SECURITIES AND EXCHANGE COMMISSION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant

☒

Filed by a Party other than the Registrant

☐

| | | | | | |

Check the appropriate box: | | | | | | |

☐ Preliminary Proxy Statement | | ☐ | | | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ Definitive Proxy Statement | | | | | | |

☐ Definitive Additional Materials | | | | | | |

☐ Soliciting Material Pursuant to § 240.14a-12 |

BlackRock 2037 Municipal Target Term Trust

BlackRock Core Bond Trust

BlackRock Corporate High Yield Fund, Inc.

BlackRock Credit Allocation Income Trust

BlackRock Debt Strategies Fund, Inc.

BlackRock Energy and Resources Trust

BlackRock Enhanced Capital and Income Fund, Inc.

BlackRock Enhanced Equity Dividend Trust

BlackRock Enhanced Global Dividend Trust

BlackRock Enhanced Government Fund, Inc.

BlackRock Enhanced International Dividend Trust

BlackRock Floating Rate Income Strategies Fund, Inc.

BlackRock Floating Rate Income Trust

BlackRock Health Sciences Trust

BlackRock Income Trust, Inc.

BlackRock Investment Quality Municipal Trust, Inc.

BlackRock Limited Duration Income Trust

BlackRock Long-Term Municipal Advantage Trust

BlackRock Multi-Sector Income Trust

BlackRock MuniAssets Fund, Inc.

BlackRock Municipal 2030 Target Term Trust

BlackRock Municipal Income Quality Trust

BlackRock Municipal Income Trust

BlackRock Municipal Income Trust II

BlackRock MuniHoldings California Quality Fund, Inc.

BlackRock MuniHoldings Fund, Inc.

BlackRock MuniHoldings New Jersey Quality Fund, Inc.

BlackRock MuniHoldings Quality Fund II, Inc.

BlackRock MuniVest Fund II, Inc.

BlackRock MuniVest Fund, Inc.

BlackRock MuniYield Fund, Inc.

BlackRock MuniYield Michigan Quality Fund, Inc.

BlackRock MuniYield Quality Fund II, Inc.

BlackRock MuniYield Quality Fund III, Inc.

BlackRock MuniYield Quality Fund, Inc.

BlackRock Resources & Commodities Strategy Trust

BlackRock Science and Technology Trust

BlackRock Taxable Municipal Bond Trust

BlackRock Utilities, Infrastructure & Power Opportunities Trust

BlackRock Virginia Municipal Bond Trust

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other than the Registrant)

| | | | | | |

Payment of Filing Fee (Check all boxes that apply): |

| | | | | | |

☐ Fee paid previously with preliminary materials | | | | | | |

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

June 5, 2024

Dear Shareholder:

A joint annual meeting of the shareholders of the BlackRock

Closed-End

Funds listed in

to the enclosed joint proxy statement (each, a “Fund”) will be held on Friday, July 26, 2024, at 10:00 a.m. (Eastern time), to consider and vote on the proposal discussed in the enclosed joint proxy statement. The meeting will be held in a virtual meeting format only. Shareholders will not have to travel to attend the meeting but will be able to view the meeting live and cast their votes by accessing a web link.

The purpose of the meeting is to seek shareholder approval of the nominees named in the enclosed joint proxy statement to the Boards of Directors or Trustees (each, a “Board” and collectively, the “Boards,” the members of which are referred to as “Board Members”) of each Fund. Each Board has unanimously approved the nominees named in the enclosed joint proxy statement on behalf of its Fund (the “Board Nominees”), subject to approval by the Fund’s shareholders. The Boards have reviewed the qualifications and backgrounds of the Board Nominees and believe that they possess the requisite experience in overseeing investment companies and that their election is in your best interest.

The Board Members responsible for your Fund recommend that you vote “

” the Board Nominees for your Fund.

In connection with your vote, we urge you to read the full text of the enclosed joint proxy statement.

You have received this joint proxy statement because you were a shareholder of record of at least one of the Funds listed in

on May 28, 2024 (the “Record Date”). Please be certain to vote by telephone or via the Internet with respect to each Fund in which you are a shareholder of record or sign, date and return each proxy card you receive from us.

We would like to assure you of our commitment to ensuring that the joint annual meeting provides shareholders with a meaningful opportunity to participate, including the ability to ask questions of the Boards and management. To support these efforts, we will:

| | • | | Provide for shareholders to begin logging into the joint annual meeting at 9:30 a.m., Eastern time on Friday, July 26, 2024, thirty minutes in advance of the joint annual meeting. |

| | • | | Permit shareholders attending the joint annual meeting to submit questions via live webcast during the joint annual meeting by following the instructions available on the meeting website during the joint annual meeting. Questions relevant to joint annual meeting matters will be answered during the joint annual meeting, subject to time constraints. |

| | • | | Engage with and respond to shareholders who ask questions relevant to joint annual meeting matters that are not answered during the joint annual meeting due to time constraints. |

| | • | | Provide the ability for participating shareholders who hold Fund shares in their name to vote or revoke their prior vote at the joint annual meeting by following the instructions that will be available on the meeting website during the joint annual meeting. Participating shareholders who are beneficial shareholders (that is if they hold Fund shares through a bank, broker, financial intermediary or other nominee) will not be able to vote at the joint annual meeting unless they have registered in advance to attend the joint annual meeting, as described below. |

Attendance at the annual meeting will be limited to each Fund’s shareholders as of the Record Date.

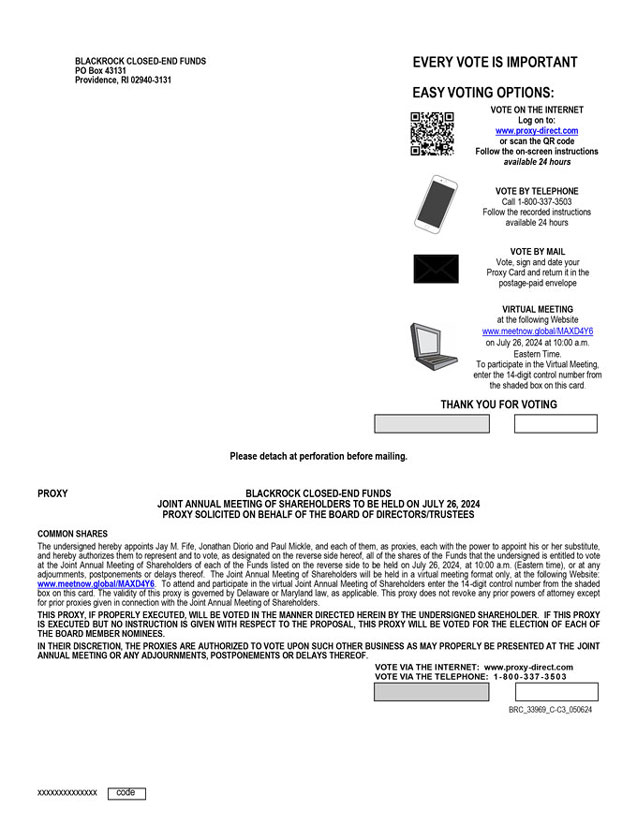

If your shares in a Fund are registered in your name, you may attend and participate in the meeting at meetnow.global/MAXD4Y6 by entering the control number found in the shaded box on your proxy card on the date and time of the meeting. You may vote during the meeting by following the instructions that will be available on the meeting website during the meeting.

If you are a beneficial shareholder of a Fund (that is if you hold your shares of a Fund through a bank, broker, financial intermediary or other nominee) and want to attend the meeting you must register in advance of the meeting. To register, you must submit proof of your proxy power (legal proxy) reflecting your Fund holdings along with your name and email address to Georgeson LLC, the Funds’ tabulator. You may email an image of your legal proxy to shareholdermeetings@computershare.com. Requests for registration must be received no later than 5:00 p.m. (Eastern time) three business days prior to the meeting date. You will receive a confirmation email from Georgeson LLC (through Computershare) of your registration and a control number and security code that will allow you to vote at the meeting.

Even if you plan to attend the meeting, please promptly follow the enclosed instructions to submit your voting instructions by telephone or via the Internet. Alternatively, you may submit voting instructions by signing and dating each proxy card you receive, and if received by mail, returning it in the accompanying postage-paid return envelope.

