UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

__________________________________

FORM 10-K

__________________________________

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2011

OR

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File No. 001-32594

______________________________________________

HEARTLAND PAYMENT SYSTEMS, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 22-3755714 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification Number) | |

90 Nassau Street, Princeton, New Jersey 08542

(Address of principal executive offices) (Zip Code)

(609) 683-3831

(Registrant’s telephone number, including area code)

____________________________________________________________

| Title of each class | Name of each exchange on which registered | |

| Common Stock, $0.001 par value | New York Stock Exchange | |

| (NONE) | ||

| (title of Class) | ||

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. o YES x NO

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. o YES x NO

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x YES o NO

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any,

every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). x YES o NO

Indicate by check mark if disclosure of delinquent filer pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | x | Accelerated filer | o | |||

| Non-accelerated filer | o (Do not check if a smaller reporting company) | Smaller reporting company | o | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). o YES x NO

The aggregate market value of the voting and non-voting common stock held by non-affiliates computed by reference to the price at which the common stock was last sold on the New York Stock Exchange on June 30, 2011 was approximately $775 million.

As of February 24, 2012, there were 38,901,939 shares of the registrant’s Common Stock, $0.001 par value, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Specifically identified portions of the registrant's definitive proxy statement to be filed with the Securities and Exchange Commission pursuant to Regulation 14A in connection with the 2012 annual meeting of shareholders are incorporated by reference into Part III of this Annual Report on Form 10-K for fiscal year ended December 31, 2011.

Heartland Payment Systems, Inc.

Annual Report on Form 10-K

For the Year Ended December 31, 2011

TABLE OF CONTENTS

| Page | ||

| Item 1. | ||

| Item 1A. | ||

| Item 1B. | ||

| Item 2. | ||

| Item 3. | ||

| Item 4. | MINE SAFETY DISCLOSURES | |

| Item 5. | ||

| Item 6. | ||

| Item 7. | ||

| Item 7A. | ||

| Item 8. | ||

| Item 9. | ||

| Item 9A. | ||

| Item 9B. | ||

| Item 10. | ||

| Item 11. | ||

| Item 12. | ||

| Item 13. | ||

| Item 14. | ||

| Item 15. | ||

FORWARD LOOKING STATEMENTS

Unless the context requires otherwise, references in this report to “the Company,” “we,” “us,” and “our” refer to

Heartland Payment Systems, Inc. and our subsidiaries.

Some of the information in this Annual Report on Form 10-K may contain forward‑looking statements that are based on our management's beliefs and assumptions and on information currently available to our management. Forward-looking statements include the information concerning our possible or assumed future results of operations, business strategies, financing plans, competitive position, industry environment, potential growth opportunities, the effects of future regulation and the effects of competition. Forward-looking statements include all statements that are not historical facts and can be identified by the use of forward-looking terminology such as the words “believe,” “expect,” “anticipate,” “intend,” “plan,” “estimate” or similar expressions.

Forward-looking statements involve risks, uncertainties and assumptions. Actual results may differ materially from those expressed in the forward-looking statements. You should understand that many important factors, in addition to those discussed elsewhere in this report, could cause our results to differ materially from those expressed in the forward-looking statements. Certain of these factors are described in Item 1A. Risk Factors and include, without limitation, our competitive environment, the business cycles and credit risks of our merchants, chargeback liability, merchant attrition, problems with our bank sponsor, our relationships with third-party bankcard payment processors, our inability to pass increased interchange fees along to our merchants, economic conditions, systems failures and government regulation.

PART I

ITEM 1. BUSINESS

Overview of Our Company

We were incorporated in Delaware in June 2000. Our headquarters are located at 90 Nassau Street, Princeton, NJ 08542, and our telephone number is (609) 683-3831.

Our primary business is to provide bankcard payment processing services to merchants in the United States and Canada. This involves facilitating the exchange of information and funds between merchants and cardholders' financial institutions, providing end-to-end electronic payment processing services to merchants, including merchant set-up and training, transaction authorization and electronic draft capture, clearing and settlement, merchant accounting, merchant assistance and support and risk management. Our merchant customers primarily fall into two categories; our core small and mid-sized merchants (referred to as "Small and Midsized Enterprises," or “SME merchants”) and Network Services' large national and mid-tier merchants, primarily in the petroleum industry (referred to as “Network Services Merchants”). We also provide additional services to our merchants, such as payroll processing, gift and loyalty programs, prepaid and stored-value solutions, and we sell and rent point-of-sale devices and supplies. In addition, we provide closed and open-loop payment solutions, and other transactional services to the college market, and in the past twelve months, we added K to 12 School Solutions, including school nutrition and point-of-sale solutions.

Bankcard Payment Processing

At December 31, 2011, we provided bankcard payment processing services to 171,801 active SME bankcard merchants located across the United States. This compares to 173,860 active SME bankcard merchants at December 31, 2010. At December 31, 2011, we provided bankcard payment processing services to 179 Network Services Merchants with approximately 54,826 locations. Our total bankcard processing volume for the year ended December 31, 2011 was $83.7 billion, an 11.7% increase from the $74.9 billion processed during the year ended December 31, 2010. Our 2011 SME bankcard processing volume was $67.5 billion, a 7.0% increase over $63.1 billion in 2010. Bankcard processing volume for 2011 includes $15.5 billion of settled volume for Network Services Merchants, compared to $11.3 billion for 2010. In addition to settling Visa and MasterCard transactions, Network Services processes a wide range of payment transactions for its predominantly petroleum customer base, including providing 2.7 billion transaction authorizations through its front-end card processing systems (primarily for Visa and MasterCard) in 2011 and 2.6 billion such transactions for the year ended December 31, 2010. We also provided bankcard processing services to approximately 10,287 merchants in Canada through our majority-owned Canadian subsidiary, Collective Point of Sale Solutions Ltd. (“CPOS”).

According to The Nilson Report, in 2010 we were the 5th largest card acquirer in the United States ranked by transaction count and the 8th largest acquirer by processed dollar volume, which consists of both credit and debit Visa and MasterCard transactions. These rankings represented 2.6 billion transactions and 4% of the total bankcard processing market, respectively. In 2011, 2010 and 2009, our bankcard processing dollar volume was $83.7 billion, $74.9 billion and $69.3 billion, respectively.

Our bankcard processing revenue from SME merchants is recurring in nature. We typically enter into three-year service contracts with our SME merchants that, in order to qualify for the agreed-upon pricing, require the achievement of agreed bankcard processing volume minimums from our merchants. Our SME gross bankcard processing revenue is driven by cardholders making purchases at our SME merchants using mostly Visa and MasterCard credit and signature-debit cards, but also American Express and Discover PIN debit cards. In December 2007, we signed a sales and servicing program agreement (“OnePoint”) with American Express Travel Related Services Company, Inc. (referred to as “American Express”) under which we sign up and service new merchants on behalf of American Express. In June 2008, we signed an agreement with DFS Services, LLC (referred to as “Discover”) to offer bankcard merchants a streamlined process that enables them to accept Discover Network cards on our processing platform.

