UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

☒ Quarterly Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the quarterly period ended June 30, 2020.

☐ Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the Transition Period From ______________________ to _________________________

Commission file number 001-32265 (American Campus Communities, Inc.)

Commission file number 333-181102-01 (American Campus Communities Operating Partnership LP)

AMERICAN CAMPUS COMMUNITIES, INC.

AMERICAN CAMPUS COMMUNITIES OPERATING PARTNERSHIP LP

(Exact name of registrant as specified in its charter)

|

| | | |

| (American Campus Communities, Inc.) | Maryland | 76-0753089 |

(American Campus Communities Operating Partnership LP) | Maryland | 56-2473181 |

| | (State or Other Jurisdiction of Incorporation or Organization) | (IRS Employer Identification No.) |

| | | | |

| | 12700 Hill Country Blvd., | Suite T-200 | 78738 |

| | Austin, | TX | (Zip Code) |

| | (Address of Principal Executive Offices) | |

(512) 732-1000

Registrant’s telephone number, including area code

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15 (d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

|

| | | | |

| American Campus Communities, Inc. | Yes | ☒ | No | ☐ |

|

| | | | |

| American Campus Communities Operating Partnership LP | Yes | ☒ | No | ☐ |

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

|

| | | | |

| American Campus Communities, Inc. | Yes | ☒ | No | ☐ |

|

| | | | |

| American Campus Communities Operating Partnership LP | Yes | ☒ | No | ☐ |

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer”, “accelerated filer”, “smaller reporting company”, and “emerging growth company” in Rule 12b-2 of the Exchange Act.

American Campus Communities, Inc.

|

| | |

| Large accelerated filer | ☒ | Accelerated Filer ☐ |

|

| | | |

| Non-accelerated filer | ☐ | Smaller reporting company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

American Campus Communities Operating Partnership LP

|

| | | |

| Large accelerated filer | ☐ | Accelerated Filer | ☐ |

|

| | | |

| Non-accelerated filer | ☒ (Do not check if a smaller reporting company) | Smaller reporting company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

|

| | | | |

| American Campus Communities, Inc. | Yes | ☐ | No | ☒ |

|

| | | | |

| American Campus Communities Operating Partnership LP | Yes | ☐ | No | ☒ |

Securities registered pursuant to Section 12(b) of the Act:

|

| | |

| Title of each class | Trading symbol(s) | Name of each exchange on which registered |

| Common stock, par value $.01 per share | ACC | New York Stock Exchange |

There were 137,632,091 shares of the American Campus Communities, Inc.’s common stock with a par value of $0.01 per share outstanding as of the close of business on July 24, 2020.

