UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

[ X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2011

OR

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number 1-16417

NUSTAR ENERGY L.P.

(Exact name of registrant as specified in its charter)

|

| | |

| Delaware | | 74-2956831 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | | |

| 2330 North Loop 1604 West | | 78248 |

| San Antonio, Texas | | (Zip Code) |

| (Address of principal executive offices) | | |

Securities registered pursuant to Section 12(b) of the Act: Common units representing partnership interests listed on the New York Stock Exchange.

Securities registered pursuant to 12(g) of the Act: None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [X] No [ ]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes [ ] No [X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [X] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule12b-2 of the Exchange Act:

|

| | | | | | |

| Large accelerated filer | | [X] | | Accelerated filer [ ] |

| | | | |

| Non-accelerated filer | | [ ] (Do not check if a smaller reporting company) | | Smaller reporting company | | [ ] |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [ ] No [X]

The aggregate market value of the common units held by non-affiliates was approximately $3,517 million based on the last sales price quoted as of June 30, 2011, the last business day of the registrant’s most recently completed second quarter.

The number of common units outstanding as of January 31, 2012 was 70,756,078.

TABLE OF CONTENTS

|

| | |

| PART I |

| Items 1., 1A. & 2. | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Item 1B. | | |

| | | |

| Item 3. | | |

| | | |

| Item 4. | | |

| |

| PART II |

| Item 5. | | |

| | | |

| Item 6. | | |

| | | |

| Item 7. | | |

| | | |

| Item 7A. | | |

| | | |

| Item 8. | | |

| | | |

| Item 9. | | |

| | | |

| Item 9A. | | |

| | | |

| Item 9B. | | |

| |

| PART III |

| Item 10. | | |

| | | |

| Item 11. | | |

| | | |

| Item 12. | | |

| | | |

| Item 13. | | |

| | | |

| Item 14. | | |

| |

| PART IV |

| Item 15. | | |

| | |

| |

PART I

Unless otherwise indicated, the terms “NuStar Energy L.P.,” “the Partnership,” “we,” “our” and “us” are used in this report to refer to NuStar Energy L.P., to one or more of our consolidated subsidiaries or to all of them taken as a whole. In the following Items 1., 1A. and 2., “Business, Risk Factors and Properties,” we make certain forward-looking statements, including statements regarding our plans, strategies, objectives, expectations, intentions and resources. The words “forecasts,” “intends,” “believes,” “expects,” “plans,” “scheduled,” “goal,” “may,” “anticipates,” “estimates” and similar expressions identify forward-looking statements. We do not undertake to update, revise or correct any of the forward-looking information. You are cautioned that such forward-looking statements should be read in conjunction with our disclosures beginning on page 37 of this report under the heading: “CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION.”

ITEM 1. BUSINESS, RISK FACTORS AND PROPERTIES

OVERVIEW

NuStar Energy L.P. (NuStar Energy), a Delaware limited partnership, completed its initial public offering of common units on April 16, 2001. Our common units are traded on the New York Stock Exchange (NYSE) under the symbol “NS.” Our principal executive offices are located at 2330 North Loop 1604 West, San Antonio, Texas 78248 and our telephone number is (210) 918-2000.

We are engaged in the terminalling and storage of petroleum products, the transportation of petroleum products and anhydrous ammonia, and petroleum refining and marketing. We divide our operations into the following three reportable business segments: storage, transportation, and asphalt and fuels marketing. As of December 31, 2011, our assets included:

| |

| • | 66 terminal and storage facilities providing 84.6 million barrels of storage capacity; |

| |

| • | 5,480 miles of refined product pipelines with 21 associated terminals providing storage capacity of 4.5 million barrels and two tank farms providing storage capacity of 1.2 million barrels; |

| |

| • | 2,000 miles of anhydrous ammonia pipelines; |

| |

| • | 940 miles of crude oil pipelines with 1.9 million barrels of associated storage capacity; |

| |

| • | two asphalt refineries with a combined throughput capacity of 104,000 barrels per day and two associated terminal facilities with a combined storage capacity of 5.0 million barrels; and |

| |

| • | a fuels refinery with a throughput capacity of 14,500 barrels per day and 0.4 million barrels of aggregate storage capacity. |

We conduct our operations through our wholly owned subsidiaries, primarily NuStar Logistics, L.P. (NuStar Logistics) and NuStar Pipeline Operating Partnership L.P. (NuPOP). Our revenues include:

| |

| • | tariffs for transporting crude oil, refined products and anhydrous ammonia through our pipelines; |

| |

| • | fees for the use of our terminal and storage facilities and related ancillary services; and |

| |

| • | sales of asphalt and other refined petroleum products. |

Our business strategy is to increase per unit cash distributions to our partners through:

| |

| • | continuous improvement of our operations by improving safety and environmental stewardship, cost controls and asset reliability and integrity; |

| |

| • | internal growth through enhancing the utilization of our existing assets by expanding our business with current and new customers, as well as investments in strategic expansion projects; |

| |

| • | external growth from acquisitions that meet our financial and strategic criteria; |

| |

| • | identification of non-core assets that do not meet our financial and strategic criteria and evaluation of potential dispositions; |

| |

| • | complementary operations such as our fuels marketing operations, which provide us the opportunity to optimize the use and profitability of our assets; and |

| |

| • | growth and improvement of our asphalt operations to benefit from anticipated decreases in overall asphalt supply and higher asphalt margins. |

The term “throughput” as used in this document generally refers to the crude oil or refined product barrels or tons of ammonia, as applicable, that pass through our pipelines, terminals, storage tanks or refineries.

Our internet website address is http://www.nustarenergy.com. Information contained on our website is not part of this report. Our annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K filed with (or furnished to)

the Securities and Exchange Commission (SEC) are available on our internet website, free of charge, as soon as reasonably practicable after we file or furnish such material (select the “Investors” link, then the “Financial Reports SEC Filings” link). We also post our corporate governance guidelines, code of business conduct and ethics, code of ethics for senior financial officers and the charters of our board’s committees on our internet website free of charge (select the “Investors” link, then the “Corporate Governance” link). Our governance documents are available in print to any unitholder that makes a written request to Corporate Secretary, NuStar Energy L.P., 2330 North Loop 1604 West, San Antonio, Texas 78248.

RECENT DEVELOPMENTS

On December 9, 2011, we issued 6,037,500 common units representing limited partner interests at a price of $53.45 per unit. We used the net proceeds from this offering of $318.0 million, including a contribution of $6.6 million from our general partner to maintain its 2% general partner interest, mainly to reduce outstanding borrowings under our five-year revolving credit agreement.

On April 19, 2011, we purchased certain refining and storage assets, inventory and other working capital items from AGE Refining, Inc. for $62.0 million, including the assumption of certain environmental liabilities. The assets consist of a 14,500 barrel per day refinery in San Antonio, Texas and 0.4 million barrels of aggregate storage capacity.

On February 9, 2011, we acquired 75% of the outstanding capital of a Turkish company, which owns two terminals in Mersin,

Turkey, with an aggregate 1.3 million barrels of storage capacity, for approximately $57.0 million. Both terminals are connected via pipelines to an offshore platform located approximately three miles off the Mediterranean Sea coast.

