UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K | | | | | | | | |

| ☑ | | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 29, 2024

or

| | | | | | | | |

| ☐ | | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | For the transition period from to |

Commission file number: 001-35406

Illumina, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | | 33-0804655 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| |

| |

5200 Illumina Way, San Diego, CA 92122

(Address of principal executive offices) (Zip code)

Registrant’s telephone number, including area code: (858) 202-4500

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.01 par value | ILMN | The Nasdaq Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes þ No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes þ No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Large accelerated filer | þ | Accelerated filer | ☐ | Non-accelerated filer | ☐ | Smaller reporting company | ☐ | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13a of the Exchange Act. o

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☑

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements.o

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b).o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No þ

As of February 7, 2025, there were 158.4 million shares (excluding 41.8 million shares held in treasury) of the registrant’s common stock outstanding. The aggregate market value of the common stock held by non-affiliates of the registrant as of June 30, 2024 (the last business day of the registrant’s most recently completed second quarter), based on the closing price for the common stock on The Nasdaq Global Select Market on June 28, 2024 (the last trading day before June 30, 2024), was $14.7 billion. This excludes an aggregate of 18.3 million shares of common stock held by officers and directors and each person known by the registrant to own 10% or more of the outstanding common stock. Exclusion of shares held by any person should not be construed to indicate that such person possesses the power, directly or indirectly, to direct or cause the direction of the management or policies of the registrant, or that the registrant is controlled by or under common control with such person.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s proxy statement for the 2025 annual meeting of stockholders are incorporated by reference into Items 10 through 14 of Part III of this Report.

ILLUMINA, INC.

FORM 10-K

FOR THE FISCAL YEAR ENDED DECEMBER 29, 2024

TABLE OF CONTENTS

| | | | | |

| BUSINESS & MARKET INFORMATION | PAGE |

| |

| |

| |

| |

| |

| |

| |

| MANAGEMENT’S DISCUSSION & ANALYSIS | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| CONSOLIDATED FINANCIAL STATEMENTS | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| OTHER KEY INFORMATION | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

See “Form 10-K Cross-Reference Index” within Other Key Information for a cross-reference to the parts and items requirements of the Securities and Exchange Commission Annual Report on Form 10-K.

Consideration Regarding Forward-Looking Statements

This annual report on Form 10-K contains, and our officers and representatives may from time to time make, “forward-looking statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Words such as: “anticipate,” “intend,” “plan,” “goal,” “seek,” “believe,” “continue,” “project,” “estimate,” “expect,” “strategy,” “future,” “likely,” “may,” “potential,” “predict,” “should,” “will,” or similar words or phrases, or the negatives of these words, may identify forward-looking statements, but the absence of these words does not necessarily mean that a statement is not forward looking. Examples of forward-looking statements include, among others, statements we make regarding:

•our expectations as to our future financial performance, results of operations, or other operational results or metrics;

•the benefits that we expect will result from our business activities and certain transactions we have completed, or may complete, such as product introductions, increased revenue, decreased expenses, and avoided expenses and expenditures;

•our expectations of the effect on our financial condition of claims, litigation, contingent liabilities, and governmental investigations, proceedings, and regulations;

•our strategies or expectations for product development, market position, financial results, and reserves;

•our ability to successfully implement cost reduction plans in a timely manner and the possibility that costs associated with our cost reduction plans are greater than we anticipate;

•risks relating to the recent divestiture of GRAIL, Inc. (f/k/a GRAIL, LLC) (GRAIL); and

•other expectations, beliefs, plans, strategies, anticipated developments, and other matters that are not historical facts.

Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on our current beliefs, expectations, and assumptions regarding the future of our business, future plans and strategies, projections, anticipated events and trends, the economy, and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks, and changes in circumstances that are difficult to predict and many of which are outside of our control. Our actual results and financial condition may differ materially from those indicated in the forward-looking statements. Therefore, you should not rely on any of these forward-looking statements. Important factors that could cause our actual results and financial condition to differ materially from those indicated in the forward-looking statements include, among others, the following:

•our expectations and beliefs regarding prospects and growth for our business and the markets in which we operate;

•the timing and mix of customer orders among our products and services;

•challenges inherent in developing, manufacturing, and launching new products and services, including expanding manufacturing operations and reliance on third-party suppliers for critical components;

•uncertainty regarding the impact of our recent inclusion by the China Ministry of Commerce announcement that Illumina is included on its “unreliable entities list”;

•any reductions or potential reductions in funding for the National Institutes of Health, or targeted cancellations by the U.S. federal government of certain grants or contracts, could negatively impact our customers and reduce demand for our products and services;

•the impact of recently launched or pre-announced products and services on existing products and services;

•uncertainty regarding, or potential changes in, diplomatic and trade relationships, for example, as a result of the recent change in the U.S. government administration;

•risks and uncertainties regarding legal and regulatory proceedings;

•the impact of tariffs recently imposed by the U.S. government and its trading partners in response, other possible tariffs or trade protection measures, import or export licensing requirements, new or different customs duties, trade embargoes and sanctions and other trade barriers;

•risks associated with contracts or other agreements containing provisions that might be implicated by the divestiture of GRAIL, including our ability to fully realize the anticipated economic benefits of our commercial arrangements with GRAIL and our obligations with respect to contingent value rights (the CVRs) issued by us in connection with the GRAIL acquisition, which may adversely affect us and our business and/or the market value of the CVRs;

•the risk of additional litigation arising against us in connection with the GRAIL acquisition;

•the assumptions underlying our critical accounting policies and estimates;

•our assessments and estimates that determine our effective tax rate;

•our assessments and beliefs regarding the outcome of pending legal proceedings and any liability that we may incur as a result of those proceedings, as well as the cost and potential diversion of management resources associated with these proceedings;

•uncertainty, or adverse economic and business conditions, including as a result of slowing or uncertain economic growth, public health crisis, or armed conflict; and

•other factors detailed in our filings with the Securities and Exchange Commission (SEC), including the risks, uncertainties, and assumptions described in Risk Factors within the Business & Market Information section of this report, or in information disclosed in public conference calls, the date and time of which are released beforehand. Any forward-looking statement made by us in this annual report on Form 10-K is based only on information currently available to us and speaks only as of the date on which it is made. We undertake no obligation, and do not intend, to publicly update any forward-looking statement, whether written or oral, that may be made from time to time, or to review or confirm analysts’ expectations, or to provide interim reports or updates on the progress of any current financial quarter, in each case whether as a result of new information, future developments, or otherwise.

Available Information

Our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and all amendments to those reports are available free of charge on our website, www.illumina.com. The information on our website is not incorporated by reference into this report. Such reports are made available as soon as reasonably practicable after filing with, or furnishing to, the SEC. The SEC also maintains an Internet site at www.sec.gov that contains reports, proxy and information statements, and other information regarding issuers that electronically file with the SEC. Copies of our annual report on Form 10-K will be made available, free of charge, upon written request.

