UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-09729

iShares Trust

(Exact name of registrant as specified in charter)

c/o BlackRock Fund Advisors

400 Howard Street, San Francisco, CA 94105

(Address of principal executive offices) (Zip code)

The Corporation Trust Company

1209 Orange Street, Wilmington, DE 19801

(Name and address of agent for service)

Registrant’s telephone number, including area code: (415) 670-2000

Date of fiscal year end: March 31, 2024

Date of reporting period: March 31, 2024

Item 1. Reports to Stockholders.

(a) The Report to Shareholders is attached herewith.

|

• iShares Copper and Metals Mining ETF | ICOP | NASDAQ |

• iShares Environmental Infrastructure and Industrials ETF | EFRA | NASDAQ |

• iShares Global 100 ETF | IOO | NYSE Arca |

• iShares Global Infrastructure ETF | IGF | NASDAQ |

• iShares Global Timber & Forestry ETF | WOOD | NASDAQ |

• iShares Lithium Miners and Producers ETF | ILIT | NASDAQ |

|

Rob Kapito

President, BlackRock Inc.

Dear Shareholder,

The combination of continued economic growth and cooling inflation provided a supportive backdrop for investors during the 12-month reporting period ended March 31, 2024. Higher interest rates helped to rein in inflation, and the Consumer Price Index decelerated substantially while remaining above pre-pandemic levels. A moderating labor market helped ease inflationary pressure, although wages continued to grow. Wage and job growth powered robust consumer spending, backstopping the economy. On October 7, 2023, Hamas launched a horrific attack on Israel. The ensuing war has had a significant humanitarian impact and could lead to heightened economic and market volatility. We see geopolitics as a structural market risk going forward. See our geopolitical risk dashboard at blackrock.com for more details.

Equity returns were robust during the period, as interest rates stabilized and the economy proved to be more resilient than many investors expected. The U.S. economy continued to show strength, and growth further accelerated in the second half of 2023. Large-capitalization U.S. stocks posted particularly substantial gains, supported by the performance of a few notable technology companies, while small-capitalization U.S. stocks’ advance was slower but still robust. Meanwhile, international developed market equities also gained strongly, while emerging market stocks advanced at a more modest pace.

The 10-year U.S. Treasury yield rose during the reporting period, as investors reacted to elevated inflation and attempted to anticipate future interest rate changes. However, higher yields drove positive returns overall for 10-year U.S. Treasuries and solid gains in shorter-duration U.S. Treasuries. The corporate bond market benefited from improving economic sentiment, although high-yield corporate bond prices fared significantly better than investment-grade bonds as demand from yield-seeking investors remained strong.

The U.S. Federal Reserve (the “Fed”), attempting to manage persistent inflation, raised interest rates twice during the 12-month period, but paused its tightening after its July meeting. The Fed also continued to reduce its balance sheet by not replacing some of the securities that reach maturity.

Supply constraints appear to have become an embedded feature of the new macroeconomic environment, making it difficult for developed economies to increase production without sparking higher inflation. Geopolitical fragmentation and an aging population risk further exacerbating these constraints, keeping the labor market tight and wage growth high. Although the Fed has stopped tightening for now, we believe that the new economic regime means that the Fed will need to maintain high rates for an extended period despite the market’s hopes for rapid interest rate cuts, as reflected in the ongoing rally. In this new regime, we anticipate greater volatility and dispersion of returns, creating more opportunities for selective portfolio management.

Looking at developed market stocks, we have an overweight stance on U.S. stocks overall, particularly given the promise of emerging AI technologies. We are also overweight Japanese stocks as shareholder-friendly policies generate increased investor interest, although we maintain an underweight stance on European stocks. In credit, there are selective opportunities in the near term despite tighter credit and financial conditions. For fixed income investing with a six- to twelve-month horizon, we see the most attractive investments in short-term U.S. Treasuries and hard-currency emerging market bonds.

Overall, our view is that investors need to think globally, position themselves to be prepared for a decarbonizing economy, and be nimble as market conditions change. We encourage you to talk with your financial advisor and visit iShares.com for further insight about investing in today’s markets.

Rob Kapito

President, BlackRock Inc.

Total Returns as of March 31, 2024 |

| | |

U.S. large cap equities

(S&P 500® Index) | | |

U.S. small cap equities

(Russell 2000® Index) | | |

International equities

(MSCI Europe, Australasia, Far East Index) | | |

Emerging market equities

(MSCI Emerging Markets Index) | | |

3-month Treasury bills

(ICE BofA 3-Month U.S. Treasury Bill Index) | | |

U.S. Treasury securities

(ICE BofA 10-Year U.S. Treasury Index) | | |

U.S. investment grade bonds

(Bloomberg U.S. Aggregate Bond Index) | | |

Tax-exempt municipal bonds

(Bloomberg Municipal Bond Index) | | |

U.S. high yield bonds

(Bloomberg U.S. Corporate High Yield 2% Issuer Capped Index) | | |

Past performance is not an indication of future results. Index performance is shown for illustrative purposes only. You cannot invest directly in an index. |

2This Page is not Part of Your Fund Report

iShares Trust

Global Market Overview

Global equity markets advanced during the 12 months ended March 31, 2024 (“reporting period”), supported by continued economic growth and moderating inflation in most parts of the world. The MSCI ACWI, a broad global equity index that includes both developed and emerging markets, returned 23.22% in U.S. dollar terms for the reporting period. Despite concerns about the impact of higher interest rates and rising prices, the global economy was resilient, posting moderate growth in 2023 at a similar pace to the prior year. Inflation began to subside in most regions of the world, as stabilizing energy prices and improved supply chains reduced pressure on consumers. However, geopolitical tensions were high during the reporting period, raising concerns about global economic disruptions from wars in Ukraine and Gaza. Following a terrorist attack on Israel by Hamas, Israel’s retaliation in Gaza and the resulting humanitarian impact raised tensions in the region, leading to counterstrikes between Israel, the U.S., and regional militant organizations. The events raised concerns among market participants that further escalation could lead to a broad regional war.

Among developed economies, the U.S. stood out, growing at a robust pace in 2023 despite elevated interest rates and persistent inflation. The U.S. consumer helped to power the expansion, as consumer spending continued to grow in both nominal and real (inflation-adjusted) terms. A strong labor market bolstered consumer spending, as employers continued to add jobs and average hourly wages increased notably. Consumer spending was also supported by higher asset values, as both home prices and strong equity performance increased household net worth. While improved supply chains eased goods inflation, the tight labor market kept labor costs near record highs, and growing services inflation was a significant driver of inflation’s overall persistence.

To counteract inflation, the U.S. Federal Reserve Bank (“Fed”) raised interest rates twice early in the reporting period, reaching the highest level since 2001. However, the Fed paused its interest rate increases thereafter as inflation edged down, keeping interest rates steady following its July 2023 meeting. The Fed also continued to decrease the size of its balance sheet by reducing the store of U.S. Treasuries it had accumulated to stabilize markets in the early phases of the coronavirus pandemic. Projections released by the Fed late in the reporting period included several interest rate decreases later in 2024, as it forecast that inflation would continue to moderate despite the robust economy.

European stocks posted strong gains as energy prices stabilized and inflation decelerated sharply. While growth in the Eurozone was nearly flat, the tepid economy meant that consumer spending was moderate, resulting in less upward pressure on prices. The European Central Bank (“ECB”) raised interest rates four times in the first half of the reporting period but declined to increase interest rates thereafter, citing progress in lowering inflation.

Asia-Pacific region stocks also advanced, albeit at a slower pace than other regions of the world. Japan returned to moderate growth in the fourth quarter of 2023 following a contraction in the third quarter. Solid exports, rising profits, and a series of corporate reforms bolstered Japanese equities. However, Chinese stocks were negatively impacted by investor concerns about government regulations and rising geopolitical tensions with the U.S. Meanwhile, emerging market stocks gained, helped by the pausing of interest rate increases from the Fed and the ECB. Stocks in India advanced significantly amid strong economic growth and robust corporate earnings, as India’s expanding middle class bolstered consumer spending.

42024 iShares Annual Report to Shareholders

Fund Summary as of March 31, 2024

iShares® Copper and Metals Mining ETF

Investment Objective

The iShares Copper and Metals Mining ETF (the “Fund”) seeks to track the investment results of an index composed of U.S. and non-U.S. equities of companies primarily engaged in copper and metal ore mining, as represented by the STOXX Global Copper and Metals Mining Index (the "Index"). The Fund invests in a representative sample of securities included in the Index that collectively has an investment profile similar to the Index. Due to the use of representative sampling, the Fund may or may not hold all of the securities that are included in the Index.

