As filed with the Securities and Exchange Commission on January 31, 2011

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

GENERAL FORM FOR REGISTRATION OF SECURITIES

Pursuant to Section 12(b) or 12(g) of the Securities Exchange Act of 1934

Global Pari-Mutuel Services, Inc.

(Exact name of registrant as specified in its charter)

| Nevada | | 88-0396452 |

| (State or other jurisdiction of incorporation or organization) | | (IRS Employer Identification No.) |

| 500 Fifth Avenue, Suite 810, New York, New York | | 10110 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code (917) 338-7301

Copies to:

Robert H. Friedman, Esq.

Kenneth M. Silverman, Esq.

Olshan Grundman Frome Rosenzweig & Wolosky LLP

Park Avenue Tower

65 East 55th Street

New York, New York 10022

(212) 451-2300

Securities to be registered pursuant to Section 12(b) of the Act:

Title of each class to be so registered | | Name of each exchange on which each class is to be registered |

| | | |

| None. | | Not applicable. |

Securities to be registered pursuant to Section 12(g) of the Act:

| Common Stock, par value $0.001 |

| (Title of Class) |

| |

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| | Large accelerated filer | ¨ | | Accelerated filer | ¨ |

| | Non-accelerated filer | ¨ | | Smaller reporting company | ý |

| | (Do not check if a smaller reporting company) | |

Page

| Item 1. | | 2 |

| | | |

| Item 1A. | | 14 |

| | | |

| Item 2. | | 20 |

| | | |

| Item 3. | | 28 |

| | | |

| Item 4. | | 28 |

| | | |

| Item 5. | | 31 |

| | | |

| Item 6. | | 33 |

| | | |

| Item 7. | | 37 |

| | | |

| Item 8. | | 41 |

| | | |

| Item 9. | | 42 |

| | | |

| Item 10. | | 42 |

| | | |

| Item 11. | | 49 |

| | | |

| Item 12. | | 51 |

| | | |

| Item 13. | | 52 |

| | | |

| Item 14. | | 52 |

| | | |

| Item 15. | | 53 |

| | | |

| Index to Financial Statements | F-1 |

You should rely only on the information contained in this document or to which we have referred you. We have not authorized anyone to provide you with information that is different. You should assume that the information contained in this document is accurate as of the date of this Form 10 only.

As used in this Form 10, unless the context otherwise requires the terms “we,” “us,” “our,” and “Global” refer to Global Pari-Mutuel Services, Inc., a Nevada corporation.

FORWARD LOOKING STATEMENTS

The statements contained in this document that are not purely historical are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Although we believe that the expectations reflected in such forward-looking statements, including those regarding future operations, are reasonable, we can give no assurance that such expectations will prove to be correct. Forward-looking statements are not guarantees of future performance and they involve various risks and uncertainties. Forward-looking statements contained in this document include statements regarding our proposed services, market opportunities and acceptance, e xpectations for revenues, cash flows and financial performance, and intentions for the future. Such forward-looking statements are included under Item 1. “Business” and Item 2. “Financial Information - Management’s Discussion and Analysis of Financial Condition and Results of Operation.” All forward-looking statements included in this document are made as of the date hereof, based on information available to us as of such date, and we assume no obligation to update any forward-looking statement. It is important to note that such statements may not prove to be accurate and that our actual results and future events could differ materially from those anticipated in such statements. Among the factors that could cause actual results to differ materially from our expectations are those described under Item 1. “Business,” Item 1A. “Risk Factors” and Item 2. “Financial I nformation - Management’s Discussion and Analysis of Financial Condition and Results of Operations.” All subsequent written and oral forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by this section and other factors included elsewhere in document.

Going Concern

Our independent registered public accounting firm has issued a “going concern” opinion raising substantial doubt about our financial viability. The accompanying consolidated financial statements for the years ended December 31, 2009 and 2008 have been prepared on a basis that contemplates the realization of assets and the satisfaction of liabilities and commitments in the normal course of business. We have continuing net losses and negative cash flows from operating activities. In addition, we have deficiencies in working capital and stockholders’ equity as of the balance sheet dates. These conditions raise substantial doubt about our ability to continue as a going concern. Our consolidated financial statements do not include any adjustments to the amounts and classification of assets and liabilities that ma y be necessary should we be unable to continue as a going concern. These circumstances caused our independent registered public accounting firm to include an explanatory paragraph in its report dated December 20, 2010 regarding their concerns about our ability to continue as a going concern. Substantial doubt about our ability to continue as a going concern may create negative reactions to the price of the common shares of our stock, and we may have a more difficult time obtaining financing.

Overview

We were organized as a Nevada corporation on January 27, 1997. We changed our corporate name to “Global Pari-Mutuel Services, Inc.” on August 30, 2005. Our offices are located at 500 Fifth Avenue, Suite 810, New York, New York 10110, and our telephone number is (917) 338-7301.

Beginning in 2000, we began developing online pari-mutuel wagering technology that facilitates pari-mutuel wagering over the internet for live horse and dog racing. During 2005, our management initiated plans to focus our principal business activities on pari-mutuel activities. It is our intent to become a leading, global provider for online pari-mutuel wagering on thoroughbred, harness and greyhound racing.

Pari-mutuel wagering is a system of cooperative betting in which the holders of winning tickets divide the total amount of money bet on a race, after subtracting taxes, racetrack fees and other expenses. The uniqueness of pari-mutuel wagering is that the public itself determines the payoff odds (e.g., if many people have bet on the actual winner of a contest, then the payoff will be relatively low because many winners will divide the pool).

We are currently pursuing the following business model:

| | 1. | Simulcast Facilities and Off-Track Betting (“OTB”) Parlors: |

| | · | To accept and process pari-mutuel wagers placed at simulcast facilities and OTB parlors; |

| | · | To provide race content to simulcast facilities and OTB parlors; |

| | 2. | International Call Center: To accept and process customers’ pari-mutuel wagers on races that are placed over the telephone through our international call-center facility; |

| | 3. | Settlement and Reconciliation: To provide settlement and reconciliation services to pari-mutuel wagerers, including: |

| | · | Keeping track of, billing, collecting and forwarding money due from the tracks to the wagerers; and |

| | · | Keeping track of, billing, collecting and forwarding money due from the wagerers to the tracks; |

| | 4. | Equipment and Software: To resell and rent equipment and software for wagering terminals to physical and virtual OTBs necessary for communication with the tracks; |

| | 5. | Global Pari-Mutuel Instant Racing Project (“IRP”): To operate, through our hub in Antigua, an online pari-mutuel based instant racing and wagering system; |

| | 6. | Global Pari-Mutuel Network: To launch an online internet model that allows international players to place wages on U.S. and international tracks through our www.rtcsportofkings.com website and the www.trackplayer.com website (the “Global Pari-Mutuel Network”); and |

| | 7. | New Product Development: To develop a new product that will allow users to compete, using a system of pari-mutuel wagering, on the relative price movements of various financial instruments. |

We presently rely on the revenues that we earn under two principal contracts pursuant to which we provide pari-mutuel wagering services through our hub operations in Antigua. Revenues earned under these two contracts accounted for approximately 78%, 44% and nil of our total revenues during the nine months ended September 30, 2010, the fiscal year ended December 31, 2009 and the fiscal year ended December 31, 2008, respectively. Revenues earned under our contract with Promotora Latinamericana de Entretenimiento, S.A. de C.V. (“PLE”) accounted for approximately 72%, 39% and nil of our total revenues during the nine months ended September 30, 2010, the fiscal year ended December 31, 2009 and the fiscal year ended December 31 , 2008, respectively, and revenues earned under our contract with ISI Maritime/Islands, Ltd. accounted for approximately 6%, 5% and nil of our total revenues during the nine months ended September 30, 2010, the fiscal year ended December 31, 2009 and the fiscal year ended December 31, 2008, respectively.