EXPLANATORY NOTE

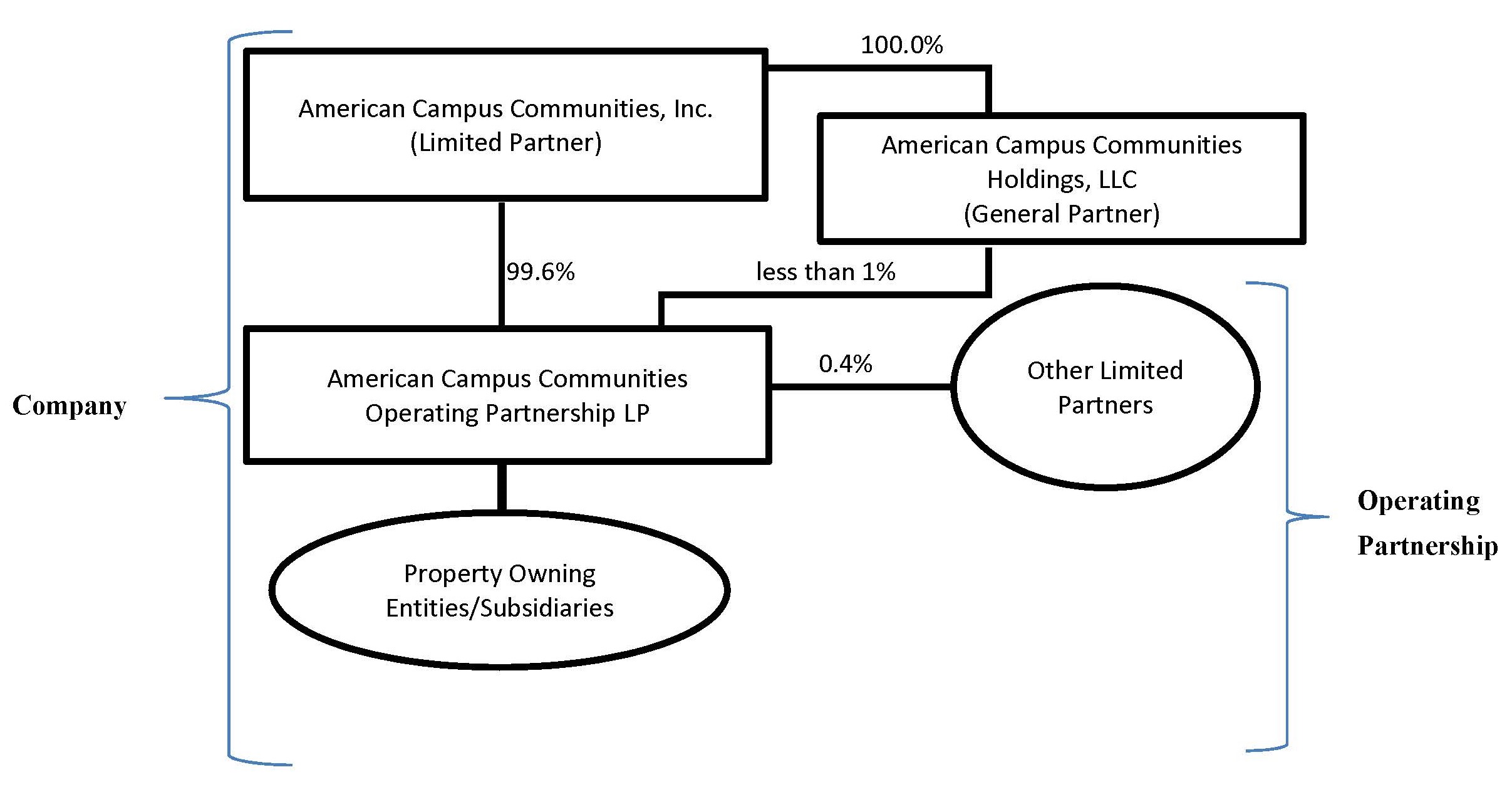

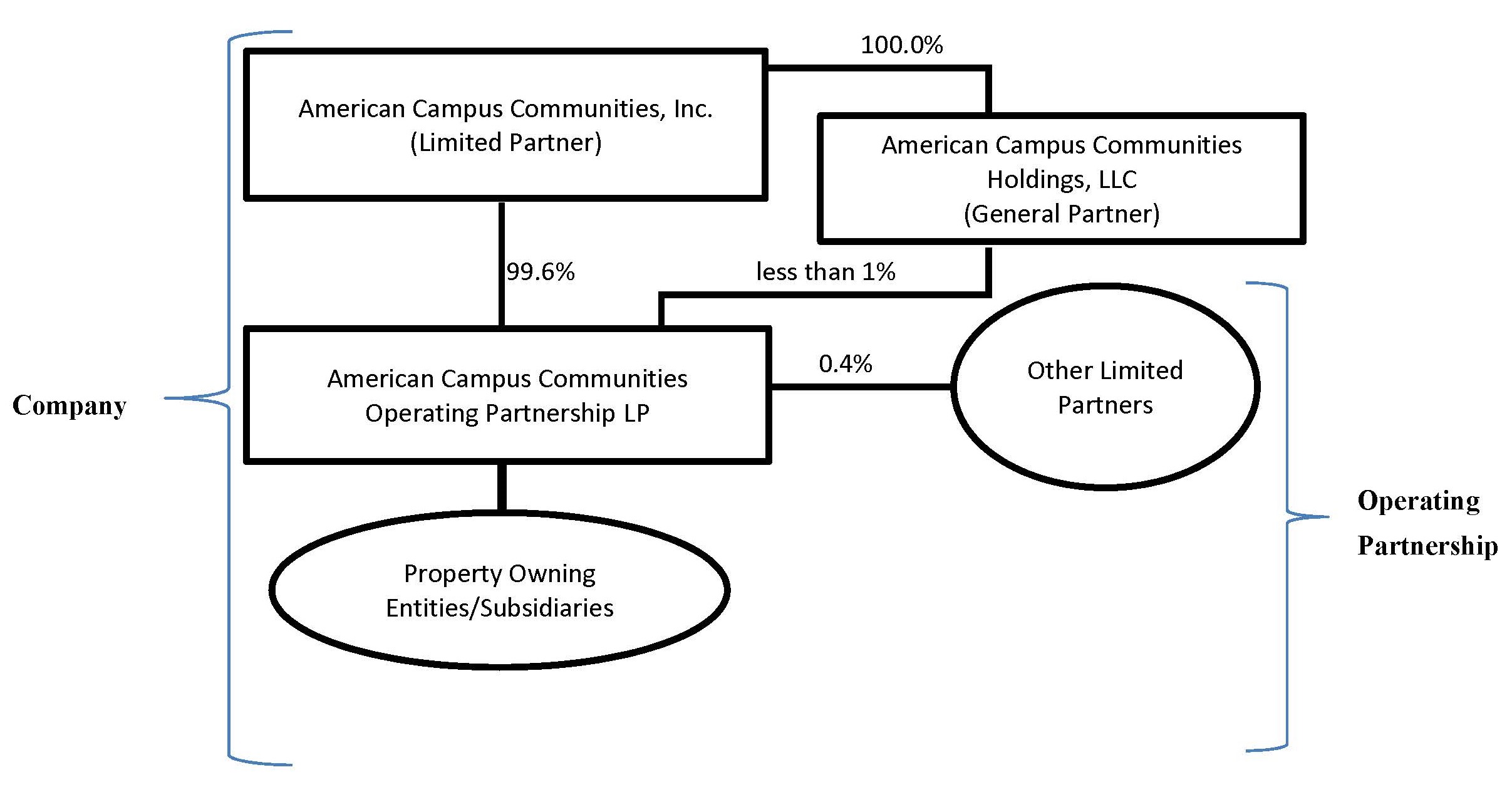

This report combines the reports on Form 10-Q for the quarterly period ended June 30, 2020 of American Campus Communities, Inc. and American Campus Communities Operating Partnership LP. Unless stated otherwise or the context otherwise requires, references to “ACC” mean American Campus Communities, Inc., a Maryland corporation that has elected to be treated as a real estate investment trust (“REIT”) under the Internal Revenue Code, and references to “ACCOP” mean American Campus Communities Operating Partnership LP, a Maryland limited partnership. References to the “Company,” “we,” “us” or “our” mean collectively ACC, ACCOP and those entities/subsidiaries owned or controlled by ACC and/or ACCOP. References to the “Operating Partnership” mean collectively ACCOP and those entities/subsidiaries owned or controlled by ACCOP. The following chart illustrates the Company’s and the Operating Partnership’s corporate structure:

The general partner of ACCOP is American Campus Communities Holdings, LLC (“ACC Holdings”), an entity that is wholly-owned by ACC. As of June 30, 2020, ACC Holdings held an ownership interest in ACCOP of less than 1%. The limited partners of ACCOP are ACC and other limited partners consisting of current and former members of management and nonaffiliated third parties. As of June 30, 2020, ACC owned an approximate 99.6% limited partnership interest in ACCOP. As the sole member of the general partner of ACCOP, ACC has exclusive control of ACCOP’s day-to-day management. Management operates the Company and the Operating Partnership as one business. The management of ACC consists of the same members as the management of ACCOP. The Company is structured as an umbrella partnership REIT (“UPREIT”) and ACC contributes all net proceeds from its various equity offerings to the Operating Partnership. In return for those contributions, ACC receives a number of units of the Operating Partnership (“OP Units,” see definition below) equal to the number of common shares it has issued in the equity offering. Contributions of properties to the Company can be structured as tax-deferred transactions through the issuance of OP Units in the Operating Partnership. Based on the terms of ACCOP’s partnership agreement, OP Units can be exchanged for ACC’s common shares on a one-for-one basis. The Company maintains a one-for-one relationship between the OP Units of the Operating Partnership issued to ACC and ACC Holdings and the common shares issued to the public. The Company believes that combining the reports on Form 10-Q of ACC and ACCOP into this single report provides the following benefits:

| |

| (1) | enhances investors’ understanding of the Company and the Operating Partnership by enabling investors to view the business as a whole in the same manner as management views and operates the business; |

| |

| (2) | eliminates duplicative disclosure and provides a more streamlined and readable presentation since a substantial portion of the disclosure applies to both the Company and the Operating Partnership; and |

| |

| (3) | creates time and cost efficiencies through the preparation of one combined report instead of two separate reports. |

ACC consolidates ACCOP for financial reporting purposes, and ACC essentially has no assets or liabilities other than its investment in ACCOP. Therefore, the assets and liabilities of the Company and the Operating Partnership are the same on their respective financial statements. However, the Company believes it is important to understand the few differences between the Company and the Operating Partnership in the context of how the entities operate as a consolidated company. All of the Company’s property

ownership, development and related business operations are conducted through the Operating Partnership. ACC also issues public equity from time to time and guarantees certain debt of ACCOP, as disclosed in this report. ACC does not have any indebtedness, as all debt is incurred by the Operating Partnership. The Operating Partnership holds substantially all of the assets of the Company, including the Company’s ownership interests in its joint ventures. The Operating Partnership conducts the operations of the business and is structured as a partnership with no publicly traded equity. Except for the net proceeds from ACC’s equity offerings, which are contributed to the capital of ACCOP in exchange for OP Units on a one-for-one common share per OP Unit basis, the Operating Partnership generates all remaining capital required by the Company’s business. These sources include, but are not limited to, the Operating Partnership’s working capital, net cash provided by operating activities, borrowings under its credit facility, the issuance of unsecured notes, and proceeds received from the disposition of certain properties. Noncontrolling interests, stockholders’ equity, and partners’ capital are the main areas of difference between the consolidated financial statements of the Company and those of the Operating Partnership. The noncontrolling interests in the Operating Partnership’s financial statements consist of the interests of unaffiliated partners in various consolidated joint ventures. The noncontrolling interests in the Company’s financial statements include the same noncontrolling interests at the Operating Partnership level and OP Unit holders of the Operating Partnership. The differences between stockholders’ equity and partners’ capital result from differences in the equity issued at the Company and Operating Partnership levels.

To help investors understand the significant differences between the Company and the Operating Partnership, this report provides separate consolidated financial statements for the Company and the Operating Partnership. A single set of consolidated notes to such financial statements is presented that includes separate discussions for the Company and the Operating Partnership when applicable (for example, noncontrolling interests, stockholders’ equity or partners’ capital, earnings per share or unit, etc.). A combined Management’s Discussion and Analysis of Financial Condition and Results of Operations section is also included that presents discrete information related to each entity, as applicable. This report also includes separate Part I, Item 4 Controls and Procedures sections and separate Exhibits 31 and 32 certifications for each of the Company and the Operating Partnership in order to establish that the requisite certifications have been made and that the Company and the Operating Partnership are compliant with Rule 13a-15 or Rule 15d-15 of the Securities Exchange Act of 1934 and 18 U.S.C. §1350.

In order to highlight the differences between the Company and the Operating Partnership, the separate sections in this report for the Company and the Operating Partnership specifically refer to the Company and the Operating Partnership. In the sections that combine disclosure of the Company and the Operating Partnership, this report refers to actions or holdings as being actions or holdings of the Company. Although the Operating Partnership is generally the entity that directly or indirectly enters into contracts and joint ventures and holds assets and debt, reference to the Company is appropriate because the Company operates its business through the Operating Partnership. The separate discussions of the Company and the Operating Partnership in this report should be read in conjunction with each other to understand the results of the Company on a consolidated basis and how management operates the Company.

FORM 10-Q

FOR THE QUARTER ENDED June 30, 2020

TABLE OF CONTENTS

|

| | |

| | PAGE NO. |

| | |

| PART I. | |

| | | |

| Item 1. | Consolidated Financial Statements of American Campus Communities, Inc. and Subsidiaries: | |

| | | |

| | Consolidated Balance Sheets as of June 30, 2020 (unaudited) and December 31, 2019 | |

| | | |

| | Consolidated Statements of Comprehensive Income for the three and six months ended June 30, 2020 and 2019 (all unaudited) | |

| | | |

| | Consolidated Statements of Changes in Equity for the three months ended March 31, 2020 and 2019 and June 30, 2020 and 2019 (all unaudited) | |

| | | |

| | Consolidated Statements of Cash Flows for the six months ended June 30, 2020 and 2019 (all unaudited) | |

| | | |

| | Consolidated Financial Statements of American Campus Communities Operating Partnership LP and Subsidiaries: | |

| | | |

| | Consolidated Balance Sheets as of June 30, 2020 (unaudited) and December 31, 2019 | |

| | | |

| | Consolidated Statements of Comprehensive Income for the three and six months ended June 30, 2020 and 2019 (all unaudited) | |

| | | |

| | Consolidated Statements of Changes in Capital for the three months ended March 31, 2020 and 2019 and June 30, 2020 and 2019 (all unaudited) | |

| | | |

| | Consolidated Statements of Cash Flows for the six months ended June 30, 2020 and 2019 (all unaudited) | |

| | | |

| | Notes to Consolidated Financial Statements of American Campus Communities, Inc. and Subsidiaries and American Campus Communities Operating Partnership LP and Subsidiaries (unaudited) | |

| | | |

| Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | |

| | | |

| Item 3. | Quantitative and Qualitative Disclosure about Market Risk | |

| | | |

| Item 4. | Controls and Procedures | |

| | |

| PART II. | |

| | | |

| Item 1. | Legal Proceedings | |

| | | |

| Item 1A. | Risk Factors | |

| | | |

| Item 2. | Unregistered Sales of Equity Securities and Use of Proceeds | |

| | | |

| Item 3. | Defaults Upon Senior Securities | |

| | | |

| Item 4. | Mine Safety Disclosures | |

| | | |

| Item 5. | Other Information | |

| | | |

| Item 6. | Exhibits | |

| | |

| SIGNATURES | |

AMERICAN CAMPUS COMMUNITIES, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(in thousands, except share data)

