UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________________________________________

FORM 10-Q

____________________________________________________

(Mark one) |

| |

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2017

OR

|

| |

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 001-35940

____________________________________________________

CHANNELADVISOR CORPORATION

(Exact name of registrant as specified in its charter)

____________________________________________________

|

| | |

| Delaware | | 56-2257867 |

(State or Other Jurisdiction of Incorporation or Organization) | | (I.R.S. Employer Identification No.) |

| | |

| 3025 Carrington Mill Boulevard, Morrisville, NC | | 27560 |

| (Address of principal executive offices) | | (Zip Code) |

(919) 228-4700

(Registrant’s telephone number, including area code)

N/A

(Former name, former address and former

fiscal year, if changed since last report)

____________________________________________________

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and "emerging growth company" in Rule 12b-2 of the Securities Exchange Act of 1934.

|

| | | |

| Large accelerated filer | ¨ | Accelerated filer | x |

| Non-accelerated filer | o (Do not check if a smaller reporting company) | Smaller reporting company | ¨ |

| | | Emerging growth company | x |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. x

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Securities Exchange Act of 1934). Yes ¨ No x

The number of outstanding shares of the registrant’s common stock, par value $0.001 per share, as of the close of business on October 19, 2017 was 26,569,655.

PART I - FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

CHANNELADVISOR CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands, except share and per share data)

|

| | | | | | | |

| September 30, 2017 |

| December 31, 2016 |

| | (unaudited) |

| |

| Assets |

|

|

|

| Current assets: |

|

|

|

| Cash and cash equivalents | $ | 54,178 |

|

| $ | 65,420 |

|

| Accounts receivable, net of allowance of $304 and $594 as of September 30, 2017 and December 31, 2016, respectively | 21,276 |

|

| 19,445 |

|

| Prepaid expenses and other current assets | 12,249 |

|

| 10,972 |

|

| Total current assets | 87,703 |

|

| 95,837 |

|

| Property and equipment, net | 11,797 |

|

| 13,252 |

|

| Goodwill | 23,486 |

|

| 21,632 |

|

| Intangible assets, net | 2,658 |

|

| 2,660 |

|

| Long-term deferred tax assets, net | 5,580 |

| | 5,244 |

|

| Other assets | 813 |

|

| 533 |

|

| Total assets | $ | 132,037 |

|

| $ | 139,158 |

|

| Liabilities and stockholders’ equity |

|

|

|

| Current liabilities: |

|

|

|

| Accounts payable | $ | 3,533 |

|

| $ | 4,709 |

|

| Accrued expenses | 10,656 |

|

| 11,067 |

|

| Deferred revenue | 26,316 |

|

| 23,474 |

|

| Other current liabilities | 4,807 |

|

| 4,450 |

|

| Total current liabilities | 45,312 |

|

| 43,700 |

|

| Long-term capital leases, net of current portion | 898 |

|

| 1,262 |

|

| Lease incentive obligation | 3,547 |

| | 4,206 |

|

| Other long-term liabilities | 3,484 |

|

| 2,993 |

|

| Total liabilities | 53,241 |

|

| 52,161 |

|

| Commitments and contingencies |

|

|

|

|

|

| Stockholders’ equity: |

|

|

|

| Preferred stock, $0.001 par value, 5,000,000 shares authorized, no shares issued and outstanding as of September 30, 2017 and December 31, 2016 | — |

| | — |

|

| Common stock, $0.001 par value, 100,000,000 shares authorized, 26,481,401 and 25,955,759 shares issued and outstanding as of September 30, 2017 and December 31, 2016, respectively | 26 |

|

| 26 |

|

| Additional paid-in capital | 259,334 |

|

| 252,158 |

|

| Accumulated other comprehensive loss | (893 | ) |

| (1,612 | ) |

| Accumulated deficit | (179,671 | ) |

| (163,575 | ) |

| Total stockholders’ equity | 78,796 |

|

| 86,997 |

|

| Total liabilities and stockholders’ equity | $ | 132,037 |

|

| $ | 139,158 |

|

The accompanying notes are an integral part of the unaudited condensed consolidated financial statements.

CHANNELADVISOR CORPORATION AND SUBSIDIARIES

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except share and per share data)

|

| | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2017 | | 2016 | | 2017 | | 2016 |

| Revenue | $ | 30,097 |

| | $ | 27,992 |

| | $ | 88,430 |

| | $ | 81,437 |

|

| Cost of revenue | 6,549 |

| | 6,811 |

| | 19,911 |

| | 20,587 |

|

| Gross profit | 23,548 |

| | 21,181 |

| | 68,519 |

| | 60,850 |

|

| Operating expenses: |

| | | | | | |

| Sales and marketing | 15,565 |

| | 13,824 |

| | 47,231 |

| | 43,064 |

|

| Research and development | 5,760 |

| | 4,512 |

| | 15,878 |

| | 13,077 |

|

| General and administrative | 6,344 |

| | 5,525 |

| | 21,552 |

| | 18,768 |

|

| Total operating expenses | 27,669 |

| | 23,861 |

| | 84,661 |

| | 74,909 |

|

| Loss from operations | (4,121 | ) | | (2,680 | ) | | (16,142 | ) | | (14,059 | ) |

| Other income (expense): | | | | | | | |

| Interest income (expense), net | 67 |

| | 11 |

| | 149 |

| | (11 | ) |

| Other income (expense), net | 36 |

| | 90 |

| | 106 |

| | 137 |

|

| Total other income (expense) | 103 |

| | 101 |

| | 255 |

| | 126 |

|

| Loss before income taxes | (4,018 | ) | | (2,579 | ) | | (15,887 | ) | | (13,933 | ) |

| Income tax expense (benefit) | 37 |

| | (27 | ) | | 209 |

| | (91 | ) |

| Net loss | $ | (4,055 | ) | | $ | (2,552 | ) | | $ | (16,096 | ) | | $ | (13,842 | ) |

| Net loss per share: | | | | | | | |

| Basic and diluted | $ | (0.15 | ) | | $ | (0.10 | ) | | $ | (0.61 | ) | | $ | (0.54 | ) |

| Weighted average common shares outstanding: | | | | | | | |

| Basic and diluted | 26,439,830 |

| | 25,723,749 |

| | 26,293,650 |

| | 25,513,105 |

|

The accompanying notes are an integral part of the unaudited condensed consolidated financial statements.

CHANNELADVISOR CORPORATION AND SUBSIDIARIES

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE LOSS

(in thousands)

|

| | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2017 | | 2016 | | 2017 | | 2016 |

| Net loss | $ | (4,055 | ) |

| $ | (2,552 | ) |

| $ | (16,096 | ) |

| $ | (13,842 | ) |

| Other comprehensive gain (loss): | | | | | | | |

| Foreign currency translation adjustments | 184 |

| | (78 | ) | | 719 |

| | (180 | ) |

| Total comprehensive loss | $ | (3,871 | ) | | $ | (2,630 | ) | | $ | (15,377 | ) | | $ | (14,022 | ) |

The accompanying notes are an integral part of the unaudited condensed consolidated financial statements.

