UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2007

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 0-33407

APP PHARMACEUTICALS, INC.

(Exact name of registrant as specified in its charter)

| | |

| Delaware | | 30-0431736 |

| (State of Incorporation) | | (I.R.S. Employer Identification No.) |

| |

1501 East Woodfield Road, Suite 300 East Schaumburg, IL 60173-5837 | | (847) 969-2700 |

| (Address of principal executive offices, including zip code) | | (Registrant’s telephone number, including area code) |

Securities registered pursuant to Section 12(b) of the Act:

| | |

| Common Stock, par value $0.001 per share | | The NASDAQ Stock Market LLC |

| (Title of Class) | | (Name of each exchange on which registered) |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

| | | | |

| Large Accelerated filer x | | Accelerated Filer ¨ | | Non-Accelerated Filer ¨ |

Indicate by check mark whether the registrant is a shell company (as determined by rule 12b-2 of the Exchange Act). Yes ¨ No x

As of June 29, 2007 (the last business day of the registrant’s most recently completed second quarter), the aggregate market value of the voting stock held by non-affiliates of the registrant was approximately $593.6 million or $317.2 million, based on the adjusted Nasdaq closing price of $11.88 per common share on that date, as adjusted for the spin-off described herein. The registrant has no non-voting common stock.

As of March 3, 2008, the registrant had 160,091,099 shares of common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Proxy Statement for the registrant’s 2008 Annual Meeting of Stockholders are incorporated by reference into Part III of this Annual Report on Form 10-K.

APP Pharmaceuticals Inc.

FORM 10-K

For the Year Ended December 31, 2007

TABLE OF CONTENTS

PART I

Unless the context otherwise requires, references in this report to “New APP,” “APP Pharmaceuticals,” “we,” “us” and “our” refer to APP Pharmaceuticals, Inc. and its subsidiaries, including our operating subsidiary APP Pharmaceuticals, LLC (which we refer to as New APP, LLC in this information statement), references to “Old Abraxis” refer to Abraxis BioScience, Inc. prior to the separation and related transactions, references to “New Abraxis” refer to New Abraxis Inc., which was our wholly owned subsidiary prior to the separation and which changed its name to Abraxis BioSciences, Inc. following the separation, and references to the “distribution,” “separation” or “spin-off” refer to the transactions in which the proprietary business was separated from Old Abraxis and New Abraxis became an independent publicly-traded company.

Note Regarding Forward-Looking Statements

This Annual Report on Form 10-K and other documents we file with the Securities and Exchange Commission contain forward-looking statements, as the term is defined in the Private Securities Litigation Reform Act of 1995. In addition, we may make forward-looking statements in press releases or written statements, or in our communications and discussion with investors and analysts in the normal course of business through meetings, webcasts, phone calls and conference calls. Such forward-looking statements, whether expressed or implied, are subject to risks and uncertainties which can cause actual results to differ materially from those currently anticipated, due to a number of factors, many of which are beyond our control, which include, but are not limited to:

| | • | | the market adoption of and demand for our existing and new pharmaceutical products; |

| | • | | our ability to maintain and/or improve sales and earnings performance; |

| | • | | the ability to successfully manufacture products in an efficient, time-sensitive and cost effective manner; |

| | • | | our ability to service our debt; |

| | • | | the impact on our products and revenues of patents and other proprietary rights licensed or owned by us, our competitors and other third parties; |

| | • | | our ability, and that of our suppliers, to comply with laws, regulations and standards, and the application and interpretation of those laws, regulations and standards, that govern or affect the pharmaceutical industry, the non-compliance with which may delay or prevent the sale of our products; |

| | • | | the difficulty in predicting the timing or outcome of product development efforts and regulatory approvals; |

| | • | | the availability and price of acceptable raw materials and components from third-party suppliers; |

| | • | | evolution of the fee-for-service arrangements being adopted by our major wholesale customers; |

| | • | | risks inherent in divestitures and spin-offs, including business risks, legal risks and risks associated with the tax and accounting treatment of such transactions; |

| | • | | inventory reductions or fluctuations in buying patterns by wholesalers or distributors; and |

| | • | | the impact of recent legislative changes to the governmental reimbursement system. |

Forward-looking statements also include the assumptions underlying or relating to any of the foregoing or other such statements. When used in this report, the words “may,” “will,” “should,” “could,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “predict” and similar expressions are generally intended to identify forward-looking statements.

1

Readers are cautioned not to place undue reliance on these forward-looking statements, which reflect management’s opinions only as of the date hereof. We undertake no obligation to revise or publicly release the results of any revision to these forward-looking statements, whether as a result of new information, changes in assumptions, future events or otherwise. Readers should carefully review the factors described in Item 1A: Risk Factors below and other documents we file from time to time with the Securities and Exchange Commission for a more detailed description of the risks and other factors that may affect the forward-looking statements. Readers should understand that it is not possible to predict or identify all such factors. Consequently, readers should not consider any such list to be a complete set of all potential risks or uncertainties.

Overview

We are a fully-integrated pharmaceutical company that develops, manufactures and markets injectable pharmaceutical products. We believe that we are the only independent U.S. public company with a primary focus on the injectable critical care, anti-infective and oncology markets, and we further believe that we offer one of the most comprehensive injectable product portfolios in the pharmaceutical industry. We manufacture products in each of the three basic forms in which injectable products are sold: liquid, powder and lyophilized, or freeze-dried.

Our products are generally used in hospitals, long-term care facilities, alternate care sites and clinics within North America. Unlike the retail pharmacy market for oral products, the injectable pharmaceuticals marketplace is largely made up of end users who have relationships with group purchasing organizations, or GPOs, and/or specialty distributors who distribute products within a particular end-user market, such as oncology clinics. GPOs and specialty distributors generally enter into collective product purchasing agreements with pharmaceutical suppliers in an effort to secure more favorable drug pricing on behalf of their members.

We began in 1996 with an initial focus on U.S. marketing and distribution of generic pharmaceutical products manufactured by others. In June 1998, we acquired Fujisawa USA, Inc.’s generic injectable pharmaceutical business, including manufacturing facilities in Melrose Park, Illinois and Grand Island, New York and a research and development facility in Melrose Park, Illinois. We also acquired additional assets in this transaction, including inventories, plant and equipment and abbreviated new drug applications that were approved by or pending with the FDA.

On April 18, 2006, we completed a merger with American BioScience, Inc., or ABI, our former parent. In connection with the closing of that merger, our certificate of incorporation was amended to change our original name of American Pharmaceutical Partners, Inc. to Abraxis BioScience, Inc. Old Abraxis was operated as two distinct business segments: the proprietary business and the hospital-based business.

On November 13, 2007, Old Abraxis was separated into two independent publicly-traded companies: our company, APP Pharmaceuticals, Inc., which owns and operates the hospital-based business; and the other which owns and operates the proprietary business. We refer to the proprietary business following the separation as “New Abraxis,” which subsequently changed its name to Abraxis BioScience, Inc. We continue to operate the hospital-based business (which we refer to as “New APP” following the separation) under the name APP Pharmaceuticals, Inc. Our common stock is traded and quoted on the NASDAQ Global Market under the symbol “APPX.”

