UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

(Mark One)

☑ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2023

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number 001-34091

MARKETAXESS HOLDINGS INC.

(Exact name of registrant as specified in its charter)

| | |

Delaware |

| 52-2230784 |

(State of incorporation) |

| (IRS Employer Identification No.) |

| |

55 Hudson Yards, New York, New York |

| 10001 |

(Address of principal executive offices) |

| (Zip Code) |

(212) 813-6000

(Registrant’s telephone number, including area code)

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT:

| | | | |

Title of each class | | Trading Symbol | | Name of each exchange on which registered |

Common Stock, $0.003 par value | | MKTX | | NASDAQ Global Select Market |

SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☑ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐ No ☑

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | |

Large accelerated filer |

| ☑ |

| Accelerated filer |

| ☐ |

Non-accelerated filer |

| ☐ |

| Smaller reporting company |

| ☐ |

| | | | Emerging growth company |

| ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☑

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☑

The aggregate market value of the shares of common stock held by non-affiliates of the registrant as of June 30, 2023 (the last business day of the registrant’s most recently completed second fiscal quarter) was approximately $7.4 billion computed by reference to the last reported sale price on the NASDAQ Global Select Market on that date. For purposes of this calculation, affiliates are considered to be executive officers, directors and holders of 10% or more of the outstanding common stock of the registrant on that date. The registrant had 37,677,426 shares of common stock, 9,241,225 of which were held by affiliates, outstanding on that date.

As of February 20, 2024, the aggregate number of shares of the registrant’s common stock outstanding was 37,867,743.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement for the 2024 Annual Meeting of Stockholders are incorporated by reference into Items 10, 11, 12, 13 and 14 of Part III of this Form 10-K.

MARKETAXESS HOLDINGS INC.

2023 FORM 10-K ANNUAL REPORT

TABLE OF CONTENTS

PART I

Cautionary Note Regarding Forward-Looking Statements

This report contains certain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by words such as “expects,” “intends,” “anticipates,” “plans,” “believes,” “seeks,” “estimates,” “will,” or words of similar meaning and include, but are not limited to, statements regarding the outlook for our future business and financial performance and our strategy. Forward-looking statements are based on management’s current expectations and assumptions, which are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict. It is routine for our internal projections and expectations to change as the year or each quarter in the year progresses, and therefore it should be clearly understood that the internal projections and beliefs upon which we base our expectations may change prior to the end of each quarter or the year. Although these expectations may change, we are under no obligation to revise or update any forward-looking statements contained in this report. Actual future events or results may differ, perhaps materially, from those contained in the projections or forward-looking statements. Factors that could cause or contribute to such differences include those discussed below and elsewhere in this report, particularly in Item 1A. “Risk Factors.”

Item 1. Business.

Overview

MarketAxess Holdings Inc. (the “Company” or “MarketAxess”) operates leading electronic trading platforms delivering greater trading efficiency, a diversified pool of liquidity and significant cost savings to our clients across the global fixed-income markets. Over 2,000 institutional investor and broker-dealer firms use our patented trading technology to efficiently trade U.S. high-grade bonds, U.S. high-yield bonds, emerging market debt, Eurobonds, municipal bonds, U.S. government bonds and other fixed-income securities. Our award-winning Open Trading® marketplace is widely regarded as the preferred all-to-all trading solution in the global credit markets, creating a unique liquidity pool for a broad range of credit market participants. We leverage our diverse set of trading protocols, automated and algorithmic trading solutions, intelligent data and index products and a range of post-trade services to provide an end-to-end trading solution to our robust network of platform participants.

We provide automated and algorithmic trading solutions that we believe, when combined with our integrated and actionable data offerings, help our clients make faster, better-informed decisions on when and how to trade on our platforms. In 2023, we introduced MarketAxess X-Pro (“X-Pro”), our newest trading platform, to more seamlessly combine our trading protocols with our proprietary data and pre-trade analytics. We expect that our recent acquisition of Pragma LLC and Pragma Financial Systems LLC (collectively, “Pragma”), a quantitative trading technology provider specializing in algorithmic and analytical trading services, will accelerate our development of artificial intelligence (“AI”) driven execution algorithms across all of our key product areas.

We operate in a large and growing market that provides us with a significant opportunity for future growth, due, in part, to the relatively low levels of electronic trading in many of our largest current product areas. We offer all-to-all trading (“Open Trading”) for most of our products in order to capitalize on this addressable market by increasing the number of potential trading counterparties and providing our clients with a menu of solutions at each step in the trading process. We believe that Open Trading drives meaningful price improvement for our clients and reduces risk in fixed-income markets by creating a global, diversified pool of liquidity whereby our institutional investor, dealer and alternative liquidity provider clients can all interact on an anonymous basis. Institutional investors can also send trading inquiries directly to their traditional broker-dealer counterparties on a disclosed basis (“disclosed RFQ”), while simultaneously accessing additional counterparties through our anonymous Open Trading solutions.

We also provide a number of integrated and actionable data offerings, including CP+™ and Axess All®, to assist clients with real-time pricing and trading decisions and transaction cost analysis. We offer a range of post-trade services, including straight-through processing, post-trade matching, trade publication, regulatory transaction reporting and market and reference data across fixed-income and other products. In 2023, 88.1% of our revenues were derived from commissions for transactions executed on our platforms. We also derive revenues from information services, post-trade services and technology services. Our expenses consist of employee compensation and benefits, depreciation and amortization, technology and communication expenses, professional and consulting fees, occupancy, marketing and advertising, clearing costs and general and administrative expenses.

