UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2024

Commission file number 000-32191

T. ROWE PRICE GROUP, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Maryland | | 52-2264646 |

| State of incorporation | | IRS Employer Identification No. |

100 East Pratt Street, Baltimore, Maryland 21202

Address, including zip code, of principal executive offices

(410) 345-2000

Registrant’s telephone number, including area code

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Common stock, $0.20 par value per share | TROW | The NASDAQ Stock Market LLC |

| (Title of class) | (Ticker symbol) | (Name of exchange on which registered) |

Securities registered pursuant to Section 12(g) of the Act: None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☒ Yes ☐ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ☐ Yes ☒ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months, and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulations S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period the registrant was required to submit such files). ☒ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large accelerated filer | ☒ | Accelerated filer | ☐ |

| Non-accelerated filer (do not check if smaller reporting company) | ☐ | Smaller reporting company | ☐ |

| Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.¨

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant's executive officers during the relevant recovery period pursuant to Section 240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). ☐ Yes ☒ No

The aggregate market value of the common equity (all voting) held by non-affiliates (excludes executive officers and directors) computed using $115.31 per share (the NASDAQ Official Closing Price on June 30, 2024, the last business day of the registrant’s most recently completed second fiscal quarter) was $25.3 billion.

The number of shares outstanding of the registrant's common stock as of the latest practicable date, February 11, 2025, is 222,634,484.

DOCUMENTS INCORPORATED BY REFERENCE: Certain portions of the registrant's Definitive Proxy Statement for the 2025 Annual Meeting of Stockholders, to be filed pursuant to Regulation 14A of the general rules and regulations under the Act, are incorporated by reference into Part III of this report.

Exhibit index begins on page 96.

| | | | | | | | |

| | PAGE |

| | |

| ITEM 1. | Business | |

| ITEM 1A. | | |

| ITEM 1B. | | |

| ITEM 1C. | Cybersecurity | |

| ITEM 2. | | |

| ITEM 3. | | |

| ITEM 4. | | |

| | |

| | |

| | |

| ITEM 5. | | |

| ITEM 6. | Reserved | |

| ITEM 7. | | |

| ITEM 7A. | | |

| ITEM 8. | | |

| ITEM 9. | | |

| ITEM 9A. | Controls and Procedures | |

| ITEM 9B. | Other Information | |

| ITEM 9C. | Disclosure Regarding Foreign Jurisdictions that Prevent Inspections | |

| | |

| | |

| ITEM 10. | | |

| ITEM 11. | | |

| ITEM 12. | | |

| ITEM 13. | | |

| ITEM 14. | | |

| | |

| | |

| ITEM 15. | | |

| ITEM 16. | Form 10-K Summary | |

| |

PART I

Item 1.Business.

T. Rowe Price Group, Inc. ("T. Rowe Price Group", "T. Rowe Price", "the firm", "we", "us", or "our") is a financial services holding company that provides global investment advisory services through its subsidiaries to investors worldwide. We are driven by our purpose: to identify and actively invest in opportunities to help people thrive in an evolving world. With more than 85 years of experience, we provide a broad range of investment solutions across equity, fixed income, multi-asset, and alternative capabilities for clients around the world— from individuals to advisors to institutions to retirement plan sponsors. We also provide certain investment advisory clients with related administrative services, including distribution, mutual fund transfer agent, accounting, and shareholder services; participant recordkeeping and transfer agent services for defined contribution retirement plans; brokerage; trust services; and non-discretionary advisory services through model delivery. We take an active, independent approach to investing, offering our dynamic perspective and meaningful partnership, so our clients can feel more confident.

The late Thomas Rowe Price, Jr., founded our firm in 1937, and the common stock of T. Rowe Price Associates, Inc. was first offered to the public in 1986. The T. Rowe Price Group, Inc. corporate holding company structure was established in 2000. Our common stock trades on the NASDAQ Global Select Market under the symbol "TROW".

Our core capabilities have enabled us to deliver excellent operating results since our initial public offering. We maintain a strong corporate culture focused on delivering superior long-term investment performance and world-class service to our clients. We distribute our broad array of active investment solutions through a diverse set of distribution channels and vehicles to meet the needs of our clients globally. These vehicles include an array of U.S. mutual funds, collective investment trusts, exchange-traded funds, subadvised funds, separately managed accounts, and other sponsored products. The other sponsored products include: open-ended investment products offered to investors outside the U.S., products offered through variable annuity life insurance plans in the U.S., affiliated private investment funds, business development companies, an interval fund, and collateralized loan obligations.

The investment management industry has been evolving and industry participants are facing several challenging trends including passive investments taking market share from traditional active strategies; continued downward fee pressure; demand for new investment vehicles to meet client needs; and an ever-changing regulatory landscape.

Despite these challenging trends, we believe there are significant opportunities that align to our core capabilities. Our ongoing financial strength and discipline allows us to respond to these opportunities with several strategic, multi-year initiatives that are designed to strengthen our long-term competitive position and to:

•Sustain our leadership position in retirement.

•Access growth of the U.S. wealth management channel through improved vehicle capabilities, technology, specialist sales, and content.

•Focus on further global growth in select high-opportunity countries where we have existing business by investing more in resources, products, and marketing.

•Broaden our reach in the private and alternatives market by leveraging our distribution channels and expanding our investment capabilities.

•Enhance our relationships with clients and renew our individual investor base by investing in our ability to provide exceptional service and unique offerings.

•Strengthen our distribution technology to enhance the digital client experience and client reporting.

•Attract and retain top talent and enable effective hybrid collaboration.

•Nurture our brand globally and leverage it effectively across channels and geographies.

•Deliver strong financial results and balance sheet strength for our stockholders over the long term.

ASSETS UNDER MANAGEMENT (AUM).

Our consolidated net revenues and net income are derived largely from investment advisory services provided by our subsidiaries, primarily T. Rowe Price Associates (TRPA), T. Rowe Price Investment Management (TRPIM), Oak Hill Advisors (OHA), and T. Rowe Price International Ltd (TRPIL). Our revenues depend largely on the total value and composition of our assets under management. Accordingly, fluctuations in financial markets and in the composition of assets under management impact our revenues and results of operations.

