UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| | | | | |

| ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2024

| | | | | |

| Or |

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 001-41850

BEYOND, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | |

| Delaware | | 87-0634302 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification Number) |

| 433 W. Ascension Way, 3rd Floor | | |

| Murray, | Utah | | 84123 |

| (Address of principal executive offices) | | (Zip code) |

(801) 947-3100

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.0001 par value per share | BYON | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ý No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large accelerated filer | x | Accelerated filer | o |

| Non-accelerated filer | o | Smaller reporting company | o |

| | Emerging growth company | o |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ý

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. o

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant's executive officers during the relevant recovery period pursuant to §240.10D-1(b). o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No ý

The aggregate market value of voting and non-voting common equity held by non-affiliates of the registrant as of the last business day of the registrant's most recently completed second quarter (June 28, 2024), was approximately $0.6 billion based upon the last sales price reported by the New York Stock Exchange. For purposes of this disclosure, shares of Common Stock held by directors and certain officers and by others who may be deemed to be affiliates of the registrant have been excluded. The exclusion of such shares is not intended to, and shall not, constitute a determination as to which persons or entities may be affiliates as that term is defined in the federal securities laws.

There were 53,144,790 shares of the Registrant's common stock, par value $0.0001, outstanding on February 21, 2025.

DOCUMENTS INCORPORATED BY REFERENCE

Certain information required by Part III of Form 10-K is incorporated by reference to the Registrant's proxy statement for the 2025 Annual Stockholders Meeting, which will be filed with the Securities and Exchange Commission within 120 days after the end of the fiscal year to which this Report relates.

TABLE OF CONTENTS

| | | | | | | | |

| | |

| | |

| | |

| Part I | |

| Item 1. | | |

| Item 1A. | | |

| Item 1B. | | |

| Item 1C. | | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| | |

| Part II | |

| Item 5. | | |

| Item 6. | | |

| Item 7. | | |

| Item 7A. | | |

| Item 8. | | |

| Item 9. | | |

| Item 9A. | | |

| Item 9B. | | |

| Item 9C. | | |

| | |

| Part III | |

| Item 10. | | |

| Item 11. | | |

| Item 12. | | |

| Item 13. | | |

| Item 14. | | |

| | |

| Part IV | |

| Item 15. | | |

| Item 16. | | |

| | |

| |

Bed Bath & Beyond, Overstock.com, Beyond+, Welcome Rewards, and Zulily are registered trademarks of Beyond, Inc. Other service marks, trademarks and trade names which may be referred to herein are the property of their respective owners.

SPECIAL CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K (this "Annual Report") and the information incorporated herein by reference, and our other public documents and statements our officers and representatives may make from time to time, contain forward-looking statements within the meaning of the federal securities laws. These statements are intended to be covered by the safe harbor provisions of these laws. You can find many of these statements by looking for words such as "may," "would," "could," "should," "will," "expect," "anticipate," "predict," "project," "potential," "continue," "contemplate," "seek," "assume," "believe," "intend," "plan," "forecast," "goal," "estimate," or other similar terms or expressions or the negative of these terms or expressions, although not all forward-looking statements contain these identifying terms or expressions.

These forward-looking statements involve known and unknown risks and uncertainties and relate to future events or our future financial or operating performance. These forward-looking statements are not historical facts, and are based on current expectations, estimates and projections about our industry and business, and on management's beliefs and certain assumptions made by management, many of which, by their nature, are inherently uncertain and beyond our control. Accordingly, you are cautioned that any such forward-looking statements are not guarantees of future performance and are subject to assumptions, risks, uncertainties, and other important factors that are difficult to predict, and that actual results and outcomes may be materially different from the results, performance, achievements, or outcomes expressed or implied by any of our forward-looking statements for a variety of reasons, including the risks, uncertainties and assumptions described in this Annual Report, especially under the headings "Summary of Risk Factors," "Risk Factors," "Legal Proceedings," and "Management's Discussion and Analysis of Financial Condition and Results of Operations." Although we believe that our assumptions and expectations reflected in the forward-looking statements are reasonable as of the date of this Annual Report, we cannot guarantee or offer any assurance of future results, levels of activity, performance, achievements or events. Our forward-looking statements contained in this report speak only as of the date of this Annual Report and, except as required by law, we undertake no obligation to update forward-looking statements to reflect events or circumstances occurring after the date of this Annual Report or any changes in our expectations or any change in any events, conditions or circumstances on which any of our forward-looking statements are based.

SUMMARY RISK FACTORS

Our business is subject to numerous risks and uncertainties, including those described in Part I, Item 1A. "Risk Factors" in this Annual Report on Form 10-K. You should carefully consider these risks and uncertainties when investing in our common stock. The principal risks and uncertainties affecting our business include the following:

•We depend on third-party companies to perform functions critical to our business, and any failure or increased cost on their part could have a material adverse effect on our business.

•We face intense competition and may not be able to compete successfully against existing or future competitors.

•We may not timely identify or effectively respond to consumer needs, expectations or trends, which could adversely affect our relationship with our customers, the demand for our products and services, and our market share.

•Our business depends on effective marketing, including marketing via email, search engine marketing, influencer marketing, and social media marketing. Our competitors have and may continue to cause us to increase our marketing costs and decrease certain other types of marketing, and have and may continue to outspend us on marketing or be more efficient in their spend.

•Economic factors, including recessions, other economic downturns, inflation, our exposure to the U.S. housing market, and decreases in consumer spending, have affected and could continue to adversely affect us.

•Tariffs, bans, or other measures or events that increase the effective price of products or limit our ability to access products we or our suppliers or fulfillment partners import into the United States could have a material adverse effect on our business.

•Our changing business model and use of the Overstock brand, Bed Bath & Beyond brand, Zulily brand, and Beyond brand, could negatively impact our business.

•The changing job market, the changes in our leadership team, the change in our compensation approach, changing job structures, or any inability to attract, retain and engage key personnel could affect our ability to successfully grow our business.

•We rely upon paid and natural search engines to rank our product offerings, and our financial results may suffer if we are unable to maintain our prior rankings in natural searches.

•If we are not profitable and/or are unable to generate sufficient positive cash flow from operations, our ability to continue in business will depend on our ability to raise additional capital, obtain financing or monetize significant assets, and we may be unable to do so.

•Our business depends on the Internet, our infrastructure and transaction-processing systems, and catastrophic events could adversely affect our operating results.

•Compliance with ever-evolving federal, state, and foreign laws and other requirements relating to the handling of information about individuals necessitates significant expenditure and resources, and any failure by us, our vendors or our business partners to comply may result in significant liability, negative publicity, and/or an erosion of trust, which could materially adversely affect our business, results of operations, and financial condition.

•If we or our third-party providers experience cyberattacks or data security incidents, there may be damage to our brand and reputation, material financial penalties, and legal liability, which would materially adversely affect our business, results of operations, and financial condition.

•Failure to comply with, or changes in, laws, regulations and enforcement activities may adversely affect the products, services and markets in which we operate.

•From time to time we are subject to various legal proceedings which could adversely affect our business, financial condition or results of operations.

•Damage to our reputation or brand image could adversely affect our sales and results of operations.

•If we do not successfully optimize and operate our fulfillment center or customer service operations, our business could be harmed.

•If we fail to effectively utilize technological advancements, including in artificial intelligence, our business and financial performance could be negatively impacted.

•Global conflict could negatively impact our business, results of operations, and financial condition.

•Product safety and quality concerns could have a material adverse impact on our revenue and profitability.

•We depend on our suppliers' and fulfillment partners' representations regarding product safety, content and quality, product compliance with various laws and regulations, including registration and/or reporting obligations, and for proper labeling of products.