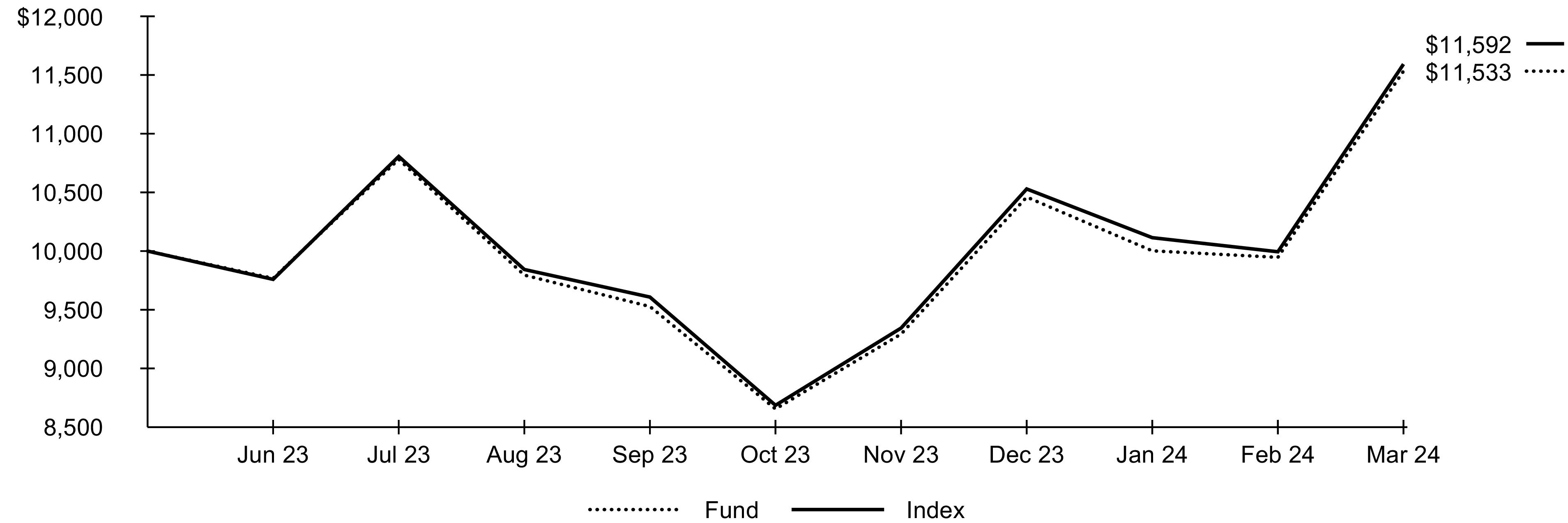

Performance

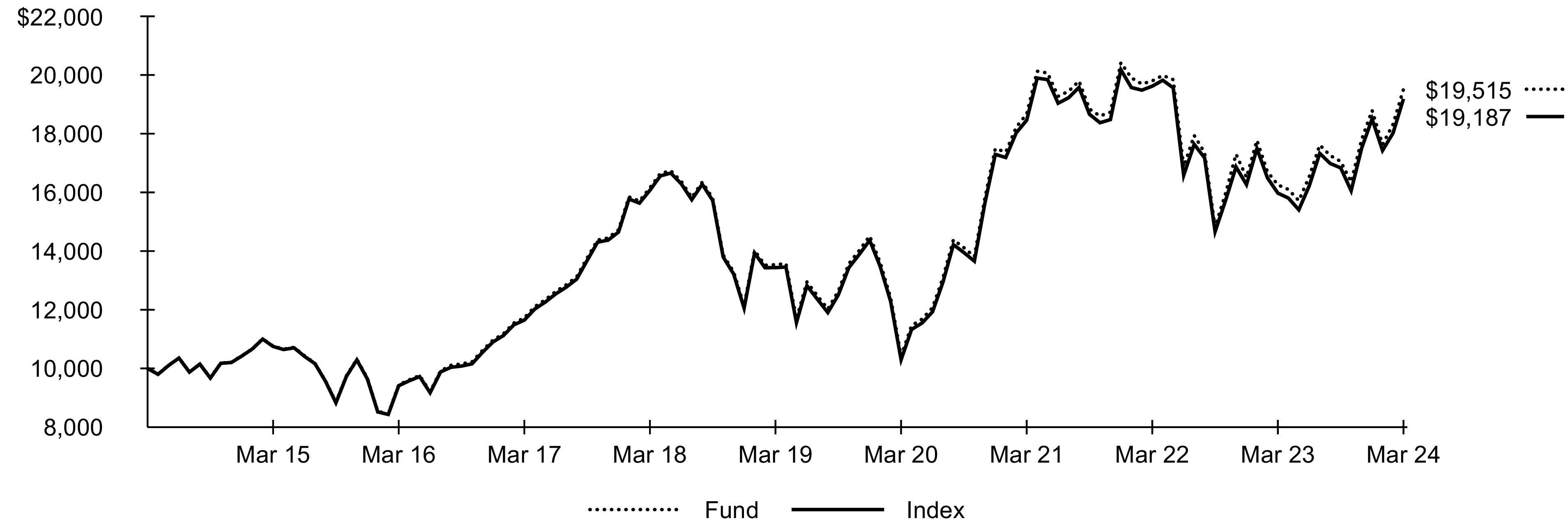

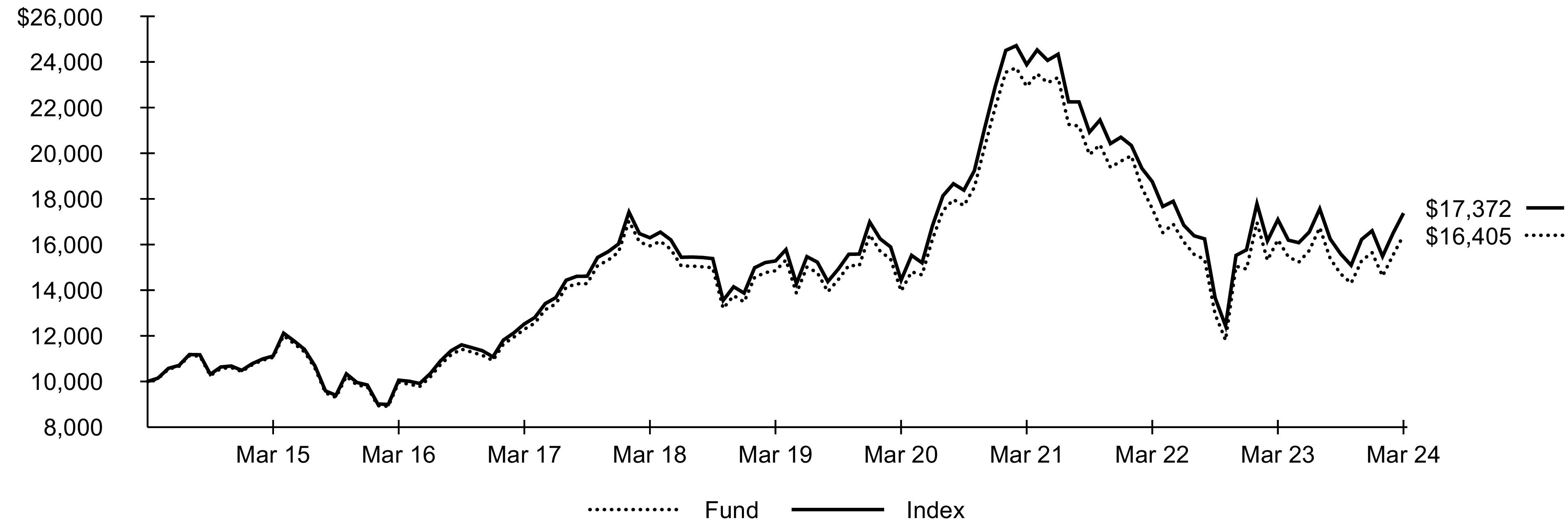

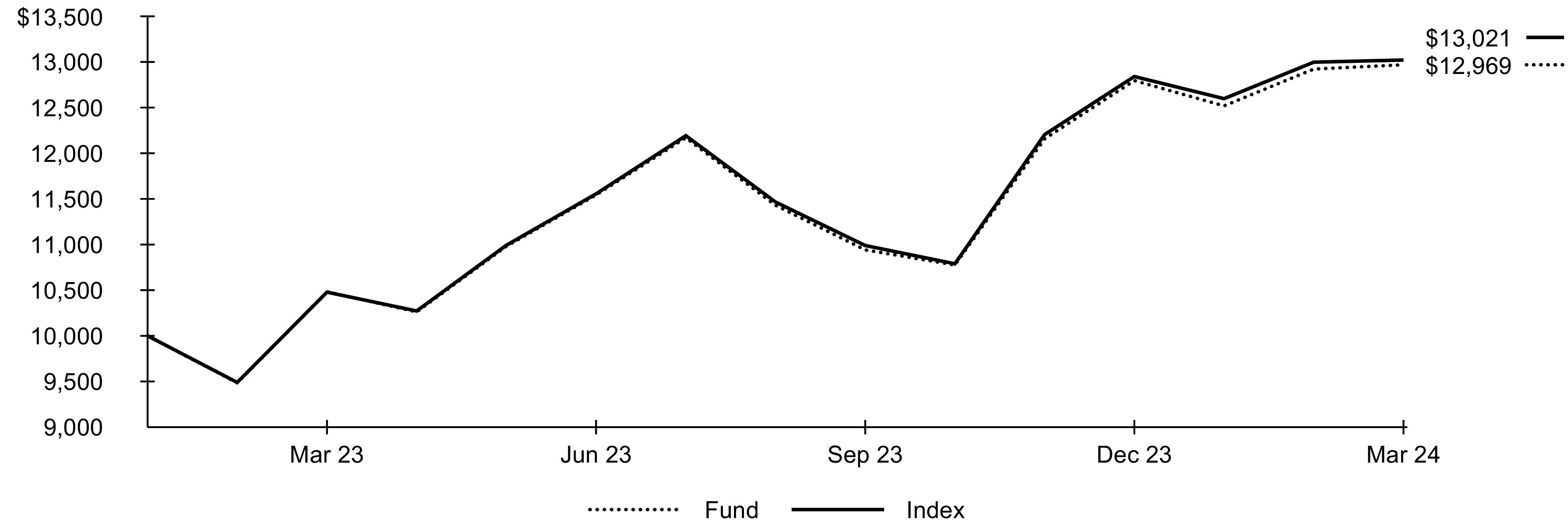

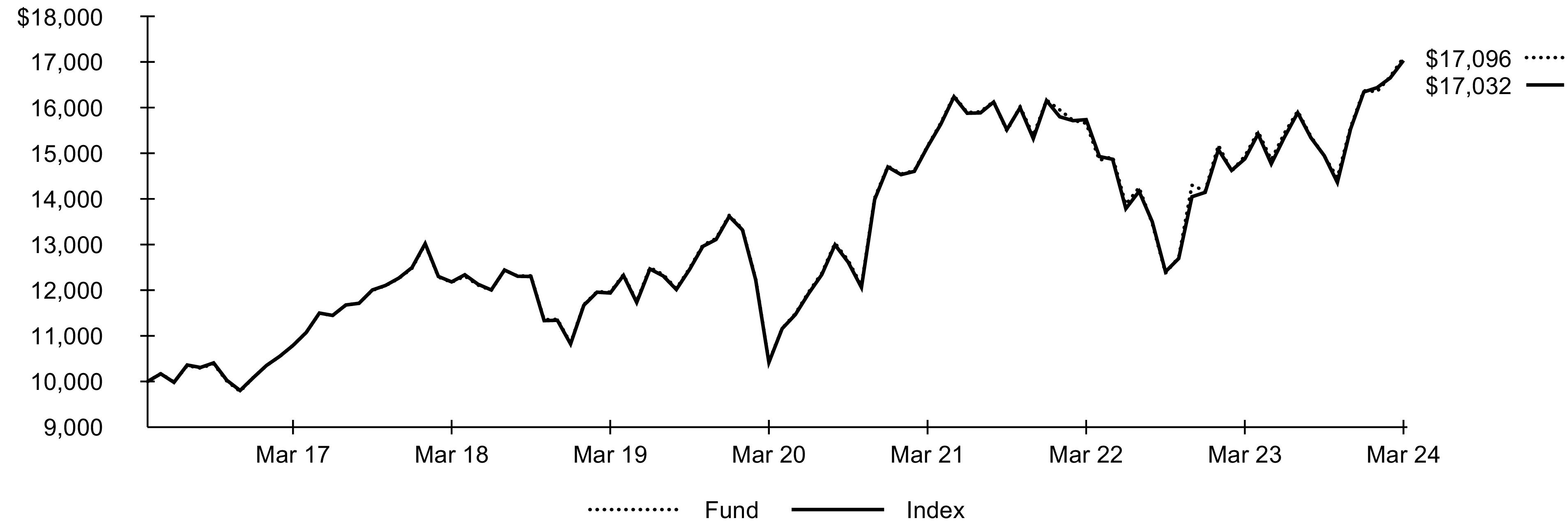

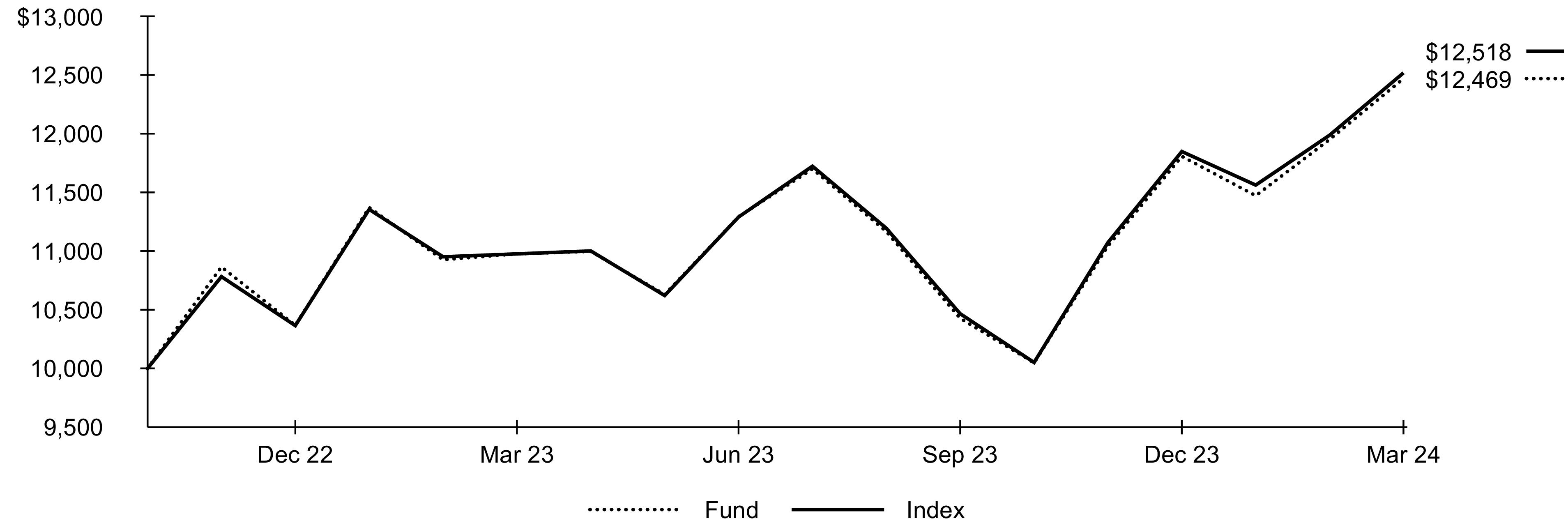

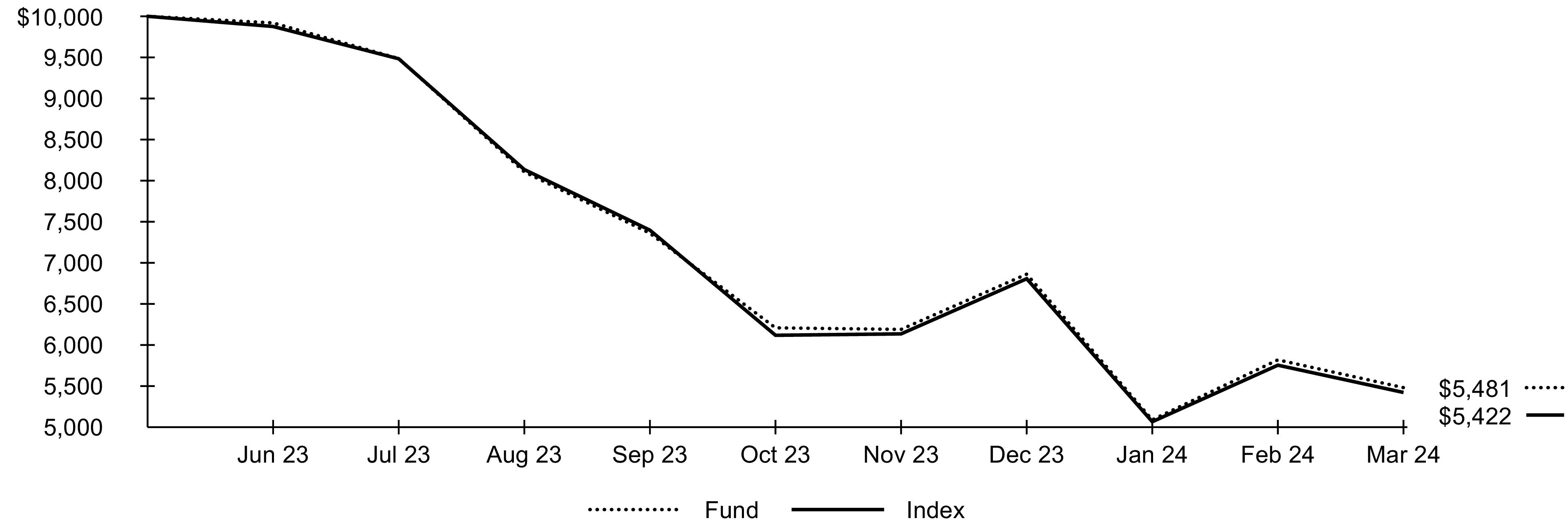

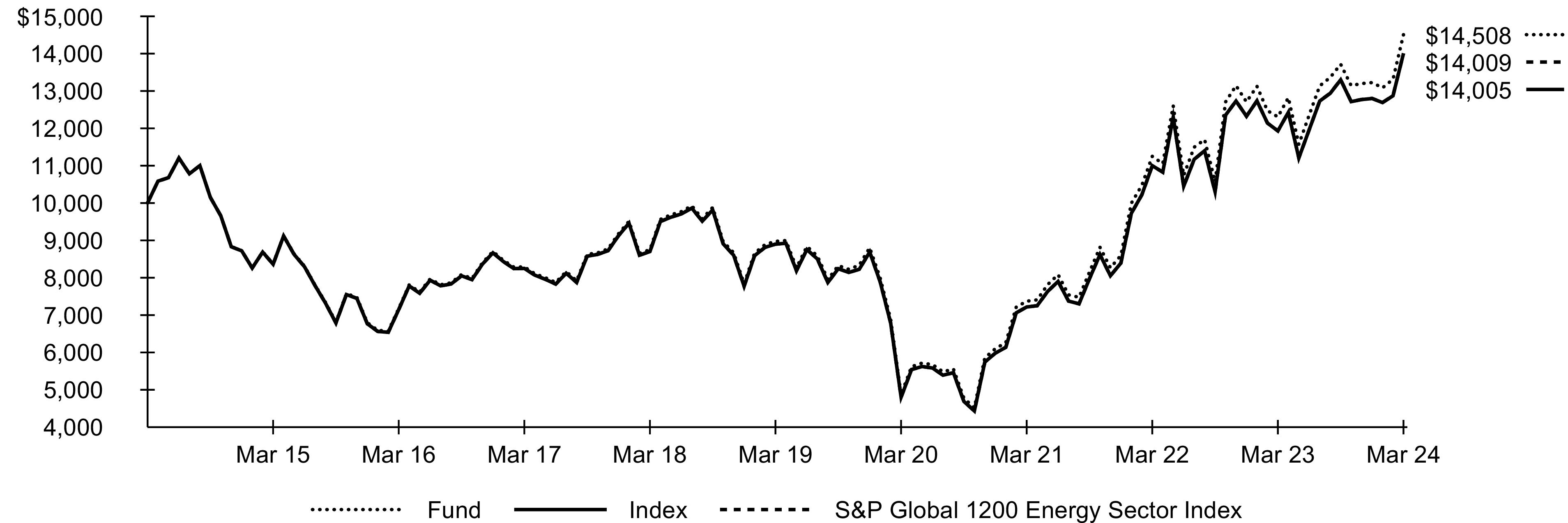

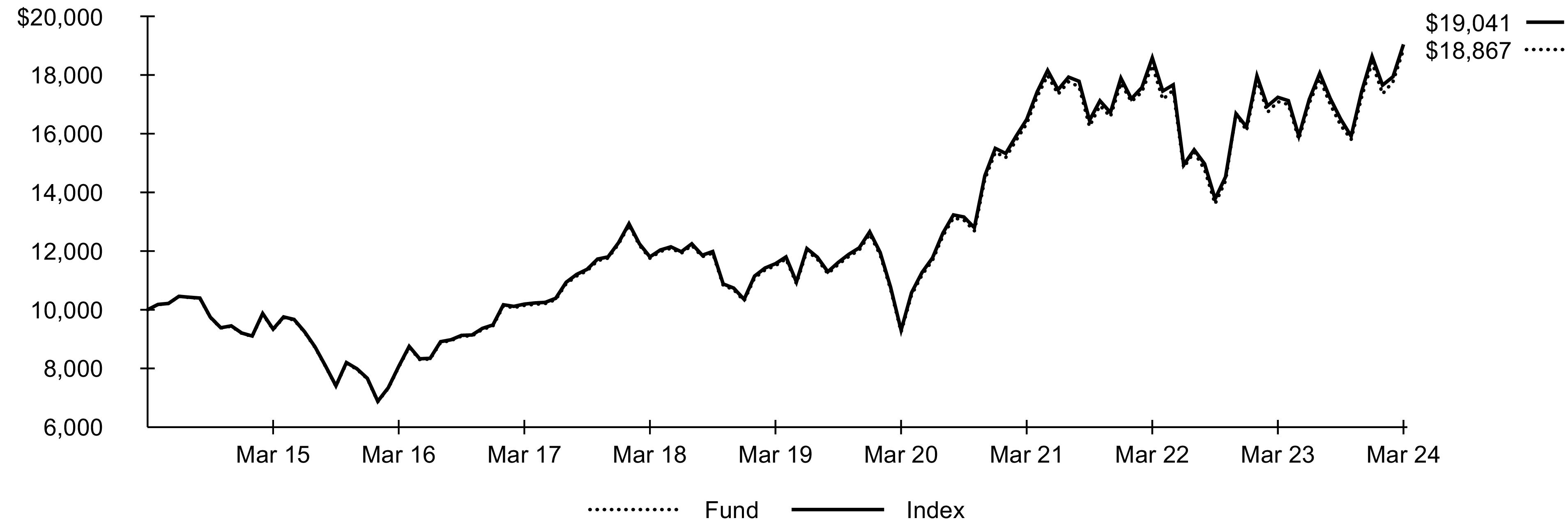

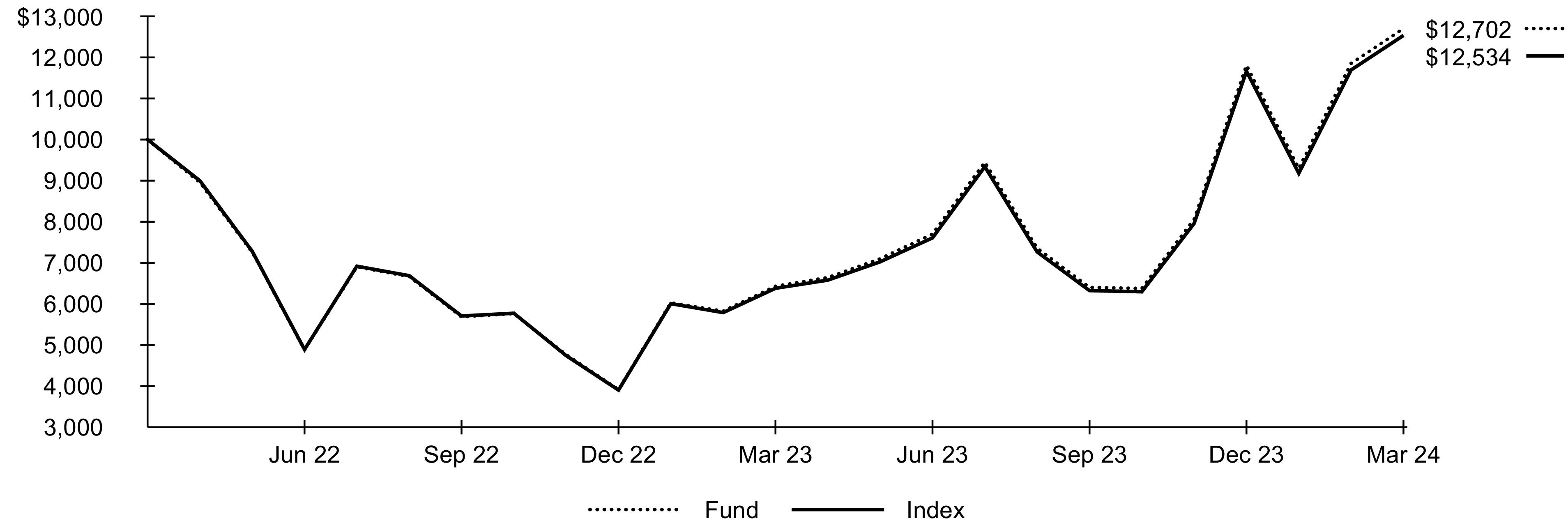

GROWTH OF $10,000 INVESTMENT(SINCE INCEPTION AT NET ASSET VALUE)

The inception date of the Fund was June 21, 2023. The first day of secondary market trading was June 23, 2023.

Past performance is not an indication of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. See “About Fund Performance” for more information.

Expense Example

| | |

Beginning

Account Value

(10/01/23) | Ending

Account Value

(03/31/24) | | Beginning

Account Value

(10/01/23) | Ending

Account Value

(03/31/24) | | |

| | | | | | |

| Expenses are equal to the annualized expense ratio, multiplied by the average account value over the period, multiplied by 183/366 (to reflect the one-half year period shown). Other fees, such as brokerage commissions and other fees to financial intermediaries, may be paid which are not reflected in the tables and examples above. See “Disclosure of Expenses” for more information. |

Fund Summary as of March 31, 2024 (continued)

iShares® Copper and Metals Mining ETF

Portfolio Management Commentary

Stocks of companies primarily engaged in copper and metal ore mining advanced for the reporting period. While the price of copper on global trading markets was nearly flat overall, prices fluctuated during the course of the reporting period. Global copper production in 2023 was similar to production in 2022, reflecting tepid industrial demand and a slow recovery in manufacturing in some countries, particularly China, one of the world’s largest consumers of copper. Nonetheless, ongoing decarbonization efforts drove significant investments in electrical infrastructure, electric vehicles, and windmills, all of which require substantial use of copper.

Copper prices, which tend to be highly sensitive to interest rates, shifted with expectations for central bank monetary policy during the reporting period. The Fed left interest rates unchanged late in the reporting period after a series of large interest rate increases, so copper prices fell, then recovered in anticipation of lower carrying costs and a boost in economic activity.

Canadian stocks contributed the most to the Index’s return. Following two interest rate increases early in the reporting period, the Bank of Canada kept interest rates steady. A large copper mining project hit its production target despite electrical grid instability, while cost management supported industry profitability.

Peruvian copper miners also contributed to the Index’s performance, despite lower earnings and production. One of Peru’s largest copper miners initiated legal action to counter illegal mining activities, which slowed the development of a large mining project.

Stocks of copper mining companies in the U.K. also advanced. A large miner that operates in Chile reported higher revenue and earnings while investing in the development of a new mine. The industry also benefited from cost management efforts and attempts to reduce carbon emissions.

Chinese stocks further contributed to the Index’s return, led by a miner with significant operations in Zambia and the Democratic Republic of Congo. Earnings per share increased despite lower revenue overall.

Portfolio Information

INDUSTRY ALLOCATION

| |

| |

Diversified Metals & Mining | |

| |

| |

TEN LARGEST HOLDINGS

| |

Grupo Mexico SAB de CV, Series B | |

| |

| |

| |

| |

Ivanhoe Mines Ltd., Class A | |

| |

First Quantum Minerals Ltd. | |

| |

| |

| Excludes money market funds. |

62024 iShares Annual Report to Shareholders

Fund Summary as of March 31, 2024

iShares® Environmental Infrastructure and Industrials ETF

Investment Objective

The iShares Environmental Infrastructure and Industrials ETF (the “Fund”) seeks to track the investment results of an index composed of U.S. and non-U.S. companies that provide infrastructure and industrials solutions aiming to support energy efficiency and emissions mitigation, pollution reduction or land and resource optimization, as represented by the FTSE Green Revenues Select Infrastructure and Industrials Index (the “Index”). The Fund invests in a representative sample of securities included in the Index that collectively has an investment profile similar to the Index. Due to the use of representative sampling, the Fund may or may not hold all of the securities that are included in the Index.

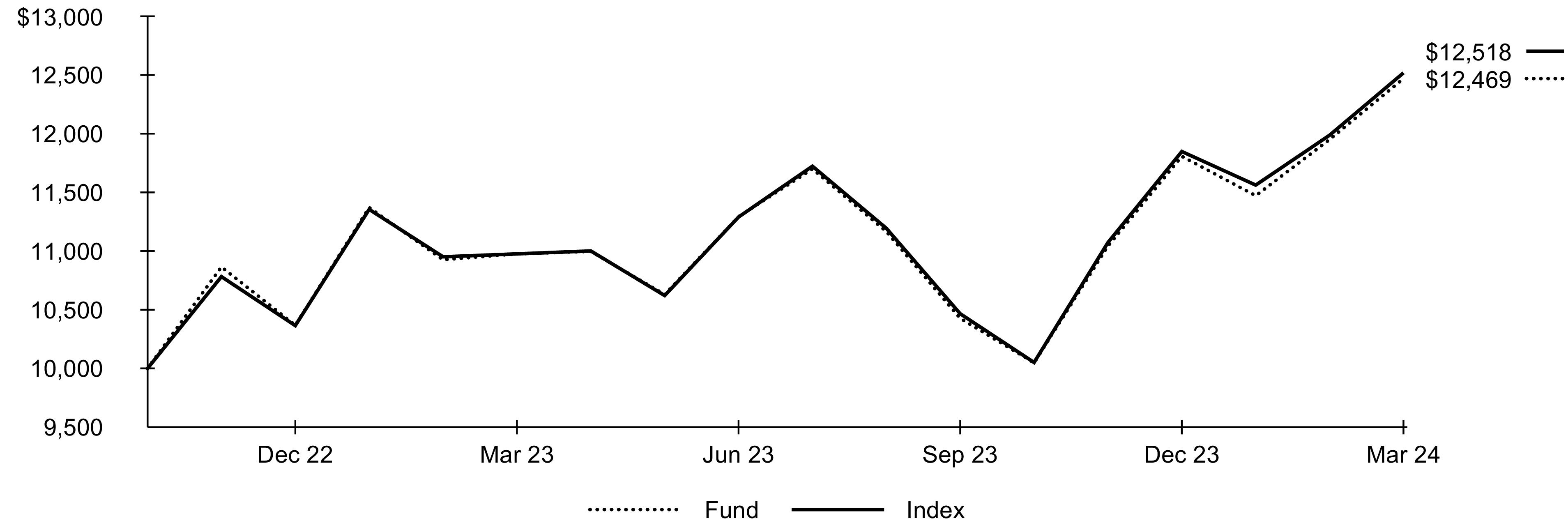

Performance

| Average Annual Total Returns | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

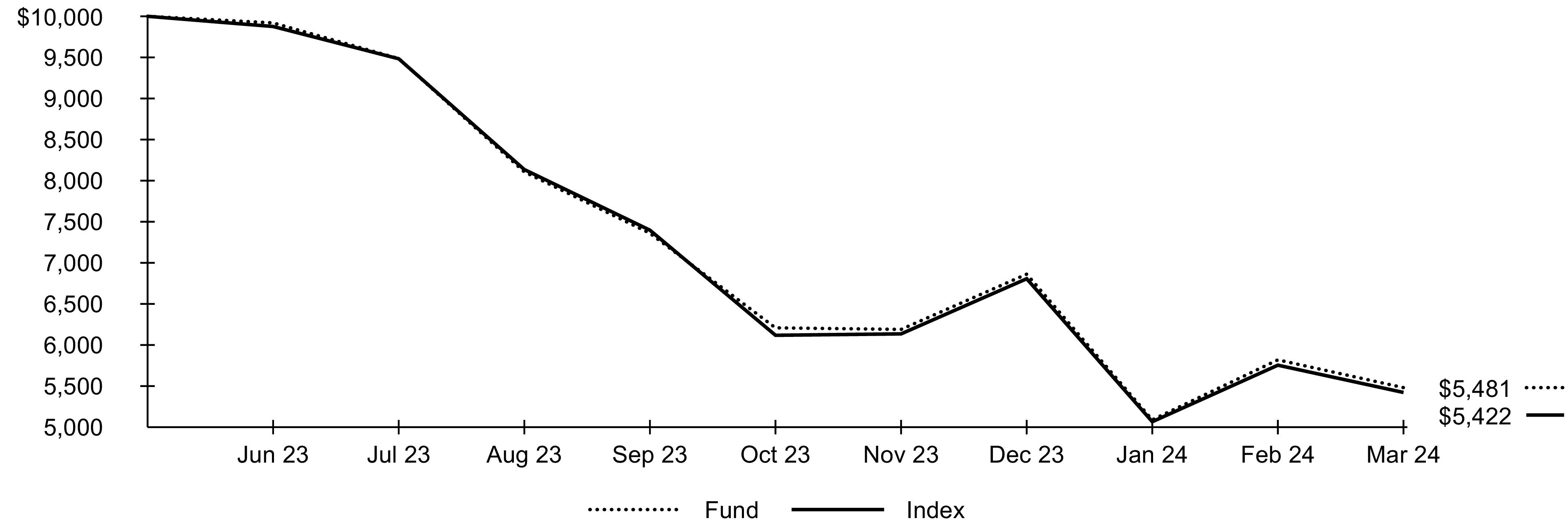

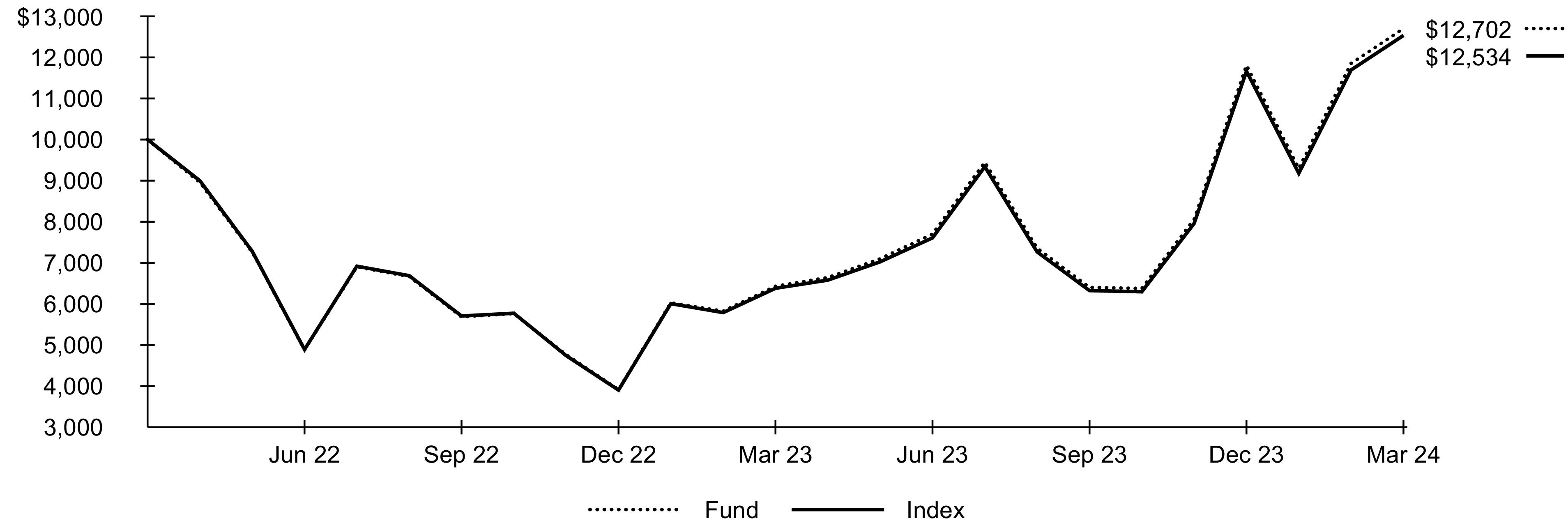

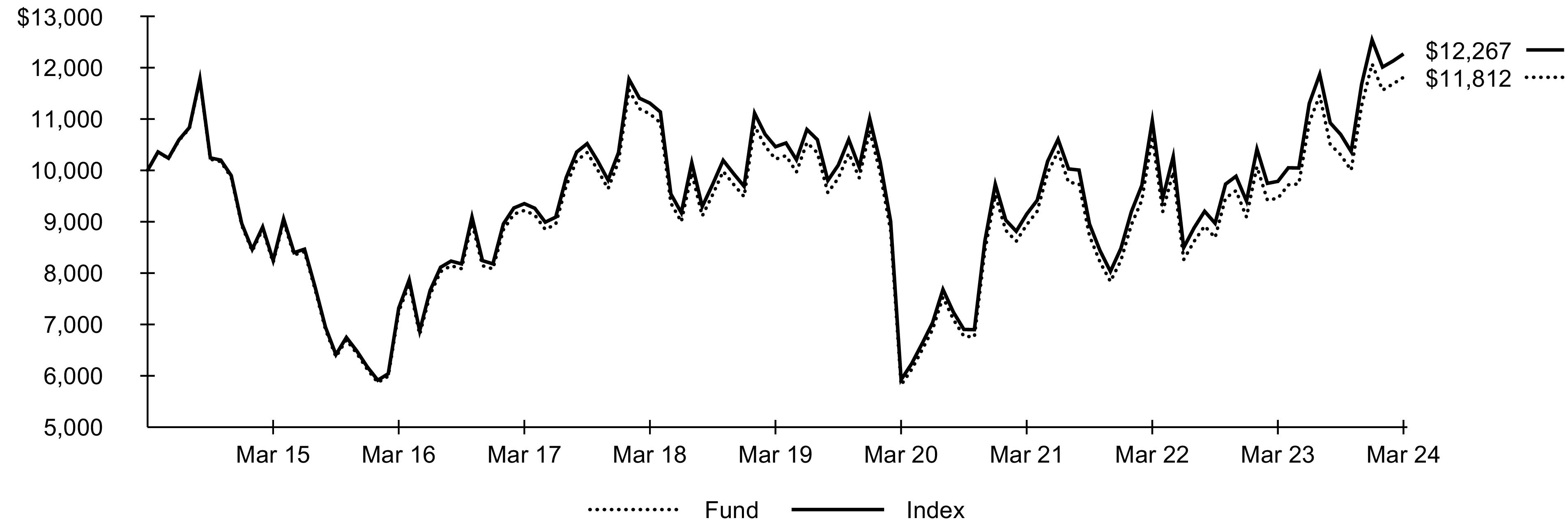

GROWTH OF $10,000 INVESTMENT(SINCE INCEPTION AT NET ASSET VALUE)

The inception date of the Fund was November 1, 2022. The first day of secondary market trading was November 3, 2022.

Past performance is not an indication of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. See “About Fund Performance” for more information.

Expense Example

| | |

Beginning

Account Value

(10/01/23) | Ending

Account Value

(03/31/24) | | Beginning

Account Value

(10/01/23) | Ending

Account Value

(03/31/24) | | |

| | | | | | |

| Expenses are equal to the annualized expense ratio, multiplied by the average account value over the period, multiplied by 183/366 (to reflect the one-half year period shown). Other fees, such as brokerage commissions and other fees to financial intermediaries, may be paid which are not reflected in the tables and examples above. See “Disclosure of Expenses” for more information. |

Fund Summary as of March 31, 2024 (continued)

iShares® Environmental Infrastructure and Industrials ETF

Portfolio Management Commentary

Global stocks of companies that provide infrastructure and industrial solutions for environmental issues posted a strong advance for the reporting period. Stocks in the U.S., which represented approximately 53% of the Index on average, contributed the most to the Index’s performance amid a global surge in infrastructure investment, solid U.S. economic growth and significant federal subsidies for certain types of infrastructure projects. In addition to several other notable bills, the 2022 Inflation Reduction Act allocated substantial funds for rebates and incentives to promote environmentally focused infrastructure. The combination of a strong economy and government subsidies drove a surge in construction and investment, leading to substantial gains among infrastructure stocks.

The U.S. industrials sector contributed the most to the Index’s return, led by the machinery industry. Strong demand for freight and transit train cars and related products drove revenue higher, enabling an increase in dividends. Robust sales of commercial water solutions and fluid treatment products helped to offset lower revenue from residential pool equipment.

Environmental infrastructure companies in the U.K. also advanced. In the industrials sector, the professional services industry drove gains amid solid revenue from sustainability assurance and testing services, particularly relating to battery technology and medical devices. The materials sector was another source of strength, as the potential acquisition of a paper packaging company sent stock prices higher. The Brazilian utilities sector further contributed to the Index’s return, as earnings and revenue exceeded analysts’ expectations.

On the downside, the materials sector in South Africa detracted from the Index’s return, as decreasing revenue due to lower platinum-group metal prices weighed on profit margins. In Belgium, the materials sector declined amid lower sales of components for rechargeable batteries.

