UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

| | | | | |

| ☑ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the quarterly period ended March 31, 2024 |

or

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the transition period from to . |

Commission file number: 000-50600

Blackbaud, Inc.

(Exact name of registrant as specified in its charter)

| | | | | |

| |

| Delaware | 11-2617163 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

65 Fairchild Street

Charleston, South Carolina 29492

(Address of principal executive offices, including zip code)

(843) 216-6200

(Registrant’s telephone number, including area code)

| | | | | | | | |

| | |

| Securities Registered Pursuant to Section 12(b) of the Act: |

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange on which Registered |

| Common Stock, $0.001 Par Value | BLKB | Nasdaq Global Select Market |

| | |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (Section 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | |

| Large accelerated filer | ☑ | | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | | Smaller reporting company | ☐ |

| | | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐ No ☑

The number of shares of the registrant’s Common Stock outstanding as of April 29, 2024 was 51,626,076.

TABLE OF CONTENTS

| | | | | | | | |

| First Quarter 2024 Form 10-Q | | 1 |

| | | | | | | | |

| | CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS |

This Quarterly Report on Form 10-Q, including the documents incorporated herein by reference, contains forward-looking statements that anticipate results based on our estimates, assumptions and plans that are subject to uncertainty. These "forward-looking statements" are made subject to the safe-harbor provisions of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements consist of, among other things, trend analyses, statements regarding future events, future financial performance, our anticipated growth, the effect of general economic and market conditions, our business strategy and our plan to build and grow our business, our operating results, our ability to successfully integrate acquired businesses and technologies, the effect of foreign currency exchange rate and interest rate fluctuations on our financial results, the impact of expensing stock-based compensation, the sufficiency of our capital resources, our ability to meet our ongoing debt and obligations as they become due, cybersecurity and data protection risks and related liabilities, and current or potential legal proceedings involving us, all of which are based on current expectations, estimates, and forecasts, and the beliefs and assumptions of our management. Words such as “believes,” “seeks,” “expects,” “may,” “might,” “should,” “intends,” “could,” “would,” “likely,” “will,” “targets,” “plans,” “anticipates,” “aims,” “projects,” “estimates” or any variations of such words and similar expressions are also intended to identify such forward-looking statements. These forward-looking statements are subject to risks, uncertainties and assumptions that are difficult to predict. Accordingly, they should not be viewed as assurances of future performance, and actual results may differ materially and adversely from those expressed in any forward-looking statements.

Important factors that could cause actual results to differ materially from our expectations expressed in forward-looking statements include, but are not limited to, those summarized under “Part II, Item 1A. Risk factors” and elsewhere in this report, in our Annual Report on Form 10-K for the year ended December 31, 2023 and in our other filings made with the United States Securities & Exchange Commission ("SEC"). Forward-looking statements represent our management's beliefs and assumptions only as of the date of this Quarterly Report on Form 10-Q. We undertake no obligation to update or revise any forward-looking statements, or to update the reasons actual results could differ materially from those anticipated in any forward-looking statement, whether as a result of new information, future events or otherwise.

| | | | | | | | |

| 2 | | First Quarter 2024 Form 10-Q |

| | | | | | | | |

| | PART I. FINANCIAL INFORMATION |

ITEM 1. FINANCIAL STATEMENTS

| | | | | | | | |

Blackbaud, Inc.

Condensed Consolidated Balance Sheets

(Unaudited) |

| (dollars in thousands, except per share amounts) | March 31,

2024 | December 31,

2023 |

| Assets | | |

| Current assets: | | |

| Cash and cash equivalents | $ | 26,376 | | $ | 31,251 | |

| Restricted cash | 356,493 | | 697,006 | |

| Accounts receivable, net of allowance of $6,204 and $6,907 at March 31, 2024 and December 31, 2023, respectively | 96,097 | | 101,862 | |

| Customer funds receivable | 3,529 | | 353 | |

| Prepaid expenses and other current assets | 94,589 | | 99,285 | |

| Total current assets | 577,084 | | 929,757 | |

| Property and equipment, net | 96,074 | | 98,689 | |

| Operating lease right-of-use assets | 35,464 | | 36,927 | |

| Software and content development costs, net | 162,491 | | 160,194 | |

| Goodwill | 1,053,130 | | 1,053,738 | |

| Intangible assets, net | 565,008 | | 581,937 | |

| Other assets | 59,883 | | 51,037 | |

| Total assets | $ | 2,549,134 | | $ | 2,912,279 | |

| Liabilities and stockholders’ equity | | |

| Current liabilities: | | |

| Trade accounts payable | $ | 48,863 | | $ | 25,184 | |

| Accrued expenses and other current liabilities | 75,271 | | 64,322 | |

| Due to customers | 358,836 | | 695,842 | |

| Debt, current portion | 19,302 | | 19,259 | |

| Deferred revenue, current portion | 360,355 | | 392,530 | |

| Total current liabilities | 862,627 | | 1,197,137 | |

| Debt, net of current portion | 1,020,520 | | 760,405 | |

| Deferred tax liability | 82,446 | | 93,292 | |

| Deferred revenue, net of current portion | 6,832 | | 2,397 | |

| Operating lease liabilities, net of current portion | 38,492 | | 40,085 | |

| Other liabilities | 4,163 | | 10,258 | |

| Total liabilities | 2,015,080 | | 2,103,574 | |

| Commitments and contingencies (see Note 9) | | |

| Stockholders’ equity: | | |

| Preferred stock; 20,000,000 shares authorized, none outstanding | — | | — | |

| Common stock, $0.001 par value; 180,000,000 shares authorized, 70,861,507 and 69,188,304 shares issued at March 31, 2024 and December 31, 2023, respectively; 51,624,243 and 53,625,440 shares outstanding at March 31, 2024 and December 31, 2023, respectively | 71 | | 69 | |

| Additional paid-in capital | 1,184,338 | | 1,203,012 | |

| Treasury stock, at cost; 19,237,264 and 15,562,864 shares at March 31, 2024 and December 31, 2023, respectively | (855,692) | | (591,557) | |

| Accumulated other comprehensive income (loss) | 1,222 | | (1,688) | |

| Retained earnings | 204,115 | | 198,869 | |

| Total stockholders’ equity | 534,054 | | 808,705 | |

| Total liabilities and stockholders’ equity | $ | 2,549,134 | | $ | 2,912,279 | |

| | |

| The accompanying notes are an integral part of these condensed consolidated financial statements. |

| | | | | | | | |

| First Quarter 2024 Form 10-Q | | 3 |

| | | | | | | | | | | |

Blackbaud, Inc. Condensed Consolidated Statements of Comprehensive Income (Loss) (Unaudited) |