_______________________________________

Assign, BaseSpace, BeadArray, Bluebee, BlueFuse, BlueGnome, cBot, Clarity LIMS, CircLigase, COVIDSeq, DesignStudio, DRAGEN, DRAGEN ORA, Emedgene, Enancio, FastTrack, Flow, Fluent Biosciences, Genetic Energy, GenomeStudio, Genomics Suite, Golden Gate, HiSeq, iHope, Illumina, Illumina Connected Analytics, Illumina Propel Certified, Infinium, iScan, iSelect, iSeq, MiniSeq, MiSeq, MiSeq FGx, Nextera, NextSeq, NovaSeq, Partek, Pattern Visualization System, PIPseq, Powered by Illumina, Praxis, Ribo-Zero, SureCell, The Analytical Spreadsheet, TruGenome, TruSeq, TruSight, Turning Data Into Discovery, Verifi, Verinata, Verinata Health, VeriSeq, XLEAP-SBS, the pumpkin orange color, and the Genetic Energy / streaming bases design are trademarks or registered trademarks of Illumina, Inc.

“GRAIL,” the GRAIL logos, and other trade names, trademarks, or service marks of GRAIL are the property of GRAIL. The “Galleri” mark and logo are registered in numerous countries including the United States and the United Kingdom. Applications to register the “Galleri” mark and logo, the “GRAIL” mark and the logo, and marks associated with GRAIL are also pending in a variety of countries.

_______________________________________

Unless the context requires otherwise, references in this annual report on Form 10-K to “Illumina,” the “Company,” “we,” “us,” and “our” refer to Illumina, Inc. and its consolidated subsidiaries.

_______________________________________

Our fiscal year is the 52 or 53 weeks ending the Sunday closest to December 31, with quarters of 13 or 14 weeks ending the Sunday closest to March 31, June 30, September 30, and December 31. References to 2024, 2023, and 2022 refer to fiscal years ended December 29, 2024, December 31, 2023, and January 1, 2023, respectively, which were all 52 weeks.

| | |

| BUSINESS & MARKET INFORMATION |

BUSINESS OVERVIEW

We are a global leader in sequencing- and array-based solutions for genetic and genomic analysis. Our products and services serve customers in a wide range of markets, enabling the adoption of genomic solutions in research and clinical settings. We were incorporated in California in April 1998 and reincorporated in Delaware in July 2000. Our principal executive offices are located at 5200 Illumina Way, San Diego, California 92122.

Our customers include leading genomic research centers, academic institutions, government laboratories, and hospitals, as well as pharmaceutical, biotechnology, commercial molecular diagnostic laboratories, and consumer genomics companies. Our portfolio of integrated sequencing and microarray systems, consumables, and analysis tools is designed to accelerate and simplify genetic analysis and addresses the range of genomic complexity, price points, and throughput, enabling customers to select the best solution for their research or clinical application.

On June 24, 2024, we completed the separation (the Spin-Off) of GRAIL into a new public company through the distribution of 26,547,021 shares of GRAIL common stock to Illumina stockholders on a pro rata basis. The distribution reflected approximately 85.5% of the outstanding common stock of GRAIL as of 5:00 p.m. New York time on June 13, 2024, the record date for the distribution (the Record Date). We retained approximately 14.5% of the shares of GRAIL common stock immediately following the Spin-Off. The disposition of GRAIL did not meet the criteria to be reported as a discontinued operation and accordingly, GRAIL’s assets, liabilities, results of operations and cash flows have not been reclassified. Refer to note 2. GRAIL Spin-Off for additional details. Genetics Primer

The instruction set for all living cells is encoded in deoxyribonucleic acid, or DNA. The complete set of DNA for any organism is referred to as its genome. DNA contains small regions called genes, which comprise a string of nucleotide bases labeled A, C, G, and T, representing adenine, cytosine, guanine, and thymine, respectively. These nucleotide bases occur in a precise order known as the DNA sequence. When a gene is “expressed,” a copy of a portion of its DNA sequence called messenger RNA (mRNA) is used as a template to direct the synthesis of a particular protein. Proteins, in turn, direct all cellular function. The illustration below is a simplified gene expression schematic.

Variations among organisms are due, in large part, to differences in their DNA sequences. Changes can result from insertions, deletions, inversions, translocations, or duplications of nucleotide bases. These changes may result in certain genes becoming overexpressed (excessive protein production), underexpressed (reduced protein production), or silenced altogether, sometimes triggering changes in cellular function. The most common form of variation in humans is called a single nucleotide polymorphism (SNP), which is a base change in a single position in a DNA sequence. Another type of variation, copy number variations (CNVs), occur when there are fewer or more copies of certain genes, segments of a gene, or stretches of DNA. In humans, genetic variation accounts for many of the physical differences we see (e.g., height, hair, eye color, etc.). Genetic variations also can have medical consequences affecting disease susceptibility, including predisposition to complex genetic diseases such as cancer,

diabetes, cardiovascular disease, and Alzheimer’s disease. They can affect individuals’ response to certain drug treatments, causing them to respond well, experience adverse side effects, or not respond at all.

Scientists are studying these variations and their consequences in humans, as well as in a broad range of animals, plants, and microorganisms. Such research takes place in government, university, pharmaceutical, biotechnology, and agrigenomics laboratories around the world, where scientists expand our knowledge of the biological functions essential for life. Beginning at the genetic level, our tools are used to elucidate the relationship between gene sequence and biological processes. Researchers who investigate human and non-human genetic variation to understand the mechanisms of disease are enabling the development of more effective diagnostics and therapeutics. They also provide greater insight into genetic variation in plants (e.g., food and biofuel crops) and animals (e.g., livestock and domestic), enabling improvements in crop yields and animal breeding programs.

By empowering genetic analysis and facilitating a deeper understanding of genetic variation and function, our tools advance disease research, drug development, and the creation of molecular diagnostic tests. We believe that this will trigger a fundamental shift in the practice of medicine and health care, and that the increased emphasis on preventive and predictive molecular medicine will usher in the era of precision health care.

Our Principal Markets

We target the markets and customers outlined below.

Research and Applied

Historically, our core business has been in the life sciences research market. This includes laboratories associated with universities, research centers, and government institutions, along with biotechnology and pharmaceutical companies. Researchers at these institutions use our products and services for basic and translational research across a spectrum of scientific applications, including targeted, exome, and whole-genome sequencing; genetic variation; gene expression; epigenetics; and metagenomics. Next-generation sequencing (NGS) technologies are being adopted due to their ability to cost-effectively sequence large sample sizes quickly and accurately, generating vast amounts of high-quality data. Both private and public funding drive this research, along with global initiatives to characterize genetic variation.

Our products also serve various applied markets including consumer genomics and agrigenomics. For example, in consumer genomics, our customers use our technologies to provide personalized genetic data and analysis to individual consumers. In agrigenomics, government and corporate researchers use our products and services to explore the genetic and biological basis for productivity and nutritional constitution in crops and livestock. Researchers can identify natural and novel genomic variation and deploy genome-wide marker-based applications to accelerate breeding and production of healthier and higher-yielding crops and livestock.

Clinical

We are focused on enabling translational and clinical markets through the introduction of best-in-class sequencing technology. Further, we are developing sample-to-answer solutions to catalyze adoption in the clinical setting, including in reproductive and genetic health and oncology. In reproductive health, our primary focus is driving noninvasive prenatal testing (NIPT) adoption globally through our technology, which identifies fetal chromosomal abnormalities by analyzing cell-free DNA in maternal blood. Our NGS technology is also accelerating rare and undiagnosed disease research to discover the genetic causes of inherited disorders by assessing many genes simultaneously. Using NGS can reduce costs compared to traditional methods of disease diagnosis, which are often expensive and inconclusive while requiring extensive testing.