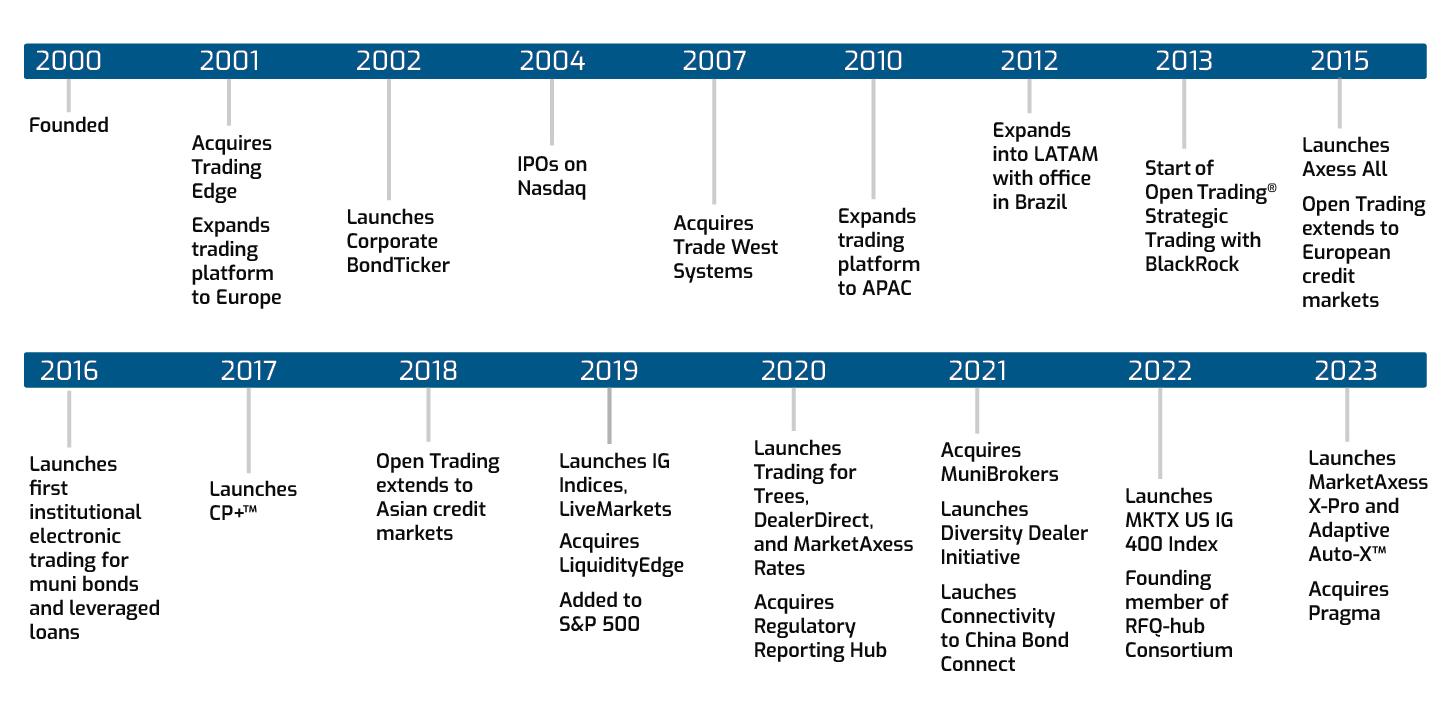

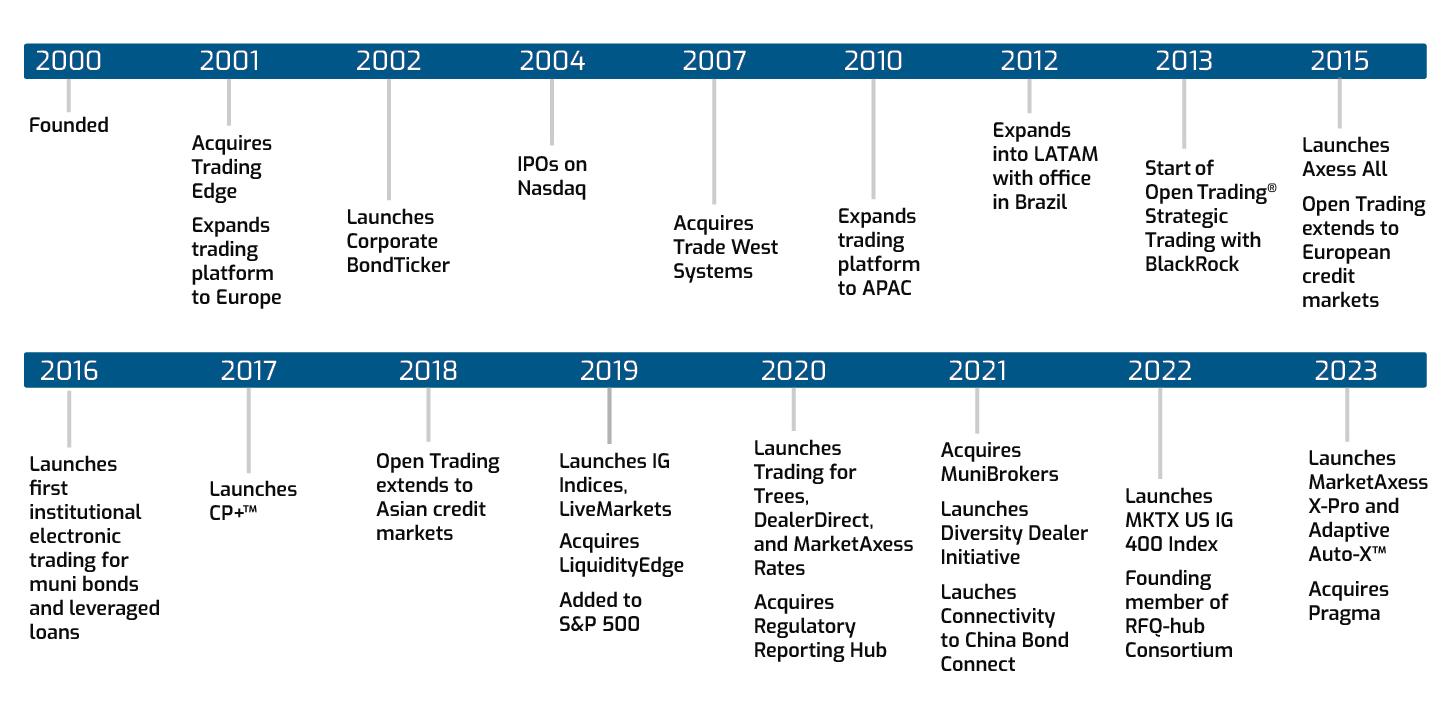

Our History

MarketAxess has been an innovative leader in electronic trading since its founding in 2000. Throughout our history, our primary goals have remained the same: improve trading efficiency and deliver meaningful transaction price improvement for our clients. Prior to our founding, our institutional investor clients were able to trade bonds by telephone with a limited set of broker-dealers with which they had institutional relationships. By 2007, our platforms enabled institutional investors to trade electronically with over thirty broker-dealers. During the global financial crisis of 2007-2008, we significantly expanded the number of non-primary and regional dealers providing liquidity on our platforms, as many dealers were forced to reduce their balance sheets for market making. Today, we are an S&P 500 company that, through our Open Trading protocols, provides an expanded liquidity pool for over 1,700 global market participants to trade a wide variety of fixed-income securities with each other.

Our Competitive Strengths

We believe that we are well positioned to strengthen our market position in electronic trading in our existing products and to extend our presence into new products and services by capitalizing on our competitive strengths, including:

Expansive Liquidity Pool Comprised of Leading Broker-Dealers and Institutional Investors

Our electronic trading platforms provide access to the liquidity generated by the participation of our institutional investor and broker-dealer clients, including substantially all of the leading broker-dealers in global fixed-income trading. We believe these broker-dealers represent the principal source of secondary market liquidity for credit and rates products. We believe that our broker-dealer clients are incentivized to use our platforms due to the ability to efficiently transact with valuable client order flow and the ability to use our Open Trading protocols to help manage their risk, source liquidity and facilitate transactions on behalf of their clients.

Our total credit trading volume has increased from approximately $2.0 trillion in 2019 to $3.1 trillion in 2023 and our estimated market share of U.S. high-grade and high-yield corporate bond volumes in 2023 was 20.4% and 17.1%, respectively. Approximately 90.9% of credit volume on our platforms during 2023 was executed by institutional clients with the remaining 9.1% of credit volume conducted between dealers.

Open Trading is a Differentiator that Expands the Liquidity Pool and Drives Price Improvement for Broker-Dealers and Institutional Investors

Global liquidity has remained a persistent concern for market participants as regulators raised bank capital requirements and adopted other measures that prompted many dealers to reduce market-making activities even as the buy-side’s bond holdings have grown rapidly. In this environment, Open Trading, our fully electronic, all-to-all trading functionality, has emerged as a solution to this liquidity problem. Open Trading participants have broader and more diverse liquidity options compared to the traditional model of bilateral trading with a limited set of dealer counterparties. The expanded pool of liquidity providers includes investment managers, global dealers, regional dealers and specialist market making and proprietary trading firms.

During 2023, over 1,700 firms participated in Open Trading, which improved the ability of both dealers and institutional investors to find natural and opportunistic matches, move orders more efficiently and achieve significant increases in execution quality and price improvement.

We believe our Open Trading protocols enhance our institutional investor clients’ ability to obtain a competitive price by allowing all of our Open Trading participants to interact with each other, thereby increasing the potential sources of liquidity available for each participant, as well as the likelihood of receiving a competitive price response. We estimate that Open Trading generated $701.9 million of price improvement for our clients in 2023, consisting of an estimated $471.5 million of liquidity taker price improvement (defined as the difference between the winning price and the best disclosed dealer cover price) and an estimated $230.4 million of liquidity provider price improvement (defined as the difference between the winning price and then current CP+ bid or offer level, offer if the provider is buying, bid if provider is selling) at the time of the inquiry. This Open Trading price improvement is in addition to the potential cost savings institutional investors can achieve by simultaneously requesting bids or offers from our broker-dealer clients via our traditional disclosed RFQ protocol. In addition, dealers use Open Trading as a source of liquidity to efficiently transfer risk and achieve enhanced bond inventory turnover, which may limit their credit exposure.