| | | Three months ended

March 31, |

| (dollars in thousands, except per share amounts) | | | | 2024 | 2023 |

| Revenue | | | | | |

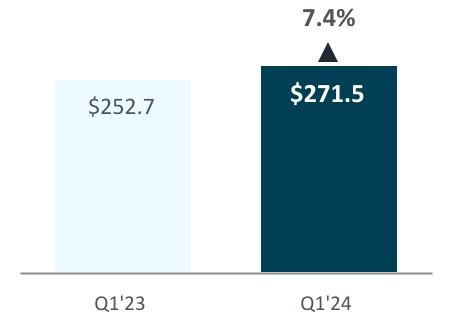

| Recurring | | | | $ | 271,518 | | $ | 252,748 | |

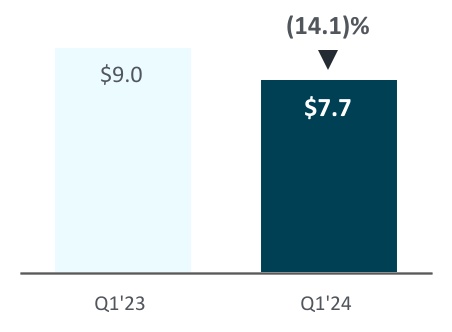

| One-time services and other | | | | 7,732 | | 9,005 | |

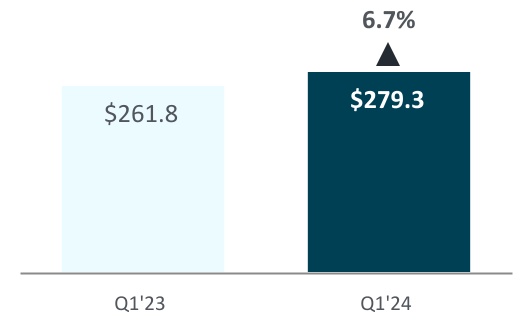

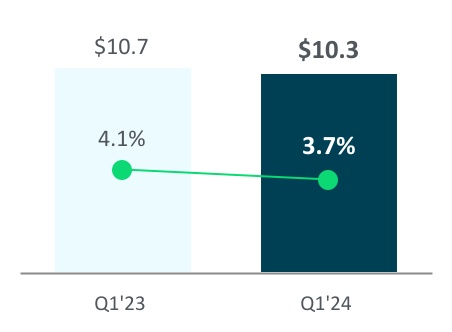

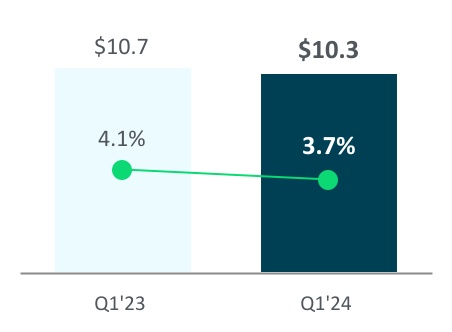

| Total revenue | | | | 279,250 | | 261,753 | |

| Cost of revenue | | | | | |

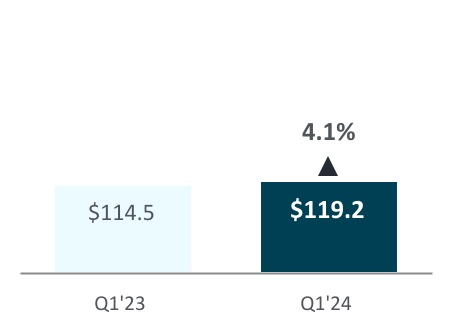

| Cost of recurring | | | | 119,188 | | 114,500 | |

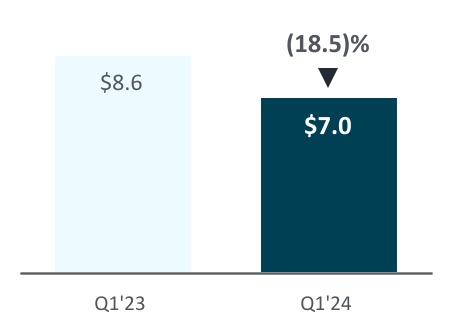

| Cost of one-time services and other | | | | 7,018 | | 8,612 | |

| Total cost of revenue | | | | 126,206 | | 123,112 | |

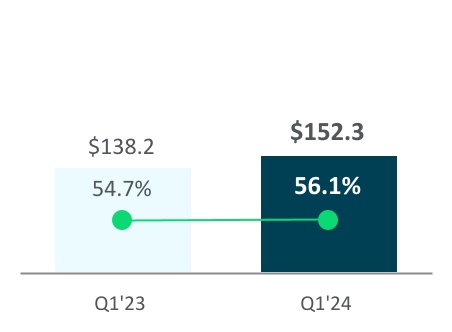

| Gross profit | | | | 153,044 | | 138,641 | |

| Operating expenses | | | | | |

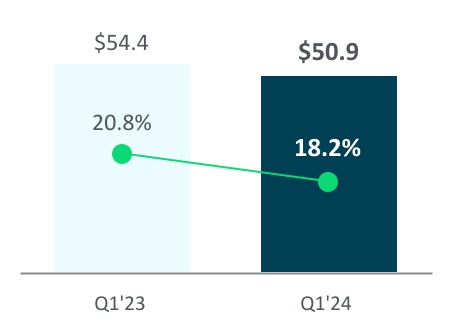

| Sales, marketing and customer success | | | | 50,865 | | 54,385 | |

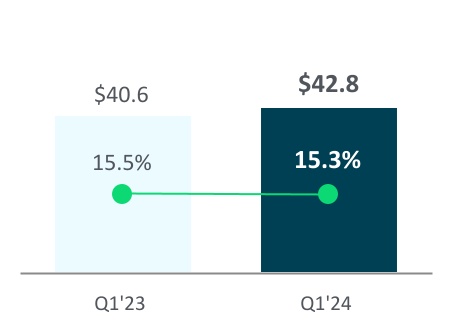

| Research and development | | | | 42,802 | | 40,591 | |

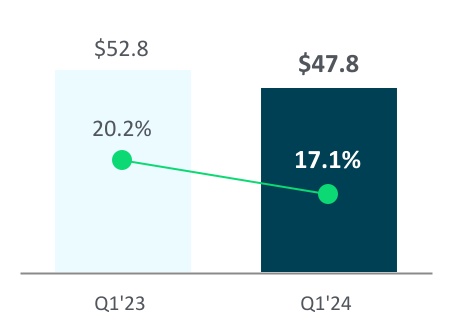

| General and administrative | | | | 47,754 | | 52,838 | |

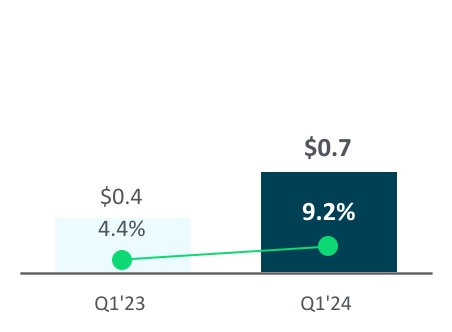

| Amortization | | | | 904 | | 774 | |

| | | | | |

| Total operating expenses | | | | 142,325 | | 148,588 | |

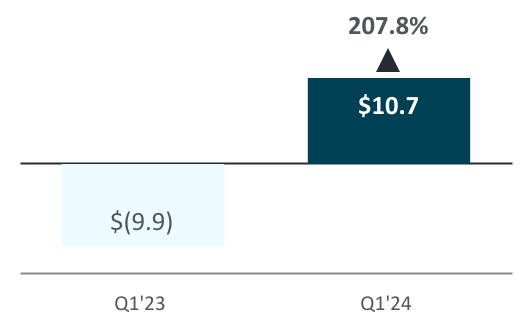

| Income (loss) from operations | | | | 10,719 | | (9,947) | |

| Interest expense | | | | (10,276) | | (10,662) | |

| Other income, net | | | | 3,347 | | 2,007 | |

| Income (loss) before benefit for income taxes | | | | 3,790 | | (18,602) | |

| Income tax benefit | | | | (1,456) | | (3,901) | |

| Net income (loss) | | | | $ | 5,246 | | $ | (14,701) | |

| Earnings (loss) per share | | | | | |

| Basic | | | | $ | 0.10 | | $ | (0.28) | |

| Diluted | | | | $ | 0.10 | | $ | (0.28) | |

| Common shares and equivalents outstanding | | | | | |

| Basic weighted average shares | | | | 52,052,370 | | 52,132,999 | |

| Diluted weighted average shares | | | | 53,414,495 | | 52,132,999 | |

| Other comprehensive income (loss) | | | | | |

| Foreign currency translation adjustment | | | | $ | (1,185) | | $ | 2,158 | |

| Unrealized gain (loss) on derivative instruments, net of tax | | | | 4,095 | | (10,692) | |

| Total other comprehensive income (loss) | | | | 2,910 | | (8,534) | |

| Comprehensive income (loss) | | | | $ | 8,156 | | $ | (23,235) | |

| | | | | |

| The accompanying notes are an integral part of these condensed consolidated financial statements. |

| | | | | | | | |

| 4 | | First Quarter 2024 Form 10-Q |

| | | | | | | | |

Blackbaud, Inc.

Condensed Consolidated Statements of Cash Flows

(Unaudited) |

| | Three months ended

March 31, |

| (dollars in thousands) | 2024 | 2023 |

| Cash flows from operating activities | | |

| Net income (loss) | $ | 5,246 | | $ | (14,701) | |

| Adjustments to reconcile net income (loss) to net cash provided by operating activities: | | |

| Depreciation and amortization | 30,095 | | 27,272 | |

| Provision for credit losses and sales returns | 305 | | 1,522 | |

| Stock-based compensation expense | 33,570 | | 29,925 | |

| Deferred taxes | (12,239) | | 9,245 | |

| Amortization of deferred financing costs and discount | 349 | | 500 | |

| Loss on disposition of business | 1,561 | | — | |

| Other non-cash adjustments | — | | (215) | |

| Changes in operating assets and liabilities, net of acquisition and disposal of businesses: | | |

| Accounts receivable | 3,844 | | 1,139 | |

| Prepaid expenses and other assets | (3,265) | | (2,750) | |

| Trade accounts payable | 23,086 | | 3,362 | |

| Accrued expenses and other liabilities | 7,912 | | (15,931) | |

| Deferred revenue | (25,845) | | (17,562) | |

| Net cash provided by operating activities | 64,619 | | 21,806 | |

| Cash flows from investing activities | | |

| Purchase of property and equipment | (261) | | (1,364) | |

| Capitalized software and content development costs | (13,070) | | (13,967) | |

| | |

| Net cash used in disposition of business | (1,179) | | — | |

| | |

| Net cash used in investing activities | (14,510) | | (15,331) | |

| Cash flows from financing activities | | |

| Proceeds from issuance of debt | 339,800 | | 92,600 | |

| Payments on debt | (79,343) | | (75,403) | |

| | |

| | |

| Employee taxes paid for withheld shares upon equity award settlement | (52,723) | | (31,417) | |

| | |

| Change in due to customers | (336,578) | | (337,159) | |

| Change in customer funds receivable | (3,197) | | (1,859) | |

| Purchase of treasury stock | (262,596) | | — | |

| Net cash used in financing activities | (394,637) | | (353,238) | |

| Effect of exchange rate on cash, cash equivalents and restricted cash | (860) | | 986 | |

| Net decrease in cash, cash equivalents and restricted cash | (345,388) | | (345,777) | |

| Cash, cash equivalents and restricted cash, beginning of period | 728,257 | | 733,931 | |

| Cash, cash equivalents and restricted cash, end of period | $ | 382,869 | | $ | 388,154 | |

The following table provides a reconciliation of cash and cash equivalents and restricted cash reported within the condensed consolidated balance sheets that sum to the total of the same such amounts shown above in the condensed consolidated statements of cash flows:

| | | | | | | | |

| (dollars in thousands) | March 31,

2024 | December 31,

2023 |

| Cash and cash equivalents | $ | 26,376 | | $ | 31,251 | |

| Restricted cash | 356,493 | | 697,006 | |

| Total cash, cash equivalents and restricted cash in the statement of cash flows | $ | 382,869 | | $ | 728,257 | |

| | |

| The accompanying notes are an integral part of these condensed consolidated financial statements. |

| | | | | | | | |

| First Quarter 2024 Form 10-Q | | 5 |

Blackbaud, Inc.

