U.S. SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D. C. 20549

FORM 10-K

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES

EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2006

or

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES

EXCHANGE ACT OF 1934

For the transition period from ________ to _________

Commission File Number 000-50055

SOMERSET HILLS BANCORP

(Exact Name of registrant as specified in its charter)

New Jersey

(State of other jurisdiction of

incorporation or organization) | | | | 22-3768777

(I. R. S. Employer

Identification No.) |

155 Morristown Road, Bernardsville, NJ

(Address of principal executive offices) | | | | 07924

(Zip Code) |

| | | (908) 221-0100

(Issuer’s telephone number) | | |

Securities registered under Section 12(b) of the Exchange Act:

Title of each class Name of each exchange on which registered

Common Stock, no par value Nasdaq

Securities registered under Section 12(g) of the Exchange Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405of the Securities Act. Yes [ ] No [ X ]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes [ ] No [ X ]

Check whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities and Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [_]

Check if there is no disclosure of delinquent filers pursuant to Item 405 of Regulation S-K contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by referenced in Part III of this Form 10-K or any amendment to this Form 10-K.

[ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (check one): Large accelerated filer [ ] Accelerated filer [ ] Non-accelerated filer [X]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [ ] No [ X ]

As of June 30, 2006, the aggregate market value of voting and non-voting equity held by non-affiliates was $39.6 million.

As of March 9th, 2007 there were 4,760,425 shares of common stock, no par value per share outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

| | 10-K Item

| | Document Incorporated

|

| Item 10. | | Directors and Executive Officers

of the Registrant | | Proxy Statement for 2007 Annual Meeting of Shareholders to be filed no later than April 30, 2007. |

| Item 11. | | Executive Compensation | | Proxy Statement for 2007 Annual Meeting of Shareholders to be filed no later than April 30, 2007. |

| Item 12. | | Security Ownership of Certain Beneficial Owners

and Management And Related Stockholder Matters | | Proxy Statement for 2007 Annual Meeting of Shareholders to be filed no later than April 30, 2007. |

| Item 13. | | Certain Relationships and Related

Transactions | | Proxy Statement for 2007 Annual Meeting of Shareholders to be filed no later than April 30, 2007. |

| Item 14. | | Principal Accountant Fees and Services | | Proxy Statement for 2007 Annual Meeting of Shareholders to be filed no later than April 30, 2007. |

PART I

ITEM 1. — DESCRIPTION OF BUSINESS

General

Somerset Hills Bancorp (the “Company”) is a one-bank holding company incorporated under the laws of New Jersey in January 2000 to serve as the holding company for Somerset Hills Bank (the “Bank”). We were organized at the direction of the Board of Directors of the Bank. Effective January 1, 2001, Somerset Hills Bancorp acquired all of the capital stock of the Bank and became a bank holding company under the Bank Holding Company Act of 1956, as amended. Our only significant operation is our investment in the Bank. Our main office is located at 155 Morristown Road, Bernardsville, New Jersey and our telephone number is (908) 221-0100.

The Bank is a commercial bank formed under the laws of the State of New Jersey in 1997. The Bank operates from its main office at 155 Morristown Road, Bernardsville, New Jersey, and its additional four branch offices located in Madison, Mendham, Morristown and Summit, New Jersey. The Bank operates a licensed mortgage company subsidiary, Sullivan Financial Services, Inc. (“Sullivan”). Sullivan operates out of its main office in West Orange, New Jersey. The Company considers Sullivan to be a separate business segment.

The Bank’s deposits are insured by the Bank Insurance Fund of the Federal Deposit Insurance Corporation up to applicable limits. The operations of the Bank are subject to the supervision and regulation of the Federal Deposit Insurance Corporation and the New Jersey Department of Banking and Insurance. Our mortgage company’s operations are subject to regulation by the New Jersey Department of Banking and Insurance, the Department of Banking in Florida, New York and Pennsylvania as well as the Department of Housing and Urban Development and the Veterans Administration.

We separate our business into two reporting segments: retail banking and mortgage banking. For financial information on our business segments, see Note 13 to the accompanying Financial Statements.

Business of the Bank

The Bank conducts a traditional commercial banking business and offers services including personal and business checking accounts and time deposits, money market accounts and regular savings accounts. The Bank’s lending activities are oriented to the small-to-medium sized business, high net worth individuals, professional practices and consumer and retail customers living and working primarily in the Bank’s market area of Somerset, Morris and Union Counties, New Jersey. The Bank offers the commercial, consumer, and mortgage-lending products typically offered by community banks and, through its mortgage company subsidiary, a variety of residential mortgage products.

The deposit services offered by the Bank include small business and personal checking and savings accounts and certificates of deposit. The Bank’s signature deposit account is the Paramount Checking Account, an interest paying account offering features such as free checks, telephone banking and bill payment, free safe deposit box and a refund of foreign ATM fees. Another deposit service the bank offers is the Escrow Ease product. Escrow Ease is specifically designed to meet the trust account needs of attorneys, realtors and title companies. The Escrow Ease Account offers the convenience of segregation of client funds, by sub account, within a single master trust account with detailed sub account reporting including the preparation of year-end tax documents. Sub accounts may be either interest or non-interest bearing and, for attorneys, can also be designated as IOLTA accounts. The Bank concentrates on customer

relationships in building our customer deposit base and competes aggressively in the area of transaction accounts.

In addition, the Bank has established a private banking and wealth management subsidiary pursuant to which it offers insurance services, securities brokerage and investment advisory services on a non-proprietary basis under the terms of an agreement with Mass Mutual, its affiliated securities brokerage and its locally affiliated agents. The Bank has also established a title insurance agency joint venture which offers traditional title agency services. The bank is a 50 percent owner of the joint venture.

Service Area

The service area of the Bank primarily consists of Somerset, Morris and Union Counties, New Jersey, although we make loans throughout New Jersey. The Bank operates through its main office in Bernardsville, New Jersey, and its branch offices located in Madison, Mendham, Morristown and Summit, New Jersey.

Our mortgage company subsidiary originates loans primarily throughout New Jersey, and to a lesser degree, New York, Pennsylvania and Florida. The mortgage company operates out of its main office in West Orange, New Jersey, and a loan origination office located at the Bank’s main office in Bernardsville, New Jersey.

Competition

The Bank operates in a highly competitive environment competing for deposits and loans with commercial banks, thrifts and other financial institutions, many of which have greater financial resources than the Bank. Many large financial institutions compete for business in the service area of the Bank. In addition, in November 1999, the Gramm-Leach-Bliley Financial Modernization Act of 1999 was passed into law. The Act permits insurance companies and securities firms, among others, to acquire financial institutions and has increased competition within the financial services industry. Certain of our competitors have significantly higher lending limits than we do and provide services to their customers that we do not offer.

Management believes that the Bank is able to compete favorably with our competitors because we provide responsive personalized service through management’s knowledge and awareness of our market area, customers and businesses.

Employees

At December 31, 2006 and 2005, we employed 82 and 76 full-time employees and 6 and 6 part-time employees, respectively. None of these employees are covered by a collective bargaining agreement and we believe that our employee relations are good.

Supervision and Regulation

Bank holding companies and banks are extensively regulated under both federal and state law. These laws and regulations are intended to protect depositors, not shareholders. In addition, the operations of Sullivan are subject to various state and federal regulations designed to protect consumers, not shareholders. To the extent that the following information describes statutory and regulatory provisions, it is qualified in its entirety by reference to the particular statutory and regulatory provisions. Any change in the applicable law or regulation may have a material effect on the business and prospects of the Company and the Bank.

BANK HOLDING COMPANY REGULATION

General

As a bank holding company registered under the Bank Holding Company Act, the Company is subject to the regulation and supervision applicable to bank holding companies by the Board of Governors of the Federal Reserve System. The Company is required to file with the Federal Reserve annual reports and other information regarding its business operations and those of its subsidiaries.

The Bank Holding Company Act requires, among other things, the prior approval of the Federal Reserve in any case where a bank holding company proposes to (i) acquire all or substantially all of the assets of any other bank, (ii) acquire direct or indirect ownership or control of more than 5% of the outstanding voting stock of any bank (unless it owns a majority of such company’s voting shares) or (iii) merge or consolidate with any other bank holding company. The Federal Reserve will not approve any acquisition, merger, or consolidation that would have a substantially anti-competitive effect, unless the anti-competitive impact of the proposed transaction is clearly outweighed by a greater public interest in meeting the convenience and needs of the community to be served. The Federal Reserve also considers capital adequacy and other financial and managerial resources and future prospects of the companies and the banks concerned, together with the convenience and needs of the community to be served, when reviewing acquisitions or mergers.