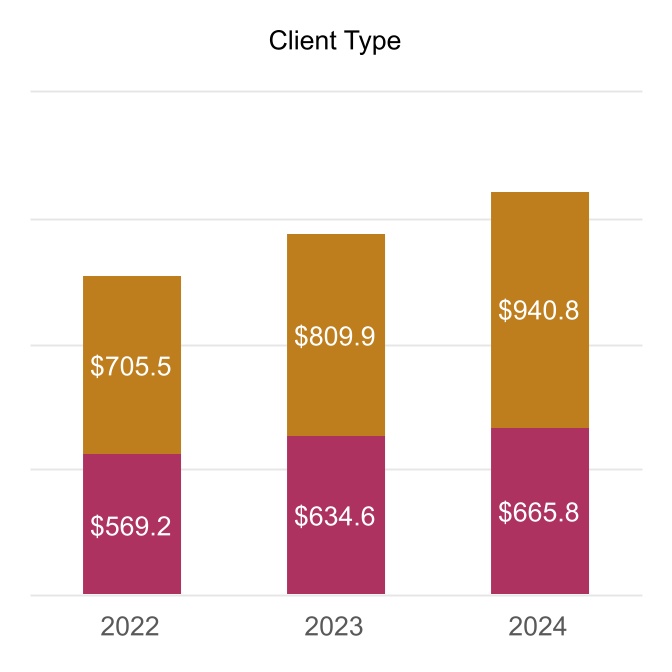

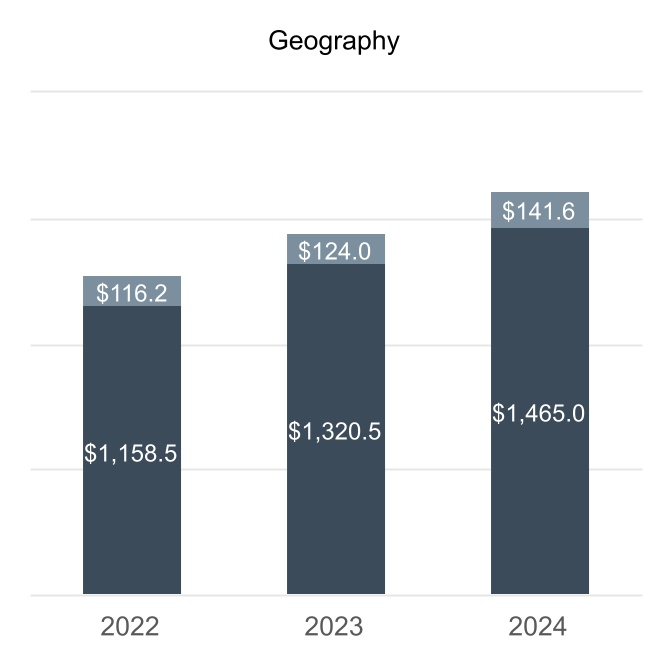

At December 31, 2024, we had $1,606.6 billion in assets under management, an increase of $162.1 billion from the end of 2023. This increase in assets under management was driven by market appreciation, net of distributions not reinvested, of $205.3 billion, offset by net cash outflows of $43.2 billion.

In 2024, our target date retirement products experienced net cash inflows of $16.3 billion. The assets under management in our target date retirement products totaled $475.6 billion at December 31, 2024, or 29.6% of our managed assets at December 31, 2024, compared to 28.3% at the end of 2023.

The following charts show our AUM (in billions) by asset class, client type, geography, and account type as of December 31 for the prior three years:

| | | | | | | | | | | |

| Equity | | Institutional(3) |

| Fixed Income, including money market | | Retail(4) |

| Multi-Asset(1) | | |

| Alternatives(2) | | |

(1)The underlying AUM of the multi-asset portfolios have been aggregated and presented in this category and not reported in the equity and fixed income rows.

(2)The alternatives asset class includes strategies authorized to invest more than 50% of its holdings in private credit, leveraged loans, mezzanine, real assets/CRE, structured products, stressed/distressed, non-investment grade CLOs, special situations, business development companies, or that have absolute return as its investment objective. Generally, only those strategies with longer than daily liquidity are included. Unfunded capital commitments of $16.2 billion at December 31, 2024, $11.6 billion at December 31, 2023, and $10.5 billion at December 31, 2022 are not reflected in AUM above.

(3)Institutional includes assets sourced from institutions along with defined contribution assets that are sourced through intermediaries and our full-service recordkeeping business.

(4)Retail includes assets sourced through our direct-marketed business and financial intermediaries.

| | | | | | | | | | | |

| United States | | U.S. Defined Contribution |

| APAC, EMEA, Canada | | Other Retirement |

| | | Other Accounts |

Additional information concerning our assets under management, results of operations, and financial condition during the past three years is contained in Part II, Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations as well as our consolidated financial statements, which are included in Item 8. of this Form 10-K.

INVESTMENT MANAGEMENT SERVICES.

Investment Capabilities

We manage a broad range of investment strategies in equity, fixed income, multi-asset, and alternatives across sectors, styles and regions. Our strategies are designed to meet the varied and changing needs and objectives of investors and are delivered across a range of vehicles. We also offer specialized advisory services, including management of stable value investment contracts, customized multi-asset solutions, and a distribution management service for the disposition of equity securities our clients receive from third-party venture capital investment pools.

The following tables set forth our broad investment capabilities as of December 31, 2024.

| | | | | | | | | | | | | | | | | | | | |

| Equity |

| Growth | Core | Value | Concentrated | Integrated (Quantitative & Fundamental) | Impact |

| U.S.: | All-Cap, Large-Cap, Mid-Cap, Small-Cap, Sectors | Large-Cap, Mid-Cap, Small-Cap | Large-Cap, Mid-Cap, Small-Cap | Large-Cap (Value) | Large-Cap (Growth & Value, Lower Volatility), Multi-Cap, Small-Cap | Large-Cap |

| Global / International: | All-Cap, Large-Cap, Small-Cap, Sectors, Regional | Large-Cap | Large-Cap, Regional | Large-Cap, Regional | Large-Cap (Core) | Large-Cap |

| | | | | | | | | | | | | | | | | | | | |

| Fixed Income |

| Cash | Low Duration | High Yield / Bank Loans | Government | Securitized | Investment Grade Credit |

| U.S.: | Taxable Money, Tax-Exempt Money | Stable Value, Short-Term Bond, Short Duration Income, Ultra-Short Term Bond | Credit Opportunities, Floating Rate, High Yield | Inflation Protection, Treasury | Securitized Credit, CLO, GNMA | Investment Grade, Corporate Income Bond |

| Global / International: | N/O | N/O | Euro High Yield, High Income, Global High Yield | Global Government Bond | N/O | Euro Investment Grade Corporate, Global Investment Grade Corporate |

| | | | | | | | | | | | | | | | | |

| |

| Multi-Sector | Dynamic Suite | Emerging Markets | Municipal

(Tax-Free) | Impact |

| U.S.: | QM Bond, Core Bond, Core Plus, Investment Grade Core, Total Return | N/O | N/O | High Yield, Intermediate Muni, Intermediate, Long-Term, Short/Intermediate | N/O |

| Global / International: | Global Multi-Sector, Global Aggregate, International Bond, Euro Aggregate | Dynamic Credit, Dynamic Global Bond, Dynamic Global Bond Investment Grade, Dynamic Emerging Markets Bond | Bond, Corporate, Corporate High Yield, Investment Grade, Local Currency, Asia Credit | N/O | Global Impact Credit |

N/O - Not offered

| | | | | | | | | | | | | | | | | |

| Multi-Asset |

| U.S. / Global / International: | Target Date, Custom Target Date | Target Allocation | Global Allocation |

| Global Income | Managed Volatility | Custom Solutions | Real Assets | Retirement Income |

| | | | | | | | | | | | | | | | | |

| Alternatives |

| U.S. / Global / International: | Private Credit | Leveraged Loans | Mezzanine | Real Assets / CRE | Structured Products |

| Stressed / Distressed | CLOs - Non-Investment Grade | Special Situations | MA Alternatives |

Our research staff conducts fundamental and quantitative security analysis primarily from offices located in the U.S. and U.K. with additional staff based in Australia, China, Hong Kong, Japan, and Singapore. We also use research provided by brokerage firms and security analysts in a supportive capacity and information received from private economists, political observers, commentators, government experts, and market analysts.

We introduce new strategies, investment vehicles, or other products to complement and expand our investment offerings, to respond to competitive developments in the financial marketplace, and to meet the changing needs of our clients. A new strategy is solely dependent on our belief we have the appropriate investment management expertise and its objective will be useful to investors over a long period.

