Table of Contents

SECURITIES AND EXCHANGE COMMISSION

| þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| o | TRANSITION REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| NEBRASKA | 84-0748903 | |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| 121 SOUTH 13TH STREET, SUITE 201 | ||

| LINCOLN, NEBRASKA | 68508 | |

| (Address of principal executive offices) | (Zip Code) |

TITLE OF EACH CLASS

Class A Common Stock, Par Value $0.01 per Share

New York Stock Exchange

None

Yeso Noþ

Yeso Noþ

| Large accelerated filerþ | Accelerated filero | Non-accelerated filero | Smaller reporting companyo |

FORM 10-K

TABLE OF CONTENTS

| PART I | ||||||||

| 2 | ||||||||

| 16 | ||||||||

| 30 | ||||||||

| 30 | ||||||||

| 30 | ||||||||

| 31 | ||||||||

| PART II | ||||||||

| 31 | ||||||||

| 34 | ||||||||

| 36 | ||||||||

| 76 | ||||||||

| 82 | ||||||||

| 82 | ||||||||

| 82 | ||||||||

| 84 | ||||||||

| PART III | ||||||||

| 84 | ||||||||

| 84 | ||||||||

| 84 | ||||||||

| 84 | ||||||||

| 84 | ||||||||

| PART IV | ||||||||

| 85 | ||||||||

| 93 | ||||||||

| Exhibit 12.1 | ||||||||

| Exhibit 21.1 | ||||||||

| Exhibit 23.1 | ||||||||

| Exhibit 31.1 | ||||||||

| Exhibit 31.2 | ||||||||

| Exhibit 32 | ||||||||

Table of Contents

2

Table of Contents

3

Table of Contents

| • | Reduced special allowance payments to for-profit lenders and not-for-profit lenders by 0.55 percentage points and 0.40 percentage points, respectively, for both Stafford and Consolidation loans disbursed on or after October 1, 2007; | ||

| • | Reduced special allowance payments to for-profit lenders and not-for-profit lenders by 0.85 percentage points and 0.70 percentage points, respectively, for PLUS loans disbursed on or after October 1, 2007; | ||

| • | Increased origination fees paid by lenders on all FFELP loan types, from 0.5 percent to 1.0 percent, for all loans first disbursed on or after October 1, 2007; | ||

| • | Eliminated all provisions relating to Exceptional Performer status, and the monetary benefit associated with it, effective October 1, 2007; and | ||

| • | Reduces default insurance to 95 percent of the unpaid principal of such loans, for loans first disbursed on or after October 1, 2012. |

4

Table of Contents

5

Table of Contents

| Year ended December 31, | ||||||||

| 2007 | 2006 | |||||||

| Beginning balance | $ | 23,414,468 | 19,912,955 | |||||

| Direct channel: | ||||||||

| Consolidation loan originations | 3,096,754 | 5,299,820 | ||||||

| Less consolidation of existing portfolio | (1,602,835 | ) | (2,643,880 | ) | ||||

| Net consolidation loan originations | 1,493,919 | 2,655,940 | ||||||

| Stafford/PLUS loan originations | 1,086,398 | 1,035,695 | ||||||

| Branding partner channel | 662,629 | 720,641 | ||||||

| Forward flow channel | 1,105,145 | 1,600,990 | ||||||

| Other channels | 804,019 | 682,852 | ||||||

| Total channel acquisitions | 5,152,110 | 6,696,118 | ||||||

| Repayments, claims, capitalized interest, participations, and other | (1,321,055 | ) | (1,332,086 | ) | ||||

| Consolidation loans lost to external parties | (800,978 | ) | (1,114,040 | ) | ||||

| Loans sold | (115,332 | ) | (748,479 | ) | ||||

| Ending balance | $ | 26,329,213 | 23,414,468 | |||||

6

Table of Contents

7

Table of Contents

8

Table of Contents

9

Table of Contents

| Top FFELP Loan Holders | Top FFELP Stafford and PLUS Originators | Top FFELP Consolidators | ||||||||||||||||||||

| Rank | Name | $ billions | Rank | Name | $ billions | Rank | Name | $ billions | ||||||||||||||

| 1 | Sallie Mae | $ | 102.3 | 1 | JPMorgan Chase | $ | 5.4 | 1 | Sallie Mae | $ | 19.3 | |||||||||||

| 2 | Citigroup | 24.6 | 2 | Sallie Mae | 5.0 | 2 | Citigroup | 4.8 | ||||||||||||||

| 3 | Nelnet | 15.8 | 3 | Nelnet | 4.1 | 3 | Nelnet | 4.1 | ||||||||||||||

| 4 | Wachovia | 10.7 | 4 | Citigroup | 3.3 | 4 | JPMorgan Chase | 2.2 | ||||||||||||||

| 5 | Wells Fargo | 9.6 | 5 | Bank of America | 2.9 | 5 | SunTrust | 1.9 | ||||||||||||||

| 6 | Brazos Group | 9.0 | 6 | Wells Fargo | 2.3 | 6 | Northstar | 1.7 | ||||||||||||||

| 7 | College Loan Corp. | 7.8 | 7 | Wachovia | 2.1 | 7 | Goal Financial | 1.7 | ||||||||||||||

| 8 | JPMorgan Chase | 7.5 | 8 | College Loan Corp. | 1.2 | 8 | College Loan Corp. | 1.6 | ||||||||||||||

| 9 | PHEAA | 6.8 | 9 | U.S. Bancorp | 1.1 | 9 | Brazos Group | 1.6 | ||||||||||||||

| 10 | Goal Financial | 5.3 | 10 | Access Group | 1.1 | 10 | PHEAA | 1.6 | ||||||||||||||

| 1. | Origination and servicing of FFEL Program loans (43.3%); | ||

| 2. | Origination and servicing of non-federally insured student loans (8.0%); and | ||

| 3. | Servicing and support outsourcing for guaranty agencies (48.7%). |

| As of December 31, 2007 | As of December 31, 2006 | |||||||||||||||

| Dollar | Percent | Dollar | Percent | |||||||||||||

| Company | $ | 25,640 | 75.8 | % | $ | 21,869 | 71.5 | % | ||||||||

| Third Party | 8,177 | 24.2 | 8,725 | 28.5 | ||||||||||||

| Total | $ | 33,817 | 100.0 | % | $ | 30,594 | 100.0 | % | ||||||||

10

Table of Contents

| Number of Third-party | ||||

| Product Type | Servicing Customers | |||

| FFELP | 121 | |||

| Private | 19 | |||

| Guaranty | 4 | |||

| Total | 144 | |||

11

Table of Contents

| Top FFELP Loan Servicers | ||||||

| Rank | Name | $ billions | ||||

| 1 | Sallie Mae | $ | 115.2 | |||

| 2 | PHEAA | 32.1 | ||||

| 3 | Nelnet | 29.2 | ||||

| 4 | ACS | 28.8 | ||||

| 5 | Great Lakes | 26.8 | ||||

| 6 | Citigroup | 19.5 | ||||

| 7 | JPMorgan Chase | 10.6 | ||||

| 8 | Wells Fargo | 10.2 | ||||

| 9 | Edfinancial | 6.4 | ||||

| 10 | Express Loan Servicing | 6.3 | ||||

12

Table of Contents

| • | Test preparation study guides and online courses | ||

| • | Admissions consulting | ||

| • | Licensing of scholarship data | ||

| • | Essay and resume editing services | ||

| • | Financial aid products | ||

| • | Student recognition publications | ||

| • | Vendor lead management services | ||

| • | Pay per click management | ||

| • | Email marketing | ||

| • | Admissions lead generation | ||

| • | List marketing services | ||

| • | Call center services |

13

Table of Contents

| • | HELMS/HELM-Net, STAR, and SLSS, systems which are used in the full servicing of FFELP, private, consolidation, and Canadian loans; | ||

| • | Mariner, which is used for consolidation loan origination; | ||

| • | InfoCentre, which is a data warehouse and analysis tool for educational loans; and | ||

| • | Uconnect, a tool to facilitate information sharing between different applications. |

14

Table of Contents

15

Table of Contents

121 South 13th Street, Suite 201

Lincoln, Nebraska 68508

Attention: Secretary

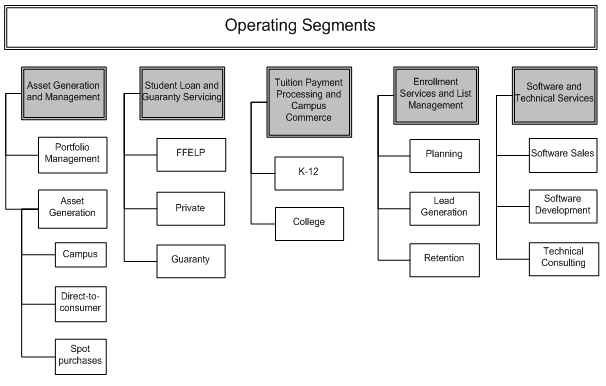

| • | Asset Generation and Management; and | ||

| • | Student Loan and Guaranty Servicing. |

| • | requiring disclosures relating to placement on “preferred lender lists”; | ||

| • | banning various arrangements between lenders and schools; | ||

| • | banning lenders from offering certain gifts to school employees; | ||

| • | eliminating the school-as-lender program; | ||

| • | encouraging borrowers to maximize their borrowing through government loan programs, rather than private loan programs with higher interest rates; | ||

| • | encouraging schools to participate in the Federal Direct Loan Program through increased federal grant funds; and | ||

| • | increasing the lender origination fee for consolidation loans. |

16

Table of Contents

| • | breaches of the Company’s internal control systems, such as a failure to adjust manual or automated servicing functions following a change in regulatory requirements; | ||

| • | privacy issues; | ||

| • | technological defects, such as a malfunction in or destruction of the Company’s computer systems; or | ||

| • | fraud by the Company’s employees or other persons in activities such as borrower payment processing. |

17

Table of Contents

| • | loan origination volume with borrowers attending certain schools; | ||

| • | loan origination volume generated by some of the Company’s branding and forward flow partners; and | ||

| • | loan and guaranty servicing volume generated by some of the Company’s loan servicing and guaranty agency customers. |

18

Table of Contents

19

Table of Contents

20

Table of Contents

| • | Tuition Payment Processing and Campus Commerce; | ||

| • | Enrollment Services and List Management; and | ||

| • | Software and Technical Services. |

21

Table of Contents

22

Table of Contents

23

Table of Contents

24

Table of Contents

| • | declare or pay any dividends or distributions on, or redeem, purchase, acquire or make a liquidation payment regarding, any of the Company’s capital stock; | ||

| • | except as required in connection with the repayment of principal, and except for any partial payments of deferred interest that may be made through the alternative payment mechanism described in the indenture relating to the Hybrid Securities, make any payment of principal of, or interest or premium, if any, on, or repay, repurchase or redeem any of the Company’s debt securities that rankpari passuwith or junior to the Hybrid Securities; or | ||

| • | make any guaranty payments regarding any guaranty by the Company of the subordinated debt securities of any of the Company’s subsidiaries if the guaranty rankspari passu with or junior in interest to the Hybrid Securities. |