Condensed Consolidated Statements of Stockholders' Equity

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (dollars in thousands) | Common stock | | Treasury stock | | Additional

paid-in

capital | Accumulated other comprehensive income (loss) | Retained

earnings | Total

stockholders'

equity |

| Shares | Amount | | Shares | Amount | |

| Balance at December 31, 2023 | 69,188,304 | | $ | 69 | | | (15,562,864) | | $ | (591,557) | | | $ | 1,203,012 | | $ | (1,688) | | $ | 198,869 | | $ | 808,705 | |

| Net income | — | | — | | | — | | — | | | — | | — | | 5,246 | | 5,246 | |

| Purchase of treasury shares under stock repurchase program | — | | — | | | (2,954,211) | | (211,412) | | | (52,244) | | — | | — | | (263,656) | |

| Vesting of restricted stock units | 1,357,125 | | — | | | — | | — | | | — | | — | | — | | — | |

| Shares withheld to satisfy tax withholdings | — | | — | | | (720,189) | | (52,723) | | | — | | — | | — | | (52,723) | |

| Stock-based compensation | — | | — | | | — | | — | | | 33,570 | | — | | — | | 33,570 | |

| Restricted stock grants | 335,237 | | 2 | | | — | | — | | | — | | — | | — | | 2 | |

| Restricted stock cancellations | (19,159) | | — | | | — | | — | | | — | | — | | — | | — | |

| Other comprehensive income | — | | — | | | — | | — | | | — | | 2,910 | | — | | 2,910 | |

| Balance at March 31, 2024 | 70,861,507 | | $ | 71 | | | (19,237,264) | | $ | (855,692) | | | $ | 1,184,338 | | $ | 1,222 | | $ | 204,115 | | $ | 534,054 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (dollars in thousands) | Common stock | | Treasury stock | | Additional

paid-in

capital | Accumulated other comprehensive income | Retained

earnings | Total

stockholders'

equity |

| Shares | Amount | | Shares | Amount | |

| Balance at December 31, 2022 | 67,814,044 | | $ | 68 | | | (14,745,230) | | $ | (537,287) | | | $ | 1,075,264 | | $ | 8,938 | | $ | 197,049 | | $ | 744,032 | |

| Net loss | — | | — | | | — | | — | | | — | | — | | (14,701) | | (14,701) | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Vesting of restricted stock units | 954,147 | | — | | | — | | — | | | — | | — | | — | | — | |

| Shares withheld to satisfy tax withholdings | — | | — | | | (533,597) | | (30,990) | | | — | | — | | — | | (30,990) | |

| Stock-based compensation | — | | — | | | — | | — | | | 29,925 | | — | | — | | 29,925 | |

| Restricted stock grants | 427,941 | | 1 | | | — | | — | | | — | | — | | — | | 1 | |

| Restricted stock cancellations | (41,269) | | — | | | — | | — | | | — | | — | | — | | — | |

| Other comprehensive loss | — | | — | | | — | | — | | | — | | (8,534) | | — | | (8,534) | |

| Balance at March 31, 2023 | 69,154,863 | | $ | 69 | | | (15,278,827) | | $ | (568,277) | | | $ | 1,105,189 | | $ | 404 | | $ | 182,348 | | $ | 719,733 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

|

| | |

| The accompanying notes are an integral part of these condensed consolidated financial statements. |

| | | | | | | | |

| 6 | | First Quarter 2024 Form 10-Q |

Blackbaud, Inc.

Notes to Condensed Consolidated Financial Statements

(Unaudited)

We are the leading software provider exclusively dedicated to powering social impact. Serving the nonprofit and education sectors, companies committed to social responsibility and individual change makers, our essential software is built to accelerate impact in fundraising, nonprofit financial management, digital giving, grantmaking, corporate social responsibility and education management. A remote-first company, we have operations in the United States, Australia, Canada, Costa Rica and the United Kingdom, supporting users in 100+ countries.

Unaudited condensed consolidated interim financial statements

The accompanying condensed consolidated interim financial statements have been prepared pursuant to the rules and regulations of the United States Securities and Exchange Commission ("SEC") for interim financial reporting. These condensed consolidated statements are unaudited and, in the opinion of management, include all adjustments (consisting of normal recurring adjustments and accruals) necessary to state fairly the consolidated balance sheets, consolidated statements of comprehensive income, consolidated statements of cash flows and consolidated statements of stockholders’ equity, for the periods presented in accordance with accounting principles generally accepted in the United States ("U.S.") ("GAAP"). The condensed consolidated balance sheet at December 31, 2023 has been derived from the audited consolidated financial statements at that date. Operating results and cash flows for the three months ended March 31, 2024 are not necessarily indicative of the results that may be expected for the fiscal year ending December 31, 2024, or any other future period. Certain information and footnote disclosures normally included in annual financial statements prepared in accordance with GAAP have been omitted in accordance with the rules and regulations for interim reporting of the SEC. These unaudited, condensed consolidated interim financial statements should be read in conjunction with the consolidated financial statements and notes thereto included in our Annual Report on Form 10-K for the year ended December 31, 2023, and other forms filed with the SEC from time to time.

Basis of consolidation

The unaudited, condensed consolidated financial statements include the accounts of Blackbaud, Inc. and its wholly owned subsidiaries. All intercompany balances and transactions have been eliminated in consolidation.

Reportable segment

We report our operating results and financial information in one operating and reportable segment. Our chief operating decision maker uses consolidated financial information to make operating decisions, assess financial performance and allocate resources. Our chief operating decision maker is our chief executive officer.

Use of estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements, as well as the reported amounts of revenues and expenses during the reporting periods. On an ongoing basis, we reconsider and evaluate our estimates and assumptions, including those that impact revenue recognition, long-lived and intangible assets, income taxes, business combinations, stock-based compensation, capitalization of software and content development costs, our allowances for credit losses and sales returns, costs of obtaining contracts, valuation of derivative instruments, loss contingencies and insurance recoveries, among others. Changes in the facts or circumstances underlying these estimates could result in material changes and actual results could materially differ from these estimates.

| | | | | | | | |

| First Quarter 2024 Form 10-Q | | 7 |

Blackbaud, Inc.

Notes to Condensed Consolidated Financial Statements

(Unaudited)

Recently issued accounting pronouncements

There are no recently issued accounting pronouncements that we expect to have a material impact on our consolidated financial statements when adopted in the future.

Summary of significant accounting policies

There have been no material changes to our significant accounting policies described in our Annual Report on Form 10-K for the year ended December 31, 2023, filed with the SEC on February 21, 2024.

| | |

| 3. Business Combinations and Dispositions |

2024 Disposition

On March 2, 2024, we completed a transaction to divest our U.K.-based creative services business EVERFI Limited, formerly a wholly-owned subsidiary of EVERFI Inc, which is a wholly-owned subsidiary of Blackbaud, Inc. EVERFI Limited's total revenue during 2023 was $8.4 million. We incurred an insignificant amount of legal costs associated with the disposition of this business. As a result of the disposition, we recorded a $1.6 million loss, which was recorded in general and administrative expense in the unaudited, condensed consolidated statement of comprehensive income for the three months ended March 31, 2024.

| | |

| 4. Earnings (Loss) Per Share |

We compute basic earnings (loss) per share by dividing net income (loss) available to common stockholders by the weighted average number of common shares outstanding during the period. Diluted earnings (loss) per share is computed by dividing net income (loss) available to common stockholders by the weighted average number of common shares and dilutive potential common shares outstanding during the period. Diluted earnings (loss) per share reflects the assumed exercise, settlement and vesting of all dilutive securities using the “treasury stock method” except when the effect is anti-dilutive. Potentially dilutive securities consist of shares issuable upon vesting of restricted stock awards and units. Diluted loss per share for the three months ended March 31, 2023 was the same as basic loss per share as there was a net loss in the period and inclusion of potentially dilutive securities was anti-dilutive.

The following table sets forth the computation of basic and diluted earnings (loss) per share:

| | | | | | | | | | | |

| | | | Three months ended March 31, |

| (dollars in thousands, except per share amounts) | | | | 2024 | 2023 |

| Numerator: | | | | | |

| Net income (loss) | | | | $ | 5,246 | | $ | (14,701) | |

| Denominator: | | | | | |

| Weighted average common shares | | | | 52,052,370 | | 52,132,999 | |

| Add effect of dilutive securities: | | | | | |

| Restricted stock and units | | | | 1,362,125 | | — | |

| Weighted average common shares assuming dilution | | | | 53,414,495 | | 52,132,999 | |

| Earnings (loss) per share | | | | | |

| Basic | | | | $ | 0.10 | | $ | (0.28) | |

| Diluted | | | | $ | 0.10 | | $ | (0.28) | |

| | | | | |

| Anti-dilutive shares excluded from calculations of diluted earnings (loss) per share | | | | 622,902 | | 1,638,453 | |

| | | | | | | | |

| 8 | | First Quarter 2024 Form 10-Q |

Blackbaud, Inc.