We typically provide seed capital for certain investment products to begin building an investment performance history in advance of the portfolio receiving sustainable client assets. The length of time we hold our seed capital investment will vary for each investment product as it is highly dependent on how long it takes to generate cash flows into the product from unrelated investors or, in the case of certain alternative products, the investment term. Generally, we ensure the investment product has a sustainable level of assets from unrelated shareholders before we consider redemption of our seed capital investment in order to maintain the product's net asset value or its performance record. At December 31, 2024, we had seed capital investments in our products of $1.3 billion. Additionally, we invest our capital in certain alternative products we manage to further align our interest with those of our clients. These investments are commonly referred to as co-investments and totaled $0.3 billion at December 31, 2024.

We may also close or limit investments to new investors across investment products in order to maintain the integrity of the investment strategy and to protect the interests of its existing shareholders and investors. At present, the following strategies, which represent about 7% of total assets under management at December 31, 2024, are generally closed to new investors:

| | | | | |

| Strategy | Year closed |

| U.S. Small-Cap Core | 2013 |

| Capital Appreciation | 2014 |

Distribution Channels and Products

We distribute our products across a diversified client base across five primary distribution channels in three broad geographical regions: Americas; Europe, Middle East and Africa ("EMEA"); and Asia Pacific ("APAC"). We service clients in 54 countries around the world. Investors domiciled outside the U.S. represented about 9% of total assets under management at the end of 2024.

The following table outlines the five distribution channels and products through which our assets under management are sourced as of December 31, 2024.

| | | | | | | | | | | | | | | | | | | | | | | |

| Vehicle | | Retail | | Institutional |

| | Americas financial intermediaries | EMEA & APAC financial intermediaries | Individual U.S. investors on a direct basis | | U.S. Defined Contribution | Institutional investors |

| | | | | | | |

| U.S. Mutual Funds | | x | | x | | x | x |

| Collective Investment Trusts | | | | | | x | x |

| Exchange-Traded Funds | | x | | x | | | x |

| College Savings Plans | | x | | x | | | |

| Model Portfolios | | x | x | x(6) | | | |

Separately Managed Accounts (SMAs)(1) | | x | x | | | | |

| Subadvised Accounts | | x | x | | | | |

| Separate Accounts | | | | x | | x | x |

SICAVs(2) / FCPs(3) | | | x | | | | x |

| Canadian Pooled Funds | | x | | | | | x |

OEICs(4) | | | x | | | | x |

Japanese ITMs(5) | | | x | | | | x |

| Australian Unit Trusts | | | x | | | | x |

| Private Funds | | | | | | | x |

| Collateralized Loan Obligations | | | | | | | x |

| Business Development Company (BDC) | | x | | | | | x |

(1) Includes both model delivery and manager traded SMAs,. (2)Société d'Investissement à Capital Variable (Luxembourg), (3)Fonds Commun de Placement (Luxembourg), (4)Open-Ended Investment Company (U.K.), (5)Japanese Investment Trust Management Funds, (6) Provided through our ActivePlus and Retirement Advisory Service Portfolios.

INVESTMENT ADVISORY FEES.

We derive substantially all of our net revenue from investment advisory fees that are earned pursuant to agreements with our sponsored products and clients. Nearly 57% of our investment advisory fees are earned from our sponsored U.S. mutual funds, with the remaining investment advisory fees earned from our collective investment trusts, subadvised funds, separately managed accounts, and other sponsored products. The other sponsored investment portfolios include: open-ended investment products offered to investors outside the U.S., products offered through variable annuity life insurance plans in the U.S., exchange traded funds, affiliated private investment funds, business development companies, and sponsored collateralized loan obligations.

Our investment advisory fees are generally computed using the value of assets under management at a contracted annual fee rate or an effective fee rate for those products with a tiered-fee rate structure. For the majority of our revenue, the value of the assets under management used to calculate the fees are based on a daily valuation. The contracted fee rate(s) applied to the fund or account’s assets under management will vary depending on the services provided, the asset class, and vehicle. For example, fee rates are typically higher for equities and alternatives compared to multi-asset and fixed income products. Additionally, fees rates are typically higher for commingled vehicles including U.S. mutual funds, private investment funds and collective investment trusts compared to separately managed accounts and subadvised funds.

Investment management agreements typically provide the ability for termination upon relatively short notice with little or no penalty. Specifically, our sponsored U.S. mutual fund investment management agreements must be approved, and fees are annually reviewed by the Boards of the respective funds, including a majority of directors who are not interested persons of the funds or of T. Rowe Price Group (as defined in the Investment Company Act of 1940). Additionally, fund shareholders must approve material changes to these investment management agreements. Each agreement automatically terminates in the event of its assignment (as defined in the Investment Company Act) and, generally, either party may terminate the agreement without penalty after a 60-day notice. The termination of one or more of the U.S. mutual fund agreements could have a material adverse effect on our results of operations.

We also earn performance-based investment advisory fees on certain separately managed accounts and affiliated private investment funds. These performance-based fees are recognized and reported separately in the consolidated income statement when performance returns exceed the stated hurdle at the end of the performance period, which can lead to an uneven recognition pattern in a given year.

We distribute certain of our sponsored products outside the U.S. through distribution agents and other financial intermediaries. The fees we earn for distributing and marketing these products are part of the investment advisory fees earned for managing the product assets. We recognize any related distribution fees paid to financial intermediaries in distribution and servicing costs.

CAPITAL ALLOCATION-BASED INCOME.

We recognize income earned from general partner interests in certain affiliated private investment funds that are entitled to a disproportionate allocation of income, also referred to as carried interest. We record our proportionate share of the investment funds' income assuming the funds were liquidated at each reporting date pursuant to each investment fund's governing agreements. The income will fluctuate period-to-period and the realization of accrued carried interest occurs over a number of years. A portion of this income is allocated to certain employees that have non-controlling interests in the entities that hold the general partner's investments.

ADMINISTRATIVE, DISTRIBUTION, AND SERVICING FEES.

Administrative Services

We provide certain ancillary administrative services to our investment advisory clients. These administrative services are provided by several of our subsidiaries and include mutual fund transfer agent, fund/portfolio accounting, distribution, and shareholder services; recordkeeping services for defined contribution retirement plans investing in our sponsored vehicles and vehicles outside the T. Rowe Price complex; transfer agent services for defined contribution retirement plans investing in our sponsored U.S. mutual funds; brokerage; trust services; and non-discretionary advisory services.

Distribution and Servicing

Our subsidiary, T. Rowe Price Investment Services, is the principal distributor of our U.S. mutual funds and contracts with third-party financial intermediaries who distribute these share classes. Certain of the U.S. mutual funds offer Advisor Class and R Class shares that are distributed to investors and defined contribution retirement plans, respectively. These share classes pay 12b-1 fees of 25 and 50 basis points, respectively, out of fund assets, for distribution, administration, and personal services. In addition, U.S. mutual funds offered to investors through variable annuity life insurance plans have a share class that pays a 12b-1 fee of 25 basis points. We pay all of the 12b-1 fees earned to financial intermediaries who source assets under management into these share classes and provide distribution, administration, and personal services on our behalf.

REGULATION.

All aspects of our business are subject to extensive federal, state, and foreign laws and regulations. These laws and regulations are primarily intended to benefit or protect our clients and product shareholders. They generally grant supervisory agencies and bodies broad administrative powers, including the power to limit or restrict the conduct of our business if we fail to comply with laws and regulations. Possible sanctions that may be imposed on us, if we fail to comply, include the suspension of individual employees, limitations on engaging in certain business activities for specified periods of time, revocation of our investment adviser and other registrations, censures, and fines. Furthermore, the regulations to which we are subject continue to change over time, resulting in uncertainty for our business as we must adapt to new laws and regulatory regimes and could significantly increase our reporting, disclosure and compliance obligations, including for cybersecurity and climate-related disclosures.