CHANNELADVISOR CORPORATION AND SUBSIDIARIES

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

|

| | | | | | | |

| | Nine Months Ended September 30, |

| | 2017 | | 2016 |

| Cash flows from operating activities | | | |

| Net loss | $ | (16,096 | ) | | $ | (13,842 | ) |

| Adjustments to reconcile net loss to cash and cash equivalents (used in) provided by operating activities: | | | |

| Depreciation and amortization | 5,041 |

| | 5,961 |

|

| Bad debt expense | 271 |

| | 246 |

|

| Stock-based compensation expense | 9,132 |

| | 10,207 |

|

| Other items, net | (499 | ) | | (769 | ) |

| Changes in assets and liabilities, net of effects from acquisition: | | | |

| Accounts receivable | (1,674 | ) | | 2,820 |

|

| Prepaid expenses and other assets | (1,370 | ) | | 1,832 |

|

| Accounts payable and accrued expenses | (51 | ) | | (1,251 | ) |

| Deferred revenue | 3,042 |

| | 4,162 |

|

| Cash and cash equivalents (used in) provided by operating activities | (2,204 | ) | | 9,366 |

|

| Cash flows from investing activities | | | |

| Purchases of property and equipment | (2,427 | ) | | (920 | ) |

| Payment of internal-use software development costs | (224 | ) | | (195 | ) |

| Acquisition, net of cash acquired | (2,177 | ) | | — |

|

| Cash and cash equivalents used in investing activities | (4,828 | ) | | (1,115 | ) |

| Cash flows from financing activities | | | |

| Repayment of capital leases | (2,586 | ) | | (2,079 | ) |

| Proceeds from exercise of stock options | 625 |

| | 821 |

|

| Payment of contingent consideration | — |

| | (338 | ) |

| Payment of statutory tax withholding related to net-share settlement of restricted stock units | (2,581 | ) | | (2,085 | ) |

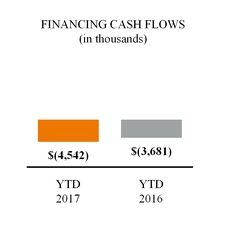

| Cash and cash equivalents used in financing activities | (4,542 | ) | | (3,681 | ) |

| Effect of currency exchange rate changes on cash and cash equivalents | 332 |

| | (313 | ) |

| Net (decrease) increase in cash and cash equivalents | (11,242 | ) | | 4,257 |

|

| Cash and cash equivalents, beginning of period | 65,420 |

| | 60,474 |

|

| Cash and cash equivalents, end of period | $ | 54,178 |

| | $ | 64,731 |

|

| Supplemental disclosure of cash flow information | | | |

| Cash paid for interest | $ | 99 |

| | $ | 126 |

|

| Cash paid for income taxes, net | $ | 151 |

| | $ | 110 |

|

| Supplemental disclosure of noncash investing and financing activities | | | |

| Accrued capital expenditures | $ | 54 |

| | $ | 439 |

|

| Capital lease obligations entered into for the purchase of fixed assets | $ | 567 |

| | $ | 1,771 |

|

The accompanying notes are an integral part of the unaudited condensed consolidated financial statements.

CHANNELADVISOR CORPORATION AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS 1. DESCRIPTION OF THE BUSINESS

ChannelAdvisor Corporation ("ChannelAdvisor" or the "Company") was incorporated in the state of Delaware and capitalized in June 2001. The Company began operations in July 2001. ChannelAdvisor is a provider of software-as-a-service, or SaaS, solutions and our mission is to connect and optimize the world's commerce. ChannelAdvisor's e-commerce cloud platform helps retailers and branded manufacturers worldwide improve their online performance by expanding sales channels, connecting with consumers around the world, optimizing their operations for peak performance and providing actionable analytics to improve competitiveness. The Company is headquartered in Morrisville, North Carolina and has international offices in England, Ireland, Germany, Australia, Brazil, China and Spain.

2. SIGNIFICANT ACCOUNTING POLICIES

Principles of Consolidation

The accompanying condensed consolidated financial statements include the accounts of the Company and its wholly-owned subsidiaries. All intercompany accounts and transactions have been eliminated in consolidation.

Interim Condensed Consolidated Financial Information

The accompanying condensed consolidated financial statements and footnotes have been prepared in accordance with generally accepted accounting principles in the United States of America ("U.S. GAAP") as contained in the Financial Accounting Standards Board ("FASB") Accounting Standards Codification ("ASC") for interim financial information. In the opinion of management, the interim financial information includes all adjustments of a normal recurring nature necessary for a fair presentation of financial position, the results of operations, comprehensive loss and cash flows. The results of operations for the three and nine months ended September 30, 2017 are not necessarily indicative of the results for the full year or the results for any future periods. These unaudited interim financial statements should be read in conjunction with the audited financial statements and related footnotes for the year ended December 31, 2016 ("fiscal 2016"), which are included in the Company’s Annual Report on Form 10-K for fiscal 2016. There have been no material changes to the Company’s significant accounting policies from those described in the footnotes to the audited financial statements contained in the Company’s Annual Report on Form 10-K for fiscal 2016.

Recent Accounting Pronouncements

|

| | |

| Standard | Description | Effect on the Financial Statements or Other Significant Matters |

| Standards that the Company has not yet adopted |

| Revenue Recognition: |

|

| | |

Accounting Standards Update ("ASU") 2014-09, Revenue from Contracts with Customers (Topic 606)

The Company's adoption date: January 1, 2018 | The standard will replace existing revenue recognition standards and provides that an entity should recognize revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services. ASU 2014-09 also requires improved disclosures to help users of financial statements better understand the nature, amount, timing, and uncertainty of revenue that is recognized. Entities have the option of using either a full retrospective or modified retrospective approach for the adoption of the standard. | The Company formed a project team to evaluate and direct the implementation of the new revenue recognition standard and related amendments. The project team developed an implementation plan centered around specific functional areas that may be impacted by the standard and its amendments, including accounting and reporting, information technology ("IT"), internal audit and contracts and legal, among others. This team has recently completed certain IT updates to the Company's accounting system to support recognition and disclosure under the new standard, and is continuing to make additional updates to facilitate the standard's adoption and reporting requirements. The project team completed an initial contract assessment on a sample of contracts and analyzed the Company's contract portfolio and associated contract costs. The team is finalizing the Company's remaining accounting positions under ASU 2014-09, as amended, including certain significant judgments and estimates required, and is currently assessing the potential changes to internal controls and the tax effect implications. The project team has reported the findings and progress of the implementation plan to management and to the Audit Committee on a frequent basis over the last two years and will continue to do so as the effective date of the new standard approaches. The Company anticipates that the adoption of the new standard will impact the timing of revenue recognition of fixed fees for its contracts, as well as the accounting for costs to obtain contracts. For managed-service contracts, the Company currently defers revenue until the completion of the implementation services, at which point the Company recognizes a cumulative catch-up adjustment equal to the revenue earned during the implementation period but previously deferred. The remaining balance of these fixed fees is recognized ratably over the remaining term of the contract. Under the new standard, the Company expects revenue recognition for the managed-service subscription and implementation fees to begin on the launch date and to be recognized over time through the contract end date, with no cumulative catch-up adjustment on the launch date. Further, the Company currently expenses sales commissions and related bonuses as incurred. Under the new standard, the Company will be required to defer and amortize a portion of these contract costs. The Company intends to adopt the new standard using the modified retrospective transition method effective January 1, 2018. The Company continues to evaluate the provisions of the new standard to identify further potential impacts to its consolidated financial statements. |

ASU 2016-08, Principal Versus Agent Considerations (Reporting Revenue Gross Versus Net)

The Company's adoption date: January 1, 2018

| The standard clarifies implementation guidance on principal versus agent considerations in ASU 2014-09. |

ASU 2016-10, Identifying Performance Obligations and Licensing

The Company's adoption date: January 1, 2018

| The standard clarifies implementation guidance on the identification of performance obligations and the licensing implementation guidance in ASU 2014-09. |

ASU 2016-12, Narrow-Scope Improvements and Practical Expedients

The Company's adoption date: January 1, 2018

| The standard clarifies the guidance on assessing collectability, presentation of sales taxes, noncash consideration and completed contracts and contract modifications at transition. |

ASU 2016-20, Technical Corrections and Improvements to Topic 606

The Company's adoption date: January 1, 2018

| The standard clarifies certain narrow aspects of ASU 2014-09. |

| Leases: |

ASU 2016-02, Leases (Topic 842)

The Company's adoption date: January 1, 2019

| The standard requires that lessees recognize assets and liabilities for leases with lease terms greater than twelve months in the statement of financial position. The standard also requires improved disclosures to help users of financial statements better understand the amount, timing and uncertainty of cash flows arising from leases. | The Company is currently evaluating the impact the adoption of the standard will have on its consolidated financial statements.

|

|

| | |

| Financial Instruments: |

ASU 2016-13, Financial Instruments - Credit Losses (Topic 326)

The Company's adoption date: January 1, 2020

| The standard replaces the incurred loss impairment methodology in current U.S. GAAP (defined below) with a methodology that reflects expected credit losses. The update is intended to provide financial statement users with more useful information about expected credit losses. | The Company is currently evaluating the impact the adoption of the standard will have on its consolidated financial statements. |

| Cash Flow: |

ASU 2016-18, Restricted Cash

The Company's adoption date: January 1, 2018

| The standard requires that entities show the changes in the total of cash, cash equivalents and restricted cash in the statement of cash flows. Transfers between cash, cash equivalents and restricted cash should not be presented as cash flow activities on the statement of cash flows. | The Company is currently evaluating the impact the adoption of the standard will have on its consolidated financial statements. |

| Standards that the Company has recently adopted |

| Stock-Based Compensation: |

ASU 2016-09, Improvements to Employee Share-Based Payment Accounting (Topic 718)

