UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-10401

Trust for Professional Managers

(Exact name of registrant as specified in charter)

615 East Michigan Street

Milwaukee, WI 53202

(Address of principal executive offices) (Zip code)

Jay S. Fitton

U.S. Bancorp Fund Services, LLC

615 East Michigan Street

Milwaukee, WI 53202

(Name and address of agent for service)

(513) 629-8104

Registrant's telephone number, including area code

Date of fiscal year end: December 31, 2022

Date of reporting period: December 31, 2022

Item 1. Reports to Stockholders.

ANNUAL REPORT

DECEMBER 31, 2022

- GROWTH FUND (MPGFX)

est. 1958

- BALANCED FUND (MAPOX)

est. 1961

- SMALL CAP FUND (MSCFX)

est. 2011

- MINNESOTA MUNICIPAL BOND ETF (MINN)

est. 2021

MAIRS & POWER FUNDS MARKET COMMENTARY (unaudited)

December 31, 2022

Firm Update | Remembering Allen Steinkopf

Allen Steinkopf, our friend, partner, and colleague, passed away on December 21, 2022. He played a large role in the success of Mairs & Power during his nine years with the firm. Allen spent time leading the Mairs & Power Small Cap Fund (MSCFX), managing advisory accounts, and providing insightful opinions on companies and investments.

Allen cared deeply about research, managing investments, and learning about the companies in which we invest. He also made sure his clients knew they were valued and appreciated. He brought so much more than his keen intellect and thoughtful analysis. Allen was passionate about coaching and mentoring younger staff to enable them to believe in themselves. He touched people's hearts and changed their lives. He will be greatly missed by all of us who had the privilege of knowing him.

Market Overview | Fourth Quarter 2022

We don't need to tell you that the market had a rough year in 2022. It recovered some in the fourth quarter with a total return (TR) of 7.56% for the S&P 500, 16.01% for the Dow Jones Industrial Average (TR), and 1.80% for the Bloomberg U.S. Government/Credit Bond Index. However, for the full year, those indexes dropped 18.11%, 6.86%, and 13.58%, respectively.

Interest rate increases were a major factor in the market's weak performance in 2022. The Federal Reserve (Fed) has been taking an aggressive approach in battling inflation. Last year, the Fed raised interest rates seven times, including an increase of 50 basis points at its December meeting. The federal funds rate is now at 4.5%, up from near zero a year ago, and the central bank has signaled that it will keep rates higher for longer.

The Fed's interest rate increases have pushed mortgage rates above 6%, compared to 3% at the end of 2021. As a result, the housing market, one of the bellwether measures of economic health, has weakened significantly. Sales of existing homes declined 7.7% in November from the previous month, putting them 40% below the peak in early 2021. That marked 10 months of declines, the longest such streak since 1999.

But despite inflation, the softening housing market, and rapidly climbing interest rates, the U.S. economy has remained remarkably resilient. Just before Christmas, the U.S. Commerce Department released third quarter GDP numbers, which showed growth of 3.2% at an annualized rate, beating consensus expectations of 2.9%. Consumers' financial health also remains fairly positive. We are seeing some increases in default rates, though from historically low levels. The savings rate declined in 2022 to a meager 2%, but the Conference Board, a private research group that tracks consumer confidence, reported that its index jumped from 101.4 in November to 108.3 in December. That's the highest it's been since April. In addition, recently released data from Mastercard shows that retail sales during the holiday season (Nov. 1 to Dec. 24) rose a festive 7.6% over 2021. One key reason for continued consumer confidence is the continued strength of the labor market. In December, a better-than-expected 223,000 jobs were created, and the unemployment rate declined to 3.5%.

GDP is the total monetary or market value of all the finished goods and services produced within a country's borders in a specific time period.

The federal funds rate is an interest rate set by the Federal Reserve to indirectly manage interest rates, inflation, and unemployment.

Future Outlook

However, the housing market's flattening is one sign that we're likely to experience a recession in 2023. Another omen is the recent data from the Purchasing Managers' Index (PMI). In December, the PMI for the services sector dropped to 44.4, versus 46.2 in November. In the manufacturing sector, the PMI was 46.2, down from 47.7 from the previous month, and the composite PMI, which measures all sectors, was 44.6, a decrease from November's 46.4. Any number below 50 indicates contraction in that part of the economy.

1

MAIRS & POWER FUNDS MARKET COMMENTARY (unaudited) (continued)

Despite these warning signs, we're convinced that the labor market will remain tight, thanks to an aging population, accelerated retirements, and lower immigration, among other factors. While there have been some signs of softening, businesses remain desperate for help. Job openings remain at a historically high 10.3 million vacancies. That tightness will likely remain a longer-term challenge for companies in managing labor costs and also presents a challenge to the Fed as it pursues its goal of 2% inflation. Lower unemployment typically results in higher wages, and that means higher prices. There was some helpful news on that front at the end of 2022: Wage growth in December slowed to 0.3% month over month and 4.6% versus a year ago.

There are other signs that inflation, while still high, has begun to come off the boil. Goods inflation, in particular, has rolled over the past few months. While services inflation is proving stickier, we expect that by the middle of this year, falling home prices will put downward pressure there as well. As inflation recedes, so should the upward pressure on interest rates. An end to rate hikes can begin to lay the foundation for renewed economic growth and a better stock market in the back half of 2023. In the meantime, however, the Fed will continue to raise rates. We believe that we're returning to the "old normal" level of interest rates that were common before the Great Recession of 2008-2009.

The tight labor situation, along with the strength of the banking sector and consumer spending, are key reasons why we anticipate that a 2023 recession could be fairly mild.

As for the market, it's likely that economic weakness will result in lower earnings per share this year. In 2022, the market fell much more than earnings, which we estimate grew 5% for the year. Our expectation is that a decline in earnings in 2023 will be relatively modest. Much of last year's market tumble was due to a contraction in valuations, and that's not necessarily a bad thing. In fact, we believe that this contraction should result in a healthier foundation for the market going forward. Over the long term, stocks and earnings travel in tandem. In 2021, stocks got ahead of themselves. Now, with the market having pulled back, we're finding more opportunities for good long-term investments at reasonable valuations.

S&P 500 Total Return (TR) Index is an unmanaged index of 500 common stocks that is generally considered representative of the U.S. stock market. It is not possible to invest directly in an index.

Dow Jones Industrial Average (TR) Index is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange and the NASDAQ,

Bloomberg U.S. Government/Credit Bond Index is a broad-based flagship benchmark that measures the non-securitized component of the U.S. Aggregate Index. It includes investment-grade, U.S. dollar-denominated, fixed-rate Treasuries, government-related and corporate securities. It is not possible to invest directly in an index.

The Purchasing Managers' Index (PMI) is an index that measures the month-over-month change in economic activity within the manufacturing sector.

Basis point is a unit of measure for interest rates and other percentages in finance. One basis point is equal to 1/100th of 1%, or 0.01%, or 0.0001.

Earnings per share (EPS) is a company's net profit divided by the number of common shares it has outstanding.

Past performance is not a guarantee of future results.

2

MAIRS & POWER GROWTH FUND (unaudited)

To Our Shareholders: December 31, 2022

The Mairs & Power Growth Fund (the "Fund") lagged the S&P 500 TR Index for the year. Absolute performance of the Fund was down 21.07% for the year while the index was down 18.11%. The Fund also underperformed its peer group, as measured by the Morningstar Large Blend Category Index, which was down 16.94% for the year.

Stock selection was the primary driver of underperformance as sector selection was a positive relative contributor for the year. Not holding stocks in the Energy sector, which was the top performing sector in 2022, was a significant drag on relative performance. As the post-Covid economy snapped back, oil prices spiked and drove the Energy sector to outperform. But this underperformance due to under allocation in Energy shares was more than offset by positive contributions from underweighting the Consumer Discretionary sector and overweighting the Healthcare and Industrial sectors. Consumer Discretionary stocks struggled to overcome macro-economic concerns, and at the same time, Healthcare benefited as it was seen as a haven from a slowing economy.

Regarding stock selection, the largest detractors from Fund performance were not concentrated in a particular industry. They included Alphabet (formerly Google), Ecolab, and Bio-Techne.

Alphabet (GOOGL) finished down 38.67% for the year. While this was not out of line with some of the other big tech communication services stocks, it still was a significant drag on Fund performance. Fundamental operations at Alphabet slowed somewhat throughout the year, but the bigger headwind appeared to be a reset in the valuations investors were willing to pay for "growthier" stocks. Alphabet started the year at a 20% premium to what was being paid for earnings of the average company in the S&P 500 and ended very close to market multiple.

Bio-Techne (TECHNE) also suffered from a shift away from growth stocks by investors. Despite the company's fundamental outlook improving on a number of future growth initiatives, the stock still finished down 35.70% for the year. The Minnesota company's investments in commercial scale biologic manufacturing and liquid biopsies, as well as ongoing investment in digital connections with customers, positions it well for the long term. A recent significant increase in the National Institute of Health budget for 2023 should also benefit the company in the near term. The Fund has added to the position on the pullback.

Another significant detractor from relative performance was Ecolab (ECL). The Minnesota-based company was down 37.11% for the year. Ecolab suffered from higher input costs due to higher energy prices in 2022. While the company was able to make some positive changes to its supply chain and do some reformulation work, it was not able to overcome the inflationary pressures and, as a result, its margins have suffered. Currency and the European economy have weighed on results as well. Ecolab is a core holding within the Growth Fund, but we are waiting for improvement in organic volume-driven growth before adding to the position.

Toro (TTC) and UnitedHealth Group (UNH) were two of the largest positive contributors to relative performance for the year. Both Minnesota-based companies were up on an absolute basis, with Toro up 14.87% for the year and UnitedHealth up 6.95%. Toro stock continued its long-term outperformance in 2022 as the company's investment in new technologies continues to payoff. The company is seeing good opportunities in both its DitchWitch acquisition, which will benefit from increased infrastructure spending, as well as its internal investment in battery powered tools and equipment.

UnitedHealth performed well as the company's market-leading position in managed care and healthcare technology have provided the scale to outmaneuver smaller competitors. At the same time, its recent investments in OptumHealth, its own health services offering, have paid off handsomely in terms of both revenue growth and profitability.

Both Toro and UnitedHealth remain core holdings at Mairs & Power, but the Fund has trimmed both stocks in 2022 on their positive performance and resultant extended valuations.

It was a disappointing year for the Fund and while a difficult inflationary environment was anticipated, the scale and competitive positions of Fund holdings were expected to put those companies and their stocks in a

3

MAIRS & POWER GROWTH FUND (unaudited) (continued)

good position to weather the inflationary storm. That desire to hold companies with durable competitive positions also steered us to companies that were gaining market share and outgrowing the market. Unfortunately, as these "growthier" stocks fell out of favor in 2022, the result was Fund underperformance. However, this underperformance in stock price, but not necessarily fundamental operations, has resulted in some attractive valuations and investment opportunities. While it is difficult to gauge when the Fed will get inflation under control and investors will become more optimistic about the economy and the stock market, the Fund should be well positioned to take advantage of that change.

