Use these links to rapidly review the document

TABLE OF CONTENTS

FIELDSTONE INVESTMENT CORPORATION AND SUBSIDIARIES INDEX TO CONSOLIDATED FINANCIAL STATEMENTS

As filed with the Securities and Exchange Commission on January 31, 2005

Registration No. 333-114802

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 9

TO

FORM S-11

REGISTRATION STATEMENT UNDER THE

SECURITIES ACT OF 1933

Fieldstone Investment Corporation

(Exact Name of Registrant as Specified in Its Governing Instruments)

11000 Broken Land Parkway

Suite 600

Columbia, Maryland 21044

(410) 772-7200

(Address, Including Zip Code and Telephone Number, Including Area Code, of Registrant's Principal Executive Offices)

Michael J. Sonnenfeld

President and Chief Executive Officer

Fieldstone Investment Corporation

11000 Broken Land Parkway

Suite 600

Columbia, Maryland 21044

(410) 772-7200

(Name, Address, Including Zip Code and Telephone Number, Including Area Code, of Agent for Service)

Copies to:

| Walter G. Lohr, Jr., Esq. HOGAN & HARTSON L.L.P. 111 South Calvert Street, 16th Floor Baltimore, Maryland 21202 (410) 659-2700 | David P. Slotkin, Esq. HOGAN & HARTSON L.L.P. 555 Thirteenth Street, N.W. Washington, D.C. 20004-1109 (202) 637-5600 |

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this registration statement.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. /x/

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If delivery of the prospectus is expected to be made pursuant to Rule 434, please check the following box. o

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall become effective in accordance with section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to section 8(a), may determine.

SUBJECT TO COMPLETION, DATED , 2005

The information in this prospectus is not complete and may be changed or supplemented. None of the securities described in this prospectus can be sold by the selling stockholders until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell the securities, nor is it a solicitation to buy the securities, in any state where any offer or sale of the securities is not permitted.

PROSPECTUS

43,328,933 Shares

Fieldstone Investment Corporation

Common Stock

We are a self-managed, fully integrated mortgage banking company that originates, securitizes, sells and services non-conforming and conforming single-family residential mortgage loans secured primarily by first liens. We have elected to be taxed as a real estate investment trust, or REIT, for federal income tax purposes, commencing with our taxable year ended December 31, 2003.

This prospectus covers the resale of up to 43,328,933 shares of our common stock that the selling stockholders listed beginning on page 155 of this prospectus may offer for sale from time to time following the effective date of the registration statement of which this prospectus is a part. We are registering these shares of common stock to provide the selling stockholders with registered securities, but this prospectus does not necessarily mean that the selling stockholders will offer or sell those shares. We are filing the registration statement pursuant to contractual obligations that exist with the selling stockholders.

No public market currently exists for our common stock, and our common stock is not currently listed on any national exchange or market system. However, shares of our common stock have been sold and may continue to be sold from time to time in private transactions at negotiated prices.

Our common stock has been approved for quotation on the NASDAQ National Market System under the symbol "FICC." Until such time as our common stock is listed on NASDAQ, we expect that the selling stockholders will sell their shares at prices between $16.00 and $18.00 per share, if any shares are sold. After our common stock is quoted on NASDAQ, the selling stockholders may sell all or a portion of these shares from time to time in market transactions through any stock exchange or market on which our common stock is then listed, in negotiated transactions or otherwise, and at prices and on terms that will be determined by the then prevailing market price or at negotiated prices.

We are not offering for sale any shares of our common stock in the registration statement of which this prospectus is a part. We will not receive any of the proceeds from sales of our shares by the selling stockholders, but will incur expenses. Our common stock is subject to transfer restrictions principally intended to preserve our status as a REIT. See "Description of Capital Stock—Restrictions on Ownership and Transfer."

Investing in our common stock involves risks. See "Risk Factors" beginning on page 12 of this prospectus for risk factors relevant to an investment in our common stock, including, among others:

- •

- We have a limited operating history with respect to our portfolio strategy, which limits your ability to evaluate a key component of our business strategy and our growth prospects and increases your investment risk.

- •

- We have invested the substantial majority of our shareholders' equity in a portfolio of non-conforming mortgage loans held for investment financed by pledging the loans to secure mortgage-backed securities. If we do not receive the payments from the loans that we anticipate, due to either early prepayment of the loans or default by more borrowers than we have anticipated, our revenues may be insufficient to cover our costs to originate, the interest expense and losses on these loans, as well as the repayment of principal on the warehouse or securitization debt used to finance these loans.

- •

- We require substantial cash to fund our loan originations, to pay our loan origination expenses and to hold our loans pending sale or securitization, and if it is not available, our business, financial condition and results of operations will be significantly harmed.

- •

- Fluctuating or rising interest rates may adversely affect our earnings or ability to borrow under our warehouse lines of credit and repurchase facilities.

- •

- The use of securitizations with over-collateralization requirements may have a negative effect on our cash flow if our loan delinquencies exceed certain levels.

- •

- We have not established a minimum distribution payment level, and we cannot assure you of our ability to make distributions to our stockholders in the future.

- •

- If we fail to qualify or remain qualified as a REIT in any taxable year, we would be subject to federal income tax on our taxable income at regular corporate rates, thereby reducing our net income and the amount of funds available for making distributions to our stockholders, and the taxable income of our securitization trusts may be subject to an entity level tax.

- •

- We may become subject to liability and incur increased expenditures as a result of our recent restatement of our financial statements.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2005

You may rely only on information contained in this prospectus or to which we have referred you. We have not authorized anyone to provide you with information that is different. This prospectus does not constitute an offer to sell, or a solicitation of an offer to buy, any shares of our common stock in any jurisdiction in which an offer or solicitation is not authorized or in which the person making the offer or solicitation is not qualified to do so, or to any person to whom it is unlawful to make an offer or solicitation. Neither the delivery of this prospectus nor any sale made hereunder shall, under any circumstances, create an implication that there has been no change in our affairs since the date of this prospectus.

i

This summary highlights the material information contained elsewhere in this prospectus but does not contain all of the information that you should consider before investing. You should read the entire prospectus, including "Risk Factors" and our financial statements and the related notes appearing elsewhere in this prospectus, before deciding to invest in our common stock. In this prospectus, unless the context indicates otherwise, references to "our company," "we," "our" and "us" refer to the activities of, and the assets and liabilities of, the business and operations of Fieldstone Investment Corporation (Fieldstone Investment) and its subsidiaries. References to "Fieldstone Mortgage" refer to the activities of our principal operating subsidiary, Fieldstone Mortgage Company.

Our Company

We are a self-managed, fully integrated mortgage banking company that originates, securitizes, sells and services non-conforming and conforming single-family residential mortgage loans secured primarily by first liens. Our goal is to be an efficient, low-cost originator of high quality residential mortgages and to provide exemplary service to our customers. We retain a significant portion of our non-conforming loans in an investment portfolio, and our current strategy is to own a portfolio of loans with a principal balance approximately equal to 12 times our shareholders' equity. We will finance this portfolio with a combination of long-term securitization debt, short-term warehouse debt and our equity. We retain the servicing rights with respect to non-conforming loans in our portfolio in order to monitor and improve their performance. We continue to sell a portion of the non-conforming loans and all of the conforming loans that we originate on a whole loan, servicing-released basis.

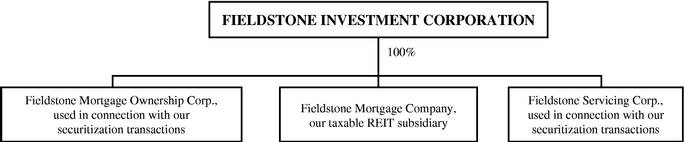

We have elected to be taxed as a real estate investment trust, or REIT, for federal income tax purposes, commencing with our taxable year ended December 31, 2003. We intend to distribute to our stockholders all or substantially all of our REIT taxable income each year in order to comply with the distribution requirements of the Internal Revenue Code and to avoid federal income tax. We intend to retain our net gains on sales of loans to build our capital base. In order to meet some of the requirements to qualify as a REIT, we conduct all of our loan origination, processing, underwriting, sales and servicing functions through our primary operating subsidiary, Fieldstone Mortgage, which we have elected to treat as a taxable REIT subsidiary. Fieldstone Mortgage funds the conforming and non-conforming loans we intend to sell.

