1,024.03 | | | $ | 0.91 | | | | 0.18 | % |

| (a) | Expenses are equal to the annualized expense ratio, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period shown). Other fees, such as brokerage commissions and other fees to financial intermediaries, may be paid which are not reflected in the tables and examples above. See “Disclosure of Expenses” for more information. | |

| | |

| Fund Summary as of March 31, 2023 (continued) | | iShares® S&P 500 Value ETF |

Portfolio Management Commentary

Value-oriented large-capitalization U.S. stocks declined marginally for the reporting period, as high inflation and tighter financial conditions impeded economic growth and weighed on equities. The financials sector detracted the most from the Index’s performance amid tightening financial conditions. The banking industry faced significant challenges, as the potential impact of a slowing economy outweighed the benefits of being able to charge more for loans. As the Fed raised interest rates to fight persistently high inflation, investors became concerned about the long-term effect on loan growth and credit losses. Bank stocks were further pressured late in the reporting period after the sudden failure of two regional banks. The financial services industry also faced headwinds, as inflationary pressure and high interest rates reduced the value of many of the industry’s equity holdings. The impact of a large hurricane in 2022 further dented earnings in the industry.

The real estate sector also detracted significantly from the Index’s return, as higher interest rates weighed on the equity real estate investment trusts (“REITs”) industry. REITs typically take on substantial debt in order to finance the purchase of the properties they manage, and higher interest rates make financing more expensive.

On the upside, stocks in the energy sector contributed to the Index’s return despite lower oil prices and a sharp decline in the price of natural gas. The price of oil and natural gas surged in the aftermath of Russia’s invasion of Ukraine. While prices subsequently fell as markets stabilized, the relatively high average prices of energy commodities supported profitability in the oil, gas, and consumable fuels industry. The information technology and consumer discretionary sectors also contributed, as a software company and an internet retailer were added to the Index upon rebalancing in December 2022 and advanced thereafter.

Portfolio Information

SECTOR ALLOCATION

| | | | |

Sector | |

| Percent of

Total Investments |

(a) |

Financials | | | 19.3 | % |

Information Technology | | | 17.2 | |

Industrials | | | 12.3 | |

Consumer Discretionary | | | 10.5 | |

Communication Services | | | 9.4 | |

Health Care | | | 9.1 | |

Consumer Staples | | | 7.4 | |

Utilities | | | 5.5 | |

Real Estate | | | 4.6 | |

Materials | | | 3.1 | |

Energy | | | 1.6 | |

| (a) | Excludes money market funds. | |

TEN LARGEST HOLDINGS

| | | | |

Security | |

| Percent of

Total Investments |

(a) |

Microsoft Corp. | | | 5.6 | % |

Berkshire Hathaway, Inc., Class B | | | 3.5 | |

Amazon.com, Inc. | | | 3.1 | |

Meta Platforms, Inc., Class A | | | 2.9 | |

JPMorgan Chase & Co. | | | 2.4 | |

Cisco Systems, Inc. | | | 1.3 | |

Walmart, Inc. | | | 1.3 | |

Salesforce, Inc. | | | 1.2 | |

Bank of America Corp. | | | 1.2 | |

Walt Disney Co. | | | 1.1 | |

| | |

| 10 | | 2 0 2 3 I S H A R E S A N N U A L R E P O R T T O S H A R E H O L D E R S |

| | |

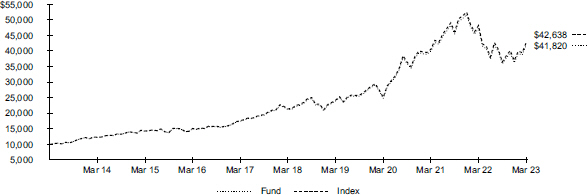

| Fund Summary as of March 31, 2023 | | iShares® S&P Small-Cap 600 Value ETF |

Investment Objective

The iShares S&P Small-Cap 600 Value ETF (the “Fund”) seeks to track the investment results of an index composed of small-capitalization U.S. equities that exhibit value characteristics, as represented by the S&P SmallCap 600 Value Index™ (the “Index”). The Fund invests in a representative sample of securities included in the Index that collectively has an investment profile similar to the Index. Due to the use of representative sampling, the Fund may or may not hold all of the securities that are included in the Index.

Performance

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Average Annual Total Returns | | | | | | Cumulative Total Returns | |

| | | | | | | |

| | | 1 Year | | | 5 Years | | | 10 Years | | | | | | 1 Year | | | 5 Years | | | 10 Years | |

| | | | | | | |

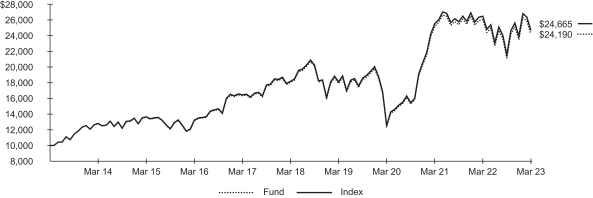

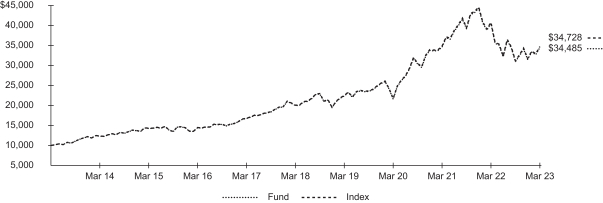

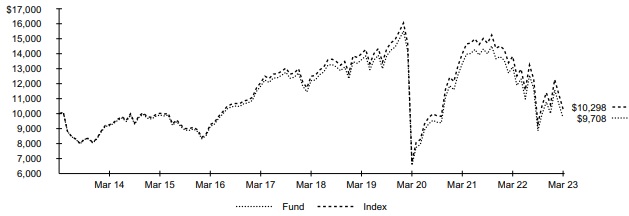

Fund NAV | | | (7.08 | )% | | | 6.05 | % | | | 9.24 | % | | | | | | | (7.08 | )% | | | 34.13 | % | | | 141.90 | % |

| | | | | | | |

Fund Market | | | (7.17 | ) | | | 6.04 | | | | 9.23 | | | | | | | | (7.17 | ) | | | 34.08 | | | | 141.73 | |

| | | | | | | |

Index | | | (6.81 | ) | | | 6.30 | | | | 9.45 | | | | | | | | (6.81 | ) | | | 35.70 | | | | 146.65 | |