As a global company which offers its products to customers in a variety of jurisdictions, our subsidiaries are registered with or licensed by various U.S. and/or non-U.S. regulators. We are subject to various securities/financial services, compliance, corporate governance, disclosure, privacy, cybersecurity, technology, anti-bribery and anti-corruption, anti-money laundering, anti-terrorist financing, and economic, trade and sanctions laws and regulations, both domestically and internationally, as well as to various cross-border rules and regulations, and the data

protection laws and regulations of numerous jurisdictions, including the General Data Protection Regulation (“GDPR”) of the European Union (“EU”) and the California Consumer Privacy Act (“CCPA”). We also must comply with complex and changing tax regimes in the jurisdictions where we operate our business.

The following table shows the securities and financial services regulator to certain of our subsidiaries:

| | | | | | | | | | | |

| Regulator | | T. Rowe Price Entity |

| Within the U.S. |

| Securities & Exchange Commission | | - T. Rowe Price Associates | - T. Rowe Price Hong Kong |

| | - T. Rowe Price International | - T. Rowe Price Japan |

| | - T. Rowe Price Australia | - T. Rowe Price Singapore |

| | - T. Rowe Price (Canada) | - T. Rowe Price Advisory Services |

| | - T. Rowe Price Investment Management | - Oak Hill Advisors |

| | - Oak Hill Advisors (Europe) | - OHA (UK) |

| | -OHA Private Credit Advisors | - OHA Private Credit Advisors II |

| | | |

| | All entities above are registered as investment advisers under the Investment Advisers Act of 1940, which imposes substantive regulation around, among other things, fiduciary duties to clients, transactions with clients, effective compliance programs, conflicts of interest, advertising, recordkeeping, reporting, and disclosure requirements. |

| State of Maryland, Office of Financial Regulation | | - T. Rowe Price Trust Company |

| | | |

| Outside the U.S. | | | |

| Financial Conduct Authority | | - T. Rowe Price International | |

| | - T. Rowe Price UK |

| | - Oak Hill Advisors (Europe) |

| | - OHA (UK) | |

| Securities and Futures Commission | | - T. Rowe Price Hong Kong | |

| | - Oak Hill Advisors (Hong Kong) |

| Monetary Authority of Singapore | | - T. Rowe Price Singapore | |

| Several provincial securities commissions in Canada | | - T. Rowe Price (Canada) | |

| Commission de Surveillance du Secteur Financier | | - T. Rowe Price (Luxembourg) Management Sàrl |

| | - OHA Services Sàrl | |

| Australian Securities and Investments Commission | | - T. Rowe Price Australia | |

| | - Oak Hill Advisors (Australia) Pty |

| Japan Financial Services Agency | | - T. Rowe Price Japan | |

| Swiss Financial Market Supervisory Authority | | - T. Rowe Price (Switzerland) |

Serving the needs of retirement savers is an important focus of our business. Such activities are subject to regulators such as the U.S. Department of Labor, and applicable laws and regulations including the Employee Retirement Income Security Act of 1974 ("ERISA").

Registrations

•Our subsidiaries providing transfer agent services, T. Rowe Price Services and T. Rowe Price Retirement Plan Services, are registered under the Securities Exchange Act of 1934.

•T. Rowe Price Investment Services (TRPIS) is an SEC registered introducing broker-dealer and member of the Financial Industry Regulatory Authority ("FINRA") and the Securities Investor Protection Corporation. This

subsidiary is the principal underwriter and distributor for our sponsored U.S. mutual funds and exchange-traded funds, and may also offer and make recommendations for certain funds that are not offered to the general public such as privately placed funds. Investors may open a brokerage account with TRPIS in order to buy and sell securities. Pershing, a third-party clearing broker and an affiliate of BNY Mellon, maintains our brokerage’s customer accounts and clears all transactions.

•T. Rowe Price Associates and certain subsidiaries are registered as commodity trading advisors and/or commodity pool operators with the Commodity Futures Trading Commission and are members of the National Futures Association.

Net Capital Requirements

Certain subsidiaries are subject to net capital requirements, including those of various federal, state, and international regulatory agencies. Each of our subsidiary's net capital, as defined, meets or exceeds all minimum requirements as of December 31, 2024.

For further discussion of the potential impact of current or proposed legal or regulatory requirements, please see the Legal and Regulatory risk factors included in Item 1A. of this Form 10-K.

COMPETITION.

As a member of the financial services industry, we are subject to substantial competition in all aspects of our business. A significant number of proprietary and other sponsors’ investment products are sold to the public by other investment management firms, broker-dealers, mutual fund companies, banks, and insurance companies. We compete with brokerage and investment banking firms, insurance companies, banks, traditional and alternative asset management companies, hedge funds, and other financial institutions and funds in all aspects of our business and in every country in which we offer our products and services. Some of these financial institutions have greater resources, may have more developed brand awareness in particular markets, or offer additional services to clients than we do. We compete with other providers of investment advisory services based primarily on the availability and objectives of the investment products offered, investment performance, fees and related expenses, and the scope and quality of investment advice and other client services.

We have and will continue to face significant competition from passive oriented investment strategies. As a result, such products have taken market share from active managers. While we cannot predict how much market share these competitors will continue to gain, we believe there will always be demand for good active management investment products.

In order to maintain and enhance our competitive position, we may review acquisition and venture opportunities and, if appropriate, engage in discussions and negotiations that could lead to an acquisition transaction or other financial relationships with another entity.

HUMAN CAPITAL.

At T. Rowe Price, our people are our greatest asset. Our culture of collaboration, diversity and inclusion enables us to identify and challenge our best ideas to arrive at well-informed decisions for our clients. To attract and retain the highest quality talent, we invest in the associate experience and develop talent and succession plans; deliver individual and firmwide training and development opportunities for our associates to learn and grow; and provide strong, competitive, and regionally specific benefits and programs that promote the health and wellness of our associates.

As of December 31, 2024, we employed 8,158 associates, an increase of 3.2% from the 7,906 associates employed at the end of 2023. We add temporary and part-time personnel to complement our staff from time to time to meet periodic and special project demands, primarily for technology and collective investment fund administrative services.

Investing In Our People

To help our clients achieve their long-term investment goals, we help our associates achieve their long-term career goals. We continuously seek to identify new opportunities for our associates to expand their experience and grow their skills while cultivating an environment that allows them to be and bring their best selves to work every day. As a result of our associates developing these skills, we can promote from within. We fill approximately one-third of our open positions with internal applicants, and most of our portfolio managers have been promoted from within. We facilitate the professional development of our associates by advancing their knowledge, skills, and experience; providing them access to in-person, virtual, and online training programs; and offering a generous tuition reimbursement program. Our comprehensive learning platform allows associates to grow in ways that matter to them, while offering customized and bespoke learning paths to build critical capabilities that advance our business priorities.

We encourage associates to participate in one of the four mentorship programs offered by the firm, which include mentoring, reciprocal mentoring, and mentor circle programs. Launched in 2022 and continuously enhanced, T. Rowe Price’s mentorship program enrollment has grown across the firm.