The Company's adoption date: January 1, 2017

| The standard is intended to simplify several aspects of the accounting for share-based payment transactions, including the accounting for income taxes, forfeitures, and statutory tax withholding requirements, as well as classification in the statement of cash flows. | The Company adopted this standard effective January 1, 2017. As a result of this adoption, the Company recognized $8.2 million of deferred tax assets attributable to accumulated excess tax benefits that under the previous guidance could not be recognized until the benefits were realized through a reduction in income taxes payable. This adjustment was applied using a modified retrospective method with a cumulative-effect adjustment to the accumulated deficit for the excess tax benefits not previously recognized. However, given the full valuation allowance of $8.2 million placed on the additional deferred tax assets, the recognition upon adoption had no impact on the Company's accumulated deficit as of January 1, 2017. Further, the Company has elected to continue to estimate forfeitures to determine the amount of compensation cost to be recognized in each period. |

Use of Estimates

The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the amounts reported in the condensed consolidated financial statements and accompanying notes. Actual results could differ from those estimates.

On an ongoing basis, the Company evaluates its estimates, including those related to the accounts receivable allowance, the useful lives of long-lived assets and other intangible assets, income taxes and assumptions used for purposes of determining stock-based compensation, among others. Estimates and assumptions are also required to value assets acquired and liabilities assumed as well as contingent consideration, where applicable, in conjunction with business combinations. The Company bases its estimates on historical experience and on various other assumptions that it believes to be reasonable, the results of which form the basis for making judgments about the carrying value of assets and liabilities.

3. STOCKHOLDERS' EQUITY

The following table summarizes the stockholders' equity activity for the nine months ended September 30, 2017 (in thousands): |

| | | |

| Balance as of December 31, 2016 | $ | 86,997 |

|

| Exercise of stock options and vesting of restricted stock units | 625 |

|

| Stock-based compensation expense | 9,132 |

|

| Statutory tax withholding related to net-share settlement of restricted stock units | (2,581 | ) |

| Net loss | (16,096 | ) |

| Foreign currency translation adjustments | 719 |

|

| Balance as of September 30, 2017 | $ | 78,796 |

|

4. BUSINESS COMBINATIONS, GOODWILL AND INTANGIBLE ASSETS

Business Combinations

On May 26, 2017, the Company entered into an Agreement and Plan of Merger (the “Merger Agreement”) pursuant to which the Company acquired all of the issued and outstanding shares of HubLogix Commerce Corp. ("HubLogix") (now ChannelAdvisor Fulfillment, Inc.), a fulfillment and logistics platform that automates order management by connecting online storefronts and marketplaces to distribution and fulfillment centers. The Company acquired HubLogix to further enhance its fulfillment network offering and capabilities.

Under the Merger Agreement, the Company paid an aggregate purchase price of $2.3 million for HubLogix, all of which was paid in cash, which amount is subject to adjustment as set forth in the Merger Agreement. The purchase price includes $0.4 million that has been placed into escrow to secure the indemnification obligations of HubLogix stockholders until November 26, 2018.

The acquisition has been accounted for under the acquisition method of accounting in accordance with Accounting Standards Codification Topic 805, Business Combinations ("ASC 805"). Under the acquisition method of accounting, the Company allocated the purchase price to the identifiable assets acquired and liabilities assumed based on their estimated acquisition-date fair value. The difference between the acquisition-date fair value of the consideration and the estimated fair value of the net assets acquired is recorded as goodwill. Goodwill represents the future economic benefits expected to arise from other intangible assets acquired that do not qualify for separate recognition, including acquired workforce, as well as expected future synergies.

Based on management’s provisional assessment of the acquisition-date fair value of the assets acquired and liabilities assumed, the purchase price of $2.3 million has been allocated to the Company’s assets and liabilities on a preliminary basis as follows: $1.9 million to goodwill, $0.5 million to identifiable intangible assets and $0.1 million to working capital as a net current liability. The purchase price allocation in conjunction with the acquisition of HubLogix is subject to change as additional information becomes available. Any adjustments will be made as soon as practicable, but not later than one year from the acquisition date.

The goodwill of $1.9 million arising from the acquisition of HubLogix consists largely of the acquired workforce, the expected company-specific synergies and the opportunity to expand the Company’s product offerings to customers. The goodwill recognized is not deductible for income tax purposes.

The Company incurred transaction costs in connection with the acquisition of $0.3 million, which are included in general and administrative expense in the accompanying condensed consolidated statements of operations for the nine months ended September 30, 2017.

Comparative pro forma financial information for this acquisition has not been presented because the acquisition is not material to the Company’s consolidated results of operations.

Goodwill and Intangible Assets

The following table shows the changes in the carrying amount of goodwill for the nine months ended September 30, 2017 (in thousands):

|

| | | |

| Balance as of December 31, 2016 | $ | 21,632 |

|

| Goodwill attributable to the HubLogix acquisition | 1,854 |

|

| Balance as of September 30, 2017 | $ | 23,486 |

|

There were no changes to the Company's goodwill during the year ended December 31, 2016.

The Company acquired intangible assets in connection with its business acquisitions. These assets were recorded at their estimated fair values at the acquisition date and are being amortized over their respective estimated useful lives using the straight-line method. The estimated useful lives and amortization methodology used in computing amortization are as follows: |

| | |

| | Estimated Useful Life | Amortization Methodology |

| Customer relationships | 7 years | Straight-line |

| Acquired technology | 7 years | Straight-line |

| Trade names | 3 years | Straight-line |

Amortization expense associated with the Company's intangible assets was $0.2 million and $0.1 million for the three months ended September 30, 2017 and 2016, respectively, and was $0.5 million and $0.4 million for the nine months ended September 30, 2017 and 2016, respectively.

5. COMMITMENTS

Sales Tax

During the first quarter of 2017, the Company completed its analysis with regard to potential unpaid sales tax obligations. Based on the results of this analysis, the Company made the decision to enter into voluntary disclosure agreements ("VDAs") with certain jurisdictions to reduce the Company’s potential sales tax liability. VDAs generally provide for a maximum look-back period, a waiver of penalties and, at times, interest as well as payment arrangements. The Company's estimated aggregate VDA liability of $2.5 million was recorded as a one-time charge in general and administrative expense in the accompanying condensed consolidated statements of operations for the nine months ended September 30, 2017. This amount represents the Company's estimate of its potential unpaid sales tax liability through the anticipated look-back periods including interest, where applicable, in all jurisdictions in which the Company has entered into or intends to enter into VDAs. If any of the tax authorities rejects the Company's VDA applications or offers terms that are other than what the Company is anticipating, or if the VDAs do not resolve all potential unpaid sales tax obligations, then it is possible that the actual aggregate unpaid sales tax liability may be higher or lower than the Company's estimate.

Through September 30, 2017, the Company has paid approximately $0.9 million under terms of the VDA agreements that it has completed with certain jurisdictions. During the third quarter of 2017, a jurisdiction rejected the Company's VDA application and will be conducting a sales tax audit. The Company believes the scope of the audit will be limited and similar in principle to the VDA program offered by that jurisdiction; as a result, the Company has determined not to revise its estimate of its potential unpaid sales tax liability. The completion date of the sales tax audit has not been determined. The Company expects to complete the remaining VDAs within the next six months following the date of filing this Quarterly Report on Form 10-Q.

6. STOCK-BASED COMPENSATION

The Company recognizes stock-based compensation expense using the accelerated attribution method, net of estimated forfeitures, in which compensation cost for each vesting tranche in an award is recognized ratably from the service inception date to the vesting date for that tranche.