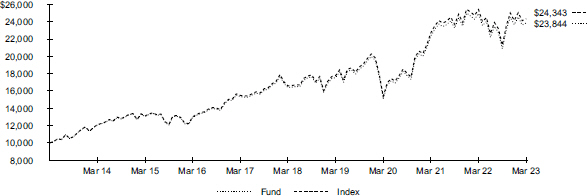

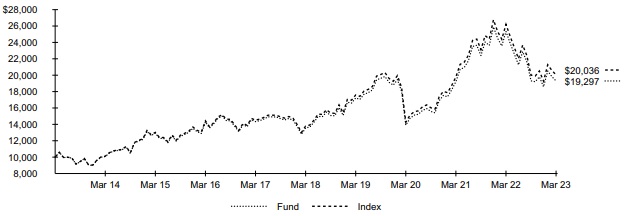

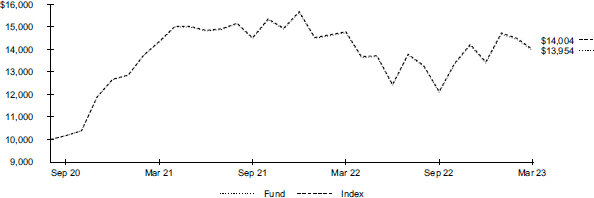

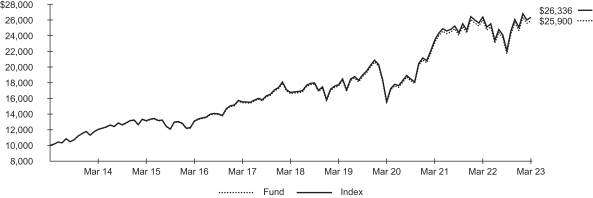

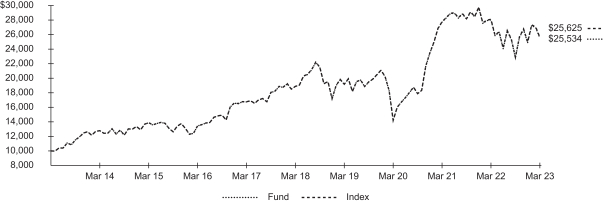

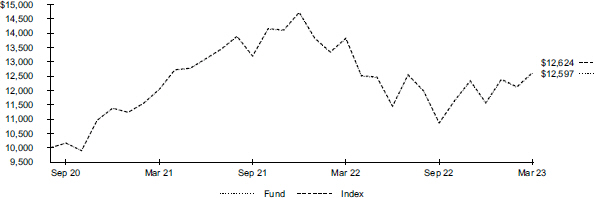

GROWTH OF $10,000 INVESTMENT

(AT NET ASSET VALUE)

Past performance is not an indication of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. See “About Fund Performance” for more information.

Expense Example

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Actual | | | | | | Hypothetical 5% Return | | | | |

| Beginning

Account Value

(10/01/22) |

| |

| Ending

Account Value

(03/31/23) |

| |

| Expenses

Paid During

the Period |

(a) | | | | | |

| Beginning

Account Value

(10/01/22) |

| |

| Ending

Account Value

(03/31/23) |

| |

| Expenses

Paid During

the Period |

(a) | |

| Annualized

Expense

Ratio |

|

$ | 1,000.00 | | | $ | 1,143.80 | | | $ | 0.96 | | | | | | | $ | 1,000.00 | | | $ | 1,024.03 | | | $ | 0.91 | | | | 0.18 | % |

| (a) | Expenses are equal to the annualized expense ratio, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period shown). Other fees, such as brokerage commissions and other fees to financial intermediaries, may be paid which are not reflected in the tables and examples above. See “Disclosure of Expenses” for more information. | |

| | |

| Fund Summary as of March 31, 2023 (continued) | | iShares® S&P Small-Cap 600 Value ETF |

Portfolio Management Commentary

Value-oriented small-capitalization U.S. stocks declined for the reporting period, as high inflation and tighter financial conditions impeded economic growth and weighed on equities. The financials sector detracted the most from the Index’s performance amid tightening financial conditions. The banking industry faced significant challenges, as the potential impact of a slowing economy outweighed the benefits of being able to charge more for loans. While bank profitability is typically supported by higher interest rates, persistently high inflation led to significant tightening from the Fed, and investors became concerned about the long-term effect of this tightening on loan growth and credit losses. Bank stocks were further pressured late in the reporting period after the sudden failure of two regional banks led to government intervention to cover depositors and prevent a contagion effect. Despite government actions to contain the impact, these bank failures weighed heavily on the industry, as markets digested the long-term implications of the disruption.

The real estate sector detracted significantly from the Index’s return, as higher interest rates and changing usage patterns weighed on equity real estate investment trusts (“REITs”). REITs typically take on substantial debt to finance the purchase of the properties they manage, and higher interest rates make financing more expensive. Furthermore, higher interest rates also meant increased bond yields, making dividend yields from REITs comparatively less attractive to income-oriented investors. An ongoing oversupply of office space due to the shift toward remote work and more stringent lending standards after the failure of two prominent banks late in the reporting period negatively affected office REITs.

On the upside, industrials stocks contributed to the Index’s return. The capital goods industry benefited from government incentives that encouraged investments in additional industrial capacity.

Portfolio Information

SECTOR ALLOCATION

| | | | |

| | |

Sector | |

| Percent of

Total Investments |

(a) |

Consumer Discretionary | | | 19.8 | % |

Financials | | | 16.7 | |

Industrials | | | 16.3 | |

Real Estate | | | 11.3 | |

Information Technology | | | 8.8 | |

Health Care | | | 8.8 | |

Materials | | | 5.4 | |

Consumer Staples | | | 4.4 | |

Energy | | | 3.7 | |

Communication Services | | | 3.0 | |

Utilities | | | 1.8 | |

(a) Excludes money market funds.

TEN LARGEST HOLDINGS

| | | | |

| | |

Security | |

| Percent of

Total Investments |

(a) |

Insight Enterprises, Inc. | | | 1.0 | % |

Meritage Homes Corp. | | | 1.0 | |

Essential Properties Realty Trust, Inc. | | | 0.8 | |

Signet Jewelers Ltd. | | | 0.8 | |

John Bean Technologies Corp. | | | 0.8 | |

Group 1 Automotive, Inc. | | | 0.7 | |

Rogers Corp. | | | 0.7 | |

ABM Industries, Inc. | | | 0.7 | |

LXP Industrial Trust | | | 0.6 | |

Avista Corp. | | | 0.6 | |

| | |

| 12 | | 2 0 2 3 I S H A R E S A N N U A L R E P O R T T O S H A R E H O L D E R S |

About Fund Performance

Past performance is not an indication of future results. Financial markets have experienced extreme volatility and trading in many instruments has been disrupted. These circumstances may continue for an extended period of time and may continue to affect adversely the value and liquidity of each Fund’s investments. As a result, current performance may be lower or higher than the performance data quoted. Performance data current to the most recent month-end is available at iShares.com. Performance results assume reinvestment of all dividends and capital gain distributions and do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. The investment return and principal value of shares will vary with changes in market conditions. Shares may be worth more or less than their original cost when they are redeemed or sold in the market. Performance for certain funds may reflect a waiver of a portion of investment advisory fees. Without such a waiver, performance would have been lower.

Net asset value or “NAV” is the value of one share of a fund as calculated in accordance with the standard formula for valuing mutual fund shares. Beginning August 10, 2020, the price used to calculate market return (“Market Price”) is the closing price. Prior to August 10, 2020, Market Price was determined using the midpoint between the highest bid and the lowest ask on the primary stock exchange on which shares of a fund are listed for trading, as of the time that such fund’s NAV is calculated. Market and NAV returns assume that dividends and capital gain distributions have been reinvested at Market Price and NAV, respectively.

An index is a statistical composite that tracks a specified financial market or sector. Unlike a fund, an index does not actually hold a portfolio of securities and therefore does not incur the expenses incurred by a fund. These expenses negatively impact fund performance. Also, market returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower.

Disclosure of Expenses

Shareholders of each Fund may incur the following charges: (1) transactional expenses, including brokerage commissions on purchases and sales of fund shares and (2) ongoing expenses, including management fees and other fund expenses. The expense examples shown (which are based on a hypothetical investment of $1,000 invested at the beginning of the period and held through the end of the period) are intended to assist shareholders both in calculating expenses based on an investment in each Fund and in comparing these expenses with similar costs of investing in other funds.

The expense examples provide information about actual account values and actual expenses. Annualized expense ratios reflect contractual and voluntary fee waivers, if any. In order to estimate the expenses a shareholder paid during the period covered by this report, shareholders can divide their account value by $1,000 and then multiply the result by the number under the heading entitled “Expenses Paid During the Period.”

