January 9, 2018

VIA EMAIL AND EDGAR

Ms. Lisa Vanjoske and Mr. Jim Rosenberg

Division of Corporation Finance

Office of Healthcare & Insurance

United States Securities and Exchange Commission

100 F Street N.E.

Washington D.C. 20549

Re: Letter Dated December 20, 2017

Aspen Insurance Holdings Limited

Form 10-K for the Fiscal Year Ended December 31, 2016

Filed February 22, 2017

File No. 001-31909

Dear Ms. Vanjoske and Mr. Rosenberg:

We are responding to the letter, dated December 20, 2017, from the staff (the “Staff”) of the United States Securities and Exchange Commission (the “Commission”) concerning the Form 10-K for the year ended December 31, 2016 of Aspen Insurance Holdings Limited and its subsidiaries (collectively, the “Company”, “we” or “our”).

Set forth below are the Company’s responses to the comments raised by the Staff. For the convenience of the Staff, we have repeated the Commission’s comments (displayed in italics) immediately prior to our responses.

Form 10-K for Fiscal Year Ended December 31, 2016

Notes to the Audited Consolidated Financial Statements

5. Segment reporting, page F-18

| |

| 1. | Please tell us whether you aggregate operating segments within each of your two reporting segments. If so, describe each operating segment within each reporting segment that is aggregated and how you met each of the criteria in ASC 280-10-50-11. If not, please explain to us what your disclosure means with respect to the "Company has considered similarities in economic characteristics, products, customers, distribution, the regulatory environment of the Company’s business segments and quantitative thresholds to determine the Company’s reportable segments.” |

The Company has concluded that none of the lines of business within its two reporting segments, Aspen Insurance and Aspen Reinsurance (“Aspen Re”), qualify as operating segments pursuant to ASC 280-10-50-11. As a result, the Company has not aggregated operating segments for reporting purposes.

Aspen Insurance and Aspen Re each write numerous lines of business and the Company has concluded that none of these lines of business satisfy all of the characteristics under ASC 280-10-50-1, among other factors, and therefore do not qualify as operating segments. As a result, the Company has concluded that Aspen Insurance and Aspen Re are the Company’s operating and reporting segments.

While the lines of business within Aspen Insurance and Aspen Re earn revenues and incur expenses, the operating results of the lines of business are not presented to and reviewed by the Company’s chief operating decision maker (in the case of the Company, the Group Executive Committee given that it evaluates the Company’s performance and decides how to allocate resources). Rather, the Company’s financial reporting activities are based on management and governance structures embedded to support Aspen Insurance and Aspen Re as the Company’s two reporting segments. Each reporting segment has its own Chief Executive Officer who is a member of the Group Executive Committee and reports to the Group Executive Committee on the activities, financial results and forecasts of their respective reporting segment. The Chief Executive Officers of Aspen Insurance and Aspen Re are likewise each supported by a separate segment executive committee.

In addition, the vast majority of internal management information is provided at a reporting segment level to the Group Executive Committee and to the Company’s Board of Directors on a quarterly basis. While the Company’s budgets and forecasts are prepared from the ground up taking into account certain financial information at the line of business level, the approved business plan establishes overall performance objectives for each of the two reporting segments by reference to separate operating return on equity (“ROE”) targets. The Aspen Insurance and Aspen Re business plans are reviewed by the relevant segment executive committee before they are ultimately considered and approved by the Group Executive Committee and the Company’s Board of Directors.

Remuneration funding is also determined by reference to reporting segment performance rather than by the performance of specific lines of business within a reporting segment. In particular, beginning in 2017, the Company has established a separate bonus pool for Aspen Insurance and Aspen Re. These pools are assessed by reference to the operating ROE result for the relevant reporting segment versus that segment’s target operating ROE. Bonus pool funding for members of the Group Executive Committee and those in corporate functions is based on the collective performance of the two reporting segments and, if relevant, by reference to the member’s specific segment result.

The Company has previously disclosed in the Form 10-K that it "has considered similarities in economic characteristics, products, customers, distribution, the regulatory environment of the Company’s business segments and quantitative thresholds to determine the Company’s reportable segments.” This statement relates to the determination made by the Company as to the difference between the two reporting segments and why it believes each qualifies as a separate reporting segment, rather than a statement as to the underlying lines of business within each reporting segment. The statement means that, in general, Aspen Insurance writes higher volume lower value business while Aspen Re business tends to be higher value and lower volume. Aspen Insurance likewise distributes business through a wide range of national and regional brokers while Aspen Re business is dominated by a few global brokers. Aspen Insurance products also tend to have a greater degree of standardization while Aspen Re policies tend to be more bespoke. In common with the insurance and reinsurance sectors, the Aspen Insurance business tends to be more highly regulated, as compared to Aspen Reinsurance, based on the jurisdictions in which they operate. The Company’s business is therefore allocated to the two reporting segments on that basis. The Company is likewise mindful of the quantitative thresholds set out in ASU 280-10-50-12 for identifying stand-alone reportable segments.