We originate our loans through our two primary divisions: non-conforming and conforming. Each division operates both wholesale and retail offices. Fieldstone Mortgage continues to originate all of our conforming and non-conforming loans. However, with respect to non-conforming loans held for investment, Fieldstone Mortgage closes the loans using funds advanced by Fieldstone Investment and simultaneously assigns the loans to Fieldstone Investment.

The conforming loans that we originate generally meet the underwriting criteria of the government-sponsored entities, Fannie Mae (formally, the Federal National Mortgage Association) and Freddie Mac (formally, the Federal Home Loan Mortgage Corporation), the Federal Housing Association (FHA) or the Veterans Administration (VA), or the criteria of institutional investors.

The non-conforming loans that we originate are underwritten in accordance with our underwriting guidelines. We base our underwriting decisions on our assessment of the borrower's willingness and ability to pay, as reflected in the borrower's historical patterns of debt repayment, the amount of equity in the borrower's property, the borrower's debt ratios and other factors. We believe that we have developed underwriting processes and criteria that generate high quality borrower data and valid appraisals, give us the ability to make sound underwriting and pricing decisions and allow us to approve and fund loans efficiently.

1

The following table shows our total fundings of non-conforming and conforming loans for the three and nine months ended September 30, 2004 and for the years ended December 31, 2003 and 2002:

| | Three Months Ended September 30, 2004 | Nine Months Ended September 30, 2004 | Year Ended December 31, 2003 | Year Ended December 31, 2002 | ||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | Loans Funded (in millions) | Percentage of Total Loans | Loans Funded (in millions) | Percentage of Total Loans | Loans Funded (in millions) | Percentage of Total Loans | Loans Funded (in millions) | Percentage of Total Loans | ||||||||||||||

| Non-Conforming | ||||||||||||||||||||||

| Refinance of existing mortgage | $ | 663 | 39 | % | $ | 1,936 | 42 | % | $ | 2,056 | 40 | % | $ | 970 | 39 | % | ||||||

| Purchase of home | $ | 1,025 | 61 | % | $ | 2,712 | 58 | % | 3,092 | 60 | % | 1,509 | 61 | % | ||||||||

| Total Non-Conforming | $ | 1,688 | 100 | % | $ | 4,648 | 100 | % | $ | 5,148 | 100 | % | $ | 2,479 | 100 | % | ||||||

Conforming | ||||||||||||||||||||||

| Refinance of existing mortgage | $ | 138 | 46 | % | $ | 536 | 55 | % | $ | 1,568 | 70 | % | $ | 974 | 63 | % | ||||||

| Purchase of home | $ | 163 | 54 | % | $ | 441 | 45 | % | 656 | 30 | % | 563 | 37 | % | ||||||||

| Total Conforming | $ | 301 | 100 | % | $ | 977 | 100 | % | $ | 2,224 | 100 | % | $ | 1,537 | 100 | % | ||||||

We finance our mortgage originations on a short-term basis through a variety of warehouse lines of credit and repurchase facilities. We retain a substantial portion of our non-conforming loans in our investment portfolio on a long-term basis, financed largely by issuing mortgage-backed securities secured by these loans. These securitizations are structured as financings for accounting purposes; therefore, we do not recognize a gain or loss on our securitization of these loans. We record interest income generated by the loans and recognize interest expense on the mortgage-backed securities over the life of the loans and corresponding mortgage-backed securities debt.

We generate earnings from the non-conforming loans we retain primarily through:

- •

- net interest income, which is the difference between the interest income we receive from the loans and the interest expense paid under our warehouse lines and repurchase facilities and to the holders of the mortgage-backed securities;

less

- •

- losses due to defaults and delinquencies on the loans; and

- •

- servicing fees and selling and general administrative expenses that we must pay.

Our net interest income will vary based upon, among other things, the difference between the weighted average interest earned on the loans and the interest payable to our warehouse lenders and the holders of the mortgage-backed securities, the performance of the underlying loans and the amount and timing of borrower prepayments of the underlying loans.

We sell all of our conforming loans as well as the non-conforming loans held for sale on a "servicing-released" basis, which means we sell the loans together with the servicing rights to the buyer of the loans. These transactions are typically referred to as whole loan sales. We aggregate these loans into mortgage pools and sell these pools of mortgages to third parties on a servicing-released basis. We generally sell our loans held for sale within 45 days of funding. We perform the initial interim servicing functions for all of our loans. We intend to develop our servicing capability to allow us to permanently service the portfolio of non-conforming loans held for investment, but until this capability is developed,

2

we contract with third parties to service these loans for us. We perform the initial interim servicing functions for these loans between the time of origination and the time of transfer of servicing to the long-term servicer of these loans, which is generally within 90 days after funding.

Under our whole loan sale strategy, our income is generated primarily by:

- •

- the sale of loans at a premium to our weighted average origination costs (net of origination fee income); and

- •

- net interest income, which is the difference between the interest income we receive from the loans and our interest expense paid under our warehouse lines and repurchase facilities used to fund the loans.

Risk Factors

Investing in our common stock involves risks. See "Risk Factors" beginning on page 12 of this prospectus for risk factors relevant to an investment in our common stock, including, among others:

- •

- We have a limited operating history with respect to our portfolio strategy, which limits your ability to evaluate a key component of our business strategy and our growth prospects and increases your investment risk.

- •

- We have invested the substantial majority of our shareholders' equity in a portfolio of non-conforming mortgage loans held for investment financed by pledging the loans to secure mortgage-backed securities. If we do not receive the payments from the loans that we anticipate, due to either early prepayment of the loans or default by more borrowers than we have anticipated, our revenues may be insufficient to cover our costs to originate, the interest expense and losses on these loans, as well as the repayment of principal on the warehouse or securitization debt used to finance these loans.

- •

- We require substantial cash to fund our loan originations, to pay our loan origination expenses and to hold our loans pending sale or securitization, and if it is not available, our business, financial condition and results of operations will be significantly harmed.

- •

- Fluctuating or rising interest rates may adversely affect our earnings or ability to borrow under our warehouse lines of credit and repurchase facilities.

- •

- The use of securitizations with over-collateralization requirements may have a negative effect on our cash flow if our loan delinquencies exceed certain levels.

- •

- We have not established a minimum distribution payment level. If the cash we generate from our operations is insufficient to make our REIT distributions, we may need to borrow funds on a short-term basis to make distributions to stockholders. We cannot assure you of our ability to make distributions to our stockholders in the future.

- •

- If we fail to qualify or remain qualified as a REIT in any taxable year, we would be subject to federal income tax on our taxable income at regular corporate rates, thereby reducing our net income and the amount of funds available for making distributions to our stockholders, and our taxable income of our securitization trusts may be subject to an entity level tax.

- •

- We may become subject to liability and incur increased expenditures as a result of our recent restatement of our financial statements.

Recent Developments

On January 14, 2005, we announced that we would restate our audited financial statements for the year ended December 31, 2003, and our unaudited financial statements for each of the first three

3

quarters of 2004, to eliminate the use of cash flow hedge accounting treatment under Statement of Financial Accounting Standards No. 133 (Statement 133) for our interest rate swap transactions in place during these periods. Cash flow hedge accounting would result in recognizing the mark to market of the remaining effective future value of the interest rate swaps' cash flow on our balance sheet in accumulated other comprehensive income, the impact of which would be reflected in total shareholders' equity but not our reported net income.

We designed our interest rate swap transactions to allow us to match-fund the interest rates on our assets and liabilities by fixing the interest rates that we pay on our warehouse and securitization debt, which bear interest at variable rates, during the period that our mortgage loan assets have a fixed interest rate, generally during the first two years of the mortgages' lives. These interest rate swaps were an effective economic hedge of our debt expense, and we attempted to document the swaps transactions to meet the requirements of Statement 133 in order for the swaps to be eligible for cash flow hedge accounting.

We have now determined that our interest rate swaps did not qualify for cash flow hedge accounting under Statement 133, and we have restated our financial statements primarily to reclassify the effective portion of the mark to market of the changes in fair market value of our interest rate swaps from accumulated other comprehensive income into current period earnings. This reclassification had no effect on our REIT taxable income, which is the basis for determining the dividends we pay to our stockholders. Periods prior to the fourth quarter of 2003 are not impacted because we did not engage in interest rate swap transactions prior to December 2003.