The expense examples also provide information about hypothetical account values and hypothetical expenses based on a fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses. In order to assist shareholders in comparing the ongoing expenses of investing in the Funds and other funds, compare the 5% hypothetical examples with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

The expenses shown in the expense examples are intended to highlight shareholders’ ongoing costs only and do not reflect any transactional expenses, such as brokerage commissions and other fees paid on purchases and sales of fund shares. Therefore, the hypothetical examples are useful in comparing ongoing expenses only and will not help shareholders determine the relative total expenses of owning different funds. If these transactional expenses were included, shareholder expenses would have been higher.

| | |

A B O U T F U N D P E R F O R M A N C E / D I S C L O S U R E O F E X P E N S E S | | 13 |

| | |

Schedule of Investments March 31, 2023 | | iShares® S&P 100 ETF (Percentages shown are based on Net Assets) |

| | | | | | | | |

| Security | | Shares | | | Value | |

|

Common Stocks | |

|

| Aerospace & Defense — 1.8% | |

Boeing Co.(a) | | | 186,200 | | | $ | 39,554,466 | |

General Dynamics Corp. | | | 74,510 | | | | 17,003,927 | |

Lockheed Martin Corp. | | | 75,232 | | | | 35,564,423 | |

Raytheon Technologies Corp. | | | 485,063 | | | | 47,502,220 | |

| | | | | | | | |

| | | | | | | 139,625,036 | |

|

| Air Freight & Logistics — 0.9% | |

FedEx Corp. | | | 76,790 | | | | 17,545,747 | |

United Parcel Service, Inc., Class B | | | 241,653 | | | | 46,878,266 | |

| | | | | | | | |

| | | | | | | 64,424,013 | |

|

| Automobiles — 2.9% | |

Ford Motor Co. | | | 1,296,398 | | | | 16,334,615 | |

General Motors Co. | | | 461,124 | | | | 16,914,028 | |

Tesla, Inc.(a) | | | 890,519 | | | | 184,747,072 | |

| | | | | | | | |

| | | | | | | 217,995,715 | |

|

| Banks — 3.8% | |

Bank of America Corp. | | | 2,310,994 | | | | 66,094,428 | |

Citigroup, Inc. | | | 641,314 | | | | 30,071,213 | |

JPMorgan Chase & Co. | | | 971,217 | | | | 126,559,287 | |

U.S. Bancorp | | | 460,756 | | | | 16,610,254 | |

Wells Fargo & Co. | | | 1,261,696 | | | | 47,162,197 | |

| | | | | | | | |

| | | | | | | 286,497,379 | |

|

| Beverages — 2.2% | |

Coca-Cola Co. | | | 1,288,705 | | | | 79,938,371 | |

PepsiCo, Inc. | | | 456,023 | | | | 83,132,993 | |

| | | | | | | | |

| | | | | | | 163,071,364 | |

|

| Biotechnology — 2.3% | |

AbbVie, Inc. | | | 585,563 | | | | 93,321,175 | |

Amgen, Inc. | | | 176,805 | | | | 42,742,609 | |

Gilead Sciences, Inc. | | | 412,896 | | | | 34,257,981 | |

| | | | | | | | |

| | | | | | | 170,321,765 | |

|

| Broadline Retail — 4.0% | |

Amazon.com, Inc.(a) | | | 2,951,894 | | | | 304,901,131 | |

| | | | | | | | |

|

| Capital Markets — 1.9% | |

Bank of New York Mellon Corp. | | | 244,295 | | | | 11,100,765 | |

BlackRock, Inc.(b) | | | 49,586 | | | | 33,178,984 | |

Charles Schwab Corp. | | | 505,047 | | | | 26,454,362 | |

Goldman Sachs Group, Inc. | | | 112,127 | | | | 36,677,863 | |

Morgan Stanley | | | 432,596 | | | | 37,981,929 | |

| | | | | | | | |

| | | | | | | 145,393,903 | |

|

| Chemicals — 0.9% | |

Dow, Inc. | | | 233,278 | | | | 12,788,300 | |

Linde PLC | | | 163,083 | | | | 57,966,221 | |

| | | | | | | | |

| | | | | | | 70,754,521 | |

|

| Communications Equipment — 0.9% | |

Cisco Systems, Inc. | | | 1,360,238 | | | | 71,106,441 | |

| | | | | | | | |

|

| Consumer Finance — 0.6% | |

American Express Co. | | | 197,129 | | | | 32,516,429 | |

Capital One Financial Corp. | | | 126,482 | | | | 12,162,509 | |

| | | | | | | | |

| | | | | | | 44,678,938 | |

|

| Consumer Staples Distribution & Retail — 2.3% | |

Costco Wholesale Corp. | | | 146,923 | | | | 73,001,631 | |

Target Corp. | | | 152,415 | | | | 25,244,496 | |

Walgreens Boots Alliance, Inc. | | | 237,624 | | | | 8,217,038 | |

Walmart, Inc. | | | 464,329 | | | | 68,465,311 | |

| | | | | | | | |

| | | | | | | 174,928,476 | |

| | | | | | | | |

| Security | | Shares | | | Value | |

|

| Diversified Telecommunication Services — 1.3% | |

AT&T Inc. | | | 2,360,159 | | | $ | 45,433,061 | |

Verizon Communications, Inc. | | | 1,390,627 | | | | 54,081,484 | |

| | | | | | | | |

| | | | | | | 99,514,545 | |

|

| Electric Utilities — 1.5% | |

Duke Energy Corp. | | | 254,955 | | | | 24,595,509 | |

Exelon Corp. | | | 329,359 | | | | 13,796,848 | |

NextEra Energy, Inc. | | | 657,972 | | | | 50,716,482 | |

Southern Co. | | | 360,472 | | | | 25,081,642 | |

| | | | | | | | |

| | | | | | | 114,190,481 | |

|

| Electrical Equipment — 0.2% | |

Emerson Electric Co. | | | 188,915 | | | | 16,462,053 | |

| | | | | | | | |

|

| Entertainment — 1.5% | |

Netflix, Inc.(a) | | | 147,460 | | | | 50,944,481 | |

Walt Disney Co.(a) | | | 604,876 | | | | 60,566,234 | |

| | | | | | | | |

| | | | | | | 111,510,715 | |

|

| Financial Services — 5.8% | |

Berkshire Hathaway, Inc., Class B(a) | | | 596,569 | | | | 184,202,610 | |

Mastercard, Inc., Class A | | | 279,366 | | | | 101,524,398 | |

PayPal Holdings, Inc.(a) | | | 374,609 | | | | 28,447,808 | |

Visa, Inc., Class A | | | 538,040 | | | | 121,306,498 | |

| | | | | | | | |

| | | | | | | 435,481,314 | |

|

| Food Products — 0.6% | |

Kraft Heinz Co. | | | 264,650 | | | | 10,234,015 | |

Mondelez International, Inc., Class A | | | 450,990 | | | | 31,443,023 | |

| | | | | | | | |

| | | | | | | 41,677,038 | |

|

| Ground Transportation — 0.5% | |

Union Pacific Corp. | | | 202,598 | | | | 40,774,873 | |

| | | | | | | | |

|

| Health Care Equipment & Supplies — 1.2% | |

Abbott Laboratories | | | 577,316 | | | | 58,459,018 | |

Medtronic PLC | | | 440,438 | | | | 35,508,112 | |

| | | | | | | | |

| | | | | | | 93,967,130 | |

|

| Health Care Providers & Services — 2.4% | |

CVS Health Corp. | | | 425,183 | | | | 31,595,349 | |

UnitedHealth Group, Inc. | | | 309,372 | | | | 146,206,113 | |

| | | | | | | | |

| | | | | | | 177,801,462 | |

|

| Hotels, Restaurants & Leisure — 1.9% | |

