UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-21149

T. Rowe Price Retirement Funds, Inc.

(Exact name of registrant as specified in charter)

100 East Pratt Street, Baltimore, MD 21202

(Address of principal executive offices)

David Oestreicher

100 East Pratt Street, Baltimore, MD 21202

(Name and address of agent for service)

Registrant’s telephone number, including area code: (410) 345-2000

Date of fiscal year end: May 31

Date of reporting period: May 31, 2024

Item 1. Reports to Shareholders

(a) Report pursuant to Rule 30e-1

Annual Shareholder Report

May 31, 2024

Retirement Blend 2020 Fund

Investor Class (TSBAX)

This annual shareholder report contains important information about Retirement Blend 2020 Fund (the "fund") for the period of June 1, 2023 to May 31, 2024. You can find the fund’s prospectus, financial information on Form N-CSR (which includes required tax information for dividends), holdings, proxy voting information, and other information atwww.troweprice.com/prospectus. You can also request this information without charge by contacting T. Rowe Price at 1-800-638-5660 or info@troweprice.com or contacting your intermediary.

What were the fund costs for the last year? (based on a hypothetical $10,000 investment)

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

|---|---|---|

| Retirement Blend 2020 Fund - Investor Class | $40 | 0.37% |

What drove fund performance during the past 12 months?

Global stock indexes were broadly positive, while fixed income markets were mixed for the 12 months ended May 31, 2024. Many central banks maintained tight monetary policies to combat inflation, and markets fluctuated amid shifting expectations for interest rate cuts as rates remained “higher for longer.” Nevertheless, investor sentiment was elevated by resilient corporate earnings and enthusiasm around the profit potential from artificial intelligence developments.

Compared with the style-specific S&P Target Date 2020 Index, structural composition contributed to performance for the trailing one-year period. As global equity markets climbed, the fund’s higher-equity and lower-cash allocations relative to its benchmark contributed to results. Security selection within the underlying U.S. large-cap value equity and emerging markets bond allocations also had favorable impacts, as the corresponding strategies each outpaced their respective benchmarks, which added value on a relative basis.

On the negative side, a leading detractor from relative performance was security selection within the dynamic global bond strategy, which trailed its benchmark. Selection within the emerging markets equity strategy weighed, as well, as it also trailed its benchmark and detracted on a relative basis.

The fund seeks the highest total return over time, consistent with an emphasis on both capital growth and income. The fund invests in a diversified portfolio of other T. Rowe Price stock and bond mutual funds that represent various asset classes and sectors. Its allocation among T. Rowe Price funds will change over time in relation to its target retirement date.