We are currently pursuing opportunities in the U.S., Mexico, Central and South America and the Caribbean, where we intend to introduce the Global Pari-Mutuel Network. We have signed contracts with approximately 40 horse and dog race tracks, which will provide us with content and race simulcasts. If we are successful in negotiating pari-mutuel license agreements with our customers and if these relationships become commercially viable, we believe the primary advantage of the Global Pari-Mutuel Network will be that it will allow customers of online international off-track betting parlors to have real-time odds and racing forms, access to the direct pari-mutuel pools at host tracks, scratches, daily results lines, daily race programs, past performance programs data, and other handicapping data and information concernin g available pools through online operations, call-centers or physical OTBs. During the nine months ended September 30, 2010, we did not have any contracts to provide settlement and reconciliation services and we did not enter into any new contracts with OTBs for the resale or rental of equipment and software. The Global Pari-Mutuel Network was launched during the last quarter of 2010 and to date has generated limited revenues.

Our principal cost of sales are (i) net commissions paid to OTBs through which wagers are placed, which were approximately 62%, 59% and 47% of total revenues during the nine months ended September 30, 2010, the fiscal year ended December 31, 2009 and the fiscal year ended December 31, 2008, respectively and (ii) simulcast fees paid to tracks, which were approximately 15%, 18% and 14% of our total revenues during the nine months ended September 30, 2010, the fiscal year ended December 31, 2009 and the fiscal year ended December 31, 2008, respectively.

In order to facilitate the implementation of our pari-mutuel wagering business model, we have taken the following measures over the past five years:

| | · | In April 2006, we acquired all of the outstanding shares of Royal Turf Club, Inc., a Nevada corporation (“RTCN”), and its subsidiary, Royal Turf Club Limited, an Antigua corporation (“RTCA”), in exchange for 6,000,000 shares of our common stock. RTCN provides software and software services for online pari-mutuel wagering on horses and greyhounds. In addition, RTCN provides content, video-streaming and direct access to the wagering pools at the race tracks through its website, www.rtcsportofkings.com as of the fourth quarter of 2010. We acquired RTCN to concentrate our business efforts on pari-mutuel wagering. Prior to 2006, our principal source of income was from credit card processing and only a small portion of our income was derived from pari-mutuel wagering. |

| | · | In December 2006, we entered into a cost and profit share agreement with Global Financial Solutions Holdings, Ltd, a newly-formed corporation organized under the laws and regulation of the Turks and Caicos Islands (“GFS”), due to our need to obtain additional financing in order to pursue our online pari-mutuel wagering model and the principal of GFS’s familiarity with operating a company in Antigua. GFS is not affiliated with us and was organized to enter into the cost and profit share agreement with us and had no prior business operations. |

| | · | In October 2007, we acquired Royal Turf Club Limited, a St. Kitts and Nevis corporation (“RTCK”), in exchange for 1,000,000 shares of our common stock; and |

| | · | In September 2009, we entered into an agreement with Racetech International under which we obtained a license for an online pari-mutuel based instant racing and wagering system as more fully described below. |

On December 7, 2010, we entered into an Equity Contribution Agreement (the “Contribution Agreement”) with BERMASE LLC (“BERMASE”), and its members, AVON ROAD BERMASE I LLC (“AVON I”), AVON ROAD BERMASE II LLC (“AVON II”), and JAF-NH, LLC (“JAF-NH”). BERMASE is a Delaware limited liability company whose purpose is to further develop online pari-mutuel wagering technology.

Under the Contribution Agreement, in exchange for all of the membership interests of BERMASE, we agreed to issue AVON I, AVON II and JAF-NH 195,437,962 shares of common stock. In connection with the Contribution Agreement, BERMASE also converted its Senior Secured Convertible Promissory Note due September 2012 in the principal amount of $400,000 issued by us to BERMASE and the related accrued interest of $9,567 into 2,047,836 shares of common stock and distributed those shares, as well as 1,200,000 shares of common stock then held by it, to AVON I, AVON II and JAF-NH.

In connection with the execution of the Contribution Agreement, we issued BERMASE an Unsecured Promissory Note, due January 2011, in the principal amount of $500,000, in respect of a $500,000 unsecured loan from BERMASE to us made simultaneously with the execution of the Contribution Agreement. The Contribution Agreement was subject to customary conditions to closing, including that BERMASE’s bank accounts have balances of at least $2,000,000 in cash at the time of closing.

Following the closing of the Contribution Agreement, which occurred on December 21, 2010, AVON I transferred 5,000,000 shares of our common stock to an affiliate and AVON II made a distribution-in-kind of 30,000,000 shares of our common stock to Robert A. Berman, a director and our non-executive chairman of the board. As of the date hereof, AVON I, AVON II, JAF-NH and their affiliates, including Mr. Berman, collectively beneficially own 70.14% of the shares of our common stock, on a fully-diluted post-transaction basis, which includes 60,559,826 shares currently subject to outstanding stock options.

As a result of the Contribution Agreement, a change of control may be deemed to have occurred since Mr. Berman now beneficially owns 66.90% of our outstanding common stock.

On December 7, 2010, we also entered into a one-year Consulting Agreement (the “Consulting Agreement”) with Bendigo Partners LLC, a New York limited liability company (“Bendigo”), pursuant to which Bendigo agreed to provide us with the services of R. Jarrett Lilien to serve as our chief executive officer, J. Leslie Whiteford to serve as our chief financial officer, Richard D. Taylor to serve as our chief operating officer, Stephen Ferrando to serve as our chief information officer, and individuals who shall serve as our chief marketing officer and internal general counsel, for a $250,000 monthly fee. In addition, pursuant to the Consulting Agreement, we granted Bendigo an option to purchase 56,799,828 shares of our common stock, which option first vests and becomes exercisable over a period of two years. � 0;The Consulting Agreement contemplates that upon expiration of its one-year term, Messrs. Lilien, Whiteford, Taylor and Ferrando will enter into employment agreements with us. As a result of the Consulting Agreement, James A. Egide resigned from his position as our chief executive officer, but retained his position as a member of our board of directors, Michael D. Bard resigned from his position as our chief financial officer and a member of our board of directors, and each of Joseph Neglia, Keith Cannon and Michael Michigami resigned as members of our board of directors. Messrs. Lilien and Taylor and Jeffrey P. Camp have been appointed to fill three of the four vacancies on our board of directors created by such resignations and Mr. Lilien will recommend candidates to fill the remaining vacancy.

With our new management team in place and the acquisition of BERMASE as our wholly-owned subsidiary, we intend to continue to pursue the development of new proprietary technology to expand our pari-mutuel trading hub to the financial services industry. To that end, we are currently in the process of developing a new business model and products that will allow users to place bets, using a system of pari-mutuel wagering, on the relative price movements of various financial instruments.

Research and Development

During the nine months ended September 30, 2010, the fiscal year ended December 31, 2009 and the fiscal year ended December 31, 2008, we spent approximately $125,000, $241,000 and $52,000, respectively, on research and development activities. The research and development costs were incurred primarily for the development of software for the Global Pari-Mutuel Network to be used in RTCA’s hub operations in Antigua, including the costs of engaging a full-time consultant to develop the software. Research and development of the Global Pari-Mutuel Network began during the fourth quarter of 2008 and was completed and launched during the fourth quarter of 2010.