The Bank Holding Company Act generally prohibits a bank holding company, with certain limited exceptions, from (i) acquiring or retaining direct or indirect ownership or control of more than 5% of the outstanding voting stock of any company which is not a bank or bank holding company, or (ii) engaging directly or indirectly in activities other than those of banking, managing or controlling banks, or performing services for its subsidiaries, unless such non-banking business is determined by the Federal Reserve to be so closely related to banking or managing or controlling banks as to be properly incident thereto.

The Bank Holding Company Act was substantially amended through the Gramm-Leach Bliley Financial Modernization Act of 1999 (“Financial Modernization Act”). The Financial Modernization Act permits bank holding companies and banks, which meet certain capital, management and Community Reinvestment Act standards to engage in a broader range of non-banking activities. In addition, bank holding companies that elect to become financial holding companies may engage in certain banking and non-banking activities without prior Federal Reserve approval. Finally, the Financial Modernization Act imposes certain new privacy requirements on all financial institutions and their treatment of consumer information. At this time, the Company has elected not to become a financial holding company, as it does not engage in any activities that are not permissible for banks.

There are a number of obligations and restrictions imposed on bank holding companies and their depository institution subsidiaries by law and regulatory policy that are designed to minimize potential loss to the depositors of such depository institutions and the FDIC insurance funds in the event the depository institution becomes in danger of default. Under a policy of the Federal Reserve with respect to bank holding company operations, a bank holding company is required to serve as a source of financial strength to its subsidiary depository institutions and to commit resources to support such institutions in circumstances where it might not do so absent such policy. The Federal Reserve also has the authority under the Bank Holding Company Act to require a bank holding company to terminate any activity or to relinquish control of a non-bank subsidiary upon the Federal Reserve’s determination that such activity or control constitutes a serious risk to the financial soundness and stability of any bank subsidiary of the bank holding company.

Capital Adequacy Guidelines for Bank Holding Companies

The Federal Reserve has adopted risk-based capital guidelines for bank holding companies. The risk-based capital guidelines are designed to make regulatory capital requirements more sensitive to differences in risk profile among banks and bank holding companies to account for off-balance sheet exposure, and to minimize disincentives for holding liquid assets. Under these guidelines, assets and off-balance sheet items are assigned to broad risk categories, each with appropriate weights. The resulting capital ratios represent capital as a percentage of total risk-weighted assets and off-balance sheet items.

The minimum ratio of total capital to risk-weighted assets (including certain off-balance sheet activities, such as standby letters of credit) is 8%. At least 4% of the total capital is required to be “Tier I Capital,” consisting of common shareholders’ equity, qualifying preferred stock and certain permissible hybrid instruments, less certain goodwill items and other intangible assets. The remainder (“Tier II Capital”) may consist of (a) the allowance for loan losses of up to 1.25% of risk-weighted assets, (b) non-qualifying preferred stock, (c) hybrid capital instruments, (d) perpetual debt, (e) mandatory convertible securities, and (f) qualifying subordinated debt and intermediate-term preferred stock up to 50% of Tier I capital. Total capital is the sum of Tier I and Tier II capital less reciprocal holdings of other banking organizations’ capital instruments, investments in unconsolidated subsidiaries and any other deductions as determined by the Federal Reserve (determined on a case by case basis or as a matter of policy after formal rule-making).

Bank holding company assets are given risk-weights of 0%, 20%, 50% and 100%. In addition, certain off-balance sheet items are given similar credit conversion factors to convert them to asset equivalent amounts to which an appropriate risk-weight will apply. These computations result in the total risk-weighted assets. Most loans are assigned to the 100% risk category, except for performing first mortgage loans fully secured by residential property which carry a 50% risk-weighting and loans secured by deposits in the bank which carry a 20% risk weighting. Most investment securities (including, primarily general obligation claims of states or other political subdivisions of the United States) are assigned to the 20% category, except for municipal or state revenue bonds, which have a 50% risk-weight, and direct obligations of the U.S. Treasury or obligations backed by the full faith and credit of the U.S. Government, which have a 0% risk-weight. In converting off-balance sheet items, direct credit substitutes including general guarantees and standby letters of credit backing financial obligations are given a 100% risk weighting. Transaction related contingencies such as bid bonds, standby letters of credit backing non-financial obligations, and undrawn commitments (including commercial credit lines with an initial maturity of more than one year) have a 50% risk weighting. Short-term commercial letters of credit have a 20% risk weighting and certain short-term unconditionally cancelable commitments have a 0% risk weighting.

In addition to the risk-based capital guidelines, the Federal Reserve has adopted a minimum Tier I capital (leverage) ratio, under which a bank holding company must maintain a minimum level of Tier I capital to average total consolidated assets of at least 3% in the case of a bank holding company that has the highest regulatory examination rating and is not contemplating significant growth or expansion. All other bank holding companies are expected to maintain a leverage ratio of at least 100 to 200 basis points above the stated minimum. See “Item 7 - Management’s Discussion and Analysis of Financial Condition and Results of Operation - - Capital Ratios”.

BANK REGULATION

As a New Jersey-chartered commercial bank, the Bank is subject to the regulation, supervision, and control of the New Jersey Department of Banking and Insurance. As an FDIC-insured institution, the Bank is subject to regulation, supervision and control of the FDIC, an agency of the federal government. The regulations of the FDIC and the New Jersey Department of Banking and Insurance impact virtually all of the Bank’s activities, including the minimum level of capital

we must maintain, our ability to pay dividends, our ability to expand through new branches or acquisitions and various other matters.

Insurance of Deposits

The Bank’s deposits are insured up to a maximum of $100,000 per depositor ($250,000 per IRA account) under the Deposit Insurance Fund of the FDIC. The FDIC has established a risk-based assessment system for all insured depository institutions. Under the risk-based assessment system, deposit insurance premium rates during 2006 ranged from 0-27 basis points of assessed deposits. For the year ended December 31, 2006, we paid deposit insurance premiums of $27,462. Commencing in January 2007, the FDIC revised its deposit insurance assessment system. Under the new system, deposit insurance assessment rates will range from 5 to 43 basis points of assessed deposits.

Capital Adequacy Guidelines

The FDIC has promulgated risk-based capital guidelines, which are designed to make regulatory capital requirements more sensitive to differences in risk profile among banks, to account for off-balance sheet exposure, and to minimize disincentives for holding liquid assets. Under these guidelines, assets and off-balance sheet items are assigned to broad risk categories, each with appropriate weights. The resulting capital ratios represent capital as a percentage of total risk-weighted assets and off-balance sheet items. These guidelines are substantially similar to the Federal Reserve Board guidelines discussed above.

In addition to the risk-based capital guidelines, the FDIC has adopted a minimum Tier 1 capital (leverage) ratio. This measurement is substantially similar to the Federal Reserve leverage capital measurement discussed above.

Dividends

As long as the operations of the Bank remain our primary source of income, our ability to pay dividends will be effected by any legal or regulatory limitations on the Bank’s ability to pay dividends to us. The Bank may pay dividends as declared from time to time by the Board of Directors out of funds legally available, subject to certain restrictions. Under the New Jersey Banking Act of 1948, the Bank may not pay a cash dividend unless, following the payment, the Bank’s capital stock will be unimpaired and the Bank will have a surplus of no less than 50% of the Bank’s capital stock or, if not, the payment of the dividend will not reduce the surplus. In addition, the Bank cannot pay dividends in such amounts as would reduce the Bank’s capital below regulatory imposed minimums. During 2005, we commenced paying quarterly cash dividends of $0.02 per share and increased the dividend in 2006 to $0.03 per share. The Board will review the amount and frequency of the Company’s cash dividends on an ongoing basis, based upon the Company’s results of operations, capital needs and other appropriate factors.

REGULATION OF SULLIVAN

As a subsidiary of the Bank, Sullivan is subject to regulation and examination by the New Jersey Department of Banking and Insurance and the FDIC. In addition, as a licensed lender, Sullivan is subject to the jurisdiction of the New Jersey Department of Banking and Insurance and, as an approved Department of Housing and Urban Development and Veterans Administration lender, Sullivan is subject to examination by the Department of Housing and Urban Development and the Veterans Administration. Sullivan is also subject to regulation by the Florida Department of Financial Services as well as the Department of Banking in New York and Pennsylvania.