New APP and New Abraxis entered into a series of agreements in connection with the separation, including a separation and distribution agreement, a transition services agreement, an employee matters agreement, a tax allocation agreement, a manufacturing agreement and various real estate leases. Please refer toNote 7—Related Parties for additional information on the separation related agreements. Also, in connection with the separation, we incurred $1 billion of indebtedness and, in addition, entered into a $150 million revolving credit facility. $700 million of the proceeds from this indebtedness was contributed to New Abraxis, approximately $12 million was used to pay fees and expenses related to the debt financing, approximately $276 million of the proceeds was

2

used to repay in full the then existing revolving credit facility and the remainder was retained by New APP. New APP is solely responsible for servicing the debt. Please refer toItem 8—Financial Statements and Supplementary Data Note 3—Spin-off of New Abraxis in the accompanying audited consolidated financial statements for further details.

Our Products

Injectable Oncology Products

We presently manufacture and market 17 injectable oncology products in 38 dosages and formulations. According to IMS Health, Inc., or IMS, a pharmaceutical market research firm, during 2007 we were the market leader for four of these products in terms of units sold in the United States. Net revenue of our injectable oncology products was $55.3 million in 2007 and represented 9 % of total 2007 revenue.

Our oncology products include:

Carboplatin. Carboplatin is indicated for the initial treatment of advanced ovarian carcinoma in combination with other chemotherapeutic agents and for the palliative treatment of recurrent ovarian carcinoma after prior chemotherapy. Carboplatin is the generic equivalent of Bristol-Myers Squibb Company’s Paraplatin®. We launched the liquid and lyophilized versions of carboplatin in October 2004, and we received approval for the liquid, 600 mg, multi-dose vial form of the product in February 2006.

Doxorubicin. Doxorubicin is indicated for use in adjuvant therapy for the treatment of breast cancer where there is evidence of axillary lymph node involvement following tumor resection. Doxorubicin has been successful in producing regression in disseminated neoplastic conditions, including several types of leukemias, ovarian, breast and bladder cancers as well as Hodgkin’s disease. Doxorubicin is the generic equivalent of Pharmacia & Upjohn Company’s Adriamycin®. We launched the liquid version of doxorubicin in August 2007.

Fludarabine. Fludarabine is indicated for the treatment of adult patients with B-cell chronic lymphocytic leukemia whose disease is unresponsive, or has progressed, despite treatment with an alkylinating-agent containing regimen. We launched fludarabine in October 2007.

Fluorouracil. Fluorouracil is part of a class of drugs known as “antineoplastics” which are used in the treatment of various cancers to slow or stop the growth of cancer cells. Fluorouracil is indicated for the palliative management of carcinoma of the colon, rectum, breast, stomach and pancreas and is the generic equivalent of Sicor Pharmaceuticals’ Adrucil®. We launched the fluorouracil in December 1998.

Ifosfamide.Ifosfamide is a chemotherapy drug used to treat germ cell testicular cancer and is often given in combination with Mesna. Bristol-Myers originally marketed ifosfamide under the brand name Ifex®. In response to customer requests, we were the first to offer individually packaged generic ifosfamide; our lyophilized form eliminated the need for the refrigerated storage required by the previous generic ifosfamide/mesna kit packaging. We launched ifosfamide in July 2002 with 180-day exclusivity.

Mesna. Mesna is a cytoprotectant used to treat the side effects associated with certain chemotherapy drugs. Bristol-Myers originally marketed mesna under the brand name Mesnex®. Launched in May 2001, we were the first to market a generic version of mesna.

Injectable Anti-Infective Products

We manufacture and market 21 injectable anti-infective products. According to IMS, we were the United States market leader for ten injectable anti-infective products in terms of units or dollars sold during 2007. Our injectable anti-infective products generated net revenues of $193.7 million in 2007 and represented 30% of 2007 total net revenues.

We believe we offer one of the most comprehensive portfolios of injectable anti-infective products, including eleven different classes of antimicrobials. We believe we are the only generic pharmaceutical company

3

that owns and operates a dedicated cephalosporins manufacturing facility in the United States. The FDA requires dedicated facilities for the manufacture of cephalosporins. We believe that we currently offer the broadest portfolio of generic cephalosporins. According to IMS, the 2007 markets for first, second and third generation cephalosporins exceeded $300 million.

Our anti-infective product line includes:

Ampicillin.Ampicillin is a penicillin based antibiotic, which treats various types of infections of the skin, central nervous system, heart, respiratory tract, sinuses, ear and kidney.

Ampicillin and Sulbactam. Ampicillin and Sulbactam is an injectable antibacterial combination consisting of the seminsynthetic antibiotic ampicillin sodium and the beta-lactamase inhibitor sulbactam sodium. Administered intravenously or intramuscular, Ampicillin and Sulbactam is indicated for the treatment of several skin and skin structure, intra-abdominal and gynecological infections due to susceptible strains of microorganisms. Ampicillin and Sulbactam is the generic equivalent of Pfizer Inc.’s Unasyn®. We launched this product in November 2006.

Azithromycin. Azithromycin is indicated for the treatment of community-acquired pneumonia and pelvic inflammatory disease when caused by susceptible microorganisms. Azithromycin is the generic equivalent of Pfizer Inc.’s Zithromax®. We launched this product in February 2006.

Cefotetan.Cefotetan is a second-generation cephalosporin with a broad range of anti-microbial activity. Cefotetan is often used for surgical prophylaxis and offers the longest half-life of any cephalopsorin. AstraZeneca marketed the innovator product under the brand name Cefotan®. We launched cefotetan in September 2007 and are currently the only company to market cefotetan in the United States.

Vancomycin.Vancomycin is an antibiotic used to treat some types of Staph, Strep or other infections, particularly in patients who are allergic to penicillins or cephalosporins. Eli Lilly originally marketed vancomycin under the brand name Vancocin®.

Injectable Critical Care Products

We manufacture and market more than 60 injectable critical care products, which includes the eight Anesthetic and Analgesics product families we acquired in June 2006. According to IMS, 13 of our critical products held first position and 9 held second position in the United States market in terms of units sold in 2007. Our critical care product line encompasses a wide range of products essential to hospitals and clinics, ranging from diluents, to heart medications, to steroidal products to sedatives. Our injectable critical care products generated net revenues of approximately $382.8 million for the year ended December 31, 2007. Products acquired in June 2006 totaled $180.7 million for the year ending December 31, 2007.

Our critical care products include:

Diprivan®.Diprivan® is a patent protected intravenous sedative-hypnotic agent and the first of a new class of intravenous anesthetic agents—the alkylphenols. Diprivan® is indicated for the induction of general anesthesia in adult and pediatric patients; maintenance of general anesthesia in adult and pediatric patients; and intensive care unit sedation for intubated, mechanically ventilated adults. Zeneca Pharmaceuticals first commercially introduced Diprivan® in the United States in 1989, and we purchased this product from AstraZeneca in June 2006. Diprivan® maintains the number one unit and dollar position in the US market.

Heparin. Injectable heparin is a blood thinner used to prevent and treat blood clotting, especially during and after surgery. We manufacture one of the most comprehensive lines of injectable therapeutic heparin. According to 2007 IMS data, we currently hold the number one unit and dollar share position for injectable therapeutic heparin. The U.S. market for injectable therapeutic heparin vials was 80 million units in 2007.