We believe a critical driver of our firm’s future growth is our ability to cultivate leaders. Our leaders balance business credibility, accountability, and leadership capability to maximize potential, drive client value, and activate our culture. Reflecting this, we offer leadership experiences that include a series of leadership speaker events and access to virtual and in-person leadership development programs led by professors at leading universities and institutions.

Attracting and Retaining Talent

We recruit and engage candidates with different backgrounds and experiences who bring new perspectives. Our talent acquisition team continually enhances our recruitment and outreach strategies for all qualified applicants. Our talent strategy has garnered recognitions, including Forbes’ World’s Best Employers, World's Most Admired Companies from Fortune, Top Workplaces Culture Excellence from Energage, and America's Most Responsible Companies from Newsweek, among others.

We publish our Equal Employment Opportunity ("EEO") data on our website at https://www.troweprice.com/content/dam/trowecorp/Pdfs/eeo-fact-sheet.pdf. In addition, we publish our annual sustainability report, which includes transparency into our data, a copy of which can be found on our website at https://www.troweprice.com/corporate/us/en/what-we-do/esg-approach/esg-corporate.html.

Offering Benefits to Further Our Commitment

We offer employee benefit solutions, including both health care and retirement benefits, where applicable; fitness club reimbursement; life insurance; and an Employee Assistance Program to support well-being. Benefit competitiveness and design is assessed for a given country, and offerings reflect our global principles and local market practice. For example, retirement programs are uniquely designed to support associates in meeting retirement goals while also reflecting regional and country-specific practices in APAC, EMEA, and North America.

Focus on Family

We have always emphasized the importance of spending quality time away from work. In addition to generous vacation time, the firm offers fully paid maternity leave for birth mothers and fully paid parental leave to all new mothers and fathers. We also provide adoption assistance to associates looking to expand their families. In the U.S., the UK, and Canada, we offer our associates backup childcare and elder care. We also launched an APAC Family Program working group designed to support working parents and caregivers throughout the region in the workplace.

AVAILABLE INFORMATION.

We intend to use our website, troweprice.com, as means of disclosing material non-public information and for complying with our disclosure obligations under Regulation FD. These disclosures will be included in the Investor Relations section of our website, investors.troweprice.com. We make our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to

Section 13(a) of the Exchange Act, available free of charge in this section of our website as soon as reasonably practicable after they have been filed with the SEC. In addition, our website includes the following information:

•our financial statement information from our periodic SEC filings in the form of XBRL data files that may be used to facilitate computer-assisted investor analysis;

•corporate governance information including our governance guidelines, committee charters, senior officer code of ethics and conduct, and other governance-related policies;

•other news and announcements that we may post from time to time that investors might find useful or interesting, including our monthly assets under management disclosure and periodic investor presentations; and

•opportunities to sign up for email alerts and RSS feeds to have information pushed in real time.

Accordingly, investors should monitor this section of our website, in addition to following our press releases, SEC filings, and public webcasts, all of which will be referenced on the website. Unless otherwise expressly stated, the information found on our website is not incorporated into this or any other report we file with, or furnish to, the SEC. Specifically, information in our sustainability report is not incorporated by reference into this Form 10-K.

The SEC maintains a website that contains the materials we file with the SEC at www.sec.gov.

Item 1A. Risk Factors.

An investment in our common stock involves various risks, including those mentioned below and those that are discussed from time to time in our periodic filings with the SEC. Investors should carefully consider these risks, along with the other information contained in this report, before making an investment decision regarding our common stock. There may be additional risks of which we are currently unaware, or which we currently consider immaterial. Any of these risks could have a material adverse effect on our business, financial condition, results of operations, liquidity, reputation, and value of our common stock.

RISKS RELATING TO OUR BUSINESS AND THE FINANCIAL SERVICES INDUSTRY.

Our revenues are based on the market value and composition of the assets under our management, all of which are subject to fluctuation caused by factors outside of our control.

We derive our revenues primarily from investment advisory services provided by our subsidiaries to individual and institutional investors. Our investment advisory fees typically are calculated as a percentage of the market value of the assets under our management. As a result, our revenues are dependent on the value and composition of the assets under our management, all of which are subject to substantial fluctuation due to many factors, including:

•Investment Performance. If the investment performance of our managed investment portfolios is less than that of our competitors or applicable third-party benchmarks, we could lose existing and potential clients and suffer a decrease in assets under management. Poor performance relative to other competing products tends to result in decreased sales and increased redemptions with corresponding decreases in our revenues.

•General Financial Market Declines. We derive a significant portion of our revenues from advisory fees on managed investment portfolios. A downturn in financial markets would cause the value of assets under our management to decrease, and may also cause investors to withdraw their investments, thereby further decreasing the level of assets under our management.

•Investment Concentration. The allocation of investment products for assets under management within market segments or strategies may impact associated fees that can vary depending on product offerings.

•Investor Mobility. Our investors may generally withdraw their funds at any time, without advance notice and with little to no significant penalty. Any redemptions and other withdrawals from, or shifting among, our investment portfolios could reduce our assets under management. These could be caused by investors reducing their investments in our portfolios in general or in the market segments in which we focus; investors

taking profits from their investments; portfolio risk characteristics, which could cause investors to move assets to other investment managers; and investor and market sentiments.

•Capacity Constraints. Prolonged periods of strong relative investment performance and/or strong investor inflows has resulted in, and may result in, capacity constraints within certain strategies, which can lead to, among other things, the closure of those strategies to new investors.

•Investing Trends. Changes in investing trends, particularly investor preference for passive or alternative investment products as well as increasing investor preference for environmentally and socially responsible investment products, and changes in retirement savings trends, may reduce interest in our products and may alter our mix of assets under management.

•Interest Rate Changes. Investor interest in and the valuation of our fixed income and multi-asset investment portfolios are affected by changes in, as well as uncertainty about interest rates.

•Geo-Political Exposure. Our managed investment portfolios may have significant investments in markets that are subject to risk of loss from political or diplomatic developments, government policies, wars, conflicts or civil unrest (such as the Russian invasion of Ukraine, the threat that Russia’s military aggression may expand, and the recent conflicts in the Middle East, including the Israel-Hamas war, and potential escalation of such conflicts), trade wars or tariffs (including those imposed or threatened by the U.S.), currency fluctuations, illiquidity and capital controls, and changes in legislation related to ownership limitations.

A decrease in the value of our assets under management, or an adverse change in their composition, particularly in market segments where our assets are concentrated, could have a material adverse effect on our investment advisory fees and revenues. For any period in which revenues decline, net income and operating margins will likely decline by a greater proportion because certain expenses will be fixed over that finite period and may not decrease in proportion to the decrease in revenues.

A majority of our revenues are based on contracts with collective investment funds that are subject to termination without cause and on short notice.

We provide investment advisory, distribution, and other administrative services to collective investment funds under various agreements. Investment advisory services are provided to each sponsored investment fund under individual investment management agreements, which can be terminated on short notice. In addition, the Board of each T. Rowe Price U.S. mutual fund must annually approve the terms of the investment management and service agreements. If a T. Rowe Price collective investment fund seeks to lower the fees that we receive or terminate its contract with us, we would experience a decline in fees earned from the collective investment funds, which could have a material adverse effect on our revenues and net income.

We operate in an intensely competitive industry. Competitive pressures may result in a loss of clients and their assets or compel us to reduce the fees we charge to clients, thereby reducing our revenues and net income.