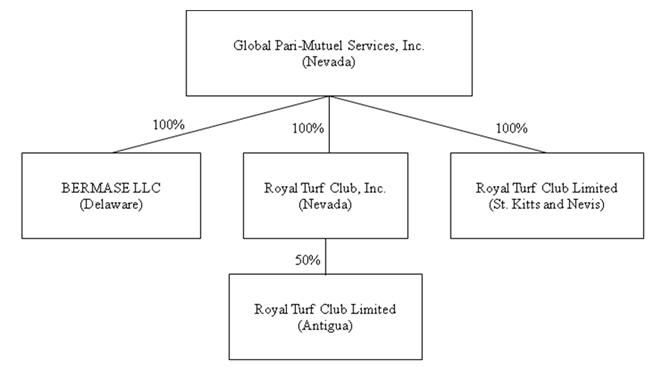

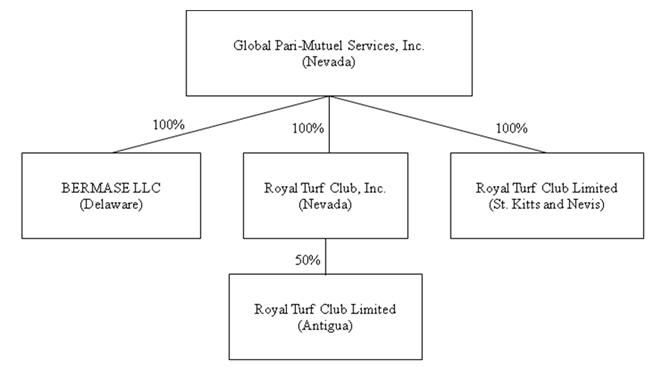

Organizational Structure

Our current organizational structure is as follows:

Global Financial Solutions Holdings

Effective as of December 31, 2006, RTCN and RTCA entered into an agreement with GFS, pursuant to which: (a) RTCA issued to GFS 50% of RTCA’s outstanding common stock (the “RTCA Shares”); (b) GFS agreed to make certain payments for the purpose of developing, constructing, implementing and operating a central system horse and dog racing hub (the “Hub Operation”); (c) RTCN agreed to manage the business of RTCA; and (d) RTCN and GFS, as the sole shareholders of RTCA, agreed to enter into certain agreements regarding the Hub Operation and their ownership of RTCA. GFS was organized to enter into the cost and profit share agreement with us and has no prior business operations.

In consideration of the RTCA Shares, GFS provided the funds necessary for all expenses related to the initial development, which included license fees, construction and implementation of the Hub Operation (the “Hub Implementation Expenses”), aggregating approximately $400,000.

The Hub Implementation Expenses included:

| | · | costs of the software, hardware, and all equipment necessary for the implementation and proper operation of the Hub Operation; |

| | · | costs of training employees, management, owners, and contractors on the proper operation of the Hub Operation; |

| | · | costs of the licensing rights to the software program for the Hub Operation; and |

| | · | operational costs directly related to the running of the Hub Operation. |

Since the Hub Operation has been launched and is considered operational, all expenses necessary and related to the ongoing operation and management of the Hub Operation (“Hub Operational Expenses”) are paid out of the funds generated by the operation of the Hub Operation prior to any distribution of profits. The Hub Operational Expenses include all costs of operating and managing the Hub Operation. GFS was responsible for all the expenses through June 30, 2008. Subsequent to June 30, 2008, any contributions needed for Hub Operational Expenses are paid by RTCN and GFS equally. Under the terms of the agreement, if either RTCN or GFS fails to make all or a part of any required contribution, at the option of the other shareholder, either (i) such other shareholder must make such payment or (ii) th e shareholder failing to make the contribution must forfeit such portion of its stockholding in RTC as is proportionate to the amount of the failure and a figure equal to an overall capitalization of RTC of twice the aggregate amount paid by GFS for the RTC Shares (excluding amounts paid by it under this sentence).

From the gross income of the Hub Operation, the manager must (i) first pay the expenses of the ongoing Hub Operation, (ii) then reimburse a shareholder for any advances or payments made after April 30, 2007, and (iii) then distribute equally to the shareholders the profits of the Hub Operation as they accrue. The term “profits” means any amounts generated by the Hub Operation after payment of all Hub Operational Expenses, and as generally defined and commonly used in practice and custom.

Acquisition of RTCK

On October 23, 2007, we acquired all of the outstanding shares of the RTCK in exchange for 1,000,000 shares of our common stock. RTCK is currently licensed by the government of St. Kitts and Nevis to operate pari-mutuel facilities. RTCK is also licensed by the Horsemen’s Association of Nevis. The acquisition of RTCK enabled us to open a call-center in St. Kitts and effectively terminated a contract between us and RTCK under which we paid royalties to RTCK aggregating $640,000. This royalty payment for $640,000 was expensed during 2007 through the issuance of the 1,000,000 shares to acquire RTCK. In May 2008, we moved our St. Kitts operations to Antigua.

Global Pari-Mutuel Instant Racing Project

On September 1, 2009, we entered into an Instant Racing Web Agreement with Racetech International with a term of seven years (the “Racetech Agreement”) under which (i) we obtained a license to operate, through our hub in Antigua, an online pari-mutuel based instant racing games and wagering system (the “IR Web System”) and (ii) Racetech International agreed to provide us with certain maintenance and support services in connection therewith. In consideration of the license and services, we agreed to pay Racetech International (a) a $10,000 annual fee and (b) 23% of net win from the IR Web System for all IR Web System games.

Instant racing utilizes recorded pari-mutuel events, currently greyhound and thoroughbred races, upon which wagerers place wagers through a terminal that is virtually identical to a self-service wagering terminal. The machine uses a random number generator to select races from a grouping of stored pari-mutuel races located in a main server. The wagerer inserts money and makes a selection of potential finishers, just like making a bet on a live race, based upon certain handicapping data that is provided via performance charts. The wagerer is not provided information concerning the race venue, date of race, name of horse or dog, or the jockey or trainer if applicable. Once the wagerer submits the wager via the terminal, the race is shown and the result is displayed. Payouts are determined by the wagers contributed to the pari-mutuel wager ing pools.

During December 2009, we established a joint venture to finance the IRP, which was based on an agreement between us and Racetech, LLC (“RT”). Pursuant to the agreement between us and RT, we have express authority to enter into this joint venture for purposes of promoting RT’s Instant Racing Project. Investors of the joint venture as a group agreed to purchase up to twenty project units from us at a cost of $25,000 per unit, consisting of $5,000 in unsecured liability and $20,000 in a loan which accrues interest at 8% per annum.

Under this arrangement, these investors were to receive 25% of the net proceeds and we were to receive the remaining 75%. Investors were also to receive 80% of the net revenue received by the joint venture until the notes and accrued interest have been paid in full. The joint venture was solely liable for the repayment of any amounts under this arrangement.

On August 10, 2010, the board of directors was authorized to offer the holders of the joint venture notes payable, the opportunity to convert their notes to shares of our common stock at $0.20 per share. This offer was valid until September 30, 2010. In September 2010, holders of notes payable totaling $350,000 less an unpaid investment balance of $10,000 converted their notes payable to 1,700,000 shares of our common stock. We also paid $87,500 in cash to the investors to repay their advances. On September 30, 2010, the joint venture was terminated and we retained all rights to future profits from the IRP.

Global Pari-Mutuel Network

We have a marketing agreement with Vector Enterprises, Inc., under which the internet pari-mutuel wagering website, www.trackplayer.com, a fully integrated advance deposit wagering (“ADW”) pari-mutuel internet horse, dog, and harness racing site, which is co-branded and owned by us, was established to accept pari-mutuel wagering. ADW is a system of wagering that allows wagerers to establish and fund an account from which they may place wagers via telephone, mobile device or through the internet. Under the agreement, Vector Enterprises, Inc. directs traffic to www.trackplayer.com through online advertising. Certain U.S. states prohibit ADW systems. See the section entitled, “Government Regulation”, below.