•We have an evolving business model, which increases the complexity of our business.

•Investment in new business strategies, acquisitions, dispositions, partnerships, or other transactions could disrupt our ongoing business, present risks not originally contemplated and materially adversely affect our business, reputation, results of operations and financial condition.

PART I

ITEM 1. BUSINESS

The following description of our business contains forward-looking statements relating to future events or our future financial or operating performance that involve risks and uncertainties, as set forth above under "Special Note Regarding Forward-Looking Statements." Our actual results could differ materially from those anticipated in these forward-looking statements as a result of certain factors described in this Annual Report, including those set forth under "Special Cautionary Note Regarding Forward-Looking Statements" Item 1A under the heading "Risk Factors," or elsewhere in this Annual Report.

Introduction

Beyond, Inc, is an e-commerce affinity marketing company with a singular focus: connecting consumers with products and services they love. As the owner of the iconic Bed Bath & Beyond, Overstock and Zulily brands, as well as several other brands, we strive to curate an exceptional online shopping experience. Our suite of premier online retail brands allow us to offer a comprehensive array of products and add-on services, catering to customers in the United States and Canada along with customers in Mexico through trademark licensing. Our e-commerce platform, which is also accessible through our mobile app, includes www.bedbathandbeyond.com, www.bedbathandbeyond.ca, www.overstock.com, and www.zulily.com, and is collectively referred to as the "Website." The Website is targeted at customers seeking a diverse array of top-tier, on-trend products at competitive prices. From furniture, bedding, and bath essentials to patio and outdoor furniture, area rugs, tabletop and cookware, décor, storage, jewelry, watches, and fashion – we offer an extensive range of products at a smart value. In addition to products, we also offer an increasing number of add-on services across our platforms, including warranties, shipping insurance, installation services, and access to home loans.

Our company, based in Murray, Utah, was founded as a Utah limited liability company in 1997, reorganized as a C corporation in the State of Utah in 1998, and reincorporated in Delaware in 2002. We launched our initial website in March 1999. In November 2023, we changed our corporate name from Overstock.com, Inc. to Beyond, Inc., and transferred the principal listing of our common stock from the Nasdaq Global Market to the New York Stock Exchange. As used herein, "Beyond", "the Company", "we", "our" and similar terms include Beyond, Inc. and its controlled subsidiaries, unless the context indicates otherwise.

Our Business

Our mission revolves around delivering an unparalleled shopping experience for products and services, tailored especially for our target audience – discerning consumers who seek seamless support in their search for high-quality, stylish products at competitive prices. Our commitment extends to providing a diverse range of offerings that cater to varied budget requirements.

In an ever-evolving market, our focus is on standing out in the online sphere by offering products and services for the home. We believe that our competitive edge lies in the following:

•Simplified Customer Experience: We prioritize an easy, user-friendly interface, emphasizing price, value, and quality. Our extensive product range is delivered in a personalized format, accessible seamlessly through our mobile app, and complemented by our dedicated customer service team.

•Cutting-edge Technologies: Our proprietary technologies and strategic technical alliances enhance the overall shopping experience, providing our customers with an intuitive and streamlined experience.

•Specialized Logistics: Our logistics capabilities are finely tuned to the demands of the furniture and home furnishings category, which we have honed over decades of e-commerce expertise.

•Strategic Partnerships: We foster long-term, mutually beneficial relationships with third-party manufacturers, distributors, and suppliers, collectively referred to as our "partners". This network forms the backbone of our supply chain, allowing us to pursue our goal of consistently meeting customer demands. In addition to our partners, we've entered into a collaborative partnership with Kirkland's Home brand that will allow us to bring back the brick & mortar experience to our customers by providing Kirkland's, Inc. with an exclusive license to operate Bed Bath & Beyond neighborhood stores. We also partner with third parties to provide various financial products and services.

•Customer Loyalty Programs: Our customer engagement and retention are bolstered by our Beyond+ membership program and our Welcome Rewards loyalty program, enhancing the overall value proposition for our customers.

We endeavor to continually expand our product assortment, which as of the date of this Annual Report, reaches into the millions, to keep pace with current trends and evolving customer preferences. The vast majority of our retail transactions are fulfilled through our network of partners, who benefit from the access we provide to a large customer base and a suite of convenient services, including marketing, order fulfillment, customer service, and returns handling. Our asset-light supply chain allows us to ship directly to customers from our partners or our warehouses, which primarily handle orders from our partners' owned inventory.

Additional Offerings

We offer additional products or services that may complement our primary retail offerings but are not significant to our revenues, including:

•Business Advertising Opportunities: Providing businesses with a platform to showcase their products or services on our Website, fostering additional exposure and opportunities for collaboration.

•Marketplace Services: Offering a unique service to our partners, enabling them to showcase and sell their products on third-party sites through our Marketplace, creating additional avenues for sales and visibility.

•International Sales Support: Facilitating international sales for certain customers outside the United States through third-party logistics providers, broadening our reach and enhancing global accessibility.

•Supplier Oasis Integration: Our Supplier Oasis platform, a singular integration point that empowers our partners to efficiently manage their products, inventory, and sales channels. This streamlined interface also provides access to multi-channel fulfillment services through our expansive distribution network, enhancing operational efficiency for our valued partners.

Manufacturer, Distributor, and Supplier Relationships

We proactively cultivate and nurture relationships with manufacturers, distributors, and suppliers to help provide an uninterrupted stream of diverse product offerings for our customers. While our manufacturers, distributors, and suppliers regularly update us on available product quantities, our arrangements with them typically do not guarantee the sustained availability of these products over a predetermined period. Our relationships are generally non-exclusive. This allows us the flexibility to exercise discretion in selecting and changing suppliers based on our evolving product assortment needs. The terms under which products are sold through our Website are predominantly in our discretion.

Sales and Marketing

We employ a diverse array of strategies to market to and engage our retail consumer audience, using both traditional and digital channels. Our outreach includes targeted direct mail as well as online initiatives, encompassing search engine marketing, display ads, affiliate marketing, e-mail campaigns, and social media promotions. Additionally, we enhance brand visibility through comprehensive advertising efforts across television, video ads, streaming video and audio platforms, social media channels, and strategic event sponsorships.

Customer Service

Our commitment to delivering unparalleled customer service extends across our channels, including our app and Website. Staffed by a team of dedicated in-house and outsourced professionals, our customer service department seeks to provide prompt and thorough responses to customer inquiries via phone, SMS, instant online chat, and e-mail, regarding product information, order details, shipping status, returns, and various other customer queries.

In addition to our in-house services, we have trusted partners who independently manage their customer service requests that are held to our high standards, as outlined in their agreements with us.

Technology

We use our internally developed Website alongside a dynamic blend of proprietary technologies, open source solutions, and commercially licensed technologies to bolster our operational capabilities. We maintain connectivity to the Internet through partnerships with multiple telecommunications companies, in order to promote seamless access.

Our primary computer infrastructure is in a data center in Utah. We leverage additional data centers and tap into the resources of public cloud providers which play a pivotal role in functions such as backups, redundancy measures, development

and testing environments, disaster recovery protocols, and the overarching support of our corporate systems infrastructure. On December 20, 2024, we consummated the sale of our corporate headquarters located at 799 West Coliseum Way, Midvale, Utah, for $52.0 million. As part of the sale, we negotiated a lease agreement with the Buyer that allows us to continue to occupy and use the headquarters' data center, comprising approximately 5,000 square feet within the main building at the headquarters, and permit the data center to continue to be served by the existing building generators. See Item 2—"Properties."