Naropin®.Naropin® is a patent protected long-acting local anesthetic that contains ropivicaine HCI, which is a member of the amino amide class of local anesthetics. Naropin® is indicated for the production of local

4

or regional anesthesia for surgery and for acute pain management. AstraZeneca developed Naropin®, and we purchased this product from AstraZeneca in June 2006.

Oxytocin. Oxytocin is used to induce labor at term and control postpartum bleeding. Wyeth-Ayerst originally marketed oxytocin under the brand name Pitocin®. We currently hold the number one unit and dollar share position for oxytocin in the US market.

Recent Developments

In the first quarter of 2008, a major supplier of heparin announced the recall of all the heparin sodium injection and heparin flush products that they were offering to the market. In response to FDA and hospital concerns about a potential shortage of therapeutic heparin, we announced that we would immediately increase manufacturing of this product. Since that time, we have has ramped up production to a level we believe is sufficient to meet the entire U.S. market demand.

Injectable Pharmaceutical Products under Development

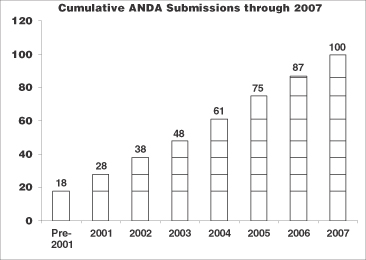

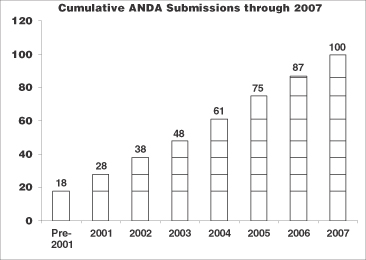

We believe that we are currently the leader in injectable ANDA drug approvals. Since June 1, 1998, when we acquired 14 pending abbreviated new drug applications, or ANDA’s, we have filed 100 applications with the FDA and received a total of 83 product approvals.

5

We currently have over 30 ANDA’s pending with the FDA and over 70 product candidates under development across our oncology, anti-infective and critical care product categories. In 2007, we received 11 ANDA approvals and 4 tentative approvals and in 2008 have received 4 approvals to date.

Research and Development

We have approximately 72 employees dedicated to product development who have expertise in areas such as pharmaceutical formulation, analytical chemistry and drug delivery. We currently lease and operate 48,000 square feet in a research and development facility in Melrose Park, Illinois. In 2006, the Melrose Park facility underwent a major renovation, reconfiguration and expansion to enhance our development capabilities.

When developing new products, we consider a variety of factors, including:

| | • | | potential pricing and gross margins; |

| | • | | existing and potential market size; |

| | • | | high barriers to entry; |

| | • | | patent expiration date; |

| | • | | our manufacturing capabilities and access to raw materials; |

| | • | | potential development and competitive challenges; and |

| | • | | whether these products complement our existing products and the opportunity to leverage these products with the development of additional products. |

We have made, and will continue to make, substantial investment in research and development. Research and development costs for the years ended December 31, 2007 and 2006 totaled $46.5 million and $27.8 million, respectively.

Sales and Marketing

Our products are primarily marketed by a dedicated sales force to hospitals, long-term care facilities, alternate care sites, clinics and doctors who administer injectable products in their offices. Many purchases by these buyers are made through arrangements with GPOs, which negotiate collective purchasing agreements on behalf of their members, or through specialty distributors, which specialize in particular therapeutic categories such as oncology. We sell to members of all of the major GPOs in the United States, which we believe

6

collectively represent over 95% of all hospital-based pharmaceutical purchasers in the United States. We also sell products to the leading specialty distributors. We believe we have access to nearly 100% of the buyers of injectable products in the United States. Our sales force is comprised of approximately 36 field sales and national accounts professionals, supported by our customer service and sales support groups. Our representatives typically have substantial injectable pharmaceutical sales experience in the geographic region in which they operate.

We currently derive, and expect to continue to derive, a large percentage of our revenue from customers that are members of a small number of GPOs. Currently, fewer than ten GPOs control a large majority of sales to hospital customers. We have purchasing arrangements with the major GPOs in the United States, including AmeriNet, Inc., Broadlane Healthcare Corporation, Consorta, Inc., MedAssets Inc., Novation, LLC, Owen Healthcare, Inc., PACT, LLC, Premier Purchasing Partners, LP, International Oncology Network, or ION, National Oncology Alliance, or NOA and U.S. Oncology, Inc. In order to maintain these relationships, we believe we need to be a reliable supplier, offer a broad product line, remain price competitive, comply with FDA regulations and provide high-quality products. Our GPO agreements are typically multi-year in duration and may be terminated on short notice.

Competition

Competition among pharmaceutical and other companies that develop, manufacture or market pharmaceutical products is intense. We compete with these entities in all areas of business, including competing to attract and retain qualified scientific and technical personnel.

We face competition from major, brand name pharmaceutical companies as well as generic manufacturers such as Hospira, Inc., Bedford Laboratories, Baxter Laboratories (including Elkin-Sinn), SICOR Inc. (acquired by Teva Pharmaceuticals USA), Mayne Pharma (acquired by Hospira, Inc.) and increased competition from new, overseas competitors.

Revenue and gross profit derived from sales of generic pharmaceutical products tend to follow a pattern based on regulatory and competitive factors. As patents for brand name products and related exclusivity periods expire, the first generic pharmaceutical manufacturer to receive regulatory approval for generic versions of these products is generally able to achieve significant market penetration and higher margins. As competing generic manufacturers receive regulatory approvals on similar products, market share, revenue and gross profit typically decline. The level of market share, revenue and gross profit attributable to a particular generic pharmaceutical product is normally related to the number of competitors in that product’s market and the timing of that product’s regulatory approval and launch in relation to competing approvals and launches. We continue to develop and introduce new products in a timely and cost-effective manner and identify niche products with significant barriers to entry in order to maintain our revenue and gross margins.

Regulatory Considerations

Prescription pharmaceutical products are subject to extensive pre- and post-market regulation by the FDA, including regulations that govern the testing, manufacturing, safety, efficacy, labeling, storage, record keeping, advertising and promotion of the products under the Federal Food Drug and Cosmetic Act and the Public Health Services Act, and by comparable agencies in foreign countries. FDA approval is required before any dosage form of any drug can be marketed in the United States. All applications for FDA approval must contain information relating to pharmaceutical formulation, stability, manufacturing, processing, packaging, labeling and quality control.

Generic Drug Approval

The Drug Price Competition and Patent Term Restoration Act of 1984, or the Hatch-Waxman Act, established abbreviated FDA approval procedures for those drugs that are no longer protected by patents and

7

which are shown to be equivalent to previously approved proprietary drugs. Approval to manufacture these drugs is obtained by filing an abbreviated new drug application, or an ANDA. An ANDA is a comprehensive submission that must contain data and information pertaining to the active pharmaceutical ingredient, drug product formulation, specifications and stability of the generic drug, as well as analytical methods, manufacturing process validation data and quality control procedures. As a substitute for clinical studies, the FDA may require data indicating that the ANDA drug formulation is equivalent to a previously approved proprietary drug. In order to obtain an ANDA approval of strength or dosage form that differs from the referenced brand name drug, an applicant must file and have granted an ANDA Suitability Petition. A product is not eligible for ANDA approval if it is not determined by the FDA to be equivalent to the referenced brand name drug or if it is intended for a different use. However, such a product might be approved under a New Drug Application, or an NDA, with supportive data from clinical trials.