Andy Adams

Lead Manager | | Pete Johnson

Co-Manager | |

MAIRS & POWER GROWTH FUND (MPGFX) CONTRIBUTORS

Year To Date (12/31/2021 – 12/31/2022)

Largest Contributors To

Relative Performance | | Largest Detractors To

Relative Performance | |

Digi International, Inc. | | | 48.76 | % | | Amazon.com, Inc. | | | -49.62 | % | |

Eli Lilly & Company | | | 34.24 | % | | Alphabet, Inc. Class C | | | -38.67 | % | |

Principal Financial Group, Inc. | | | 20.05 | % | | QUALCOMM, Inc. | | | -38.61 | % | |

The Toro Company | | | 14.87 | % | | Ecolab, Inc. | | | -37.11 | % | |

UnitedHealth Group, Inc. | | | 6.95 | % | | Bio-Techne Corporation | | | -35.70 | % | |

Largest relative contributors and detractors are securities that were selected based on their contribution to the portfolio as of December 31, 2022. The performance number shown is total return of the security for the period and includes only securities held for the entire period. Total return is the amount of value an investor earns from a security over a specific period and when distributions are reinvested. Past performance does not guarantee future results.

All holdings in the portfolio are subject to change without notice and may or may not represent current or future portfolio composition. The mention of specific securities is not intended as a recommendation or an offer of a particular security, nor is it intended to be a solicitation for the purchase or sale of any security.

All investments have risks. The Growth Fund is designed for long-term investors. Equity investments are subject to market fluctuations and the Fund's share price can fall because of weakness in the broad market, a particular industry or specific holdings. Investments in small and midcap companies generally are more volatile. International investing risks include among others political, social or economic instability, difficulty in predicting international trade patterns, taxation and foreign trading practices and greater fluctuations in price than U.S. corporations.

This commentary includes forward-looking statements such as economic predictions and portfolio manager opinions. The statements are subject to change at any time based on market and other conditions. No predictions, forecasts, outlooks, expectations or beliefs are guaranteed.

S&P 500 Total Return (TR) Index is an unmanaged index of 500 common stocks that is generally considered representative of the U.S. stock market. It is not possible to invest directly in an index.

Morningstar U.S. Fund Large-Blend portfolios are fairly representative of the overall U.S. stock marketing in size, growth rates, and price. Stocks in the top 70% of the capitalization of the U.S equity market are defined as large-cap. The blend style is assigned to portfolios where neither growth nor value characteristics predominate. These portfolios tend to invest across the spectrum of U.S. industries, and owing to their broad exposure, the portfolios' returns are often similar to those of the S&P 500 Index.

4

Mairs & Power Growth Fund

PERFORMANCE INFORMATION (unaudited) December 31, 2022

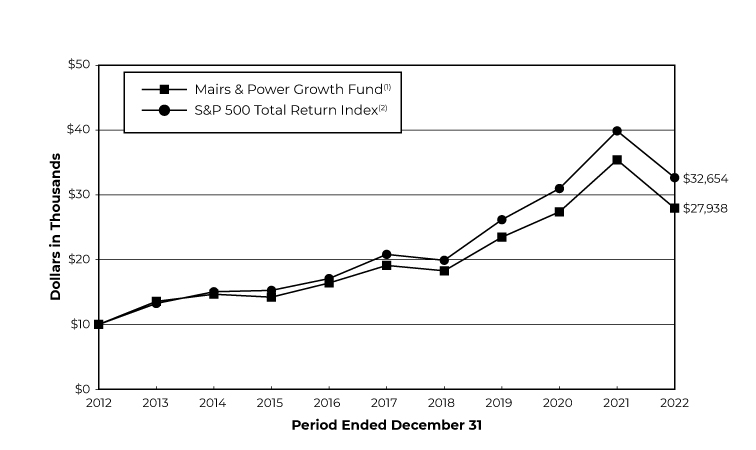

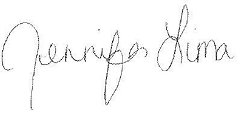

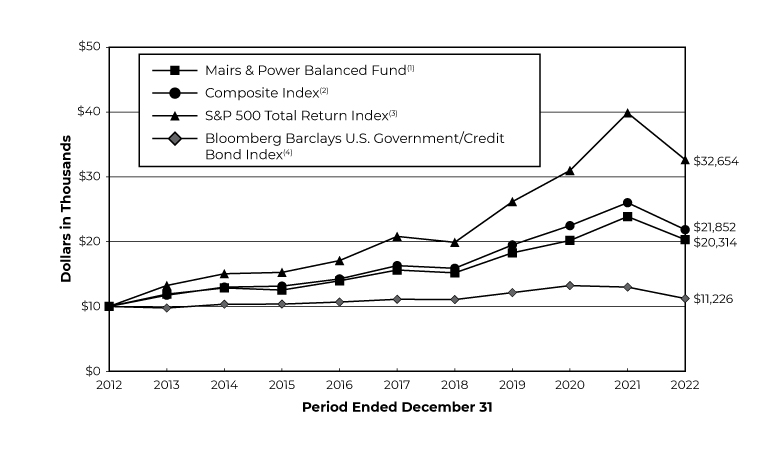

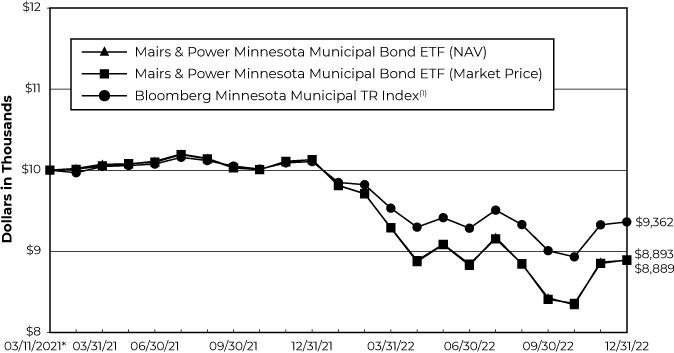

Ten years of investment performance (through December 31, 2022)

This chart illustrates the performance of a hypothetical $10,000 investment made in the Fund 10 years ago.

Average annual total returns for periods ended December 31, 2022

| | | 1 year | | 5 years | | 10 years | | 20 years | |

Mairs & Power Growth Fund(1) | | | -21.07 | % | | | 7.89 | % | | | 10.82 | % | | | 9.68 | % | |

S&P 500 Total Return Index(2) | | | -18.11 | % | | | 9.42 | % | | | 12.56 | % | | | 9.80 | % | |

Performance data quoted represents past performance and does not guarantee future results. All performance information shown includes the reinvestment of dividend and capital gain distributions, but does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. For the most recent month-end performance figures, visit the Fund's website at www.mairsandpower.com or call Shareholder Services at (800) 304-7404. Per the Prospectus dated April 20, 2022, the expense ratio for the Fund is 0.61%. See the Financial Highlights in this report for the most recent expense ratio.

(1) Performance figures reflect the historical performance of the Mairs & Power Growth Fund (the "Predecessor Growth Fund"), a series of Mairs & Power Funds Trust, for periods prior to April 29, 2022.

(2) The S&P 500 Total Return Index is an unmanaged index of 500 common stocks that is generally considered representative of the U.S. stock market. It tracks both the capital gains of a group of stocks over time and assumes that any cash distributions, such as dividends, are reinvested back into the index. It is not possible to invest directly in an index.

5

Mairs & Power Growth Fund

FUND INFORMATION (unaudited) December 31, 2022

Portfolio Managers

Andrew R. Adams, CFA, lead manager of the Mairs & Power Growth Fund and Predecessor Growth Fund since April 1, 2019, co-manager from January 1, 2015 through April 1, 2019, University of Wisconsin-Madison, MS Finance 1997

Peter J. Johnson, CFA, co-manager of the Mairs & Power Growth Fund and Predecessor Growth Fund since April 1, 2019, University of Wisconsin-Madison, MBA Applied Security Analysis 2010

General Information

Fund Symbol | | | MPGFX | | |

Net Asset Value (NAV) Per Share | | $ | 118.00 | | |

Expense Ratio | | | 0.63 | % | |

Portfolio Turnover Rate | | | 11.04 | % | |

Sales Charge | | | None1 | | |

Fund Inception Year | | | 1958 | | |

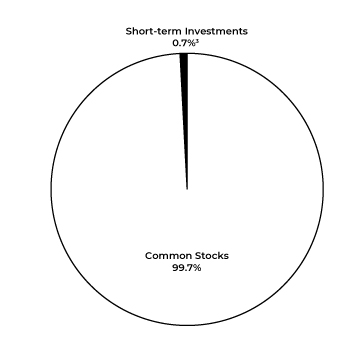

Portfolio Composition

Top Ten Portfolio Holdings

(Percent of Total Net Assets)2

Microsoft Corp | | | 7.8 | % | |

UnitedHealth Group Inc | | | 6.2 | | |

Alphabet Inc | | | 4.9 | | |

Toro Co/The | | | 4.1 | | |

US Bancorp/MN | | | 3.9 | | |

Amazon.com Inc | | | 3.8 | | |

Graco Inc | | | 3.6 | | |

Ecolab Inc | | | 3.5 | | |

Nvidia Corp | | | 3.3 | | |

Bio-Techne Corp | | | 3.0 | | |

Portfolio Diversification

(Percent of Total Net Assets)

Common Stocks 99.7% | |

Information Technology | | | 26.0 | % | |

Health Care | | | 20.3 | | |

Industrials | | | 19.0 | | |

Financials | | | 10.9 | | |

Materials | | | 7.9 | | |

Communication Services | | | 5.7 | | |

Consumer Discretionary | | | 5.2 | | |

Consumer Staples | | | 4.2 | | |

Utilities | | | 0.5 | | |

Short-term Investments 0.3%3 | | | 0.3 | | |

| | | | 100.0 | % | |

1 Although the Fund is no-load, investment management fees and other expenses still apply.

2 All holdings in the portfolio are subject to change without notice and may or may not represent current or future portfolio composition. The mention of specific securities is not intended as a recommendation or offer for a particular security, nor is it intended to be a solicitation for the purchase or sale of any security.

3 Represents short-term investments and other assets and liabilities (net).

The Schedule of Investments and portfolio diversification utilize the Global Industry Classification Standard (GICS®) which was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor's Financial Services LLC ("S&P"). GICS is a service mark of MSCI, Inc. and S&P and has been licensed for use by Mairs & Power, Inc. (the "Adviser").