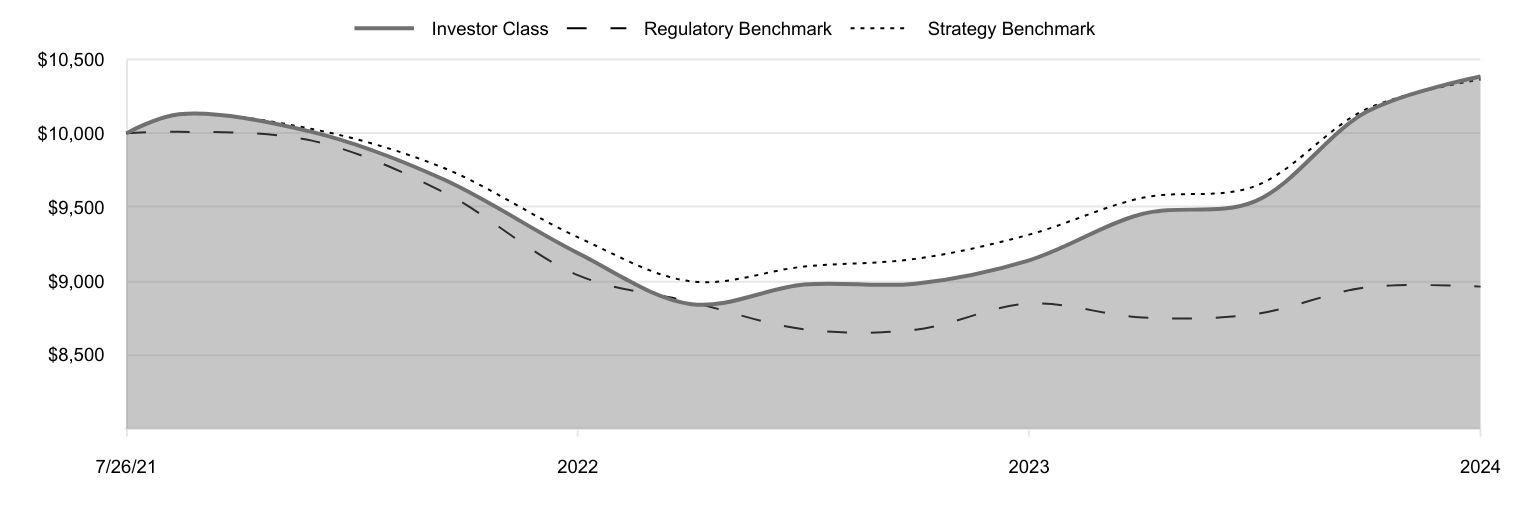

How has the fund performed?

Cumulative Returns of a Hypothetical $10,000 Investment as of May 31, 2024

| Investor Class | Regulatory Benchmark | Strategy Benchmark | |

|---|---|---|---|

| 7/26/21 | 10,000 | 10,000 | 10,000 |

| 8/31/21 | 10,130 | 10,011 | 10,126 |

| 11/30/21 | 10,010 | 9,951 | 10,030 |

| 2/28/22 | 9,689 | 9,603 | 9,767 |

| 5/31/22 | 9,190 | 9,040 | 9,297 |

| 8/31/22 | 8,843 | 8,858 | 8,997 |

| 11/30/22 | 8,976 | 8,673 | 9,098 |

| 2/28/23 | 8,982 | 8,670 | 9,150 |

| 5/31/23 | 9,140 | 8,847 | 9,314 |

| 8/31/23 | 9,455 | 8,753 | 9,564 |

| 11/30/23 | 9,539 | 8,776 | 9,642 |

| 2/29/24 | 10,148 | 8,958 | 10,167 |

| 5/31/24 | 10,385 | 8,962 | 10,365 |

202405-3565004, 202407-3567639

F1344-052 7/24

Average Annual Total Returns

| 1 Year | Since Inception 7/26/2021 | |

|---|---|---|

| Retirement Blend 2020 Fund (Investor Class) | 13.62% | 1.33% |

| Bloomberg U.S. Aggregate Bond Index (Regulatory Benchmark) | 1.31 | - 3.78 |

| S&P Target Date 2020 Index (Strategy Benchmark) | 11.28 | 1.27 |

The preceding line graph shows the value of a hypothetical $10,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The fund’s performance information included in the line graph and table above is compared with a regulatory required index that represents an overall securities market (Regulatory Benchmark). In addition, the line graph and table may also include one or more indexes that more closely aligns to the fund's investment strategy (Strategy Benchmark(s)). Due to new SEC Rules on shareholder reporting the fund adopted a new broad-based securities market index, referred to as the Regulatory Benchmark. Market index returns do not include expenses, which are deducted from fund returns. The fund's total return figures reflect the reinvestment of dividends and capital gains, if any. Neither the fund’s returns nor the index returns reflect the deduction of taxes that a shareholder would pay on fund distributions or redemptions of fund shares. The fund’s past performance is not a good predictor of the fund’s future performance. Updated performance information can be found at www.troweprice.com.

What are some fund statistics?

Fund Statistics

| Total Net Assets (000s) | $170,943 |

| Number of Portfolio Holdings | 26 |

| Investment Advisory Fees Paid (000s) | $299 |

| Portfolio Turnover Rate | 29.7% |

What did the fund invest in?