One advantage of the ANDA approval process is that an ANDA applicant generally can rely upon equivalence data in lieu of conducting pre-clinical testing and clinical trials to demonstrate that a product is safe and effective for its intended use. We generally file ANDAs to obtain approval to manufacture and market our generic products. No assurance can be given that ANDAs submitted for our products will receive FDA approval on a timely basis, if at all.

New Drug Approval

The process required by the FDA before a new drug may be marketed in the United States generally involves:

| | • | | completion of pre-clinical laboratory and animal testing; |

| | • | | submission of an investigational new drug application, or IND, which must become effective before trials may begin; |

| | • | | performance of adequate and well-controlled human clinical trials to establish the safety and efficacy of the proposed drug product’s intended use; and |

| | • | | submission to and approval by the FDA of a new drug application, or NDA. |

Clinical trials are typically conducted in three sequential phases that may overlap. These phases generally include:

| | • | | Phase I during which the drug is introduced into healthy human subjects or, on occasion, patients, and generally is tested for safety, stability, dose tolerance and metabolism; |

| | • | | Phase II during which the drug is introduced into a limited patient population to determine the efficacy of the product in specific targeted diseases, to determine dosage tolerance and optimal dosage and to identify possible adverse effects and safety risks; and |

| | • | | Phase III during which the clinical trial is expanded to a more diverse patient group in geographically dispersed trial sites to further evaluate clinical efficacy, optimal dosage and safety. |

The drug sponsor, the FDA or the Institutional Review Board at each institution at which a clinical trial is being performed may suspend a clinical trial at any time for various reasons, including a belief that the subjects are being exposed to an unacceptable health risk.

The results of product development, preclinical animal studies and human studies are submitted to the FDA as part of the NDA. The NDA also must contain extensive manufacturing information. The FDA may approve on the basis of the submission made or disapprove the NDA if applicable FDA regulatory criteria are not satisfied. The FDA may also require additional clinical data. Under certain circumstances, drug sponsors may obtain approval pursuant to Section 505(b)(2) of the Federal Food, Drug & Cosmetic Act based in part upon literature or an FDA finding and/or effectiveness for another approved product, even where the products are not duplicates in

8

terms of chemistry and bioequivalence. Once approved, the FDA may withdraw the product approval if compliance with pre- and post-market regulatory standards is not maintained or if problems occur after the product reaches the marketplace. In addition, the FDA may require post-marketing studies to monitor the effect of approved products and may limit further marketing of the product based on the results of these post-marketing studies. The FDA has broad post-market regulatory and enforcement powers, including the ability to levy fines and civil penalties, suspend or delay issuance of approvals, seize or recall products, and withdraw approvals.

Satisfaction of FDA pre-market approval requirements typically takes several years and the actual time required may vary substantially based upon the type, complexity and novelty of the product or disease. Government regulation may delay or prevent marketing of potential products for a considerable period of time and impose costly procedures upon a manufacturer’s activities. Success in early stage clinical trials does not assure success in later stage clinical trials. Data obtained from clinical activities is not always conclusive and may be susceptible to varying interpretations that could delay, limit or prevent regulatory approval. Even if a product receives regulatory approval, later discovery of previously unknown problems with a product may result in restrictions on the product or even complete withdrawal of the product from the market.

In addition to regulating and auditing human clinical trials, the FDA regulates and inspects equipment, facilities, laboratories, and processes used in the manufacturing and testing of such products prior to providing approval to market a product. If after receiving clearance from the FDA, a material change is made in manufacturing equipment, location or process, additional regulatory review may be required. Our manufacturers also must adhere to current Good Manufacturing Practice and product-specific regulations enforced by the FDA through its facilities inspection program. The FDA also conducts regular, periodic visits to re-inspect equipment, facilities, laboratories and processes following the initial approval. If, as a result of these inspections, the FDA determines that the equipment, facilities, laboratories, or processes of our manufacturers do not comply with applicable FDA regulations and conditions of product approval, the FDA may seek civil, criminal, or administrative sanctions and/or remedies against our manufacturers, including the suspension of manufacturing operations.

We are also subject to various federal and state laws pertaining to health care “fraud and abuse,” including anti-kickback laws and false claims laws. Anti-kickback laws make it illegal to solicit, offer, receive, or pay any remuneration in exchange for, or to induce, the referral of business, including the purchase or prescription of a particular drug. The federal government has published regulations that identify “safe harbors” or exemptions for certain arrangements that do not violate the anti-kickback statutes. Due to the breadth of the statutory provisions and the absence of guidance in the form of regulations or court decisions addressing some of practices, it is possible that our practices might be challenged under anti-kickback or similar laws. False claims laws prohibit anyone from knowingly and willingly presenting, or causing to be presented for payment to third party payers (including Medicare and Medicaid), claims for reimbursed drugs or services that are false or fraudulent, claims for items or services not provided as claimed, or claims for medically unnecessary items or services. The activities of our strategic partners relating to the sale and marketing of our products may be subject to scrutiny under these laws. Violations of fraud and abuse laws may be punishable by criminal and/or civil sanctions, including fines and civil monetary penalties, as well as the possibility of exclusion from federal health care programs (including Medicare and Medicaid). If the government were to allege against or convict us of violating these laws, there could be a material adverse effect on us. Our activities could be subject to challenge for the reasons discussed above and due to the broad scope of these laws and the increasing attention being given to them by law enforcement authorities.

We are also subject to regulation under the Occupational Safety and Health Act, the Toxic Substances Control Act, the Resource Conservation and Recovery Act, and other current and potential future federal, state, or local laws, rules, and/or regulations. Our research and development activities involve the controlled use of chemicals, biological materials and other hazardous materials. We believe that our procedures comply with the standards prescribed by federal, state, or local laws, rules, and/or regulations; however, the risk of injury or accidental contamination cannot be completely eliminated.

9

Manufacturing

Our manufacturing operations are located in Melrose Park, Illinois, Grand Island, New York, and Barceloneta, Puerto Rico. The Puerto Rico facility, which we acquired from Pfizer Inc. in February 2007, consists of a validated manufacturing plant with capabilities of producing EU and US compliant injectable pharmaceuticals, as well as protein based biologics and metered dosed inhalers. We began commercial manufacturing from our Puerto Rico facility in the second half of 2007. These manufacturing facilities, which include dedicated cephalosporin powder filling, liquid filling line and oncolytic manufacturing suites, have in the aggregate approximately 848,500 square feet of manufacturing, packaging, laboratory, office and warehouse space.

We can produce a broad range of dosage formulations, including lyophilized products, liquids, both aseptically filled and terminally sterilized, and powders. We currently produce approximately 190 million vials of product per year and have the capacity to produce 250 million vials of product per year.

Since 1998, we increased our capacity from three to 14 lyophilizers with an additional four presently pending installation. This increased lyophilizer capacity has enhanced our ability to deliver on our product pipeline.