6

Mairs & Power Growth Fund

SCHEDULE OF INVESTMENTS December 31, 2022

Shares | | Security Description | | Value | |

| | | COMMON STOCKS 99.7% | |

| | | COMMUNICATION SERVICES 5.7% | |

| | 2,381,802 | | | Alphabet Inc (a) | | $ | 211,337,292 | | |

| | 420,000 | | | Walt Disney Co/The (a) | | | 36,489,600 | | |

| | | | 247,826,892 | | |

| | | CONSUMER DISCRETIONARY 5.2% | |

| | 1,958,000 | | | Amazon.com Inc (a) | | | 164,472,000 | | |

| | 157,999 | | | Gentherm Inc (a) | | | 10,315,755 | | |

| | 35,000 | | | Home Depot Inc/The | | | 11,055,100 | | |

| | 218,000 | | | Polaris Inc | | | 22,018,000 | | |

| | 124,306 | | | Target Corp | | | 18,526,566 | | |

| | | | 226,387,421 | | |

| | | CONSUMER STAPLES 4.2% | |

| | 2,621,592 | | | Hormel Foods Corp | | | 119,413,516 | | |

| | 802,000 | | | Sysco Corp | | | 61,312,900 | | |

| | | | 180,726,416 | | |

| | | FINANCIALS 10.9% | |

| | 924,000 | | | Charles Schwab Corp/The | | | 76,932,240 | | |

| | 627,000 | | | JPMorgan Chase & Co | | | 84,080,700 | | |

| | 246,000 | | | Northern Trust Corp | | | 21,768,540 | | |

| | 634,000 | | | Principal Financial Group Inc | | | 53,205,280 | | |

| | 3,871,000 | | | US Bancorp/MN | | | 168,814,310 | | |

| | 1,600,000 | | | Wells Fargo & Co | | | 66,064,000 | | |

| | | | 470,865,070 | | |

| | | HEALTH CARE 20.3% | |

| | 415,212 | | | Abbott Laboratories | | | 45,586,125 | | |

| | 1,554,800 | | | Bio-Techne Corp | | | 128,861,824 | | |

| | 139,000 | | | Eli Lilly & Co | | | 50,851,760 | | |

| | 60,000 | | | Inspire Medical Systems Inc (a) | | | 15,112,800 | | |

| | 674,584 | | | Johnson & Johnson | | | 119,165,264 | | |

| | 1,624,000 | | | Medtronic PLC (b) | | | 126,217,280 | | |

| | 85,061 | | | Neogen Corp (a) | | | 1,295,479 | | |

| | 3,145,000 | | | Roche Holding AG (c) | | | 123,126,750 | | |

| | 506,000 | | | UnitedHealth Group Inc | | | 268,271,080 | | |

| | | | 878,488,362 | | |

| | | INDUSTRIALS 19.0% | |

| | 158,438 | | | 3M Co | | | 18,999,885 | | |

| | 492,000 | | | CH Robinson Worldwide Inc | | | 45,047,520 | | |

| | 49,000 | | | Chart Industries Inc (a) | | | 5,646,270 | | |

| | 1,422,247 | | | Donaldson Co Inc | | | 83,727,681 | | |

| | 1,588,000 | | | Fastenal Co | | | 75,144,160 | | |

| | 130,000 | | | Generac Holdings Inc (a) | | | 13,085,800 | | |

7

Mairs & Power Growth Fund

SCHEDULE OF INVESTMENTS (continued) December 31, 2022

Shares | | Security Description | | Value | |

| | | COMMON STOCKS (continued) | |

| | | INDUSTRIALS (continued) | |

| | 2,295,000 | | | Graco Inc | | $ | 154,361,700 | | |

| | 225,000 | | | Honeywell International Inc | | | 48,217,500 | | |

| | 2,005,659 | | | nVent Electric PLC (b) | | | 77,157,702 | | |

| | 268,000 | | | Rockwell Automation Inc | | | 69,028,760 | | |

| | 937,966 | | | Tennant Co (d) | | | 57,750,566 | | |

| | 1,564,200 | | | Toro Co/The | | | 177,067,440 | | |

| | | | 825,234,984 | | |

| | | INFORMATION TECHNOLOGY 26.0% (f) | |

| | 563,371 | | | Digi International Inc (a) | | | 20,591,210 | | |

| | 693,000 | | | Entegris Inc | | | 45,453,870 | | |

| | 1,031,000 | | | Fiserv Inc (a) | | | 104,203,170 | | |

| | 1,148,700 | | | Jamf Holding Corp (a) | | | 24,467,310 | | |

| | 500,000 | | | Littelfuse Inc | | | 110,100,000 | | |

| | 1,406,000 | | | Microsoft Corp | | | 337,186,920 | | |

| | 341,500 | | | Motorola Solutions Inc | | | 88,007,965 | | |

| | 978,000 | | | NVIDIA Corp | | | 142,924,920 | | |

| | 859,000 | | | QUALCOMM Inc | | | 94,438,460 | | |

| | 413,000 | | | salesforce.com Inc (a) | | | 54,759,670 | | |

| | 290,000 | | | Visa Inc | | | 60,250,400 | | |

| | 545,857 | | | Workiva Inc (a) | | | 45,835,612 | | |

| | | | 1,128,219,507 | | |

| | | MATERIALS 7.9% | |

| | 1,039,000 | | | Ecolab Inc | | | 151,236,840 | | |

| | 1,324,827 | | | HB Fuller Co | | | 94,884,110 | | |

| | 403,953 | | | Sherwin-Williams Co/The | | | 95,870,165 | | |

| | | | 341,991,115 | | |

| | | UTILITIES 0.5% | |

| | 429,000 | | | Alliant Energy Corp | | | 23,685,090 | | |

| | | | | TOTAL COMMON STOCKS

(cost $2,442,226,500) | | $ | 4,323,424,857

| | |

| | | SHORT-TERM INVESTMENTS 0.1% | |

| 4,713,004 | | | First American Government Obligations Fund, Class X, 0.0407% (e)

(cost $4,713,004) | | $ | 4,713,004 | | |

| | | | TOTAL INVESTMENTS 99.8%

(cost $2,446,939,504) | | $ | 4,328,137,861 | | |

| | | | | OTHER ASSETS AND LIABILITIES (NET) 0.2% | | | 8,347,803 | | |

| | | | | TOTAL NET ASSETS 100.0% | | $ | 4,336,485,664 | | |

8

Mairs & Power Growth Fund

SCHEDULE OF INVESTMENTS (continued) December 31, 2022

(a) Non-income producing.

(b) Issuer headquartered overseas but considered domestic. The Adviser defines foreign issuers as those whose operational leadership or headquarters is located in a foreign country; provided, however, if an issuer is believed by the Adviser to be headquartered in a jurisdiction primarily for tax purposes, the Adviser will consider the following additional factors: 1) the location of the primary exchange trading its securities; 2) where it derives the majority of its revenues; and/or 3) where it earns the majority of its profits.

(c) American Depositary Receipt

(d) Affiliated company at December 31, 2022.

(e) The rate quoted is the annualized seven-day effective yield as of December 31, 2022.

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor's Financial Services LLC ("S&P"). GICS is a service mark of MSCI, Inc. and S&P and has been licensed for use by the Adviser.

(f) The Fund is significantly invested in the information technology sector and therefore is subject to additional risks. Companies in the information technology sector and companies that rely heavily on technology are particularly vulnerable to rapid changes in technology product cycles, rapid product obsolescence, government regulation and competition.

See accompanying Notes to Financial Statements.

9

MAIRS & POWER BALANCED FUND (unaudited)

To Our Shareholders: December 31, 2022

The Mairs & Power Balanced Fund (the "Fund") finished 2022 down 14.91%. The Fund outperformed the benchmark composite index (60% S&P 500 Total Return Index and 40% Bloomberg US Government/Credit Bond Index), which lost 16.00%, while the Morningstar US Fund Allocation 50%-70% peer group fell 13.84%.

The year 2022 now holds the distinction of being the only year in the last 150 years where both stocks and bonds fell more than 10%; here's to hoping that it remains that way for the next 150 years as well. We also hope this is the last time a bond discussion comes first as this is not the norm.

Historically, bond returns have helped smooth the volatile nature of stock returns. However, with the Federal Reserve-induced return to normalcy in rates compared to the low interest rate environment which has prevailed since the Great Financial Crisis of 2008-2009, we are experiencing the painful withdrawals after years of cheap credit. With an increase in rates and more reasonable expected return on fixed income going forward, the standard 60-40 portfolio of stocks and bonds should have greater ability to help mitigate volatility in downturns.

Our fixed income portfolio outperformed the Bloomberg U.S. Government/Credit Bond Index since it maintained a duration short of the index which more than offset the portfolio's overweight to corporate credit. The Federal Reserve (Fed) continues raising the federal funds rate and is backing off its bond purchasing program, which has contributed to higher interest rates and worsening liquidity in the marketplace. The 10-year treasury yield rose from 1.51% at the end of 2021 to 3.88% at the end of 2022. Credit spreads widened since the beginning of the year, which indicates the market believes we will return to a more normalized credit environment. Our focus has been, and will continue to be, to selectively underwrite companies to achieve long-term outperformance.

Investors may be aware of our long-term equity investment strategy, which seeks to identify companies with durable competitive advantages, buy them at attractive valuations, and hold them for the long-run returns. Our equity portfolio outperformed the S&P 500 in 2022.

The Fund's underweight to Technology had a pronounced positive impact on relative equity returns in 2022, and selection within the Technology sector added to performance with our focus on robust cash flow generating companies.

Motorola Solutions (MSI) provided positive relative returns as it proved its operating model's strength with robust sales and bookings as municipalities consistently invest in advanced communications systems for first responders. Fiserv (FISV) and Visa (V) outperformed as well given a rebound in consumer spending and cross-border travel. Also contributing positively to returns was the general lack of Technology names carrying extended valuations fueled by the recent low interest rate environment.

Consumer Discretionary outperformed meaningfully primarily due to the Fund's underweight to the sector. Selection was also positive, as the Fund's two traditional retailer holdings, Home Depot (HD) and Target (TGT), outperformed the sector.

Given our regional tilt, the Fund continues to have an outsized exposure to industrial companies given their preponderance in the Upper Midwest. This overweight to Industrials helped performance while the selection of companies within the sector offset that slightly. Toro Company (TTC) was a shining star, accounting for nearly all sector outperformance as the company's innovations around autonomy and electrification continue to connect with the commercial landscaping and consumer end markets. Several companies that had performed well in recent years – Fastenal (FAST), Rockwell Automation (ROK), and UPS (UPS) – dragged on returns, but we continue to have a favorable long-term view of these holdings.

Communication Services benefited primarily from what the Fund avoided, namely social media and streaming companies. As mentioned in prior reports, Activision's (ATVI) sale announcement positively affected performance early in the year, and the Fund has since exited the position. These benefits were largely offset by

10

MAIRS & POWER BALANCED FUND (unaudited) (continued)

Alphabet (GOOG), the portfolio's largest holding, which lagged the market due to concerns around advertising trends in the face of a potential recession.

The lack of Energy holdings in the portfolio hurt performance for the year, but we have concluded commodity-driven energy firms cannot build sustainable durable competitive advantages, so we continue to seek opportunities to participate in the sector through firms with lower commodity dependence.

Materials was a large detractor to returns in 2022, as the Fund's holdings face short- term pressure partly due to the hydrocarbon price increases. The value-add portion of the supply chain, which is one step removed from commoditized materials, experienced significant cost pressure, including the Fund's two largest Materials holdings, Ecolab (ECL) and Sherwin Williams (SHW).

Financials had a small negative impact on returns as our near market weight was offset by negative selection effects. Notably, our recent addition of Northern Trust Corporation (NTRS) was ill-timed as the weak financial markets, combined with cost increases, impacted margins. We are confident in the company's long-term business model built on recurring revenues and an impressive record of client service allowing it to continue to execute well into the future. Positively, Principal Financial Group (PFG) benefited performance as it showed strength in asset management flows and a quality risk profile for its insurance business.

Asset allocation detracted from performance as stock returns in the Fund lagged bond returns for the year. As highlighted previously, the outperformance of stocks in the Fund compared to the index more than offset the overallocation to equities.

Lastly, we would like to make note of a shift in sector classification to take place next year. It will affect several of our names and will noticeably decrease our Technology exposure. Visa (V), Fiserv (FISV), and ADP (ADP) are all moving out of the Technology sector in March 2023, where those names account for about a quarter of the Fund's current Technology exposure.

Kevin Earley

Lead Manager | | Robert Thompson

Co-Manager | |

MAIRS & POWER BALANCED FUND (MAPOX) CONTRIBUTORS

Year To Date (12/31/2021 – 12/31/2022)

Largest Contributors

To Relative Performance | | Largest Detractors

To Relative Performance | |

Eli Lilly & Company | | | 34.24 | % | | Alphabet Inc. Class C | | | -38.67 | % | |

Hershey Company | | | 21.86 | % | | QUALCOMM, Inc. | | | -38.61 | % | |

Principal Financial Group, Inc. | | | 20.05 | % | | Ecolab, Inc. | | | -37.11 | % | |

The Toro Company | | | 14.87 | % | | Sherwin-Williams Company | | | -31.96 | % | |

UnitedHealth Group, Inc. | | | 6.95 | % | | U.S. Bancorp | | | -19.12 | % | |

Largest relative contributors and detractors are securities that were selected based on their contribution to the portfolio as of December 31, 2022. The performance number shown is total return of the security for the period and includes only securities held for the entire period. Total return is the amount of value an investor earns from a security over a specific period and when distributions are reinvested. Past performance does not guarantee future results.