Competition

E-commerce is intensely competitive and has relatively low barriers to entry. We believe that competition in this industry is based predominantly on:

•price;

•product and services quality and assortment;

•shopping convenience and product findability;

•website organization and experience;

•order processing and fulfillment;

•order delivery time and accuracy;

•customer service;

•website functionality on mobile devices;

•brand recognition; and

•brand reputation.

We compete with a diverse range of discount general retailers, off-price and club retailers, private sales platforms, specialty retailers, and liquidators in the online pure-play, brick-and-mortar, and omni-channel retail spheres, where the potential exists for competitors to emulate our strategies and target our customer base.

Our current and potential e-commerce competitors include entities that may have greater brand recognition, longer operating histories, larger customer bases, and significantly greater financial, marketing, and other resources than we do. Further, any of them may enter into strategic or commercial relationships with larger, more established and well-financed companies, including exclusive distribution arrangements with our vendors or service suppliers that could deny us access to key products or needed services at competitive prices or at all, or acquisitions of our suppliers or service providers, which could have the same effect. Many of them do or could devote greater resources to marketing and promotional campaigns and devote substantially more resources to their websites and systems development than we do. Many have supply chain operations that decrease product shipping times to their customers, have options for in-store product pick-up, allow in-store returns, or offer other delivery and returns options that we do not have. New technologies, the continued enhancement of existing technologies, developments in related areas such as same-day product deliveries, and the development of proprietary delivery systems increase competitive pressures on us.

Intellectual Property and Trade Secrets

We regard our domain names and other intellectual property as critical to our success. We rely on a combination of laws and regulations, including via contractual restrictions with our employees, customers, suppliers, affiliates, and others to establish and protect our proprietary rights, including the law pertaining to trade secrets.

Government Regulation and Legal Matters

We are subject to a wide variety of laws, rules, mandates, and regulations, some of which apply or may apply to us as a result of our business, and others of which apply to us for other reasons, such as our status as a publicly-held company or the places in which we operate. Our business is subject to general business regulations and laws, and regulations and laws specifically governing the internet, e-commerce, and other financial products and services we offer or may offer. Existing and future laws and regulations, directives (including executive orders) and changing enforcement priorities, may result in increasing expenses and may impede our growth. Applicable and potentially applicable regulations and laws include without limitation regulations and laws regarding taxation, business licensing or certification requirements, advertising practices, online services, the use of cryptocurrency, intellectual property rights, privacy, encryption, restrictions on pricing or discounts, and the U.S. Foreign Corrupt Practices Act and other applicable U.S. and foreign laws prohibiting corrupt payments to government officials and other third parties, privacy, consumer and data protection, pricing, content, copyrights, distribution, mobile communications, electronic device certification, electronic waste, energy consumption, environmental regulation, electronic contracts and other communications, competition, employment, import and export matters including tariffs and the importation of specified or proscribed items and importation quotas, information reporting requirements, access to our services and facilities, the design and operation of websites, health, safety, and sanitation standards, the characteristics and quality of products and services, product labeling and unfair and deceptive trade practices.

From time to time, we receive claims and become subject to regulatory investigations or other governmental actions, including consumer protection, employment, intellectual property, and other commercial litigation related to the conduct of our business. We periodically prosecute lawsuits to enforce our legal rights. These matters and other types of claims could result in legal expenses, fines, adverse judgments or settlements and increase the cost of doing business. They could also require us to change our business practices in expensive and significant ways. In addition, litigation could result in legal outcomes or interpretations of the law that may limit our current or future business, require us to change our business practices, or increase our costs or otherwise adversely impact our business.

For further information, see (Item 1A—"Risk Factors") and the information set forth under Item 8 of Part II, "Financial Statements and Supplementary Data"—Note 15—Commitments and Contingencies, Legal proceedings and contingencies, contained in the "Notes to Consolidated Financial Statements" of this Annual Report.

Human Capital Management

On December 31, 2024, we had approximately 610 full-time employees. We have never had a work stoppage and none of our employees are represented by a labor union. We consider our employee relations to be good. Competition for qualified personnel in our industry is high. Beyond places great value on its human capital management and knows its people are critical to driving the business to success. We focus on our human capital management in many ways, including the following.

Inclusion & Belonging

We embrace inclusion and belonging and collaboration in our workforce, our ways of thinking, and our decision-making. We know that fostering an inclusive culture delivers better business outcomes. We are committed to creating a workplace that values and celebrates the unique backgrounds, perspectives, and experiences of our employees. Our commitments to improving workplace practices include: (1) increasing employee engagement of our team at all levels, (2) continuing real and meaningful gender and race dialogue within our Company, (3) valuing the varied and broad voices of our employees, (4) fostering inclusion and safety within our workforce, (5) continuing to condemn all forms of discrimination and harassment, (6) encouraging our employees to vote by utilizing their flexible time away or voting time off, and (7) fostering an inclusive work environment where every employee feels valued and respected. Among the many ways we demonstrate these commitments are through our hiring and development practices, flexible and working-parent-friendly programs, anti-discrimination policies, a focus on pay equity, and promoting mentorship programs to support career growth for all employees.

We view inclusion and belonging as a competitive advantage that drives innovation, creativity, and success. We are dedicated to creating a workplace where everyone has the opportunity to thrive, and we believe that our commitment to inclusion and belonging will contribute to our long-term growth and sustainability. Through our commitments, actions, words, investments, and values, we promote a work environment that enables employees to feel safe to express their ideas and perspectives and feel they belong within our team.

Workforce Compensation & Pay Equity

The total rewards philosophy of Beyond is to create and maintain competitive programs that attract, motivate, develop, and retain employees based on the prevailing industry and geographic labor markets where the Company does business. Our competitive compensation programs consist of cash and non-cash compensation based on relevant pay factors designed to balance market competitiveness and cost containment to incentivize achievement of financial performance goals and business objectives and to aid in retaining human capital. We designed our total rewards to link the market competitiveness of an employee's compensation with overall Company performance, aligning employees' financial interests with the interests of the Company and its stockholders.

Elements of our compensation package for all non-executive employees consists of base salary or wages, short-term bonus incentives to reward the achievement of key financial performance goals and business objectives, and for eligible key contributors, long-term equity incentives that align to the interests of the Company and its stockholders.

We monitor changes in the value of each employee's job annually and adjust base pay and short-term incentives based on a combination of factors, including, but not limited to, employee performance to pre-determined goals and the Company's overall performance against broader financial and operational goals and objectives. We determine external market competitiveness by gathering salary information from professionally managed third-party salary surveys and by determining pay for individual employees based on their skill level, experience, education, and any other relevant compensatory factors. We balance internal pay equity with external pay equity to ensure compensation is fairly and equitably dispersed and in compliance with applicable laws, regulations, or other legal requirements.

Management is committed to the proposition that the total rewards of every employee in pay and benefits are distributed regardless of their race, gender, gender identity, sexual orientation, religion, national origin, color, veteran status, age, or disability. To further this commitment, we define appropriate metrics to track progress.

We offer all employees the ability to save for retirement by matching dollar for dollar up to 6% of their savings into a qualified savings plan up to certain pre-determined limits set by the IRS.

Our intention is to offer every employee fair and equitable cash compensation and competitive non-cash benefits to help employees manage the wealth, health, and wellness of both themselves and their families.

Talent Acquisition & Retention

We work diligently to attract the best talent from a diverse range of sources. We prioritize hiring local talent in the Salt Lake City market to support the current and future demands of our business. We also recruit talent from twenty-six states across the United States and the Republic of Ireland. We endeavor to establish relationships with universities, professional associations, and industry groups to proactively attract talent. We look for ways to improve our recruiting process regularly and ensure each applicant feels welcome and comfortable through the recruiting process. Our panel interviews are set up with a diverse group of interviewers to ensure for the best candidate experience.