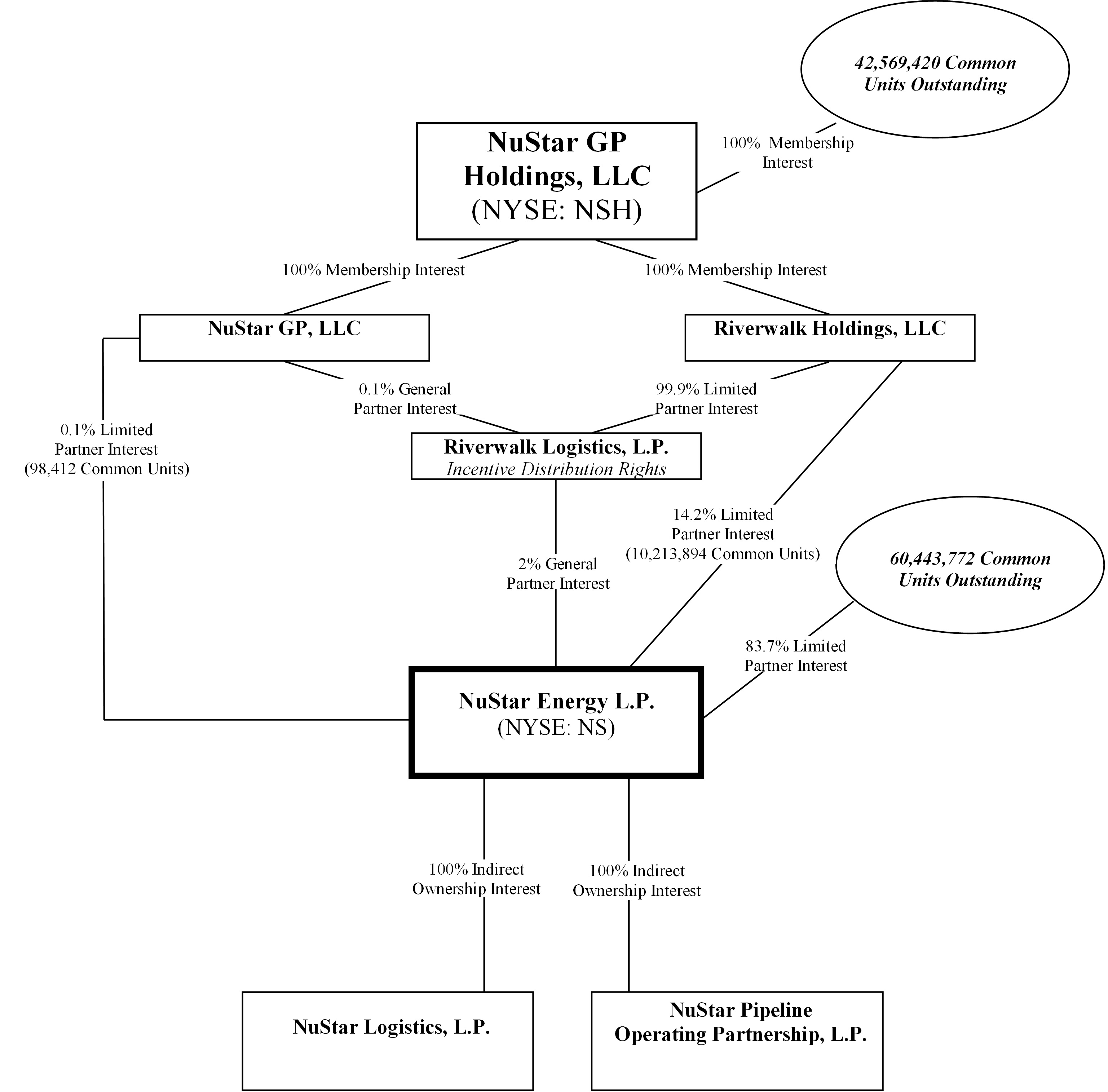

ORGANIZATIONAL STRUCTURE

Our operations are managed by NuStar GP, LLC, the general partner of our general partner. NuStar GP, LLC, a Delaware limited liability company, is a consolidated subsidiary of NuStar GP Holdings, LLC (NuStar GP Holdings) (NYSE: NSH).

The following chart depicts our organizational structure at December 31, 2011.

SEGMENTS

Our three reportable business segments are storage, transportation, and asphalt and fuels marketing. Detailed financial information about our segments is included in Note 23 in the Notes to Consolidated Financial Statements in Item 8. “Financial Statements and Supplementary Data.”

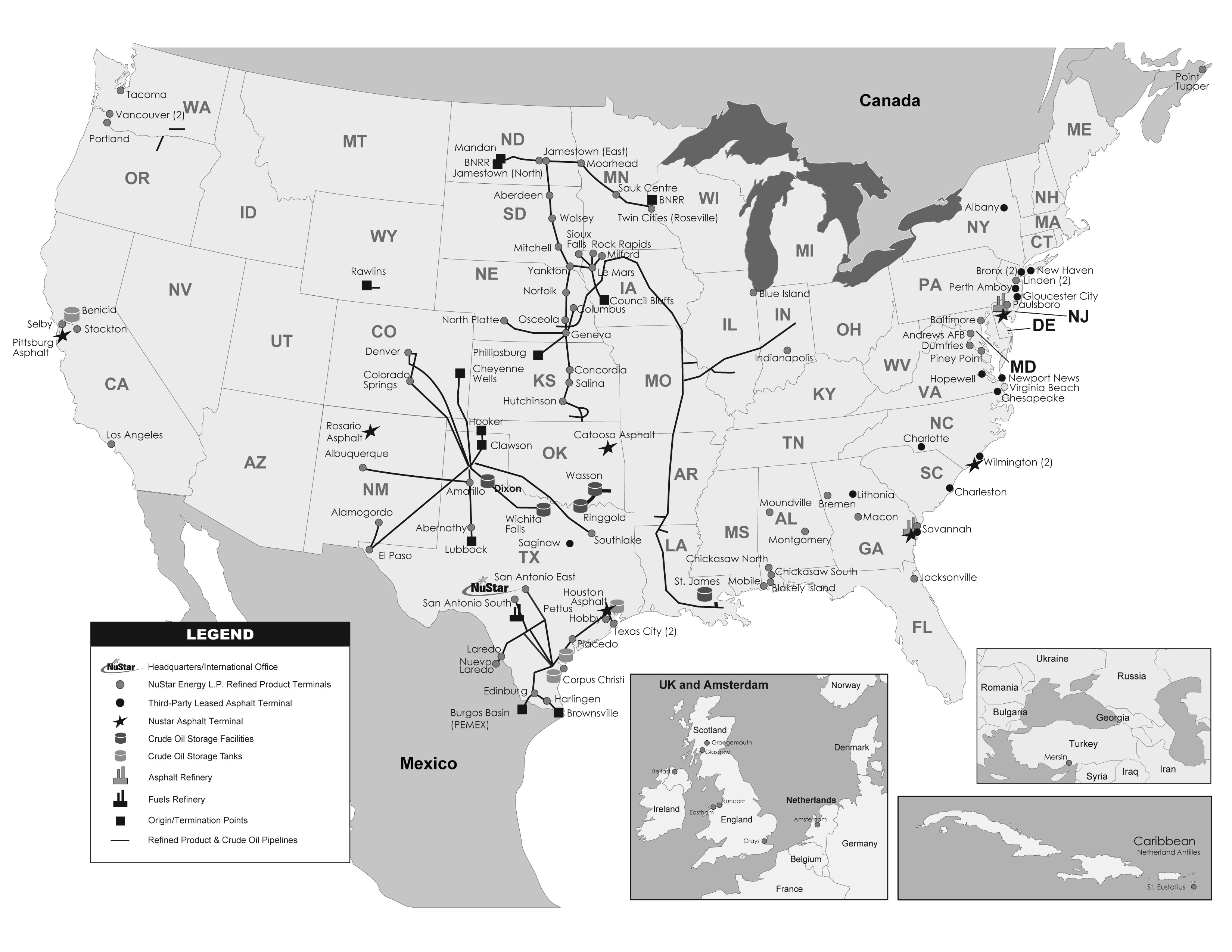

The following map depicts our operations at December 31, 2011.

STORAGE

Our storage segment includes terminal and storage facilities that provide storage, handling and other services for petroleum products, specialty chemicals, crude oil and other liquids and storage tanks used to store and deliver crude oil. As of December 31, 2011, we owned and operated:

| |

| • | 54 terminal and storage facilities in the United States, with total storage capacity of 53.4 million barrels; |

| |

| • | A terminal on the island of St. Eustatius with tank capacity of 13.0 million barrels and a transshipment facility; |

| |

| • | A terminal located in Point Tupper with tank capacity of 7.4 million barrels and a transshipment facility; |

| |

| • | Six terminals located in the United Kingdom and one terminal located in Amsterdam, the Netherlands, with total storage capacity of approximately 5.6 million barrels; |

| |

| • | Two terminals in Mersin, Turkey with total storage capacity of 1.3 million barrels; and |

| |

| • | A terminal located in Nuevo Laredo, Mexico. |

Description of Largest Terminal Facilities

St. Eustatius. We own and operate a 13.0 million barrel petroleum storage and terminalling facility located on the island of St. Eustatius in the Caribbean (formerly the Netherlands Antilles), which is located at a point of minimal deviation from major shipping routes. This facility is capable of handling a wide range of petroleum products, including crude oil and refined products, and it can accommodate the world’s largest tankers for loading and discharging crude oil and other petroleum products. A two-berth jetty, a two-berth monopile with platform and buoy systems, a floating hose station and an offshore single point mooring buoy with loading and unloading capabilities serve the terminal’s customers’ vessels. The fuel oil and petroleum product facilities have in-tank and in-line blending capabilities, while the crude tanks have tank-to-tank blending capability and in-tank mixers. In addition to the storage and blending services at St. Eustatius, this facility has the flexibility to utilize certain storage capacity for both feedstock and refined products to support our atmospheric distillation unit. This unit is capable of processing up to 25,000 barrels per day of feedstock, ranging from condensates to heavy crude oil. We own and operate all of the berthing facilities at the St. Eustatius terminal. Separate fees apply for the use of the berthing facilities, as well as associated services, including pilotage, tug assistance, line handling, launch service, emergency response services and other ship services.

St. James, Louisiana. Our St. James terminal has a total storage capacity of 8.2 million barrels. Additionally, the facility has a rail-loading facility and three docks with barge and ship access. The facility is located on almost 900 acres of land, some of which is undeveloped.