Booking Holdings, Inc.(a) | | | 12,843 | | | | 34,064,902 | |

McDonald’s Corp. | | | 242,515 | | | | 67,809,619 | |

Starbucks Corp. | | | 380,546 | | | | 39,626,255 | |

| | | | | | | | |

| | | | | | | 141,500,776 | |

|

| Household Products — 1.8% | |

Colgate-Palmolive Co. | | | 276,386 | | | | 20,770,408 | |

Procter & Gamble Co. | | | 781,139 | | | | 116,147,558 | |

| | | | | | | | |

| | | | | | | 136,917,966 | |

|

| Industrial Conglomerates — 1.3% | |

3M Co. | | | 182,545 | | | | 19,187,305 | |

General Electric Co. | | | 360,676 | | | | 34,480,626 | |

Honeywell International, Inc. | | | 221,229 | | | | 42,281,286 | |

| | | | | | | | |

| | | | | | | 95,949,217 | |

|

| Insurance — 0.3% | |

American International Group, Inc. | | | 246,147 | | | | 12,395,963 | |

MetLife, Inc. | | | 218,299 | | | | 12,648,244 | |

| | | | | | | | |

| | | | | | | 25,044,207 | |

|

| Interactive Media & Services — 7.1% | |

Alphabet, Inc., Class A(a) | | | 1,972,098 | | | | 204,565,726 | |

| | |

| 14 | | 2 0 2 3 I S H A R E S A N N U A L R E P O R T T O S H A R E H O L D E R S |

| | |

Schedule of Investments (continued) March 31, 2023 | | iShares® S&P 100 ETF (Percentages shown are based on Net Assets) |

| | | | | | | | |

| Security | | Shares | | | Value | |

|

| Interactive Media & Services (continued) | |

Alphabet, Inc., Class C, NVS(a) | | | 1,719,182 | | | $ | 178,794,928 | |

Meta Platforms, Inc., Class A(a) | | | 736,975 | | | | 156,194,481 | |

| | | | | | | | |

| | | | | | | 539,555,135 | |

|

| IT Services — 1.3% | |

Accenture PLC, Class A | | | 208,514 | | | | 59,595,386 | |

International Business Machines Corp. | | | 299,366 | | | | 39,243,889 | |

| | | | | | | | |

| | | | | | | 98,839,275 | |

|

| Life Sciences Tools & Services — 1.7% | |

Danaher Corp. | | | 217,033 | | | | 54,700,997 | |

Thermo Fisher Scientific, Inc. | | | 129,861 | | | | 74,847,985 | |

| | | | | | | | |

| | | | | | | 129,548,982 | |

|

| Machinery — 0.5% | |

Caterpillar, Inc. | | | 172,314 | | | | 39,432,336 | |

| | | | | | | | |

|

| Media — 0.9% | |

Charter Communications, Inc., Class A(a) | | | 34,985 | | | | 12,510,986 | |

Comcast Corp., Class A | | | 1,392,857 | | | | 52,803,209 | |

| | | | | | | | |

| | | | | | | 65,314,195 | |

|

| Oil, Gas & Consumable Fuels — 3.8% | |

Chevron Corp. | | | 589,030 | | | | 96,106,135 | |

ConocoPhillips | | | 405,232 | | | | 40,203,066 | |

Exxon Mobil Corp. | | | 1,363,515 | | | | 149,523,055 | |

| | | | | | | | |

| | | | | | | 285,832,256 | |

|

| Pharmaceuticals — 5.8% | |

Bristol-Myers Squibb Co. | | | 703,995 | | | | 48,793,893 | |

Eli Lilly & Co. | | | 261,129 | | | | 89,676,921 | |

Johnson & Johnson | | | 865,685 | | | | 134,181,175 | |

Merck & Co., Inc. | | | 839,499 | | | | 89,314,299 | |

Pfizer, Inc. | | | 1,858,632 | | | | 75,832,186 | |

| | | | | | | | |

| | | | | | | 437,798,474 | |

|

| Retail REITs — 0.2% | |

Simon Property Group, Inc. | | | 107,983 | | | | 12,090,857 | |

| | | | | | | | |

|

| Semiconductors & Semiconductor Equipment — 6.8% | |

Advanced Micro Devices, Inc.(a) | | | 533,868 | | | | 52,324,403 | |

Broadcom, Inc. | | | 138,367 | | | | 88,767,965 | |

Intel Corp. | | | 1,369,806 | | | | 44,751,562 | |

NVIDIA Corp. | | | 814,534 | | | | 226,253,109 | |

QUALCOMM, Inc. | | | 369,189 | | | | 47,101,133 | |

Texas Instruments, Inc. | | | 300,055 | | | | 55,813,230 | |

| | | | | | | | |

| | | | | | | 515,011,402 | |

|

| Software — 11.7% | |

Adobe, Inc.(a) | | | 151,584 | | | | 58,415,926 | |

| | | | | | | | |

| Security | | Shares | | | Value | |

|

| Software (continued) | |

Microsoft Corp. | | | 2,464,726 | | | $ | 710,580,506 | |

Oracle Corp. | | | 508,872 | | | | 47,284,386 | |

Salesforce, Inc.(a) | | | 331,110 | | | | 66,149,156 | |

| | | | | | | | |

| | | | | | | 882,429,974 | |

|

| Specialized REITs — 0.4% | |

American Tower Corp. | | | 154,167 | | | | 31,502,485 | |

| | | | | | | | |

|

| Specialty Retail — 1.8% | |

Home Depot, Inc. | | | 337,463 | | | | 99,592,081 | |

Lowe’s Cos., Inc. | | | 200,224 | | | | 40,038,793 | |

| | | | | | | | |

| | | | | | | 139,630,874 | |

|

| Technology Hardware, Storage & Peripherals — 10.8% | |

Apple Inc. | | | 4,924,493 | | | | 812,048,896 | |

| | | | | | | | |

|

| Textiles, Apparel & Luxury Goods — 0.7% | |

NIKE, Inc., Class B | | | 412,453 | | | | 50,583,236 | |

| | | | | | | | |

|

| Tobacco — 1.0% | |

Altria Group, Inc. | | | 591,210 | | | | 26,379,790 | |

Philip Morris International, Inc. | | | 513,299 | | | | 49,918,328 | |

| | | | | | | | |

| | | | | | | 76,298,118 | |

|

| Wireless Telecommunication Services — 0.4% | |

T-Mobile U.S., Inc.(a) | | | 196,117 | | | | 28,405,586 | |

| | | | | | | | |

| | |

Total Long-Term Investments — 99.7%

(Cost: $6,642,321,886) | | | | | | | 7,528,812,540 | |

| | | | | | | | |

| | |

| Short-Term Securities | | | | | | |

| | |

| Money Market Funds — 0.2% | | | | | | |

BlackRock Cash Funds: Treasury, SL Agency Shares, 4.73%(b)(c)(d) | | | 14,929,868 | | | | 14,929,868 | |

| | | | | | | | |

| | |

Total Short-Term Securities — 0.2%

(Cost: $14,929,868) | | | | | 14,929,868 | |

| | | | | | | | |

| | |

Total Investments — 99.9%

(Cost: $6,657,251,754) | | | | | 7,543,742,408 | |

Other Assets Less Liabilities — 0.1% | | | | | | | 4,285,132 | |

| | | | | | | | |

Net Assets — 100.0% | | | | | | $ | 7,548,027,540 | |

| | | | | | | | |

| (a) | Non-income producing security. |

| (b) | Affiliate of the Fund. |

| (c) | Annualized 7-day yield as of period end. |

| (d) | All or a portion of this security was purchased with the cash collateral from loaned securities. |

| | |

S C H E D U L E S O F I N V E S T M E N T S | | 15 |

| | |

Schedule of Investments (continued) March 31, 2023 | | iShares® S&P 100 ETF |

Affiliates

Investments in issuers considered to be affiliate(s) of the Fund during the year ended March 31, 2023 for purposes of Section 2(a)(3) of the Investment Company Act of 1940, as amended, were as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Affiliated Issuer | | Value at