ITEM 1A. - RISK FACTORS

Our business, financial condition, results of operations and the trading prices of our securities can be materially and adversely affected by many events and conditions including the following:

Risks affecting Our Business:

Our continued growth may negatively affect profitability.

Our asset size has grown each year we have been in existence. Since December 31, 2002, we have grown by more than 93 percent. Our business plan calls for our continued expansion. We project opening two new branches in the next twelve months. This growth could negatively impact our future profitability in several ways, including through potential loan losses and the need for future provisions to the loan loss reserve, and an increase in operating and other non-interest expenses associated with growth.

Our continued growth and success also depends on the ability of our officers and key employees to manage our growth effectively, to attract and retain skilled employees and to expand the capabilities of our management information systems. Accordingly, there can be no assurance that we will be successful in managing our expansion and the failure to do so would adversely affect our financial position.

Our future success may be dependent upon our Chief Executive Officer.

Our future success in implementing our current business strategy is dependent on the continued services of Stewart E. McClure, Jr., our President, Chief Executive Officer and Chief Operating Officer. If Mr. McClure were to become unavailable for any reason, our operations would likely suffer. Although we have an employment agreement with Mr. McClure, no assurances can be given that we will continue to benefit from Mr. McClure’s ongoing involvement in our operations.

Defensive measures contained in the certificate of incorporation limit the ability of shareholders to exert control over the board of directors. Our board may consider issues other than price in evaluating offers.

Our certificate of incorporation contains certain provisions which have been adopted to permit the board to act in the best interests of all shareholders in the event of an unsolicited takeover bid. These provisions may also have significant effects in limiting the ability of our shareholders to effect an immediate change in the composition of the board of directors and to otherwise exercise their voting power to affect the composition of the board or to accept an offer that the shareholders may consider to be in their best interests but which the board does not accept. In general, these provisions provide (i) for a classified board of directors; (ii) that directors may not be removed by shareholders without cause; (iii) that the affirmative vote of 75% of the outstanding shares of common stock are required to approve a merger, consolidation or sale of substantially all of the company’s assets, unless the proposed transaction is approved by a majority of the board of directors; and (iv) prior notice of any shareholder nominations and proposals. In addition, our certificate of incorporation provides that when the Board of Directors evaluates a tender or exchange offer for our securities, a proposal to merge or consolidate with another entity, or a proposal to have all or substantially all of our property and assets acquired by another entity, the Board may, as permitted by New Jersey law, give due consideration to all facts that it deems relevant in evaluating what is in the best interests of the company, the bank and the shareholders.

Risks Related to the Banking Industry:

The Company is subject to interest rate risk.

The Company’s earnings and cash flows are largely dependent upon its net interest income. Net interest income is the difference between interest income earned on interest-earning assets such as loans and securities and interest expense paid on interest-bearing liabilities such as deposits and borrowed funds. Interest rates are highly sensitive to many factors that are beyond the Company’s control, including general economic conditions and policies of various governmental and regulatory agencies and, in particular, the Board of Governors of the Federal Reserve System. Changes in monetary policy, including changes in interest rates, could influence not only the interest the Company receives on loans and securities and the amount of interest it pays on deposits and borrowings, but such changes could also affect (i) the Company’s ability to originate loans and obtain deposits, (ii) the fair value of the Company’s financial assets and liabilities, and (iii) the average duration of the Company’s mortgage-backed securities portfolio. If the interest rates paid on deposits and other borrowings increase at a faster rate than the interest rates received on loans and other investments, the Company’s net interest income, and therefore earnings, could be adversely affected. Earnings could also be adversely affected if the interest rates received on loans and other investments fall more quickly than the interest rates paid on deposits and other borrowings. In addition, a flat yield curve, in which short-term deposit and borrowing rates equal longer-term investment or loan rates, could adversely impact net interest income as the spread between interest-earning assets and interest-bearing liabilities compresses.

Although management believes it has implemented effective asset and liability management strategies, to reduce the potential effects of changes in interest rates on the Company’s results of operations, any substantial, unexpected, prolonged change in market interest rates could have a material adverse effect on the Company’s financial condition and results of operations.

Changes in local economic conditions could adversely affect our loan portfolio.

Our success depends to a great extent upon the general economic conditions of the local markets that we serve. Unlike larger banks that are more geographically diversified, we provide banking and financial services primarily to customers in our northern and central New Jersey markets, so any decline in the economy of New Jersey could have an adverse impact on us.

Our loans, the ability of borrowers to repay these loans and the value of collateral securing these loans, are impacted by economic conditions. Our financial results, the credit quality of our existing loan portfolio, and the ability to generate new loans with acceptable yield and credit characteristics may be adversely affected by changes in prevailing economic conditions, including declines in real estate values, changes in interest rates, adverse employment conditions and the monetary and fiscal policies of the federal government. Although economic conditions in our primary market area are strong and have aided our recent growth, we cannot assure you that these conditions will continue to prevail.

There is a risk that we may not be repaid in a timely manner, or at all, for loans we make.

The risk of nonpayment (or deferred or delayed payment) of loans is inherent in commercial banking. Such non-payment, or delayed or deferred payment of loans to the Company, if they occur, may have a material adverse effect on our earnings and overall financial condition. Additionally, in compliance with applicable banking laws and regulations, the Company maintains an allowance for loan losses created through charges against earnings. As of December 31, 2006, the Company’s allowance for loan losses was $2.2 million. The Company’s marketing focus on small to medium-size businesses may result in the assumption by the Company of certain lending risks that are different from or greater than those which would apply to loans made to larger companies. We seek to minimize our credit risk exposure through credit controls,

which include evaluation of potential borrowers, available collateral, liquidity and cash flow. However, there can be no assurance that such procedures will actually reduce loan losses.

Our allowance for loan losses may not be adequate to cover actual losses.

Like all financial institutions, we maintain an allowance for loan losses to provide for loan defaults and nonperformance. Our allowance for loan losses may not be adequate to cover actual losses, and future provisions for loan losses could materially and adversely affect results of our operations. Risks within the loan portfolio are analyzed on a continuous basis by management, and periodically, by an independent loan review function and by the audit committee. A risk system, consisting of multiple grading categories, is utilized as an analytical tool to assess risk and the appropriate level of loss reserves. Along with the risk system, management further evaluates risk characteristics of the loan portfolio under current economic conditions and considers such factors as the financial condition of the borrowers, past and expected loan loss experience, and other factors management feels deserve recognition in establishing an adequate reserve. This risk assessment process is performed at least quarterly, and, as adjustments become necessary, they are realized in the periods in which they become known. The amount of future losses is susceptible to changes in economic, operating and other conditions, including changes in interest rates that may be beyond our control, and these losses may exceed current estimates. State and federal regulatory agencies, as an integral part of their examination process, review our loans and allowance for loan losses and may require an increase in our allowance for loan losses. Although we believe that our allowance for loan losses is adequate to cover probable and reasonably estimated losses, we cannot assure you that we will not further increase the allowance for loan losses or that regulators will not require us to increase this allowance. Either of these occurrences could adversely affect our earnings.

We are in competition with many other banks, including larger commercial banks which have greater resources than us.

The banking industry within the State of New Jersey is highly competitive. The Company’s principal market area is also served by branch offices of large commercial banks and thrift institutions. In addition, in 1999 the Gramm-Leach-Bliley Financial Modernization Act of 1999 was passed into law. The Modernization Act permits other financial entities, such as insurance companies and securities firms, to acquire or form financial institutions, thereby further increasing competition. A number of our competitors have substantially greater resources than we do to expend upon advertising and marketing, and their substantially greater capitalization enables them to make much larger loans. Our success depends a great deal upon our judgment that large and mid-size financial institutions do not adequately serve small businesses in our principal market area and our ability to compete favorably for such customers. In addition to competition from larger institutions, we also face competition for individuals and small businesses from recently formed banks seeking to compete as “home town” institutions. Most of these new institutions have focused their marketing efforts on the smaller end of the small business market we serve.

The laws that regulate our operations are designed for the protection of depositors and the public, but not our stockholders.

The federal and state laws and regulations applicable to our operations give regulatory authorities extensive discretion in connection with their supervisory and enforcement responsibilities, and generally have been promulgated to protect depositors and the deposit insurance funds and not for the purpose of protecting stockholders. These laws and regulations can materially affect our future business. Laws and regulations now affecting us may be changed at any time, and the interpretation of such laws and regulations by bank regulatory authorities is also subject to change. We can give no assurance that future changes in laws and regulations or changes in their interpretation will not adversely affect our business.