A summary of the impact of the restatement on net income and shareholders' equity is as follows (in thousands):

| | | Three Months Ended | | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | Nine Months Ended September 30, 2004 | ||||||||||||||

| | Year Ended December 31, 2003 | March 31, 2004 | June 30, 2004 | September 30, 2004 | ||||||||||||

| Net income as previously reported | $ | 50,008 | $ | 2,274 | $ | 7,979 | $ | 14,741 | $ | 24,994 | ||||||

| Effect of the restatement: | ||||||||||||||||

| Effective portion of mark-to market of swaps previously recorded in other comprehensive income (loss) | (2,176 | ) | (6,276 | ) | 23,863 | (12,530 | ) | 5,057 | ||||||||

| Inter-period correction of mark to market of swaps | — | — | (1,656 | ) | 1,656 | — | ||||||||||

| Accrued interest payable-swaps | — | 231 | (63 | ) | 84 | 252 | ||||||||||

| Total effect of the restatement | (2,176 | ) | (6,045 | ) | 22,144 | (10,790 | ) | 5,309 | ||||||||

| Net income (loss) as restated | $ | 47,832 | $ | (3,771 | ) | $ | 30,123 | $ | 3,951 | $ | 30,303 | |||||

| | Balance as of December 31, 2003 | Balance as of March 31, 2004 | Balance as of June 30, 2004 | Balance as of September 30, 2004 | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Total Shareholders' Equity: | |||||||||||||

| Effect of the restatement: | |||||||||||||

| Balance as previously reported | $ | 513,554 | $ | 510,145 | $ | 539,082 | $ | 529,153 | |||||

| Inter-period correction of mark to market of swaps | — | — | (1,656 | ) | — | ||||||||

| Accrued interest payable-swaps | — | 231 | 168 | 252 | |||||||||

| Balance as restated | $ | 513,554 | $ | 510,376 | $ | 537,594 | $ | 529,405 | |||||

For all prior periods affected, and for future periods unless and until we elect and satisfy all of the requirements of Statement 133 for cash flow hedge accounting, the period to period changes in the fair market value of our interest rate swaps will be recognized as either an increase or decrease in our current period net income through other income (expense)—portfolio derivatives. We are currently

4

assessing alternative hedge strategies and methods of documenting our hedging relationships in order to permit us to achieve cash flow hedge accounting for interest rate swaps we enter into in the future. There can be no assurance that we will be able to design a hedge strategy that will meet the technical requirements of Statement 133. For tax accounting purposes, these interest rate swaps will continue to be accounted for as hedges of warehouse and securitization debt financing mortgage loans under Section 1221 of the Internal Revenue Code, and, therefore, the mark to market gains and losses will not be recognized for calculating REIT taxable income or for the REIT income tests.

Our Principal Office

Our principal offices are located at 11000 Broken Land Parkway, Suite 600, Columbia, Maryland 21044. Our telephone number is (410) 772-7200. Our website is www.FieldstoneInvestment.com. Fieldstone Mortgage's website is www.fmcc.com or www.FieldstoneMortgage.com. The information on our websites does not constitute a part of this prospectus.

Restrictions on Ownership of Our Common Stock

Due to limitations on the concentration of ownership of REIT shares imposed by the Internal Revenue Code, our charter documents generally prohibit any stockholder from actually or constructively owning more than 9.8% of the outstanding shares of our common stock. Our board may, in its sole discretion, waive the ownership limit with respect to a particular stockholder if our board is presented with satisfactory evidence that the ownership will not then or in the future jeopardize our REIT status. Our charter also prohibits certain cooperatives, governmental entities and tax-exempt organizations that are exempt from the unrelated business income tax from owning our shares because a tax could be imposed on us if our shares are held by these entities.

Our Corporate History, Formation and Tax Status

Fieldstone Mortgage has been acquiring and selling mortgage loans since its formation in 1995 as a Maryland corporation. Fieldstone Mortgage began originating mortgage loans in 1996. Fieldstone Mortgage was acquired in 1998 by Fieldstone Holdings Corp. (Fieldstone Holdings). Fieldstone Investment was formed as a Maryland corporation on August 20, 2003 to be the successor to Fieldstone Holdings. On November 14, 2003, Fieldstone Holdings merged with and into Fieldstone Investment, with Fieldstone Investment being the surviving entity, and as a result, Fieldstone Mortgage became the principal operating subsidiary of Fieldstone Investment.

Prior to 2003, Fieldstone Holdings operated as a regular taxable C corporation. Effective January 1, 2003, Fieldstone Holdings made an election to be taxed as an S corporation. Effective November 13, 2003, prior to merging with Fieldstone Investment, Fieldstone Holdings revoked its S corporation status. We have elected to be taxed as a REIT for federal income tax purposes, effective November 13, 2003. Our qualification as a REIT depends upon our ability to meet, on a continuing basis, various complex requirements under the Internal Revenue Code relating to, among other things, the sources of our gross income, the composition and values of our assets, our distribution levels and the diversity of ownership of our capital stock. We believe that we are organized as required to qualify as a REIT under the Internal Revenue Code and that our manner of operation will enable us to meet the requirements for taxation as a REIT for federal income tax purposes.

As a REIT, we generally are not subject to federal income tax on the REIT taxable income that we distribute currently to our stockholders. If we fail to qualify as a REIT in any taxable year, we will be subject to federal income tax at regular corporate rates. Even if we qualify as a REIT, we may be subject to some federal, state and local taxes on our income and property. We have elected to treat Fieldstone Mortgage as our taxable REIT subsidiary. Fieldstone Mortgage is a regular taxable corporation that is subject to federal, state and local income tax on profits it earns on its mortgage

5

origination business, including profits from the sale of conforming loans and any non-conforming loans not held in our portfolio.

Our Distribution Policy

To satisfy the requirements to qualify as a REIT, and to reduce our liability to pay taxes on our income, we will make regular quarterly distributions of all or substantially all of our REIT taxable income to our stockholders. Under the Internal Revenue Code, REITs are subject to numerous organizational and operational requirements, including a requirement that they distribute at least 90% of their REIT taxable income, excluding net capital gains, to their stockholders on an annual basis. If we fail to qualify as a REIT, we will be subject to tax as a regular corporation and may face substantial tax liability. Even if we qualify as a REIT, we may be subject to certain federal, state and local taxes on a portion of our income and property. Our REIT taxable income, and our cash available for distribution, will not include any earnings of Fieldstone Mortgage that we choose to retain in that subsidiary (by not making a dividend of those earnings to Fieldstone Investment). Any distributions we make will be at the discretion of our board of directors and will depend upon, among other things, our actual results of operations. Our actual results of operations and our ability to pay distributions will be affected by a number of factors, including the net interest income we receive from the non-conforming loans we retain in our portfolio, the revenue we receive from the securitization and sale of loans, our operating expenses and any other expenditures. In addition, if our minimum distribution required to maintain our REIT status exceeds our cash available for distribution because our income for tax purposes exceeds our cash flow from operations, we could be forced to borrow funds, sell assets or raise capital on unfavorable terms in order to maintain our REIT status.

We have not established a minimum distribution payment level, and we cannot assure you of our ability to make distributions to our stockholders in the future. We anticipate that our distributions generally will be taxable as ordinary income to our stockholders, although if we were to restructure our investment portfolio and sell loans held in the portfolio, a portion of any distributions may be designated by us as capital gain, based on the tax accounting for our income. In addition, a portion of our dividend will be classified as excess inclusion income. If our distributions exceed our accumulated REIT taxable income, as calculated for federal income tax purposes, distributions may constitute a return of capital for tax purposes. We will furnish annually to each of our stockholders a statement setting forth distributions paid during the preceding year and their characterization for tax purposes. See "Material Federal Income Tax Considerations."

144A Offering

We sold a total of 47.15 million shares of our common stock in the fourth quarter of 2003. Of these shares, we sold 36.56 million shares at $13.95 per share to Friedman, Billings, Ramsey & Co., Inc., or FBR, as initial purchaser, on November 14, 2003, and an additional 195,400 shares of our common stock at $13.95 per share to FBR, as initial purchaser, on December 11, 2003, pursuant to the exercise by FBR of its option to purchase shares to cover additional allotments. FBR resold 33,166,835 shares to investors at a price of $15.00 per share in transactions not involving registration under the Securities Act. As part of this same offering, we sold 10,398,936 shares of our common stock (including 356,540 shares sold to our employees and directors in a directed share program) directly in a private placement in reliance on the exemption from registration provided in Section 4(2) of the Securities Act and Rule 506 of Regulation D thereunder, at a price of $15.00 per share. FBR received a fee of $1.05 per share as placement agent in respect of the shares sold in the private placement (except for the shares sold in the directed share program for which no fee was paid). We also issued 400,000 shares of our common stock to FBR as consideration for financial advisory services, at a price of $0.01 per share. The value of the shares issued to FBR for its financial advisory services was approximately $6.0 million.

