UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

___________________________________

FORM 10-K | |

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2010

OR

| |

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE TRANSITION PERIOD FROM ______________ TO _____________

COMMISSION FILE NUMBER: 000-49697

REPUBLIC AIRWAYS HOLDINGS INC.

(Exact name of registrant as specified in its charter)

| | |

DELAWARE (State or other jurisdiction of incorporation or organization) | | 06-1449146 (I.R.S. Employer Identification Number) |

8909 Purdue Road, Suite 300, Indianapolis, Indiana 46268

(Address of principal executive offices) (Zip Code)

(317) 484-6000

(Registrant’s telephone number, including area code)

_____________________________

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, par value $.001 per share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). o Yes o No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in the definitive proxy statement incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of ”large accelerated filer," "accelerated filer” and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one): | | | |

Large accelerated filer o | Accelerated filer x | Non-accelerated filer o (Do not check if a smaller reporting company) | Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes o No x

The aggregate market value of Common Stock held by non-affiliates (based upon the closing sale price of the Common Stock on the NASDAQ National Market System (now the NASDAQ Global Market System) on June 30, 2010 was approximately $212,249,534.

Indicate the number of shares outstanding of the registrant’s Common Stock as of the latest practicable date: As of March 15, 2011, 48,196,303 shares of common stock were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive Proxy Statement to be used in connection with its 2011 Annual Meeting of Stockholders are incorporated by reference into Part III of this report.

TABLE OF CONTENTS

| | |

| | Part I | |

| | | |

| Item 1. | Business | |

| Item 1A. | Risk Factors | |

| Item 1B. | Unresolved Staff Comments | |

| Item 2. | Properties | |

| Item 3. | Legal Proceedings | |

| Item 4. | [Reserved] | |

| | | |

| | Part II | |

| | | |

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases Of Equity Securities | |

| Item 6. | Selected Financial Data | |

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | |

| Item 7A. | Quantitative and Qualitative Disclosures About Market Risk | |

| Item 8. | Financial Statements and Supplementary Data | |

| Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | |

| Item 9A. | Controls and Procedures | |

| Item 9B. | Other Information | |

| | Part III | |

| | | |

| Item 10. | Directors, Executive Officers and Corporate Governance | |

| Item 11. | Executive Compensation | |

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | |

| Item 13. | Certain Relationships and Related Transactions, and Director Independence | |

| Item 14. | Principal Accounting Fees and Services | |

| | | |

| | Part IV | |

| | | |

| Item 15. | Exhibits, Financial Statements Schedules | |

| Signatures | | |

| | | |

| 10.45(d)†† | Amendment Number Three to Delta Connection Agreement, by and among Delta Airlines, Inc., Shuttle America Corp. (as assignee of Republic Airline, Inc.) and Republic Airways Holdings, Inc., dated as of January 31, 2011. | |

| EX-23.1 | Consent of Independent Registered Public Accounting Firm | |

| EX-31.1 | Certification of Chief Executive Officer | |

| EX-31.2 | Certification of Chief Financial Officer | |

| EX-32.1 | Certification of Chief Executive Officer | |

| EX-32.2 | Certification of Chief Financial Officer | |

| | | |

| †† | A request for confidential treatment was filed for certain portions of the indicated document. Confidential portions have been omitted and filed separately with the Commission as required by Rule 406. | |

Forward-Looking Statements

In addition to historical information, this Annual Report on Form 10-K contains forward-looking statements. Republic Airways Holdings Inc. (the “Company”) may, from time to time, make written or oral forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements encompass our beliefs, expectations, hopes or intentions regarding future events. Words such as “may,” “will,” “should,” “expect,” “plan,” “intend,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” or “continue,” the negative of such terms or other terminology are used to identify forward-looking statements. All forward-looking statements included in this Annual Report on Form 10-K are made as of the date hereof and are based on information available to us as of such date. We assume no obligation to update any forward-looking statement. Our results could differ materially from those anticipated in these forward-looking statements for many reasons, including, among others, the “Risk Factors” set forth herein.

PART I

ITEM 1. BUSINESS

General

Overview

We are a Delaware holding company organized in 1996 that offers scheduled passenger services through our wholly-owned operating air carrier subsidiaries: Chautauqua Airlines, Inc. (“Chautauqua”), Shuttle America Corporation (“Shuttle”), Republic Airline Inc. (“Republic Airline”), Frontier Airlines, Inc. (“Frontier”), and Lynx Airlines, Inc. (“Lynx”). Unless the context indicates otherwise, the terms the “Company,” “we,” “us,” or “our,” refer to Republic Airways Holdings Inc. and our subsidiaries.

As of December 31, 2010, our operating subsidiaries offered scheduled passenger service on 1,540 flights daily to 128 cities in 41 states, Canada, Mexico, and Costa Rica under our Frontier operations and through fixed-fee code-share agreements with AMR Corp., the parent of American Airlines, Inc. (“American”), Continental Airlines, Inc. (“Continental”), Delta Air Lines, Inc. (“Delta”), United Air Lines, Inc. (“United”), and US Airways, Inc. (“US Airways”) (collectively referred to as our “Partners”). Currently, we provide our Partners with fixed-fee regional airline services, operating as AmericanConnection, Continental Express, Delta Connection, United Express, or US Airways Express, including service out of their hubs and focus cities.

The following table outlines the type of aircraft our subsidiaries operate and their respective operations within our business units as of December 31, 2010:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | Fixed-Fee Code-Share Agreement Partners | | | | |

| Operating Subsidiaries | | Aircraft Size | | Frontier | | American | | Continental | | Delta | | United | | US Airways | | Spares | | Number of Aircraft |

| Chautauqua | | 37 to 50 | | 13 | | | 15 | | | 15 | | | 24 | | | — | | | 9 | | | 2 | | | 78 | |

| Shuttle | | 70 to 76 | | — | | | — | | | — | | | 16 | | | 38 | | | — | | | — | | | 54 | |

| Republic Airline | | 70 to 99 | | 32 | | | — | | | — | | | — | | | — | | | 58 | | | — | | | 90 | |

| Frontier | | 120 to 162 | | 50 | | | — | | | — | | | — | | | — | | | — | | | — | | | 50 | |

| Lynx | | 74 | | 3 | | | — | | | — | | | — | | | — | | | — | | | — | | | 3 | |

| Total number of operating aircraft | | 98 | | | 15 | | | 15 | | | 40 | | | 38 | | | 67 | | | 2 | | | 275 | |

During 2010, our operational fleet decreased from 290 to 275. The Company removed eight Q400 aircraft from its Frontier operations. Five were returned to the lessor, two were held for sale as of December 31, 2010, and one has been subleased. Seven CRJ aircraft were returned to the lessor from our fixed-fee service with Continental. Four A318 aircraft were removed from our Frontier operation and sold or returned to the lessor. Two E145 aircraft were subleased offshore and one E170 was sold. Four E190 aircraft and three A320 aircraft were placed into our Frontier operation during the year.

We have long-term, fixed-fee regional jet code-share agreements with each of our Partners that are subject to us maintaining specified performance levels. Pursuant to these fixed-fee agreements, which provide for minimum aircraft utilization at fixed rates, we are authorized to use our Partners' two-character flight designation codes to identify our flights and fares in our Partners' computer reservation systems, to paint our aircraft in the style of our Partners, to use their service marks and to market ourselves as a carrier for our Partners. Our fixed-fee agreements have historically limited our exposure to fluctuations in fuel prices, fare competition and passenger volumes. Our development of relationships with multiple major airlines has enabled us to reduce our dependence on any single airline, allocate our overhead more efficiently among our Partners and reduce the cost of our services to our Partners.

Our branded operations are comprised of the former operations of Midwest Air Group, Inc. (“Midwest”) and Frontier, both of which we acquired in 2009. As of October 2010, these operations now fly as a single consolidated branded network under the Frontier brand. Frontier have the largest market share in Milwaukee and the second largest market share in Denver. Our branded operations has a significant base of frequent flyer members and strong support in their local communities.