Duration is a measure of the sensitivity of the price of a bond or other debt instrument to a change in interest rates.

Basis point is a unit of measure for interest rates and other percentages in finance. One basis point is equal to 1/100th of 1%, or 0.01%, or 0.0001.

11

MAIRS & POWER BALANCED FUND (unaudited) (continued)

All holdings in the portfolio are subject to change without notice and may or may not represent current or future portfolio composition. The mention of specific securities is not intended as a recommendation or an offer of a particular security, nor is it intended to be a solicitation for the purchase or sale of any security.

All investments have risks. The Balanced Fund is designed for long-term investors. The Fund's share price can fall because of weakness in the broad market, a particular industry or specific holdings. Investments in small and midcap companies generally are more volatile. International investing risks include among others political, social or economic instability, difficulty in predicting international trade patterns, taxation and foreign trading practices and greater fluctuations in price than U.S. corporations. The Balanced Fund is subject to yield and share price variances with changes in interest rates and market conditions. Investors should note that if interest rates rise significantly from current levels, bond total returns will decline and may even turn negative in the short-term. There is also a chance that some of the Balanced Fund's holdings may have their credit rating downgraded or may default.

Investments in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longer-term debt securities. Investments in lower rated and non-rated securities present a greater risk of loss to principal and interest than higher rated securities.

This commentary includes forward-looking statements such as economic predictions and portfolio manager opinions. The statements are subject to change at any time based on market and other conditions. No predictions, forecasts, outlooks, expectations or beliefs are guaranteed.

Composite Index reflects an unmanaged portfolio of 60% of the S&P 500 TR Index and 40% of the Bloomberg Barclays U.S. Government/Credit Bond Index. It is not possible to invest directly in an index.

Morningstar US Fund Allocation – 50%-70% Equity Category is designed to benchmark target-date and target-risk investment products. Index is based on well-established asset allocation methodology from Ibbotson Associates, a Morningstar company. Index has 60% global equity exposure and 40% global bond exposure. It is not possible to invest directly in an index.

S&P 500 Total Return (TR) Index is an unmanaged index of 500 common stocks that is generally considered representative of the U.S. stock market. It is not possible to invest directly in an index.

Bloomberg U.S. Government/Credit Bond Index is a broad-based flagship benchmark that measures the non-securitized component of the U.S. Aggregate Index. It includes investment-grade, U.S. dollar-denominated, fixed-rate Treasuries, government-related and corporate securities. It is not possible to invest directly in an index.

12

Mairs & Power Balanced Fund

PERFORMANCE INFORMATION (unaudited) December 31, 2022

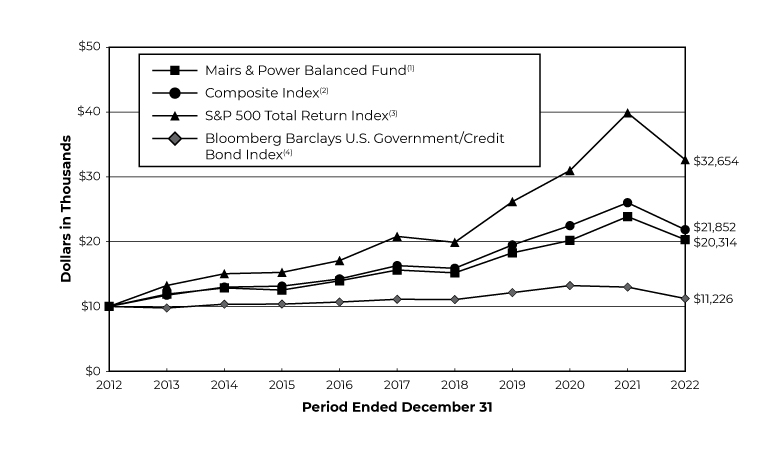

Ten years of investment performance (through December 31, 2022)

This chart illustrates the performance of a hypothetical $10,000 investment made in the Fund 10 years ago.

Average annual total returns for periods ended December 31, 2022

| | | 1 year | | 5 years | | 10 years | | 20 years | |

Mairs & Power Balanced Fund(1) | | | -14.91 | % | | | 5.39 | % | | | 7.34 | % | | | 7.81 | % | |

Composite Index(2) | | | -16.00 | % | | | 6.03 | % | | | 8.13 | % | | | 7.39 | % | |

S&P 500 Total Return Index(3) | | | -18.11 | % | | | 9.42 | % | | | 12.56 | % | | | 9.80 | % | |

Bloomberg U.S. Government/

Credit Bond Index(4) | | | -13.58 | % | | | 0.21 | % | | | 1.16 | % | | | 3.18 | % | |

Performance data quoted represents past performance and does not guarantee future results. All performance information shown includes the reinvestment of dividend and capital gain distributions, but does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. For the most recent month-end performance figures, visit the Fund's website at www.mairsandpower.com or call Shareholder Services at (800) 304-7404. Per the Prospectus dated April 20, 2022, the expense ratio for the Fund is 0.69%. See the Financial Highlights in this report for the most recent expense ratio.

(1) Performance figures reflect the historical performance of the Mairs & Power Balanced Fund (the "Predecessor Balanced Fund"), a series of Mairs & Power Funds Trust, for periods prior to April 29, 2022.

(2) The Composite Index reflects an unmanaged portfolio comprised of 60% of the S&P 500 Total Return Index and 40% of the Bloomberg Barclays U.S. Government/Credit Bond Index. It is not possible to invest directly in an index.

(3) The S&P 500 Total Return Index is an unmanaged index of 500 common stocks that is generally considered representative of the U.S. stock market. It tracks both the capital gains of a group of stocks over time and assumes that any cash distributions, such as dividends, are reinvested back into the index. It is not possible to invest directly in an index.

(4) The Bloomberg U.S. Government/Credit Bond Index is a broad-based flagship benchmark that measures the non-securitized component of the U.S. Aggregate Index. It includes investment-grade, U.S. dollar-denominated, fixed-rate Treasuries, government-related and corporate securities. It is not possible to invest directly in an index.

13

Mairs & Power Balanced Fund

FUND INFORMATION (unaudited) December 31, 2022

Portfolio Managers

Kevin V. Earley, CFA, lead manager of the Mairs & Power Balanced Fund and Predecessor Balanced Fund since April 1, 2018, co-manager from January 1, 2015 through April 1, 2018, University of Minnesota, MBA Finance 1990

Robert W. Thompson, CFA, co-manager of the Mairs & Power Balanced Fund and Predecessor Balanced Fund since April 1, 2018, University of Minnesota, MBA Finance 1995

General Information

Fund Symbol | | | MAPOX | | |

Net Asset Value (NAV) Per Share | | $ | 93.06 | | |

Expense Ratio | | | 0.69 | % | |

Portfolio Turnover Rate | | | 9.68 | % | |

Sales Charge | | | None1 | | |

Fund Inception Year | | | 1961 | | |

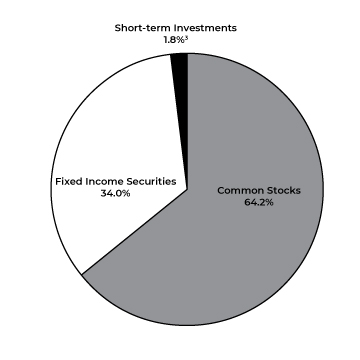

Portfolio Composition

Top Ten Common Stock Holdings

(Percent of Total Net Assets)2

Microsoft Corp | | | 3.8 | % | |

Alphabet Inc | | | 3.4 | | |

Eli Lilly & Co | | | 2.5 | | |

UnitedHealth Group Inc | | | 2.5 | | |

Abbott Laboratories | | | 2.4 | | |

Toro Co/The | | | 2.4 | | |

US Bancorp/MN | | | 2.4 | | |

JP Morgan Chase & Co | | | 2.2 | | |

Fiserv Inc | | | 2.1 | | |

Graco Inc | | | 2.0 | | |

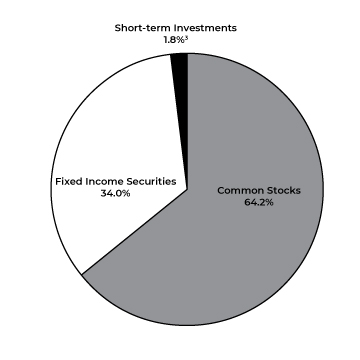

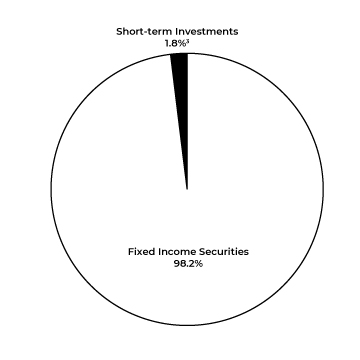

Portfolio Diversification

(Percent of Total Net Assets)

Fixed Income Securities 33.8% | |

Corporate Bonds | | | 29.0 | % | |

U.S. Government Obligations | | | 2.2 | | |

Asset Backed Securities | | | 1.5 | | |

Municipal Bonds | | | 1.1 | | |

Common Stocks 65.2% | |

Health Care | | | 15.4 | | |

Information Technology | | | 14.9 | | |

Industrials | | | 10.6 | | |

Financials | | | 8.5 | | |

Consumer Staples | | | 4.2 | | |

Materials | | | 4.2 | | |

Communications Services | | | 4.1 | | |

Consumer Discretionary | | | 2.4 | | |

Utilities | | | 0.9 | | |

Short-term Investments 1.0%3 | | | 1.0 | | |

| | | | 100.0 | % | |

1 Although the Fund is no-load, investment management fees and other expenses still apply.

2 All holdings in the portfolio are subject to change without notice and may or may not represent current or future portfolio composition. The mention of specific securities is not intended as a recommendation or offer for a particular security, nor is it intended to be a solicitation for the purchase or sale of any security.

3 Represents short-term investments and other assets and liabilities (net).

The Schedule of Investments and portfolio diversification utilize the Global Industry Classification Standard (GICS®) which was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor's Financial Services LLC ("S&P"). GICS is a service mark of MSCI, Inc. and S&P and has been licensed for use by Mairs & Power, Inc. (the "Adviser").