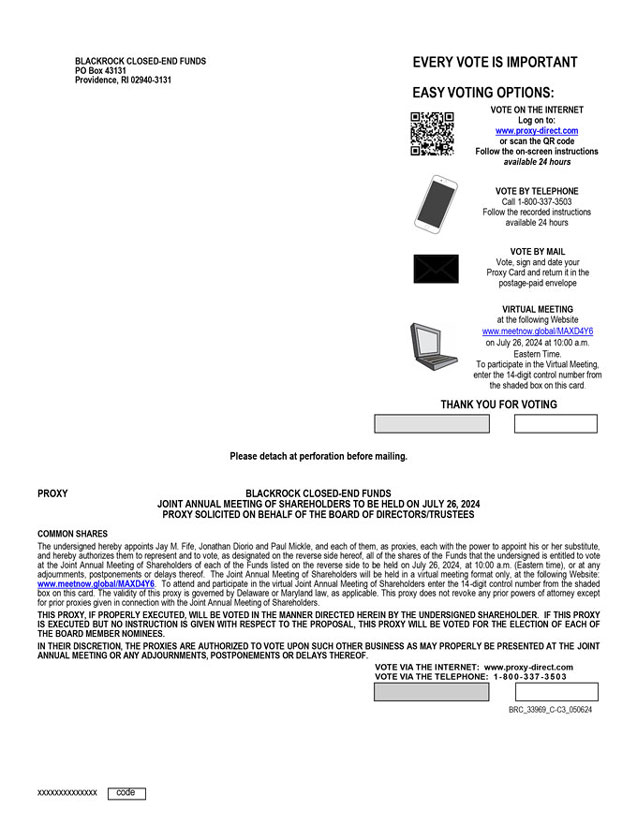

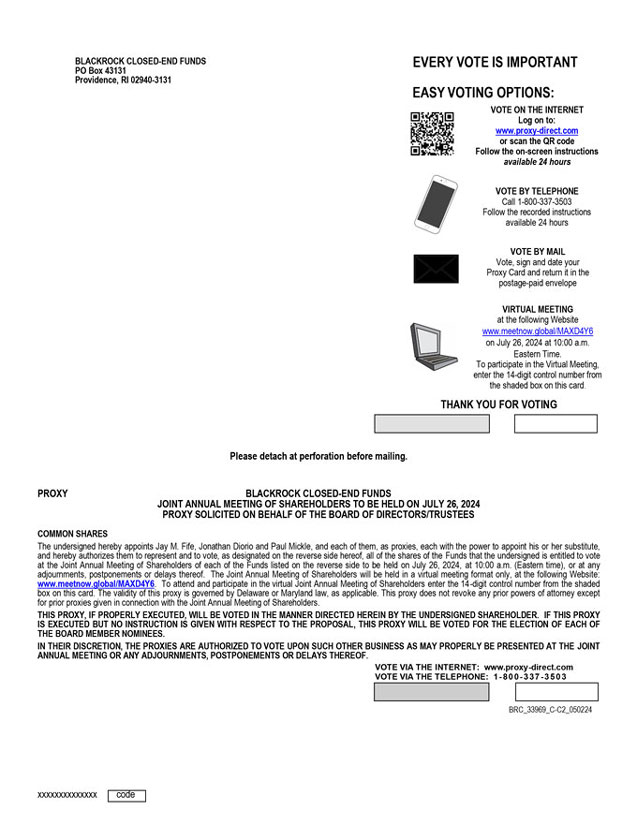

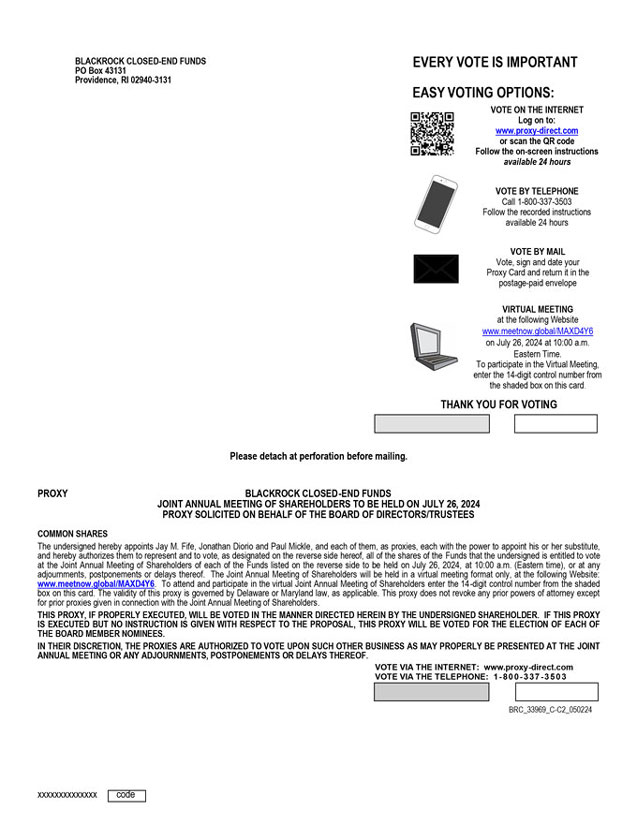

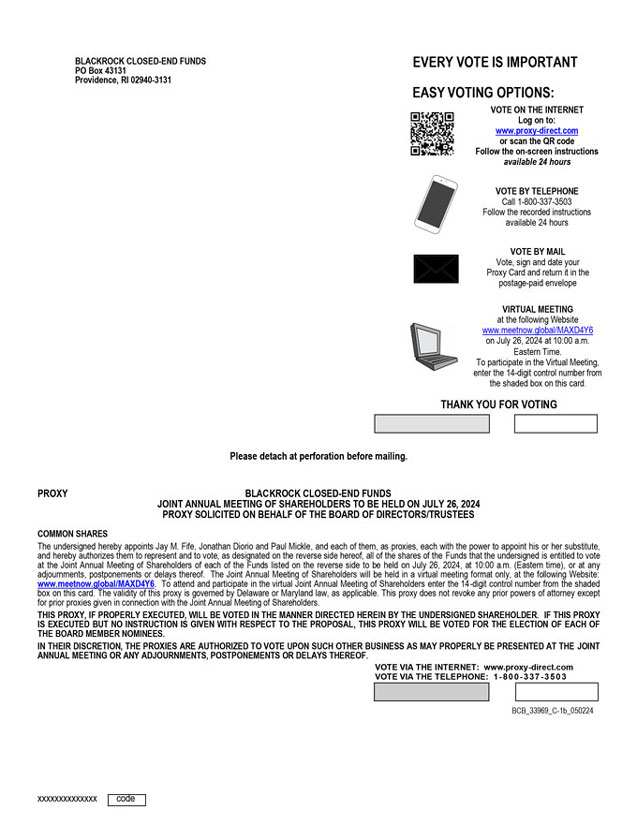

We encourage you to carefully review the enclosed materials, which explain this proposal in more detail. As a shareholder, your vote is important, and we hope that you will respond today to ensure that your shares will be represented at the meeting. You may vote using one of the methods below by following the instructions on your proxy card or voting instruction form(s):

| | • | | By touch-tone telephone; |

| | • | | By signing, dating and returning the enclosed proxy card or voting instruction form(s) in the postage-paid envelope; or |

| | • | | By participating at the meeting as described above. |

If you do not vote using one of these methods, you may be called by Georgeson LLC, the Funds’ proxy solicitor, to vote your shares.

If you have any questions about the proposal to be voted on or the virtual meeting, please call Georgeson LLC, the firm assisting us in the solicitation of proxies, toll free at

Sincerely,

Janey Ahn

Secretary of the Funds

50 Hudson Yards, New York, NY 10001

While we encourage you to read the full text of the enclosed joint proxy statement, for your convenience we have provided a brief overview of the matters to be voted on.

| | Why am I receiving the joint proxy statement? |

| A: | | Each Fund is required to hold an annual meeting of shareholders for the election of Board Members. This joint proxy statement describes a proposal to approve the nominees to the Board of the Fund(s) in which you own shares and provides you with other information relating to the meeting. The enclosed proxy card(s) indicate the Fund(s) in which you own shares. The table starting on page 8 of the joint proxy statement identifies the Board Members, including the Board Nominees, for each Fund. |

| | Will my vote make a difference? |

| A: | | Your vote is very important and can make a difference in the governance and management of your Fund(s), no matter how many shares you own. We encourage all shareholders to participate in the governance of their Fund(s). Your vote can help ensure that the Board Nominees will be elected. |

| | How do the Boards of the Funds recommend that I vote? |

| A: | | The Boards have reviewed the qualifications and backgrounds of the Board Nominees and believe that the Board Nominees possess the requisite experience in overseeing investment companies and are familiar with the Funds and their investment advisers. The Boards have approved the Board Nominees named in the joint proxy statement, believe their election is in your best interest and unanimously recommend that you voteeach Board Nominee. |

| | When and where will the meeting be held? |

| A: | | The meeting will be held on Friday, July 26, 2024, at 10:00 a.m. (Eastern time). The meeting will be held in a virtual meeting format only. Shareholders will not have to travel to attend the meeting but will be able to view the meeting live and cast their votes by accessing a web link. |

| A: | | You can provide voting instructions by telephone, by calling the toll-free number on the proxy card(s) or on the Important Notice Regarding the Availability of Proxy Materials for the Joint Annual Meeting of Shareholders to be Held on July 26, 2024 (the “Notice of Internet Availability of Proxy Materials”), or by going to the Internet address provided on the Notice of Internet Availability of Proxy Materials or proxy card(s) and following the instructions. If you vote by telephone or via the Internet, you will be asked to enter a unique code that has been assigned to you, which is printed on your proxy card(s) or Notice of Internet Availability of Proxy Materials, as applicable. This code is designed to confirm your identity, provide access to the voting website and confirm that your voting instructions are properly recorded. Alternatively, if you received your proxy card(s) by mail, you can vote your shares by signing and dating the proxy card(s) and mailing it (them) in the enclosed postage-paid envelope. |

| | | You may also vote at the meeting; however, even if you plan to attend the virtual meeting, we still encourage you to provide voting instructions by one of the methods discussed above. In addition, we ask that you please note the following: |

| | | If your shares in a Fund are registered in your name, you may attend and participate in the meeting at meetnow.global/MAXD4Y6 by entering the control number found in the shaded box on your proxy card on the date and time of the meeting. You may vote during the meeting by following the instructions that will be available on the meeting website during the meeting. |

| | | Also, if you are a beneficial shareholder of a Fund, you will not be able to vote at the virtual meeting unless you have registered in advance to attend the meeting. To register, you must submit proof of your proxy power (legal proxy) reflecting your Fund holdings along with your name and email address to Georgeson LLC (“Georgeson”), the Funds’ tabulator. You may email an image of your legal proxy to shareholdermeetings@computershare.com. Requests for registration must be received no later than 5:00 p.m. (Eastern time) three business days prior to the meeting date. You will receive a confirmation email from Georgeson (through Computershare) of your registration and a control number and security code that will allow you to vote at the Meeting. |

| | | Even if you plan to attend the meeting, please promptly follow the enclosed instructions to submit your voting instructions by telephone or via the Internet. Alternatively, you may submit voting instructions by signing and dating each proxy card you receive, and if received by mail, returning it in the accompanying postage-paid return envelope. |

| | Are the Funds paying for the cost of the joint proxy statement? |

| A: | | The costs associated with the joint proxy statement, including the printing, distribution and proxy solicitation costs, will be borne by the Funds. Additionalcosts, such as legal expenses and auditor fees, incurred in connection with the preparation of the joint proxy statement, also will be borne by the Funds. Costs that are borne by the Funds collectively will be allocated among the Funds on the basis of a combination of their respective net assets and number of shareholder accounts, except when direct costs can reasonably be attributed to one or more specific Funds. |

| | | The Funds and BlackRock, Inc. have retained Georgeson, 1290 Avenue of the Americas, 9 th Floor, New York, NY 10104, a proxy solicitation firm, to assist in the distribution of proxy materials and the solicitation and tabulation of proxies. It is anticipated that Georgeson will be paid approximately $159,352 for such services (including reimbursements ofexpenses). |

| | Whom do I call if I have questions? |

| A: | | If you need more information, or have any questions about voting, please call Georgeson, the Funds’ proxy solicitor, toll free at |

Please vote

now

. Your vote is important.

To avoid the wasteful and unnecessary expense of further solicitation and no matter how large or small your holdings may be, we urge you to indicate your voting instructions on the enclosed proxy card(s), and if received by mail, date and sign it (them) and return it (them) promptly in the postage-paid envelope provided, or record your voting instructions by telephone or via the Internet. If you submit a properly executed proxy card but do not indicate how you wish your shares to be voted, your shares will be voted “

FOR

” the election of the Board Nominees. If your shares of a Fund are held through a broker, you must provide voting instructions to your broker about how to vote your shares in order for your broker to vote your shares as you instruct at the meeting.

June 5, 2024

NOTICE OF JOINT ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON JULY 26, 2024

To the Shareholders:

A joint annual meeting of the shareholders of the BlackRock

Closed-End

Funds identified below (each, a “Fund”) will be held on Friday, July 26, 2024, at 10:00 a.m. (Eastern time), to consider and vote on the proposal, as more fully discussed in the accompanying joint proxy statement. The meeting will be held in a virtual meeting format only. Shareholders will not have to travel to attend the meeting but will be able to view the meeting live and cast their votes by accessing a web link.

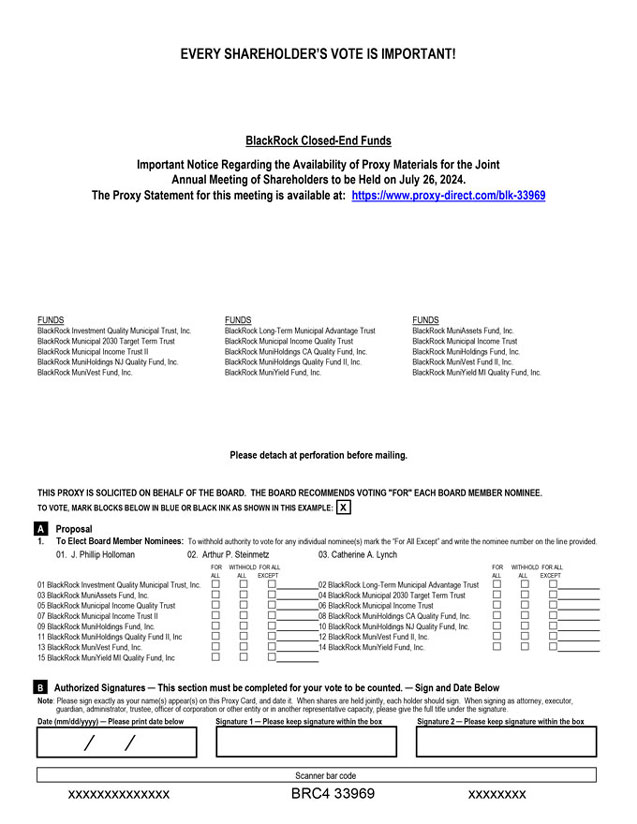

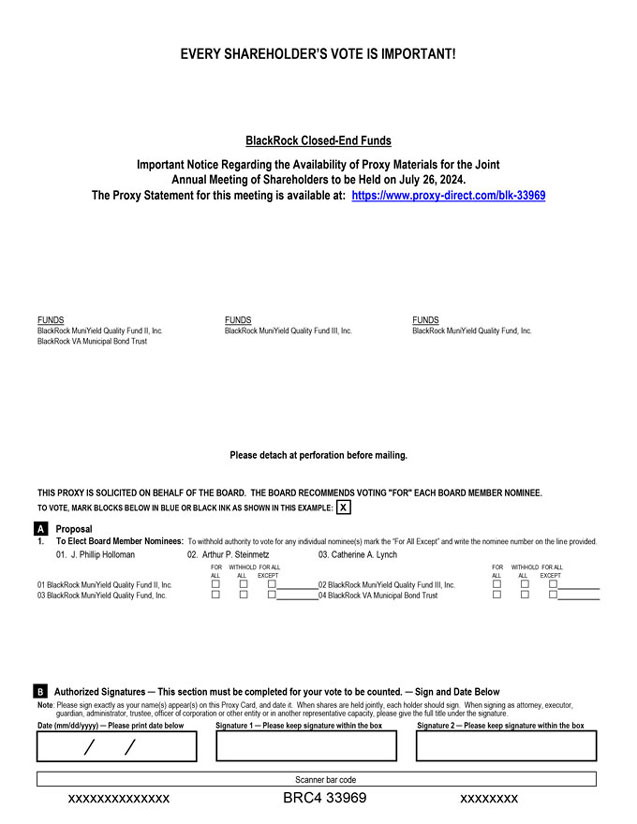

| | PROPOSAL 1. | To elect to the Board (defined below) of your Fund(s) the nominees named in the accompanying joint proxy statement. |

| | | To transact such other business as may properly come before the meeting or any adjournments, postponements or delays thereof. |

The purpose of the meeting is to seek shareholder approval of the nominees named in the accompanying joint proxy statement to the Boards of Directors or Trustees (each, a “Board,” and collectively, the “Boards,” the members of which are referred to as “Board Members”) of each Fund. Each Board has unanimously approved the nominees on behalf of its Fund (the “Board Nominees”), subject to approval by the Fund’s shareholders. The Boards have reviewed the qualifications and backgrounds of the Board Nominees and believe that the Board Nominees possess the requisite experience in overseeing investment companies and that their election is in your best interest.