Business Strategy

| |

| • | Continue to operate a high-quality fleet of aircraft across an efficient network - We intend to maintain a modern, high-quality fleet of aircraft that meets or exceeds stringent industry operating standards and complies with the terms of our fixed-fee regional jet code-share agreements. We also intend to continue to operate and optimize our existing network and hubs to make our network as efficient as possible for both our Partners and branded customers. |

| |

| • | Continue to operate a diversified business model that generates compelling returns on invested capital for our |

shareholders - Our business model is unique among US airlines in that it combines the stable cash flow generation of our fixed-fee regional jet operations with the attractive growth prospects of our branded operations at Frontier. We believe that this diversity of service offerings provides us with a distinct advantage over our competitors and provides for a very stable base of cash flows as well as significant upside from our branded Frontier platform.

| |

| • | Pursue a fleet renewal strategy that further improves our cost structure - As previously disclosed, we have placed a firm order with Embraer for the delivery of six E-190 aircraft with the option to purchase another 18 E-190/E-195 aircraft at a later time. This decision supports our strategy to continue exiting the smaller regional jet aircraft market and focus on larger aircraft at both our regional jet and branded operations which will greatly enhance Republic's unit cost structure. |

| |

| • | Continue to take advantage of growth opportunities resulting from industry consolidation and continue to grow Frontier's network - It is our belief that the recent merger activity in the domestic airline sector could lead to further opportunities for Republic to gain market share as the large network carriers consolidate their hubs and reduce their presence in certain markets. |

| |

| • | Pursue alliances to broaden our existing network and customer reach - We intend to pursue strategic and long-term alliances with other airlines in order to broaden our existing network, generate larger economies of scale and provide a greater number of attractive destinations to both existing and new customers. We believe that strategic alliances are a cost-effective method to grow our market share and expand our customer base. |

Markets and Routes

Markets

As of December 31, 2010, we offered scheduled passenger service on 1,540 flights daily to 128 cities in 41 states, Canada, Mexico, and Costa Rica.

Fixed-fee Routes

Our Partners determine the routes that we operate for them, which are subject to certain parameters in our agreements. The following table illustrates the hub and focus cities for each Partner as of December 31, 2010:

| | |

| Partner | | Hub and Focus Cities |

| American | | Chicago, IL |

| Continental | | Houston, TX and Cleveland, OH |

| Delta | | Atlanta, GA, Cincinnati, OH, and New York, NY |

| United | | Chicago, IL, Denver, CO, and Washington D.C. (Newark, NJ in 2011 due to UA/CO merger) |

| US Airways | | Charlotte, NC, New York, NY, Philadelphia, PA, and Washington D.C. |

Branded Routes

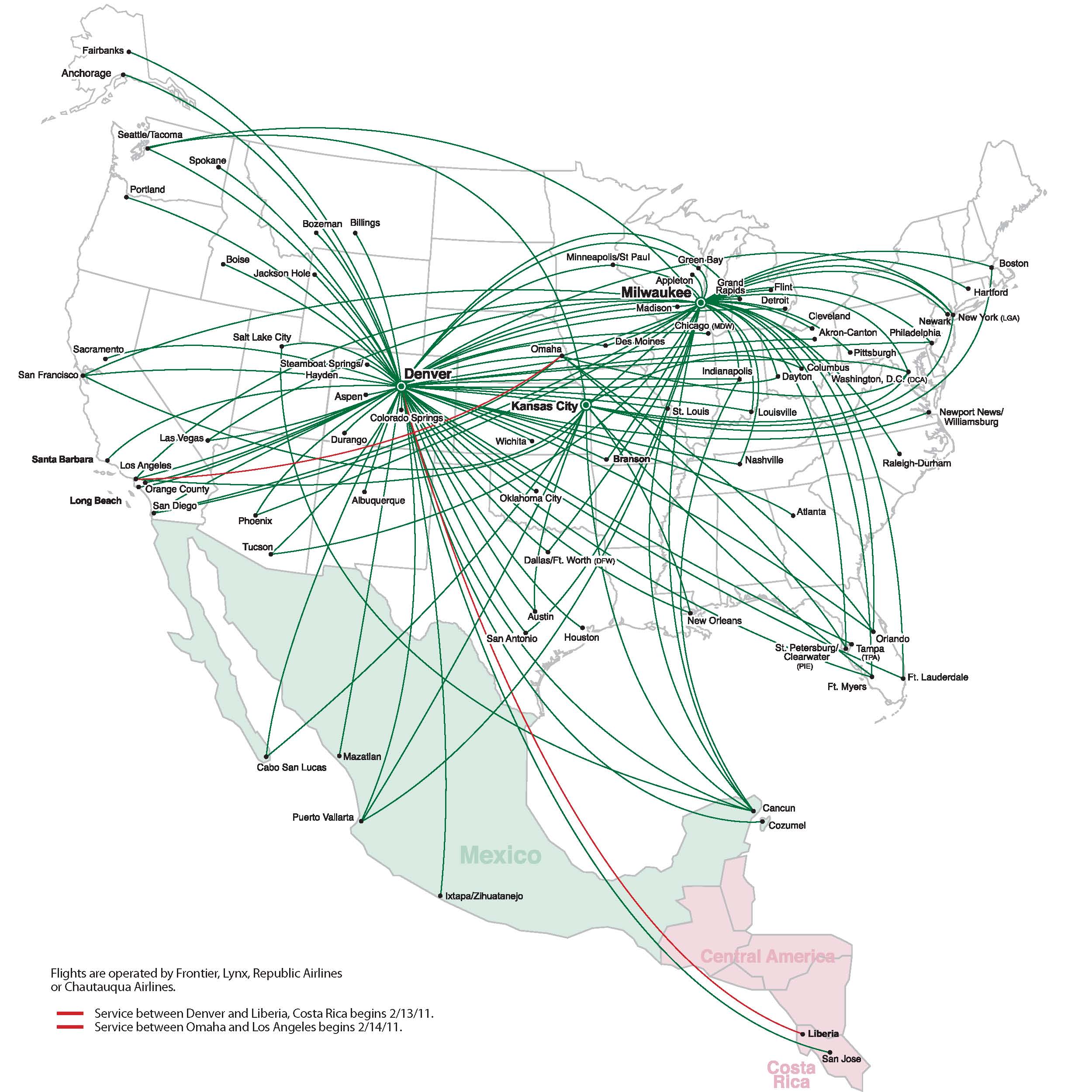

The following illustrates the routes we flew for our branded operations as of December 31, 2010:

Maintenance of Aircraft and Training

Using a combination of Federal Aviation Administration (“FAA”) certified maintenance vendors and our own personnel and facilities we maintain our aircraft on a scheduled and "as-needed" basis. We emphasize preventive maintenance and inspect our aircraft engines and airframes as required.

We have maintenance agreements for engines, auxiliary power units (“APU”) and other airframe components for our E140/145 and E170/175 aircraft. For our E140/145 aircraft, we have agreements to maintain the engines, APUs, avionics and wheels and brakes through October 2012, June 2013, December 2016 and June 2014, respectively. For our E170/175 aircraft, we have agreements to maintain the avionics, wheels and brakes, APUs and engines through December 2014, February 2017, July 2019 and December 2018, respectively. Under these agreements, we are charged for covered services based on a fixed rate for each flight hour or flight cycle accumulated by the engines or airframes in our service during each month. The rates are subject

to annual revisions, generally based on certain Bureau of Labor Statistics' labor and material indices. We believe these agreements, coupled with our ongoing maintenance program, reduce the likelihood of unexpected levels of engine, APU, avionics and wheels and brakes maintenance expense during their term. Certain of these agreements contain minimum guarantee amounts, penalty provisions for either the early removal of aircraft or agreement termination for activity levels below the minimums.

While we do not have long term maintenance agreements for our Airbus (except for our wheels and brakes) and Q400 fleets, we have made significant deposits with the aircraft lessors for future maintenance events which will reduce our future cash requirements. As of December 31, 2010, we had maintenance deposits of $147.2 million.