Stock-based compensation expense is included in the following line items in the accompanying condensed consolidated statements of operations for the three and nine months ended September 30, 2017 and 2016 (in thousands): |

| | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2017 | | 2016 | | 2017 | | 2016 |

| Cost of revenue | $ | 259 |

| | $ | 330 |

| | $ | 753 |

| | $ | 941 |

|

| Sales and marketing | 970 |

| | 1,161 |

| | 2,960 |

| | 3,651 |

|

| Research and development | 588 |

| | 496 |

| | 1,659 |

| | 1,485 |

|

| General and administrative | 1,023 |

| | 878 |

| | 3,760 |

| | 4,130 |

|

| | $ | 2,840 |

| | $ | 2,865 |

| | $ | 9,132 |

| | $ | 10,207 |

|

During the nine months ended September 30, 2017, the Company granted the following share-based awards: |

| | | | | | |

| | Number of Shares Underlying Grant | | Weighted Average Grant Date Fair Value |

| Stock options | 597,034 |

| | $ | 4.21 |

|

| Restricted stock units ("RSUs") | 1,325,172 |

| | 10.44 |

|

| Total share-based awards | 1,922,206 |

| | 8.50 |

|

7. NET LOSS PER SHARE

Diluted net loss per share is the same as basic net loss per share for all periods presented because the effects of potentially dilutive items were anti-dilutive given the Company’s net loss. The following securities have been excluded from the calculation of weighted average common shares outstanding because the effect is anti-dilutive for the three and nine months ended September 30, 2017 and 2016:

|

| | | | | |

| | Three and Nine Months Ended September 30, |

| | 2017 | | 2016 |

| Stock options | 2,132,715 |

| | 1,657,549 |

|

| RSUs | 2,547,941 |

| | 2,342,444 |

|

8. INCOME TAXES

At the end of each interim reporting period, the Company estimates its effective income tax rate expected to be applicable for the full year. This estimate is used to determine the income tax provision or benefit on a year-to-date basis and may change in subsequent interim periods.

The Company’s effective tax rate was (0.9)% and 1.0% for the three months ended September 30, 2017 and 2016, respectively, and (1.3)% and 0.7% for the nine months ended September 30, 2017 and 2016, respectively. The tax (expense) benefit for each of the periods was based on state, local and foreign taxes. The Company’s effective tax rate for these periods is lower than the U.S. federal statutory rate of 34% primarily due to operating losses which are subject to a valuation allowance. The Company cannot recognize the tax benefit of operating loss carryforwards generated in certain jurisdictions due to uncertainties relating to future taxable income in those jurisdictions in terms of both its timing and its sufficiency, which would enable the Company to realize the benefits of those carryforwards. The Company began recognizing tax expense during the 2017 interim periods compared to having recognized tax benefits during the 2016 interim periods. This was in part a result of releasing valuation allowances in certain foreign jurisdictions during the fourth quarter of 2016. In addition, during the interim periods in 2017, the Company no longer had sufficient deferred tax liabilities in one of its foreign subsidiaries necessary to realize the tax benefit of all of its deferred tax assets for that same foreign subsidiary. The Company recorded a valuation allowance against the deferred tax assets of that foreign subsidiary, net of deferred tax liabilities. As a result, the Company is not currently permitted to recognize the tax benefit of that subsidiary’s losses.

9. SEGMENT AND GEOGRAPHIC INFORMATION

Operating segments are defined as components of an enterprise for which discrete financial information is available that is evaluated regularly by the chief operating decision maker (“CODM”) for purposes of allocating resources and evaluating financial performance. The Company’s CODM reviews financial information presented on a consolidated basis for purposes of allocating resources and evaluating financial performance. As such, the Company’s operations constitute a single operating segment and one reportable segment.

Substantially all assets were held in the United States during the nine months ended September 30, 2017 and the year ended December 31, 2016. The table below summarizes revenue by geography for the three and nine months ended September 30, 2017 and 2016 (in thousands). The Company categorizes domestic and international revenue from customers based on their billing address.

|

| | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2017 | | 2016 | | 2017 | | 2016 |

| Domestic | $ | 23,156 |

| | $ | 21,985 |

| | $ | 69,354 |

| | $ | 63,458 |

|

| International | 6,941 |

| | 6,007 |

| | 19,076 |

| | 17,979 |

|

| Total revenue | $ | 30,097 |

| | $ | 27,992 |

| | $ | 88,430 |

| | $ | 81,437 |

|

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Certain statements contained in this Quarterly Report on Form 10-Q may constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. The words or phrases “would be,” “will allow,” “intends to,” “will likely result,” “are expected to,” “will continue,” “is anticipated,” “estimate,” “project,” or similar expressions, or the negative of such words or phrases, are intended to identify “forward-looking statements.” We have based these forward-looking statements on our current expectations and projections about future events. Because such statements include risks and uncertainties, actual results may differ materially from those expressed or implied by such forward-looking statements. Factors that could cause or contribute to these differences include those below and elsewhere in this Quarterly Report on Form 10-Q, particularly in Part II – Item 1A, “Risk Factors,” and our other filings with the Securities and Exchange Commission. Statements made herein are as of the date of the filing of this Form 10-Q with the Securities and Exchange Commission and should not be relied upon as of any subsequent date. Unless otherwise required by applicable law, we do not undertake, and we specifically disclaim, any obligation to update any forward-looking statements to reflect occurrences, developments, unanticipated events or circumstances after the date of such statement.

The following discussion and analysis of our financial condition and results of operations should be read in conjunction with our unaudited condensed consolidated financial statements and related notes that appear in Item 1 of this Quarterly Report on Form 10-Q and with our audited consolidated financial statements and related notes for the year ended December 31, 2016, which are included in our Annual Report on Form 10-K for fiscal 2016.

We are a leading provider of software-as-a-service, or SaaS, solutions and our mission is to connect and optimize the world's commerce. Our e-commerce cloud platform helps retailers and branded manufacturers worldwide improve their online performance by expanding sales channels, connecting with consumers around the world, optimizing their operations for peak performance and providing actionable analytics to improve competitiveness. Our customers include the online businesses of traditional retailers, online retailers and branded manufacturers (manufacturers that market the products they produce under their own name), as well as advertising agencies that use our solutions on behalf of their clients. Through our platform, we enable our customers to connect with new and existing sources of demand for their products, including e-commerce marketplaces, such as Amazon, eBay, Jet.com, Newegg, Sears and Walmart, search engines and comparison shopping websites, such as Google, Microsoft's Bing and Nextag, and social channels, such as Facebook, Instagram and Pinterest. Our suite of solutions, accessed through a standard web browser, provides our customers with a single, integrated user interface to manage their product listings, inventory availability, pricing optimization, search terms, orders and fulfillment, as well as data analytics and other critical functions across these channels. We also offer solutions that allow branded manufacturers to send their web visitors or digital marketing audiences directly to authorized resellers and to gain insight into consumer behavior. Our proprietary cloud-based technology platform delivers significant breadth, scalability and flexibility.

FINANCIAL RESULTS

| |

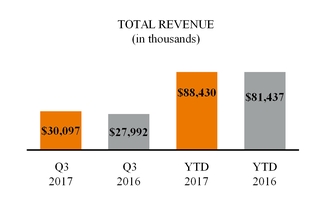

| • | Total revenue of $30.1 million and $88.4 million for the three and nine months ended September 30, 2017 increased 7.5% and 8.6%, respectively, from the comparable prior year periods; |

| |

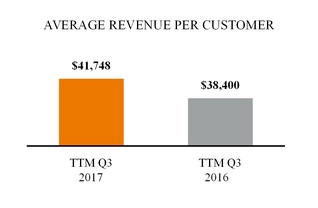

| • | Average revenue per customer of $41,748 for the twelve months ended September 30, 2017 increased 8.7% compared with $38,400 for the twelve months ended September 30, 2016; |

| |

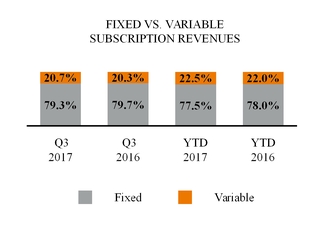

| • | Revenue was comprised of 79.3% and 20.7% fixed and variable subscription fees, respectively, for the three months ended September 30, 2017 compared with fixed and variable subscription fees of 79.7% and 20.3%, respectively, for the three months ended September 30, 2016. Revenue was comprised of 77.5% and 22.5% fixed and variable subscription fees, respectively, for the nine months ended September 30, 2017, compared with fixed and variable subscription fees of 78.0% and 22.0%, respectively, for the nine months ended September 30, 2016; |