Point Tupper. We own and operate a 7.4 million barrel terminalling and storage facility located at Point Tupper on the Strait of Canso, near Port Hawkesbury, Nova Scotia, which is located approximately 700 miles from New York City and 850 miles from Philadelphia. This facility is the deepest independent, ice-free marine terminal on the North American Atlantic coast, with access to the East Coast, Canada and the Midwestern United States via the St. Lawrence Seaway and the Great Lakes system. With one of the premier jetty facilities in North America, the Point Tupper facility can accommodate substantially all of the world’s largest, fully laden very large crude carriers and ultra large crude carriers for loading and discharging crude oil, petroleum products and petrochemicals. Crude oil and petroleum product movements at the terminal are fully automated. Separate fees apply for the use of the jetty facility, as well as associated services, including pilotage, tug assistance, line handling, launch service, spill response services and other ship services.

Piney Point, Maryland. Our terminal and storage facility in Piney Point is located on approximately 400 acres on the Potomac River. The Piney Point terminal has 5.4 million barrels of storage capacity and is the closest deep-water facility to Washington, D.C. This terminal competes with other large petroleum terminals in the East Coast water-borne market extending from New York Harbor to Norfolk, Virginia. The terminal currently stores petroleum products consisting primarily of fuel oils and asphalt. The terminal has a dock with a 36-foot draft for tankers and four berths for barges. It also has truck-loading facilities, product-blending capabilities and is connected to a pipeline that supplies residual fuel oil to two power generating stations.

Amsterdam. Our Amsterdam terminal has a total storage capacity of 3.8 million barrels. This facility is located at the Port of Amsterdam and primarily stores petroleum products including gasoline, diesel and fuel oil. This facility has two docks for vessels and five docks for inland barges.

Linden, New Jersey. We own 50% of ST Linden Terminal LLC, which owns a terminal and storage facility in Linden, New Jersey. The terminal is located on a 44-acre facility that provides it with deep-water terminalling capabilities at New York Harbor. This terminal primarily stores petroleum products, including gasoline, jet fuel and fuel oils. The facility has a total storage capacity of 4.0 million barrels and can receive and deliver products via ship, barge and pipeline. The terminal includes two docks and leases a third with draft limits of 36, 26 and 20 feet, respectively.

Terminal and Storage Facilities

The following table sets forth information about our terminal and storage facilities as of December 31, 2011:

|

| | | | |

| Facility | Tank Capacity | | Primary Products Handled |

| | (Barrels) | | |

| U.S. Terminals and Storage Facilities: | | | |

| Mobile, AL (Blakely Island) | 1,100,000 |

| | Crude oil and feedstocks |

| Mobile, AL (Chickasaw North) | 294,000 |

| | Crude oil and feedstocks |

| Mobile, AL (Chickasaw South) | 286,000 |

| | Crude oil and feedstocks |

| Montgomery, AL | 162,000 |

| | Petroleum products |

| Moundville, AL | 310,000 |

| | Petroleum products |

| Los Angeles, CA | 606,000 |

| | Petroleum products |

| Benicia, CA (refinery tankage) | 3,815,000 |

| | Crude oil and feedstocks |

| Pittsburg, CA | 361,000 |

| | Asphalt |

| Selby, CA | 2,829,000 |

| | Petroleum products, ethanol |

| Stockton, CA | 676,000 |

| | Petroleum products, ethanol, fertilizer |

| Colorado Springs, CO | 320,000 |

| | Petroleum products, ethanol |

| Denver, CO | 100,000 |

| | Petroleum products, ethanol |

| Jacksonville, FL | 2,505,000 |

| | Petroleum products, asphalt |

| Bremen, GA | 178,000 |

| | Petroleum products |

| Macon, GA (a) | 307,000 |

| | Petroleum products |

| Savannah, GA | 857,000 |

| | Petroleum products, chemicals |

| Blue Island, IL | 719,000 |

| | Petroleum products, ethanol |

| Indianapolis, IN | 366,000 |

| | Petroleum products |

| St. James, LA | 8,196,000 |

| | Crude oil and feedstocks |

| Andrews AFB, MD (a) | 72,000 |

| | Petroleum products |

| Baltimore, MD | 809,000 |

| | Chemicals, asphalt, petroleum products |

| Piney Point, MD | 5,404,000 |

| | Petroleum products, asphalt |

| Wilmington, NC | 304,000 |

| | Asphalt |

| Linden, NJ | 353,000 |

| | Petroleum products |

| Linden, NJ (b) | 3,957,000 |

| | Petroleum products |

| Paulsboro, NJ | 69,000 |

| | Petroleum products |

| Alamogordo, NM (a) | 120,000 |

| | Petroleum products |

| Albuquerque, NM | 245,000 |

| | Petroleum products, ethanol |

| Rosario, NM | 160,000 |

| | Asphalt |

| Catoosa, OK | 340,000 |

| | Asphalt |

| Portland, OR | 1,203,000 |

| | Petroleum products, ethanol |

| Abernathy, TX | 155,000 |

| | Petroleum products |

| Amarillo, TX | 260,000 |

| | Petroleum products |

| Corpus Christi, TX | 327,000 |

| | Petroleum products |

| Corpus Christi, TX (North Beach) | 1,600,000 |

| | Crude oil and feedstocks |

| Corpus Christi, TX (refinery tankage) | 4,023,000 |

| | Crude oil and feedstocks |

| Edinburg, TX | 267,000 |

| | Petroleum products |

| El Paso, TX (c) | 343,000 |

| | Petroleum products, ethanol |

| Harlingen, TX | 281,000 |

| | Petroleum products |

| Houston, TX (Hobby Airport) | 106,000 |

| | Petroleum products |

| Houston, TX | 90,000 |

| | Asphalt |

|

| | | | |

| Facility | Tank Capacity | | Primary Products Handled |

| | (Barrels) | | |

| Laredo, TX | 215,000 |

| | Petroleum products |

| Placedo, TX | 97,000 |

| | Petroleum products |

| San Antonio (east), TX | 150,000 |

| | Petroleum products |

| San Antonio (south), TX | 215,000 |

| | Petroleum products |

| Southlake, TX | 575,000 |

| | Petroleum products, ethanol |

| Texas City, TX | 125,000 |

| | Petroleum products |

| Texas City, TX | 2,775,000 |

| | Chemicals, petroleum products |

| Texas City, TX (refinery tankage) | 3,087,000 |

| | Crude oil and feedstocks |

| Dumfries, VA | 544,000 |

| | Petroleum products, asphalt |

| Virginia Beach, VA (a) | 41,000 |

| | Petroleum products |

| Tacoma, WA | 359,000 |

| | Petroleum products, ethanol |

| Vancouver, WA | 328,000 |

| | Chemicals |

| Vancouver, WA | 408,000 |

| | Petroleum products |

| Total U.S. | 53,394,000 |

| | |

| | | | |

| Foreign Terminals and Storage Facilities: | | | |

| St. Eustatius, the Netherlands | 12,986,000 |

| | Petroleum products, crude oil and feedstocks |

| Amsterdam, the Netherlands | 3,848,000 |

| | Petroleum products |

| Point Tupper, Canada | 7,354,000 |

| | Petroleum products, crude oil and feedstocks |

| Grays, England | 1,956,000 |

| | Petroleum products |

| Eastham, England | 2,156,000 |

| | Chemicals, petroleum products |

| Runcorn, England | 145,000 |

| | Molten sulfur |

| Grangemouth, Scotland | 555,000 |

| | Petroleum products, chemicals |

| Glasgow, Scotland | 360,000 |

| | Petroleum products |

| Belfast, Northern Ireland | 440,000 |

| | Petroleum products |

| Mersin, Turkey (d) | 740,000 |

| | Petroleum products |

| Mersin, Turkey (d) | 606,000 |

| | Petroleum products |

| Nuevo Laredo, Mexico | 34,000 |

| | Petroleum products |

| Total Foreign | 31,180,000 |

| | |

| | | | |

| Total Terminals and Storage Facilities | 84,574,000 |

| | |

| |

| (a) | Terminal facility also includes pipelines to U.S. government military base locations. |

| |

| (b) | We own 50% of this terminal through a joint venture. |

| |

| (c) | We own a 66.67% undivided interest in the El Paso refined product terminal. The tankage capacity and number of tanks represent the proportionate share of capacity attributable to our ownership interest. |

| |

| (d) | We own 75% of the outstanding capital of a Turkish company, which owns two terminals in Mersin, Turkey. |

Storage Operations

Revenues for the storage segment include fees for tank storage agreements, in which a customer agrees to pay for a certain amount of storage in a tank over a period of time (storage lease revenues), and throughput agreements, in which a customer pays a fee per barrel for volumes moving through our terminals (throughput revenues). Our terminals also provide blending, additive injections, handling and filtering services. We charge a fee for each barrel of crude oil and certain other feedstocks that we deliver to Valero Energy Corporation's (Valero Energy) Benicia, Corpus Christi West and Texas City refineries from our crude oil storage tanks. Our facilities at Point Tupper and St. Eustatius charge fees to provide services such as pilotage, tug assistance, line handling, launch service, spill response services and other ship services.