03/31/22 | | | Purchases

at Cost | | | Proceeds from Sale | | | Net

Realized

Gain (Loss) | | | Change in

Unrealized

Appreciation

(Depreciation) | | | Value at

03/31/23 | | | Shares

Held at

03/31/23 | | | Income | | | Capital Gain

Distributions

from Underlying

Funds | |

BlackRock Cash Funds: Institutional, SL Agency Shares(a) | | $ | 9,415,762 | | | $ | — | | | $ | (9,448,345 | )(b) | | $ | 32,574 | | | $ | 9 | | | $ | — | | | | — | | | $ | 133,167 | (c) | | $ | — | |

BlackRock Cash Funds: Treasury, SL Agency Shares | | | 16,943,000 | | | | — | | | | (2,013,132 | )(b) | | | — | | | | — | | | | 14,929,868 | | | | 14,929,868 | | | | 471,122 | | | | 10 | |

BlackRock, Inc. | | | 37,188,333 | | | | 7,561,373 | | | | (7,250,310 | ) | | | 2,166,228 | | | | (6,486,640 | ) | | | 33,178,984 | | | | 49,586 | | | | 497,404 | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | $ | 2,198,802 | | | $ | (6,486,631 | ) | | $ | 48,108,852 | | | | | | | $ | 1,101,693 | | | $ | 10 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | (a) | As of period end, the entity is no longer held. | |

| | (b) | Represents net amount purchased (sold). | |

| | (c) | All or a portion represents securities lending income earned from the reinvestment of cash collateral from loaned securities, net of fees and collateral investment expenses, and other payments to and from borrowers of securities. | |

Derivative Financial Instruments Outstanding as of Period End

Futures Contracts

| | | | | | | | | | | | | | | | |

| |

Description | | Number of

Contracts | | | Expiration

Date | | | Notional

Amount

(000) | | | Value/

Unrealized

Appreciation

(Depreciation) | |

| |

Long Contracts | | | | | | | | | | | | | | | | |

S&P 500 E-mini Index | | | 92 | | | | 06/16/23 | | | $ | 19,034 | | | $ | 1,013,158 | |

| | | | | | | | | | | | | | | | |

Derivative Financial Instruments Categorized by Risk Exposure

As of period end, the fair values of derivative financial instruments located in the Statements of Assets and Liabilities were as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| |

| | | Commodity

Contracts | | | Credit

Contracts | | | Equity

Contracts | | | Foreign

Currency

Exchange

Contracts | | | Interest

Rate

Contracts | | | Other

Contracts | | | Total | |

| |

Assets — Derivative Financial Instruments | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Futures contracts | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Unrealized appreciation on futures contracts(a) | | $ | — | | | $ | — | | | $ | 1,013,158 | | | $ | — | | | $ | — | | | $ | — | | | $ | 1,013,158 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | (a) | Net cumulative unrealized appreciation (depreciation) on futures contracts, if any, are reported in the Schedule of Investments. In the Statements of Assets and Liabilities, only current day’s variation margin is reported in receivables or payables and the net cumulative unrealized appreciation (depreciation) is included in accumulated earnings (loss). | |

For the period ended March 31, 2023, the effect of derivative financial instruments in the Statements of Operations was as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| |

| | | Commodity

Contracts | | | Credit

Contracts | | | Equity

Contracts | | | Foreign

Currency

Exchange

Contracts | | | Interest

Rate

Contracts | | | Other

Contracts | | | Total | |

| |

Net Realized Gain (Loss) from | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Futures contracts | | $ | — | | | $ | — | | | $ | (1,457,413 | ) | | $ | — | | | $ | — | | | $ | — | | | $ | (1,457,413 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

Net Change in Unrealized Appreciation (Depreciation) on | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Futures contracts | | $ | — | | | $ | — | | | $ | (112,487 | ) | | $ | — | | | $ | — | | | $ | — | | | $ | (112,487 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | |

| 16 | | 2 0 2 3 I S H A R E S A N N U A L R E P O R T T O S H A R E H O L D E R S |

| | |

Schedule of Investments (continued) March 31, 2023 | | iShares® S&P 100 ETF |

Average Quarterly Balances of Outstanding Derivative Financial Instruments

| | | | | | | | |

| | | |

Futures contracts | | | | | | | | |

| | |

Average notional value of contracts — long | | | | | | $ | 19,070,550 | |

For more information about the Fund’s investment risks regarding derivative financial instruments, refer to the Notes to Financial Statements.

Fair Value Hierarchy as of Period End

Various inputs are used in determining the fair value of financial instruments. For a description of the input levels and information about the Fund’s policy regarding valuation of financial instruments, refer to the Notes to Financial Statements.

The following table summarizes the Fund’s financial instruments categorized in the fair value hierarchy. The breakdown of the Fund’s financial instruments into major categories is disclosed in the Schedule of Investments above.

| | | | | | | | | | | | | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Assets | | | | | | | | | | | | | | | | |

Investments | | | | | | | | | | | | | | | | |

Long-Term Investments | | | | | | | | | | | | | | | | |

Common Stocks | | $ | 7,528,812,540 | | | $ | — | | | $ | — | | | $ | 7,528,812,540 | |

Short-Term Securities | | | | | | | | | | | | | | | | |

Money Market Funds | | | 14,929,868 | | | | — | | | | — | | | | 14,929,868 | |

| | | | | | | | | | | | | | | | |

| | $ | 7,543,742,408 | | | $ | — | | | $ | — | | | $ | 7,543,742,408 | |

| | | | | | | | | | | | | | | | |

Derivative Financial Instruments(a) | | | | | | | | | | | | | | | | |

Assets | | | | | | | | | | | | | | | | |

Equity Contracts | | $ | 1,013,158 | | | $ | — | | | $ | — | | | $ | 1,013,158 | |

| | | | | | | | | | | | | | | | |

| (a) | Derivative financial instruments are futures contracts. Futures contracts are valued at the unrealized appreciation (depreciation) on the instrument. | |

See notes to financial statements.

| | |

S C H E D U L E S O F I N V E S T M E N T S | | 17 |

| | |

Schedule of Investments March 31, 2023 | | iShares® S&P 500 Growth ETF (Percentages shown are based on Net Assets) |

| | | | | | | | |

| Security | | Shares | | | Value | |

|

Common Stocks | |

|

| Aerospace & Defense — 1.0% | |

General Dynamics Corp. | | | 196,450 | | | $ | 44,831,854 | |

L3Harris Technologies, Inc. | | | 156,703 | | | | 30,751,397 | |

Lockheed Martin Corp. | | | 265,930 | | | | 125,713,089 | |

Northrop Grumman Corp. | | | 170,732 | | | | 78,830,379 | |

TransDigm Group, Inc. | | | 40,094 | | | | 29,551,283 | |

| | | | | | | | |

| | | | | | | 309,678,002 | |

|

| Air Freight & Logistics — 0.1% | |

CH Robinson Worldwide, Inc. | | | 104,022 | | | | 10,336,666 | |

Expeditors International of Washington, Inc. | | | 262,202 | | | | 28,873,684 | |