New Product Development

With our new management team in place and the acquisition of BERMASE as our wholly-owned subsidiary, we intend to continue to pursue the development of new proprietary technology to expand our pari-mutuel trading hub to the financial services industry. To that end, we are currently in the process of developing a new product that will allow users to compete, using a system of pari-mutuel wagering, on the relative price movements of various financial instruments.

Strategically, our goal is to be the leading “social” financial services destination and our vision is to be at the intersection of the global financial markets, horse racing, fantasy sports, and online gaming community. We anticipate that this may be accomplished through a series of games, unique content, and an entertaining user interface.

We expect that, if we are able to successfully develop and market such product, the back office and operations will be handled through existing infrastructure and vendor agreements. New content is in development and, if developed successfully, would result in what we believe to be a new front-end experience.

We anticipate that our proposed product would include the following games:

| | · | Company-Generated Races: Players would compete at choosing the best relative performers in races in which we determine race participants and duration; |

| | · | User-Generated Races: Players would compete at choosing the best relative performers in races in which players determine race participants and duration; and |

| | · | Fantasy Racing: Participants would play a number of races in a given day or week and those with the most points at the end of the competition win. |

The proposed product is currently in development, but we will require additional financing in order to complete its development. If we are able to obtain additional financing, we anticipate launching the product in the third quarter of 2011. There can be no assurance, however, that we will be able to obtain additional financing, meet proposed launch dates or be able to successfully develop or market such product or ultimately expand our pari-mutuel trading hub to the financial services industry.

Competition

Competition in our market place is primarily based on price and accessibility to the various horse and dog racing wagering pools.

Our principal competition for customers in Mexico and Central America is Hipodromo de Agua Caliente, S.A. de C.V. (“Caliente”). Caliente provides online wagering on horse and dog racing and is our principal competition for the provision of (i) pari-mutuel wagering services and content to physical OTB operators through our hub operations in Antigua and (ii) pari-mutuel wagering services through our international call center. Caliente is a legal bookmaking operator that offers customers track prices with payout limits. The pari-mutuel wagering services that we offer, however, provide for no payout limits due to the common pooling service that we offer.

The following companies compete with us for our customers where we provide pari-mutuel wagering services and content to international simulcast facilities and the Global Pari-Mutuel Network. TVG and the Television Games Network are direct competitors in the interactive, pari-mutuel wagering market. TVG operates an ADW website and currently operates in 15 states. In January 2009, Betfair completed its purchase of TVG. Betfair’s main product is a betting exchange, which is not legal in the United States. Changes by Betfair in the operation of TVG, including investment of significant resources into the operation of TVG or expansion into states where TVG currently does not operate, would increase competition for us. The Television Games Network is a 24-hour national racing channel for distribution over cable, Dish Network and DIRECTV®, along with an in-home pari-mutuel wagering system that requires a dedicated television set-top box.

Magna Entertainment Corporation (“Magna”) and its affiliated ADW website, XpressBet, and Churchill Downs and its affiliated ADW website, Twinspires.com, are also direct competitors in the U.S. interactive, pari-mutuel wagering market. In March 2007, Magna and Churchill Downs announced that they had formed a joint venture called TrackNet through which the companies’ horse racing content would be available to each other’s various distribution platforms, including XpressBet and Twinspires, and to third parties, including racetracks, casinos and other ADW providers. Magna and Churchill Downs also jointly own Horse Racing Television (HRTV). Magna filed for Chapter 11 bankruptcy protection on March 5, 2009. On February 18, 2010, Magna filed a Plan and related Disclosure Statem ent (the “Magna Plan”) in connection with its Chapter 11 proceedings, which was confirmed by order of the Bankruptcy Court on April 26, 2010. On April 30, 2010, the closing conditions of the Magna Plan were satisfied or waived, and the Magna Plan became effective following the close of business on April 30, 2010. Magna’s operations were transferred to MI Developments Inc. on April 30, 2010 pursuant to the Magna Plan.

Youbet.com, Inc. operates as a licensed multi-jurisdictional facilitator of online pari-mutuel horse race wagering, and supplier of tote equipment and services to the racing industry. Its principle product, Youbet Express, offers interactive and real-time audio/video broadcasts, access to database of handicapping information, and the ability to wager on various horse races in the United States, Canada, the United Kingdom, Australia and South Africa. Churchill Downs acquired Youbet.com on June 2, 2010.

Other competitors include Premier Turf Club, The Racing Channel, doing business as Oneclickbetting.com, and AmWest Entertainment. We expect to compete with these entities, as well as new companies, which may enter the interactive, pari-mutuel gaming market. It is possible that our current and potential competitors may have greater resources than us.

Governmental Regulation

Electronic transaction processing is regulated in the United States through the banking industry and card issuers, however, we are not aware of any governmental entity that regulates the payment processing services that we propose to market on behalf of banks or of any current attempts to impose governmental regulation on payment processing services.

Gaming activities are subject to extensive statutory and regulatory control in the United States by state and internationally by various government authorities. All 50 states currently have statutes or regulations restricting gaming activities, and three states do not permit gaming at all. Federal and state statutes and regulations are likely to be significantly affected by any changes in the political climate and economic and regulatory policies. These changes could affect our proposed operations in a materially adverse way.

We believe that our proposed pari-mutuel activities conform to current gaming laws and regulations as we understand them to be currently applied. There is very little clear statutory and case law authority and, therefore, this conclusion can be challenged by either governmental authorities or private citizens.

Pari-mutuel wagering is governed by state legislation. States adopt and enforce rules and regulations requiring all entities involved in pari-mutuel horseracing to be licensed. States prohibiting advanced deposit pari-mutuel wagering include Alaska, Arizona, Colorado, District of Columbia, Georgia, Hawaii, Mississippi, Missouri, Nebraska, Nevada, New Mexico, North Carolina, Oklahoma, South Carolina, and Utah.

The Interstate Horseracing Act of 1978 (“IHRA”) regulates pari-mutuel wagering on horseracing across state lines. This statute was created to remove pari-mutuel horseracing from illegal wagering activities covered by the Federal Wire Act (Chapter 18 USC) (the “Wire Act”). The IHRA was amended in December 2000 to clarify that pari-mutuel wagering may be placed via telephone or other electronic media (including the internet), and accepted by an off-track betting system where such wagers are lawful in each state involved. Thus, management believes existing federal statutes appear to allow pari-mutuel wagering on horse races and the Wire Act would not indirectly prohibit such activities.

In the fourth quarter of 2006, Congress passed the Unlawful Internet Gambling Enforcement Act of 2006 (the “UIGEA”) which includes certain racing protective provisions by maintaining the status quo with respect to wagering activities covered under the IHRA. The UIGEA prohibits the acceptance of credit cards, electronic funds transfers, checks of the proceeds of other financial transactions by persons engaged in unlawful betting or wagering businesses. However, the UIGEA specifically excludes from the definition of unlawful internet gambling “any activity that is allowed under the Interstate Horseracing Act of 1978”. On November 12, 2009, the Department of the Treasury and the Federal Reserve Board jointly published the final rule implementing the UIGEA.

Other federal laws impacting gaming activities include IHRA, the Interstate Wagering Paraphernalia Act, the Travel Act and the Organized Crime Control Act. Certain legislation is currently being considered in Congress and individual states in this regard.

Currently, certain online international off-track betting parlors permit their customers to bet on horse races taking place within the United States. However, their customers are not included in the general pari-mutuel pool created for the races, and they do not normally have access to pari-mutuel pools that result from the betting decisions of other participants.