Advanced End-to-End Technology

Our electronic trading platforms are based on a secure and scalable architecture that makes broad use of distributed computing to achieve speed and reliability. Our technology provides clients with end-to-end and customizable connectivity to fixed-income markets. In designing X-Pro, our newest platform, we enhanced the trading experience by providing traders with a flexible user experience, intuitive workflows and easy access to our proprietary data and pre-trade analytics. To further support more efficient trade execution, we also offer several automated and algorithmic trading solutions, which allow clients to set eligibility criteria for their orders that our platforms will use to determine whether or not to execute a trade in accordance with the pre-defined parameters. For example, we introduced our Adaptive Auto-X automated and algorithmic trading solution for fixed-income in 2023, which provides our clients with a suite of AI-driven algorithms that integrate all our trading protocols. We believe that these automated and algorithmic trading solutions reduce trading inefficiencies and human errors while allowing traders to focus on higher-value trades.

In addition to services directly related to the execution of trades, we also offer our clients several other pre- and post-trade services. In the pre-trade period, our platforms assist participants with price discovery by providing them with dealer pricing and real-time and historical trade data. Following the execution of a trade, our platforms support all of the essential tools and functionalities to enable our participants to achieve straight through processing (“STP”) for trade settlement and to measure transaction costs to evidence best execution.

The Company is focused on investing in our resiliency, scalability and risk management systems. We also prioritize continuing product delivery on current technologies, delivering approximately 1,000 unique new business and technical features to our clients during the year ended December 31, 2023.

Growing, Comprehensive International Offering and Client Base

Our platforms provide global fixed-income market participants with trading functionality across Eurobond and emerging markets credit and rates markets, connecting clients in over 90 countries to local and global dealers. MarketAxess has over 1,000 active client firms located outside the U.S. that access our platforms through our regulated venues in Europe, Asia and Latin America. Our Open Trading functionality allows international clients to access cross-border liquidity more efficiently with few regulatory hurdles.

The MarketAxess emerging markets trading platform also offers the most comprehensive offering for local currency bond trading across the Latin America, Central & Eastern Europe, Middle East and Africa, and Asia-Pacific (“APAC”) regions. Our platforms provide clients with the ability to trade emerging market local currency debt denominated in 28 local currencies with over 130 broker-dealers.

Next Generation Data and Analytical Tools Supporting the Increasing Automation of Trading Workflows

Our data and analytical tools enhance the value proposition of our trading platforms and improve the trading experience of our clients. We support our clients’ trading functions by offering value-added analytics that rely on machine-learning, automation and algorithms that are designed to improve the trading decisions and workflows of our clients. Our data and analytical tools are designed to help clients make better trading decisions, benefiting our current clients and attracting new market participants to our network. For example, we believe that our automation solutions enable more efficient execution of smaller trades, and allow traders to instead focus their attention on larger, and often higher-value, trades.

Our Strategy

Our objective is to provide the leading global electronic trading platforms for fixed-income securities, allowing broker-dealers and institutional investors to connect, trade and achieve cost savings more easily and efficiently, while offering a broad array of information, trading and technology services to market participants across an end-to-end trading solution. The key elements of our strategy are:

Increase Penetration in Credit Markets

We believe that we have a large opportunity remaining to capture additional market share in the credit product markets in which we have already established a leadership position. For example, the estimated Composite Corporate Bond average daily volume (“ADV”) on our platforms for the year ended December 31, 2023 for our combined U.S. high-grade, U.S. high-yield, emerging markets and Eurobonds product areas (collectively, “Composite Corporate Bond”) was approximately $9.8 billion, representing just 19.3% of the estimated addressable market of approximately $51.1 billion. The traditional methods of bilateral trading, including the telephone or electronic messaging, continue to be one of our principal competitors in the credit markets in which we have established a leadership position. We continue to focus on capturing additional market share across our core credit markets. In 2023, we introduced X-Pro, our new trading platform, to clients in the United States. We believe that the modernized design of X-Pro will help increase our market share in our core markets. X-Pro also includes enhanced functionality for portfolio trading, which has represented a larger proportion of trading volumes in recent periods.

Continue Expansion into New Product Areas

By leveraging our Open Trading functionality and capitalizing on our experience of building market share in markets like U.S high-grade and U.S. high-yield bonds, we plan to increase our product footprint in newer product areas, including emerging market local currency bonds, municipal bonds, U.S. government bonds and European government bonds. Each of these markets has unique trading protocols, market structures and settlement solutions that require a lengthy ramp-up period, but which will provide diverse revenue sources if we can obtain significant market share. For example, in 2021, we acquired MuniBrokers LLC (“MuniBrokers”), a central electronic trading venue serving municipal bond inter-dealer brokers and dealers, in order to expand our existing municipal bond trading solution. The acquisition connects our leading trading technology with the liquidity of one of the industry’s largest electronic inter-dealer marketplaces, creating a compelling and diverse liquidity solution that we believe will ultimately deliver an improved execution experience. In addition, with the acquisition of Pragma in 2023, we have expanded our automated and algorithmic trading solutions to new asset classes, including equities and foreign exchange.

Expand Trading Protocols and Leverage the Open Trading Network

We believe that we are the only fixed-income electronic trading platform that embraces all-to-all trading in each of our product areas. Open Trading exponentially increases the number of potential trading counterparties by allowing both our broker-dealer clients and institutional investor clients to interact in an all-to-all trading environment of over 1,700 firms. Our clients executed approximately $955.6 billion in credit trading volume using Open Trading during 2023, representing 35.2% of total eligible credit trading volume on our platforms, and realized approximately $701.9 million in estimated price improvement through this unique liquidity solution in 2023. We believe that the combination of Open Trading and our vast client network provides the basis for MarketAxess to enhance liquidity and improve market resiliency in global fixed-income markets. In 2023, we introduced Open Trading for emerging market local currency bonds, including for the local currency markets of Poland, Czech Republic, Hungary and South Africa.

Continue to Invest in and Grow our Business through Geographic Diversification

We are continuing to expand and diversify our business internationally. Our revenues from international clients have grown from 16.9% of total revenue in 2019 to 20.8% of total revenues for the year ended December 31, 2023. As of December 31, 2023, our institutional investor and broker-dealer clients are based in over 90 countries with over 1,000 total active international client firms and approximately 5,800 total active international traders. We offer cross-regional electronic trading services in U.S fixed-income markets for international clients, as well as in Eurobonds and emerging market debt. By offering liquidity in both hard-currency and local currency emerging market debt, we have created an efficient emerging market trading ecosystem for our institutional investor and broker-dealer clients. In the last five years, we have seen significant growth in the Europe, Middle East and Africa (“EMEA”), Latin America and APAC regions. The ADV in the EMEA, Latin America and APAC regions on the MarketAxess platforms has grown from $2.5 billion in 2019 to $4.2 billion in 2023. We believe we can increase our penetration and revenue opportunities in international markets by continuing to invest in creating client relationships abroad.

Pursue Select Acquisitions and Strategic Alliances

We continually evaluate opportunities to supplement our internal growth by entering into strategic alliances, or acquiring businesses or technologies, that we believe will enable us to enter new markets, provide new client segments, new products or services, or otherwise expand our market share in the fixed-income markets that we operate in today. We believe that one of the key drivers of our success to date has been the ability to grow our product offerings. For example, in 2021, we acquired MuniBrokers, a central electronic venue serving municipal bond inter-dealer brokers and dealers, in order to expand our existing municipal bond trading solution. In 2022, we made a significant minority investment in RFQ-hub, a bilateral multi-asset and multi-dealer RFQ platform. In 2023, we acquired Pragma, expanding our automated and algorithmic trading solutions to equities and foreign exchange. In addition, we expect the acquisition of Pragma to accelerate development of execution algorithms and data-driven analytics across all of our fixed-income product areas.

The Fixed-Income Products Available on our Platform

We operate in a large and growing market, which consists of credit and rates fixed-income products. According to the Securities Industry and Financial Markets Association (“SIFMA”), as of September 30, 2023, the most recent date available, there were approximately $10.6 trillion in principal amount of fixed-income securities outstanding in the U.S. corporate bond market, which reflects a five-year compound annual growth rate of 4.5%. In addition, according to SIFMA, as of December 31, 2023, there were approximately $26.4 trillion in principal amount of fixed-income securities outstanding in the U.S. government bond market, which reflects a five-year compound annual growth rate of 11.1%.

Our proprietary technology allows institutional investor and broker-dealer clients to access this market by trading both credit and rates products on our platforms.