25

Table of Contents

| • | pay dividends or distributions in additional shares of the Company’s capital stock; | ||

| • | declare or pay a dividend in connection with the implementation of a shareholders’ rights plan, or issue stock under such a plan, or redeem or repurchase any rights distributed pursuant to such a plan; and | ||

| • | purchase common stock for issuance pursuant to any employee benefit plans. |

26

Table of Contents

| • | changes in interest rates and credit market conditions affecting the cost and availability of financing for the Company’s student loan assets; | ||

| • | changes in the education financing regulatory framework; | ||

| • | changes in demand for education financing or other products and services that the Company offers; | ||

| • | variations in the Company’s quarterly operating results; | ||

| • | changes in financial estimates by securities analysts; | ||

| • | changes in market valuations of comparable companies; and | ||

| • | future sales of the Company’s Class A common stock. |

27

Table of Contents

28

Table of Contents

29

Table of Contents

| Lease | ||||||||

| Approximate | expiration | |||||||

| Location | Primary Function or Segment | square feet | date | |||||

| Lincoln, NE | Corporate Headquarters, Asset Generation and Management, Student Loan and Guaranty Servicing | 137,000 | — | |||||

| Aurora, CO | Asset Generation and Management, Student Loan and Guaranty Servicing, Software and Technical Services | 124,000 | February 2015 | |||||

| Jacksonville, FL | Student Loan and Guaranty Servicing, Software and Technical Services | 109,000 | January 2014 | |||||

| Lawrenceville, NJ | Enrollment Services and List Management | 62,000 | April 2011 | |||||

30

Table of Contents

31

Table of Contents

| 2007 | 2006 | |||||||||||||||||||||||||||||||

| 1st Quarter | 2nd Quarter | 3rd Quarter | 4th Quarter | 1st Quarter | 2nd Quarter | 3rd Quarter | 4th Quarter | |||||||||||||||||||||||||

| High | $ | 27.92 | $ | 28.00 | $ | 24.35 | $ | 19.61 | $ | 43.19 | $ | 42.97 | $ | 40.65 | $ | 30.79 | ||||||||||||||||

| Low | 23.38 | 22.99 | 17.11 | 11.99 | 40.00 | 36.04 | 28.52 | 25.24 | ||||||||||||||||||||||||

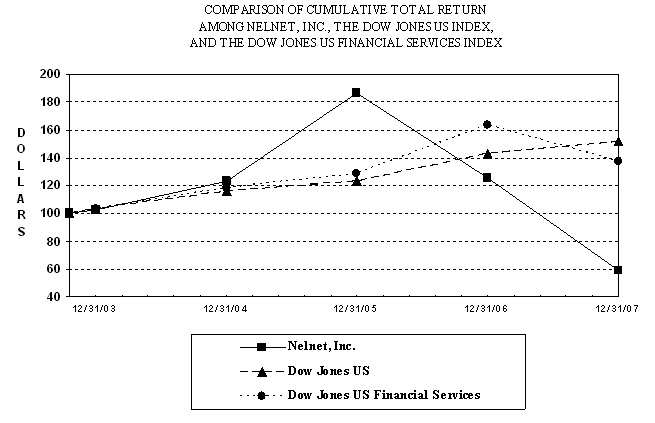

| Company/Index | 12/11/2003 | 12/31/2003 | 12/31/2004 | 12/31/2005 | 12/31/2006 | 12/31/2007 | ||||||||||||||||||

| Nelnet, Inc. | $ | 100.00 | $ | 102.75 | $ | 123.53 | $ | 186.61 | $ | 125.50 | $ | 59.17 | ||||||||||||

| Dow Jones U.S. Index | $ | 100.00 | $ | 103.71 | $ | 116.17 | $ | 123.52 | $ | 142.75 | $ | 151.33 | ||||||||||||

| Dow Jones U.S. Financial Services Index | $ | 100.00 | $ | 103.63 | $ | 118.41 | $ | 128.33 | $ | 163.95 | $ | 137.54 | ||||||||||||

32

Table of Contents

| Total number of | Maximum number | |||||||||||||||

| shares purchased | of shares that may | |||||||||||||||

| Total number | Average | as part of publicly | yet be purchased | |||||||||||||

| of shares | price paid | announced plans | under the plans | |||||||||||||

| Period | purchased (1) | per share | or programs (2) (3) | or programs (4) | ||||||||||||

| October 1 - October 31, 2007 | 3,247 | $ | 18.95 | 3,247 | 6,717,146 | |||||||||||

| November 1 - November 30, 2007 | 65,581 | 16.08 | 65,581 | 7,332,998 | ||||||||||||

| December 1 - December 31, 2007 | 2,100 | 12.85 | 2,100 | 7,555,499 | ||||||||||||

| Total | 70,928 | $ | 16.11 | 70,928 | ||||||||||||

| (1) | The total number of shares includes: (i) shares purchased pursuant to the 2006 Plan discussed in footnote (2) below; and (ii) shares purchased pursuant to the 2006 ESLP discussed in footnote (3) below, of which there were none for the months of October, November, or December 2007. Shares of Class A common stock purchased pursuant to the 2006 Plan included (i) 3,247 shares, 1,169 shares, and 1,515 shares in October, November, and December, respectively, that had been issued to the Company’s 401(k) plan and allocated to employee participant accounts pursuant to the plan’s provisions for Company matching contributions in shares of Company stock, and were purchased by the Company from the plan pursuant to employee participant instructions to dispose of such shares, (ii) 11,312 shares and 585 shares in November and December, respectively, purchased from employees upon termination of employment with the Company, which shares were originally acquired pursuant to the 2006 ESLP, and (iii) 53,100 shares in November purchased in the open market in transactions not related to the 2006 ESLP. | |

| (2) | On May 25, 2006, the Company publicly announced that its Board of Directors had authorized a stock repurchase program to repurchase up to a total of five million shares of the Company’s Class A common stock (the “2006 Plan”). On February 7, 2007, the Company’s Board of Directors increased the total shares the Company is allowed to repurchase to 10 million. The 2006 Plan had an initial expiration date of May 24, 2008, which was extended until May 24, 2010 by the Company’s Board of Directors on January 30, 2008. | |

| (3) | On May 25, 2006, the Company publicly announced that the shareholders of the Company approved an Employee Stock Purchase Loan Plan (the “2006 ESLP”) to allow the Company to make loans to employees for the purchase of shares of the Company’s Class A common stock either in the open market or directly from the Company. A total of $40 million in loans may be made under the 2006 ESLP, and a total of one million shares of Class A common stock are reserved for issuance under the 2006 ESLP. Shares may be purchased directly from the Company or in the open market through a broker at prevailing market prices at the time of purchase, subject to any conditions or restrictions on the timing, volume, or prices of purchases as determined by the Compensation Committee of the Board of Directors and set forth in the Stock Purchase Loan Agreement with the participant. The 2006 ESLP shall terminate May 25, 2016. | |

| (4) | The maximum number of shares that may yet be purchased under the plans is calculated below. There are no assurances that any additional shares will be repurchased under either the 2006 Plan or the 2006 ESLP. Shares under the 2006 ESLP may be issued by the Company rather than purchased in open market transactions. |

| (B / C) | (A + D) | |||||||||||||||||||

| Approximate | Approximate | Approximate | ||||||||||||||||||

| dollar value | Closing price | number of | number of | |||||||||||||||||

| Maximum | of shares that | on the last | shares that may | shares that may | ||||||||||||||||

| number of shares | may yet be | trading day of | yet be | yet be | ||||||||||||||||

| that may yet be | purchased | the Company's | purchased | purchased | ||||||||||||||||

| purchased under | under the | Class A | under the | under the | ||||||||||||||||

| the 2006 Plan | 2006 ESLP | Common Stock | 2006 ESLP | 2006 Plan and | ||||||||||||||||

| As of | (A) | (B) | (C) | (D) | 2006 ESLP | |||||||||||||||

| October 31, 2007 | 4,755,359 | $ | 36,450,000 | $ | 18.58 | 1,961,787 | 6,717,146 | |||||||||||||

| November 30, 2007 | 4,689,778 | 36,450,000 | 13.79 | 2,643,220 | 7,332,998 | |||||||||||||||

| December 31, 2007 | 4,687,678 | 36,450,000 | 12.71 | 2,867,821 | 7,555,499 | |||||||||||||||

33

Table of Contents

| • | During 2004 through 2006, the Company acquired the stock and certain assets of 17 different entities; | ||

| • | The Company began recognizing interest income in 2004 on a loan portfolio in which it earned a minimum interest rate of 9.5 percent. Interest income earned on this portfolio decreased as a result of rising interest rates and the pay down of the portfolio. As a result of the Company’s settlement entered into with the Department, beginning July 1, 2006 the Company no longer recognizes 9.5 percent floor income on this loan portfolio; | ||

| • | In May 2007, the Company sold EDULINX, a Canadian student loan service provider and subsidiary of the Company. As a result of this transaction, the results of operations for EDULINX are reported as discontinued operations for all periods presented; | ||

| • | Upon passage of the College Cost Reduction Act in September 2007, management evaluated the carrying amount of goodwill and certain intangible assets. Based on the legislative changes and the student loan business model modifications the Company implemented as a result of the legislative changes, the Company recorded an impairment charge of $39.4 million; | ||

| • | In September 2007, the Company recorded an expense of $15.7 million to increase the Company’s allowance for loan losses related to the increase in risk share as a result of the elimination of the Exceptional Performer program; and | ||

| • | In September 2007, the Company announced a strategic initiative to create efficiencies and lower costs in advance of the enactment of the College Cost Reduction Act, which impacted the FFEL Program in which the Company participates. As a result of these strategic decisions, the Company recorded restructuring charges of $20.3 million. |