Your Board unanimously recommends that you vote “

FOR

” the Board Nominees with respect to which you are being asked to vote.

Shareholders of record of each Fund as of the close of business on May 28, 2024 (the “Record Date”) are entitled to vote at the meeting and at any adjournments, postponements or delays thereof. A list of each Fund’s shareholders as of the Record Date will be available electronically for inspection by any record shareholder of such Fund at the shareholder meeting. For each Delaware Trust, such list will be available for inspection beginning ten days prior to the date of the meeting. Fund shareholders interested in inspecting the list of shareholders for their respective Fund should contact Georgeson LLC at blackrockcef@georgeson.com for additional information.

If you owned shares of more than one Fund as of the Record Date, you may receive more than one proxy card or voting instruction form. Please be certain to vote by telephone or via the Internet with respect to each Fund in which you are a shareholder of record or sign, date and return each proxy card you receive from us.

If you have any questions about the proposal to be voted on or the virtual meeting, please call Georgeson LLC, the firm assisting us in the solicitation of proxies, toll free at

By Order of the Boards,

Janey Ahn

Secretary of the Funds

50 Hudson Yards, New York, NY 10001

Holding Annual Meetings of Shareholders on July 26, 2024

| | |

| | |

| BlackRock 2037 Municipal Target Term Trust | | BMN |

| BlackRock Core Bond Trust | | BHK |

| BlackRock Corporate High Yield Fund, Inc. | | HYT |

| BlackRock Credit Allocation Income Trust | | BTZ |

| BlackRock Debt Strategies Fund, Inc. | | DSU |

| BlackRock Energy and Resources Trust | | BGR |

| BlackRock Enhanced Capital and Income Fund, Inc. | | CII |

| BlackRock Enhanced Equity Dividend Trust | | BDJ |

| BlackRock Enhanced Global Dividend Trust | | BOE |

| BlackRock Enhanced Government Fund, Inc. | | EGF |

| BlackRock Enhanced International Dividend Trust | | BGY |

| BlackRock Floating Rate Income Strategies Fund, Inc. | | FRA |

| BlackRock Floating Rate Income Trust | | BGT |

| BlackRock Health Sciences Trust | | BME |

| BlackRock Income Trust, Inc. | | BKT |

| BlackRock Investment Quality Municipal Trust, Inc. | | BKN |

| BlackRock Limited Duration Income Trust | | BLW |

| BlackRock Long-Term Municipal Advantage Trust | | BTA |

| BlackRock Multi-Sector Income Trust | | BIT |

| BlackRock MuniAssets Fund, Inc. | | MUA |

| BlackRock Municipal 2030 Target Term Trust | | BTT |

| BlackRock Municipal Income Quality Trust | | BYM |

| BlackRock Municipal Income Trust | | BFK |

| BlackRock Municipal Income Trust II | | BLE |

| BlackRock MuniHoldings California Quality Fund, Inc. | | MUC |

| BlackRock MuniHoldings Fund, Inc. | | MHD |

| BlackRock MuniHoldings New Jersey Quality Fund, Inc. | | MUJ |

| BlackRock MuniHoldings Quality Fund II, Inc. | | MUE |

| BlackRock MuniVest Fund II, Inc. | | MVT |

| BlackRock MuniVest Fund, Inc. | | MVF |

| BlackRock MuniYield Fund, Inc. | | MYD |

| BlackRock MuniYield Michigan Quality Fund, Inc. | | MIY |

| BlackRock MuniYield Quality Fund II, Inc. | | MQT |

| BlackRock MuniYield Quality Fund III, Inc. | | MYI |

| BlackRock MuniYield Quality Fund, Inc. | | MQY |

| BlackRock Resources & Commodities Strategy Trust | | BCX |

| BlackRock Science and Technology Trust | | BST |

| BlackRock Taxable Municipal Bond Trust | | BBN |

| BlackRock Utilities, Infrastructure & Power Opportunities Trust | | BUI |

| BlackRock Virginia Municipal Bond Trust | | BHV |

| | | | |

| | | | |

| |

| | | 1 | |

| |

| | | 5 | |

| |

| | | 7 | |

| |

| | | 19 | |

| |

| | | 20 | |

| |

| | | 23 | |

| |

| | | A-1 | |

| |

| | | B-1 | |

| |

| | | C-1 | |

| |

| | | D-1 | |

| |

| | | E-1 | |

| |

| | | F-1 | |

| |

| | | G-1 | |

| |

| | | H-1 | |

ANNUAL MEETING OF SHAREHOLDERS

This joint proxy statement (this “Proxy Statement”) is furnished in connection with the solicitation of proxies by the Boards of Directors or Trustees (each, a “Board,” and collectively, the “Boards,” the members of which are referred to as “Board Members”) of each BlackRock

Closed-End

Fund listed in

of this Proxy Statement (each, a “Fund”). The proxies will be voted at the joint annual meeting (the “meeting”) of shareholders of the Funds and at any and all adjournments, postponements or delays thereof. The meeting will be held on Friday, July 26, 2024, at 10:00 a.m. (Eastern time). The meeting will be held for the purposes set forth in the accompanying Notice of Joint Annual Meeting of Shareholders to be Held on July 26, 2024. The meeting will be held in a virtual meeting format only.

The Boards of the Funds have determined that the use of this Proxy Statement for the meeting is in the best interests of the Funds and their shareholders in light of the similar matters being considered and voted on by the shareholders of each Fund. Distribution to shareholders of this Proxy Statement and the accompanying materials, or the Important Notice Regarding the Availability of Proxy Materials for the Joint Annual Meeting of Shareholders to be Held on July 26, 2024 (the “Notice of Internet Availability of Proxy Materials”), will commence on or about June 5, 2024.

Each Fund listed in

to this Proxy Statement is organized as a Maryland corporation (each, a “Maryland Corporation”), a Maryland statutory trust (a “Maryland Trust”) or a Delaware statutory trust (each, a “Delaware Trust”). The Maryland Corporations, the Maryland Trust and the Delaware Trusts are

closed-end

management investment companies registered under the Investment Company Act of 1940 (the “1940 Act”). A list identifying each Fund as a Maryland Corporation, a Maryland Trust or a Delaware Trust is set forth in

.

Shareholders of record of a Fund as of the close of business on May 28, 2024 (the “Record Date”) are entitled to notice of and to vote at that Fund’s annual meeting of shareholders and at any and all adjournments, postponements or delays thereof. Shareholders of the Funds are entitled to one vote for each share held, with no shares having cumulative voting rights. Holders of Preferred Shares (as defined below) will have equal voting rights with the holders of shares of common stock or common shares of beneficial interest (collectively, the “Common Shares”) of the Preferred Funds (as defined below). Holders of Preferred Shares will vote together with the holders of Common Shares as a single class on each nominee to the Board of each Preferred Fund in which they own Preferred Shares, except that holders of Preferred Shares are entitled to vote separately as a class to elect two Board Members for each Preferred Fund in which they own Preferred Shares. With respect to the Preferred Funds (as defined below), the Board Members representing holders of Preferred Shares are Class I and Class II Board Members and only Class II Board Members are standing for election this year. The quorum and voting requirements for each Fund are described in the section herein entitled “Vote Required and Manner of Voting Proxies.”

The Maryland Corporations have elected to be subject to the Maryland Control Share Acquisition Act (the “

MCSAA

”) and the Delaware Trusts are subject to the control beneficial interest acquisition provisions of the Delaware Statutory Trust Act.

1

On December 5, 2023, the U.S. District Court for the Southern District of New York granted judgment in favor of a plaintiff’s claim for rescission of resolutions by sixteen

closed-end

funds that are Maryland corporations and statutory trusts, including certain BlackRock-sponsored funds domiciled in Maryland, that “opted in” to elect to be subject to the MCSAA. The district court declared that the funds’ elections violate Section 18(i) of the 1940 Act. The funds have appealed the district court’s decision to the U.S. Court of Appeals for the Second Circuit. In light of the district court’s decision, the MCSAA will not apply to the funds’ upcoming and next year’s annual shareholder meetings.

As used herein, the “Preferred Shares” consist of the variable rate muni term preferred shares (collectively, the “VMTP Shares”) of each of the Funds identified in

as having VMTP Shares outstanding (collectively, the “VMTP Funds”), the remarketable variable rate muni term preferred shares (collectively, the “RVMTP Shares”) of the Fund identified in

as having RVMTP Shares outstanding (the “RVMTP Fund”), and the variable rate demand preferred shares (collectively, the “VRDP Shares”) of each of the Funds identified in

as having VRDP Shares outstanding (collectively, the “VRDP Funds”). The “Preferred Funds” are collectively defined as the VMTP Funds, the RVMTP Fund and the VRDP Funds.

The number of shares outstanding of each Fund as of the close of business on the Record Date and the managed assets of each Fund on the Record Date are shown in

. Except as set forth in

, to the knowledge of each Fund, as of April 30, 2024, no person was the beneficial owner of more than five percent of a class of a Fund’s outstanding shares.

The Fund(s) in which you owned shares on the Record Date is named on the proxy card(s) or Notice of Internet Availability of Proxy Materials. If you owned shares of more than one Fund on the Record Date, you may receive more than one proxy card or voting instruction form. Even if you plan to attend the meeting, please sign, date and return EACH proxy card you receive or, if you provide voting instructions by telephone or via the Internet, please vote on the proposal affecting EACH Fund you own. If you vote by telephone or via the Internet, you will be asked to enter a unique code that has been assigned to you, which is printed on your proxy card(s) or Notice of Internet Availability of Proxy Materials, as applicable. This code is designed to confirm your identity, provide access to the voting website and confirm that your voting instructions are properly recorded.

All properly executed proxies received prior to the meeting will be voted at the meeting and at any and all adjournments, postponements or delays thereof. On any matter coming before the meeting as to which a shareholder has specified a choice on that shareholder’s proxy, the shares will be voted accordingly. If a proxy card is properly executed and returned and no choice is specified with respect to the proposal, the shares will be voted “

” the proposal. Shareholders who execute proxies or provide voting instructions by telephone or via the Internet may revoke them with respect to the proposal at any time before a vote is taken on the proposal by filing with the applicable Fund a written notice of revocation (addressed to the Secretary of the Fund at the principal executive offices of the Fund at the New York address provided herein), by delivering a duly executed proxy bearing a later date, or by attending the virtual meeting and voting at the meeting, in all cases prior to the exercise of the authority granted in the proxy card. Merely attending the meeting, however, will not revoke any previously executed proxy. If you hold shares through a bank, broker or other intermediary, please consult your bank, broker or intermediary regarding your ability to revoke voting instructions after such instructions have been provided.

Please be certain to vote by telephone or via the Internet with respect to each fund in which you are a shareholder of record or sign, date and return each proxy card you receive from us.