Demand for Refined Petroleum Products

The operations of our refined product terminals depend in large part on the level of demand for products stored in our terminals in the markets served by those assets. The majority of products stored in our terminals are refined petroleum products. Demand for our terminalling services will generally increase or decrease with demand for refined petroleum products, and demand for refined petroleum products tends to increase or decrease with the relative strength of the economy.

Customers

We provide storage and terminalling services for crude oil and refined petroleum products to many of the world’s largest producers of crude oil, integrated oil companies, chemical companies, oil traders and refiners. In addition, our blending capabilities in our storage assets have attracted customers who have leased capacity primarily for blending purposes. The largest customer of our storage segment is Valero Energy, which accounted for approximately 20% of the total revenues of the segment for the year ended December 31, 2011. No other customer accounted for more than 10% of the revenues of the segment for this period.

Competition and Business Considerations

Many major energy and chemical companies own extensive terminal storage facilities. Although such terminals often have the same capabilities as terminals owned by independent operators, they generally do not provide terminalling services to third parties. In many instances, major energy and chemical companies that own storage and terminalling facilities are also significant customers of independent terminal operators. Such companies typically have strong demand for terminals owned by independent operators when independent terminals have more cost-effective locations near key transportation links, such as deep-water ports. Major energy and chemical companies also need independent terminal storage when their owned storage facilities are inadequate, either because of size constraints, the nature of the stored material or specialized handling requirements.

Independent terminal owners generally compete on the basis of the location and versatility of terminals, service and price. A favorably located terminal will have access to various cost-effective transportation modes both to and from the terminal. Transportation modes typically include waterways, railroads, roadways and pipelines. Terminals located near deep-water port facilities are referred to as “deep-water terminals,” and terminals without such facilities are referred to as “inland terminals,” although some inland facilities located on or near navigable rivers are served by barges.

Terminal versatility is a function of the operator’s ability to offer complex handling requirements for diverse products. The services typically provided by the terminal include, among other things, the safe storage of the product at specified temperature, moisture and other conditions, as well as receipt at and delivery from the terminal, all of which must be in compliance with applicable environmental regulations. A terminal operator’s ability to obtain attractive pricing is often dependent on the quality, versatility and reputation of the facilities owned by the operator. Although many products require modest terminal modification, operators with versatile storage capabilities typically require less modification prior to usage, ultimately making the storage cost to the customer more attractive.

The main competition at our St. Eustatius and Point Tupper locations for crude oil handling and storage is from “lightering,” which involves transferring liquid cargo from larger vessels to smaller vessels, usually while at sea. The price differential between lightering and terminalling is primarily driven by the charter rates for vessels of various sizes. Lightering generally takes significantly longer than discharging at a terminal. Depending on charter rates, the longer charter period associated with lightering is generally offset by various costs associated with terminalling, including storage costs, dock charges and spill response fees. However, terminalling is generally safer and reduces the risk of environmental damage associated with lightering, provides more flexibility in the scheduling of deliveries and allows our customers to deliver their products to multiple locations. Lightering in U.S. territorial waters creates a risk of liability for owners and shippers of oil under the U.S. Oil Pollution Act of 1990 and other state and federal legislation. In Canada, similar liability exists under the Canadian Shipping Act. Terminalling also provides customers with the ability to access value-added terminal services.

Our crude oil storage tanks are physically integrated with and serve refineries owned by Valero Energy. Additionally, we have entered into various agreements with Valero Energy governing the usage of these tanks. As a result, we believe that we will not face significant competition for our services provided to those refineries.

TRANSPORTATION

Our pipeline operations consist of the transportation of refined petroleum products, crude oil and anhydrous ammonia. Refined product pipelines in Texas, Oklahoma, Colorado, New Mexico, Kansas, Nebraska, Iowa, South Dakota, North Dakota and Minnesota cover approximately 5,480 miles. Our crude oil pipelines in Texas, Oklahoma, Kansas, Colorado and Illinois cover 940 miles. Our anhydrous ammonia pipeline in Louisiana, Arkansas, Missouri, Illinois, Indiana, Iowa and Nebraska covers 2,000 miles. As of December 31, 2011, we owned and operated:

| |

| • | refined product pipelines with an aggregate length of 3,130 miles originating at Valero Energy’s McKee, Three Rivers and Corpus Christi refineries and terminating at certain of NuStar Energy’s terminals, or connecting to third-party pipelines or terminals for further distribution, including a 25-mile hydrogen pipeline (collectively, the Central West System); |

| |

| • | a 1,910-mile refined product pipeline originating in southern Kansas and terminating at Jamestown, North Dakota, with a western extension to North Platte, Nebraska and an eastern extension into Iowa (the East Pipeline); |

| |

| • | a 440-mile refined product pipeline originating at Tesoro Corporation’s Mandan, North Dakota refinery and terminating in Minneapolis, Minnesota (the North Pipeline); |

| |

| • | crude oil pipelines in Texas, Oklahoma, Kansas, Colorado and Illinois with an aggregate length of 940 miles and crude oil storage facilities providing 1.9 million barrels of storage capacity in Texas, Oklahoma and Colorado that are located along the crude oil pipelines; and |

| |

| • | a 2,000-mile anhydrous ammonia pipeline originating at the Louisiana delta area that travels north through the midwestern United States forking east and west to terminate in Nebraska and Indiana (the Ammonia Pipeline). |

We charge tariffs on a throughput basis for transporting refined products, crude oil, feedstocks and anhydrous ammonia.

Description of Pipelines

Central West System. The Central West System pipelines were constructed to support the refineries to which they are connected. These pipelines are physically integrated with and principally serve refineries owned by Valero Energy. The refined products transported in these pipelines include gasoline, distillates (including diesel and jet fuel), natural gas liquids and other products produced primarily by Valero Energy’s McKee, Three Rivers and Corpus Christi refineries. These pipelines deliver refined products to key markets in Texas, New Mexico and Colorado. The Central West System transported approximately 104.8 million barrels for the year ended December 31, 2011.

The following table lists information about each of our refined product pipelines included in the Central West System:

|

| | | | | | | | | | | |

| Origin and Destination | | Refinery | | Length | | Ownership | | Capacity |

| | | | | (Miles) | | | | (Barrels/Day) |

| McKee to El Paso, TX | | McKee | | 408 |

| | 67 | % | | 42,000 |

|

| McKee to Colorado Springs, CO | | McKee | | 256 |

| | 100 | % | | 32,500 |

|

| Colorado Springs, CO to Airport | | McKee | | 2 |

| | 100 | % | | 12,000 |

|

| Colorado Springs to Denver, CO | | McKee | | 101 |

| | 100 | % | | 32,000 |

|

| McKee to Denver, CO | | McKee | | 321 |

| | 30 | % | | 11,000 |

|

| McKee to Amarillo, TX (6”) (a) | | McKee | | 49 |

| | 100 | % | | 51,000 |

|

| McKee to Amarillo, TX (8”) (a) | | McKee | | 49 |

| | 100 | % | | |

| Amarillo to Abernathy, TX | | McKee | | 102 |

| | 67 | % | | 12,000 |

|

| Amarillo, TX to Albuquerque, NM | | McKee | | 293 |

| | 50 | % | | 17,000 |

|

| Abernathy to Lubbock, TX | | McKee | | 19 |

| | 46 | % | | 8,000 |

|

| McKee to Southlake, TX | | McKee | | 375 |

| | 100 | % | | 19,000 |

|

| Three Rivers to San Antonio, TX | | Three Rivers | | 81 |

| | 100 | % | | 33,500 |

|

Three Rivers to US/Mexico International Border near Laredo, TX | | Three Rivers | | 108 |

| | 100 | % | | 32,000 |

|

| Three Rivers to Corpus Christi, TX | | Three Rivers | | 72 |

| | 100 | % | | 15,000 |

|

| Three Rivers to Pettus to San Antonio, TX | | Three Rivers | | 103 |

| | 100 | % | | 27,500 |

|

| Three Rivers to Pettus, TX (b) | | Three Rivers | | 30 |

| | 100 | % | | N/A |

|

| El Paso, TX to Kinder Morgan | | McKee | | 12 |

| | 67 | % | | 65,500 |

|

| Corpus Christi to Pasadena, TX | | Corpus Christi | | 208 |

| | 100 | % | | 105,000 |

|

| Corpus Christi to Brownsville, TX | | Corpus Christi | | 194 |

| | 100 | % | | 45,000 |

|

US/Mexico International Border near Penitas, TX to Edinburg, TX | | N/A | | 33 |

| | 100 | % | | 24,000 |

|

| Clear Lake, TX to Texas City, TX | | N/A | | 25 |

| | 100 | % | | N/A |

|

| Other refined product pipeline (c) | | N/A | | 289 |

| | 50 | % | | N/A |

|

| Total | | | | 3,130 |

| | | | 584,000 |

|

| |

| (a) | The capacity information disclosed above for the McKee to Amarillo, Texas 6-inch pipeline reflects both McKee to Amarillo, Texas pipelines on a combined basis. |

| |

| (b) | The refined product pipeline from Three Rivers to Pettus, Texas is temporarily idled. The Pettus to Corpus Christi, Texas segment of this refined product pipeline was reactivated as a crude oil pipeline in the second quarter of 2011. |

| |

| (c) | This category consists of the temporarily idled 6-inch Amarillo, Texas to Albuquerque, New Mexico refined product pipeline. |

East Pipeline. The East Pipeline covers 1,910 miles, including 242 miles that are temporarily idled, and moves refined products and natural gas liquids north in pipelines ranging in diameter from 6 inches to 16 inches. The East Pipeline system also includes storage capacity of approximately 1.2 million barrels at our two tanks farms at McPherson and El Dorado, Kansas. The East Pipeline transports refined petroleum products and natural gas liquids to NuStar Energy and third party terminals along the system and to receiving pipeline connections in Kansas. Shippers on the East Pipeline obtain refined petroleum products from refineries in Kansas, Oklahoma and Texas. The East Pipeline transported approximately 51.9 million barrels for the year ended December 31, 2011.