Asset Allocation (as a % of Net Assets)

| Domestic Equity Funds | 39.7% |

| Domestic Bond Funds | 32.4 |

| International Equity Funds | 13.3 |

| International Bond Funds | 12.4 |

| Short-Term and Other | 2.2 |

Top Ten Holdings (as a % of Net Assets)

| T. Rowe Price Equity Index 500 Fund | 14.4% |

| T. Rowe Price QM U.S. Bond Index Fund | 13.9 |

| T. Rowe Price U.S. Limited Duration TIPS Index Fund | 11.3 |

| T. Rowe Price International Equity Index Fund | 6.9 |

| T. Rowe Price Hedged Equity Fund | 5.4 |

| T. Rowe Price Value Fund | 5.2 |

| T. Rowe Price International Bond Fund (USD Hedged) | 4.8 |

| T. Rowe Price Growth Stock Fund | 4.7 |

| T. Rowe Price Real Assets Fund | 3.5 |

| T. Rowe Price Dynamic Global Bond Fund | 3.3 |

If you invest directly with T. Rowe Price, you can elect to receive future shareholder reports or other important documents through electronic delivery by enrolling at www.troweprice.com/paperless. If you invest through a financial intermediary such as an investment advisor, a bank, retirement plan sponsor or a brokerage firm, please contact that organization and ask if it can provide electronic delivery.

Bloomberg and S&P do not accept any liability for any errors or omissions in the indexes or data, and hereby expressly disclaim all warranties of originality, accuracy, completeness, timeliness, merchantability and fitness for a particular purpose. No party may rely on any indexes or data contained in this communication. Visit www.troweprice.com/en/us/market-data-disclosures for additional legal notices & disclaimers.

Retirement Blend 2020 Fund

Investor Class (TSBAX)

T. Rowe Price Investment Services, Inc.

100 East Pratt Street

Baltimore, MD 21202

Annual Shareholder Report

May 31, 2024

Retirement Blend 2020 Fund

I Class (TBLDX)

This annual shareholder report contains important information about Retirement Blend 2020 Fund (the "fund") for the period of June 1, 2023 to May 31, 2024. You can find the fund’s prospectus, financial information on Form N-CSR (which includes required tax information for dividends), holdings, proxy voting information, and other information atwww.troweprice.com/prospectus. You can also request this information without charge by contacting T. Rowe Price at 1-800-638-5660 or info@troweprice.com or contacting your intermediary.

What were the fund costs for the last year? (based on a hypothetical $10,000 investment)

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

|---|---|---|

| Retirement Blend 2020 Fund - I Class | $22 | 0.21% |

What drove fund performance during the past 12 months?

Global stock indexes were broadly positive, while fixed income markets were mixed for the 12 months ended May 31, 2024. Many central banks maintained tight monetary policies to combat inflation, and markets fluctuated amid shifting expectations for interest rate cuts as rates remained “higher for longer.” Nevertheless, investor sentiment was elevated by resilient corporate earnings and enthusiasm around the profit potential from artificial intelligence developments.

Compared with the style-specific S&P Target Date 2020 Index, structural composition contributed to performance for the trailing one-year period. As global equity markets climbed, the fund’s higher-equity and lower-cash allocations relative to its benchmark contributed to results. Security selection within the underlying U.S. large-cap value equity and emerging markets bond allocations also had favorable impacts, as the corresponding strategies each outpaced their respective benchmarks, which added value on a relative basis.

On the negative side, a leading detractor from relative performance was security selection within the dynamic global bond strategy, which trailed its benchmark. Selection within the emerging markets equity strategy weighed, as well, as it also trailed its benchmark and detracted on a relative basis.

The fund seeks the highest total return over time, consistent with an emphasis on both capital growth and income. The fund invests in a diversified portfolio of other T. Rowe Price stock and bond mutual funds that represent various asset classes and sectors. Its allocation among T. Rowe Price funds will change over time in relation to its target retirement date.