We perform our heavy and routine maintenance projects at our facilities in Columbus, Denver, Indianapolis, Louisville, Milwaukee, Pittsburgh and St. Louis, and we perform routine maintenance services from select line maintenance stations.

All mechanics and avionics specialists employed by us have appropriate training and experience and hold required licenses issued by the FAA. We provide periodic in-house and outside training for our maintenance and flight personnel and also take advantage of manufacturers’ training programs that are offered when acquiring new aircraft.

We have agreements with Flight Safety International to provide for aircraft simulator training for our pilots. We have no current plans to acquire our own simulator in the near term and believe that Flight Safety or other third party vendors will be able to provide us with adequate and cost effective flight simulator training to provide training for our pilots.

Employees

As of December 31, 2010, we employed approximately 9,850 full-time equivalent employees. The following is a table of our principal collective bargaining agreements and their respective amendable dates as of December 31, 2010:

| | | | | | | |

Employee Group | | Number of Full- Time Equivalent Employees | | Representing Union | | Amendable Date |

| Pilots | | 1,847 | | | International Brotherhood of Teamsters Airline Division Local 747 | | Oct-07 |

| | | 603 | | | Frontier Airline Pilots Association ("FAPA") | | Mar-12 |

| | | 27 | | | United Transportation Union (Lynx) | | * |

| Flight Attendants | | 1,562 | | | International Brotherhood of Teamsters Airline Division Local 210 | | Sep-09 |

| | | 826 | | | Association of Flight Attendants - CWA ("AFA-CWA") | | * |

| Mechanics and tool room attendants | | 153 | | | Teamsters Airline Division | | Oct-11 |

| Groomers and cleaners | | 116 | | | Teamsters Airline Division | | Sep-15 |

| Dispatchers | | 102 | | | Transport Workers Union of America Local 540 | | Jun-12 |

| | | 18 | | | Transport Workers Union | | Sep-12 |

| Material Specialists | | 26 | | | International Brotherhood of Teamsters | | Oct-11 |

_______________________

* Currently in negotiations

As of December 31, 2010, we had 4,570 employees who are not currently represented by any union. Because of the high level of unionization among our employees, we are subject to risks of work interruption or stoppage and/or the incurrence of additional expenses associated with union representation of our employees. We have never experienced any work stoppages or other job actions and generally consider our relationship with our employees to be good. The union contract for our pilots and our flight attendants, except Frontier’s pilots, is currently amendable. The union contracts for our mechanics and tool room attendants and our material specialists are amendable in 2011.

Executive Officers of the Company

The following table sets forth information regarding our current executive officers, directors and key employees as of December 31, 2010:

| | | | | |

| Name | | Age | | Position |

| Bryan K. Bedford | | 49 | | | Chairman of the Board, President and Chief Executive Officer |

| Robert H. Cooper | | 51 | | | Executive Vice President, Chief Financial Officer, Treasurer and Secretary |

| Wayne C. Heller | | 52 | | | Executive Vice President, Chief Operating Officer |

| Lawrence J. Cohen | | 55 | | | Director |

| Douglas J. Lambert | | 53 | | | Director |

| Mark L. Plaumann | | 55 | | | Director |

| Richard P. Schifter | | 58 | | | Director |

| Neal S. Cohen | | 50 | | | Director |

| David N. Siegel | | 49 | | | Director |

Bryan K. Bedford joined us in July 1999 as our President and Chief Executive Officer and a member of our board of directors and became chairman of the board in August 2001. From July 1995 through July 1999, Mr. Bedford was the president and chief executive officer and a director of Mesaba Holdings, Inc., a publicly-owned regional airline. He has over 22 years of experience in the regional airline industry, and was named regional airline executive of the year in 1998 by Commuter and Regional Airline News and again in 2005 by Regional Airline World magazine. Mr. Bedford is a licensed pilot and a certified public accountant. He also served as the 1998 Chairman of the Regional Airline Association (RAA), and remains on the Board of Directors of the RAA.

Robert H. Cooper joined us in August 1999 as Vice President and Chief Financial Officer. In February 2002, he became executive vice president, chief financial officer, treasurer and secretary and assumed responsibility for all purchasing and material control. He was previously employed with Mesaba Holdings, Inc. from September 1995 through August 1999 as its vice president, chief financial officer and treasurer. Mr. Cooper is a certified public accountant. He has over 17 years experience in the regional airline industry. He has responsibility for financial accounting, treasury, public reporting, investor relations, human resources, information technology, purchasing and material control. On November 2, 2010, the Company announced the retirement of Mr. Cooper. Mr. Cooper’s term of employment is expected to continue until April 1, 2011.

Wayne C. Heller joined us in August 1999 as Vice President—Flight Operations with responsibility for flight crew supervision, system control, flight safety and flight quality standards. In February 2002, he became Executive Vice President and Chief Operating Officer of Chautauqua, and assumed responsibility for all aircraft maintenance, records and engineering. From April 1996 until August 1999 he was employed by Mesaba Airlines, Inc., as its Director of System Operations Control. He is a licensed pilot and a licensed dispatcher and has over 29 years of regional airline experience in operations.

Lawrence J. Cohen has been a director since June 2002. He is the owner and Chairman of Pembroke Companies, Inc., an investment and management firm that he founded in 1991. The firm makes investments in and provides strategic management services to real estate and specialty finance related companies. From 1989 to 1991, Mr. Cohen worked at Bear Stearns & Co. where he attained the position of Managing Director. From 1983 to 1989, Mr. Cohen served as first Vice President in the Real Estate Group of Integrated Resources, Inc. From 1980 to 1983, Mr. Cohen was an associate at the law firm of Proskauer Rose Goetz & Mendelsohn. Mr. Cohen is a member of the bar in both New York and Florida.

Douglas J. Lambert has been a director since August 2001. He is presently a Managing Director in the North American Commercial Restructuring practice group of Alvarez and Marsal, Inc. Mr. Lambert was a Senior Vice President of Wexford Capital LLC. From 1983 to 1994, Mr. Lambert held various financial positions with Integrated Resources, Inc.'s Equipment Leasing Group, including Treasurer and Chief Financial Officer. He is a certified public accountant.

Mark L. Plaumann has been a director since June 2002. He is presently a Managing-Member of Greyhawke Capital Advisors LLC, which he co-founded in 1998. From 1995 to 1998, Mr. Plaumann was a Senior Vice President of Wexford Capital LLC. From 1990 to 1995, Mr. Plaumann was employed by Alvarez & Marsal, Inc. as a Managing Director. From 1985 to 1990, Mr. Plaumann worked for American Healthcare Management, Inc., where he attained the position of President. From 1974 to 1985, Mr. Plaumann worked in both the audit and consulting divisions of Ernst & Young, where he attained the position of Senior

Manager and he is a certified public accountant. Mr. Plaumann is the Chair of our Audit Committee, is an “audit committee financial expert” and is independent as defined under applicable SEC and NASDAQ rules.

Richard P. Schifter has been a director since July 2009. He has been a partner at TPG Capital (formerly Texas Pacific Group) since 1994. Prior to joining TPG, Mr. Schifter was a partner at the law firm of Arnold & Porter in Washington, D.C., where he specialized in bankruptcy law and corporate restructuring and represented Air Partners in connection with the acquisition of Continental Airlines in 1993. Mr. Schifter joined Arnold & Porter in 1979 and was a partner from 1986 through 1994. Mr. Schifter also served on the Boards of Directors of Ryanair Holdings, PLC from 1996 through 2003, America West Holdings from 1994 to 2005, US Airways Group from 2005 to 2006 and Midwest Airlines, Inc. from 2007 to 2009.