North Pipeline. The North Pipeline originates at Tesoro’s Mandan, North Dakota refinery and runs from west to east approximately 440 miles from its origin to the Minneapolis, Minnesota area. For the year ended December 31, 2011, the North Pipeline transported approximately 15.3 million barrels.

Pipeline-Related Terminals. The East and North Pipelines also include 21 truck-loading terminals through which refined petroleum products are delivered to storage tanks and then loaded into petroleum product transport trucks. Revenues earned at these terminals relate solely to the volumes transported on the pipeline. Separate fees are not charged for the use of these terminals. Instead, the terminalling fees are a portion of the transportation rate included in the pipeline tariff. As a result, these terminals are included in this segment instead of the storage segment.

The following table lists information about each of our refined product terminals connected to the East or North Pipelines:

|

| | | | |

| Location of Terminals | Tank Capacity | | Related Pipeline System |

| | (Barrels) | | |

| Iowa: | | | |

| LeMars | 103,000 |

| | East |

| Milford | 172,000 |

| | East |

| Rock Rapids | 223,000 |

| | East |

| Kansas: | | | |

| Concordia | 79,000 |

| | East |

| Hutchinson | 114,000 |

| | East |

| Salina | 90,000 |

| | East |

| Minnesota: | | | |

| Moorhead | 451,000 |

| | North |

| Sauk Centre | 116,000 |

| | North |

| Roseville | 479,000 |

| | North |

| Nebraska: | | | |

| Columbus | 171,000 |

| | East |

| Geneva | 674,000 |

| | East |

| Norfolk | 182,000 |

| | East |

| North Platte | 247,000 |

| | East |

| Osceola | 79,000 |

| | East |

| North Dakota: | | | |

| Jamestown (North) | 139,000 |

| | North |

| Jamestown (East) | 176,000 |

| | East |

| South Dakota: | | | |

| Aberdeen | 181,000 |

| | East |

| Mitchell | 63,000 |

| | East |

| Sioux Falls | 381,000 |

| | East |

| Wolsey | 148,000 |

| | East |

| Yankton | 245,000 |

| | East |

| Total | 4,513,000 |

| | |

Ammonia Pipeline. The 2,000 mile pipeline, including 57 miles that are temporarily idled, originates in the Louisiana delta area, where it has access to three marine terminals and three anhydrous ammonia plants on the Mississippi River. It runs north through Louisiana and Arkansas into Missouri, where at Hermann, Missouri, one branch splits and goes east into Illinois and Indiana, while the other branch continues north into Iowa and then turns west into Nebraska. The Ammonia Pipeline is connected to multiple third-party-owned terminals, which include industrial facility delivery locations. Product is supplied to the pipeline from anhydrous ammonia plants in Louisiana and imported product delivered through the marine terminals. Anhydrous ammonia is primarily used as agricultural fertilizer. It is also used as a feedstock to produce other nitrogen derivative fertilizers and explosives. The Ammonia Pipeline transported approximately 1.5 million tons (or approximately 13.8 million barrels) for the year ended December 31, 2011.

Crude Oil Pipelines. Our crude oil pipelines primarily transport crude oil and other feedstocks from various points in Texas, Oklahoma, Kansas and Colorado to Valero Energy’s McKee, Three Rivers and Ardmore refineries. We can use our crude oil storage facilities in Texas, Oklahoma and Colorado, located along the crude oil pipelines, to store and batch crude oil prior to shipment in the crude oil pipelines. Our crude oil pipelines also transport crude oil and other feedstocks to the ConocoPhillips Wood River refinery in Illinois. The crude oil pipelines transported approximately 111.6 million barrels for the year ended December 31, 2011.

The following table sets forth information about each of our crude oil pipelines:

|

| | | | | | | | | |

| Origin and Destination | Refinery | Length | | Ownership | | Capacity |

| | | (Miles) | | | | (Barrels/Day) |

| Dixon, TX to McKee | McKee | 44 |

| | 100 | % | | 63,500 |

|

| Hooker, OK to Clawson, TX (a) | McKee | 41 |

| | 50 | % | | 22,000 |

|

| Clawson, TX to McKee | McKee | 31 |

| | 100 | % | | 36,000 |

|

| Wichita Falls, TX to McKee | McKee | 272 |

| | 100 | % | | 110,000 |

|

| Corpus Christi, TX to Three Rivers | Three Rivers | 70 |

| | 100 | % | | 120,000 |

|

| Ringgold, TX to Wasson, OK | Ardmore | 44 |

| | 100 | % | | 90,000 |

|

| Wasson, OK to Ardmore (8”-10”) (b) | Ardmore | 24 |

| | 100 | % | | 90,000 |

|

| Wasson, OK to Ardmore (8”) | Ardmore | 15 |

| | 100 | % | | 40,000 |

|

| Patoka, IL to Wood River | Wood River | 57 |

| | 24 | % | | 60,500 |

|

| Three Rivers to Corpus Christi, TX (Odem) | Corpus Christi | 68 |

| | 100 | % | | 38,000 |

|

| Pettus to Corpus Christi, TX | N/A | 60 |

| | 100 | % | | 30,000 |

|

| Other (c) | N/A | 214 |

| | | | N/A |

|

| Total | | 940 |

| | | | 700,000 |

|

| |

| (a) | We receive 50% of the tariff with respect to 100% of the barrels transported in the Hooker, Oklahoma to Clawson, Texas pipeline. Accordingly, the capacity is given with respect to 100% of the pipeline. |

| |

| (b) | The Wasson, Oklahoma to Ardmore (8”- 10”) pipelines referred to above originate at Wasson as two pipelines but merge into one pipeline prior to reaching Ardmore. |

| |

| (c) | This category consists of the temporarily idled Cheyenne Wells, CO to McKee and Healdton to Ringling, Oklahoma crude oil pipelines. |

The following table sets forth information about the crude oil storage facilities located along our crude oil pipelines:

|

| | | |

| Location | Refinery | Capacity |

| | | (Barrels) |

| Dixon, TX | McKee | 240,000 |

|

| Ringgold, TX | Ardmore | 600,000 |

|

| Wichita Falls, TX | McKee | 660,000 |

|

| Wasson, OK | Ardmore | 225,000 |

|

| Clawson, TX | McKee | 65,000 |

|

| Other (a) | McKee | 67,000 |

|

| Total | | 1,857,000 |

|

| |

| (a) | This category includes crude oil tanks along the Cheyenne Wells, Colorado to McKee crude oil pipelines located at Carlton, Colorado, Sturgis, Oklahoma, and Stratford, Texas. |

Other Pipelines. We also own three single-use pipelines, located near Umatilla, Oregon, Rawlins, Wyoming and Pasco, Washington, each of which supplies diesel fuel to a railroad fueling facility.

Pipeline Operations

Revenues for the pipelines are based upon origin-to-destination throughput volumes traveling through our pipelines and their related tariff rates.

In general, a shipper on our refined petroleum product pipelines delivers products to the pipeline from refineries or third-party pipelines. Shippers are required to supply us with a notice of shipment indicating sources of products and destinations. Shipments are tested or receive certifications to ensure compliance with our product specifications. We charge our shippers tariff rates based on transportation from the origination point on the pipeline to the point of delivery. We invoice our refined product shippers upon delivery for our Central West System and our North and Ammonia Pipelines, and we invoice our shippers on our East Pipeline when their product enters the line.

Shippers on our crude oil pipelines deliver crude oil to the pipelines for transport to refineries that connect to the pipelines. The costs associated with the crude oil storage facilities located along the crude oil pipelines are considered in establishing the tariffs charged for transporting crude oil from the crude oil storage facilities to the refineries.

The pipelines in the Central West System, the East Pipeline, the North Pipeline and the Ammonia Pipeline and the crude oil pipelines are subject to federal regulation by one or more of the following governmental agencies or laws: the Federal Energy Regulatory Commission (the FERC), the Surface Transportation Board (the STB), the Department of Transportation (DOT), the Environmental Protection Agency (EPA) and the Homeland Security Act. Additionally, the operations and integrity of the pipelines are subject to the respective state jurisdictions.