Employees

As of January 28, 2011, we have one full-time employee and we utilize the services of four consultants that devote substantially all of their time to the company. In addition, as of December 7, 2010, we entered into the Consulting Agreement, pursuant to which R. Jarrett Lilien serves as our chief executive officer, J. Leslie Whiteford serves as our chief financial officer, Richard D. Taylor serves as our chief operating officer, Stephen Ferrando serves as our chief information officer, and two additional individuals will serve as our chief marketing officer and internal general counsel. We consider our relationships with our employees and consultants to be good. In the event that additional full or part-time employees or consultants are required to conduct or expand our business operations, we believe we will be ab le to identify, hire and/or engage qualified personnel.

Deregistration

On March 31, 2010, we filed a Form 12b-25 notifying the Securities and Exchange Commission (“SEC”) of our inability to timely file an annual report on Form 10-K for the fiscal year ended December 31, 2009 and representing that the Form 10-K would be filed no later than April 15, 2010, the date that was the fifteenth calendar day following the prescribed due date for our Form 10-K. Subsequent to filing the Form 12b-25, we determined that due to the significant costs of operating as a public reporting company, the substantial time that being a public reporting company required of our management team and the availability of deregistration as an option in accordance with SEC rules, we determined that it would be in the best interest of our stockholders and our company at the time to deregister our common stock under S ection 12(g) of the Exchange Act. As a result, on June 7, 2010, we filed a Form 15 deregistering our common stock under Section 12(g) of the Exchange Act in reliance upon Rule 12g-4(a)(1) and Rule 12g-4(a)(2) without first filing our Form 10-K and our Form 10-Q for the fiscal quarter ended March 31, 2010. As a result, when we filed the Form 15 deregistering our common stock under Section 12(g) of the Exchange Act, we were not in compliance with Section 13(a) of the Exchange Act, which requires every issuer of a security registered pursuant to Section 12 of the Exchange Act to file periodical and other reports with the SEC in accordance with the SEC’s rules and regulations. There can be no assurance that we will not fall out of compliance with Section 13(a) of the Exchange Act again in the future.

With our new management team in place as of December 7, 2010 and the acquisition of BERMASE as our wholly-owned subsidiary, which was consummated on December 21, 2010, as a result of which we acquired $2,000,000 in cash, we intend to continue to pursue the development of new proprietary technology to expand our pari-mutuel trading hub to the financial services industry, including the development of a new product as more fully described above. We anticipate that we may need to raise additional capital through future financings. As a result, we determined to reregister our securities under Section 12(g) of the Exchange Act in order to better position ourselves to obtain access to capital markets and ultimately be successful in the implementation of our business plan.

Where You Can Find More Information

Due to our deregistration on June 7, 2010 of our common stock under Section 12(g) of the Exchange Act, we were not subject to the reporting requirements of Section 13(a) or 15(d) of the Exchange Act immediately before the filing of this Registration Statement on Form 10. Upon effectiveness of this Registration Statement, we will file annual, quarterly and current reports and other information with the SEC. Our filings will be available to the public at the SEC’s website at http://www.sec.gov. You may also read and copy any materials filed by us with the SEC at the SEC’s Public Reference Room at 100 F Street, N. E., Washington, DC 20549 You may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330.

We have limited capital resources and cannot ensure access to additional capital if needed.

Our historical operating losses have required us to seek additional capital through the issuance of our common stock on a number of occasions. If we continue to sustain operating losses in future periods, we may be forced to seek additional capital to fund our operations. We do not know whether we will be able to obtain additional capital if needed, or on what terms the capital would be available, if at all. Depending on market conditions and our prospects, additional financing may not be available or may result in significant dilution to our current stockholders.

Our independent registered public accounting firm has issued a “going concern” opinion raising substantial doubt about our financial viability.

The accompanying consolidated financial statements for the years ended December 31, 2009 and 2008 have been prepared on a basis that contemplates the realization of assets and the satisfaction of liabilities and commitments in the normal course of business. We have continuing net losses and negative cash flows from operating activities. In addition, we have deficiencies in working capital and stockholders’ equity as of the balance sheet dates. These conditions raise substantial doubt about our ability to continue as a going concern. Our consolidated financial statements do not include any adjustments to the amounts and classification of assets and liabilities that may be necessary should we be unable to continue as a going concern. These circumstances caused our independent registered public accounting firm to include an explanatory paragraph in its report dated December 20, 2010 regarding their concerns about our ability to continue as a going concern. Substantial doubt about our ability to continue as a going concern may create negative reactions to the price of the common shares of our stock and we may have a more difficult time obtaining financing.

Since our common stock is classified as “penny stock,” the restrictions of the SEC’s penny stock regulations may result in less liquidity for our common stock.

The SEC has adopted regulations which define a “penny stock” to be any equity security that has a market price (as therein defined) of less than $5.00 per share or an exercise price of less than $5.00 per share, subject to certain exceptions. For any transactions involving a penny stock, unless exempt, the rules require the delivery, prior to any transaction involving a penny stock by a retail customer, of a disclosure schedule prepared by the SEC relating to the penny stock market. Disclosure is also required to be made about commissions payable to both the broker/dealer and the registered representative and current quotations for the securities. Finally, monthly statements are required to be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks. Because the market price for shares of our common stock is less than $5.00, and we do not satisfy any of the exceptions to the SEC’s definition of penny stock, our common stock is classified as penny stock. As a result of the penny stock restrictions, brokers or potential investors may be reluctant to trade in our securities, which may result in less liquidity for our common stock.

When we filed the Form 15 deregistering our common stock under Section 12(g) of the Exchange Act on June 7, 2010, we were not in compliance with Section 13(a) of the Exchange Act and there can be no assurance that we will comply with Section 13(a) of the Exchange Act again in the future. Failure to comply with Section 13(a) of the Exchange Act may have a material adverse affect on our stock price and the value of our business.

On March 31, 2010, we filed a Form 12b-25 notifying the SEC of our inability to timely file an annual report on Form 10-K for the fiscal year ended December 31, 2009 and representing that the Form 10-K would be filed no later than April 15, 2010, the date that was the fifteenth calendar day following the prescribed due date for our Form 10-K. Subsequent to filing the Form 12b-25, we determined that due to the significant costs of operating as a public reporting company, the substantial time that being a public reporting time required of our management team and the availability of deregistration as an option in accordance with SEC rules, we determined that it would be in the best interest of our stockholders and our company at the time to deregister o ur common stock under Section 12(g) of the Exchange Act. As a result, on June 7, 2010, we filed a Form 15 deregistering our common stock under Section 12(g) of the Exchange Act in reliance upon Rule 12g-4(a)(1) and Rule 12g-4(a)(2) without first filing our Form 10-K and our Form 10-Q for the fiscal quarter ended March 31, 2010. As a result, when we filed the Form 15 deregistering our common stock under Section 12(g) of the Exchange Act, we were not in compliance with Section 13(a) of the Exchange Act, which requires every issuer of a security registered pursuant to Section 12 of the Exchange Act to file periodical and other reports with the SEC in accordance with the SEC’s rules and regulations. There can be no assurance that we will not fall out of compliance with Section 13(a) of the Exchange Act again in the future. Failure to be in compliance with Section 13(a) of the Exchange Act may have a material adverse affect on our stock price and the value of our business.

Your ability to influence corporate decisions may be limited because ownership of our common stock is concentrated.

Our directors and executive officers as a group beneficially owned 204,216,107 (approximately 91.40% of our outstanding common stock as of January 28, 2011). As a result of their ownership of our common stock, our directors and executive officers, collectively, may be able to control matters requiring stockholder approval, including the election of directors and approval of significant corporate transactions. Such concentration of ownership may also have the effect of delaying or preventing a change in control of the company, and this may have a material adverse effect on the trading price of our common stock.

Our limited operating history makes it difficult for investors to evaluate our performance and/or assess our future prospects.