6

The shares sold to FBR and those sold by us directly in the private placement are collectively referred to as the 144A Offering.

Our net proceeds from the 144A Offering were approximately $658.1 million. We have used the net proceeds as follows:

- •

- approximately $188.1 million to redeem 94.83% of our common stock outstanding immediately prior to the closing of the 144A Offering;

- •

- approximately $33.0 million to repay in full the principal and interest on our subordinated debt outstanding immediately prior to the closing of the 144A Offering;

- •

- approximately $4.4 million to pay advisory, legal and accounting fees incurred in connection with the 144A Offering, including fees incurred in connection with filing the registration statement of which this prospectus is a part, and the reimbursement of certain fees and expenses incurred by FBR; and

- •

- the remainder, $432.6 million, for building our investment portfolio, working capital and other general corporate purposes, including repaying outstanding borrowings under our warehouse lines and repurchase facilities.

For a more detailed discussion of the 144A Offering see "Our Structure and Formation Transactions; 144A Offering."

7

This prospectus covers the resale of up to 43,328,933 shares of our common stock, which represents 88.7% of our total outstanding common stock. We issued and sold 47,150,000 shares in the 144A Offering. FBR has represented to us that the shares it purchased in the 144A Offering and those it placed on our behalf were resold to qualified institutional buyers, as defined in Rule 144A under the Securities Act, institutional accredited investors, as defined in Rule 501 under the Securities Act, or to non-U.S. persons, as defined in Regulation S under the Securities Act, initially at a price of $15.00 per share.

| Common stock offered by the selling stockholders | 43,328,933 shares(1) | |

Common stock outstanding | 48,839,626 shares(2) | |

Offering price | The selling stockholders are offering, from time to time, the shares being offered by this prospectus at the then current market price. | |

Use of proceeds | We will not receive any proceeds from the sale of the shares of common stock sold by the selling stockholders. | |

Trading | Our common stock has been approved for quotation on the NASDAQ National Market under the symbol "FICC;" however, an active trading market for our common stock may never develop. |

- (1)

- Includes (i) 42,553,073 of the 47,150,000 shares issued and sold in the 144A Offering and (ii) 775,860 shares owned by Michael J. Sonnenfeld, our president and chief executive officer, prior to the 144A Offering.

- (2)

- Includes (i) 47.15 million shares issued and sold in the 144A Offering, (ii) 400,000 shares issued to FBR in consideration for financial advisory services rendered, (iii) 775,860 shares owned by Michael J. Sonnenfeld, our president and chief executive officer, prior to the 144A Offering, (iv) 496,866 shares of restricted stock issued to our directors, officers and key employees under our Equity Incentive Plan and (v) 16,900 shares issued upon the exercise of options. Excludes 736,600 shares issuable upon the exercise of options outstanding on January 31, 2005.

8

Summary Selected Historical Consolidated Financial Data

(In Thousands)

The following table presents summary selected historical consolidated financial data for Fieldstone Investment, including the financial data for Fieldstone Holdings, deemed to be our predecessor for accounting purposes. The historical financial statements represent the combined financial condition and results of operations of Fieldstone Investment and its subsidiaries. In addition, the historical consolidated financial data included below for the years ended December 31, 1999 through 2002 and the three and nine months ended September 30, 2003 reflect our business strategy prior to the completion of the 144A Offering. See "Business" beginning on page 97. Accordingly, our historical financial results will not be indicative of our future performance. In addition, because the information in this table is only a summary and does not provide all of the information contained in our financial statements, including related notes, you should read "Management's Discussion and Analysis of Financial Condition and Results of Operations" and the financial statements, including the related notes, contained elsewhere in this prospectus.

Our consolidated statements of condition as of December 31, 2003 and September 30, 2004 and our consolidated statements of operations for the three and nine months ended September 30, 2004 and year ended December 31, 2003 have been restated to reflect the elimination of the use of cash flow hedge accounting treatment for our interest rate swap transactions in effect during such periods. See "Management's Discussion and Analysis of Financial Condition and Results of Operations—Restatement of Consolidated Financial Statements" and Note 2 to our financial statements contained elsewhere in this prospectus.

| | Three Months Ended September 30, | Nine Months Ended September 30, | Year Ended December 31, | |||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | 2004 (as restated) | 2003 | 2004 (as restated) | 2003 | 2003 (as restated) | 2002 | 2001 | 2000 | 1999 | |||||||||||||||||||||

| | (Unaudited) | (Unaudited) | (Unaudited) | (Unaudited) | | | | | | |||||||||||||||||||||

| Operating Data: | ||||||||||||||||||||||||||||||

| Revenues: | ||||||||||||||||||||||||||||||

| Interest income: | ||||||||||||||||||||||||||||||

| Loans held for investment | $ | 60,141 | $ | 4,819 | $ | 130,139 | $ | 4,819 | $ | 17,749 | $ | — | $ | — | $ | — | $ | — | ||||||||||||

| Loans held for sale | 6,445 | 11,845 | 19,036 | 37,594 | 49,118 | 33,666 | 16,747 | 8,639 | 5,823 | |||||||||||||||||||||

| Total interest income | 66,586 | 16,664 | 149,175 | 42,413 | 66,867 | 33,666 | 16,747 | 8,639 | 5,823 | |||||||||||||||||||||

Interest expense: | ||||||||||||||||||||||||||||||

| Loans held for investment | 20,274 | 1,953 | 38,705 | 1,953 | 5,137 | — | — | — | — | |||||||||||||||||||||

| Loans held for sale | 1,543 | 4,271 | 4,271 | 13,531 | 17,424 | 13,543 | 10,287 | 7,571 | 3,898 | |||||||||||||||||||||

| Subordinated debt | — | 121 | — | 350 | 510 | 576 | 741 | 1,106 | 757 | |||||||||||||||||||||

| Total interest expense | 21,817 | 6,345 | 42,976 | 15,834 | 23,071 | 14,119 | 11,028 | 8,677 | 4,655 | |||||||||||||||||||||

| Net interest income (expense) | 44,769 | 10,319 | 106,199 | 26,579 | 43,796 | 19,547 | 5,719 | (38 | ) | 1,168 | ||||||||||||||||||||

| Provision for loan losses—loans held for investment | 5,921 | 51 | 14,878 | 51 | 2,078 | — | — | — | — | |||||||||||||||||||||

| Net interest income after provision for loan losses | 38,848 | 10,268 | 91,321 | 26,528 | 41,718 | 19,547 | 5,719 | (38 | ) | 1,168 | ||||||||||||||||||||

| Gains on sale of mortgage loans, net | 14,238 | 27,782 | 41,356 | 96,060 | 117,882 | 74,875 | 42,429 | 25,065 | 13,841 | |||||||||||||||||||||

| Other income (expense)—portfolio derivatives | (15,032 | ) | — | (4,488 | ) | — | (3,398 | ) | — | — | — | — | ||||||||||||||||||

| Fees and other income | 1,067 | 878 | 2,898 | 2,307 | 3,188 | 3,230 | 2,834 | 2,305 | 1,631 | |||||||||||||||||||||

| Total revenues | 39,121 | 38,928 | 131,087 | 124,895 | 159,390 | 97,652 | 50,982 | 27,332 | 16,640 | |||||||||||||||||||||

| Payroll and related expenses, net | 20,690 | 18,693 | 62,417 | 50,381 | 84,227 | 40,482 | 28,260 | 23,629 | 17,003 | |||||||||||||||||||||

| General and administrative expenses(1) | 12,944 | 7,424 | 33,829 | 20,287 | 29,947 | 19,568 | 14,619 | 13,530 | 10,232 | |||||||||||||||||||||

| Total expenses | 33,634 | 26,117 | 96,246 | 70,668 | 114,174 | 60,050 | 42,879 | 37,159 | 27,235 | |||||||||||||||||||||

| Income (loss) before taxes | 5,487 | 12,811 | 34,841 | 54,227 | 45,216 | 37,602 | 8,103 | (9,827 | ) | (10,595 | ) | |||||||||||||||||||

| Provision for income tax expense (benefit) | 1,536 | — | 4,538 | 12,736 | (2,616 | ) | 15,855 | (3,140 | ) | — | (1,385 | ) | ||||||||||||||||||

| Net income (loss) | $ | 3,951 | $ | 12,811 | $ | 30,303 | $ | 41,491 | $ | 47,832 | $ | 21,747 | $ | 11,243 | $ | (9,827 | ) | $ | (9,210 | ) | ||||||||||

| Earnings (loss) per share of common stock: | ||||||||||||||||||||||||||||||

| Basic | $ | 0.08 | $ | 0.85 | $ | 0.62 | $ | 2.77 | $ | 2.48 | $ | 1.44 | $ | 0.74 | $ | (0.65 | ) | $ | (1.05 | ) | ||||||||||

| Diluted | 0.08 | 0.85 | 0.62 | 2.77 | 2.47 | 1.44 | 0.74 | (0.65 | ) | (1.05 | ) | |||||||||||||||||||

| Dividends per common share(2) | 0.24 | 1.53 | 0.31 | 2.53 | 2.53 | — | — | — | — | |||||||||||||||||||||