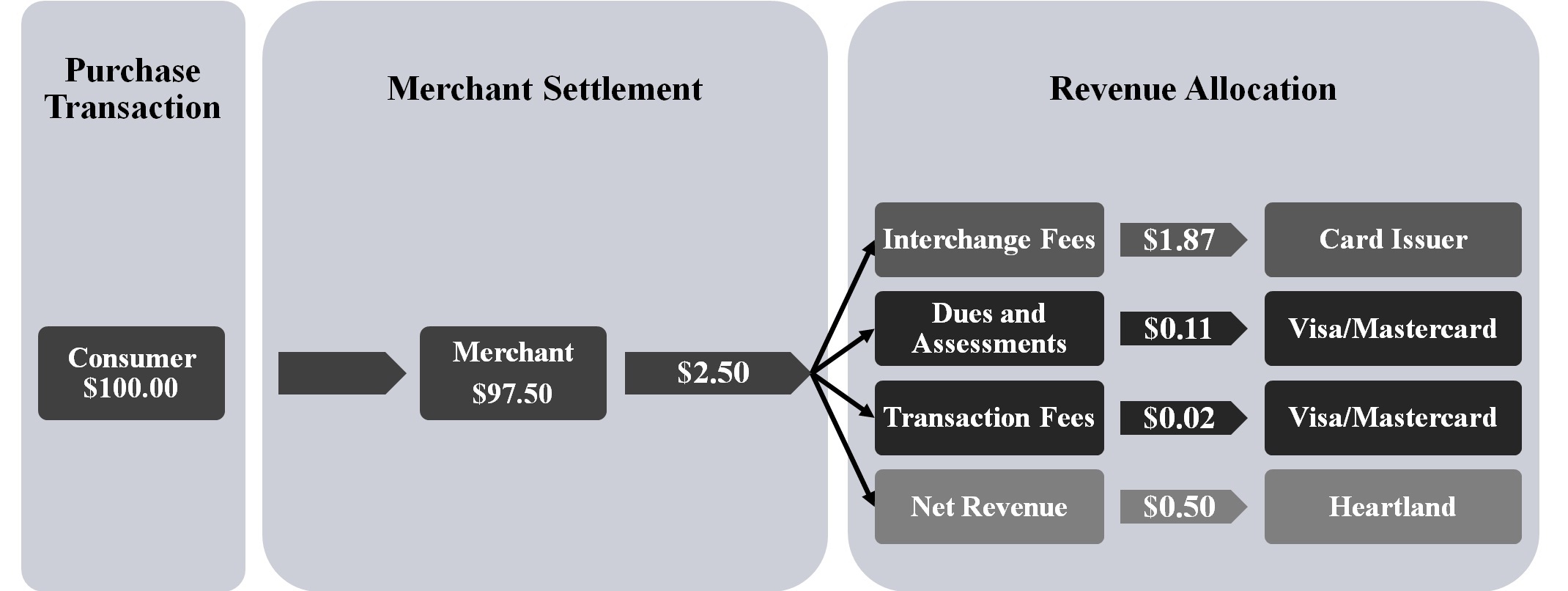

We generally benefit from consumers' increasing use of bankcards in place of cash and checks, and sales growth (if any) experienced by our retained SME merchants. Most of our SME revenue is from gross processing fees, which are primarily a combination of a percentage of the dollar amount of each card transaction we process plus a flat fee per transaction. We make mandatory payments of interchange fees to card issuing banks through card networks and dues, assessments and transaction authorization fees to Visa, MasterCard and Discover, and we retain the remainder as net revenue. For example, in a transaction using a Visa or MasterCard credit card, the allocation of funds resulting from a $100 transaction is depicted below.

1

Our bankcard processing revenue from our Network Services Merchants is also recurring in nature. We typically enter into five-year contracts with our large national merchants and three year contracts with our mid-tier merchants. However, in contrast to SME merchants, our processing revenues from Network Services Merchants generally consist of a flat fee per transaction and thus revenues are driven primarily by the number of transactions we process (whether settled, or only authorized), not bankcard processing volume.

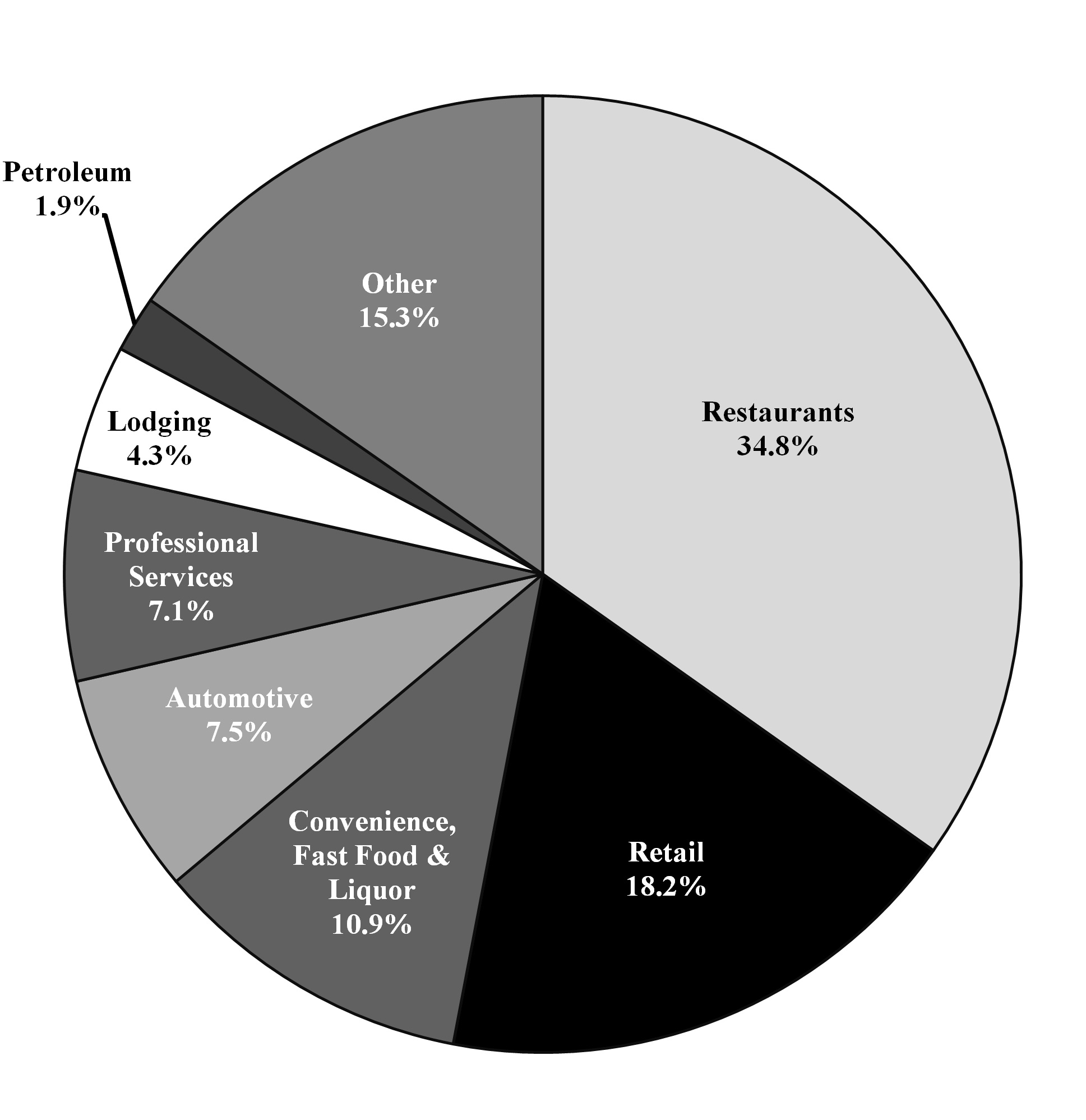

We sell and market our SME bankcard payment processing services through a nationwide direct sales force of 790 Relationship Managers and Territory Managers. We focus our sales efforts on low-risk bankcard merchants and have developed systems and procedures designed to minimize our exposure to potential merchant losses. In 2011, 2010 and 2009, we experienced merchant losses in amounts equal to 0.76 basis points (0.0076%), 1.44 basis points (0.0144%) and 1.01 basis points (0.0101%) of SME bankcard processing volume, respectively. The relatively higher loss rates in 2009 and 2010 tracked with overall deteriorating economic conditions in those years, which contributed to increased incidences of merchant fraud. We attribute the improved merchant loss rate in 2011 to the combination of a stronger economy and our improved credit monitoring. We have developed significant expertise in industries that we believe present relatively low risks as the customers are generally present and the products or services are generally delivered at the time the transaction is processed. These industries include restaurants, brick and mortar retailers, convenience and liquor stores, automotive sales, repair shops and gas stations, professional service providers, lodging establishments and others. As of December 31, 2011, approximately 26.3% of our SME bankcard merchants were restaurants, approximately 19.0% were brick and mortar retailers, approximately 11.5% were convenience and liquor stores, approximately 7.8% were automotive sales and repair shops, approximately 10.4% were professional service providers, approximately 3.4% were lodging establishments, and approximately 1.5% were gas stations.

We have developed a number of proprietary payment processing systems to increase our operating efficiencies and distribute our processing and merchant data to our three main constituencies: our merchant base, our sales force and our customer service staff. We provide authorization and data capture services to our SME merchants through our own front-end processing system, which we call HPS Exchange. We provide clearing, settlement and merchant accounting services through our own internally developed back-end processing system, which we call Passport. Our control over our front-end and back-end systems enables us to more effectively customize these services to the needs of our Relationship Managers and merchants. At December 31, 2011, our internally developed systems are providing substantially all aspects of a merchant's processing needs for most of our SME merchants. At December 31, 2011, our internal systems are providing all aspects of our Network Services Merchants' processing needs.