34

Table of Contents

| Year ended Decmber 31, | ||||||||||||||||||||

| 2007 | 2006 | 2005 | 2004 | 2003 | ||||||||||||||||

| (dollars in thousands, except share data) | ||||||||||||||||||||

Income Statement Data: | ||||||||||||||||||||

| Net interest income | $ | 244,614 | 308,459 | 328,999 | 398,160 | 171,722 | ||||||||||||||

| Less provision (recovery) for loan losses | 28,178 | 15,308 | 7,030 | (529 | ) | 11,475 | ||||||||||||||

| Net interest income after provision (recovery) for loan losses | 216,436 | 293,151 | 321,969 | 398,689 | 160,247 | |||||||||||||||

| Other income | 330,835 | 263,166 | 145,801 | 119,893 | 121,976 | |||||||||||||||

| Derivative market value, foreign currency, and put option adjustments | 26,806 | (31,075 | ) | 96,227 | (11,918 | ) | (1,183 | ) | ||||||||||||

| Derivative settlements, net | 18,677 | 23,432 | (17,008 | ) | (34,140 | ) | (1,601 | ) | ||||||||||||

| Salaries and benefits | (236,631 | ) | (214,676 | ) | (142,132 | ) | (130,840 | ) | (124,273 | ) | ||||||||||

| Amortization of intangible assets | (30,426 | ) | (25,062 | ) | (8,151 | ) | (8,707 | ) | (12,766 | ) | ||||||||||

| Impairment expense | (49,504 | ) | (21,488 | ) | — | — | — | |||||||||||||

| Other operating expenses | (219,048 | ) | (185,053 | ) | (117,448 | ) | (98,580 | ) | (96,111 | ) | ||||||||||

| Income before income taxes and minority interest | 57,145 | 102,395 | 279,258 | 234,397 | 46,289 | |||||||||||||||

| Income from continuing operations | 35,429 | 65,916 | 178,074 | 149,170 | 27,103 | |||||||||||||||

| Income (loss) from discontinued operations, net of tax | (2,575 | ) | 2,239 | 3,048 | 9 | — | ||||||||||||||

| Net income | 32,854 | 68,155 | 181,122 | 149,179 | 27,103 | |||||||||||||||

| Earnings per share, basic and diluted: | ||||||||||||||||||||

| Continuing operations | $ | 0.71 | 1.23 | 3.31 | 2.78 | 0.60 | ||||||||||||||

| Discontinued operations | (0.05 | ) | 0.04 | 0.06 | — | — | ||||||||||||||

| Net income | 0.66 | 1.27 | 3.37 | 2.78 | 0.60 | |||||||||||||||

| Weighted average shares outstanding (basic) | 49,618,107 | 53,593,056 | 53,761,727 | 53,648,605 | 45,501,583 | |||||||||||||||

| Weighted average shares outstanding (diluted) | 49,628,802 | 53,593,056 | 53,761,727 | 53,648,605 | 45,501,583 | |||||||||||||||

| Dividends per common share | $ | 0.28 | — | — | — | — | ||||||||||||||

Other Data: | ||||||||||||||||||||

| Origination and acquisition volume (a) | $ | 5,152,110 | 6,696,118 | 8,471,121 | 4,070,529 | 3,093,014 | ||||||||||||||

| Average student loans | 25,143,059 | 21,696,466 | 15,716,388 | 11,809,663 | 9,316,354 | |||||||||||||||

| Student loans serviced (at end of period) (b) | 33,817,458 | 30,593,592 | 26,988,839 | 21,076,045 | 18,773,899 | |||||||||||||||

Ratios: | ||||||||||||||||||||

| Core student loan spread | 1.13 | % | 1.42 | % | 1.51 | % | 1.66 | % | 1.78 | % | ||||||||||

| Net loan charge-offs as a percentage of average student loans | 0.030 | % | 0.012 | % | 0.006 | % | 0.070 | % | 0.080 | % | ||||||||||

| Shareholders’ equity to total assets (at end of period) | 2.09 | % | 2.51 | % | 2.85 | % | 3.01 | % | 2.56 | % | ||||||||||

| As of December 31, | ||||||||||||||||||||

| 2007 | 2006 | 2005 | 2004 | 2003 | ||||||||||||||||

| (dollars in thousands) | ||||||||||||||||||||

Balance Sheet Data: | ||||||||||||||||||||

| Cash and cash equivalents | $ | 111,746 | 102,343 | 96,678 | 41,181 | 198,423 | ||||||||||||||

| Student loans receivables, net | 26,736,122 | 23,789,552 | 20,260,807 | 13,461,814 | 10,455,442 | |||||||||||||||

| Goodwill and intangible assets | 277,525 | 353,008 | 243,630 | 16,792 | 11,630 | |||||||||||||||

| Total assets | 29,162,783 | 26,796,873 | 22,798,693 | 15,169,511 | 11,932,831 | |||||||||||||||

| Bonds and notes payable | 28,115,829 | 25,562,119 | 21,673,620 | 14,300,606 | 11,366,458 | |||||||||||||||

| Shareholders’ equity | 608,879 | 671,850 | 649,492 | 456,175 | 305,489 | |||||||||||||||

| (a) | Initial loans originated or acquired through various channels, including originations through the direct channel; acquisitions through the branding partner channel, the forward flow channel, and the secondary market (spot purchases); and loans acquired in portfolio and business acquisitions. | |

| (b) | The student loans serviced does not include loans serviced by EDULINX for all periods presented. |

35

Table of Contents

| • | Fee-based revenue for the year ended December 31, 2007 was 56% of total revenues compared to 44% for the year ended December 31, 2006. | ||

| • | Fee-based revenue increased $71.8 million, or 30%, from $239.8 million for the year ended December 31, 2006 to $311.6 million for the year ended December 31, 2007. | ||

| • | Operating expenses, excluding acquisitions and restructuring and legislative charges, increased $5.0 million, or 1.2%, from $399.7 million for the year ended December 31, 2006 to $404.7 million for the year ended December 31, 2007. | ||

| • | The Company repurchased 3.4 million shares of its Class A common stock for $82.1 million during the year ended December 31, 2007. | ||

| • | The Company paid a cash dividend of $0.07 per share on the Company’s Class A and Class B common stock on March 15, 2007, June 15, 2007, September 15, 2007, and December 17, 2007. Total dividends paid in 2007 was $13.8 million. | ||

| • | As of December 31, 2007, student loan assets were $26.7 billion, an increase of $2.9 billion, or 12.4%, compared to December 31, 2006. |

| • | The Company sold EDULINX and is reporting this transaction as discontinued operations; | ||

| • | The College Cost Reduction Act was enacted; | ||

| • | The Company initiated a restructuring plan; and | ||

| • | The debt and secondary markets experienced unprecedented disruptions. |

| • | Reduced special allowance payments to for-profit lenders and not-for-profit lenders by 0.55 percentage points and 0.40 percentage points, respectively, for both Stafford and Consolidation loans disbursed on or after October 1, 2007; | ||

| • | Reduced special allowance payments to for-profit lenders and not-for-profit lenders by 0.85 percentage points and 0.70 percentage points, respectively, for PLUS loans disbursed on or after October 1, 2007; |

36

Table of Contents

| • | Increased origination fees paid by lenders on all FFELP loan types, from 0.5 percent to 1.0 percent, for all loans first disbursed on or after October 1, 2007; | ||

| • | Eliminated all provisions relating to Exceptional Performer status, and the monetary benefit associated with it, effective October 1, 2007; and | ||

| • | For loans first disbursed on or after October 1, 2012, reduces default insurance to 95 percent of the unpaid principal of such loans. |

37

Table of Contents

38

Table of Contents

| • | Reduced special allowance payments to for-profit lenders and not-for-profit lenders by 0.55 percentage points and 0.40 percentage points, respectively, for both Stafford and Consolidation loans disbursed on or after October 1, 2007; | ||

| • | Reduced special allowance payments to for-profit lenders and not-for-profit lenders by 0.85 percentage points and 0.70 percentage points, respectively, for PLUS loans disbursed on or after October 1, 2007; | ||

| • | Increased origination fees paid by lenders on all FFELP loan types, from 0.5 percent to 1.0 percent, for all loans first disbursed on or after October 1, 2007; | ||

| • | Eliminated all provisions relating to Exceptional Performer status, and the monetary benefit associated with it, effective October 1, 2007; and | ||

| • | Reduces default insurance to 95 percent of the unpaid principal of such loans, for loans first disbursed on or after October 1, 2012. |

39

Table of Contents

40

Table of Contents

| Year ended | ||||||||||||

| December 31, | December 31, | |||||||||||

| 2007 | 2006 | $ Change | ||||||||||

| Interest income: | ||||||||||||

| Loan interest | $ | 1,667,057 | 1,455,715 | 211,342 | ||||||||

| Investment interest | 80,219 | 93,918 | (13,699 | ) | ||||||||

| Total interest income | 1,747,276 | 1,549,633 | 197,643 | |||||||||

| Interest expense: | ||||||||||||

| Interest on bonds and notes payable | 1,502,662 | 1,241,174 | 261,488 | |||||||||

| Net interest income | 244,614 | 308,459 | (63,845 | ) | ||||||||

| Provision for loan losses | 28,178 | 15,308 | 12,870 | |||||||||

| Net interest income after provision for loan losses | $ | 216,436 | 293,151 | (76,715 | ) | |||||||

| Year ended | ||||||||||||

| December 31, | December 31, | |||||||||||

| 2007 | 2006 | $ Change | ||||||||||

| Loan and guaranty servicing income | $ | 128,069 | 121,593 | 6,476 | ||||||||

| Other fee-based income | 160,888 | 102,318 | 58,570 | |||||||||

| Software services income | 22,669 | 15,890 | 6,779 | |||||||||

| Other income | 19,209 | 23,365 | (4,156 | ) | ||||||||

| Derivative market value, foreign currency, and put option adjustments | 26,806 | (31,075 | ) | 57,881 | ||||||||

| Derivative settlements, net | 18,677 | 23,432 | (4,755 | ) | ||||||||

| Total other income | $ | 376,318 | 255,523 | 120,795 | ||||||||

| • | Loan and guaranty servicing income increased due to an increase in guaranty servicing income which was offset by a decrease in FFELP loan servicing income. | ||

| • | Other fee-based income increased due to business acquisitions, an increase in the number of managed tuition payment plans, an increase in campus commerce and related clients, and an increase in lead generation sales due to additional customers. |

41

Table of Contents

| • | Software services income increased as a result of new customers, additional projects for existing customers, and increased fees. | ||

| • | Other income decreased as a result of a decrease in gains on the sales of student loan assets of $13.0 million, offset by a gain on the sale of an entity accounted for under the equity method of $3.9 million in September 2007. The remaining change is a result of income earned on certain investment activities. | ||

| • | The change in derivative market value, foreign currency, and put option adjustments was caused by a change in the fair value of the Company’s derivative portfolio and foreign currency rate fluctuations which are further discussed in Item 7A, “Quantitative and Qualitative Disclosures about Market Risk.” | ||

| • | The change in derivative settlements is discussed in Item 7A, “Quantitative and Qualitative Disclosures about Market Risk.” |

| Net change | ||||||||||||||||||||

| after impact of | ||||||||||||||||||||

| Impact of | acquisitions and | |||||||||||||||||||

| Year ended | Impact of | restructuring and | restructuring and | Year ended | ||||||||||||||||

| December 31, 2006 | acquisitions | impairment charges | impairment charges | December 31, 2007 | ||||||||||||||||

| Salaries and benefits | $ | 214,676 | 13,562 | 6,315 | 2,078 | 236,631 | ||||||||||||||

| Other expenses | 185,053 | 27,112 | 3,916 | 2,967 | 219,048 | |||||||||||||||

| Amortization of intangible assets | 25,062 | 5,364 | — | — | 30,426 | |||||||||||||||

| Impairment expense | 21,488 | — | 28,016 | — | 49,504 | |||||||||||||||

| Total operating expenses | $ | 446,279 | 46,038 | 38,247 | 5,045 | 535,609 | ||||||||||||||