We have a strong employee value proposition that leverages our culture, shared alignment to critical business and financial objective and goals, collaborative and flexible working environment, shared sense of purpose, desire to do the right thing and innovative work to attract talent to our company. We empower employees to find new and better ways of doing things and the scale of our business means that careers can develop in exciting and unexpected directions. To ensure the long-term continuity of our business, we actively manage the development of existing talent to fill the roles that are most critical to the on-going success of our Company.

Our employees have an average tenure of seven years overall, with an average tenure of six and a half years in our customer service and warehouse departments.

Employee Safety & Wellness

Creating a culture where all employees feel supported and valued is a key part of our Company mission. We continue to evolve our programs to meet our employees' wealth, health, and wellness needs, which we believe is essential to attract and retain employees of the highest caliber, and we offer a competitive benefits package focused on fostering work/life integration. We offer comprehensive benefit options to our employees and their families to live healthier and more secure lives. Some of the various insurances we offer include medical, dental, and vision, among others, along with health savings accounts, flexible

spending accounts and generous 401(k) matching and employee stock purchase plan (ESPP) programs. In addition to these more traditional benefits offerings, we also expanded our employee assistance program (EAP) to better align with our national employee base. We offer family planning services including fertility coverage to assist potential parents. We offer paid parental leave for all new parents who have been with the Company for at least 90-days to ensure they are able to adjust. We also offer a caregiver benefit to parents who need to travel for work, which allows employees who have a child under the age of two to travel with the employee. In 2024, we expanded our benefits to include a flexible work schedule by offering flexible time away (unlimited) to all exempt employees, to allow our employees maximum flexibility and trust in our performance-based culture. Additionally, we launched an employee volunteer program, We Go Beyond, pursuant to which each full-time employee spends at least 32 hours a year of work time volunteering for an organization of choice in their community.

Development & Training

We recognize how important it is for our employees to develop and progress in their careers. We provide a variety of resources to help our employees grow in their current roles and build new skills, including online development resources from a competency model development library to hundreds of online courses in our learning management system. We emphasize individual development planning as part of our annual goal setting process, and offer mentoring programs, along with change management and project management upskilling opportunities. We have leadership development resources for all leaders across the organization and continue to build tools for leaders to develop their teams on the job and in roles to create new opportunities to learn and grow. We also encourage higher education and continuing professional education by subsidizing these opportunities for our employees.

Company Culture

We attribute the high levels of employee engagement to our corporate culture. We strive for a work environment that is performance-based, results-driven, inclusive, agile, and collaborative. Our corporate vision, mission, values, leadership principles, and employee qualities help define who we are, where we are going, and the behavior we expect of the Company and our employees to be successful in the organization.

Our values articulate our commitment to an inclusive, outcome-driven work environment, and embody our "becoming" culture and spirit. Our three leadership principles guide our interactions with colleagues, creating a psychologically safe environment for productive and collaborative exchanges for improved outcomes. We strive to clearly define, look for, measure, and develop ten qualities in our employees so that we all become empowered to be effective and valuable contributors in the organization. We believe this culture allows us to attract, develop, engage, and retain highly qualified employees for each role in the organization. Our goal is for every employee to feel they are a valued and empowered member of a winning team, doing meaningful work, in an environment of trust. The Company endeavors to regularly reinforce this culture throughout the entire employee experience.

Oversight & Governance

Our focus on human capital management has been a hallmark of the Company for years, understanding that people truly are a Company's most valuable asset, and that culture is an organization's ultimate competitive advantage. Our 401(k) committee meets quarterly to review the plan and determine if any changes need to be made to the portfolio, in order to best serve our employees. Our board of directors dedicates time in quarterly meetings with management to discuss trends in hiring, engagement, and attrition. Our Compensation Committee is actively involved in determining competitive compensation strategies to help us continually improve in attracting, developing, and retaining top talent for our Company.

Information About Our Executive Officers

The following persons were executive officers of Beyond as of February 25, 2025:

| | | | | | | | | | | | | | | |

| Executive Officers | | | Age | | Position |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Adrianne Lee | | | 47 | | Chief Financial & Administrative Officer (Principal Financial Officer and Principal Accounting Officer) |

| Marcus Lemonis | | | 51 | | Executive Chairman of the Board of Directors |

| | | | | |

| Dave Nielsen | | | 55 | | President (Principal Executive Officer) |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

Adrianne Lee was appointed as our Chief Financial & Administrative Officer in February 2024, and previously served as Chief Financial Officer from March 2020 to February 2024. Prior to joining Beyond, Ms. Lee served as Senior Vice President and CFO of North America RAC from December 2018 to March 2020 and as Vice President—Global Financial Planning and Analysis and Corporate Development at The Hertz Corporation from December 2017 to December 2018.

Marcus Lemonis was appointed as the Executive Chairman of the Board of Directors of Beyond, effective February 20, 2024. Mr. Lemonis joined the Board on October 2, 2023, and has served as Chairman of the Board since December 10, 2023. Mr. Lemonis has served as the Chief Executive Officer and Chairman of the Board of Camping World Holdings, Inc. since 2002.

Dave Nielsen was appointed as our President in June 2024. Prior to that, Mr. Nielsen served as Division Chief Executive Officer, Overstock from February 2024 to June 2024, Interim Chief Executive Officer and President from November 2023 to February 2024, President from May 2019 to November 2023, and Chief Sourcing and Operations Officer from October 2018 to May 2019. Mr. Nielsen served as Chief Executive Officer and board member for Global Access from July 2015 to October 2018. Mr. Nielsen originally joined Beyond in 2009 and previously served as our Senior Vice President of Business Development, Senior Vice President and General Merchandise Manager and Co-President.

Available Information

We make our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act, available free of charge through the Investor Relations section of our main website, www.beyond.com, as soon as reasonably practicable after we electronically file such material with, or furnish it to, the Securities and Exchange Commission (the "SEC"). The SEC also maintains a website at www.sec.gov that contains reports, proxy and information statements, and other information filed by us. Our Internet Website and the information contained therein or connected thereto are not a part of or incorporated into this Annual Report on Form 10-K.

ITEM 1A. RISK FACTORS

Any investment in our securities involves a high degree of risk. Please consider the following risk factors carefully. If any one or more of the following risks were to occur, it could have a material adverse effect on our business, prospects, financial condition and results of operations, and the market price of our securities could decrease significantly. Statements below to the effect that an event could or would harm our business (or have an adverse effect on our business or similar statements) mean that the event could or would have a material adverse effect on our business, prospects, financial condition and results of operations, which in turn could or would have a material adverse effect on the market price of our securities. Many of the risks we face involve more than one type of risk. Consequently, you should carefully read all of the risk factors below, and in any reports we file with the SEC after we file this Annual Report, before making any decision to acquire or hold our securities.

Risks Relating to Our Company and its Operational, Litigation and Regulatory Environment

We depend on third-party companies to perform functions critical to our business, and any failure or increased cost on their part could have a material adverse effect on our business.

We depend on third-party companies, including third-party carriers, insurers, warranty providers, and a large number of independent fulfillment partners whose products we offer for sale on our Website, to perform functions critical to our business and our ability to deliver products and services to our customers on time and at a reasonable cost. We depend on our carriers, insurers, warranty providers, and fulfillment partners to perform traditional retail operations such as maintaining inventory, preparing merchandise for shipment to our customers, delivering purchased merchandise on a timely and cost-effective basis, insuring the products, and offering warranty services associated with products. We also depend on the delivery and product assembly services that we and they utilize, on the payment processors that facilitate our customers' payments for their purchases, and on other third parties (including SaaS, IaaS, and other cloud-based third-party service providers) over which we have no control, for the operation of our business. Difficulties with any of our significant fulfillment partners or third-party carriers, insurers, warranty providers, delivery or product assembly services, payment processors or any of the third-party service providers involved in our business, regardless of the reason, could have a material adverse effect on our financial results, business and prospects.