Neal S. Cohen has been a director since October 2009. He is president and chief operating officer for Laureate Education, Inc. Previously, Mr. Cohen was executive vice president for international strategy and chief executive officer for regional airlines at Northwest Airlines. In addition, Mr. Cohen had served as executive vice president and chief financial officer at Northwest Airlines. Prior to his tenure with Northwest Airlines Inc., Mr. Cohen was executive vice president and chief financial officer for US Airways. Mr. Cohen has served as chief financial officer for various service and financial organizations as well as Sylvan Learning Systems, Inc., the predecessor company of Laureate Education, Inc.

David N. Siegel has been a director since October 2009. He was Executive Chairman of XOJET, a private aviation company, in 2010, where he previously served as CEO, and continues to serve as a board member. Mr. Siegel has commercial aviation experience spanning more than two decades including serving as the president and chief executive officer of US Airways and in senior executive roles at Northwest Airlines and Continental Airlines. From June 2004 to September 2008, Mr. Siegel was chairman and chief executive officer of Gate Gourmet Group, Inc., the world's largest independent airline catering, hospitality and logistics company. Prior to Gate Gourmet Group, Mr. Siegel served as president, chief executive and member of the board of US Airways Group, Inc., and US Airways, Inc., the airline operating unit. Prior to joining US Airways, Mr. Siegel was chairman and chief executive officer of Avis Rent A Car System, Inc., a subsidiary of Cendant Corp. Mr. Siegel’s extensive experience in the airline industry includes seven years at Continental Airlines in various senior management roles, including president of its Continental Express subsidiary.

Code-Share Agreements

Through our subsidiaries, we have entered into code-share agreements with US Airways, American, Delta, United and Continental that authorize us to use their two-character flight designator codes ("US," "AA," "DL," "UA" and "CO") to identify our flights and fares in their computer reservation systems, to paint our aircraft with their colors and/or logos, to use their service marks and to market and advertise our status as US Airways Express, AmericanConnection, Delta Connection, United Express or Continental Express, respectively. Under the code-share agreements between our subsidiaries and each of US Airways, American, Delta, United and Continental, we are compensated on a fixed-fee basis on all of our flights. In addition, under our code-share agreements, our passengers participate in frequent flyer programs of the Partners, and the Partners provide additional services such as reservations, ticket issuance, ground support services, commuter slot rights and airport facilities.

US Airways Code-Share Agreements

Under our fixed-fee Jet Services Agreements with US Airways, we operated, as of December 31, 2010, nine E145 aircraft, 20 E170 aircraft and 38 E175 aircraft. As of December 31, 2010, we were providing 426 flights per day as US Airways Express.

In exchange for providing the designated number of flights and performing our other obligations under the code-share agreements, we receive compensation from US Airways three times each month in consideration for the services provided under the code-share agreements. We receive an additional amount per available seat mile flown and may also receive incentives or pay penalties based upon our performance, including fleet launch performance, on-time departure performance and completion percentage rates. In addition, certain operating costs are considered "pass through" costs whereby US Airways has agreed to reimburse us the actual amount of costs we incur for these items. US Airways provides fuel directly for all of our US Airways operations. Landing fees, passenger catering, passenger liability insurance and aircraft property tax costs are pass through costs and are included in our fixed-fee services revenue.

Unless otherwise extended or amended, the code-share agreement for the E145 aircraft terminates in July 2014 and the code-share agreement for the E170/175 aircraft terminates in September 2015 with respect to the 20 E170 aircraft and eight of the E175 aircraft. The remaining 30 E175 aircraft terminate 12 years from each aircraft’s in-service date and therefore would terminate from February 2019 to July 2020. US Airways may terminate the code-share agreements at any time for cause upon not less than 90 days notice and subject to our right to cure under certain conditions.

Pursuant to a licensing agreement, we assigned 113 commuter slots at Ronald Reagan Washington National (DCA) Airport and 24 commuter slots at New York-LaGuardia (LGA) Airport to US Airways and these commuter slots are being operated by US Airways and US Airways Express carriers. Prior to the expiration of this agreement, US Airways has the right to repurchase all, but not less than all, of the DCA commuter slots at a predetermined price. The licensing agreement between us and US Airways for the LGA commuter slots expired on December 31, 2006, but we maintain a security interest in the LGA slots if US Airways fails to perform under the current licensing agreement.

The Delta Code-Share Agreements

As of December 31, 2010, we operated 24 E145 aircraft and 16 E175 aircraft for Delta under fixed-fee code-share agreements. As of December 31, 2010, we provided 211 flights per day as Delta Connection.

Unless otherwise extended or amended, the code-share agreements for the E145 and E175 aircraft terminate in May 2016 and January 2019, respectively. Delta may terminate the code-share agreements at any time, with or without cause, if it provides us 180 days written notice, for the E145 regional jet code-share agreement, and July 2015 for the E170 regional jet code-share agreement. With respect to the E145 agreement, if Delta chooses to terminate any aircraft early, it may not reduce the number of aircraft in service to less than 12 during the 12-month period following the 180 day initial notice period unless it completely terminates the code-share agreement. We refer to this as Delta's partial termination right.

If Delta exercises this right under either agreement or if we terminate either agreement for cause, we have the right to require Delta either to purchase, sublease or assume the lease of aircraft leased by us with respect to any of the aircraft we previously operated for Delta under that agreement. As of December 31, 2010, the Company estimates a payment of $79.6 million and $115.6 million would be required from Delta should they exercise the early termination provision under the E145 or E170 agreement, respectively. If we choose not to exercise our put right, or if Delta terminates either agreement for cause, they may require us to sell or sublease to them or Delta may assume the lease of aircraft leased by us with respect to any of the aircraft we previously operated for it under that agreement.

Certain of our operating costs are considered "pass through" costs, whereby Delta has agreed to reimburse us the actual amount of costs we incur for these items. Beginning in June 2009 we did not record fuel expense and the related revenue for the Delta operations. Aircraft rent/ownership expenses are also considered a pass through cost, but the reimbursement is limited to specified amounts for certain aircraft. Engine maintenance expenses, landing fees, passenger liability insurance, hull insurance, war risk insurance, de-icing costs, and aircraft property taxes are some of the pass through costs included in our fixed-fee services revenue.

On January 31, 2011, we entered into an amendment to the Delta Connection agreement. The amendment establishes the annual base rate costs for certain periods, adds eight additional E170 aircraft within the scope of the agreement and amends certain provisions of the agreement.

The agreements may be subject to immediate or early termination under various circumstances.

The United Code-Share Agreements

As of December 31, 2010, we operated 38 E170 aircraft and provided 202 flights per day as United Express. The seven E145 aircraft operated under this agreement at December 31, 2009 were removed from service in early January 2010. Two of the aircraft were returned to our lessor and the remaining five were placed into our branded operations.

The fixed rates that we receive from United under the code-share agreements are annually adjusted in accordance with an agreed escalation formula. Additionally, certain of our operating costs are considered "pass through" costs whereby United has agreed to reimburse us the actual amount of costs we incur for these items. Fuel and oil, landing fees, war risk insurance, liability insurance and aircraft property taxes are pass through costs and included in our fixed-fee services revenue. United provides fuel directly in certain locations.

The E145 code-share agreement was terminated effective January 2010. Unless otherwise extended or amended, the E170 code-share agreement terminates on June 30, 2019, with certain aircraft terms expiring between June 2016 and June 2019. United has the option of extending the E170 agreement for five years or less. In addition, the code-share agreements may be terminated under certain conditions.

United has a call option to assume our ownership or leasehold interest in certain aircraft if we wrongfully terminate the code-share agreements or if United terminates the agreements for our breach for certain reasons.

The American Code-Share Agreement

As of December 31, 2010, we operated 15 E140 aircraft for American under a fixed-fee code-share agreement and provided 113 flights per day as AmericanConnection.

Under the code-share agreement, American retains all passenger, certain cargo and other revenues associated with each flight, and is responsible for all revenue-related expenses. We share revenue with American for certain cargo shipments. Additionally, certain operating costs are considered "pass through" costs and American has agreed to reimburse us the actual amount of costs we incur for these items. Beginning in May 2009 we did not record fuel expense and the related revenue for the American operations. Aircraft lease payments are also considered a pass through cost, but are limited to a specified amount. Landing fees, hull and liability insurance and aircraft property tax costs are pass through costs and included in our fixed-fee services revenue.