42

Table of Contents

| Year ended | ||||||||||||

| December 31, | December 31, | |||||||||||

| 2006 | 2005 | $ Change | ||||||||||

| Interest income: | ||||||||||||

| Loan interest | $ | 1,455,715 | 904,949 | 550,766 | ||||||||

| Investment Interest | 93,918 | 44,161 | 49,757 | |||||||||

| Total interest income | 1,549,633 | 949,110 | 600,523 | |||||||||

| Interest expense: | ||||||||||||

| Interest on bonds and notes payable | 1,241,174 | 620,111 | 621,063 | |||||||||

| Net interest income | 308,459 | 328,999 | (20,540 | ) | ||||||||

| Provision for loan losses | 15,308 | 7,030 | 8,278 | |||||||||

| Net interest income after provision for loan losses | $ | 293,151 | 321,969 | (28,818 | ) | |||||||

| Year ended | ||||||||||||

| December 31, | December 31, | |||||||||||

| 2006 | 2005 | $ Change | ||||||||||

| Loan and guaranty servicing income | $ | 121,593 | 93,332 | 28,261 | ||||||||

| Other fee-based income | 102,318 | 35,641 | 66,677 | |||||||||

| Software services income | 15,890 | 9,169 | 6,721 | |||||||||

| Other income | 23,365 | 7,659 | 15,706 | |||||||||

| Derivative market value, foreign currency, and put option adjustments | (31,075 | ) | 96,227 | (127,302 | ) | |||||||

| Derivative settlements, net | 23,432 | (17,008 | ) | 40,440 | ||||||||

| Total other income | $ | 255,523 | 225,020 | 30,503 | ||||||||

| • | Loan and guaranty servicing income increased due to growth from acquisitions offset by a decrease in FFELP loan servicing income. | ||

| • | Other fee-based income increased largely due to recent acquisitions. In addition, the Company experienced an increase in borrower late fee income related to loan portfolio growth, an increase in the number of managed tuition payment plans, and an increase in list sales volume. | ||

| • | Software services income increased due to the acquisition of 5280 Solutions, LLC (“5280”). | ||

| • | Other income increased as a result of the gains on the sales of student loan assets. | ||

| • | The change in derivative market value, foreign currency, and put option adjustments was caused by a change in the fair value of the Company’s derivative portfolio and foreign currency rate fluctuations which are further discussed in Item 7A, “Quantitative and Qualitative Disclosures about Market Risk.” | ||

| • | The change in derivative settlements is discussed in Item 7A, “Quantitative and Qualitative Disclosures about Market Risk.” |

43

Table of Contents

| Net change | ||||||||||||||||||||

| after impact of | ||||||||||||||||||||

| Year ended | Impact of | Impact of | acquisitions and | Year ended | ||||||||||||||||

| December 31, 2005 | acquisitions | impairment charges | impairment charges | December 31, 2006 | ||||||||||||||||

| Salaries and benefits | $ | 142,132 | 60,222 | — | 12,322 | 214,676 | ||||||||||||||

| Other expenses | 117,448 | 65,709 | — | 1,896 | 185,053 | |||||||||||||||

| Amortization of intangible assets | 8,151 | 16,911 | — | — | 25,062 | |||||||||||||||

| Impairment expense | — | — | 21,488 | — | 21,488 | |||||||||||||||

| Total operating expenses | $ | 267,731 | 142,842 | 21,488 | 14,218 | 446,279 | ||||||||||||||

| As of December 31, | Change | |||||||||||||||

| 2007 | 2006 | Dollars | Percent | |||||||||||||

Assets: | ||||||||||||||||

| Student loans receivable, net | $ | 26,736,122 | 23,789,552 | 2,946,570 | 12.4 | % | ||||||||||

| Cash, cash equivalents, and investments | 1,120,838 | 1,773,751 | (652,913 | ) | (36.8 | ) | ||||||||||

| Goodwill | 164,695 | 191,420 | (26,725 | ) | (14.0 | ) | ||||||||||

| Intangible assets, net | 112,830 | 161,588 | (48,758 | ) | (30.2 | ) | ||||||||||

| Fair value of derivative instruments | 222,471 | 146,099 | 76,372 | 52.3 | ||||||||||||

| Assets of discontinued operations | — | 27,309 | (27,309 | ) | (100.0 | ) | ||||||||||

| Other assets | 805,827 | 707,154 | 98,673 | 14.0 | ||||||||||||

| Total assets | $ | 29,162,783 | 26,796,873 | 2,365,910 | 8.8 | % | ||||||||||

Liabilities: | ||||||||||||||||

| Bonds and notes payable | $ | 28,115,829 | 25,562,119 | 2,553,710 | 10.0 | % | ||||||||||

| Fair value of derivative instruments | 5,885 | 27,973 | (22,088 | ) | (79.0 | ) | ||||||||||

| Other liabilities | 432,190 | 534,931 | (102,741 | ) | (19.2 | ) | ||||||||||

| Total liabilities | 28,553,904 | 26,125,023 | 2,428,881 | 9.3 | ||||||||||||

Shareholders’ equity | 608,879 | 671,850 | (62,971 | ) | (9.4 | ) | ||||||||||

| Total liabilities and shareholders’ equity | $ | 29,162,783 | $ | 26,796,873 | $ | 2,365,910 | 8.8 | % | ||||||||

44

Table of Contents

45

Table of Contents

| Year ended December 31, 2007 | ||||||||||||||||||||||||||||||||||||||||

| Student | Tuition | Enrollment | "Base net | |||||||||||||||||||||||||||||||||||||

| Asset | Loan | Payment | Services | Software | Corporate | income" | ||||||||||||||||||||||||||||||||||

| Generation | and | Processing | and | and | Activity | Eliminations | Adjustments | GAAP | ||||||||||||||||||||||||||||||||

| and | Guaranty | and Campus | List | Technical | Total | and | and | to GAAP | Results of | |||||||||||||||||||||||||||||||

| Management | Servicing | Commerce | Management | Services | Segments | Overhead | Reclassifications | Results | Operations | |||||||||||||||||||||||||||||||

| Total interest income | $ | 1,730,882 | 5,459 | 3,809 | 347 | 18 | 1,740,515 | 7,485 | (3,737 | ) | 3,013 | 1,747,276 | ||||||||||||||||||||||||||||

| Interest expense | 1,465,883 | — | 7 | 7 | — | 1,465,897 | 40,502 | (3,737 | ) | — | 1,502,662 | |||||||||||||||||||||||||||||

| Net interest income | 264,999 | 5,459 | 3,802 | 340 | 18 | 274,618 | (33,017 | ) | — | 3,013 | 244,614 | |||||||||||||||||||||||||||||

| Less provision for loan losses | 28,178 | — | — | — | — | 28,178 | — | — | — | 28,178 | ||||||||||||||||||||||||||||||

| Net interest income after provision for loan losses | 236,821 | 5,459 | 3,802 | 340 | 18 | 246,440 | (33,017 | ) | — | 3,013 | 216,436 | |||||||||||||||||||||||||||||

| Other income: | ||||||||||||||||||||||||||||||||||||||||

| Loan and guaranty servicing income | 294 | 127,775 | — | — | — | 128,069 | — | — | — | 128,069 | ||||||||||||||||||||||||||||||

| Other fee-based income | 13,387 | — | 42,682 | 103,311 | — | 159,380 | 1,508 | — | — | 160,888 | ||||||||||||||||||||||||||||||

| Software services income | — | — | — | 594 | 22,075 | 22,669 | — | — | — | 22,669 | ||||||||||||||||||||||||||||||

| Other income | 8,030 | — | 84 | — | — | 8,114 | 11,095 | — | — | 19,209 | ||||||||||||||||||||||||||||||

| Intersegment revenue | — | 74,687 | 688 | 891 | 15,683 | 91,949 | 9,040 | (100,989 | ) | — | — | |||||||||||||||||||||||||||||

| Derivative market value, foreign currency, and put option adjustments | — | — | — | — | — | — | — | — | 26,806 | 26,806 | ||||||||||||||||||||||||||||||

| Derivative settlements, net | 6,628 | — | — | — | — | 6,628 | 12,049 | — | — | 18,677 | ||||||||||||||||||||||||||||||

| Total other income | 28,339 | 202,462 | 43,454 | 104,796 | 37,758 | 416,809 | 33,692 | (100,989 | ) | 26,806 | 376,318 | |||||||||||||||||||||||||||||

| Operating expenses: | ||||||||||||||||||||||||||||||||||||||||

| Salaries and benefits | 23,101 | 85,462 | 20,426 | 33,480 | 23,959 | 186,428 | 49,839 | (1,747 | ) | 2,111 | 236,631 | |||||||||||||||||||||||||||||

| Restructure expense — severance and contract termination costs | 2,406 | 1,840 | — | 929 | 58 | 5,233 | 4,998 | (10,231 | ) | — | — | |||||||||||||||||||||||||||||

| Impairment expense | 28,291 | — | — | 11,401 | — | 39,692 | 9,812 | — | — | 49,504 | ||||||||||||||||||||||||||||||

| Other expenses | 29,205 | 36,618 | 8,901 | 60,445 | 2,995 | 138,164 | 77,915 | 2,969 | 30,426 | 249,474 | ||||||||||||||||||||||||||||||

| Intersegment expenses | 74,714 | 10,552 | 364 | 335 | 775 | 86,740 | 5,240 | (91,980 | ) | — | — | |||||||||||||||||||||||||||||

| Total operating expenses | 157,717 | 134,472 | 29,691 | 106,590 | 27,787 | 456,257 | 147,804 | (100,989 | ) | 32,537 | 535,609 | |||||||||||||||||||||||||||||

| Income (loss) before income taxes | 107,443 | 73,449 | 17,565 | (1,454 | ) | 9,989 | 206,992 | (147,129 | ) | — | (2,718 | ) | 57,145 | |||||||||||||||||||||||||||

| Income tax expense (benefit) (a) | 40,828 | 27,910 | 6,675 | (553 | ) | 3,796 | 78,656 | (57,285 | ) | — | 345 | 21,716 | ||||||||||||||||||||||||||||