We were initially incorporated in January 1997. From January 1997 to October 1998, our business operations primarily consisted of efforts to develop and market online casino services. We discontinued efforts to develop online casino services in June 1998. We subsequently pursued development of an electronic currency services business, development of a credit card processing services business, a related operation of providing ATM debit card services to online gaming customers and marketing credit card services of international credit card processors to merchants. From 2005 to the present, we have focused on our pari-mutuel business opportunities. As a result, there is a very limited operating history upon which an evaluation of our company can be based. Our future prospect s are subject to risks and uncertainties that are generally encountered by newly operational companies in new and rapidly evolving markets. These risks include, but are not limited to:

| | · | Whether we can successfully market and execute our business model for pari-mutuel wagering; |

| | · | Whether the demand for our proposed services will grow to a level sufficient to support our operations; |

| | · | Whether governing laws, regulations or regulatory initiatives will force us to discontinue or alter certain business operations or practices; |

| | · | Whether our technology partners can respond effectively to market changes; |

| | · | Whether we and our strategic partners can develop and maintain products and services that are equal or superior to the services and products of competitors; |

| | · | Whether we can maintain strong alliances with those to whom we outsource our data and technology needs; and |

| | · | Whether we can generate the funds as needed to sell the services we intend to offer, and attract, retain, and motivate qualified personnel. |

There can be no assurance that we can be successful in addressing these risks. Our limited operating history and the uncertain nature of the markets for our proposed services make the prediction of future results of operations extremely difficult. As a result of the foregoing factors and the other factors identified herein, there can be no assurance that we will ever operate profitably on a quarterly or annual basis.

We may become subject to government regulation and legal uncertainties, which may adversely affect our business.

We believe that we are not currently subject to regulation by any U.S. or foreign governmental agency, other than regulations applicable to businesses generally. However, due to the increasing usage of the internet and concerns about online gaming in general, it is possible that a number of laws and regulations may be adopted in the future that would affect our conducting business over the internet. Presently, there are few laws or regulations that apply specifically to the sale of goods and services on the internet. Any new legislation applicable to us could expose us to substantial liability, including significant expenses necessary to comply with these laws and regulations. Furthermore, the growth and development of the market for electronic commerce may promote more stringent consumer prote ction and privacy laws that may impose additional burdens on companies conducting business online, including us. The adoption of additional laws or regulations may decrease the growth of the internet or other online services, which could, in turn, decrease the demand for our services and increase our cost of doing business. For example, we may become subject to some or all of the following sources of regulation: state or federal banking regulations; federal money laundering regulations; international banking, financial services or gaming regulations or laws governing other regulated industries; or U.S. and international regulation of internet transactions. The application to us of existing laws and regulations relating to issues such as banking, currency exchange, online gaming, pricing, taxation, quality of services, electronic contracting, and intellectual property ownership and infringement is unclear. In addition, we may become subject to new laws and regulatio ns directly applicable to the internet and our activities. If we are found to be in violation of any current or future regulations, we could be exposed to financial liability, including substantial fines which could be imposed on a per transaction basis; forced to change our business practices; or forced to cease doing business altogether or with the residents of one or more states or countries.

We must adapt to new regulations governing the transmission, use and processing of personal information in electronic commerce.

Our services involve handling, transmitting, verifying and processing personal information of customers that we service. As electronic commerce continues to evolve, federal, state and foreign governments may adopt laws and regulations covering user privacy. New laws regulating the solicitation, collection or processing of personal or consumer information could increase the costs and complexity of our operations and adversely affect our business.

Even if there is a demand for our online pari-mutuel wagering support services, the revenues generated from such services may not exceed the costs associated with providing the services.

We plan to provide settlement and reconciliation services to facilitate online pari-mutuel wagering. We have not entered into any contracts with respect to, or otherwise obtained any commitments from anyone to purchase or use the pari-mutuel support services we propose to offer. We can provide no assurance that there will be any demand for our online pari-mutuel wagering support services. If there is a demand, we can provide no assurance that the revenues generated from such services will exceed the costs associated with providing the services.

We may not attract or retain qualified management and employees.

Our future success and our ability to expand our operations will depend on our ability to retain highly qualified management and employees. As a newly operational company, we may have difficulty or be unable to retain or attract highly qualified management and employees. Failure to attract and retain personnel will make it difficult for us to manage our business and meet our objectives, and will likely have a material adverse effect on our business operations. We do not carry key person life insurance on any of our senior management personnel. The loss of the services of any of our executive officers or other key employees may have a material adverse effect on our business.

We intend to conduct the majority of our business offshore, which is subject to additional risks that may adversely affect our business.

We, or our affiliates, intend to conduct the majority of our business offshore. Conducting business outside of the United States is subject to additional risks that may affect our ability to sell our products and services and result in reduced revenues, including, without limitation:

| | · | Currency exchange fluctuations; |

| | · | Changes in regulatory requirements; |

| | · | Reduced protection of intellectual property rights; |

| | · | Evolving privacy laws in foreign countries; |

| | · | The burden of complying with a variety of foreign laws; and |

| | · | Political or economic instability or constraints on international trade. |

We cannot be certain that one or more of these factors will not materially adversely affect our future international operations and, consequently, our business, financial condition, and operating results.

We have not sought to protect our intellectual property through registration. Our inability to protect our intellectual property rights may force us to incur unanticipated costs.

Our inability to protect our intellectual property could reduce the value of our products and services. Various events outside of our control pose a threat to our intellectual property rights as well as to our products and services. For example, effective intellectual property protection may not be available in every country in which our products and services are distributed or made available through the internet. Also, the efforts we have taken to protect our proprietary rights may not be sufficient or effective. Any significant impairment of our intellectual property rights could harm our business or our ability to compete. Also, protecting our intellectual property rights is costly and time consuming. Any increase in the unauthorized use of our intellectual property could make it more expensive to do business and harm our o perating results.

We currently do not have any registered intellectual property, including patents, trademarks and copyrights. Although we may seek to obtain patent protection for our innovations, it is possible we may not be able to protect some of these innovations. Changes in patent law, such as changes in the law regarding patentable subject matter, can also impact our ability to obtain patent protection for our innovations. In addition, given the costs of obtaining patent protection, we may choose not to protect certain innovations that later turn out to be important. Furthermore, there is always the possibility, despite our efforts, that the scope of the protection gained will be insufficient or that an issued patent may be deemed invalid or unenforceable.

We may also seek to maintain certain intellectual property as trade secrets. The secrecy could be compromised by outside parties, or by our employees, which would cause us to lose the competitive advantage resulting from these trade secrets.

We may be unable to obtain the licenses or other proprietary rights necessary to implement our business plan.

We expect to be dependent upon the intellectual property and other resources of our technology providers. We may be required to obtain licenses to certain intellectual property or other proprietary rights from such parties. Such licenses or proprietary rights may not be made available under acceptable terms, if at all. If we do not obtain required licenses or proprietary rights, we could encounter delays in product development or find that the deployment of technology and/or sale of services requiring such licenses are foreclosed.

Our stock price is volatile.

Transactions in our common stock are presently reported on the Pink Sheets. The trading price of our common stock has been and may continue to be subject to wide fluctuations. In the last twelve months transactions in our common stock have been reported as low as $0.14 and as high as $1.40. The wide swings in the price of our common stock have not always been in response to factors that we can identify. Factors that are likely to contribute to the volatility of the trading price of our common stock include, among others:

| | · | The relatively low volume of trading in our common stock; |

| | · | The number of short positions in our common stock; |

| | · | The control of the market for our common stock by very few participants; |

| | · | The general unavailability of information about our company and our business; |

| | · | Financial predictions and recommendations by stock analysts (or the absence thereof) concerning our company and other companies competing in our market; |

| | · | Public announcements of technical innovations relating to our business, new products or services by us or our competitors, or acquisitions or strategic alliances by us or our competitors; |

| | · | Public reports concerning our services or those of our competitors or concerning developments or trends; and |

| | · | Operating and stock price performance of companies that investors or stock analysts may deem comparable to us. |

We are unlikely to pay dividends on our common stock for the foreseeable future.