We may be subject to higher operating costs as a result of government regulation.

We are subject to extensive federal and state legislation, regulation and supervision which is intended primarily to protect depositors and the Federal Deposit Insurance Company’s Deposit Insurance Fund, rather than investors. In addition, as a publicly traded company, we are subject to regulation and supervision by the Securities and Exchange Commission (“SEC”). In recent years, new legislation such as the Sarbanes-Oxley Act of 2002 and regulation adopted by the SEC thereunder have greatly increased compliance costs and burdens on publicly traded companies. Future legislative and regulatory changes may further increase our costs of doing business or otherwise adversely affect us and create competitive advantages for competitors.

We cannot predict how changes in technology will impact our business.

The financial services market, including banking services, is increasingly affected by advances in technology, including developments in:

| • | | debit cards and so-called “smart cards.” |

Our ability to compete successfully in the future will depend on whether we can anticipate and respond to technological changes. To develop these and other new technologies we will likely have to make additional capital investments. Although we continually invest in new technology, we cannot assure you that we will have sufficient resources or access to the necessary proprietary technology to remain competitive in the future.

The Company’s information systems may experience an interruption or breach in security.

The Company relies heavily on communications and information systems to conduct its business. Any failure, interruption or breach in security of these systems could result in failures or disruptions in the Company’s customer relationship management, general ledger, deposit, loan and other systems. While the Company has policies and procedures designed to prevent or limit the effect of the failure, interruption or security breach of its information systems, there can be no assurance that any such failures, interruptions or security breaches will not occur or, if they do occur, that they will be adequately addressed. The occurrence of any failures, interruptions or security breaches of the Company’s information systems could damage the Company’s reputation, result in a loss of customer business, subject the Company to additional regulatory scrutiny, or expose the Company to civil litigation and possible financial liability, any of which could have a material adverse effect on the Company’s financial condition and results of operations.

Item 1B. Unresolved Staff Comments

There are no unresolved staff comments.

ITEM 2. — DESCRIPTION OF PROPERTY

The Bank owns its main office in Bernardsville and a proposed branch office in Long Valley, New Jersey, and leases its Madison, Mendham, Morristown and Summit, New Jersey branch offices. In addition, the Bank leases the Main office of Sullivan Financial Services, Inc. in West Orange NJ and a branch office in Edison, NJ listed below. The following table sets forth certain information regarding the properties of the Bank:

Owned Properties

|

Location

| Square Feet

|

| Bernardsville | 14,000 | |

| Long Valley | 1,200 | |

| |

| | Leased Properties

| |

Location

| Square Feet

| Monthly Rental

| Expiration of Term

|

| Madison | 4,000 | $10,000 | 2016 |

| Mendham | 2,500 | $ 8,695 | 2010 |

| Morristown | 2,379 | $ 4,361 | 2008 |

| Summit | 4,016 | $ 9,167 | 2009 |

| West Orange (1) | 5,756 | $ 9,833 | 2010 |

| Edison (2) | 1,775 | $ 2,884 | 2010 |

| (1) | | Main office of Sullivan |

| (2) | | Branch office of Sullivan |

ITEM 3. - LEGAL PROCEEDINGS

We are periodically parties to or otherwise involved in legal proceedings arising in the normal course of business, such as claims to enforce liens, claims involving the making and servicing of real property loans, and other issues incident to the business of the Company and the Bank. Management does not believe that there is any pending or threatened proceeding against the Company or the Bank, which if determined adversely, would have a material effect on the business or financial position of the Company.

ITEM 4. - SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

No matters were submitted for a vote of registrant’s shareholders during the fourth quarter of fiscal 2006.

PART II

ITEM 5. - MARKET FOR THE COMMON EQUITY AND RELATED STOCKHOLDER MATTERS

The Company’s common stock is currently traded on Nasdaq Global Market under the symbol “SOMH.”

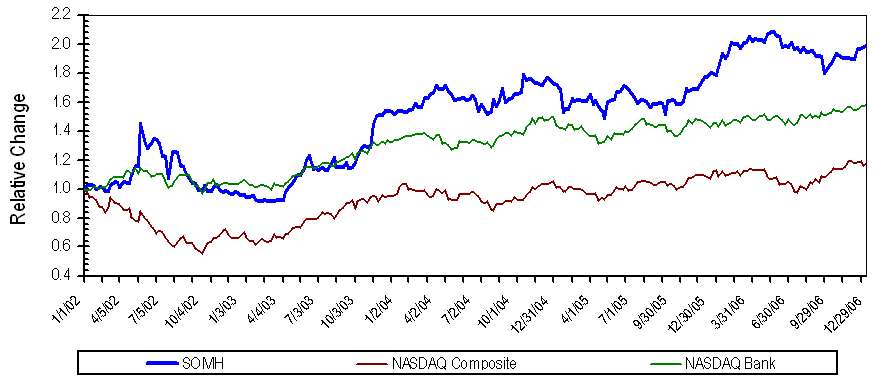

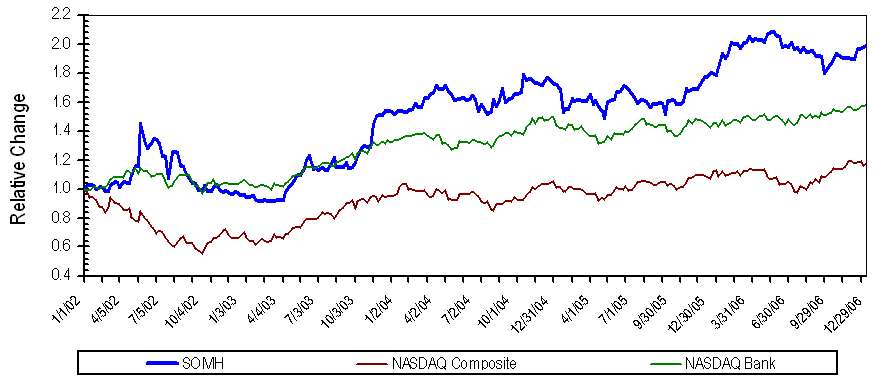

The following is a graph showing the performance of the Company’s stock verses the NASDAQ composite and the NASDAQ Bank indexes:

Fiscal Year Ending

|

| | 1/1/02

| 12/31/02

| 12/31/03

| 12/31/04

| 12/31/05

| 12/31/06

|

| Somerset Hills Bancorp | 100.00 | 98.33 | 154.87 | 175.31 | 181.88 | 201.18 |

| NASDAQ Bank Index | 100.00 | 106.98 | 141.83 | 160.89 | 157.70 | 179.22 |

| NASDAQ Composite Index | 100.00 | 68.80 | 103.64 | 113.07 | 115.43 | 127.36 |

The following table shows the high and low bid prices for the common stock as reported on the Nasdaq SmallCap Market from January 1, 2005 through December 31, 2006. High and low bid prices reflect inter-dealer quotations, without retail markup, markdown or commissions, and may not necessarily represent actual transactions.

| | Bid Price (1)

| Dividends

Declared

|

| | High

| Low

|

| | 2006

| | |

| First Quarter | $14.52 | | $11.77 | | $0.02 | |

| Second Quarter | 14.62 | | 12.82 | | 0.03 | |

| Third Quarter | 14.00 | | 12.02 | | 0.06 | |

| Fourth Quarter | 13.62 | | 12.14 | | 0.00 | |

| | 2005

| | |

| First Quarter | $11.88 | | $ 9.98 | | $0.00 | |

| Second Quarter | 11.59 | | 9.84 | | 0.02 | |

| Third Quarter | 11.19 | | 10.18 | | 0.02 | |

| Fourth Quarter | 12.27 | | 10.62 | | 0.02 | |

| (1) | | The prices quoted above have been adjusted to reflect the 5% stock dividend declared in April 2005 and paid in June 2005 and stock dividend declared in April 2006 and paid in May 2006. |

As of December 31, 2006, there were 192 record holders of our common stock.

During 2005, we commenced paying quarterly cash dividends of $0.02 per share and increased the quarterly dividend in 2006 to $0.03 per share. In 2006, the Company declared the fourth quarter dividend during the third quarter, although it was paid in the fourth quarter. The Board

will review the amount and frequency of the Company’s cash dividends on an ongoing basis, based upon the Company’s results of operations, capital needs and other appropriate factors.