Portfolio Information

TEN LARGEST HOLDINGS

| |

American Water Works Co. Inc. | |

Westinghouse Air Brake Technologies Corp. | |

| |

| |

| |

| |

Advanced Drainage Systems Inc. | |

| |

| |

| |

| Excludes money market funds. |

82024 iShares Annual Report to Shareholders

Fund Summary as of March 31, 2024

Investment Objective

The iShares Global 100 ETF (the “Fund”) seeks to track the investment results of an index composed of 100 large-capitalization global equities, as represented by the S&P Global 100TM (the “Index”). The Fund invests in a representative sample of securities included in the Index that collectively has an investment profile similar to the Index. Due to the use of representative sampling, the Fund may or may not hold all of the securities that are included in the Index.

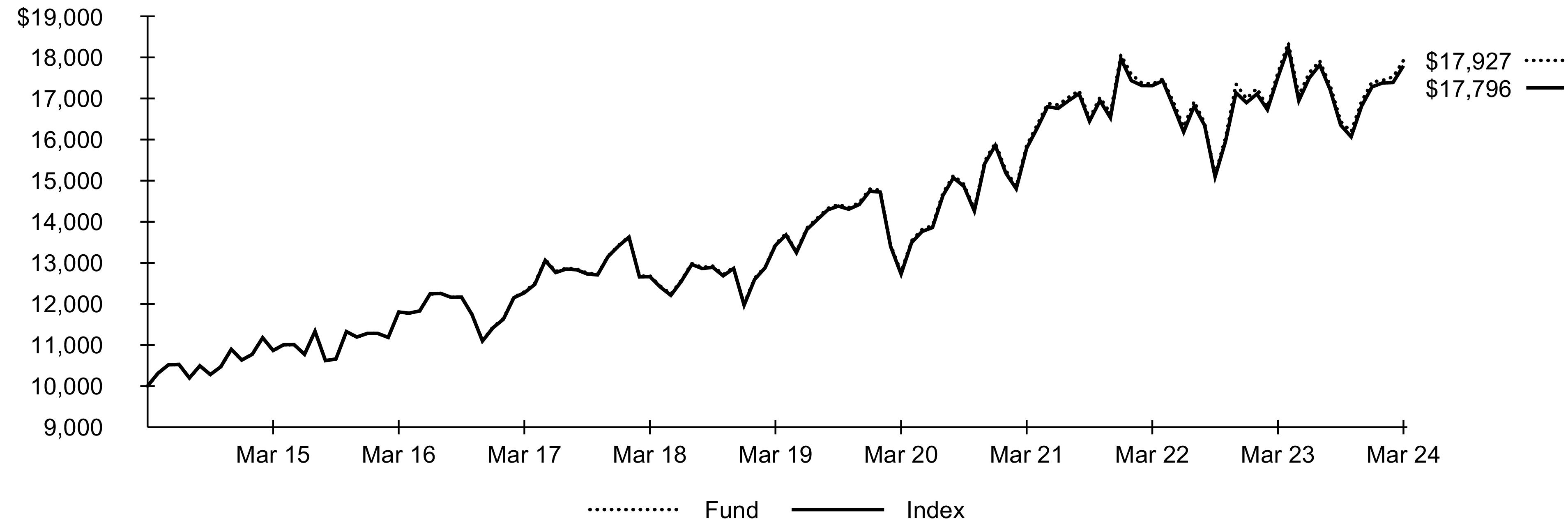

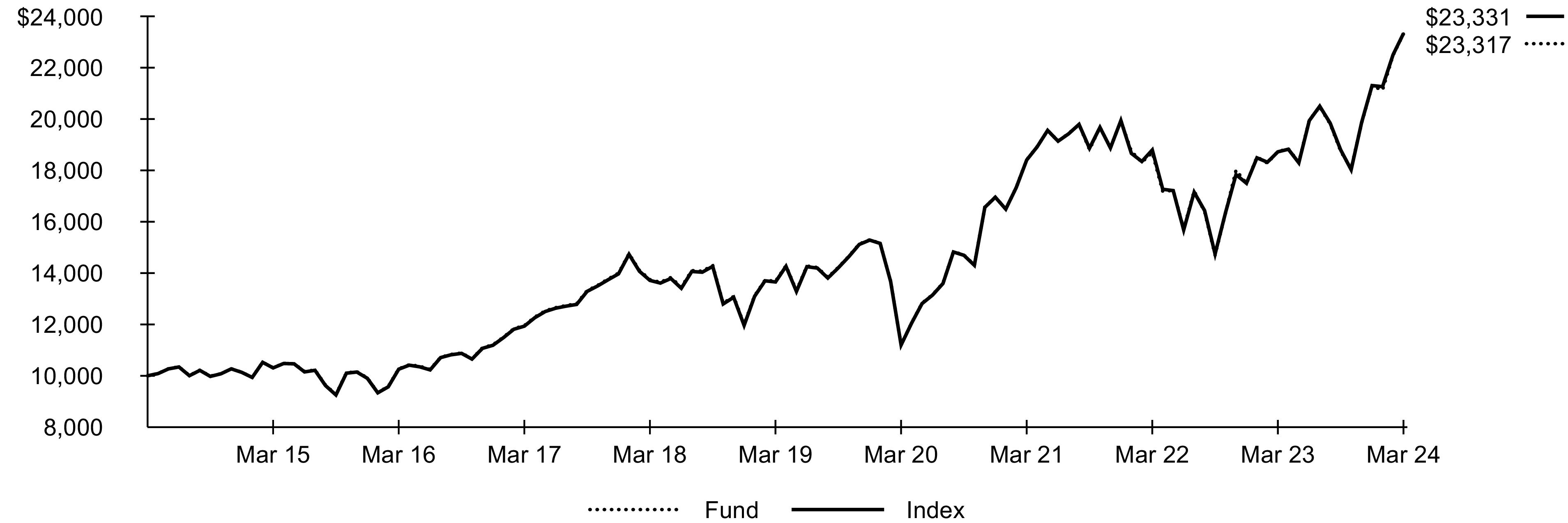

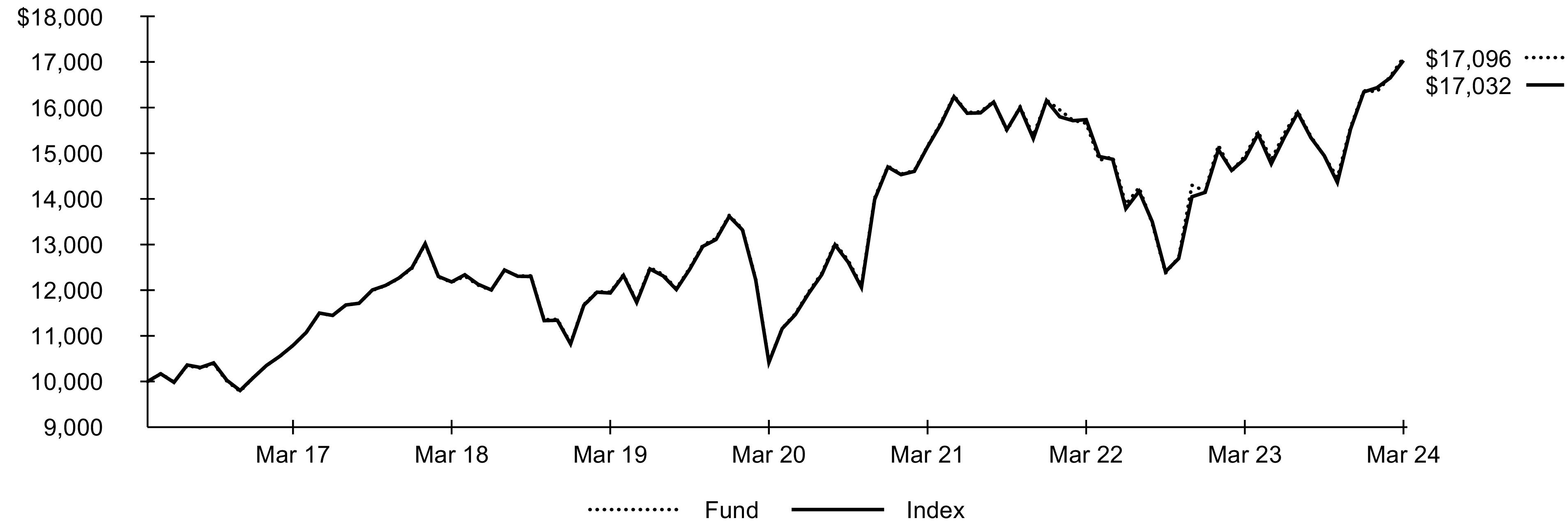

Performance

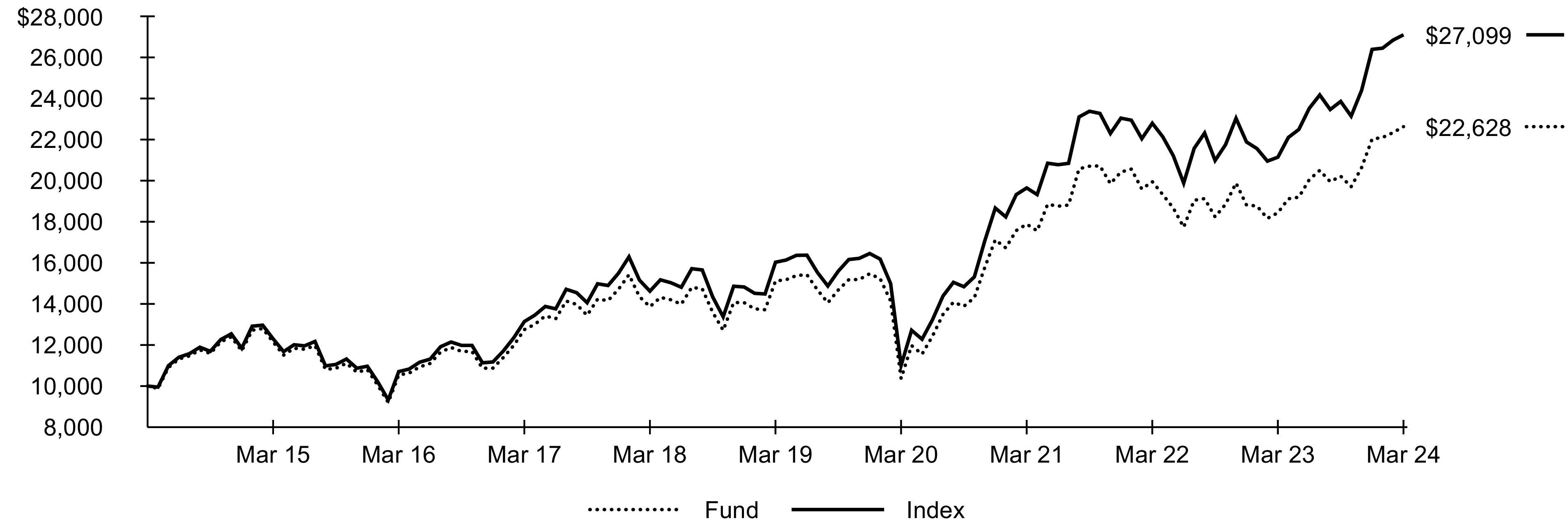

| Average Annual Total Returns | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

