UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14 (a) of the Securities

Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| x | | Preliminary Proxy Statement |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | | Definitive Proxy Statement |

| ¨ | | Definitive Additional Materials |

| ¨ | | Soliciting Material pursuant to §240.14a-12 |

NAPSTER, INC.

(Name of Registrant as Specified in Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| ¨ | | Fee paid previously with preliminary materials: |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

Preliminary Copy

August [·], 2008

Dear Stockholder:

On behalf of the Board of Directors, you are cordially invited to attend the 2008 Annual Meeting of Stockholders of Napster, Inc. to be held at our Napster offices located at 9044 Melrose Avenue, Los Angeles, California 90069, on September 18, 2008, at 10:00 a.m., local time. The formal notice of the Annual Meeting appears on the following page. The attached Notice of Annual Meeting and Proxy Statement describe the matters that we expect to be acted upon at the Annual Meeting.

During the Annual Meeting, stockholders will have the opportunity to ask questions. Whether or not you plan to attend the Annual Meeting, it is important that your shares be represented. Regardless of the number of shares you own, please sign and date the enclosed WHITE proxy card and promptly return it to us in the enclosed postage-prepaid envelope. If you sign and return your proxy card without specifying your choices, your shares will be voted in accordance with the recommendations of the Board of Directors contained in the Proxy Statement.

We look forward to seeing you on September 18, 2008 and urge you to return your WHITE proxy card as soon as possible.

|

Sincerely, |

|

/s/ Wm. Christopher Gorog |

Wm. Christopher Gorog Chairman and Chief Executive Officer |

Preliminary Copy

NAPSTER, INC.

9044 MELROSE AVE.

LOS ANGELES, CALIFORNIA 90069

(310) 281-5000

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON SEPTEMBER 18, 2008

To the Stockholders of Napster, Inc.:

Notice is hereby given that the Annual Meeting of Stockholders of Napster, Inc. will be held at 10:00 a.m., local time, on September 18, 2008, at our Napster offices located at 9044 Melrose Avenue, Los Angeles, California 90069 for the following purposes, as more fully described in the accompanying Proxy Statement:

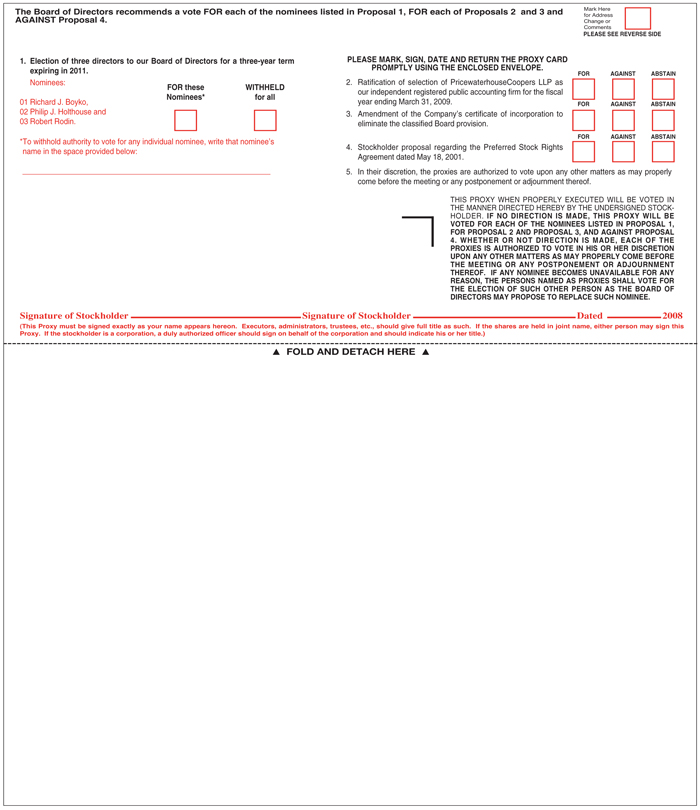

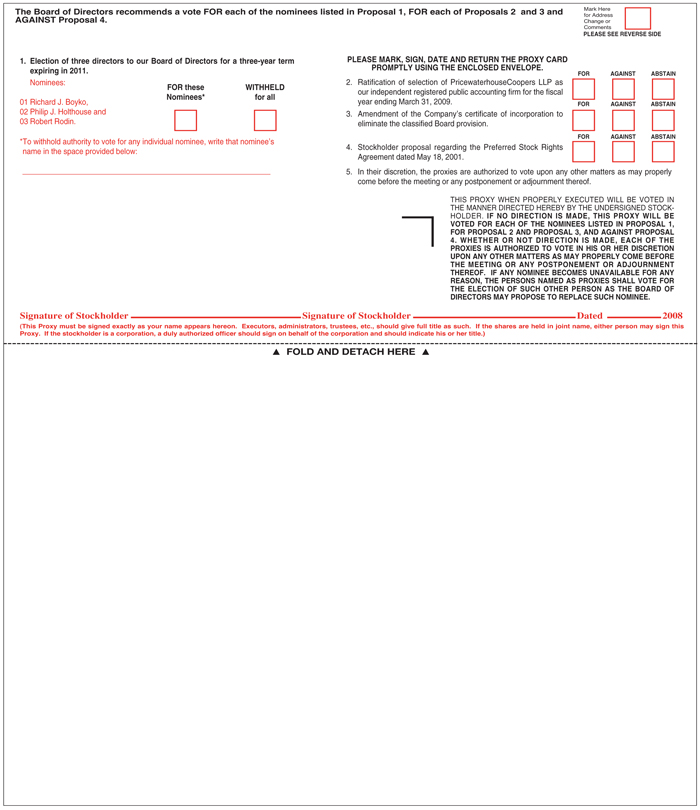

1. To elect three directors for a term of three years expiring at the 2011 Annual Meeting of Stockholders and until their respective successors are duly elected and qualified;

2. To ratify the selection of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending March 31, 2009;

3. To vote upon a proposal to amend the Company’s certificate of incorporation to eliminate the classified Board provision;

4. To vote upon a proposal submitted by stockholders regarding our Preferred Stock Rights Agreement dated May 18, 2001, if properly presented at the Annual Meeting; and

5. To transact such other business as may properly come before the meeting and any postponements or adjournments thereof.

The Board of Directors has fixed the close of business on July 24, 2008 as the record date for determining stockholders entitled to notice of, and to vote at, the Annual Meeting and any postponement or adjournment thereof.

|

By order of the Board of Directors, |

|

/s/ Aileen Atkins |

Aileen Atkins Secretary |

Los Angeles, California

August [·], 2008

ALL STOCKHOLDERS ARE URGED TO ATTEND THE MEETING IN PERSON OR BY PROXY. WHETHER OR NOT YOU EXPECT TO BE PRESENT AT THE MEETING, PLEASE COMPLETE, SIGN AND DATE THE ENCLOSED WHITE PROXY CARD AND RETURN IT PROMPTLY IN THE ENCLOSED POSTAGE-PREPAID ENVELOPE FURNISHED FOR THAT PURPOSE.

Preliminary Copy

NAPSTER, INC.

9044 MELROSE AVE.

LOS ANGELES, CALIFORNIA 90069

(310) 281-5000

PROXY STATEMENT

We are sending this Proxy Statement to you, the stockholders of Napster, Inc., a Delaware corporation, as part of our Board of Directors’ solicitation of proxies to be voted at our Annual Meeting of Stockholders to be held at 10:00 a.m., local time, on September 18, 2008, at 9044 Melrose Avenue, Los Angeles, CA 90069, and any postponements or adjournments thereof.

We are mailing this Proxy Statement and proxy card on or about August [·], 2008. We are also enclosing a copy of our 2008 Annual Report to Stockholders, which includes our financial statements for the fiscal year ended March 31, 2008 (“fiscal 2008”). The Annual Report is not, however, part of the proxy materials.

The Company has received a notice from a stockholder seeking to nominate himself and two other stockholders for election to the Board of Directors at the Annual Meeting. Two of these stockholders have also notified the Company of their intention to present three additional proposals for consideration at the Annual Meeting. See “Other Matters” on page 43 of this Proxy Statement. You may receive proxy materials from these stockholders that solicit your proxy and ask you to support their director nominations to the Board of Directors and the three proposals. The Board of Directors has not endorsed the stockholder director nominations or any of the other three proposals. As a result, we urge stockholders NOT to sign or return any proxy card that you receive from these stockholders.