If your shares in a Fund are registered in your name, you may attend and participate in the meeting at meetnow.global/MAXD4Y6 by entering the control number found in the shaded box on

2

your proxy card on the date and time of the meeting. You may vote during the meeting by following the instructions that will be available on the meeting website during the meeting. If you are a beneficial shareholder of a Fund (that is if you hold your shares of a Fund through a bank, broker, financial intermediary or other nominee) you will not be able to vote at the virtual meeting unless you have registered in advance to attend the meeting. To register, you must submit proof of your proxy power (legal proxy) reflecting your Fund holdings along with your name and email address to Georgeson LLC (“Georgeson”), the Funds’ tabulator. You may email an image of your legal proxy to shareholdermeetings@computershare.com. Requests for registration must be received no later than 5:00 p.m. (Eastern time) three business days prior to the meeting date. You will receive a confirmation email from Georgeson (through Computershare) of your registration and a control number and security code that will allow you to vote at the meeting. Even if you plan to participate in the virtual meeting, please promptly follow the enclosed instructions to submit voting instructions by telephone or via the Internet. Alternatively, you may submit voting instructions by signing and dating each proxy card and voting instruction form you receive, and returning it in the accompanying postage-paid return envelope.

Each Fund will furnish, without charge, a copy of its annual report and most recent semi-annual report succeeding the annual report, if any, to a shareholder upon request. Such requests should be directed to the applicable Fund at 50 Hudson Yards, New York, NY 10001, or by calling toll free at

Copies of annual and semi-annual reports of each Fund are also available on the EDGAR Database on the U.S. Securities and Exchange Commission’s website at

.

BlackRock, Inc. (“BlackRock”) will update performance and certain other data for the Funds on a monthly basis on its website in the

“Closed-End

Funds” section of

as well as certain other material information as necessary from time to time. Investors and others are advised to check the website for updated performance information and the release of other material information about the Funds. This reference to BlackRock’s website is intended to allow investors public access to information regarding the Funds and does not, and is not intended to, incorporate BlackRock’s website in this Proxy Statement.

Please note that only one annual or semi-annual report or this Proxy Statement or Notice of Internet Availability of Proxy Materials may be delivered to two or more shareholders of a Fund who share an address, unless the Fund has received instructions to the contrary. To request a separate copy of an annual report or semi-annual report or this Proxy Statement or Notice of Internet Availability of Proxy Materials, or for instructions on how to request a separate copy of these documents or as to how to request a single copy if multiple copies of these documents are received, shareholders should contact the applicable Fund at the New York address and phone number provided above.

Please vote

now

. Your vote is important.

To avoid the wasteful and unnecessary expense of further solicitation and no matter how large or small your holdings may be, we urge you to indicate your voting instructions on the enclosed proxy card(s), and if received by mail, date and sign it (them) and return it (them) promptly in the postage-paid envelope provided, or record your voting instructions by telephone or via the Internet. If you submit a properly executed proxy card but do not indicate how you wish your shares to be voted, your shares will be voted “

FOR

” the election of the Board Nominees. If your shares of a Fund are held through a broker, you must provide voting instructions to your broker about how to vote your shares in order for your broker to vote your shares as you instruct at the meeting.

3

PLEASE VOTE PROMPTLY BY SIGNING AND RETURNING THE

ENCLOSED PROXY CARD/VOTING INSTRUCTION FORM OR BY RECORDING YOUR

VOTING INSTRUCTIONS BY TELEPHONE OR VIA THE INTERNET, NO MATTER HOW

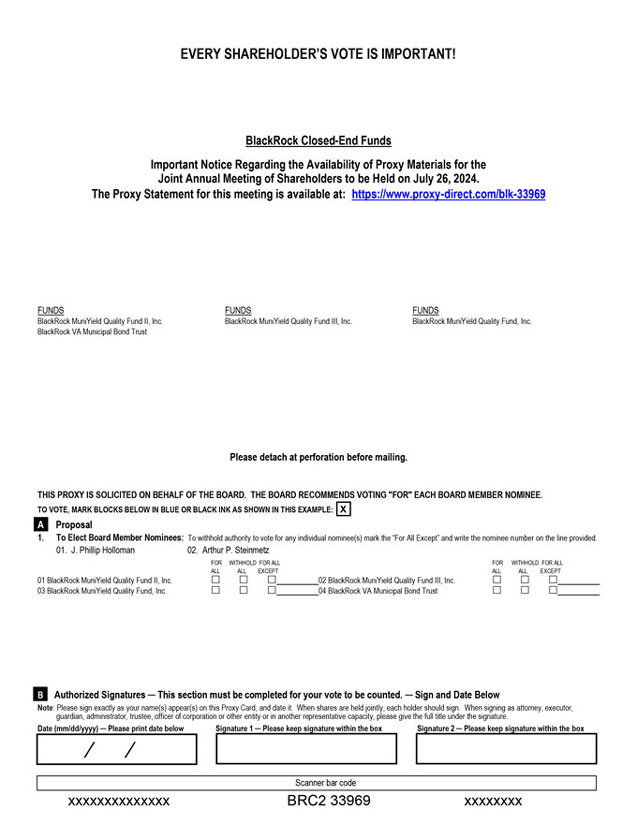

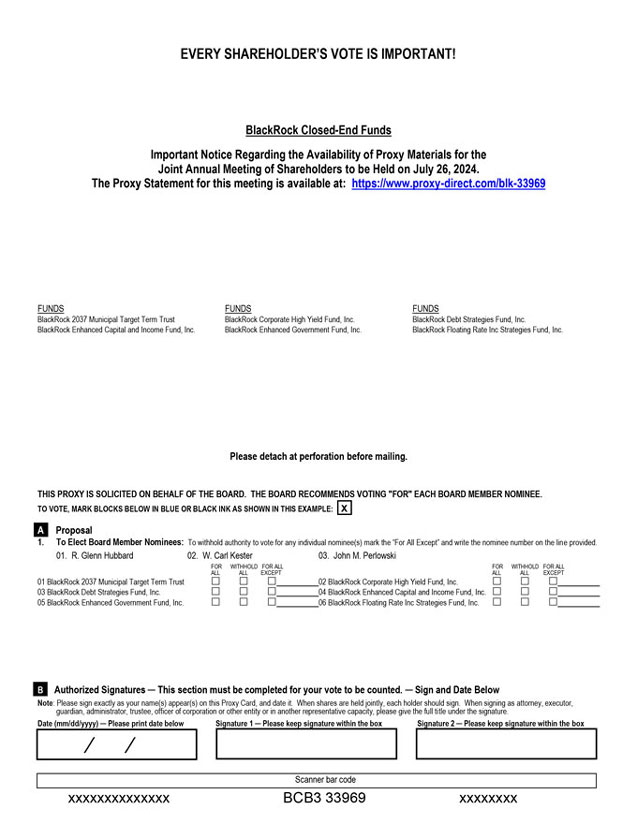

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR

THE JOINT ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON JULY 26, 2024.

THE PROXY STATEMENT FOR THIS MEETING IS AVAILABLE AT:

https://www.proxy-direct.com/blk-33969

4

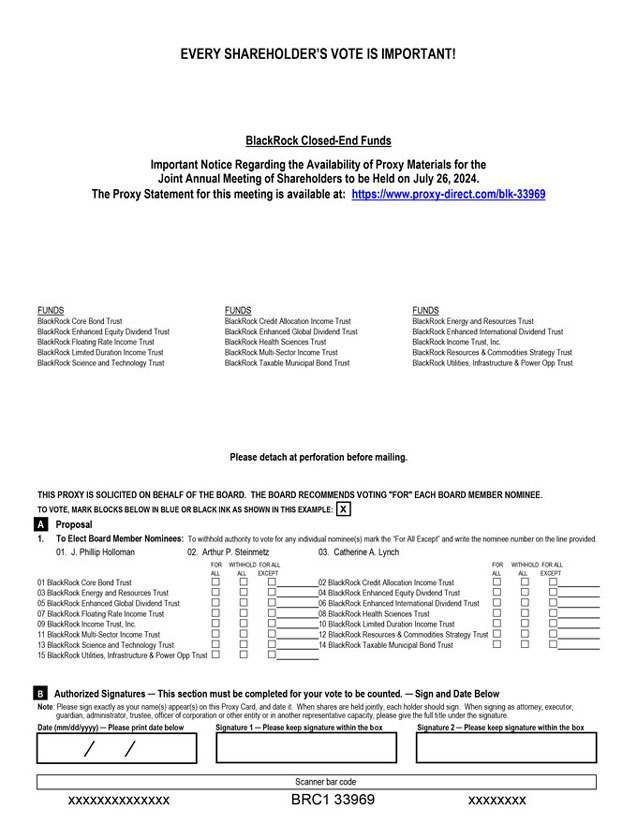

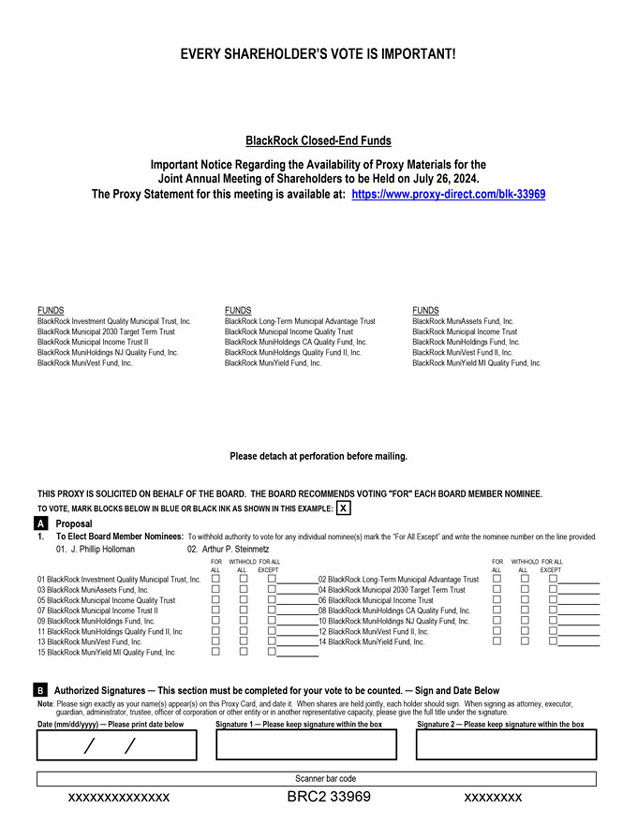

SUMMARY OF PROPOSAL AND FUNDS VOTING

The following table shows the Funds for which the Board Nominees are standing for election.