| |

| • | Revenue derived from customers located outside of the United States as a percentage of total revenue was 23.1% and 21.6% for the three and nine months ended September 30, 2017, respectively, compared to 21.5% and 22.1% for the comparable prior year periods; |

| |

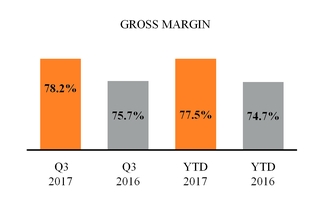

| • | Gross margin of 78.2% and 77.5% for the three and nine months ended September 30, 2017, respectively, improved by 250 basis points and 280 basis points, respectively, from the comparable prior year periods; |

| |

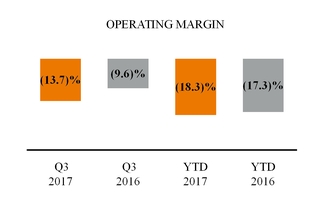

| • | Operating margin of (13.7)% and (18.3)% for the three and nine months ended September 30, 2017, respectively, declined compared to operating margin of (9.6)% and (17.3)% for the comparable prior year periods; |

| |

| • | Net loss of $(4.1) million for the three months ended September 30, 2017 increased compared to net loss of $(2.6) million for the comparable prior year period, and net loss of $(16.1) million for the nine months ended September 30, 2017 increased compared to net loss of $(13.8) million for the comparable prior year period; |

| |

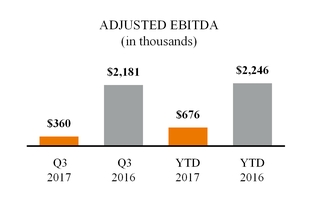

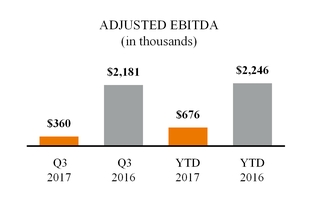

| • | Adjusted EBITDA of $0.4 million and $0.7 million for the three and nine months ended September 30, 2017, respectively, decreased compared to adjusted EBITDA of $2.2 million for both of the comparable prior year periods; |

| |

| • | Cash and cash equivalents was $54.2 million at September 30, 2017 compared with $65.4 million at December 31, 2016; and |

| |

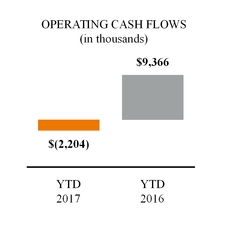

| • | Operating cash flow was $(2.2) million for the nine months ended September 30, 2017 compared to $9.4 million for the nine months ended September 30, 2016. |

TRENDS IN OUR BUSINESS

The following trends have contributed to the results of our consolidated operations, and we anticipate that they will continue to impact our future results:

| |

| • | Growth in Online Shopping. Consumers continue to move more of their retail spending from offline to online retail. The continuing shift to online shopping and overall growth has contributed to our historical growth and we expect that this online shift will continue to benefit our business. |

| |

| • | Product Offering Expansion. As online shopping evolves, we continue to expand our product offerings to reflect the needs of companies seeking to attract consumers. This expansion may result in additional research and development investment. |

| |

| • | Growth in Mobile Usage. We believe the shift toward mobile commerce will increasingly favor aggregators such as Amazon, eBay and Google Shopping, all of which are focal points of our platform. These aggregators understand the identity of the buyer, helping to reduce friction in the mobile commerce process, while offering a wide selection of merchandise in a single location. The growth in mobile commerce may result in increased revenue for us. |

| |

| • | Shift to Larger Customers. We believe that the growth in online shopping increasingly favors larger enterprises. This move impacts our business both in longer sales cycles as well as increased average revenue per customer. |

| |

| • | Evolving Fulfillment Landscape. Consumers have been conditioned to expect fast, efficient delivery of products. We believe that determining and executing on a fulfillment strategy is critical to success for online sellers. Therefore, it will be increasingly important for us to facilitate and optimize fulfillment services on behalf of our customers, which in turn may result in additional research and development investment. We believe our acquisition of HubLogix will further enhance the Company's fulfillment offering and strategy. |

| |

| • | Focus on Employees. None of our success would be possible without our team. We strive to provide our employees competitive compensation and benefits programs to help drive the success of our customers. We increased headcount by 4.3% from September 30, 2016 to September 30, 2017 to help drive revenue growth and support our overall operations. |

| |

| • | Shifts in Foreign Currency. Our operations in the United Kingdom were impacted by the 7.8% decline in the average exchange rate of the British Pound Sterling against the U.S. Dollar for the nine months ended September 30, 2017 as compared to the comparable prior year period. The decline of the British Pound Sterling against the U.S. Dollar resulted in a $1.0 million decrease in revenue for the nine months ended September 30, 2017 as compared to the nine months ended September 30, 2016. Revenue for the three months ended September 30, 2017 as compared to the three months ended September 30, 2016 was not materially affected by the decline of the British Pound Sterling against the U.S. Dollar. |

| |

| • | Seasonality. Our revenue fluctuates as a result of seasonal variations in our business, principally due to the peak consumer demand and related increased volume of our customers’ gross merchandise value, or GMV, during the year-end holiday season. As a result, we have historically had higher revenue in our fourth quarter than other quarters due to increased GMV processed through our platform, resulting in higher variable subscription fees. |

OPPORTUNITIES AND RISKS

| |

| • | Dynamic E-commerce Landscape. We will need to continue to innovate in the face of a rapidly changing e-commerce landscape if we are to remain competitive, and we will need to effectively manage our growth, especially related to our international expansion. |

| |

| • | Retailers and Branded Manufacturers. As consumer preferences potentially shift away from smaller retailers, we need to continue to add large retailers and branded manufacturers as profitable customers. These larger customers generally pay a lower percentage of GMV as fees to us based on the relatively higher volume of their GMV processed through our platform. To help drive our future growth, we have made significant investments in our sales force and allocated resources focused on growing our customer base of large retailers and branded manufacturers. We continue to focus our efforts on increasing value for our customers to support higher rates. |

| |

| • | Increasing Complexity and Fragmentation of E-commerce. Although e-commerce continues to expand as retailers and branded manufacturers continue to increase their online sales, it is also becoming more complex and fragmented due to the hundreds of channels available to retailers and branded manufacturers and the rapid pace of change and innovation across those channels. In order to gain consumers’ attention in a more crowded and competitive online marketplace, many retailers and an increasing number of branded manufacturers sell their merchandise through multiple online channels, each with its own rules, requirements and specifications. In particular, third-party marketplaces are an increasingly important driver of growth for a number of large online retailers and branded manufacturers, and as a result we need to continue to support multiple channels in a variety of geographies in order to support our targeted revenue growth. As of September 30, 2017, we supported approximately 80 marketplaces. |

| |

| • | Global Growth in E-commerce. We believe the growth in e-commerce globally presents an opportunity for retailers and branded manufacturers to engage in international sales. However, country-specific marketplaces are often the market share leaders in their regions, as is the case for Alibaba in Asia. In order to help our customers capitalize on this potential market opportunity, and to address our customers’ needs with respect to cross-border trade, we intend to continue to invest in our international operations, specifically in the Asia Pacific region. Doing business overseas involves substantial challenges, including management attention and resources needed to adapt to multiple languages, cultures, laws and commercial infrastructure, as further described in this report under the caption "Risks Related to our International Operations." |

Our senior management continuously focuses on these and other trends and challenges, and we believe that our culture of innovation and our history of growth and expansion will contribute to the success of our business. We cannot, however, assure you that we will be successful in addressing and managing the many challenges and risks that we face.

KEY FINANCIAL AND OPERATING METRICS The average revenue generated by our customers is a primary determinant of our revenue. We calculate this metric by dividing our revenue for a particular period by the average monthly number of customers during the period, which is calculated by taking the sum of the number of customers at the end of each month in the period and dividing by the number of months in the period. We typically calculate average revenue per customer in absolute dollars on a trailing twelve-month, or TTM, basis, but we may also calculate percentage changes in average revenue per customer on a quarterly basis in order to help us evaluate our period-over-period performance. For purposes of this metric and the number of customers metric described below, we include all customers who subscribe to at least one of our solutions, excluding customers acquired from our acquisition of HubLogix and customers subscribing only to certain legacy product offerings that are no longer part of our strategic focus.