We did not repurchase any of our equity securities during the fourth quarter of 2006. In February 2007, our Board of Directors adopted a stock repurchase program under which we may repurchase up to 250,000 shares of our common stock in open market or privately negotiated transactions.

ITEM 6. SELECTED CONSOLIDATED FINANCIAL DATA AND OTHER DATA

Selected Consolidated Financial Data and Other Data

(in thousands, except per share data)

Set forth below is selected historical financial data of the Company. This information is derived in part from and should be read in conjunction with the consolidated financial statements and notes thereto presented in the Annual Report to Stockholders.

| Years Ended December 31,

|

|---|

| 2006

| 2005

| 2004

| 2003

| 2002

|

|---|

| Selected Operating Data: | | | | | | | | | | |

| Total interest income | $15,782 | | $11,605 | | $8,202 | | $7,883 | | $6,759 | |

| Total interest expense | 6,054 | | 3,194 | | 2,019 | | 2,583 | | 2,773 | |

|

| |

| |

| |

| |

| |

| Net interest income | 9,728 | | 8,411 | | 6,183 | | 5,300 | | 3,986 | |

| Provision for loan losses | 201 | | 392 | | 225 | | 336 | | 448 | |

|

| |

| |

| |

| |

| |

| Net interest income after provision for |

| loan loss | 9,527 | | 8,019 | | 5,958 | | 4,964 | | 3,538 | |

| Other income | 2,869 | | 2,939 | | 2,845 | | 4,570 | | 3,268 | |

| Other expenses | 9,022 | | 8,414 | | 7,331 | | 8,217 | | 6,519 | |

|

| |

| |

| |

| |

| |

| Income before income taxes | 3,374 | | 2,544 | | 1,472 | | 1,317 | | 287 | |

| Income tax expense | 1,176 | | 429 | | 113 | | 144 | | 108 | |

|

| |

| |

| |

| |

| |

| Net income | $ 2,198 | | $ 2,115 | | $1,359 | | $1,173 | | $ 179 | |

|

| |

| |

| |

| |

| |

| (1)Net income - Basic | $ 0.58 | | $ 0.62 | | $ 0.40 | | $ 0.35 | | $ 0.09 | |

| (1)Net income - Diluted | $ 0.50 | | $ 0.54 | | $ 0.35 | | $ 0.34 | | $ 0.09 | |

| (1) | | All per share data has been restated to reflect the 5% stock dividends declared in 2002, 2003, 2004, 2005 and 2006. |

| At December 31,

|

|---|

| Selected Financial Data: | | 2006

| 2005

| 2004

| 2003

| 2002

|

| Total Assets | | $289,428 | | $245,926 | | $181,876 | | $169,679 | | $149,788 | |

| Net Loans | | 190,265 | | 165,118 | | 131,039 | | 107,374 | | 93,269 | |

| Total Deposits | | 250,221 | | 208,244 | | 154,875 | | 145,651 | | 125,444 | |

| Stockholders’ Equity | | 37,896 | | 25,305 | | 23,048 | | 21,721 | | 20,664 | |

| | | | | | | |

| Selected Financial Ratios: | | 2006

| 2005

| 2004

| 2003

| 2002

|

| Return on Average Assets (ROA) | | 0.86 | % | 1.00 | % | 0.76 | % | 0.70 | % | 0.15 | % |

| Return on Average Equity (ROE) | | 7.62 | % | 8.82 | % | 6.09 | % | 5.53 | % | 1.33 | % |

| Equity to Total Assets at Year-End | | 13.09 | % | 10.29 | % | 12.67 | % | 12.80 | % | 13.80 | % |

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OR PLAN OF OPERATIONS

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

Some of the statements in this document discuss future expectations, contain projections or results of operations or financial conditions or state other “forward-looking” information. Those statements are subject to known and unknown risk; uncertainties and other factors that could cause the actual results to differ materially from those contemplated by the statements. We based the forward-looking statements on various factors and using numerous assumptions. Important factors that may cause actual results to differ from those contemplated by forward-looking statements including those discussed under Item 1A - Risk Factors and the following factor for example:

| - | | the success or failure of our efforts to implement our business strategy; |

| - | | the effect of changing economic conditions and in particular changes in interest rates; |

| - | | changes in government regulations, tax rates and similar matters; |

| - | | our ability to attract and retain quality employees; and |

| - | | other risks which may be described in our future filings with the SEC. |

We do not promise to update forward-looking information to reflect actual results or changes in assumptions or other factors that could affect those statements other than material changes to such information.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF CONSOLIDATED

FINANCIAL CONDITION AND RESULTS OF OPERATION

The following discussion and analysis of financial condition and results of operations should be read in conjunction with the Company’s consolidated financial statements and the notes thereto included herein. When necessary, reclassifications have been made to prior years’ data throughout the following discussion and analysis for purposes of comparability.

CRITICAL ACCOUNTING POLICIES AND ESTIMATES

“Management’s Discussion and Analysis of Financial Condition and Results of Operation,” is based upon the Company’s consolidated financial statements, which have been prepared in accordance with U.S. generally accepted accounting principles. The preparation of these financial statements requires the Company to make estimates and judgements that effect the reported amounts of assets, liabilities, revenues and expenses. Note 1 to the Company’s Audited Consolidated Financial Statements for the year ended December 31, 2006 contains a summary of the Company’s significant accounting policies. Management believes the Company’s policy with respect to the methodology for the determination of the allowance for loan losses involves a higher degree of complexity and requires management to make difficult and subjective judgments which often require assumptions or estimates about highly uncertain matters. Changes in these judgments, assumptions or estimates could materially impact results of operations. This critical policy and its application is periodically reviewed with the Audit Committee and the Board of Directors.

The allowance for loan losses is based upon management’s evaluation of the adequacy of the allowance, including an assessment of known and inherent risks in the portfolio, giving consideration to the size and composition of the loan portfolio, actual loan loss experience, level of delinquencies, detailed analysis of individual loans for which full collectibility may not be assured, the existence and estimated net realizable value of any underlying collateral and guarantees securing the loans, and current economic and market conditions. Although management uses the best information available, the level of the allowance for loan losses remains an estimate which is subject to significant judgement and short-term change. Various regulatory agencies, as an integral part of their examination process, periodically review the Company’s allowance for loan losses. Such agencies may require the Company to make additional provisions for loan losses based upon information available to them at the time of their examination. Furthermore, the majority of the Company’s loans are secured by real estate in the State of New Jersey. Accordingly, the collectibility of a substantial portion of the carrying value of the Company’s loan portfolio is susceptible to changes in local market conditions and may be adversely affected should real estate values decline or the northern New Jersey area experience an adverse economic shock. Future adjustments to the allowance for loan losses may be necessary due to economic, operating, regulatory and other conditions beyond the Company’s control.

OVERVIEW AND STRATEGY

The Company serves as a holding company for the Bank, which is its primary asset and only operating subsidiary. The Bank conducts a traditional banking business, making commercial loans, consumer loans, and residential and commercial real estate loans. In addition, the Bank offers various non-deposit products through non-proprietary relationships with third party vendors. The Bank relies primarily upon deposits as the funding source for its assets. The Bank offers traditional deposit products. In addition, as an alternative to traditional certificate of deposit accounts, the Bank offers its Paramount Checking Account, an interest paying checking account which also provides a suite of additional services, such as free checks, free telephone banking and free bill payment, free safe deposit box and refunds for foreign ATM fees. Although the rate the Bank pays on the Paramount Checking Account is higher than the rate offered on most interest paying checking accounts by the Bank’s competitors, management believes the account has helped to reduce the Bank’s overall cost of funds and has been an integral part of the Bank’s core account acquisition strategy. Core accounts consist of noninterest-bearing deposits-demand, now, money market and savings accounts. Paramount Checking Account balances are generally higher than other account balances, and the account helps the Bank develop an overall relationship with its customers, which frequently leads to cross-selling opportunities, which the Bank actively pursues through direct mailings and other special promotions. Another component to the Bank’s core account acquisition strategy is the generation of deposit accounts which result from new commercial loan customers who move their deposit relationship to the bank and the continued expansion of the Bank’s Escrow Ease product. Escrow Ease is specially designed to meet the trust account needs of attorney’s, realtors and title companies. At December 31, 2006, the core accounts represented 85.8% of total deposit accounts.

Through its Sullivan Financial Services subsidiary (“Sullivan”), the Bank also engages in mortgage banking operations, originating loans for resale into the secondary market. We treat the operations of Sullivan as a separate reporting segment apart from our commercial banking business. See Note 13 to the accompanying Audited Financial Statements for financial information on our business segments.

