market partners. These profit sharing expenses are reflected in restaurant other operating expenses. Restaurant labor expenses also include share-based compensation expense related to restaurant-level employees.

Restaurant Rent Expense. Restaurant rent expense includes all rent, except pre-opening rent, associated with the leasing of real estate and includes base, percentage and straight-line rent expense.

Restaurant Other Operating Expenses. Restaurant other operating expenses consist of all other restaurant-level operating costs, the major components of which are credit card fees, profit sharing incentive compensation for our restaurant managing partners and market partners, utilities, supplies, general liability insurance, advertising, repairs and maintenance, property taxes and outside services.

Pre-opening Expenses. Pre-opening expenses, which are charged to operations as incurred, consist of expenses incurred before the opening of a new or relocated restaurant and consist principally of opening and training team compensation and benefits, travel expenses, rent, food, beverage and other initial supplies and expenses. The majority of pre-opening costs incurred relate to the hiring and training of employees due to the significant investment we make in training our people. Pre-opening costs vary by location depending on a number of factors, including the size and physical layout of each location; the number of management and hourly employees required to operate each restaurant; the availability of qualified restaurant staff members; the cost of travel and lodging for different geographic areas; the timing of the restaurant opening; and the extent of unexpected delays, if any, in obtaining final licenses and permits to open each restaurant.

Depreciation and Amortization Expenses. Depreciation and amortization expenses include the depreciation of fixed assets and amortization of intangibles with definite lives, substantially all of which relates to restaurant-level assets.

Impairment and Closure Costs, Net. Impairment and closure costs, net include any impairment of long-lived assets, including property and equipment, operating lease right-of-use assets and goodwill, and expenses associated with the closure of a restaurant. Closure costs also include any gains or losses associated with a relocated restaurant or the sale of a closed restaurant and/or assets held for sale as well as lease costs associated with closed or relocated restaurants.

General and Administrative Expenses. General and administrative expenses comprise expenses associated with corporate and administrative functions that support development and restaurant operations and provide an infrastructure to support future growth. This includes salary, incentive-based and share-based compensation expense related to executive officers and Support Center employees, salary and share-based compensation expense related to market partners, software hosting fees, professional fees, group insurance, advertising expense and the realized and unrealized holding gains and losses related to the investments in our deferred compensation plan.

Interest Income (Expense), Net. Interest income (expense), net includes earnings on cash and cash equivalents and is reduced by interest expense, net of capitalized interest, on our debt or financing obligations including the amortization of loan fees.

Equity Income from Investments in Unconsolidated Affiliates. Equity income includes our percentage share of net income earned by unconsolidated affiliates and our share of any gain on the acquisition of these affiliates. As of December 26, 2023 and December 27, 2022, we owned a 5.0% to 10.0% equity interest in 20 and 23 domestic franchise restaurants, respectively.

Net Income Attributable to Noncontrolling Interests. Net income attributable to noncontrolling interests represents the portion of income attributable to the other owners of the majority-owned restaurants. Our consolidated subsidiaries include 20 majority-owned restaurants for all periods presented.

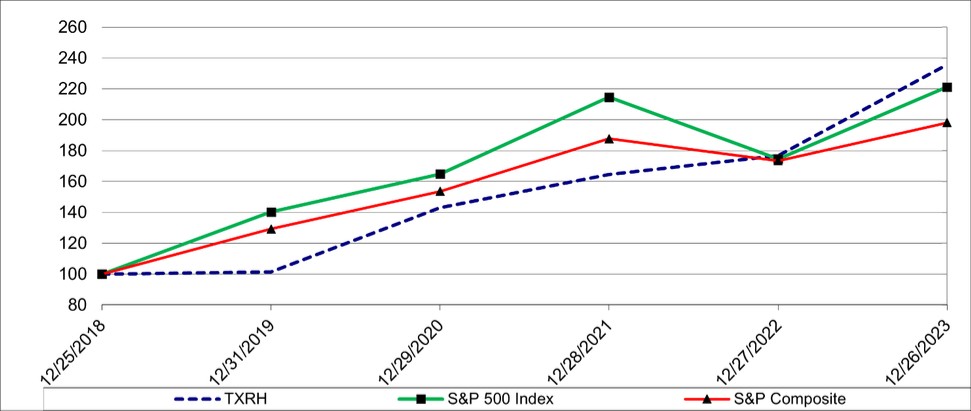

2023 Financial Highlights

Total revenue increased $616.8 million or 15.4% to $4.6 billion in 2023 compared to $4.0 billion in 2022 primarily due to an increase in comparable restaurant sales and an increase in store weeks. Comparable restaurant sales and store weeks increased 10.1% and 5.8%, respectively, at company restaurants in 2023. The increase in comparable restaurant sales was due to an increase in guest traffic along with an increase in per person average check. The increase in store weeks was due to new store openings and the acquisition of franchise restaurants.

Net income increased $35.1 million or 13.0% to $304.9 million in 2023 compared to $269.8 million in 2022 primarily due to higher restaurant margin dollars, as described below, partially offset by higher general and