If American terminates the code-share agreement for cause, American has a call option to require that we assign to American all of its rights under the leases of aircraft, and to lease to American the aircraft to the extent we own them, used at that time under the code-share agreement. If American exercises its call option, we are required to pay certain maintenance costs in transferring the aircraft to American's maintenance program.

Unless otherwise extended or amended, the term of the American code-share agreement continues until February 1, 2013. However, American may terminate the code-share agreement without cause upon 180 days notice, provided that such notice may not be given prior to September 30, 2011. If American terminates the code-share agreement without cause, we have the right to put the leases of the aircraft, or to sell the aircraft to American to the extent owned by us, used under the code-share agreement to American. The agreement may be subject to termination for cause prior to that date under various circumstances.

The Continental Code-Share Agreement

As of December 31, 2010, we operated 15 E145 aircraft for Continental under a fixed-fee code-share agreement and provided 88 flights per day as Continental Express.

Unless otherwise extended or amended, the E145 code-share agreement terminates on September 4, 2012. Seven of the aircraft are expected to come out of service in 2011 and the final eight aircraft are expected to come out of service in 2012. Under certain conditions, Continental may extend the term on the aircraft up to five additional years.

All fuel is purchased directly by Continental and is not charged back to Chautauqua. Under the agreement, Continental purchases all capacity at predetermined rates and industry standard pass through costs.

The agreement may be subject to early termination under various circumstances.

Competition and Economic Conditions

The airline industry is highly competitive. Generally, the airline industry is highly sensitive to general economic conditions, in large part due to the discretionary nature of a substantial percentage of both business and pleasure travel. In the past, many airlines have reported decreased earnings or substantial losses resulting from periods of economic recession, heavy fare discounting, high fuel prices and other factors. Economic downturns combined with competitive pressures have contributed to a number of bankruptcies and liquidations among major and regional carriers and our recent acquisitions of branded carriers adds these risks to our business.

The principal competitive factors in the airline industry are fare pricing, customer service, flight schedules and aircraft types. The airline industry is particularly susceptible to price discounting because airlines incur only nominal costs to provide service to passengers occupying otherwise unsold seats. We face significant competition with respect to routes, services and fares. Our domestic routes are subject to competition from carriers that provide service at low fares to destinations also served by us. In particular, we face significant competition at our hub airports in Milwaukee and Denver either directly at those airports or at the hubs of other airlines that are located in close proximity to our hubs. Certain of our competitors are larger and have significant financial resources. Our ability to compete effectively depends, in significant part, on our ability to maintain a cost structure that is competitive with other carriers.

The growth in the fixed fee business for regional carriers which occurred over the past decade has significantly diminished in recent times as major carriers have reduced capacity and as increased fuel prices have limited the cost efficiencies of small

regional jets. We believe future growth opportunities in the fixed-fee business will most likely come as contracts come up for renewal though competition for market share may lead to lower margins and higher risks. If our Partners are negatively affected by economic conditions or higher fuel prices, they may file for bankruptcy or reduce the number of flights we operate in order to reduce their operating costs.

Regulatory Matters

Government Regulation

All interstate air carriers are subject to regulation by the Department of Transportation (DOT), the Federal Aviation Administration (FAA), the Transportation Security Administration (TSA), and certain other governmental agencies. Regulations promulgated by the DOT primarily relate to economic aspects of air service, those of the TSA to security and those of the FAA to operations and safety. The FAA requires operating, airworthiness and other certifications; approval of personnel who may engage in flight maintenance or operations activities; record keeping procedures in accordance with FAA requirements; and FAA approval of flight training and retraining programs. Generally, governmental agencies enforce their regulations through, among other mechanisms, certifications, which are necessary for our continued operations, and proceedings, which can result in civil or criminal penalties or suspension or revocation of operating authority. The FAA can also issue maintenance directives and other mandatory orders relating to, among other things, grounding of aircraft, inspection of aircraft, installation of new safety-related items and the mandatory removal, replacement or modification of aircraft parts that have failed or may fail in the future.

We believe that we are operating in material compliance with FAA regulations and hold all necessary operating and airworthiness certificates and licenses. We incur substantial costs in maintaining our current certifications and otherwise complying with the laws, rules and regulations to which we are subject. Our flight operations, maintenance programs, record keeping and training programs are conducted under FAA approved procedures.

The DOT allows local airport authorities to implement procedures designed to abate special noise problems, provided such procedures do not unreasonably interfere with interstate or foreign commerce or the national transportation system. Certain airports, including major airports at Boston, Washington, D.C., the New York area, Dallas, Philadelphia, Charlotte, Chicago, Los Angeles, San Diego, Orange County (California) and San Francisco, have established airport restrictions to limit noise, including restrictions on aircraft types to be used and limits on the number of hourly or daily operations or the time of such operations. In some instances, these restrictions have caused curtailments in service or increases in operating costs, and such restrictions could limit our ability to commence or expand our operations at affected airports. Local authorities at other airports are considering adopting similar noise regulations.

Pursuant to law and the regulations of the DOT, we must be actually controlled by United States citizens. In this regard, our President and at least two-thirds of our Board of Directors must be United States citizens and not more than 25% of our voting stock may be owned or controlled by foreign nationals, although subject to DOT approval the percentage of foreign economic ownership may be as high as 49%.

Environmental Regulation

The Airport Noise and Capacity Act of 1990 (ANCA) generally recognizes the rights of airport operators with noise problems to implement local noise abatement programs so long as such programs do not interfere unreasonably with interstate or foreign commerce or the national air transportation system. The ANCA generally requires FAA approval of local noise restrictions on commercial aircraft. While we have had sufficient scheduling flexibility to accommodate local noise restrictions imposed to date, our operations could be adversely affected if locally-imposed regulations become more restrictive or widespread.

The Environmental Protection Agency (EPA) regulates operations, including air carrier operations, which affect the quality of air in the United States. We believe the aircraft in our fleet meet all emission standards issued by the EPA. We may become subject to additional taxes or requirements to obtain permits for green house gas emissions.

Safety and Health Regulation

The Company and its third-party maintenance providers are subject to the jurisdiction of the FAA with respect to the Company’s aircraft maintenance and operations, including equipment, ground facilities, dispatch, communications, flight training personnel, and other matters affecting air safety. To ensure compliance with its regulations, the FAA requires airlines to obtain, and the Company has obtained, operating, airworthiness, and other certificates. These certificates are subject to suspension or revocation for cause. In addition, pursuant to FAA regulations, the Company has established, and the FAA has approved, the Company’s operations specifications and a maintenance program for the Company’s aircraft, ranging from frequent routine

inspections to major overhauls. The FAA, acting through its own powers or through the appropriate U.S. Attorney, also has the power to bring proceedings for the imposition and collection of fines for violation of the Federal Aviation Regulations.

The Company is subject to various other federal, state, and local laws and regulations relating to occupational safety and health, including Occupational Safety and Health Administration and Food and Drug Administration regulations.

Security Regulation

Pursuant to the Aviation and Transportation Security Act (the “Aviation Security Act”), the TSA, a division of the U.S. Department of Homeland Security, is responsible for certain civil aviation security matters. The Aviation Security Act addresses procedures for, among other things, flight deck security, the use of federal air marshals onboard flights, airport perimeter access security, airline crew security training, security screening of passengers, baggage, cargo, mail, employees, and vendors, training and qualifications of security screening personnel, provision of passenger data to U.S. Customs and Border Protection, and background checks. Under the Aviation Security Act, substantially all security screeners at airports are federal employees, and significant other elements of airline and airport security are overseen and performed by federal employees, including federal security managers, federal law enforcement officers, and federal air marshals.