| | | | | | | | |

| | | | | | | 39,210,350 | |

|

| Automobiles — 3.0% | |

Tesla, Inc.(a) | | | 4,433,837 | | | | 919,843,824 | |

| | | | | | | | |

|

| Beverages — 2.7% | |

Brown-Forman Corp., Class B, NVS | | | 164,649 | | | | 10,581,991 | |

Coca-Cola Co. | | | 4,170,633 | | | | 258,704,365 | |

Constellation Brands, Inc., Class A | | | 149,685 | | | | 33,812,345 | |

Keurig Dr Pepper, Inc. | | | 700,791 | | | | 24,723,906 | |

Monster Beverage Corp.(a) | | | 1,258,178 | | | | 67,954,194 | |

PepsiCo, Inc. | | | 2,270,549 | | | | 413,921,083 | |

| | | | | | | | |

| | | | | | | 809,697,884 | |

|

| Biotechnology — 4.2% | |

AbbVie, Inc. | | | 2,915,476 | | | | 464,639,410 | |

Amgen, Inc. | | | 880,262 | | | | 212,803,339 | |

Biogen, Inc.(a) | | | 111,439 | | | | 30,983,385 | |

Gilead Sciences, Inc. | | | 2,055,791 | | | | 170,568,979 | |

Incyte Corp.(a) | | | 304,623 | | | | 22,015,104 | |

Moderna, Inc.(a) | | | 544,184 | | | | 83,575,779 | |

Regeneron Pharmaceuticals, Inc.(a) | | | 177,259 | | | | 145,648,403 | |

Vertex Pharmaceuticals, Inc.(a) | | | 423,844 | | | | 133,540,529 | |

| | | | | | | | |

| | | | | | | 1,263,774,928 | |

|

| Broadline Retail — 2.4% | |

Amazon.com, Inc.(a) | | | 6,760,671 | | | | 698,309,708 | |

Etsy, Inc.(a)(b) | | | 120,900 | | | | 13,459,797 | |

| | | | | | | | |

| | | | | | | 711,769,505 | |

|

| Building Products — 0.0% | |

Masco Corp. | | | 261,921 | | | | 13,022,712 | |

| | | | | | | | |

|

| Capital Markets — 1.0% | |

Ameriprise Financial, Inc. | | | 173,976 | | | | 53,323,644 | |

Cboe Global Markets, Inc. | | | 117,204 | | | | 15,733,465 | |

Charles Schwab Corp. | | | 1,484,445 | | | | 77,755,229 | |

FactSet Research Systems, Inc. | | | 37,897 | | | | 15,730,666 | |

MarketAxess Holdings, Inc. | | | 30,211 | | | | 11,821,262 | |

Moody’s Corp. | | | 121,946 | | | | 37,317,915 | |

MSCI, Inc., Class A | | | 75,073 | | | | 42,017,607 | |

Nasdaq, Inc. | | | 358,272 | | | | 19,586,730 | |

Raymond James Financial, Inc. | | | 318,972 | | | | 29,750,519 | |

| | | | | | | | |

| | | | | | | 303,037,037 | |

|

| Chemicals — 1.5% | |

Air Products & Chemicals, Inc. | | | 366,145 | | | | 105,160,505 | |

Albemarle Corp. | | | 193,012 | | | | 42,663,373 | |

CF Industries Holdings, Inc. | | | 323,165 | | | | 23,426,231 | |

Corteva, Inc. | | | 810,857 | | | | 48,902,786 | |

FMC Corp. | | | 207,725 | | | | 25,369,454 | |

Linde PLC | | | 495,244 | | | | 176,029,527 | |

Mosaic Co. | | | 561,631 | | | | 25,767,630 | |

| | | | | | | | |

| | | | | | | 447,319,506 | |

| | | | | | | | |

| Security | | Shares | | | Value | |

|

| Commercial Services & Supplies — 0.6% | |

Cintas Corp. | | | 83,852 | | | $ | 38,796,643 | |

Copart, Inc.(a) | | | 705,812 | | | | 53,084,121 | |

Republic Services, Inc. | | | 186,330 | | | | 25,195,543 | |

Rollins, Inc. | | | 384,115 | | | | 14,415,836 | |

Waste Management, Inc. | | | 361,230 | | | | 58,941,899 | |

| | | | | | | | |

| | | | | | | 190,434,042 | |

|

| Communications Equipment — 0.4% | |

Arista Networks, Inc.(a) | | | 407,827 | | | | 68,457,840 | |

Motorola Solutions, Inc. | | | 151,494 | | | | 43,346,978 | |

| | | | | | | | |

| | | | | | | 111,804,818 | |

|

| Construction & Engineering — 0.1% | |

Quanta Services, Inc. | | | 235,378 | | | | 39,223,390 | |

| | | | | | | | |

|

| Construction Materials — 0.1% | |

Vulcan Materials Co. | | | 129,391 | | | | 22,198,320 | |

| | | | | | | | |

|

| Consumer Finance — 0.3% | |

American Express Co. | | | 480,933 | | | | 79,329,899 | |

Discover Financial Services | | | 255,917 | | | | 25,294,836 | |

| | | | | | | | |

| | | | | | | 104,624,735 | |

|

| Consumer Staples Distribution & Retail — 1.2% | |

Costco Wholesale Corp. | | | 482,784 | | | | 239,880,886 | |

Dollar General Corp. | | | 368,524 | | | | 77,559,561 | |

Dollar Tree, Inc.(a)(b) | | | 343,563 | | | | 49,318,469 | |

| | | | | | | | |

| | | | | | | 366,758,916 | |

|

| Distributors — 0.1% | |

Genuine Parts Co. | | | 167,160 | | | | 27,967,539 | |

Pool Corp. | | | 40,286 | | | | 13,795,538 | |

| | | | | | | | |

| | | | | | | 41,763,077 | |

|

| Electric Utilities — 0.2% | |

NRG Energy, Inc. | | | 177,163 | | | | 6,074,919 | |

PG&E Corp.(a)(b) | | | 2,651,589 | | | | 42,876,194 | |

| | | | | | | | |

| | | | | | | 48,951,113 | |

|

| Electrical Equipment — 0.1% | |

AMETEK, Inc. | | | 189,360 | | | | 27,519,689 | |

| | | | | | | | |

|

| Electronic Equipment, Instruments & Components — 0.4% | |

Amphenol Corp., Class A | | | 980,011 | | | | 80,086,499 | |

CDW Corp. | | | 140,657 | | | | 27,412,642 | |

Keysight Technologies, Inc.(a)(b) | | | 159,112 | | | | 25,693,406 | |

| | | | | | | | |

| | | | | | | 133,192,547 | |

|

| Energy Equipment & Services — 0.2% | |

Schlumberger NV | | | 1,241,604 | | | | 60,962,756 | |

| | | | | | | | |

|

| Entertainment — 0.3% | |

Activision Blizzard, Inc. | | | 692,056 | | | | 59,233,073 | |

Electronic Arts, Inc. | | | 291,995 | | | | 35,170,798 | |

| | | | | | | | |

| | | | | | | 94,403,871 | |

|

| Financial Services — 4.1% | |

Fiserv, Inc.(a)(b) | | | 721,664 | | | | 81,569,682 | |

FleetCor Technologies, Inc.(a) | | | 64,865 | | | | 13,676,785 | |

Jack Henry & Associates, Inc. | | | 120,447 | | | | 18,153,772 | |

Mastercard, Inc., Class A | | | 1,390,885 | | | | 505,461,518 | |

Visa, Inc., Class A | | | 2,678,870 | | | | 603,978,030 | |

| | | | | | | | |

| | | | | | | 1,222,839,787 | |

|

| Food Products — 1.1% | |

Archer-Daniels-Midland Co. | | | 440,714 | | | | 35,107,277 | |

Bunge Ltd. | | | 101,294 | | | | 9,675,603 | |

Campbell Soup Co. | | | 193,842 | | | | 10,657,433 | |

General Mills, Inc. | | | 660,967 | | | | 56,486,240 | |

Hershey Co. | | | 242,818 | | | | 61,775,327 | |

| | |

| 18 | | 2 0 2 3 I S H A R E S A N N U A L R E P O R T T O S H A R E H O L D E R S |

| | |

Schedule of Investments (continued) March 31, 2023 | | iShares® S&P 500 Growth ETF (Percentages shown are based on Net Assets) |