In addition to our core processing platforms, we are constantly innovating and developing new technologies to provide state-of-the-art payments solutions. Our End-to-End Encryption solution (known as E3™) was launched in May 2010 to protect sensitive card data as it moves through the merchant's network and our platforms, resulting in a more secure payments network. Approximately 20,000 small and mid-sized business owners across the country are now using E3-enabled terminals to protect their businesses and their customers.

In 2011, we launched our next generation of sales productivity tools we call atlas. atlas is revolutionizing the way our Relationship Managers interact with merchants by using mobile tablets to reduce paperwork, analyze pricing, and manage sales opportunities.

2

Payroll Processing Services

Through our wholly-owned subsidiary, Heartland Payroll Company, we operate a full-service nationwide payroll processing service, including check printing, direct deposit, related federal, state and local tax deposits and providing accounting documentation. We developed a new comprehensive payroll management system, which we refer to as PlusOne Payroll, that streamlines all aspects of the payroll process to enable time and cost savings. PlusOne Payroll was made available to new and existing customers beginning in 2010, and during 2011 we fully converted our existing payroll customers to PlusOne Payroll.

At December 31, 2011, 2010 and 2009, we processed payroll for 11,841, 11,131 and 9,382 customers, respectively. Our nationwide direct sales force sells our payroll processing services solely on a commission basis. In 2011, 2010 and 2009, we installed 3,723, 4,858 and 4,303 new payroll processing customers, respectively.

Other Products and Services

Other products and services which we offer, such as K to 12 School Solutions, Micropayment, Campus Solutions, and Loyalty and Heartland Gift Marketing, are discussed in “—Our Services and Products.”

Processing System Intrusion

On January 20, 2009, the we publicly announced the discovery of a criminal breach of our payment systems environment (the “Processing System Intrusion”). The Processing System Intrusion involved malicious software that appears to have been used to collect in-transit, unencrypted payment card data while it was being processed by us during the transaction authorization process. We believe the breach has been contained and did not extend beyond 2008.

Since our announcement of the Processing System Intrusion on January 20, 2009 and through December 31, 2011, we have expensed a total of $147.1 million, before reducing those charges by $31.2 million of total insurance recoveries. The majority of the total charges, or approximately $114.7 million, related to settlements of claims. Approximately $32.4 million of the total charges were for legal fees and costs we incurred for investigations, defending various claims and actions, remedial actions and crisis management services.

The following table summarizes our Provision for Processing System Intrusion, which we recorded for settlement accruals, legal fees and costs we incurred for defending various claims and actions associated with the Processing System Intrusion, and amounts we recovered from our insurance providers for the years ended December 31, 2011, 2010 and 2009:

| Year Ended December 31, | ||||||||||||

| 2011 | 2010 | 2009 | ||||||||||

| (in millions, except per share data) | ||||||||||||

| (Charges) for settlement accruals, legal fees and costs | $ | (1.0 | ) | $ | (13.1 | ) | $ | (132.9 | ) | |||

| Insurance recoveries | — | 27.2 | 4.0 | |||||||||

| (Provision for) recovery of processing system intrusion costs | $ | (1.0 | ) | $ | 14.1 | $ | (128.9 | ) | ||||

| Per share | $ | (0.02 | ) | $ | 0.22 | $ | (2.16 | ) | ||||

During the year ended December 31, 2010, we settled the following claims and disputes related to the Processing System Intrusion:

| • | On January 7, 2010, we entered into a settlement agreement with Heartland Bank, KeyBank National Association (“KeyBank,” and, together with Heartland Bank, the “Sponsor Banks”), and Visa U.S.A. Inc., Visa International Service Association and Visa Inc. (collectively, “Visa”) to resolve potential claims and other disputes among us, the Sponsor Banks and Visa with respect to the potential rights and claims of Visa and certain issuers of Visa-branded credit and debit cards related to the Processing System Intrusion (the “Visa Settlement Agreement”). After including a $780,000 credit for fines previously collected by Visa during 2009, the amount we paid under the Visa Settlement Agreement was $59.3 million. The costs of this settlement were included in our Provision for Processing System Intrusion on our Consolidated Statement of Operations for the year ended December 31, 2009 and in our Reserve for Processing System Intrusion on our Consolidated Balance Sheet as of December 31, 2009. Financial institutions representing more than 97 percent of eligible Visa-branded credit and debit cards have accepted the offers they received pursuant to the settlement entered into between and among the us, Visa, and the Sponsor Banks. |

3

On February 18, 2010, we entered into a bridge loan agreement (the “Bridge Loan Agreement”) with KeyBank, as administrative agent, and KeyBank and Heartland Bank as bridge lenders. On that date, KeyBank made a bridge loan to us in the amount of $20.0 million and Heartland Bank made a bridge loan in the amount of $8.0 million (collectively, the “Bridge Loan”). See Note 11, Credit Facilities for additional terms of the Bridge Loan.

On February 18, 2010, we also entered into a Commitment Increase Agreement pursuant to the Amended and Restated Credit Agreement dated as of May 30, 2008 (the “Commitment Increase Agreement”) whereby KeyBank, as one of the lenders under the Amended and Restated Credit Agreement, agreed to increase our revolving credit commitment to us under the Amended and Restated Credit Agreement by $25.0 million (the “Increased Credit Commitment”). See Note 11, Credit Facilities for additional terms of the Commitment Increase Agreement.

The proceeds of the Bridge Loan and the Increased Credit Commitment, together with a portion of our cash reserves, were used to fund the settlement with Visa. The Visa Settlement Agreement was consummated on February 18, 2010, with a payment of $58.6 million.

| • | On May 19, 2010, we entered into a settlement agreement with MasterCard Worldwide (“MasterCard”) to resolve potential claims and other disputes among us, the Sponsor Banks and MasterCard related to the Processing System Intrusion (the “MasterCard Settlement Agreement”). Under the MasterCard Settlement Agreement, alternative recovery offers totaling $41.4 million were made to eligible MasterCard issuers with respect to losses alleged to have been incurred by them as a result of the Processing System Intrusion. The $41.4 million included a $6.6 million credit for fines previously collected by MasterCard during 2009, so the maximum amount payable under the settlement was $34.8 million if all MasterCard issuers had accepted the settlement. On September 3, 2010 and September 14, 2010, we paid approximately $34.4 million because certain issuers did not accept settlement. Those issuers, who represent less than 1% of the accounts eligible for the settlement, have been preliminarily awarded $367,172 by MasterCard, and we are contesting that award. |

| • | On August 31, 2010, we entered into an agreement of settlement and release with DFS Services, LLC ("Discover") to resolve potential claims and other disputes among us and Discover (and its affiliates and certain of its issuers) with respect to the Processing System Intrusion (the “Discover Settlement Agreement”). On September 2, 2010, we paid Discover $5.0 million in full and final satisfaction of any and all claims of Discover, its affiliates and certain of its issuers arising from or relating to the Processing System Intrusion. The Discover Settlement Agreement contains mutual releases by and between us and Discover (on behalf of itself and its affiliates) relating to the Processing System Intrusion. |

During the year ended December 31, 2009, we settled the following claims and disputes related to the Processing System Intrusion:

| • | On December 17, 2009, we entered into a settlement agreement and release with American Express to resolve potential claims and other disputes among us and American Express (and its issuers) with respect to the Processing System Intrusion, and subsequently we paid approximately $3.5 million in full and final satisfaction of any and all claims of American Express and its issuers arising from or relating to the Processing System Intrusion (the "AMEX Settlement Agreement"). The AMEX Settlement Agreement contains mutual releases by and between us and American Express (on behalf of itself and its issuers) relating to the Processing System Intrusion. |

These settlement amounts were previously provided for in our Provision for Processing System Intrusion and carried in our Reserve for Processing System Intrusion. We do not consider it a reasonable possibility that losses exceeding the amounts already recognized on the matters subject to the settlement agreements will be incurred. With regard to the unsettled claims related to the Processing System Intrusion, which we describe in “—Item 3 Legal Proceedings,” we determined material losses in addition to those previously accrued are not considered reasonably possible on any such claim disclosed. We are prepared to vigorously defend ourselves against any unsettled claims relating to the Processing System Intrusion that have been asserted against us and our Sponsor Banks to date. We feel we have strong defenses to all the claims that have been asserted against us and our Sponsor Banks relating to the Processing System Intrusion.