TSA-mandated security procedures can have a negative effect on the Customer experience and the Company’s operations. For example, in 2006, the TSA implemented security measures regulating the types of liquid items that can be carried onboard aircraft. In 2009, the TSA introduced its Secure Flight Initiative. As part of that initiative, the Company has begun collecting additional Customer data. The Secure Flight Initiative was created to help reduce the number of passengers who are misidentified as possible terrorists because their names are similar to those of people on security watch lists. The program standardized how names are matched, as well as added age and gender to a passenger’s profile. Under the program, the Company is required to ask for Customer names exactly as they appear on a government-issued photo ID such as a passport or driver’s license. In addition, the Company must ask Customers for their gender and date of birth. The TSA has also indicated its intent to expand its use of whole body imaging machines around the United States.

The Company has made significant investments to address the effect of security regulations, including investments in facilities, equipment, and technology to process Customers efficiently and restore the airport experience; however, the Company is not able to predict the ongoing impact, if any, that various security measures will have on Passenger revenues and the Company’s costs, both in the short-term and the long-term.

Additional Information

The Company files annual, quarterly and current reports and other information with the SEC. These materials can be inspected and copied at the SEC's Public Reference Room at 450 Fifth Street, N.W., Washington, D.C. 20549. Copies of these materials may also be obtained by mail at prescribed rates from the SEC's Public Reference Room at the above address. Information about the Public Reference Room can be obtained by calling the SEC at 1-800-SEC-0330. The SEC also maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC. The address of the SEC's Internet site is www.sec.gov.

On our website, www.rjet.com/investorrelations.html, we provide free of charge our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K as soon as reasonably practicable after they have been electronically filed or furnished to the Securities and Exchange Commission. The code of ethics, adopted by our Board of Directors, which applies to all our employees, can also be found on our website, www.rjet.com/investorrelations.html. Our audit committee charter is also available on our website.

ITEM 1A. RISK FACTORS

The following risk factors, in addition to the information discussed elsewhere herein, should be carefully considered in evaluating us and our business:

Risks Related To Our Operations

We are vulnerable to increases in aircraft fuel costs.

High oil prices may have a significant adverse impact on the future results of operations. We cannot predict the future cost and availability of fuel, or the impact of disruptions in oil supplies or refinery productivity based on natural disasters, which would affect our ability to compete. The unavailability of adequate fuel supplies could have an adverse effect on our

Frontier operations. In addition, larger airlines may have a competitive advantage because they pay lower prices for fuel, and other airlines, such as Southwest Airlines, may have substantial fuel hedges that give them a competitive advantage. Because fuel costs are now a significant portion of our operating costs, substantial changes in fuel costs can materially affect our operating results and/or cause us to reduce our scheduled operations at Frontier. Fuel prices continue to be susceptible to, among other factors, speculative trading in the commodities market, political unrest in various parts of the world, Organization of Petroleum Exporting Countries policy, the rapid growth of economies in China and India, the levels of inventory carried by the oil companies, the amount of reserves built by governments, refining capacity, and weather. These and other factors that impact the global supply and demand for aircraft fuel may affect our financial performance due to its high sensitivity to fuel prices. A one-cent change in the cost of each gallon of fuel would impact our pre-tax income by approximately $2.3 million per year based on our current fleet and aircraft fuel consumption.

Since the acquisitions of Midwest and Frontier, fuel has become a major component of our operating expenses, accounting for 24.4% of our total operating expenses for the year ended December 31, 2010. Our ability to pass on increased fuel costs has been and may continue to be limited by economic and competitive conditions.

We depend heavily on the Denver and Milwaukee markets to be successful.

Our business strategy for Frontier is focused on adding flights to and from our Denver and Milwaukee bases of operations. As of December 31, 2010, 95% of our flights originate or depart from Denver International Airport, known as DIA, and General Mitchell International Airport in Milwaukee, known as MKE (this does not include seasonal non-hub flying to Mexico). A reduction in our share of either market, increased competition, or reduced passenger traffic to or from or through Denver or Milwaukee could have an adverse effect on our financial condition and results of operations. In addition, our dependence on a hub system operating out of DIA makes us more susceptible to adverse weather conditions and other traffic delays in the Rocky Mountain region than some of our competitors that may be better able to spread these traffic risks over larger route networks.

We face intense competition by United Airlines, Southwest Airlines and other airlines at DIA and by AirTran, Southwest Airlines, and Delta Air Lines at MKE.

The airline industry is highly competitive. We compete with United in our hub in Denver, and we anticipate that we will compete with United in any additional markets we elect to serve in the future. United and United's regional airline affiliates are the dominant carriers out of DIA. In addition, Southwest Airlines started service to and from Denver in January 2006 and has grown significantly since then to become the third largest carrier at DIA. Southwest pricing has caused downward pressure on Frontier yields and any future Southwest exposure may place further downward pressure

on our revenue. Fare wars, predatory pricing, and “capacity dumping,” in which a competitor places additional aircraft on selected routes, and other competitive activities could adversely affect us. In Milwaukee, although Frontier is the largest carrier, we face competition from AirTran, Southwest Airlines, and Delta Air Lines. In addition, AirTran and Southwest Airlines have recently announced plans to merge, which may change the competitive landscape in DIA and MKE. The future activities of competing branded carriers in DIA, MKE and any other focus city from which we operate may have a material adverse effect on our revenue and results of operations.

Our fixed-fee business is dependent on our code-share relationships with our Partners.

We depend on relationships created by our regional jet fixed-fee code-share agreements with American, Continental, Delta, United and US Airways for all of our fixed-fee service revenues. Any material modification to, or termination of, our code-share agreements with any of these Partners could have a material adverse effect on our financial condition, results of our operations and the price of our common stock. Each of the code-share agreements contains a number of grounds for termination by our Partners, including our failure to meet specified performance levels.

In addition, because all of our fixed-fee service revenues are currently generated under the code-share agreements, if any one of them is terminated, we cannot assure you that we would be able to enter into substitute code-share arrangements, that any such substitute arrangements would be as favorable to us as the current code-share agreements or that we could successfully utilize those aircraft in our branded operations.

Our customers may react negatively to the consolidation of our branded service under the “Frontier” name.

As we move toward a unified branded operation, there may be customer dissatisfaction with the branding direction taken by us. Additionally, customers in certain markets may not respond positively or recognize the Frontier brand.

We may be unable to profitably redeploy smaller aircraft removed from service.

Certain of our Partners have indicated a desire to schedule fewer 50 seat aircraft. In addition, in most cases, the term of the aircraft lease or debt agreement exceeds the term of the aircraft under its respective code-share agreement. To the extent that aircraft are removed from service, we must either sell or sublease the aircraft to another party or redeploy it in order to cover our carrying expenses for that aircraft. Our inability to sell, sublease and/or redeploy aircraft that have been removed from fixed-fee service could have a material adverse effect on our financial condition, results of operations and the price of our common stock.

Further, as we review our branded fleet, we may determine to substitute larger aircraft for smaller aircraft. Our inability to profitably redeploy or dispose of the smaller aircraft could have a material adverse effect on our financial condition, results of operations and the price of our common stock.

The airline industry has recently gone through a period of consolidation and transition; consequently, we have fewer potential Partners.

Since 1978 and continuing to the present, the airline industry has undergone substantial consolidation, and it may in the future undergo additional consolidation. For example, recently AirTran and Southwest Airlines announced plans to merge, Continental and United completed a merger and in 2008, Delta and Northwest completed a merger. Other recent developments include the domestic code-share alliance between United and US Airways, and the merger of America West and US Airways. We, as well as our Partners, routinely monitor changes in the competitive landscape and engage in analysis and discussions regarding our strategic position, including potential alliances and business combination transactions. Further consolidation could limit the number of potential partners with whom we could enter into code-share relationships. Although none of our contracts with our Partners allow termination or are amendable in the event of consolidation, any additional consolidation or significant alliance activity within the airline industry could adversely affect our relationship with our Partners.

If the financial strength of any of our Partners decreases, our financial strength is at risk.