The number of customers increased slightly during the third quarter of 2017 compared to the third quarter of 2016. The graphical presentation above does not include approximately 50 net new customers acquired from our acquisition of HubLogix during the second quarter of 2017. We continue our focus on obtaining large retailer and branded manufacturer customers, which may represent a smaller number of customers, but a potentially larger source of predictable or sustaining recurring revenue.

Adjusted EBITDA represents our earnings before interest expense, income tax expense (benefit) and depreciation and amortization, adjusted to eliminate stock-based compensation expense and, for the nine months ended September 30, 2017, a $2.5 million one-time charge in connection with our decision to enter into VDAs with certain jurisdictions. Refer to Note 5 to our unaudited condensed consolidated financial statements included elsewhere in this report for additional information regarding this one-time charge. We believe that adjusted EBITDA provides useful information to management and others in understanding and evaluating our operating results. However, adjusted EBITDA is not a measure calculated in accordance with U.S. GAAP and should not be considered as an alternative to any measure of financial performance calculated and presented in accordance with U.S. GAAP. In addition, adjusted EBITDA may not be comparable to similarly titled measures of other companies because other companies may not calculate adjusted EBITDA in the same manner that we do. Please refer to "Adjusted EBITDA" below for a discussion of the limitations of adjusted EBITDA and a reconciliation of adjusted EBITDA to net loss, the most comparable U.S. GAAP measurement.

Adjusted EBITDA

Our use of adjusted EBITDA has limitations as an analytical tool, and you should not consider it in isolation or as a substitute for analysis of our results as reported under U.S. GAAP. Some of these limitations are:

| |

| • | although depreciation and amortization are non-cash charges, the assets being depreciated and amortized may have to be replaced in the future and adjusted EBITDA does not reflect cash capital expenditure requirements for such replacements or for new capital expenditure requirements; |

| |

| • | adjusted EBITDA does not reflect changes in, or cash requirements for, our working capital needs; |

| |

| • | adjusted EBITDA does not reflect the potentially dilutive impact of equity-based compensation; |

| |

| • | adjusted EBITDA does not reflect interest or tax payments that may represent a reduction in cash available to us; and |

| |

| • | other companies, including companies in our industry, may calculate adjusted EBITDA differently, which reduces its usefulness as a comparative measure. |

Because of these and other limitations, you should consider adjusted EBITDA together with U.S. GAAP-based financial performance measures, including various cash flow metrics, net income (loss) and our other U.S. GAAP results. The following table presents a reconciliation of net loss to adjusted EBITDA for each of the periods indicated (in thousands):

|

| | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2017 | | 2016 | | 2017 | | 2016 |

| Net loss | $ | (4,055 | ) | | $ | (2,552 | ) | | $ | (16,096 | ) | | $ | (13,842 | ) |

| Adjustments: |

| |

| |

| |

|

| Interest (income) expense, net | (67 | ) | | (11 | ) | | (149 | ) | | 11 |

|

| Income tax expense (benefit) | 37 |

| | (27 | ) | | 209 |

| | (91 | ) |

| Depreciation and amortization expense | 1,605 |

| | 1,906 |

| | 5,041 |

| | 5,961 |

|

| Total adjustments | 1,575 |

| | 1,868 |

| | 5,101 |

| | 5,881 |

|

| EBITDA | (2,480 | ) | | (684 | ) | | (10,995 | ) | | (7,961 | ) |

| Stock-based compensation expense | 2,840 |

| | 2,865 |

| | 9,132 |

| | 10,207 |

|

| One-time charge for VDAs related to sales taxes | — |

| | — |

| | 2,539 |

| | — |

|

| Adjusted EBITDA | $ | 360 |

| | $ | 2,181 |

| | $ | 676 |

| | $ | 2,246 |

|

The following tables set forth our condensed consolidated statement of operations data and such data expressed as a percentage of revenues for each of the periods indicated.

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, | Period-to-Period Change |

| | 2017 | | 2016 | | 2017 | | 2016 | | Q3 2017 to Q3 2016 | | YTD 2017 to YTD 2016 |

| (dollars in thousands) | | | | |

| Revenue | $ | 30,097 |

| | $ | 27,992 |

| | $ | 88,430 |

| | $ | 81,437 |

| | $ | 2,105 |

| 7.5 | % | | $ | 6,993 |

| 8.6 | % |

| Cost of revenue | 6,549 |

| | 6,811 |

| | 19,911 |

| | 20,587 |

| | (262 | ) | (3.8 | ) | | (676 | ) | (3.3 | ) |

| Gross profit | 23,548 |

| | 21,181 |

| | 68,519 |

| | 60,850 |

| | 2,367 |

| 11.2 |

| | 7,669 |

| 12.6 |

|

| Operating expenses: | | | | | | | | | | | | — |

| |

| Sales and marketing | 15,565 |

| | 13,824 |

| | 47,231 |

| | 43,064 |

| | 1,741 |

| 12.6 |

| | 4,167 |

| 9.7 |

|

| Research and development | 5,760 |

| | 4,512 |

| | 15,878 |

| | 13,077 |

| | 1,248 |

| 27.7 |

| | 2,801 |

| 21.4 |

|

| General and administrative | 6,344 |

| | 5,525 |

| | 21,552 |

| | 18,768 |

| | 819 |

| 14.8 |

| | 2,784 |

| 14.8 |

|

| Total operating expenses | 27,669 |

| | 23,861 |

| | 84,661 |

| | 74,909 |

| | 3,808 |

| 16.0 |

| | 9,752 |

| 13.0 |

|

| Loss from operations | (4,121 | ) | | (2,680 | ) | | (16,142 | ) | | (14,059 | ) | | (1,441 | ) | 53.8 |

| | (2,083 | ) | 14.8 |

|

| Other income (expense): | | | | | | | | | | | |

| |

| Interest income (expense), net | 67 |

| | 11 |

| | 149 |

| | (11 | ) | | 56 |

| * |

| | 160 |

| * |

|

| Other income (expense), net | 36 |

| | 90 |

| | 106 |

| | 137 |

| | (54 | ) | * |

| | (31 | ) | * |

|

| Total other income (expense) | 103 |

| | 101 |

| | 255 |

| | 126 |

| | 2 |

| * |

| | 129 |

| * |

|

| Loss before income taxes | (4,018 | ) | | (2,579 | ) | | (15,887 | ) | | (13,933 | ) | | (1,439 | ) | 55.8 |

| | (1,954 | ) | 14.0 |

|

| Income tax expense (benefit) | 37 |

| | (27 | ) | | 209 |

| | (91 | ) | | 64 |

| * |

| | 300 |

| * |

|

| Net loss | $ | (4,055 | ) | | $ | (2,552 | ) | | $ | (16,096 | ) | | $ | (13,842 | ) | | $ | (1,503 | ) | 58.9 |

| | $ | (2,254 | ) | 16.3 |

|

* Not meaningful.

|

| | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2017 | | 2016 | | 2017 | | 2016 |

| | (as a percentage of revenue)

| | (as a percentage of revenue)

|

| Revenue | 100.0 | % | | 100.0 | % | | 100.0 | % | | 100.0 | % |

| Cost of revenue | 21.8 |

| | 24.3 |

| | 22.5 |

| | 25.3 |

|

| Gross profit | 78.2 |

| | 75.7 |

| | 77.5 |

| | 74.7 |

|

| Operating expenses: | | | | | | | |

| Sales and marketing | 51.7 |

| | 49.4 |

| | 53.4 |

| | 52.9 |

|

| Research and development | 19.1 |

| | 16.1 |

| | 18.0 |

| | 16.1 |

|

| General and administrative | 21.1 |

| | 19.7 |

| | 24.4 |

| | 23.0 |

|

| Total operating expenses | 91.9 |

| | 85.2 |

| | 95.7 |

| | 92.0 |

|

| Loss from operations | (13.7 | ) | | (9.6 | ) | | (18.3 | ) | | (17.3 | ) |

| Other income (expense): | | | | | | | |

| Interest income (expense), net | 0.2 |

| | 0.0 |

| | 0.2 |

| | 0.0 |

|

| Other income (expense), net | 0.1 |

| | 0.3 |

| | 0.1 |

| | 0.2 |

|

| Total other income (expense) | 0.3 |

| | 0.3 |

| | 0.3 |

| | 0.2 |

|

| Loss before income taxes | (13.4 | ) | | (9.2 | ) | | (18.0 | ) | | (17.1 | ) |

