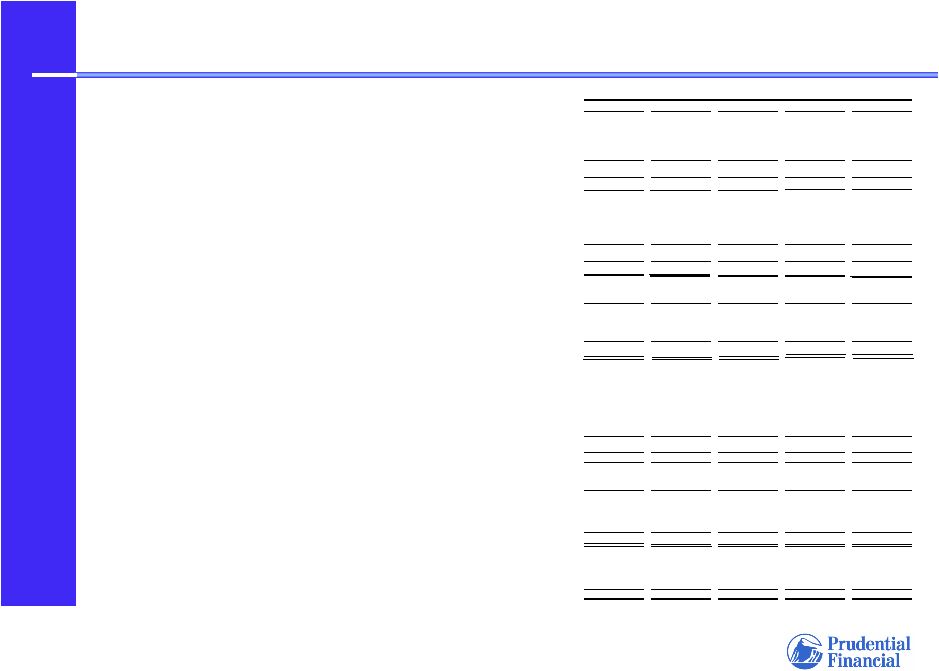

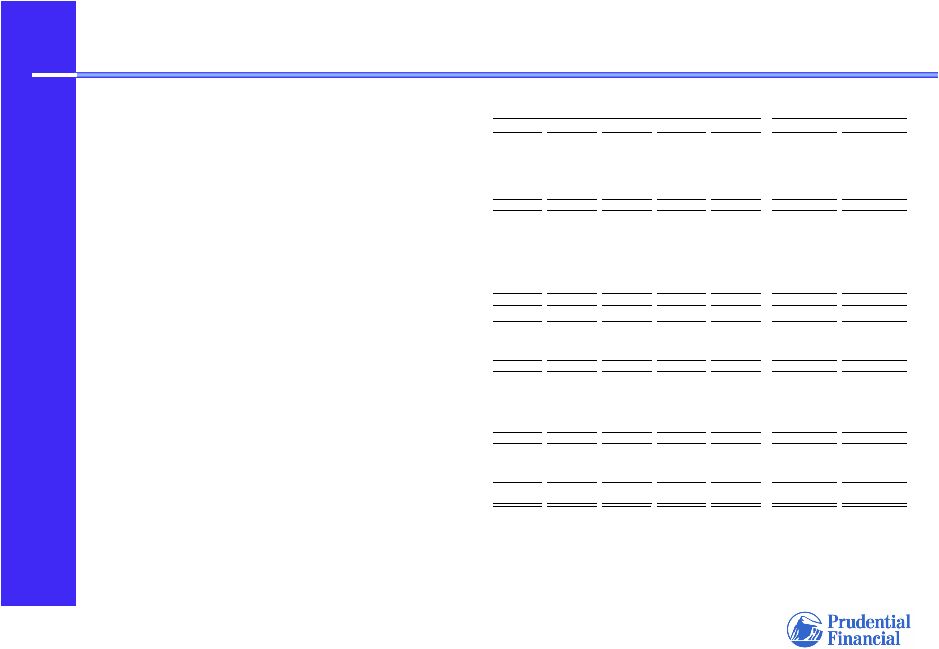

6 Investor Day 12.04.07 Reconciliation between adjusted operating income and the comparable GAAP measure (continued) Reconciliation between adjusted operating income and the comparable GAAP measure (continued) Prudential Financial, Inc. (in millions, except per share data) Sept 30, 2006 Sept 30, 2007 Financial Services Businesses: Pre-tax adjusted operating income by division: Insurance Division 1,010 $ 1,255 $ Investment Division 768 1,086 International Insurance and Investments Division 1,168 1,410 Corporate and other operations 60 (4) Total pre-tax adjusted operating income 3,006 3,747 Income taxes, applicable to adjusted operating income 861 1,104 Financial Services Businesses after-tax adjusted operating income 2,145 2,643 Reconciling items: Realized investment gains (losses), net, and related charges and adjustments (40) 63 Investment gains (losses) on trading account assets supporting insurance liabilities, net (8) 10 Change in experience-rated contractholder liabilities due to asset value changes 28 4 Sales practices remedies and costs - - Divested businesses 58 29 Equity in earnings of operating joint ventures (223) (323) Total reconciling items, before income taxes (185) (217) Income taxes, not applicable to adjusted operating income (91) (90) Total reconciling items, after income taxes (94) (127) Income from continuing operations (after-tax) of Financial Services Businesses before equity in earnings of operating joint ventures, extraordinary gain on acquisition and cumulative effect of accounting change 2,051 2,516 Equity in earnings of operating joint ventures, net of taxes 146 200 Income from continuing operations (after-tax) of Financial Services Businesses before extraordinary gain on acquisition and cumulative effect of accounting change 2,197 2,716 Income (loss) from discontinued operations, net of taxes 54 4 Extraordinary gain on acquisition, net