We are directly affected by the financial and operating strength of the Partners in our fixed-fee regional airline code-share business. In the event of a decrease in the financial or operational strength of any of our Partners, such Partner may be unable to make the payments due to us under its code-share agreement. In addition, it may reduce utilization of our aircraft to the minimum levels specified in the code-share agreements, and it is possible that any code-share agreement with a code-share Partner that files for reorganization under Chapter 11 of the bankruptcy code may not be assumed in bankruptcy and could be modified or terminated. Any such event could have an adverse effect on our operations and the price of our common stock. As of February 3, 2011, Standard & Poor's and Moody's, respectively, maintained ratings of B- and Caa1 for US Airways, B- and Caa1 for AMR Corp., the parent of American, B and B2 for Delta, and B and B2 for United Continental Holdings, Inc., the parent of United and Continental.

Our Partners may expand their direct operation of aircraft thus limiting the expansion of our relationships with them.

We depend on major airlines such as our Partners to contract with us instead of purchasing and operating their own aircraft. However, some major airlines own their own regional airlines and operate their own aircraft instead of entering into contracts with us or other regional carriers. For example, American and Delta have acquired many aircraft which they fly under their affiliated carriers, American Eagle, with respect to American, and Comair, with respect to Delta. In addition, US Airways is operating aircraft through its PSA subsidiary. We have no guarantee that in the future our Partners will choose to enter into contracts with us instead of purchasing their own aircraft or entering into relationships with competing regional airlines. They are not prohibited from doing so under our code-share agreements. In addition, US Airways previously announced that, pursuant to an agreement with its pilots, US Airways will not enter into agreements with its regional affiliates to fly E190 and higher capacity aircraft and it is possible that our other partners will make the same decision. A decision by US Airways, American, Delta, United, or Continental to phase out our contract based code-share relationships as they expire and instead acquire and operate their own aircraft or to enter into similar agreements with one or more of our competitors could have a material adverse effect on our financial condition, results of operations and the price of our common stock.

Any labor disruption or labor strikes by our employees or those of our Partners would adversely affect our ability to conduct our business.

All of our pilots, flight attendants, dispatchers, and aircraft appearance agents as well as our mechanics at Frontier are represented by unions. Collectively, these employees represent approximately 54% of our workforce. Although we have never had a work interruption or stoppage and believe our relations with our unionized employees are generally good, we are subject to risks of work interruption or stoppage and/or may incur additional administrative expenses associated with union

representation of our employees. If we are unable to reach agreement with any of our unionized work groups on the amended terms of their collective bargaining agreements, we may be subject to work interruptions and/or stoppages. Any sustained work stoppages could adversely affect our ability to fulfill our obligations under our code-share agreements and could have a material adverse effect on our financial condition, results of operations and the price of our common stock.

Under the terms of our jet code-share agreement with US Airways, if we are unable to provide scheduled flights as a result of a strike by our employees, it is only required to pay us for certain fixed costs for specified periods. Under the terms of the code-share agreements with the remainder of our Partners, none of them are required to pay us any amounts during the period our employees are on strike and we are unable to provide scheduled flights. A sustained strike by our employees would require us to bear costs otherwise paid by our Partners.

In addition, a labor disruption other than a union authorized strike may materially impact our results of operations and could cause us to be in material breach of our code-share agreements, all of which require us to meet specified flight completion levels during specified periods. Our Partners have the right to terminate their code-share agreements if we fail to meet these completion levels.

Our Partners may be restricted in increasing the level of business that they conduct with us, thereby limiting our growth.

In general, the pilots' unions of certain major airlines have negotiated “scope clauses” in their collective bargaining agreements, known as CBAs, that restrict the number and/or size of aircraft that can be operated by the regional code-share partners of such major airlines.

The US Airways' pilot CBA provides that the total number of aircraft in US Airways operations not flown by US Airways pilots (which includes flying by partners under code-share arrangements) may not exceed 465. Within the overall 465 aircraft limit, there is no quantity limitation on the number of small regional jets (defined as aircraft configured with 78 or fewer seats) that may be flown by regional code-share partners. Also within the 465 total aircraft limit, US Airways can outsource up to 93 aircraft with more than 78, but fewer than 91 seats, including E175 and C900 aircraft. US Airways does not restrict the aircraft that its partners may fly for other carriers.

The American Airlines' pilot CBA prohibits regional code-share partners from operating aircraft with more than 50 seats, whether flown on behalf of American or for other carriers.

Delta's pilot CBA prohibits its regional code-share partners from operating aircraft with more than 76 seats, whether flown on behalf of Delta or for other carriers. Further, code-share partners may operate no more than 255 aircraft configured with 51 to 76 seats (including 120 aircraft configured with 71 to 76 seats, subject to increase with increases in Delta's fleet size).

United's pilot CBA prohibits code-share partners from operating aircraft on behalf of United configured with more than 70 seats or weighing more than 80,000 pounds. However, this limitation does not apply to aircraft flown by the code-share partner on behalf of carriers other than United.

Continental's pilot CBA prohibits code-share partners from operating aircraft on behalf of Continental configured with more than 50 seats. However, similar to United's restriction, this limitation does not apply to aircraft flown by the code-share partner on behalf of carriers other than Continental.

We have significant debt and off-balance sheet obligations and any inability to pay would adversely impact our operations.

The airline business is very capital intensive and, as a result, many airline companies are highly leveraged. During the years ended December 31, 2010 and 2009, our mandatory debt service payments for aircraft totaled $319.4 million and $278.3 million, respectively, and our mandatory lease payments totaled $233.8 million and $194.3 million, respectively. We have significant lease obligations with respect to our aircraft, which aggregated approximately $1.5 billion and $1.6 billion at December 31, 2010 and 2009, respectively.

We have a significant amount of variable interest rate debt. Approximately $482.7 million and $506.8 million of our debt as of December 31, 2010 and 2009, respectively, is subject to variable market interest rates. If rates increase significantly, our results of operations and cash flows could be adversely impacted.

There can be no assurance that our operations will generate sufficient cash flow to make such payments or that we will

be able to obtain financing to acquire the additional aircraft or make other capital expenditures necessary for our expansion. If we default under our loan or lease agreements, the lender/lessor has available extensive remedies, including, without limitation, repossession of the respective aircraft and other assets. Even if we are able to timely service our debt, the size of our long-term debt and lease obligations could negatively affect our financial condition, results of operations and the price of our common stock in many ways, including:

| |

| • | increasing the cost, or limiting the availability of, additional financing for working capital, acquisitions or other purposes; |

| |

| • | limiting the ways in which we can use our cash flow, much of which may have to be used to satisfy debt and lease obligations; and |

| |

| • | adversely affecting our ability to respond to changing business or economic conditions. |

We may be unable to continue to comply with financial covenants in certain financing agreements, which, if not complied with, could materially and adversely affect our liquidity and financial condition.

We are required to comply with certain financial covenants under certain of our financing arrangements. We are required to maintain $125 million of unrestricted cash, maintain certain cash flow, debt service coverage and working capital covenants. As of December 31, 2010, we were in compliance with all our covenants.

We currently depend on Embraer and Airbus to support our fleet of aircraft.

We rely on Embraer as the manufacturer of substantially all of our regional jets and on Airbus as the manufacturer of our narrow-body jets. Our risks in relying primarily on a single manufacturer for each aircraft type include:

| |

| • | the failure or inability of Embraer or Airbus to provide sufficient parts or related support services on a timely basis; |

| |

| • | the interruption of fleet service as a result of unscheduled or unanticipated maintenance requirements for these aircraft; |

| |

| • | the issuance of FAA directives restricting or prohibiting the use of Embraer or Airbus aircraft or requiring time-consuming inspections and maintenance; and |

| |

| • | the adverse public perception of a manufacturer as a result of an accident or other adverse publicity. |

Our operations could be materially adversely affected by the failure or inability of Embraer, Airbus or any key component manufacturers to provide sufficient parts or related support services on a timely basis or by an interruption of fleet service as a result of unscheduled or unanticipated maintenance requirements for our aircraft.