Additional costs we expect to incur for legal fees and costs for defending the unsettled claims and actions associated with the Processing System Intrusion will be recognized as incurred. Such costs are not expected to be material to our results of operations, financial condition and cash flow.

4

Payment Processing Industry Overview

The payment processing industry provides merchants with credit, debit, gift and loyalty card and other payment processing services, along with related information services. The industry continues to grow as a result of wider merchant acceptance, increased consumer use of bankcards and advances in payment processing and telecommunications technology. According to The Nilson Report, total expenditures for all card type transactions by U.S. consumers were $3.3 trillion in 2010, and are expected to grow to $5.2 trillion by 2015, representing a compound annual growth rate of 9.9%. The proliferation of bankcards has made the acceptance of bankcard payments a virtual necessity for many businesses, regardless of size, in order to remain competitive. This use of bankcards, enhanced technology initiatives, efficiencies derived from economies of scale and the availability of more sophisticated products and services to all market segments has led to a highly competitive and specialized industry.

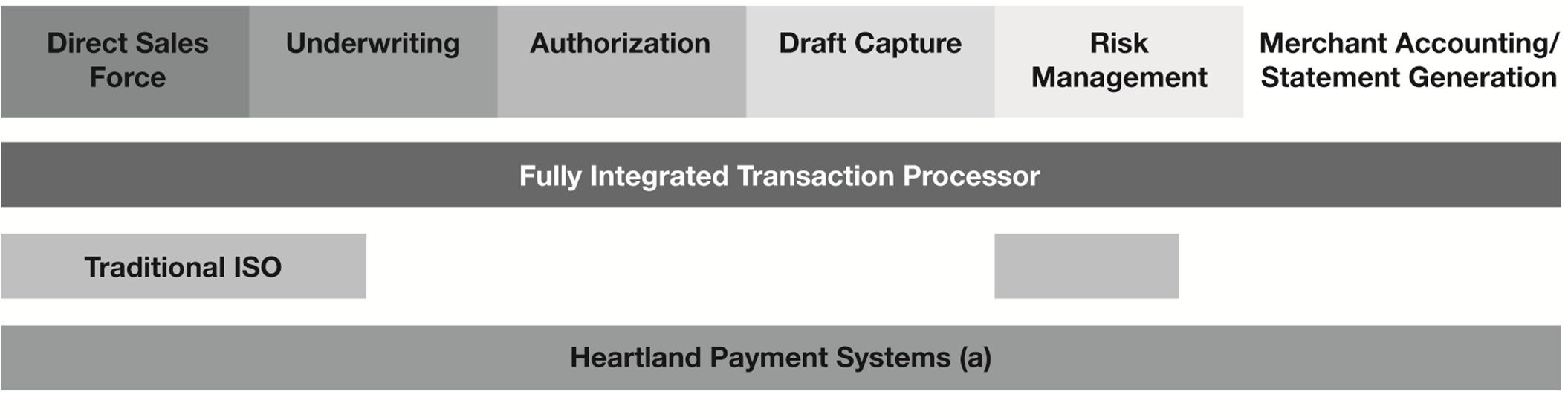

Segmentation of Merchant Service Providers

The payment processing industry is dominated by a small number of large, fully-integrated payment processors that sell directly to, and handle the processing needs of, the nation's largest merchants. Large national merchants (i.e., those with multiple locations and high volumes of bankcard transactions) typically demand and receive the full range of payment processing services at low per-transaction costs.

Payment processing services are generally sold to the SME merchant market segment through banks and Independent Sales Organizations that generally procure most of the payment processing services they offer from large payment processors. It is difficult, however, for banks and Independent Sales Organizations to customize payment processing services for the SME merchant on a cost-effective basis or to provide sophisticated value-added services. Accordingly, services to the SME merchant market segment historically have been characterized by basic payment processing without the availability of the more customized and sophisticated processing, information-based services or customer service that is offered to large merchants. The continued growth in bankcard transactions is expected to cause SME merchants to increasingly value sophisticated payment processing and information services similar to those provided to large merchants.

The following table sets forth the typical range of services provided directly (in contrast to using outsourced providers) by fully integrated transaction processors, traditional Independent Sales Organizations and us.

(a) HPS Exchange: 93% of our SME merchant bankcard transactions

Passport: 99% of our SME merchants

We believe that the card-based payment processing industry will continue to benefit from the following trends:

Growth in Card Transactions

The proliferation in the uses and types of cards, including in particular debit and prepaid cards, the rapid growth of the Internet, significant technological advances in payment processing and financial incentives offered by issuers have contributed greatly to wider merchant acceptance and increased consumer use of such cards.

Technology

At present, many large payment processors provide customer service and applications via legacy systems that are difficult and costly to alter or otherwise customize. In contrast to these systems, recent advances in mobile and cloud computing provide payment processors with the opportunity to deploy less costly technology that has improved flexibility and

5

responsiveness. In addition, the dramatic increase in merchants' use of the Internet to process their transactions further enhances the ability of payment processors to provide faster and more reliable service at lower per-transaction costs than previously possible.

Advances in personal computers, mobile technology, and point-of-sale terminal technology, including integrated cash registers and networked systems, have increasingly allowed access to a greater array of sophisticated services at the point of sale and have contributed to the demand for such services. These trends have created the opportunity for payment processors to leverage technology by developing business management and other software application products and services.

Our Competitive Strengths

We believe our competitive strengths related to Bankcard Payment Processing, particularly SME, include the following:

Large, Experienced, Efficient, Direct Sales Force

We sell and market our SME bankcard payment processing services through a nationwide direct sales force of 790 Relationship Managers and Territory Managers who work exclusively for us. Many of our competitors rely on Independent Sales Organizations that often generate merchant accounts for multiple payment processing companies simultaneously. Our sales professionals have local merchant relationships and industry-specific knowledge that allow them to effectively compete for merchants; these relationships are also supported by our 114 Account Managers, who are focused on installing new merchants and responding to any ongoing servicing needs. We compensate our sales force primarily through commissions, which are based upon the performance of their SME merchant accounts. Our sales professionals have considerable latitude in pricing a new account, but we believe that the shared economics motivate them to sign attractively priced contracts with SME merchants generating significant bankcard processing volume. The residual commissions our sales force receives from their SME merchant accounts give them an incentive to maintain a continuing dialogue and servicing presence with their SME merchants. We believe that our compensation structure is atypical in our industry and contributes to building profitable, long-term relationships with our SME merchants. In 2011, our sales force generated approximately 44,960 SME bankcard merchant applications and installed approximately 39,700 new SME bankcard merchants.

Recurring and Predictable Revenue

We generate recurring revenue through our payment processing services. Our revenue is recurring in nature because we typically enter into multi-year service contracts with our SME and Network Services Merchants. Our recurring revenue grows as the number of transactions or dollar volume processed for an SME merchant increases or as we add new SME merchants. In 2011, approximately 92% of our SME bankcard processing volume came from merchants we installed in 2010 and earlier.

Internal Growth

We grew our SME payment processing business exclusively through internal expansion by generating new SME merchant contracts submitted by our own direct sales force. Substantially all of our SME merchants were originally underwritten by our staff, and we have substantial experience responding to the SME merchants' processing needs and the risks associated with them. We believe this practice both enhances our SME merchant retention and reduces our risks. We believe that internally generated SME merchant contracts generally are of a higher quality and are more predictable than contracts acquired from third parties, and the costs associated with such contracts generally are lower than the costs associated with contracts acquired from third parties.

While we continue to pursue internal growth, we have selectively taken advantage of acquisition opportunities, for example Network Services in 2008, and continue to expand into other markets that we previously did not have the technical capabilities to support. See “—Our Strategy — Pursue Strategic Acquisitions” and “—Our Services and Products” later in this section for descriptions of these acquisitions.

Strong Position and Substantial Experience in Our Target Markets

As of December 31, 2011, we were providing payment processing services to 171,801 active SME merchants located across the United States. We believe our understanding of the needs of SME merchants and the risks inherent in doing business with them, combined with our efficient direct sales force, provides us with a competitive advantage over larger service

6

providers that access this market segment indirectly. We also believe that we have a competitive advantage over service providers of a similar or smaller size that may lack our extensive experience and resources, and so do not benefit from the economies of scale that we have achieved.