We are subject to competition in all aspects of our business from other financial institutions. Some of these financial institutions have greater resources than we do and may offer a broader range of financial products across more markets. Some competitors operate in a different regulatory environment than we do which may give them certain competitive advantages in the investment products and portfolio structures that they offer. We compete with other providers of investment advisory services primarily based on the availability and objectives of the investment products offered, investment performance, fees and related expenses, and the scope and quality of investment advice, other client services and technology offerings. Some institutions have proprietary products, distribution channels or technology offerings that make it more difficult for us to compete with them. In addition, in recent years, there has been continued consolidation in the asset management industry, which continues to alter our competitive landscape, has led to fee compression, and requires us to modify or adapt our product offerings to attract and retain customers. Substantially all of our investment products are available without sales or redemption fees, which means that investors may be more willing to transfer assets to competing products. If our clients reduce their investments with us, and we are not able to attract new clients, our AUM, revenue and earnings could decline.

The market environment in recent years has led investors to increasingly favor lower fee passive investment products. As a result, investment advisors that emphasize passive products have gained and may continue to gain market share from active managers like us. While we believe there will always be demand for strong performing active management, we cannot predict how much market share these competitors will gain.

Furthermore, many aspects of the asset management industry are seeing increased regulatory activity and scrutiny, in particular related to environmental, social, and governance ("ESG") practices and related matters, transparency and unbundling of fees, inducements, conflicts of interest, risk management, cybersecurity, technology, privacy and data protection, diversity, equity and inclusion, and compensation. We may respond to these regulatory matters or may be impacted by these actions in a manner different from our competitors, which may impact our AUM or result in the loss of clients and their assets.

As part of our continued efforts to attract and retain clients, we develop and launch new products and services, which may require expenditure of resources and may expose us to new regulatory or compliance requirements as well as increased risk of operational or client service errors.

In the event that we decide to reduce the fees we charge for investment advisory services in response to competitive pressures, which we have done selectively in the past, revenues and operating margins could be adversely impacted. Fee reductions may vary depending on strategy and product offerings, which could result in investment rebalancing or reallocation adversely impacting revenues and operating margins.

The failure or negative performance of products offered by competitors may cause our products, which are similar, to be impacted irrespective of our performance.

Many competitors offer similar products to those offered by us, and the failure or negative performance of competitors’ products could lead to a loss of confidence in similar products we offer, irrespective of the performance of such products. Any loss of confidence in a product type could lead to withdrawals, redemptions and liquidity issues in such products, which may cause our AUM, revenue and earnings to decline.

Our operations are complex and a failure to properly execute operational processes could have an adverse effect on our reputation and decrease our revenues.

We provide global investment management and administrative services to our clients. In certain cases, we rely on third-party service providers for the execution and delivery of these services. There can be no assurance that these service providers will properly perform these processes or that there will not be interruptions in services from these third parties. Failure to properly execute or oversee these services could have an adverse impact on our business, financial results and reputation, and subject us to regulatory sanctions, fines, penalties, or litigation.

New investment strategies, investment vehicles, distribution channels, advancement in technology and digital wealth and distribution tools, or other evolutions of or additions to our business may increase the risk that our existing systems may not be adequate to control the risks introduced by such changes. Business changes may require us to update our processes or technology and may increase risk to meeting our business objectives. In addition, our existing information systems and technology platforms might not be able to accommodate our business operations, and the cost of maintaining or upgrading such systems might increase from its current level. If any of these scenarios were to arise, it could disrupt our operations, increase our expenses or result in financial exposure, regulatory inquiry, litigation or reputational damage.

Our business model is dependent on our personnel, who as part of their roles support disclosure and internal controls, compliance, supervision, technology and training to provide comfort that our activities do not violate applicable guidelines, rules and regulations or adversely affect our clients, counterparties or us. We also rely on the personnel of others involved in our business, such as third-party service providers, intermediaries or other vendors. Our personnel and the personnel of others involved in our business may make errors or engage in fraudulent or malicious activities, that are not always immediately detected or that cannot be easily remediated, which may disrupt our operations, cause losses, lead to regulatory fines or sanctions, litigation, or otherwise damage our reputation.

The quantitative models we use may contain errors, which could result in financial losses or adversely impact product performance and client relationships.

We use various quantitative models (including ones supported by AI and machine-learning algorithms) to support investment decisions and investment processes, including those related to portfolio management and portfolio risk analysis, as well as those related to client investment or savings advice or guidance. Any errors in the underlying

models or model assumptions could have unanticipated and adverse consequences on our business and reputation.

Any damage to our reputation could harm our business and lead to a loss of revenues and net income or access to capital.

We have spent many years developing our reputation for integrity, strong investment performance, and superior client service. Our brand is a valuable intangible asset, but it is vulnerable to a variety of threats that can be difficult or impossible to control, and costly or even impossible to remediate, if damaged. Regulatory inquiries and rumors can tarnish or substantially damage our reputation, even if those inquiries are satisfactorily addressed. For example, ESG issues have been the subject of increased focus by regulators, clients and other stakeholders. Various clients and stakeholders have divergent views on ESG matters, with some aiming to increase their exposure to ESG investing and some choosing not to invest in products or strategies with an ESG investment objective, including in the countries in which we operate and invest, as well as states and localities where we serve public sector clients. These differences pose challenges for us to manage divergent goals and preferences, and increase the risk that any action or lack thereof by us concerning ESG, or any actual or perceived failure to adequately address the ESG expectations will be viewed negatively by some stakeholders, which could adversely impact our reputation and business. We also communicate certain initiatives and goals for our corporate and investing activities related to ESG matters. We could be scrutinized or criticized for the scope or nature of any such initiatives or goals, and may not be able to accomplish them within our anticipated timeframe or at all. Our global presence and investments on behalf of our clients around the world could also lead to heightened scrutiny and criticism in an increasingly fragmented geopolitical landscape.

Misconduct by our personnel or third-party service providers could likewise adversely impact our reputation and lead to a loss of client assets. While we maintain policies, procedures, and controls to reduce the likelihood of unauthorized activities, we are subject to the risk that our personnel or third parties acting on our behalf may circumvent controls or act in a manner inconsistent with our policies and procedures. Real or perceived conflicts between our clients’ interests and our own, as well as any fraudulent activity or other exposure of client assets or information, may impair our reputation and subject us to litigation or regulatory action. Any damage to our brand could impede our ability to attract and retain clients and key personnel, and reduce the amount of assets under our management, any of which could have a material adverse effect on our revenues and net income.

Failure to comply with client contractual requirements and/or investment guidelines could result in costs of correction, damage awards or regulatory fines and penalties against us and loss of revenues due to client terminations.

Many of the agreements under which we manage assets or provide products or services specify investment guidelines or requirements, such as adherence to investment restrictions or limits, that we are required to observe in the provision of our services. Laws and regulations impose similar requirements for certain investment products. While we maintain various compliance procedures and other controls to seek to prevent, detect and correct such errors, any failure to comply with these guidelines or requirements could result in damage to our reputation or in our clients seeking to recover losses, withdrawing their assets or terminating their contracts. Regulators likewise may commence enforcement actions for violations of such requirements, which could lead to fines and penalties against us. Any such events could cause our revenues and profitability to decline, and significant errors for which we are responsible could have a material adverse impact on our reputation, results of operations, financial condition or liquidity.

Our alternatives products include investments in private credit, real estate, and equity investments in private companies, which may expose us to new or increased risks and liabilities and to reputational harm.