For the year ended December 31, 2006, the Company recognized net income of $2.2 million, or $0.50 per diluted share and $0.58 per basic share, compared to net income of $2.1 million, or $0.54 per diluted share and $0.62 per basic share for 2005. The Company’s performance in 2006 reflects a substantial increase in interest income from the loan portfolio due to an increase in loan volume and rate, partially offset by increased interest expense, reflecting an increase in deposits

and a substantial increase in the average cost of deposits, reflecting market increases in short term interest rates. Our 2005 results were also affected by the recognition of $449,000 in income due to the reversal of a valuation allowance for deferred taxes. There was no comparable tax benefit in 2006.

During 2006 our deposits increased significantly. Management used the resultant cash to fund the loan and investment portfolio and to pay down Federal Home Loan Bank advances.

It is management’s intention to seek additional branching opportunities in and around our existing market area. Efforts will also be made to identify acquisition opportunities in and adjacent to our market area.

RESULTS OF OPERATIONS - 2006 versus 2005

The Company’s results of operations depend primarily on its net interest income, which is the difference between the interest earned on its interest-earning assets and the interest paid on funds borrowed to support those assets, primarily deposits. Net interest margin is the difference between the weighted average rate received on interest-earning assets and the weighted average rate paid on interest-bearing liabilities, as well as the average level of interest-earning assets as compared with that of interest-bearing liabilities. Net income is also affected by the amount of non-interest income and other non-interest expenses.

NET INCOME

For the year ended December 31, 2006, the Company had net income of $2.2 million or $0.58 per basic share compared to net income of $2.1 million or $0.62 per basic share for the year ended December 31, 2005. All per share data has been restated to reflect all subsequent stock dividends. The increase in net income for 2006 compared to 2005 is a result of a 15.6% increase in net interest income to $9.7 million from $8.4 million in the prior year, partially offset by a 7.2%, or $608 thousand, increase in non-interest expense to $9.0 million from $8.4 million for 2005. In addition, our 2005 results were also effected by the recognition of $449,000 in income in the fourth quarter due to the reversal of a valuation allowance for deferred tax assets. On a per share basis, the tax benefit in 2005 accounted for $0.13 of our basic earnings per share. There was no comparable tax benefit in 2006.

NET INTEREST INCOME

The increase in net interest income is primarily the result of a 36.0% increase in total interest income from $11.6 million in 2005 to $15.8 million in 2006. This increase in interest income was partially offset by an increase of 89.5% or $2.9 million in total interest expense to $6.1 million in 2006 from $3.2 million in 2005. Total interest income benefited from strong growth in average interest earning assets and was augmented by the higher yields resulting from the rise in short-term market rates during the year. However, the same rate factors caused the average cost of the Company’s interest bearing liabilities to increase from 2.16% in 2005 to 3.35% in 2006.

Total average interest earning assets increased $39.6 million or 20.3% from an average of $195.0 million in 2005 to an average of $234.6 million in 2006. We experienced strong loan growth during 2006 with average loan balances, not including loans held for sale, increasing by $34.1 million. The increase in average volume for investment securities was $10.8 million. The increase in total interest income reflects an increase of $2.7 million due to growth in average interest earning assets augmented by an increase of $1.5 million due to an increase in yield on interest earning assets.

Average total interest-bearing liabilities increased by $32.3 million in 2006, consisting of an increase of $16.3 million in average interest bearing demand deposits and $8.7 million in average

money market deposits. The increase in interest expense of $2.9 million resulted from increases of $1.7 million due to rate factors augmented by an increase of $1.2 million due to an increase in interest-bearing liabilities.

The net interest margin for the year ended December 31, 2006 was 4.15% compared to 4.31% for 2005. The decrease in net interest margin was due primarily to a greater increase in the rate paid on our interest-bearing liabilities than the yield on interest-earning assets. The average yield on earning assets for 2006 was 6.73%, or 78 basis points higher than the 5.95% for 2005. The 2006 average cost of interest-bearing liabilities was 3.35%, or 119 basis points higher than the 2.16% for 2005. The net interest rate spread, which is the difference between the average yield on earning assets and the cost of interest-bearing funds, decreased 41 basis points from 3.79% in 2005 to 3.38% in 2006. Despite these contractions in our net interest margin and net interest spread, the growth in our earning assets led to the increase in our net interest income.

Average Balance Sheets

The following table sets forth certain information relating to the Company’s average assets and liabilities for the years ended December 31, 2006, 2005, and 2004, and reflects the average yield on assets and average cost of liabilities for the periods indicated. Such yields are derived by dividing income or expense by the average balance of assets or liabilities, respectively, for the periods shown. Securities available for sale are reflected in the following table at amortized cost. Non-accrual loans are included in the average loan balance.

For the years ended December 31,

(dollars in thousands)

| | 2006

| 2005

| 2004

|

| | Average

Balance

| Interest

| Average

Yield/Cost

| Average

Balance

| Interest

| Average

Yield/Cost

| Average

Balance

| Interest

| Average

Yield/Cost

|

ASSETS: | | | | | | | | | | | | | | | | | | |

Interest-Earning Assets: | | | | | | | | | | | | | | | | | | |

Cash and due from banks | $786 | | $38 | | 4.84 | % | $1,092 | | $33 | | 3.01 | % | $782 | | $9 | | 1.18 | % |

Loans receivable | 179,130 | | 12,974 | | 7.24 | | 145,030 | | 9,469 | | 6.53 | | 118,360 | | 6,561 | | 5.54 | |

Investment securities | 41,986 | | 1,985 | | 4.73 | | 31,159 | | 1,239 | | 3.98 | | 28,374 | | 998 | | 3.52 | |

Loans held for sale | 9,645 | | 627 | | 6.50 | | 11,468 | | 683 | | 5.96 | | 10,320 | | 567 | | 5.50 | |

Federal funds sold | 3,069 | | 158 | | 5.16 | | 6,250 | | 181 | | 2.90 | | 5,639 | | 67 | | 1.20 | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Total interest earning assets | 234,616 | | 15,782 | | 6.73 | % | 194,999 | | 11,605 | | 5.95 | % | 163,475 | | 8,202 | | 5.02 | % |

Non-interest earning assets | 21,985 | | | | | | 18,745 | | | | | | 16,206 | | | | | |

Allowance for loan losses | (2,104 | ) | | | | | (1,742 | ) | | | | | (1,489 | ) | | | | |

| |

| | | | | |

| | | | | |

| | | | | |

TOTAL ASSETS | $254,497 | | | | | | $212,002 | | | | | | $178,192 | | | | | |

| |

| | | | | |

| | | | | |

| | | | | |

LIABILITIES AND STOCKHOLDERS’ EQUITY | | | | | | | | | | | | | | | | | | |

Interest-Bearing Liabilities: | | | | | | | | | | | | | | | | | | |

Interest bearing demand deposits | $116,346 | | $3,745 | | 3.22 | % | $100,048 | | $1,957 | | 1.96 | % | $84,380 | | $958 | | 1.13 | % |

Savings accounts | 6,421 | | 97 | | 1.51 | | 6,866 | | 74 | | 1.08 | | 4,963 | | 27 | | 0.55 | |

Money Market accounts | 24,255 | | 766 | | 3.16 | | 15,561 | | 263 | | 1.69 | | 8,356 | | 68 | | 0.82 | |

Certificates of deposit | 28,045 | | 1,174 | | 4.19 | | 23,182 | | 795 | | 3.43 | | 26,092 | | 909 | | 3.48 | |

FHLB advances | 5,399 | | 271 | | 5.02 | | 2,445 | | 101 | | 4.12 | | 1,576 | | 55 | | 3.49 | |

Federal funds purchased | 14 | | 1 | | 4.69 | | 84 | | 4 | | 4.53 | | 144 | | 2 | | 1.43 | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Total interest bearing liabilities | 180,480 | | 6,054 | | 3.35 | % | 148,186 | | 3,194 | | 2.16 | % | 125,511 | | 2,019 | | 1.61 | % |

Non-interest bearing deposits | 43,640 | | | | | | 38,610 | | | | | | 29,630 | | | | | |