|

| | | | | | | | |

| | | June 30, 2020 | | December 31, 2019 |

| | | (Unaudited) | | |

| Assets | | | | |

| | | | | |

| Investments in real estate: | | | | |

| Owned properties, net | | $ | 6,659,939 |

| | $ | 6,694,715 |

|

| On-campus participating properties, net | | 72,273 |

| | 75,188 |

|

| Investments in real estate, net | | 6,732,212 |

| | 6,769,903 |

|

| | | | | |

| Cash and cash equivalents | | 31,011 |

| | 54,650 |

|

| Restricted cash | | 29,959 |

| | 26,698 |

|

| Student contracts receivable, net | | 9,194 |

| | 13,470 |

|

| Operating lease right of use assets | | 459,110 |

| | 460,857 |

|

| Other assets | | 253,024 |

| | 234,176 |

|

| | | | | |

| Total assets | | $ | 7,514,510 |

| | $ | 7,559,754 |

|

| | | | | |

| Liabilities and equity | | |

| | |

|

| | | | | |

| Liabilities: | | |

| | |

|

| Secured mortgage, construction and bond debt, net | | $ | 747,086 |

| | $ | 787,426 |

|

| Unsecured notes, net | | 2,373,767 |

| | 1,985,603 |

|

| Unsecured term loans, net | | 199,297 |

| | 199,121 |

|

| Unsecured revolving credit facility | | 186,500 |

| | 425,700 |

|

| Accounts payable and accrued expenses | | 72,335 |

| | 88,411 |

|

| Operating lease liabilities | | 482,492 |

| | 473,070 |

|

| Other liabilities | | 161,091 |

| | 157,368 |

|

| Total liabilities | | 4,222,568 |

| | 4,116,699 |

|

| | | | | |

| Commitments and contingencies (Note 12) | |

|

| |

|

|

| | | | | |

| Redeemable noncontrolling interests | | 20,912 |

| | 104,381 |

|

| | | | | |

| Equity: | | |

| | |

|

| American Campus Communities, Inc. and Subsidiaries stockholders’ equity: | | |

| | |

|

| Common stock, $0.01 par value, 800,000,000 shares authorized, 137,540,345 and 137,326,824 shares issued and outstanding at June 30, 2020 and December 31, 2019, respectively | | 1,375 |

| | 1,373 |

|

| Additional paid in capital | | 4,469,251 |

| | 4,458,456 |

|

| Common stock held in rabbi trust, 91,746 and 77,928 shares at June 30, 2020 and December 31, 2019, respectively | | (3,951 | ) | | (3,486 | ) |

| Accumulated earnings and dividends | | (1,207,645 | ) | | (1,144,721 | ) |

| Accumulated other comprehensive loss | | (26,465 | ) | | (16,946 | ) |

| Total American Campus Communities, Inc. and Subsidiaries stockholders’ equity | | 3,232,565 |

| | 3,294,676 |

|

| Noncontrolling interests – partially owned properties | | 38,465 |

| | 43,998 |

|

| Total equity | | 3,271,030 |

| | 3,338,674 |

|

| | | | | |

| Total liabilities and equity | | $ | 7,514,510 |

| | $ | 7,559,754 |

|

|

| | | | | | | | |

| | | | | |

| Consolidated variable interest entities’ assets and debt included in the above balances: |

| | | | | |

| Investments in real estate, net | | $ | 591,263 |

| | $ | 788,393 |

|

| Cash, cash equivalents and restricted cash | | $ | 36,988 |

| | $ | 59,908 |

|

| Other assets | | $ | 14,818 |

| | $ | 18,387 |

|

| Secured mortgage and construction debt, net | | $ | 417,248 |

| | $ | 418,241 |

|

| Accounts payable, accrued expenses and other liabilities | | $ | 40,071 |

| | $ | 56,976 |

|

See accompanying notes to consolidated financial statements.

1

AMERICAN CAMPUS COMMUNITIES, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(unaudited, in thousands, except share and per share data)

|

| | | | | | | | | | | | | | | | |

| | | Three Months Ended

June 30, | | Six Months Ended

June 30, |

| | | 2020 | | 2019 | | 2020 |

| 2019 |

| Revenues: | | | | | | | | |

| Owned properties | | $ | 177,186 |

| | $ | 203,156 |

| | $ | 409,277 |

| | $ | 427,575 |

|

| On-campus participating properties | | 4,101 |

| | 6,396 |

| | 14,810 |

| | 17,844 |

|

| Third-party development services | | 1,290 |

| | 3,607 |

| | 3,345 |

| | 6,778 |

|

| Third-party management services | | 2,668 |

| | 3,465 |

| | 6,497 |

| | 5,776 |

|

| Resident services | | 302 |

| | 747 |

| | 1,022 |

| | 1,529 |

|

| Total revenues | | 185,547 |

| | 217,371 |

| | 434,951 |

| | 459,502 |

|

| | | | | | | | | |

| Operating expenses (income): | | |

| | |

| | |

| | |

|

| Owned properties | | 85,749 |

| | 90,763 |

| | 178,223 |

| | 182,932 |

|

| On-campus participating properties | | 3,208 |

| | 3,806 |

| | 6,574 |

| | 7,763 |

|

| Third-party development and management services | | 4,977 |

| | 4,513 |

| | 11,184 |

| | 8,699 |

|

| General and administrative | | 9,767 |

| | 8,115 |

| | 19,925 |

| | 15,430 |

|

| Depreciation and amortization | | 66,441 |

| | 68,815 |

| | 132,610 |

| | 137,570 |

|

| Ground/facility leases | | 2,893 |

| | 3,236 |

| | 6,962 |

| | 6,785 |

|

| Loss (gain) from disposition of real estate | | — |

| | 282 |

| | (48,525 | ) | | 282 |

|

| Provision for impairment | | — |

| | — |

| | — |

| | 3,201 |

|

| Total operating expenses | | 173,035 |

| | 179,530 |

| | 306,953 |

| | 362,662 |

|

| | | | | | | | | |

| Operating income | | 12,512 |

| | 37,841 |

| | 127,998 |

| | 96,840 |

|

| | | | | | | | | |

| Nonoperating income (expenses): | | |

| | |

| | |

| | |

|

| Interest income | | 870 |

| | 969 |

| | 1,721 |

| | 1,895 |

|

| Interest expense | | (27,168 | ) | | (27,068 | ) | | (54,951 | ) | | (54,129 | ) |

| Amortization of deferred financing costs | | (1,255 | ) | | (1,218 | ) | | (2,542 | ) | | (2,350 | ) |

| Loss from early extinguishment of debt | | — |

| | — |

| | (4,827 | ) | | — |

|

| Total nonoperating expenses | | (27,553 | ) | | (27,317 | ) | | (60,599 | ) | | (54,584 | ) |

| | | | | | | | | |

| (Loss) income before income taxes | | (15,041 | ) | | 10,524 |

| | 67,399 |

| | 42,256 |

|

| Income tax provision | | (381 | ) | | (314 | ) | | (760 | ) | | (678 | ) |

| Net (loss) income | | (15,422 | ) | | 10,210 |

| | 66,639 |

| | 41,578 |

|

| Net loss (income) attributable to noncontrolling interests | | 2,078 |

| | 176 |

| | 872 |

| | (1,552 | ) |

| Net (loss) income attributable to ACC, Inc. and Subsidiaries common stockholders | | $ | (13,344 | ) | | $ | 10,386 |

| | $ | 67,511 |

| | $ | 40,026 |

|

| | | | | | | | | |

| Other comprehensive income (loss) | | |

| | |

| | |

| | |

|

| Change in fair value of interest rate swaps and other | | 282 |

| | (8,593 | ) | | (9,519 | ) | | (14,387 | ) |

| Comprehensive (loss) income | | $ | (13,062 | ) | | $ | 1,793 |

| | $ | 57,992 |

| | $ | 25,639 |

|

| | | | | | | | | |

| Net (loss) income per share attributable to ACC, Inc. and Subsidiaries common shareholders | | |

| | |

| | |

| | |

|

| Basic and diluted | | $ | (0.10 | ) | | $ | 0.07 |

| | $ | 0.48 |

| | $ | 0.28 |

|

| | | | | | | | | |

| Weighted-average common shares outstanding: | | |

| | |

| | |

| | |

|

| Basic | | 137,613,560 |

| | 137,268,696 |

| | 137,545,365 |

| | 137,185,576 |

|

| Diluted | | 137,613,560 |

| | 138,243,388 |

| | 138,652,106 |

| | 138,198,134 |

|

| | | | | | | | | |

See accompanying notes to consolidated financial statements.