1

QUESTIONS AND ANSWERS

What am I voting on?

At the Annual Meeting, our stockholders will be voting on four proposals: (i) the election of three directors to serve until our 2011 annual meeting of stockholders and until their successors are duly elected and qualified; (ii) the ratification of the selection of PricewaterhouseCoopers LLP (“PwC”) as our independent registered public accounting firm; (iii) the amendment of the Company’s certificate of incorporation to eliminate the classified Board provision; and (iv) if properly presented at the Annual Meeting, a stockholder proposal regarding our Preferred Stock Rights Agreement dated May 18, 2001.

We will also consider any other business that properly comes before the Annual Meeting or any adjournments or postponements thereof, including the director nominations and three additional stockholder proposals described under “Other Matters” on page 43 of this Proxy Statement, if properly presented at the Annual Meeting.

For the stockholder proposal regarding our Preferred Stock Rights Agreement and each of the additional matters described under “Other Matters” to be properly presented at the Annual Meeting, the stockholder that submitted the proposal or director nominations (or a qualified representative of that stockholder) must appear at the Annual Meeting to present the proposal or nominations. For these purposes, to be considered a qualified representative of a stockholder, a person must be a duly authorized officer, manager or partner of that stockholder or must be authorized by a writing executed by the stockholder or an electronic transmission delivered by the stockholder to act for the stockholder as proxy at the Annual Meeting, and such person must produce the writing or electronic transmission, or a reliable reproduction of the writing or electronic transmission, at the Annual Meeting. Pursuant to our bylaws, the chairman of the Annual Meeting will determine whether any business proposed to be transacted by our stockholders has been properly presented for stockholder action at the meeting, even if we have received proxies in respect of the vote on such matter.

How does the Board of Directors recommend I vote on the proposals?

Our Board of Directors recommends that the stockholders vote:

| | • | | FOR the Board of Directors’ nominees for director, which are Richard J. Boyko, Philip J. Holthouse and Robert Rodin, |

| | • | | FOR the ratification of the selection of PwC as our independent registered public accounting firm for the fiscal year ending March 31, 2009 (“fiscal 2009”), |

| | • | | FOR the amendment to the Company’s certificate of incorporation to eliminate the classified Board provision, and |

| | • | | AGAINST the stockholder proposal regarding our Preferred Stock Rights Agreement dated May 18, 2001. |

Who is entitled to vote at the meeting?

Stockholders of record as of the close of business on July 24, 2008, which is known as the record date, are entitled to vote at the Annual Meeting.

How do I vote?

If your shares are registered directly in your name, you are considered the “stockholder of record” with respect to those shares and this Proxy Statement and the WHITE proxy card are being sent directly to you by the Company. As the stockholder of record, you may direct your vote by completing, signing and dating the

2

WHITE proxy card you receive and returning it in the postage-prepaid envelope. As the stockholder of record, you also have the right to attend the Annual Meeting and vote in person. Most stockholders hold their shares through a broker, bank or other nominee (that is, in “street name”) rather than directly in their own name. If you hold your shares in street name, you are a “beneficial owner,” and the proxy materials are being forwarded to you by your broker, bank or other nominee together with a WHITE voting instruction card. Because a beneficial holder is not the stockholder of record, you may not vote these shares in person at the meeting unless you obtain a “legal proxy” from the broker, bank or other nominee that holds your shares, giving you the right to vote the shares at the meeting. Even if you plan to attend the Annual Meeting, we recommend that you complete, sign and date the enclosed WHITE proxy card and return it promptly in the enclosed postage-prepaid envelope so that your vote will be counted if you later decide not to attend the Annual Meeting.

How will my shares be voted if I return a blank WHITE proxy card?

If you are a stockholder of record, and you return a signed WHITE proxy card but do not mark the boxes showing how you wish to vote, your shares will be voted FOR the Board’s director nominees; FOR the ratification of the selection of PwC as our independent registered public accounting firm; FOR the amendment of the Company’s certificate of incorporation to eliminate the classified Board provision; and AGAINST the stockholder proposal regarding the Preferred Stock Rights Agreement dated May 18, 2001, if properly presented at the Annual Meeting. In addition, if you return a signed WHITE proxy card, the persons named in the proxy will exercise their discretion to vote AGAINST each of the three stockholder proposals discussed under “Other Matters” on page 43 of this Proxy Statement, if properly presented at the Annual Meeting, and will vote in their discretion with respect to any other business as may properly come before the meeting and any postponements or adjournments thereof. If you hold your shares in street name and do not provide your broker with voting instructions (including by returning a blank WHITE voting instruction card), your shares may be treated as “broker non-votes” and may not be counted in connection with certain matters (as described below).

How can I change my vote or revoke my proxy?

You have the right to change your vote or revoke your proxy at any time before your shares are actually voted at the Annual Meeting. If you are a stockholder of record, you may do so by:

| | • | | notifying our corporate secretary in writing; |

| | • | | signing and returning a later-dated proxy card; or |

| | • | | voting in person at the Annual Meeting. |

For shares you hold in street name, you may change your vote by submitting new voting instructions to your broker, bank or other nominee or, if you have obtained a legal proxy from your broker, bank or other nominee giving you the right to vote your shares at the Annual Meeting, by attending the meeting and voting in person.

What does it mean if I receive more than one proxy or voting instruction card?

It probably means your shares are registered differently and are in more than one account. Sign and return all WHITE proxy or voting instruction cards to ensure that all your shares are voted.

As previously noted, the Company has received a notice from a stockholder seeking to nominate himself and two other stockholders for election to the Board of Directors at the Annual Meeting, and two of these stockholders have also notified the Company of their intention to present three additional proposals for

3

consideration at the Annual Meeting. As a result, you may receive proxy materials and proxy cards from both the Company and these stockholders. The Board encourages you to vote each WHITE proxy or voting instruction card you receive and urges you not to sign or return any proxy card sent to you by these stockholders.

How many shares can vote?

As of the record date, [·] shares of our common stock were issued and outstanding. Holders of our common stock as of the record date are entitled to one vote per share for each matter before the meeting.

How many votes are required to approve the proposals?

Proposal 1: A plurality of the shares of common stock present, in person or represented by proxy, and entitled to vote is required to elect the nominees for director. A plurality means that the nominees receiving the largest number of votes, up to the number of nominees to be elected, will be elected. Each stockholder will be entitled to vote the number of shares of common stock held as of the record date by that stockholder for each director position to be filled. Stockholders will not be allowed to cumulate their votes in the election of directors.

Proposal 2: The affirmative vote of the holders of a majority of the shares of common stock present, in person or represented by proxy, and entitled to vote on the proposal is required to ratify the selection of PwC as Napster’s independent registered public accounting firm for fiscal 2009.

Proposal 3: The affirmative vote of holders of at least 80% of the outstanding shares of common stock entitled to vote generally in the election of directors, whether or not present or represented at the meeting, is required to approve the amendment to the Company’s certificate of incorporation to eliminate the classified Board provision.

Proposal 4: The affirmative vote of holders of a majority of the shares of common stock present, in person or represented by proxy, and entitled to vote on the proposal is required to approve the stockholder proposal regarding the Preferred Stock Rights Agreement dated May 18, 2001, if such proposal is properly presented at the Annual Meeting.

If other matters are properly brought before the Annual Meeting, the vote required will be determined in accordance with applicable law, the Nasdaq Marketplace Rules, and Napster’s charter and bylaws, as applicable.

What constitutes a quorum?

A quorum is a majority of the outstanding shares of our common stock entitled to vote at the Annual Meeting. Both abstentions and broker non-votes are counted for determining the presence of a quorum. As there were [·] shares of our common stock outstanding as of the record date, we will need at least [·] shares present in person or by proxy at the Annual Meeting for a quorum to exist.

What happens if I abstain?

When an eligible voter attends the meeting, in person or by proxy, but decides not to vote, his or her decision not to vote is called an abstention. Properly executed proxy cards that are marked “abstain” on any proposal will be treated as abstentions for that proposal. In all matters other than the election of directors, abstentions have the same effect as votes AGAINST the proposal.

4

How will broker non-votes be treated?