| | | | | | | | |

| Security | | Shares | | | Value | |

| | |

| Food Products (continued) | | | | | | |

Hormel Foods Corp. | | | 345,212 | | | $ | 13,767,055 | |

Kellogg Co. | | | 233,078 | | | | 15,606,903 | |

Lamb Weston Holdings, Inc. | | | 237,666 | | | | 24,840,850 | |

McCormick & Co., Inc., NVS | | | 211,575 | | | | 17,605,156 | |

Mondelez International, Inc., Class A | | | 1,213,704 | | | | 84,619,443 | |

| | | | | | | | |

| | | | | | | 330,141,287 | |

|

| Gas Utilities — 0.1% | |

Atmos Energy Corp. | | | 144,293 | | | | 16,212,762 | |

| | | | | | | | |

|

| Ground Transportation — 0.8% | |

CSX Corp. | | | 1,662,035 | | | | 49,761,328 | |

JB Hunt Transport Services, Inc. | | | 136,724 | | | | 23,989,593 | |

Old Dominion Freight Line, Inc.(b) | | | 149,756 | | | | 51,042,835 | |

Union Pacific Corp. | | | 504,302 | | | | 101,495,821 | |

| | | | | | | | |

| | | | | | | 226,289,577 | |

|

| Health Care Equipment & Supplies — 1.6% | |

Abbott Laboratories | | | 1,494,644 | | | | 151,347,651 | |

Boston Scientific Corp.(a)(b) | | | 1,250,361 | | | | 62,555,561 | |

Dexcom, Inc.(a) | | | 637,751 | | | | 74,093,911 | |

Hologic, Inc.(a) | | | 406,450 | | | | 32,800,515 | |

IDEXX Laboratories, Inc.(a)(b) | | | 66,905 | | | | 33,457,852 | |

Insulet Corp.(a)(b) | | | 114,312 | | | | 36,460,956 | |

Intuitive Surgical, Inc.(a)(b) | | | 282,928 | | | | 72,279,616 | |

ResMed, Inc. | | | 131,319 | | | | 28,757,548 | |

| | | | | | | | |

| | | | | | | 491,753,610 | |

|

| Health Care Providers & Services — 3.9% | |

Cigna Group | | | 241,187 | | | | 61,630,514 | |

Elevance Health, Inc. | | | 393,759 | | | | 181,054,326 | |

HCA Healthcare, Inc. | | | 188,601 | | | | 49,730,312 | |

Humana, Inc. | | | 131,785 | | | | 63,976,346 | |

McKesson Corp. | | | 104,101 | | | | 37,065,161 | |

Molina Healthcare, Inc.(a) | | | 96,210 | | | | 25,735,213 | |

Quest Diagnostics, Inc. | | | 121,093 | | | | 17,132,237 | |

UnitedHealth Group, Inc. | | | 1,540,313 | | | | 727,936,521 | |

| | | | | | | | |

| | | | | | | 1,164,260,630 | |

|

| Hotels, Restaurants & Leisure — 1.7% | |

Chipotle Mexican Grill, Inc.(a) | | | 45,558 | | | | 77,826,276 | |

Domino’s Pizza, Inc. | | | 26,620 | | | | 8,781,139 | |

Hilton Worldwide Holdings, Inc. | | | 211,325 | | | | 29,769,353 | |

Marriott International, Inc., Class A | | | 225,963 | | | | 37,518,897 | |

McDonald’s Corp. | | | 748,579 | | | | 209,310,174 | |

Starbucks Corp. | | | 966,249 | | | | 100,615,508 | |

Yum! Brands, Inc. | | | 295,388 | | | | 39,014,847 | |

| | | | | | | | |

| | | | | | | 502,836,194 | |

|

| Household Durables — 0.1% | |

DR Horton, Inc. | | | 258,365 | | | | 25,239,677 | |

| | | | | | | | |

|

| Household Products — 1.4% | |

Clorox Co. | | | 92,190 | | | | 14,588,146 | |

Colgate-Palmolive Co. | | | 756,525 | | | | 56,852,854 | |

Kimberly-Clark Corp. | | | 266,833 | | | | 35,814,325 | |

Procter & Gamble Co. | | | 2,139,113 | | | | 318,064,712 | |

| | | | | | | | |

| | | | | | | 425,320,037 | |

|

| Independent Power and Renewable Electricity Producers — 0.1% | |

AES Corp. | | | 651,856 | | | | 15,696,692 | |

| | | | | | | | |

|

| Insurance — 1.9% | |

Aon PLC, Class A | | | 223,413 | | | | 70,439,885 | |

Arch Capital Group Ltd.(a)(b) | | | 609,054 | | | | 41,336,495 | |

Arthur J. Gallagher & Co. | | | 223,270 | | | | 42,713,783 | |

Brown & Brown, Inc. | | | 230,376 | | | | 13,228,190 | |

| | | | | | | | |

| Security | | Shares | | | Value | |

| | |

| Insurance (continued) | | | | | | |

Chubb Ltd. | | | 389,905 | | | $ | 75,711,753 | |

Everest Re Group Ltd. | | | 37,168 | | | | 13,306,887 | |

Globe Life, Inc. | | | 105,245 | | | | 11,579,055 | |

Marsh & McLennan Cos., Inc. | | | 522,224 | | | | 86,976,407 | |

Principal Financial Group, Inc. | | | 229,537 | | | | 17,059,190 | |

Progressive Corp. | | | 964,230 | | | | 137,942,744 | |

Travelers Cos., Inc. | | | 206,258 | | | | 35,354,684 | |

W R Berkley Corp. | | | 337,195 | | | | 20,993,761 | |

| | | | | | | | |

| | | | | | | 566,642,834 | |

|

| Interactive Media & Services — 6.3% | |

Alphabet, Inc., Class A(a) | | | 9,818,842 | | | | 1,018,508,481 | |

Alphabet, Inc., Class C, NVS(a) | | | 8,559,651 | | | | 890,203,704 | |

| | | | | | | | |

| | | | | | | 1,908,712,185 | |

|

| IT Services — 0.7% | |

Accenture PLC, Class A | | | 508,716 | | | | 145,396,120 | |

EPAM Systems, Inc.(a) | | | 64,568 | | | | 19,305,832 | |

Gartner, Inc.(a) | | | 130,080 | | | | 42,376,161 | |

VeriSign, Inc.(a) | | | 73,911 | | | | 15,619,612 | |

| | | | | | | | |

| | | | | | | 222,697,725 | |

|

| Life Sciences Tools & Services — 2.6% | |

Agilent Technologies, Inc. | | | 292,473 | | | | 40,460,715 | |

Bio-Techne Corp. | | | 123,311 | | | | 9,148,443 | |

Danaher Corp. | | | 1,080,527 | | | | 272,336,025 | |

IQVIA Holdings, Inc.(a) | | | 146,781 | | | | 29,193,273 | |

Mettler-Toledo International, Inc.(a) | | | 23,746 | | | | 36,336,367 | |

Thermo Fisher Scientific, Inc. | | | 646,622 | | | | 372,693,522 | |

Waters Corp.(a) | | | 97,900 | | | | 30,312,777 | |

| | | | | | | | |

| | | | | | | 790,481,122 | |

|

| Machinery — 1.4% | |

Caterpillar, Inc. | | | 514,814 | | | | 117,810,036 | |

Cummins, Inc. | | | 119,315 | | | | 28,501,967 | |

Deere & Co. | | | 445,767 | | | | 184,048,279 | |

IDEX Corp. | | | 71,128 | | | | 16,432,702 | |

Illinois Tool Works, Inc. | | | 233,159 | | | | 56,762,558 | |

Snap-on, Inc. | | | 49,622 | | | | 12,251,176 | |

| | | | | | | | |

| | | | | | | 415,806,718 | |

|

| Metals & Mining — 0.6% | |