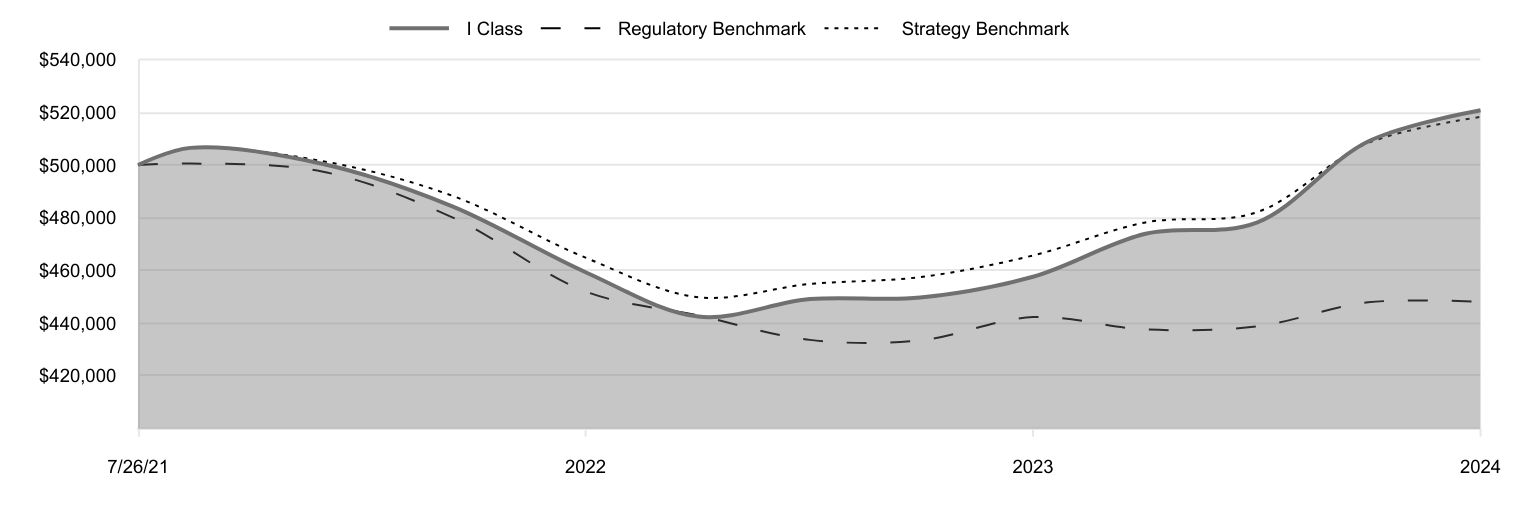

How has the fund performed?

Cumulative Returns of a Hypothetical $500,000 Investment as of May 31, 2024

| I Class | Regulatory Benchmark | Strategy Benchmark | |

|---|---|---|---|

| 7/26/21 | 500,000 | 500,000 | 500,000 |

| 8/31/21 | 506,500 | 500,558 | 506,281 |

| 11/30/21 | 500,500 | 497,555 | 501,510 |

| 2/28/22 | 484,317 | 480,173 | 488,326 |

| 5/31/22 | 459,337 | 452,013 | 464,848 |

| 8/31/22 | 442,513 | 442,914 | 449,844 |

| 11/30/22 | 449,141 | 433,671 | 454,887 |

| 2/28/23 | 449,732 | 433,491 | 457,491 |

| 5/31/23 | 457,622 | 442,327 | 465,694 |

| 8/31/23 | 473,928 | 437,629 | 478,223 |

| 11/30/23 | 478,136 | 438,788 | 482,083 |

| 2/29/24 | 508,915 | 447,914 | 508,327 |

| 5/31/24 | 520,788 | 448,102 | 518,245 |

202405-3565004, 202407-3567639

F1345-052 7/24

Average Annual Total Returns

| 1 Year | Since Inception 7/26/2021 | |

|---|---|---|

| Retirement Blend 2020 Fund (I Class) | 13.80% | 1.44% |

| Bloomberg U.S. Aggregate Bond Index (Regulatory Benchmark) | 1.31 | - 3.78 |

| S&P Target Date 2020 Index (Strategy Benchmark) | 11.28 | 1.27 |

The preceding line graph shows the value of a hypothetical $500,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The fund’s performance information included in the line graph and table above is compared with a regulatory required index that represents an overall securities market (Regulatory Benchmark). In addition, the line graph and table may also include one or more indexes that more closely aligns to the fund's investment strategy (Strategy Benchmark(s)). Due to new SEC Rules on shareholder reporting the fund adopted a new broad-based securities market index, referred to as the Regulatory Benchmark. Market index returns do not include expenses, which are deducted from fund returns. The fund's total return figures reflect the reinvestment of dividends and capital gains, if any. Neither the fund’s returns nor the index returns reflect the deduction of taxes that a shareholder would pay on fund distributions or redemptions of fund shares. The fund’s past performance is not a good predictor of the fund’s future performance. Updated performance information can be found at www.troweprice.com.