If you are the beneficial owner of shares held in “street name” by a broker or nominee, the broker or nominee, as the record holder of the shares, is required to vote those shares in accordance with your instructions. If you do not give instructions to the broker or nominee, that person will nevertheless be entitled to vote the shares with respect to routine matters (such as the ratification of the selection of our independent registered public accounting firm and the amendment of our certificate of incorporation to eliminate the classified Board provision), but will not be permitted to vote the shares with respect to “non-routine” items (in which case, the shares will be treated as broker non-votes). The stockholder proposal regarding the Preferred Stock Rights Agreement is a non-routine item. In addition, if proxies are solicited by the stockholder proponents in support of their director nominees and the three proposals described under “Other Matters” on page 43 of this Proxy Statement, then all items on the agenda for the Annual Meeting, including the election of directors, will be non-routine items for those brokerage accounts solicited. Thus, if you do not give your broker specific instructions with respect to the voting of your shares, your shares may be treated as “broker non-votes” and will not be counted in determining whether the number of votes necessary to approve those matters has been obtained.

Who can attend the Annual Meeting?

All stockholders as of July 24, 2008 can attend the Annual Meeting.

What do I need for admission to the Annual Meeting?

You are entitled to attend the Annual Meeting only if you are a stockholder of record or a beneficial owner as of July 24, 2008, or you hold a valid proxy for the Annual Meeting. If you are a stockholder of record, your name will be verified against the list of stockholders of record prior to your being admitted to the Annual Meeting. You should be prepared to present photo identification for admission. If you hold your shares in street name, you should provide proof of beneficial ownership on the record date, such as a brokerage account statement showing that you owned Napster stock as of the record date, a copy of the WHITE voting instruction card provided by your broker, bank or other nominee, or other similar evidence of ownership as of the record date, as well as your photo identification, for admission. If you do not provide photo identification or comply with the other procedures outlined above upon request, you will not be admitted to the Annual Meeting.

When are stockholder proposals due for the 2009 Annual Meeting?

Proposals for Inclusion in Proxy Statement. If you want to include a stockholder proposal in the proxy materials for our 2009 Annual Meeting of Stockholders, it must be delivered to our corporate secretary at our principal office located at 9044 Melrose Avenue, Los Angeles, California 90069 no later than April [· ], 2009. In addition, to be included in our proxy materials, your proposal must also comply with the Company’s bylaws and Rule 14a-8 under the Securities Exchange Act of 1934 regarding the inclusion of stockholder proposals in company-sponsored proxy materials. If we change the date of the 2009 Annual Meeting by more than 30 days from the anniversary date of this year’s Annual Meeting, your proposal must be received by our corporate secretary at our principal office a reasonable time before we begin to print and mail our proxy materials for the 2009 Annual Meeting.

Proposals and Director Nominations to be Addressed at Meeting. If you intend to nominate persons for election to the Board of Directors at the 2009 Annual Meeting or you wish to present a proposal at our 2009 Annual Meeting and do not timely request inclusion of the proposal in our proxy statement, then we must receive written notice of such nomination or proposal no later than the close of business on May 21, 2009 (provided, however, that if the date of the 2009 Annual Meeting has been changed by more than 30 days from

5

the date of the previous year’s meeting, nominations and proposals must be delivered no later than the close of business on the 120th day prior to the date of the 2009 Annual Meeting or the 10th day following the day on which public announcement of the date of the 2009 Annual Meeting is first made, whichever occurs first). The stockholder’s written notice must include certain information concerning the stockholder and each nominee and proposal, as specified in the Company’s bylaws.

How will Napster solicit proxies for the Annual Meeting?

We are soliciting proxies by mailing this Proxy Statement and the WHITE proxy card to our stockholders. We will pay the solicitation costs and will reimburse banks, brokerage houses and other custodians, nominees and fiduciaries for their reasonable expenses in forwarding proxy materials to beneficial owners. We estimate that the total expenditures relating to our proxy solicitation (other than salaries and wages of officers and employees) will be approximately $[·], of which approximately $[·] has been incurred as of the date of this Proxy Statement. The Company may conduct the solicitation by mail, personally, telephonically or by facsimile through its officers, directors and employees identified on Appendix A, none of whom will receive additional compensation for assisting with the solicitation. The Company may also solicit stockholders through press releases issued by the Company, advertisements in periodicals and postings on the Company’s website. The Company has also engaged Laurel Hill Advisory Group, LLC, who may assist us in the solicitation of proxies for a fee that would be approximately $10,000 plus out-of-pocket expenses. In addition, the Company has agreed to indemnify Laurel Hill Advisory against certain liabilities arising out of or in connection with the engagement. Laurel Hill Advisory has advised the Company that approximately 25 of its employees would be involved in the proxy solicitation by Laurel Hill Advisory on behalf of the Company.

How do I obtain a copy of the Annual Report on Form 10-K that Napster filed with the Securities and Exchange Commission?

Our Annual Report on Form 10-K is part of the Annual Report that is being mailed to you with this Proxy Statement. If, for whatever reason, you need another copy, we will provide one to you free of charge upon your written request to our corporate secretary at Napster, Inc., Attn: Secretary, 9044 Melrose Avenue, Los Angeles, California 90069.

How do I obtain a separate set of proxy materials if I share an address with other stockholders?

As permitted by applicable law, only one copy of the proxy materials, which include this Proxy Statement and the Annual Report, is being delivered to stockholders with the same last name residing at the same address, unless such stockholders have notified Napster of their desire to receive multiple copies of the proxy materials. Napster will promptly deliver within 30 days, upon oral or written request, a separate copy of the proxy materials to any stockholder residing at an address to which only one copy was mailed. If you are a stockholder at a shared address to which we delivered a single copy of the proxy materials and you desire to receive a separate copy of this Proxy Statement or the Annual Report, or if you desire to receive a separate proxy statement or annual report in the future, or if you are a stockholder at a shared address to which we delivered multiple copies of the proxy materials and you desire to receive one copy in the future, please submit your request by mail to our corporate secretary at Napster, Inc., Attn: Secretary, 9044 Melrose Avenue, Los Angeles, California 90069.

6

PROPOSAL 1

ELECTION OF DIRECTORS

Our Board of Directors currently consists of eight directors. Our certificate of incorporation provides for a classified Board of Directors consisting of three classes of directors, each serving staggered three-year terms. At the Annual Meeting, three directors will be elected for a term of three years expiring at our 2011 Annual Meeting of Stockholders and until their successors are duly elected and qualified. The Board’s nominees, Richard J. Boyko, Philip J. Holthouse and Robert Rodin, are presently members of our Board of Directors. The Board of Directors recommends that the stockholders vote in favor of the election of the nominees named in this Proxy Statement to serve as members of our Board of Directors. See “Nominees” below.

The five directors whose terms of office do not expire in 2008 will continue to serve after the Annual Meeting until such time as their respective terms of office expire and their respective successors are duly elected and qualified. See “Other Directors” below.

All nominees named below have consented to being named in this Proxy Statement and to serve as directors, if elected. If at the time of the Annual Meeting the nominees should be unable or decline to serve, the persons named as proxies on the proxy card will vote for such substitute nominee(s) as our Board of Directors recommends, or vote to allow the vacancy created thereby to remain open until filled by our Board of Directors, as our Board of Directors recommends. The Board of Directors has no reason to believe that the nominees will be unable or decline to serve as directors if elected.

Nominees

The names of the Board’s nominees for election to our Board of Directors for a three-year term expiring at the 2011 Annual Meeting and certain biographical information concerning such nominees are set forth below:

Richard J. Boyko, age 59, has served as a director since April 2001. Mr. Boyko’s current term as a director expires at the Annual Meeting in 2008. Since July 2003, Mr. Boyko has served as the managing director of the VCU School of Mass Communications graduate program in advertising. Prior to that, Mr. Boyko served as co-president and chief creative officer of Ogilvy & Mather, an advertising agency. He joined Ogilvy & Mather in November 1990. Mr. Boyko also serves on the board of Martha Stewart Living Omnimedia. Mr. Boyko majored in advertising at Art Center College of Design.

