Exhibit 13

This document is a free translation only. Due to the complexities of language translation, translations are not always precise. The original document was prepared in Portuguese, and in case of any divergence, discrepancy or difference between this version and the Portuguese version, the Portuguese version shall prevail. The Portuguese version is the only valid and complete version and shall prevail for any and all purposes. There is no assurance as to the accuracy, reliability or completeness of the translation. Any person reading this translation and relying on it should do so at his or her own risk.

Exhibit 5.3.5 to the Amendment to the Original PRJ of Oi Group

Assets, Liabilities and Rights of UPI TVCo

UPI TVCo will be composed of 100% of the shares issued by SPE TVCo and by assets, liabilities, agreements and clients that make up Oi’s pay TV business.

The assets that will potentially comprise the SPE TVCo will be net remaining assets formed by the registered assets of the DTH transaction in the fixed assets of Oi Móvel. Section A to this Exhibit 5.3.5 presents current examples of the net remaining assets, including (i) DTH equipment, (ii) Headends and Platforms to provide DTH services, and (iii) DTH installation.

The agreements necessary for the provision of DTH TV services will be migrated to SPE TVCO, such as, but not limited to, the agreements with content programmers and the SES - 6 satellite capacity agreement described in Section C of this Exhibit 5.3.5.

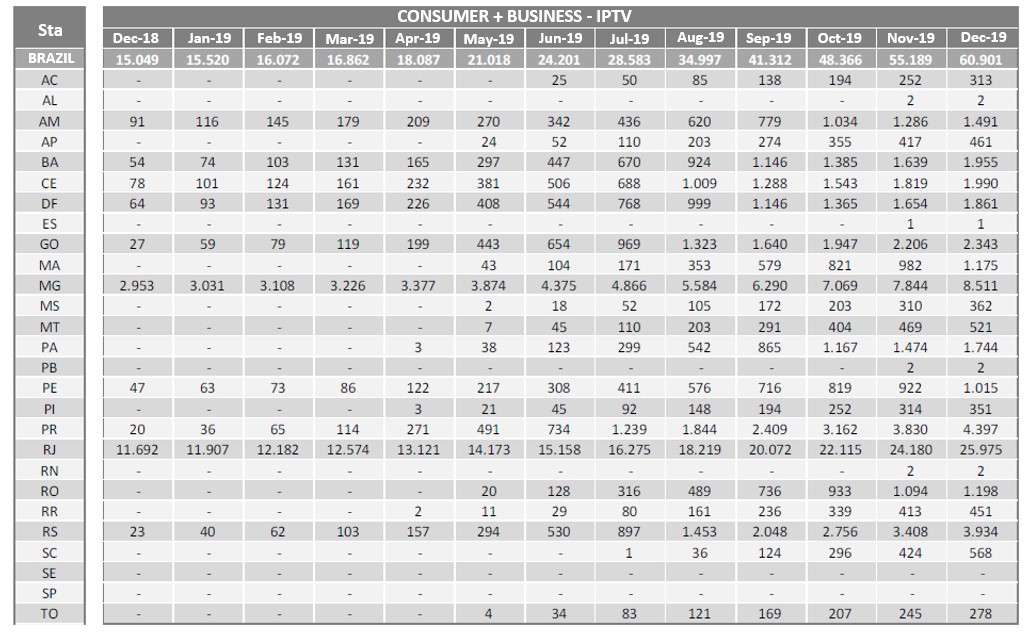

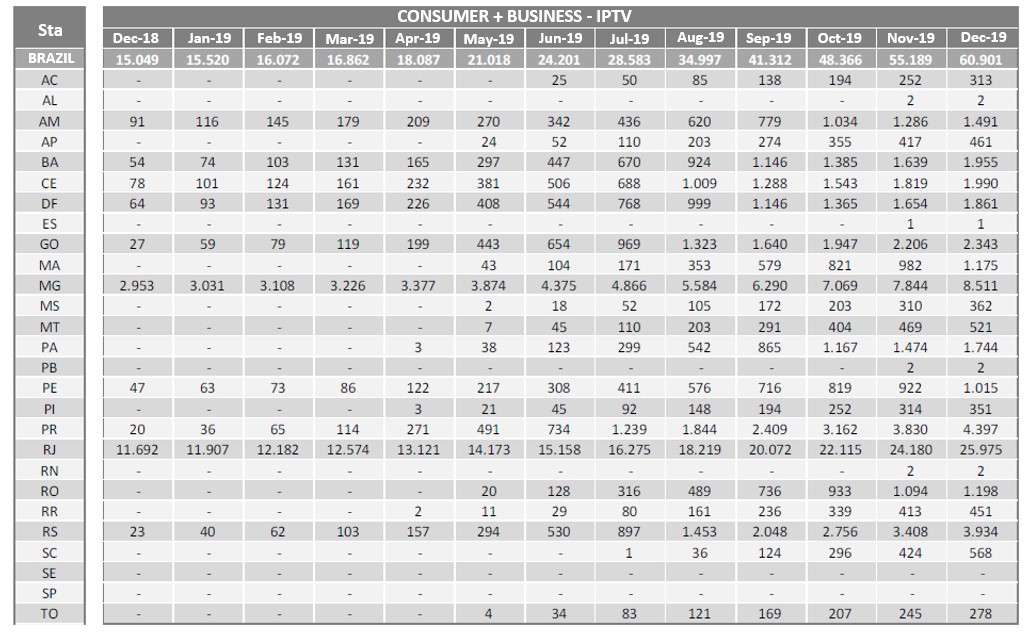

SPE TVCo’s clients will be those referring to DTH and IPTV operations. Currently, Oi Móvel’s TV clients that will be migrated have a national distribution, with presence in the 27 federation units, as described in Section B to this Exhibit 5.3.5. TV services are provided by DTH (Direct to Home) or IPTV (Internet Protocol TV). IPTV clients are supported on the Oi Group’s FTTH network.

Until the publication of the Public Notice for the Competitive Bidding Procedure for the sale of UPI TVCo, the final list of assets, liabilities, contracts and clients that will comprise UPI TVCo, originating mainly from Oi Móvel, will be completed and detailed. Debtors may include any new examples in Sections A, B and C to this Exhibit 5.3.5, provided that they comply with the applicable legal and regulatory requirements.

Section A of Exhibit 5.3.5

Current Example of the Bookkeeping Net Equity DTH

| Category of the Asset | Sub-Category | Bookkeeping Value (Millions of BRL) |

| i) DTH Equipment | DTH Decoder | 554.62 |

| Other Equipment | 15.54 |

| ii) Headends and Platforms | Headends (DTH Exclusive) | 31.12 |

| Headends (DTH Exclusive Land) | 25.29 |

| iii) DTH Facility | DTH Facility | 634.57 |

Section B of Exhibit 5.3.5

DTH and IPTV Clients

Section C of Exhibit 5.3.5

Satellite Capacity Agreement - New Skyes

· Owner and Operator of the Satellite: New Skies Satellites B.V., commercially represented in Brazil by New Skies Satellites Ltda

· Counterparties of the Oi Group: Oi Móvel S.A

· 1.296MHz in the Ku band in satellite SES-6

· Contractual term from July 2013 to July 2027

· Take or Pay modality

Payment flows set forth for the remainder of the agreement: USD 373,061,945