In addition to manufacturing, we have fully integrated manufacturing support systems, including quality assurance, quality control, regulatory affairs and inventory control. These support systems enable us to maintain high standards of quality for our products and simultaneously deliver reliable services and goods to our customers on a timely basis.

We are required to comply with the applicable FDA manufacturing requirements contained in the FDA’s current Good Manufacturing Practice, or cGMP, regulations. cGMP regulations require quality control and quality assurance as well as the corresponding maintenance of records and documentation. Our manufacturing facilities must meet cGMP requirements to permit us to manufacture our products. We are subject to the periodic inspection of our facilities, procedures and operations and/or the testing of our products by the FDA, the Drug Enforcement Administration and other authorities to assess our compliance with applicable regulations.

Failure to comply with the statutory and regulatory requirements subjects the manufacturer to possible legal or regulatory action, including the seizure or recall of products, injunctions, consent decrees placing significant restrictions on or suspending manufacturing operations, and civil and criminal penalties. Adverse experiences with the product must be reported to the FDA and could result in the imposition of market restriction through labeling changes or in product removal. Product approvals may be withdrawn if compliance with regulatory requirements is not maintained or if problems concerning safety or efficacy of the product occur following approval.

Raw Materials

The manufacture of our products requires raw materials and other components that must meet stringent FDA requirements. Some of these raw materials and other components currently are available only from a limited number of sources. Additionally, regulatory approvals for a particular product denote the raw materials and components, and the suppliers for such materials that may be used for that product. Even when more than one supplier exists, we may elect to list, and in some cases have only listed, one supplier in our applications with the FDA. Any change in or addition of a supplier not previously approved must then be submitted through a formal approval process with the FDA. From time to time, it is necessary to maintain increased levels of certain raw materials due to the anticipation of raw material shortages or in response to market opportunities.

Intellectual Property

We rely on trade secrets, unpatented proprietary know-how, continuing technological innovation and patent protection to preserve our competitive position. Our success depends on our ability to operate without infringing the patents and proprietary rights of third parties. We cannot determine with certainty whether patents or patent applications of other parties will materially affect our ability to make, use or sell any products. A number of

10

pharmaceutical companies, biotechnology companies, universities and research institutions may have filed patent applications or may have been granted patents that cover aspects of our or our licensors’ products, product candidates or other technologies.

Intellectual property protection is highly uncertain and involves complex legal and factual questions. Our patents and those for which we have or will license rights may be challenged, invalidated, infringed or circumvented, and the rights granted in those patents may not provide proprietary protection or competitive advantages to us. We and our licensors may not be able to develop patentable products. Even if patent claims are allowed, the claims may not issue, or in the event of issuance, may not be sufficient to protect the technology owned by or licensed to us.

Third-party patent applications and patents could reduce the coverage of the patents licensed, or that may be licensed to or owned by us. If patents containing competitive or conflicting claims are issued to third parties, we may be enjoined from commercialization of products or be required to obtain licenses to these patents or to develop or obtain alternative technology. In addition, other parties may duplicate, design around or independently develop similar or alternative technologies to our licensors or ours.

Litigation may be necessary to enforce patents issued or licensed to us or to determine the scope or validity of another party’s proprietary rights. U.S. Patent and Trademark Office interference proceedings may be necessary if we and another party both claim to have invented the same subject matter. We could incur substantial costs and our management’s attention would be diverted if:

| | • | | patent litigation is brought by third parties; |

| | • | | we are party to or participate in patent suits brought against or initiated by our licensors; |

| | • | | we initiate similar suits; or |

| | • | | we are party to or participate in an interference proceeding. |

In addition, we may not prevail in any of these actions or proceedings.

Employees

As of December 31, 2007, we had a total of 1,375 full-time employees, of which 72 were engaged in research and development, 315 were in quality assurance and quality control, 779 were in manufacturing, 61 were in sales and marketing and 148 were in administration and finance. None of our employees are represented by a labor union or subject to a collective bargaining agreement. We have not experienced any work stoppage and consider our relations with our employees to be good.

Environment

We believe that our operations comply in all material respects with applicable laws and regulations concerning the environment. While it is impossible to predict accurately the future costs associated with environmental compliance and potential remediation activities, compliance with environmental laws is not expected to require significant capital expenditures and has not had, and is not expected to have, a material adverse effect on our earnings or competitive position.

Available Information

Our Internet address is www.apppharma.com. Our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to such reports, are available free of charge on our website as soon as reasonably practical after they are electronically filed or furnished to the SEC. The information found on our website shall not be deemed incorporated by reference by any general statement into any filing under the Securities Act of 1933 or under the Securities Exchange Act of 1934, except to the extent we specifically incorporate the information found on our website by reference, and shall not be deemed filed under such Acts.

11

The SEC also maintains an Internet site that contains reports, proxy and information statements, and other information about issuers that file reports electronically with the SEC. The address of that site is http://www.sec.gov.

You should carefully consider the risks described below before investing in our securities. The risks described below are not only risks unique to our company. Our business is also subject to the risks that affect many other companies, such as competition and general economic conditions. Additional risks not currently known to us or that we currently believe are immaterial also may impair our business operations and our liquidity.

Factors That May Affect Future Results of Operations

If we are unable to develop and commercialize new products, our financial condition will deteriorate.

Profit margins for a pharmaceutical product generally decline as new competitors enter the market. As a result, our future success will depend on our ability to commercialize the product candidates we are currently developing, as well as develop new products in a timely and cost-effective manner. We currently have over 30 ANDAs pending with the FDA and over 70 product candidates under development. Successful development and commercialization of our product candidates will require significant investment in many areas, including research and development and sales and marketing, and we may not realize a return on those investments. In addition, development and commercialization of new products are subject to inherent risks, including:

| | • | | failure to receive necessary regulatory approvals; |

| | • | | difficulty or impossibility of manufacture on a large scale; |

| | • | | prohibitive or uneconomical costs of marketing products; |

| | • | | inability to secure raw material or components from third-party vendors in sufficient quantity or quality or at a reasonable cost; |

| | • | | failure to be developed or commercialized prior to the successful marketing of similar or superior products by third parties; |

| | • | | lack of acceptance by customers; |

| | • | | impact of authorized generic competition; |

| | • | | infringement on the proprietary rights of third parties; |

| | • | | grant of new patents for existing products may be granted, which could prevent the introduction of newly-developed products for additional periods of time; and |

| | • | | grant to another manufacturer by the FDA of a 180-day period of marketing exclusivity under the Drug Price Competition and Patent Term Restoration Act of 1984, or the Hatch-Waxman Act, as patents or other exclusivity periods for brand name products expire. |

The timely and continuous introduction of new products is critical to our business. Our financial condition will deteriorate if we are unable to successfully develop and commercialize new products.

If sales of our key products decline, our business may be adversely affected.