Philip J. Holthouse, age 49, has served as a director since January 2004. Mr. Holthouse’s current term as a director expires at the Annual Meeting in 2008. Mr. Holthouse is a partner with Holthouse Carlin & Van Trigt LLP, which he co-founded in 1991. Mr. Holthouse holds a master’s degree in business taxation and a bachelor’s degree in business administration, both from the University of Southern California, a law degree from Loyola Law School in Los Angeles and is a certified public accountant.

Robert Rodin, age 54, has served as a director since April 2001. Mr. Rodin’s current term as a director expires at the Annual Meeting in 2008. Since October 2002, Mr. Rodin has been the founder and chief executive officer of the RDN Group, a management consulting firm. From 1999 through October 2002, Mr. Rodin was the founder, chairman of the board and chief executive officer of eConnections, a provider of extended supply chain intelligence solutions. From 1999 to 2000, Mr. Rodin served as Avnet’s president of global supply change management and electronic commerce solutions and as a member of Avnet’s global managing board. From 1991 through 1999, Mr. Rodin served as chief executive officer and president of Marshall Industries, an industrial electronics distributor prior to its sale to Avnet. Mr. Rodin also serves on the board of SM&A. Mr. Rodin holds a B.A. in psychology from University of Connecticut.

THE BOARD OF DIRECTORS RECOMMENDS THAT STOCKHOLDERS VOTE FOR EACH OF THE ABOVE MENTIONED NOMINEES.

7

Other Directors

The following persons will continue to serve as members of our Board of Directors after the Annual Meeting until their respective terms of office expire (as indicated below) and their respective successors are duly elected and qualified:

Vernon E. Altman, age 62, has served as a director since December 2001. Mr. Altman’s current term as a director expires at the Annual Meeting in 2010. Mr. Altman is a senior partner and director of Bain & Company, a leading international consulting firm, and Mr. Altman leads Bain’s technology/telecommunication practice and Bain’s full potential transformation practice. Mr. Altman joined Bain at its founding in 1973. Mr. Altman received bachelor’s and master’s degrees in electrical engineering from Massachusetts Institute of Technology (MIT), and a master’s degree in management from MIT’s Sloan School.

Wm. Christopher Gorog, age 55, has served as our chief executive officer and a director since September 2000. Mr. Gorog’s current term as a director expires at the Annual Meeting in 2010. Mr. Gorog has served as our chairman of the board since September 2001. From February 1999 to September 2000, Mr. Gorog served as a consultant in the entertainment and media industry, including serving as advisor to J.H. Whitney, an asset management company, in HOB Entertainment, Inc.’s acquisition of Universal Concerts. From November 1995 to February 1999, Mr. Gorog served as president of new business development at Universal Studios, an entertainment company. From January 1995 to November 1995, Mr. Gorog served as executive vice president of group operations at Universal Studios. Mr. Gorog earned a B.A.S. in telecommunications and film from San Diego State University.

Joseph C. Kaczorowski, age 52, has served as a director since April 2001. Mr. Kaczorowski’s current term as a director expires at the Annual Meeting in 2009. Since June 2008, Mr. Kaczorowski has been a partner at Grosvenor Park, a specialist provider of financial solutions to the entertainment industry. Mr. Kaczorowski served as president of HOB Entertainment, Inc., an entertainment company, from May 2004 until January 2007. He joined HOB Entertainment, Inc. in August 1996. Mr. Kaczorowski holds a B.S. in accounting from St. John’s University and is a certified public accountant.

Ross Levinsohn, age 45, has served as a director since February 2007. Mr. Levinsohn’s current term as a director expires at the Annual Meeting in 2010. Since August 2007, Mr. Levisohn has been a partner with Velocity Interactive Group, a leading investment firm that focuses on digital media and communications. From January 2005 to December 2006, Mr. Levinsohn served as president of Fox Interactive Media (the internet and media arm of News Corporation). Mr. Levinsohn was formerly Senior Vice President and General Manager of Fox Sports Interactive Media from January 2001 to January 2005. Prior to joining Fox, Mr. Levinsohn was employed by AltaVista Network from April 1999 to June 2000, where he last served as Vice President and Executive Producer of the AltaVista Network. Before that, Mr. Levinsohn served as Vice President, Programming and Executive Producer of CBS Sportsline and as the Director of Production and Marketing Enterprises for HBO. Mr. Levinsohn received a B.A. in broadcast communications from American University.

Brian C. Mulligan, age 49, has served as a director since March 2003. Mr. Mulligan’s current term as a director expires at the Annual Meeting in 2009. Mr. Mulligan is currently chairman of Brooknol Advisors, LLC, an advisory and investment firm specializing in media and entertainment. From April 2004 through January 2005, Mr. Mulligan was a senior executive advisor—media and entertainment with Cerberus Capital Management LP, an investment firm. From September 2002 to March 2004, Mr. Mulligan founded and was a principal with Universal Partners, a group formed to acquire Universal Studios, Inc. From April 2002 to August 2002, Mr. Mulligan was an Executive Advisor with The Boston Consulting Group, Inc., a business consulting firm. From January 2001 to March 2002, Mr. Mulligan served as chairman and consultant for Fox Television, Inc., including the television stations group, cable channels, and business operations of the Fox Network of News Corporation. From November 1999 to December 2000, Mr. Mulligan was the chief financial officer of The Seagram Company Ltd., parent company of Universal Music and Universal Studios, Inc. From June 1999 to December 1999, he was co-chairman of Universal Pictures, Inc., an entertainment company. Mr. Mulligan holds

8

a bachelor’s degree in business administration from the University of Southern California and a master’s degree in business administration from the John E. Anderson Graduate School of Management from the University of California, Los Angeles.

Director Independence

Our Corporate Governance Guidelines require that a majority of the directors serving on our Board of Directors meet the standard of director independence set forth in The Nasdaq Stock Market, Inc. listing standards as the same may be amended from time to time, as well as other factors not inconsistent with the Nasdaq listing standards that our Board of Directors considers appropriate for effective oversight and decision-making. Our Board of Directors has affirmatively determined that each of the directors, except Wm. Christopher Gorog, is an independent director.

Attendance at Meetings

Our Board of Directors met in person or conducted telephonic meetings a total of twelve (12) times during fiscal 2008. During that same period, the Board did not act by unanimous written consent. During fiscal 2008, no director attended fewer than 75% of the total number of meetings of the Board of Directors and all Board committees of which he was a member.

Policy Regarding Director Attendance at Annual Meetings of the Stockholders

It is the policy of Napster that at least one member of its Board of Directors will attend each Annual Meeting of Stockholders, and all directors are encouraged to attend such meetings. Napster will reimburse directors for reasonable expenses incurred in attending Annual Meetings of Stockholders. One director attended the Annual Meeting of Stockholders on September 20, 2007.

Communications with the Board of Directors

Stockholders may communicate with any and all company directors by transmitting correspondence by mail, facsimile or email, addressed as follows:

Chairman of the Board

or Board of Directors

or [individual director]

c/o Corporate Secretary

Napster, Inc.

9044 Melrose Avenue

Los Angeles, CA 90069

Fax: 310-281-5121

boardofdirectors@napster.com

The corporate secretary shall maintain a log of such communications and transmit as soon as practicable such communications to the identified director addressee(s), unless there are safety or security concerns with respect to the communication or the communication contains commercial matters not related to the stockholder’s stock ownership, as determined by the corporate secretary. The Board of Directors or individual directors so addressed shall be advised of any communication withheld for safety or security reasons as soon as practicable.

Committees of the Board of Directors

Our Board of Directors has established a standing audit committee, a standing compensation committee, a standing executive committee and a standing nominating and governance committee. Each of these committees (other than the executive committee) is comprised entirely of directors who are not officers of Napster.

9

Audit Committee

The audit committee of our Board of Directors (the “Audit Committee”) consists of three non-employee directors: Messrs. Altman, Kaczorowski, and Holthouse. Mr. Kaczorowski is the Chairperson of our Audit Committee. Our Audit Committee operates under a written charter that was originally adopted in 2001 and restated in July 2008. The Audit Committee Charter is available in the Corporate Governance section of our website at http://investor.napster.com. The Audit Committee Charter requires that the Audit Committee consist of three or more Board members who satisfy the “independence” requirements of Nasdaq and applicable law, including Rule 10A-3 under the Securities Exchange Act of 1934. Each of the members of the Audit Committee satisfies these requirements. In addition, the Board has determined that Mr. Kaczorowski is an “audit committee financial expert” as defined under the rules of the Securities and Exchange Commission. The Audit Committee reviews our auditing, accounting, financial reporting and internal control functions and is responsible for the selection and retention of our independent registered public accounting firm. The Audit Committee has also considered whether the provision of non-audit services by PwC is compatible with maintaining the independence of PwC.