| | | | | | | | | | |

| | | | | | | | | | Preferred Shares Nominees Standing for Election (2) |

| BlackRock 2037 Municipal Target Term Trust | | BMN | | | | X | | | | |

| BlackRock Core Bond Trust | | BHK | | | | X | | | | |

| BlackRock Corporate High Yield Fund, Inc. | | HYT | | | | X | | | | |

| BlackRock Credit Allocation Income Trust | | BTZ | | | | X | | | | |

| BlackRock Debt Strategies Fund, Inc. | | DSU | | | | X | | | | |

| BlackRock Energy and Resources Trust | | BGR | | | | X | | | | |

| BlackRock Enhanced Capital and Income Fund, Inc. | | CII | | | | X | | | | |

| BlackRock Enhanced Equity Dividend Trust | | BDJ | | | | X | | | | |

| BlackRock Enhanced Global Dividend Trust | | BOE | | | | X | | | | |

| BlackRock Enhanced Government Fund, Inc. | | EGF | | | | X | | | | |

| BlackRock Enhanced International Dividend Trust | | BGY | | | | X | | | | |

| BlackRock Floating Rate Income Strategies Fund, Inc. | | FRA | | | | X | | | | |

| BlackRock Floating Rate Income Trust | | BGT | | | | X | | | | |

| BlackRock Health Sciences Trust | | BME | | | | X | | | | |

| BlackRock Income Trust, Inc. | | BKT | | | | X | | | | |

| BlackRock Investment Quality Municipal Trust, Inc. | | BKN | | | | X | | | | X |

| BlackRock Limited Duration Income Trust | | BLW | | | | X | | | | |

| BlackRock Long-Term Municipal Advantage Trust | | BTA | | | | X | | | | X |

| BlackRock Multi-Sector Income Trust | | BIT | | | | X | | | | |

| BlackRock MuniAssets Fund, Inc. | | MUA | | | | X | | | | X |

| BlackRock Municipal 2030 Target Term Trust | | BTT | | | | X | | | | X |

| BlackRock Municipal Income Quality Trust | | BYM | | | | X | | | | X |

| BlackRock Municipal Income Trust | | BFK | | | | X | | | | X |

| BlackRock Municipal Income Trust II | | BLE | | | | X | | | | X |

| BlackRock MuniHoldings California Quality Fund, Inc. | | MUC | | | | X | | | | X |

| BlackRock MuniHoldings Fund, Inc. | | MHD | | | | X | | | | X |

| BlackRock MuniHoldings New Jersey Quality Fund, Inc. | | MUJ | | | | X | | | | X |

| BlackRock MuniHoldings Quality Fund II, Inc. | | MUE | | | | X | | | | X |

| BlackRock MuniVest Fund II, Inc. | | MVT | | | | X | | | | X |

| BlackRock MuniVest Fund, Inc. | | MVF | | | | X | | | | X |

| BlackRock MuniYield Fund, Inc. | | MYD | | | | X | | | | X |

| BlackRock MuniYield Michigan Quality Fund, Inc. | | MIY | | | | X | | | | X |

| BlackRock MuniYield Quality Fund II, Inc. | | MQT | | | | X | | | | X |

| BlackRock MuniYield Quality Fund III, Inc. | | MYI | | | | X | | | | X |

| BlackRock MuniYield Quality Fund, Inc. | | MQY | | | | X | | | | X |

| BlackRock Resources & Commodities Strategy Trust | | BCX | | | | X | | | | |

| BlackRock Science and Technology Trust | | BST | | | | X | | | | |

| BlackRock Taxable Municipal Bond Trust | | BBN | | | | X | | | | |

| BlackRock Utilities, Infrastructure & Power Opportunities Trust | | BUI | | | | X | | | | |

| BlackRock Virginia Municipal Bond Trust | | BHV | | | | X | | | | X |

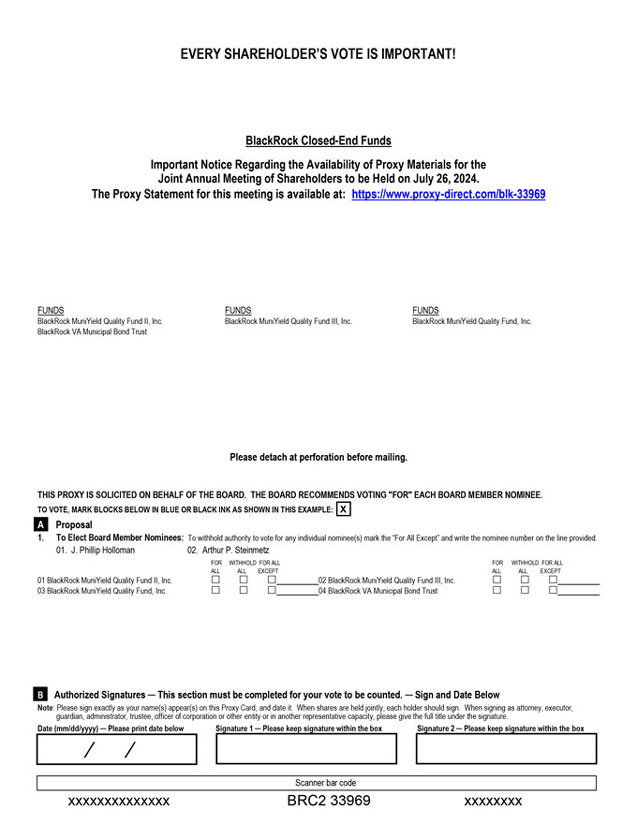

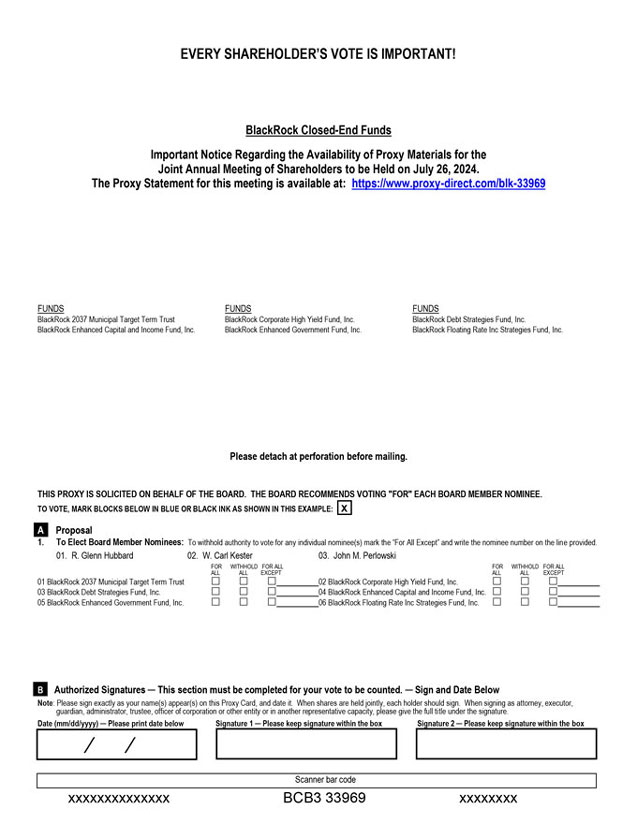

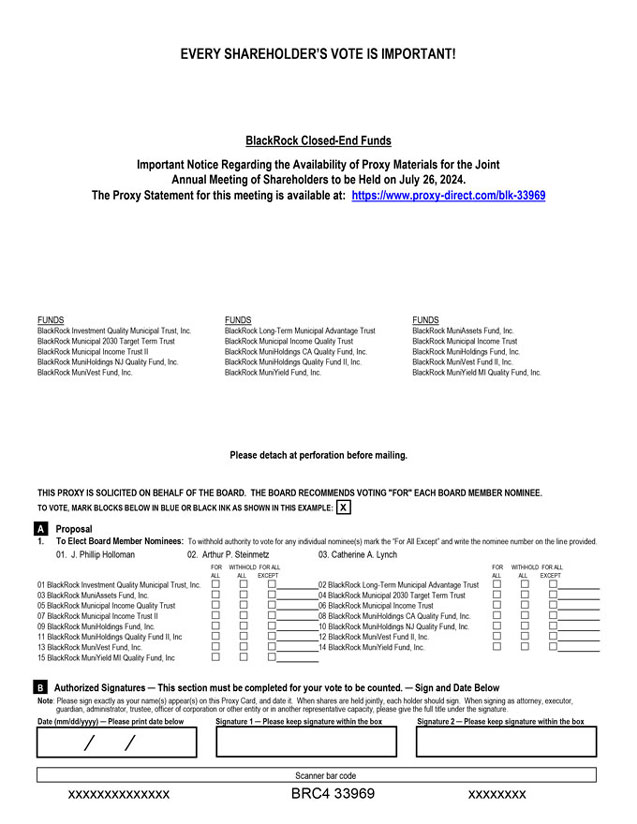

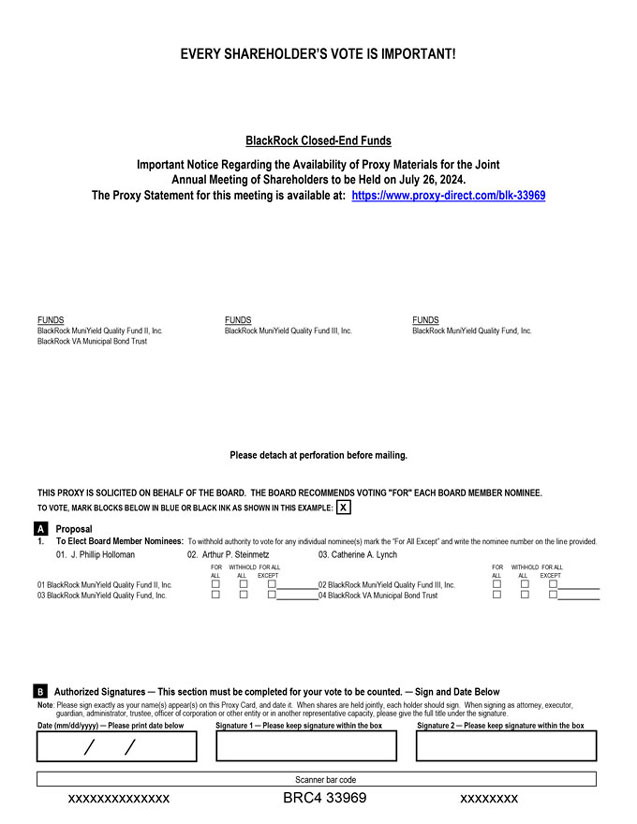

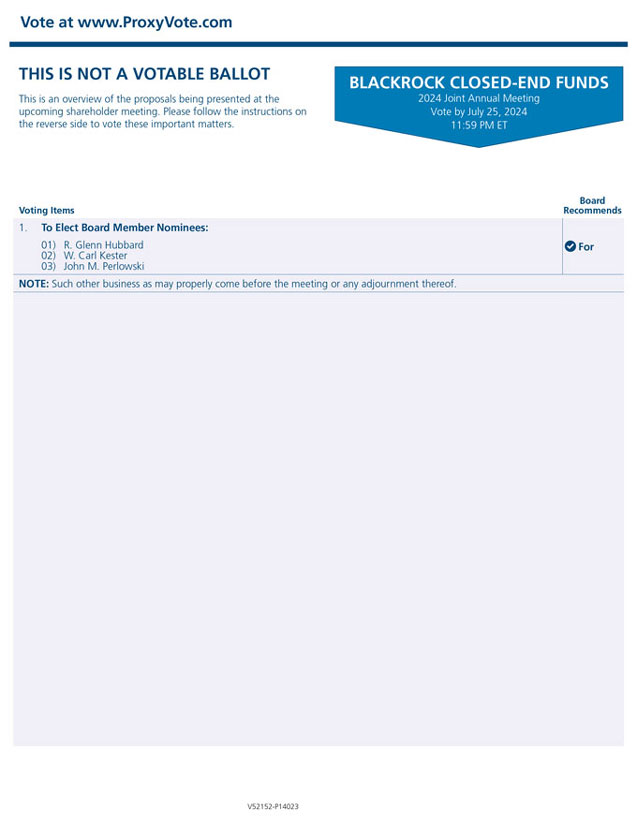

| (1) | | The Class II Board Nominees for HYT, DSU, CII, EGF, FRA and BMN are R. Glenn Hubbard, W. Carl Kester and John M. Perlowski. For each other Fund, the Class II Board Nominees are J. Phillip Holloman, Catherine A. Lynch and Arthur P. Steinmetz. For the Preferred Funds, each of the Class II Board Nominees are voted upon by the holders of Common |

5

| | Shares and Preferred Shares of each respective Preferred Fund voting together as a single class, except for Ms. Lynch, who is the Preferred Shares Nominee (as defined below) for each Preferred Fund. For the Preferred Funds, Ms. Lynch is voted upon by the holders of Preferred Shares of each respective Preferred Fund voting as a separate class. For Funds other than the Preferred Funds, each of the Class II Board Nominees is voted upon by the holders of Common Shares of each respective Fund voting as a single class. Please see the description herein under “PROPOSAL 1 – ELECTION OF BOARD NOMINEES.” |

| (2) | | With respect to the Preferred Funds, Catherine A. Lynch and W. Carl Kester are currently the Board Members elected solely by the owners of Preferred Shares. Only Catherine A. Lynch is standing for election this year as a Preferred Shares Nominee. Ms. Lynch is voted upon by the holders of Preferred Shares of each respective Preferred Fund voting as a separate class. W. Carl Kester’s term as a Class I Board Member of the Preferred Funds is scheduled to expire in 2026; therefore, he is not standing for election this year as a Preferred Shares Nominee. Please see the description herein under “PROPOSAL 1 — ELECTION OF BOARD NOMINEES” for a more detailed discussion regarding the Preferred Shares Nominee. |

6

PROPOSAL 1—ELECTION OF BOARD NOMINEES

The purpose of Proposal 1 is to elect Board Members for each Fund.