| Net income (loss) from continuing operations | 66,615 | 45,539 | 10,890 | (901 | ) | 6,193 | 128,336 | (89,844 | ) | — | (3,063 | ) | 35,429 | |||||||||||||||||||||||||||

| Income (loss) from discontinued operations, net of tax | — | — | — | — | — | — | — | — | (2,575 | ) | (2,575 | ) | ||||||||||||||||||||||||||||

| Net income (loss) | $ | 66,615 | 45,539 | 10,890 | (901 | ) | 6,193 | 128,336 | (89,844 | ) | — | (5,638 | ) | 32,854 | ||||||||||||||||||||||||||

| Total assets | $ | 28,696,640 | 206,008 | 119,084 | 121,202 | 21,186 | 29,164,120 | 48,147 | (49,484 | ) | — | 29,162,783 | ||||||||||||||||||||||||||||

| Year ended December 31, 2007: | ||||||||||||||||||||||||||||||||||||||||

| After Tax Operating Margin - excluding restructure expense, impairment expense, and provision for loan losses related to the loss of Exceptional Performer | 34.0 | % | 22.5 | % | 23.0 | % | 6.4 | % | 16.5 | % | 24.0 | % | ||||||||||||||||||||||||||||

| Year ended December 31, 2006: | ||||||||||||||||||||||||||||||||||||||||

| After Tax Operating Margin - excluding impairment expense | 34.5 | % | 20.8 | % | 19.7 | % | 11.6 | % | 15.1 | % | 26.8 | % | ||||||||||||||||||||||||||||

| Year ended December 31, 2005: | ||||||||||||||||||||||||||||||||||||||||

| After Tax Operating Margin | 40.2 | % | 21.6 | % | 18.4 | % | 29.7 | % | 28.1 | % | 33.7 | % | ||||||||||||||||||||||||||||

| (a) | Income taxes are based on a percentage of net income before tax for the individual operating segment. |

46

Table of Contents

| Year ended December 31, 2006 | ||||||||||||||||||||||||||||||||||||||||

| Student | Tuition | Enrollment | "Base net | |||||||||||||||||||||||||||||||||||||

| Asset | Loan | Payment | Services | Software | Corporate | income" | ||||||||||||||||||||||||||||||||||

| Generation | and | Processing | and | and | Activity | Eliminations | Adjustments | GAAP | ||||||||||||||||||||||||||||||||

| and | Guaranty | and Campus | List | Technical | Total | and | and | to GAAP | Results of | |||||||||||||||||||||||||||||||

| Management | Servicing | Commerce | Management | Services | Segments | Overhead | Reclassifications | Results | Operations | |||||||||||||||||||||||||||||||

| Total interest income | $ | 1,534,423 | 8,957 | 4,029 | 531 | 105 | 1,548,045 | 4,446 | (2,858 | ) | — | 1,549,633 | ||||||||||||||||||||||||||||

| Interest expense | 1,215,529 | — | 8 | — | — | 1,215,537 | 28,495 | (2,858 | ) | — | 1,241,174 | |||||||||||||||||||||||||||||

| Net interest income | 318,894 | 8,957 | 4,021 | 531 | 105 | 332,508 | (24,049 | ) | — | — | 308,459 | |||||||||||||||||||||||||||||

| Less provision for loan losses | 15,308 | — | — | — | — | 15,308 | — | — | — | 15,308 | ||||||||||||||||||||||||||||||

| Net interest income after provision for loan losses | 303,586 | 8,957 | 4,021 | 531 | 105 | 317,200 | (24,049 | ) | — | — | 293,151 | |||||||||||||||||||||||||||||

| Other income: | ||||||||||||||||||||||||||||||||||||||||

| Loan and guaranty servicing income | — | 121,593 | — | — | — | 121,593 | — | — | — | 121,593 | ||||||||||||||||||||||||||||||

| Other fee-based income | 11,867 | — | 35,090 | 55,361 | — | 102,318 | — | — | — | 102,318 | ||||||||||||||||||||||||||||||

| Software services income | 238 | 5 | — | 157 | 15,490 | 15,890 | — | — | — | 15,890 | ||||||||||||||||||||||||||||||

| Other income | 19,966 | 97 | — | — | — | 20,063 | 3,302 | — | — | 23,365 | ||||||||||||||||||||||||||||||

| Intersegment revenue | — | 63,545 | 503 | 1,000 | 17,877 | 82,925 | 662 | (83,587 | ) | — | — | |||||||||||||||||||||||||||||

| Derivative market value, foreign currency, and put option adjustments | — | — | — | — | — | — | — | — | (31,075 | ) | (31,075 | ) | ||||||||||||||||||||||||||||

| Derivative settlements, net | 18,381 | — | — | — | — | 18,381 | 5,051 | — | — | 23,432 | ||||||||||||||||||||||||||||||

| Total other income | 50,452 | 185,240 | 35,593 | 56,518 | 33,367 | 361,170 | 9,015 | (83,587 | ) | (31,075 | ) | 255,523 | ||||||||||||||||||||||||||||

| Operating expenses: | ||||||||||||||||||||||||||||||||||||||||

| Salaries and benefits | 53,036 | 83,988 | 17,607 | 15,510 | 22,063 | 192,204 | 32,979 | (12,254 | ) | 1,747 | 214,676 | |||||||||||||||||||||||||||||

| Impairment expense | 21,687 | — | — | — | — | 21,687 | (199 | ) | — | — | 21,488 | |||||||||||||||||||||||||||||

| Other expenses | 51,085 | 32,419 | 8,371 | 30,854 | 3,238 | 125,967 | 59,086 | — | 25,062 | 210,115 | ||||||||||||||||||||||||||||||

| Intersegment expenses | 52,857 | 12,577 | 1,025 | 17 | — | 66,476 | 4,857 | (71,333 | ) | — | — | |||||||||||||||||||||||||||||

| Total operating expenses | 178,665 | 128,984 | 27,003 | 46,381 | 25,301 | 406,334 | 96,723 | (83,587 | ) | 26,809 | 446,279 | |||||||||||||||||||||||||||||

| Income (loss) before income taxes | 175,373 | 65,213 | 12,611 | 10,668 | 8,171 | 272,036 | (111,757 | ) | — | (57,884 | ) | 102,395 | ||||||||||||||||||||||||||||

| Income tax expense (benefit) (a) | 66,642 | 24,780 | 4,791 | 4,054 | 3,105 | 103,372 | (46,902 | ) | — | (20,233 | ) | 36,237 | ||||||||||||||||||||||||||||

| Net income (loss) before minority interest | 108,731 | 40,433 | 7,820 | 6,614 | 5,066 | 168,664 | (64,855 | ) | — | (37,651 | ) | 66,158 | ||||||||||||||||||||||||||||

| Minority interest in subsidiary income | — | — | (242 | ) | — | — | (242 | ) | — | — | — | (242 | ) | |||||||||||||||||||||||||||

| Net income (loss) from continuing operations | 108,731 | 40,433 | 7,578 | 6,614 | 5,066 | 168,422 | (64,855 | ) | — | (37,651 | ) | 65,916 | ||||||||||||||||||||||||||||

| Income from discontinued operations, net of tax | — | — | — | — | — | — | — | — | 2,239 | 2,239 | ||||||||||||||||||||||||||||||

| Net income (loss) | $ | 108,731 | 40,433 | 7,578 | 6,614 | 5,066 | 168,422 | (64,855 | ) | — | (35,412 | ) | 68,155 | |||||||||||||||||||||||||||

| Total assets | $ | 26,174,592 | 398,939 | 177,105 | 152,962 | 29,359 | 26,932,957 | 37,268 | (200,661 | ) | 27,309 | 26,796,873 | ||||||||||||||||||||||||||||

| (a) | Income taxes are based on a percentage of net income before tax for the individual operating segment. |

47

Table of Contents

| Year ended December 31, 2005 | ||||||||||||||||||||||||||||||||||||||||

| Student | Tuition | Enrollment | "Base net | |||||||||||||||||||||||||||||||||||||

| Asset | Loan | Payment | Services | Software | Corporate | income" | ||||||||||||||||||||||||||||||||||

| Generation | and | Processing | and | and | Activity | Eliminations | Adjustments | GAAP | ||||||||||||||||||||||||||||||||

| and | Guaranty | and Campus | List | Technical | Total | and | and | to GAAP | Results of | |||||||||||||||||||||||||||||||

| Management | Servicing | Commerce | Management | Services | Segments | Overhead | Reclassifications | Results | Operations | |||||||||||||||||||||||||||||||

| Total interest income | $ | 940,390 | 4,580 | 1,384 | 165 | 21 | 946,540 | 2,615 | (45 | ) | — | 949,110 | ||||||||||||||||||||||||||||

| Interest expense | 609,863 | — | — | — | — | 609,863 | 10,293 | (45 | ) | — | 620,111 | |||||||||||||||||||||||||||||

| Net interest income | 330,527 | 4,580 | 1,384 | 165 | 21 | 336,677 | (7,678 | ) | — | — | 328,999 | |||||||||||||||||||||||||||||

| Less provision for loan losses | 7,030 | — | — | — | — | 7,030 | — | — | — | 7,030 | ||||||||||||||||||||||||||||||

| Net interest income after provision for loan losses | 323,497 | 4,580 | 1,384 | 165 | 21 | 329,647 | (7,678 | ) | — | — | 321,969 | |||||||||||||||||||||||||||||

| Other income (expense): | ||||||||||||||||||||||||||||||||||||||||

| Loan and guaranty servicing income | — | 93,332 | — | — | — | 93,332 | — | — | — | 93,332 | ||||||||||||||||||||||||||||||

| Other fee-based income | 9,053 | — | 14,239 | 12,349 | — | 35,641 | — | — | — | 35,641 | ||||||||||||||||||||||||||||||

| Software services income | 127 | — | — | — | 9,042 | 9,169 | — | — | — | 9,169 | ||||||||||||||||||||||||||||||

| Other income | 3,596 | 14 | — | — | — | 3,610 | 4,049 | — | — | 7,659 | ||||||||||||||||||||||||||||||

| Intersegment revenue | — | 42,798 | — | 139 | 5,848 | 48,785 | 408 | (49,193 | ) | — | — | |||||||||||||||||||||||||||||

| Derivative market value, foreign currency, and put option adjustments | — | — | — | — | — | — | — | — | 96,227 | 96,227 | ||||||||||||||||||||||||||||||

| Derivative settlements, net | (17,008 | ) | — | — | — | — | (17,008 | ) | — | — | — | (17,008 | ) | |||||||||||||||||||||||||||

| Total other income (expense) | (4,232 | ) | 136,144 | 14,239 | 12,488 | 14,890 | 173,529 | 4,457 | (49,193 | ) | 96,227 | 225,020 | ||||||||||||||||||||||||||||