Notes to Condensed Consolidated Financial Statements

(Unaudited)

| | |

| 5. Fair Value Measurements |

We use a three-tier fair value hierarchy to measure fair value. This hierarchy prioritizes the inputs into three broad levels as follows:

•Level 1 - Quoted prices for identical assets or liabilities in active markets;

•Level 2 - Quoted prices for similar assets and liabilities in active markets, quoted prices for identical or similar assets in markets that are not active, and model-derived valuations in which all significant inputs and significant value drivers are observable in active markets; and

•Level 3 - Valuations derived from valuation techniques in which one or more significant inputs are unobservable.

Recurring fair value measurements

Financial assets and liabilities that are measured at fair value on a recurring basis consisted of the following, as of the dates indicated below:

| | | | | | | | | | | | | | | | | | | | | | | |

| Fair value measurement using | | |

| (dollars in thousands) | Quoted Prices in Active Markets for Identical Assets and Liabilities

(Level 1) | | Significant Other Observable Inputs

(Level 2) | | Significant Unobservable Inputs

(Level 3) | | Total |

| Fair value as of March 31, 2024 | | | | | | | |

| Financial assets: | | | | | | | |

| Interest rate swaps | $ | — | | | $ | 16,293 | | | $ | — | | | $ | 16,293 | |

| Foreign currency forward contracts | — | | | 260 | | | — | | | 260 | |

| Total financial assets | $ | — | | | $ | 16,553 | | | $ | — | | | $ | 16,553 | |

| | | | | | | |

| Fair value as of March 31, 2024 | | | | | | | |

| Financial liabilities: | | | | | | | |

| | | | | | | |

| Foreign currency forward contracts | $ | — | | | $ | 92 | | | $ | — | | | $ | 92 | |

| Contingent consideration obligations | — | | | — | | | 1,403 | | | 1,403 | |

| Total financial liabilities | $ | — | | | $ | 92 | | | $ | 1,403 | | | $ | 1,495 | |

| | | | | | | |

| Fair value as of December 31, 2023 | | | | | | | |

| Financial assets: | | | | | | | |

| Interest rate swaps | $ | — | | | $ | 16,198 | | | $ | — | | | $ | 16,198 | |

| Foreign currency forward contracts | — | | | — | | | — | | | — | |

| Total financial assets | $ | — | | | $ | 16,198 | | | $ | — | | | $ | 16,198 | |

| | | | | | | |

| Fair value as of December 31, 2023 | | | | | | | |

| Financial liabilities: | | | | | | | |

| Interest rate swaps | $ | — | | | $ | 5,004 | | | $ | — | | | $ | 5,004 | |

| Foreign currency forward contracts | — | | | 536 | | | — | | | 536 | |

| Contingent consideration obligations | — | | | — | | | 1,403 | | | 1,403 | |

| Total financial liabilities | $ | — | | | $ | 5,540 | | | $ | 1,403 | | | $ | 6,943 | |

| | | | | | | | |

| First Quarter 2024 Form 10-Q | | 9 |

Blackbaud, Inc.

Notes to Condensed Consolidated Financial Statements

(Unaudited)

Our derivative instruments within the scope of Accounting Standards Codification ("ASC") 815, Derivatives and Hedging, are required to be recorded at fair value. Our derivative instruments that are recorded at fair value include interest rate swaps and foreign currency forward contracts. See Note 8 to these unaudited, condensed consolidated financial statements for additional information about our derivative instruments.

The fair value of our interest rate swaps and foreign currency forward contracts are based on model-driven valuations using Secured Overnight Financing Rate ("SOFR") rates and foreign currency forward rates, respectively, which are observable at commonly quoted intervals. Accordingly, our interest rate swaps and foreign currency forward contracts are classified within Level 2 of the fair value hierarchy.

Contingent consideration obligations arise from business acquisitions. The fair values are based on discounted cash flow analyses reflecting a probability-weighted assessment approach derived from the likelihood of possible achievement of specified performance measures or events and captures the contractual nature of the contingencies, commercial risk, and the time value of money. As the fair value measurements for our contingent consideration obligations contain significant unobservable inputs, they are classified within Level 3 of the fair value hierarchy.

We believe the carrying amounts of our cash and cash equivalents, restricted cash, accounts receivable, trade accounts payable, accrued expenses and other current liabilities and due to customers approximate their fair values at March 31, 2024 and December 31, 2023, due to the immediate or short-term maturity of these instruments.

We believe the carrying amount of our debt approximates its fair value at March 31, 2024 and December 31, 2023, as the debt bears interest rates that approximate market value. As SOFR rates are observable at commonly quoted intervals, our debt under the 2020 Credit Facility (as defined below) is classified within Level 2 of the fair value hierarchy. The fair value of our fixed rate debt does not exceed the carrying amount.

We did not transfer any assets or liabilities among the levels within the fair value hierarchy during the three months ended March 31, 2024.

Non-recurring fair value measurements

Assets and liabilities that are measured at fair value on a non-recurring basis include long-lived assets, intangible assets, goodwill and operating lease right-of-use ("ROU") assets. These assets are recognized at fair value during the period in which an acquisition is completed or at lease commencement, from updated estimates and assumptions during the measurement period, or when they are considered to be impaired. These non-recurring fair value measurements, primarily for long-lived assets, intangible assets acquired and operating lease ROU assets, are based on Level 3 unobservable inputs. In the event of an impairment, we determine the fair value of these assets other than goodwill using a discounted cash flow approach, which contains significant unobservable inputs and, therefore, is considered a Level 3 fair value measurement. The unobservable inputs in the analysis generally include future cash flow projections and a discount rate. For goodwill impairment testing, we estimate fair value using market-based methods including the use of market capitalization and consideration of a control premium.

There were no significant non-recurring fair value adjustments to our long-lived assets, intangible assets, goodwill and operating lease ROU assets during the three months ended March 31, 2024.

| | |

| 6. Consolidated Financial Statement Details |

Restricted cash

| | | | | | | | |

| (dollars in thousands) | March 31,

2024 | December 31,

2023 |

| Restricted cash due to customers | $ | 355,307 | | $ | 695,489 | |

| | |

| Real estate escrow balances and other | 1,186 | | 1,517 | |

| Total restricted cash | $ | 356,493 | | $ | 697,006 | |

| | | | | | | | |

| 10 | | First Quarter 2024 Form 10-Q |

Blackbaud, Inc.

Notes to Condensed Consolidated Financial Statements

(Unaudited)

Prepaid expenses and other assets

| | | | | | | | |

| (dollars in thousands) | March 31,

2024 | December 31,

2023 |

Costs of obtaining contracts(1)(2) | $ | 61,313 | | $ | 62,377 | |

Prepaid software maintenance and subscriptions(3) | 34,668 | | 35,169 | |

| Derivative instruments | 16,553 | | 16,198 | |

Implementation costs for cloud computing arrangements, net(4)(5) | 9,792 | | 9,259 | |

| Prepaid insurance | 8,617 | | 3,940 | |

| Unbilled accounts receivable | 6,432 | | 5,615 | |

| Taxes, prepaid and receivable | 3,407 | | 3,418 | |

| Deferred tax assets | 617 | | 644 | |

| Other assets | 13,073 | | 13,702 | |

| Total prepaid expenses and other assets | 154,472 | | 150,322 | |

| Less: Long-term portion | 59,883 | | 51,037 | |

| Prepaid expenses and other current assets | $ | 94,589 | | $ | 99,285 | |

(1)Amortization expense from costs of obtaining contracts was $4.8 million and $8.3 million for the three months ended March 31, 2024 and 2023, respectively.

(2)The current portion of costs of obtaining contracts as of March 31, 2024 and December 31, 2023 was $18.8 million and $25.3 million, respectively.

(3)The current portion of prepaid software maintenance and subscriptions as of March 31, 2024 and December 31, 2023 was $31.6 million and $32.4 million, respectively.

(4)These costs primarily relate to the multi-year implementations of our new global enterprise resource planning and customer relationship management systems.

(5)Amortization expense from capitalized cloud computing implementation costs was insignificant for the three months ended March 31, 2024 and 2023, respectively. Accumulated amortization for these costs was $8.4 million and $7.7 million as of March 31, 2024 and December 31, 2023, respectively.