What are some fund statistics?

Fund Statistics

| Total Net Assets (000s) | $170,943 |

| Number of Portfolio Holdings | 26 |

| Investment Advisory Fees Paid (000s) | $299 |

| Portfolio Turnover Rate | 29.7% |

What did the fund invest in?

Asset Allocation (as a % of Net Assets)

| Domestic Equity Funds | 39.7% |

| Domestic Bond Funds | 32.4 |

| International Equity Funds | 13.3 |

| International Bond Funds | 12.4 |

| Short-Term and Other | 2.2 |

Top Ten Holdings (as a % of Net Assets)

| T. Rowe Price Equity Index 500 Fund | 14.4% |

| T. Rowe Price QM U.S. Bond Index Fund | 13.9 |

| T. Rowe Price U.S. Limited Duration TIPS Index Fund | 11.3 |

| T. Rowe Price International Equity Index Fund | 6.9 |

| T. Rowe Price Hedged Equity Fund | 5.4 |

| T. Rowe Price Value Fund | 5.2 |

| T. Rowe Price International Bond Fund (USD Hedged) | 4.8 |

| T. Rowe Price Growth Stock Fund | 4.7 |

| T. Rowe Price Real Assets Fund | 3.5 |

| T. Rowe Price Dynamic Global Bond Fund | 3.3 |

If you invest directly with T. Rowe Price, you can elect to receive future shareholder reports or other important documents through electronic delivery by enrolling at www.troweprice.com/paperless. If you invest through a financial intermediary such as an investment advisor, a bank, retirement plan sponsor or a brokerage firm, please contact that organization and ask if it can provide electronic delivery.

Bloomberg and S&P do not accept any liability for any errors or omissions in the indexes or data, and hereby expressly disclaim all warranties of originality, accuracy, completeness, timeliness, merchantability and fitness for a particular purpose. No party may rely on any indexes or data contained in this communication. Visit www.troweprice.com/en/us/market-data-disclosures for additional legal notices & disclaimers.

Retirement Blend 2020 Fund

I Class (TBLDX)

T. Rowe Price Investment Services, Inc.

100 East Pratt Street

Baltimore, MD 21202

Item 1. (b) Notice pursuant to Rule 30e-3.

Not applicable.

Item 2. Code of Ethics.

The registrant has adopted a code of ethics, as defined in Item 2 of Form N-CSR, applicable to its principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. A copy of this code of ethics is filed as an exhibit to this Form N-CSR. No substantive amendments were approved or waivers were granted to this code of ethics during the period covered by this report.

Item 3. Audit Committee Financial Expert.

The registrant’s Board of Directors has determined that Mr. Paul F. McBride qualifies as an audit committee financial expert, as defined in Item 3 of Form N-CSR. Mr. McBride is considered independent for purposes of Item 3 of Form N-CSR.

Item 4. Principal Accountant Fees and Services.

(a) – (d) Aggregate fees billed for the last two fiscal years for professional services rendered to, or on behalf of, the registrant by the registrant’s principal accountant were as follows:

| 2024 | 2023 | |||||||||||||

Audit Fees | $ | 14,377 | $ | 13,806 | ||||||||||

Audit-Related Fees | - | - | ||||||||||||

Tax Fees | - | - | ||||||||||||

All Other Fees | - | - | ||||||||||||

Audit fees include amounts related to the audit of the registrant’s annual financial statements and services normally provided by the accountant in connection with statutory and regulatory filings. Audit-related fees include amounts reasonably related to the performance of the audit of the registrant’s financial statements and specifically include the issuance of a report on internal controls and, if applicable, agreed-upon procedures related to fund acquisitions. Tax fees include amounts related to services for tax compliance, tax planning, and tax advice. The nature of these services specifically includes the review of distribution calculations and the preparation of Federal, state, and excise tax returns. All other fees include the registrant’s pro-rata share of amounts for agreed-upon procedures in conjunction with service contract approvals by the registrant’s Board of Directors/Trustees.