The majority of our pipelines are common carrier and are subject to federal and state tariff regulation. In general, we are authorized by the FERC to adopt market-based rates. Common carrier activities are those for which transportation through our pipelines is available, at published tariffs filed, in the case of interstate petroleum product shipments, with the FERC or, in the case of intrastate petroleum product shipments, with the relevant state authority, to any shipper of petroleum products who requests such services and satisfies the conditions and specifications for transportation. The Ammonia Pipeline is subject to federal regulation by the STB and state regulation by Louisiana.

We use Supervisory Control and Data Acquisition remote supervisory control software programs to continuously monitor and control our pipelines. The system monitors quantities of products injected in and delivered through the pipelines and automatically signals the appropriate personnel upon deviations from normal operations that require attention.

Demand for and Sources of Refined Products

The operations of our Central West System and the East and North Pipelines depend on the level of demand for refined products in the markets served by the pipelines and the ability and willingness of refiners and marketers having access to the pipelines to supply such demand by deliveries through the pipelines.

The majority of the refined products delivered through the pipelines in the Central West System are gasoline and diesel fuel that originate at refineries owned by Valero Energy. Demand for these products fluctuates as prices for these products fluctuate. Prices fluctuate for a variety of reasons including the overall balance in supply and demand, which is affected by general economic conditions and affects refinery utilization rates, among other factors. Prices for gasoline and diesel fuel tend to increase in the warm weather months when people tend to drive automobiles more often and further distances.

The majority of the refined products delivered through the North Pipeline are delivered to the Minneapolis, Minnesota metropolitan area and consist of gasoline and diesel fuel. Demand for those products fluctuates based on general economic conditions and with changes in the weather as more people drive during the warmer months.

Much of the refined products and natural gas liquids delivered through the East Pipeline and volumes on the North Pipeline that are not delivered to Minneapolis are ultimately used as fuel for railroads, ethanol denaturant or in agricultural operations, including fuel for farm equipment, irrigation systems, trucks used for transporting crops and crop-drying facilities. Demand for refined products for agricultural use, and the relative mix of products required, is affected by weather conditions in the markets served by the East and North Pipelines. The agricultural sector is also affected by government agricultural policies and crop prices. Although periods of drought suppress agricultural demand for some refined products, particularly those used for fueling farm equipment, the demand for fuel for irrigation systems often increases during such times. The mix of refined products delivered for agricultural use varies seasonally, with gasoline demand peaking in early summer, diesel fuel demand peaking in late summer and propane demand higher in the fall. In addition, weather conditions in the areas served by the East Pipeline affect the mix of the refined products delivered through the East Pipeline, although historically any overall impact on the total volumes shipped has not been significant.

Our refined product pipelines are also dependent upon adequate levels of production of refined products by refineries connected to the pipelines, directly or through connecting pipelines. The refineries are, in turn, dependent upon adequate supplies of suitable grades of crude oil. The pipelines in the Central West System and our crude oil pipelines are connected to refineries owned by Valero Energy, and certain pipelines are subject to long-term throughput agreements with Valero Energy. Valero Energy refineries connected directly to our pipelines obtain crude oil from a variety of foreign and domestic sources. If operations at one of these refineries were discontinued or significantly reduced, it could have a material adverse effect on our operations, although we would endeavor to minimize the impact by seeking alternative customers for those pipelines.

The North Pipeline is heavily dependent on Tesoro’s Mandan, North Dakota refinery, which primarily runs North Dakota crude oil (although it has the ability to process other crude oils). If operations at the Tesoro refinery were interrupted, it could have a material effect on our operations. Other than the Valero Energy refineries described above and the Tesoro refinery, if operations at any one refinery were discontinued, we believe (assuming unchanged demand for refined products in markets served by the

refined product pipelines) that the effects thereof would be short-term in nature and our business would not be materially adversely affected over the long term because such discontinued production could be replaced by other refineries or other sources.

The refineries connected directly to the East Pipeline obtain crude oil from producing fields located primarily in Kansas, Oklahoma and Texas, and, to a much lesser extent, from other domestic or foreign sources. In addition, refineries in Kansas, Oklahoma and Texas are also connected to the East Pipeline by third party pipelines. These refineries obtain their supplies of crude oil from a variety of sources. The majority of the refined products transported through the East Pipeline are produced at three refineries located at McPherson and El Dorado, Kansas and Ponca City, Oklahoma, which are operated by the National Cooperative Refining Association (NCRA), HollyFrontier Corporation and ConocoPhillips Company, respectively. The NCRA and Frontier Oil Corporation refineries are connected directly to the East Pipeline. The East Pipeline also has access to Gulf Coast supplies of products through third party connecting pipelines that receive products originating on the Gulf Coast.

Demand for and Sources of Anhydrous Ammonia

The Ammonia Pipeline is one of two major anhydrous ammonia pipelines in the United States and the only one capable of receiving foreign production directly into the system and transporting anhydrous ammonia into the nation’s corn belt.

Our Ammonia Pipeline operations depend on overall nitrogen fertilizer use, management practices, the price of natural gas, which is the primary component of anhydrous ammonia, and the level of demand for direct application of anhydrous ammonia as a fertilizer for crop production (Direct Application). Demand for Direct Application is dependent on the weather, as Direct Application is not effective if the ground is too wet or too dry.

Corn producers have fertilizer alternatives to anhydrous ammonia, such as liquid or dry nitrogen fertilizers. Liquid and dry nitrogen fertilizers are both less sensitive to weather conditions during application but are generally more costly than anhydrous ammonia. In addition, anhydrous ammonia has the highest nitrogen content of any nitrogen-derivative fertilizer.

Customers

The largest customer of our transportation segment was Valero Energy, which accounted for approximately 45% of the total segment revenues for the year ended December 31, 2011. In addition to Valero Energy, we had a total of approximately 65 shippers for the year ended December 31, 2011, including integrated oil companies, refining companies, farm cooperatives, railroads and others. No other customer accounted for greater than 10% of the total revenues of transportation segment for the year ended December 31, 2011.

Competition and Business Considerations

Because pipelines are generally the lowest-cost method for intermediate and long-haul movement of refined petroleum products, our more significant competitors are common carrier and proprietary pipelines owned and operated by major integrated and large independent oil companies and other companies in the areas where we deliver products. Competition between common carrier pipelines is based primarily on transportation charges, quality of customer service and proximity to end users. We believe high capital costs, tariff regulation, environmental considerations and problems in acquiring rights-of-way make it unlikely that other competing pipeline systems comparable in size and scope to our pipelines will be built in the near future, as long as our pipelines have available capacity to satisfy demand and our tariffs remain at economically reasonable levels.

The costs associated with transporting products from a loading terminal to end users limit the geographic size of the market that can be served economically by any terminal. Transportation to end users from our loading terminals is conducted primarily by trucking operations of unrelated third parties. Trucks may competitively deliver products in some of the areas served by our pipelines. However, trucking costs render that mode of transportation uncompetitive for longer hauls or larger volumes. We do not believe that trucks are, or will be, effective competition to our long-haul volumes over the long-term.

Most of our refined product pipelines within the Central West System and our crude oil pipelines are physically integrated with and principally serve refineries owned by Valero Energy. As the pipelines are physically integrated with Valero Energy’s refineries, we believe that we will not face significant competition for transportation services provided to the Valero Energy refineries we serve.

The East and North Pipelines compete with an independent common carrier pipeline system owned by Magellan Midstream Partners, L.P. (Magellan) that operates approximately 100 miles east of and parallel to the East Pipeline and in close proximity to the North Pipeline. The Magellan system is a more extensive system than the East and North Pipelines. Competition with Magellan is based primarily on transportation charges, quality of customer service and proximity to end users. In addition, refined product pricing at either the origin or terminal point on a pipeline may outweigh transportation costs. Certain of the East Pipeline’s and the North Pipeline’s delivery terminals are in direct competition with Magellan’s terminals.

Competitors of the Ammonia Pipeline include another anhydrous ammonia pipeline that originates in Oklahoma and Texas and terminates in Minnesota. The competing pipeline has the same Direct Application demand and weather issues as the Ammonia Pipeline but is restricted to domestically produced anhydrous ammonia. Midwest production facilities, nitrogen fertilizer substitutes and barge and railroad transportation represent other forms of direct competition to the pipeline under certain market conditions.

ASPHALT AND FUELS MARKETING

Our asphalt and fuels marketing segment includes our asphalt operations, our fuels marketing operations and our San Antonio refinery. Our asphalt operations include two asphalt refineries at which we refine crude oil to produce asphalt and certain other refined products. Within our fuels marketing operations, we purchase crude oil and refined petroleum products for resale. Additionally, this segment includes a fuels refinery in San Antonio, Texas, at which we refine crude oil to produce various refined petroleum products. The results of operations for the asphalt and fuels marketing segment depend largely on the margin between our cost and the sales prices of the products we market. Therefore, the results of operations for this segment are more sensitive to changes in commodity prices compared to the operations of the storage and transportation segments.