We have never declared or paid cash dividends on our capital stock. We currently intend to retain all available funds and any future earnings for use in the operation and expansion of our business. We do not anticipate paying any cash dividends in the foreseeable future, and it is unlikely that investors will derive any current income from ownership of our common stock. This means that the potential for economic gain from ownership of our stock depends on appreciation of our common stock price and will only be realized by a sale of the common stock at a price higher than your purchase price.

We have the right to, and expect to, issue additional shares of stock without stockholder approval.

We have authorized capital of 395,000,000 shares of common stock. As of January 28, 2011, 222,729,316 shares of our common stock were issued and outstanding. Our board of directors has authority, without action or vote of our stockholders, to issue all or part of the authorized but unissued shares. In addition, our Articles of Incorporation, as amended, permit our board of directors to create and issue one or more series of preferred stock, which may be convertible into shares of our common stock, and may be entitled to preferential rights with respect to dividends, voting, distributions or other matters. Any such issuance of common or preferred stock will dilute the percentage ownership of our stockholders and may dilute the book value of outstanding shares of our common stock.

Management’s Discussion and Analysis of Financial Condition and Results of Operation

Pari-mutuel wagering is driven in part by discretionary spending and industry competition. The continuing overall weakness in the U.S. economy resulted in considerable negative pressure on consumer spending and contributed to a decline in our pari-mutuel revenues during the nine months ended September 30, 2010 compared to the same period in 2009 and for the year ended December 31, 2009 compared to year ended December 31, 2008. Our financial results for the nine months ended September 30, 2010 compared to the same period in 2009 were negatively affected due also to lost revenues associated with the discontinuation of our wagering settlement and reconciliation services previously performed for third parties. During the nine months ended September 30, 2010 and the year ended December 31, 2009, we continued our attempt to counteract these d eclines by continuing to spend on research and development projects that we believe will expand our pari-mutuel wagering opportunities. In December 2010, we acquired BERMASE and engaged a new management team that we believe will further expand our pari-mutuel wagering opportunities.

Critical Accounting Estimates and Policies

The preparation of financial statements in conformity with generally accepted accounting principles (“GAAP”) requires management to make estimates and assumptions that affect the amounts reported in the financial statements and judgments related to the application of certain accounting policies.

While we base our estimates on historical experience, current information and other factors deemed relevant, actual results could differ from those estimates. We consider accounting estimates to be critical to our reported financial results if (i) the accounting estimate requires us to make assumptions about matters that are uncertain and (ii) different estimates that we reasonably could have used for the accounting estimate in the current period, or changes in the accounting estimate that are reasonably likely to occur from period to period, would have material impact on our financial statements.

We consider our policies for revenue recognition to be critical due to the continuously evolving standards and industry practice related to revenue recognition, changes which could materially impact the way we report revenues. Accounting policies related to: fair value of financial instruments, trade accounts receivable, property and equipment, impairment of long-lived assets, track settlements and wagering deposits, stock-based compensation, and income taxes are also considered to be critical as these policies involve considerable subjective judgment and estimation by management. Critical accounting policies, and our procedures related to these policies, are described below.

Fair Value of Financial Instruments

The carrying amounts reported in the balance sheets for current assets and current liabilities approximate fair value due to their short-term nature. The carrying amounts reported for long-term debt approximate fair value because the underlying instruments bear interest rates which approximate current market rates for obligations with similar terms.

Trade Accounts Receivable

Accounts receivable are stated at the amount we expect to collect. We regularly review our accounts receivable and make provisions for potentially uncollectible balances. Uncollectible balances are written off against the allowance after extensive efforts of collection and when balances are deemed uncollectible. Recoveries of trade receivables previously written off are recorded when cash is received. A trade receivable is considered to be past due if any portion of the receivable balance has not been received by is within its normal terms.

Property and Equipment

Property and equipment is stated at cost less accumulated depreciation. Depreciation is computed using the straight-line method over the estimated useful lives of the asset, which range from six to ten years.

Maintenance and repairs of equipment are charged to operations and major improvements are capitalized. Upon retirement, sale, or other disposition of equipment, the cost and accumulated depreciation are eliminated from the accounts and gain or loss is included in operations.

Impairment of Long-lived Assets

We periodically review the carrying value of our long-lived assets in relation to historical results, as well as management’s best estimate of future trends, events and overall business climate. If such reviews indicate that the carrying value of such assets may not be recoverable, we will then estimate the future cash flows generated by such assets (undiscounted and without interest charges). If such future cash flows are insufficient to recover the carrying amount of the assets, then impairment is triggered and the carrying value of any impaired assets would then be reduced to fair value.

Track Settlements and Wagering Deposits

Track settlements and wagering deposits consist of amounts due to customers and/or tracks based on the outcome of bets placed. In the case of settlement and reconciliation contracts, we record the liability when money is received from the payer and decreases the liability when the settlement is paid out to the payee. Under customer contracts wherein the customer agrees to pay us for access to pari-mutuel wagering pools with pari-mutuel tracks that we have contracts with, we record the liability when the outcome of bets placed are known and decrease the liability when the settlement is paid out to the tracks.

Revenue Recognition

Revenue from our various pari-mutuel operations is recognized when persuasive evidence of a contract arrangement exists, the fee is fixed or determinable and collectability is probable. We earn and record commissions on wagers placed with tracks for customers as revenue when the wagers are settled, typically the same day as the wager, based upon associated track contracts. We earn and record fees from settlement and reconciliation services as revenue after the services have been provided, based upon our contracts for settlement and reconciliation services. We earn and record fixed fees from our resale and rental of equipment and software to physical and virtual OTBs when the equipment or the software has been delivered and fully installed at the OTB site, based upon our contracts for the resale and rental of equipment and software.

Stock-Based Compensation

The cost of all share-based awards to employees, including grants of employee stock options and restricted stock, is recognized in the financial statements based on the fair value of the awards at grant date. The fair value of stock option awards is determined using the Black-Scholes valuation model on the date of grant. The fair value of restricted stock awards is equal to the market price of our common stock on the date of grant. The fair value of share-based awards is recognized as stock-based compensation expense on a straight-line basis over the requisite service period from the date of grant.

Income Taxes

We recognize an asset or liability for the deferred tax consequences of all temporary differences between the tax bases of assets or liabilities and their reported amounts in the financial statements. Temporary differences will result in taxable or deductible amounts in future years when the amounts reported in the financial statements are recovered or settled. These deferred tax assets or liabilities are measured using the tax rates that are anticipated to be in effect when the differences are expected to reverse. Deferred tax assets are reviewed periodically for recoverability and a valuation allowance is provided as necessary.

Discussion of Operating Results

The following discussion of our operating results explains material changes in our results of operations for the three and nine months ended September 30, 2010 and year ended December 31, 2009 compared to their respective prior periods. The discussion should be read in conjunction with the financial statements and related notes included elsewhere in this Form 10.

For The Three and Nine Month Periods ended September 30, 2010 and 2009

The following discussion and analysis provides information which management believes is relevant to an assessment and understanding of our results of operations, financial condition, and cash flows, and should be read in conjunction with the condensed consolidated financial statements and notes thereto that are contained in this Form 10, as well as Management’s Discussion and Analysis of Financial Condition and Results of Operations For The Years Ended December 31, 2009 and 2008.