Also at December 31, 2011, we provided bankcard payment processing services to approximately 179 Network Services Merchants with approximately 54,826 locations. These Network Services Merchants are primarily in the petroleum industry. We believe that our understanding of the processing needs of petroleum merchants and the products we offer them provides us with a competitive advantage.

Industry Expertise

Historically, we have focused our sales efforts on SME merchants who have certain key attributes and on industries in which we believe our direct sales model is most effective and the risks associated with bankcard processing are relatively low. These attributes include owners who are typically on location, interact with customers in person, value a local sales and servicing presence and often consult with trade associations and other civic groups to help make purchasing decisions.

To further promote our products and services, we have entered into referral arrangements with various trade associations, with an emphasis on state restaurant and hospitality groups. We believe that these partnerships have enabled us to gain exposure and credibility within the restaurant industry and have provided us with opportunities to market our products to new merchants. On January 19, 2010, we formed a strategic partnership with The National Restaurant Association to foster our delivery of a unified payments processing platform to the restaurant industry. This alliance has provided restaurateurs nationwide with effective tools, solutions and resources that help them reduce their expenses, improve operations and increase profitability all from one source with integrated technology product platforms.

In December 2011, the restaurant industry represented approximately 34.8% of our SME bankcard processing volume and 49.7% of our SME transactions, consistent with prior years. We believe that the restaurant industry will remain an area of focus, though its growth will likely approximate the growth in the overall portfolio. Restaurants represent an attractive segment for us: according to a report by the National Restaurant Association, restaurant industry sales are expected to reach approximately $631.8 billion in 2012, which would represent a 3.5% increase over projected industry sales for 2011 and the twentieth consecutive year of growth. The projected restaurant industry growth for 2012 is in spite of a challenging economy and this steady growth profile, combined with the industry's low seasonality, makes restaurant merchant bankcard processing volume very stable and predictable. In addition, the incidence of chargebacks is very low among restaurants, as the service typically is provided before the card is used. Our industry focus not only differentiates us from other payment processors, but also allows us to forge relationships with key trade associations that attract merchants to our business. Our industry focus also allows us to better understand a merchant's needs and tailor our services accordingly.

Although we have historically focused significant sales and marketing efforts on the restaurant industry, our SME merchant base also includes a broad range of brick and mortar retailers, lodging establishments, automotive repair shops, convenience and liquor stores, professional service providers, and gas stations. See “—Our Merchant Base” for detail on December 2011 bankcard processing volume by merchant category.

Our historical focus on SME merchants has diversified our merchant portfolio and we believe has reduced the risks associated with revenue concentration. In 2011, no single SME merchant represented more than 1.02% of our total bankcard processing volume, consistent with prior years.

Our Network Services business has further diversified our total merchant portfolio adding a substantial base of large national merchants, primarily in the petroleum industry.

Merchant Focused Culture

We have built a corporate culture and established practices that we believe improve the quality of services and products we provide to our merchants. We developed and endorsed The Merchant Bill of Rights, an advocacy initiative that details ten principles we believe should characterize all merchants' processing relationships. The Merchant Bill of Rights allows our sales team to differentiate our approach to bankcard processing from alternative approaches, and we believe that a focus on these principles by our merchants will enhance our merchant relationships. We believe that our culture and practices allow us to maintain strong merchant relationships and differentiate ourselves from our competitors in obtaining new merchants.

Our merchant-focused culture spans from our sales force, which maintains a local market presence to provide rapid,

7

personalized customer service, through our service center, which is segmented into regional teams to optimize responsiveness, and to our technology organization, which has developed a customer management interface and information system that alerts our Relationship Managers to any problems a merchant has reported and provides them with detailed information on the merchants in their portfolio. Additionally, we believe that we are one of the few companies that discloses our pricing to SME merchants. We think this approach contributes substantially to building long-term merchant relationships.

Scalable Operating Structure

Our scalable operating structure generally allows us to expand our operations without proportionally increasing our fixed and semi-fixed support costs. In addition, our technology platform, including both HPS Exchange and Passport, was designed with the flexibility to support significant growth and drive economies of scale with relatively low incremental costs. Most of our operating costs are related to the number of individuals we employ. We have in the past used, and expect in the future to use, technology to leverage our personnel, which should cause our personnel costs to increase at a slower rate than our bankcard processing volume.

Advanced Technology

We employ information technology systems which use the Internet to improve management reporting, enrollment processes, customer service, sales management, productivity, merchant reporting and problem resolution. We believe that these systems help attract both new merchants and Relationship Managers and provide us with a competitive advantage over many of our competitors who rely on less flexible legacy systems.

We provide authorization and data capture services to our SME merchants through our internally-developed front-end processing system, HPS Exchange. This system incorporates real time reporting tools through interactive point-of-sale database maintenance via the Internet. These tools enable merchants, and our employees, to change the messages on credit card receipts and to view sale and return transactions entered into the point-of-sale device with a few second delay on any computer linked to the Internet. During the years ended December 31, 2011, 2010 and 2009, approximately 93%, 90% and 88%, respectively, of our SME transactions were processed through HPS Exchange.

We provide clearing, settlement and merchant accounting services through our own internally developed back-end processing system, Passport. Passport enables us to customize these services to the needs of our Relationship Managers and merchants. At both December 31, 2011 and 2010, approximately 99% of total SME bankcard merchants were processing on Passport. In the fourth quarter of 2010, the clearing, settlement and merchant accounting services for Network Services' settled transactions were converted onto Passport. At December 31, 2011 and 2010, our internally developed systems have been providing substantially all aspects of a merchant's processing needs for most of our SME merchants and all of our Network Services Merchants' processing needs.

We actively leverage the latest advances in technology to provide the best payments experience for merchants with reliability levels that we believe exceed industry norms. In 2011, we enabled our first cloud computing datacenter and consolidated several legacy data centers. This consolidation reduced processing costs while giving us even more flexibility, scalability, leverage and availability for our front-end processing, back-end processing, and other products.

Comprehensive Underwriting and Risk Management System

Through our experience in assessing risks associated with providing payment processing services to SME merchants, we have developed procedures and systems that provide risk management and fraud prevention solutions designed to minimize losses. Our underwriting processes help us to evaluate merchant applications and balance the risks of accepting a merchant against the benefit of the bankcard processing volume we anticipate the merchant will generate. We believe our systems and procedures enable us to identify potentially fraudulent activity and other questionable business practices quickly, thereby minimizing both our losses and those of our merchants. As evidence of our ability to manage these risks, and notwithstanding the challenging economic environment faced by our SME merchants in recent years, in 2011, 2010 and 2009 we experienced SME merchant losses in amounts equal to 0.76 basis points, 1.44 basis points and 1.01 basis points of SME bankcard processing volume, respectively. The 2009 and 2010 year-over-year increases in our merchant losses tracked the overall deteriorating economic conditions in those years, which contributed to increased incidences of merchant fraud.

8

Our Strategy

Our current growth strategy is to increase our market share as a provider of payment processing services to merchants in the United States and Canada. We believe that the forecasted increase in the use of bankcards as a payment method, combined with our sales and marketing approaches, will continue to present us with significant growth opportunities. Additionally, we intend to continue growing our payroll processing business, and enhance our other products such as K to 12 School Solutions, Micro Payments, Campus Solutions, and Loyalty and Heartland Gift Marketing. Key elements of our strategy include:

Expand Our Direct Sales Force

Unlike many of our competitors who rely on Independent Sales Organizations or salaried salespeople and telemarketers, we have built a direct, commission-only sales force. Our sales model divides the United States into 11 primary geographic regions overseen by Regional Directors. The Regional Directors are primarily responsible for hiring Relationship Managers and increasing the number of installed merchants in their territory.

Historically, we compensated our sales managers based on their success in growing the sales force and increasing the total SME merchant base in their regions. Prior to the economic downturn, increases in our direct sales force, including our Relationship Managers, had led to significant growth in the total SME merchants for which we process and the gross margin generated by those merchants. However, during the third quarter of 2010, we refocused our sales organization toward improving individual sales persons' productivity, and so we reduced our Relationship Manager count, but at the same time, more fully engaged our Territory Managers in the sales process by requiring them to achieve individual minimum monthly gross margin install targets. Combining our Relationship Managers and Territory Managers gives us a count of 790 at December 31, 2011, compared to 917 at December 31, 2010 and 1,069 at December 31, 2009. We anticipate renewed growth in our sales force in the next few years in order to increase our share of our target markets, while maintaining the enhanced sales productivity levels of recent quarters.