Other liabilities | 1,542 | | | | | | 1,225 | | | | | | 736 | | | | | |

| |

| | | | | |

| | | | | |

| | | | | |

Total liabilities | 225,662 | | | | | | 188,021 | | | | | | 155,877 | | | | | |

Stockholders’ Equity | 28,835 | | | | | | 23,981 | | | | | | 22,315 | | | | | |

| |

| | | | | |

| | | | | |

| | | | | |

TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY | $254,497 | | | | | | $212,002 | | | | | | $178,192 | | | | | |

| |

| |

| | | |

| |

| | | |

| |

| | | |

Net Interest Income | | | $9,728 | | | | | | $8,411 | | | | | | $6,183 | | | |

| | | |

| | | | | |

| | | | | |

| | | |

Net Interest Rate Spread (1) | | | | | 3.38 | % | | | | | 3.79 | % | | | | | 3.41 | % |

Net Interest Margin (2) | | | | | 4.15 | % | | | | | 4.31 | % | | | | | 3.78 | % |

Ratio of Average Interest-Earning Assets to

Average Interest-Bearing Liabilities | 130.00 | % | | | | | 131.59 | % | | | | | 130.25 | % | | | | |

| |

| | | | | |

| | | | | |

| | | | | |

| (1) | | Net Interest Rate Spread equals Total interest earning assets yield less Total interest bearing liabilities cost. |

| (2) | | Net Interest Margin equals Net Interest Income divided by Total average interest earning assets. |

Rate/Volume Analysis

The following table presents, by category, the major factors that contributed to the changes in net interest income on a tax equivalent basis for each of the years ended December 31, 2006 and 2005.

| Year Ended

December 31,

2006 versus

2005

| Year Ended

December 31,

2005 versus

2004

|

|---|

| (in thousands) |

|---|

| Increase (Decrease)

due to change in

Average | Increase (Decrease)

due to change in

Average |

|---|

| Volume

| Rate

| Net

| Volume

| Rate

| Net

|

|---|

| Interest Income: | | | | | | | | | | | | | |

| Cash and due from banks | | $ (15 | ) | $ 20 | | $ 5 | | $ 9 | | $ 15 | | $ 24 | |

| Loans | | 2,469 | | 1,036 | | 3,505 | | 1,742 | | 1,166 | | 2,908 | |

| Securities | | 512 | | 234 | | 746 | | 111 | | 130 | | 241 | |

| Loans held for sale | | (118 | ) | 62 | | (56 | ) | 68 | | 48 | | 116 | |

| Federal funds sold | | (164 | ) | 141 | | (23 | ) | 18 | | 96 | | 114 | |

|

| |

| |

| |

| |

| |

| |

| Total interest income | | $ 2,684 | | $ 1,493 | | $ 4,177 | | $ 1,948 | | $ 1,455 | | $ 3,403 | |

|

| |

| |

| |

| |

| |

| |

| Interest Expense: | |

| Federal funds purchased | | $ (3 | ) | $ - | | $ (3 | ) | $ (3 | ) | $ 5 | | $ 2 | |

| Interest bearing deposits | | 525 | | 1,263 | | 1,788 | | 307 | | 692 | | 999 | |

| Savings accounts | | (7 | ) | 30 | | 23 | | 21 | | 26 | | 47 | |

| Money Market accounts | | 275 | | 228 | | 503 | | 122 | | 73 | | 195 | |

| Certificates of deposit | | 204 | | 175 | | 379 | | (100 | ) | (14 | ) | (114 | ) |

| FHLB advances | | 148 | | 22 | | 170 | | 36 | | 10 | | 46 | |

|

| |

| |

| |

| |

| |

| |

| Total interest expense | | 1,142 | | 1,718 | | 2,860 | | 383 | | 792 | | 1,175 | |

|

| |

| |

| |

| |

| |

| |

| Net interest income | | $ 1,542 | | $ (225 | ) | $ 1,317 | | $ 1,565 | | $ 663 | | $ 2,228 | |

|

| |

| |

| |

| |

| |

| |

PROVISION FOR LOAN LOSSES

For the year ended December 31, 2006, the Company’s provision for loan losses was $201 thousand, a decrease of $191 thousand from the provision of $392 thousand for the year ended December 31, 2005. The decrease was the result of the Company’s low historical loss history and the seasoning of the loan portfolio as the portfolio matures. The change in the provision for loan losses reflects management’s judgment concerning the risks inherent in the Company’s existing portfolio and the size of the allowance necessary to provide for probable losses inherent in the portfolio. The provision reflects the current economic conditions, borrowers’ financial condition and loan growth as well as the strength of the Bank’s loan portfolio. The allowance for loan losses was approximately $2.2 million at December 31, 2006, representing 1.13% of total outstanding loans. The allowance for loan losses at December 31, 2005 was approximately $2.0 million or 1.21% of total outstanding loans at that date.

NON-INTEREST INCOME

Our non-interest income consists primarily of gains on sales of mortgage loans originated by our mortgage company subsidiary. For the year ended December 31, 2006, our non-interest income decreased by $70 thousand from the prior year. For the year ended December 31, 2006, we recognized $2.9 million in total non-interest income, a decrease of 2.4% from the comparable period in 2005.

Other components of non-interest income include fees on deposit accounts, which increased $10 thousand or 3.7%, to $283 thousand from $273 thousand in 2005. In addition, our other income increased by $86 thousand, or 20.6%, to $503 thousand for the year ended December 31, 2006. The increase primarily reflects income received from our investment in our joint venture title insurance agency, which increased $37 thousand or 57.8% to $101 thousand from $64 thousand in 2005. There was also a decrease of $2 thousand in gains on sales of securities, do to a $2 thousand loss in 2005 versus no loss in 2006.

NON-INTEREST EXPENSES

For the year ended December 31, 2006, our non-interest expense increased $608 thousand or 7.2% to $9.0 million compared to $8.4 million for the year ended December 31, 2005. The increase primarily reflects increases in salaries and employee benefits of $687 thousand, or 16.4%, to $4.9 million in 2006 from $4.2 million in 2005. Occupancy expense increased $206 thousand, or 14.7%, to $1.6 million in 2006 from $1.4 million in 2005. Data processing increased $56 thousand, or 14.8%, to $435 thousand in 2006 from $379 thousand in 2005. Other operating expenses decreased $364 thousand, or 22.0%, to $1.3 million in 2006 from $1.7 million in 2005. The increases in non-interest expense, primarily reflects the related costs associated with the new branch in Madison and the Bank’s two proposed new branches in Sterling and Long Valley.

INCOME TAX EXPENSE

The income tax provision for the years ended December 31, 2006 and 2005 was $1.2 million and $429 thousand, respectively. The effective tax rate for the years ended December 31, 2006 and 2005 was 34.9% and 16.9%, respectively. The income tax provision for 2005 includes the reversal of the remaining valuation allowance of $495 thousand as it became more likely than not that the gross deferred tax asset will be realized. There was no comparable item of tax benefit in 2006.

RESULTS OF OPERATIONS - 2005 versus 2004

NET INCOME

For the year ended December 31, 2005, the Company had net income of $2.1 million or $0.62 per basic share compared to net income of $1.4 million or $0.40 per basic share for the year ended December 31, 2004. All per share data has been restated to reflect all subsequent stock dividends. The increase in net income for 2005 compared to 2004 is a result of a 36.0% increase in net interest income to $8.4 million from $6.2 million in the prior year, partially offset by a 14.8%, or $1.1 million, increase in non-interest expense to $8.4 million from $7.3 million for 2004. In addition, our 2005 results were also effected by the recognition of $449,000 in income in the fourth quarter due to the reversal of a valuation allowance for deferred tax assets.

NET INTEREST INCOME

The increase in net interest income is primarily the result of a 41.5% increase in total interest income from $8.2 million in 2004 to $11.6 million in 2005. This increase in interest income was partially offset by an increase of 58.2% or $1.2 million in total interest expense to $3.2 million in 2005 from $2.0 million in 2004. Total interest income benefited from strong growth in average interest earning assets and was augmented by the higher yields resulting from the rise in short-term market rates during the year.

Total average interest earning assets increased $31.5 million or 19.3% from an average of $163.5 million in 2004 to an average of $195.0 million in 2005. We experienced strong loan growth during 2005 with average loan balances, not including loans held for sale, increasing by $26.7 million. The increase in average volume for investment securities was $2.8 million. The increase in total interest income reflects an increase of $1.9 million due to growth in average interest earning assets augmented by an increase of $1.5 million due to an increase in yield on interest earning assets.