9

| | Three Months Ended September 30, | Nine Months Ended September 30, | Year Ended December 31, | ||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | 2004 (as restated) | 2003 | 2004 (as restated) | 2003 | 2003 (as restated) | 2002 | 2001 | 2000 | 1999 | ||||||||||||||||||||

| Other Data (unaudited): | |||||||||||||||||||||||||||||

| Non-Conforming fundings(3) | $ | 1,687,570 | $ | 1,460,422 | $ | 4,648,533 | $ | 3,530,633 | $ | 5,148,182 | $ | 2,479,323 | $ | 1,175,389 | $ | 681,135 | $ | 487,812 | |||||||||||

| Conforming fundings(3) | 301,269 | 669,764 | 976,564 | 1,905,626 | 2,223,868 | 1,537,084 | 1,070,455 | 459,192 | — | ||||||||||||||||||||

| Total mortgage fundings(3) | $ | 1,988,839 | $ | 2,130,186 | $ | 5,625,097 | $ | 5,436,259 | $ | 7,372,050 | $ | 4,016,407 | $ | 2,245,844 | $ | 1,140,327 | $ | 487,812 | |||||||||||

Yield on loans held for sale(4) | 7.4 | % | 6.7 | % | 7.2 | % | 7.0 | % | 7.0 | % | 7.6 | % | 8.5 | % | 9.2 | % | 9.9 | % | |||||||||||

| Cost of financing for loans held for sale(5) | 2.7 | % | 2.7 | % | 2.5 | % | 2.8 | % | 2.8 | % | 3.4 | % | 5.8 | % | 8.4 | % | 6.9 | % | |||||||||||

| Net yield on loans held for sale(6) | 5.6 | % | 4.3 | % | 5.6 | % | 4.5 | % | 4.5 | % | 4.6 | % | 3.3 | % | 1.1 | % | 3.3 | % | |||||||||||

Yield on loans held for investment(4) | 6.5 | % | 6.5 | % | 6.6 | % | 6.5 | % | 6.6 | % | — | — | — | — | |||||||||||||||

| Cost of financing for loans held for investment(5) | 2.3 | % | 2.7 | % | 2.1 | % | 2.7 | % | 2.3 | % | — | — | — | — | |||||||||||||||

| Net yield on loans held for investment(6) | 4.3 | % | 3.9 | % | 4.6 | % | 3.9 | % | 4.7 | % | — | — | — | — | |||||||||||||||

Net cash settlements received/(paid)—portfolio derivatives(7) | (0.3 | )% | — | (0.5 | )% | — | — | — | — | — | — | ||||||||||||||||||

Yield on loans held for investment after provision for loan losses | 3.7 | % | 3.8 | % | 3.9 | % | 3.8 | % | 3.9 | % | — | — | — | — | |||||||||||||||

Yield—net interest income on loans held for sale and loans held for investment after provision for loan losses(6) | 3.9 | % | 4.1 | % | 4.1 | % | 4.3 | % | 4.5 | % | 4.4 | % | 2.9 | % | 0.0 | % | 2.0 | % | |||||||||||

Weighted average interest rate(8) | |||||||||||||||||||||||||||||

| Non-Conforming fundings | 7.3 | % | 7.2 | % | 7.1 | % | 7.3 | % | 7.3 | % | 8.4 | % | 9.6 | % | 10.7 | % | 9.9 | % | |||||||||||

| Conforming fundings | 5.8 | % | 5.5 | % | 5.6 | % | 5.6 | % | 5.6 | % | 6.4 | % | 7.1 | % | 8.2 | % | — | ||||||||||||

| Total | 7.1 | % | 6.7 | % | 6.9 | % | 6.7 | % | 6.8 | % | 7.7 | % | 8.4 | % | 9.7 | % | 9.9 | % | |||||||||||

Weighted average whole loan sales price over par | |||||||||||||||||||||||||||||

| Non-Conforming fundings | 3.0 | % | 3.6 | % | 3.1 | % | 3.9 | % | 3.8 | % | 4.2 | % | 4.2 | % | 3.5 | % | 3.1 | % | |||||||||||

| Conforming fundings | 2.1 | % | 1.8 | % | 2.0 | % | 2.0 | % | 2.0 | % | 2.0 | % | 2.1 | % | 1.9 | % | — | ||||||||||||

| Total | 2.7 | % | 2.8 | % | 2.7 | % | 3.2 | % | 3.1 | % | 3.3 | % | 3.2 | % | 2.9 | % | 3.1 | % | |||||||||||

Average hedge gain (loss) on whole loan sales | |||||||||||||||||||||||||||||

| Non-Conforming fundings | (0.41 | )% | (0.03 | )% | (0.17 | )% | (0.10 | )% | (0.09 | )% | (0.07 | )% | — | — | — | ||||||||||||||

| Conforming fundings | (0.16 | )% | 0.19 | % | (0.02 | )% | 0.02 | % | 0.02 | % | 0.03 | % | (0.19 | )% | — | — | |||||||||||||

| Total | (0.33 | )% | 0.07 | % | (0.11 | )% | (0.05 | )% | (0.05 | )% | (0.05 | )% | (0.09 | )% | — | — | |||||||||||||

Weighted average credit score(8) | |||||||||||||||||||||||||||||

| Non-Conforming fundings | 652 | 655 | 652 | 652 | 653 | 645 | 632 | 616 | 618 | ||||||||||||||||||||

| Conforming fundings | 707 | 717 | 705 | 715 | 713 | 704 | 680 | 673 | — | ||||||||||||||||||||

| Total | 660 | 675 | 661 | 674 | 671 | 667 | 653 | 635 | 618 | ||||||||||||||||||||

Weighted average loan to value(8) | |||||||||||||||||||||||||||||

| Non-Conforming fundings | 84.3 | % | 86.2 | % | 84.6 | % | 86.1 | % | 86.0 | % | 85.7 | % | 84.6 | % | 78.4 | % | 82.1 | % | |||||||||||

| Conforming fundings | 76.1 | % | 72.5 | % | 74.9 | % | 73.4 | % | 73.7 | % | 75.9 | % | 83.3 | % | 85.6 | % | — | ||||||||||||

| Total | 83.0 | % | 81.9 | % | 82.9 | % | 81.6 | % | 82.3 | % | 82.0 | % | 83.9 | % | 81.3 | % | 82.1 | % | |||||||||||

| Provision for loan losses—sold loans (9) | 0.0 | % | 0.4 | % | 0.3 | % | 0.4 | % | 0.4 | % | 0.5 | % | 0.4 | % | 0.2 | % | 0.5 | % | |||||||||||

Full documentation—non-conforming fundings(8) | 58.4 | % | 55.6 | % | 60.9 | % | 55.0 | % | 55.0 | % | 51.0 | % | 55.0 | % | 80.2 | % | 89.2 | % | |||||||||||