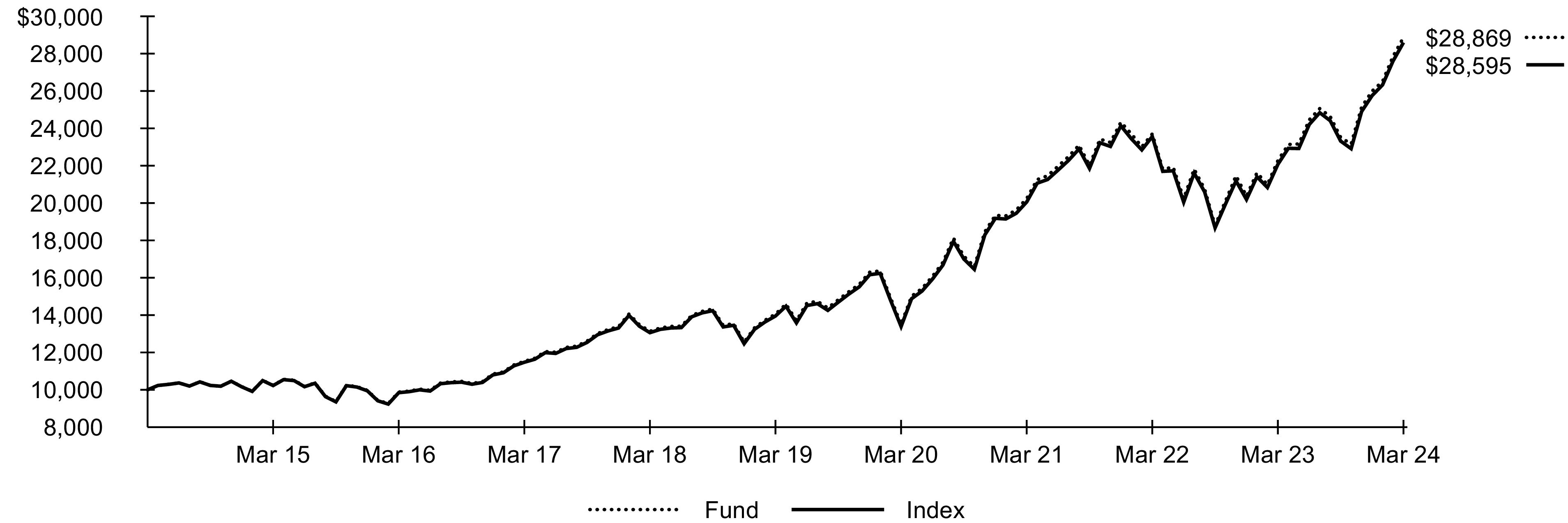

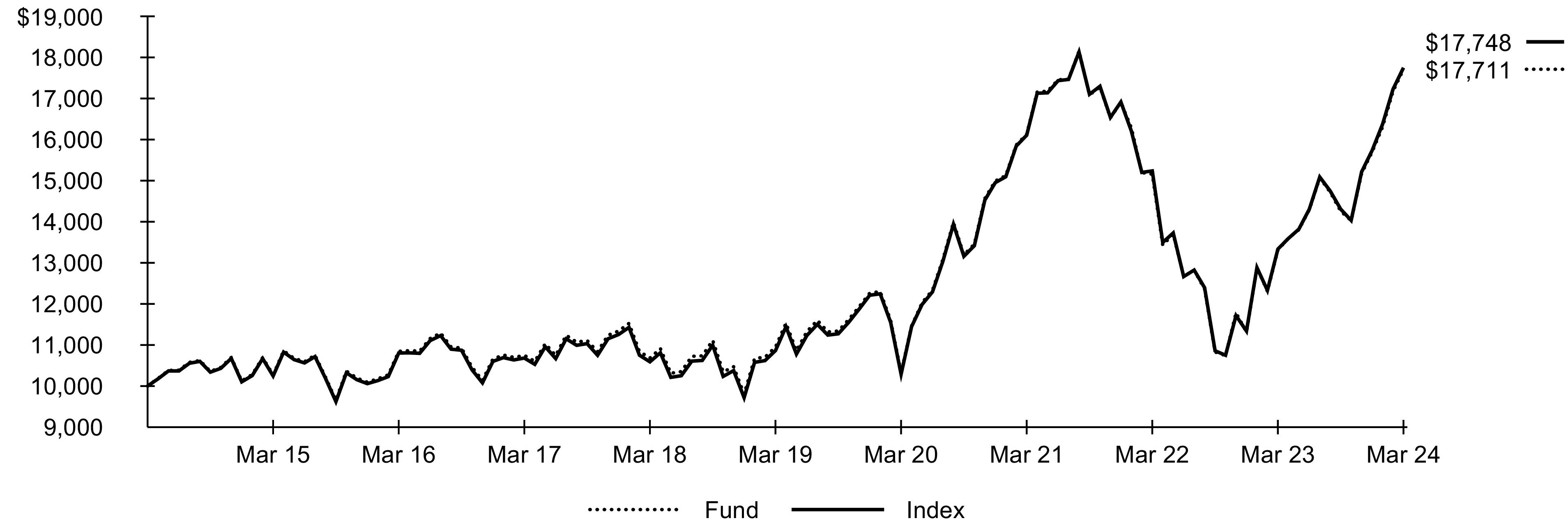

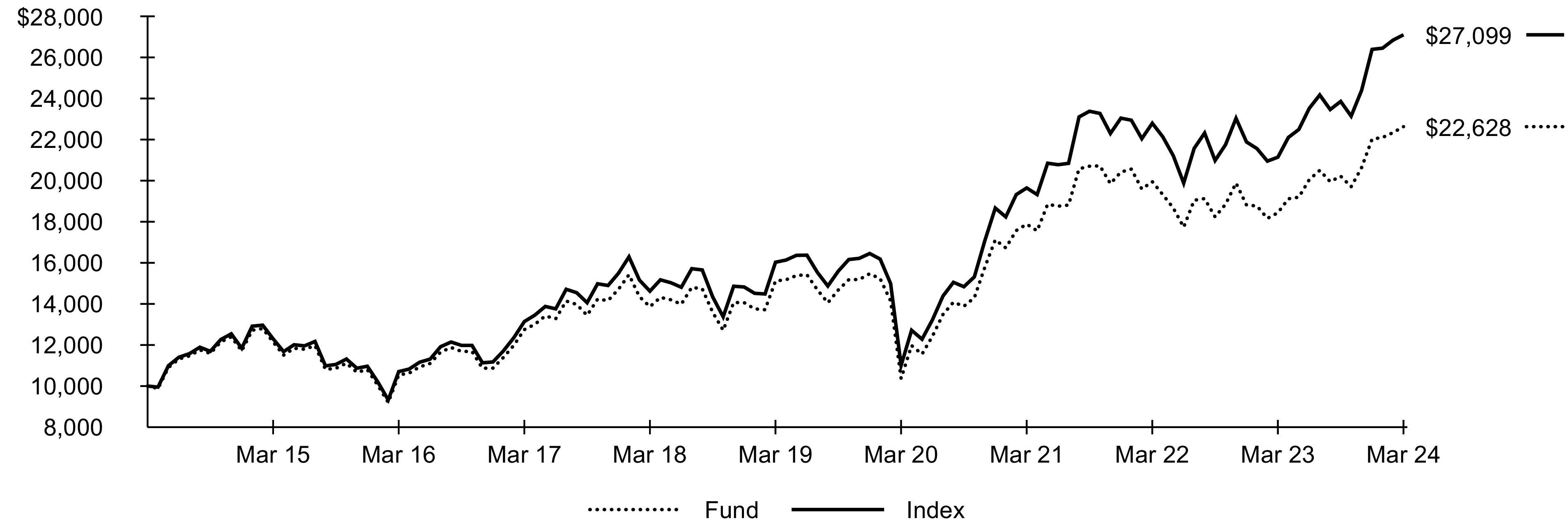

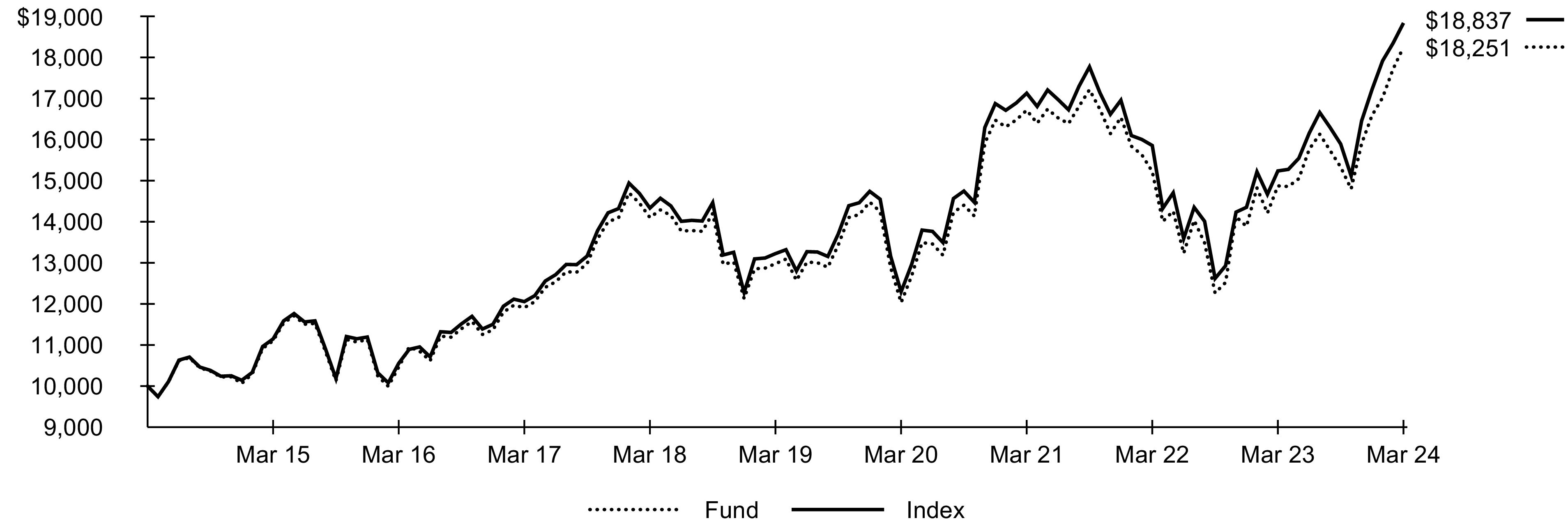

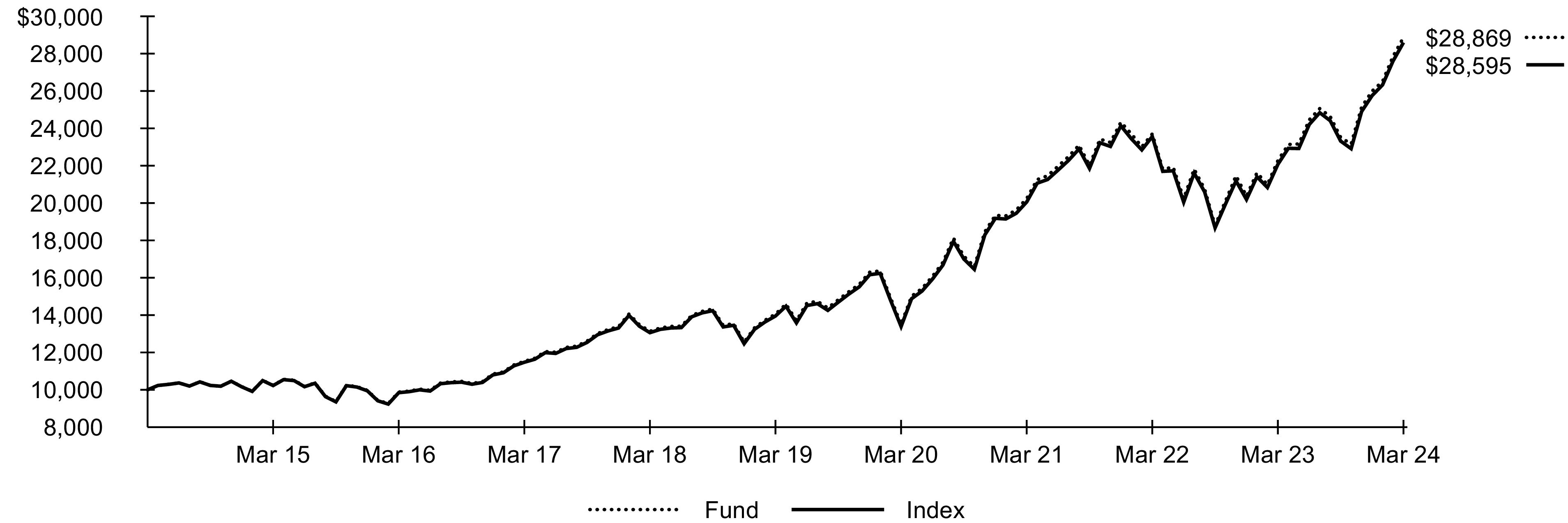

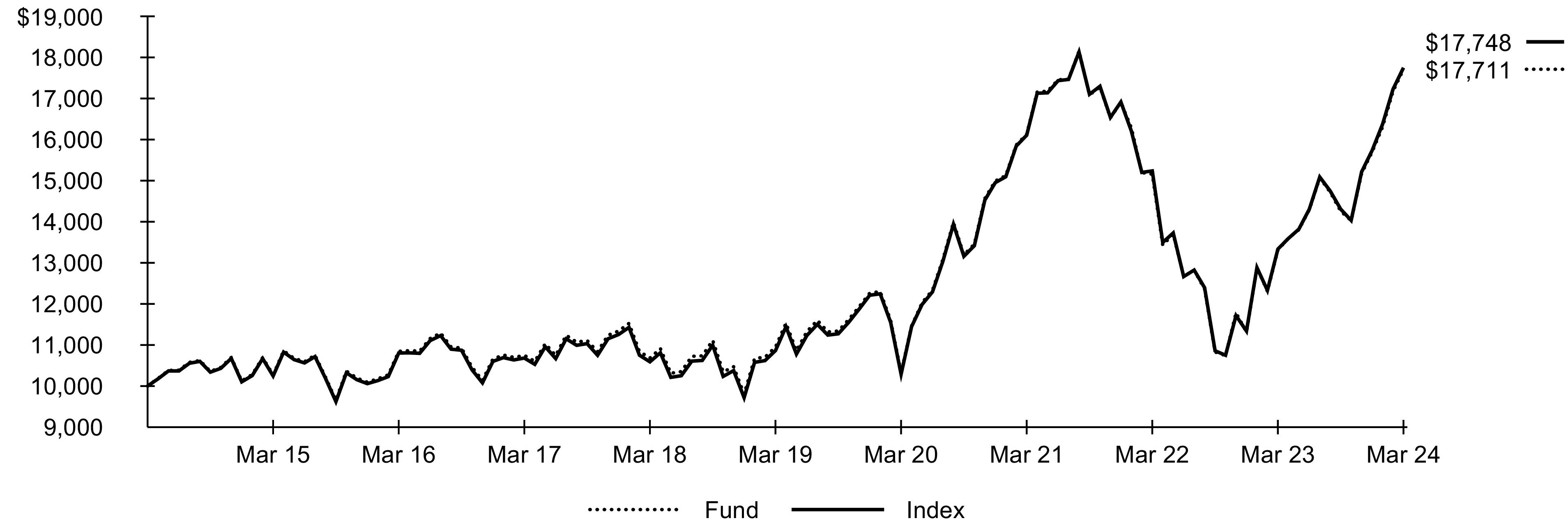

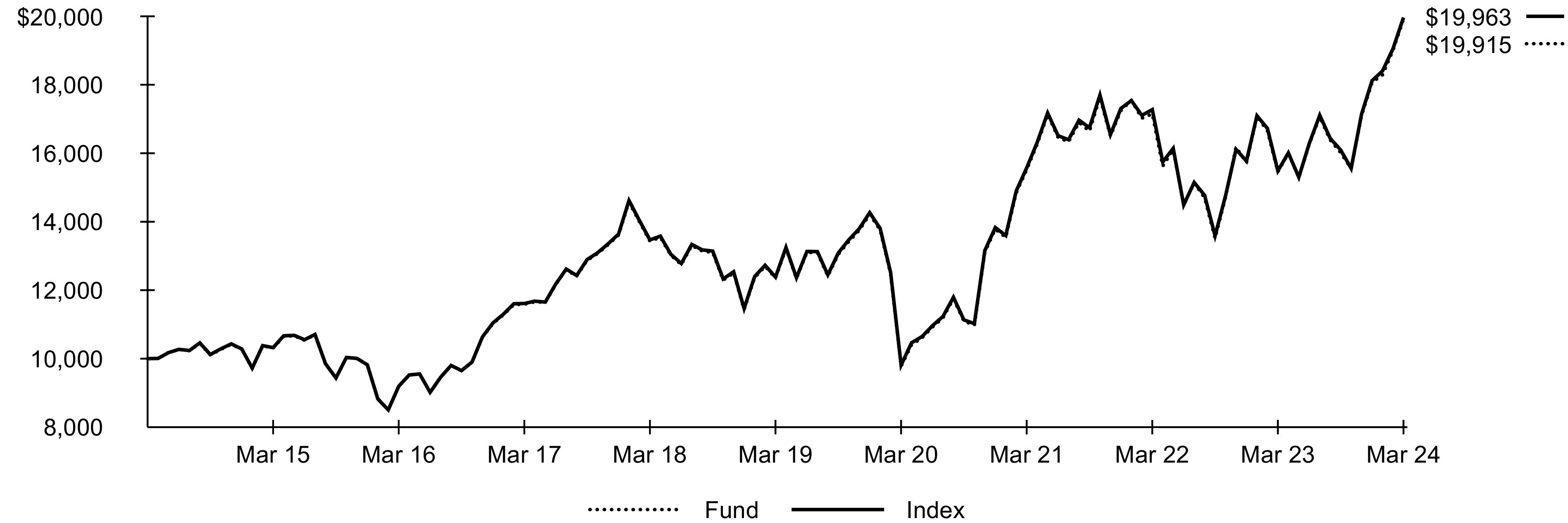

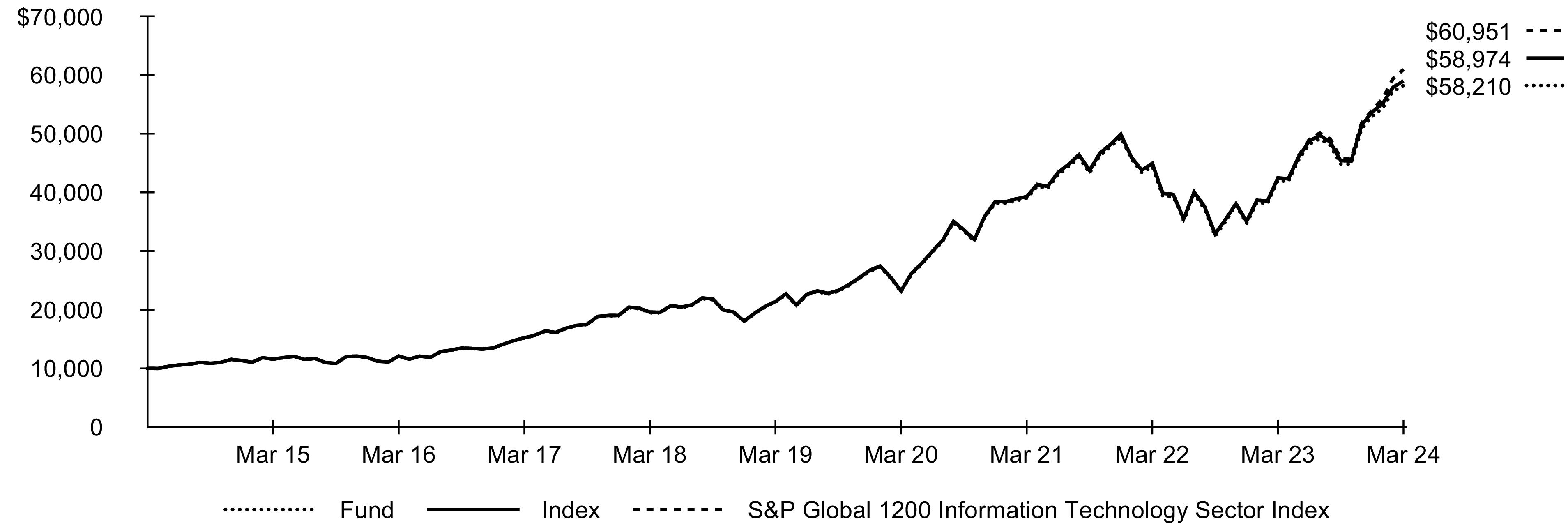

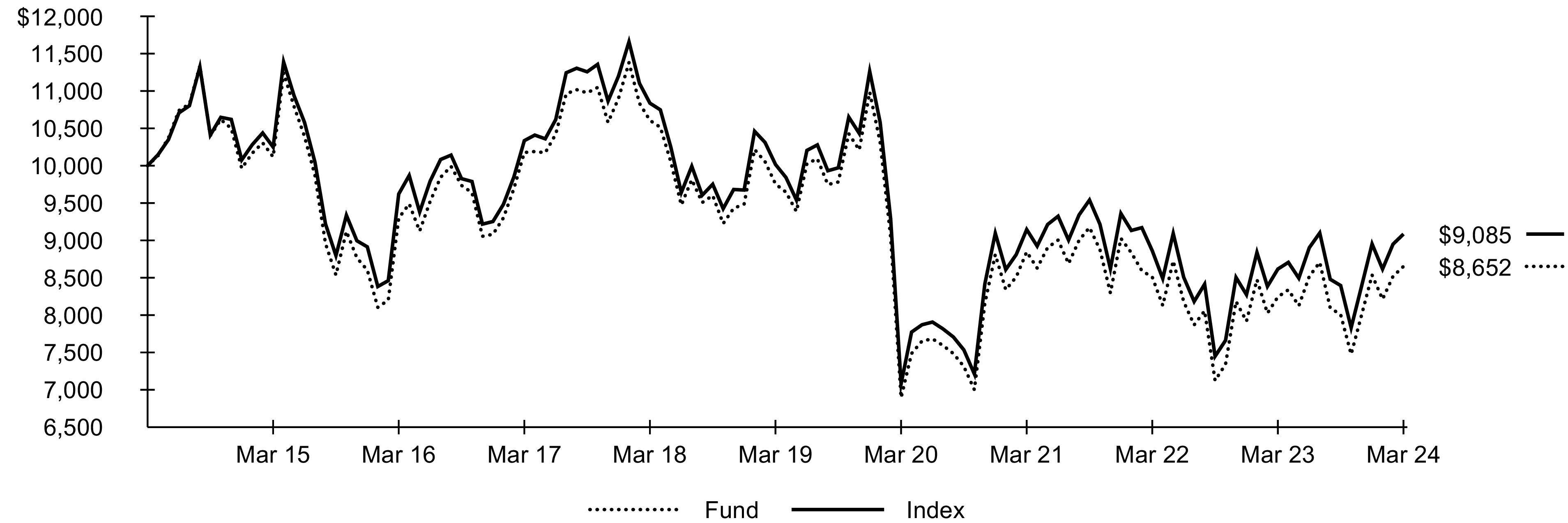

GROWTH OF $10,000 INVESTMENT(AT NET ASSET VALUE)

Past performance is not an indication of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. See “About Fund Performance” for more information.

Expense Example

| | |

Beginning

Account Value

(10/01/23) | Ending

Account Value

(03/31/24) | | Beginning

Account Value

(10/01/23) | Ending

Account Value

(03/31/24) | | |

| | | | | | |

| Expenses are equal to the annualized expense ratio, multiplied by the average account value over the period, multiplied by 183/366 (to reflect the one-half year period shown). Other fees, such as brokerage commissions and other fees to financial intermediaries, may be paid which are not reflected in the tables and examples above. See “Disclosure of Expenses” for more information. |

Fund Summary as of March 31, 2024 (continued)

Portfolio Management Commentary

Large-capitalization global stocks advanced strongly for the reporting period amid resilient global economic growth and cooling inflation in most parts of the world. Stocks from the U.S., which represented approximately 75% of the Index on average, contributed the most to the Index’s return.

Within the U.S., the information technology sector was the largest source of strength amid notable innovations in artificial intelligence (“AI”) technology. Rapid advances in generative AI, which allows users to generate outputs using simple natural language queries, drove a surge in investor enthusiasm for products and technologies associated with AI. The semiconductors industry gained the most, as companies purchased specialized chips used to provide computing capacity for AI applications, which require significant processing power. Additionally, the semiconductors industry continued to invest in building the next generation of processors for AI applications, further supporting stock prices.

The U.S. software and services industry also posted significant gains, driven by strength among systems software companies. Enthusiasm for generative AI products benefited a large company in the industry with a significant investment in a prominent consumer-facing AI platform, a chatbot that grew its user base more quickly than any other consumer application in history. Integration of AI into already existing productivity software also propelled gains, as many customers adopted new AI features that automated certain writing and coding tasks.

The U.S. consumer discretionary sector also contributed. As the U.S. economy continued to expand, consumers increased their spending at a robust pace, driving substantial gains in the sector. Despite rising interest rates and higher borrowing costs, spending remained resilient, as strong household balance sheets, higher wages, and elevated asset prices supported consumers. Higher online sales and new AI cloud services propelled gains in the broadline retail industry.

Japanese stocks further contributed to the Index’s performance, led by the consumer discretionary sector. Robust demand for hybrid electric vehicles and strong pricing bolstered revenues and profit margins in the automobiles and components industry. Stocks in the Netherlands also contributed, as the semiconductors and semiconductor equipment industry benefited from a recovery in demand for microchips.

Portfolio Information

SECTOR ALLOCATION

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Other (each representing less than 1%) | |

TEN LARGEST COUNTRIES

Country/Geographic Region | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| Excludes money market funds. |

102024 iShares Annual Report to Shareholders

Fund Summary as of March 31, 2024

iShares® Global Infrastructure ETF

Investment Objective

The iShares Global Infrastructure ETF (the “Fund”) seeks to track the investment results of an index composed of developed market equities in the infrastructure industry, as represented by the S&P Global Infrastructure IndexTM (the “Index”). The Fund invests in a representative sample of securities included in the Index that collectively has an investment profile similar to the Index. Due to the use of representative sampling, the Fund may or may not hold all of the securities that are included in the Index.

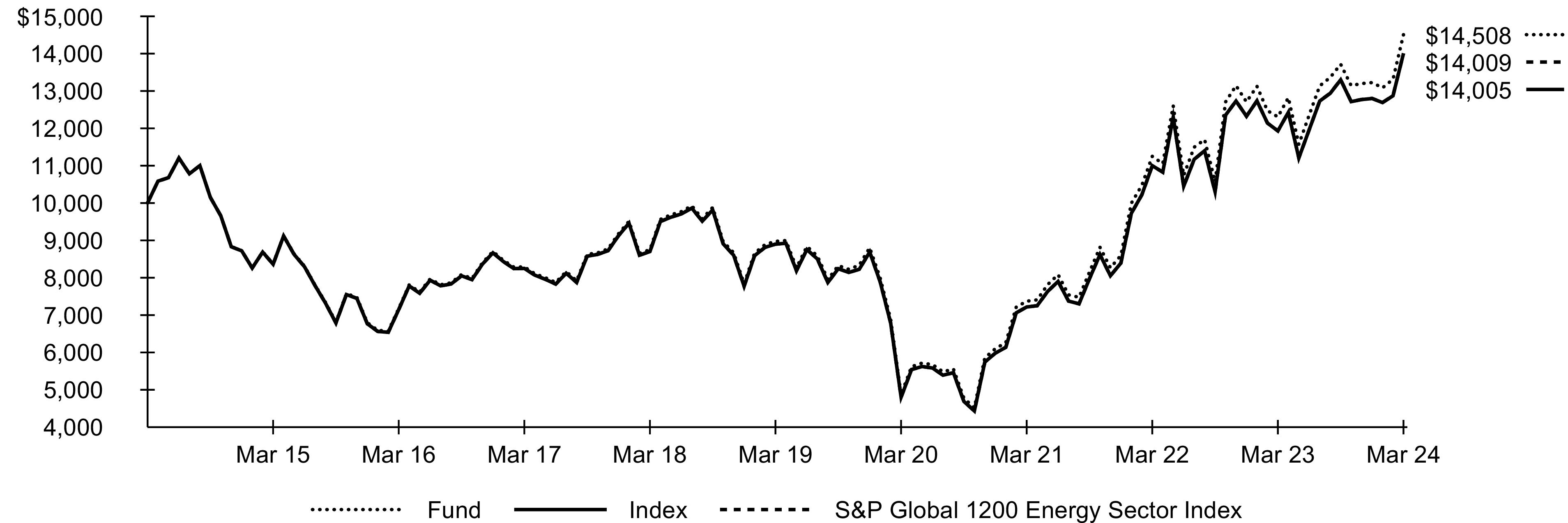

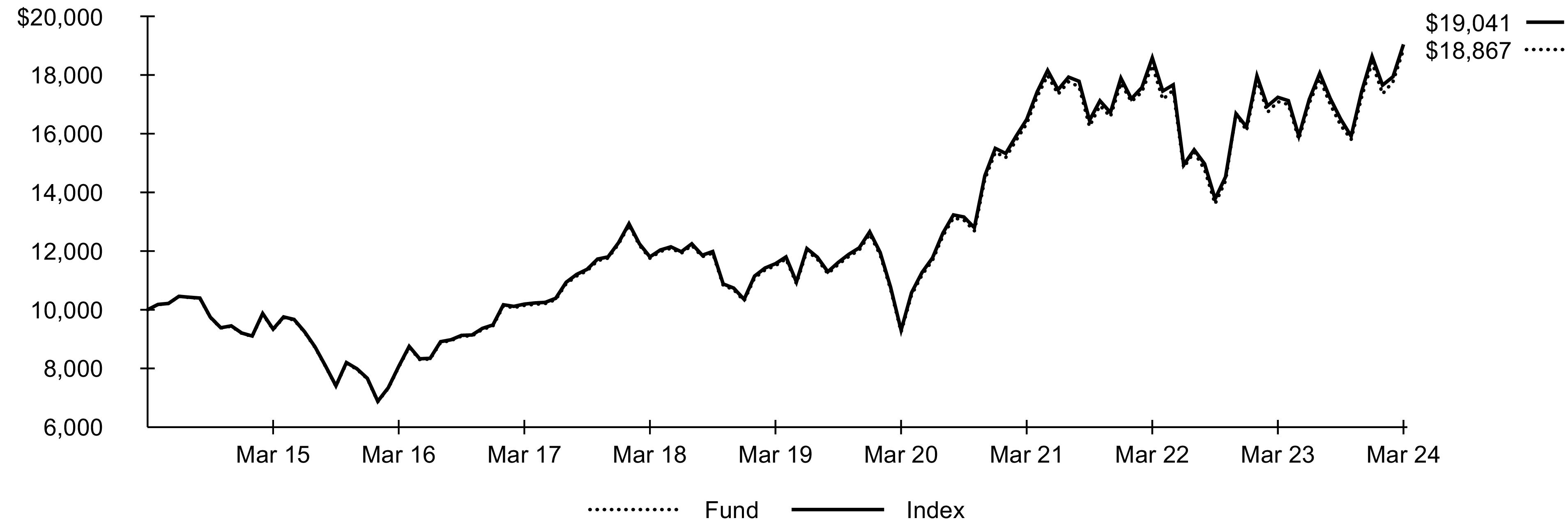

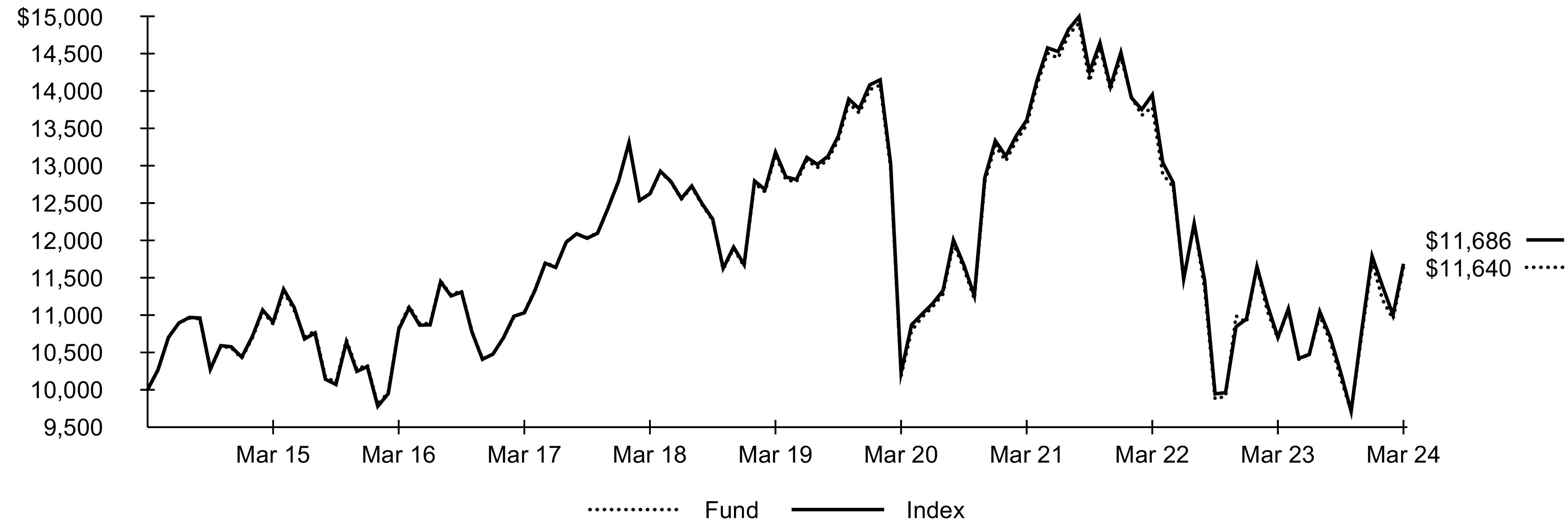

Performance

| Average Annual Total Returns | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