of taxes - - Cumulative effect of accounting change, net of taxes - - Net income of Financial Services Businesses 2,251 $ 2,720 $ Earnings per share of Common Stock (diluted): Financial Services Businesses after-tax adjusted operating income 4.41 $ 5.69 $ Reconciling items: Realized investment gains (losses), net, and related charges and adjustments (0.08) 0.13 Investment gains (losses) on trading account assets supporting insurance liabilities, net (0.02) 0.02 Change in experience-rated contractholder liabilities due to asset value changes 0.06 0.01 Sales practices remedies and costs - - Divested businesses 0.12 0.06 Equity in earnings of operating joint ventures (0.45) (0.68) Total reconciling items, before income taxes (0.37) (0.46) Income taxes, not applicable to adjusted operating income (0.18) (0.19) Total reconciling items, after income taxes (0.19) (0.27) Income from continuing operations (after-tax) of Financial Services Businesses before equity in earnings of operating joint ventures, extraordinary gain on acquisition and cumulative effect of accounting change 4.22 5.42 Equity in earnings of operating joint ventures, net of taxes 0.29 0.43 Income from continuing operations (after-tax) of Financial Services Businesses before extraordinary gain on acquisition and cumulative effect of accounting change 4.51 5.85 Income (loss) from discontinued operations, net of taxes 0.11 0.01 Extraordinary gain on acquisition, net of taxes - - Cumulative effect of accounting change, net of taxes - - Net income of Financial Services Businesses 4.62 $ 5.86 $ Weighted average number of outstanding Common shares (diluted basis) 497.8 471.6 Reconciliation to Consolidated Net Income of Prudential Financial, Inc: Net income of Financial Services Businesses (above) 2,251 $ 2,720 $ Net income (loss) of Closed Block Business 140 113 Consolidated net income 2,391 $ 2,833 $ Direct equity adjustments for earnings per share calculations 51 $ 42 $ Nine months ended |