Mortgage sales | |||||||||||||||||||||||||||||

| Non-Conforming loan sales | $ | 583,078 | $ | 891,306 | $ | 1,744,202 | $ | 3,022,483 | $ | 3,989,664 | $ | 2,128,497 | $ | 1,047,115 | $ | 648,136 | $ | 477,981 | |||||||||||

| Conforming loan sales | 285,790 | 781,792 | 971,983 | 2,017,214 | 2,372,853 | 1,365,081 | 1,008,349 | 410,744 | — | ||||||||||||||||||||

| Total mortgage sales | $ | 868,868 | $ | 1,673,098 | $ | 2,716,185 | $ | 5,039,697 | $ | 6,362,517 | $ | 3,493,578 | $ | 2,055,464 | $ | 1,058,880 | $ | 477,981 | |||||||||||

| Ratios (unaudited): | |||||||||||||||||||||||||||||

| Debt to capital(10) | 7.5 | 15.5 | 7.5 | 15.5 | 2.9 | 16.2 | 10.7 | 12.4 | 5.7 | ||||||||||||||||||||

| Return on average equity (annualized) | 3.0 | % | 95.0 | % | 7.7 | % | 111.6 | % | 44.4 | % | 88.3 | % | 167.6 | % | N/A | N/A | |||||||||||||

| Return on average assets (annualized) | 0.4 | % | 5.1 | % | 1.3 | % | 6.6 | % | 4.8 | % | 4.7 | % | 5.4 | % | (9.6 | )% | (15.1 | )% | |||||||||||

| Average equity as a percentage of average assets | 12.5 | % | 5.4 | % | 16.5 | % | 5.9 | % | 10.7 | % | 5.3 | % | 3.2 | % | (0.9 | )% | (0.2 | )% | |||||||||||

| Net cost to originate(11) | |||||||||||||||||||||||||||||

| Non-Conforming | 2.4 | % | 2.1 | % | 2.4 | % | 2.2 | % | 2.3 | % | 2.2 | % | 2.8 | % | 4.0 | % | 5.2 | % | |||||||||||

| Conforming | 2.4 | % | 1.6 | % | 2.3 | % | 1.6 | % | 1.7 | % | 1.7 | % | 1.8 | % | 2.3 | % | — | ||||||||||||

| Total | 2.4 | % | 2.0 | % | 2.4 | % | 2.0 | % | 2.1 | % | 2.0 | % | 2.3 | % | 3.3 | % | 5.2 | % | |||||||||||

| Operating expenses as a percentage of total loans funded(12) | 2.4 | % | 1.9 | % | 2.4 | % | 2.0 | % | 2.0 | % | 2.2 | % | 2.7 | % | 3.8 | % | 6.2 | % | |||||||||||

| Operating expenses as a percentage of average assets(13) | 3.2 | % | 10.4 | % | 4.1 | % | 11.3 | % | 11.4 | % | 12.9 | % | 20.6 | % | 36.5 | % | 44.6 | % | |||||||||||

| Efficiency ratio(14) | 86.0 | % | 67.1 | % | 73.4 | % | 56.6 | % | 71.6 | % | 61.5 | % | 84.1 | % | 136.0 | % | 163.7 | % | |||||||||||

10

| | Three Months Ended September 30, | Nine Months Ended September 30, | Year Ended December 31, | ||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | 2004 (as restated) | 2003 | 2004 (as restated) | 2003 | 2003 (as restated) | 2002 | 2001 | 2000 | 1999 | ||||||||||||||||||||

| Statements of Condition Data (unaudited): | |||||||||||||||||||||||||||||

| Mortgage loans held for sale, net | |||||||||||||||||||||||||||||

| Non-Conforming loans | $ | 101,943 | $ | 582,390 | $ | 101,943 | $ | 582,390 | $ | 404,099 | $ | 578,853 | $ | 223,307 | $ | 95,371 | $ | 57,473 | |||||||||||

| Conforming loans | 154,824 | 148,293 | 154,824 | 148,293 | 106,285 | 270,830 | 105,535 | 45,915 | — | ||||||||||||||||||||

| Total | $ | 256,767 | $ | 730,683 | $ | 256,767 | $ | 730,683 | $ | 510,384 | $ | 849,683 | $ | 328,842 | $ | 141,286 | $ | 57,473 | |||||||||||

| Mortgage loans held for sale—average balance | $ | 340,087 | $ | 686,936 | $ | 348,677 | $ | 708,850 | $ | 695,890 | $ | 436,062 | $ | 193,585 | $ | 92,293 | $ | 57,869 | |||||||||||

| Mortgage loans held for sale, net—seriously delinquent(15) | 1.7 | % | 0.6 | % | 1.7 | % | 0.6 | % | 0.4 | % | 1.3 | % | 0.5 | % | 2.5 | % | 5.6 | % | |||||||||||

| Mortgage loans held for investment, net | |||||||||||||||||||||||||||||

| Loans to be securitized | $ | 1,408,855 | $ | 502,378 | $ | 1,408,855 | $ | 502,378 | $ | 835,271 | $ | — | $ | — | $ | — | $ | — | |||||||||||

| Loans securitized | 2,720,098 | — | 2,720,098 | — | 491,570 | — | — | — | — | ||||||||||||||||||||

| Total | $ | 4,128,953 | $ | 502,378 | $ | 4,128,953 | $ | 502,378 | $ | 1,326,841 | $ | — | $ | — | $ | — | $ | — | |||||||||||

| Mortgage loans held for investment—average balance | $ | 3,602,695 | $ | 288,365 | $ | 2,608,641 | $ | 97,178 | $ | 266,558 | $ | — | $ | — | $ | — | $ | — | |||||||||||

| Mortgage loans held for investment, net—seriously delinquent(15) | 1.2 | % | 0.0 | % | 1.2 | % | 0.0 | % | 0.4 | % | — | — | — | — | |||||||||||||||

| Weighted average credit score—mortgage loans held for investment | 649 | 659 | 649 | 659 | 653 | — | — | — | — | ||||||||||||||||||||

| Warehouse financing—loans held for sale—ending (audited as of year end) | $ | 98,796 | $ | 643,332 | $ | 98,796 | $ | 643,332 | $ | 450,456 | $ | 789,424 | $ | 296,144 | $ | 130,837 | $ | 53,286 | |||||||||||

| Warehouse financing—loans held for investment—ending (audited as of year end) | 1,241,026 | 489,854 | 1,241,026 | 489,854 | 537,132 | — | — | — | — | ||||||||||||||||||||

| Warehouse financing—loans held for sale—average balance | 222,459 | 619,321 | 224,010 | 642,857 | 619,795 | 392,561 | 174,086 | 89,251 | 55,506 | ||||||||||||||||||||

| Warehouse financing—loans held for investment—average balance | 697,437 | 282,794 | 606,881 | 95,301 | 102,548 | — | — | — | — | ||||||||||||||||||||

| Securitization financing—average balance | 2,762,324 | — | 1,786,848 | — | 115,822 | — | — | — | — | ||||||||||||||||||||

| Subordinated debt—average balance | — | 11,308 | — | 11,214 | 12,246 | 12,168 | 11,448 | 11,979 | 9,053 | ||||||||||||||||||||

| Average assets(16) | 4,187,111 | 1,006,709 | 3,158,439 | 837,288 | 1,005,335 | 464,205 | 208,109 | 101,931 | 61,074 | ||||||||||||||||||||

| Average equity(16) | $ | 524,292 | $ | 53,963 | $ | 521,786 | 49,568 | $ | 107,714 | 24,632 | 6,707 | (912 | ) | (138 | ) | ||||||||||||||

- (1)

- Represents the accumulation of occupancy, depreciation and amortization, servicing fees and general and administration expense reported within the consolidated statements of operations.

- (2)

- Fieldstone Holdings paid dividends of $15 million and $23 million to its shareholders in the second and third quarters, respectively, of 2003, prior to the formation of Fieldstone Investment.

- (3)

- Funding volumes shown for the three and nine months ended September 30, 2003 and 2004 and for the years ended December 31, 2000 through 2003 include loans funded by us and exclude loans brokered by Fieldstone Mortgage to other mortgage companies. Brokered loans for the years ended December 31, 2000 through 2003 were $82.2 million, $109.0 million, $113.6 million and $123.2 million, respectively. Brokered loans for the three months ended September 30, 2003 and 2004 were $31.8 million and $36.8 million, respectively. Brokered loans for the nine months ended September 30, 2003 and 2004 were $90.7 million and $99.6 million, respectively. Wholesale fundings in 1999 include $304 thousand of loans purchased from third party originators.

- (4)

- Calculated as interest income divided by average loans.

- (5)

- Calculated as interest expense divided by average debt.

- (6)

- Calculated as net interest income divided by average loans.

- (7)

- Calculated as net cash settlements on existing derivatives plus net cash settlements incurred or paid to terminate derivatives prior to final maturity (a component of "other income (expense)—portfolio derivatives") divided by average debt.

- (8)

- Weighted average interest rate, credit score, loan to value, and full documentation (including bank statements) based on loans funded by us only (excluding brokered loans).

- (9)

- Calculated as provision for loan losses—sold loans divided by mortgage sales. The provision is recorded as a reduction of gain on sale of loans.

- (10)

- Capital is defined as stockholders' equity plus subordinated debt.