2

AMERICAN CAMPUS COMMUNITIES, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY

(unaudited, in thousands, except share data)

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Common Shares | | Par Value of Common Shares | | Additional Paid in Capital | | Common Shares Held in Rabbi Trust | | Common Shares Held in Rabbi Trust at Cost | | Accumulated Earnings and Dividends | | Accumulated Other Comprehensive (Loss) Income | | Noncontrolling Interests – Partially Owned Properties | | Total |

| Equity, December 31, 2019 | | 137,326,824 |

| | $ | 1,373 |

| | $ | 4,458,456 |

| | 77,928 |

| | $ | (3,486 | ) | | $ | (1,144,721 | ) | | $ | (16,946 | ) | | $ | 43,998 |

| | $ | 3,338,674 |

|

| Adjustments to reflect redeemable noncontrolling interests at fair value | | — |

| | — |

| | 9,490 |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 9,490 |

|

| Amortization of restricted stock awards | | — |

| | — |

| | 3,988 |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 3,988 |

|

| Vesting of restricted stock awards | | 199,695 |

| | 2 |

| | (4,157 | ) | | — |

| | — |

| | — |

| | — |

| | — |

| | (4,155 | ) |

| Distributions to common and restricted stockholders and other ($0.47 per common share) | | — |

| | — |

| | — |

| | — |

| | — |

| | (65,242 | ) | | — |

| | — |

| | (65,242 | ) |

| Distributions to noncontrolling interests - partially owned properties | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | (2,566 | ) | | (2,566 | ) |

| Change in fair value of interest rate swaps and other | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | (9,801 | ) | | — |

| | (9,801 | ) |

| Deposits to deferred compensation plan, net of withdrawals | | (3,488 | ) | | — |

| | 129 |

| | 3,488 |

| | (129 | ) | | — |

| | — |

| | — |

| | — |

|

| Net income | | — |

| | — |

| | — |

| | — |

| | — |

| | 80,855 |

| | — |

| | 895 |

| | 81,750 |

|

| Equity, March 31, 2020 | | 137,523,031 |

|

| $ | 1,375 |

|

| $ | 4,467,906 |

| | 81,416 |

| | $ | (3,615 | ) |

| $ | (1,129,108 | ) |

| $ | (26,747 | ) |

| $ | 42,327 |

|

| $ | 3,352,138 |

|

| Adjustments to reflect redeemable noncontrolling interests at fair value | | — |

| | — |

| | (3,410 | ) | | — |

| | — |

| | — |

| | — |

| | — |

| | (3,410 | ) |

| Amortization of restricted stock awards and vesting of restricted stock units | | 27,644 |

| | — |

| | 4,439 |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 4,439 |

|

| Vesting of restricted stock awards | | — |

| | — |

| | (20 | ) | | — |

| | — |

| | — |

| | — |

| | — |

| | (20 | ) |

| Distributions to common and restricted stockholders and other ($0.47 per common share) | | — |

| | — |

| | — |

| | — |

| | — |

| | (65,193 | ) | | — |

| | — |

| | (65,193 | ) |

| Distributions to noncontrolling interests - partially owned properties | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | (1,816 | ) | | (1,816 | ) |

| Change in fair value of interest rate swaps and other | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 282 |

| | — |

| | 282 |

|

| Deposits to deferred compensation plan, net of withdrawals | | (10,330 | ) | | — |

| | 336 |

| | 10,330 |

| | (336 | ) | | — |

| | — |

| | — |

| | — |

|

| Net loss | | — |

| | — |

| | — |

| | — |

| | — |

| | (13,344 | ) | | — |

| | (2,046 | ) | | (15,390 | ) |

| Equity, June 30, 2020 | | 137,540,345 |

| | $ | 1,375 |

| | $ | 4,469,251 |

| | 91,746 |

| | $ | (3,951 | ) | | $ | (1,207,645 | ) | | $ | (26,465 | ) | | $ | 38,465 |

| | $ | 3,271,030 |

|

See accompanying notes to consolidated financial statements.

3

AMERICAN CAMPUS COMMUNITIES, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY

(unaudited, in thousands, except share data)

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Common

Shares | | Par Value of

Common

Shares | | Additional Paid

in Capital | | Common Shares Held in Rabbi Trust | | Common Shares Held in Rabbi Trust at Cost | | Accumulated

Earnings and

Dividends | | Accumulated

Other

Comprehensive

(Loss) Income | | Noncontrolling

Interests –

Partially Owned

Properties | | Total |

| Equity, December 31, 2018 | | 136,967,286 |

| | $ | 1,370 |

| | $ | 4,458,240 |

| | 69,603 |

| | $ | (3,092 | ) | | $ | (971,070 | ) | | $ | (4,397 | ) | | $ | 65,750 |

| | $ | 3,546,801 |

|

| Adjustments to reflect redeemable noncontrolling interests at fair value | | — |

| | — |

| | (2,547 | ) | | — |

| | — |

| | — |

| | — |

| | — |

| | (2,547 | ) |

| Amortization of restricted stock awards | | — |

| | — |

| | 3,765 |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 3,765 |

|

| Vesting of restricted stock awards | | 180,961 |

| | — |

| | (3,831 | ) | | — |

| | — |

| | — |

| | — |

| | — |

| | (3,831 | ) |

| Distributions to common and restricted stockholders and other ($0.46 per common share) | | — |

| | — |

| | — |

| | — |

| | — |

| | (63,611 | ) | | — |

| | — |

| | (63,611 | ) |

| Contributions by noncontrolling interests - partially owned properties | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 625 |

| | 625 |

|

| Distributions to noncontrolling interests - partially owned properties | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | (3,661 | ) | | (3,661 | ) |

| Conversion of common and preferred operating partnership units to common stock | | 42,271 |

| | — |

| | 251 |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 251 |

|

| Change in fair value of interest rate swaps and other | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | (5,794 | ) | | — |

| | (5,794 | ) |

| Deposits to deferred compensation plan, net of withdrawals | | (1,829 | ) | | — |

| | 70 |

| | 1,829 |

| | (70 | ) | | — |

| | — |

| | — |

| | — |

|

| Net income | | — |

| | — |

| | — |

| | — |

| | — |

| | 29,640 |

| | — |

| | 1,469 |

| | 31,109 |

|

| Equity, March 31, 2019 | | 137,188,689 |

| | $ | 1,370 |

| | $ | 4,455,948 |

| | 71,432 |

| | $ | (3,162 | ) | | $ | (1,005,041 | ) | | $ | (10,191 | ) | | $ | 64,183 |

| | $ | 3,503,107 |

|

| Adjustments to reflect redeemable noncontrolling interests at fair value | | — |

| | — |

| | 660 |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 660 |

|

| Amortization of restricted stock awards and vesting of restricted stock units | | 15,925 |

| | — |

| | 3,744 |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 3,744 |

|

| Vesting of restricted stock awards | | — |

| | 2 |

| | (146 | ) | | — |

| | — |

| | — |

| | — |

| | — |

| | (144 | ) |

| Distributions to common and restricted stockholders and other ($0.47 per common share) | | — |

| | — |

| | — |

| | — |

| | — |

| | (64,978 | ) | | — |

| | — |

| | (64,978 | ) |

| Contributions by noncontrolling interests - partially owned properties | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 79 |

| | 79 |

|

| Distributions to noncontrolling interests - partially owned properties | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | (3,037 | ) | | (3,037 | ) |

| Change in fair value of interest rate swaps and other | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 4,566 |

| | — |

| | 4,566 |

|

| Termination of interest rate swaps | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | (13,159 | ) | | — |

| | (13,159 | ) |

| Deposits to deferred compensation plan, net of withdrawals | | (4,103 | ) | | — |

| | 206 |

| | 4,103 |

| | (206 | ) | | — |

| | — |

| | — |

| | — |

|

| Net income (loss) | | — |

| | — |

| | — |

| | — |

| | — |

| | 10,386 |

| | — |

| | (339 | ) | | 10,047 |

|

| Equity, June 30, 2019 | | 137,200,511 |

| | $ | 1,372 |

| | $ | 4,460,412 |

| | 75,535 |

| | $ | (3,368 | ) | | $ | (1,059,633 | ) | | $ | (18,784 | ) | | $ | 60,886 |

| | $ | 3,440,885 |

|

See accompanying notes to consolidated financial statements.

4

AMERICAN CAMPUS COMMUNITIES, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(unaudited, in thousands)

|

| | | | | | | | |

| | | Six Months Ended June 30, |

| | | 2020 | | 2019 |

| Operating activities | | | | |

| Net income | | $ | 66,639 |

| | $ | 41,578 |

|

| Adjustments to reconcile net income to net cash provided by operating activities: | | |

| | |

|

| (Gain) loss from disposition of real estate | | (48,525 | ) | | 282 |

|

| Loss from early extinguishment of debt | | 4,827 |

| | — |

|

| Provision for impairment | | — |

| | 3,201 |

|

| Depreciation and amortization | | 132,610 |

| | 137,570 |

|

| Amortization of deferred financing costs and debt premiums/discounts | | 379 |

| | 53 |

|

| Share-based compensation | | 8,427 |

| | 7,509 |

|

| Income tax provision | | 760 |

| | 678 |

|

| Amortization of interest rate swap terminations and other | | 855 |

| | 268 |

|

| Termination of interest rate swaps | | — |

| | (13,159 | ) |

| Changes in operating assets and liabilities: | |

|

| |

|

|

| Student contracts receivable, net | | 4,236 |

| | (970 | ) |

| Other assets | | (3,988 | ) | | (4,723 | ) |

| Accounts payable and accrued expenses | | (17,304 | ) | | (22,416 | ) |

| Other liabilities | | (5,781 | ) | | (1,492 | ) |

| Net cash provided by operating activities | | 143,135 |

| | 148,379 |

|

| | | | | |

| Investing activities | | |

| | |

|

| Proceeds from disposition of properties and land parcels | | 146,144 |

| | 8,854 |

|

| Capital expenditures for owned properties | | (25,075 | ) | | (24,427 | ) |

| Investments in owned properties under development | | (156,757 | ) | | (220,925 | ) |

| Capital expenditures for on-campus participating properties | | (1,166 | ) | | (767 | ) |

| Other investing activities | | (14,635 | ) | | (2,342 | ) |

| Net cash used in investing activities | | (51,489 | ) | | (239,607 | ) |

| | | | | |

| Financing activities | | |

| | |

|

| Proceeds from unsecured notes | | 795,808 |

| | 398,816 |

|

| Pay-off of mortgage and construction loans | | (34,219 | ) | | — |

|

| Costs paid related to early extinguishment of debt | | (4,156 | ) | | — |

|

| Pay-off of unsecured notes | | (400,000 | ) | | — |

|

| Proceeds from revolving credit facility | | 1,456,700 |

| | 390,200 |

|

| Paydowns of revolving credit facility | | (1,695,900 | ) | | (591,900 | ) |

| Proceeds from construction loans | | — |

| | 26,051 |

|

| Scheduled principal payments on debt | | (3,983 | ) | | (4,017 | ) |

| Debt issuance costs | | (9,614 | ) | | (6,562 | ) |

| Increase in ownership of consolidated subsidiary | | (77,200 | ) | | — |

|

| Contribution by noncontrolling interests | | — |

| | 704 |

|

| Taxes paid on net-share settlements | | (4,175 | ) | | (3,975 | ) |

| Distributions paid to common and restricted stockholders | | (130,435 | ) | | (128,589 | ) |