Asphalt Operations

The following table lists information about our asphalt refineries and related terminals as of December 31, 2011. The tank capacity includes storage for asphalt, crude oil and other feedstocks.

|

| | | | | |

| Facility | Production Capacity | | Tank Capacity |

| | (Barrels Per Day) | | (Barrels) |

| Paulsboro, NJ | 74,000 |

| | 3,643,000 |

|

| Savannah, GA | 30,000 |

| | 1,369,000 |

|

| Total | 104,000 |

| | 5,012,000 |

|

Paulsboro Refinery. The Paulsboro refinery is located in Paulsboro, New Jersey on the Delaware River. Its location on the Delaware River allows for direct access to receipts and shipments. The refinery consists of two petroleum refining units, a liquid storage terminal for petroleum and chemical products, three marine docks, a polymer-modified asphalt production facility and a testing laboratory. The Paulsboro refinery supplies various asphalt grades and intermediate products by ship, barge, railcar and tanker trucks to a network of twelve asphalt terminals in the northeastern United States. These asphalt terminals, combined with asphalt storage at the refinery, provide us with an aggregate storage capacity of 4.0 million barrels that we own or lease from third parties.

Savannah Refinery. The Savannah refinery is located in Savannah, Georgia adjacent to the Savannah River and is the only asphalt producer on the United States southeastern seaboard. Its location on the Savannah River allows for direct access to receipts and shipments. The refinery includes two atmospheric towers, a tank farm, a marine dock, a polymer modified asphalt production facility, a testing laboratory and processing areas. The Savannah refinery supplies various asphalt grades by truck, rail and marine vessel to a network of nine asphalt terminals in the southeastern United States. These asphalt terminals, combined with asphalt storage at the refinery, provide us with an aggregate storage capacity of 1.9 million barrels that we own or lease from third parties.

The following table lists the throughputs and yields for each refinery for the year ended December 31, 2011:

|

| | |

| | Volumes | Percentage |

| | (barrels per day) | |

| Paulsboro: | | |

| Crude oil throughput | 35,844 | |

| Yields: | | |

| Asphalt | 24,474 | 69% |

| Naphtha | 915 | 2% |

| Marine diesel oil | 5,982 | 17% |

| Light marine gas oil | 200 | 1% |

| Vacuum gas oil | 4,000 | 11% |

| Savannah: | | |

| Crude oil throughput | 10,439 | |

| Yields: | | |

| Asphalt | 7,779 | 75% |

| Naphtha | 366 | 4% |

| Light marine gas oil | 2,225 | 21% |

Customers. We produce several grades of asphalt products for various applications. Those applications include hot mix paving, which is used in road construction, roofing shingles for housing construction, asphalt emulsions and asphalt cutbacks used for street maintenance, as well as polymer-modified asphalt, which is a premium asphalt cement used for roads with heavy traffic in harsh weather conditions. The majority of our asphalt customers are road and bridge construction companies who operate asphalt hot mix plants that combine rock aggregate with asphalt to make road pavements. Our customers serve the private commercial sector by building residential roads, parking lots, asphalt paths and courts as well as the public sector by building highways and transportation infrastructure for the various state Departments of Transportation.

Crude Supply. We obtain the majority of the crude oil processed in our asphalt refineries from Petróleos de Venezuela S. A. (PDVSA), the national oil company of Venezuela, under a long-term supply agreement. In 2011, we began purchasing crude oil from Statoil Brasil Oleo E Gas Limitada (Statoil) under a three-year agreement. Our cost of crude oil purchased under the supply agreements fluctuates based upon a market-based pricing formula using published market indices, subject to adjustments per the agreements. The refineries can process alternative asphaltic crudes and other feedstocks and we are currently working to diversify our crude supply options.

Competition and Business Considerations. The asphalt industry is highly fragmented and regional in nature. Our competitors range in size from major oil companies and independent refiners to small family-owned businesses. It is considered a niche business with few integrated, asphalt-focused refiners that have production, logistics and wholesale and marketing capabilities.

Fuels Marketing Operations

Our fuels marketing operations provide us the opportunity to generate additional gross margin while complementing the activities of our storage and transportation segments. These operations involve the purchase of crude oil, fuel oil, bunker fuel and other refined products for resale. We utilize transportation and storage assets, including our own terminals and pipelines. Rates charged by our storage segment and tariffs charged by our transportation segment to the asphalt and fuels marketing segment are consistent with rates charged to third parties.

Since our fuels marketing operations expose us to commodity price risk, we sometimes enter into derivative instruments to mitigate the effect of commodity price fluctuations on our operations. The derivative instruments we use consist primarily of futures contracts and swaps traded on the NYMEX for the purposes of hedging the price risk of our physical inventory.

Customers. Fuels marketing customers include major integrated refiners and trading companies. Customers for our bunker fuel sales are mainly ship owners, including cruise line companies.

Competition and Business Considerations. Our fuels marketing operations have numerous competitors, including large integrated refiners, marketing affiliates of other partnerships in our industry, as well as various international and domestic trading companies. In the sale of bunker fuel, we compete with ports offering bunker fuels that are along the route of travel of the vessel.

San Antonio Refinery

On April 19, 2011, we purchased a fuels refinery with a throughput capacity of 14,500 barrels per day located in San Antonio, Texas (the San Antonio Refinery) and 0.4 million barrels of aggregate storage capacity. The refinery includes a 14,500 barrel per day crude unit, a naphtha hydrotreater unit, a diesel hydrotreater unit and a reformate splitter unit. In addition, the refinery has a seven-bay truck loading rack and approximately 0.2 million barrels of storage capacity at the refinery, as well as 0.2 million barrels of crude oil storage capacity in Elmendorf, Texas. We mainly produce jet fuels, ultra-low sulfer diesel (ULSD), reformates, naphtha and vacuum gas oil.

The operations of San Antonio Refinery expose us to commodity price risk. In an attempt to mitigate the impact of commodity price fluctuations, we entered into over-the-counter swaps. Those swaps fix the purchase price of a portion of the crude oil supply and the sales price of a portion of certain products produced by the refinery.

The following table lists the throughputs and yields for the San Antonio Refinery for the year ended December 31, 2011:

|

| | |

| | Volumes | Percentage |

| | (barrels per day) | |

| | | |

| Crude oil throughput | 10,857 | |

| Yields: | | |

| Jet fuels | 1,332 | 13% |

| ULSD | 2,864 | 27% |

| Reformates | 2,001 | 19% |

| Naphtha | 1,361 | 13% |

| Vacuum gas oil | 1,961 | 19% |

| Other | 950 | 9% |

Customers. The San Antonio refinery customers include major integrated refiners, trading companies and chemical companies. The majority of our sales occur at our truck rack at current market prices. We sell a portion of our jet fuel to the federal government under a supply agreement, with the balance sold to commercial and private jet operators.

Crude Oil Supply. We purchase various grades of crude oil from local suppliers operating in South Texas. Local production, including the developing Eagle Ford shale, provides us a reliable source of crude oil. We purchase crude oil from our suppliers under short-term and spot agreements, generally at current market prices. This local supply of crude oil enables us to take advantage of lower transportation costs.

Competition and Business Considerations. Although we are the only refinery in the San Antonio area, our competitors include large integrated oil companies and independent refiners, that have product terminals located in close proximity to our refinery.

EMPLOYEES

Our operations are managed by NuStar GP, LLC. As of December 31, 2011, NuStar GP, LLC had 1,508 employees performing services for our United States operations. Certain of our wholly owned subsidiaries had 436 employees performing services for our international operations. We believe that NuStar GP, LLC and our subsidiaries each have satisfactory relationships with their employees.

RATE REGULATION

Several of our petroleum pipelines are interstate common carrier pipelines, which are subject to regulation by the FERC under the Interstate Commerce Act (ICA) and the Energy Policy Act of 1992 (the EP Act). The ICA and its implementing regulations give the FERC authority to regulate the rates charged for service on interstate common carrier pipelines and generally require the rates and practices of interstate oil pipelines to be just, reasonable and nondiscriminatory. The ICA also requires tariffs that set forth the rates a common carrier pipeline charges for providing transportation services on its interstate common carrier liquids pipelines, as well as the rules and regulations governing these services, to be maintained on file with the FERC. The EP Act deemed certain rates in effect prior to its passage to be just and reasonable and limited the circumstances under which a complaint can be made against such “grandfathered” rates. The EP Act and its implementing regulations also allow interstate common carrier oil pipelines to annually index their rates up to a prescribed ceiling level. In addition, the FERC retains cost-of-service ratemaking, market-based rates and settlement rates as alternatives to the indexing approach.

The Ammonia Pipeline is subject to regulation by the STB under the current version of the ICA. The ICA and its implementing regulations give the STB authority to regulate the rates we charge for service on the Ammonia Pipeline and generally require that our rates and practices be reasonable and nondiscriminatory.