Our alternatives products include investments in private credit, real estate, and equity investments in private companies, which may expose our investment products, clients and us to new or increased risks and liabilities. These may include:

•risks related to the potential illiquidity, valuation and disposition of such investments;

•risks related to emerging and less established companies that have, among other things, short operating histories, not yet achieved or sustained profitability, new technologies and products, nascent control functions, quickly evolving markets and limited financial resources;

•credit risks, including interest-rate movements and an issuer’s ability to make principal and interest payments on the debt it issues;

•risks related to investment in “distressed” securities, including abrupt and erratic market movements and above-average price volatility;

•risks associated with a lack of diversification, such that any adverse change in one or a small number of issuers could have a material adverse effect on an investment product or client’s investments;

•risks relating to the use of leverage, including as a result of changes in interest rates or an inability to timely obtain and effectively deploy leverage;

•failures on the part of third-party managers, service providers or sub-contractors appointed in connection with investments or projects to adequately perform their contractual duties or operate in accordance with applicable laws;

•exposure to stringent and complex foreign, federal, state and local laws, ordinances and regulations;

•changes to the supply and demand for properties and/or tenancies;

•risks related to the availability, cost, coverage and other limitations on insurance; and

•the financial resources of tenants or loan counterparties; and contingent liabilities on disposition of investments.

These (and similar) risks may expose our investment products, clients and us, to the extent of our investment in such investment products, to expenses and liabilities, including costs associated with delays or remediation and increased legal or regulatory costs, all of which could impact the returns earned by our investment products and clients. These risks could also result in direct liability for us by exposing us to losses, regulatory sanctions or litigation, including claims for compensatory or punitive damages. The occurrence of any such events may expose us to reputational harm, or cause our AUM, revenues and net income to decline.

Our expenses are subject to significant fluctuations that could materially decrease net income.

Our operating results are dependent on the level of our expenses, which can vary significantly for many reasons, including:

•expenses incurred in connection with our multi-year strategic plan to strengthen our long-term competitive position;

•variations in the level of total compensation expense due to changes in, among other things, bonuses, stock-based awards, employee benefit costs due to regulatory or plan design changes, labor market conditions, our employee count and mix, competitive factors, market performance, and inflation;

•changes in the level of our advertising and promotion expenses, including the costs of expanding investment advisory services to investors outside of the U.S. and further penetrating U.S. distribution channels;

•expenses and capital costs incurred to maintain and enhance our administrative and operating services infrastructure, such as technology assets, depreciation, amortization, and research and development;

•changes in the costs incurred for third-party service providers that perform certain administrative and operating services, including as a result of changes in market conditions, labor costs and inflation;

•changes in expenses that are correlated to our assets under management, such as distribution and servicing fees;

•a future impairment of investments that is recognized in our consolidated balance sheet;

•a future impairment of goodwill or other intangible assets that is recognized in our consolidated balance sheet;

•unanticipated material fluctuations in foreign currency exchange rates applicable to the costs of our operations abroad;

•unanticipated costs incurred to protect investor accounts and client goodwill;

•future changes to legal and regulatory requirements and potential litigation; and

•disruptions of infrastructure and third-party services such as communications, power, cloud services, transfer agent, investment management, trading, and accounting systems.

Under our agreements with the U.S. mutual funds, we charge the funds certain administrative fees and related expenses based upon contracted terms. If we fail to accurately estimate our underlying expense levels or are required to incur expenses relating to the U.S. mutual funds that are not otherwise paid by the funds, our operating results will be adversely affected. While we are under no obligation to provide financial support to our investment products, any financial support provided would reduce capital available for other purposes and may have an adverse effect on revenues and net income.

Our hedging strategies utilized to mitigate risk may not be effective, which could impact our earnings.

We employ hedging strategies related to our supplemental savings plan and other incentive plans in order to hedge the liability related to the plans. In the event that our hedging strategies are not effective, the resulting impact may adversely affect our results of operations, cash flows or financial condition.

Changes in tax laws or exposure to additional tax liabilities may impact our financial position or the marketability of the products and services we offer our clients.

We are subject to income taxes as well as non-income-based taxes and complex tax regimes in both the United States and various foreign jurisdictions in which we operate. We cannot predict future changes in the tax regulations to which we are subject, and any such changes could have a material impact on our tax liability or result in increased costs of our tax compliance efforts. For example, a financial transaction tax on stocks, bonds and a broad range of financial instruments has been proposed in the United States and the EU.

Additionally, changes in the status of tax deferred investment options, including retirement plans, tax-free municipal bonds, the capital gains and corporate dividend tax rates, and other individual and corporate tax rates could cause investors to view certain investment products less favorably and reduce investor demand for products and services we offer, which could have an adverse effect on our assets under management and revenues.

Examinations and audits by tax authorities could result in additional tax payments for prior periods, which could impact our financial results.

Based on the global nature of our business, from time to time we are subject to tax audits in various jurisdictions. The calculation of our tax liabilities involves dealing with uncertainties in the application of complex tax regulations in a multitude of jurisdictions across our global operations. Tax authorities may disagree with certain positions we have taken and assess additional taxes (and, in certain cases, interest, fines, or penalties). We have a process to evaluate whether to record tax liabilities for anticipated tax audit issues based on our estimate of whether, and the extent to which, additional income taxes will be due, and adjust these liabilities in light of changing facts and circumstances. Due to the complexity of some of these uncertainties, however, the ultimate resolution may result in a payment that is materially different from our estimates and impact our financial results.

We have contracted with third-party financial intermediaries that distribute our investment products and such relationships may not be available or profitable to us in the future.

Third-party financial intermediaries we contract with generally offer their clients various investment products in addition to, and in competition with, our investment products, and have no contractual obligation to encourage investment in our products. It would be difficult for us to acquire or retain the management of those assets without the assistance of the intermediaries, and we cannot assure that we will be able to maintain an adequate number of investment product offerings and successful distribution relationships.

In addition, some investors rely on third-party financial planners, registered investment advisers, and other consultants or financial professionals to advise them on the choice of an investment adviser and investment products. These professionals and consultants may favor a competing investment product for reasons we cannot control. We cannot assure that our investment products will be among their recommended choices in the future. Further, their recommendations can change over time and we could lose their recommendation and their clients' assets under our management. Increasing competition for these distribution and sales channels as well as regulatory changes and initiatives may cause our distribution costs to rise, could cause further cost increases in the future, or could otherwise negatively impact the distribution of our products. Mergers, acquisitions, and other

ownership or management changes could also adversely impact our relationships with these third-party intermediaries. As a result of these changes, more of our revenues may be concentrated with fewer intermediaries, which may impact our dependence on these intermediaries. A failure to maintain our third-party distribution and sales channels, or a failure to maintain strong business relationships with our distributors and other intermediaries, may impair our distribution and sales operations. Any inability to access and successfully sell our products to clients through such third-party channels could have a negative effect on our level of AUM and adversely impact our business. Moreover, we can provide no assurance that we will continue to have access to the third-party financial intermediaries that currently distribute our products on favorable terms or at all, or that we will continue to have the opportunity to offer all or some of our existing products through them. The presence of any of the adverse conditions discussed above would reduce revenues and net income, possibly by material amounts.

Natural disasters and other unpredictable events could adversely affect our operations and financial results.