| Distributions paid to noncontrolling interests | | (4,850 | ) | | (7,291 | ) |

| Net cash (used in) provided by financing activities | | (112,024 | ) | | 73,437 |

|

| | | | | |

| Net change in cash, cash equivalents, and restricted cash | | (20,378 | ) | | (17,791 | ) |

| Cash, cash equivalents, and restricted cash at beginning of period | | 81,348 |

| | 106,517 |

|

| Cash, cash equivalents, and restricted cash at end of period | | $ | 60,970 |

| | $ | 88,726 |

|

| | | | | |

| Reconciliation of cash, cash equivalents, and restricted cash to the consolidated balance sheets | | | | |

| Cash and cash equivalents | | $ | 31,011 |

| | $ | 51,541 |

|

| Restricted cash | | 29,959 |

| | 37,185 |

|

| Total cash, cash equivalents, and restricted cash at end of period | | $ | 60,970 |

| | $ | 88,726 |

|

| | | | | |

See accompanying notes to consolidated financial statements.

5

AMERICAN CAMPUS COMMUNITIES, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(unaudited, in thousands)

|

| | | | | | | | |

| | | Six Months Ended June 30, |

| | | 2020 | | 2019 |

| Supplemental disclosure of non-cash investing and financing activities | | |

| | |

|

| Conversion of common and preferred operating partnership units to common stock | | $ | — |

| | $ | 251 |

|

| Accrued development costs and capital expenditures | | $ | 32,880 |

| | $ | 39,646 |

|

| Change in fair value of derivative instruments, net | | $ | (10,374 | ) | | $ | (1,496 | ) |

| Change in fair value of redeemable noncontrolling interest | | $ | 6,080 |

| | $ | (1,887 | ) |

| Initial recognition of operating lease right of use assets | | $ | — |

| | $ | 280,687 |

|

| Initial recognition of operating lease liabilities | | $ | — |

| | $ | 279,982 |

|

| | | | | |

| Supplemental disclosure of cash flow information | | |

| | |

|

| Interest paid | | $ | 56,362 |

| | $ | 54,186 |

|

| | | | | |

See accompanying notes to consolidated financial statements.

6

AMERICAN CAMPUS COMMUNITIES OPERATING PARTNERSHIP LP AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(in thousands, except unit data)

|

| | | | | | | | |

| | | June 30, 2020 | | December 31, 2019 |

| | | (Unaudited) | | |

| Assets | | | | |

| | | | | |

| Investments in real estate: | | | | |

| Owned properties, net | | $ | 6,659,939 |

| | $ | 6,694,715 |

|

| On-campus participating properties, net | | 72,273 |

| | 75,188 |

|

| Investments in real estate, net | | 6,732,212 |

| | 6,769,903 |

|

| | | | | |

| Cash and cash equivalents | | 31,011 |

| | 54,650 |

|

| Restricted cash | | 29,959 |

| | 26,698 |

|

| Student contracts receivable, net | | 9,194 |

| | 13,470 |

|

| Operating lease right of use assets | | 459,110 |

| | 460,857 |

|

| Other assets | | 253,024 |

| | 234,176 |

|

| | | | | |

| Total assets | | $ | 7,514,510 |

| | $ | 7,559,754 |

|

| | | | | |

| Liabilities and capital | | |

| | |

|

| | | | | |

| Liabilities: | | |

| | |

|

| Secured mortgage, construction and bond debt, net | | $ | 747,086 |

| | $ | 787,426 |

|

| Unsecured notes, net | | 2,373,767 |

| | 1,985,603 |

|

| Unsecured term loans, net | | 199,297 |

| | 199,121 |

|

| Unsecured revolving credit facility | | 186,500 |

| | 425,700 |

|

| Accounts payable and accrued expenses | | 72,335 |

| | 88,411 |

|

| Operating lease liabilities | | 482,492 |

| | 473,070 |

|

| Other liabilities | | 161,091 |

| | 157,368 |

|

| Total liabilities | | 4,222,568 |

| | 4,116,699 |

|

| | | | | |

| Commitments and contingencies (Note 12) | |

|

| |

|

|

| | | | | |

| Redeemable limited partners | | 20,912 |

| | 104,381 |

|

| | | | | |

| Capital: | | |

| | |

|

| Partners’ capital: | | |

| | |

|

| General partner - 12,222 OP units outstanding at both June 30, 2020 and December 31, 2019 | | 35 |

| | 40 |

|

| Limited partner - 137,619,869 and 137,392,530 OP units outstanding at June 30, 2020 and December 31, 2019, respectively | | 3,258,995 |

| | 3,311,582 |

|

| Accumulated other comprehensive loss | | (26,465 | ) | | (16,946 | ) |

| Total partners’ capital | | 3,232,565 |

| | 3,294,676 |

|

| Noncontrolling interests - partially owned properties | | 38,465 |

| | 43,998 |

|

| Total capital | | 3,271,030 |

| | 3,338,674 |

|

| | | | | |

| Total liabilities and capital | | $ | 7,514,510 |

| | $ | 7,559,754 |

|

|

| | | | | | | | |

| | | | | |

| Consolidated variable interest entities’ assets and debt included in the above balances: |

| | | | | |

| Investments in real estate, net | | $ | 591,263 |

| | $ | 788,393 |

|

| Cash, cash equivalents and restricted cash | | $ | 36,988 |

| | $ | 59,908 |

|

| Other assets | | $ | 14,818 |

| | $ | 18,387 |

|

| Secured mortgage and construction debt, net | | $ | 417,248 |

| | $ | 418,241 |

|

| Accounts payable, accrued expenses and other liabilities | | $ | 40,071 |

| | $ | 56,976 |

|

See accompanying notes to consolidated financial statements.

7

AMERICAN CAMPUS COMMUNITIES OPERATING PARTNERSHIP LP AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(unaudited, in thousands, except unit and per unit data)

|

| | | | | | | | | | | | | | | | |

| | | Three Months Ended

June 30, | | Six Months Ended

June 30, |

| | | 2020 | | 2019 | | 2020 | | 2019 |

| Revenues: | | | | | | | | |

| Owned properties | | $ | 177,186 |

| | $ | 203,156 |

| | $ | 409,277 |

| | $ | 427,575 |

|

| On-campus participating properties | | 4,101 |

| | 6,396 |

| | 14,810 |

| | 17,844 |

|

| Third-party development services | | 1,290 |

| | 3,607 |

| | 3,345 |

| | 6,778 |

|

| Third-party management services | | 2,668 |

| | 3,465 |

| | 6,497 |

| | 5,776 |

|

| Resident services | | 302 |

| | 747 |

| | 1,022 |

| | 1,529 |

|

| Total revenues | | 185,547 |

| | 217,371 |

| | 434,951 |

| | 459,502 |

|

| | | | | | | | | |

| Operating expenses (income): | | |

| | |

| | |

| | |

|

| Owned properties | | 85,749 |

| | 90,763 |

| | 178,223 |

| | 182,932 |

|

| On-campus participating properties | | 3,208 |

| | 3,806 |

| | 6,574 |

| | 7,763 |

|

| Third-party development and management services | | 4,977 |

| | 4,513 |

| | 11,184 |

| | 8,699 |

|

| General and administrative | | 9,767 |

| | 8,115 |

| | 19,925 |

| | 15,430 |

|

| Depreciation and amortization | | 66,441 |

| | 68,815 |

| | 132,610 |

| | 137,570 |

|

| Ground/facility leases | | 2,893 |

| | 3,236 |

| | 6,962 |

| | 6,785 |

|

| Loss (gain) from disposition of real estate | | — |

| | 282 |

| | (48,525 | ) | | 282 |

|

| Provision for impairment | | — |

| | — |

| | — |

| | 3,201 |

|

| Total operating expenses | | 173,035 |

| | 179,530 |

| | 306,953 |

| | 362,662 |

|

| | | | | | | | | |

| Operating income | | 12,512 |

| | 37,841 |

| | 127,998 |

| | 96,840 |

|

| | | | | | | | | |

| Nonoperating income (expenses): | | |

| | |

| | |

| | |

|

| Interest income | | 870 |

| | 969 |

| | 1,721 |

| | 1,895 |

|

| Interest expense | | (27,168 | ) | | (27,068 | ) | | (54,951 | ) | | (54,129 | ) |

| Amortization of deferred financing costs | | (1,255 | ) | | (1,218 | ) | | (2,542 | ) | | (2,350 | ) |

| Loss from early extinguishment of debt | | — |

| | — |

| | (4,827 | ) | | — |

|

| Total nonoperating expenses | | (27,553 | ) | | (27,317 | ) | | (60,599 | ) | | (54,584 | ) |

| (Loss) income before income taxes | | (15,041 | ) | | 10,524 |

| | 67,399 |

| | 42,256 |

|

| Income tax provision | | (381 | ) | | (314 | ) | | (760 | ) | | (678 | ) |

| Net (loss) income | | (15,422 | ) | | 10,210 |

| | 66,639 |

| | 41,578 |

|

| Net loss (income) attributable to noncontrolling interests – partially owned properties | | 2,046 |