In discharging its duties, the Audit Committee oversees the following matters:

| | • | | the integrity of our financial statements; |

| | • | | our compliance with legal and regulatory requirements; |

| | • | | the independent registered public accounting firm’s qualifications and independence; and |

| | • | | the performance of our independent registered public accounting firm. |

The Audit Committee met in person or conducted telephonic meetings a total of eleven (11) times during fiscal 2008. During that same period, the Audit Committee acted one (1) time by unanimous written consent.

Compensation Committee

The compensation committee of our Board of Directors (the “Compensation Committee”) consists of three non-employee directors: Messrs. Kaczorowski, Levinsohn and Rodin. Mr. Rodin is the Chairperson of our Compensation Committee. The Compensation Committee Charter was adopted in 2001 and restated in October 2005, and is available in the Corporate Governance section of our website at http://investor.napster.com. The restated Compensation Committee Charter requires that the Compensation Committee consist of two or more Board members who satisfy the “independence” requirements of Nasdaq and will qualify as non-employee directors under Rule 16b-3 under the Securities Exchange Act of 1934, as amended, and as outside directors under Internal Revenue Code Section 162(m) and applicable law. Each of the members of the Compensation Committee satisfies these requirements.

The Compensation Committee met in person or conducted telephonic meetings a total of six (6) times during fiscal 2008. During that same period, the Compensation Committee acted one (1) time by unanimous written consent.

Executive Committee

The executive committee of our Board of Directors (the “Executive Committee”) consists of three non-employee directors and one employee director: Messrs. Gorog, Kaczorowski, Mulligan and Rodin. Our Executive Committee works with management in connection with the business and affairs of our company.

The Executive Committee Charter was adopted in January 2007, and is available in the Corporate Governance section of our website at http://investor.napster.com. According to the Executive Committee Charter, the Executive Committee will be comprised of three or more directors, and the members of the Executive Committee will be appointed by and serve at the discretion of our Board of Directors.

10

The Executive Committee met in person or conducted telephonic meetings a total of two (2) times during fiscal 2008. During that same period, the Executive Committee acted one (1) time by unanimous written consent.

Nominating and Governance Committee

The nominating and governance committee of our Board of Directors (the “Nominating & Governance Committee”) consists of two non-employee directors: Messrs. Boyko and Mulligan. Mr. Mulligan is the Chairperson of our Nominating & Governance Committee. Our Nominating & Governance Committee (a) assists our Board of Directors in identifying individuals qualified to become Board members and Board committee members, and selects, or recommends that the Board select, the director nominees for each Annual Meeting of stockholders and the Board committee nominees for approval by the Board; and (b) monitors and evaluates our Board’s corporate governance policies and makes recommendations to our Board with respect thereto.

Our Nominating & Governance Committee Charter was adopted August 15, 2003 and is available in the Corporate Governance section of our website at http://investor.napster.com. This charter requires that the Nominating & Governance Committee consists of two or more board members who satisfy the “independence” requirements of Nasdaq. Each of the members of the Nominating & Governance Committee satisfies these requirements.

The Nominating & Governance Committee met in person or conducted telephonic meetings a total of two (2) times during fiscal 2008. During that same period, the Nominating & Governance Committee did not act by unanimous written consent.

Director Qualifications

The Nominating & Governance Committee has established the following minimum criteria for evaluating prospective nominees:

| | • | | Reputation for integrity, strong moral character and adherence to high ethical standards. |

| | • | | Holds or has held a generally recognized position of leadership in community and/or chosen field of endeavor, and has demonstrated high levels of accomplishment. |

| | • | | Demonstrated business acumen and experience, and ability to exercise sound business judgment and common sense in matters that relate to the current and long-term objectives of Napster. |

| | • | | Ability to read and understand basic financial statements and other financial information pertaining to Napster. |

| | • | | Commitment to understand Napster and its business, industry and strategic objectives. |

| | • | | Commitment and ability to regularly attend and participate in meetings of our Board of Directors, Board committees and stockholders, number of other company boards on which the candidate serves and ability to generally fulfill all responsibilities as a director of Napster. |

| | • | | Willingness to represent and act in the interests of all stockholders of Napster rather than the interests of a particular group. |

| | • | | Good health and ability to serve. |

| | • | | For prospective non-employee directors, independence under Securities and Exchange Commission and applicable stock exchange rules, and the absence of any conflict of interest (whether due to a business or personal relationship) or legal impediment to, or restriction on, the nominee serving as a director. |

| | • | | Willingness to accept the nomination to serve as a director of Napster. |

11

Other Factors for Potential Consideration

The Nominating & Governance Committee will also consider the following factors in connection with its evaluation of each prospective nominee:

| | • | | Whether the prospective nominee will foster a diversity of skills and experiences. |

| | • | | Whether the nominee possesses the requisite education, training and experience to qualify as “financially literate” or as an “audit committee financial expert” under applicable stock exchange and Securities and Exchange Commission rules. |

| | • | | For incumbent directors standing for re-election, the Nominating & Governance Committee will assess the incumbent director’s performance during his or her term, including the number of meetings attended, level of participation, and overall contribution to Napster. |

| | • | | Composition of the Board and whether the prospective nominee will add to or complement the Board’s existing strengths. |

Identifying and Evaluating Nominees for Directors

The Nominating & Governance Committee initiates the process by preparing a slate of potential candidates who, based on their biographical information and other information available to the Nominating & Governance Committee, appear to meet the criteria specified above and/or who have specific qualities, skills or experience being sought (based on input from the full Board).

Outside Advisors. The Nominating & Governance Committee may engage a third-party search firm or other advisors to assist in identifying prospective nominees.

Stockholder Suggestions for Potential Nominees. The Nominating & Governance Committee will consider suggestions of nominees from stockholders. Stockholders may recommend individuals for consideration by submitting the materials set forth below to Napster addressed to the Chairman of the Nominating & Governance Committee at Napster’s address. To be timely, the written materials must be submitted within the time permitted for submission of a stockholder proposal for inclusion in Napster’s proxy statement for the subject Annual Meeting.

The written materials must include: (1) all information relating to the individual recommended that is required to be disclosed pursuant to Regulation 14A under the Securities Exchange Act of 1934 (including such person’s written consent to being named in the proxy statement as a nominee and to serving as a director if elected); (2) the name(s) and address(es) of the stockholder(s) making the nomination and the amount of Napster’s securities which are owned beneficially and of record by such stockholder(s); (3) appropriate biographical information (including a business address and a telephone number) and a statement as to the individual’s qualifications, with a focus on the criteria described above; (4) a representation that the stockholder of record is a holder of record of stock of Napster entitled to vote on the date of submission of such written materials; and (5) any material interest of the stockholder in the nomination.

The Nominating & Governance Committee will evaluate a prospective nominee suggested by any stockholder in the same manner and against the same criteria as any other prospective nominee identified by the Nominating & Governance Committee from any other source.

Nomination of Incumbent Directors. The re-nomination of existing directors is not automatic, but rather is based on continuing qualification under the criteria set forth above.

For incumbent directors standing for re-election, the Nominating & Governance Committee will assess the incumbent director’s performance during his or her term, including the number of meetings attended, level of participation, and overall contribution to Napster, the number of other company boards on which the individual

12

serves, composition of the Board at that time, and any changed circumstances affecting the individual director which may bear on his or her ability to continue to serve on the Board.

Upon completion of the above procedures, the Nominating & Governance Committee shall determine the list of potential candidates to be recommended to the full Board for nomination at the Annual Meeting.

Code of Conduct

We have adopted a Code of Conduct applicable to all employees, officers and Board members. The Code of Conduct was amended and restated in October 2005. A copy of the Amended and Restated Code of Conduct is available in the Corporate Governance section of our website at http://investor.napster.com and, along with the charters for our board committees, may be obtained upon request, without charge, by writing to our corporate secretary at Napster, Inc., attn: Secretary, 9044 Melrose Avenue, Los Angeles, CA 90069. We intend to satisfy the disclosure requirement under Item 5.05 of Form 8-K regarding any amendment to, or waiver from, applicable provisions of the Code of Conduct by our principal executive officer, principal financial officer, principal accounting officer or controller or persons performing similar functions by posting such information on our website, at the address and location specified above.