14

Mairs & Power Balanced Fund

SCHEDULE OF INVESTMENTS December 31, 2022

Par Value | | Security Description | | Value | |

| | | FIXED INCOME SECURITIES 33.8% | |

| | | CORPORATE BONDS 29.0% | |

| | | COMMUNICATION SERVICES 1.1% | |

$ | 1,688,000 | | | Netflix Inc | | | 5.875 | % | | 11/15/28 | | $ | 1,715,059 | | |

| | 2,000,000 | | | Comcast Corp | | | 4.250 | % | | 01/15/33 | | | 1,893,924 | | |

| | 1,000,000 | | | Verizon Communications Inc | | | 4.400 | % | | 11/01/34 | | | 922,984 | | |

| | 1,880,000 | | | Cox Communications Inc (b) | | | 4.800 | % | | 02/01/35 | | | 1,679,488 | | |

| | 3,000,000 | | | AT&T Inc | | | 4.500 | % | | 05/15/35 | | | 2,742,352 | | |

| | | | 8,953,807 | | |

| | | CONSUMER DISCRETIONARY 3.4% | |

| | 1,000,000 | | | General Motors Financial Co Inc | | | 3.950 | % | | 04/13/24 | | | 981,134 | | |

| | 250,000 | | | General Motors Co | | | 4.000 | % | | 04/01/25 | | | 244,238 | | |

| | 1,000,000 | | | General Motors Financial Co Inc | | | 4.300 | % | | 07/13/25 | | | 970,373 | | |

| | 1,064,000 | | | Block Financial LLC | | | 5.250 | % | | 10/01/25 | | | 1,063,638 | | |

| | 1,500,000 | | | Ford Motor Co | | | 4.346 | % | | 12/08/26 | | | 1,426,981 | | |

| | 1,000,000 | | | Darden Restaurants Inc | | | 3.850 | % | | 05/01/27 | | | 956,679 | | |

| | 2,245,000 | | | Lear Corp | | | 3.800 | % | | 09/15/27 | | | 2,093,134 | | |

| | 1,000,000 | | | General Motors Co | | | 4.200 | % | | 10/01/27 | | | 943,465 | | |

| | 1,000,000 | | | AutoNation Inc | | | 3.800 | % | | 11/15/27 | | | 911,093 | | |

| | 2,000,000 | | | Hasbro Inc | | | 3.900 | % | | 11/19/29 | | | 1,786,491 | | |

| | 2,000,000 | | | Advance Auto Parts Inc | | | 3.900 | % | | 04/15/30 | | | 1,762,358 | | |

| | 2,000,000 | | | Mohawk Industries Inc | | | 3.625 | % | | 05/15/30 | | | 1,732,515 | | |

| | 2,000,000 | | | Block Financial LLC | | | 3.875 | % | | 08/15/30 | | | 1,759,593 | | |

| | 1,000,000 | | | Kohl's Corp (a) | | | 3.625 | % | | 05/01/31 | | | 701,380 | | |

| | 1,750,000 | | | Ford Motor Credit Co LLC | | | 3.625 | % | | 06/17/31 | | | 1,378,278 | | |

| | 1,000,000 | | | Starbucks Corp | | | 3.000 | % | | 02/14/32 | | | 857,562 | | |

| | 500,000 | | | Tapestry Inc | | | 3.050 | % | | 03/15/32 | | | 391,606 | | |

| | 500,000 | | | Ford Motor Co | | | 6.100 | % | | 08/19/32 | | | 463,524 | | |

| | 2,000,000 | | | eBay, Inc | | | 6.300 | % | | 11/22/32 | | | 2,091,741 | | |

| | 500,000 | | | Kohl's Corp | | | 6.875 | % | | 12/15/37 | | | 391,757 | | |

| | 1,000,000 | | | General Motors Co | | | 5.150 | % | | 04/01/38 | | | 870,157 | | |

| | 1,000,000 | | | Ford Motor Co | | | 4.750 | % | | 01/15/43 | | | 720,491 | | |

| | 1,100,000 | | | Whirlpool Corp | | | 5.150 | % | | 03/01/43 | | | 963,146 | | |

| | 750,000 | | | Hasbro Inc | | | 5.100 | % | | 05/15/44 | | | 645,830 | | |

| | 1,073,000 | | | Kohl's Corp | | | 5.550 | % | | 07/17/45 | | | 677,921 | | |

| | | | 26,785,085 | | |

| | | CONSUMER STAPLES 1.3% | |

| | 2,500,000 | | | Land O' Lakes Inc (b) (c) | | | 7.250 | % | | 04/04/27 | | | 2,150,000 | | |

| | 1,949,000 | | | Land O' Lakes Capital Trust I | | | 7.450 | % | | 03/15/28 | | | 1,910,020 | | |

| | 2,500,000 | | | Land O' Lakes Inc (b) (c) | | | 7.000 | % | | 09/18/28 | | | 2,204,063 | | |

| | 250,000 | | | Smithfield Foods Inc (b) | | | 3.000 | % | | 10/15/30 | | | 191,019 | | |

| | 1,000,000 | | | Walgreens Boots Alliance Inc | | | 4.500 | % | | 11/18/34 | | | 880,322 | | |

15

Mairs & Power Balanced Fund

SCHEDULE OF INVESTMENTS (continued) December 31, 2022

Par Value | | Security Description | | Value | |

| | | FIXED INCOME SECURITIES (continued) | |

| | | CORPORATE BONDS (continued) | |

| | | CONSUMER STAPLES (continued) | |

$ | 1,000,000 | | | Anheuser-Busch Cos LLC / Anheuser-Busch InBev

Worldwide Inc | | | 4.700 | % | | 02/01/36 | | $ | 950,952 | | |

| | 1,000,000 | | | Walgreens Boots Alliance Inc | | | 4.800 | % | | 11/18/44 | | | 846,304 | | |

| | 1,000,000 | | | Molson Coors Brewing Co | | | 4.200 | % | | 07/15/46 | | | 785,028 | | |

| | | | 9,917,708 | | |

| | | CONSUMER, NON-CYCLICAL 0.1% | |

| | 1,000,000 | | | Wildlife Conservation Society | | | 3.414 | % | | 08/01/50 | | | 686,217 | | |

| | | | 686,217 | | |

| | | ENERGY 0.5% | |

| | 1,500,000 | | | Sunoco Logistics Partners Operations LP | | | 3.450 | % | | 01/15/23 | | | 1,498,768 | | |

| | 1,000,000 | | | Boardwalk Pipelines LP | | | 4.950 | % | | 12/15/24 | | | 989,185 | | |

| | 1,200,000 | | | Kinder Morgan Inc | | | 5.300 | % | | 12/01/34 | | | 1,131,602 | | |

| | 500,000 | | | Murphy Oil Corp (a) | | | 6.125 | % | | 12/01/42 | | | 393,790 | | |

| | | | 4,013,345 | | |

| | | FINANCIALS 10.9% | |

| | 1,000,000 | | | Standard Chartered PLC (b) (d) | | | 3.950 | % | | 01/11/23 | | | 999,567 | | |

| | 500,000 | | | First American Financial Corp | | | 4.300 | % | | 02/01/23 | | | 499,505 | | |

| | 374,000 | | | Assurant Inc | | | 4.200 | % | | 09/27/23 | | | 369,942 | | |

| | 500,000 | | | CNA Financial Corp | | | 7.250 | % | | 11/15/23 | | | 510,612 | | |

| | 500,000 | | | Pacific Life Insurance Co | | | 7.900 | % | | 12/30/23 | | | 509,676 | | |

| | 1,000,000 | | | HSBC Holdings PLC (d) | | | 4.250 | % | | 03/14/24 | | | 983,035 | | |

| | 540,000 | | | Wintrust Financial Corp | | | 5.000 | % | | 06/13/24 | | | 535,135 | | |

| | 824,000 | | | Assured Guaranty US Holdings Inc | | | 5.000 | % | | 07/01/24 | | | 823,493 | | |

| | 3,088,000 | | | Legg Mason Inc | | | 3.950 | % | | 07/15/24 | | | 3,026,814 | | |

| | 1,500,000 | | | Symetra Financial Corp | | | 4.250 | % | | 07/15/24 | | | 1,472,471 | | |

| | 1,000,000 | | | Citigroup Inc | | | 4.000 | % | | 08/05/24 | | | 982,605 | | |

| | 3,000,000 | | | Synchrony Financial | | | 4.250 | % | | 08/15/24 | | | 2,934,247 | | |

| | 2,000,000 | | | Old Republic International Corp | | | 4.875 | % | | 10/01/24 | | | 1,990,485 | | |

| | 1,627,000 | | | Associated Banc-Corp | | | 4.250 | % | | 01/15/25 | | | 1,584,666 | | |

| | 4,000,000 | | | Kemper Corp | | | 4.350 | % | | 02/15/25 | | | 3,880,850 | | |

| | 1,050,000 | | | TCF National Bank | | | 4.600 | % | | 02/27/25 | | | 1,028,351 | | |

| | 1,000,000 | | | BBVA USA | | | 3.875 | % | | 04/10/25 | | | 975,659 | | |

| | 250,000 | | | Liberty Mutual Insurance Co (b) | | | 8.500 | % | | 05/15/25 | | | 261,549 | | |

| | 1,000,000 | | | Prudential Insurance Co of America/The (b) | | | 8.300 | % | | 07/01/25 | | | 1,058,812 | | |

| | 1,000,000 | | | Synchrony Financial | | | 4.500 | % | | 07/23/25 | | | 960,844 | | |

| | 2,000,000 | | | Janus Capital Group Inc | | | 4.875 | % | | 08/01/25 | | | 1,970,269 | | |

| | 2,000,000 | | | HSBC Holdings PLC (d) | | | 4.250 | % | | 08/18/25 | | | 1,927,464 | | |

| | 20,000 | | | Wells Fargo & Co (c) | | | 4.70 | % | | 12/15/25 | | | 367,800 | | |

| | 1,520,000 | | | Legg Mason Inc | | | 4.750 | % | | 03/15/26 | | | 1,526,427 | | |

| | 1,000,000 | | | Hanover Insurance Group Inc/The | | | 4.500 | % | | 04/15/26 | | | 980,753 | | |

16

Mairs & Power Balanced Fund

SCHEDULE OF INVESTMENTS (continued) December 31, 2022

Par Value | | Security Description | | Value | |

| | | FIXED INCOME SECURITIES (continued) | |

| | | CORPORATE BONDS (continued) | |

| | | FINANCIALS (continued) | |

$ | 1,000,000 | | | Wells Fargo & Co | | | 4.100 | % | | 06/03/26 | | $ | 970,308 | | |

| | 3,290,000 | | | Old Republic International Corp | | | 3.875 | % | | 08/26/26 | | | 3,122,847 | | |

| | 500,000 | | | Morgan Stanley | | | 4.350 | % | | 09/08/26 | | | 486,568 | | |

| | 1,000,000 | | | JPMorgan Chase & Co | | | 4.125 | % | | 12/15/26 | | | 968,731 | | |

| 4,000,000

| | | PNC Financial Services Group Inc/The (c) (i)

| | | 3.400% (5 Year

CMT Rate +

2.595%) | | |

09/15/26 | | | 3,180,000 | | |

| | 4,000,000 | | | Mercury General Corp | | | 4.400 | % | | 03/15/27 | | | 3,751,682 | | |

| | 450,000 | | | Athene Holding Ltd (d) | | | 4.125 | % | | 01/12/28 | | | 415,424 | | |

| 500,000

| | | Citigroup Inc (i)

| | | 3.070% (SOFR +

1.280%) | | |

02/24/28 | | | 452,119 | | |

| | 250,000 | | | Provident Cos Inc | | | 7.250 | % | | 03/15/28 | | | 263,627 | | |

| | 2,000,000 | | | E*TRADE Financial Corp | | | 4.500 | % | | 06/20/28 | | | 1,952,143 | | |

| | 500,000 | | | Farmers Exchange Capital | | | 7.050 | % | | 07/15/28 | | | 514,897 | | |

| | 1,000,000 | | | Lazard Group LLC | | | 4.375 | % | | 03/11/29 | | | 927,811 | | |

| | 2,500,000 | | | Wintrust Financial Corp | | | 4.850 | % | | 06/06/29 | | | 2,275,707 | | |

| | 2,300,000 | | | Assurant Inc | | | 3.700 | % | | 02/22/30 | | | 1,958,217 | | |

| 4,000,000

| | | Capital One Financial Corp. (i)

| | | 5.247% (SOFR +

2.600%) | | |

07/26/30 | | | 3,826,227 | | |

| 500,000

| | | Park National Corp (i)

| | | 4.500% (TSFR3M +

4.390%) | | |

09/01/30 | | | 462,655 | | |

| | 500,000 | | | Goldman Sachs Group Inc/The | | | 4.250 | % | | 11/15/30 | | | 455,142 | | |

| | 500,000 | | | Goldman Sachs Group Inc/The | | | 4.000 | % | | 02/15/31 | | | 450,935 | | |

| | 2,000,000 | | | Synchrony Financial | | | 2.875 | % | | 10/28/31 | | | 1,508,986 | | |

| | 1,000,000 | | | Blackstone Holdings Finance Co LLC (b) | | | 2.550 | % | | 03/30/32 | | | 783,428 | | |

| 2,000,000

| | | Goldman Sachs Group Inc/The (i)

| | | 2.650% (SOFR +

1.264%) | | |

10/21/32 | | | 1,589,574 | | |

| | 500,000 | | | Goldman Sachs Group Inc/The | | | 4.300 | % | | 12/15/32 | | | 448,107 | | |

| 1,700,000

| | | Morgan Stanley (i)

| | | 2.943% (SOFR +

1.290%) | | |

01/21/33 | | | 1,384,470 | | |

| 500,000

1,000,000 | | | American Express Co (i)