| | 230 |

| | 1,130 |

| | (1,338 | ) |

| Net (loss) income attributable to American Campus Communities Operating Partnership LP | | (13,376 | ) | | 10,440 |

| | 67,769 |

| | 40,240 |

|

| Series A preferred units distributions | | (14 | ) | | (9 | ) | | (28 | ) | | (40 | ) |

| Net (loss) income attributable to common unitholders | | $ | (13,390 | ) | | $ | 10,431 |

| | $ | 67,741 |

| | $ | 40,200 |

|

| | | | | | | | | |

| Other comprehensive income (loss) | | |

| | |

| | |

| | |

|

| Change in fair value of interest rate swaps and other | | 282 |

| | (8,593 | ) | | (9,519 | ) | | (14,387 | ) |

| Comprehensive (loss) income | | $ | (13,108 | ) | | $ | 1,838 |

| | $ | 58,222 |

| | $ | 25,813 |

|

| | | | | | | | | |

| Net (loss) income per unit attributable to common unitholders | | |

| | |

| | |

| | |

|

| Basic and diluted | | $ | (0.10 | ) | | $ | 0.07 |

| | $ | 0.48 |

| | $ | 0.28 |

|

| | | | | | | | | |

| Weighted-average common units outstanding | | |

| | |

| | |

| | |

|

| Basic | | 138,082,035 |

| | 137,863,484 |

| | 138,013,840 |

| | 137,780,364 |

|

| Diluted | | 138,082,035 |

| | 138,838,176 |

| | 139,120,581 |

| | 138,792,922 |

|

See accompanying notes to consolidated financial statements.

8

AMERICAN CAMPUS COMMUNITIES OPERATING PARTNERSHIP LP AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CHANGES IN CAPITAL

(unaudited, in thousands, except unit data)

|

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | Accumulated | | Noncontrolling | | |

| | | | | | | Other | | Interests - | | |

|

| | | General Partner | | Limited Partner | | Comprehensive | | Partially Owned | | |

|

| | | Units | | Amount | | Units | | Amount | | (Loss) Income | | Properties | | Total |

| Capital, December 31, 2019 | | 12,222 |

| | $ | 40 |

| | 137,392,530 |

| | $ | 3,311,582 |

| | $ | (16,946 | ) | | $ | 43,998 |

| | $ | 3,338,674 |

|

| Adjustments to reflect redeemable limited partners’ interest at fair value | | — |

| | — |

| | — |

| | 9,490 |

| | — |

| | — |

| | 9,490 |

|

| Amortization of restricted stock awards | | — |

| | — |

| | — |

| | 3,988 |

| | — |

| | — |

| | 3,988 |

|

| Vesting of restricted stock awards | | — |

| | — |

| | 199,695 |

| | (4,155 | ) | | — |

| | — |

| | (4,155 | ) |

| Distributions to common and restricted unit holders and other ($0.47 per common unit) | | — |

| | (6 | ) | | — |

| | (65,236 | ) | | — |

| | — |

| | (65,242 | ) |

| Distributions to noncontrolling joint venture partners | | — |

| | — |

| | — |

| | — |

| | — |

| | (2,566 | ) | | (2,566 | ) |

| Change in fair value of interest rate swaps and other | | — |

| | — |

| | — |

| | — |

| | (9,801 | ) | | — |

| | (9,801 | ) |

| Net income | | — |

| | 7 |

| | — |

| | 80,848 |

| | — |

| | 895 |

| | 81,750 |

|

| Capital, March 31, 2020 | | 12,222 |

| | $ | 41 |

| | 137,592,225 |

| | $ | 3,336,517 |

| | $ | (26,747 | ) | | $ | 42,327 |

| | $ | 3,352,138 |

|

| Adjustments to reflect redeemable limited partners’ interest at fair value | | — |

| | — |

| | — |

| | (3,410 | ) | | — |

| | — |

| | (3,410 | ) |

| Amortization of restricted stock awards and vesting of restricted stock units | | — |

| | — |

| | 27,644 |

| | 4,439 |

| | — |

| | — |

| | 4,439 |

|

| Vesting of restricted stock awards | | — |

| | — |

| | — |

| | (20 | ) | | — |

| | — |

| | (20 | ) |

| Distributions to common and restricted unit holders and other ($0.47 per common unit) | | — |

| | (5 | ) | | — |

| | (65,188 | ) | | — |

| | — |

| | (65,193 | ) |

| Distributions to noncontrolling joint venture partners | | — |

| | — |

| | — |

| | — |

| | — |

| | (1,816 | ) | | (1,816 | ) |

| Change in fair value of interest rate swaps and other | | — |

| | — |

| | — |

| | — |

| | 282 |

| | — |

| | 282 |

|

| Net loss | | — |

| | (1 | ) | | — |

| | (13,343 | ) | | — |

| | (2,046 | ) | | (15,390 | ) |

| Capital, June 30, 2020 | | 12,222 |

| | $ | 35 |

| | 137,619,869 |

| | $ | 3,258,995 |

| | $ | (26,465 | ) | | $ | 38,465 |

| | $ | 3,271,030 |

|

See accompanying notes to consolidated financial statements.

9

AMERICAN CAMPUS COMMUNITIES OPERATING PARTNERSHIP LP AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CHANGES IN CAPITAL

(unaudited, in thousands, except unit data)

|

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | Accumulated | | Noncontrolling | | |

| | | | | | | Other | | Interests - | | |

|

| | | General Partner | | Limited Partner | | Comprehensive | | Partially Owned | | |

|

| | | Units | | Amount | | Units | | Amount | | (Loss) Income | | Properties | | Total |

| Capital, December 31, 2018 | | 12,222 |

| | $ | 55 |

| | 137,024,667 |

| | $ | 3,485,393 |

| | $ | (4,397 | ) | | $ | 65,750 |

| | $ | 3,546,801 |

|

| Adjustments to reflect redeemable limited partners’ interest at fair value | | — |

| | — |

| | — |

| | (2,547 | ) | | — |

| | — |

| | (2,547 | ) |

| Amortization of restricted stock awards | | — |

| | — |

| | — |

| | 3,765 |

| | — |

| | — |

| | 3,765 |

|

| Vesting of restricted stock awards | | — |

| | — |

| | 180,961 |

| | (3,831 | ) | | — |

| | — |

| | (3,831 | ) |

| Distributions to common and restricted unit holders and other ($0.46 per common unit) | | — |

| | (6 | ) | | — |

| | (63,605 | ) | | — |

| | — |

| | (63,611 | ) |

| Contribution by noncontrolling interests - partially owned properties | | — |

| | — |

| | — |

| | — |

| | — |

| | 625 |

| | 625 |

|

| Distributions to noncontrolling joint venture partners | | — |

| | — |

| | — |

| | — |

| | — |

| | (3,661 | ) | | (3,661 | ) |

| Conversion of common and preferred operating partnership units to common stock | | — |

| | — |

| | 42,271 |

| | 251 |

| | — |

| | — |

| | 251 |

|

| Change in fair value of interest rate swaps and other | | — |

| | — |

| | — |

| | — |

| | (5,794 | ) | | — |

| | (5,794 | ) |

| Net income | | — |

| | 3 |

| | — |

| | 29,637 |

| | — |

| | 1,469 |

| | 31,109 |

|

| Capital, March 31, 2019 | | 12,222 |

| | $ | 52 |

| | 137,247,899 |

| | $ | 3,449,063 |

| | $ | (10,191 | ) | | $ | 64,183 |

| | $ | 3,503,107 |

|

| Adjustments to reflect redeemable limited partners’ interest at fair value | | — |

| | — |

| | — |

| | 660 |

| | — |

| | — |

| | 660 |

|

| Amortization of restricted stock awards and vesting of restricted stock units | | — |

| | — |

| | 15,925 |

| | 3,744 |

| | — |

| | — |

| | 3,744 |

|

| Vesting of restricted stock awards | | — |

| | — |

| | — |

| | (144 | ) | | — |

| | — |

| | (144 | ) |

| Distributions to common and restricted unit holders and other ($0.47 per common unit) | | — |

| | (5 | ) | | — |

| | (64,973 | ) | | — |

| | — |

| | (64,978 | ) |

| Contribution by noncontrolling interests - partially owned properties | | — |

| | — |

| | — |

| | — |

| | — |

| | 79 |

| | 79 |

|

| Distributions to noncontrolling joint venture partners | | — |

| | — |

| | — |

| | — |

| | — |

| | (3,037 | ) | | (3,037 | ) |

| Change in fair value of interest rate swaps and other | | — |

| | — |

| | — |

| | — |

| | 4,566 |

| | — |

| | 4,566 |

|

| Termination of interest rate swaps | | — |

| | — |

| | — |

| | — |

| | (13,159 | ) | | — |

| | (13,159 | ) |

| Net income (loss) | | — |

| | 1 |

| | — |

| | 10,385 |

| | — |

| | (339 | ) | | 10,047 |

|

| Capital, June 30, 2019 | | 12,222 |

| | $ | 48 |

| | 137,263,824 |

| | $ | 3,398,735 |

| | $ | (18,784 | ) | | $ | 60,886 |

| | $ | 3,440,885 |

|

See accompanying notes to consolidated financial statements.