Revenue and Cost of Revenue

During the nine months ended September 30, 2010 and 2009, our revenue was $951,161 and $1,417,201, respectively. During the nine months ended September 30, 2010, $891,161 of the revenue was generated from providing pari-mutuel hub and content services and $60,000 was provided by our settlement with Sol Mutuel (see Note 8 to our unaudited condensed consolidated financial statements). Cost of sales during the nine months ended September 30, 2010 was $739,308 and gross profit was $211,853. During the nine months ended September 30, 2009, $1,368,737 of the revenue was generated from providing pari-mutuel hub and content services, $18,428 from settlement and reconciliation services and $30,036 from sales and rental of equipment related to pari-mutuel wagering. Cost of sales during the nine months ended Septem ber 30, 2009 was $1,147,674 and gross profit was $269,527. Gross profit as a percent of revenue increased to 22.3% from 19.0%, this was principally caused by the Sol Mutuel settlement that had no costs of sales. Sales decreased due to the termination of two pari-mutuel hub and content services contracts, one in the third quarter of 2009 and the other in the second quarter of 2010, offset by a new contract with PLE which began during the second quarter of 2009. Revenues from our contract with PLE accounted for 72% of the total revenue during the nine-month period ended September 30, 2010 as compared to 32% of the total revenue during the nine-month period ended September 30, 2009. We no longer have any contracts to provide settlement and reconciliation services, nor have we entered into any contracts for the resale or rental of equipment or software.

During the three months ended September 30, 2010 and 2009, our revenues were $237,465 and $563,034, respectively. During the three months ended September 30, 2010, all of the revenue was generated from providing pari-mutuel hub and content services, 93% of which revenue was generated by us under our contract with PLE. Cost of sales during the three months ended September 30, 2010 was $204,877 and gross profit was $32,588. During the three months ended September 30, 2009, $565,718 of the revenue was generated from providing pari-mutuel hub and content services offset by a credit of $2,684 for rental of equipment related to pari-mutuel wagering. Cost of sales during the three months ended September 30, 2009 was $462,337 and gross profit was $100,697. Gross profit as a percent of reven ue decreased to 13.7% from 17.9%, this was principally caused by increased volume at tracks where we have lower returns. Sales decreased due to the termination of two pari-mutuel hub and content services contracts, one in the third quarter of 2009 and the other in the second quarter of 2010 offset by a new contract with PLE which began during the second quarter of 2009.

General and Administrative Expenses

General and administrative expenses were approximately $996,000 during the nine-month period ended September 30, 2010 as compared to approximately $1,323,000 during the nine-month period ended September 30, 2009. This decrease of approximately $327,000 is principally attributable to a $219,000 decrease in non-cash stock-based compensation expense which was primarily based on the variance in the Black-Scholes valuations of the 575,000 stock options issued during the nine months ended September 30, 2009 and 550,000 stock options issued during the nine months ended September 30 2010, a $65,000 decrease in bad debt expense due to recovery of previously written-off accounts receivable and a $37,000 reduction in the cost of operations in Antigua.

General and administrative expenses were approximately $391,000 during the three months ended September 30, 2010 as compared to $308,000 during the three months ended September 30, 2009. This increase of approximately $83,000 is principally attributable to a $113,000 increase in non-cash stock-based compensation expense, which was primarily attributable to the Black-Scholes valuation of 550,000 stock options issued during the three months ended September 30, 2010 compared to none issued during the three months ended September 30, 2009, offset by a $30,000 reduction in other general and administrative expenses.

We spent approximately $72,000 on the development of our internet software model and the investigation of a possible expanded pari-mutuel gaming platform during the three months ended September 30, 2010 and spent approximately $68,000 on the development of our internet software model during the three months ended September 30, 2009.

We spent approximately $125,000 on the development of our internet software model and the investigation of a possible expanded pari-mutuel gaming platform during the nine months ended September 30, 2010 and spent approximately $188,000 on the development of our internet software model during the nine months ended September 30, 2009.

Interest Expense

We spent approximately $420,000 on interest expense during the nine months ended September 30, 2010, principally attributed to $400,000 in non-cash amortization of debt discount due to the beneficial conversion feature related to the 9% senior convertible promissory note in the amount of $400,000 and the cost related to the warrant to purchase 7,000,000 shares of our common stock, which were issued pursuant to the Securities Purchase Agreement, dated as of September 15, 2010, by and between us and BERMASE (see Note 1 to our unaudited condensed consolidated financial statements. We spent approximately $27,000 on interest expense during the nine months ended September 30, 2009 on borrowings.

We spent approximately $388,000 on interest expense during the three months ended September 30, 2010, principally attributed to $400,000 in non-cash amortization of debt discount due to the beneficial conversion feature related to the 9% senior convertible promissory note in the amount of $400,000 and the cost related to the warrant to purchase 7,000,000 shares of our common stock, as described in the paragraph above, offset by a reduction in interest expense of approximately $14,000 associated with the cancellation of the IRP joint venture notes payable. We spent approximately $46,000 on interest expense during the three months ended September 30, 2009 on borrowings.

For The Years Ended December 31, 2009 and 2008

The following discussion and analysis provides information which management believes is relevant to an assessment and understanding of our results of operations, financial condition, and cash flows. The discussion should be read in conjunction with our audited financial statements and notes thereto included elsewhere in this Form 10.

Revenue and Cost of Revenue

During the years ended December 31, 2009 and 2008, our revenue was $1,837,615 and $1,225,590, respectively. During the year ended December 31, 2009, $1,789,151 of the revenue was generated from providing pari-mutuel hub and content services, $18,428 from settlement and reconciliation services and $30,036 from sales and rental of equipment related to pari-mutuel wagering. During the year ended December 31, 2008, $922,202 of the revenue was generated from providing pari-mutuel hub and content services, $256,325 from settlement and reconciliation services and $47,063 from sales and rental of equipment related to pari-mutuel wagering. Revenues generated during the year ended December 31, 2009 were approximately $612,000 more than revenues generated during the year ended December 31, 2008 due primarily to a $ 710,000 increase in revenues from a new contract with an OTB operation, a $116,000 increase from call-in business, and a $98,000 increase from a new contract with a high volume bettor. These increases were offset by a reduction in revenues of $238,000 due to a decrease in volume processed with our settlement and reconciliation customer, Sol Mutuel, and the eventual termination of that contract (see Note 9 to our audited consolidated financial statements), a $57,000 decrease in volume from previously existing customers, and a $17,000 decrease in sales and rental of equipment associated with pari-mutuel wagering.

Cost of sales during the year ended December 31, 2009 was $1,492,876 and gross profit was $344,739. Cost of sales during the year ended December 31, 2008 was $830,481 and gross profit was $395,109. During the year ended December 31, 2009, cost of sales was 81.2% of revenue as compared to 67.8% of revenue during year ended December 31, 2008. This change is attributed to the reduction in settlement and reconciliation revenue from $256,325 during the year ended December 31, 2008 to $18,428 during the year ended December 31, 2009. Cost of sales associated with settlement and reconciliation revenue was minimal. Settlement and reconciliation revenue declined due to the termination of the contract with Sol Mutuel (see Note 9 to our audited consolidated financial statements).

General and Administrative Expenses

General and administrative expenses were approximately $1,713,000 during the year ended December 31, 2009 and approximately $2,130,000 during the year ended December 31, 2008. This decrease of approximately $417,000 is principally attributable to an approximate $547,000 reduction in expenses associated with an incentive given to convert notes to common stock, an approximate $90,000 reduction in costs associated with the settlement of accounts payable through the issuance of common stock and an approximate $52,000 reduction of consulting expenses associated with raising capital, offset by an approximate $105,000 increase in non-cash stock-based option compensation, an approximate $70,000 increase in the provision for doubtful accounts and an approximate $77,000 increase in costs to acquire track data.

Research and Development