The Board of each Fund consists of ten Board Members, eight of whom are not “interested persons” of the Funds (as defined in the 1940 Act) (the “Independent Board Members”). The Funds divide their Board Members into three classes: Class I, Class II and Class III, and generally only one class of Board Members stands for election each year.

Under this classified board structure, generally only those Board Members in a single class may be replaced in any one year. The Board believes that it is in the best interest of the Funds, as

closed-end,

exchange traded investment companies subject to extensive regulation by the Securities and Exchange Commission (“SEC”), to have a classified board structure. The Board believes that a classified board structure provides a Fund and its shareholders with important benefits. The Board believes that a classified board structure promotes continuity of experiences and an orderly succession of Board Members by ensuring that at any given time there are experienced board members serving on the Board who are familiar with such Fund, its business, operations and investment and compliance policies, and its relationships with its services providers. Specifically, the Board believes that a classified board structure: (a) creates a more experienced Board that is better able to identify and accomplish long-term objectives in supervising the management of the Funds; (b) enhances the independence of the Independent Board Members from management and from special interest groups by providing them with a three-year term of office, so they are better positioned to make decisions that are in the best long-term interest of the Funds and their shareholders; (c) strengthens the Funds’ ability to attract and retain qualified individuals who are willing to make multi-year commitments to the Funds and to develop a deep understanding of the Funds; (d) allows new Board Members an opportunity to gain knowledge from experienced Board Members; (e) helps prevent complete changes in control and corresponding changes in fund philosophy or strategies in any one year; and (f) protects against abrupt changes in a Fund based on the short-term objectives of shareholders who may seek to implement an agenda that is contrary to the long-term interest of Fund shareholders.

The Board further believes that the considerations with respect to classified boards in the

closed-end,

exchange traded investment company context are different than those for traditional operating companies, and in this regard notes that the classified board structure is expressly acknowledged by the 1940 Act, the principal regulatory regime governing the Funds and their operations. The role of a board of a

closed-end,

exchange traded investment company is different in material respects to the role of a board of directors of a traditional operating company. For example, an investment company’s board has the primary responsibility for oversight of the fund’s service providers and management of conflicts of interest involving the fund, including oversight of the fund’s investment advisory arrangements. A traditional operating company does not have investment advisers and is not subject to the same types of conflicts of interests that an investment company’s board must oversee. Additionally, an investment company registered pursuant to the 1940 Act is subject to extensive regulation with respect to governance and operations that requires independence of its board members and makes them accountable to shareholders. The Board believes that a classified board structure is consistent with good corporate governance, which depends principally on active and independent board members who have extensive business experience and are knowledgeable about critical aspects of the Funds.

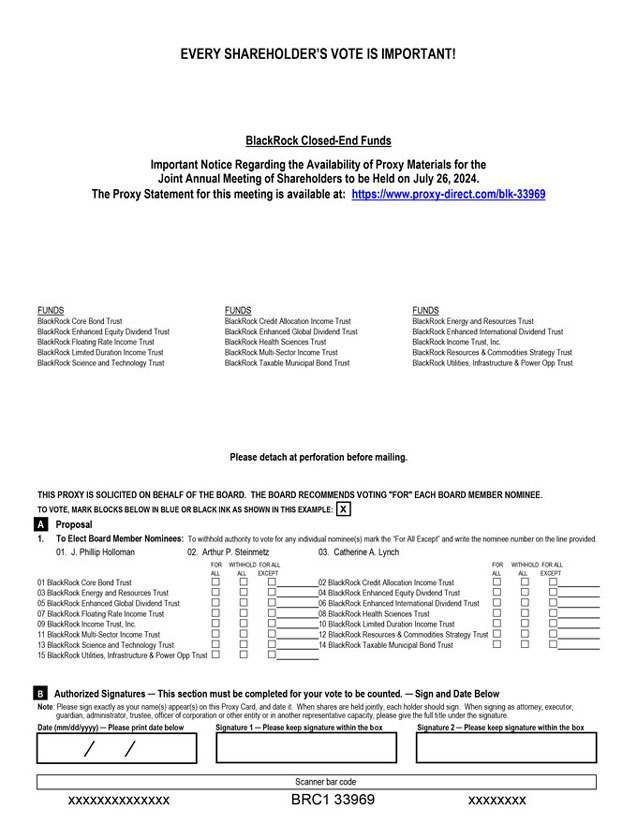

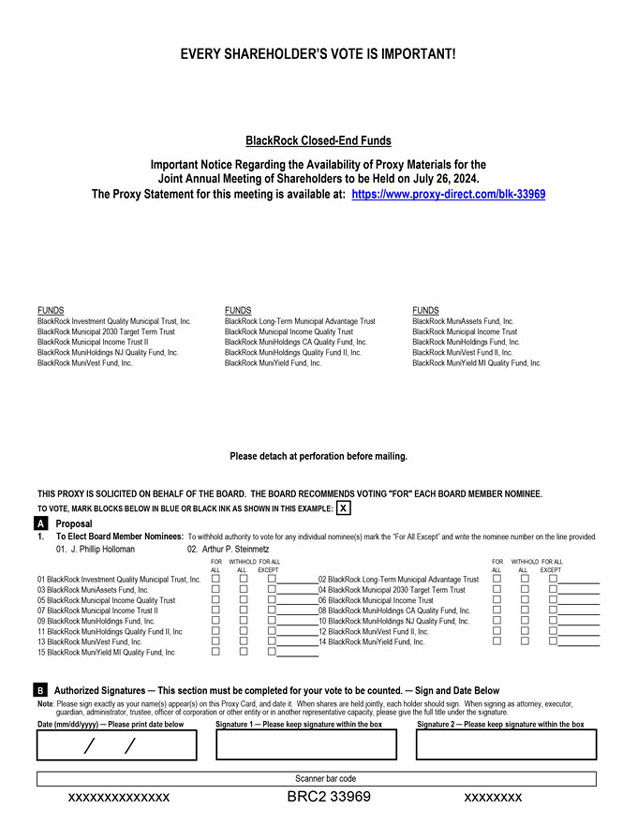

The Class II Board Members are standing for election this year. The Class II Board Nominees for HYT, DSU, CII, EGF, FRA and BMN are R. Glenn Hubbard, W. Carl Kester and John M. Perlowski. For each other Fund, the Class II Board Nominees are J. Phillip Holloman, Catherine A. Lynch and Arthur P. Steinmetz. Each Class II Board Member elected at the meeting will serve until the later of the date of the Fund’s 2027 annual meeting or until his or her successor is elected and qualifies, or until his or her earlier death, resignation, retirement or removal.

7

With respect to the Preferred Funds, the owners of Preferred Shares are entitled to vote as a separate class to elect two of the Board Members (the “Preferred Shares Nominees”) for the Preferred Fund in which they own Preferred Shares. This means that owners of Common Shares are not entitled to vote in connection with the election of the Preferred Shares Nominees. However, the owners of Common Shares and the owners of Preferred Shares, voting together as a single class, are entitled to elect the remainder of the Board Nominees. Catherine A. Lynch and W. Carl Kester are currently the Board Members elected solely by the owners of Preferred Shares. Only Catherine A. Lynch is standing for election this year as a Preferred Shares Nominee. W. Carl Kester’s term as a Class I Board Member of the Preferred Funds is scheduled to expire in 2026; therefore, he is not standing for election this year as a Preferred Shares Nominee.

With respect to HYT, DSU, CII, EGF, FRA and BMN, the Board recommends a vote “

” the election of R. Glenn Hubbard, W. Carl Kester and John M. Perlowski. With respect to all of the other Funds, the Board recommends a vote “

” the election J. Phillip Holloman, Catherine A. Lynch and Arthur P. Steinmetz. The aforementioned nominees to the Board of each Fund are collectively referred to herein as the “Board Nominees.” To vote for the Board Nominees, please vote by telephone or via the Internet, as described in the proxy card, or date and sign the enclosed proxy card and return it promptly in the enclosed postage-paid envelope. Each of the Board Nominees has consented to being named in this Proxy Statement and to serve as a Board Member if elected.

Board Members’/Nominees’ Biographical Information

Please refer to the below table which identifies the Board Nominees and any Preferred Shares Nominees for election to the Board of each Fund and sets forth certain biographical information about the Board Members, including the Board Nominees, for all of the Funds. Please note that only the Class II Board Members are standing for election this year. Each Board Nominee was reviewed by the Governance and Nominating Committee (the “Governance Committee”) of the Board of each respective Fund and nominated by the full Board. R. Glenn Hubbard was selected to serve as the Chair of each Board, and W. Carl Kester was selected to serve as the Vice Chair of each Board. All of the

closed-end

investment companies registered under the 1940 Act advised by BlackRock Advisors, LLC (the “Advisor”), including the Funds, are referred to collectively as the “BlackRock

Closed-End

Funds.” The BlackRock

Closed-End

Funds, together with certain other registered investment companies advised by the Advisor or its affiliates, are included in a complex of funds referred to as the BlackRock Fixed-Income Complex.

| | | | | | | | | | | | |

Name, Address (1) and Year of Birth | | Position(s)

Held with

Funds | | Term of

Office and

Length of

Time

Served* | | | | Number of

BlackRock-

Advised

Registered

Investment

Companies

(“RICs”)

Consisting of

Investment

Portfolios

(“Portfolios”)

Overseen** | | | Public

Company and

Other Investment

Company

Directorships

Held

During Past

Five Years*** |

Independent Board Members/Nominees | | | | | | | | | | |

| | | | | |

1958 | | Chair of the Boards and Director/ Trustee | | 2024 for HYT, DSU, CII, EGF, FRA and BMN; 2026 for all other Funds; from 2007 to present | | Dean, Columbia Business School from 2004 to 2019; Faculty member, Columbia Business School since 1988. | |

| 68 RICs

consisting

of 102

Portfolios |

| | ADP (data and information services) from 2004 to 2020; Metropolitan Life Insurance Company (insurance); TotalEnergies SE (multi-energy) |

8

| | | | | | | | | | |

Name, Address (1) and Year of Birth | | Position(s)

Held with

Funds | | Term of

Office and

Length of

Time

Served* | | | | Number of

BlackRock-

Advised

Registered

Investment

Companies

(“RICs”)

Consisting of

Investment

Portfolios

(“Portfolios”)

Overseen** | | Public

Company and

Other Investment

Company

Directorships

Held

During Past

Five Years*** |

1951 | | Vice Chair of the Boards and Director/ Trustee | | 2024 for HYT, DSU, CII, EGF, FRA and BMN; 2026 for all other Funds; from 2007 to present | | Baker Foundation Professor and George Fisher Baker Jr. Professor of Business Administration, Emeritus, Harvard Business School since 2022; George Fisher Baker Jr. Professor of Business Administration, Harvard Business School from 2008 to 2022; Deputy Dean for Academic Affairs from 2006 to 2010; Chairman of the Finance Unit, from 2005 to 2006; Senior Associate Dean and Chairman of the MBA Program from 1999 to 2005; Member of the faculty of Harvard Business School since 1981. | | 70 RICs

consisting

of 104

Portfolios | | None |

| | | | | |

1955 | | Director/ Trustee | | 2026 for HYT, DSU, CII, EGF, FRA and BMN; 2025 for all other Funds; from 2016 to present | | Advisor, U.S. Department of the Treasury from 2014 to 2015; President, Retirement Plan Services, for T. Rowe Price Group, Inc. from 2007 to 2012; executive positions within Fidelity Investments from 1989 to 2007. | | 70 RICs

consisting

of 104

Portfolios | | Unum (insurance); The Hanover Insurance Group (Board Chair); Huntsman Corporation (Lead Independent Director and non-Executive Vice Chair of the Board) (chemical products) |

| | | | | |

Lorenzo A. Flores 1964 | | Director/ Trustee | | 2026 for all Funds; from 2021 to present | | Chief Financial Officer, Intel Foundry since 2024; Vice Chairman, Kioxia, Inc. from 2019 to 2024; Chief Financial Officer, Xilinx, Inc. from 2016 to 2019; Corporate Controller, Xilinx, Inc. from 2008 to 2016. | | 68 RICs

consisting

of 102

Portfolios | | None |

9

| | | | | | | | | | |

Name, Address (1) and Year of Birth | | Position(s)