Our credit products consist of the following areas:

•U.S. high-grade bonds, which refers to U.S. corporate debt rated BBB- or better by Standard & Poor’s (“S&P”) or Baa3 or better by Moody’s Investor Service (“Moody’s”);

•U.S. high-yield bonds, which refers to U.S. corporate debt rated lower than BBB- by S&P or Baa3 by Moody’s;

•Emerging market debt, which we define as U.S. dollar, Euro or local currency denominated bonds issued by sovereign entities or corporations domiciled in a developing country, typically located in Latin America, Asia, or Central and Eastern Europe;

•Eurobonds, which we define generally to consist of bonds intended to be distributed to European investors, primarily bonds issued by European corporations, excluding bonds that are issued by corporations domiciled in an emerging markets country and excluding most government bonds that trade in Europe;

•Municipal bonds, which are debt securities issued by states, cities, counties and other governmental entities in the U.S. to fund day-to-day obligations and to finance a wide variety of public projects, such as highways or water systems, and typically offer interest payments that are exempt from federal income taxation and may be exempt from state income and other taxes; and

•Other credit products, including leveraged loans, which are senior secured commercial facilities provided by a syndicate of lenders for below investment-grade companies (credit rating below BBB- or Baa3).

Our rates products consist of the following areas:

•U.S. government bonds, which are government instruments issued by the U.S. Department of the Treasury;

•Agency bonds, which are securities issued by a federal government department or by a government-sponsored enterprise, including the Federal National Mortgage Association and Federal Home Loan Mortgage Corporation; and

•Other government bonds, including European government bonds, which are bonds issued by governments of countries in the European Union (“E.U.”) and non-E.U. European countries, as well as bonds issued by other supranational organizations, agencies and sovereigns, including the European Commission.

The six largest product areas available on our platform for the year ended December 31, 2023 were U.S. high-grade, U.S. high-yield, emerging market debt, Eurobonds, municipal bonds and U.S. government bonds. In the chart below, we show MarketAxess' ADV and the amount of new issuance of such product areas for the years ended December 31, 2023 and 2022, except where indicated:

| | | | | | | | | | | | | | | | | | | | | | | | | |

| MarketAxess ADV(1) | | Amount of New Issuance |

| 2023 | | | 2022 | | | % Change | | | | 2023 | | | 2022 | | | % Change | | |

| (In billions) |

U.S. high-grade(2) | $ | 5.9 | | | $ | 5.5 | | | | 6.8 | | % | | $ | 1,207.0 | | | $ | 1,215.7 | | | | (0.7 | ) | % |

U.S. high-yield(2) | | 1.6 | | | | 1.7 | | | | (6.3 | ) | | | | 175.2 | | | | 106.5 | | | | 64.5 | | |

Emerging market debt(3) | | 2.9 | | | | 2.8 | | | | 3.5 | | | | | 245.0 | | | | 219.0 | | | | 11.9 | | |

Eurobonds(2) | | 1.8 | | | | 1.5 | | | | 21.2 | | | | | 567.7 | | | | 460.0 | | | | 23.4 | | |

Municipal bonds(4) | | 0.4 | | | | 0.4 | | | | 16.1 | | | | | 380.5 | | | | 386.6 | | | | (1.6 | ) | |

U.S. government bonds(4) | | 18.3 | | | | 21.5 | | | | (15.0 | ) | | | | 22,699.6 | | | | 16,730.9 | | | | 35.7 | | |

——––——––——––——––——––——––——–——

| |

(1) | There were 249 U.S. trading days in each of 2023 and 2022, based on the SIFMA holiday recommendation calendar and 251 and 250 United Kingdom (“U.K”) trading days in each of 2023 and 2022, respectively, based primarily on the U.K. bank holiday schedule. |

(2) | For U.S. high-grade, U.S. high-yield and Eurobonds, the amount of new issuance is according to J.P. Morgan Markets. |

(3) | For emerging markets debt, the amount of new issuance is according to J.P. Morgan Markets. The amount of new issuance excludes debt issued by emerging market sovereigns, which are included in our definition of emerging markets debt. |

(4) | For municipal bonds and U.S. government bonds, the amount of new issuance is according to SIFMA. |

We plan to leverage our Open Trading functionality to continue to capture additional market share across our core credit markets while increasing our footprint in newer product areas. In the chart below, we show estimated market ADV and our estimated market share for the years ended December 31, 2023 and 2022, of U.S. high-grade/high-yield bonds combined, U.S. high-grade bonds, U.S. high-yield bonds, municipal bonds and U.S. government bonds.

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Market ADV | | Estimated Market Share |

| 2023 | | | 2022 | | | % Change | | | | 2023 | | | 2022 | | | Bps Change |

| (In billions) | | | | | | | | | | |

U.S. high-grade/U.S high-yield

combined (1) | $ | 38.1 | | | $ | 35.3 | | | | 7.9 | | % | | | 19.6 | | % | | 20.4 | | % | | (80 | ) | Bps |

U.S. high-grade(1) | | 28.7 | | | | 25.7 | | | | 11.7 | | | | | 20.4 | | | | 21.3 | | | | (90 | ) | |

U.S. high-yield(1) | | 9.3 | | | | 9.5 | | | | (2.1 | ) | | | | 17.1 | | | | 17.9 | | | | (80 | ) | |

Municipal bonds(2) | | 7.4 | | | | 8.4 | | | | (11.7 | ) | | | | 5.9 | | | | 4.5 | | | | 140 | | |

U.S. government bonds(3) | | 653.8 | | | | 612.8 | | | | 6.7 | | | | | 2.8 | | | | 3.5 | | | | (70 | ) | |

——––——––——––——––——––——––——–——

| |

(1) | For U.S. high-grade and high-yield, market ADV is as measured by the Financial Industry Regulatory Authority (“FINRA”) Trade Reporting and Compliance Engine (“TRACE”). |

(2) | For municipal bonds, 2023 and 2022 market ADV is estimated by excluding estimates for new issuance, commercial paper and variable-rate trading activity from the data reported by the Municipal Securities Rulemaking Board (the “MSRB”). |

(3) | For U.S. government bonds, market ADV is as reported by the Federal Reserve Bank’s Reported Primary Dealer U.S. Treasury Bond Trading Volumes, which was reported on a one-week lag. |

Finally, we believe that the current level of electronic trading in our largest product areas is relatively low, creating a long runway for future market share growth. For example, we estimate that the level of electronic trading as a percentage of all means of trading (referred to as “electronic market share”) for U.S. high-grade bonds and U.S. high-yield bonds is approximately 45.0% and 30.0%, respectively. As a comparison, based on third party estimates, the level of electronic market share for U.S. exchange traded cash equities, U.S. equity options and foreign exchange spots are each over 90.0%.

Our End-to-End Trading Solutions

A key principle of our strategy is connecting the most robust network of participants through our end-to-end trading solutions. The diverse trading protocols available on our platforms are complemented by pre-trade intelligent data products and a range of post-trade services. In 2023, 88.1% of our revenues were derived from commissions for transactions executed on our platforms, 6.2% of our revenues were derived from our data products and 5.3% of our revenues were derived from our post-trade services.

Trade Execution Solutions

Through our platforms, our broker-dealer and institutional investor clients have access to a wide range of trading protocols to assist them with achieving best execution. In addition, we are innovating and modernizing our platforms by integrating a suite of automated and algorithmic trading solutions, as well as order and execution workflow solutions, to help clients manage risks, establish guardrails, streamline processes, remain compliant and improve execution quality.

In 2023, we introduced X-Pro to select clients in the United States. We believe that this new platform more seamlessly combines our trading protocols with our proprietary data and pre-trade analytics discussed under “— Integrated and Actionable Data” below. We further believe that it provides enhanced low- and high-touch trading workflows, from automation with Auto-X to portfolio trading. We plan to continue to expand the use of X-Pro by our broker-dealer and institutional investor clients.