Bank of America Corp. (i) | | | 4.989% (SOFR +

2.255%)

5.015% (SOFR + | | |

05/26/33

| | | 483,706

| | |

| | | | | | 2.160 | %) | | 07/22/33 | | | 955,572 | | |

| 2,000,000

| | | US Bancorp (i)

| | | 5.850% (SOFR +

2.090%) | | |

10/21/33 | | | 2,089,811 | | |

| | 538,000 | | | Bank of America Corp | | | 4.000 | % | | 08/15/34 | | | 464,729 | | |

| 3,000,000

| | | Fulton Financial Corp (i)

| | | 3.750% (TSFR3M +

2.700%) | | |

03/15/35 | | | 2,465,465 | | |

| 2,150,000

| | | Bank of Montreal (d) (i)

| | | 3.088% (5 Year

CMT Rate +

1.400%) | | |

01/10/37 | | | 1,636,273 | | |

| | 500,000 | | | Principal Financial Group Inc | | | 4.350 | % | | 05/15/43 | | | 414,431 | | |

17

Mairs & Power Balanced Fund

SCHEDULE OF INVESTMENTS (continued) December 31, 2022

Par Value | | Security Description | | Value | |

| | | FIXED INCOME SECURITIES (continued) | |

| | | CORPORATE BONDS (continued) | |

| | | FINANCIALS (continued) | |

$ | 500,000

| | | BAC Capital Trust XIV (c) (i)

| | | 5.169% (3 Month

LIBOR USD +

0.400%) | | |

01/17/23 | | $ | 383,218 | | |

| 2,500,000

| | | M&T Bank Corp (c) (i)

| | | 5.125% (3 Month

LIBOR USD +

3.520%) | | |

11/01/26 | | | 2,157,934 | | |

| 1,000,000

| | | SVB Financial Group (c) (i)

| | | 4.100% (10 Year

CMT Rate +

3.064%) | | |

02/15/31 | | | 577,321 | | |

| 3,000,000

| | | JPMorgan Chase & Co (c) (i)

| | | 3.650% (5 Year

CMT Rate +

2.850%) | | |

06/01/26 | | | 2,576,250 | | |

| 2,000,000

| | | Bank of New York Mellon Corp/The (c) (i)

| | | 3.750% (5 Year

CMT Rate +

2.630%) | | |

12/20/26 | | | 1,615,914 | | |

| 6,000,000

| | | Charles Schwab Corp (c) (i)

| | | 4.000% (10 Year

CMT Rate +

3.079%) | | |

12/01/30 | | | 4,792,200 | | |

| | | | 84,923,460 | | |

| | | HEALTH CARE 0.7% | |

| | 500,000 | | | Wyeth LLC | | | 6.450 | % | | 02/01/24 | | | 509,249 | | |

| | 2,000,000 | | | AbbVie Inc | | | 3.800 | % | | 03/15/25 | | | 1,952,535 | | |

| | 43,000 | | | Bristol-Myers Squibb Co | | | 3.875 | % | | 08/15/25 | | | 41,897 | | |

| | 1,000,000 | | | Cigna Corp | | | 4.500 | % | | 02/25/26 | | | 986,817 | | |

| | 700,000 | | | Zimmer Biomet Holdings Inc | | | 4.250 | % | | 08/15/35 | | | 584,696 | | |

| | 1,400,000 | | | CVS Health Corp | | | 4.780 | % | | 03/25/38 | | | 1,285,462 | | |

| | | | 5,360,656 | | |

| | | INDUSTRIALS 2.7% | |

| | 1,000,000 | | | GATX Corp | | | 3.900 | % | | 03/30/23 | | | 995,696 | | |

| | 1,500,000 | | | Hillenbrand Inc | | | 5.000 | % | | 09/15/26 | | | 1,450,530 | | |

| | 500,000 | | | Toro Co/The | | | 7.800 | % | | 06/15/27 | | | 533,420 | | |

| | 2,000,000 | | | Kennametal Inc | | | 4.625 | % | | 06/15/28 | | | 1,883,206 | | |

| | 3,000,000 | | | Steelcase Inc | | | 5.125 | % | | 01/18/29 | | | 2,617,500 | | |

| | 1,000,000 | | | Oshkosh Corp | | | 3.100 | % | | 03/01/30 | | | 848,531 | | |

| | 1,000,000 | | | Flowserve Corp | | | 3.500 | % | | 10/01/30 | | | 836,708 | | |

| | 3,000,000 | | | Hillenbrand Inc | | | 3.750 | % | | 03/01/31 | | | 2,463,900 | | |

| | 4,000,000 | | | United Rentals North America Inc | | | 3.750 | % | | 01/15/32 | | | 3,268,520 | | |

| | 2,000,000 | | | Eaton Corp | | | 4.000 | % | | 11/02/32 | | | 1,852,819 | | |

| | 1,000,000 | | | GATX Corp | | | 4.900 | % | | 03/15/33 | | | 939,621 | | |

| | 1,000,000 | | | Alcoa Inc | | | 5.950 | % | | 02/01/37 | | | 972,666 | | |

| | 1,400,000 | | | Leidos Holdings Inc | | | 5.950 | % | | 12/01/40 | | | 1,322,565 | | |

| | 1,000,000 | | | FedEx Corp | | | 4.100 | % | | 04/15/43 | | | 790,506 | | |

| | | | 20,776,188 | | |

18

Mairs & Power Balanced Fund

SCHEDULE OF INVESTMENTS (continued) December 31, 2022

Par Value | | Security Description | | Value | |

| | | FIXED INCOME SECURITIES (continued) | |

| | | CORPORATE BONDS (continued) | |

| | | INFORMATION TECHNOLOGY 4.9% | |

$ | 696,000 | | | Dell International LLC / EMC Corp | | | 5.450 | % | | 06/15/23 | | $ | 696,515 | | |

| | 1,031,000 | | | Arrow Electronics Inc | | | 4.000 | % | | 04/01/25 | | | 997,466 | | |

| | 2,000,000 | | | Hewlett Packard Enterprise Co | | | 4.900 | % | | 10/15/25 | | | 1,984,787 | | |

| | 1,000,000 | | | Dell International LLC / EMC Corp | | | 6.020 | % | | 06/15/26 | | | 1,023,614 | | |

| | 2,500,000 | | | Motorola Solutions Inc | | | 4.600 | % | | 02/23/28 | | | 2,431,198 | | |

| | 1,500,000 | | | Trimble Inc | | | 4.900 | % | | 06/15/28 | | | 1,443,580 | | |

| | 1,000,000 | | | Fiserv Inc | | | 4.200 | % | | 10/01/28 | | | 949,832 | | |

| | 3,000,000 | | | Entegris Escrow Corp (b) | | | 4.750 | % | | 04/15/29 | | | 2,741,857 | | |

| | 1,000,000 | | | Juniper Networks Inc | | | 3.750 | % | | 08/15/29 | | | 895,569 | | |

| | 1,000,000 | | | Dell International LLC / EMC Corp | | | 5.300 | % | | 10/01/29 | | | 982,787 | | |

| | 2,000,000 | | | Avnet Inc | | | 3.000 | % | | 05/15/31 | | | 1,562,124 | | |

| | 1,000,000 | | | HP Inc | | | 2.650 | % | | 06/17/31 | | | 784,034 | | |

| | 1,000,000 | | | Autodesk Inc | | | 2.400 | % | | 12/15/31 | | | 806,584 | | |

| | 1,000,000 | | | Magallanes Inc (b) | | | 4.279 | % | | 03/15/32 | | | 827,377 | | |

| | 1,000,000 | | | Avnet Inc | | | 5.500 | % | | 06/01/32 | | | 929,248 | | |

| | 2,000,000 | | | Broadcom Inc | | | 4.300 | % | | 11/15/32 | | | 1,774,892 | | |

| | 3,000,000 | | | Intel Corp | | | 4.000 | % | | 12/15/32 | | | 2,799,374 | | |

| | 2,000,000 | | | HP Inc | | | 5.500 | % | | 01/15/33 | | | 1,890,948 | | |

| | 2,850,000 | | | Leidos Inc | | | 5.500 | % | | 07/01/33 | | | 2,645,769 | | |

| | 1,000,000 | | | Broadcom Inc (b) | | | 3.469 | % | | 04/15/34 | | | 804,295 | | |

| | 1,500,000 | | | Western Union Co/The | | | 6.200 | % | | 11/17/36 | | | 1,503,868 | | |

| | 1,500,000 | | | Broadcom Inc (b) | | | 4.926 | % | | 05/15/37 | | | 1,317,516 | | |

| | 3,000,000 | | | Oracle Corp | | | 3.600 | % | | 04/01/40 | | | 2,240,942 | | |

| | 1,000,000 | | | Dell Inc | | | 5.400 | % | | 09/10/40 | | | 881,710 | | |

| | 1,000,000 | | | Analog Devices Inc | | | 2.800 | % | | 10/01/41 | | | 741,590 | | |

| | 570,000 | | | Discovery Communications LLC | | | 4.950 | % | | 05/15/42 | | | 429,227 | | |

| | 2,000,000 | | | Motorola Solutions Inc | | | 5.500 | % | | 09/01/44 | | | 1,821,586 | | |

| | | | 37,908,289 | | |

| | | MATERIALS 2.4% | |

| | 756,000 | | | Eastman Chemical Co | | | 3.800 | % | | 03/15/25 | | | 734,680 | | |

| | 865,000 | | | Union Carbide Corp | | | 7.500 | % | | 06/01/25 | | | 906,390 | | |

| | 2,000,000 | | | DowDuPont Inc | | | 4.493 | % | | 11/15/25 | | | 1,970,672 | | |

| | 200,000 | | | Worthington Industries Inc | | | 4.550 | % | | 04/15/26 | | | 193,975 | | |

| | 1,500,000 | | | Cabot Corp | | | 3.400 | % | | 09/15/26 | | | 1,390,428 | | |

| | 782,000 | | | HB Fuller Co | | | 4.000 | % | | 02/15/27 | | | 723,636 | | |

| | 3,200,000 | | | HB Fuller Co | | | 4.250 | % | | 10/15/28 | | | 2,842,928 | | |

| | 4,000,000 | | | Cabot Corp | | | 4.000 | % | | 07/01/29 | | | 3,595,667 | | |

| | 1,175,000 | | | Albemarle Wodgina Property Ltd (d) | | | 3.450 | % | | 11/15/29 | | | 1,037,929 | | |

| | 3,000,000 | | | Freeport McMoRan Inc | | | 4.250 | % | | 03/01/30 | | | 2,727,919 | | |

| | 1,250,000 | | | Dow Chemical Co/The | | | 4.250 | % | | 10/01/34 | | | 1,138,996 | | |