10

AMERICAN CAMPUS COMMUNITIES OPERATING PARTNERSHIP LP AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(unaudited, in thousands)

|

| | | | | | | | |

| | | Six Months Ended June 30, |

| | | 2020 | | 2019 |

| Operating activities | | | | |

| Net income | | $ | 66,639 |

| | $ | 41,578 |

|

| Adjustments to reconcile net income to net cash provided by operating activities: | | |

| | |

|

| (Gain) loss from disposition of real estate | | (48,525 | ) | | 282 |

|

| Loss from early extinguishment of debt | | 4,827 |

| | — |

|

| Provision for impairment | | — |

| | 3,201 |

|

| Depreciation and amortization | | 132,610 |

| | 137,570 |

|

| Amortization of deferred financing costs and debt premiums/discounts | | 379 |

| | 53 |

|

| Share-based compensation | | 8,427 |

| | 7,509 |

|

| Income tax provision | | 760 |

| | 678 |

|

| Amortization of interest rate swap terminations and other | | 855 |

| | 268 |

|

| Termination of interest rate swaps | | — |

| | (13,159 | ) |

| Changes in operating assets and liabilities: | | | | |

| Student contracts receivable, net | | 4,236 |

| | (970 | ) |

| Other assets | | (3,988 | ) | | (4,723 | ) |

| Accounts payable and accrued expenses | | (17,304 | ) | | (22,416 | ) |

| Other liabilities | | (5,781 | ) | | (1,492 | ) |

| Net cash provided by operating activities | | 143,135 |

| | 148,379 |

|

| | | | | |

| Investing activities | | |

| | |

|

| Proceeds from disposition of properties and land parcels | | 146,144 |

| | 8,854 |

|

| Capital expenditures for owned properties | | (25,075 | ) | | (24,427 | ) |

| Investments in owned properties under development | | (156,757 | ) | | (220,925 | ) |

| Capital expenditures for on-campus participating properties | | (1,166 | ) | | (767 | ) |

| Other investing activities | | (14,635 | ) | | (2,342 | ) |

| Net cash used in investing activities | | (51,489 | ) | | (239,607 | ) |

| | | | | |

| Financing activities | | |

| | |

|

| Proceeds from unsecured notes | | 795,808 |

| | 398,816 |

|

| Pay-off of mortgage and construction loans | | (34,219 | ) | | — |

|

| Costs paid related to early extinguishment of debt | | (4,156 | ) | | — |

|

| Pay-off of unsecured notes | | (400,000 | ) | | — |

|

| Proceeds from revolving credit facility | | 1,456,700 |

| | 390,200 |

|

| Paydowns of revolving credit facility | | (1,695,900 | ) | | (591,900 | ) |

| Proceeds from construction loans | | — |

| | 26,051 |

|

| Scheduled principal payments on debt | | (3,983 | ) | | (4,017 | ) |

| Debt issuance costs | | (9,614 | ) | | (6,562 | ) |

| Increase in ownership of consolidated subsidiary | | (77,200 | ) | | — |

|

| Contribution by noncontrolling interests | | — |

| | 704 |

|

| Taxes paid on net-share settlements | | (4,175 | ) | | (3,975 | ) |

| Distributions paid to common and preferred unitholders | | (129,722 | ) | | (128,151 | ) |

| Distributions paid on unvested restricted stock awards | | (1,181 | ) | | (1,031 | ) |

| Distributions paid to noncontrolling interests - partially owned properties | | (4,382 | ) | | (6,698 | ) |

| Net cash (used in) provided by financing activities | | (112,024 | ) | | 73,437 |

|

| | | | | |

| Net change in cash, cash equivalents, and restricted cash | | (20,378 | ) | | (17,791 | ) |

| Cash, cash equivalents, and restricted cash at beginning of period | | 81,348 |

| | 106,517 |

|

| Cash, cash equivalents, and restricted cash at end of period | | $ | 60,970 |

| | $ | 88,726 |

|

| | | | | |

| Reconciliation of cash, cash equivalents, and restricted cash to the consolidated balance sheets | | | | |

| Cash and cash equivalents | | $ | 31,011 |

| | $ | 51,541 |

|

| Restricted cash | | 29,959 |

| | 37,185 |

|

| Total cash, cash equivalents, and restricted cash at end of period | | $ | 60,970 |

| | $ | 88,726 |

|

| | | | | |

See accompanying notes to consolidated financial statements.

11

AMERICAN CAMPUS COMMUNITIES OPERATING PARTNERSHIP LP AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(unaudited, in thousands)

|

| | | | | | | | |

| | | Six Months Ended June 30, |

| | | 2020 | | 2019 |

| Supplemental disclosure of non-cash investing and financing activities | | |

| | |

|

| Conversion of common and preferred operating partnership units to common stock | | $ | — |

| | $ | 251 |

|

| Accrued development costs and capital expenditures | | $ | 32,880 |

| | $ | 39,646 |

|

| Change in fair value of derivative instruments, net | | $ | (10,374 | ) | | $ | (1,496 | ) |

| Change in fair value of redeemable noncontrolling interest | | $ | 6,080 |

| | $ | (1,887 | ) |

| Initial recognition of operating lease right of use assets | | $ | — |

| | $ | 280,687 |

|

| Initial recognition of operating lease liabilities | | $ | — |

| | $ | 279,982 |

|

| | | | | |

| Supplemental disclosure of cash flow information | | |

| | |

|

| Interest paid | | $ | 56,362 |

| | $ | 54,186 |

|

| | | | | |

See accompanying notes to consolidated financial statements.

12

AMERICAN CAMPUS COMMUNITIES, INC. AND SUBSIDIARIES

AMERICAN CAMPUS COMMUNITIES OPERATING PARTNERSHIP LP AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)

1. Organization and Description of Business

American Campus Communities, Inc. (“ACC”) is a real estate investment trust (“REIT”) that commenced operations effective with the completion of an initial public offering (“IPO”) on August 17, 2004. Through ACC’s controlling interest in American Campus Communities Operating Partnership LP (“ACCOP”), ACC is one of the largest owners, managers and developers of high quality student housing properties in the United States in terms of beds owned and under management. ACC is a fully integrated, self-managed and self-administered equity REIT with expertise in the acquisition, design, financing, development, construction management, leasing and management of student housing properties. ACC’s common stock is publicly traded on the New York Stock Exchange (“NYSE”) under the ticker symbol “ACC.”

The general partner of ACCOP is American Campus Communities Holdings, LLC (“ACC Holdings”), an entity that is wholly-owned by ACC. As of June 30, 2020, ACC Holdings held an ownership interest in ACCOP of less than 1%. The limited partners of ACCOP are ACC and other limited partners consisting of current and former members of management and nonaffiliated third parties. As of June 30, 2020, ACC owned an approximate 99.6% limited partnership interest in ACCOP. As the sole member of the general partner of ACCOP, ACC has exclusive control of ACCOP’s day-to-day management. Management operates ACC and ACCOP as one business. The management of ACC consists of the same members as the management of ACCOP. ACC consolidates ACCOP for financial reporting purposes, and ACC does not have significant assets other than its investment in ACCOP. Therefore, the assets and liabilities of ACC and ACCOP are the same on their respective financial statements. References to the “Company” means collectively ACC, ACCOP and those entities/subsidiaries owned or controlled by ACC and/or ACCOP. References to the “Operating Partnership” mean collectively ACCOP and those entities/subsidiaries owned or controlled by ACCOP. Unless otherwise indicated, the accompanying Notes to the Consolidated Financial Statements apply to both the Company and the Operating Partnership.

As of June 30, 2020, the Company’s property portfolio contained 166 properties with approximately 111,900 beds. The Company’s property portfolio consisted of 126 owned off-campus student housing properties that are in close proximity to colleges and universities, 34 American Campus Equity (“ACE®”) properties operated under ground/facility leases, and 6 on-campus participating properties operated under ground/facility leases with the related university systems. Of the 166 properties, 3 were under development as of June 30, 2020, and when completed will consist of a total of approximately 10,500 beds. The Company’s communities contain modern housing units and are supported by a resident assistant system and other student-oriented programming, with many offering resort-style amenities.

Through one of ACC’s taxable REIT subsidiaries (“TRSs”), the Company also provides construction management and development services, primarily for student housing properties owned by colleges and universities, charitable foundations, and others. As of June 30, 2020, also through one of ACC’s TRSs, the Company provided third-party management and leasing services for 35 properties that represented approximately 26,100 beds. Third-party management and leasing services are typically provided pursuant to management contracts that have initial terms that range from one year to five years. As of June 30, 2020, the Company’s total owned and third-party managed portfolio included 201 properties with approximately 138,000 beds.

2. Summary of Significant Accounting Policies

Basis of Presentation and use of Estimates

The accompanying consolidated financial statements, presented in U.S. dollars, are prepared in accordance with U.S. generally accepted accounting principles (“GAAP”). GAAP requires the Company to make estimates and assumptions that affect the reported amounts of assets and liabilities, disclosure of contingent assets and liabilities as of the date of the financial statements, and revenue and expenses during the reporting periods. The Company’s actual results could differ from those estimates and assumptions. All material intercompany transactions among consolidated entities have been eliminated. All dollar amounts in the tables herein, except share, per share, unit and per unit amounts, are stated in thousands unless otherwise indicated.

AMERICAN CAMPUS COMMUNITIES, INC. AND SUBSIDIARIES

AMERICAN CAMPUS COMMUNITIES OPERATING PARTNERSHIP LP AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)

Principles of Consolidation

The Company’s consolidated financial statements include its accounts and the accounts of other subsidiaries and joint ventures (including partnerships and limited liability companies) over which it has control. Investments acquired or created are evaluated based on the accounting guidance relating to variable interest entities (“VIEs”), which requires the consolidation of VIEs in which the Company is considered to be the primary beneficiary. If the investment is determined not to be a VIE, then the investment is evaluated for consolidation using the voting interest model.