Cancer is a disease of the genome, and the goal of cancer genomics is to identify genomic changes that transform a normal cell into a cancerous one. Understanding these genomic changes will improve diagnostic accuracy, increase understanding of the prognosis, and enable oncologists to target therapies to individuals. Customers in the translational and clinical oncology markets use our products to perform research that may help identify individuals who are genetically predisposed to cancer and to identify molecular changes in a tumor. We believe that circulating tumor DNA (ctDNA) will become an important clinical tool for managing oncology patients during all stages of tumor progression. Our technology is being used to research the implications of ctDNA in treatment determination, treatment monitoring, minimal residual disease, and asymptomatic screening. For example, GRAIL’s Galleri blood test for early-stage cancer detection is enabled by our sequencing technology.

Our Principal Products, Services, and Technologies

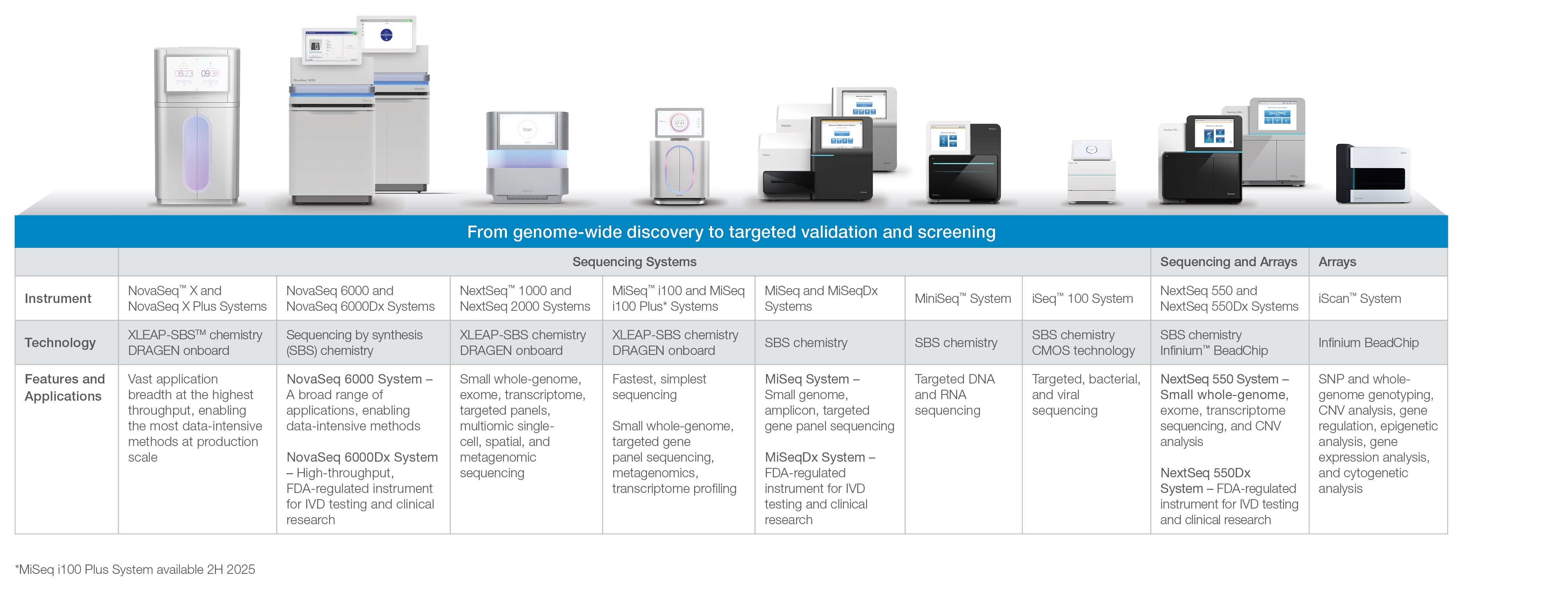

Our unique technology platforms support the scale of experimentation necessary for population-scale studies, genome-wide discovery, target selection, and validation studies (see Figure 1 below). Customers use our products to analyze the genome at all levels of complexity, from targeted panels to whole-genome sequencing. A large and dynamic Illumina user community has published hundreds of thousands of customer-authored scientific papers using our technologies. Through rapid innovation, we are changing the economics of genetic research, enabling projects that were previously considered impossible, and supporting clinical advances towards precision medicine.

Most of our product sales consist of sequencing- and array-based instruments and consumables, which include reagents, flow cells, and library preparation, based on our proprietary technologies. We also perform various services for our customers. In 2024, 2023, and 2022, instrument sales represented 12%, 16%, and 16%, respectively, of total consolidated revenue; consumable sales represented 72%, 68%, and 70%, respectively, of total consolidated revenue; and services represented 16%, 16%, and 14%, respectively, of total consolidated revenue.

Figure 1: Illumina Platform Overview:

Sequencing

DNA sequencing is the process of determining the order of nucleotide bases (A, C, G, or T) in a DNA sample. Our portfolio of sequencing platforms represents a family of systems that we believe set the standard for productivity, cost-effectiveness, and accuracy among NGS technologies. Customers use our platforms to perform whole-genome, de novo, exome and RNA sequencing, and targeted resequencing of specific gene regions and genes.

Whole-genome sequencing determines the complete DNA sequence of an organism. In de novo sequencing, the goal is to sequence and assemble the genome of that sample without using information from prior sequencing of that species. In targeted resequencing, a portion of the sequence of an organism is compared to a standard or reference sequence from previously sequenced samples to identify genetic variation. Understanding the similarities and differences in DNA sequence between and within species helps us understand the function of the structures encoded in the DNA.

Our DNA sequencing technology is based on our proprietary reversible terminator-based sequencing chemistry, referred to as sequencing by synthesis (SBS) biochemistry. SBS tracks the addition of labeled nucleotides as the DNA chain is copied in a massively parallel fashion. In 2023, we launched XLEAP-SBSTM, a faster, higher quality, and more robust version of our SBS chemistry that delivers the highest level of data accuracy and performance. Our XLEAP-SBS sequencing technology provides researchers with a broad range of applications and the ability to sequence more than 20,000 human genomes per year per instrument.

Our sequencing platforms can generate between 500 megabases (Mb) and 16.0 terabases (Tb) (equivalent to approximately 128 human genomes) of genomic data in a single run, depending on the instrument and application.

There are different price points per gigabase (Gb) for each instrument, and for different applications, which range from small-genome, amplicon, and targeted gene-panel sequencing to population-scale whole human genome sequencing. Since we launched our first sequencing system in 2007, our systems have significantly reduced the cost of sequencing. In 2023, we launched the NovaSeqTM X Plus, a production-scale sequencing system that can sequence a human genome for as little as $200. In 2024, we launched the benchtop MiSeq i100 series, our fastest, simplest sequencing system, featuring room temperature reagents, empowering every lab, everywhere.

Illumina informatics products play a critical role in supporting our sequencing applications and customers’ needs across a range of activities, including sample preparation, instrument control and management, and post-run analysis. Our BaseSpace Informatics Suite integrates directly with our sequencing instruments, allowing customers to manage their biological sample and sequencing runs, process and analyze the raw genomic data, and derive meaningful results. It facilitates data sharing, provides data-storage solutions and streamlines analysis through a growing number of applications developed by us and the bioinformatics community. Our DRAGEN Bio-IT Platform is used for secondary analysis and analyzes sequencing data from a variety of experiment types, including whole genomes, whole exomes, germline and somatic datasets, and RNA sequencing experiments with industry leading accuracy, speed and efficiency. Additionally, Illumina Connected Analytics is an integrated bioinformatics solution that provides a comprehensive, private, cloud-based data platform that empowers customers to manage, analyze, and explore large volumes of multi-omic data in a secure, scalable, and flexible environment.