Disclosed Request for Quote

Our traditional disclosed RFQ protocol allows our institutional investor clients to simultaneously request competing, executable bids or offers from our dealer clients and execute trades with the dealer of their choice from among those that choose to respond. We are not a counterparty to any of the disclosed RFQ trades that are executed on our platforms between institutional investor clients and dealer clients; rather, our platforms enable them to meet, agree on a price and then execute and settle the transaction directly with each other. The disclosed RFQ protocol is available for transactions in all our product areas and can be used for:

•multiple-dealer inquiries to over 140 dealers;

•list trading, which is the ability to request bids and offers on up to 60 bonds at the same time;

•portfolio trading, which allows our market participants to transact bond basket trades of up to 2,100 securities in an all-or-none trading protocol with one aggregate price for the portfolio transaction; and

•swap trading, which is the ability to request an offer to purchase one bond and a bid to sell another bond.

In 2023, over 60.0% of all credit volume on the MarketAxess platform was executed via a form of our disclosed RFQ protocol.

Open Trading

We offer Open Trading, our all-to-all trading solution, for most of our products and trading protocols. Open Trading complements our disclosed RFQ protocol by increasing the number of potential counterparties through allowing all participants to interact anonymously in an all-to-all trading environment of over 1,700 potential counterparties. We believe the increased liquidity drives meaningful price improvement to our clients and helps reduce liquidity risk in the fixed-income markets in which we participate. Open Trading participants are able to maintain their anonymity from trade initiation all the way through to settlement. Unlike our disclosed RFQ protocol, in connection with our Open Trading protocols, we execute bond transactions between and among institutional investor and broker-dealer clients on a matched principal basis by serving as counterparty to both the buyer and the seller in matching back-to-back trades.

We currently offer Open Trading protocols in U.S. high-grade bonds, U.S. high-yield bonds, Eurobonds, certain emerging market debt, municipal bonds, U.S. government bonds, agency bonds and other government bonds. Following the introduction of Open Trading on our platforms in 2013, we have continued to build upon the technology to develop more features and services. We now offer several Open Trading protocols, including:

•Open Trading RFQ, which provides our Open Trading participants with the ability to display requests for bids and offers anonymously to the entire MarketAxess trading community, thereby creating broad visibility of their inquiry among market participants and increasing the likelihood that the request will result in a completed trade. The Open Trading RFQ protocol is typically used simultaneously with a disclosed RFQ, providing the requestor with an increased likelihood of achieving best execution by seeking pricing from a participant’s known dealer trading relationships and the Open Trading marketplace at the same time;

•Dealer RFQ, which allows dealers to initiate RFQs to all other dealers or to the entire Open Trading network, is used by our dealer clients to manage risk, source liquidity, and facilitate transactions on behalf of their clients;

•Mid-X sessions, a sessions-based mid-point matching tool that allows broker-dealers to trade against the mid-point price established by CP+ at a given time instead of bilaterally negotiating a price, which we believe removes some of the pricing challenges inherent in other trading protocols;

•Live Markets, an order book functionality that allows participants to post one or two-way, live, executable quotes for the most active corporate bonds and U.S. government bonds, including newly issued debt, benchmark issues and news-driven securities;

•Public Axes™, which is an order book-style price discovery process that gives participants the ability to view and execute trades upon anonymous or disclosed indications of interest from the inventory posted on our platforms; and

•Diversity Dealer Initiative, which leverages the liquidity-enhancing features of Open Trading, but also allows institutional investor clients to select minority-, women- and veteran-owned broker-dealers to intermediate the resulting Open Trading transaction.

In 2023, approximately 35.2% of all eligible credit volume on the MarketAxess platform was executed via Open Trading protocols.

Automated and Algorithmic Trading Solutions

We believe that our automated and algorithmic trading solutions, which allow clients to set eligibility criteria for their orders that our platforms will use to determine whether to execute a trade in accordance with the pre-defined parameters, increase trading efficiency and allow traders to focus on higher-value trades. We expect that bond trading velocity will grow in the years ahead due to the increased adoption of trading automation by both broker-dealer and institutional investor participants.

Some of our fixed-income automation tools include:

•Auto-X RFQ, which allows clients to automatically execute a request-for-quote using simple variables such as trade size, price and number of respondents. In 2023, Auto-X RFQ represented 23.1% of total trade count and 9.7% of our credit trading volume. 41.0% of Auto-X RFQ trades in 2023 were “no touch,” meaning such trades were initiated automatically by clients using pre-specified instructions, up from 33.0% in 2022;

•Auto-X Responder, which allows clients to automatically respond to requests using either a specified response level or a mid-point price generated by one of our data products;

•Adaptive Auto-X, which provides our clients with a suite of AI-driven algorithms that integrate many of our key trading protocols to help the trader decide the size of their order, which MarketAxess protocol to use, which counterparty to trade with and what time of day to trade; and

•U.S. Treasury Hedging, which automatically provides a U.S. Treasury hedge for trades in credit products available on our platforms.

In addition, we support a large and growing base of dealer market making algorithms. Dealer market making algorithms enhance the liquidity available on our platforms by increasing the number of competitive responses to each RFQ, thereby increasing a participant’s likelihood of completing a trade at the best price. In 2023, there were 32.5 million dealer algorithmic responses on our platforms, up 37.0% from 2022. In addition, dealers are increasingly using algorithmic responses to execute larger trades. In 2023, 69.2% of client-to-dealer inquiries for a trade of greater than $5.0 million notional value in U.S. high grade bonds received one or more algorithmic responses, up from 57.0% in 2022. In 2023, there were 204 client firms using our automated and algorithmic trading solutions, up 25.9% from 2022.

In 2023, we acquired Pragma, expanding our automated and algorithmic trading solutions offerings to include equities and foreign exchange for institutional clients, banks and broker-dealers, and securities exchanges. The Pragma360 platform provides a customized software-as-a-service algorithmic trading solution with hosted and dedicated trading environments for clients, which is integrated with Panorama, Pragma’s advanced, web-based algorithm management system. Pragma also provides Polaris, a customizable trading platform available to floor brokers of the New York Stock Exchange and their clients.

Order and Execution Workflow Solutions

We provide order and execution workflow solutions designed to meet the specific needs of our institutional investor and broker-dealer clients. For example, LiquidityBridge®, is our execution management system offered to dealers that allows users to manage and facilitate the complex liquidity flows across multiple trading platforms, including the MarketAxess system. LiquidityBridge brings together real-time comparison and execution of bond prices across multiple sectors, allowing users to rapidly react to trading opportunities. In addition, Axess IQ™ is our order and execution workflow solution designed to meet the needs of the wealth management and private banking community by improving liquidity discovery, execution efficiency and alpha generation for firms with large numbers of individual client orders.

Integrated and Actionable Data

Timely and accurate data is particularly important in the fixed-income markets where real-time data has traditionally been scarce and transparency has been limited. We offer the following data products and index solutions:

Data Products

Traders are increasingly using data and machine-learning for pre-trade analytics, automated execution, transaction cost analysis and post-trade solutions. Our data strategy is centered on using our data offerings to support trading activity through our diverse trading protocols and growing our revenues from our commercial data offerings. We believe that our electronic trading platforms allow institutional investors to compile, sort and use information to discover investment opportunities that might have been difficult or impossible to identify using a manual information-gathering process or other electronic services. Our data products are based on the trading activity, completed transactions and trade reporting services that occur on or through our platforms, as well as public sources such as TRACE.

Our data products include:

•CP+, a pricing algorithm that generates near real-time pricing for U.S. high grade, U.S. high yield, Eurobonds, emerging markets and European government bonds based on a variety of data inputs, including feeds from our trading platforms, our post-trade services and TRACE. CP+ is used by clients as a pre-trade reference price to enhance trading outcomes and transaction cost analysis. CP+ can be combined with our auto-execution service, providing clients with an alert if a response is “off market.”

•Axess All, the first intra-day trade tape for the European fixed-income market, is sourced from the thousands of daily bond transactions processed by our post-trade services business and includes aggregated volume and pricing for the most actively traded European fixed-income instruments.

•Axess All Prints®, which is an enhanced, real-time transacted price service for the most actively traded European fixed-income instruments.

•BondTicker®, which provides real-time TRACE data enhanced with MarketAxess trade data and analytical tools in order to provide professional market participants with a comprehensive set of corporate bond price information with associated analytical tools that are not otherwise available.