Further Penetrate Existing SME Bankcard Target Markets and Enter Into New Markets

We believe that we have an opportunity to grow our business by further penetrating the SME market through our direct sales force and alliances with local trade organizations, banks and value-added resellers. We believe that our sales model, combined with our community-based strategy that involves our Relationship Managers building relationships with various trade groups and other associations in their territory, will enable our Relationship Managers to continuously add new merchants. We intend to further expand our bankcard processing sales efforts into new target markets with relatively low risk characteristics, including markets that have not traditionally accepted electronic payment methods. These markets include governments, schools and the business-to-business market.

Expand Our Services and Product Offerings

We have focused on offering a broad set of payment-related products to our customers. In addition to our bankcard processing services, our current product offerings include payroll processing, K to 12 School Solutions, Micropayments, Campus Solutions, and Loyalty and Heartland Gift Marketing. See “— Our Services and Products” for descriptions of these services. In 2010 and 2011 in a series of four acquisitions, we added K to 12 School Solutions to our product set, expanding our customer base by offering school nutrition and point-of-sale solutions, including Internet payment capability, to a wide base of schools, students and their parents (see “— Our Services and Products —K to 12 School Solutions” for more information).

We also distribute products that will help our merchants reduce their costs and grow their businesses, such as SmartLink. SmartLink is our state of the art technology for consolidating multiple in-store devices onto a single lower-cost, high-speed broadband circuit. SmartLink transmits both transactional data as well as integral back-office information. It streamlines networked services, reduces costs and enhances operational efficiency for our merchants.

We may develop new products and services internally, enter into arrangements with third-party providers of these products or selectively acquire new technology and products. Many of these new service offerings are designed to work on the same point-of-sale devices that are currently in use, enabling merchants to purchase a greater volume of their services from us and eliminating their need to purchase additional hardware. We believe that these new products and services will enable us to leverage our existing infrastructure and create opportunities to cross-sell our products and services among our various merchant bases, as well as enhance merchant retention and increase processing revenue.

9

Leverage Our Technology

We intend to continue leveraging our technology platforms to increase operating efficiencies and provide real-time processing and data to our merchants, sales force and customer service staff. Since our inception, we have been developing Internet-based systems to improve and streamline our information systems, including customer-use reporting, management reporting, enrollment, customer service, sales management and risk management reporting tools. We continually develop enriched back office solutions which allow merchants to integrate their payment processing data into any of the major small business accounting software packages, and remain on the leading edge of the merchant marketplace. We continue to make material investments in our payment processing capabilities, which allows us to offer a differentiated payment processing product that is faster, less expensive, and more comprehensive than competing products.

Enhance Merchant Retention

By providing our merchants with a consistently high level of service and support, we strive to enhance merchant retention. We recognize that our ability to maintain strong merchant relationships is important to not only maintaining our recurring revenues, but to our growth. We believe that our practice of fully disclosing our pricing policies to our merchants creates goodwill. We developed and endorsed The Merchant Bill of Rights, an advocacy initiative that details ten principles we believe should characterize all merchants' processing relationships.

We have passed on to our merchants the benefits of reductions in debit interchange rates mandated by the “Durbin Amendment,” which was part of the July 2010 Dodd-Frank Wall Street Reform and Consumer Protection Act and went into effect on October 1, 2011. The Durbin Amendment places limits on debit card interchange rates that card issuing banks with assets in excess of $10 billion may charge. We believe that the Merchant Bill of Rights and our approach to passing along the benefits of the Durbin Amendment to our merchants allows our sales force to differentiate our approach to bankcard processing from alternative approaches, and we believe that a focus on these principles by our merchants will enhance our merchant relationships.

We have developed a customer management interface that alerts our Relationship Managers and Account Managers to any problems an SME merchant has reported and provides them with detailed information on the merchants in their portfolio. In addition, we believe that our flexible back-end processing platform, Passport, allows us to tailor our services to the needs of our sales force and merchants, which we believe will further enhance merchant retention. Passport's flexibility allows us to enhance the information available to our merchants, and to offer new services to them.

Pursue Strategic Acquisitions

Although we intend to continue to pursue growth through the efforts of our direct sales force, we may also expand our merchant base or gain access to other target markets by acquiring complementary businesses, products or technologies, including other providers of payment processing. Our 2006 acquisition of Debitek, Inc. and 2007 acquisition of General Meters Corp, are examples of expanding by acquiring complementary businesses. In 2008, we acquired CPOS, a Canadian provider of payment processing services and secure point-of-sale solutions, that provided us with an entrance into the Canadian credit and debit card processing market. In 2008, we also acquired Network Services which handles a wide range of payment transactions for its predominantly petroleum customer base. Our acquisition of Chockstone in 2008 provided for expansion into the loyalty marketing and gift card solutions market.

On December 30, 2010, we purchased the K to 12 School Solutions business previously operated by Lunchbox. Lunchbox provided an initial customer base of approximately 4,400 schools. Lunchbox was the first of four acquisitions we made in the K to 12 School Solutions business. K to 12 School Solutions develops, manufactures, sells and services and maintains computer software designed to facilitate accounting and management functions of food service operations of schools. On January 12, 2011, February 4, 2011 and September 30, 2011, we acquired the K to 12 School Solutions businesses of Comalex, Inc., mySchoolBucks, LLC, and School-Link Technologies, Inc, respectively. Comalex, mySchoolBucks and School-Link added approximately 3,700, 900 and 10,000 schools, respectively, to our K to 12 School Solutions product. These acquisitions have given us an almost 20% market share in this industry and enable us to offer school nutrition and point-of-sale solutions, including Internet payment capability enabling on-line deposits of funds into student accounts, to over 19,000 public and private schools.

10

Our Services and Products

SME Merchant Bankcard Payment Processing

We derive the majority of our SME processing revenues from fee income relating to Visa and MasterCard payment processing, which is primarily comprised of a percentage of the dollar amount of each transaction we process, as well as a flat fee per transaction. The percentage we charge is typically a fixed margin over interchange, which is the percentage set by Visa and MasterCard depending on the type of card used and the way the transaction is handled by the merchant. On average, the gross revenue we generate from processing a Visa or MasterCard transaction equals approximately $2.50 for every $100 we process. We also receive fees from American Express, Discover, and JCB for facilitating their transactions with our SME merchants. Our American Express agreement includes a compensation model which provides us percentage-based residual on the American Express volume we process, plus fees for every transaction we process. Under our agreement with Discover, our revenue model is similar to our Visa and MasterCard models.

We receive revenues as compensation for providing bankcard payment processing services to merchants, including merchant set-up and training, transaction authorization and electronic draft capture, clearing and settlement, merchant accounting, merchant support and chargeback resolution. In 2005, we began providing clearing, settlement and accounting services through Passport, our own internally developed back-end processing system. Passport enables us to customize these services to the needs of our Relationship Managers and merchants. At December 31, 2011 and 2010, approximately 99% of our SME bankcard merchants were processing on Passport. In addition, we sell and rent point-of-sale devices and supplies and provide additional services to our merchants, such as gift and loyalty programs, paper check authorization and chargeback processing. These payment-related services and products are described in more detail below:

Merchant Set-up and Training— After we establish a contract with a merchant, we create the software configuration that is downloaded to the merchant's existing, newly purchased or rented point-of-sale terminal, cash register or computer. This configuration includes the merchant identification number, which allows the merchant to accept Visa and MasterCard as well as any other cards, such as American Express, Discover and JCB, provided for in the contract. The configuration might also accommodate check verification, gift and loyalty programs and allow the terminal or computer to communicate with a pin-pad or other device. Once the download has been completed by the Relationship Manager or Account Manager, we conduct a training session on use of the system. We also offer our merchants flexible low-cost financing options for point-of-sale terminals, including installment sale and monthly rental programs.

Authorization and Draft Capture— We provide electronic payment authorization and draft capture services for all major bankcards. Authorization generally involves approving a cardholder's purchase at the point of sale after verifying that the bankcard is not lost or stolen and that the purchase amount is within the cardholder's credit or account limit. The electronic authorization process for a bankcard transaction begins when the merchant “swipes” the card through its point-of-sale terminal and enters the dollar amount of the purchase. After capturing the data, the point-of-sale terminal transmits the authorization request through HPS Exchange or the third-party processor to the card-issuing bank for authorization. The transaction is approved or declined by the card-issuing bank and the response is transmitted back through HPS Exchange or the third-party processor to the merchant. At the end of each day, and, in certain cases, more frequently, the merchant will “batch out” a group of authorized transactions, transmitting them through us to the bankcard networks for payment.