Held with

Funds | | Term of

Office and

Length of

Time

Served* | | | | Number of

BlackRock-

Advised

Registered

Investment

Companies

(“RICs”)

Consisting of

Investment

Portfolios

(“Portfolios”)

Overseen** | | Public

Company and

Other Investment

Company

Directorships

Held

During Past

Five Years*** |

Stayce D. Harris 1959 | | Director/ Trustee | | 2026 for HYT, DSU, CII, EGF, FRA and BMN; 2025 for all other Funds; from 2021 to present | | Lieutenant General, Inspector General of the United States Air Force from 2017 to 2019; Lieutenant General, Assistant Vice Chief of Staff and Director, Air Staff, United States Air Force from 2016 to 2017; Major General, Commander, 22nd Air Force, AFRC, Dobbins Air Reserve Base, Georgia from 2014 to 2016; Pilot, United Airlines from 1990 to 2020. | | 68 RICs

consisting

of 102

Portfolios | | KULR Technology Group, Inc. in 2021; The Boeing Company (airplane manufacturer) |

| | | | | |

1955 | | Director/ Trustee | | 2025 for HYT, DSU, CII, EGF, FRA and BMN; 2024 for all other Funds; from 2021 to present | | President and Chief Operating Officer, Cintas Corporation from 2008 to 2018. | | 68 RICs

consisting

of 102

Portfolios | | PulteGroup, Inc. (home construction); Rockwell Automation Inc. (industrial automation); Vestis Corporation (uniforms and facilities services) |

| | | | | |

Catherine A. Lynch (3)(4)(5) 1961 | | Director/ Trustee | | 2026 for HYT, DSU, CII, EGF, FRA and BMN; 2024 for all other Funds; from 2016 to present | | Chief Executive Officer, Chief Investment Officer and various other positions, National Railroad Retirement Investment Trust from 2003 to 2016; Associate Vice President for Treasury Management, The George Washington University from 1999 to 2003; Assistant Treasurer, Episcopal Church of America from 1995 to 1999. | | 70 RICs

consisting

of 104

Portfolios | | PennyMac Mortgage Investment Trust |

10

| | | | | | | | | | | | |

Name, Address (1) and Year of Birth | | Position(s)

Held with

Funds | | Term of

Office and

Length of

Time

Served* | | | | Number of

BlackRock-

Advised

Registered

Investment

Companies

(“RICs”)

Consisting of

Investment

Portfolios

(“Portfolios”)

Overseen** | | | Public

Company and

Other Investment

Company

Directorships

Held

During Past

Five Years*** |

Arthur P. Steinmetz (3)(5) 1958 | | Director/ Trustee | | 2025 for HYT, DSU, CII, EGF, FRA and BMN; 2024 for all other Funds; from 2023 to present | | Consultant, Posit PBC (enterprise data science) since 2020; Director, ScotiaBank (U.S.) from 2020 to 2023; Chairman, Chief Executive Officer and President of OppenheimerFunds, Inc. from 2015, 2014 and 2013, respectively to 2019); Trustee, President and Principal Executive Officer of 104 OppenheimerFunds funds from 2014 to 2019. Portfolio manager of various OppenheimerFunds fixed income mutual funds from 1986 to 2014. | |

| 70 RICs

consisting

of 104

Portfolios |

| | Trustee of 104 OppenheimerFunds funds from 2014 to 2019 |

| | | | |

Interested Board Members/Nominees | | | | | | | | | | |

| | | | | |

Robert Fairbairn 1965 | | Director/ Trustee | | 2025 for all Funds; from 2018 to present | | Vice Chairman of BlackRock, Inc. since 2019; Member of BlackRock’s Global Executive and Global Operating Committees; Co-Chair of BlackRock’s Human Capital Committee; Senior Managing Director of BlackRock, Inc. from 2010 to 2019; oversaw BlackRock’s Strategic Partner Program and Strategic Product Management Group from 2012 to 2019; Member of the Board of Managers of BlackRock Investments, LLC from 2011 to 2018; Global Head of BlackRock’s Retail and iShares® businesses from 2012 to 2016. | |

| 96 RICs

consisting

of 268

Portfolios |

| | None |

11

| | | | | | | | | | |

Name, Address (1) and Year of Birth | | Position(s)

Held with

Funds | | Term of

Office and

Length of

Time

Served* | | | | Number of

BlackRock-

Advised

Registered

Investment

Companies

(“RICs”)

Consisting of

Investment

Portfolios

(“Portfolios”)

Overseen** | | Public

Company and

Other Investment

Company

Directorships

Held

During Past

Five Years*** |

1964 | | Director/ Trustee, President and Chief Executive Officer | | 2024 for HYT, DSU, CII, EGF, FRA and BMN; 2026 for all other Funds; Director/ Trustee from 2014 to present; President and Chief Executive Officer from 2011 to present | | Managing Director of BlackRock, Inc. since 2009; Head of BlackRock Global Accounting and Product Services since 2009; Advisory Director of Family Resource Network (charitable foundation) since 2009. | | 98 RICs

consisting

of 270

Portfolios | | None |

| * | | Date shown is the earliest date a person has served for the Funds covered by this Proxy Statement. Following the combination of Merrill Lynch Investment Managers, L.P. (“MLIM”) and BlackRock, Inc. in September 2006, the various legacy MLIM and legacy BlackRock fund boards were realigned and consolidated into three new fund boards in 2007. As a result, although the chart shows certain Independent Board Members as joining the Funds’ Boards in 2007, those Board Members first became members of the boards of other legacy MLIM or legacy BlackRock funds as follows: R. Glenn Hubbard, 2004; and W. Carl Kester, 1995. |

| ** | | For purposes of this chart, “RICs” refers to investment companies registered under the 1940 Act and “Portfolios” refers to the investment programs of the BlackRock-advised funds. The BlackRock Fixed-Income Complex is comprised of 70 RICs consisting of 104 Portfolios. |

| *** | | Directorships disclosed under this column do not include directorships disclosed under the column “Principal Occupation(s) During Past Five Years.” |

| † | | Each Independent Board Member will serve until his or her successor is elected and qualifies, or until his or her earlier death, resignation, retirement or removal, or until December 31 of the year in which he or she turns 75. The maximum age limitation may be waived as to any Board Member by action of a majority of the Board upon a finding of good cause therefor. |

| †† | | Messrs. Fairbairn and Perlowski are both “interested persons,” as defined in the 1940 Act, of the Funds based on their positions with BlackRock, Inc. and its affiliates. Messrs. Fairbairn and Perlowski are also board members of the BlackRock Multi-Asset Complex. Interested Board Members serve until their resignation, removal or death, or until December 31 of the year in which they turn 72. The maximum age limitation may be waived as to any Board Member by action of a majority of the Board Members upon a finding of good cause therefor. |

| (1) | | The address of each Board Member and Board Nominee is c/o BlackRock, Inc., 50 Hudson Yards, New York, NY 10001. |

| (2) | | Class II Board Member and Board Nominee for HYT, DSU, CII, EGF, FRA and BMN. |

| (3) | | Class II Board Member and Board Nominee for all Funds other than HYT, DSU, CII, EGF, FRA and BMN. |

| (4) | | Preferred Shares Nominee. W. Carl Kester’s term as a Class I Board Member of the Preferred Funds is scheduled to expire in 2026; therefore, he is not standing for election this year as a Preferred Shares Nominee. |

| (5) | | Ms. Egan, Dr. Kester, Ms. Lynch, Mr. Steinmetz and Mr. Perlowski are also trustees of the BlackRock Credit Strategies Fund and BlackRock Private Investments Fund. |

The Independent Board Members have adopted a statement of policy that describes the experiences, qualifications, skills and attributes that are necessary and desirable for potential Independent Board Member candidates (the “Statement of Policy”). The Boards believe that each Independent Board Member satisfied, at the time he or she was initially elected or appointed as a Board Member, and continues to satisfy, the standards contemplated by the Statement of Policy as well as the standards set forth in each Fund’s

By-laws.

Furthermore, in determining that a

12

particular Board Member was and continues to be qualified to serve as a Board Member, the Boards have considered a variety of criteria, none of which, in isolation, was controlling. The Boards believe that, collectively, the Board Members/Nominees have balanced and diverse experiences, skills, attributes and qualifications, which allow the Boards to operate effectively in governing the Funds and protecting the interests of shareholders. Among the attributes common to all Board Members/Nominees is their ability to review critically, evaluate, question and discuss information provided to them, to interact effectively with the Funds’ investment adviser,

sub-advisers,

other service providers, counsel and independent auditors, and to exercise effective business judgment in the performance of their duties as Board Members. Each Board Member’s/Nominee’s ability to perform his or her duties effectively is evidenced by his or her educational background or professional training; business, consulting, public service or academic positions; experience from service as a board member of the Funds or the other funds in the BlackRock fund complexes (and any predecessor funds), other investment funds, public companies, or

entities or other organizations; ongoing commitment and participation in Board and committee meetings, as well as their leadership of standing and other committees throughout the years; or other relevant life experiences.

The table below discusses some of the experiences, qualifications and skills of the Board Members, including the Board Nominees, that support the conclusion that they should serve (or continue to serve) on the Boards.

| | |

| | Experience, Qualifications and Skills |

| R. Glenn Hubbard** | | R. Glenn Hubbard has served in numerous roles in the field of economics, including as the Chairman of the U.S. Council of Economic Advisers of the President of the United States. Dr. Hubbard has served as the Dean of Columbia Business School, as a member of the Columbia Faculty and as a Visiting Professor at the John F. Kennedy School of Government at Harvard University, the Harvard Business School and the University of Chicago. Dr. Hubbard’s experience as an adviser to the President of the United States adds a dimension of balance to the Funds’ governance and provides perspective on economic issues. Dr. Hubbard’s service on the boards of ADP and Metropolitan Life Insurance Company provides the Boards with the benefit of his experience with the management practices of other financial companies. Dr. Hubbard’s long-standing service on the boards of directors/trustees of the closed-end funds in the BlackRock Fixed-Income Complex also provides him with a specific understanding of the Funds, their operations, and the business and regulatory issues facing the Funds. Dr. Hubbard’s independence from the Funds and the Advisor enhances his service as Chair of the Boards, Chair of the Executive Committee and a member of the Governance Committee, the Compliance Committee and the Performance Oversight Committee. |

13

| | |

| | Experience, Qualifications and Skills |

| W. Carl Kester** | | The Boards benefit from W. Carl Kester’s experiences as a professor and author in finance, and his experience as the George Fisher Baker Jr. Professor of Business Administration at Harvard Business School and as Deputy Dean of Academic Affairs at Harvard Business School from 2006 through 2010 adds to the Board a wealth of expertise in corporate finance and corporate governance. Dr. Kester has authored and edited numerous books and research papers on both subject matters, including co-editing a leading volume of finance case studies used worldwide. Dr. Kester’s long-standing service on the boards of directors/trustees of theclosed-end funds in the BlackRock Fixed-Income Complex also provides him with a specific understanding of the Funds, their operations, and the business and regulatory issues facing the Funds. Dr. Kester’s independence from the Funds and the Advisor enhances his service as a Vice Chair of the Boards, Chair of the Governance Committee and a member of the Executive Committee, the Discount Committee, the Compliance Committee, the Performance Oversight Committee and the Securities Lending Committee. |

| |

| Cynthia L. Egan | | Cynthia L. Egan brings to the Boards a broad and diverse knowledge of investment companies and the retirement industry as a result of her many years of experience as President, Retirement Plan Services, for T. Rowe Price Group, Inc. and her various senior operating officer positions at Fidelity Investments, including her service as Executive Vice President of FMR Co., President of Fidelity Institutional Services Company and President of the Fidelity Charitable Gift Fund. Ms. Egan has also served as an advisor to the U.S. Department of Treasury as an expert in domestic retirement security. Ms. Egan began her professional career at the Board of Governors of the Federal Reserve and the Federal Reserve Bank of New York. Ms. Egan is also a director of UNUM Corporation, a publicly traded insurance company providing personal risk reinsurance, and a director and Chair of the Board of The Hanover Group, a public property casualty insurance company. Ms. Egan is also the lead independent director and non-executive Vice Chair of the Board of Huntsman Corporation, a publicly traded manufacturer and marketer of chemical products. Ms.