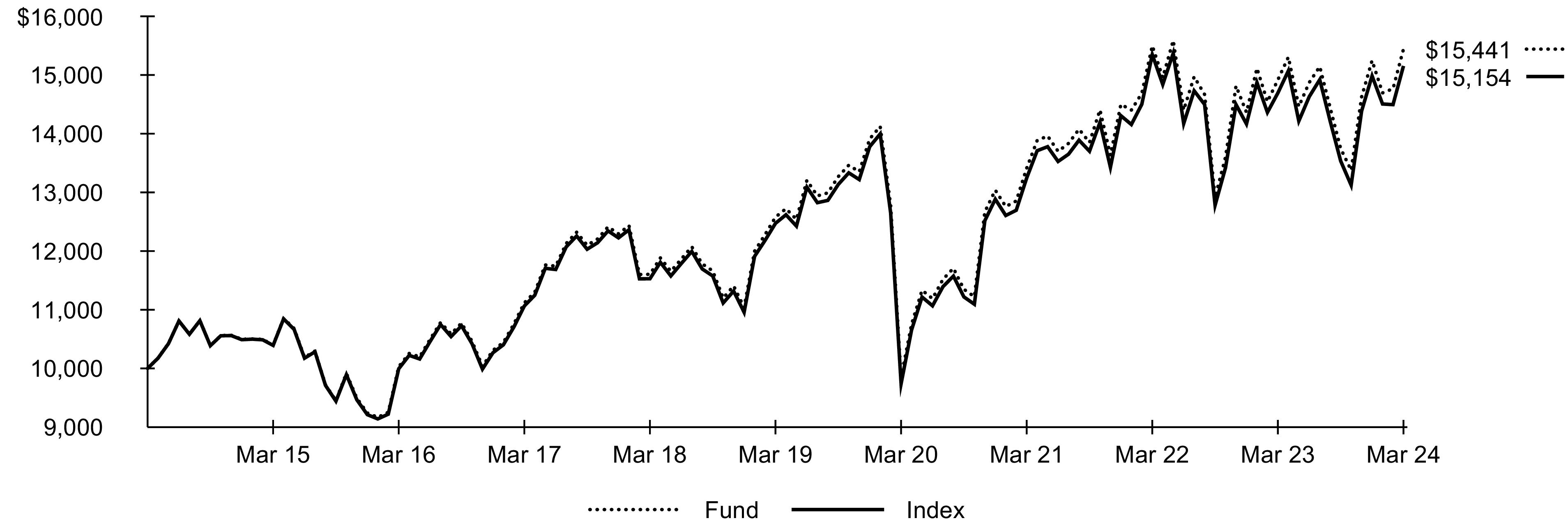

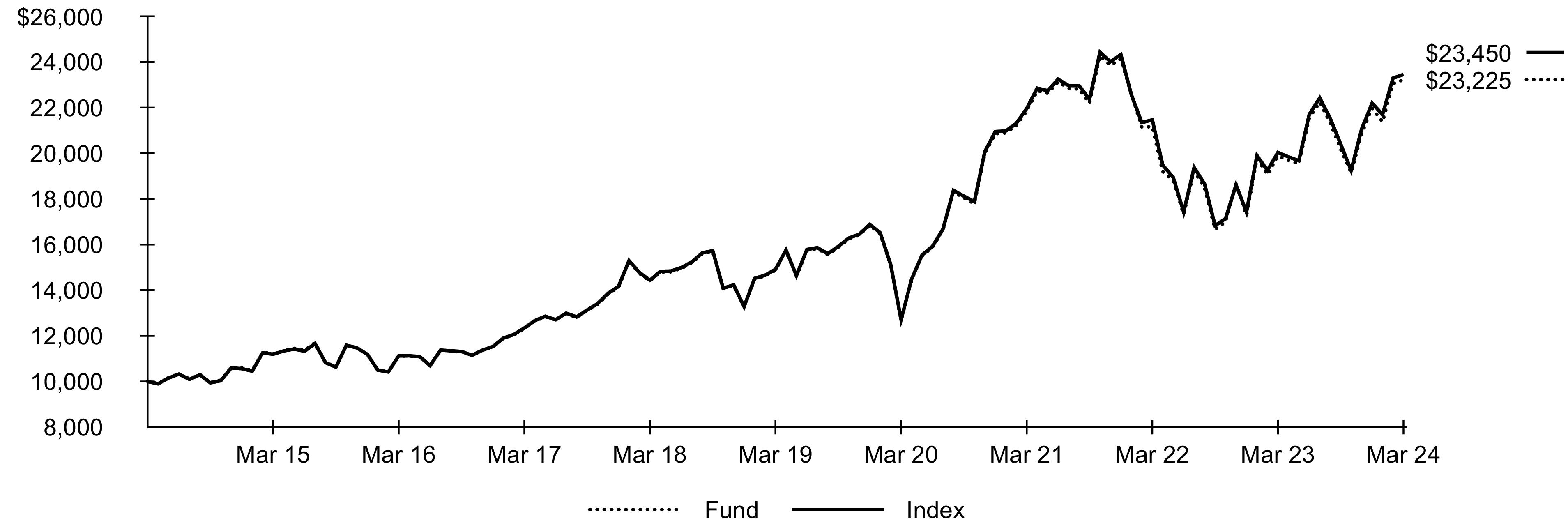

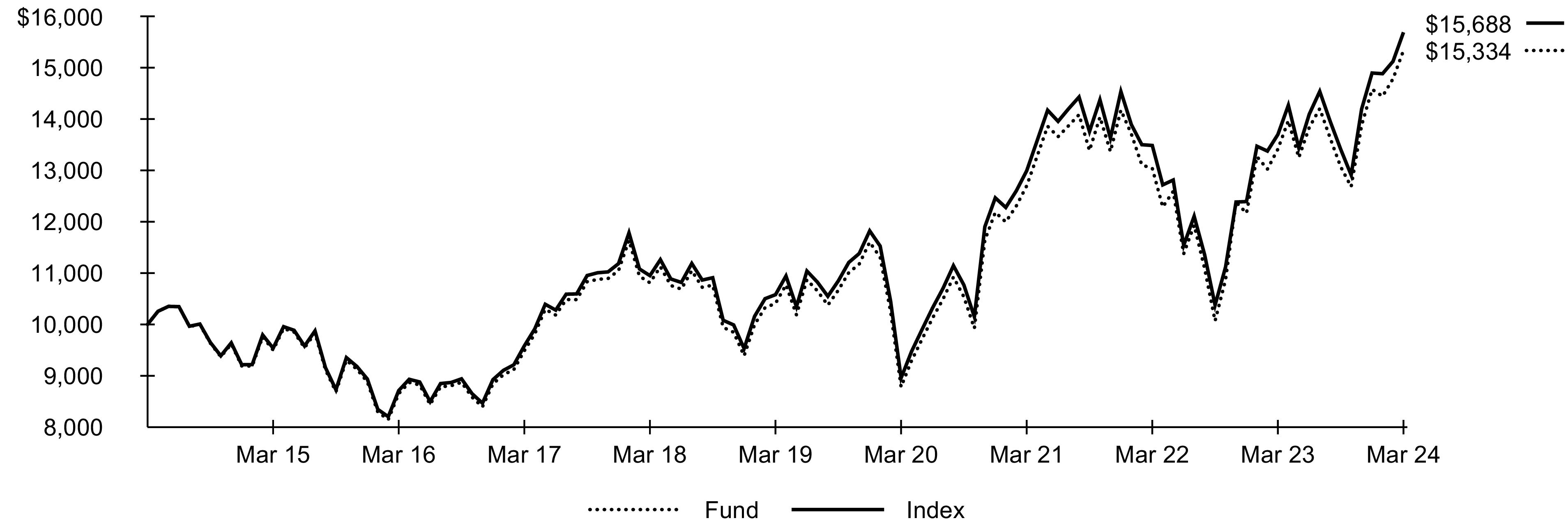

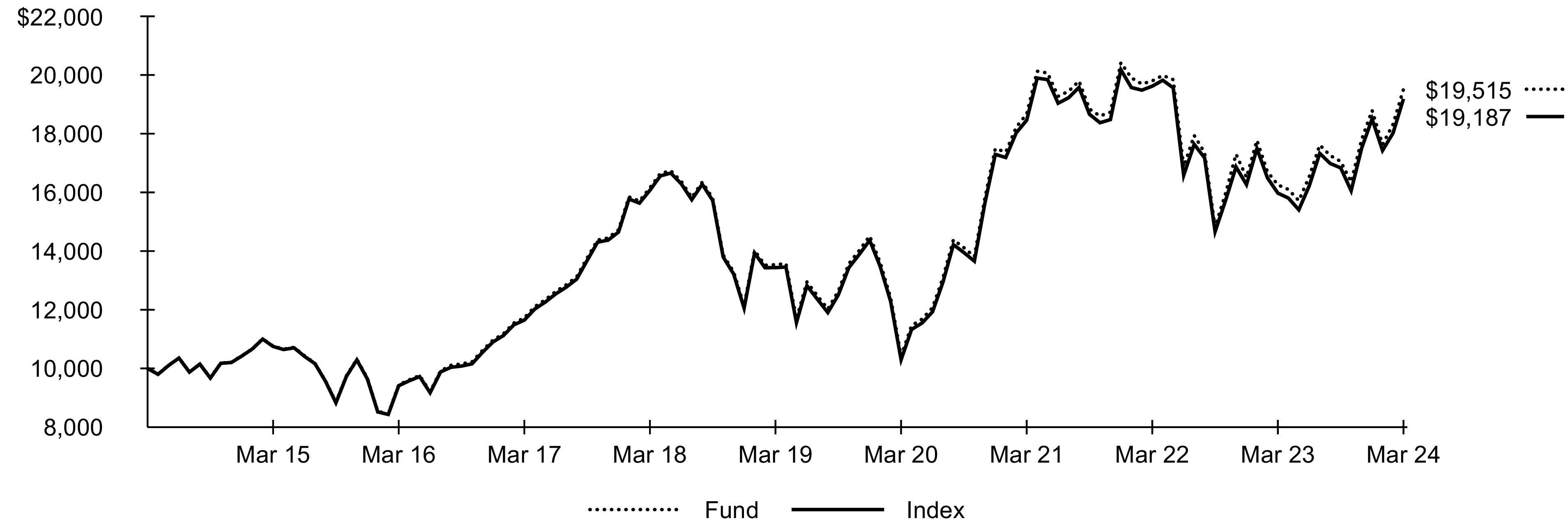

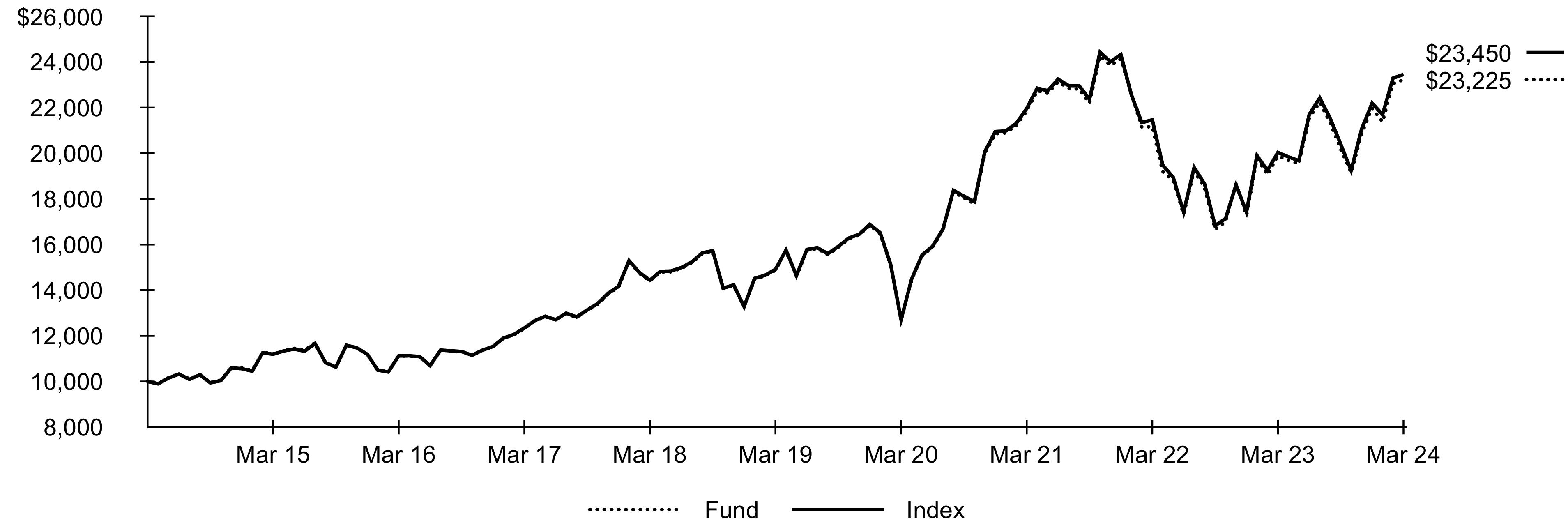

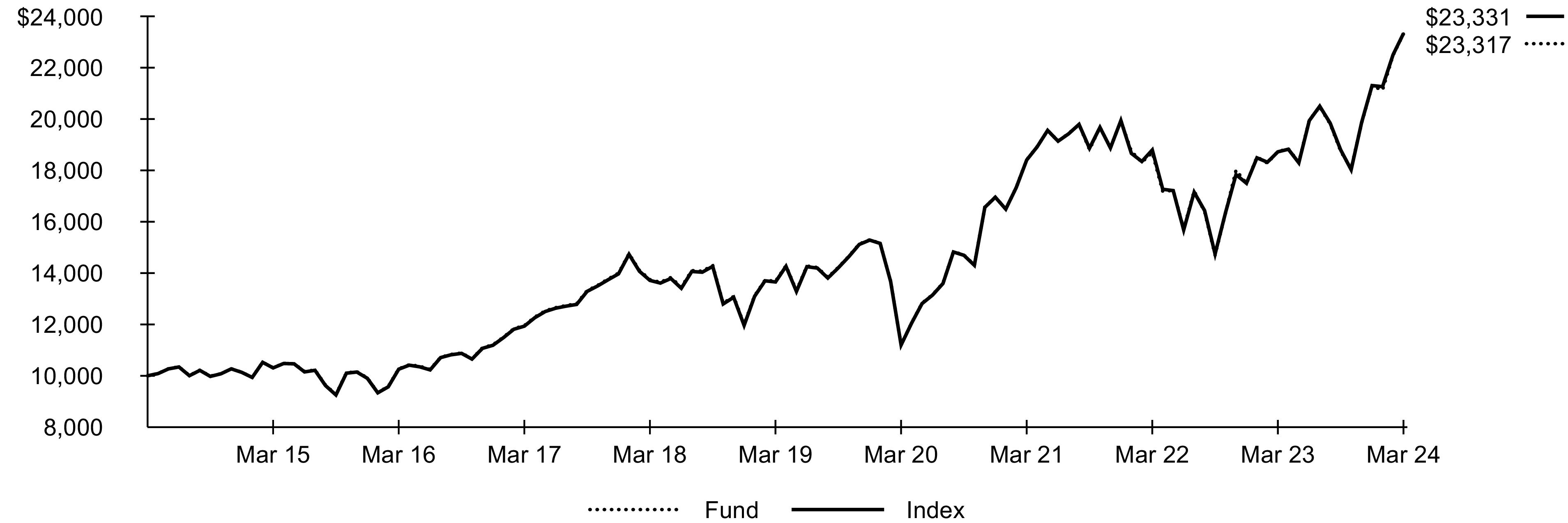

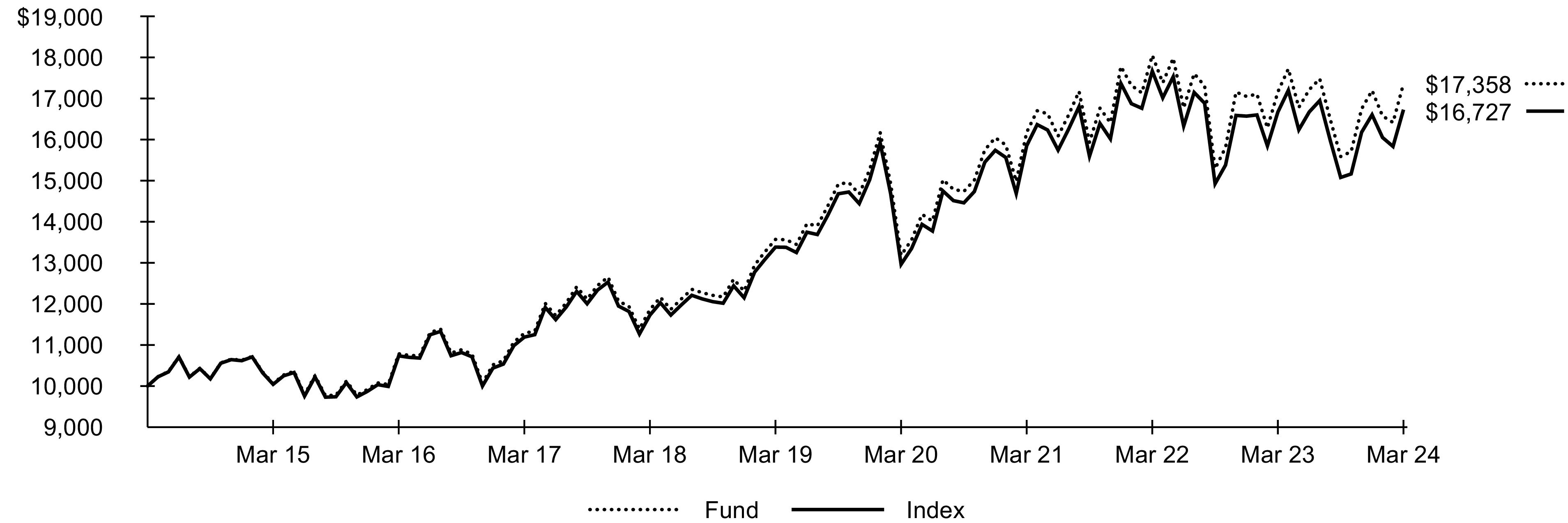

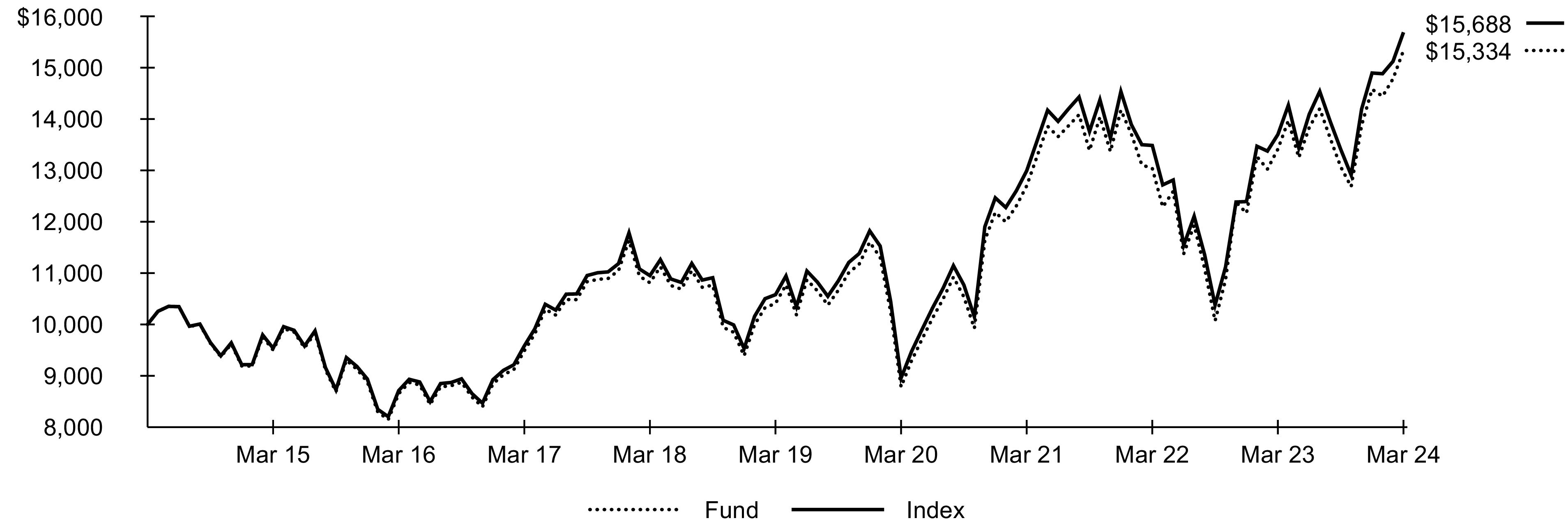

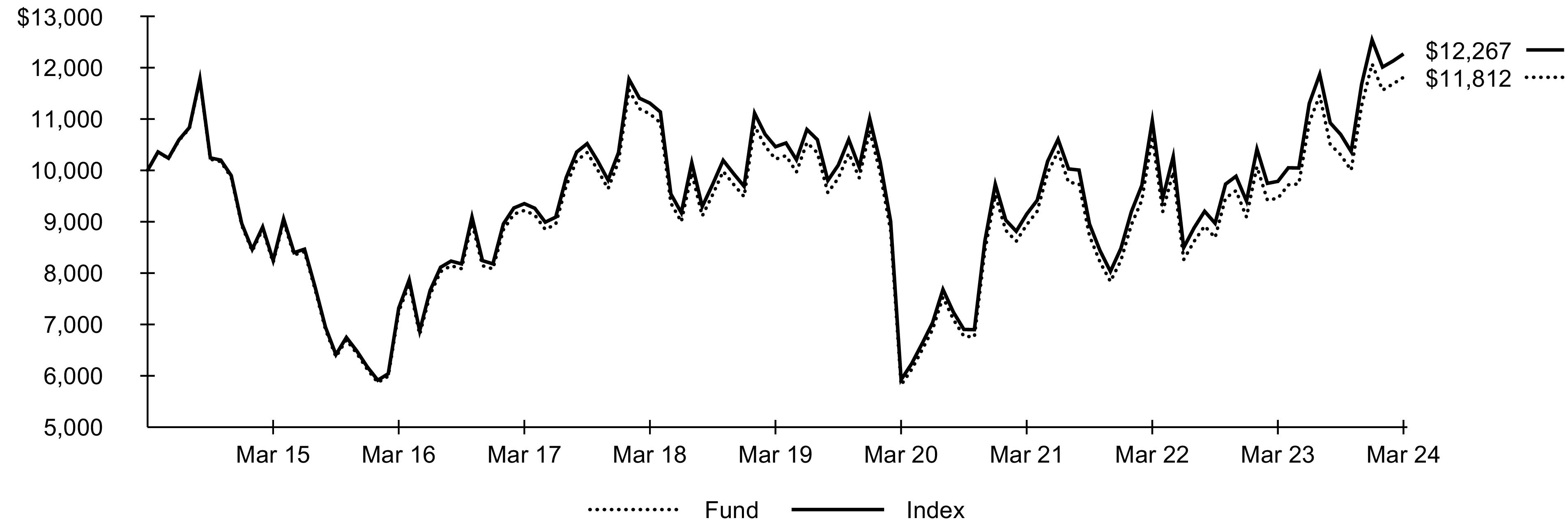

GROWTH OF $10,000 INVESTMENT(AT NET ASSET VALUE)

Past performance is not an indication of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. See “About Fund Performance” for more information.

Expense Example

| | |

Beginning

Account Value

(10/01/23) | Ending

Account Value

(03/31/24) | | Beginning

Account Value

(10/01/23) | Ending

Account Value

(03/31/24) | | |

| | | | | | |

| Expenses are equal to the annualized expense ratio, multiplied by the average account value over the period, multiplied by 183/366 (to reflect the one-half year period shown). Other fees, such as brokerage commissions and other fees to financial intermediaries, may be paid which are not reflected in the tables and examples above. See “Disclosure of Expenses” for more information. |

Fund Summary as of March 31, 2024 (continued)

iShares® Global Infrastructure ETF

Portfolio Management Commentary

Global infrastructure stocks advanced for the reporting period amid solid global economic growth. Stocks from the U.S., which represented approximately 39% of the Index on average, contributed the most to the Index’s performance amid solid U.S. economic growth and significant federal subsidies for certain types of infrastructure projects. The Infrastructure Investment and Jobs Act, passed in 2021, continued to disburse funds, while the CHIPS and Science act of 2022 promoted significant investments in microchip manufacturing. The combination of a strong economy and government subsidies drove a surge in infrastructure construction and investment, leading to substantial gains among infrastructure stocks.

The U.S. energy sector contributed the most to the Index’s return, as both oil and natural gas production in the U.S. reached all-time highs. Disruption to energy markets following Russia’s 2022 invasion of Ukraine and efforts by the government to stabilize energy prices drove investment in domestic production. The war also significantly impacted European energy markets, which imported large quantities of Russian natural gas prior to the invasion. European countries pivoted to alternative sources of gas, including U.S. liquefied natural gas. The surge in U.S. oil and natural gas production benefited the oil and gas storage and transportation industry, which provides energy infrastructure such as pipelines and storage facilities. Expansion in the industry drove strong earnings and allowed for investments in new projects while also raising dividends.

Spanish infrastructure stocks also contributed to the Index’s performance, as the Spanish economy posted faster growth than the E.U. average, bolstered by a strong recovery in tourism. The robust tourist economy drove gains in the industrials sector, where the airport services industry benefited from increased passenger traffic. Rising air travel in Spain and Latin America drove strong gains in revenues and profit, and approval for an airport fee increase by the Spanish government further buoyed the industry’s outlook.

On the downside, Chinese stocks detracted from the Index’s performance, amid slowing consumer spending and deflation. The transportation infrastructure industry in the industrials sector declined the most, as analysts adjusted their revenue forecasts down following an earnings report.

Portfolio Information

INDUSTRY ALLOCATION

| |

| |

| |

Oil & Gas Storage & Transportation | |

| |

| |

| |

| |

Other (each representing less than 1%) | |

TEN LARGEST COUNTRIES

Country/Geographic Region | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| Excludes money market funds. |

122024 iShares Annual Report to Shareholders

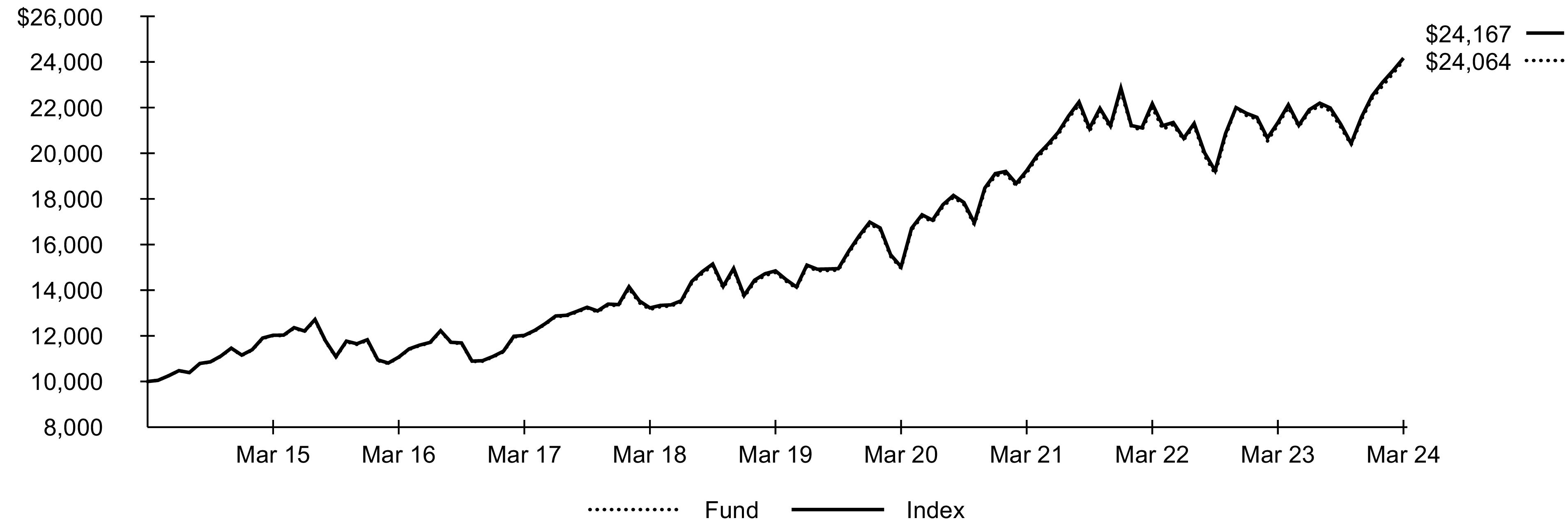

Fund Summary as of March 31, 2024

iShares® Global Timber & Forestry ETF

Investment Objective

The iShares Global Timber & Forestry ETF (the “Fund”) seeks to track the investment results of an index composed of global equities in or related to the timber and forestry industry, as represented by the S&P Global Timber & Forestry IndexTM (the “Index”). The Fund invests in a representative sample of securities included in the Index that collectively has an investment profile similar to the Index. Due to the use of representative sampling, the Fund may or may not hold all of the securities that are included in the Index.