We introduced HPS Exchange, our internally developed front-end processing system, in August 2001. During the years ended December 31, 2011, 2010 and 2009, approximately 93%, 90% and 88%, respectively, of our SME transactions were processed through HPS Exchange. The remainder of our front-end processing is outsourced to third-party processors, primarily TSYS Acquiring Solutions. Although we will continue to install new SME merchants on TSYS' systems, we anticipate that the percentage of SME transactions that are outsourced will continue to decline as we install a high percentage of new merchants on HPS Exchange. Additionally, in the fourth quarter of 2010 we sold many of our remaining merchant accounts that had not been converted onto HPS Exchange and were still processing on third party front-end platforms other than TSYS. The sale's purpose was to eliminate servicing inefficiencies associated with these merchant accounts.

Clearing and Settlement— Clearing and settlement processes, along with Merchant Accounting, represent the “back-end” of a transaction. Once a transaction has been “batched out” for payment, the payment processor transfers the merchant data to Visa or MasterCard who then collect funds from the card issuing banks. This is typically referred to as “clearing.” After a transaction has been cleared, the transaction is “settled” by Visa or MasterCard by payment of funds to the payment processor's sponsor bank the next day. The payment processor creates an electronic payment file in ACH format for that day's cleared activity and sends the ACH file to its sponsor bank. The ACH payments system generates a credit to the merchants' bank accounts for the

11

value of the file. The merchant thereby receives payment for the value of the purchased goods or services, generally two business days after the sale. Under the terms of the agreements with American Express and Discover, the process is substantially similar to the Visa and MasterCard process, and the merchant receives one deposit for all cards accepted, in contrast to the previously existing arrangement, where an acceptor of Visa and MasterCard, American Express and Discover would have received three deposits.

Passport, our internally developed back-end system, enables us to customize these services to the needs of our merchants and Relationship Managers. For example, in 2011 we launched Optimized Funding for SME merchants. Optimized Funding allows for our merchants to get paid for their transactions faster than they would previously and compliments our Next Day Funding relationships with certain banks.

Merchant Accounting— Utilizing Passport, we organize our SME merchants' transaction data into various files for merchant accounting and billing purposes. We send our SME merchants detailed monthly statements itemizing daily deposits and fees, and summarizing activity by bankcard type. These detailed statements allow our SME merchants to monitor sales performance, control expenses, disseminate information and track profitability. We also provide information related to exception item processing and various other items of information, such as volume, discounts, chargebacks, interchange qualification levels and funds held for reserves to help them track their account activity. SME merchants may access this archived information through our customer service representatives or online through our Internet-based customer service reporting system.

Merchant Support Services— We provide merchants with ongoing service and support for their processing needs. Customer service and support includes answering billing questions, responding to requests for supplies, resolving failed payment transactions, troubleshooting and repair of equipment, educating merchants on Visa and MasterCard compliance and assisting merchants with pricing changes and purchases of additional products and services. We maintain a toll-free help-line 24 hours a day, seven days a week, which is staffed by our customer service representatives and, during 2011, answered an average of approximately 137,000 customer calls per month. The information access and retrieval capabilities of our intranet-based systems provide our customer service representatives prompt access to merchant account information and call history. This data allows them to quickly respond to inquiries relating to fees, charges and funding of accounts, as well as technical issues.

Chargeback Services— In the event of a billing dispute between a cardholder and a merchant, we assist the merchant in investigating and resolving the dispute as quickly and accurately as possible with card issuers and the bankcard networks, ensuring that the merchant is adequately represented under the bankcard network rules. We immediately notify the merchant and pass through a debit to the merchant's account for the chargeback. For Visa and MasterCard, the merchant is reimbursed as soon as they provide us with a valid response, as the act of representing the items allows us to reclaim the funds. Under American Express and Discover rules, the funds are reimbursed to us, and to the merchant, as soon as the case is resolved in the merchant's favor. After a merchant incurs three chargebacks per anniversary year, we typically charge our merchants a $25 fee for each subsequent chargeback they incur.

Network Services Merchant Bankcard Payment Processing

Network Services is a provider of payment processing solutions, serving large national merchants in a variety of industries such as petroleum, convenience store, parking and retail. More recently, we have added mid-tier petroleum merchants to our Network Services' merchant base and have made SmartLink available to our merchants. Services include payment processing, prepaid services, POS terminals, helpdesk services and merchant bankcard services. In addition to Visa and MasterCard transactions, Network Services handles a wide range of payment transactions for its predominantly petroleum customer base. SmartLink is our platform for consolidating multiple in-store devices onto a single lower-cost, high-speed broadband circuit. SmartLink transmits both transactional data as well as integral back-office information. It streamlines networked services, reduces costs and enhances operational efficiency for our merchants.

Our bankcard processing revenue from Network Services Merchants is recurring in nature. In contrast to SME merchants, our processing revenues from Network Services Merchants generally consist of a flat fee per transaction and thus are primarily driven by the number of transactions we process (whether settled, or only authorized), not processing volume.

Authorization and Draft Capture— Network Services provides electronic payment authorization and draft capture for all major bankcards, client private label cards and fleet cards. Authorization generally involves approving a cardholder's purchase at the point of sale after verifying that the purchase amount is within the cardholder's credit or account limit and that the card is not lost or stolen. The electronic authorization process for a card transaction begins when the merchant “swipes” the card through its point-of-sale terminal and enters the dollar amount of the purchase. Network Services offers two front-end processing hosts,

12

VAPS and NWS. After capturing the data, the point-of-sale terminal transmits the authorization request through the VAPS or NWS host to the card-issuing entity for authorization. The transaction is approved or declined by the card-issuing entity and the response is transmitted back through the VAPS or NWS host or the third-party processor to the merchant. At the end of each day, and, in certain cases, more frequently, the merchant will “batch out” a group of authorized transactions, transmitting them through us to the bankcard networks for payment.

VAPS and NWS provide distinct functionality and processing options for our large corporate customers. These hosts provide efficient transaction payment processing and real-time authorizations using fully redundant routing paths. Our Network Services Merchants can rely on quick response times and high availability. We maintain two redundant data centers for our Network Services Merchant transaction processing. If one site fails, the other site is capable of supporting 100% of the workload so this assures uninterrupted transaction processing. Each data center maintains direct connections to Visa, MasterCard, Discover, Fiserv and American Express. The Fiserv connection is our gateway for PIN debit and EBT processing.

Clearing and Settlement— Clearing and settlement processes represent the “back-end” of a transaction. Once a transaction has been “batched out” for payment, we transfer the completed transaction detail file to our Passport back-end processing system for clearing and settlement. During the “clearing” process, the transaction detail is split out and sent to Visa or MasterCard who then collect funds from the card issuing banks. After a transaction has been cleared, the transaction is “settled” by Visa or MasterCard by payment of funds to our sponsor bank the next day. We then create either electronic payment files for wire or ACH for that day's cleared activity and send the files to our sponsor bank. The payments system generates a wire or credit to the merchants' bank accounts for the value of the file.

We provide deposit information to our Network Services settlement merchants each day via our Internet-based settlement reporting system. Deposits are broken out by card type and show gross sales, less chargebacks, interchange, and miscellaneous adjustments.

Merchant Boarding— The Merchant Support area supports new site setup requests, changes to existing locations, and any deletions. In addition, we provide Network Services Merchants with a web-based system, Prometheus, that allows merchants to manage their sites' data in the mainframe database after their initial setup has been completed. The benefits of Prometheus include reducing complexity, decreasing delay in boarding, allowing merchants to control their data entry, and minimizing the learning curve and data entry. The only requirements are Windows and a user ID. Boarding merchants using Prometheus access allows direct connect into Prometheus through a network connection.