Additionally, the rates and practices for our intrastate common carrier pipelines are subject to regulation by state commissions in Colorado, Kansas, Louisiana, North Dakota and Texas. Although the applicable state statutes and regulations vary, they generally require that intrastate pipelines publish tariffs setting forth all rates, rules and regulations applying to intrastate service, and generally require that pipeline rates and practices be just, reasonable and nondiscriminatory.

Shippers may challenge tariff rates rules and regulations on our pipelines. There are no pending challenges or complaints regarding our tariffs.

ENVIRONMENTAL AND SAFETY REGULATION

Our operations are subject to extensive federal, state and local environmental laws and regulations, including those relating to the discharge of materials into the environment, waste management, pollution prevention measures, pipeline integrity and operator qualifications, among others. Our operations are also subject to extensive federal and state health and safety laws and regulations, including those relating to pipeline safety. The principal environmental and safety risks associated with our operations relate to unauthorized emissions into the air, unauthorized releases into soil, surface water or groundwater and personal injury and property damage. Compliance with these environmental and safety laws, regulations and permits increases our capital expenditures and our overall cost of business, and violations of these laws, regulations and/or permits can result in significant civil and criminal liabilities, injunctions or other penalties.

We have adopted policies, practices and procedures in the areas of pollution control, pipeline integrity, operator qualifications, public relations and education, product safety, process safety management, occupational health and the handling, storage, use and disposal of hazardous materials that are designed to prevent material environmental or other damage, to ensure the safety of our pipelines, our employees, the public and the environment and to limit the financial liability that could result from such events. Future governmental action and regulatory initiatives could result in changes to expected operating permits and procedures, additional remedial actions or increased capital expenditures and operating costs that cannot be assessed with certainty at this time. In addition, contamination resulting from spills of petroleum products occurs within the industry. Risks of additional costs and liabilities are inherent within the industry, and there can be no assurances that significant costs and liabilities will not be incurred in the future.

Capital Expenditures Attributable to Compliance with Environmental Regulations. In 2011, our capital expenditures attributable to compliance with environmental regulations were $6.0 million, and are currently estimated to be approximately $17.7 million for 2012.

RENEWABLE ENERGY AND ALTERNATIVE FUEL MANDATES

Several federal and state programs require the purchase and use of renewable energy and alternative fuels, such as battery-powered engines, biodiesel, wind energy, and solar energy. These mandates could impact the demand for refined petroleum

products. For example, Congress enacted the Energy Independence and Security Act of 2007 and the American Recovery and Reinvestment Act of 2009, which, among things, mandated annually increasing levels for the use of renewable fuels such as ethanol, commencing in 2008 and escalating for 15 years, as well as increasing energy efficiency goals, including higher fuel economy standards for motor vehicles, subsidized loans for renewable energy projects, and provided funding for energy efficiency and renewable energy programs. These statutory mandates and programs may over time offset projected increases or reduce the demand for refined petroleum products, particularly gasoline, in certain markets. The increased production and use of biofuels may also create opportunities for additional pipeline transportation and additional blending opportunities within the terminals division, although that potential cannot be quantified at present. Other legislative changes may similarly alter the expected demand and supply projections for refined petroleum products in ways that cannot be predicted.

WATER

The Federal Water Pollution Control Act of 1972, as amended, also known as the Clean Water Act, and analogous or more stringent state statutes impose restrictions and strict controls regarding the discharge of pollutants into state waters or waters of the United States. The discharge of pollutants into state waters or waters of the United States is prohibited, except in accordance with the terms of a permit issued by applicable federal or state authorities. The Oil Pollution Act, enacted in 1990, amends provisions of the Clean Water Act as they pertain to prevention, response to and liability for oil spills. Spill prevention control and countermeasure requirements of the Clean Water Act and some state laws require response plans and the use of dikes and similar structures to help prevent contamination of state waters or waters of the United States in the event of an unauthorized discharge. Violations of any of these statutes and the related regulations could result in significant costs and liabilities.

AIR EMISSIONS

Our operations are subject to the Federal Clean Air Act, as amended, and analogous or more stringent state and local statutes. These laws and regulations regulate emissions of air pollutants from various industrial sources, including some of our operations, and also impose various monitoring and reporting requirements. Such laws and regulations may require a facility to obtain pre-approval for the construction or modification of certain projects or facilities expected to produce air emissions or result in the increase of existing air emissions, and obtain and strictly comply with the provisions of any air permits. It is possible that these statutes and the related regulations may be revised to be more restrictive in the future, necessitating additional capital expense to ensure our operations are in compliance. We are unable to estimate the effect on our financial condition or results of operations or the amount and timing of such required expenditures.

SOLID WASTE

We generate non-hazardous and minimal quantities of hazardous solid wastes that are subject to the requirements of the federal Resource Conservation and Recovery Act (RCRA) and analogous or more stringent state statutes. We are not currently required to comply with a substantial portion of RCRA requirements because we do not operate any waste treatment, storage or disposal facilities. However, it is possible that additional wastes, which could include wastes currently generated during operations, will also be designated as “hazardous wastes.” Hazardous wastes are subject to more rigorous and costly disposal requirements than are non-hazardous wastes.

HAZARDOUS SUBSTANCES

The Comprehensive Environmental Response, Compensation and Liability Act, referred to as CERCLA and also known as Superfund, and analogous or more stringent state laws, impose joint and several liability, without regard to fault or the legality of the original act, on some classes of persons that contributed to the release of a “hazardous substance” into the environment. These persons include the owner or operator of the site and entities that disposed or arranged for the disposal of the hazardous substances found at the site. CERCLA also authorizes the EPA and, in some instances, third parties to act in response to threats to the public health or the environment and to seek recovery from the responsible classes of persons for the costs that they incur. In the course of our ordinary operations, we may generate waste that falls within CERCLA’s definition of a “hazardous substance.”

We currently own or lease, and have in the past owned or leased, properties where hydrocarbons are being or have been handled. Although we believe that we have utilized operating and disposal practices that were standard in the industry at the time, hydrocarbons or other wastes may have been disposed of or released on or under the properties owned or leased by us or on or under other locations where these wastes have been taken for disposal. In addition, we acquired many of these properties from third parties, and we did not control those third parties’ treatment and disposal or release of hydrocarbons or other wastes. These properties and wastes disposed thereon may be subject to CERCLA, RCRA and analogous state laws. Under these laws, we could be required to remove or remediate previously disposed wastes (including wastes disposed of or released by prior owners or operators), to clean up contaminated property (including contaminated groundwater) or to perform remedial

operations to prevent future contamination. In addition, we may be exposed to joint and several liability under CERCLA for all or part of the costs required to clean up sites at which hazardous substances may have been disposed of or released into the environment.

While remediation of subsurface contamination is in process at several of our facilities, based on current available information, we believe that the cost of these activities will not materially affect our financial condition or results of operations. Such costs, however, are often unpredictable and, therefore, there can be no assurances that the future costs will not become material.

PIPELINE INTEGRITY AND SAFETY

Our pipelines are subject to extensive federal and state laws and regulations governing pipeline integrity and safety. For example, the federal Pipeline Safety Act of 1968, the Pipeline Safety Improvement Act of 2002, the Pipeline Inspection, Protection, Enforcement, and Safety Act of 2006 and the Pipeline Safety, Regulatory Certainty and Job Creation Act of 2011 and their respective implementing regulations generally require pipeline operators to maintain qualification programs for key pipeline operating personnel, to review and update their existing pipeline safety public education programs, to provide information for the National Pipeline Mapping System, to maintain spill response plans, to conduct spill response training, to implement integrity management programs for pipelines that could affect high consequence areas (i.e., areas with concentrated populations, navigable waterways and other unusually sensitive areas), maintain detailed operating and maintenance procedures and to manage human factors in pipeline control centers, including controller fatigue. While compliance with the statutes and analogous or more stringent state laws may affect our capital expenditures and operating expenses, we believe that the cost of such compliance will not materially affect our competitive position or have a material effect on our financial condition or results of operations.

RISK FACTORS

RISKS RELATED TO OUR BUSINESS

We may not be able to generate sufficient cash from operations to enable us to pay distributions at current levels to our unitholders every quarter.

The amount of cash that we can distribute to our unitholders each quarter principally depends upon the amount of cash we generate from our operations, which will fluctuate from quarter to quarter based on, among other things:

| |

| • | throughput volumes transported in our pipelines; |

| |

| • | lease renewals or throughput volumes in our terminals and storage facilities; |

| |

| • | tariff rates and fees we charge and the returns we realize for our services; |

| |

| • | the results of our marketing, trading and hedging activities, which fluctuate depending upon the relationship between refined product prices and prices of crude oil and other feedstocks; |

| |

| • | demand for crude oil, refined products and anhydrous ammonia; |

| |

| • | the effect of worldwide energy conservation measures; |

| |

| • | domestic and foreign governmental regulations and taxes; and |

| |

| • | prevailing economic conditions. |