| Income tax expense (benefit) | 0.1 |

| | (0.1 | ) | | 0.2 |

| | (0.1 | ) |

| Net loss | (13.5 | )% | | (9.1 | )% | | (18.2 | )% | | (17.0 | )% |

Depreciation and Amortization

Depreciation and amortization expense is included in the following line items in the accompanying unaudited condensed consolidated statements of operations for the three and nine months ended September 30, 2017 and 2016 (in thousands):

|

| | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2017 | | 2016 | | 2017 | | 2016 |

| Cost of revenue | $ | 933 |

| | $ | 1,109 |

| | $ | 3,058 |

| | $ | 3,497 |

|

| Sales and marketing | 283 |

| | 266 |

| | 812 |

| | 853 |

|

| Research and development | 102 |

| | 111 |

| | 324 |

| | 345 |

|

| General and administrative | 287 |

| | 420 |

| | 847 |

| | 1,266 |

|

| Total depreciation and amortization expense | $ | 1,605 |

| | $ | 1,906 |

| | $ | 5,041 |

| | $ | 5,961 |

|

REVENUE

We derive the majority of our revenue from subscription fees paid to us by our customers for access to and usage of our SaaS solutions for a specified contract term, which is usually one year. A portion of the subscription fee is typically fixed and based on a specified minimum amount of GMV or advertising spend that a customer expects to process through our platform. The remaining portion of the subscription fee is variable and is based on a specified percentage of GMV or advertising spend processed through our platform in excess of the customer’s specified minimum GMV or advertising spend amount. In most cases, the specified percentage of excess GMV or advertising spend on which the variable portion of the subscription is based is fixed and does not vary depending on the amount of the excess. We also receive implementation fees, which may include fees for providing launch assistance and training.

Because our customer contracts generally contain both fixed and variable pricing components, changes in GMV between periods do not translate directly or linearly into changes in our revenue. We use customized pricing structures for each of our customers depending upon the individual situation of the customer. For example, some customers may commit to a higher specified minimum GMV amount per month in exchange for a lower fixed percentage fee on that committed GMV. In addition, the percentage fee assessed on the variable GMV in excess of the committed minimum for each customer is typically higher than the fee on the fixed, committed portion. As a result, our overall revenue could increase or decrease even without any change in overall GMV between periods, depending on which customers generated the GMV. In addition, changes in GMV from month to month for any individual customer that are below the specified minimum amount would have no effect on our revenue from that customer, and each customer may alternate between being over the committed amount or under it from month to month. For these reasons, while GMV is an important qualitative and long-term directional indicator, we do not regard it as a useful quantitative measurement of our historic revenues or as a predictor of future revenues.

We recognize revenue derived from fixed subscription fees and implementation fees ratably over the contract period once four conditions have been satisfied:

| |

| • | The contract has been signed by both parties; |

| |

| • | The customer has access to our platform and transactions can be processed; |

| |

| • | The fees are fixed or determinable; and |

| |

| • | Collection is reasonably assured. |

We generally invoice our customers for the fixed portion of the subscription fee in advance, in monthly, quarterly, semi-annual or annual installments. We invoice our customers for the implementation fee at the inception of the arrangement. Fixed subscription and implementation fees that have been invoiced are initially recorded as deferred revenue and are generally recognized ratably over the contract term.

We invoice and recognize revenue from the variable portion of subscription fees in the period in which the related GMV or advertising spend is processed, assuming that the four conditions specified above have been met.

Comparison of Q3 2017 to Q3 2016

Revenue increased by 7.5%, or $2.1 million, to $30.1 million for the three months ended September 30, 2017 over the prior year period primarily due to an increase in the average revenue per customer as well as an increase in the number of customers.

On a trailing three-month basis, average revenue per customer increased 7.4%, to $10,441 for the three months ended September 30, 2017 as compared to $9,719 for the three months ended September 30, 2016. The increase in the average revenue per customer was primarily driven by the growth of our marketplaces solution. This growth was largely attributable to an overall increase in transaction volume and, to a lesser extent, to modest overall increases in the percentage fees assessed on the fixed and variable portions of GMV under our contractual arrangements with some of our customers during the period. Because we generally enter into annual contracts with our customers, we may renegotiate either or both of the fixed and variable components of the pricing structure of a customer’s contract each year. In addition, the increase in average revenue per customer was due in part to our established customers who have increased their revenue over time on our platform. In general, as customers mature they generate a higher amount of GMV from which we derive revenue and in some cases they may subscribe to additional modules on our platform, thereby increasing our subscription revenue.

Comparison of YTD 2017 to YTD 2016

Revenue increased by 8.6%, or $7.0 million, to $88.4 million for the nine months ended September 30, 2017 over the prior year period primarily due to an increase in the average revenue per customer as well as an increase in the number of customers.

On a trailing nine-month basis, average revenue per customer increased 8.5%, to $30,677 for the nine months ended September 30, 2017 as compared to $28,266 for the nine months ended September 30, 2016.

COST OF REVENUE

Cost of revenue primarily consists of:

| |

| • | Salaries and personnel-related costs for employees providing services to our customers and supporting our platform infrastructure, including benefits, bonuses and stock-based compensation; |

| |

| • | Co-location facility costs for our data centers; |

| |

| • | Infrastructure maintenance costs; and |

| |

| • | Fees we pay to credit card vendors in connection with our customers’ payments to us. |

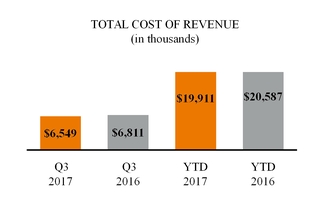

Comparison of Q3 2017 to Q3 2016

Cost of revenue decreased by 3.8%, or $0.3 million, to $6.5 million for the three months ended September 30, 2017 over the prior year period, with the change being comprised primarily of a decrease in compensation and employee-related costs, including stock-based compensation expense.

Comparison of YTD 2017 to YTD 2016

Cost of revenue decreased by 3.3%, or $0.7 million, to $19.9 million for the nine months ended September 30, 2017 over the prior year period, with the change being comprised primarily of decreases of:

| |

| • | $0.3 million in compensation and employee-related costs, including stock-based compensation expense; and |

| |

| • | $0.3 million in co-location and infrastructure maintenance costs primarily associated with closing a data center and retiring servers used to support legacy product offerings that are no longer part of our strategic focus. |

OPERATING EXPENSES

SALES AND MARKETING EXPENSE

Sales and marketing expense consists primarily of:

| |

| • | Salaries and personnel-related costs for our sales and marketing and customer support employees, including benefits, bonuses, stock-based compensation and commissions; |

| |

| • | Marketing, advertising and promotional event programs; and |

| |

| • | Corporate communications. |

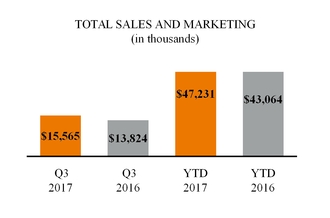

Comparison of Q3 2017 to Q3 2016

Sales and marketing expense increased by 12.6%, or $1.7 million, to $15.6 million for the three months ended September 30, 2017 over the prior year period, with the change being comprised of increases of:

| |

| • | $1.0 million in compensation and employee-related costs, mainly due to additional headcount in our sales organization; and |

| |

| • | $0.7 million in marketing and advertising expenses, promotional event programs and travel costs to support expanding marketing activities to continue to grow our business. |

Comparison of YTD 2017 to YTD 2016

Sales and marketing expense increased by 9.7%, or $4.2 million, to $47.2 million for the nine months ended September 30, 2017 over the prior year period, with the change being comprised of increases of:

| |

| • | $2.6 million in compensation and employee-related costs, mainly due to additional headcount in our sales organization; and |

| |

| • | $1.6 million in marketing and advertising expenses, promotional event programs and travel costs to support expanding marketing activities to continue to grow our business. |

RESEARCH AND DEVELOPMENT EXPENSE

Research and development expense consists primarily of:

| |

| • | Salaries and personnel-related costs for our research and development employees, including benefits, bonuses and stock-based compensation; |

| |

| • | Costs related to the development, quality assurance and testing of new technology and enhancement of our existing platform technology; and |