Accrued expenses and other liabilities

| | | | | | | | |

| (dollars in thousands) | March 31,

2024 | December 31,

2023 |

| Taxes payable | $ | 29,753 | | $ | 21,282 | |

Accrued legal costs(1) | 11,713 | | 3,659 | |

| Customer credit balances | 9,102 | | 10,238 | |

| Operating lease liabilities, current portion | 6,714 | | 6,701 | |

| Accrued commissions and salaries | 2,987 | | 4,413 | |

| Accrued health care costs | 2,387 | | 3,865 | |

| Accrued vacation costs | 2,349 | | 2,452 | |

| Accrued transaction-based costs related to payments services | 1,917 | | 4,323 | |

| Contingent consideration liability | 1,403 | | 1,403 | |

| Derivative instruments | 92 | | 5,540 | |

| | |

| | |

| Other liabilities | 11,017 | | 10,704 | |

| Total accrued expenses and other liabilities | 79,434 | | 74,580 | |

| Less: Long-term portion | 4,163 | | 10,258 | |

| Accrued expenses and other current liabilities | $ | 75,271 | | $ | 64,322 | |

(1)All accrued legal costs are classified as current. See Note 9 to these unaudited, condensed consolidated financial statements for additional information about our loss contingency accruals and other legal expenses.

| | | | | | | | |

| First Quarter 2024 Form 10-Q | | 11 |

Blackbaud, Inc.

Notes to Condensed Consolidated Financial Statements

(Unaudited)

Other income, net

| | | | | | | | | | | |

| | | Three months ended March 31, |

| (dollars in thousands) | | | | 2024 | 2023 |

| Interest income | | | | $ | 2,048 | | $ | 1,236 | |

| Currency revaluation gains (losses) | | | | 283 | | (245) | |

| Other income, net | | | | 1,016 | | 1,016 | |

| Other income, net | | | | $ | 3,347 | | $ | 2,007 | |

| | | | | |

| | | | | |

The following table summarizes our debt balances and the related weighted average effective interest rates, which includes the effect of interest rate swap agreements.

| | | | | | | | | | | | | | | | | |

| Debt balance at | | Weighted average

effective interest rate at |

| (dollars in thousands) | March 31,

2024 | December 31,

2023 | | March 31,

2024 | December 31,

2023 |

| Credit facility: | | | | | |

| Revolving credit loans | $ | 379,000 | | $ | 114,100 | | | 7.10 | % | 7.52 | % |

| Term loans | 603,438 | | 607,500 | | | 3.48 | % | 3.51 | % |

| Real estate loans | 56,364 | | 56,745 | | | 5.22 | % | 5.22 | % |

| Other debt | 2,231 | | 2,800 | | | 8.50 | % | 8.42 | % |

| Total debt | 1,041,033 | | 781,145 | | | 4.90 | % | 4.24 | % |

| Less: Unamortized discount and debt issuance costs | 1,211 | | 1,481 | | | | |

| Less: Debt, current portion | 19,302 | | 19,259 | | | 6.99 | % | 7.02 | % |

| Debt, net of current portion | $ | 1,020,520 | | $ | 760,405 | | | 4.86 | % | 4.17 | % |

2020 credit facility

In October 2020, we entered into a five-year $900.0 million senior credit facility (the "2020 Credit Facility"). At March 31, 2024, we were in compliance with our debt covenants under the 2020 Credit Facility.

Real estate loans

In August 2020, we completed the purchase of our global headquarters facility. As part of the purchase price, we assumed the seller’s obligations under two senior secured notes with a then-aggregate outstanding principal amount of $61.1 million (collectively, the “Real Estate Loans”). At March 31, 2024, we were in compliance with our debt covenants under the Real Estate Loans.

Other debt

From time to time, we enter into third-party financing agreements for purchases of software and related services for our internal use. Generally, the agreements are non-interest-bearing notes requiring annual payments. Interest associated with the notes is imputed at the rate we would incur for amounts borrowed under our then-existing credit facility at the inception of the notes.

| | | | | | | | |

| 12 | | First Quarter 2024 Form 10-Q |

Blackbaud, Inc.

Notes to Condensed Consolidated Financial Statements

(Unaudited)

The following table summarizes our currently effective supplier financing agreements as of March 31, 2024:

| | | | | | | | | | | | | | |

| (dollars in thousands) | Term

in Months | Number of

Annual Payments | First Annual

Payment Due | Original Loan

Value |

Effective dates of agreements (1): | | | | |

| December 2022 | 39 | 3 | | January 2023 | $ | 1,710 | |

| January 2023 | 36 | 3 | | April 2023 | $ | 2,491 | |

| | | | |

| | | | |

(1)Represent noncash investing and financing transactions during the periods indicated as we purchased software and services by assuming directly related liabilities.

The changes in supplier financing obligations during the three months ended March 31, 2024, consisted of the following:

| | | | | |

| (dollars in thousands) | Total |

| Balance at December 31, 2023 | $ | 2,800 | |

| Additions | — | |

| Settlements | (569) | |

| Balance at March 31, 2024 | $ | 2,231 | |

| | |

| 8. Derivative Instruments |

We generally use derivative instruments to manage our interest rate and foreign currency exchange risk. We currently have derivatives classified as cash flow hedges and net investment hedges. We do not enter into any derivatives for trading or speculative purposes.

All of our derivative instruments are governed by International Swap Dealers Association, Inc. master agreements with our counterparties. As of March 31, 2024 and December 31, 2023, we have presented the fair value of our derivative instruments at the gross amounts in the condensed consolidated balance sheets as the gross fair values of our derivative instruments equaled their net fair values.

Cash flow hedges

We have entered into interest rate swap agreements, which effectively convert portions of our variable rate debt under the 2020 Credit Facility to a fixed rate for the term of the swap agreements. We designated each of the interest rate swaps as cash flow hedges at the inception of the contracts. As of March 31, 2024 and December 31, 2023, the aggregate notional values of the interest rate swaps were $935.0 million and $935.0 million, respectively. All of the contracts have maturities on or before October 2028.

We have entered into foreign currency forward contracts to hedge revenues denominated in the Canadian Dollar ("CAD") against changes in the exchange rate with the United States Dollar ("USD"). We designated each of these foreign currency forward contracts as cash flow hedges at the inception of the contracts. As of March 31, 2024 and December 31, 2023, the aggregate notional values of the foreign currency forward contracts designated as cash flow hedges that we held to buy USD in exchange for Canadian Dollars were $30.6 million CAD and $29.9 million CAD, respectively. All of the contracts have maturities of 12 months or less.

| | | | | | | | |

| First Quarter 2024 Form 10-Q | | 13 |

Blackbaud, Inc.

Notes to Condensed Consolidated Financial Statements

(Unaudited)

Net investment hedges

We have entered into foreign currency forward contracts to hedge a portion of the foreign currency exposure that arises on translation of our investments denominated in British Pounds ("GBP") into USD. We designated each of these foreign currency forward contracts as net investment hedges at the inception of the contracts. As of March 31, 2024 and December 31, 2023, the aggregate notional values of the foreign currency forward contracts designated as net investment hedges to reduce the volatility of the U.S. dollar value of a portion of our GBP-denominated investments was £16.6 million and £13.2 million, respectively.

The fair values of our derivative instruments were as follows as of:

| | | | | | | | | | | | | | | | | | | | | | | |

| | Asset derivatives | | | Liability derivatives |

| (dollars in thousands) | Balance sheet location | March 31,

2024 | December 31,

2023 | | Balance sheet location | March 31,

2024 | December 31,

2023 |

| Derivative instruments designated as hedging instruments: | | | | | | | |

| Interest rate swaps, current portion | Prepaid expenses

and other current assets | $ | 12,328 | | $ | 16,198 | | | Accrued expenses

and other current liabilities | $ | — | | $ | — | |

| Foreign currency forward contracts, current portion | Prepaid expenses and other current assets | 260 | | — | | | Accrued expenses

and other

current liabilities | 92 | | 536 | |

| Interest rate swaps, long-term | Other assets | 3,965 | | — | | | Other liabilities | — | | 5,004 | |

| Total derivative instruments designated as hedging instruments | | $ | 16,553 | | $ | 16,198 | | | | $ | 92 | | $ | 5,540 | |

The effects of derivative instruments in cash flow and net investment hedging relationships were as follows:

| | | | | | | | | | | | | |

| Gain (loss) recognized in accumulated other comprehensive income (loss) as of | Location of gain (loss) reclassified from accumulated other comprehensive income (loss) into income (loss) | | | Gain reclassified from accumulated other comprehensive income (loss) into income (loss) |

| (dollars in thousands) | March 31,

2024 | | | Three months ended March 31, 2024 |

| Cash Flow Hedges | | | | | |

| Interest rate swaps | $ | 16,293 | | Interest expense | | | $ | 5,473 | |

| Foreign currency forward contracts | $ | 260 | | Revenue | | | $ | 34 | |

| Net Investment Hedges | | | | | |

| Foreign currency forward contracts | $ | (92) | | | | | $ | — | |

| | | | | |

| March 31,

2023 | | | | Three months ended March 31, 2023 |

| Cash Flow Hedges | | | | | |

| Interest rate swaps | $ | 17,594 | | Interest expense | | | $ | 4,499 | |

| Foreign currency forward contracts | $ | 14 | | Revenue | | | $ | 125 | |

| Net Investment Hedges | | | | | |

| Foreign currency forward contracts | $ | (417) | | | | | $ | — | |

| | | | | | | | |

| 14 | | First Quarter 2024 Form 10-Q |

Blackbaud, Inc.