13

The following report of the Audit Committee does not constitute soliciting material and should not be deemed filed with the Securities and Exchange Commission under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, or incorporated by reference in any document so filed.

AUDIT COMMITTEE REPORT

To the Board of Directors

of Napster, Inc.

The Audit Committee has reviewed and discussed with Napster’s management and its independent registered public accounting firm, PricewaterhouseCoopers LLP, Napster’s audited financial statements for the years ended March 31, 2006, 2007 and 2008, known as the Audited Financial Statements. In addition, we have discussed with PricewaterhouseCoopers LLP the matters required by statement on Auditing Standards No. 61, as amended.

The Audit Committee also has received and reviewed the written disclosures and the letter from PricewaterhouseCoopers LLP required by Independence Standards Board Standard No. 1, and we have discussed with that firm its independence from Napster. We also have discussed with Napster’s management and PricewaterhouseCoopers LLP such other matters and received such assurances from them as we deemed appropriate.

Management is responsible for Napster’s internal controls and the financial reporting process. PricewaterhouseCoopers LLP is responsible for performing an independent audit of Napster’s financial statements in accordance with generally accepted auditing standards and issuing a report thereon. The Audit Committee’s responsibility is to monitor and oversee these processes.

Based on the foregoing review and discussions and a review of the report of PricewaterhouseCoopers LLP with respect to the Audited Financial Statements, and relying thereon, we recommended to Napster’s Board of Directors the inclusion of the Audited Financial Statements in Napster’s Annual Report on Form 10-K for the fiscal year ended March 31, 2008.

THE AUDIT COMMITTEE

Vernon E. Altman

Joseph C. Kaczorowski

Philip J. Holthouse

14

SECURITY OWNERSHIP OF CERTAIN

BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth, as of June 30, 2008, certain information with respect to the beneficial ownership of our common stock by:

| | • | | each person or group of affiliated persons known by us to own beneficially more than 5% of the outstanding shares of our common stock; |

| | • | | each of our Named Officers; and |

| | • | | all of our directors and executive officers as a group. |

Unless otherwise specified, the address of each beneficial owner is 9044 Melrose Ave., Los Angeles, CA 90069.

| | | | | |

Name | | Shares of Common

Stock Beneficially

Owned(1) | | Percentage of

Outstanding

Shares owned

(%) | |

5% or Greater Stockholders | | | | | |

Eminence Capital, LLC(2)

65 East 55th Street, 25th Floor

New York, NY 10022 | | 4,275,838 | | 8.94 | % |

Lloyd I. Miller, III(3)

4550 Gordon Drive

Naples, Florida 34102 | | 2,355,679 | | 4.92 | % |

Executive Officers and Directors | | | | | |

Wm. Christopher Gorog(4) | | 3,094,274 | | 6.24 | % |

Bradford D. Duea(5) | | 620,118 | | 1.29 | % |

Christopher Allen(6) | | 450,000 | | * | |

Suzanne Colvin(7) | | 264,573 | | * | |

Nand Gangwani | | 63,331 | | * | |

Laura B. Goldberg | | 39,966 | | * | |

Vernon E. Altman(8) | | 52,344 | | * | |

Richard J. Boyko(9) | | 60,594 | | * | |

Philip J. Holthouse(10) | | 49,844 | | * | |

Joseph C. Kaczorowski(11) | | 77,813 | | * | |

Brian C. Mulligan(12) | | 56,563 | | * | |

Robert Rodin(13) | | 94,716 | | * | |

Ross Levinsohn(14) | | 15,625 | | * | |

All directors and executive officers as a group (11 persons)(15) | | 4,836,464 | | 9.65 | % |

| (1) | | Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission. The number of shares beneficially owned by a person and the percentage ownership of that person includes shares of common stock subject to options held by that person that are currently exercisable or exercisable within 60 days of June 30, 2008 and shares that may be purchased through the Napster 2001 Employee Stock Purchase Plan on August 15, 2008. As of June 30, 2008, there were 47,853,159 outstanding shares of common stock. To our knowledge, except as otherwise indicated in the footnotes to this table and subject to applicable community property laws, each stockholder named in the table has sole voting and investment power with respect to the shares set forth opposite such stockholder’s name. |

15

| (2) | | As reported on a Schedule 13D/A filed on May 27, 2008. The Schedule 13D/A was filed by: (a) Eminence Capital, LLC, a New York limited liability company (“Eminence Capital”); (b) Eminence GP, LLC, a New York limited liability company (“Eminence GP”); and (c) Ricky C. Sandler, a U.S. citizen. The Schedule 13D/A indicates that it relates to shares of the Company’s common stock held for the accounts of Eminence Partners, LP, a New York limited partnership (“Eminence I”); Eminence Partners II, LP, a New York limited partnership (“Eminence II”); and Eminence Fund, Ltd. (“Offshore Fund”), a Cayman Islands company. Eminence I, Eminence II and the Offshore Fund are collectively referred to as the “Eminence Funds.” According to the Schedule 13D/A, (a) Eminence Capital is the beneficial owner of, and has shared voting and dispositive power with respect to, 4,275,838 shares of common stock, (b) Eminence GP is the beneficial owner of, and has shared voting and dispositive power with respect to, 1,797,968 shares of common stock, and (c) Ricky C. Sandler is the beneficial owner of, and has shared voting and dispositive power with respect to, 4,275,838 shares of common stock. The Schedule 13D/A indicates that (i) Eminence Capital serves as the investment manager to the Eminence Funds with respect to the shares of common stock directly owned by the Eminence Funds and may be deemed to have voting and dispositive power over the shares held for the accounts of the Eminence Funds; (ii) Eminence GP serves as general partner or manager with respect to the shares of common stock directly owned by the Eminence Funds, respectively, and may be deemed to have voting and dispositive power over the shares held for the accounts of the Partnerships, and (iii) Mr. Sandler is the Managing Member of each of Eminence Capital and Eminence GP and may be deemed to have voting and dispositive power with respect to the shares of common stock directly owned by the Eminence Funds. |

| (3) | | As reported on a Schedule 13G/A filed on February 8, 2008. The Schedule 13G/A was filed by Lloyd I. Miller to report his beneficial ownership of 2,355,679 shares of our common stock. The Schedule 13G/A indicates that Mr. Miller has sole voting and dispositive power over 1,186,067 of such shares as a manager of a limited liability company that is the general partnership of a certain limited partnership and as an individual. The Schedule 13G/A also indicates that Mr. Miller has shared voting and dispositive power over 1,169,612 of such shares as an investment advisor to the trustee of a certain family trust. |

| (4) | | Includes options to purchase 1,755,267 shares of our common stock within 60 days of June 30, 2008, 750 shares of our common stock purchasable through the Napster 2001 Employee Stock Purchase Plan on August 15, 2008, and 957,858 unvested shares of restricted common stock. Until vested, the shares of restricted common stock are subject to certain transfer restrictions and, in the event of a termination of the executive’s employment, forfeiture. |

| (5) | | Includes options to purchase 257,394 shares of our common stock within 60 days of June 30, 2008, 750 shares of our common stock purchasable through the Napster 2001 Employee Stock Purchase Plan on August 15, 2008, and 288,697 unvested shares of restricted common stock. Until vested, the shares of restricted common stock are subject to certain transfer restrictions and, in the event of a termination of the executive’s employment, forfeiture. |

| (6) | | Consists of 400,000 unvested shares of restricted common stock. Until vested, the shares of restricted common stock are subject to certain transfer restrictions and, in the event of a termination of the executive’s employment, forfeiture. |

| (7) | | Includes 750 shares of our common stock purchasable through the Napster 2001 Employee Stock Purchase Plan on August 15, 2008 and 235,355 unvested shares of restricted common stock. Until vested, the shares of restricted common stock are subject to certain transfer restrictions and, in the event of a termination of the executive’s employment, forfeiture. |

| (8) | | Consists of options to purchase 42,969 shares of our common stock within 60 days of June 30, 2008 and 5,859 unvested shares of restricted common stock. Until vested, the shares of restricted common stock are subject to certain transfer restrictions and, in the event that the director does not continue to be a member of the Board, forfeiture. |

| (9) | | Includes options to purchase 49,219 shares of our common stock within 60 days of June 30, 2008 and 5,859 unvested shares of restricted common stock. Until vested, the shares of restricted common stock |