In 2024, 2023, and 2022, total sequencing revenue comprised 91% of total consolidated revenue for all periods.

Arrays

Arrays are used for a broad range of DNA and RNA analysis applications, including SNP genotyping, CNV analysis, gene expression analysis, and methylation analysis, and enable the detection of millions of known genetic markers on a single array. Arrays are the primary technology used in consumer genomics applications.

Our BeadArray technology combines microscopic beads and a substrate in a proprietary manufacturing process to produce arrays that can perform many assays simultaneously. This facilitates large-scale analysis of genetic variation and biological function in a unique, high-throughput, cost-effective, and flexible manner. Using our BeadArray technology, we achieve high-throughput analysis via a high density of test sites per array and the ability to format arrays in various configurations. To serve the needs of multiple markets and market segments, we can vary the size, shape, and format of the substrate into which the beads self-assemble and create specific bead types for different applications. Our iScan System and our NextSeq 550 System can be used to image arrays.

In 2024, 2023, and 2022, total array revenue comprised 9% of total consolidated revenue for all periods.

Consumables

We have developed various library preparation and sequencing kits to simplify workflows and accelerate analysis. Our sequencing applications include whole-genome sequencing kits, which sequence entire genomes of any size and complexity, and targeted resequencing kits, which can sequence exomes, specific genes, RNA or other genomic regions of interest. In January 2025, we launched Illumina Single Cell 3’ RNA Prep, a simple, end-to-end single cell workflow allowing transcriptome studies of hundreds to millions of cells. Our sequencing kits maximize the ability of our customers to characterize the target genome accurately and are sold in various configurations, addressing a wide range of applications.

Customers use our array-based genotyping consumables for a wide range of analyses, including diverse species, disease-related mutations, and genetic characteristics associated with cancer. Customers can select from a range of human, animal, and agriculturally relevant genome panels or create their own custom arrays to investigate millions of genetic markers targeting any species.

Services

We offer support services to customers who have purchased our products. In addition, we provide whole-genome sequencing, genotyping, NIPT, and product support services. Human whole-genome sequencing services are provided through our CLIA-certified, CAP-accredited laboratory. Using our services, customers can perform whole-genome sequencing projects and microarray projects (including large-scale genotyping studies and whole-genome association studies). We also provide NIPT services through our partner laboratories that direct samples to us on a test send-out basis in our CLIA-certified, CAP-accredited laboratory.

GRAIL

GRAIL’s multi-cancer early detection test, Galleri, is designed as a screening test for adults with an elevated risk for cancer, such as those aged 50 or older, and was commercially launched in 2021 as a laboratory developed test.

Intellectual Property

We have an extensive intellectual property portfolio. As of December 29, 2024, excluding GRAIL which was spun-off on June 24, 2024, we owned or had exclusive licenses to 1,337 issued U.S. patents and 1,119 pending U.S. patent applications and 8,027 issued patents outside the U.S. and 5,668 pending patent applications outside the U.S. Our issued and pending patents cover various aspects of our arrays, assays, oligo synthesis, sequencing technology, instruments, digital microfluidics, software, bioinformatics, and chemical-detection technologies, and our issued patents have terms that expire between 2025 and 2049. We continue to file new patent applications to protect the full range of our technologies. We have filed or have been granted counterparts for many of these patents and applications in foreign countries. We protect our trade secrets, know-how, copyrights, and trademarks. Our success depends in part on obtaining patent protection for our products and processes, preserving trade secrets, patents, obtaining copyrights and trademarks, operating without infringing the proprietary rights of third parties, and acquiring licenses for technology or products. In addition, we invest in technological innovation, and we seek beneficial licensing opportunities to develop and maintain our competitive position. We are party to various exclusive and nonexclusive license agreements and other arrangements with third parties that grant us rights to use key aspects of our sequencing and array technologies, assay methods, chemical detection methods, reagent kits, and scanning equipment. We have additional nonexclusive license agreements with various third parties for other components of our products. In most cases, the agreements remain in effect over the term of the underlying patents, may be terminated at our request without further obligation, and require that we pay customary royalties.

Research and Development

We have historically made substantial investments in research and development and we expect to continue to make investments in research and development during 2025 to support business growth and our innovation pipeline. Our research and development efforts prioritize continuous innovation coupled with product evolution. Research and development expense in 2024, 2023, and 2022 was $1,169 million, $1,354 million, and $1,321 million, respectively.

Marketing and Distribution

We market and distribute our products directly to customers in North America, Europe, Latin America, and the Asia-Pacific region. In addition, we sell through life-science distributors in certain markets within Europe, the Asia-Pacific region, Latin America, the Middle East, and Africa. We expect to continue making commercial investments in 2025 and beyond as we launch new products and expand our potential commercial base in alignment with our strategy.

Manufacturing

We manufacture sequencing and array platforms and reagent kits. In 2024, we continued to increase our manufacturing capability, and we expect to increase our manufacturing capability again in 2025 to meet customer demand. To address increasing product complexity and volume, we continue to automate manufacturing processes to accelerate throughput and improve quality and yield. We are committed to providing medical devices and related services that consistently meet customer and applicable regulatory requirements. We adhere to health and safety standards required by federal, state, and local health ordinances, such as standards for the use, handling, and disposal of hazardous substances. Our key manufacturing and distribution facilities operate under a quality management system certified to ISO 13485.

Raw Materials

Our manufacturing operations require a wide variety of raw materials, electronic and mechanical components, chemical and biochemical materials, and other supplies. Multiple commercial sources provide many of our components and supplies, but there are some raw materials and components that we obtain from single-source suppliers. To manage potential risks arising from single-source suppliers, we believe that, if necessary, we could redesign our products using alternative components or for use with alternative reagents or develop an internal supply capability. In addition, while we attempt to keep our inventory at minimal levels, we purchase incremental inventory as circumstances warrant to protect our supply chain. If the capabilities of our suppliers and component manufacturers are limited or stopped, due to pandemics, disasters, quality, regulatory, or other reasons, it could negatively impact our ability to manufacture our products.

Competition

Although we believe that our products and services provide significant advantages over products and services currently available from other sources, we expect continued intense competition. Our competitors offer products, services, and software for sequencing, SNP genotyping, gene expression, proteomics, and molecular diagnostics markets. In some cases, we compete for the resources our customers allocate for purchasing a wide range of sequencing and non-sequencing products used to analyze genetic variation and associated biological functions, some of which are complementary or adjacent to our own but not directly competitive; in other cases, our products face direct competition as customers choose among sequencing and non-sequencing products that are designed to address the same use case or answer the same biological question. Some of our competitors have, or will have, substantially greater financial, technical, research, artificial intelligence capabilities, and other resources than we do, along with larger, more established marketing, sales, distribution, and service organizations. In addition, they may have greater name recognition than we do in the markets we address, and in some cases a larger installed base of systems. We expect new competitors to emerge and the intensity of competition to increase. To compete effectively, we must scale our organization and infrastructure appropriately and demonstrate that our products have superior throughput, cost, and accuracy.