Our top ten products comprised approximately 57% of our total revenue for the year ended December 31, 2007. Our key products could lose market share or revenue due to numerous factors, many of which are beyond our control, including:

| | • | | lower prices offered on similar products by other manufacturers; |

| | • | | substitute or alternative products or therapies; |

12

| | • | | development by others of new pharmaceutical products or treatments that are more effective than our products; |

| | • | | introduction of other generic equivalents or products which may be therapeutically interchanged with our products; |

| | • | | interruptions in manufacturing or supply; |

| | • | | changes in the prescribing practices of physicians; |

| | • | | changes in third-party reimbursement practices; and |

| | • | | migration of key customers to other manufacturers or sellers. |

Any factor adversely affecting the sale of our key products may cause our revenues to decline.

If we or our suppliers are unable to comply with ongoing and changing regulatory standards, sales of our products could be delayed or prevented.

Virtually all aspects of our business, including the development, testing, manufacturing, processing, quality, safety, efficacy, packaging, labeling, record-keeping, distribution, storage and advertising and promotion of our products and disposal of waste products arising from these activities, are subject to extensive regulation by federal, state and local governmental authorities in the United States, including the FDA and the Department of Health and Humans Services Office of Inspector General (OIG). Our business is also subject to regulation in foreign countries. Compliance with these regulations is costly and time-consuming.

Our manufacturing facilities and procedures and those of our suppliers are subject to ongoing regulation, including periodic inspection by the FDA and foreign regulatory agencies. For example, manufacturers of pharmaceutical products must comply with detailed regulations governing current good manufacturing practices, including requirements relating to quality control and quality assurance. We must spend funds, time and effort in the areas of production, safety, quality control and quality assurance to ensure compliance with these regulations. We cannot assure that our manufacturing facilities or those of our suppliers will not be subject to regulatory action in the future.

Our products generally must receive appropriate regulatory clearance before they can be sold in a particular country, including the United States. We may encounter delays in the introduction of a product as a result of, among other things, insufficient or incomplete submissions to the FDA for approval of a product, objections by another company with respect to our submissions for approval, new patents by other companies, patent challenges by other companies which result in a 180-day exclusivity period, and changes in regulatory policy during the period of product development or during the regulatory approval process. The FDA has the authority to revoke drug approvals previously granted and remove from the market previously approved products for various reasons, including issues related to current good manufacturing practices for that particular product or in general. We may be subject from time to time to product recalls initiated by us or by the FDA. Delays in obtaining regulatory approvals, the revocation of a prior approval, or product recalls could impose significant costs on us and adversely affect our ability to generate revenue.

Our inability or the inability of our suppliers to comply with applicable FDA and other regulatory requirements can result in, among other things, warning letters, fines, consent decrees restricting or suspending our manufacturing operations, delay of approvals for new products, injunctions, civil penalties, recall or seizure of products, total or partial suspension of sales and criminal prosecution. Any of these or other regulatory actions could materially adversely affect our business and financial condition.

State pharmaceutical marketing compliance and reporting requirements may expose us to regulatory and legal action by state governments or other government authorities.

In recent years, several states, including California, Vermont, Maine, Minnesota, New Mexico and West Virginia, in addition to the District of Columbia, have enacted legislation requiring pharmaceutical companies to

13

establish marketing compliance programs and file periodic reports on sales, marketing, pricing and other activities. Similar legislation is being considered in other states. Many of these requirements are new and uncertain, and available guidance is limited. We are continuing to assess our compliance with these state laws. Unless we are in full compliance with these laws, we could face enforcement action and fines and other penalties and could receive adverse publicity, all of which could harm our business.

We may be required to change the labeling of our products if side effects or manufacturing problems are identified after the products are on the market.

If side effects are identified after any of our products are on the market, or if manufacturing problems occur, regulatory approval may be withdrawn and reformulation of products, additional clinical trials, changes in labeling of products, and changes to or re-approvals of our manufacturing facilities may be required, any of which could have a material adverse effect on sales of the affected products and on our business and results of operations. For example, a supplier recently initiated a recall of its heparin product due to increased adverse events associated with the product.

After any of our products are approved for commercial use, we or regulatory bodies could decide that changes to our product labeling are required. Label changes may be necessary for a number of reasons, including the identification of actual or theoretical safety or efficacy concerns by regulatory agencies or the discovery of significant problems with a similar product that implicates an entire class of products. Any significant concerns raised about the safety or efficacy of our products could also result in the need to reformulate those products, to conduct additional clinical trials, to make changes to our manufacturing processes, or to seek re-approval of our manufacturing facilities. Significant concerns about the safety and effectiveness of a product could ultimately lead to the revocation of its marketing approval. The revision of product labeling or the regulatory actions described above could be required even if there is no clearly established connection between the product and the safety or efficacy concerns that have been raised. The revision of product labeling or the regulatory actions described above could have a material adverse effect on sales of the affected products and on our business and results of operations.

The manufacture of our products is highly exacting and complex, and if we or our suppliers encounter production problems, our business may suffer.

Almost all of the pharmaceutical products we make are sterile, injectable drugs. We also purchase some such products from other companies. The manufacture of all our products is highly exacting and complex, due in part to strict regulatory requirements and standards which govern both the manufacture of a particular product and the manufacture of these types of products in general. Problems may arise during their manufacture due to a variety of reasons including equipment malfunction, failure to follow specific protocols and procedures and environmental factors. If problems arise during the production of a batch of product, that batch of product may have to be discarded. This could, among other things, lead to loss of the cost of raw materials and components used, lost revenue, time and expense spent in investigating the cause and, depending on the cause, similar losses with respect to other batches or products. If such problems are not discovered before the product is released to the market, recall costs may also be incurred. To the extent we experience problems in the production of our pharmaceutical products, this may be detrimental to our business, operating results and reputation. Additionally, we could incur additional costs if we fail to timely transfer products to our Puerto Rico manufacturing facility.

Our markets are highly competitive and, if we are unable to compete successfully, our revenue will decline and our business will be harmed.

The markets for injectable pharmaceutical products are highly competitive, rapidly changing and undergoing consolidation. Most of our products are generic injectable versions of brand name products that are still being marketed by proprietary pharmaceutical companies. The first company to market a generic product is often initially able to achieve high sales, profitability and market share with respect to that product. Prices, revenue and market size for a product typically decline, however, as additional generic manufacturers enter the market.

14

We face competition from major, brand name pharmaceutical companies as well as generic manufacturers such as Hospira, Inc., Bedford Laboratories, Baxter Laboratories (including Elkin-Sinn), SICOR Inc. (acquired by Teva Pharmaceuticals USA) and Mayne Pharma (acquired by Hospira, Inc.) and, in the future, increased competition from new, foreign competitors. Smaller and foreign companies may also prove to be significant competitors, particularly through collaboration arrangements with large and established companies. Many of our competitors have significantly greater research and development, financial, sales and marketing, manufacturing, regulatory and other resources than us. As a result, they may be able to devote greater resources to the development, manufacture, marketing or sale of their products, receive greater resources and support for their products, initiate or withstand substantial price competition, more readily take advantage of acquisition or other opportunities, or otherwise more successfully market their products.

Any reduction in demand for our products could lead to a decrease in prices, fewer customer orders, reduced revenues, reduced margins, reduced levels of profitability, or loss of market share. These competitive pressures could adversely affect our business and operating results.

We face uncertainty related to pricing and reimbursement and health care reform.