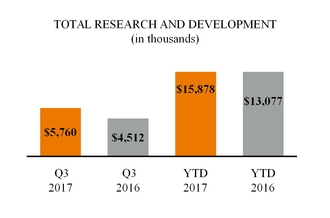

Comparison of Q3 2017 to Q3 2016

Research and development expense increased by 27.7%, or $1.2 million, to $5.8 million for the three months ended September 30, 2017 over the prior year period, with the change being comprised primarily of increases of:

| |

| • | $1.0 million in compensation and employee-related costs, mainly due to additional headcount gained with our acquisition of HubLogix to support our growth and the enhancement of our product offerings; and |

| |

| • | $0.1 million in software and hosting expenses to further support our growth and investment in research and development. |

Comparison of YTD 2017 to YTD 2016

Research and development expense increased by 21.4%, or $2.8 million, to $15.9 million for the nine months ended September 30, 2017 over the prior year period, with the change being comprised primarily of increases of:

| |

| • | $2.3 million in compensation and employee-related costs, mainly due to additional headcount gained with our acquisition of HubLogix to support our growth and the enhancement of our product offerings; and |

| |

| • | $0.2 million in software and hosting expenses. |

GENERAL AND ADMINISTRATIVE EXPENSE

General and administrative expense consists primarily of:

| |

| • | Salaries and personnel-related costs for administrative, finance and accounting, information systems, legal and human resource employees, including benefits, bonuses and stock-based compensation; |

| |

| • | Consulting and professional fees; |

| |

| • | Costs associated with compliance with the Sarbanes-Oxley Act and other regulations governing public companies. |

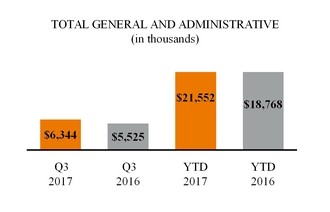

Comparison of Q3 2017 to Q3 2016

General and administrative expense increased by 14.8%, or $0.8 million, to $6.3 million for the three months ended September 30, 2017 over the prior year period, with the change being comprised primarily of increases of:

| |

| • | $0.3 million in compensation and employee-related costs, including stock-based compensation expense, mainly due to additional headcount; and |

| |

| • | $0.3 million in professional fees including consulting and accounting and tax services primarily in connection with our implementation of the new revenue recognition standard and our VDA process. |

Comparison of YTD 2017 to YTD 2016

General and administrative expense increased by 14.8%, or $2.8 million, to $21.6 million for the nine months ended September 30, 2017 over the prior year period, with the change being comprised primarily of increases of:

| |

| • | $2.5 million one-time charge in connection with entering into VDAs with certain jurisdictions; |

| |

| • | $0.1 million in compensation and employee-related costs, mainly due to additional headcount; and |

| |

| • | $0.1 million in professional fees including consulting and accounting and tax services primarily in connection with our implementation of the new revenue recognition standard and our VDA process. |

GROSS AND OPERATING MARGINS

Comparison of Q3 2017 to Q3 2016

Gross margin improved by 250 basis points to 78.2% during the three months ended September 30, 2017 compared to the prior year period as a result of the increase in revenue and decrease in cost of revenue noted above. Our improved gross margin was a result of our continuing strategic efforts to achieve increasing scale in our business operations.

Operating margin declined by 410 basis points to (13.7)% during the three months ended September 30, 2017 compared to the prior year period due to a 16.0% growth in operating expenses, primarily due to an increase in compensation and

employee-related costs driven by additional headcount as we invest in resources to support the growth of our business. These operating expenses exceeded the 7.5% increase in revenue and 3.8% decrease in cost of revenue.

Comparison of YTD 2017 to YTD 2016

Gross margin improved by 280 basis points to 77.5% during the nine months ended September 30, 2017 compared to the prior year period as a result of the increase in revenue and decrease in cost of revenue noted above.

Operating margin declined by 100 basis points to (18.3)% during the nine months ended September 30, 2017 compared to the prior year period due to a 13.0% growth in operating expenses which includes the $2.5 million one-time charge related to the VDAs described above and an increase in compensation and employee-related costs driven by additional headcount as we invest in resources to support the growth of our business. These operating expenses exceeded the 8.6% increase in revenue and 3.3% decrease in cost of revenue.

CRITICAL ACCOUNTING POLICIES AND ESTIMATES

Our management’s discussion and analysis of our financial condition and results of operations is based on our condensed consolidated financial statements, which have been prepared in accordance with U.S. GAAP. The preparation of these condensed consolidated financial statements requires us to make estimates and assumptions that affect the reported amounts of assets and liabilities, disclosure of contingent assets and liabilities at the date of the condensed consolidated financial statements and the reported amounts of revenue and expenses during the reported period. In accordance with U.S. GAAP, we base our estimates on historical experience and on various other assumptions that we believe are reasonable under the circumstances. Actual results may differ from these estimates under different assumptions or conditions, and to the extent that there are differences between our estimates and actual results, our future financial statement presentation, financial condition, results of operations and cash flows will be affected. During the nine months ended September 30, 2017, there were no material changes to our critical accounting policies and use of estimates, which are disclosed in our audited consolidated financial statements for the year ended December 31, 2016 included in our Annual Report on Form 10-K for fiscal 2016.

Recent Accounting Pronouncements

Refer to Note 2 to our condensed consolidated financial statements included in this report for a full description of recent accounting pronouncements.

LIQUIDITY AND CAPITAL RESOURCES

We derive our liquidity and operating capital primarily from cash flows from operations. Based on our current level of operations and anticipated growth, we believe our future cash flows from operating activities and our existing cash balances will be sufficient to meet our cash requirements for at least the next 12 months.

CASH FLOWS

Operating activities cash flows are largely driven by:

| |

| • | The amount of cash we invest in personnel and infrastructure to support the anticipated growth of our business; |

| |

| • | The amount and timing of customer payments; |

| |

| • | The seasonality of our business, as noted above, which results in variations in the timing of invoicing and the receipt of payments from our customers; and |

| |

| • | In 2017, the amounts paid in connection with entering into VDAs related to our potential sales tax liability. |

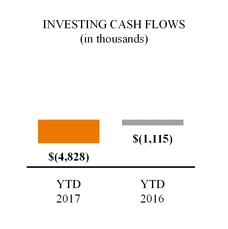

Investing activities cash flows are largely driven by:

| |

| • | Acquisitions, net of cash acquired; |

| |

| • | Capitalized expenditures to create internally developed software and implement software purchased for internal use; and |

| |

| • | Purchases of property and equipment to support the expansion of our infrastructure and acquisitions. |

Financing activities cash flows are largely driven by:

| |

| • | Proceeds from the exercises of stock options; |

| |

| • | Payments on capital lease obligations; |

| |

| • | Tax withholdings related to the net-share settlement of restricted stock units; and |

| |

| • | Acquisition-related contingent consideration. |

YTD 2017

Operating Activities

Our cash used in operating activities consisted of a net loss of $16.1 million adjusted for certain non-cash items totaling $13.9 million, which consisted of stock-based compensation expense, depreciation and amortization expense, bad debt expense and other non-cash items, principally the amortization of a lease incentive obligation related to our corporate headquarters.

The net decrease in cash resulting from changes in working capital of $(0.1) million primarily consisted of:

| |

| • | a $1.7 million increase in accounts receivable which is a result of increased revenue and customer growth; |

| |

| • | a $1.4 million increase in prepaid expenses and other assets, primarily related to certain customer arrangements for which we collect and remit monthly activity-based fees incurred for specific channels on behalf of our customers (we record the amounts due from customers as a result of these arrangements as other receivables); and |

| |

| • | a $0.1 million net decrease in accounts payable and accrued expenses that is a result of a decrease in accounts payable of $1.2 million, driven by the timing of payments to our vendors during the period, partially offset by a $1.1 million increase in accrued expenses primarily attributable to the balance of a one-time charge in connection with our decision to enter into VDAs related to our potential unpaid sales tax liability. These decreases in cash were partially offset by an increase in cash due to |

| |

| • | a $3.0 million increase in deferred revenue as a result of an increased number of customers prepaying for subscription services invoiced on a semi-annual and annual basis. |

Investing Activities