Segment and Geographic Information

We have one reportable segment, Core Illumina, as of December 29, 2024. Prior to the Spin-Off of GRAIL into a separate, independent publicly traded company on June 24, 2024, our reportable segments included both Core Illumina and GRAIL. See note 12. Segment and Geographic Information for details on our reportable segments. We currently sell our products to a number of customers outside the United States, including customers in other areas of North America, Latin America, Europe, China, and the Asia-Pacific region. Shipments to customers outside the United States totaled $2,084 million, or 48%, of total consolidated revenue in 2024, compared to $2,145 million, or 48%, and $2,294 million, or 50%, in 2023 and 2022, respectively. We consider the U.S. dollar to be the functional currency of our international operations due to the primary activities of our foreign subsidiaries. We expect that sales to international customers will continue to be an important and growing source of revenue. See note 1. Organization and Significant Accounting Policies and note 3. Revenue within the Consolidated Financial Statements section of this report for further information concerning our foreign and domestic operations. Backlog

Our backlog was $657 million and $653 million as of December 29, 2024 and December 31, 2023, respectively, and consists of orders believed to be firm as of the balance sheet date. However, we may allow customers to make product substitutions as we launch new products. The timing of shipments depends on several factors, including agreed upon shipping schedules, which may span multiple quarters, and whether the product is catalog or custom. We expect 78% of our backlog as of December 29, 2024 to be shipped in 2025, 10% in 2026, and the remainder thereafter. Although we generally recognize revenue when control of our products and services is transferred to our customers, some customer contracts might require us to defer revenue recognition beyond the transfer of control.

Properties

The following table, excluding GRAIL which was spun-off on June 24, 2024, summarizes the facilities we leased as of December 29, 2024, including location and size of each principal facility and designated use. We believe our facilities are adequate for our current and near-term needs, and we will be able to locate additional facilities, as needed.

| | | | | | | | | | | | | | | | | | | | |

| Location | | Approximate Square Feet | | Operation | | Lease

Expiration Dates |

| San Diego, CA | | 860,000 | | | Office, Lab, Manufacturing, and Distribution | | 2030 – 2031 |

| Singapore | | 584,000 | | | Office, Lab, Manufacturing, and Distribution | | 2027 – 2037 |

| San Francisco Bay Area, CA | | 269,000 | | | Office, Lab, and Manufacturing | | 2025 – 2033 |

| Cambridge, United Kingdom | | 181,000 | | | Office, Lab, and Manufacturing | | 2025 – 2038 |

| Madison, WI | | 133,000 | | | Office, Lab, and Manufacturing | | 2033 | |

| Eindhoven, the Netherlands | | 90,000 | | | Office and Distribution | | 2036 | |

| China | | 86,000 | | | Office and Lab | | 2026 – 2028 |

| India | | 66,000 | | | Office and Lab | | 2027 – 2029 |

| Other | | 140,000 | | | Office and Lab | | 2025 – 2030 |

Human Capital

To continue as a leader in genomics, we need to harness the world’s best talent and give them the opportunity to thrive. We are committed to attracting, retaining, developing, and supporting our people to enable everyone to fully contribute to our mission and deliver on the transformative power of genomics. We drive innovation by embracing new perspectives and making Illumina a place where everyone can belong. Our key human capital objectives include: attract extraordinary talent, invest in our people, support employee health, safety, and well-being, and engage our people and communities. Additional information is included in our annual Corporate Social Responsibility (CSR) Report, located on our website at www.illumina.com/csr. Information on our website, including the CSR Report, shall not be deemed incorporated by reference into this Annual Report. Our annual CSR Report is guided by the reporting frameworks of the Global Reporting Initiative (GRI), Sustainable Accounting Standards Board (SASB), and the Task Force for Climate related Financial Disclosures (TCFD).

As of December 29, 2024, excluding GRAIL which was spun-off on June 24, 2024, our global workforce was comprised of approximately 8,970 full time employees, 60 part time employees, and 1,340 contingent workers. The regional representation includes approximately 5,250 employees in the Americas, 1,290 employees in Europe, 2,190 employees in Africa, Middle East and Asia, and 300 employees in Greater China. The global voluntary turnover rate for 2024 was 7%. Additional details about our workforce for 2024 will be available in our annual CSR Report, which we expect to publish in May 2025 on our website at www.illumina.com/csr.

Cybersecurity

We recognize the importance of developing, implementing, and maintaining robust cybersecurity measures to safeguard our information systems and protect the confidentiality, integrity, and availability of our data. Our cybersecurity risk management strategy is integrated into our established enterprise risk management program, which includes defined risk, assessment, mitigation, and reporting processes. Our information security team has deployed multiple technical and operational processes to aid in our ability to continuously identify and respond to cybersecurity threats and incidents. Our cybersecurity incident management process includes impact assessment, containment, mitigation and recovery strategies.

In addition to our continuous monitoring of our information systems, we utilize third parties to provide external threat intelligence and evaluation of incident notifications in order to identify potential threats or incidents that could impact us. We also evaluate our cybersecurity program against the National Institute of Standards and Technology’s Cybersecurity Framework. For all suspected cybersecurity incidents, the information security team conducts a preliminary assessment to determine the potential severity and impact extent of the incident and, where appropriate, a materiality assessment is made. Upon a confirmed cybersecurity incident, the information security team initiates an incident response process with goals to contain, respond, recover, protect and minimize any impacts caused by the incident. The response process includes deployment of a variety of short term and long-term technical and procedural actions as appropriate. Further, we have established a third party risk management program to monitor suppliers who have access to our information.

Our Audit Committee, a committee of our Board of Directors, is responsible for governing management’s review and assessment of our cybersecurity and other information technology risks, controls, and procedures, including management’s incident resolution process and any specific cybersecurity issues that could affect the adequacy of our internal controls. Our Chief Information Officer provides regular updates to the Audit Committee and to the Board of Directors, including a review of any security risk events and improvements in our security controls.

Our information security team, under the Chief Information Officer, is led by our Chief Information Security Officer (CISO) and is responsible for assessing and managing risks from cybersecurity threats. Our CISO has over 20 years of information security experience, including as a leader of information security programs at other large enterprises, and is supported by a team of professionals focused on information security. Our information security team regularly meets to review our cybersecurity posture, the broader cybersecurity landscape and any identified cybersecurity incidents. Our information security team has procedures in place for investigating suspected cybersecurity incidents, as well as monitoring cybersecurity risks and ongoing mitigation strategies, the status of prevention, detection, and mitigation controls and any planned future control enhancements.