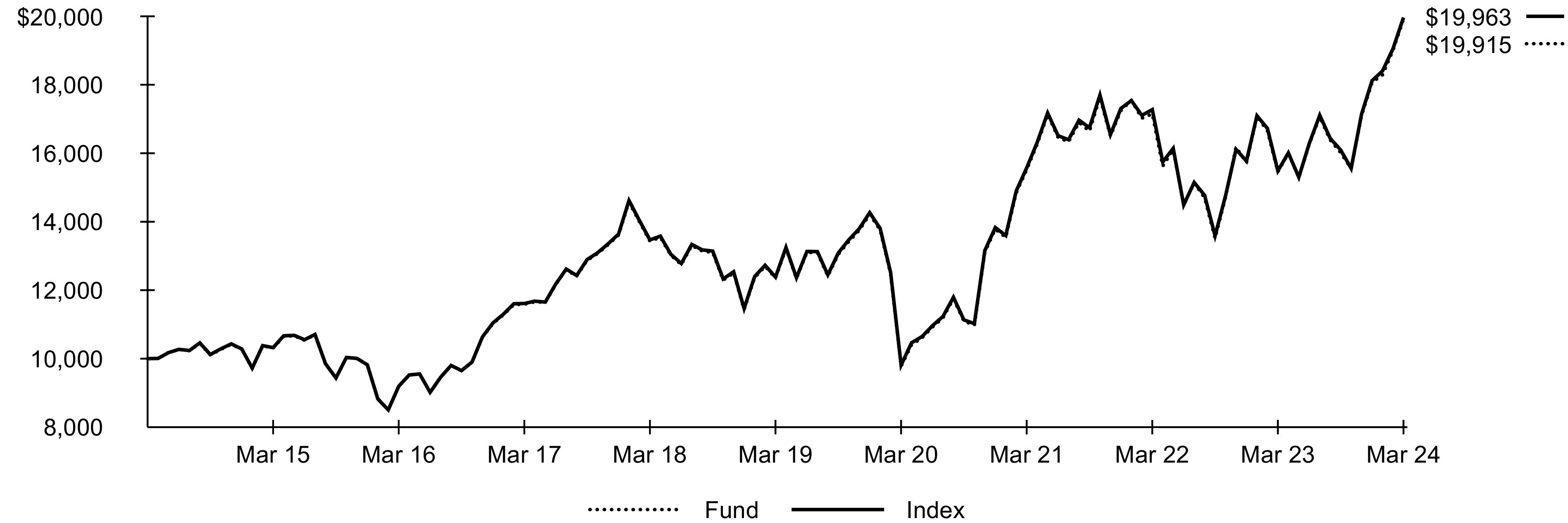

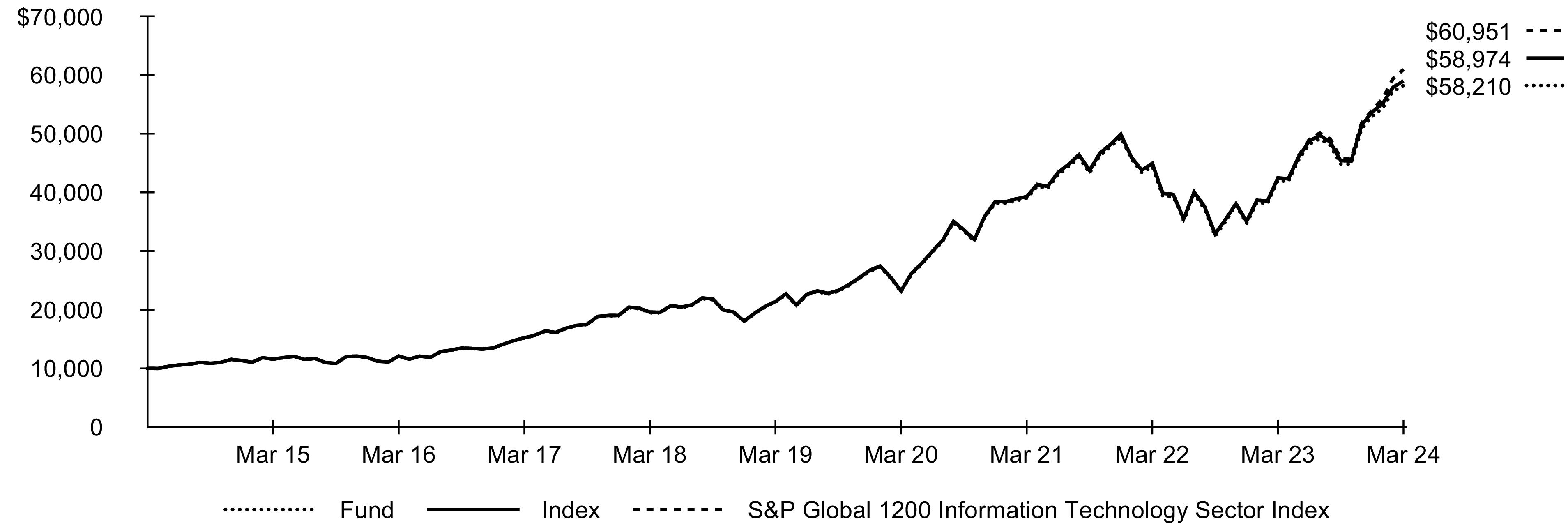

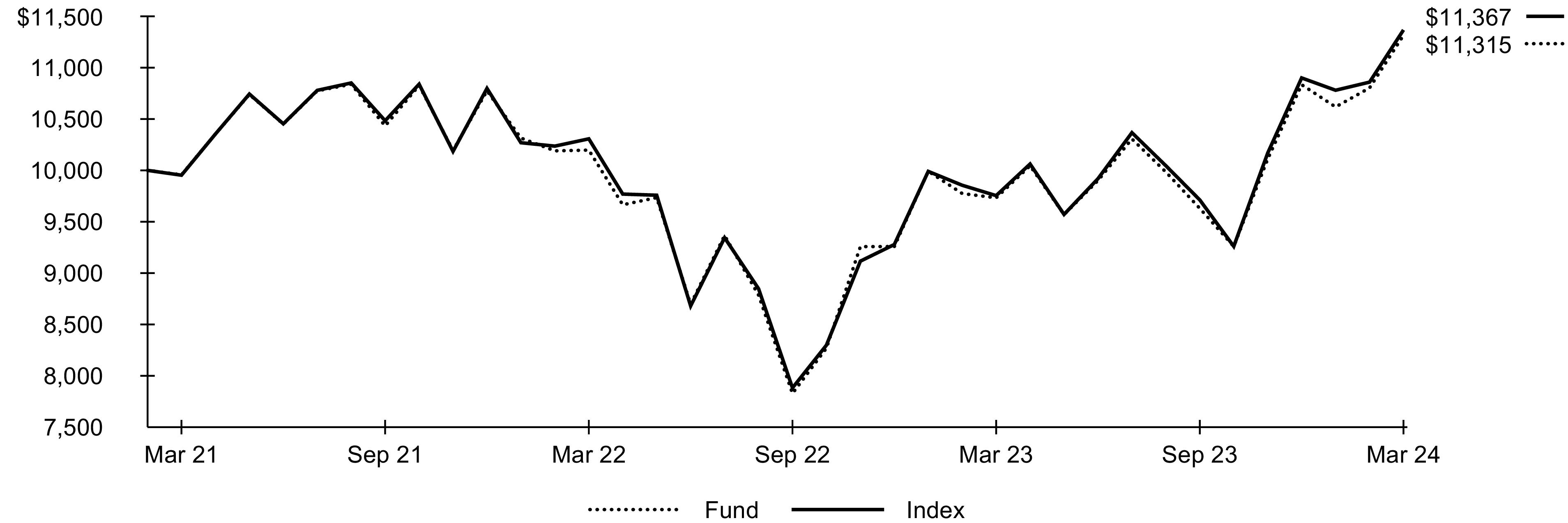

Performance

| Average Annual Total Returns | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| The NAV total return presented in the table for the one-year period differs from the same period return disclosed in the financial highlights. The total return in the financial highlights is calculated in the same manner but differs due to certain adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles. |

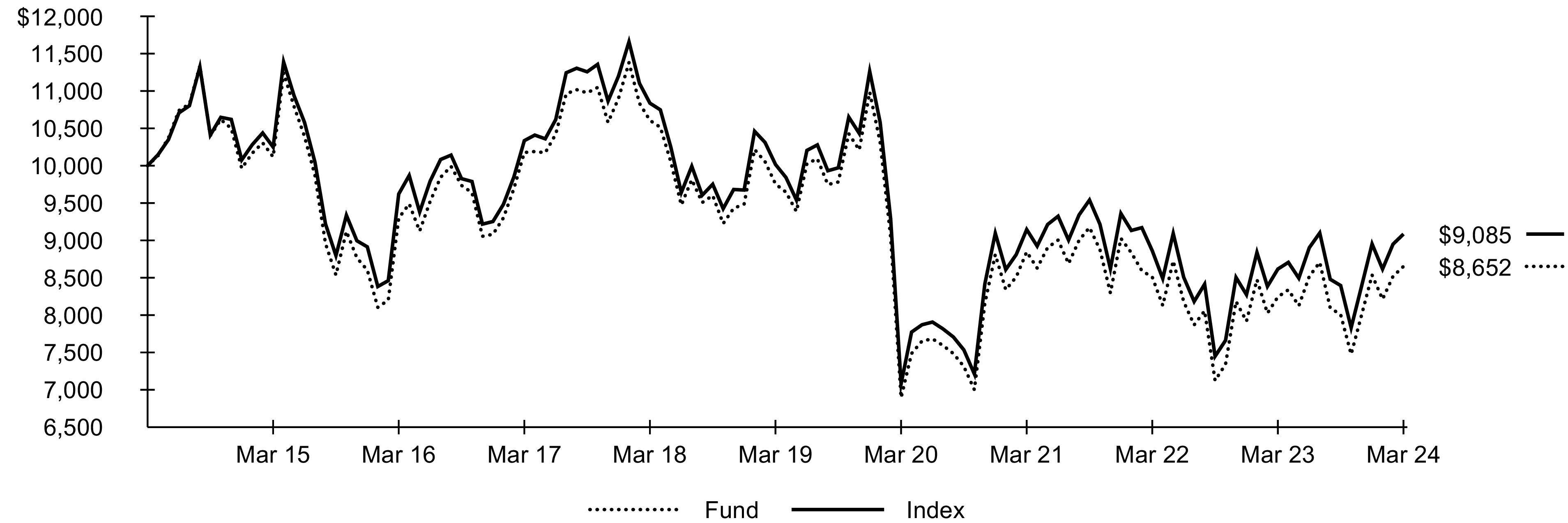

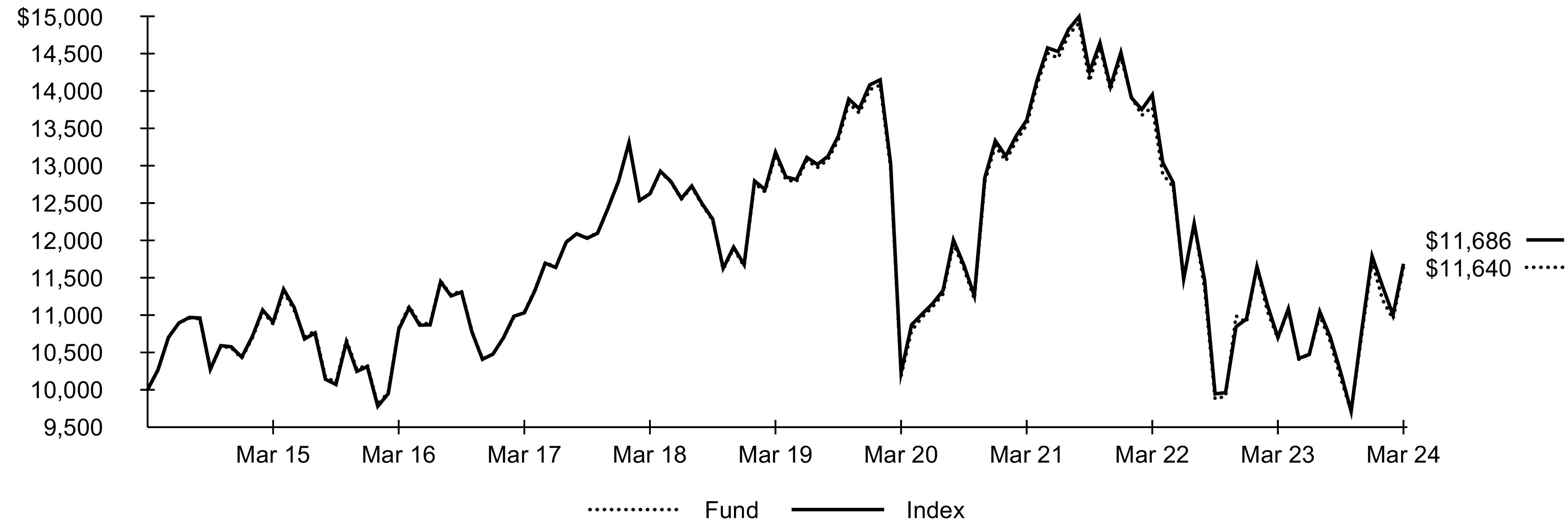

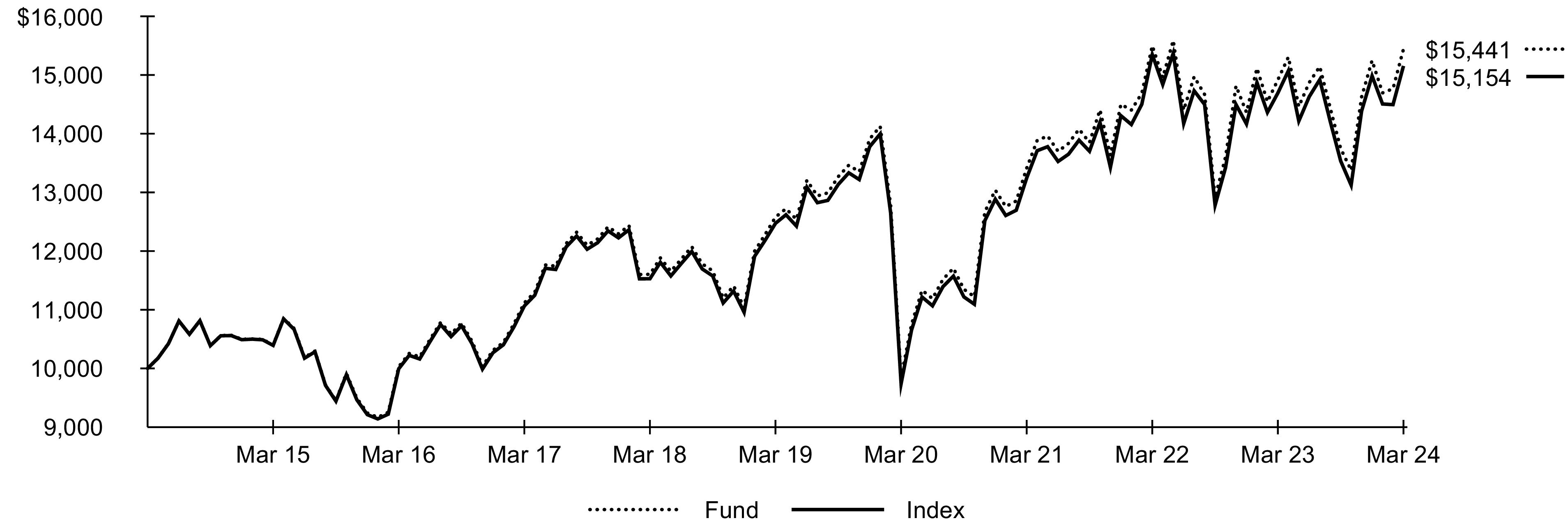

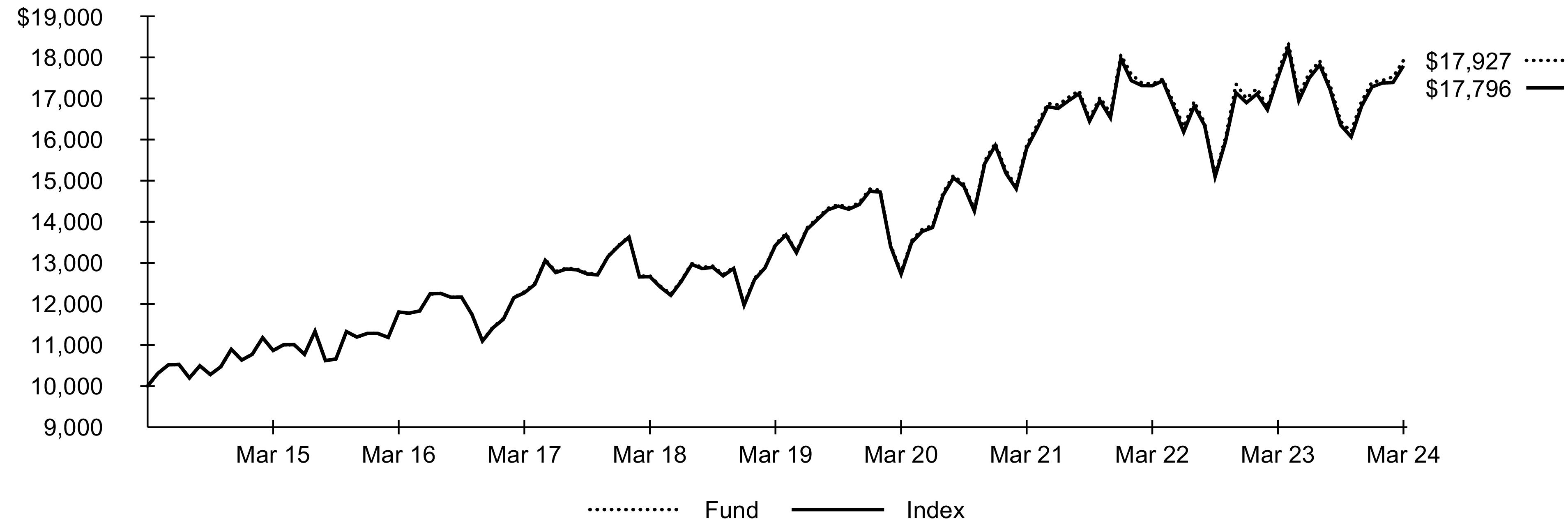

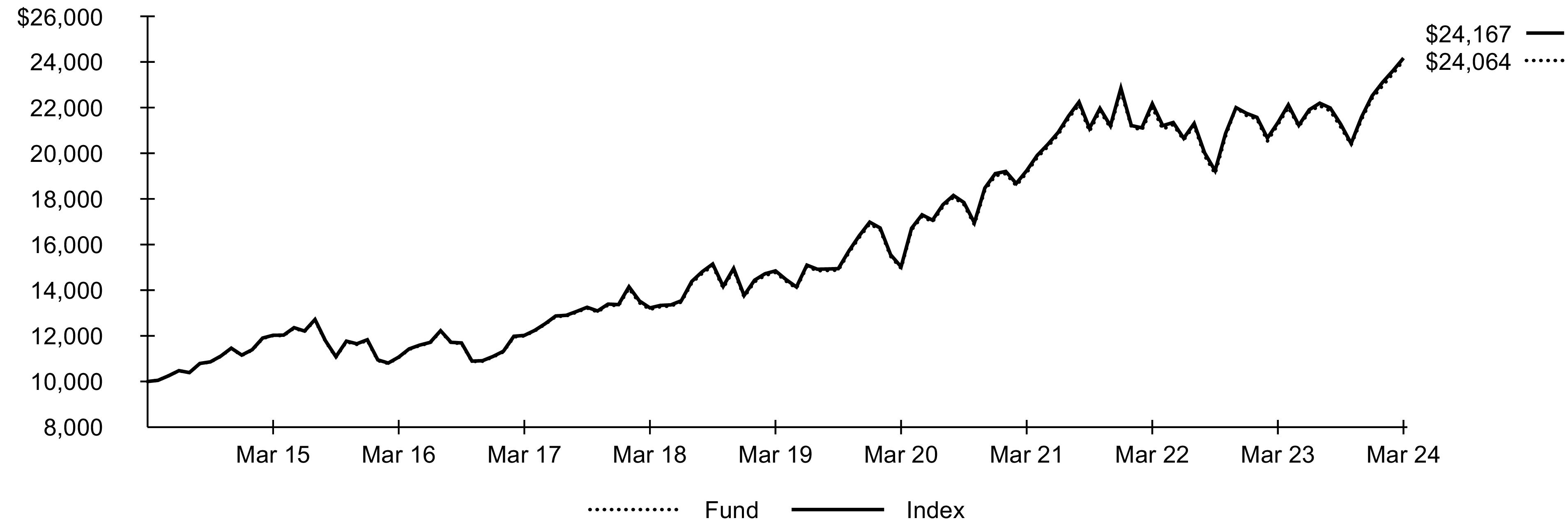

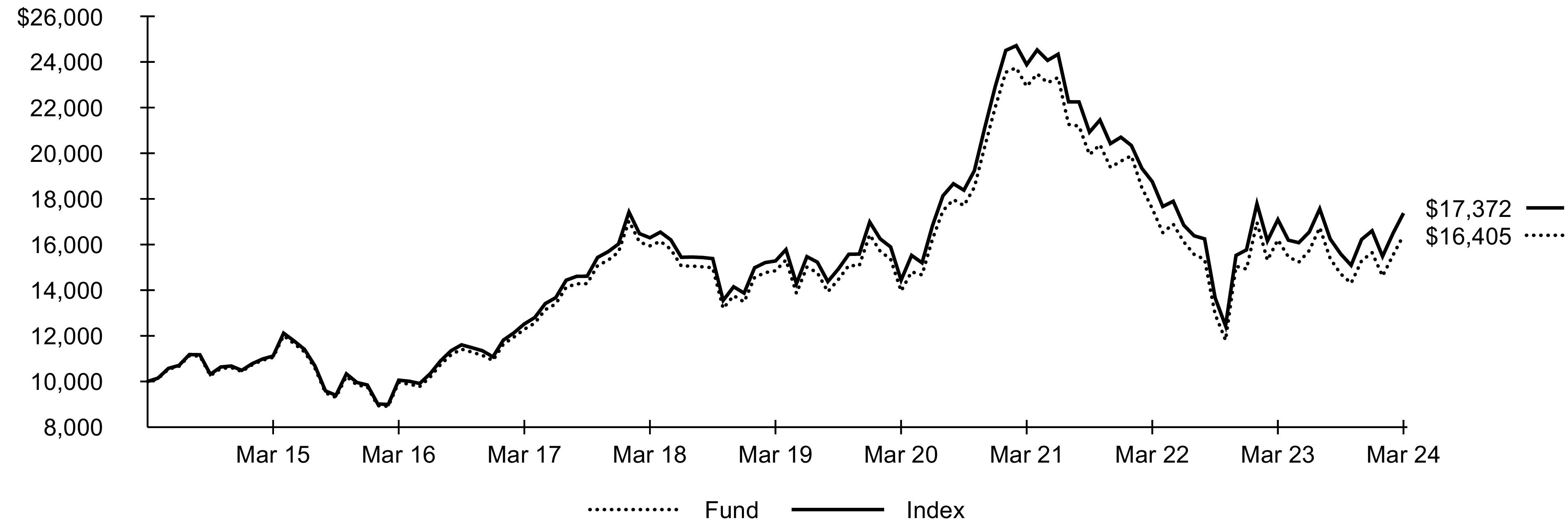

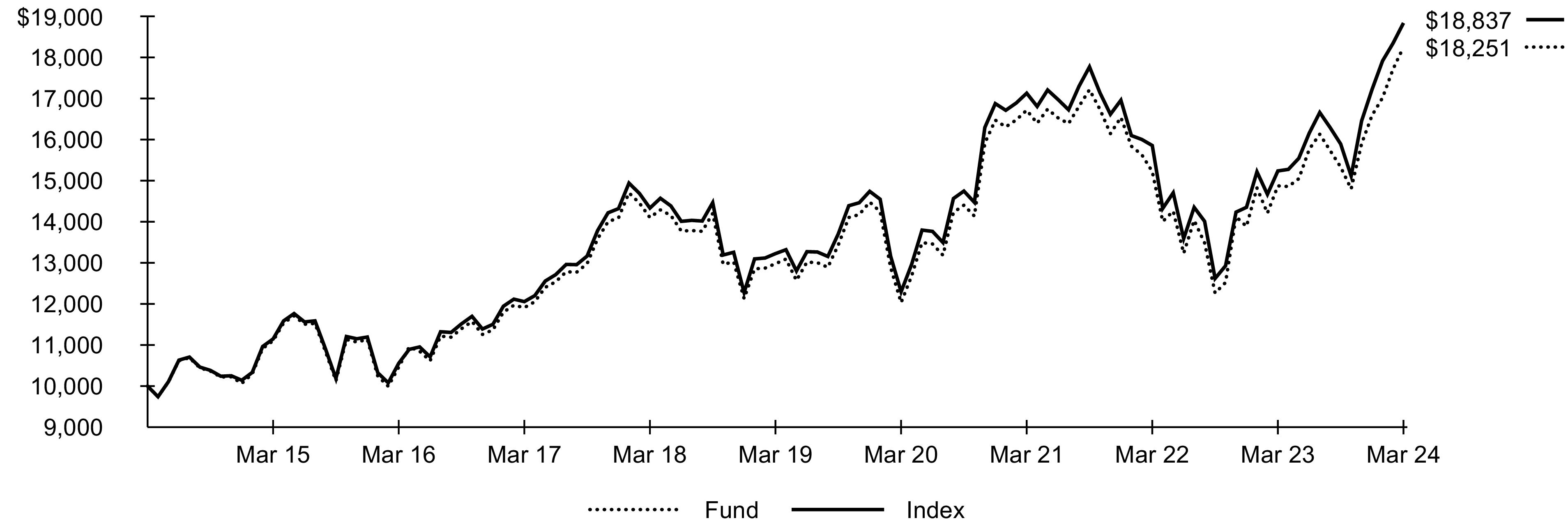

GROWTH OF $10,000 INVESTMENT(AT NET ASSET VALUE)

Past performance is not an indication of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. See “About Fund Performance” for more information.