Average total interest-bearing liabilities increased by $22.7 million in 2005, consisting of an increase of $15.7 million in average interest bearing deposits and $7.2 million in average money market deposits. The increase in interest expense of $1.2 million resulted from increases of $792 thousand due to rate factors augmented by an increase of $383 thousand due to an increase in interest-bearing liabilities.

The net interest margin for the year ended December 31, 2005 was 4.31% compared to 3.78% for 2004. The increase in net interest margin was due primarily to a greater increase in yield on interest-earning assets than the increase in the rate paid on our interest-bearing liabilities. In addition, the growth of our interest earning assets contributed to the increase in our interest income. The average yield on earning assets for 2005 was 5.95%, or 93 basis points higher than the 5.02% for 2004. The 2005 average cost of interest-bearing liabilities was 2.16%, or 55 basis points higher than the 1.61% for 2004. The net interest rate spread, which is the difference between the average yield on earning assets and the cost of interest-bearing funds, increased 38 basis points from 3.41% in 2004 to 3.79% in 2005.

PROVISION FOR LOAN LOSSES

For the year ended December 31, 2005, the Company’s provision for loan losses was $392 thousand, an increase of $167 thousand from the provision of $225 thousand for the year ended December 31, 2004. The increase was the result of an increase in loans outstanding for the year. The change in the provision for loan losses reflects management’s judgment concerning the risks inherent in the Company’s existing portfolio and the size of the allowance necessary to provide for probable losses inherent in the portfolio. The provision reflects the current economic

conditions, borrowers’ financial condition and loan growth as well as the strength of the Bank’s loan portfolio. The allowance for loan losses was approximately $2.0 million at December 31, 2005, representing 1.21% of total outstanding loans. The allowance for loan losses at December 31, 2004 was approximately $1.6 million or 1.23% of total outstanding loans at that date.

NON-INTEREST INCOME

Our non-interest income consists primarily of gains on sales of mortgage loans originated by our mortgage company subsidiary. For the year ended December 31, 2005, our non-interest income increased by $94 thousand from the prior year. For the year ended December 31, 2005, we recognized $2.9 million in total non-interest income, an increase of 3.3% over $2.8 million in total non-interest income for the comparable period in 2004.

Other components of non-interest income include fees on deposit accounts, which decreased $16 thousand or 5.5%, to $273 thousand from $289 thousand in 2004. In addition, in 2005 our other income increased by $53 thousand, or 14.6%, to $417 thousand for the year ended December 31, 2005. The increase primarily reflects income received from our investment in our Title Company, which increased $44 thousand or 220.0% to $64 thousand from $20 thousand in 2004. There was also a decrease of $11 thousand in gains on sales of securities, which was a $9 thousand gain in 2004 versus a $2 thousand loss in 2005.

NON-INTEREST EXPENSES

For the year ended December 31, 2005, our non-interest expense increased $1.1 million or 14.8% to $8.4 million compared to $7.3 million for the year ended December 31, 2004. The increase primarily reflects increases in salaries and employee benefits of $485 thousand, or 13.1%, to $4.2 million in 2005 from $3.7 million in 2004. Occupancy expense increased $155 thousand, or 12.5%, to $1.4 million in 2005 from $1.2 million in 2004. Data processing increased $91 thousand, or 31.6%, to $379 thousand in 2005 from $288 thousand in 2004 and other operating expenses increased $270 thousand, or 19.5%, to $1.7 million in 2005 from $1.4 million in 2004. The increases in non-interest expense, primarily reflects the related costs associated with the new branch in Summit and the Bank’s 3 proposed new branches in Madison, Sterling and Long Valley.

INCOME TAX EXPENSE

The income tax provision for the years ended December 31, 2005 and 2004 was $429 thousand and $113 thousand, respectively. The effective tax rate for the years ended December 31, 2005 and 2004 was 16.9% and 7.6%, respectively. The income tax provision for 2005 includes the reversal of the remaining valuation allowance of $495 thousand as it is more likely than not that the gross deferred tax asset will be realized. The income tax provision for 2004 consists of state taxes only as the federal provision was offset by the utilization of the federal operating loss carryforward.

FINANCIAL CONDITION

Total assets at December 31, 2006 increased by $43.5 million or 17.7%, to $289.4 million compared to $245.9 million at December 31, 2005. Total loans, net were $190.3 million, loans held for sale were $5.0 million, total investment securities available for sale were $38.9 million, total investment securities held to maturity were $10.5 million and total cash and cash equivalents were $28.6 million. We also had goodwill of $1.2 million associated with our purchase of Sullivan. Total deposits at December 31, 2006 increased by $42.0 million, or 20.2% to $250.2 million compared to $208.2 million at December 31, 2005. Stockholders’ equity increased $12.6 million or 49.8%, to $37.9 million in 2006 compared to $25.3 million at December 31, 2005, reflecting both retained earnings from 2006 operations and the purchase of 1,275,000 shares of common stock upon the exercise of outstanding common stock purchase warrants for aggregate proceeds of $10.1 million.

LOAN PORTFOLIO

Gross loans, not including loans held for sale, grew by $25.3 million, or 15.1%, during 2006 from $167.3 million as of December 31, 2005 to $192.6 million at year-end 2006. The composition of the loan portfolio, by category, as of December 31, 2006 is as follows: 75.6% of our loans are commercial and commercial real estate loans, 3.7% of our loans are secured by first liens on residential real estate and 20.7% of our loans are consumer or other loans to individuals, including home equity loans. Commercial and industrial loans are primarily secured by collateral, such as cash balances with the Bank, marketable securities held by or under the control of the Bank, business assets including accounts receivable, inventory and equipment and liens on commercial and residential real estate. Real estate loans consist primarily of loans secured by first mortgage liens on commercial property and may be used to finance the purchase, refinance or construction of such properties. Commercial and commercial real estate loans increased by $14.5 million or 11.1% to $145.6 million at December 31, 2006 from $131.1 million at December 31, 2005. Combined, these two categories of loans represented 75.6% of our total loan portfolio at December 31, 2006, compared to 78.4% of our total loan portfolio at year end 2005. Consumer loans primarily consist of home equity loans. The growth in our consumer loans of $9.8 million or 32.8% is primarily due to an increase in home equity loans of 32.4% or $9.5 million to $38.8 million in 2006 from $29.3 million in 2005. Our consumer installment loans increased by $333 thousand to $984 thousand in 2006 from $651 thousand in 2005.

The Bank’s lending activities are generally oriented to small-to-medium sized businesses, high net worth individuals, professional practices and consumer and retail customers living and working in the Bank’s market area of Somerset, Morris and Union Counties, New Jersey. The Bank has not made loans to borrowers outside of the United States. The Bank believes that its strategy of customer service, competitive rate structures and selective marketing have enabled it to gain market entry. Bank mergers and lending restrictions at larger banks competing with the Bank have also contributed to the Bank’s efforts to attract borrowers.

The following table sets forth the classification of our loans by major category as of December 31, 2006, 2005, 2004, 2003 and 2002, respectively:

| | 2006

| 2005

| 2004

| 2003

| 2002

|

| | Amount | Percent of

Total Loans | Amount | Percent of

Total Loans | Amount | Percent of

Total Loans | Amount | Percent of

Total Loans | Amount | Percent of

Total Loans |

|

|

|

|

|

|

|

|

|

|

|

Commercial and industrial | $78,366 | | 40.7 | % | $78,299 | | 46.8 | % | $66,552 | | 50.1 | % | $ 52,797 | | 48.5 | % | $44,460 | | 47.0 | % |

Real Estate: | | | | | | | | | | | | | | | | | | | | |

Commercial real estate properties | 67,244 | | 34.9 | | 52,802 | | 31.6 | | 32,953 | | 24.8 | | 25,828 | | 23.7 | | 23,991 | | 25.4 | |

Residential properties | 7,145 | | 3.7 | | 6,225 | | 3.7 | | 3,745 | | 2.8 | | 3,192 | | 2.9 | | 2,872 | | 3.0 | |

Consumer and installment | 984 | | 0.5 | | 651 | | 0.4 | | 1,157 | | 0.9 | | 2,674 | | 2.5 | | 7,080 | | 7.5 | |

Home equity | 38,832 | | 20.2 | | 29,324 | | 17.5 | | 28,464 | | 21.4 | | 24,437 | | 22.4 | | 16,226 | | 17.1 | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Gross Loans | 192,571 | | 100.0 | % | 167,301 | | 100.0 | % | 132,871 | | 100.0 | % | 108,928 | | 100.0 | % | 94,629 | | 100.0 | % |

| | | |

| | | |

| | | |

| | | |