We believe that risks from prior cybersecurity threats to information systems owned and used by us, including as a result of any previous cybersecurity incidents, have not materially affected our business to date. We can provide no assurance that there will not be incidents in the future or that they will not materially affect us, including our business strategy, results of operations, or financial condition. We maintain a cybersecurity insurance policy which may mitigate certain financial impacts of a cybersecurity incident. Please refer to “Risks Relating to Information Technology Security and Continuity” within the Risk Factors within the Business & Market Information Section of this report. Environmental Matters

As a global corporate citizen, we recognize the importance of the environment to a healthy, sustainable future for our business, our patients, and communities. We are committed to the protection of our employees and the environment with an approach to continuously strengthen our environmental stewardship. We believe that we are in material compliance with current applicable laws and regulations. However, we could be held liable for damages and fines should contamination of the environment or individual exposures to hazardous substances occur. In addition, we cannot predict how changes in these laws and regulations, or the development of new laws and regulations, will affect our business operations or the cost of compliance. Further, regulators are considering, and in some cases have implemented, new environmental disclosure rules. For example, California has recently enacted new climate-related disclosure rules and requirements. The cost of complying with any new disclosure regimes is uncertain. In addition, climate change may impact our business by increasing operating costs due to additional regulatory requirements, physical risks to our facilities, energy limitations, and disruptions to our supply chain. These potential risks are accounted for in our business planning, including investment in renewable energy, reducing energy and water consumption, greenhouse gas emissions, and waste production. As part of our climate action plan, we established emission reduction targets in line with a 1.5 degree pathway, established Net Zero emission commitments by 2050, and had those targets verified by the Sciences Based Target Initiative. Additional information is included in our annual CSR Report located on our website at www.Illumina.com/csr.

Government Regulation

As we expand product lines to address the diagnosis of disease, regulation by governmental authorities in the U.S. and other countries will become an increasingly significant factor in development, testing, production, and marketing activities. Products that we develop in the molecular diagnostic markets, depending on their intended use, may be regulated as medical devices or in vitro diagnostic products (IVDs) by the FDA and comparable agencies in other countries. In the U.S., certain of our products may require FDA clearance following a pre-market notification process, also known as a 510(k) clearance, or premarket approval (PMA) from the FDA. The usually shorter 510(k) clearance process, which we used for the FDA-cleared assays that are run on our FDA-regulated MiSeqDx instrument, generally takes from three to six months after submission, but it can take significantly longer. The longer PMA process, which we used for our FDA-approved TruSight Comprehensive Oncology panel that is run on our NextSeq550 Dx instrument, is typically much more costly and uncertain. It can take from 9 to 18 months after a complete filing, but it can take significantly longer and requires conducting clinical studies that are generally more extensive than those required for 510(k) clearance. All of the products that are currently regulated by the FDA as medical devices and IVDs are also subject to the FDA Quality System Regulation (QSR). Obtaining the requisite regulatory approvals, including the FDA quality system inspections that are required for PMA approval, can be expensive and may involve considerable delay. In the U.S., the products we develop for oncology and non-invasive prenatal testing will be regulated by the PMA process. We cannot be certain which of our other planned molecular diagnostic products will be subject to the shorter 510(k) clearance process, or which of these will need to go through the PMA process.

The regulatory approval process for such products may be significantly delayed, may be significantly more expensive than anticipated, and may conclude without such products being approved by the FDA. Without timely regulatory approval, we will not be able to launch or successfully commercialize such products, which would adversely affect our earnings and competitive position. Many of the products that we are developing are the first of their kind. The regulatory approval pathways for such products do not currently exist and therefore have a high degree of uncertainty.

Changes to the current regulatory framework, including the imposition of additional or new regulations, could arise at any time during the development or marketing of our products. This may negatively affect our ability to obtain or maintain FDA or comparable regulatory clearance or approval of our products. In addition, regulatory agencies may introduce new requirements that may change the regulatory requirements for us or our customers, or both. For example, the final rule published by the FDA in 2024 allows the FDA to regulate laboratory developed tests (LDTs). Under the final rule, our customers will be required to either submit their current test for FDA approval or find an IVD manufacturer to supply them with IVDs.

If our products labeled as “For Research Use Only,” or RUO, are used, or could be used, for the diagnosis of disease, the regulatory requirements related to marketing, selling, and supporting such products could be uncertain. This is true even if such use by our customers occurs without our consent. If the FDA or other regulatory authorities assert that any of our RUO products are subject to regulatory clearance or approval, our business, financial condition, or results of operations could be adversely affected.

Our products sold as medical devices or IVDs in Europe are now regulated under the In Vitro Diagnostics Regulation (EU) 2017/746, the IVDR, that went into full enforcement in May 2022. These regulations include requirements for both presentation and review of performance data and quality-system requirements.

Certain of our products are currently available through laboratories that are certified under the Clinical Laboratory Improvements Amendments (CLIA) of 1988. These products are commonly called “laboratory developed tests,” or LDTs. For a number of years, the FDA has exercised its regulatory enforcement discretion not to regulate LDTs as medical devices if created and used within a single laboratory. However, as mentioned above, the FDA published a final rule in 2024 that phases out the enforcement discretion over a 4 year time period. The final rule is effective as of the 2024 publication. While this rule is being challenged in the U.S. court system, if the final rule stands in its current form, laboratories will be required to submit LDTs for FDA approval and will be required to implement a fully compliant Quality Management System (QMS).

Certification of CLIA laboratories includes standards in the areas of personnel qualifications, administration, and participation in proficiency testing, patient test management, and quality control procedures. CLIA also mandates that, for high complexity labs such as ours, to operate as a lab, we must have an accreditation by an organization recognized by CLIA such as the College of Pathologists (CAP), which we have obtained and must maintain. If we were to lose our CLIA certification or CAP accreditation, our business, financial condition, or results of operations could be adversely affected. In addition, state laboratory licensing and inspection requirements may also apply to our products, which, in some cases, are more stringent than CLIA requirements.

RISK FACTORS

This report and other documents we file with the SEC contain forward-looking statements that are based on current expectations, estimates, forecasts and projections about us, our future performance, our business, our beliefs and our management’s assumptions. These statements are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict. You should carefully consider the risks and uncertainties our business faces. The risks described below are not the only ones we face. Our business is also subject to the risks that affect many other companies, such as employment relations, general economic conditions, geopolitical events and international operations. Further, additional risks not currently known to us or that we currently believe are immaterial may in the future materially and adversely affect our business, operations, liquidity and stock price.

Risks Relating to Our Sales of Products and Services, Marketing and Research and Development

Our success depends upon the continued emergence and growth of markets for analysis of genetic variation, and continued substantial increases in the use of sequencing as the cost of sequencing declines.

The usefulness of our technologies depends in part upon the availability of genetic data and its usefulness in clinical, research, and consumer applications. We are focusing on markets for analysis of genetic variation or biological function, namely sequencing, genotyping, and gene expression profiling. These markets are relatively new and emerging, and they may not develop as quickly as we anticipate, or reach what we expect to be their full potential. Other methods of analysis of genetic variation and biological function may emerge and displace the methods we are developing. In addition, a reduction or delay in research and development budgets and government funding may adversely affect our business. For example, changes in the regulatory environment affecting life sciences and pharmaceutical companies, and reduced allocations to government agencies that fund research and development activities, such as the U.S. National Institutes of Health, or NIH, or targeted cancellations by the U.S. federal government of certain grants or contracts, could adversely affect our business or results of operations.

The introduction of next-generation sequencing technologies, including ours, has reduced the cost of sequencing by a factor of more than 10,000 and reduced the sequencing time per Gb by a factor of approximately 12,000 over the last 20 years. Consequently, demand for sequencing-related products and services has increased substantially as new applications are enabled and more sequencing is done in connection with existing applications. If, as we expect, the cost of sequencing continues to fall, we cannot be sure that the demand for related products and services will increase at least proportionately as new applications are enabled or more sequencing is done in connection with existing applications. In the future, if demand for our products and services due to lower sequencing costs is less than we expect, our business, financial condition, and results of operations will be adversely affected.