Notes to Condensed Consolidated Financial Statements

(Unaudited)

Our policy requires that derivatives used for hedging purposes be designated and effective as a hedge of the identified risk exposure at the inception of the contract. Accumulated other comprehensive income (loss) includes unrealized gains or losses from the change in fair value measurement of our derivative instruments each reporting period and the related income tax expense or benefit. Excluding net investment hedges, changes in the fair value measurements of the derivative instruments and the related income tax expense or benefit are reflected as adjustments to accumulated other comprehensive income (loss) until the actual hedged expense is incurred or until the hedge is terminated at which point the unrealized gain (loss) and related tax effects are reclassified from accumulated other comprehensive income (loss) to current earnings. For net investment hedges, changes in the fair value measurements of the derivative instruments and the related income tax expense or benefit are reflected as adjustments to translation adjustment, a component of accumulated other comprehensive income (loss), and recognized in earnings only when the hedged GBP investment is liquidated. The estimated accumulated other comprehensive income as of March 31, 2024 that is expected to be reclassified into earnings within the next twelve months is $14.7 million. There were no ineffective portions of our interest rate swap or foreign currency forward derivatives during the three months ended March 31, 2024 and 2023. See Note 11 to these unaudited, condensed consolidated financial statements for a summary of the changes in accumulated other comprehensive income (loss) by component. We classify cash flows related to derivative instruments as operating activities in the condensed consolidated statements of cash flows.

| | |

| 9. Commitments and Contingencies |

Leases

We have operating leases for corporate offices, subleased offices and certain equipment and furniture. As of March 31, 2024, we did not have any operating leases that had not yet commenced.

The following table summarizes the components of our lease expense:

| | | | | | | | | | | |

| | | Three months ended March 31, |

| (dollars in thousands) | | | | 2024 | 2023 |

Operating lease cost(1) | | | | $ | 1,986 | | $ | 2,385 | |

| Variable lease cost | | | | 313 | | 432 | |

| Sublease income | | | | (698) | | (811) | |

| Net lease cost | | | | $ | 1,601 | | $ | 2,006 | |

(1)Includes short-term lease costs, which were immaterial.

Other commitments

The term loans under the 2020 Credit Facility require periodic principal payments. The balance of the term loans and any amounts drawn on the revolving credit loans are due upon maturity of the 2020 Credit Facility in October 2025. The Real Estate Loans also require periodic principal payments and the balance of the Real Estate Loans are due upon maturity in April 2038.

We have contractual obligations for third-party technology used in our solutions and for other services we purchase as part of our normal operations. In certain cases, these arrangements require a minimum annual purchase commitment by us. As of March 31, 2024, the remaining aggregate minimum purchase commitment under these arrangements was approximately $239.8 million through 2029.

Solution and service indemnifications

In the ordinary course of business, we provide certain indemnifications of varying scope to customers against claims of intellectual property infringement made by third parties arising from the use of our solutions or services. We have not identified any losses that might be covered by these indemnifications.

| | | | | | | | |

| First Quarter 2024 Form 10-Q | | 15 |

Blackbaud, Inc.

Notes to Condensed Consolidated Financial Statements

(Unaudited)

Legal proceedings

We are subject to legal proceedings and claims that arise in the ordinary course of business, as well as certain other non-ordinary course proceedings, claims and investigations, as described below. We make a provision for a loss contingency when it is both probable that a material liability has been incurred and the amount of the loss can be reasonably estimated. If only a range of estimated losses can be determined, we accrue an amount within the range that, in our judgment, reflects the most likely outcome; if none of the estimates within that range is a better estimate than any other amount, we accrue the low end of the range. For proceedings in which an unfavorable outcome is reasonably possible but not probable and an estimate of the loss or range of losses arising from the proceeding can be made, we disclose such an estimate, if material. If such a loss or range of losses is not reasonably estimable, we disclose that fact. We review any such loss contingency provisions at least quarterly and adjust them to reflect the impacts of negotiations, settlements, rulings, advice of legal counsel and other information and events pertaining to a particular case. We recognize insurance recoveries, if any, when they are probable of receipt. All associated costs due to third-party service providers and consultants, including legal fees, are expensed as incurred.

Legal proceedings are inherently unpredictable. However, we believe that we have valid defenses with respect to the legal matters pending or threatened against us and intend to defend ourselves vigorously against all claims asserted. It is possible that our consolidated financial position, results of operations or cash flows could be materially negatively affected in any particular period by an unfavorable resolution of one or more of such legal proceedings.

Security incident

As previously disclosed, we are subject to risks and uncertainties as a result of a ransomware attack against us in May 2020 in which a cybercriminal removed a copy of a subset of data from our self-hosted environment (the "Security Incident"). Based on the nature of the Security Incident, our research and third party (including law enforcement) investigation, we do not believe that any data went beyond the cybercriminal, has been misused, or has been disseminated or otherwise made available publicly. Our investigation into the Security Incident remains ongoing.

As a result of the Security Incident, we are currently subject to certain legal proceedings, claims and investigations, as discussed below, and could be the subject of additional legal proceedings, claims, inquiries and investigations in the future that might result in adverse judgments, settlements, fines, penalties or other resolution. To limit our exposure to losses related to claims against us, including data breaches such as the Security Incident, we maintain $50 million of insurance above a $250 thousand deductible payable by us. As noted below, this coverage reduced our financial exposure related to the Security Incident in prior years.

We recorded expenses and offsetting insurance recoveries related to the Security Incident as follows:

| | | | | | | | | | | |

| | | Three months ended March 31, |

| (dollars in thousands) | | | | 2024 | 2023 |

| Gross expense | | | | $ | 10,323 | | $ | 17,783 | |

| Offsetting insurance recoveries | | | | — | | — | |

| Net expense | | | | $ | 10,323 | | $ | 17,783 | |

| | | | | | | | |

| 16 | | First Quarter 2024 Form 10-Q |

Blackbaud, Inc.

Notes to Condensed Consolidated Financial Statements

(Unaudited)

The following summarizes our cumulative expenses, insurance recoveries recognized and insurance recoveries paid as of:

| | | | | | | | |

| (dollars in thousands) | March 31,

2024 | December 31,

2023 |

| Cumulative gross expense | $ | 171,754 | | $ | 161,431 | |

| Cumulative offsetting insurance recoveries recognized | (50,000) | | (50,000) | |

| Cumulative net expense | $ | 121,754 | | $ | 111,431 | |

| | |

| Cumulative offsetting insurance recoveries paid | $ | (50,000) | | $ | (50,000) | |

Recorded expenses have consisted primarily of payments to third-party service providers and consultants, including legal fees, settlement of the previously disclosed SEC and multi-state Attorneys General investigations (discussed below), settlements of customer claims and accruals for certain loss contingencies. Not included in the expenses discussed above were costs associated with enhancements to our cybersecurity program. We present expenses and insurance recoveries related to the Security Incident in general and administrative expense on our unaudited, condensed consolidated statements of comprehensive income (loss) and as operating activities on our unaudited, condensed consolidated statements of cash flows. Total costs related to the Security Incident exceeded the limit of our insurance coverage during the first quarter of 2022. We expect to continue to experience significant expenses related to our response to the Security Incident, resolution of legal proceedings, claims and investigations, including those discussed below, and our efforts to further enhance our cybersecurity measures. For the three months ended March 31, 2024, we incurred net pre-tax expenses of $10.3 million related to the Security Incident, which included $3.3 million for ongoing legal fees and additional accruals for loss contingencies of $7.0 million. During the three months ended March 31, 2024, we had net cash outlays of $2.0 million related to the Security Incident for ongoing legal fees. In line with our policy, legal fees are expensed as incurred. For full year 2024, we currently expect pre-tax expenses of approximately $5.0 million to $10.0 million and cash outlays of approximately $8.0 million to $13.0 million for ongoing legal fees related to the Security Incident. Not included in these ranges are our previous settlements or current accruals for loss contingencies related to the matters discussed below.

As of March 31, 2024, we have recorded approximately $8.5 million in aggregate liabilities for loss contingencies based primarily on recent negotiations with certain customers and governmental agencies related to the Security Incident that we believed we could reasonably estimate in accordance with our loss contingency procedures described above. Our liabilities for loss contingencies are recorded in accrued expenses and other current liabilities on our unaudited, condensed consolidated balance sheets. It is reasonably possible that our estimated actual losses may change in the near term for those matters and be materially in excess of the amounts accrued, but we are unable at this time to reasonably estimate the possible additional loss.

There are other Security Incident-related matters, including customer claims, customer constituent class actions and governmental investigations, for which we have not recorded a liability for a loss contingency as of March 31, 2024 because we are unable at this time to reasonably estimate the possible loss or range of loss. Each of these matters could, separately or in the aggregate, result in an adverse judgment, settlement, fine, penalty or other resolution, the amount, scope and timing of which we are currently unable to predict, but could have a material adverse impact on our results of operations, cash flows or financial condition.

Customer claims. To date, we have received approximately 260 specific requests from customers for reimbursement of expenses incurred by them related to the Security Incident, approximately 214 (or 82%) of which have been fully resolved and closed and approximately 39 (or 15%) are inactive and are considered by us to have been abandoned by the customers. We have also received approximately 400 reservations of the right to seek expense recovery in the future from customers or their attorneys in the U.S., U.K. and Canada related to the Security Incident, none of which resulted in claims submitted to us and are considered by us to have been abandoned by the customers. We have also received notices of proposed claims on behalf of a number of U.K. data subjects, which we are reviewing. In addition, insurance companies representing various customers’ interests through subrogation claims have contacted us, and certain insurance companies have filed subrogation claims in court, of which 3 cases remain active and unresolved.

| | | | | | | | |

| First Quarter 2024 Form 10-Q | | 17 |

Blackbaud, Inc.