We face intense competition and may not be able to compete successfully against existing or future competitors.

The online retail market is evolving rapidly and is intensely competitive. Barriers to entry can be minimal, and current and new competitors can launch new websites at a relatively low cost. We currently compete with numerous competitors, including:

•online retailers with or without discount departments, including Amazon.com, AliExpress (part of the Alibaba Group), eBay, Temu, and Rakuten.com;

•online shopping services, including Google Shopping, Facebook, Instagram, and TikTok;

•online specialty retailers such as Wayfair, Build.com, Houzz, Hayneedle, Rugs.com, Groupon, and World Market;

•furniture specialists including Bob's Discount Furniture, Havertys, Raymour & Flanigan, At Home, Tuesday Morning, Living Spaces, Nebraska Furniture Mart, RC Willey, and Rooms To Go;

•traditional general merchandise and specialty retailers and liquidators including Ashley Furniture, Best Buy, Big Lots, Costco, Crate and Barrel, Ethan Allen, Gilt, Home Depot, HomeGoods, Hudson's Bay Company, IKEA, J.C. Penney Company, Kirkland's, Kohl's, Lands' End, Lowe's, Macy's, Nordstrom, Pottery Barn, Arhaus, RH, Ross Stores, Saks Fifth Avenue, Sears, T.J. Maxx, Target, Walmart, West Elm, and Williams-Sonoma, all of which also have an online presence; and

•online liquidators such as SmartBargains.

We expect that existing and future traditional manufacturers and retailers will continue to add or improve their e-commerce offerings, and that our existing and future e-commerce competitors, including Amazon, will continue to increase their offerings, their delivery capabilities, and the ways in which they entice and enable shoppers to purchase goods, including their mobile technology and the voice-activated shopping services offered by Amazon. Further, large marketplace websites and sites which aggregate marketplace sellers with a large product selection are becoming increasingly popular. We may not be able to place our products on these sites to take advantage of their internal search platforms and some shoppers may begin their searches at these websites rather than utilize traditional search engines at all. Many of our competitors specialize in one or more of the areas in which we offer products. For example, our furniture offerings compete with numerous retail furniture websites

and traditional furniture retail specialists. We also face competition from shopping services such as Google Shopping, which offers products from Walmart, Costco, Target and many other retailers. Competition from our competitors, many of whom have longer operating histories, larger customer bases, greater brand recognition, greater access to capital and significantly greater financial, marketing and other resources than we do, affects us and has had and could continue to have a material adverse effect on our financial results, business and prospects.

We may not timely identify or effectively respond to consumer needs, expectations or trends, which could adversely affect our relationship with our customers, the demand for our products and services, and our market share.

The success of our business depends in part on our ability to identify and respond promptly to evolving trends in demographics, shifts in consumer preferences, expectations and needs, changes in the macroeconomic environment, and unexpected weather conditions, natural disasters, or public health issues (including pandemics and related impacts) that impact our customers, while also managing appropriate inventory levels and maintaining an excellent customer experience. It is difficult to successfully predict the products and services our customers will demand. As our customers expect a more personalized experience, our ability to collect, use, retain, and protect relevant customer data is important to our ability to effectively meet their expectations. Our ability to collect and use that data, however, is subject to a number of external factors, including the impact of legislation or regulations governing data privacy, data-driven technologies such as artificial intelligence, and data security, as well as customer expectations around data collection, retention, and use. In addition, each of our primary customer groups has different needs and expectations, many of which evolve as the demographics in a particular customer group change. Customer preferences and expectations related to sustainability of products and operations are also changing. In addition, as the impacts of COVID-19 have subsided, customers have shifted more of their spending back to travel, dining and other experiences, compared to the historic levels of home improvement spending we saw during the heights of the pandemic. If we do not successfully differentiate the shopping experience to attract our customers and meet their individual needs and expectations, it may adversely impact our sales and our market share.

Customer expectations about the methods by which they purchase and receive products or services are also becoming more demanding. Customers routinely and increasingly use technology and a variety of electronic devices and digital platforms to rapidly compare products and prices, read product reviews, determine real-time product availability, and purchase products, and new channels and tools to expand the customer experience appear and change rapidly. We must continually anticipate and adapt to these changes in the shopping and purchasing process by continuing to adjust and enhance the customer experience as well as our delivery options. We cannot guarantee that our current or future fulfillment options will be maintained and implemented successfully or that we will be able to meet customer expectations on delivery or pickup times, options and costs.

Failure to provide a relevant and effective customer experience in a timely manner that keeps pace with technological developments and dynamic customer expectations, preferences, and trends or to differentiate the customer experience could adversely affect our relationship with our customers, the demand for our products and services, and our market share.

Our business depends on effective marketing, including marketing via email, search engine marketing, influencer marketing, and social media marketing. Our competitors have and may continue to cause us to increase our marketing costs and decrease certain other types of marketing, and have and may continue to outspend us on marketing or be more efficient in their spend.

We depend on effective marketing and inflow of customer traffic. We depend on search engine marketing, email, and other e-commerce marketing methods to promote our site and offerings and to generate a substantial portion of our revenue. If a significant portion of our target customers no longer utilize email, or if we are unable to effectively and economically deliver email or marketing materials through other channels to our potential customers, whether for legal, regulatory or other reasons, it would have a material adverse effect on our business. For example, some email services have features that organize incoming emails into categories and such categorization or similar inbox organizational features may result in our emails being delivered in a less prominent location in a customer’s inbox or viewed as “spam” by our customers and may reduce the likelihood of that customer opening our emails. Actions by third parties to block, impose restrictions on or charge for the delivery of emails or other messages could also adversely impact our business. From time to time, Internet service providers or other third parties may block bulk email transmissions or otherwise experience technical difficulties that result in our inability to successfully deliver emails or other messages to third parties.

We also rely on social media and influencers for marketing purposes, and anything that limits our ability or our customers' ability or desire to utilize social media could have a material adverse effect on our business, including changes to the terms of social networking services to limit promotional communications, any restrictions that would limit our ability or our customers' ability to send communications through their services, disruptions or downtime experienced by these social

networking services, or decline in or cessation of the use of or engagement with social networking services, including due to legislation, regulation, or directives (including executive orders).

In addition to competing with us for customers, suppliers, and employees, our competitors have and may continue to directly increase our operating costs, by driving up the cost of various forms of online advertising. Furthermore, our competitors may outspend us or be more efficient on various forms of advertising or marketing, making our marketing efforts less effective. We may elect to decrease our use of search engine marketing or other forms of marketing from time to time in order to decrease our costs, which may have a material adverse effect on our financial results and business. We may also elect to spend additional amounts on search engine marketing or other forms of marketing from time to time in order to increase traffic to our Website, or to take other strategic actions to increase traffic and/or conversion, and such increased spending may not be effective on a cost-benefit basis, or at all. If we are unable to develop, improve, implement and maintain effective and efficient cost-effective advertising and marketing programs, it would have a material adverse effect on our financial results and business.

Economic factors, including recessions, other economic downturns, inflation, our exposure to the U.S. housing market, and decreases in consumer spending, have affected and could continue to adversely affect us.