In both domestic and foreign markets, sales of our products will depend in part on the availability of reimbursement from third-party payors such as government health administration authorities, private health insurers, health maintenance organizations and other health care-related organizations. However, reimbursement by such payors is presently undergoing reform, and there is significant uncertainty at this time how this will affect sales of certain pharmaceutical products. There is possible U.S. legislation or regulatory action affecting, among other things, pharmaceutical pricing and reimbursement, including under Medicaid and Medicare, the importation of prescription drugs that are marketed outside the U.S. and sold at prices that are regulated by governments of various foreign countries.

Medicare, Medicaid and other governmental reimbursement legislation or programs govern drug coverage and reimbursement levels in the United States. Federal law requires all pharmaceutical manufacturers to rebate a percentage of their revenue arising from Medicaid-reimbursed drug sales to individual states. Generic drug manufacturers’ agreements with federal and state governments provide that the manufacturer will remit to each state Medicaid agency, on a quarterly basis, 11% of the average manufacturer price for generic products marketed and sold under abbreviated new drug applications covered by the state’s Medicaid program. For proprietary products, which are marketed and sold under new drug applications, manufacturers are required to rebate the greater of (a) 15.1% of the average manufacturer price or (b) the difference between the average manufacturer price and the lowest manufacturer price for products sold during a specified period.

Both the federal and state governments in the United States and foreign governments continue to propose and pass new legislation, rules and regulations designed to contain or reduce the cost of health care. Existing regulations that affect the price of pharmaceutical and other medical products may also change before any of our products are approved for marketing. Cost control initiatives could decrease the price that we receive for any product we develop in the future. In addition, third-party payers are increasingly challenging the price and cost-effectiveness of medical products and services and litigation has been filed against a number of pharmaceutical companies in relation to these issues. Additionally, significant uncertainty exists as to the reimbursement status of newly approved injectable pharmaceutical products. Our products may not be considered cost effective or adequate third-party reimbursement may not be available to enable us to maintain price levels sufficient to realize an adequate return on our investment.

If we are unable to maintain our key customer arrangements, sales of our products and revenue would decline.

Almost all injectable pharmaceutical products are sold to customers through arrangements with group purchasing organizations, or GPOs, and distributors. The majority of hospitals contract with the GPO of their

15

choice for their purchasing needs. We currently derive, and expect to continue to derive, a large percentage of our revenue from customers that are members of a small number of GPOs. Currently, fewer than ten GPOs control a large majority of sales to hospital customers.

We have purchasing arrangements with the major GPOs in the United States, including AmeriNet, Inc., Broadlane Healthcare Corporation, Consorta, Inc., MedAssets Inc., Novation, LLC, Owen Healthcare, Inc., PACT, LLC, Premier Purchasing Partners, LP, International Oncology Network, or ION, National Oncology Alliance, or NOA, and U.S. Oncology, Inc. In order to maintain these relationships, we believe we need to be a reliable supplier, offer a broad product line, remain price competitive, comply with FDA regulations and provide high-quality products. The GPOs through which we sell our products also have purchasing agreements with other manufacturers that sell competing products and the bid process for products such as ours is highly competitive. Most of our GPO agreements may be terminated on short notice. If we are unable to maintain our arrangements with GPOs and key customers, sales of our products and revenue would decline.

The strategy to license rights to or acquire and commercialize proprietary or other specialty injectable products may not be successful, and we may never receive any return on our investment in these product candidates.

We may license rights to or acquire or commercialize proprietary or other specialty injectable products or technologies. Other companies, including those with substantially greater financial and sales and marketing resources, will compete with us to license rights to or acquire or commercialize these products. We may not be able to license rights to or acquire these proprietary or other products or technologies on acceptable terms, if at all. Even if we obtain rights to a pharmaceutical product and commit to payment terms, including, in some cases, up-front license payments, we may not be able to generate product sales sufficient to create a profit or otherwise avoid a loss.

A product candidate may fail to result in a commercially successful drug for other reasons, including the possibility that the product candidate may:

| | • | | fail to receive necessary regulatory approvals; |

| | • | | be difficult or uneconomical to produce in commercial quantities; |

| | • | | be precluded from commercialization by proprietary rights of third parties; or |

| | • | | fail to achieve market acceptance. |

The marketing strategy, distribution channels and levels of competition with respect to any licensed or acquired product may be different from those of our current products, and we may not be able to compete favorably in any new product category.

Our chief executive officer and entities affiliated with him own a significant percentage of our common stock and could exercise significant influence over matters requiring stockholder approval, regardless of the wishes of other stockholders.

As of December 31, 2007, our chief executive officer and entities affiliated with him owned over 80% of our common stock. Accordingly, they have the ability to significantly influence all matters requiring stockholder approval, including the election and removal of directors and approval of significant corporate transactions such as mergers, consolidations and sales of assets. This concentration of ownership could have the effect of delaying, deferring or preventing a change in control or impeding a merger or consolidation, takeover or other business combination, which could cause the market price of our common stock to fall or prevent our stockholders from receiving a premium in such a transaction. This significant concentration of stock ownership may adversely affect the market for and trading price of our common stock if investors perceive that conflicts of interest may exist or arise.

16

We depend heavily on the principal members of our management team, the loss of whom could harm our business.

We depend heavily on the principal members of our management team. Each of the members of the executive management team is employed “at will.” The loss of the services of any member of the executive management team may significantly delay or prevent the achievement of product development or business objectives.

To be successful, we must attract, retain and motivate key employees, and the inability to do so could seriously harm our operations.

To be successful, we must attract, retain and motivate executives and other key employees. We face competition for qualified scientific, technical and other personnel, which may adversely affect our ability to attract and retain key personnel. We also must continue to attract and motivate employees and keep them focused on our strategies and goals.

We depend on third parties to supply raw materials and other components and may not be able to obtain sufficient quantities of these materials, which will limit our ability to manufacture our products on a timely basis and harm our operating results.

The manufacture of our products requires raw materials and other components that must meet stringent FDA requirements. Some of these raw materials and other components are available only from a limited number of sources. Additionally, our regulatory approvals for each particular product denote the raw materials and components, and the suppliers for such materials, we may use for that product. Obtaining approval to change, substitute or add a raw material or component, or the supplier of a raw material or component, can be time consuming and expensive, as testing and regulatory approval is necessary. If our suppliers are unable to deliver sufficient quantities of these materials on a timely basis or we encounter difficulties in our relationships with these suppliers, the manufacture and sale of our products may be disrupted, and our business, operating results and reputation could be adversely affected.

Other companies may claim that we infringe their intellectual property or proprietary rights, which could cause us to incur significant expenses or prevent us from selling our products.

Our success depends in part on our ability to operate without infringing the patents and proprietary rights of third parties. The manufacture, use, offer for sale and sale of pharmaceutical products have been subject to substantial litigation in the pharmaceutical industry. These lawsuits relate to the enforceability, validity and infringement of patents or proprietary rights of third parties. Infringement litigation is prevalent with respect to generic versions of products for which the patent covering the brand name product is expiring, particularly since many companies which market generic products focus their development efforts on products with expiring patents. A number of pharmaceutical companies, biotechnology companies, universities and research institutions may have filed patent applications or may have been granted patents that cover aspects of our products or our licensors’ products, product candidates or other technologies.