Egan’s independence from the Funds and the Advisor enhances her service as Chair of the Compliance Committee and a member of the Discount Committee, the Governance Committee, the Performance Oversight Committee and the Securities Lending Committee. |

| |

| Lorenzo A. Flores | | The Boards benefit from Lorenzo A. Flores’s many years of business, leadership and financial experience in his roles at various public and private companies. In particular, Mr. Flores’s service as Chief Financial Officer of Intel Foundry, a semiconductor manufacturing unit of Intel Corporation, Chief Financial Officer and Corporate Controller of Xilinx, Inc., a technology and semiconductor company that supplies programmable logic devices, and Vice Chairman of Kioxia, Inc., a manufacturer and supplier of flash memory and solid state drives, and his long experience in the technology industry allow him to provide insight to into financial, business and technology trends. Mr. Flores’s knowledge of financial and accounting matters qualifies him to serve as a member of the Audit Committee. Mr. Flores’s independence from the Funds and the Advisor enhances his service as a member of the Performance Oversight Committee. |

14

| | |

| | Experience, Qualifications and Skills |

| Stayce D. Harris | | The Boards benefit from Stayce D. Harris’s leadership and governance experience gained during her extensive military career, including as a three-star Lieutenant General of the United States Air Force. In her most recent role, Ms. Harris reported to the Secretary and Chief of Staff of the Air Force on matters concerning Air Force effectiveness, efficiency and the military discipline of active duty, Air Force Reserve and Air National Guard forces. Ms. Harris’s experience on governance matters includes oversight of inspection policy and the inspection and evaluation system for all Air Force nuclear and conventional forces; oversight of Air Force counterintelligence operations and service on the Air Force Intelligence Oversight Panel; investigation of fraud, waste and abuse; and oversight of criminal investigations and complaints resolution programs. Ms. Harris is also a director of The Boeing Company. Ms. Harris’s independence from the Funds and the Advisor enhances her service as a member of the Compliance Committee and the Performance Oversight Committee. |

| |

| J. Phillip Holloman* | | The Boards benefit from J. Phillip Holloman’s many years of business and leadership experience as an executive, director and advisory board member of various public and private companies. In particular, Mr. Holloman’s service as President and Chief Operating Officer of Cintas Corporation and director of PulteGroup, Inc. and Rockwell Automation Inc. allows him to provide insight into business trends and conditions. Mr. Holloman’s knowledge of financial and accounting matters qualifies him to serve as a member of the Audit Committee. Mr. Holloman’s independence from the Funds and the Advisor enhances his service as a member of the Governance Committee and the Performance Oversight Committee. |

| |

| Catherine A. Lynch* | | Catherine A. Lynch, who served as the Chief Executive Officer and Chief Investment Officer of the National Railroad Retirement Investment Trust, benefits the Boards by providing business leadership and experience and a diverse knowledge of pensions and endowments. Ms. Lynch is also a trustee of PennyMac Mortgage Investment Trust, a specialty finance company that invests primarily in mortgage-related assets. Ms. Lynch also holds the designation of Chartered Financial Analyst. Ms. Lynch’s knowledge of financial and accounting matters qualifies her to serve as Chair of the Audit Committee. Ms. Lynch’s independence from the Funds and the Advisor enhances her service as the Chair of the Discount Committee and the Chair of the Securities Lending Committee, and a member of the Governance Committee and the Performance Oversight Committee. |

15

| | |

| | Experience, Qualifications and Skills |

| Arthur P. Steinmetz* | | The Boards benefits from Arthur P. Steinmetz’s many years of business and leadership experience as an executive, chairman and director of various companies in the financial industry. Mr. Steinmetz’s service as Chairman, Chief Executive Officer and President of the OppenheimerFunds, Inc. and as Trustee, President and Principal Executive Officer of certain OppenheimerFunds funds provides insight into the asset management industry. He has also served as a Director of ScotiaBank (U.S.). Mr. Steinmetz’s knowledge of financial and accounting matters qualifies him to serve as a member of the Audit Committee. Mr. Steinmetz’s independence from the Funds and the Advisor enhances his service as Chair of the Performance Oversight Committee and a member of the Discount Committee. |

| |

| Robert Fairbairn | | Robert Fairbairn has more than 25 years of experience with BlackRock, Inc. and over 30 years of experience in finance and asset management. In particular, Mr. Fairbairn’s positions as Vice Chairman of BlackRock, Inc., Member of BlackRock’s Global Executive and Global Operating Committees and Co-Chair of BlackRock’s Human Capital Committee provide the Boards with a wealth of practical business knowledge and leadership. In addition, Mr. Fairbairn has global investment management and oversight experience through his former positions as Global Head of BlackRock’s Retail and iShares® businesses, Head of BlackRock’s Global Client Group, Chairman of BlackRock’s international businesses and his previous oversight over BlackRock’s Strategic Partner Program and Strategic Product Management Group. Mr. Fairbairn also serves as a board member for the funds in the BlackRock Multi-Asset Complex. |

| |

| John M. Perlowski** | | John M. Perlowski’s experience as Managing Director of BlackRock, Inc. since 2009, as the Head of BlackRock Global Accounting and Product Services since 2009, and as President and Chief Executive Officer of the Funds provides him with a strong understanding of the Funds, their operations, and the business and regulatory issues facing the Funds. Mr. Perlowski’s prior position as Managing Director and Chief Operating Officer of the Global Product Group at Goldman Sachs Asset Management, and his former service as Treasurer and Senior Vice President of the Goldman Sachs Mutual Funds and as Director of the Goldman Sachs Offshore Funds provides the Boards with the benefit of his experience with the management practices of other financial companies. Mr. Perlowski also serves as a board member for the funds in the BlackRock Multi-Asset Complex. Mr. Perlowski’s experience with BlackRock enhances his service as a member of the Executive Committee. |

| * | | Class II Board Member and Board Nominee for all Funds other than HYT, DSU, CII, EGF, FRA and BMN. |

| ** | | Class II Board Member and Board Nominee for HYT, DSU, CII, EGF, FRA and BMN. |

Board Leadership Structure and Oversight

The Boards consist of ten Board Members, eight of whom are Independent Board Members. The registered investment companies advised by the Advisor or its affiliates (the “BlackRock-advised Funds”) are organized into the BlackRock Multi-Asset Complex, the BlackRock Fixed-Income Complex, and the iShares Complex (each, a “BlackRock Fund Complex”). The Funds are

16

included in the BlackRock Fund Complex referred to as the BlackRock Fixed-Income Complex. The Board Members also oversee as board members the operations of the other

open-end

and

closed-end

registered investment companies included in the BlackRock Fixed-Income Complex.

The Boards have overall responsibility for the oversight of the Funds. The Chair of the Boards and the Chief Executive Officer are different people. Not only is the Chair an Independent Board Member, but also the Chair of each Board committee (each, a “Committee”) is an Independent Board Member. The Boards have seven standing Committees: an Audit Committee, a Governance Committee, a Compliance Committee, a Performance Oversight Committee, a Securities Lending Committee, a Discount Committee and an Executive Committee.

The Boards currently oversee the Funds’ usage of leverage, including the Funds’ incurrence, refinancing and maintenance of leverage and, to the extent necessary or appropriate, authorize or approve the execution of documentation in respect thereto. The Executive Committee of each Fund has authority to make any such authorizations or approvals that are required between regular meetings of the Boards.

The Funds do not have a compensation committee because their executive officers, other than the Funds’ Chief Compliance Officer (“CCO”), do not receive any direct compensation from the Funds and the CCO’s compensation is comprehensively reviewed by the Boards. The role of the Chair of the Boards is to preside over all meetings of the Boards and to act as a liaison with service providers, officers, attorneys, and other Board Members between meetings. The Chair of each Committee performs a similar role with respect to such Committee. The Chair of the Boards or Chair of a Committee may also perform such other functions as may be delegated by the Boards or the Committees from time to time. The Independent Board Members meet regularly outside the presence of the Funds’ management, in executive sessions or with other service providers to the Funds. The Boards have regular meetings five times a year, including a meeting to consider the approval of the Funds’ investment management agreements and, if necessary, may hold special meetings before their next regular meeting. The Audit Committee, the Governance Committee, the Compliance Committee, the Performance Oversight Committee and the Securities Lending Committee each meets regularly and the Executive Committee and the Discount Committee each meets on an ad hoc basis to conduct the oversight functions delegated to that Committee by the Boards and reports its findings to the Boards. The Boards and each standing Committee conduct annual assessments of their oversight function and structure. The Boards have determined that the Boards’ leadership structure is appropriate because it allows the Boards to exercise independent judgment over management and to allocate areas of responsibility among Committees and the Boards to enhance oversight.

The Boards decided to separate the roles of Chief Executive Officer from the Chair because they believe that having an independent Chair:

| | • | | increases the independent oversight of the Funds and enhances the Boards’ objective evaluation of the Chief Executive Officer; |

| | • | | allows the Chief Executive Officer to focus on the Funds’ operations instead of Board administration; |

| | • | | provides greater opportunities for direct and independent communication between shareholders and the Boards; and |

| | • | | provides independent spokespersons for the Funds. |

The Boards have engaged the Advisor to manage the Funds on a

basis. Each Board is responsible for overseeing the Advisor, other service providers, the operations of each Fund and

17

associated risks in accordance with the provisions of the 1940 Act, state law, other applicable laws, each Fund’s charter, and each Fund’s investment objective(s) and strategies. The Boards review, on an ongoing basis, the Funds’ performance, operations, and investment strategies and techniques. The Boards also conduct reviews of the Advisor and its role in running the operations of the Funds.

risk management with respect to the Funds is the responsibility of the Advisor or other service providers (depending on the nature of the risk), subject to the supervision of the Advisor. The Funds are subject to a number of risks, including investment, compliance, operational and valuation risks, among others. While there are a number of risk management functions performed by the Advisor or other service providers, as applicable, it is not possible to eliminate all of the risks applicable to the Funds. Risk oversight is part of the Boards’ general oversight of the Funds and is addressed as part of various Board and Committee activities. The Boards, directly or through Committees, also review reports from, among others, management, the independent registered public accounting firm for the Funds, the Advisor, and internal auditors for the Advisor or its affiliates, as appropriate, regarding risks faced by the Funds and management’s or the service providers’ risk functions. The Committee system facilitates the timely and efficient consideration of matters by the Board Members and facilitates effective oversight of compliance with legal and regulatory requirements and of the Funds’ activities and associated risks. The Boards have approved the appointment of a Chief Compliance Officer, who oversees the implementation and testing of the Funds’ compliance program and reports regularly to the Boards regarding compliance matters for the Funds and their service providers. The Independent Board Members have engaged independent legal counsel to assist them in performing their oversight responsibilities.

Information relating to compensation paid to the Board Members for each Fund’s most recent fiscal year is set forth in

.

Equity Securities Owned by Board Members and Board Nominees

Information relating to the amount of equity securities owned by Board Members/Nominees in the Funds that they oversee as of March 31, 2024 is set forth in

.

Attendance of Board Members at Annual Shareholders’ Meetings

It is the policy of all the Funds to encourage Board Members to attend the annual shareholders’ meeting. All but three of the Board Members of each Fund in office at the time attended last year’s annual shareholders’ meeting.

During the calendar year 2023, the Board of each Fund met nine times. Information relating to the number of times that the Boards met during each Fund’s most recent full fiscal year is set forth in

. No incumbent Board Member attended less than 75% of the aggregate number of meetings of each Board and of each Committee on which the Board Member served during each Fund’s most recently completed full fiscal year.

Information relating to the various standing Committees of the Boards is set forth in

.

Section 16(a) of the Securities Exchange Act of 1934 (the “Exchange Act”) and the rules thereunder require the Funds’ Board Members, executive officers, persons who own, either directly or indirectly, more than ten percent of a registered class of a Fund’s equity securities, the Advisor and certain officers of the Advisor (the “Section 16 insiders”), including in some cases former Section 16 insiders for a period of up to 6 months, to file reports on holdings of, and transactions in, Fund shares with the SEC. Based solely on a review of copies of

18