16

| | are subject to certain transfer restrictions and, in the event that the director does not continue to be a member of the Board, forfeiture. |

| (10) | | Includes options to purchase 30,469 shares of our common stock within 60 days of June 30, 2008 and 5,859 unvested shares of restricted common stock. Until vested, the shares of restricted common stock are subject to certain transfer restrictions and, in the event that the director does not continue to be a member of the Board, forfeiture. |

| (11) | | Includes options to purchase 59,063 shares of our common stock within 60 days of June 30, 2008 and 7,031 unvested shares of restricted common stock. Until vested, the shares of restricted common stock are subject to certain transfer restrictions and, in the event that the director does not continue to be a member of the Board, forfeiture. |

| (12) | | Includes options to purchase 37,813 shares of our common stock within 60 days of June 30, 2008 and 7,031 unvested shares of restricted common stock. Until vested, the shares of restricted common stock are subject to certain transfer restrictions and, in the event that the director does not continue to be a member of the Board, forfeiture. |

| (13) | | Includes options to purchase 59,063 shares of our common stock within 60 days of June 30, 2008 and 7,031 unvested shares of restricted common stock. Until vested, the shares of restricted common stock are subject to certain transfer restrictions and, in the event that the director does not continue to be a member of the Board, forfeiture. |

| (14) | | Consists of 10,546 unvested shares of restricted common stock. Until vested, the shares of restricted common stock are subject to certain transfer restrictions and, in the event that the director does not continue to be a member of the Board, forfeiture. |

| (15) | | Includes options to purchase 2,291,257 shares of our common stock within 60 days of June 30, 2008, 2,250 shares of our common stock purchasable through the Napster 2001 Employee Stock Purchase Plan on August 15, 2008 and 1,931,126 unvested shares of restricted common stock. See notes 4-14 above. |

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16 of the Securities Exchange Act of 1934, as amended (“Section 16”), requires our executive officers (as defined under Section 16), directors and persons who beneficially own greater than 10% of the Company’s common stock (collectively, “Reporting Persons”) to file with the Securities and Exchange Commission initial reports of ownership and changes in ownership of the Company’s common stock. Reporting Persons are required by Securities and Exchange Commission regulations to furnish us with copies of all of the reports they file pursuant to Section 16.

Based solely on our review of these reports and written representations from our directors and executive officers that no other reports were required, we believe that during fiscal 2008 all filing requirements applicable to the Reporting Persons pursuant to Section 16 were timely met, with the exception of the following Form 4 filings that were not timely filed to report the disposal of shares that were withheld and reacquired by the Company to satisfy tax withholding obligations on each vesting date occurring during fiscal 2008 with respect to restricted shares previously awarded to the Reporting Person: five (5) Form 4 filings for Wm. Christopher Gorog; five (5) Form 4 filings for Bradford D. Duea; and two (2) Form 4 filings for Suzanne M. Colvin. We also failed to timely file the following Form 4s for two former executive officers to report the disposal of shares that were withheld and reacquired by the Company to satisfy tax withholding obligations on each vesting date occurring during fiscal 2008 while such former executive officer remained subject to Section 16 with respect to restricted shares previously awarded to such former executive officer: three (3) Form 4 filings for Nand Gangwani and three (3) Form 4 filings for Laura Goldberg.

17

PROCESSES AND PROCEDURES FOR DETERMINATION OF EXECUTIVE AND DIRECTOR COMPENSATION

The Compensation Committee is responsible for discharging the Board of Directors’ responsibilities relating to the compensation of Napster’s executives and directors. The Compensation Committee evaluates and approves the compensation arrangements, plans, policies and programs that apply to our executive officers and members of our Board of Directors. Pursuant to the Compensation Committee’s Charter, its principal compensation related responsibilities, duties and areas of authority include, among other things:

| | • | | To develop, review, evaluate and approve Napster’s overall compensation policies and establish appropriate performance-based incentives; |

| | • | | To review and approve the goals and objectives relevant to the compensation of our Chief Executive Officer, to evaluate the performance of our Chief Executive Officer and to determine the terms of the compensatory agreements and arrangements for our Chief Executive Officer; |

| | • | | To consider and approve the compensatory agreements and arrangements for our other executive officers; |

| | • | | To make recommendations to our Board of Directors with respect to Napster’s incentive compensation plans and equity-based compensation plans; |

| | • | | To review all of Napster’s other compensation plans and arrangements; |

| | • | | To set and review the compensation arrangements in effect for members of our Board of Directors and committees of our Board of Directors; |

| | • | | To retain compensation consultants, independent counsel and other advisors and experts as it deems necessary or appropriate to carry out its duties; and |

| | • | | To perform any other appropriate activities. |

The Compensation Committee’s Charter permits it to rely on members of management when performing its duties. The Compensation Committee takes into account our Chief Executive Officer’s recommendations regarding the corporate goals and objectives, performance evaluations and compensatory arrangements for Napster’s executive officers other than the Chief Executive Officer. In addition, our Board of Directors has delegated to our Chief Executive Officer the authority to approve certain stock option and restricted stock grants under Napster’s equity plans to persons who are not executive vice president level employees of Napster.

As indicated above, pursuant to its Charter, the Compensation Committee is authorized to retain compensation consultants to assist it in carrying out its duties. The Compensation Committee has the sole authority to terminate any compensation consultant it retains and to approve the firm’s fees and other retention terms. The Compensation Committee retained Hewitt Associates LLC at the end of fiscal 2007 to assist it in selecting Napster’s appropriate comparative peer group companies and to prepare a survey of the long-term equity incentive opportunities provided to executives by Napster and each of our peer group companies for compensation benchmarking purposes. Hewitt also assisted Napster in evaluating the dilutive effects of equity awards granted, or proposed to be granted, by Napster and our comparative peer group companies. The Compensation Committee also retained Hewitt at the end of fiscal 2008, with its review focused on modeling and evaluating the dilutive effects of the long-term equity incentive opportunities provided to executives by Napster and our comparative peer group companies.

18

DIRECTOR COMPENSATION—FISCAL 2008

The following table presents information regarding the compensation paid during fiscal 2008 to individuals who were members of our Board of Directors at any time during fiscal 2008 and who were not also our employees (referred to herein as “non-employee directors”). The compensation paid to any director who was also one of our employees during fiscal 2008 is presented below in the Summary Compensation Table—Fiscal 2008 and the related explanatory tables. Such employee-directors do not receive separate compensation for service on our Board of Directors.

| | | | | | | | |

Name (a) | | Fees

Earned or

Paid in

Cash ($)

(b) | | Stock

Awards

($)(1)(2)(4)

(c) | | Option

Awards

($)(1)(3)(4)

(d) | | Total ($)