Notes to Condensed Consolidated Financial Statements

(Unaudited)

Customer constituent class actions. Presently, we are a defendant in putative consumer class action cases in U.S. federal courts (most of which have been consolidated under multi district litigation to a single federal court) and in Canadian courts alleging harm from the Security Incident. The plaintiffs in these cases, who purport to represent various classes of individual constituents of our customers, generally claim to have been harmed by alleged actions and/or omissions by us in connection with the Security Incident and assert a variety of common law and statutory claims seeking monetary damages, injunctive relief, costs and attorneys’ fees and other related relief.

Lawsuits that are putative class actions require a plaintiff to satisfy a number of procedural requirements before proceeding to trial. These requirements include, among others, demonstration to a court that the law proscribes in some manner our activities, the making of factual allegations sufficient to suggest that our activities exceeded the limits of the law and a determination by the court—known as class certification—that the law permits a group of individuals to pursue the case together as a class. If these procedural requirements are not met, the lawsuit cannot proceed as a class action and the plaintiff may lose the financial incentive to proceed with the case. We are currently engaged in court proceedings to determine whether this will proceed as a class action. Frequently, a court’s determination as to these procedural requirements is subject to appeal to a higher court. As a result of these uncertainties, we may be unable to determine the probability of loss until, or after, a court has finally determined that a plaintiff has satisfied the applicable class action procedural requirements.

Furthermore, for putative class actions, it is often not possible to reasonably estimate the possible loss or a range of loss amounts, even where we have determined that a loss is reasonably possible. Generally, class actions involve a large number of people and raise complex legal and factual issues that result in uncertainty as to their outcome and, ultimately, making it difficult for us to estimate the amount of damages that a plaintiff might successfully prove. This analysis is further complicated by the fact that the plaintiffs lack contractual privity with us.

Governmental investigations. We have received a Civil Investigative Demand from the office of the California Attorney General relating to the Security Incident and are in discussions with the Attorney General about potential resolution of issues arising from this investigation. Although we are hopeful that we can resolve this matter on acceptable terms, there is no assurance that we will be able to do so on terms acceptable to us and the state of California.

We also are subject to the following pending governmental actions:

•an investigation by the U.S. Federal Trade Commission (the "FTC"), as further described below; and

•an investigation by the U.S. Department of Health and Human Services.

We also responded to inquiries from the Office of the Australian Information Commissioner in September 2020 and the Office of the Privacy Commissioner of Canada in October 2020.

As previously disclosed, on February 1, 2024, the FTC announced its approval of an Agreement Containing Consent Order (the “Proposed Order”) evidencing its settlement with the Company in connection with the Security Incident. Pursuant to its rules, the FTC placed the Proposed Order and related draft complaint on the public record for a period of 30 days for the receipt of public comments after which the FTC will consider any comments received from interested persons prior to determining whether and in what form to finalize the Proposed Order. The 30-day comment period expired on March 14, 2024. As part of the FTC’s proposed order, the Company has not been fined and is not otherwise required to make any payment. Furthermore, the Company has agreed to the FTC’s proposed order without admitting or denying any of the FTC’s allegations, except as expressly stated otherwise in the Proposed Order. If finalized, the settlement described in the Proposed Order will fully resolve the FTC investigation. Although we believe the Proposed Order will be finalized in substantially its current form, there can be no assurances as to whether that will occur or its timing. For more information, see the form of Proposed Order that was furnished as Exhibit 99.2 to the Company’s Current Report on Form 8-K filed with the SEC on February 2, 2024 and in Note 11 to our audited consolidated financial statements contained in our Annual Report on Form 10-K filed with the SEC on February 21, 2024.

As previously disclosed, on October 5, 2023, we entered into separate, substantially similar Administrative Orders with each of 49 state Attorneys General and the District of Columbia relating to the Security Incident which fully resolved the previously disclosed multi-state Civil Investigative Demand and the separate Civil Investigative Demand from the Office of the Indiana Attorney General relating to the Security Incident.

| | | | | | | | |

| 18 | | First Quarter 2024 Form 10-Q |

Blackbaud, Inc.

Notes to Condensed Consolidated Financial Statements

(Unaudited)

On March 9, 2023, we reached a settlement with the SEC in connection with the Security Incident that fully resolved the previously disclosed SEC investigation of the Security Incident.

On September 28, 2021, the Information Commissioner’s Office in the United Kingdom under the U.K. Data Protection Act 2018 notified us that it has closed its investigation of the Security Incident.

On September 24, 2021, we received notice from the Spanish Data Protection Authority that it has concluded its investigation of the Security Incident.

On January 15, 2021, we were notified by the Data Protection Commission of Ireland that it has concluded its investigation of the Security Incident.

For more information about these completed government investigations and related actions, see Note 11 to our audited consolidated financial statements contained in our Annual Report on Form 10-K filed with the SEC on February 21, 2024.

We continue to cooperate with all ongoing investigations, which include various requests for documents, policies, narratives and communications, as well as requests to interview or depose various Company-related personnel. As noted above, each of these separate governmental investigations could result in adverse judgments, settlements, fines, penalties or other resolution, the amount, scope and timing of which we are currently unable to predict, but could have a material adverse impact on our results of operations, cash flows or financial condition.

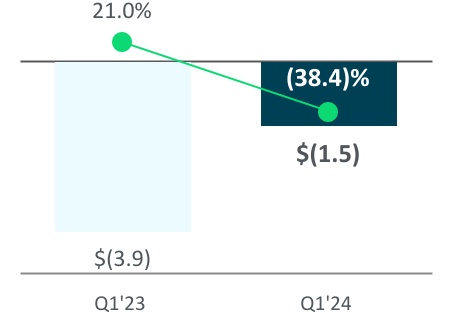

Our income tax benefit and effective income tax rates, including the effects of period-specific events, were:

| | | | | | | | | | | |

| | | | Three months ended March 31, |

| (dollars in thousands) | | | | 2024 | 2023 |

| Income tax benefit | | | | $ | (1,456) | | $ | (3,901) | |

| Effective income tax rate | | | | (38.4) | % | 21.0 | % |

The change in our effective income tax rate for the three months ended March 31, 2024 when compared to the same period in 2023 was primarily attributable to favorable impacts of benefits attributable to stock-based compensation and research and development tax credits.

Stock repurchase program

Under our stock repurchase program, we are authorized to repurchase shares from time to time in accordance with applicable laws both on the open market, including under trading plans established pursuant to Rule 10b5-1 under the Securities Exchange Act of 1934, as amended, and in privately negotiated transactions. The timing and amount of repurchases depends on several factors, including market and business conditions, the trading price of our common stock and the nature of other investment opportunities. The repurchase program does not have an expiration date and may be limited, suspended or discontinued at any time without prior notice. Under the 2024 Credit Agreement (as defined below), we have restrictions on our ability to repurchase shares of our common stock, which are summarized on page 40 in this report. We account for purchases of treasury stock under the cost method. On January 17, 2024, our Board of Directors reauthorized, expanded and replenished our stock repurchase program by expanding the total capacity under the program from $250.0 million to $500.0 million available for repurchases.

In March 2024, we entered into an issuer forward repurchase transaction with a large financial institution to repurchase an aggregate $200 million of shares of our common stock (the "ASR Transaction"). Pursuant to the terms of the ASR Transaction, we provided the financial institution with a prepayment of $200 million and received an initial delivery of 2.1 million shares of our common stock, representing approximately 70% of the total shares then-expected to be repurchased under the ASR

| | | | | | | | |

| First Quarter 2024 Form 10-Q | | 19 |

Blackbaud, Inc.

Notes to Condensed Consolidated Financial Statements

(Unaudited)

Transaction. The final number of shares of common stock delivered to us under the ASR Transaction will be based on the average of the daily volume-weighted average prices of the common stock during the term of the ASR Transaction, less a discount and subject to customary adjustments upon events affecting the common stock (e.g., dilutive or concentrative events, mergers and acquisitions, and market disruptions). At settlement, the financial institution may be required to deliver additional shares of our common stock to us or, under certain circumstances, we may be required to deliver a cash payment or shares of our common stock to the financial institution, with the method of settlement at our election. The final settlement of the ASR Transaction is scheduled to occur by the fourth quarter of 2024, unless settled earlier at the election of the financial institution.

The difference of $52.2 million between the prepayment of $200 million and the value of the shares repurchased on the ASR Transaction date represents an unsettled prepaid forward contract indexed to our common stock and met all of the applicable criteria for equity classification; therefore, it was not accounted for as a derivative instrument as of March 31, 2024. Because of our ability to settle in shares, the $52.2 million prepaid forward contract was classified as a reduction to additional paid-in capital within our unaudited, condensed consolidated statement of stockholders' equity. We funded the ASR Transaction prepayment with borrowings pursuant to a revolving credit loan under the 2020 Credit Facility.

During the three months ended March 31, 2024, we repurchased an aggregate of 2,954,211 shares for $262.6 million, including the initial delivery of shares repurchased pursuant to the ASR Transaction. The remaining amount available to purchase stock under the approved stock repurchase program was $259.7 million as of March 31, 2024.