Freeport-McMoRan, Inc. | | | 2,358,556 | | | | 96,488,526 | |

Nucor Corp. | | | 416,773 | | | | 64,378,925 | |

Steel Dynamics, Inc. | | | 274,702 | | | | 31,057,808 | |

| | | | | | | | |

| | | | | | | 191,925,259 | |

|

| Multi-Utilities — 0.2% | |

Sempra Energy | | | 310,584 | | | | 46,947,877 | |

WEC Energy Group, Inc. | | | 270,424 | | | | 25,633,491 | |

| | | | | | | | |

| | | | | | | 72,581,368 | |

|

| Oil, Gas & Consumable Fuels — 7.0% | |

APA Corp. | | | 530,674 | | | | 19,136,104 | |

Chevron Corp. | | | 2,932,752 | | | | 478,507,816 | |

ConocoPhillips | | | 2,017,642 | | | | 200,170,263 | |

Coterra Energy, Inc. | | | 1,298,911 | | | | 31,875,276 | |

Devon Energy Corp. | | | 1,079,838 | | | | 54,650,601 | |

Diamondback Energy, Inc. | | | 302,171 | | | | 40,844,454 | |

EOG Resources, Inc. | | | 968,401 | | | | 111,007,807 | |

EQT Corp. | | | 605,976 | | | | 19,336,694 | |

Exxon Mobil Corp. | | | 6,788,776 | | | | 744,457,176 | |

Hess Corp. | | | 457,156 | | | | 60,500,025 | |

Marathon Oil Corp. | | | 1,046,435 | | | | 25,072,583 | |

Marathon Petroleum Corp. | | | 360,129 | | | | 48,556,193 | |

Occidental Petroleum Corp.(b) | | | 1,200,608 | | | | 74,953,957 | |

| | |

S C H E D U L E S O F I N V E S T M E N T S | | 19 |

| | |

Schedule of Investments (continued) March 31, 2023 | | iShares® S&P 500 Growth ETF (Percentages shown are based on Net Assets) |

| | | | | | | | |

| Security | | Shares | | | Value | |

|

| Oil, Gas & Consumable Fuels (continued) | |

ONEOK, Inc. | | | 736,127 | | | $ | 46,773,510 | |

Pioneer Natural Resources Co. | | | 391,357 | | | | 79,930,754 | |

Targa Resources Corp. | | | 373,177 | | | | 27,223,262 | |

Williams Cos., Inc. | | | 2,005,481 | | | | 59,883,663 | |

| | | | | | | | |

| | | | | | | 2,122,880,138 | |

|

| Pharmaceuticals — 6.4% | |

Bristol-Myers Squibb Co. | | | 3,505,079 | | | | 242,937,026 | |

Eli Lilly & Co. | | | 1,300,172 | | | | 446,505,068 | |

Johnson & Johnson | | | 2,672,282 | | | | 414,203,710 | |

Merck & Co., Inc. | | | 4,179,795 | | | | 444,688,390 | |

Pfizer, Inc. | | | 9,253,884 | | | | 377,558,467 | |

| | | | | | | | |

| | | | | | | 1,925,892,661 | |

|

| Professional Services — 1.0% | |

Automatic Data Processing, Inc. | | | 683,044 | | | | 152,066,086 | |

Broadridge Financial Solutions, Inc. | | | 93,375 | | | | 13,685,974 | |

CoStar Group, Inc.(a) | | | 669,760 | | | | 46,112,976 | |

Equifax, Inc.(b) | | | 99,169 | | | | 20,115,440 | |

Leidos Holdings, Inc. | | | 147,205 | | | | 13,551,692 | |

Paychex, Inc. | | | 301,082 | | | | 34,500,986 | |

Verisk Analytics, Inc. | | | 118,770 | | | | 22,787,212 | |

| | | | | | | | |

| | | | | | | 302,820,366 | |

|

| Semiconductors & Semiconductor Equipment — 9.0% | |

Advanced Micro Devices, Inc.(a) | | | 1,435,356 | | | | 140,679,242 | |

Analog Devices, Inc. | | | 392,670 | | | | 77,442,377 | |

Applied Materials, Inc. | | | 1,389,840 | | | | 170,714,047 | |

Broadcom, Inc. | | | 413,373 | | | | 265,195,314 | |

Enphase Energy, Inc.(a) | | | 223,787 | | | | 47,057,930 | |

First Solar, Inc.(a) | | | 163,565 | | | | 35,575,388 | |

KLA Corp. | | | 228,272 | | | | 91,119,334 | |

Lam Research Corp. | | | 222,503 | | | | 117,953,290 | |

Microchip Technology, Inc. | | | 441,413 | | | | 36,981,581 | |

Monolithic Power Systems, Inc. | | | 73,977 | | | | 37,028,448 | |

NVIDIA Corp. | | | 4,055,520 | | | | 1,126,501,790 | |

NXP Semiconductors NV | | | 252,880 | | | | 47,155,798 | |

ON Semiconductor Corp.(a)(b) | | | 712,225 | | | | 58,630,362 | |

QUALCOMM, Inc. | | | 1,838,187 | | | | 234,515,898 | |

SolarEdge Technologies, Inc.(a) | | | 92,047 | | | | 27,977,686 | |

Teradyne, Inc. | | | 125,029 | | | | 13,441,868 | |

Texas Instruments, Inc. | | | 941,219 | | | | 175,076,146 | |

| | | | | | | | |

| | | | | | | 2,703,046,499 | |

|

| Software — 9.9% | |

Adobe, Inc.(a) | | | 354,766 | | | | 136,716,173 | |

Autodesk, Inc.(a) | | | 195,513 | | | | 40,697,986 | |

Cadence Design Systems, Inc.(a)(b) | | | 452,030 | | | | 94,966,983 | |

Fair Isaac Corp.(a)(b) | | | 41,527 | | | | 29,180,608 | |

Fortinet, Inc.(a) | | | 1,068,070 | | | | 70,983,932 | |

Gen Digital, Inc. | | | 502,843 | | | | 8,628,786 | |

Intuit, Inc. | | | 245,455 | | | | 109,431,203 | |

Microsoft Corp. | | | 7,117,532 | | | | 2,051,984,476 | |

Oracle Corp. | | | 1,494,793 | | | | 138,896,166 | |

Paycom Software, Inc.(a)(b) | | | 79,436 | | | | 24,149,338 | |

PTC, Inc.(a) | | | 176,375 | | | | 22,616,566 | |

ServiceNow, Inc.(a)(b) | | | 334,602 | | | | 155,496,241 | |

Synopsys, Inc.(a) | | | 251,315 | | | | 97,070,419 | |

Tyler Technologies, Inc.(a) | | | 32,088 | | | | 11,379,688 | |

| | | | | | | | |

| | | | | | | 2,992,198,565 | |

| | | | | | | | |

| Security | | Shares | | | Value | |

|

| Specialized REITs — 0.8% | |

American Tower Corp. | | | 406,412 | | | $ | 83,046,228 | |

Extra Space Storage, Inc. | | | 110,908 | | | | 18,070,240 | |

Iron Mountain, Inc. | | | 303,628 | | | | 16,064,958 | |

Public Storage | | | 161,421 | | | | 48,771,741 | |

SBA Communications Corp. | | | 99,560 | | | | 25,992,129 | |

VICI Properties, Inc. | | | 945,471 | | | | 30,841,264 | |

Weyerhaeuser Co. | | | 686,101 | | | | 20,672,223 | |

| | | | | | | | |

| | | | | | | 243,458,783 | |

|

| Specialty Retail — 2.5% | |

AutoZone, Inc.(a) | | | 30,898 | | | | 75,951,919 | |

Home Depot, Inc. | | | 890,461 | | | | 262,792,850 | |

Lowe’s Cos., Inc. | | | 687,873 | | | | 137,553,964 | |

O’Reilly Automotive, Inc.(a) | | | 102,806 | | | | 87,280,238 | |

TJX Cos., Inc. | | | 1,219,136 | | | | 95,531,497 | |