Our products may be used to provide genetic information about humans, agricultural crops, other food sources, and other living organisms. The information obtained from our products could be used in a variety of applications, which may have underlying ethical, legal, and social concerns regarding privacy and the appropriate uses of the resulting information, including preimplantation genetic screening of embryos, prenatal genetic testing, genetic engineering or modification of agricultural products, or testing genetic predisposition for certain medical conditions, particularly for those that have no known cure. Our customers’ implementation of our products to provide their own products and services may raise such concerns and affect our own reputation. U.S. and international governmental authorities could, for social or other purposes, call for limits on or regulation of the use of genetic testing or prohibit testing for genetic predisposition to certain conditions, particularly for those that have no known cure. Similarly, such concerns may lead individuals to refuse to use genetics tests, even if permissible. These and other ethical, legal, and social concerns about genetic testing may limit market acceptance of our technology for certain applications or reduce the potential markets for our technology, either of which could have an adverse effect on our business, financial condition, or results of operations.

We face intense competition, which could render our products obsolete, result in significant price reductions, or substantially limit the volume of products that we sell.

We compete with third parties that design, manufacture, and market products and services for analysis of genetic variation and biological function and other applications using a wide range of technologies. We have faced, and expect to continue to face, increased pricing pressure from competitors who offer sequencing products and we have experienced lengthened sales cycles with many customers due to competition. In some cases, we compete for the resources our customers allocate for purchasing a wide range of sequencing and non-sequencing products, some of which are complementary or adjacent to our own but not directly competitive; in other cases, our products face direct

competition as customers choose among sequencing and non-sequencing products that are designed to address the same use case or answer the same biological question. For example, complementary third-party sequencing technologies address use cases to which our products are not as well suited. If we are unable to develop or acquire new technologies that address these complementary sequencing applications, our rate of growth and our ability to grow the overall market for sequencing could be adversely affected.

We anticipate that we will continue to face increased competition as existing companies develop new or improved products and as new companies enter the market with new technologies. One or more of our competitors may render one or more of our technologies obsolete or uneconomical. Some of our competitors have greater financial and personnel resources, broader product lines, more focused product lines, a more established customer base, more experience and broader reach in clinical markets, and more experience in research and development than we do. Furthermore, life sciences, clinical genomics, and pharmaceutical companies, which are our potential customers and strategic partners, could also develop competing products. We believe that customers in our markets display a significant amount of loyalty to their initial supplier of a particular product; therefore, it may be difficult to generate sales to potential customers who have purchased products from competitors. To the extent we are unable to be the first to develop or supply new products, our competitive position may suffer.

The market for clinical and diagnostic products, in particular, is currently limited and highly competitive, with several large companies having significant market share, intellectual property portfolios, and regulatory expertise. For example, the market for noninvasive prenatal testing is rapidly developing, and if our competitors are able to develop and commercialize products superior to or less expensive than ours or are able to obtain regulatory clearances before we do, our business could be adversely impacted. Established clinical and diagnostic companies also have an installed base of instruments in several markets, including clinical and reference laboratories, which could deter acceptance of our products. In addition, some of these companies have formed alliances with genomics companies that provide them access to genetic information that may be incorporated into their diagnostic tests, potentially creating a competitive advantage for them.

China’s Ministry of Commerce has added Illumina to its List of Unreliable Entities, which could result in fines or restrictions on our ability to do business in China and could have a material adverse effect on our revenue and results of operations.

On February 4, 2025, China’s Ministry of Commerce (MOFCOM) announced that it had added Illumina to its List of Unreliable Entities under the Provisions of the List of Unreliable Entities (the UEL Provisions). Under the UEL Provisions, potential penalties for companies placed on the List of Unreliable Entities can include monetary fines, restrictions or prohibitions on the sale of goods in China, engaging in import and export activities related to China, making investments in, or extracting investments from, China, denial of entry of our relevant personnel into China, restrictions or revocation of work permits, stay or residence status of our relevant personnel in China, or other measures.

MOFCOM has not announced what penalties will be imposed on us and we cannot currently predict the duration of our inclusion on the List of Unreliable Entities or any actions that may ultimately be taken by MOFCOM. The decision to place us on the List of Unreliable Entities and any future decision to take action to impose and enforce penalties or restrictions against us could have a material adverse effect on our revenue and results of operations. Furthermore, if, as a result of any such penalties or restrictions, we were to cease entirely or curtail operations in China, we could incur material impairment charges related to any such exit or disposal activities. Our revenue from the Greater China region, which includes China, Taiwan, and Hong Kong, was $308 million in 2024. See note 3. Revenue. If we do not successfully manage the development, manufacturing, and launch of new products or services, including product transitions, our financial results could be adversely affected.

We face risks associated with launching new products and pre-announcing products and services when the products or services have not been fully developed or tested. In addition, we may experience difficulty in managing or forecasting customer reactions, purchasing decisions, transition requirements, or programs with respect to newly-launched products (or products in development), which could adversely affect sales of our existing products. If our products and services are not able to deliver the performance or results expected by our target markets or are not delivered on a timely basis, our reputation and credibility may suffer. If we encounter development challenges or discover errors in our products late in our development cycle, we may delay the product launch date. The expenses or losses associated with unsuccessful product development or launch activities, or a lack of market acceptance of our new products, could adversely affect our business, financial condition, or results of operations.

As we announce future products or integrate new products into our portfolio, such as new instruments or instrument platforms, we face numerous risks relating to product transitions and the evolution of our product portfolio. We may be unable to accurately forecast new product demand and the impact of new products on the demand for current or established products. We may experience challenges relating to managing excess and obsolete inventories, managing new or higher product cost structures, and managing different sales and support requirements. Announcements of currently planned or other new products may cause customers to defer or stop purchasing our current or established products until new products become available. In addition, customers may defer or stop purchasing our current or established products as they assess the features and technological characteristics of new products, as compared to our current or established products, before making a financial commitment.

Our continued growth is dependent on continuously developing and commercializing new products.

Our target markets are characterized by rapid technological change, changes in customer needs, existing and emerging competition, strong price competition, and frequent new product introductions. Accordingly, our continued growth depends on developing and commercializing new products and services, including improving our existing products and services, in order to address evolving market requirements on a timely basis. If we fail to innovate or adequately invest in new technologies, we could lose our competitive position in the markets that we serve.

To the extent that we fail to introduce new and innovative products, or such products are not accepted in the market or suffer significant delays in development, our financial results may suffer. An inability, for technological or other reasons, to successfully develop and introduce new products on a timely basis could reduce our growth rate or otherwise have an adverse effect on our business.

In the past, we have experienced, and are likely to experience in the future, delays in the development and introduction of new products. There can be no assurance that we will keep pace with the rapid rate of change in our markets or that our new products will adequately meet the requirements of the marketplace, achieve market acceptance, or compete successfully with third-party technologies. Some of the factors affecting our ability to develop and successfully commercialize new products and services include:

•the functionality and performance of new and existing products and services;

•the timing of introduction of new products or services relative to competing products and services;

•availability, quality, and price relative to competing products and services;

•scientists’ and customers’ opinions of the utility of new products or services;

•citation of new products or services in published research;

•regulatory trends and approvals; and

•our ability to acquire or otherwise gain access to third party technologies, products, or businesses.

As we develop, market, or sell diagnostic tests, we may encounter delays in receipt, or limits in the amount, of reimbursement approvals and public health funding, which will impact our ability to grow revenues in the healthcare market.