19

Mairs & Power Balanced Fund

SCHEDULE OF INVESTMENTS (continued) December 31, 2022

Par Value | | Security Description | | Value | |

| | | FIXED INCOME SECURITIES (continued) | |

| | | CORPORATE BONDS (continued) | |

| | | MATERIALS (continued) | |

$ | 1,000,000 | | | Newmont Mining Corp | | | 4.875 | % | | 03/15/42 | | $ | 918,878 | | |

| | 325,000 | | | Albemarle Corp | | | 5.450 | % | | 12/01/44 | | | 296,612 | | |

| | 250,000 | | | Steel Dynamics Inc | | | 3.250 | % | | 10/15/50 | | | 164,158 | | |

| | | | 18,642,868 | | |

| | | REAL ESTATE 0.0% | |

| | 350,000 | | | CBRE Services Inc | | | 4.875 | % | | 03/01/26 | | | 346,327 | | |

| | | | 346,327 | | |

| | | UTILITIES 1.0% | |

| | 53,000 | | | National Fuel Gas Co | | | 3.750 | % | | 03/01/23 | | | 52,860 | | |

| | 250,000 | | | Jersey Central Power & Light Co (b) | | | 4.300 | % | | 01/15/26 | | | 241,597 | | |

| | 2,000,000 | | | National Fuel Gas Co | | | 3.950 | % | | 09/15/27 | | | 1,852,196 | | |

| | 416,000 | | | Toledo Edison Co (b) | | | 2.650 | % | | 05/01/28 | | | 364,874 | | |

| | 1,000,000 | | | National Fuel Gas Co | | | 4.750 | % | | 09/01/28 | | | 938,548 | | |

| | 2,000,000 | | | Alliant Energy Finance LLC (b) | | | 3.600 | % | | 03/01/32 | | | 1,735,888 | | |

| | 1,165,000 | | | Duke Energy Progress LLC | | | 5.700 | % | | 04/01/35 | | | 1,165,504 | | |

| | 1,080,000 | | | Southwestern Public Service Co | | | 6.000 | % | | 10/01/36 | | | 1,079,738 | | |

| | 1,021,000 | | | Northern Natural Gas Co (b) | | | 4.100 | % | | 09/15/42 | | | 779,748 | | |

| | | | 8,210,953 | | |

| | | TOTAL CORPORATE BONDS | | | 226,524,903 | | |

| | | US GOVERNMENT NOTES/BONDS 2.2% | |

| | 1,000,000 | | | United States Treasury Note/Bond | | | 0.875 | % | | 01/31/24 | | | 959,805 | | |

| | 1,000,000 | | | United States Treasury Note/Bond | | | 0.250 | % | | 03/15/24 | | | 948,574 | | |

| | 3,000,000 | | | United States Treasury Note/Bond | | | 0.750 | % | �� | 03/31/26 | | | 2,692,266 | | |

| | 1,000,000 | | | United States Treasury Note/Bond | | | 0.750 | % | | 04/30/26 | | | 895,234 | | |

| | 1,000,000 | | | United States Treasury Note/Bond | | | 1.125 | % | | 10/31/26 | | | 895,742 | | |

| | 1,000,000 | | | United States Treasury Note/Bond | | | 1.250 | % | | 06/30/28 | | | 866,602 | | |

| | 1,000,000 | | | United States Treasury Note/Bond | | | 1.000 | % | | 07/31/28 | | | 851,875 | | |

| | 7,000,000 | | | United States Treasury Note/Bond | | | 2.625 | % | | 02/15/29 | | | 6,485,937 | | |

| | 1,000,000 | | | United States Treasury Note/Bond | | | 3.250 | % | | 05/15/42 | | | 882,969 | | |

| | 2,000,000 | | | United States Treasury Note/Bond | | | 3.000 | % | | 02/15/49 | | | 1,662,422 | | |

| | | | 17,141,426 | | |

| | | ASSET BACKED SECURITIES 1.5% | |

| | 262,720 | | | US Airways 2010-1 Class A Pass Through Trust | | | 6.250 | % | | 04/22/23 | | | 260,187 | | |

| | 797,638 | | | Delta Air Lines 2015-1 Class B Pass Through Trust | | | 4.250 | % | | 07/30/23 | | | 774,926 | | |

| | 496,198 | | | American Airlines 2015-2 Class B Pass Through Trust | | | 4.400 | % | | 09/22/23 | | | 481,873 | | |

| | 160,298 | | | US Airways 2011-1 Class A Pass Through Trust | | | 7.125 | % | | 10/22/23 | | | 160,227 | | |

| | 1,916,598 | | | American Airlines 2016-1 Class B Pass Through Trust | | | 5.250 | % | | 01/15/24 | | | 1,872,277 | | |

20

Mairs & Power Balanced Fund

SCHEDULE OF INVESTMENTS (continued) December 31, 2022

Par Value | | Security Description | | Value | |

| | | FIXED INCOME SECURITIES (continued) | |

| | | ASSET BACKED SECURITIES (continued) | |

$ | 578,112 | | | Spirit Airlines Pass Through Trust 2015-1B | | | 4.450 | % | | 04/01/24 | | $ | 549,423 | | |

| | 1,474,280 | | | Hawaiian Airlines 2013-1 Class A Pass Through Certificates | | | 3.900 | % | | 01/15/26 | | | 1,275,623 | | |

| | 1,026,752 | | | Continental Airlines 2012-2 Class A Pass Through Trust | | | 4.000 | % | | 10/29/24 | | | 985,804 | | |

| | 623,755 | | | American Airlines 2017-1 Class B Pass Through Trust | | | 4.950 | % | | 02/15/25 | | | 585,035 | | |

| | 633,263 | | | United Airlines 2013-1 Class A Pass Through Trust | | | 4.300 | % | | 08/15/25 | | | 597,289 | | |

| | 558,082 | | | American Airlines 2016-3 Class B Pass Through Trust | | | 3.750 | % | | 10/15/25 | | | 497,456 | | |

| | 443,831 | | | US Airways 2013-1 Class A Pass Through Trust | | | 3.950 | % | | 11/15/25 | | | 403,423 | | |

| | 503,875 | | | United Airlines 2014-1 Class A Pass Through Trust | | | 4.000 | % | | 04/11/26 | | | 465,696 | | |

| | 422,515 | | | United Airlines 2014-2 Class A Pass Through Trust | | | 3.750 | % | | 09/03/26 | | | 387,532 | | |

| | 1,119,797 | | | American Airlines 2014-1 Class A Pass Through Trust | | | 3.700 | % | | 10/01/26 | | | 962,925 | | |

| | 290,997 | | | American Airlines 2015-1 Class A Pass Through Trust | | | 3.375 | % | | 05/01/27 | | | 240,551 | | |

| | 433,253 | | | American Airlines 2015-2 Class A Pass Through Trust | | | 4.000 | % | | 09/22/27 | | | 351,776 | | |

| | 132,882 | | | American Airlines 2015-2 Class AA Pass Through Trust | | | 3.600 | % | | 09/22/27 | | | 119,588 | | |

| | 82,555 | | | Spirit Airlines Pass Through Trust 2015-1A | | | 4.100 | % | | 04/01/28 | | | 71,090 | | |

| | 723,446 | | | British Airways 2018-1 Class A Pass Through Trust (b) (d) | | | 4.125 | % | | 09/20/31 | | | 622,854 | | |

| | | | 11,665,555 | | |

| | | MUNICIPAL BONDS 1.1% | |

| | 650,000 | | | Glendale Community College District/CA | | | 2.113 | % | | 08/01/31 | | | 513,881 | | |

| | 500,000 | | | Socorro Independent School District | | | 2.125 | % | | 08/15/31 | | | 407,735 | | |

| | 920,000 | | | Pierre School District No 32-2 | | | 2.040 | % | | 08/01/33 | | | 706,508 | | |

| | 500,000 | | | Redondo Beach Unified School District | | | 2.040 | % | | 08/01/34 | | | 364,231 | | |

| | 500,000 | | | DeKalb Kane & LaSalle Counties Etc Community College

District No 523 Kishwaukee | | | 3.017 | % | | 02/01/36 | | | 390,168 | | |

| | 1,000,000 | | | Crowley Independent School District | | | 3.010 | % | | 08/01/38 | | | 775,272 | | |

| | 500,000 | | | Idaho Bond Bank Authority | | | 2.354 | % | | 09/15/38 | | | 354,455 | | |

| | 850,000 | | | Worthington Independent School District No 518 | | | 3.300 | % | | 02/01/39 | | | 683,840 | | |

| | 610,000 | | | Rockwall Independent School District | | | 3.091 | % | | 02/15/39 | | | 471,914 | | |

| | 885,000 | | | Massachusetts Development Finance Agency | | | 2.550 | % | | 05/01/40 | | | 605,066 | | |

| | 750,000 | | | Woodbury County Law Enforcement Center Authority | | | 3.090 | % | | 06/01/40 | | | 567,344 | | |

| | 505,000 | | | Village of Ashwaubenon WI | | | 2.970 | % | | 06/01/40 | | | 374,464 | | |

| | 300,000 | | | Desert Community College District | | | 2.457 | % | | 08/01/40 | | | 201,558 | | |

| | 800,000 | | | Utah Transit Authority | | | 3.443 | % | | 12/15/42 | | | 634,645 | | |

| | 1,000,000 | | | Borough of Naugatuck CT | | | 3.090 | % | | 09/15/46 | | | 680,722 | | |

| | 1,000,000 | | | Michigan State University | | | 4.496 | % | | 08/15/48 | | | 895,017 | | |