Recently Issued Accounting Pronouncements

In March 2020, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) 2020-04, “Reference Rate Reform (Topic 848), Facilitation of the Effects of Reference Rate Reform on Financial Reporting.” ASU 2020-04 contains practical expedients for reference rate reform related activities that impact debt, leases, derivatives and other contracts. The guidance in ASU 2020-04 is optional and may be elected over time as reference rate reform activities occur. During the first quarter of 2020, the Company elected to apply the hedge accounting expedients related to probability and the assessments of effectiveness for future LIBOR-indexed cash flows to assume that the index upon which future hedged transactions will be based matches the index on the corresponding derivatives. Application of these expedients preserves the presentation of derivatives consistent with past presentation. The Company continues to evaluate the impact of the guidance and may apply other elections as applicable as additional changes in the market occur.

In March 2020, the Securities and Exchange Commission (“SEC”) adopted final rules that amend the financial disclosure requirements for subsidiary issuers and guarantors of registered debt securities in Rule 3-10 of Regulation S-X. Under the amended rules, parent companies can provide alternative disclosures in lieu of separate audited financial statements of subsidiary issuers and guarantors that meet certain circumstances. The rule is effective on January 4, 2021, but earlier compliance is permitted. The Company is in the process of evaluating the rule and its potential effect on the consolidated financial statements of both ACC and ACCOP.

In addition, the Company does not expect the following accounting pronouncements issued by the FASB to have a material effect on its consolidated financial statements:

|

| | |

| Accounting Standards Update | | Effective Date |

| | | |

| ASU 2019-12, “Income Taxes (Topic 740): Simplifying the Accounting for Income Taxes" | | January 1, 2021 |

Recently Adopted Accounting Pronouncements

In June 2016, the FASB issued ASU 2016-13, “Financial Instruments-Credit Losses (Topic 326), Measurement of Credit Losses on Financial Instruments.” The standard requires entities to estimate a lifetime expected credit loss for most financial assets, including trade and other receivables, held-to-maturity debt securities, loans and other financial instruments, and to present the net amount of the financial instrument expected to be collected. In November 2018, the FASB issued ASU 2018-19, “Codification Improvements to Topic 326, Financial Instruments-Credit Losses,” which amends the transition requirements and scope of ASU 2016-13 and clarifies that receivables arising from operating leases are not within the scope of the credit losses standard, but rather, should be accounted for in accordance with the leases standard. The Company adopted ASU 2016-13 on January 1, 2020.

The Company notes that a majority of its financial instruments result from operating leasing transactions, which as mentioned above, are not within the scope of the new standard. However, the Company did perform both a quantitative and qualitative analysis on the financial assets that are covered under this guidance, including its loans receivable. Based on this analysis, which included analyzing historical performance, occupancy rates, projected future performance, and macroeconomic trends, the Company concluded this new standard did not have a material impact on the consolidated financial statements.

In addition, on January 1, 2020, the Company adopted the following accounting pronouncements which did not have a material effect on the Company’s consolidated financial statements:

| |

| • | ASU 2018-15, “Intangibles - Goodwill and Other - Internal-Use Software (Subtopic 350-40): Customer’s Accounting for Implementation Costs Incurred in a Cloud Computing Arrangement that is a Service Contract” |

AMERICAN CAMPUS COMMUNITIES, INC. AND SUBSIDIARIES

AMERICAN CAMPUS COMMUNITIES OPERATING PARTNERSHIP LP AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)

| |

| • | ASU 2018-13, “Fair Value Measurement (Topic 820): Disclosure Framework - Changes to the Disclosure Requirements for Fair Value Measurement” |

In April 2020, the FASB issued a Staff Question & Answer (“Q&A”) which was intended to reduce the challenges of evaluating the enforceable rights and obligations of leases for concessions granted to lessees in response to the novel coronavirus disease (“COVID-19”), which was characterized on March 11, 2020 by the World Health Organization as a pandemic. Prior to this guidance, the Company was required to determine, on a lease by lease basis, if a lease concession should be accounted for as a lease modification, potentially resulting in any lease concessions granted being recorded as a reduction to revenue on a straight-line basis over the remaining terms of the leases. The Q&A allows both lessors and lessees to bypass this analysis and elect not to evaluate whether concessions provided in response to the COVID-19 pandemic are lease modifications. This relief is subject to certain conditions being met, including ensuring the total remaining lease payments are substantially the same or less as compared to the original lease payments prior to the concession being granted. The Company, as lessor, has elected to apply such relief and will therefore not evaluate if lease concessions that were granted in response to the COVID-19 pandemic meet the definition of a lease modification. Accordingly, the Company accounted for qualifying rent concessions as negative variable lease payments, which reduced revenue from such leases in the period the concessions were granted. The Company, as a lessee, has not received any concessions under its ground or other lease agreements resulting from the COVID-19 pandemic.

Interim Financial Statements

The accompanying interim financial statements are unaudited but have been prepared in accordance with GAAP for interim financial information and in conjunction with the rules and regulations of the SEC. Accordingly, they do not include all disclosures required by GAAP for complete financial statements. In the opinion of management, all adjustments (consisting solely of normal recurring matters) necessary for a fair presentation of the financial statements of the Company for these interim periods have been included. Because of the seasonal nature of the Company’s operations, the results of operations and cash flows for any interim period are not necessarily indicative of results for other interim periods or for the full year. These financial statements should be read in conjunction with the financial statements and the notes thereto included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2019.

Restricted Cash

Restricted cash consists of funds held in trust and invested in low risk investments, generally consisting of government backed securities, as permitted by the indentures of trusts, which were established in connection with three bond issues for the Company’s on-campus participating properties. Additionally, restricted cash includes escrow accounts held by lenders and resident security deposits, as required by law in certain states. Restricted cash also consists of escrow deposits made in connection with potential property acquisitions and development opportunities. These escrow deposits are invested in interest-bearing accounts at federally-insured banks. Realized and unrealized gains and losses are not material for the periods presented.

Leasing Revenue

The Company’s primary business involves leasing properties to students under agreements that are classified as operating leases, and which have terms of 12 months or less. These student leases do not provide for variable rent payments. The Company is also a lessor under commercial leases at certain owned properties, some of which provide for variable lease payments based upon tenant performance such as a percentage of sales. The Company recognizes the base lease payments provided for under the leases on a straight-line basis over the lease term, and variable payments are recognized in the period in which the changes in facts and circumstances on which the variable payments are based occur. Lease income under both student and commercial leases is included in owned property revenues in the accompanying consolidated statements of comprehensive income. Lease income under student leases totaled $176.9 million and $194.3 million for the three months ended June 30, 2020 and 2019, respectively, and $408.3 million and $416.0 million for the six months ended June 30, 2020 and 2019, respectively. During the three months ended June 30, 2020, through its Resident Hardship Program, the Company provided $8.6 million in rent abatements to its tenants experiencing financial hardship due to COVID-19 and an additional $15.1 million in rent abatements through its University Partnerships. As discussed above, these abatements were recorded as a reduction to Owned Properties Revenue. Also during the three months ended June 30, 2020, an additional $1.5 million in rent abatements were granted to tenants at the Company’s on-campus participating properties, which are reflected as a reduction to On-campus Participating Properties Revenue. The Company also waived all late fees and online payment fees and suspended financial related evictions. Lease income under commercial leases totaled $2.9 million and $3.2 million for the three months ended June 30, 2020 and 2019, respectively, and $6.1 million and $6.6 million for the six months ended June 30, 2020 and 2019, respectively.

AMERICAN CAMPUS COMMUNITIES, INC. AND SUBSIDIARIES

AMERICAN CAMPUS COMMUNITIES OPERATING PARTNERSHIP LP AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)

Consolidated VIEs

The Company has investments in various entities that qualify as VIEs for accounting purposes and for which the Company is the primary beneficiary and therefore includes the entities in its consolidated financial statements. These VIEs include the Operating Partnership, 5 joint ventures that own a total of 10 operating properties and a land parcel, and 6 properties owned under the on-campus participating property structure. The VIE assets and liabilities consolidated within the Company's assets and liabilities are disclosed at the bottom of the accompanying consolidated balance sheets.

Impairment of Long-Lived Assets

Management assesses whether there has been an impairment in the value of the Company’s investments in real estate whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. As of June 30, 2020, the Company has continued to assess whether the global economic disruption caused by the novel coronavirus disease (“COVID-19”), which was characterized on March 11, 2020 by the World Health Organization as a pandemic, was an impairment indicator. The Company examined a number of factors including the overall market and economic environment, economic and operating conditions of the Company’s properties, as well as the demand, creditworthiness, and performance from the properties’ tenants, and concluded that there were no impairments of the carrying values of the Company’s investments in real estate as of June 30, 2020.

3. Earnings Per Share

Earnings Per Share – Company

Basic earnings per share is computed using net income attributable to common stockholders and the weighted average number of shares of the Company’s common stock outstanding during the period. Diluted earnings per share reflects common shares issuable from the assumed conversion of American Campus Communities Operating Partnership Units (“OP Units”) and common share awards granted. Only those items having a dilutive impact on basic earnings per share are included in diluted earnings per share.

The following potentially dilutive securities were outstanding for the three and six months ended June 30, 2020 and 2019, but were not included in the computation of diluted earnings per share because the effects of their inclusion would be anti-dilutive.

|

| | | | | | | | | | | | |