Physicians and patients may not order diagnostic tests that we develop, market, sell, or enable, such as our prenatal tests, unless third-party payors, such as managed care organizations as well as government payors such as Medicare and Medicaid and governmental payors outside of the United States, pay a substantial portion of the test price. Third-party payors are often reluctant to reimburse healthcare providers for the use of medical tests that involve new technologies or provide novel diagnostic information. In addition, third-party payors are increasingly limiting reimbursement coverage for medical diagnostic products and, in many instances, are exerting pressure on diagnostic product suppliers to reduce their prices. Reimbursement by a payor may depend on a number of factors, including a payor's determination that tests using our technologies are: not experimental or investigational; medically necessary; appropriate for the specific patient; cost-effective; supported by peer-reviewed publications; and included in clinical practice guidelines.

Since each third-party payor often makes independent reimbursement decisions and may also make decisions on an individual patient basis, obtaining such approvals is a time-consuming and costly process that requires Illumina and/or our customers to provide scientific and clinical data supporting the clinical benefits of each of our products. As a result, there can be no assurance that reimbursement approvals will be obtained. This process can delay the broad market introduction of new products, and could have a negative effect on our results of operations. As a result, third-party reimbursement may not be consistent or financially adequate to cover the cost of diagnostic products that we develop, market, or sell. This could limit our ability to sell our products or cause us to reduce prices, which would adversely affect our results of operations.

Even if tests are reimbursed, third-party payors may withdraw their coverage policies, cancel their contracts with our customers at any time, review and adjust the rate of reimbursement, require co-payments from patients, or stop paying for tests, which would reduce our revenues. In addition, insurers, including managed care organizations as well as government payors such as Medicare and Medicaid, have increased their efforts to control the cost, utilization, and delivery of healthcare services. These measures have resulted in reduced payment rates and decreased utilization for the clinical laboratory industry. Reductions in the reimbursement rate of payors may occur in the future. Reductions in the prices at which our tests are reimbursed could have a negative impact on our results of operations.

Uncertainties with respect to the development, deployment, and use of artificial intelligence in our business and products may result in harm to our business and reputation.

We have incorporated, and expect to continue to incorporate, artificial intelligence (AI) into our business activities and our product and service offerings. As with many innovations, AI presents risks and challenges that could adversely impact our business. The development, adoption, and use of AI technologies are still in their early stages and ineffective or inadequate AI development or deployment practices could result in unintended consequences. For example, AI algorithms may be flawed or may be based on datasets that are biased or insufficient. In addition, any disruption or failure in the AI functionality we incorporate into our business activities, products or services could adversely impact our business or result in delays or errors in our offerings. Conversely, any failure to successfully develop and deploy AI in our business activities, products and services could adversely affect our competitiveness (particularly if our competitors successfully deploy AI in their businesses, products, and services), and the development and deployment of AI will require additional investment and increase our costs. There also may be real or perceived social harm, unfairness, or other outcomes that undermine public confidence in the use and deployment of AI. Any of the foregoing may result in decreased demand for our products or harm to our reputation, business, financial condition, or results of operations.

The legal and regulatory landscape surrounding AI technologies is rapidly evolving and uncertain, including in the areas of intellectual property, cybersecurity, and privacy and data protection. Compliance with new or changing laws, regulations or industry standards relating to AI may impose significant costs and may limit our ability to develop, deploy, or use AI technologies. Failure to appropriately respond to this evolving landscape may result in legal liability, regulatory action, or brand and reputational harm.

Risks Relating to Supply Chain, Manufacturing, and Quality

We depend on third-party manufacturers and suppliers for some of our products, or sub-assemblies, components, and materials used in our products, and if shipments from these manufacturers or suppliers are delayed or interrupted, or if the quality of the products, components, or materials supplied do not meet our requirements, we may not be able to launch, manufacture, or ship our products in a timely manner, or at all.

The complex nature of our products requires customized, precision-manufactured sub-assemblies, components, and materials that currently are available from a limited number of sources, and, in the case of some sub-assemblies, components, and materials, from only a single source. If deliveries from these vendors are delayed or interrupted for any reason, or if we are otherwise unable to secure a sufficient supply, we may not be able to obtain these sub-assemblies, components, or materials on a timely basis or in sufficient quantities or at satisfactory qualities. We may need to enter into contractual relationships with manufacturers for commercial-scale production of some of our products, in whole or in part, or develop these capabilities internally, and there can be no assurance that we will be able to do this on a timely basis, in sufficient quantities, satisfactory quality, or on commercially reasonable terms. In addition, the lead time needed to establish a relationship with a new supplier, and qualify their supply, can be lengthy, and we may experience delays in meeting demand in the event we must switch to a new supplier. The time and effort required to qualify a new supplier could result in additional costs, diversion of resources, or reduced manufacturing yields, any of which would negatively impact our operating results. Accordingly, we may not be able to establish or maintain reliable, high-volume manufacturing at commercially reasonable costs. In addition, the manufacture or

shipment of our products may be delayed or interrupted if the quality of the products, sub-assemblies, components, or materials supplied by our vendors does not meet our requirements. Current or future social and environmental regulations or critical issues, such as those relating to the sourcing of minerals from conflict-affected areas such as the Democratic Republic of the Congo or the need to eliminate environmentally sensitive materials from our products, could restrict the supply of components and materials used in production or increase our costs. Any delay or interruption to our manufacturing process or in shipping our products could result in lost revenue, which would adversely affect our business, financial condition, or results of operations.

In the past, defects have been discovered in our products, as a result of which we have incurred costs and our products have been subject to recalls. If defects are discovered in our products in the future, we may incur additional unforeseen costs, our products may be subject to recalls, customers may not purchase our products, our reputation may suffer, and ultimately our sales and operating earnings could be negatively impacted.

Our products incorporate complex, precision-manufactured mechanical parts, electrical components, optical components, and fluidics, as well as computer software and complex surface chemistry, biochemistry and reagents, any of which may contain or result in errors or failures, especially when first introduced. In the course of conducting our business, we must adequately address quality issues associated with our products and services, including defects in our engineering, software development, product cybersecurity, design, and manufacturing processes, as well as defects in third-party components included in our products. In addition, new products or enhancements may contain undetected errors or performance problems that, despite testing, are discovered only after commercial shipment. Defects or errors in our products have resulted in shipment holds, product recalls, negative publicity and adverse financial impacts in the past. The costs incurred in correcting any defects or errors may be substantial and could adversely affect our operating margins. Identifying the root cause of quality issues, particularly those affecting reagents and third-party components, may be difficult, which increases the time needed to address quality issues as they arise, and increases the risk that similar problems could recur. Because our products are designed to be used to perform complex genomic analysis and our instruments can be, and often are, connected to the internet, which presents product cybersecurity risk, we expect that our customers will have an increased sensitivity to such defects. If we do not meet applicable regulatory or quality standards, our products may be, and in the past have been, subject to recall, and, under certain circumstances, we may be required to, and have in the past been required to, notify applicable regulatory authorities about a recall. Quality issues may also result in, and have in the past resulted in, additional regulatory and governmental scrutiny. If our products are subject to recall or shipment holds, our reputation, business, financial condition, or results of operations could be adversely affected.

If we are unable to increase our manufacturing or service capacity and develop and maintain operation of our manufacturing or service capability, we may not be able to launch or support our products or services in a timely manner, or at all.