(e)(1) The registrant’s audit committee has adopted a policy whereby audit and non-audit services performed by the registrant’s principal accountant for the registrant, its investment adviser, and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant require pre-approval in advance at regularly scheduled audit committee meetings. If such a service is required between regularly scheduled audit committee meetings, pre-approval may be authorized by one audit committee member with ratification at the next scheduled audit committee meeting. Waiver of pre-approval for audit or non-audit services requiring fees of a de minimis amount is not permitted.

(2) No services included in (b) – (d) above were approved pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X.

(f) Less than 50 percent of the hours expended on the principal accountant’s engagement to audit the registrant’s financial statements for the most recent fiscal year were attributed to work performed by persons other than the principal accountant’s full-time, permanent employees.

(g) The aggregate fees billed for the most recent fiscal year and the preceding fiscal year by the registrant’s principal accountant for non-audit services rendered to the registrant, its investment adviser, and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant were $1,230,000 and $1,521,000, respectively.

(h) All non-audit services rendered in (g) above were pre-approved by the registrant’s audit committee. Accordingly, these services were considered by the registrant’s audit committee in maintaining the principal accountant’s independence.

(i) Not applicable.

(j) Not applicable.

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Investments.

(a) Not applicable. The complete schedule of investments is included in Item 7 of this Form N-CSR.

(b) Not applicable.

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies.

(a – b) Report pursuant to Regulation S-X.

Item 8. Changes in and Disagreements with Accountants for Open-End Management Investment Companies.

Not applicable.

Item 9. Proxy Disclosures for Open-End Management Investment Companies.

Not applicable.

Item 10. Remuneration Paid to Directors, Officers, and Others of Open-End Management Investment Companies.

Remuneration paid to Directors is included in Item 7 of this Form N-CSR.

Item 11. Statement Regarding Basis for Approval of Investment Advisory Contract.

If applicable, see Item 7.

Item 12. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable.

Item 13. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable.

Item 14. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

Not applicable.

Item 15. Submission of Matters to a Vote of Security Holders.

There has been no change to the procedures by which shareholders may recommend nominees to the registrant’s board of directors.

Item 16. Controls and Procedures.

(a) The registrant’s principal executive officer and principal financial officer have evaluated the registrant’s disclosure controls and procedures within 90 days of this filing and have concluded that the registrant’s disclosure controls and procedures were effective, as of that date, in ensuring that information required to be disclosed by the registrant in this Form N-CSR was recorded, processed, summarized, and reported timely.

(b) The registrant’s principal executive officer and principal financial officer are aware of no change in the registrant’s internal control over financial reporting that occurred during the period covered by this report that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting.

Item 17. Disclosure of Securities Lending Activities for Closed-End Management Investment Companies.

Not applicable.

Item 18. Recovery of Erroneously Awarded Compensation.

Not applicable.

Item 19. Exhibits.

(a)(1) The registrant’s code of ethics pursuant to Item 2 of Form N-CSR is attached.

(2) Listing standards relating to recovery of erroneously awarded compensation: not applicable.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

T. Rowe Price Retirement Blend 2020 Fund | ||||

| By | /s/ David Oestreicher | |||

| David Oestreicher | ||||

| Principal Executive Officer | ||||

| Date | July 18, 2024 | |||

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| By | /s/ David Oestreicher | |||

| David Oestreicher | ||||

| Principal Executive Officer | ||||

| Date | July 18, 2024

| |||

| By | /s/ Alan S. Dupski | |||

| Alan S. Dupski | ||||

| Principal Financial Officer | ||||

| Date | July 18, 2024 | |||