•Relative Liquidity Score, a product that provides a defined measurement of the current liquidity for individual bonds and highlights the relative potential ease that a trader can expect when transacting in such instruments.

Index Solutions

To meet the increasing need for passive fixed-income investment strategies, we have also introduced liquid indices powered by real-time data. In 2022, we introduced the MarketAxess U.S. Investment Grade Corporate Bond 400 Index (the “MKTX 400 Index”), which is an index constructed to measure the performance of 400 U.S. dollar denominated investment grade corporate bonds with higher-than-average liquidity relative to the broader U.S. corporate bond market. The index utilizes Relative Liquidity Scores and CP+ in the construction and evaluation processes. State Street Global Advisors has launched an exchange traded fund that seeks to track the MKTX 400 Index. In addition, in 2022, we also announced a strategic collaboration with MSCI Inc. to create co-branded fixed-income indices incorporating our liquidity data. The first of such indices, the MSCI MarketAxess USD HY Tradable Corporate Bond Index, which uses Relative Liquidity Scores to identify and select the liquid fixed-income securities, launched in November 2022.

Post-Trade Services

We provide post-trade matching and regulatory reporting services for European investment firms and market and reference data across a range of fixed-income products. In response to the requirements of the Markets in Financial Instruments Directive (“MiFID II”) in Europe, we have developed a comprehensive suite of value-add solutions, including SensAI, pre-trade transparency services, systematic internaliser (“SI”) determination and monitoring, best execution reporting, commodity position reporting, data quality analysis and peer benchmarking.

In the E.U. and U.K., all firms regulated as “investment firms” under MiFID II are required to submit complete and accurate details of qualifying transactions to their national regulator no later than the close of the working day following the date of the transaction. This process is known as transaction reporting. Firms may either report directly to their regulator or use an entity that is licensed as an Approved Reporting Mechanism (“ARM”), such as our subsidiaries in the U.K. and the Netherlands, to validate and submit such reports to their regulator. Our multi-asset class ARM reporting solution allows our clients to report to 23 different European regulators. We have also collaborated with Equilend on a full front-to-back Securities Financing Transactions Regulation (“SFTR”) solution to support mutual clients with their SFTR reporting requirements.

Under the Markets in Financial Instruments Regulation (“MiFIR”), all regulated investment firms in the U.K. and the E.U. are required to comply with pre- and post-trade transparency requirements pursuant to which quotes and trades must be made public subject to a system of waivers and deferrals. Firms are required to utilize an Approved Publication Arrangement (“APA”), such as our APAs in the U.K. and the Netherlands, to comply with the post-trade transparency requirement and many firms utilize a third-party provider to satisfy the pre-trade transparency requirement. The MarketAxess transparency and APA trade reporting solutions are available through our Insight™ platform, offering our clients a pre- and post-trade transparency solution, including APA trade reporting, quote publication, SI determination and instrument liquidity classification.

Post-trade matching enables counterparties to match the economic trade details of a trade and settlement information shortly after execution, reducing the risk of trade errors and fails during settlement. We provide a near real-time post-trade matching and exception management tool which covers a broad range of securities, including fixed-income and equities. By confirming all economic details within minutes of trade execution, we help our clients to mitigate their operational risk, improve STP and efficiency and address the complexities of MiFID II and the Central Securities Depositories Regulation.

MarketAxess has over 1,000 post-trade reporting, post-trade matching and transparency clients, including investment firms, venues and aggregators.

Our Clients

Over 2,000 institutional investor and broker-dealer firms are active users of our platforms. Since our founding, we have developed trusted relationships with many of our clients and have invested in maintaining strong relationships with our largest clients. Although institutional investors, specialist market making firms, proprietary trading firms and other non-traditional liquidity providers have increasingly provided liquidity on our platforms through Open Trading, we believe traditional broker-dealers still represent the principal source of secondary market liquidity in the markets in which we operate. Certain of our clients may account for a significant portion of our trading volume. Market knowledge and feedback from these clients have also been important factors in the development of many of our offerings and solutions. Our institutional investor and broker-dealer clients are increasingly trading multiple products on our platforms and using multiple trading protocols in order to execute upon their trading strategies.

Our Technology

Proprietary Technology

Our electronic trading platforms are based on a secure and scalable architecture that makes broad use of distributed computing to achieve speed and reliability. Our technology provides clients with end-to-end and customizable connectivity to fixed-income markets.

We support the achievement of best execution through our many trading protocols, including technologies such as our recently launched new platform, X-Pro, and our all-to-all Open Trading protocols. In designing X-Pro, we enhanced the trading experience by providing traders with a flexible user experience, intuitive workflows and easy access to our proprietary data and pre-trade analytics. Open Trading increases the number of potential trading counterparties by allowing participants to interact anonymously in an all-to-all trading environment of over 1,700 potential counterparties. We believe this technology enhances our institutional investor clients’ ability to obtain a competitive price by allowing all Open Trading participants to interact with each other and increases the likelihood of receiving a competitive price response. We estimate that Open Trading generated approximately $701.9 million of price improvement for our clients in 2023.

In addition, our clients have access to automated and algorithmic trading technologies, such as Auto-X RFQ, Auto-X Responder and Adaptive Auto-X, which allow clients to set eligibility criteria for their orders that will determine whether a trade is executed on our platforms in accordance with their pre-defined parameters. These automated and algorithmic trading protocols are designed to help increase trading efficiency, freeing traders to focus on more complex or higher-value trades.

In addition to services directly related to the execution of trades, MarketAxess offers clients several other pre- and post-trade services. In the pre-trade period, our platforms assist our participants by providing them with value-added services, such as real-time and historical trade price information, liquidity and turnover analytics, bond reference data and trade order matching alerts. Following the execution of a trade, our platforms enable our participants to realize the full benefits of electronic trading and demonstrate best execution, including customization, real-time trade details, STP, account allocations, automated audit trails, regulatory trade reporting, trade detail matching and transaction cost analysis.

Technology Team

The design and quality of our technology products is supported by a team of approximately 380 full-time technology professionals led by managers with deep market knowledge and fixed-income expertise. This combination of market knowledge and industry expertise allows us to address client demand and to focus on solutions that can be scaled across client sectors, fixed-income asset classes and trading protocols. Our technology is critical to our growth and our ability to execute our business strategy.

Our technology team is focused on:

•Continuing to evolve our technology platform. We believe that it is imperative that we continue to invest in and evolve our technology in order to continue innovating and delivering new features and protocols to our clients, such as the launch of X-Pro in 2023. For example, we increasingly utilize cloud technology to capitalize on innovative tooling, cost savings and improvements to development velocity.

•Investing in resiliency, scale and risk management. We recognize the value of investing in our capacity and risk management capabilities. The MarketAxess platforms are built on industry-standard technologies and have been designed to handle loads that exceed our current trading volume. In addition, all critical server-side components, including networks, application servers and databases, have backup solutions. This maximizes uptime and minimizes the potential for loss of transaction data in the event of an internal failure. We also seek to minimize the impact of external failures by automatically recovering connections in the event of a communications failure. Most of our broker-dealer clients and a significant number of our institutional investor clients have redundant dedicated high-speed communication paths to our network to provide fast data transfer. Our security measures include industry-standard communications encryption.

•Continuing product delivery and improvement of features. Our technology team is focused on our agile product development cycle and continued innovation of our platforms with new features. During the year ended December 31, 2023, we delivered approximately 1,000 unique new business and technical features to our clients.

See Part I, Item 1C – “Cybersecurity” for more information about our cybersecurity program as well as Part I, Item 1A. – “Risk Factors — Technology, IT Systems and Cybersecurity Risks.”

Environmental, Social and Governance

We are focused on growing our business by delivering sustainable long-term value for our customers, employees, stockholders, and the communities where we live and work. At MarketAxess, our environmental, social and governance (“ESG”) strategy encompasses both corporate and commercial objectives.