The occurrence of extreme events, such as armed conflicts, terrorist attacks, epidemic, pandemic or disease outbreaks (such as the COVID-19 pandemic), infrastructure failures, natural disasters or extreme weather events (which may increase in intensity or frequency as a result of climate change), and other events outside of our control could adversely affect our revenues, expenses, and net income by:

•decreasing investment valuations in, and returns on, the investment portfolios that we manage;

•causing disruptions in national or global economies that decrease investor confidence and make investment products generally less attractive;

•incapacitating or inflicting losses of lives among our personnel;

•interrupting our business operations or those of critical service providers or other providers;

•affecting the availability of infrastructure upon which our operations depend, such as road networks and electrical power grids;

•triggering technology delays or failures; and

•requiring substantial capital expenditures and operating expenses to remediate damage, replace our facilities, and restore our operations.

A significant portion of our business operations are concentrated in the Baltimore, Maryland region; Colorado Springs, Colorado; Forth Worth, Texas; New York City, New York; and London, England. In addition, we maintain offices with our personnel in many other global locations, including Sydney, Australia; Hong Kong; Singapore; Tokyo, Japan; and Luxembourg, some of which are in areas that are particularly vulnerable to extreme events. We have developed various backup systems and contingency plans, but we cannot be assured that those preparations will be adequate in all circumstances that could arise, or that material interruptions and disruptions will not occur. We also rely to varying degrees on outside service providers for service delivery in addition to technology and disaster contingency support, and we cannot be assured that these service providers will be able to perform in an adequate and timely manner. If we lose the availability of any personnel, or, if we are unable to respond adequately to such an event in a timely manner, we may be unable to service our clients or timely resume our business operations, which could lead to financial losses, a tarnished reputation and loss of clients that could result in a decrease in assets under management, lower revenues, and materially reduced net income, particularly if our responses to such events are less adequate than those of our competitors.

Our business, financial condition, and results of operation may be adversely affected by pandemics, epidemics or disease outbreaks.

Pandemics, epidemics or disease outbreaks, as well as measures enacted to prevent their spread, may create significant volatility, uncertainty and disruption to the global economy and may impact our business, financial condition and results of operations. For example, the coronavirus pandemic adversely affected global financial markets and impacted global supply chains. Concerns and uncertainty regarding pandemics, epidemics or disease outbreaks could lead to increased volatility in global capital and credit markets, adversely affect our operations, key executives and other personnel, clients, investors, service providers and other vendors, suppliers, and other third parties, and negatively impact our assets under management, revenues, income, business and operations. Since our revenue is based on the market value and composition of the assets under our management, the impact of such

events on global financial markets and our clients’ investment decisions could adversely affect our revenue and operating results.

Furthermore, while we have in place robust and well-established plans for operational resiliency and business continuity that address the potential impact of pandemics, epidemics or disease outbreaks to our personnel and our facilities, and to date have been successful in navigating the challenges presented by the COVID-19 pandemic, no assurance can be given that the steps we have taken will continue to be effective or appropriate against future pandemics, epidemics or disease outbreaks. In the event that our personnel become incapacitated by pandemics, epidemics or disease outbreaks, our business operations may be impacted, which could lead to reputational and financial harm.

Our investment income and asset levels may be negatively impacted by fluctuations in our investment portfolio.

Separately from the investments we manage for our clients, we currently have a substantial investment portfolio

in a variety of asset classes including equities, fixed income products, multi-asset products, financial instruments, real estate and alternative investments. Investments in these products are generally made to establish a track record, meet purchase size requirements for trading blocks or demonstrate economic alignment with other investors in our funds. All of these investments are subject to investment market risk, and our non-operating investment income could be adversely affected by the realization of losses upon the disposition of our investments or the recognition of significant impairments or unrealized losses on these investments. In addition, related investment income has fluctuated significantly over the years depending upon the performance of our corporate investments, including the impact of market conditions and interest rates, and the size of our corporate money market and longer-term collective investment fund holdings. Fluctuations in other investment income are expected to occur in the future. Redemptions and other withdrawals from, or shifting among, client portfolios also reduce our investment income. These changes could be caused by investors reducing their investments in client portfolios in general or in the market segments in which we focus; investors taking profits from their investments; and portfolio risk characteristics, which could cause investors to move assets to other investment managers. Poor performance relative to other competing products tends to result in decreased sales and increased redemptions with corresponding decreases in our revenues, which may have a material adverse effect on us.

The soundness of other financial services institutions could adversely affect us or the client portfolios we manage.

Financial services institutions are interrelated as a result of trading, clearing, counterparty or other relationships. We, and the client portfolios that we manage, have exposure to many different counterparties, and routinely execute transactions with counterparties in the financial services industry. Many of these transactions expose us or such client portfolios to credit risk in the event of default of its counterparty. While we regularly conduct assessments of counterparty risks, the risk of non-performance by such parties is subject to sudden swings in the financial and credit markets. Such non-performance could produce a financial loss for us or the portfolios we manage. In addition, concerns regarding the soundness of other financial services institutions may generate public concerns regarding us or the financial services industry more broadly, which could harm our reputation and adversely affect our results of operations and financial condition, even if the underlying matters impacting other financial institutions are of limited or no direct applicability to us.

We may review and pursue strategic transactions in order to maintain or enhance our competitive position and these could pose risks.

From time to time, we consider strategic opportunities, including potential acquisitions, dispositions, consolidations, organizational restructurings, joint ventures or similar transactions, any of which may impact our business. We cannot be certain that we will be able to identify, consummate and successfully complete such transactions, and no assurance can be given with respect to the timing, likelihood or business effect of any possible transaction. These initiatives typically involve a number of risks and present financial, managerial and operational challenges to our ongoing business operations. In addition, acquisitions and related transactions involve risks, including unanticipated problems regarding integration of investor account and investment security recordkeeping, additional or new regulatory requirements, operating facilities and technologies, and new personnel; adverse effects on our earnings in the event acquired intangible assets or goodwill become impaired; distracting management and other key personnel from our existing businesses; and the existence of liabilities or contingencies not disclosed to or otherwise known by us prior to closing a transaction.

We own a 23% investment in UTI Asset Management Company Ltd ("UTI"), an Indian asset management company, and we may consider non-controlling minority investments in other entities in the future. We may not realize future returns from such investments or any collaborative activities that may develop in the future.

Climate change-related risks could adversely affect our business, products, operations and clients, which may cause our AUM, revenues and earnings to decline.

Our business and the assets we manage on behalf of clients could be impacted by climate change-related risks. Climate change may present risk to our business through changes in the physical climate or from the process of transitioning to a lower-carbon economy. Climate-related physical risks arise from the direct impacts of a changing climate in the short-, medium- and long-term. Such risks may include an increase in the intensity and frequency of extreme weather events, changes in temperature, rising sea levels and increase of wildfires, which may damage infrastructure and facilities, increase energy costs, negatively impact workforces, as well as disrupt connectivity or supply chains. Within our investment portfolios, changes in weather patterns around the world can impact companies in which we invest on behalf of our clients. Weather pattern changes may cause investment professionals to re-evaluate investments in affected companies. Valuations may be impacted resulting in declines in asset values and potential loss of revenue. Climate-related transition risks arise from exposure to the transition to a lower-carbon economy through policy, regulatory, technology and market changes. For instance, new regulations and changes in existing regulations may lead to increased compliance costs, enhanced reporting obligations, regulation of existing products and/or services, exposure to litigation, and aggressive or inconsistent levels of regulatory enforcement globally. Additionally, climate change may influence client preferences by increasing the demand for investment products oriented toward climate change mitigation. Conversely, a climate-related backlash could negatively impact demand for climate or transition related products. Climate change may also impact our reputation if we are perceived to fall short of our own corporate commitments or stakeholder expectations. Any of these risks may have a material adverse effect on our AUM, revenue and earnings.