Various economic conditions, including recessions, other economic downturns, inflation, weaknesses in the U.S. housing market, and decreased consumer discretionary spending have adversely affected and could further adversely affect our financial performance. We believe that our sales of home-related products are affected by the strength of the U.S. housing market and overall consumer sentiment on discretionary goods. Recessions or other economic downturns, in particular in the U.S. housing market, have negatively impacted our sales in the past, and could have a material adverse effect on our financial results, business, and prospects in the future. Similarly, a substantial portion of the products and services we offer are products or services that consumers may view as discretionary items rather than necessities. As a result, our results of operations are sensitive to changes in macroeconomic conditions that impact consumer spending, including discretionary spending. Difficult macroeconomic conditions also impact our customers' ability to obtain consumer credit and therefore their purchasing power. Other factors, including consumer confidence in the economy, employment levels, interest rates, inflation, fuel and energy costs, tax rates, and consumer debt levels could reduce consumer spending or change consumer purchasing habits. Any of the foregoing could have a material adverse effect on our financial results, business, and prospects.

Tariffs, bans, or other measures or events that increase the effective price of products or limit our ability to access products we or our suppliers or fulfillment partners import into the United States could have a material adverse effect on our business.

We and many of our suppliers and fulfillment partners source a large percentage of the products we offer on our Website from China and other countries. President Donald J. Trump has advocated for greater restrictions on international trade in general, including increased tariffs on certain goods imported into the United States, particularly from China. If the United States imposes tariffs or bans on imports, or if other factors that are outside of our control increase the prices of imported products sold on our Website or limit our ability to access products sold on our Website, the increased prices and/or supply chain challenges could have a material adverse effect on our financial results, business and prospects.

Our changing business model and use of the Overstock brand, Bed Bath & Beyond brand, Zulily brand, and Beyond brand, could negatively impact our business.

Our business has undergone a number of changes in the recent past, including our company name changing from Overstock.com, Inc. to Beyond, Inc., our purchase of the Bed Bath & Beyond and Zulily brands, changing our company ticker symbol from OSTK to BYON, and transferring the listing of our common stock from the Nasdaq Stock Market LLC to the New York Stock Exchange. These changes, along with others, may cause negative impacts to our business, including customer and stockholder confusion about our brands, the need for higher promotional discounting or marketing costs to acquire and maintain customers, diversion of the attention of management or key personnel, employee fatigue resulting from implementation efforts, disruptions to existing business relationships, and other unforeseen costs, expenses, losses, disruptions, delays, or negative impacts that could have a material adverse effect on our financial results, business and prospects.

The changing job market, the changes in our leadership team, the change in our compensation approach, changing job structures, or any inability to attract, retain and engage key personnel could affect our ability to successfully grow our business.

Our performance is substantially dependent on the continued service and performance of our senior management, our board of directors, and other key personnel. In 2024, we underwent significant changes to our executive management team and board of directors, structural changes to our organization, and changes to our workforce with reductions in force. Additionally, in 2024, we adjusted our approach to our executives' equity compensation from a fully time-based approach to a fully performance-based approach.

With many businesses allowing employees to work remotely, we are forced to compete with businesses in other locations and states to attract and retain key employees. We recently sold our corporate headquarters and announced that local employees will be asked to increase their onsite work from three days each week to four days each week at a new location. We also announced the elimination of our 9-80 schedule (where employees were permitted to work nine-hour days, rather than standard eight-hour days, and take every other Friday off from work). Changes in leadership, structural changes to our organization, reductions in force, changed approach to performance-based compensation, and changes in job structures could create consequences such as a lack of or decreased productivity, a lack of engagement, employee dissatisfaction, and employee fatigue, any of which could impair our ability to recruit, hire, and retain employees. Our success depends on our ability to identify, attract, recruit, hire, train, engage, retain, and motivate highly-skilled personnel necessary to successfully operate our business. Our failure to do any of the foregoing could have a material adverse effect on our financial results, business and prospects.

We rely upon paid and natural search engines to rank our product offerings, and our financial results may suffer if we are unable to maintain our prior rankings in natural searches.

We rely on paid and natural search engines to attract consumer interest in our product offerings, including Google, Bing, and Yahoo!. Changes to their ranking algorithms and competition from other retailers to attract consumer interest may adversely affect our product offerings in paid and/or natural searches. Search engine companies change their natural search engine algorithms periodically and online retailers compete to rank well with these search engine companies. Our ranking in natural searches may be adversely affected by those changes, as has occurred from time to time, which has led us to pursue revenue growth in other more expensive marketing channels. Google's search engine is dominant in our business and has historically been a significant source of traffic to our website. Search engine companies may also determine that we are not in compliance with their guidelines from time to time, as has occurred in the past, and they may penalize us in their search algorithms as a result. In recent years, we have experienced declines in our rankings in Google's natural search engine, which has required us to utilize more expensive marketing channels or otherwise compensate for the loss of some of the natural search traffic. Any future declines in our rankings in Google's natural search engine could have a material adverse effect on our business.

If we are not profitable and/or are unable to generate sufficient positive cash flow from operations, our ability to continue in business will depend on our ability to raise additional capital, obtain financing or monetize significant assets, and we may be unable to do so.