Future or existing patents issued to third parties may contain claims that conflict with our products. We are subject to infringement claims from time to time in the ordinary course of our business, and third parties could assert infringement claims against us in the future with respect to our current products, products we may develop or products we may license. In addition, our patents and patent applications, or those of our licensors, could face other challenges, such as interference, opposition and reexamination proceedings. Any such challenge, if successful, could result in the invalidation of, or a narrowing of scope of, any such patents and patent applications. Litigation or other proceedings could force us to:

| | • | | stop or delay selling, manufacturing or using products that incorporate or are made using the challenged intellectual property; |

17

| | • | | enter into licensing or royalty agreements that may not be available on acceptable terms, if at all. |

Any litigation or interference proceedings, regardless of their outcome, would likely delay the regulatory approval process, be costly and require significant time and attention of key management and technical personnel.

Our inability to protect our intellectual property rights in the United States and foreign countries could limit our ability to manufacture or sell our products.

We rely on trade secrets, unpatented proprietary know-how, continuing technological innovation and patent protection to preserve our competitive position. Our patents and those for which we have or will license rights, may be challenged, invalidated, infringed or circumvented, and the rights granted in those patents may not provide proprietary protection or competitive advantages to us. We and our licensors may not be able to develop patentable products. Even if patent claims are allowed, the claims may not issue, or in the event of issuance, may not be sufficient to protect the technology owned by or licensed to us. Third-party patents could reduce the coverage of the patents licensed, or that may be license to or owned by us. If patents containing competitive or conflicting claims are issued to third parties, we may be prevented from commercializing the products covered by such patents, or may be required to obtain or develop alternate technology. In addition, other parties may duplicate, design around or independently develop similar or alternative technologies.

We may not be able to prevent third parties from infringing or using our intellectual property. We generally control and limit access to, and the distribution of, our product documentation and other proprietary information. Despite our efforts to protect this proprietary information, however, unauthorized parties may obtain and use information that we regard as proprietary. Other parties may independently develop similar know-how or may even obtain access to our technologies.

The laws of some foreign countries do not protect proprietary information to the same extent as the laws of the United States, and many companies have encountered significant problems and costs in protecting their proprietary information in these foreign countries.

The U.S. Patent and Trademark Office and the courts have not established a consistent policy regarding the breadth of claims allowed in pharmaceutical patents. The allowance of broader claims may increase the incidence and cost of patent interference proceedings and the risk of infringement litigation. On the other hand, the allowance of narrower claims may limit the value of our proprietary rights.

We may become subject to federal false claims or other similar litigation brought by private individuals and the government.

The Federal False Claims Act allows persons meeting specified requirements to bring suit alleging false or fraudulent Medicare or Medicaid claims and to share in any amounts paid to the government in fines or settlement. These suits, known as qui tam actions, have increased significantly in recent years and have increased the risk that a health care company will have to defend a false claim action, pay fines and/or be excluded from Medicare and Medicaid programs. Federal false claims litigation can lead to civil monetary penalties, criminal fines and imprisonment and/or exclusion from participation in Medicare, Medicaid and other federally funded health programs. Other alternate theories of liability may also be available to private parties seeking redress for such claims. A number of parties have brought claims against numerous pharmaceutical manufacturers, and we cannot be certain that such claims will not be brought against us, or if they are brought, that such claims might not be successful.

18

We may need to change our business practices to comply with changes to, or may be subject to charges under, the fraud and abuse laws.

We are subject to various federal and state laws pertaining to health care fraud and abuse, including the federal Anti-Kickback Statute and its various state analogues, the federal False Claims Act and marketing and pricing laws. Violations of these laws are punishable by criminal and/or civil sanctions, including, in some instances, imprisonment and exclusion from participation in federal and state health care programs such as Medicare and Medicaid. We may have to change our advertising and promotional business practices, or our existing business practices could be challenged as unlawful due to changes in laws, regulations or rules or due to administrative or judicial findings, which could materially adversely affect our business.

We may be required to defend lawsuits or pay damages for product liability claims.

Product liability is a major risk in testing and marketing biotechnology and pharmaceutical products. We may face substantial product liability exposure in human clinical trials and for products that we sell after regulatory approval. Historically, we have carried product liability insurance and we expect to continue to carry such policies. Product liability claims, regardless of their merits, could exceed policy limits, divert management’s attention and adversely affect our reputation and the demand for our products.

Future sales of substantial amounts of our common stock may adversely affect our market price.

In connection with our 2006 merger with ABI, we issued a significant number of shares of our common stock to a small number of former ABI shareholders. Although such shares are not immediately freely tradable, we have granted registration rights to the former ABI shareholders, including our chief executive officer, to permit the resale of the shares of our common stock that they received in the merger. Future sales of substantial amounts of our common stock into the public market, or perceptions in the market that such sales could occur, may adversely affect the prevailing market price of our common stock.

Our stock price has been volatile in response to market and other factors.

The market price for our common stock has been and may continue to be volatile and subject to price and volume fluctuations in response to market and other factors, including the following, some of which are beyond our control:

| | • | | the concentration of the ownership of our shares by a limited number of affiliated stockholders may limit interest in our securities; |

| | • | | variations in quarterly operating results from the expectations of securities analysts or investors; |

| | • | | revisions in securities analysts’ estimates or reductions in security analysts’ coverage; |

| | • | | announcements of technological innovations or new products or services by us or our competitors; |

| | • | | reductions in the market share of our products; |

| | • | | announcements by us or our competitors of significant acquisitions, strategic partnerships, joint ventures or capital commitments; |

| | • | | general technological, market or economic trends; |

| | • | | investor perception of our industry or prospects; |

| | • | | insider selling or buying; |

| | • | | investors entering into short sale contracts; |

| | • | | regulatory developments affecting our industry; and |

| | • | | additions or departures of key personnel. |

19

Risks Relating to the Separation of New Abraxis from New APP

Debt incurred in connection with the separation could adversely affect our operations and financial condition.

We are leveraged as a result of the separation of New Abraxis. We have incurred $1 billion of indebtedness and have an additional $150 million revolving credit facility that is currently unused. $700 million of the proceeds of the indebtedness was contributed to New Abraxis in connection with the separation. Such indebtedness, coupled with the restrictions on our ability to issue equity securities due to the separation without jeopardizing the intended tax consequences of the separation, could have adverse consequences for our business, financial condition and results of operations, such as:

| | • | | making more difficult the satisfaction of our obligations to our lenders, resulting in possible defaults on and acceleration of such indebtedness; |

| | • | | limiting our ability to obtain additional financing to fund growth, working capital, capital expenditures, debt service requirements, acquisitions or other cash requirements; |

| | • | | limiting our operational flexibility in planning for or reacting to changing conditions in our business and industry; |

| | • | | requiring dedication of a substantial portion of our cash flows from operations to make payments on our debt, which would reduce the availability of such cash flows to fund working capital, capital expenditures and other general corporate purposes; |

| | • | | limiting our ability to compete with companies that are not as leveraged, or whose debt is at more favorable interest rates and that, as a result, may be better positioned to withstand economic downturns; and |

| | • | | increasing our vulnerability to economic downturns and changing market conditions or preventing us from carrying out capital spending that is necessary or important to our growth strategy and efforts to improve operating margins. |