(h) |

Vernon E. Altman | | 40,000 | | 5,968 | | 13,992 | | 59,960 |

Richard J. Boyko | | 40,000 | | 5,968 | | 13,992 | | 59,960 |

Philip J. Holthouse | | 40,000 | | 5,968 | | 26,480 | | 72,448 |

Joseph C. Kaczorowski | | 54,000 | | 28,675 | | 16,793 | | 99,468 |

Ross Levinsohn | | 40,000 | | 12,800 | | — | | 52,800 |

Brian C. Mulligan | | 44,000 | | 28,675 | | 15,994 | | 88,669 |

Robert Rodin | | 44,000 | | 28,675 | | 16,793 | | 89,468 |

| (1) | | The amounts reported in Column (c) and Column (d) above reflect the aggregate dollar amounts recognized for stock and option awards for financial statement reporting purposes with respect to fiscal 2008 (disregarding any estimate of forfeitures related to service-based vesting conditions). For a discussion of the assumptions and methodologies used to calculate the amounts reported, please see (i) the discussion of restricted stock and option awards contained in Note 10 (Employee Benefit Plans) to Napster’s Consolidated Financial Statements, included as part of Napster’s Annual Report on Form 10-K for the fiscal year ended March 31, 2008, and (ii) similar Employee Benefit Plan notes contained in Napster’s Consolidated Financial Statements filed on Form 10-Ks for prior fiscal years as to the restricted stock and option awards granted in those years, each of which notes is incorporated herein by reference. |

| (2) | | As described below, each of our continuing non-employee directors is entitled to an annual award of 3,125 shares of restricted stock. Any continuing non-employee director serving as the chair of our Board of Directors or the Audit, Compensation or Nominating & Governance Committees is entitled to an additional 625 shares of restricted stock (for a total annual award of 3,750 shares of restricted stock). The grant date fair value for financial statement reporting purposes of the 3,125 restricted shares granted to each continuing non-employee director during fiscal 2008 was equal to $6,156 and the grant date fair value for financial statement reporting purposes of the additional 625 restricted shares granted to Messrs. Kaczorowski, Mulligan and Rodin during fiscal 2008 in respect of their chair positions was equal to $1,231. See footnote (1) above for the assumptions used to value these awards. |

| (3) | | Beginning in January 2006, Napster began granting non-employee directors the equity portion of their compensation in the form of restricted shares instead of in stock options. The amounts reported for option awards represent the dollar amounts recognized in Napster’s fiscal 2008 financial statements for grants of option awards to non-employee directors prior to January 2006. |

19

| (4) | | The following table presents the aggregate number of outstanding unvested shares of restricted stock and outstanding unexercised options held by each of our non-employee directors as of March 31, 2008. Any shares of restricted stock that vested before March 31, 2008 are not included in the following table in accordance with Securities and Exchange Commission rules. |

| | | | |

Director | | Number of

Options

Outstanding | | Number of

Shares of

Restricted

Stock

Outstanding |

Vernon E. Altman | | 43,750 | | 7,031 |

Richard J. Boyko | | 50,000 | | 7,031 |

Philip J. Holthouse | | 31,250 | | 7,031 |

Joseph C. Kaczorowski | | 60,000 | | 8,437 |

Ross Levinsohn | | — | | 12,500 |

Brian C. Mulligan | | 38,750 | | 8,437 |

Robert Rodin | | 60,000 | | 8,437 |

Director Compensation

Compensation for non-employee directors during fiscal 2008 generally consisted of an annual cash retainer, an additional retainer for members of certain committees, meeting fees for members of the Executive Committee and awards of shares of restricted stock.

Annual Retainer

The following table sets forth the schedule of annual retainer and meeting fees for each non-employee director in effect during fiscal 2008:

| | | |

Type of Fee | | Dollar

Amount |

Annual Board Retainer | | $ | 30,000 |

Additional Annual Retainer for Service on any of the Audit Committee, Compensation Committee or Nominating & Governance Committee | | $ | 10,000 |

Per Meeting Fee for Attendance at Meetings of the Executive Committee | | $ | 2,000 |

All non-employee directors are also reimbursed for out-of-pocket expenses they incur serving as directors.

Restricted Stock Awards

Annual Grants. Under our Amended and Restated 2001 Stock Plan (the “2001 Stock Plan”), each continuing non-employee director with at least six months of service automatically receives an annual award of 3,125 shares of restricted stock on each January 1. The annual award for non-employee directors serving as the chair of our Board of Directors or the Audit, Compensation or Nominating & Governance Committees is increased to 3,750, in light of the additional duties and responsibilities these directors are required to perform. Each share of restricted stock is an actual share of Napster’s common stock that remains subject to forfeiture, but which otherwise has the same voting and dividend rights as other shares of our common stock.

Each non-employee director’s annual grant of restricted shares becomes vested as to 6.25% of the shares subject to the grant on each quarterly anniversary of the grant date, meaning that each grant will be fully vested on the fourth anniversary of the grant date. Non-employee directors’ restricted shares will also become fully vested upon a change in control of Napster. The vesting of each non-employee director’s restricted shares is

20

subject to the non-employee director’s service on our Board of Directors on the applicable vesting date. Unvested restricted shares will be forfeited for no value upon a non-employee director’s termination of services for Napster for any reason.

Our Board of Directors administers the 2001 Stock Plan with respect to non-employee director awards, and has the ability to interpret and make all required determinations under the plan, subject to plan limits. This authority includes making any required proportionate adjustments to outstanding restricted shares to reflect any impact resulting from various corporate events such as stock splits, stock dividends, combinations or reclassifications, and determining whether restricted shares should become fully vested in connection with a dissolution or liquidation of Napster.

Initial Grants. Each non-employee director who is newly appointed to our Board of Directors is entitled to a one-time award of 12,500 shares of restricted stock on the date he or she is first appointed. If the new non-employee director is initially appointed as the chair of our Board of Directors or the Audit, Compensation or Nominating & Governance Committees, the size of the initial award is increased to 15,000 shares of restricted stock. Non-employee directors’ initial restricted share awards become vested in the same manner and according to the same vesting schedule described above for annual grants, and otherwise have the same material terms as annual restricted share awards. We did not make any initial grants during fiscal 2008, because no non-employee directors were newly appointed to our Board of Directors during this fiscal year.

COMPENSATION DISCUSSION AND ANALYSIS

This section contains a discussion of the material elements of compensation awarded to, earned by or paid to the principal executive and principal financial officers of Napster, as well as a discussion of the material elements of compensation awarded to, earned or paid to two former officers who served as executive officers during fiscal 2008. As indicated in our Annual Report to Stockholders for fiscal 2008 filed on Form 10-K, we have determined that only four individuals were serving as executive officers of Napster at the end of our fiscal year. In accordance with Securities and Exchange Commission rules, the compensation of two of our former executive officers who left Napster during fiscal 2008 is also discussed. These six individuals are referred to as the “Named Officers” in this Proxy Statement.

Napster’s current executive compensation programs are determined and approved by the Compensation Committee. None of the Named Officers is a member of the Compensation Committee. As contemplated by its Charter, the Compensation Committee takes into account the Chief Executive Officer’s recommendations regarding the corporate goals and objectives, performance evaluations and compensatory arrangements for Napster’s executive officers other than the Chief Executive Officer. Our Interim Chief Financial Officer also advises the Compensation Committee with respect to the impact of executive and employee compensation on Napster’s actual and budgeted financial results. The other Named Officers do not currently have any role in determining or recommending the form or amount of compensation paid to our Named Officers.

Executive Compensation Program Objectives and Overview

Napster’s current executive compensation programs are intended to achieve three fundamental objectives: (1) recruit and retain superior talent; (2) create a significant direct relationship between pay and performance; and (3) create proper incentives for the executives to enhance the value of Napster for the benefit of our stockholders. In structuring our current executive compensation programs, we are guided by the following basic philosophies:

| | • | | “At Risk” Compensation. A significant portion of each executive’s compensation should be “at risk” and tied to Napster’s financial performance and the executive’s contributions to that performance. The percentage of total compensation that is “at risk” should be the highest for our executives. |

21

| | • | | Competition. Napster operates in the highly competitive technology industry and should provide competitive compensation opportunities so that we can attract and retain the superior talent needed for us to succeed in the evolving digital music distribution services market. |

| | • | | Alignment with Stockholder Interests. Executive compensation should be structured to align executives’ economic interests with those of our stockholders, and executive stock ownership should be encouraged. The equity portion of each executive’s compensation should be an important and significant component of the executive’s compensation. |

As described in more detail below, the material elements of our current executive compensation programs for Named Officers include a base salary, an annual cash bonus opportunity, a long-term equity incentive opportunity, perquisites and severance and other benefits payable in connection with a termination of employment or change in control. We believe that each element of our executive compensation program helps us to achieve one or more of our compensation objectives, as illustrated by the table below.

| | |

Compensation Element | | Compensation Objectives Designed to be Achieved |

Base Salary | | • Recruit and retain superior talent |

| |

Annual Cash Bonus Opportunity | | • Directly link pay to performance • Incentivize creation of stockholder value |

| |

Long-Term Equity Incentives | | • Incentivize creation of stockholder value • Recruit and retain superior talent • Directly link pay to performance |

| |

Perquisites | | • Recruit and retain superior talent |

| |

Severance and Other Benefits Payable Upon Termination of Employment or a Change in Control | | • Recruit and retain superior talent |