Merchant Reporting—Merchants interested in flexible reporting alternatives have been provided with InfoCentral, an information database. InfoCentral is an architecture that consists of various technologies, which include relational and multi-dimensional databases and user reporting tools. Other than a suitable web browser, no additional software is required to access InfoCentral. Users can access InfoCentral from any location anywhere and at any time from any PC that has access to the Internet. Heartland InfoCentral Reporting allows the users to view their back-end settlement reporting to include funding, interchange qualifications, fees and disputes. These reports are viewable at the client and location level. Some merchants choose to receive a Daily Activity File (DAF), and Daily Dispute File (DDF) to import into their accounting systems.

Help Desk Services— The large national merchant Help Desk manages merchant trouble ticket initiation, escalation and resolution. The Help Desk also provides vendor and technician support, password resets, supply order servicing, and assists with special projects.

Our Help Desk's operating philosophy focuses on providing the highest level of quality support to our customers. To provide this high level of support, we train our Help Desk agents to focus on resolving the caller's issue or concern during the first call. As a result, our agents are not limited by restrictive and unproductive talk time limits so that they can focus on delivering a working solution to the caller. Our merchant Help Desk is open 24 hours a day, seven days a week with full Help Desk support.

The Help Desk provides three possible levels of support on all point-of-sale (“POS”) solutions that are certified to process on our network:

| • | 1st level support includes full support of all of the POS functions, downloading of the POS, and replacement of the POS (when applicable), as well as all of the support functions provided at 2nd and 3rd level. |

| • | 2nd level support includes full support of the communication between the POS and our network and minor support of the POS functions, mostly limited to those functions related to communication or network identification, as well as any support provided at 3rd level. |

| • | 3rd level support includes research and analysis of data being sent by the POS to our network. |

13

Chargeback Services— In the event of a billing dispute between a cardholder and a merchant, we assist the merchant in investigating and resolving the dispute as quickly and accurately as possible with card issuers and the bankcard networks, ensuring that the merchant is adequately represented under the bankcard network rules. We provide detailed online reporting to help our Network Services Merchants manage chargebacks received from Visa, MasterCard and Discover.

Collective Point of Sale Solutions Ltd.

In March 2008, we acquired a majority interest in CPOS, a Canadian provider of bankcard payment processing services and secure point-of-sale solutions. This acquisition provides us with an entrance into the Canadian credit and debit bankcard processing market. As of December 31, 2011 and 2010, we provided bankcard processing services to approximately 10,287 and 8,300 merchants, respectively, in Canada. Revenues for our CPOS services were $11.4 million, $8.5 million and $6.0 million, respectively, in 2011, 2010 and 2009.

Payroll Processing Services

Through our wholly-owned subsidiary, Heartland Payroll Company, we operate a full-service nationwide payroll processing service. Revenues for our Payroll Processing Services were $19.5 million, $17.3 million and $15.0 million, respectively, in 2011, 2010 and 2009. Our payroll services include check printing, direct deposit, related federal, state and local tax deposits and providing accounting documentation. In addition, we offer a “PayAdvantage” card, which provides employees the opportunity to have all, or a portion, of their payroll deposited to a Visa debit card account. In order to improve operating efficiencies and ease-of-use for our customers and to decrease our own processing costs, we offer electronic and paperless payroll processing that allows an employer to submit its periodic payroll information to us via the Internet. If a customer chooses the online option, all reports and interactions between the employer and us can be managed electronically, eliminating the need for cumbersome paperwork. Approximately 53% of our payroll customers currently submit their information electronically. However, if a customer chooses not to submit their payroll data online, they may submit such information via phone or facsimile. Regardless of input method, clients can choose to have Heartland Payroll Company print and ship their payroll package or to receive this information electronically. As of December 31, 2011, 2010 and 2009, we provided payroll processing services to 11,841, 11,131 and 9,382 customers, respectively. In 2011, 2010 and 2009, we installed 3,723, 4,858 and 4,303 new payroll processing customers, respectively.

We developed a new comprehensive payroll management system, which we refer to as PlusOne Payroll, that streamlines all aspects of the payroll process to enable time and cost savings. PlusOne Payroll was made available to new and existing customers beginning in 2010. At December 31, 2011, all of our payroll processing customers were processing on PlusOne Payroll. We consider our PlusOne Payroll platform to be state-of-the art, enabling us to process payroll on a large scale and provide customizable solutions for businesses of all sizes. PlusOne Payroll enables faster processing and continuous updates to help businesses remain compliant with payroll, tax and human resources regulations. The platform features web-hosted access, enabling businesses and their accountants to securely access all payroll data from virtually anywhere with SSL-encryption protection. It also provides robust, easy-to-use reporting for better business analysis. PlusOne Payroll is equipped to interface with the leading providers of accounting and time and attendance applications, as well as restaurant and retail point-of-sale systems. During 2011, we have continued to build upon this platform and have completed the Employee Self Serve web portal that allows employees to review copies of their paychecks, vouchers, payroll detail and maintain their individual demographic information.

K to 12 School Solutions

Our K to 12 School Solutions focus on providing school nutrition programs with solutions to manage their operations, and provides online payment and information portals that are used daily.

On December 30, 2010, we purchased the K to 12 School Solutions business previously operated by Lunchbox. On January 12, 2011, February 4, 2011 and September 30, 2011, we acquired the K to 12 School Solutions businesses of Comalex, Inc., mySchoolBucks, LLC, and School-Link Technologies, Inc, respectively. K to 12 School Solutions develops, manufactures, sells and services and maintains computer software designed to facilitate accounting and management functions of school food service operations. We offer school nutrition and point-of-sale solutions including Internet payment capability enabling on-line deposits of funds into student accounts, to over 19,000 public and private schools, students and their parents. Lunchbox, Comalex, mySchoolBucks and School-Link added approximately 4,400, 3,700, 900 and 10,000 schools, respectively, to our K to 12 School Solutions product. These acquisitions have given us an almost 20% market share in this industry.

14

During 2011, we introduced a number of new products and technologies such as SeeMyPlateTM, enhanced strategic partnerships with industry associations, and added online payments capabilities to the schools we serve. Our technology allows parents to pay electronically for a wide range of products and services, from school meals to student activity fees and other school-related purchases, eliminating the need for checks and cash for such transactions.

Micropayments

We began providing payment solutions within the small value transaction market in 2006. Revenues for Micropayments were $6.6 million, $6.8 million and $4.8 million, respectively, in 2011, 2010 and 2009. We manufacture and sell solutions comprising unattended online wireless credit card based payment systems, and unattended value top up systems for off-line closed loop smart (chip) card based payment systems. Our electronic cash systems provide small value transaction processing for laundromat machines, vending machines, and cash registers, in apartment laundries, cruise ships, corporate and university campuses, and penitentiaries. These systems offer consumers convenient ways to use their credit cards in laundromats with our new Waverider system, purchase and reload electronic cash cards, and spend the value on the card for small value purchases in both attended and unattended point of sale locations. In addition, we provide merchants financial settlement between the value (electronic cash card) issuer and the vendor/merchant who accepts the card as payment. We believe that there is increasing consumer demand for, and merchant interest in, card-based solutions for small denomination transactions, and expect to make additional investments in the future in developing solutions in this area.

Campus Solutions

Our campus solutions product provides an open or closed networked payments solution for a college or university campus to efficiently process small value electronic transactions. Revenues for Campus Solutions were $5.8 million, $5.7 million and $4.8 million, respectively, in 2011, 2010 and 2009. Besides payment processing, our solutions enable personal identification, door access, cashless vending transactions, cashless laundry, meal plans and cashless printing. Our innovative Give Something Back Network adds Internet and phone accessible debit card based financial services to the students, faculty, staff and local community merchants of an educational institution. In addition, our Acceluraid program, which we introduced in 2010, addresses a major operational need for campuses by providing a debit card based platform for reimbursing financial aid refunds. At December 31, 2011, we have twenty colleges enrolled, representing 110,000 students and over $290 million in annual reimbursement. We currently have 182 OneCard and Acceluraid college and university accounts.

Loyalty and Heartland Gift Marketing

We continue to leverage our November 2008 acquisition of Chockstone, Inc., to provide gift and loyalty card programs. Revenues for Loyalty and Gift Marketing were $12.0 million, $9.2 million and $6.4 million, respectively, in 2011, 2010 and 2009. Through our Loyalty Group, we deliver a full suite of card-based marketing services to merchant locations through real-time communications with the merchant point-of-sale, enabling us to leverage existing installations across our merchant base and enhancing our overall value proposition to the merchant community. In addition to servicing the SME merchant market, the Loyalty Group also provides gift and loyalty services to regional and national brands.