Corporate ESG Objectives

As part of our vision to maximize stakeholder value, we strive to incorporate ESG principles into our business strategies and organizational culture. Our 2022 ESG Report, which can be found on our corporate website (available at https://www.marketaxess.com/sustainability), included the Company’s first reporting against the Task Force on Climate-Related Disclosure (TCFD) framework in order to give our stakeholders additional insight into our climate change practices and policies. The ESG Report also includes the results of the Company’s comprehensive non-financial ESG materiality and prioritization assessment, which identified eighteen key ESG topics and six priority topics critical for MarketAxess to manage and drive long-term business performance and societal impact. Finally, the Company responded to the Climate Disclosure Project’s Climate Change Questionnaire in July 2023. Please also refer to “— Human Capital Resources” for additional information on our human capital management strategies.

Our ESG Reports and CDP questionnaire responses are not, and shall not be deemed to be, a part of this Form 10-K or incorporated into any of our other filings made with the U.S. Securities and Exchange Commission (the “SEC”).

Commercial ESG Objectives

In order to help our institutional investor and broker-dealer clients meet their ESG goals and strategies, we have begun to develop ESG-integrated product offerings. For example, through our “Trading for Trees” program, five trees are planted by One Tree Planted, our partner charitable organization, for every $1.0 million of green bond trades executed on our platforms. In 2023, $74.2 billion in green bond trading volume was executed globally on our platforms, an increase of 17.2% from 2022.

In addition, our Diversity Dealer Initiative enables buy side firms to trade more easily with certain minority-, women- and veteran-owned broker-dealers, while still achieving best execution. The Diversity Dealer Initiative leverages our anonymous all-to-all Open Trading marketplace and provides enhanced trading connections by giving institutional investor clients the option to select a diversity dealer to intermediate an Open Trading transaction.

The Company began purchasing renewable energy-related transferable tax credits under the Inflation Reduction Act (the “IRA”) in 2023. The transferability market created by the IRA allows producers of renewable energy or related manufacturing components to sell the tax credits generated by their activities to corporate purchasers. Through the purchase of these credits, the Company has reduced its federal tax liability while supporting innovative companies as they continue to drive the United States’ transition to renewable energy.

Sales and Marketing

We sell and promote our offerings and solutions using a variety of sales and marketing strategies. Our sales organization follows a team-based approach to covering clients, deploying our product and regional expertise as best dictated by evolving market conditions. Our sales force, which works closely with our product management and technology teams, is responsible for new client acquisition and the management of ongoing client relationships to increase clients’ awareness, knowledge and usage of our solutions and products. Our sales team is also responsible for training and supporting new and existing clients on their use of our trade execution services, integrated and actionable data offerings and post-trade solutions, including how to optimize their trading performance and efficiency through our various trading protocols.

Given the breadth of our global client network, trading volume activity and engagement with regulators, we regularly educate market participants on market trends, the impact of regulatory changes and technology advancements. Our senior executives often provide insight and thought leadership to the industry through conversations with the media, appearances at important industry events, roundtables and forums, submitting authored opinion pieces to media outlets and conducting topical webinars for our clients. We believe this provides a valued service for our constituents and enhances our brand awareness and stature within the financial community. Additionally, we employ various marketing strategies to strengthen our brand position and explain our offerings, including through our public website, advertising, digital and social media, earned media, direct marketing, promotional mailings, industry conferences and hosted events.

Seasonality

Our revenue can be impacted by seasonal effects caused by increased levels of new bond issuance, which often occurs in the first quarter of a year, or slow-downs in trading activity, particularly during the customary holiday periods in August and December.

Competition

The global fixed-income securities industry generally, and the electronic financial services markets in which we engage in particular, are highly competitive, and we expect competition to intensify in the future. We compete with a broad range of market participants globally. Some of these market participants compete with us in a particular market, while select others compete against substantially all of our platforms and solutions.

We primarily compete on the basis of our client network, the liquidity provided by our broker-dealer clients, the unique liquidity and the potential for price improvement offered by our Open Trading protocols, the total transaction costs associated with our services, the breadth of products, protocols and services offered, as well as the quality, reliability, security and ease of use of our platforms. We believe our competitive position is enhanced by the familiarity and integration of our clients' systems with our electronic trading platforms and other systems.

Our trading platforms face the following main areas of competition:

•Bilateral Trading — We compete with bond trading business conducted over the telephone or electronic messaging directly between broker-dealers and their institutional investor clients. Institutional investors have historically purchased fixed-income securities by telephoning or otherwise communicating via instant messaging with bond sales professionals at one or more broker-dealers and inquiring about the price and availability of individual bonds. This remains the manner in which the majority of corporate bond volumes are still traded between institutional investors and broker-dealers.

•Other multi-party electronic trading platforms — There are numerous other electronic trading platforms currently in existence, including several that have only commenced operations in the last few years. We compete with Tradeweb (indirectly controlled by the London Stock Exchange), Bloomberg, Intercontinental Exchange, Trumid and others in the credit and municipal markets; and Tradeweb, Bloomberg, CME Group (BrokerTec), BGC Partners (Fenics UST) and others in the rates markets. In addition, some broker-dealers and institutional investors operate, or have invested in, proprietary electronic trading systems or information networks that enable institutional investors to trade directly with a broker-dealer, and/or with other institutional investors over an electronic medium. As we expand our business into new products, we will likely come into more direct competition with other electronic trading platforms or firms offering traditional services.

•EMS and OMS Providers – There are various providers of execution management services (“EMS”) and order management services (“OMS”) that have announced plans to offer aggregation of trading venue liquidity, as well as direct-to-dealer fully electronic trading solutions.

•Securities and Futures Exchanges — In recent years, exchanges have pursued acquisitions that have put them in competition with us. For example, the London Stock Exchange Group acquired a significant stake in Tradeweb and Intercontinental Exchange acquired BondPoint and TMC Bonds, retail-focused platforms, and IDC, a provider of fixed-income data, in an effort to expand its portfolio of fixed-income products and services. CME Group also operates platforms that compete with us. Exchanges also have data and analytics businesses, which increasingly put their offerings in direct competition with us.

Our data business competes with several large market data and information providers, such as Bloomberg, the London Stock Exchange (Refinitiv), Intercontinental Exchange and S&P Global, which currently have a data and analytics relationship with virtually every institutional firm. These entities are currently direct competitors to our information services business and already are or may in the future become direct competitors to our electronic trading platforms.

Our post-trade business competes with other approved regulatory mechanisms in Europe that have ARM and APA designations, such as the London Stock Exchange’s UnaVista and Tradeweb, to provide post-trade matching and regulatory transaction reporting and transparency services to European clients.

Our automated and algorithmic trading solutions business competes with other providers of commercial algorithms.

We face intense competition, and we expect competition to continue to intensify in the future. See Part I, Item 1A. – “Risk Factors — Risks Related to Operating in the Electronic Fixed-Income Trading Markets — We face substantial competition that could reduce our market share and harm our financial performance.”

Intellectual Property

We rely upon a combination of copyright, patent, trade secret and trademark laws, written agreements and common law to protect our proprietary technology, processes and other intellectual property. Our software code, elements of our electronic trading platforms, website and other proprietary materials are protected by copyright laws. We have been issued several patents covering significant trading protocols and other aspects of our trading system technology.

The written agreements upon which we rely to protect our proprietary technology, processes and intellectual property include agreements designed to protect our trade secrets. Examples of these written agreements include third party nondisclosure agreements, employee nondisclosure and inventions assignment agreements, and agreements with customers, contractors and strategic partners. Other written agreements upon which we rely to protect our proprietary technology, processes and intellectual property take many forms and contain provisions related to patent, copyright, trademark and trade secret rights.

We have registered the MarketAxess® name and logo for trademark in the U.S., Europe and in other parts of the world. We also have a number of other registered or pending trademarks and service marks globally, including Open Trading®, BondTicker®, CP+™, Axess All® and Now You’re In The Market® among others. In addition, we own, or have filed applications for, the rights to trade names, copyrights, domain names and service marks that we use in the marketing of products and services to clients.

In addition to our efforts to register our intellectual property, we believe that factors such as the technological and creative skills of our personnel, new product and service developments, frequent enhancements and reliability with respect to our services are essential to establishing and maintaining a technology and market leadership position.