| Operating expenses: | ||||||||||||||||||||||||||||||||||||||||

| Salaries and benefits | 39,482 | 62,204 | 7,065 | 3,081 | 7,197 | 119,029 | 33,555 | (10,452 | ) | — | 142,132 | |||||||||||||||||||||||||||||

| Other expenses | 39,659 | 24,269 | 3,815 | 3,512 | 968 | 72,223 | 45,225 | — | 8,151 | 125,599 | ||||||||||||||||||||||||||||||

| Intersegment expenses | 33,070 | 5,196 | 99 | — | (8 | ) | 38,357 | 384 | (38,741 | ) | — | — | ||||||||||||||||||||||||||||

| Total operating expenses | 112,211 | 91,669 | 10,979 | 6,593 | 8,157 | 229,609 | 79,164 | (49,193 | ) | 8,151 | 267,731 | |||||||||||||||||||||||||||||

| Income (loss) before income taxes | 207,054 | 49,055 | 4,644 | 6,060 | 6,754 | 273,567 | (82,385 | ) | — | 88,076 | 279,258 | |||||||||||||||||||||||||||||

| Income tax expense (benefit) (a) | 78,680 | 18,641 | 1,765 | 2,302 | 2,567 | 103,955 | (36,701 | ) | — | 33,327 | 100,581 | |||||||||||||||||||||||||||||

| Net income (loss) before minority interest | 128,374 | 30,414 | 2,879 | 3,758 | 4,187 | 169,612 | (45,684 | ) | — | 54,749 | 178,677 | |||||||||||||||||||||||||||||

| Minority interest in subsidiary income | — | — | (603 | ) | — | — | (603 | ) | — | — | — | (603 | ) | |||||||||||||||||||||||||||

| Net income (loss) from continuing operations | 128,374 | 30,414 | 2,276 | 3,758 | 4,187 | 169,009 | (45,684 | ) | — | 54,749 | 178,074 | |||||||||||||||||||||||||||||

| Income from discontinued operations, net of tax | — | — | — | — | — | — | — | — | 3,048 | 3,048 | ||||||||||||||||||||||||||||||

| Net income (loss) | $ | 128,374 | 30,414 | 2,276 | 3,758 | 4,187 | 169,009 | (45,684 | ) | — | 57,797 | 181,122 | ||||||||||||||||||||||||||||

| Total assets | $ | 22,327,023 | 473,538 | 90,794 | 41,649 | 23,178 | 22,956,182 | 58,173 | (248,081 | ) | 32,419 | 22,798,693 | ||||||||||||||||||||||||||||

| (a) | Income taxes are based on a percentage of net income before tax for the individual operating segment. |

48

Table of Contents

| Student | Tuition | Enrollment | ||||||||||||||||||||||||||

| Asset | Loan | Payment | Services | Software | Corporate | |||||||||||||||||||||||

| Generation | and | Processing | and | and | Activity | |||||||||||||||||||||||

| and | Guaranty | and Campus | List | Technical | and | |||||||||||||||||||||||

| Management | Servicing | Commerce | Management | Services | Overhead | Total | ||||||||||||||||||||||

| Year ended December 31, 2007 | ||||||||||||||||||||||||||||

| Derivative market value, foreign currency, and put option adjustments | $ | (24,224 | ) | — | — | — | — | (2,582 | ) | (26,806 | ) | |||||||||||||||||

| Amortization of intangible assets | 5,634 | 5,094 | 5,815 | 12,692 | 1,191 | — | 30,426 | |||||||||||||||||||||

| Compensation related to business combinations | — | — | — | — | — | 2,111 | 2,111 | |||||||||||||||||||||

| Variable-rate floor income | (3,013 | ) | — | — | — | — | — | (3,013 | ) | |||||||||||||||||||

| Income (loss) from discontinued operations, net of tax | — | 2,575 | — | — | — | — | 2,575 | |||||||||||||||||||||

| Net tax effect (a) | 8,209 | (1,936 | ) | (2,209 | ) | (4,823 | ) | (452 | ) | 1,556 | 345 | |||||||||||||||||

| Total adjustments to GAAP | $ | (13,394 | ) | 5,733 | 3,606 | 7,869 | 739 | 1,085 | 5,638 | |||||||||||||||||||

| Year ended December 31, 2006 | ||||||||||||||||||||||||||||

| Derivative market value, foreign currency, and put option adjustments | $ | 5,483 | — | — | — | — | 25,592 | 31,075 | ||||||||||||||||||||

| Amortization of intangible assets | 7,617 | 5,641 | 5,968 | 4,573 | 1,263 | — | 25,062 | |||||||||||||||||||||

| Compensation related to business combinations | — | — | — | — | — | 1,747 | 1,747 | |||||||||||||||||||||

| Variable-rate floor income | — | — | — | — | — | — | — | |||||||||||||||||||||

| Income (loss) from discontinued operations, net of tax | — | (2,239 | ) | — | — | — | — | (2,239 | ) | |||||||||||||||||||

| Net tax effect (a) | (4,978 | ) | (2,143 | ) | (2,268 | ) | (1,738 | ) | (480 | ) | (8,626 | ) | (20,233 | ) | ||||||||||||||

| Total adjustments to GAAP | $ | 8,122 | 1,259 | 3,700 | 2,835 | 783 | 18,713 | 35,412 | ||||||||||||||||||||

| Year ended December 31, 2005 | ||||||||||||||||||||||||||||

| Derivative market value, foreign currency, and put option adjustments | $ | (95,854 | ) | — | — | — | — | (373 | ) | (96,227 | ) | |||||||||||||||||

| Amortization of intangible assets | 1,840 | 1,082 | 2,350 | 2,032 | 847 | — | 8,151 | |||||||||||||||||||||

| Compensation related to business combinations | — | — | — | — | — | — | — | |||||||||||||||||||||

| Variable-rate floor income | — | — | — | — | — | — | — | |||||||||||||||||||||

| Income (loss) from discontinued operations, net of tax | — | (3,048 | ) | — | — | — | — | (3,048 | ) | |||||||||||||||||||

| Net tax effect (a) | 35,726 | (412 | ) | (893 | ) | (772 | ) | (322 | ) | — | 33,327 | |||||||||||||||||

| Total adjustments to GAAP | $ | (58,288 | ) | (2,378 | ) | 1,457 | 1,260 | 525 | (373 | ) | (57,797 | ) | ||||||||||||||||

| (a) | Tax effect computed at 38%. The change in the value of the put option (included in Corporate Activity and Overhead) is not tax effected as this is not deductible for income tax purposes. |

49

Table of Contents

50

Table of Contents

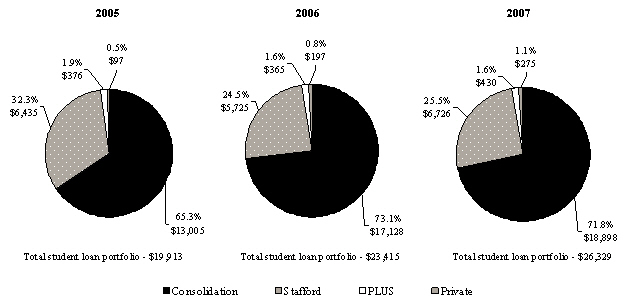

| As of December 31, 2007 | As of December 31, 2006 | As of December 31, 2005 | ||||||||||||||||||||||

| Dollars | Percent | Dollars | Percent | Dollars | Percent | |||||||||||||||||||

| Federally insured: | ||||||||||||||||||||||||

| Stafford | $ | 6,725,910 | 25.2 | % | $ | 5,724,586 | 24.1 | % | $ | 6,434,655 | 31.8 | % | ||||||||||||

| PLUS/SLS | 429,941 | 1.6 | 365,112 | 1.5 | 376,042 | 1.8 | ||||||||||||||||||

| Consolidation | 18,898,547 | 70.7 | 17,127,623 | 72.0 | 13,005,378 | 64.2 | ||||||||||||||||||

| Non-federally insured | 274,815 | 1.0 | 197,147 | 0.8 | 96,880 | 0.5 | ||||||||||||||||||

| Total | 26,329,213 | 98.5 | 23,414,468 | 98.4 | 19,912,955 | 98.3 | ||||||||||||||||||

| Unamortized premiums and deferred origination costs | 452,501 | 1.7 | 401,087 | 1.7 | 361,242 | 1.8 | ||||||||||||||||||

| Allowance for loan losses: | ||||||||||||||||||||||||

| Allowance — federally insured | (24,534 | ) | (0.1 | ) | (7,601 | ) | — | (98 | ) | — | ||||||||||||||

| Allowance — non-federally insured | (21,058 | ) | (0.1 | ) | (18,402 | ) | (0.1 | ) | (13,292 | ) | (0.1 | ) | ||||||||||||

| Net | $ | 26,736,122 | 100.0 | % | $ | 23,789,552 | 100.0 | % | $ | 20,260,807 | 100.0 | % | ||||||||||||

51

Table of Contents

| Year ended December 31, | ||||||||||||

| 2007 | 2006 | 2005 | ||||||||||

| Beginning balance | $ | 23,414,468 | 19,912,955 | 13,299,094 | ||||||||

| Direct channel: | ||||||||||||

| Consolidation loan originations | 3,096,754 | 5,299,820 | 4,037,366 | |||||||||

| Less consolidation of existing portfolio | (1,602,835 | ) | (2,643,880 | ) | (1,966,000 | ) | ||||||

| Net consolidation loan originations | 1,493,919 | 2,655,940 | 2,071,366 | |||||||||

| Stafford/PLUS loan originations | 1,086,398 | 1,035,695 | 720,545 | |||||||||

| Branding partner channel (a) (b) | 662,629 | 720,641 | 657,720 | |||||||||

| Forward flow channel | 1,105,145 | 1,600,990 | 1,153,125 | |||||||||

| Other channels (b) | 804,019 | 682,852 | 796,886 | |||||||||

| Total channel acquisitions | 5,152,110 | 6,696,118 | 5,399,642 | |||||||||

| Repayments, claims, capitalized interest, participations, and other | (1,321,055 | ) | (1,332,086 | ) | (1,002,260 | ) | ||||||

| Consolidation loans lost to external parties | (800,978 | ) | (1,114,040 | ) | (855,000 | ) | ||||||

| Loans acquired in portfolio and business acquisitions | — | — | 3,071,479 | |||||||||

| Loans sold | (115,332 | ) | (748,479 | ) | — | |||||||

| Ending balance | $ | 26,329,213 | 23,414,468 | 19,912,955 | ||||||||

| (a) | Included in the branding partner channel are private loan originations of $110.5 million, $55.7 million, and $13.4 million for the years ended December 31, 2007, 2006, and 2005, respectively. | |

| (b) | Included in other channels for the year ended December 31, 2006 is $190.1 million of acquisitions that were previously presented as branding partner channel acquisitions. This reclassification was made for comparative purposes due to the nature of the transactions. |