In summary, the Company has determined the appropriateness of its reporting segment disclosure based on the identification of its two operating segments, namely Aspen Insurance and Aspen Re. To minimize confusion and enhance disclosure, the Company therefore proposes rephrasing the statement highlighted by the Staff in future filings with the Commission as follows: “The Company has determined its reportable segments, Aspen Insurance and Aspen Re, by

taking into account the manner in which management makes operating decisions and assesses operating performance.”

2. Reserves for Losses and Loss Adjustment Expenses, page F-41

We see from disclosure in your Form 8-K filed on December 6, 2017 that you provide loss triangles on your website in a much more disaggregated form and for more accident years than you presented herein. Please tell us why, and address the following:

With regard to the tables herein of information about claims development by accident year, why you concluded that five years of information was sufficient when it appears that claims incurred typically remain outstanding for more than five years. Refer to ASC 944-40-50-4B. If you were relying on impracticability as discussed in ASC 944 -40-65-1.d. to limit the years presented to five, please advise.

Why you did not disaggregate the tables of incurred claims and paid claims further into, for example, the lines of business you present on pages 9 and 11 of Form 10-K. In this regard, we are concerned that the tables may be aggregating lines with significantly different characteristics. Refer to ASC 944-40-50-4H. For each of the lines, provide us analysis of the characteristics to support your aggregation. If a line includes multiple lines such as with "property and casualty insurance" within the insurance segment, provide the analysis for each line. In your response provide us the individual tables by line, if available, or to the extent not available, provide us quantitative data by line such as claims payout period, incurred loss, claims paid and development per line for each of the last three years.

There were a number of factors which the Company considered when determining the sufficiency of accident year claims development disclosure in the Form 10-K. Ultimately, however, the Company relied on the impracticality provisions set out in ASC 944-40-65-1(e) to limit the disclosure of claims development to five years in the Form 10-K due to the following principal reasons:

| |

| • | the prescribed format required in the Form 10-K (i.e., the disclosure of net claims information and consistent net claims development data for older accident years) was unavailable at the time of filing as the apportionment of ceded recoveries across lines of business and segments was not standardized in prior periods; and |

| |

| • | establishing suitable internal controls over financial reporting to comply with the requirements to design, develop and test systems to produce the underlying data was only practicable for more recent accident years. |

In subsequent periods, and in line with the transitional provisions in ASU 944-40-65-1(e), the Company will incrementally increase its claims development disclosure so that, in time, a full ten years of development will be reported in its Form 10-K.

The Company did not disaggregate the tables of incurred claims and paid claims beyond its reporting segments in the Form 10-K due to the following factors:

| |

| • | in accordance with ASU 944-40-50-4H, the Company aims to ensure that information in its filings is not obscured by the inclusion of a large amount of insignificant detail or the aggregation of items that have significantly different characteristics. The Company considered the similarities in the net claims development patterns of the majority of the lines of business written within each of the reporting segments; |

| |

| • | as noted in the response to question 1 above, the standard disaggregation used internally and in the majority of the Company’s external reports is at the reporting segment level; disclosure of information at a more disaggregated level is therefore less useful to a user of the Company’s accounts as information would be more difficult to reconcile to other disclosure in the financial statements and also less meaningful due to the way in which reinsurance recoveries related to multiple lines of business are allocated; and |

| |

| • | as further noted in the response to question 1 above, the Company’s chief operating decision maker (i.e. the Group Executive Committee) evaluates financial performance, including loss development, at the reporting segment level. |

The Company did, however, publish gross loss development data in a more disaggregated form and for more accident years in its 2016 Global Loss Development Triangles as filed on a Current Report on Form 8-K with the Commission on December 6, 2017 (the “2016 Global Loss Triangles”) than disclosed under “Reserves for Losses and Loss Adjustment Expenses” on page F-41 of the Form 10-K. The Company considered it appropriate to publish more disaggregated information in its 2016 Global Loss Triangles in line with similar publications by peer companies for certain interested constituents and due to the following factors:

| |

| • | the claims development information disclosed in the 2016 Global Loss Triangles was presented on a gross of reinsurance basis unlike the disclosure in the Form 10-K which was provided on a net of reinsurance basis. As a result, the Company did not have to revise the allocation of reinsurance recoveries which in prior periods had been made at a more aggregated level and when disaggregated would become less meaningful; |

| |

| • | the 2016 Global Loss Triangles are not subject to the same internal controls over financial reporting as apply to disclosures in the Form 10-K; and |

| |

| • | the 2016 Global Loss Triangles are published annually, not quarterly, and are not subject to filing deadlines. |