Changes in accumulated other comprehensive income (loss) by component

The changes in accumulated other comprehensive income (loss) by component, consisted of the following:

| | | | | | | | | | | |

| | | Three months ended March 31, |

| (in thousands) | | | | 2024 | 2023 |

| Accumulated other comprehensive (loss) income, beginning of period | | | | $ | (1,688) | | $ | 8,938 | |

| By component: | | | | | |

| Gains and losses on cash flow hedges: | | | | | |

| Accumulated other comprehensive income balance, beginning of period | | | | $ | 8,158 | | $ | 23,833 | |

| Other comprehensive income (loss) before reclassifications, net of tax effects of $(2,966) and $2,566 | | | | 8,121 | | (7,289) | |

| Amounts reclassified from accumulated other comprehensive income (loss) | | | | (5,507) | | (4,624) | |

| Tax expense included in provision for income taxes | | | | 1,481 | | 1,221 | |

| Total amounts reclassified from accumulated other comprehensive income (loss) | | | | (4,026) | | (3,403) | |

| Net current-period other comprehensive income (loss) | | | | 4,095 | | (10,692) | |

| Accumulated other comprehensive income balance, end of period | | | | $ | 12,253 | | $ | 13,141 | |

| Foreign currency translation adjustment: | | | | | |

| Accumulated other comprehensive loss balance, beginning of period | | | | $ | (9,846) | | $ | (14,895) | |

| Translation adjustment | | | | (1,185) | | 2,158 | |

| Accumulated other comprehensive loss balance, end of period | | | | (11,031) | | (12,737) | |

| Accumulated other comprehensive income, end of period | | | | $ | 1,222 | | $ | 404 | |

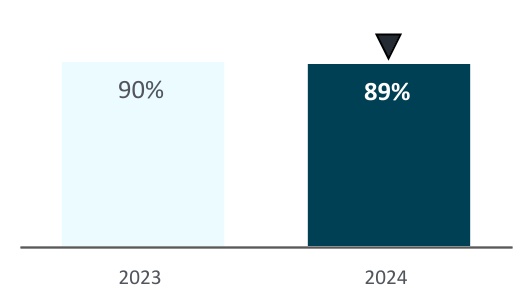

Transaction price allocated to the remaining performance obligations

As of March 31, 2024, approximately $1.2 billion of revenue under contract is expected to be recognized from remaining performance obligations. We expect to recognize revenue on approximately 50% of these remaining performance obligations over the next 12 months, with the remainder recognized thereafter.

| | | | | | | | |

| 20 | | First Quarter 2024 Form 10-Q |

Blackbaud, Inc.

Notes to Condensed Consolidated Financial Statements

(Unaudited)

We applied the practical expedient in ASC 606-10-50-14 and have excluded the value of unsatisfied performance obligations for (i) contracts with an original expected length of one year or less (one-time services); and (ii) contracts for which we recognize revenue at the amount to which we have the right to invoice for services performed (transactional revenue).

Contract balances

Our contract assets as of March 31, 2024 and December 31, 2023 were insignificant. Our closing balances of deferred revenue were as follows:

| | | | | | | | |

| (in thousands) | March 31,

2024 | December 31,

2023 |

| Total deferred revenue | $ | 367,187 | | $ | 394,927 | |

The decrease in deferred revenue during the three months ended March 31, 2024 was primarily due to a seasonal decrease in customer contract renewals. Historically, due to the timing of customer budget cycles, we have an increase in customer contract renewals at or near the beginning of our third quarter. Generally, our lowest balance of deferred revenue during the year is at the end of our first quarter. The amount of revenue recognized during the three months ended March 31, 2024 that was included in the deferred revenue balance at the beginning of the period was approximately $173 million. The amount of revenue recognized during the three months ended March 31, 2024 from performance obligations satisfied in prior periods was insignificant.

Disaggregation of revenue

We sell our cloud solutions and related services in three primary geographical markets: to customers in the United States, to customers in the United Kingdom and to customers located in other countries. The following table presents our revenue by geographic area based on the address of our customers:

| | | | | | | | | | | |

| | | Three months ended March 31, |

| (dollars in thousands) | | | | 2024 | 2023 |

| United States | | | | $ | 238,109 | | $ | 221,669 | |

| United Kingdom | | | | 26,129 | | 26,048 | |

| Other countries | | | | 15,012 | | 14,036 | |

| Total revenue | | | | $ | 279,250 | | $ | 261,753 | |

The Social Sector and Corporate Sector market groups comprised our go-to-market organizations as of March 31, 2024. The following is a description of each market group as of that date:

•The Social Sector market group focuses on sales to customers and prospects in the social sector, such as nonprofits, foundations, education institutions, healthcare organizations and other not-for-profit entities globally, and includes JustGiving; and

•The Corporate Sector market group focuses on sales to customers and prospects in the corporate sector globally, and includes EVERFI and YourCause.

| | | | | | | | |

| First Quarter 2024 Form 10-Q | | 21 |

Blackbaud, Inc.

Notes to Condensed Consolidated Financial Statements

(Unaudited)

The following table presents our revenue by market group:

| | | | | | | | | | | |

| | | Three months ended March 31, |

| (dollars in thousands) | | | | 2024 | 2023 |

| Social Sector | | | | $ | 244,444 | | $ | 224,897 | |

| Corporate Sector | | | | 34,806 | | 36,856 | |

| | | | | |

| Total revenue | | | | $ | 279,250 | | $ | 261,753 | |

The following table presents our recurring revenue by type:

| | | | | | | | | | | |

| | | Three months ended March 31, |

| (dollars in thousands) | | | | 2024 | 2023 |

| Contractual recurring | | | | $ | 190,855 | | $ | 177,603 | |

| Transactional recurring | | | | 80,663 | | 75,145 | |

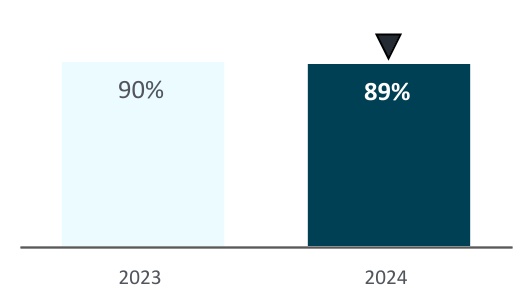

| Total recurring revenue | | | | $ | 271,518 | | $ | 252,748 | |

| | | | | |

| | | | | |

April 2024 credit agreement refinancing

On April 30, 2024, we entered into the Third Amendment to Credit Agreement (the "Amendment"), by and among us, the lenders party thereto and Bank of America N.A., as administrative agent (the "Agent"). The Amendment amends the Amended and Restated Credit Agreement, dated as of October 30, 2020 (as previously amended, the "Existing Credit Agreement" and the Existing Credit Agreement as amended by the Amendment, the “2024 Credit Agreement”), by and among us, the lenders from time-to-time party thereto and the Agent.

The Amendment amends the Existing Credit Agreement to, among other things, (a) refinance the existing $1.1 billion credit facilities under the Existing Credit Agreement to provide for new credit facilities in the aggregate principal amount of $1.5 billion consisting of (i) a $700.0 million revolving credit facility with a $50.0 million letter of credit subfacility, a $50.0 million swingline subfacility and a $150.0 million sublimit available for multicurrency borrowings (the “2024 Revolving Facility”) and (ii) a $800.0 million term loan facility (the “2024 Term Facility” and together with the 2024 Revolving Facility, the “2024 Credit Facilities”), (b) extend the maturity date to April 30, 2029, (c) modify the definition of Applicable Margin (as defined below) and (iv) modify certain negative and financial covenants to provide additional operational flexibility.

Under the 2024 Credit Facilities, dollar tranche revolving loans and term loans bear interest at a rate per annum equal to, at the option of the Company: (a) a base rate equal to the highest of (i) the Federal Funds Rate plus 0.50%, (ii) the prime rate announced by Bank of America, N.A., and (iii) Term SOFR plus 1.00% (the “Base Rate”), plus an applicable margin as specified in the 2024 Credit Agreement (the “Applicable Margin”); (b) Term SOFR plus the Applicable Margin; or (c) the Daily SOFR Rate plus the Applicable Margin. The Applicable Margin shall be adjusted quarterly, varies based on our net leverage ratio and varies based on whether the loan is a Base Rate Loan (0.375% to 1.500%), or a Term SOFR Loan/Daily SOFR Loan (1.375% to 2.500%). The 2024 Credit Agreement also provides for a commitment fee of between 0.250% and 0.500% of the unused commitment under the 2024 Revolving Facility depending on our net leverage ratio.

Under the 2024 Credit Facilities, designated currency tranche revolving loans bear interest at a rate per annum equal to, at the option of the Company: (a) the Designated Currency Daily Rate (as defined in the 2024 Credit Agreement) plus the Applicable Margin; or (b) the Designated Currency Term Rate (as defined in the 2024 Credit Agreement) plus the Applicable Margin. The Applicable Margin shall be adjusted quarterly and varies based on our net leverage ratio for both Designated Currency Daily Rate Loans and Designated Currency Term Rate Loans (1.375% to 2.500%).

We may prepay the 2024 Credit Agreement in whole or in part at any time without premium or penalty, other than customary breakage costs with respect to certain types of loans.