Government Regulation

The securities industry and financial markets in the U.S. and elsewhere are subject to extensive regulation. In these jurisdictions, government regulators and self-regulatory organizations oversee the conduct of our business, and have broad powers to promulgate and interpret laws, rules and regulations that may serve to restrict or limit our business. As a matter of public policy, these regulators are charged with safeguarding the integrity of the securities and other financial markets and with protecting the interests of investors participating in those markets. Our active broker-dealer and regulated venue subsidiaries fall within the scope of their regulations. Rulemaking by regulators, including resulting market structure changes, has had an impact on our business by directly affecting our method of operation and, at times, our profitability.

As registered broker-dealers, trading venues and other types of regulated entities as described below, certain of our subsidiaries are subject to laws, rules and regulations (including the rules of self-regulatory organizations) that cover all aspects of their business, including manner of operation, system integrity, anti-money laundering and financial crimes, handling of material non-public information, safeguarding data, capital requirements, reporting, record retention, market access, licensing of employees and the conduct of officers, employees and other associated persons.

From time to time, regulations impose increased obligations on our regulated subsidiaries, including our broker-dealer subsidiaries. These increased obligations require the implementation and maintenance of internal practices, procedures and controls, which have increased our costs. Many of our regulators, as well as other governmental authorities, are empowered to bring enforcement actions and to conduct administrative proceedings, examinations, inspections and investigations, which may result in increased compliance costs, penalties, fines, enhanced oversight, increased financial and capital requirements, additional restrictions or limitations, censure, suspension or disqualification of the entity and/or its officers, employees or other associated persons, or other sanctions, such as disgorgement, restitution or the revocation or limitation of regulatory approvals. Whether or not resulting in adverse findings, regulatory proceedings, examinations, inspections and investigations can require substantial expenditures of time and money and can have an adverse impact on a firm’s reputation, client relationships and profitability. From time to time, we and our associated persons have been and are subject to routine reviews, none of which to date have had a material adverse effect on our businesses, financial condition, results of operations or prospects. As a result of such reviews, and any future actions or reviews, we may be required to, among other things, amend certain internal structures and frameworks such as our operating procedures, systems and controls.

The regulatory environment in which we operate is subject to constant change. We are unable to predict how certain new laws and proposed rules and regulations will be implemented or in what form, or whether any changes to existing laws, rules and regulations, including the interpretation, implementation or enforcement thereof or a relaxation or amendment thereof, will occur in the future. We believe that uncertainty and potential delays around the final form of certain new rules and regulations may negatively impact our clients and trading volumes in certain markets in which we transact, although a relaxation of or the amendment of existing rules and requirements could potentially have a positive impact in certain markets. For example, regulators are speaking more regularly about the benefits of all-to-all trading to promote market resiliency in fixed-income products. While we generally believe the net impact of the laws, rules and regulations may be positive for our business, it is possible that unintended consequences may materially adversely affect us in ways yet to be determined. See Part I, Item 1A. – “Risk Factors – Regulatory and Legal Risks - Our business and the trading businesses of many of our clients are subject to increasingly extensive government and other regulation, which may affect our trading volumes and increase our cost of doing business.”

U.S. Regulation

In the U.S., the SEC is the federal governmental agency primarily responsible for the administration of the federal securities laws, including adopting and enforcing rules and regulations applicable to broker-dealers. One of our U.S. broker-dealer subsidiaries operates an alternative trading system (“ATS”) subject to the SEC’s Regulation ATS, which includes certain specific requirements and compliance responsibilities in addition to those faced by broker-dealers generally, and an exempt ATS for U.S. government bonds. Broker-dealers are also subject to regulation by state securities administrators in those states in which they conduct business or have registered to do business. We are also subject to the various anti-fraud provisions of the Securities Act of 1933, as amended (the “Securities Act”), the Securities Exchange Act of 1934, as amended (the “Exchange Act”), the Commodity Exchange Act, certain state securities laws and the rules and regulations promulgated thereunder. We also may be subject to vicarious and controlling person liability for the activities of our subsidiaries and our officers, employees and affiliated persons.

Much of the regulation of broker-dealers’ operations in the United States has been delegated to self-regulatory organizations. These self-regulatory organizations adopt rules (which are generally subject to approval by the SEC) that govern the operations of broker-dealers and conduct periodic inspections and examinations of their operations. In the case of our U.S. broker-dealer subsidiaries, the principal self-regulatory organization is FINRA. Our U.S. broker-dealer subsidiaries are subject to both scheduled and unscheduled examinations by the SEC and FINRA. In addition, our municipal securities-related activities are subject to the rules of the MSRB.

The SEC recently conducted a review of the regulatory framework for fixed-income electronic trading platforms for the purpose of evaluating the potential regulatory gaps that may exist among such platforms, including ours, with respect to access to markets, system integrity, surveillance, and transparency, among other things. In January 2022, as a result of this review, the SEC proposed rules that will expand Regulation ATS and Regulation SCI to ATS that trade government securities and amend the SEC rule regarding the definition of an “exchange” to include Communication Protocol Systems, such as our RFQ protocols. Based on these proposed rules, we expect that we will have to operate all of our trading protocols in compliance with Regulation ATS and we could become subject to Regulation SCI for certain parts of our business in the future. It is unknown at this time to what extent new legislation will be passed into law or whether pending or new regulatory proposals will be adopted or modified, or what effect such passage, adoption or modification will have, whether positive or negative, on our industry, our clients or us.

The SEC has also adopted final rule amendments that, effective May 2024, will shorten the standard settlement cycle for most broker-dealer securities transactions from two business days after the trade date (T+2) to one business day after the trade date (T+1). The shortening of the settlement cycle will lead to a reduction in the length of exposure to trading counterparties and lower margin requirements for our clearing operations, but it is also expected to increase the operational costs and complexities associated with cross border transactions conducted on our platforms.

The SEC also adopted final rules on December 13, 2023 regarding the central clearing of certain secondary market transactions involving U.S. Treasury securities. This central clearing mandate will impact certain of our participants who do not centrally clear such trades today, and some have expressed concerns about the potential impact of additional clearing costs. The full impact of this change, and what effect it will have, whether positive or negative, on our industry, our clients or us is unknown at this time.

Non-U.S. Regulation

Outside of the United States, we are currently directly regulated by: the Financial Conduct Authority (the “FCA”) in the U.K., De Nederlandsche Bank (“DNB”) and the Netherlands Authority for the Financial Markets (“AFM”) in the Netherlands, the European Securities and Markets Authority (“ESMA”) in the E.U., the Monetary Authority of Singapore (the “MAS”) in Singapore, the Investment Industry Regulatory Organization of Canada (the “IIROC”) and provincial regulators in Canada, and the Securities and Exchange Commission and Central Bank in Brazil. We also hold cross-border licenses or permissions to operate in other jurisdictions with other regulatory bodies, including the Swiss Financial Market Supervisory Authority (“FINMA”), the Securities & Futures Commission of Hong Kong, the Australian Securities and Investment Commission in Australia (“ASIC”), the Danish Financial Supervisory Authority, the German Federal Financial Supervisory Authority (“BaFin”), the Commission de Surveillance du Secteur Financier of Luxembourg, the Italian Commissione Nazionale per le Società e la Borsa (“Consob”), the Norwegian Financial Supervisory Authority, the Finnish Financial Supervisory Authority, the China Foreign Exchange Trade System (“CFETS”), a direct subsidiary of the People’s Bank of China (PBC) and China’s Bond Connect Company Limited.

The FCA’s strategic objective is to ensure that the relevant markets function properly and its operational objectives are to protect consumers, to protect and enhance the integrity of the U.K. financial system and to promote effective competition in the interests of consumers. It has investigative and enforcement powers derived from the Financial Services and Markets Act (“FSMA”) and subsequent legislation and regulations. Subject to the FSMA, individuals or companies that seek to acquire or increase their control in a firm that the FCA regulates are required to obtain prior approval from the FCA.

In 2023, amendments to the FSMA repealed the financial services framework inherited from the E.U. The amended FSMA provides the FCA increased regulatory authority, including the power to reform the E.U. rules and the ability to devise a new financial services regime, and establishes a new secondary objective to promote “economic growth and international competitiveness” for the U.K. The U.K. is also reviewing and amending its MiFID II and MiFIR regime, including the U.K. CTP framework for bonds and the transparency regime for bonds and derivatives.