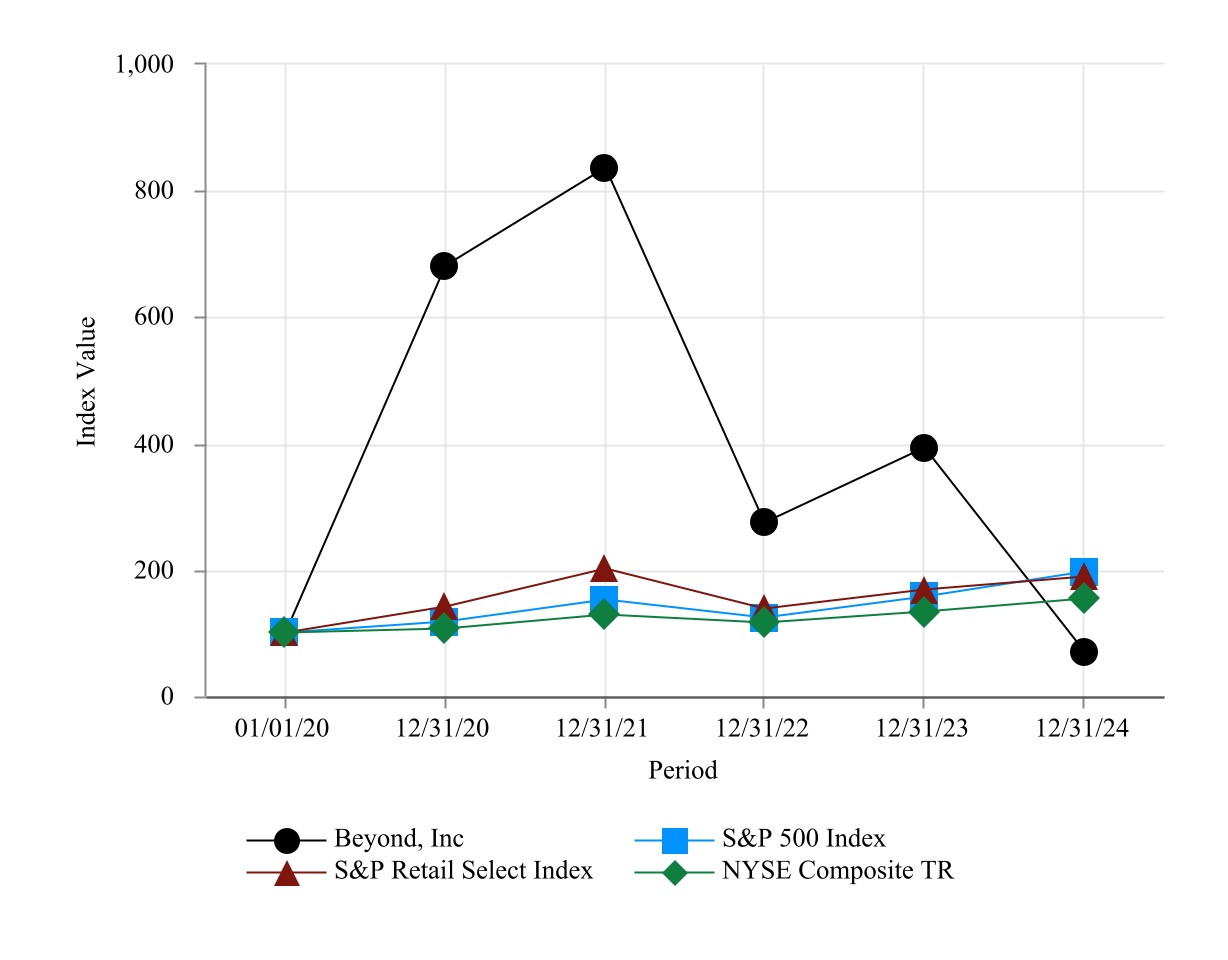

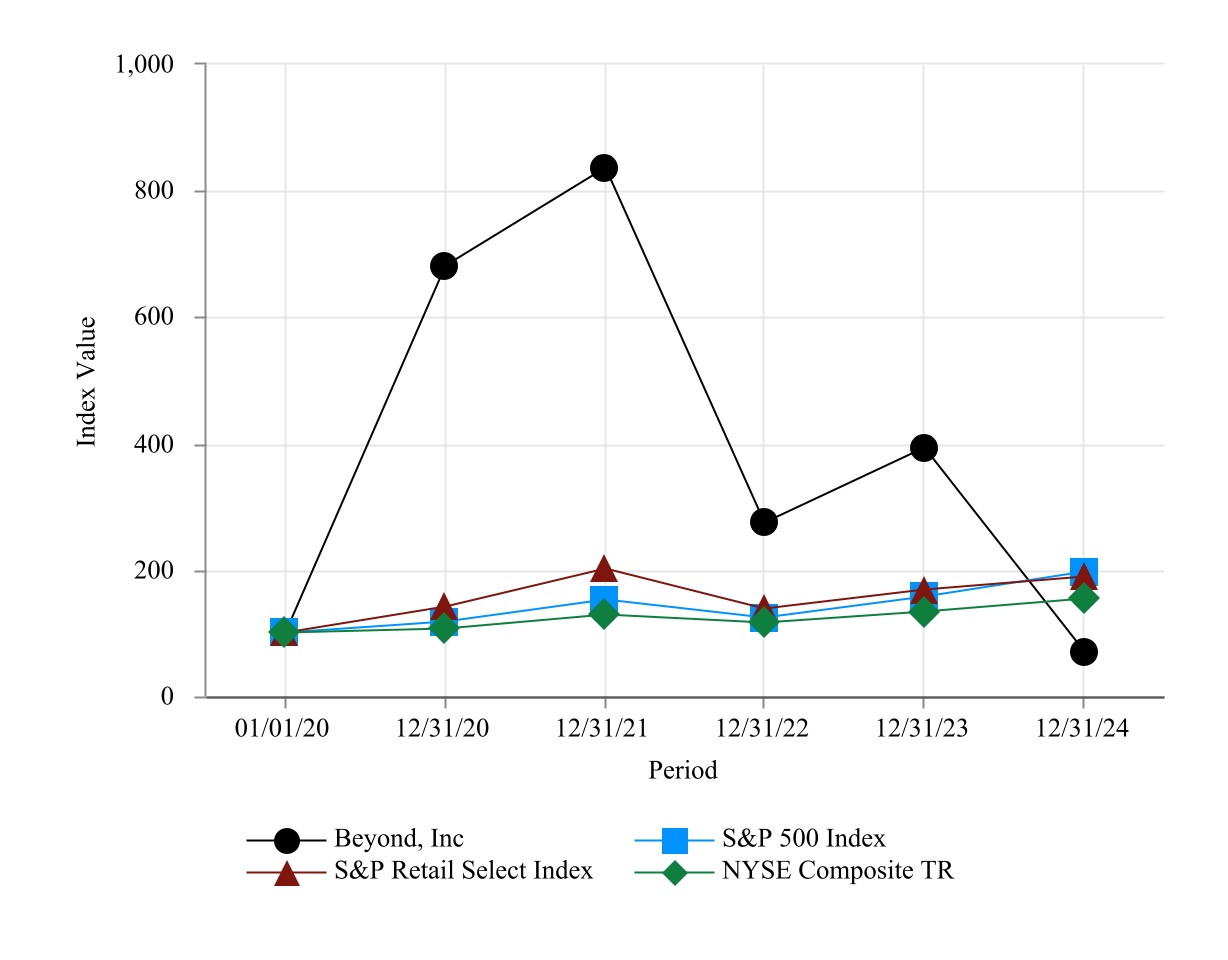

At December 31, 2024, our accumulated deficit was $740.5 million. We experienced significant losses in years leading up to 2020. Although our financial results were significantly better in 2020 and 2021, we incurred additional losses in 2022 through 2024, which included significant non-cash losses on our equity method investments and a write-down loss on our corporate headquarters. If we are unable to successfully manage our business in the future, our ability to continue in business could depend on our ability to raise sufficient additional capital, obtain sufficient financing, or sell or otherwise monetize significant assets. Additionally, we may not be able to raise capital on acceptable terms or at all. The occurrence of any of the foregoing risks would have a material adverse effect on our financial results, business and prospects.

Our business depends on the Internet, our infrastructure and transaction-processing systems, and catastrophic events could adversely affect our operating results.

We are completely dependent on our infrastructure and on the availability, reliability and security of the Internet and related systems. Although we have migrated and continue to migrate some of our computer systems and operations to the public cloud, a substantial majority of our computer and communications infrastructure is running in our private cloud on hardware that is located at a single facility, which we sold on December 20, 2024. As part of the sale, we entered into a lease agreement that allows us to continue to occupy and use the data center at the facility.

Our systems and operations, and those of the third parties that we rely on, are vulnerable to damage or interruption from natural disasters or extreme weather events (such as earthquakes, floods, fires and droughts), including those related to, or exacerbated by, climate change, other types of fires or floods, power loss, telecommunications failure, software or hardware malfunctions, terrorist attacks, cyberattacks, acts of war, break-ins, and similar events. The adverse effects of any such catastrophic event would be exacerbated if experienced at the same time as another unexpected and adverse event, such as a pandemic. Current events, including political events, social activism, tension and potential for violence, may impact our workforce, customers, properties and the communities where we operate. If our customers and employees do not perceive our response to be appropriate or adequate for a particular region or for our company as a whole, we could suffer damage to our reputation and brand, which could adversely affect our business. As a consequence of these or other catastrophic events, we may experience interruption to our operations or losses of property, equipment and/or inventory, which could adversely affect our revenue and profitability.

Our back-up facility by itself is not adequate to support fulfillment of sales orders. Our servers and applications are vulnerable to malware, physical or electronic break-ins, internal sabotage, and other disruptions, the occurrence of any of which could lead to interruptions, delays, loss of critical data or the inability to accept and fulfill customer orders. Any internal or critical third-party system interruption that results in the unavailability of our websites or our mobile app or reduced performance of our transaction systems could interrupt or substantially reduce our ability to conduct our business. We have experienced periodic systems interruptions due to server failure, application failure, power failure and intentional cyberattacks in the past, and may experience additional interruptions or failures in the future. Any failure or impairment of our infrastructure or of the availability of the Internet or related systems caused by any source, including the housing or maintenance of our hardware by a third party (including the purchaser of the facility where it is now located), or any inability to access or protect our hardware in a timely manner, could have a material adverse effect on our financial results, business and prospects. In addition, the occurrence of any event that would adversely affect e-commerce or discourage or prevent consumers from shopping online or via mobile apps could significantly decrease the volume of our sales.