Reduced utilization levels of our aircraft under the fixed-fee agreements would adversely impact our revenues, earnings and liquidity.

Our agreements with our Partners require each of them to schedule our aircraft to a minimum level of utilization. However, the aircraft have historically been utilized more than the minimum requirement. Even though the fixed-fee rates may adjust, either up or down, based on scheduled utilization levels or require a fixed amount per day to compensate us for our fixed costs, if our aircraft are at or below the minimum requirement (including taking into account the stage length and frequency of our scheduled flights) we will likely lose both the opportunity to recover a margin on the variable costs of flights that would have been flown if our aircraft were more fully utilized and the opportunity to earn incentive compensation on such flights.

Increases in our labor costs, which constitute a substantial portion of our total operating costs, will directly impact our earnings.

Labor costs constitute a significant percentage of our total operating costs, and we have experienced pressure to increase wages and benefits for our employees. Under our code-share agreements, our reimbursement rates contemplate labor costs that increase on a set schedule generally tied to an increase in the consumer price index or the actual increase in the contract. We are entirely responsible for our labor costs, and we may not be entitled to receive increased payments for our flights from our Partners if our labor costs increase above the assumed costs included in the reimbursement rates. As a result, a significant increase in our labor costs above the levels assumed in our reimbursement rates could result in a material reduction in our earnings. Many of our employees within our Frontier operations experienced a reduction in pay levels during the Frontier bankruptcy. Any restoration of these reductions in pay levels will increase our labor costs.

We have collective bargaining agreements with our pilots, flight attendants, dispatchers, mechanics, material specialists and aircraft appearance agents. We cannot assure that future agreements with our employees' unions will be on terms in line with our expectations or comparable to agreements entered into by our competitors, and any future agreements may increase our labor costs and reduce both our income and our competitiveness for future business opportunities. As of December 31, 2010, approximately 54% of the Company's workforce is employed under union contracts. Because of the high level of unionization among our employees, we are subject to risks of work interruption or stoppage and/or the incurrence of additional expenses associated with union representation of our employees. We have never experienced any work stoppages or other job actions and generally consider our relationship with our employees to be good. The union contract for our pilots and our flight attendants, except Frontier’s pilots, is currently amendable. The union contracts for our mechanics and tool room attendants and our material specialists are amendable in 2011.

Our credit card processors have the ability to increase their holdbacks in certain circumstances. The initiation of such holdbacks likely would have a material adverse effect on our liquidity.

In our Frontier business, most of the tickets we sell are paid for by customers who use credit cards. Our credit card processing agreements generally provide for a 95% holdback of receivables. If circumstances were to occur that would allow our processor to increase their holdbacks, our liquidity would be negatively impacted.

Our business could be harmed if we lose the services of our key personnel.

Our business depends upon the efforts of our Chief Executive Officer, Bryan Bedford, and our other key management and operating personnel. American can terminate its code-share agreement if we replace Mr. Bedford without its consent, which cannot be unreasonably withheld. We may have difficulty replacing management or other key personnel who leave and, therefore, the loss of the services of any of these individuals could harm our business. We maintain a “key man” life insurance policy in the amount of $5 million for Mr. Bedford, but this amount may not adequately compensate us in the event we lose his services.

On November 3, 2010, we and our Chief Financial Officer, Robert Hal Cooper, entered into an agreement pursuant to which Mr. Cooper will serve as Chief Financial Officer through at least April 1, 2011. We are interviewing both internal and external candidates for the chief financial officer position and expect to name a replacement before Mr. Cooper departs. We anticipate a smooth transition of responsibilities from Mr. Cooper to his successor.

We may experience difficulty finding, training and retaining employees.

The airline industry is experiencing a shortage of qualified personnel, specifically pilots and maintenance technicians. In addition, as is common with most of our competitors, we have, from time to time, faced considerable turnover of our employees. Our pilots, flight attendants and maintenance technicians sometimes leave to work for larger airlines, which generally offer higher salaries and more extensive benefit programs than regional airlines or other low cost carriers are financially able to offer. Should the turnover of employees, particularly pilots and maintenance technicians, sharply increase, the result will be significantly higher training costs than otherwise would be necessary. An inability to recruit, train and retain qualified employees may adversely impact our performance.

Our acquisition of Midwest and Frontier affects the comparability of our historical financial results.

Our results of operations for the year ended December 31, 2010 includes a full year impact of our Frontier and Midwest acquisitions, while our 2009 results of operations include the results of Midwest for five months and Frontier for

three months, and the results for the year ended December 31, 2008 and all prior periods do not include Midwest and Frontier. This complicates the ability to compare our results of operations and statement of cash flows.

We experience high costs at DIA, which may impact our results of operations.

Our largest hub of flight operations is DIA where we experience high costs. Financed through revenue bonds, DIA depends on landing fees, gate rentals, income from airlines and the traveling public, and other fees to generate income to service its debt and to support its operations. Our cost of operations at DIA will vary as traffic increases or diminishes at the airport or as significant improvement projects are undertaken by the airport. We believe that our operating costs at DIA exceed those that other airlines incur at most hub airports in other cities, which decreases our ability to compete with other airlines with lower costs at their hub airports.

Our maintenance expenses may be higher than we anticipate and will increase as our fleet ages.

We bear the cost of all routine and major maintenance on our owned and leased aircraft. Maintenance expenses comprise a significant portion of our operating expenses. In addition, we are required periodically to take aircraft out of service for heavy maintenance checks, which can increase costs and reduce revenue. We also may be required to comply with regulations and airworthiness directives the FAA issues, the cost of which our aircraft lessors may only partially assume depending upon the magnitude of the expense. Although we believe that our owned and leased aircraft are currently in compliance with all FAA issued airworthiness directives, additional airworthiness directives likely will be required in the future, necessitating additional expense.

Because the average age of our Embraer aircraft is approximately 5.5 years old and that of our Airbus aircraft is approximately 6.0 years old, our aircraft require less maintenance now than they will in the future. We have incurred lower maintenance expenses because most of the parts on our aircraft are under multi-year warranties. Our maintenance costs will increase significantly as our fleet ages and these warranties expire.

Our ability to utilize net operating loss carry-forwards may be limited.

At December 31, 2010, we had estimated federal net operating loss carry-forwards, which we refer to as NOLs, of $1.3 billion for federal income tax purposes that begin to expire in 2015. We have recorded a valuation allowance for $345 million of those NOLs. Section 382 of the Internal Revenue Code, which we refer to as Section 382, imposes limitations on a corporation's ability to utilize NOLs if it experiences an “ownership change.” In general terms, an ownership change may result from transactions increasing the ownership of certain stockholders in the stock of a corporation by more than 50 percentage points over a three-year period. In the event of an ownership change, utilization of our NOLs would be subject to an annual limitation under Section 382. Any unused NOLs in excess of the annual limitation may be carried over to later years.

The imposition of a limitation on our ability to use our NOLs to offset future taxable income could cause U.S. federal income taxes to be paid earlier than otherwise would be paid if such limitation were not in effect and could cause such NOLs to expire unused, reducing or eliminating the benefit of such NOLs. Based on analysis that we performed, we believe we have not experienced a change in ownership as defined by Section 382, and, therefore, our NOLs are not currently under any Section 382 limitation, except for NOLs acquired from Frontier.

The lack of marketing alliances could harm our Frontier business.

Many branded airlines have marketing alliances with other airlines, under which they market and advertise their status as marketing alliance partners. Among other things, they share the use of two-letter flight designator codes to identify their flights and fares in the computerized reservation systems and permit reciprocity in their frequent flyer programs. Frontier does not have an extensive network of marketing partners. The lack of marketing alliances and limited international presence puts us at a competitive disadvantage to global network carriers, whose ability to attract passengers through more widespread alliances, particularly on international routes, may adversely affect our passenger traffic and our results of operations.