Expense Example

| | |

Beginning

Account Value

(10/01/23) | Ending

Account Value

(03/31/24) | | Beginning

Account Value

(10/01/23) | Ending

Account Value

(03/31/24) | | |

| | | | | | |

| Expenses are equal to the annualized expense ratio, multiplied by the average account value over the period, multiplied by 183/366 (to reflect the one-half year period shown). Other fees, such as brokerage commissions and other fees to financial intermediaries, may be paid which are not reflected in the tables and examples above. See “Disclosure of Expenses” for more information. |

Fund Summary as of March 31, 2024 (continued)

iShares® Global Timber & Forestry ETF

Portfolio Management Commentary

Global timber and forestry stocks rose substantially during the reporting period, driven by a strong performance in the U.S. and Brazil, as the outlook for the global economy improved. U.S. equities contributed the most to the Index’s return, led by the containers and packaging industry within the materials sector. While the industry as a whole saw decreased demand for its products due to both slower economic growth and concerns about an eventual recession, sales volumes generally improved over the reporting period as markets became more optimistic about the economy achieving a soft landing. Within the industry, some leading manufacturers of packaging materials made concerted efforts to improve efficiency, reduce costs, and make strategic acquisitions, buoying investor sentiment.

Equities in Brazil also contributed significantly to the Index’s return, led by the paper products industry. The country’s exports of pulp, the primary raw material used in making paper, increased early in the reporting period, with a notable rise in exports to China and North America. However, the combination of increased supply and depressed economic activity in targeted markets led to falling pulp prices, creating a challenging market for paper producers. However, the outlook for U.S. and global economic growth improved significantly as the reporting period progressed. This improvement allowed major producers of paper to increase prices late in the reporting period, providing a material boost to revenue.

Equities in Japan also contributed, led by the homebuilding industry in the consumer discretionary sector. Early in the reporting period, monthly U.S. housing starts surged to their highest level since 1990, as a shortage of single-family homes and prospects for lower interest rates encouraged renewed building activity. As such, Japan-based homebuilding companies with a significant presence in the U.S. or that were active in acquiring U.S.-based homebuilding companies over the reporting period were able to benefit from increased activity.

Portfolio Information

INDUSTRY ALLOCATION

| |

| |

Paper & Plastic Packaging Products & Materials | |

| |

| |

| |

Oil & Gas Refining & Marketing | |

TEN LARGEST COUNTRIES

Country/Geographic Region | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| Excludes money market funds. |

142024 iShares Annual Report to Shareholders

Fund Summary as of March 31, 2024

iShares® Lithium Miners and Producers ETF

Investment Objective

The iShares Lithium Miners and Producers ETF (the “Fund”) seeks to track the investment results of an index composed of U.S. and non-U.S. equities of companies primarily engaged in lithium ore mining and/or lithium compounds manufacturing, as represented by the STOXX Global Lithium Miners and Producers Index (the "Index"). The Fund invests in a representative sample of securities included in the Index that collectively has an investment profile similar to the Index. Due to the use of representative sampling, the Fund may or may not hold all of the securities that are included in the Index.

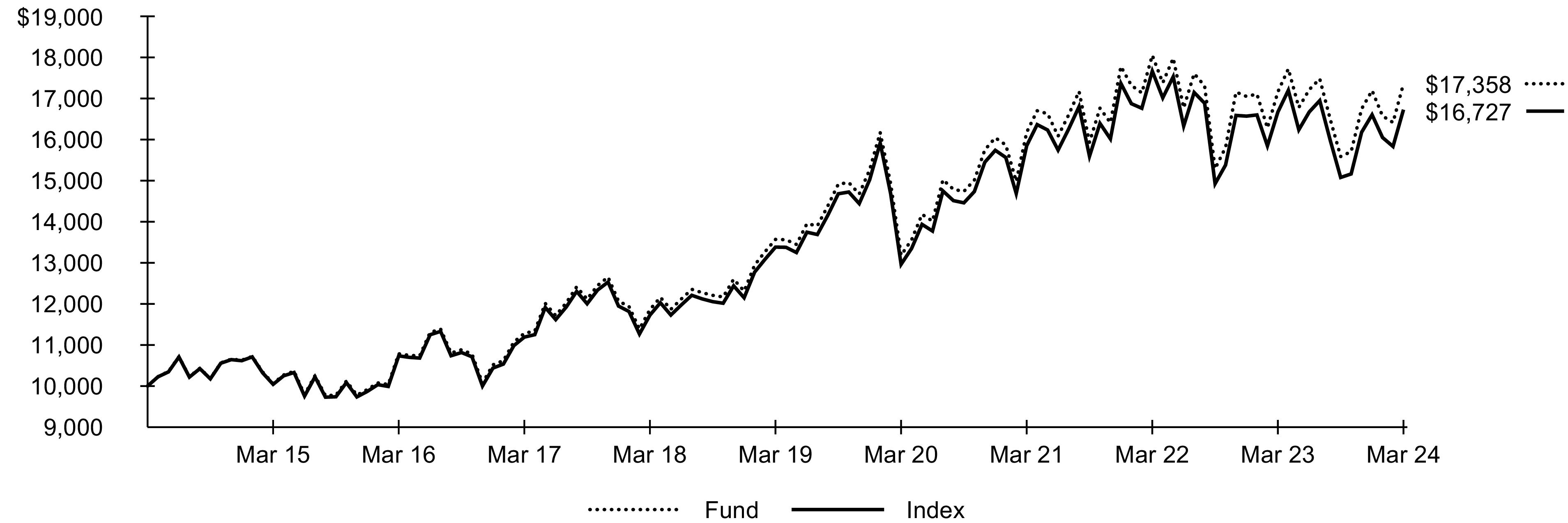

Performance

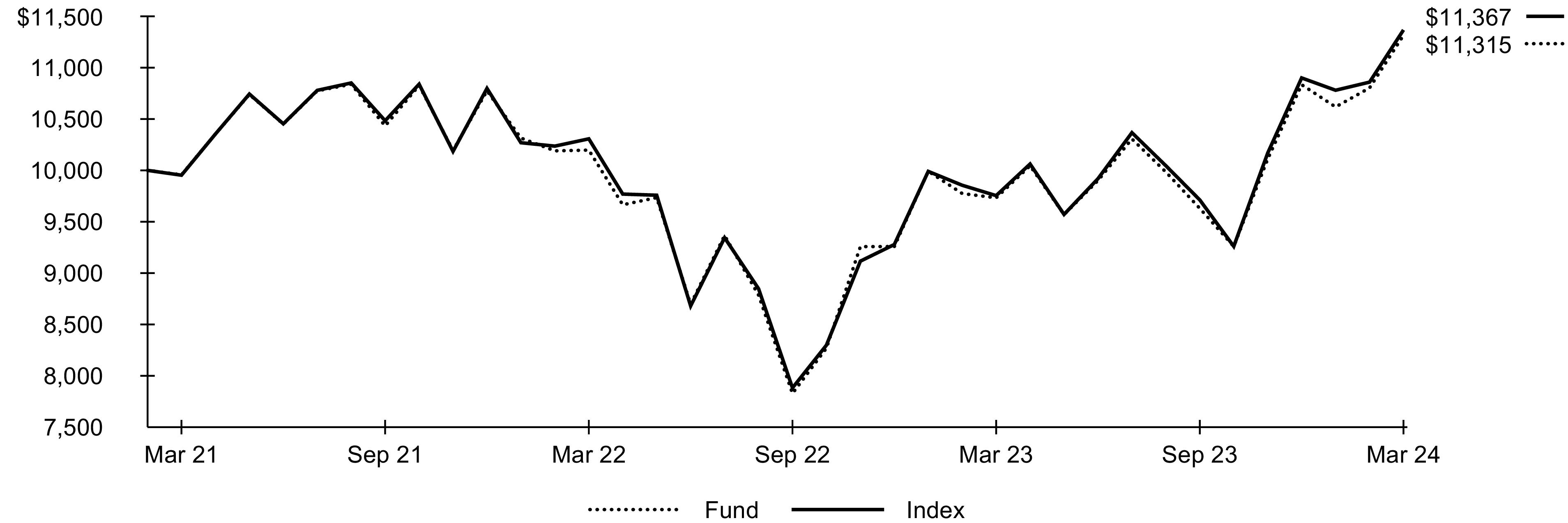

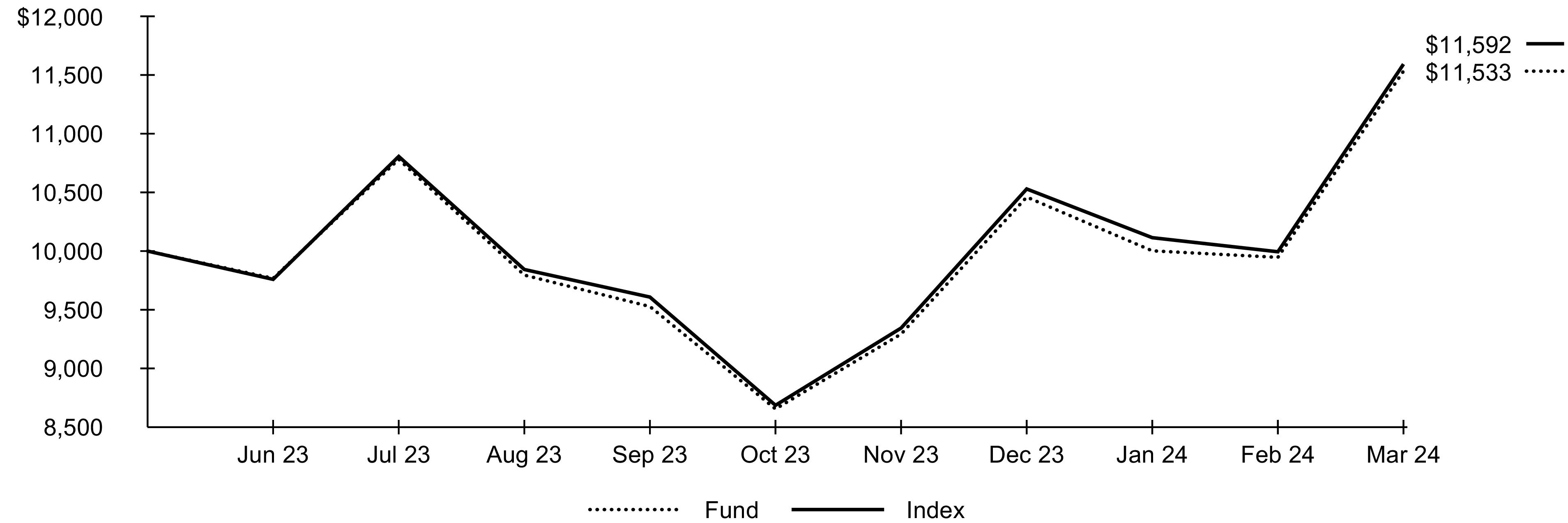

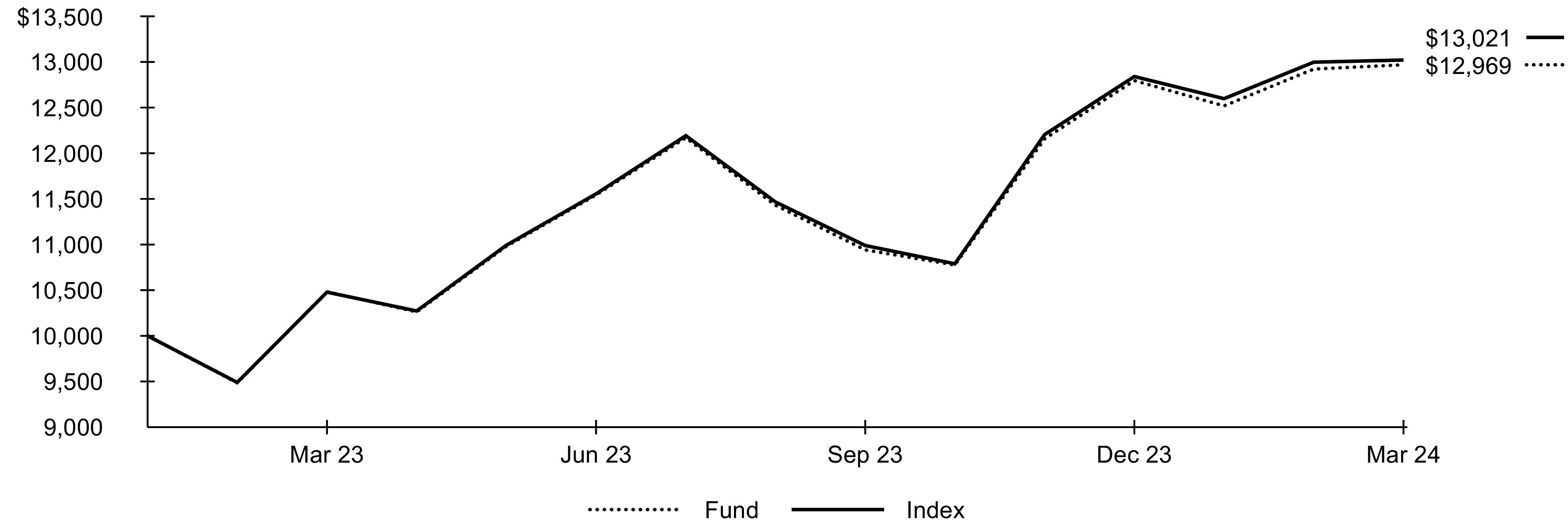

GROWTH OF $10,000 INVESTMENT(SINCE INCEPTION AT NET ASSET VALUE)

The inception date of the Fund was June 21, 2023. The first day of secondary market trading was June 23, 2023.

Past performance is not an indication of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. See “About Fund Performance” for more information.

Expense Example

| | |

Beginning

Account Value

(10/01/23) | Ending

Account Value

(03/31/24) | | Beginning

Account Value

(10/01/23) | Ending

Account Value

(03/31/24) | | |

| | | | | | |

| Expenses are equal to the annualized expense ratio, multiplied by the average account value over the period, multiplied by 183/366 (to reflect the one-half year period shown). Other fees, such as brokerage commissions and other fees to financial intermediaries, may be paid which are not reflected in the tables and examples above. See “Disclosure of Expenses” for more information. |

Fund Summary as of March 31, 2024 (continued)

iShares® Lithium Miners and Producers ETF

Portfolio Management Commentary

The stocks of global lithium miners and producers declined significantly for the reporting period amid a sharp decrease in the price of lithium. Lithium is an important component in the manufacture of some types of rechargeable batteries, in particular batteries for powering electric vehicles (“EVs”), which use a large proportion of mined lithium. Consequently, the price of lithium tends to fluctuate with expectations for EV production. Prior to the beginning of the reporting period, rapid increases in EV production drove lithium prices to record levels amid concerns that demand would outstrip supply. However, higher prices drove new exploration and production efforts, and lithium supply increased significantly in 2023. Meanwhile, a slowdown in EV sales, despite car makers offering discounted prices and selling below cost, led analysts to lower their outlook for EV adoption. This slowdown created a mismatch between lithium supply and demand, driving down the price of lithium and weighing on the stocks of lithium producers. Lithium’s sharp price decline required the industry to cut costs and curtail expansion plans.

Australian lithium mining stocks detracted the most from the Index’s performance. Revenue in the industry declined rapidly as the realized price of its principal product fell by 75%. A large Australian miner implemented a leadership change as the company investigated expanding its non-lithium mining operations to offset weakness from lithium revenue. Headwinds in the market for lithium also prompted restructuring activity, as companies reacted to difficult financial conditions. A large Australian lithium producer was acquired by a major U.S. producer, creating a new company that can operate across the lithium supply chain.

U.S. stocks also detracted from the Index’s return, despite government efforts to encourage domestic lithium production. Regulatory uncertainty, technical challenges, and low lithium prices worked against the U.S. lithium industry. The industry instituted cost-cutting measures that deferred spending, reduced headcount, and paused expansions into new projects.

Portfolio Information

INDUSTRY ALLOCATION

| |

Diversified Metals & Mining | |

| |

Electrical Components & Equipment | |

| |

Technology Hardware, Storage & Peripherals | |

TEN LARGEST HOLDINGS

| |

| |

Sociedad Quimica y Minera de Chile SA | |

| |

| |

| |

| |

SK IE Technology Co. Ltd. | |

| |

| |

Tianqi Lithium Corp., Class A | |

| Excludes money market funds. |

162024 iShares Annual Report to Shareholders

Past performance is not an indication of future results. Financial markets have experienced extreme volatility and trading in many instruments has been disrupted. These circumstances may continue for an extended period of time and may continue to affect adversely the value and liquidity of each Fund’s investments. As a result, current performance may be lower or higher than the performance data quoted. Performance data current to the most recent month-end is available at iShares.com. Performance results assume reinvestment of all dividends and capital gain distributions and do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. The investment return and principal value of shares will vary with changes in market conditions. Shares may be worth more or less than their original cost when they are redeemed or sold in the market. Performance for certain funds may reflect a waiver of a portion of investment advisory fees. Without such a waiver, performance would have been lower.

Net asset value or “NAV” is the value of one share of a fund as calculated in accordance with the standard formula for valuing mutual fund shares. Beginning August 10, 2020, the price used to calculate market return (“Market Price”) is the closing price. Prior to August 10, 2020, Market Price was determined using the midpoint between the highest bid and the lowest ask on the primary stock exchange on which shares of a fund are listed for trading, as of the time that such fund’s NAV is calculated. Since shares of a fund may not trade in the secondary market until after the fund’s inception, for the period from inception to the first day of secondary market trading in shares of the fund, the NAV of the fund is used as a proxy for the Market Price to calculate market returns. Market and NAV returns assume that dividends and capital gain distributions have been reinvested at Market Price and NAV, respectively.

An index is a statistical composite that tracks a specified financial market or sector. Unlike a fund, an index does not actually hold a portfolio of securities and therefore does not incur the expenses incurred by a fund. These expenses negatively impact fund performance. Also, index returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, index returns would be lower.

Disclosure of Expenses

Shareholders of each Fund may incur the following charges: (1) transactional expenses, including brokerage commissions on purchases and sales of fund shares and (2) ongoing expenses, including management fees and other fund expenses. The expense examples shown (which are based on a hypothetical investment of $1,000 invested at the beginning of the period and held through the end of the period) are intended to assist shareholders both in calculating expenses based on an investment in each Fund and in comparing these expenses with similar costs of investing in other funds.

The expense examples provide information about actual account values and actual expenses. Annualized expense ratios reflect contractual and voluntary fee waivers, if any. In order to estimate the expenses a shareholder paid during the period covered by this report, shareholders can divide their account value by $1,000 and then multiply the result by the number under the heading entitled “Expenses Paid During the Period.”

The expense examples also provide information about hypothetical account values and hypothetical expenses based on a fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses. In order to assist shareholders in comparing the ongoing expenses of investing in the Funds and other funds, compare the 5% hypothetical examples with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

The expenses shown in the expense examples are intended to highlight shareholders’ ongoing costs only and do not reflect any transactional expenses, such as brokerage commissions and other fees paid on purchases and sales of fund shares. Therefore, the hypothetical examples are useful in comparing ongoing expenses only and will not help shareholders determine the relative total expenses of owning different funds. If these transactional expenses were included, shareholder expenses would have been higher.

About Fund Performance/Disclosure of Expenses17

Schedule of InvestmentsMarch 31, 2024

iShares® Copper and Metals Mining ETF(Percentages shown are based on Net Assets)

| | |

|

|

| | |

Al Masane Al Kobra Mining Co. | | |

| | |

| | |

Baiyin Nonferrous Group Co. Ltd. | | |

| | |

| | |

Chengtun Mining Group Co. Ltd., Class A(a) | | |

China Nonferrous Mining Corp Ltd. | | |

| | |

| | |

| | |

| | |

First Quantum Minerals Ltd. | | |

| | |

| | |

Grupo Mexico SAB de CV, Series B | | |

| | |

Ivanhoe Mines Ltd., Class A(a)(b) | | |

Jiangxi Copper Co. Ltd., Class A | | |

Jinchuan Group International Resources Co. Ltd. | | |

| | |

| | |

| | |

| | |

| | |

| | |

Sandfire Resources Ltd.(a)(b) | | |

| | |

| | |

Metals & Mining (continued) |

Teck Resources Ltd., Class B | | |

| | |

WA1 Resources Ltd., NVS(a) | | |

Western Mining Co. Ltd., Class A | | |

| | |

Zijin Mining Group Co. Ltd., Class A | | |

| | |

Total Long-Term Investments — 99.6%

(Cost: $6,304,710) | |

|

Money Market Funds — 8.3% |

BlackRock Cash Funds: Institutional, SL Agency Shares, 5.50%(c)(d)(e) | | |

Total Short-Term Securities — 8.3%

(Cost: $585,686) | |

Total Investments — 107.9%

(Cost: $6,890,396) | |

Liabilities in Excess of Other Assets — (7.9)% | |

| |

| Non-income producing security. |

| All or a portion of this security is on loan. |

| |

| Annualized 7-day yield as of period end. |

| All or a portion of this security was purchased with the cash collateral from loaned securities. |

Affiliates

Investments in issuers considered to be affiliate(s) of the Fund during the period ended March 31, 2024 for purposes of Section 2(a)(3) of the Investment Company Act of 1940, as amended, were as follows:

| | | | | Change in

Unrealized

Appreciation

(Depreciation) | | | | Capital

Gain

Distributions

from

Underlying

Funds |

BlackRock Cash Funds: Institutional, SL Agency Shares | | | | | | | | | |

BlackRock Cash Funds: Treasury, SL Agency Shares(d) | | | | | | | | | |

| | | | | | | | | |

| Commencement of operations. |

| Represents net amount purchased (sold). |

| All or a portion represents securities lending income earned from the reinvestment of cash collateral from loaned securities, net of fees and collateral investment expenses, and other payments to and from borrowers of securities. |

| As of period end, the entity is no longer held. |

182024 iShares Annual Report to Shareholders

Schedule of Investments (continued)March 31, 2024

iShares® Copper and Metals Mining ETF

Derivative Financial Instruments Outstanding as of Period End

Futures Contracts

| | | | Value/

Unrealized

Appreciation

(Depreciation) |

| | | | |

Micro E-Mini Russell 2000 Index | | | | |

Derivative Financial Instruments Categorized by Risk Exposure

As of period end, the fair values of derivative financial instruments located in the Statements of Assets and Liabilities were as follows:

| | | | Foreign

Currency

Exchange

Contracts | | | |

Assets—Derivative Financial Instruments | | | | | | | |

| | | | | | | |

Unrealized appreciation on futures contracts(a) | | | | | | | |

| Net cumulative unrealized appreciation (depreciation) on futures contracts are reported in the Schedule of Investments. In the Statements of Assets and Liabilities, only current day's variation margin is reported in receivables or payables and the net cumulative unrealized appreciation (depreciation) is included in accumulated earnings (loss). |

For the period ended March 31, 2024, the effect of derivative financial instruments in the Statements of Operations was as follows:

| | | | Foreign

Currency

Exchange

Contracts | | | |

Net Realized Gain (Loss) from | | | | | | | |

| | | | | | | |

Net Change in Unrealized Appreciation (Depreciation) on | | | | | | | |

| | | | | | | |

Average Quarterly Balances of Outstanding Derivative Financial Instruments

| |

Average notional value of contracts — long | |

For more information about the Fund’s investment risks regarding derivative financial instruments, refer to the Notes to Financial Statements.

Fair Value Hierarchy as of Period End

Various inputs are used in determining the fair value of financial instruments. For a description of the input levels and information about the Fund’s policy regarding valuation of financial instruments, refer to the Notes to Financial Statements.

The following table summarizes the Fund’s financial instruments categorized in the fair value hierarchy. The breakdown of the Fund’s financial instruments into major categories is disclosed in the Schedule of Investments above.

Schedule of Investments19

Schedule of Investments (continued)March 31, 2024

iShares® Copper and Metals Mining ETF

Fair Value Hierarchy as of Period End (continued)

| | | | |

Derivative Financial Instruments(a) | | | | |

| | | | |

| | | | |

| Derivative financial instruments are futures contracts. Futures contracts are valued at the unrealized appreciation (depreciation) on the instrument. |

See notes to financial statements.