| | | | 8,626,820 | | |

| | TOTAL FIXED INCOME SECURITIES

(cost $297,280,052) | | $ | 263,958,704 | | |

21

Mairs & Power Balanced Fund

SCHEDULE OF INVESTMENTS (continued) December 31, 2022

Shares | | Security Description | | Value | |

| | | COMMON STOCKS 65.2% | |

| | | COMMUNICATION SERVICES 4.1% | |

| | 301,000 | | | Alphabet Inc (e) | | $ | 26,707,730 | | |

| | 58,000 | | | Walt Disney Co/The (e) | | | 5,039,040 | | |

| | | | 31,746,770 | | |

| | | CONSUMER DISCRETIONARY 2.4% | |

| | 39,860 | | | Home Depot Inc/The | | | 12,590,180 | | |

| | 43,000 | | | Target Corp | | | 6,408,720 | | |

| | | | 18,998,900 | | |

| | | CONSUMER STAPLES 4.2% | |

| | 43,630 | | | Hershey Co/The | | | 10,103,399 | | |

| | 338,510 | | | Hormel Foods Corp | | | 15,419,131 | | |

| | 94,000 | | | Sysco Corp | | | 7,186,300 | | |

| | | | 32,708,830 | | |

| | | FINANCIALS 8.5% | |

| | 42,000 | | | American Express Co | | | 6,205,500 | | |

| | 127,633 | | | JPMorgan Chase & Co | | | 17,115,585 | | |

| | 86,000 | | | Northern Trust Corp | | | 7,610,140 | | |

| | 78,000 | | | Principal Financial Group Inc | | | 6,545,760 | | |

| | 425,017 | | | US Bancorp/MN | | | 18,534,992 | | |

| | 256,308 | | | Wells Fargo & Co | | | 10,582,957 | | |

| | | | 66,594,934 | | |

| | | HEALTH CARE 15.4% | |

| | 173,610 | | | Abbott Laboratories | | | 19,060,642 | | |

| | 62,000 | | | Baxter International Inc | | | 3,160,140 | | |

| | 114,000 | | | Bio-Techne Corp | | | 9,448,320 | | |

| | 125,000 | | | Elanco Animal Health Inc (e) | | | 1,527,500 | | |

| | 54,300 | | | Eli Lilly & Co | | | 19,865,112 | | |

| | 86,000 | | | Johnson & Johnson | | | 15,191,900 | | |

| | 173,000 | | | Medtronic PLC (f) | | | 13,445,560 | | |

| | 4,895 | | | Neogen Corp (e) | | | 74,551 | | |

| | 103,000 | | | Pfizer Inc | | | 5,277,720 | | |

| | 352,000 | | | Roche Holding AG (g) | | | 13,780,800 | | |

| | 37,013 | | | UnitedHealth Group Inc | | | 19,623,552 | | |

| | | | 120,455,797 | | |

| | | INDUSTRIALS 10.6% | |

| | 20,277 | | | 3M Co | | | 2,431,618 | | |

| | 65,000 | | | CH Robinson Worldwide Inc | | | 5,951,400 | | |

| | 95,000 | | | Donaldson Co Inc | | | 5,592,650 | | |

| | 135,000 | | | Fastenal Co | | | 6,388,200 | | |

| | 237,057 | | | Graco Inc | | | 15,944,454 | | |

| | 19,000 | | | Honeywell International Inc | | | 4,071,700 | | |

22

Mairs & Power Balanced Fund

SCHEDULE OF INVESTMENTS (continued) December 31, 2022

Shares | | Security Description | | Value | |

| | | COMMON STOCKS (continued) | |

| | | INDUSTRIALS (continued) | |

| | 140,000 | | | nVent Electric PLC (f) | | $ | 5,385,800 | | |

| | 19,000 | | | Rockwell Automation Inc | | | 4,893,830 | | |

| | 101,000 | | | Tennant Co | | | 6,218,570 | | |

| | 164,905 | | | Toro Co/The | | | 18,667,246 | | |

| | 40,000 | | | United Parcel Service Inc, Class B | | | 6,953,600 | | |

| | | | 82,499,068 | | |

| | | INFORMATION TECHNOLOGY 14.9% | |

| | 22,000 | | | Automatic Data Processing Inc | | | 5,254,920 | | |

| | 34,000 | | | Entegris Inc | | | 2,230,060 | | |

| | 166,000 | | | Fiserv Inc (e) | | | 16,777,620 | | |

| | 41,000 | | | Littelfuse Inc | | | 9,028,200 | | |

| | 125,000 | | | Microsoft Corp | | | 29,977,500 | | |

| | 50,000 | | | Motorola Solutions Inc | | | 12,885,500 | | |

| | 118,000 | | | QUALCOMM Inc | | | 12,972,920 | | |

| | 50,000 | | | salesforce.com Inc (e) | | | 6,629,500 | | |

| | 54,000 | | | Texas Instruments Inc | | | 8,921,880 | | |

| | 58,000 | | | Visa Inc | | | 12,050,080 | | |

| | | | 116,728,180 | | |

| | | MATERIALS 4.2% | |

| | 90,000 | | | Ecolab Inc | | | 13,100,400 | | |

| | 108,270 | | | HB Fuller Co | | | 7,754,297 | | |

| | 49,000 | | | Sherwin-Williams Co/The | | | 11,629,170 | | |

| | | | 32,483,867 | | |

| | | UTILITIES 0.9% | |

| | 104,000 | | | Xcel Energy Inc | | | 7,291,440 | | |

| | | | TOTAL COMMON STOCKS

(cost $285,300,782) | | $ | 509,507,786 | | |

| | | SHORT-TERM INVESTMENTS 0.5% | |

| 3,523,143 | | | First American Government Obligations Fund, Class X, 0.0407% (h)

(cost $3,523,143) | | $ | 3,523,143 | | |

| | | | TOTAL INVESTMENTS 99.5%

(cost $586,103,977) | | $ | 776,989,633 | | |

| | | | | OTHER ASSETS AND LIABILITIES (NET) 0.5% | | | 3,857,450 | | |

| | | | | TOTAL NET ASSETS 100.0% | | $ | 780,847,083 | | |

23

Mairs & Power Balanced Fund

SCHEDULE OF INVESTMENTS (continued) December 31, 2022

(a) Step Bonds – Securities for which the coupon rate of interest will adjust on specified future dates(s). The rate disclosed represents the coupon rate in effect as of December 31, 2022.

(b) Securities exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. These securities have been determined to be liquid under guidelines established by the Funds's Board of Trustees. As of December 31, 2022, these securities represented $18,763,932 or 2.4% of total net assets.

(c) Perpetual maturity, date shown, if applicable, represents next contractual call date.

(d) Foreign security denominated in U.S. dollars. As of December 31, 2022, these securities represented $7,622,545 or 1.0% of total net assets.

(e) Non-income producing.

(f) Issuer headquartered overseas but considered domestic. The Adviser defines foreign issuers as those whose operational leadership or headquarters is located in a foreign country; provided, however, if an issuer is believed by the Adviser to be headquartered in a jurisdiction primarily for tax purposes, the Adviser will consider the following additional factors: 1) the location of the primary exchange trading its securities; 2) where it derives the majority of its revenues; and/or 3) where it earns the majority of its profits.

(g) American Depositary Receipt

(h) The rate quoted is the annualized seven-day effective yield as of December 31, 2022.

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor's Financial Services LLC ("S&P"). GICS is a service mark of MSCI, Inc. and S&P and has been licensed for use by the Adviser.

(i) Variable rate security; the rate shown represents the rate at December 31, 2022.

See accompanying Notes to Financial Statements.

24

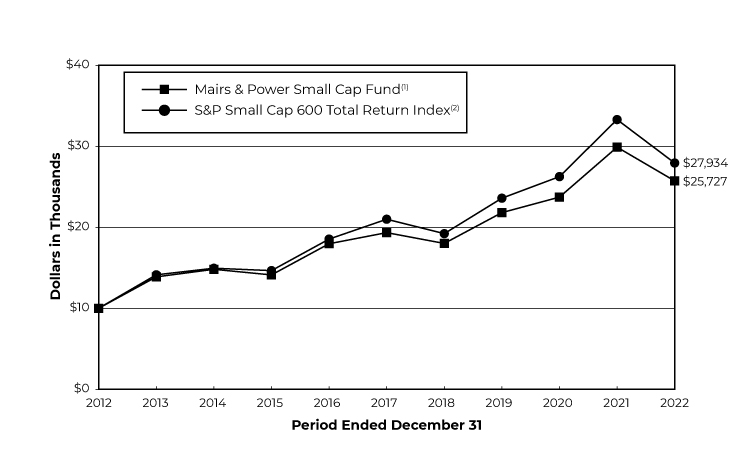

MAIRS & POWER SMALL CAP FUND (unaudited)

To Our Shareholders: December 31, 2022

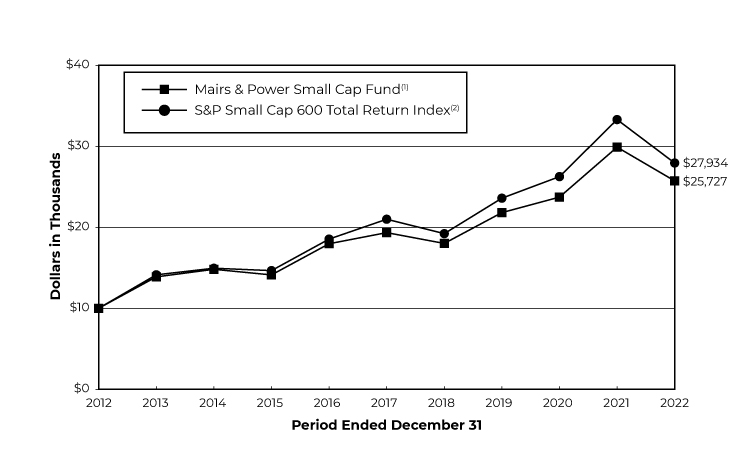

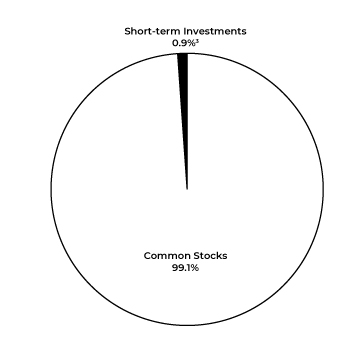

For 2022, the Mairs & Power Small Cap Fund (the "Fund") was down 13.93%, while its S&P Small Cap 600 TR benchmark fell 16.10%, and the Morningstar U.S. Fund Small Blend declined 16.35%. In the fourth quarter of 2022, the Fund was up 9.70%, the S&P Small Cap 600 TR was up 9.19%, and the Morningstar U.S. Fund Small Blend rose 9.01%.

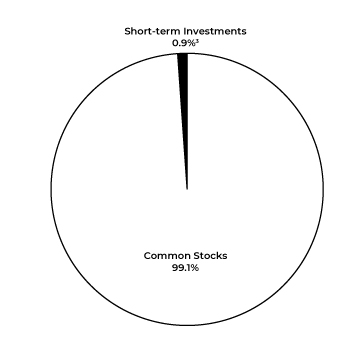

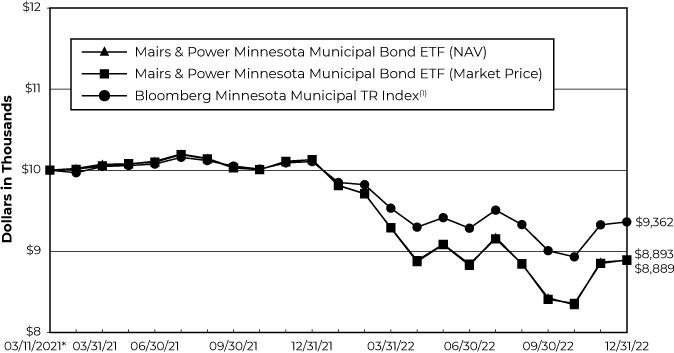

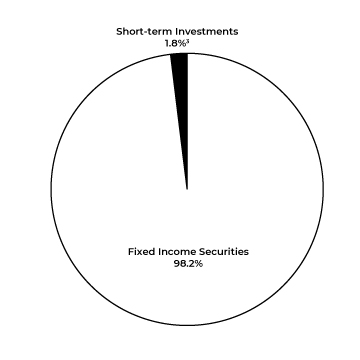

The absence of Energy holdings was a headwind to relative performance year-to-date, and in the fourth quarter. The combination of underinvestment by the industry and recent geopolitical tensions have caused fossil fuel supplies to fall short of demand, driving up the prices of both Energy commodities and Energy stocks. We believe these conditions are temporary, and therefore we will continue to steer clear of the sector. Over the long term, we continue to believe that the broader Energy sector, which is made up primarily of companies in the traditional fossil fuel supply chain, will face secular headwinds as advancements in transportation, as well as battery and storage technologies, make the transition from fossil fuels to renewable sources of energy increasingly compelling, both financially and environmentally.