- (11)

- Calculated as total expenses (excluding $4.4 million and $10.3 million for the three and nine months ended September 30, 2004, respectively, of REIT and portfolio costs, primarily for portfolio managers, third-party servicing fees and analytic costs, and for senior executives and corporate management expenses) and premium paid, net of fees collected, divided by fundings. The impact of net deferred origination costs and change of control expenses is not included.

- (12)

- Calculated as total expenses divided by fundings. The impact of net deferred origination costs and change of control expenses is not included.

- (13)

- Calculated as total expenses divided by average assets. The impact of net deferred origination costs and change of control expenses is included.

- (14)

- Calculated as total expenses divided by net revenues. The impact of net deferred origination costs and change of control expenses is included.

- (15)

- Seriously delinquent is defined as 60 plus days past due.

- (16)

- Average assets are calculated using a true average loans balance and month end balances for the other assets. Average equity is calculated using month end balances.

11

An investment in our common stock involves a high degree of risk. You should carefully consider the following risk factors, together with the other information contained in this prospectus, before purchasing our common stock. Any of the following factors could harm our business, financial condition and results of operations and could result in a partial or complete loss of your investment.

We have a limited operating history with respect to our portfolio strategy, which limits your ability to evaluate a key component of our business strategy and our growth prospects and increases your investment risk.

Historically, our business has consisted primarily of the origination and sale of conforming and non-conforming mortgage loans. Our current business strategy, which we began implementing in August 2003, is to retain a substantial portion of the non-conforming loans we originate on a long-term basis, financed by issuing mortgage-backed securities secured by these loans. Our current strategy is to own a portfolio of loans with a principal balance approximately equal to 12 times our shareholders' equity. We will finance this portfolio with a combination of long-term securitization debt, short-term warehouse debt and our equity. We expect to incur financing debt on the portfolio of approximately 11 times our equity. From August 1, 2003 through December 31, 2003, we retained 50% of the non-conforming loans we originated during that period. During the nine months ended September 30, 2004, we retained 68% of the non-conforming loans we originated during that period, and we expect to continue to retain approximately 65% of the non-conforming loans we originate until we have invested all of the proceeds from the 144A Offering according to our portfolio strategy. After we have invested all of those proceeds, the percentage of loans we retain will vary based primarily upon the rate of prepayments of principal on the loans we hold in our portfolio, because we will retain new loans to replace prepaid loans, and the availability of loans which meet our investment criteria. We closed our first securitization transaction, issuing $488 million of mortgage-backed securities on October 7, 2003, our second, issuing $663 million of mortgage-backed securities on February 10, 2004, our third, issuing $844 million of mortgage-backed securities on April 21, 2004, our fourth, issuing $949 million of mortgage-backed securities on July 1, 2004, our fifth, issuing $845 million of mortgage-backed securities on October 5, 2004 and our sixth, issuing $864 million of mortgage-backed securities on November 30, 2004. Our ability to complete securitizations in the future will depend upon a number of factors, including the experience and ability of our management team, conditions in the securities markets generally, conditions in the mortgage-backed securities market specifically, the performance of our portfolio of securitized loans and our ability to obtain credit enhancement. In addition, poor performance of any pool of loans that we securitize could increase the expense of any of our subsequent securitizations. If we are unable to securitize efficiently the loans in our portfolio, then our revenues for the duration of our investment in those loans could decline, which would lower our earnings for the time the loans remain in our portfolio. We cannot assure you that we will be able to complete loan securitizations in the future on favorable terms, or at all.

We have invested the substantial majority of our shareholders' equity in a portfolio of non-conforming mortgage loans held for investment financed by pledging the loans to secure mortgage-backed securities. If we do not receive the payments from the loans that we anticipate, due to either early prepayment of the loans or default by more borrowers than we have anticipated, our revenues may be insufficient to cover our costs to originate, the interest expense and losses on these loans, as well as the repayment of principal on the warehouse or securitization debt used to finance these loans.

Historically, we sold all of the loans that we originated on a servicing-released basis. As a result, we are unable to track the delinquency, loss and prepayment history of these loans. Consequently, we do not have representative historical delinquency, bankruptcy, foreclosure, default or prepayment

12

experience that may be referred to for purposes of estimating future delinquency, loss and prepayment rates for our originated loans. In view of our lack of historical loan performance data, it is extremely difficult to validate our loss or prepayment assumptions used to calculate assumed net interest income in current and future securitizations of our non-conforming loans. If we do not receive the payments from the loans that we have anticipated, our revenues may be insufficient to cover our costs to originate, the interest expense and losses on these loans, as well as the repayment of principal on the warehouse and securitization debt used to finance these loans. The greater the difference between our assumptions and actual performance proves to be, the greater the effect will be on our earnings, the interest rates and over-collateralization levels of our mortgage-backed securities and the timing and receipt of our future revenues, the value of the residual interests held on our statement of condition and our cash flow.

Our business requires a significant amount of cash, and if it is not available, our business and financial performance will be significantly harmed.

We require substantial cash to fund loans that we originate pending sale or securitization and to pay our loan origination expenses. We also need cash to meet our working capital and minimum REIT dividend distribution requirements and other needs.

We expect that our primary sources of working capital and cash will consist of:

- •

- our warehouse lines and repurchase facilities;

- •

- our equity;

- •

- net interest income we receive from the securitization of our loans;

- •

- our operating profits and the proceeds from the sales or repayments of our conforming loans and a portion of our non-conforming loans; and

- •

- net proceeds from the sale of mortgage-backed securities.

If we cannot access sufficient cash, we will be unable to continue our operations, grow our loan portfolio and maintain our REIT status.

Dependence upon financing facilities and securitizations and our ability to maintain our status as a REIT may create liquidity risks.

Liquidity risks associated with warehouse lines and credit facilities.

Pending sale or securitization of a pool of mortgage loans, we will finance mortgage loans that we originate through borrowings under our warehouse lines and repurchase facilities. It is possible that our warehouse lenders could experience changes in their ability to advance funds to us, independent of our performance or the performance of our loans. In addition, if the regulatory capital requirements imposed on our lenders change, our lenders may be required to increase significantly the cost of the lines of credit that they provide to us. Our repurchase facilities are dependent on our counterparties' ability to re-sell loans originated by us to third parties. If there is a disruption of the repurchase market generally, or if one of our counterparties is itself unable to access the repurchase market, our access to this source of liquidity could be adversely affected.

We finance substantially all of our loans through three warehouse lines and four repurchase facilities. Each of these facilities is cancelable by the lender for cause at any time. As of January 31, 2005, the maximum available outstanding balance under these seven facilities was approximately $1.9 billion. The initial term of each facility is generally 364 days or less, and the facilities mature at various times during the year. We cannot provide any assurances that we will be able to extend these existing facilities on favorable terms, or at all. If we are not able to renew any of these credit facilities

13

or arrange for new financing on terms acceptable to us, or if we default on our covenants or are otherwise unable to access funds under any of these facilities, we may not be able to originate new loans or continue to fund our operations.

Cash could be required to meet margin calls under the terms of our borrowings in the event that there is a decline in the market value of the loans that collateralize our debt, the terms of short-term debt becomes less attractive, or for other reasons. If we are required to meet significant margin calls, we may not be able to originate new loans or continue to fund our operations.

Liquidity risks associated with credit enhancements provided in connection with our securitizations.

In connection with our securitizations, we provide credit enhancement for a portion of the mortgage-backed securities that we issue called "senior securities." The credit enhancement for the senior securities comes primarily from either designating another portion of the securities we issue as "subordinate securities" (on which the credit risk from the loans is concentrated), purchasing financial guaranty insurance policies for the loans, or both. The market for subordinate securities could become temporarily illiquid or trade at steep discounts, thereby reducing the cash flow we receive over time from the loans securing our mortgage-backed securities. If we purchase financial guaranty insurance policies and the expense of these insurance policies increases, our net income will be reduced as the cost of borrowing increases. While we have used these senior and subordinated credit enhancement features in connection with our previous securitizations, we cannot assure you that these features will be available at costs that would allow us to achieve our desired level of net income from future securitizations.

Some of the mortgage-backed securities that we have issued and intend to issue in the future to finance our portfolio of loans require, or will require, in the early years after issuance of the mortgage-backed securities that we "lock out" cash flows and receive less than our pro-rata share of cash flows from principal payments. In addition, if the performance of the loans pledged to collateralize the mortgage-backed securities is worse than the thresholds set forth in the securitization documents, then the net interest income we would otherwise receive will be held as over-collateralization reserves to provide additional credit enhancements for the outstanding senior securities.