52

Table of Contents

| Year ended December 31, | ||||||||||||

| 2007 | 2006 | 2005 | ||||||||||

| Balance at beginning of period | $ | 26,003 | 13,390 | 7,272 | ||||||||

| Provision for loan losses: | ||||||||||||

| Federally insured loans | 23,158 | 9,268 | 280 | |||||||||

| Non-federally insured loans | 5,020 | 6,040 | 6,750 | |||||||||

| Total provision for loan losses | 28,178 | 15,308 | 7,030 | |||||||||

| Charge-offs, net of recoveries: | ||||||||||||

| Federally insured loans | (6,225 | ) | (1,765 | ) | (299 | ) | ||||||

| Non-federally insured loans | (1,193 | ) | (930 | ) | (613 | ) | ||||||

| Net charge-offs | (7,418 | ) | (2,695 | ) | (912 | ) | ||||||

| Sale of non-federally insured loans | (1,171 | ) | — | — | ||||||||

| Balance at end of period | $ | 45,592 | 26,003 | 13,390 | ||||||||

| Allocation of the allowance for loan losses: | ||||||||||||

| Federally insured loans | $ | 24,534 | 7,601 | 98 | ||||||||

| Non-federally insured loans | 21,058 | 18,402 | 13,292 | |||||||||

| Total allowance for loan losses | $ | 45,592 | 26,003 | 13,390 | ||||||||

| Net loan charge-offs as a percentage of average student loans | 0.030 | % | 0.012 | % | 0.006 | % | ||||||

| Total allowance as a percentage of average student loans | 0.181 | % | 0.120 | % | 0.085 | % | ||||||

| Total allowance as a percentage of ending balance of student loans | 0.173 | % | 0.111 | % | 0.067 | % | ||||||

| Non-federally insured allowance as a percentage of the ending balance of non-federally insured loans | 7.663 | % | 9.334 | % | 13.720 | % | ||||||

| Average student loans | $ | 25,143,059 | 21,696,466 | 15,716,388 | ||||||||

| Ending balance of student loans | 26,329,213 | 23,414,468 | 19,912,955 | |||||||||

| Ending balance of non-federally insured loans | 274,815 | 197,147 | 96,880 | |||||||||

53

Table of Contents

| As of December 31, 2007 | As of December 31, 2006 | |||||||||||||||

| Dollars | Percent | Dollars | Percent | |||||||||||||

Federally Insured Loans: | ||||||||||||||||

| Loans in-school/grace/deferment(1) | $ | 7,115,505 | $ | 6,271,558 | ||||||||||||

| Loans in forebearance(2) | 3,015,456 | 2,318,184 | ||||||||||||||

| Loans in repayment status: | ||||||||||||||||

| Loans current | 13,937,702 | 87.5 | % | 12,944,768 | 88.5 | % | ||||||||||

| Loans delinquent 31-60 days(3) | 682,956 | 4.3 | 623,439 | 4.3 | ||||||||||||

| Loans delinquent 61-90 days(3) | 353,303 | 2.2 | 299,413 | 2.0 | ||||||||||||

| Loans delinquent 91 days or greater(4) | 949,476 | 6.0 | 759,959 | 5.2 | ||||||||||||

| Total loans in repayment | 15,923,437 | 100.0 | % | 14,627,579 | 100.0 | % | ||||||||||

| Total federally insured loans | $ | 26,054,398 | $ | 23,217,321 | ||||||||||||

Non-Federally Insured Loans: | ||||||||||||||||

| Loans in-school/grace/deferment(1) | $ | 111,946 | $ | 83,973 | ||||||||||||

| Loans in forebearance(2) | 12,895 | 6,113 | ||||||||||||||

| Loans in repayment status: | ||||||||||||||||

| Loans current | 142,851 | 95.3 | % | 101,084 | 94.4 | % | ||||||||||

| Loans delinquent 31-60 days(3) | 3,450 | 2.3 | 2,681 | 2.5 | ||||||||||||

| Loans delinquent 61-90 days(3) | 1,247 | 0.8 | 1,233 | 1.2 | ||||||||||||

| Loans delinquent 91 days or greater(4) | 2,426 | 1.6 | 2,063 | 1.9 | ||||||||||||

| Total loans in repayment | 149,974 | 100.0 | % | 107,061 | 100.0 | % | ||||||||||

| Total non-federally insured loans | $ | 274,815 | $ | 197,147 | ||||||||||||

| (1) | Loans for borrowers who still may be attending school or engaging in other permitted educational activities and are not yet required to make payments on the loans,e.g., residency periods for medical students or a grace period for bar exam preparation for law students. | |

| (2) | Loans for borrowers who have temporarily ceased making full payments due to hardship or other factors, according to a schedule approved by the servicer consistent with the established loan program servicing procedures and policies. | |

| (3) | The period of delinquency is based on the number of days scheduled payments are contractually past due and relate to repayment loans, that is, receivables not charged off, and not in school, grace, deferment, or forbearance. | |

| (4) | Loans delinquent 91 days or greater include loans in claim status, which are loans which have gone into default and have been submitted to the guaranty agency for FFELP loans, or, if applicable, the insurer for non-federally insured loans, to process the claim for payment. |

| Year ended December 31, | ||||||||||||

| 2007 | 2006 | 2005 | ||||||||||

| Student loan yield (a) | 7.76 | % | 7.85 | % | 6.90 | % | ||||||

| Consolidation rebate fees | (0.77 | ) | (0.72 | ) | (0.65 | ) | ||||||

| Premium and deferred origination costs amortization (b) | (0.36 | ) | (0.39 | ) | (0.49 | ) | ||||||

| Student loan net yield | 6.63 | 6.74 | 5.76 | |||||||||

| Student loan cost of funds (c) | (5.49 | ) | (5.12 | ) | (3.75 | ) | ||||||

| Student loan spread | 1.14 | 1.62 | 2.01 | |||||||||

| Variable-rate floor income (d) | (0.01 | ) | — | — | ||||||||

| Special allowance yield adjustments, net of settlements on derivatives (e) | — | (0.20 | ) | (0.50 | ) | |||||||

| Core student loan spread | 1.13 | % | 1.42 | % | 1.51 | % | ||||||

| Average balance of student loans | $ | 25,143,059 | 21,696,466 | 15,716,388 | ||||||||

| Average balance of debt outstanding | 26,599,361 | 23,379,258 | 16,759,511 | |||||||||

| (a) | The student loan yield for the year ended December 31, 2006 does not include the $2.8 million charge to write off accounts receivable from the Department related to third quarter 2006 9.5% special allowance payments that will not be received under the Company’s previously disclosed Settlement Agreement with the Department. The $2.8 million relates to loans earning 9.5% special allowance payments that were not subject to the OIG audit. |

54

Table of Contents

| (b) | Premium and deferred origination costs amortization for the year ended December 31, 2006 excludes premium amortization related to the Company’s portfolio of 9.5% loans purchased in October 2005 as part of a business combination. | |

| (c) | The student loan cost of funds includes the effects of net settlement costs on the Company’s derivative instruments (excluding the $2.0 million settlement related to the derivative instrument entered into in connection with the issuance of the junior subordinated hybrid securities for the year ended December 31, 2006 and the net settlements of $12.1 million and $7.0 million for the years ended December 31, 2007 and December 31, 2006, respectively, on those derivatives no longer hedging student loan assets). | |

| (d) | Variable-rate floor income is calculated by the Company on a statutory basis. As a result of the disruptions in the debt and secondary capital markets which began in August 2007, the benefit of variable-rate floor income has not been realized by the Company due to the widening of the spread between short term interest rate indices and the Company’s actual cost of funds. The Company entered into interest rate swaps with effective dates beginning in January 2008 to hedge a portion of the variable-rate floor income. Settlements on these derivatives will be presented as part of the Company’s statutory calculation of variable-rate floor income. | |

| (e) | The special allowance yield adjustment represents the impact on net spread had certain 9.5% loans earned at statutorily defined rates under a taxable financing. The special allowance yield adjustment includes net settlements on derivative instruments that were used to hedge this loan portfolio earning the excess yield. On January 19, 2007, the Company entered into a Settlement Agreement with the Department to resolve the audit by the OIG of the Company’s portfolio of student loans receiving 9.5% special allowance payments. Under the terms of the Agreement, all 9.5% special allowance payments were eliminated for periods on and after July 1, 2006. The Company had been deferring recognition of 9.5% special allowance payments related to those loans subject to the OIG audit effective July 1, 2006 pending satisfactory resolution of this issue. |

55

Table of Contents

| Year ended | ||||||||||||

| December 31, | December 31, | |||||||||||

| 2007 | 2006 | $ Change | ||||||||||

| Net interest income after the provision for loan losses | $ | 236,821 | 303,586 | (66,765 | ) | |||||||

| Loan and guaranty servicing income | 294 | — | 294 | |||||||||

| Other fee-based income | 13,387 | 11,867 | 1,520 | |||||||||

| Software services income | — | 238 | (238 | ) | ||||||||

| Other income | 8,030 | 19,966 | (11,936 | ) | ||||||||

| Derivative settlements, net | 6,628 | 18,381 | (11,753 | ) | ||||||||

| Total other income | 28,339 | 50,452 | (22,113 | ) | ||||||||

| Salaries and benefits | 23,101 | 53,036 | (29,935 | ) | ||||||||

| Restructure expense — severance and contract termination costs | 2,406 | — | 2,406 | |||||||||

| Impairment expense | 28,291 | 21,687 | 6,604 | |||||||||

| Other expenses | 29,205 | 51,085 | (21,880 | ) | ||||||||

| Intersegment expenses | 74,714 | 52,857 | 21,857 | |||||||||

| Total operating expenses | 157,717 | 178,665 | (20,948 | ) | ||||||||

| “Base net income” before income taxes | 107,443 | 175,373 | (67,930 | ) | ||||||||

| Income tax expense | 40,828 | 66,642 | (25,814 | ) | ||||||||

| “Base net income” | $ | 66,615 | 108,731 | (42,116 | ) | |||||||

| After Tax Operating Margin | 25.1 | % | 30.7 | % | ||||||||

| After Tax Operating Margin - excluding restructure expense, impairment expense, and provision for loan losses related to the loss of Exceptional Performer | 34.0 | % | 34.5 | % | ||||||||

| Year ended December 31, | Change | |||||||||||||||

| 2007 | 2006 | Dollars | Percent | |||||||||||||

| Loan interest | $ | 1,948,751 | 1,699,859 | 248,892 | 14.6 | % | ||||||||||

| Consolidation rebate fees | (193,687 | ) | (156,751 | ) | (36,936 | ) | (23.6 | ) | ||||||||

| Amortization of loan premiums and deferred origination costs | (91,020 | ) | (87,393 | ) | (3,627 | ) | (4.2 | ) | ||||||||

| Total loan interest | 1,664,044 | 1,455,715 | 208,329 | 14.3 | ||||||||||||

| Investment interest | 66,838 | 78,708 | (11,870 | ) | (15.1 | ) | ||||||||||

| Total interest income | 1,730,882 | 1,534,423 | 196,459 | 12.8 | ||||||||||||

| Interest on bonds and notes payable | 1,462,679 | 1,213,446 | 249,233 | 20.5 | ||||||||||||

| Intercompany interest | 3,204 | 2,083 | 1,121 | 53.8 | ||||||||||||

| Provision for loan losses | 28,178 | 15,308 | 12,870 | 84.1 | ||||||||||||

| Net interest income after provision for loan losses | $ | 236,821 | 303,586 | (66,765 | ) | (22.0 | ) | |||||||||

| • | Loan interest for the year ended December 31, 2006 included $32.3 million of 9.5% special allowance payments. The Company received no 9.5% special allowance payments for the year ended December 31, 2007 as a result of the Settlement Agreement with the Department. |

| • | The average student loan portfolio increased $3.4 billion, or 15.9%, for the year ended December 31, 2007 compared to the same period in 2006. Student loan yield, excluding 9.5% special allowance payments, increased to 7.75% in 2007 from 7.69% in 2006. The increase in student loan yield is the result of a higher interest rate environment and is offset by an increase in the percentage of lower yielding consolidation loans to the total portfolio. Loan interest income, excluding the 9.5% special allowance payments, increased $281.2 million as a result of these factors. |