202024 iShares Annual Report to Shareholders

Schedule of InvestmentsMarch 31, 2024

iShares® Environmental Infrastructure and Industrials ETF(Percentages shown are based on Net Assets)

| | |

|

|

Advanced Drainage Systems Inc. | | |

China Lesso Group Holdings Ltd. | | |

Reliance Worldwide Corp. Ltd. | | |

| | |

| | |

|

| | |

Commercial Services & Supplies — 10.5% |

| | |

| | |

| | |

| | |

| | |

| | |

Construction & Engineering — 5.0% |

| | |

| | |

| | |

| | |

Containers & Packaging — 7.2% |

| | |

| | |

| | |

Electronic Equipment, Instruments & Components — 5.8% |

| | |

| | |

| | |

| | |

| | |

|

Construcciones y Auxiliar de Ferrocarriles SA | | |

| | |

Franklin Electric Co. Inc. | | |

| | |

| | |

Mueller Water Products Inc., Class A | | |

| | |

| | |

| | |

| | |

Torishima Pump Manufacturing Co. Ltd. | | |

Watts Water Technologies Inc., Class A | | |

Westinghouse Air Brake Technologies Corp. | | |

| | |

| | |

|

| | |

| | |

| | |

| | |

| | |

|

Qatar Electricity & Water Co. QSC | | |

| | |

| | |

Professional Services — 5.7% |

| | |

| | |

| | |

|

Aguas Andinas SA, Class A | | |

American States Water Co. | | |

American Water Works Co. Inc. | | |

Beijing Enterprises Water Group Ltd. | | |

California Water Service Group | | |

China Water Affairs Group Ltd. | | |

Cia de Saneamento de Minas Gerais Copasa MG | | |

Cia. de Saneamento Basico do Estado de Sao Paulo SABESP | | |

| | |

| | |

| | |

United Utilities Group PLC | | |

| | |

Total Common Stocks — 99.3%

(Cost: $3,962,000) | |

|

|

Marcopolo SA, Preference Shares, NVS | | |

Total Preferred Stocks — 0.4%

(Cost: $14,621) | |

|

|

Dawonsys Co. Ltd. (Expires 04/30/24, Strike Price KRW 10,210.00)(b) | | |

Total Rights — 0.0%

(Cost: $—) | |

Total Investments — 99.7%

(Cost: $3,976,621) | |

Other Assets Less Liabilities — 0.3% | |

| |

| Security exempt from registration pursuant to Rule 144A under the Securities Act of 1933, as amended. These securities may be resold in transactions exempt from registration to qualified institutional investors. |

| Non-income producing security. |

Schedule of Investments21

Schedule of Investments (continued)March 31, 2024

iShares® Environmental Infrastructure and Industrials ETF

Affiliates

Investments in issuers considered to be affiliate(s) of the Fund during the year ended March 31, 2024 for purposes of Section 2(a)(3) of the Investment Company Act of 1940, as amended, were as follows:

| | | | | Change in

Unrealized

Appreciation

(Depreciation) | | | | Capital

Gain

Distributions

from

Underlying

Funds |

BlackRock Cash Funds: Institutional, SL Agency Shares(a) | | | | | | | | | |

BlackRock Cash Funds: Treasury, SL Agency Shares(a) | | | | | | | | | |

| | | | | | | | | |

| As of period end, the entity is no longer held. |

| Represents net amount purchased (sold). |

| All or a portion represents securities lending income earned from the reinvestment of cash collateral from loaned securities, net of fees and collateral investment expenses, and other payments to and from borrowers of securities. |

Derivative Financial Instruments Outstanding as of Period End

Futures Contracts

| | | | Value/

Unrealized

Appreciation

(Depreciation) |

| | | | |

Micro E-Mini Russell 2000 Index | | | | |

Derivative Financial Instruments Categorized by Risk Exposure

As of period end, the fair values of derivative financial instruments located in the Statements of Assets and Liabilities were as follows:

| | | | Foreign

Currency

Exchange

Contracts | | | |

Liabilities—Derivative Financial Instruments | | | | | | | |

| | | | | | | |

Unrealized depreciation on futures contracts(a) | | | | | | | |

| Net cumulative unrealized appreciation (depreciation) on futures contracts are reported in the Schedule of Investments. In the Statements of Assets and Liabilities, only current day's variation margin is reported in receivables or payables and the net cumulative unrealized appreciation (depreciation) is included in accumulated earnings (loss). |

For the period ended March 31, 2024, the effect of derivative financial instruments in the Statements of Operations was as follows:

| | | | Foreign

Currency

Exchange

Contracts | | | |

Net Realized Gain (Loss) from | | | | | | | |

| | | | | | | |

Net Change in Unrealized Appreciation (Depreciation) on | | | | | | | |

| | | | | | | |

Average Quarterly Balances of Outstanding Derivative Financial Instruments

| |

Average notional value of contracts — long | |

For more information about the Fund’s investment risks regarding derivative financial instruments, refer to the Notes to Financial Statements.

222024 iShares Annual Report to Shareholders

Schedule of Investments (continued)March 31, 2024

iShares® Environmental Infrastructure and Industrials ETF

Fair Value Hierarchy as of Period End

Various inputs are used in determining the fair value of financial instruments. For a description of the input levels and information about the Fund’s policy regarding valuation of financial instruments, refer to the Notes to Financial Statements.

The following table summarizes the Fund’s financial instruments categorized in the fair value hierarchy. The breakdown of the Fund’s financial instruments into major categories is disclosed in the Schedule of Investments above.

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

Derivative Financial Instruments(a) | | | | |

| | | | |

| | | | |

| Derivative financial instruments are futures contracts. Futures contracts are valued at the unrealized appreciation (depreciation) on the instrument. |

See notes to financial statements.

Schedule of Investments23

Schedule of InvestmentsMarch 31, 2024

iShares® Global 100 ETF(Percentages shown are based on Net Assets)

| | |

|

|

| | |

|

| | |

|

| | |

| | |

| | |

| | |

LVMH Moet Hennessy Louis Vuitton SE | | |

| | |

| | |

| | |

| | |

|

| | |

| | |

| | |

Deutsche Bank AG, Registered | | |

Deutsche Telekom AG, Registered | | |

| | |

| | |

Muenchener Rueckversicherungs-Gesellschaft AG in Muenchen, Registered | | |

| | |

| | |

| | |

|

| | |

| | |

| | |

Mitsubishi UFJ Financial Group Inc. | | |

| | |

Seven & i Holdings Co. Ltd. | | |

| | |

| | |

| | |

|

| | |

| | |

| | |

|

Samsung Electronics Co. Ltd. | | |

|

Banco Bilbao Vizcaya Argentaria SA | | |

| | |

| | |

| | |

|

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

|

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

|

| | |

| | |

| | |

Alphabet Inc., Class A(a) | | |

Alphabet Inc., Class C, NVS(a) | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Goldman Sachs Group Inc. (The) | | |

Honeywell International Inc. | | |

| | |

| | |

International Business Machines Corp. | | |

| | |

Johnson Controls International PLC | | |

| | |

| | |

Marsh & McLennan Companies Inc. | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Philip Morris International Inc. | | |

Procter & Gamble Co. (The) | | |

| | |

| | |

Thermo Fisher Scientific Inc. | | |

242024 iShares Annual Report to Shareholders

Schedule of Investments (continued)March 31, 2024

iShares® Global 100 ETF(Percentages shown are based on Net Assets)

| | |

United States (continued) |

| | |

| | |

Total Long-Term Investments — 99.6%

(Cost: $3,247,328,653) | |

|

Money Market Funds — 0.2% |

BlackRock Cash Funds: Treasury, SL Agency Shares, 5.29%(b)(c) | | |

Total Short-Term Securities — 0.2%

(Cost: $9,330,000) | |

Total Investments — 99.8%

(Cost: $3,256,658,653) | |

Other Assets Less Liabilities — 0.2% | |

| |

| Non-income producing security. |

| |

| Annualized 7-day yield as of period end. |

Affiliates

Investments in issuers considered to be affiliate(s) of the Fund during the year ended March 31, 2024 for purposes of Section 2(a)(3) of the Investment Company Act of 1940, as amended, were as follows:

| | | | | Change in

Unrealized

Appreciation

(Depreciation) | | | | Capital

Gain

Distributions

from

Underlying

Funds |

BlackRock Cash Funds: Institutional, SL Agency Shares(a) | | | | | | | | | |

BlackRock Cash Funds: Treasury, SL Agency Shares | | | | | | | | | |

| | | | | | | | | |

| As of period end, the entity is no longer held. |

| Represents net amount purchased (sold). |

| All or a portion represents securities lending income earned from the reinvestment of cash collateral from loaned securities, net of fees and collateral investment expenses, and other payments to and from borrowers of securities. |

Derivative Financial Instruments Outstanding as of Period End

Futures Contracts

| | | | Value/

Unrealized

Appreciation

(Depreciation) |

| | | | |

| | | | |

| | | | |

| | | | |

Schedule of Investments25

Schedule of Investments (continued)March 31, 2024

Derivative Financial Instruments Categorized by Risk Exposure

As of period end, the fair values of derivative financial instruments located in the Statements of Assets and Liabilities were as follows:

| | | | Foreign

Currency

Exchange

Contracts | | | |

Assets—Derivative Financial Instruments | | | | | | | |

| | | | | | | |

Unrealized appreciation on futures contracts(a) | | | | | | | |

| Net cumulative unrealized appreciation (depreciation) on futures contracts are reported in the Schedule of Investments. In the Statements of Assets and Liabilities, only current day's variation margin is reported in receivables or payables and the net cumulative unrealized appreciation (depreciation) is included in accumulated earnings (loss). |

For the period ended March 31, 2024, the effect of derivative financial instruments in the Statements of Operations was as follows:

| | | | Foreign

Currency

Exchange

Contracts | | | |

Net Realized Gain (Loss) from | | | | | | | |

| | | | | | | |

Net Change in Unrealized Appreciation (Depreciation) on | | | | | | | |

| | | | | | | |

Average Quarterly Balances of Outstanding Derivative Financial Instruments

| |

Average notional value of contracts — long | |

For more information about the Fund’s investment risks regarding derivative financial instruments, refer to the Notes to Financial Statements.

Fair Value Hierarchy as of Period End

Various inputs are used in determining the fair value of financial instruments. For a description of the input levels and information about the Fund’s policy regarding valuation of financial instruments, refer to the Notes to Financial Statements.

The following table summarizes the Fund’s financial instruments categorized in the fair value hierarchy. The breakdown of the Fund’s financial instruments into major categories is disclosed in the Schedule of Investments above.

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

Derivative Financial Instruments(a) | | | | |

| | | | |

| | | | |

| Derivative financial instruments are futures contracts. Futures contracts are valued at the unrealized appreciation (depreciation) on the instrument. |

See notes to financial statements.

262024 iShares Annual Report to Shareholders

Schedule of InvestmentsMarch 31, 2024

iShares® Global Infrastructure ETF(Percentages shown are based on Net Assets)

| | |

|

|

Corp. America Airports SA(a) | | |

|

| | |

Dalrymple Bay Infrastructure Ltd.(b) | | |

| | |

| | |

| | |

|

Centrais Eletricas Brasileiras SA, ADR | | |

Cia. de Saneamento Basico do Estado de Sao Paulo SABESP, ADR | | |

Companhia Paranaense de Energia, ADR | | |

Ultrapar Participacoes SA, ADR | | |

| | |

|

| | |

| | |

| | |

| | |

Westshore Terminals Investment Corp. | | |

| | |

|

Anhui Expressway Co. Ltd., Class H | | |

Beijing Capital International Airport Co. Ltd., Class H(a)(b) | | |

CGN Power Co. Ltd., Class H(c) | | |

| | |

China Longyuan Power Group Corp. Ltd., Class H | | |

China Merchants Port Holdings Co. Ltd. | | |

China Resources Gas Group Ltd. | | |

China Resources Power Holdings Co. Ltd. | | |

COSCO SHIPPING Ports Ltd.(b) | | |

Jiangsu Expressway Co. Ltd., Class H | | |

| | |

Shenzhen Expressway Corp. Ltd., Class H | | |

Shenzhen International Holdings Ltd. | | |

Sichuan Expressway Co. Ltd., Class H | | |

Yuexiu Transport Infrastructure Ltd.(b) | | |

Zhejiang Expressway Co. Ltd., Class H | | |

| | |

|

| | |

| | |

Gaztransport Et Technigaz SA | | |

| | |

| | |

|

| | |

Fraport AG Frankfurt Airport Services Worldwide(a) | | |

| | |

|

| | |

| | |

| | |

|

Japan Airport Terminal Co. Ltd.(b) | | |

| | |

|

Grupo Aeroportuario del Centro Norte SAB de CV, ADR | | |

Grupo Aeroportuario del Pacifico SAB de CV, ADR | | |

Grupo Aeroportuario del Sureste SAB de CV, ADR | | |

| | |

|

Auckland International Airport Ltd. | | |

|

| | |

|

Hutchison Port Holdings Trust, Class U(b) | | |

| | |

SIA Engineering Co. Ltd.(b) | | |

| | |

|

| | |

| | |

| | |

|

Flughafen Zurich AG, Registered | | |

|

| | |

|

American Electric Power Co. Inc. | | |

American Water Works Co. Inc. | | |

| | |

| | |

| | |

Constellation Energy Corp. | | |

| | |

| | |

| | |

| | |

Equitrans Midstream Corp. | | |

| | |

| | |

| | |

| | |

| | |

Public Service Enterprise Group Inc. | | |

| | |

| | |

| | |

| | |

Williams Companies Inc. (The) | | |

| | |

| | |

Total Common Stocks — 99.5%

(Cost: $3,354,957,083) | |

Schedule of Investments27

Schedule of Investments (continued)March 31, 2024

iShares® Global Infrastructure ETF(Percentages shown are based on Net Assets)

| | |

|

|

Cia. Energetica de Minas Gerais, Preference Shares, ADR | | |

Total Preferred Stocks — 0.1%

(Cost: $3,989,789) | |

Total Long-Term Investments — 99.6%

(Cost: $3,358,946,872) | |

|

Money Market Funds — 0.4% |

BlackRock Cash Funds: Institutional, SL Agency Shares, 5.50%(d)(e)(f) | | |

BlackRock Cash Funds: Treasury, SL Agency Shares, 5.29%(d)(e) | | |

Total Short-Term Securities — 0.4%

(Cost: $13,360,594) | |

Total Investments — 100.0%

(Cost: $3,372,307,466) | |

Other Assets Less Liabilities — 0.0% | |

| |

| Non-income producing security. |

| All or a portion of this security is on loan. |

| Security exempt from registration pursuant to Rule 144A under the Securities Act of 1933, as amended. These securities may be resold in transactions exempt from registration to qualified institutional investors. |

| |

| Annualized 7-day yield as of period end. |

| All or a portion of this security was purchased with the cash collateral from loaned securities. |

Affiliates

Investments in issuers considered to be affiliate(s) of the Fund during the year ended March 31, 2024 for purposes of Section 2(a)(3) of the Investment Company Act of 1940, as amended, were as follows:

| | | | | Change in

Unrealized

Appreciation

(Depreciation) | | | | Capital

Gain

Distributions

from

Underlying

Funds |

BlackRock Cash Funds: Institutional, SL Agency Shares | | | | | | | | | |

BlackRock Cash Funds: Treasury, SL Agency Shares | | | | | | | | | |

| | | | | | | | | |

| Represents net amount purchased (sold). |

| All or a portion represents securities lending income earned from the reinvestment of cash collateral from loaned securities, net of fees and collateral investment expenses, and other payments to and from borrowers of securities. |

Derivative Financial Instruments Outstanding as of Period End

Futures Contracts

| | | | Value/

Unrealized

Appreciation

(Depreciation) |

| | | | |

| | | | |

| | | | |

| | | | |

Dow Jones U.S. Real Estate Index | | | | |

| | | | |

282024 iShares Annual Report to Shareholders

Schedule of Investments (continued)March 31, 2024

iShares® Global Infrastructure ETF

Derivative Financial Instruments Categorized by Risk Exposure

As of period end, the fair values of derivative financial instruments located in the Statements of Assets and Liabilities were as follows:

| | | | Foreign

Currency

Exchange

Contracts | | | |

Assets—Derivative Financial Instruments | | | | | | | |

| | | | | | | |

Unrealized appreciation on futures contracts(a) | | | | | | | |

| Net cumulative unrealized appreciation (depreciation) on futures contracts are reported in the Schedule of Investments. In the Statements of Assets and Liabilities, only current day's variation margin is reported in receivables or payables and the net cumulative unrealized appreciation (depreciation) is included in accumulated earnings (loss). |

For the period ended March 31, 2024, the effect of derivative financial instruments in the Statements of Operations was as follows:

| | | | Foreign

Currency

Exchange

Contracts | | | |

Net Realized Gain (Loss) from | | | | | | | |

| | | | | | | |

Net Change in Unrealized Appreciation (Depreciation) on | | | | | | | |

| | | | | | | |

Average Quarterly Balances of Outstanding Derivative Financial Instruments

| |

Average notional value of contracts — long | |

For more information about the Fund’s investment risks regarding derivative financial instruments, refer to the Notes to Financial Statements.

Fair Value Hierarchy as of Period End

Various inputs are used in determining the fair value of financial instruments. For a description of the input levels and information about the Fund’s policy regarding valuation of financial instruments, refer to the Notes to Financial Statements.

The following table summarizes the Fund’s financial instruments categorized in the fair value hierarchy. The breakdown of the Fund’s financial instruments into major categories is disclosed in the Schedule of Investments above.

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

Derivative Financial Instruments(a) | | | | |

| | | | |

| | | | |

| Derivative financial instruments are futures contracts. Futures contracts are valued at the unrealized appreciation (depreciation) on the instrument. |

See notes to financial statements.

Schedule of Investments29

Schedule of InvestmentsMarch 31, 2024

iShares® Global Timber & Forestry ETF(Percentages shown are based on Net Assets)

| | |

|

|

| | |

| | |

| | |

| | |

|

| | |

| | |

| | |

West Fraser Timber Co. Ltd. | | |

| | |

|

| | |

| | |

| | |

|

Nine Dragons Paper Holdings Ltd.(a) | | |

Shandong Sun Paper Industry JSC Ltd., Class A | | |

| | |

|

| | |

| | |

| | |

|

| | |

|

| | |

Nippon Paper Industries Co. Ltd. | | |

| | |

Sumitomo Forestry Co. Ltd. | | |

| | |

|

| | |

| | |

| | |

|

| | |

|

| | |

|

Ence Energia y Celulosa SA(b) | | |

|

| | |

| | |

|

| | |

Svenska Cellulosa AB SCA, Class B | | |

| | |

|

| | |

| | |

| | |

| | |

|

| | |

|

Clearwater Paper Corp.(a) | | |

| | |

Mercer International Inc. | | |

| | |

| | |

| | |

| | |

| | |

| | |

Total Long-Term Investments — 99.2%

(Cost: $192,110,598) | |

|

Money Market Funds — 0.2% |

BlackRock Cash Funds: Institutional, SL Agency Shares, 5.50%(c)(d)(e) | | |

BlackRock Cash Funds: Treasury, SL Agency Shares, 5.29%(c)(d) | | |

Total Short-Term Securities — 0.2%

(Cost: $439,395) | |

Total Investments — 99.4%

(Cost: $192,549,993) | |

Other Assets Less Liabilities — 0.6% | |

| |

| Non-income producing security. |

| All or a portion of this security is on loan. |

| |

| Annualized 7-day yield as of period end. |

| All or a portion of this security was purchased with the cash collateral from loaned securities. |

302024 iShares Annual Report to Shareholders

Schedule of Investments (continued)March 31, 2024

iShares® Global Timber & Forestry ETF

Affiliates

Investments in issuers considered to be affiliate(s) of the Fund during the year ended March 31, 2024 for purposes of Section 2(a)(3) of the Investment Company Act of 1940, as amended, were as follows:

| | | | | Change in

Unrealized

Appreciation

(Depreciation) | | | | Capital

Gain

Distributions

from

Underlying

Funds |

BlackRock Cash Funds: Institutional, SL Agency Shares | | | | | | | | | |

BlackRock Cash Funds: Treasury, SL Agency Shares | | | | | | | | | |

| | | | | | | | | |

| Represents net amount purchased (sold). |

| All or a portion represents securities lending income earned from the reinvestment of cash collateral from loaned securities, net of fees and collateral investment expenses, and other payments to and from borrowers of securities. |

Derivative Financial Instruments Outstanding as of Period End

Futures Contracts

| | | | Value/

Unrealized

Appreciation

(Depreciation) |

| | | | |

E-Mini Russell 1000 Value Index | | | | |

Derivative Financial Instruments Categorized by Risk Exposure

As of period end, the fair values of derivative financial instruments located in the Statements of Assets and Liabilities were as follows:

| | | | Foreign

Currency

Exchange

Contracts | | | |

Assets—Derivative Financial Instruments | | | | | | | |

| | | | | | | |

Unrealized appreciation on futures contracts(a) | | | | | | | |

| Net cumulative unrealized appreciation (depreciation) on futures contracts are reported in the Schedule of Investments. In the Statements of Assets and Liabilities, only current day's variation margin is reported in receivables or payables and the net cumulative unrealized appreciation (depreciation) is included in accumulated earnings (loss). |

For the period ended March 31, 2024, the effect of derivative financial instruments in the Statements of Operations was as follows:

| | | | Foreign

Currency

Exchange

Contracts | | | |

Net Realized Gain (Loss) from | | | | | | | |

| | | | | | | |

Net Change in Unrealized Appreciation (Depreciation) on | | | | | | | |

| | | | | | | |

Average Quarterly Balances of Outstanding Derivative Financial Instruments

| |

Average notional value of contracts — long | |

For more information about the Fund’s investment risks regarding derivative financial instruments, refer to the Notes to Financial Statements.

Schedule of Investments31

Schedule of Investments (continued)March 31, 2024

iShares® Global Timber & Forestry ETF

Fair Value Hierarchy as of Period End

Various inputs are used in determining the fair value of financial instruments. For a description of the input levels and information about the Fund’s policy regarding valuation of financial instruments, refer to the Notes to Financial Statements.

The following table summarizes the Fund’s financial instruments categorized in the fair value hierarchy. The breakdown of the Fund’s financial instruments into major categories is disclosed in the Schedule of Investments above.

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

Derivative Financial Instruments(a) | | | | |

| | | | |

| | | | |

| Derivative financial instruments are futures contracts. Futures contracts are valued at the unrealized appreciation (depreciation) on the instrument. |

See notes to financial statements.

322024 iShares Annual Report to Shareholders

Schedule of InvestmentsMarch 31, 2024

iShares® Lithium Miners and Producers ETF(Percentages shown are based on Net Assets)

| | |

|

|

| | |

Arcadium Lithium PLC, NVS(a) | | |

Canmax Technologies Co. Ltd., Class A | | |

Chengxin Lithium Group Co. Ltd., Class A | | |

| | |

CNGR Advanced Material Co. Ltd. | | |

Do-Fluoride New Materials Co. Ltd., Class A | | |

| | |

Ganfeng Lithium Group Co. Ltd., Class A | | |

Guangzhou Tinci Materials Technology Co. Ltd., Class A | | |

| | |

Shenzhen Capchem Technology Co. Ltd. | | |

Shenzhen Dynanonic Co. Ltd. | | |

Shenzhen Senior Technology Material Co. Ltd., Class A | | |

Sichuan Yahua Industrial Group Co. Ltd., Class A | | |

| | |

Tianqi Lithium Corp., Class A | | |

Yunnan Energy New Material Co. Ltd., Class A | | |

| | |

Electrical Equipment — 19.1% |

Beijing Easpring Material Technology Co. Ltd., Class A | | |

Hunan Changyuan Lico Co. Ltd. | | |

Hunan Yuneng New Energy Battery Material Co. Ltd., NVS | | |

Jiangsu Ruitai New Energy Materials Co. Ltd., NVS | | |

Jiangxi Special Electric Motor Co. Ltd., NVS(a) | | |

Ningbo Ronbay New Energy Technology Co. Ltd. | | |

Shijiazhuang Shangtai Technology Co. Ltd., NVS | | |

SK IE Technology Co. Ltd.(a)(c) | | |

Sociedad Quimica y Minera de Chile SA, ADR | | |

XTC New Energy Materials Xiamen Co. Ltd., NVS | | |

| | |

|

American Lithium Corp., NVS(a)(b) | | |

| | |

| | |

Latin Resources Ltd., NVS(a) | | |

Liontown Resources Ltd.(a) | | |

Lithium Americas Corp.(a)(b) | | |

| | |

| | |

| | |

Sigma Lithium Corp.(a)(b) | | |

| | |

Metals & Mining (continued) |

Sinomine Resource Group Co. Ltd., Class A | | |

Tibet Mineral Development Co. | | |

Vulcan Energy Resources Ltd.(a)(b) | | |

Winsome Resources Ltd., NVS(a) | | |

| | |

| | |

Technology Hardware, Storage & Peripherals — 7.6% |

| | |

Total Common Stocks — 99.5%

(Cost: $4,356,822) | |

|

|

Foosung Co. Ltd. (Expires 04/18/24, Strike Price KRW 6870)(a) | | |

Total Rights — 0.0%

(Cost: $—) | |

Total Long-Term Investments — 99.5%

(Cost: $4,356,822) | |

|

Money Market Funds — 12.7% |

BlackRock Cash Funds: Institutional, SL Agency Shares, 5.50%(d)(e)(f) | | |

Total Short-Term Securities — 12.7%

(Cost: $344,837) | |

Total Investments — 112.2%

(Cost: $4,701,659) | |

Liabilities in Excess of Other Assets — (12.2)% | |

| |

| Non-income producing security. |

| All or a portion of this security is on loan. |

| Security exempt from registration pursuant to Rule 144A under the Securities Act of 1933, as amended. These securities may be resold in transactions exempt from registration to qualified institutional investors. |

| |

| Annualized 7-day yield as of period end. |

| All or a portion of this security was purchased with the cash collateral from loaned securities. |

Affiliates

Investments in issuers considered to be affiliate(s) of the Fund during the period ended March 31, 2024 for purposes of Section 2(a)(3) of the Investment Company Act of 1940, as amended, were as follows:

| | | | | Change in

Unrealized

Appreciation

(Depreciation) | | | | Capital

Gain

Distributions

from

Underlying

Funds |

BlackRock Cash Funds: Institutional, SL Agency Shares | | | | | | | | | |

BlackRock Cash Funds: Treasury, SL Agency Shares(d) | | | | | | | | | |

| | | | | | | | | |

| Commencement of operations. |

Schedule of Investments33

Schedule of Investments (continued)March 31, 2024

iShares® Lithium Miners and Producers ETF

Affiliates (continued)

| Represents net amount purchased (sold). |

| All or a portion represents securities lending income earned from the reinvestment of cash collateral from loaned securities, net of fees and collateral investment expenses, and other payments to and from borrowers of securities. |

| As of period end, the entity is no longer held. |

Derivative Financial Instruments Categorized by Risk Exposure