The Staff have requested additional claims data at a line of business level for each of the last three years. As stated above, the claims information disclosed in the Form 10-K is presented on a net of reinsurance basis which, due to the nature of the Company’s reinsurance program, requires us to apportion reinsurance recoveries across lines of business and reporting segments.

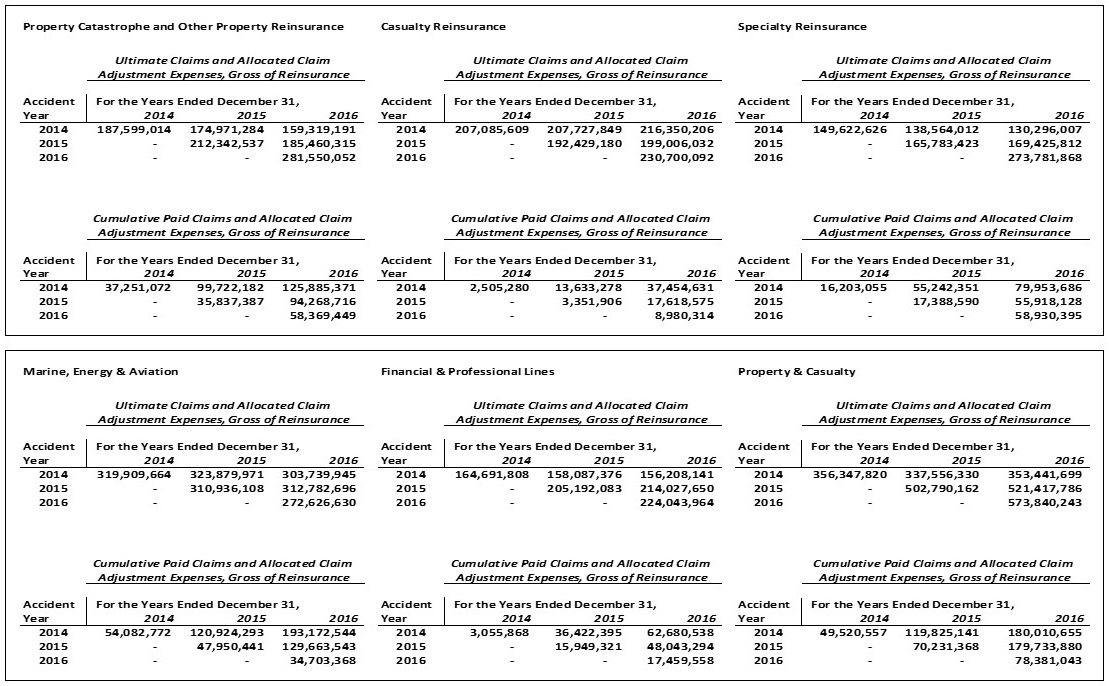

Presented in the tables below on a gross of reinsurance basis is the analysis requested by the Staff for the Company’s lines of business. As can be seen from the tables below, the majority of established reserves for the Company’s lines of business in each of Aspen Insurance and Aspen Re exhibit similar claims development trends and patterns.

As a result, the Company concluded that presenting claims development tables at a reporting segment level did not obscure the development pattern of lines of business which have significantly different characteristics.

The Company acknowledges that it is responsible for the adequacy and accuracy of the disclosure in the filings, that Staff comments or changes to disclosure in response to Staff comments do not foreclose the Commission from taking any action with respect to the Form 10-K, and that the Company may not assert Staff comments as a defense in any proceeding initiated by the Commission or any person under the Federal securities laws of the United States.

Thank you for your consideration of the responses. If you have any further questions or comments, please contact me at 011-44-207-184-8804, Joseph Ferraro of Willkie Farr & Gallagher LLP at 011-44-203-580-4707 or Michael Groll of Willkie Farr & Gallagher LLP at 1-212-728-8616.

Yours sincerely,

Scott Kirk

Chief Financial Officer

Aspen Insurance Holdings Limited

Grahame Dawe

Silvia Martinez

Marc MacGillivray

Aspen Insurance Holdings Limited

Salim Tharani

KPMG LLP

Joseph Ferraro

Michael Groll

Willkie Farr & Gallagher LLP