In addition, our operating cash flow could be reduced if discount amortization significantly exceeds premium amortization, or for other reasons. If prepayments on the loans securitizing any of our mortgage-backed securities slow or our credit quality deteriorates, cash flow that we might otherwise receive in connection with the mortgage-backed securities might be delayed significantly.

Liquidity risks associated with our REIT status.

If our minimum distribution required to maintain our REIT status exceeds our cash available for distribution, because our income for tax purposes exceeded our cash flow from operations, we could be forced to borrow funds, sell assets or raise capital on unfavorable terms in order to maintain our REIT status. Additionally, negative cash flow could threaten our continued ability to satisfy the income and assets tests necessary to maintain our status as a REIT or our solvency. See "—Risks Associated with our Organization and Structure."

Liquidity risks associated with the change in our business strategy.

In August 2003, we began to retain a portion of our non-conforming loans to build a portfolio of non-conforming mortgages and issue mortgage-backed securities, rather than selling these loans for a gain shortly after origination. As indicated above, some of the mortgage-backed securities that we have issued and expect to issue in the future may, for an initial period, require that any excess cash flow from the mortgages (after payments required to be made to the senior securities and to the servicer) be retained in an issuing trust to build over-collateralization to support the senior securities we have sold.

14

Accordingly, we may receive little or no cash as the owner of the loans during that initial period. For some period of time our portfolio of securitized loans may not generate sufficient net interest income to cover our operating expenses, and in this event we will use proceeds remaining from the 144A Offering, approximately $362 million as of September 30, 2004, to meet our operating expenses as we continue to originate new loans for our portfolio. If we have fully invested all of the net proceeds of the 144A Offering prior to our portfolio generating sufficient cash for us to fund our operations, if it ever does, then we will need to either restructure the mortgage-backed securities supporting our portfolio, sell additional shares of capital stock or debt securities to generate additional working capital or, if we are unable to sell additional securities on reasonable terms or at all, we will need to either reduce our origination business or sell a higher portion of our loans. If we sell our loans rather than put them into our investment portfolio, then we will reduce the rate at which we increase our portfolio and we will owe taxes relative to any gains we achieve by selling our loans. In the event that our liquidity needs exceed our available capital, we may need to sell assets at an inopportune time, which will result in a reduction in our earnings.

The failure to prevail in our litigation with our former shareholders could have an adverse effect on our liquidity.

On May 24, 2004, our former shareholders prior to the closing of the 144A Offering, filed a lawsuit against us alleging that the shareholders whose shares were redeemed following the closing of the 144A Offering, for approximately $188.1 million, are entitled to an additional post-closing redemption price payment of between $15.8 million and $19.8 million. On June 14, 2004, we filed our answer generally denying all of the allegations in the complaint. The Redemption Agreement between the redeemed shareholders and us required us to adjust the redemption price we paid to the redeemed shareholders based on our November 13, 2003 balance sheet, as audited by KPMG LLP. On January 12, 2004, KPMG issued an independent auditors' report of our November 13, 2003 balance sheet. Based on this audit and the terms of the Redemption Agreement, we paid an additional $1.8 million to the redeemed shareholders on February 18, 2004. The lawsuit alleges that our November 13, 2003 balance sheet should have included a deferred tax asset that, if included, would have increased our net worth on November 13, 2003. The lawsuit also alleges that the redeemed shareholders are entitled to an increase in the redemption price if our November 13, 2003 balance sheet is revised to include the deferred tax asset. On April 20, 2004, following notification by the redeemed shareholders of their dispute concerning our November 13, 2003 balance sheet, KPMG requested that we no longer rely upon their January 12, 2004 independent auditors' report of our November 13, 2003 balance sheet. On September 9, 2004, in its response to a request for disclosure from the plaintiffs, KPMG stated, among other things, that it had determined that the deferred tax asset, which is reflected in our December 31, 2003 audited financial statements, should have been reflected in our November 13, 2003 balance sheet. If we ultimately are unsuccessful, we could be required to pay to the redeemed shareholders in excess of $18 million, plus any potential interest expense, costs or expenses associated with the litigation, which at such time could have an adverse effect on our liquidity. See "Management's Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources—Commitments and Contingencies" beginning on page 89 and "Business—Legal Proceedings" beginning on page 130.

Our ability to generate net interest income from our securitized loans is dependent upon the success of our portfolio-based model of securitizations, which is subject to several risks.

The success of our portfolio-based model of securitizations is subject to the effects of fluctuations in interest rates and loan defaults.

We expect to generate a substantial portion of our earnings and cash flow from the non-conforming loans we originate and securitize, primarily through net interest income. A substantial

15

portion of the net interest income generated by our securitized loans is based upon the difference between the weighted average interest earned on the mortgage loans held in our portfolio and the interest payable to holders of the mortgage-backed securities. The interest expense on the mortgage-backed securities is typically adjusted monthly relative to market interest rates. Because the interest expense associated with the mortgage-backed securities typically adjusts faster than the interest income from the mortgage loans, our net interest income can be volatile in response to changes in interest rates. Also, the net interest income we receive from securitizations will likely decrease and our cash flow will be reduced if there are defaults on a significant number of our securitized loans or if a large number of our securitized loans prepay prior to their scheduled maturities. The effects will be magnified if the defaults or prepayments occur with respect to securitized loans with interest rates that are high relative to the rest of our securitized loans. Generally, loans with higher relative interest rates represent loans to higher-risk borrowers and these loans generally have a higher default rate than loans to lower-risk borrowers. As a result, our cash flow could be significantly reduced, limiting our ability to make distributions to you.

We are subject to the risk of margin calls while our loans held for investment are financed with short term borrowings, and we are obligated to repay the full amount of our debt under our short term borrowings regardless of the value of the mortgage loans collateralizing the debt.

Our portfolio-based model is based on our expectation that the interest income we receive from the loans in the portfolio will exceed the interest expense of the debt we incur for financing those loans. However, we are required to repay our portfolio debt regardless of the loans' performance, which means that our portfolio income is at risk for the expense of repaying our debt as well as for the performance of the loans. This is true both for the short-term debt we incur to finance loans held for investment prior to securitization and for the securitization debt that we incur as long term financing of our loans held for investment. We are subject to two risks while our loans held for investment are financed with short term borrowings that we are not subject to relative to our securitization debt: first, we may be required to make additional payments to our lenders (known as "margin calls") relative to our short term financing if the lenders determine that the market value of the mortgage loans they hold as collateral has declined, which could happen at any time as a result of increases in market interest rates; and second, we are obligated to repay the full amount of our debt under our short term borrowings regardless of the value of the mortgage loans collateralizing the debt. Our securitization debt is long-term structured debt on which we never have margin calls and are at risk only for the small amount we have invested in the loans initially.

Over-collateralization may reduce or eliminate our net interest income.

The terms of our securitizations may require that a portion of the net interest income from the securitized loans initially be directed to the senior securities of the securitization trust to achieve over-collateralization. Consequently, we may not receive all or a portion of the net interest income that would otherwise be available to be distributed from the related securitized pool of loans. In addition, because the application of the net interest income to the senior securities of a securitization trust is dependent upon the performance of the related mortgage loans, there may be material variations in the amount, if any, of the net interest income distributed to us from period to period, and there may be extended periods when we receive no net interest income. Any variations in the rate or timing of receipt of distributions may reduce or eliminate our net interest income. Even though we record net interest income as a result of excess amounts we receive in our securitizations, we may not have the right to use this income. To the extent we are unable to use these amounts to fund our current business operations or to fund distributions, we will be required to secure other financing at a time when we may be unable to do so on reasonable terms, or at all.

16

We may not succeed in developing a portfolio-based model of securitizations.

We expect to rely upon our ability to securitize our non-conforming loans to generate cash proceeds for repayment of our warehouse lines and repurchase facilities and to originate additional conforming and non-conforming mortgage loans. We cannot assure you, however, that we will be successful in securitizing a substantial portion of the non-conforming loans that we accumulate. In the event that it is not possible or economical for us to complete the securitization of a substantial portion of our non-conforming loans, we may continue to hold these loans and bear the risks of interest rate changes and loan defaults and delinquencies, and we may exceed our capacity under our warehouse lines and repurchase facilities and be unable or limited in our ability to originate future mortgage loans. If we determine that we should sell all or part of our non-conforming loans initially funded in our investment portfolio rather than securitizing them, there could be a significant reduction in our net income and stockholder distributions because of the potential application of a 100% tax on gains of such sales pursuant to the rules governing REITs.