56

Table of Contents

| • | Consolidation rebate fees increased due to the $3.4 billion, or 22.9%, increase in the average consolidation loan portfolio. |

| • | The amortization of loan premiums and deferred origination costs increased $3.6 million, or 4.2%, as a result of loan portfolio growth. In December 2006, the Company wrote off $21.7 million of premiums on loans earning 9.5% special allowance payments as a result of the Settlement Agreement with the Department. For the year ended December 31, 2006, the Company recognized $8.5 million of premium amortization related to these loans. The remaining decrease in amortization was the result of certain premiums and loan costs that became fully amortized in 2006. |

| • | Investment interest decreased as a result of an overall decrease in cash held in 2007 as compared to 2006. During the second and third quarter of 2006, proceeds from the issuance of a debt transaction were held as cash until the loans were available for securitization. As a result, the Company earned investment interest on this cash until it was used to fund student loans. |

| • | Interest expense increased due to the $3.2 billion, or 13.8%, increase in average debt for the year ended December 31, 2007 compared to the same period in 2006. In addition, the Company’s cost of funds (excluding net derivative settlements) increased to 5.51% for the year ended December 31, 2007 compared to 5.20% for the same period a year ago. Interest expense was impacted in 2007 by credit market disruptions as further discussed in this Report. |

| • | The provision for loan losses increased because the Company recognized a $15.7 million provision in the third quarter of 2007 on its federally insured portfolio as a result of the College Cost Reduction Act, offset by a $6.9 million provision the Company recognized in the first quarter of 2006 on its federally insured portfolio as a result of HERA which was enacted into law on February 8, 2006. |

57

Table of Contents

| Year ended | ||||||||||||

| December 31, | December 31, | |||||||||||

| 2006 | 2005 | $ Change | ||||||||||

| Net interest income after the provision for loan losses | $ | 303,586 | 323,497 | (19,911 | ) | |||||||

| Other fee-based income | 11,867 | 9,053 | 2,814 | |||||||||

| Software services income | 238 | 127 | 111 | |||||||||

| Other income | 19,966 | 3,596 | 16,370 | |||||||||

| Derivative settlements, net | 18,381 | (17,008 | ) | 35,389 | ||||||||

| Total other income (expense) | 50,452 | (4,232 | ) | 54,684 | ||||||||

| Salaries and benefits | 53,036 | 39,482 | 13,554 | |||||||||

| Impairment expense | 21,687 | — | 21,687 | |||||||||

| Other expenses | 51,085 | 39,659 | 11,426 | |||||||||

| Intersegment expenses | 52,857 | 33,070 | 19,787 | |||||||||

| Total operating expenses | 178,665 | 112,211 | 66,454 | |||||||||

| “Base net income” before income taxes | 175,373 | 207,054 | (31,681 | ) | ||||||||

| Income tax expense | 66,642 | 78,680 | (12,038 | ) | ||||||||

| “Base net income” | $ | 108,731 | 128,374 | (19,643 | ) | |||||||

| After Tax Operating Margin | 30.7 | % | 40.2 | % | ||||||||

| After Tax Operating Margin - excluding impairment expense | 34.5 | % | 40.2 | % | ||||||||

| Year ended December 31, | Change | |||||||||||||||

| 2006 | 2005 | Dollars | Percent | |||||||||||||

| Loan interest | $ | 1,699,859 | 1,084,178 | 615,681 | 56.8 | % | ||||||||||

| Consolidation rebate fees | (156,751 | ) | (102,699 | ) | (54,052 | ) | (52.6 | ) | ||||||||

| Amortization of loan premiums and deferred origination costs | (87,393 | ) | (76,530 | ) | (10,863 | ) | (14.2 | ) | ||||||||

| Total loan interest | 1,455,715 | 904,949 | 550,766 | 60.9 | ||||||||||||

| Investment interest | 78,708 | 35,441 | 43,267 | 122.1 | ||||||||||||

| Total interest income | 1,534,423 | 940,390 | 594,033 | 63.2 | ||||||||||||

| Interest on bonds and notes payable | 1,213,446 | 609,830 | 603,616 | 99.0 | ||||||||||||

| Intercompany interest | 2,083 | 33 | 2,050 | 6,212.1 | ||||||||||||

| Provision for loan losses | 15,308 | 7,030 | 8,278 | 117.8 | ||||||||||||

| Net interest income after provision for loan losses | $ | 303,586 | 323,497 | (19,911 | ) | (6.2 | ) | |||||||||

| • | Loan interest for the years ended December 31, 2006 and 2005, included $32.3 million and $94.7 million, respectively, of 9.5% special allowance payments. The decrease in 9.5% special allowance payments is a result of the Settlement Agreement with the Department, an increase in interest rates, which decreases the excess special allowance payments over the statutorily defined rates under a taxable financing, and a decrease in the portfolio of loans earning the 9.5% special allowance payments. |

| • | The average student loan portfolio increased $6.0 billion, or 38.0%, for the year ended December 31, 2006 compared to 2005. Student loan yield, excluding the 9.5% special allowance payments, increased to 7.69% in 2006 from 6.30% in 2005. The increase in student loan yield is a result of a rising interest rate environment and is offset by an increase in the percentage of lower yielding consolidation loans to the total portfolio. Loan interest income, excluding the 9.5% special allowance payments, increased $678.1 million as a result of these factors. |

| • | Consolidation rebate fees increased due to the $5.0 billion, or 51.7%, increase in the average consolidation loan portfolio. |

| • | Amortization of loan premiums and deferred origination costs increased as a result of the growth in the student loan portfolio and business combinations. |

58

Table of Contents

| • | Investment interest has increased as a result of an increase in cash, cash equivalents, and investments from student loan growth and business combinations, and as a result of the rising interest rate environment. |

| • | Interest expense increased $603.6 million due to the $6.6 billion, or 39.5%, increase in average debt for the year ended December 31, 2006 compared to 2005. In addition, the Company’s cost of funds (excluding net derivative settlements) increased to 5.20% for the year ended December 31, 2006 up from 3.64% for the same period a year ago. |

| • | The provision for loan losses increased because the Company recognized a $6.9 million provision in 2006 on its federally insured portfolio as a result of HERA which was enacted into law on February 8, 2006. |

| • | Servicing fees expense increased $4.4 million for the year ended December 31, 2006 compared to 2005 as a result of the acquisition of the Chela portfolio of loans which were not serviced by the Company. |

| • | Advertising and marketing expenses increased $2.8 million as a result of the increased sales and marketing efforts. |

| • | Trustee and other debt related fees increased $1.8 million, or approximately 19%, related to the $6.6 billion, or 39.5%, increase in average debt outstanding. The Company’s trustee and other debt-related fees did not increase at the same rate as the increase in average debt outstanding due to a reduction in fee rates paid by the Company. |

59

Table of Contents

| As of December 31, | ||||||||||||||||

| 2007 | 2006 | |||||||||||||||

| Dollar | Percent | Dollar | Percent | |||||||||||||

| (dollars in millions) | ||||||||||||||||

| Company | $ | 25,640 | 75.8 | % | $ | 21,869 | 71.5 | % | ||||||||

| Third Party | 8,177 | 24.2 | 8,725 | 28.5 | ||||||||||||

| Total | $ | 33,817 | 100.0 | % | $ | 30,594 | 100.0 | % | ||||||||

| Year ended | ||||||||||||

| December 31, | December 31, | |||||||||||

| 2007 | 2006 | $ Change | ||||||||||

| Net interest income after the provision for loan losses | $ | 5,459 | 8,957 | (3,498 | ) | |||||||

| Loan and guaranty servicing income | 127,775 | 121,593 | 6,182 | |||||||||

| Software services income | — | 5 | (5 | ) | ||||||||

| Other income | — | 97 | (97 | ) | ||||||||

| Intersegment revenue | 74,687 | 63,545 | 11,142 | |||||||||

| Total other income | 202,462 | 185,240 | 17,222 | |||||||||

| Salaries and benefits | 85,462 | 83,988 | 1,474 | |||||||||

| Restructure expense — severance and contract termination costs | 1,840 | — | 1,840 | |||||||||

| Other expenses | 36,618 | 32,419 | 4,199 | |||||||||

| Intersegment expenses | 10,552 | 12,577 | (2,025 | ) | ||||||||

| Total operating expenses | 134,472 | 128,984 | 5,488 | |||||||||

| “Base net income” before income taxes | 73,449 | 65,213 | 8,236 | |||||||||

| Income tax expense | 27,910 | 24,780 | 3,130 | |||||||||

| “Base net income” | $ | 45,539 | 40,433 | 5,106 | ||||||||

| After Tax Operating Margin | 21.9 | % | 20.8 | % | ||||||||

| After Tax Operating Margin - excluding restructure expense | 22.5 | % | 20.8 | % | ||||||||

60

Table of Contents

| Year ended December 31, | ||||||||||||||||

| 2007 | 2006 | $ Change | % Change | |||||||||||||

| Origination and servicing of FFEL Program loans | $ | 55,376 | 66,374 | (10,998 | ) | (16.6 | )% | |||||||||

| Origination and servicing of non-federally insured student loans | 10,297 | 9,672 | 625 | 6.5 | ||||||||||||