Compliance with ever-evolving federal, state, and foreign laws and other requirements relating to the handling of information about individuals necessitates significant expenditure and resources, and any failure by us, our vendors or our business partners to comply may result in significant liability, negative publicity, and/or an erosion of trust, which could materially adversely affect our business, results of operations, and financial condition.

In connection with running our business, we receive, store, use and otherwise process information that relates to individuals and/or constitutes "personal data," "personal information," "personally identifiable information," or similar terms under applicable data privacy laws (collectively, "Personal Information"), including from and about actual, former and prospective customers as well as our employees and business contacts. We also depend on a number of third party vendors in relation to the operation of our business, a number of which process Personal Information on our behalf. In addition, we share Personal Information with, and obtain Personal Information from, certain business partners pursuant to commercial arrangements.

We, our vendors and our business partners are subject to a variety of federal, state and foreign data privacy laws, rules, regulations, industry standards and other requirements. These requirements, and their application, interpretation and amendment are constantly evolving. It is also possible that new laws, regulations and other requirements, or amendments to or changes in interpretations of existing laws, regulations and other requirements, may require us to incur significant costs, implement new processes, or change our handling of information and business operations, which could ultimately hinder our ability to grow our business by extracting value from our data assets. For example, in the United States, the Federal Trade Commission and state regulators enforce a variety of data privacy issues, such as promises made in privacy policies or failures to appropriately protect information about individuals, as unfair or deceptive acts or practices in or affecting commerce in violation of the Federal Trade Commission Act or similar state laws.

In addition, in recent years, certain states have adopted or modified data privacy and security laws and regulations that may apply to our business. For example, the California Consumer Privacy Act ("CCPA") requires businesses that process personal information of California residents to, among other things: provide certain disclosures to California residents regarding the business's collection, use, and disclosure of their personal information; receive and respond to requests from California residents to access, delete, and correct their personal information, or to opt-out of certain disclosures of their personal information; and enter into specific contractual provisions with service providers that process California resident personal information on the business's behalf. The enactment of the CCPA is prompting a wave of similar legislative developments in other states in the United States, which creates a patchwork of overlapping but different state laws. For example, since the

CCPA went into effect, numerous state laws that share similarities with the CCPA are now in effect. Similar laws have been proposed in many other states and at the federal level as well.

Additionally, laws, regulations, and standards covering marketing, advertising, and other activities conducted by telephone, email, mobile devices, and the internet may be or become applicable to our business, such as the Telephone Consumer Protection Act (the "TCPA"), the Controlling the Assault of Non-Solicited Pornography and Marketing Act of 2003 (the "CAN-SPAM Act"), and similar state consumer protection and communication privacy laws. For example, we send text messages to customers as part of our business operations. The actual or perceived improper sending of text messages may subject us to potential risks, including liabilities or claims relating to consumer protection laws such as the TCPA, which imposes significant restrictions on the ability to make telephone calls or send text messages to mobile telephone numbers without the prior consent of the person being contacted.

We may also be subject to international privacy laws such as the European Union General Data Protection Regulation and the UK General Data Protection Regulation, as well as laws and regulations in other jurisdictions. These laws contain significant privacy requirements that may impose restrictions on our ability to collect, use, and otherwise process Personal Information.

Even though we believe we are generally in compliance with applicable laws, rules and regulations relating to privacy and data security, these laws are in some cases relatively new and the interpretation and application of these laws are uncertain. Any failure or perceived failure by us (or in some cases, our vendors and business partners) to comply with data privacy laws, rules, regulations, industry standards and other requirements could result in proceedings or actions against us by individuals, consumer rights groups, government agencies, or others. We could incur significant costs in investigating and defending such claims and, if found liable, pay significant damages or fines or be required to make changes to our business. Further, these proceedings and any subsequent adverse outcomes may subject us to significant negative publicity and an erosion of trust. If any of these events were to occur, our business, results of operations, and financial condition could be materially adversely affected.

If we or our third-party providers experience cyberattacks or data security incidents, there may be damage to our brand and reputation, material financial penalties, and legal liability, which would materially adversely affect our business, results of operations, and financial condition.

We rely on our computer systems, hardware, software, technology infrastructure and online sites and networks and those of our for both internal and external operations that are critical to our business (collectively, "IT Systems"). We own and manage some of these IT Systems but also rely on third parties for a range of IT Systems and related products and services, including but not limited to our suppliers, banks, credit card processors, delivery services, and public cloud providers. We and certain of our third-party providers collect, maintain and process data about customers, employees, business partners and others, including personal information, confidential and proprietary intellectual property, financial information, trade secrets, and other business information (collectively, "Confidential Information").

Our business involves the storage and transmission of Confidential Information, and we face numerous and evolving cybersecurity risks that could threaten the confidentiality, integrity and availability of our IT Systems and Confidential Information, including from diverse threat actors, such as state-sponsored organizations, opportunistic hackers and hacktivists, as well as through diverse attack vectors, such as social engineering or phishing, malware (e.g., ransomware), malfeasance by insiders, human or technological error, and as a result of malicious code embedded in open-source software, or misconfigurations, bugs or other vulnerabilities in commercial software that is integrated into our or our third parties’ IT Systems, products or services. Because we make extensive use of third party suppliers and service providers, such as banks, credit card processors, delivery services and cloud services that support our internal and customer-facing operations, successful cyberattacks that disrupt or result in unauthorized access to third party IT Systems can materially impact our operations and financial results. Moreover, we have acquired and continue to acquire companies with cybersecurity vulnerabilities or unsophisticated security measures, which exposes us to significant cybersecurity, operational, and financial risks. Remote and hybrid working arrangements at our company (and at many third-party providers) also increase cybersecurity risks due to the challenges associated with managing remote computing assets and security vulnerabilities that are present in many non-corporate and home networks. Additionally, any integration of artificial intelligence in our or any service providers' or business partners' operations, products or services is expected to pose new or unknown cybersecurity risks and challenges.

Cyberattacks are expected to accelerate on a global basis in frequency and magnitude as threat actors are becoming increasingly sophisticated in using techniques and tools—including artificial intelligence—that circumvent security controls, evade detection and remove forensic evidence. As a result, we may be unable to detect, investigate, remediate or recover from

future attacks or incidents, or to avoid a material adverse impact to our IT Systems, Confidential Information or business. There can also be no assurance that our cybersecurity risk management program and processes, including our policies, controls or procedures, will be fully implemented, complied with or effective in protecting our IT Systems and Confidential Information. Furthermore, given the nature of complex systems, software and services like ours, and the scanning tools that we deploy across our networks and products, we regularly identify and track security vulnerabilities. We are unable to comprehensively apply patches or confirm that measures are in place to mitigate all such vulnerabilities, or that patches will be applied before vulnerabilities are exploited by a threat actor.

We and certain of our third-party providers and business partners have experienced a variety of cyber-attacks, which have increased in number and variety over time. Any adverse impact to the availability, integrity or confidentiality of our IT Systems or Confidential Information can result in significant legal and financial exposure (such as class actions), regulatory investigations, damage to our reputation that cause us to lose existing or future customers, a loss of confidence in our security measures, and significant incident response, system restoration or remediation and future compliance costs, any of which could have a material adverse effect on our financial results, operations results, and business. Moreover, any insurance coverage we may carry may be inadequate to cover the expenses and other potential financial exposure we could face due to a cyber-attack or data breach and there can be no assurance that applicable insurance will be available to us in the future on economically reasonable terms or at all.