QuickLinks -- Click here to rapidly navigate through this document

As filed with the Securities and Exchange Commission on January 18, 2006.

Registration No.: 333-130425

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 2

to

FORM F-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

DESARROLLADORA HOMEX, S.A. DE C.V.

(Exact name of Registrant as specified in its charter)

HOMEX DEVELOPMENT CORP.

(Translation of Registrant's name into English)

| United Mexican States (State or other jurisdiction of incorporation or organization) | 1520 (Primary Standard Industrial Classification Code Number) | None (IRS Employer Identification No.) |

Andador Javier Mina 891-B

Colonia Centro Sinaloa

80200 Culiacán, Sinaloa, México

(52 667) 758-5800

(Address and telephone number of registrant's principal executive offices)

CT Corporation System

111 Eighth Avenue, 13th Floor

New York, NY 10011

(212) 590-9200

(Name, address and telephone number of agent for service)

Copies to: | ||

| Michael L. Fitzgerald, Esq. Milbank, Tweed, Hadley & McCloy LLP One Chase Manhattan Plaza New York, NY 10005 (212) 530-5000 | Jorge U. Juantorena, Esq. Cleary Gottlieb Steen & Hamilton LLP One Liberty Plaza New York, New York 10006 (212) 225-2000 | |

Approximate date of commencement of proposed sale to the public:

As soon as practicable after this Registration Statement becomes effective.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, check the following box. o

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a registration statement pursuant to General Instruction I.C. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. o

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.C. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. o

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay the effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

SUBJECT TO COMPLETION, DATED JANUARY 18, 2006

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This Prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state or jurisdiction where the offer or sale is not permitted.

PROSPECTUS

DESARROLLADORA HOMEX, S.A. DE C.V.

40,491,106 Common shares

The selling shareholders named in this prospectus are selling common shares a portion of which may be in the form of American Depositary Shares, or ADSs, in an international offering. Concurrently the selling shareholders are selling common shares in an offering in Mexico. The ADSs will be evidenced by American Depositary Receipts, or ADRs, and each ADS represents the right to receive six common shares.

We will not receive any proceeds from the sale of the ADSs or common shares. The offering price and underwriting discount and commission in the international offering and the offering in Mexico will be substantially equivalent.

The ADSs are listed on the New York Stock Exchange under the symbol "HXM" and the common shares are listed on the Mexican Stock Exchange under the symbol "HOMEX". On January 13, 2006, the last reported sale price of the ADSs on the New York Stock Exchange was $31.38 per ADS and the last reported sale price of the common shares on the Mexican Stock Exchange was Ps.55.29 per share.

Investing in our common shares involves risks. See "Risk Factors" beginning on page 13.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

| | Per Common Share | Per ADS | Total | |||

|---|---|---|---|---|---|---|

| Public Offering Price | ||||||

| Underwriting Discount | ||||||

| Proceeds to the Selling Shareholders |

The selling shareholders have granted to the underwriters an option to purchase up to 5,671,954 additional common shares, which can be in the form of ADSs, to cover over-allotments, if any.

The underwriters expects to deliver the common shares to purchasers against payment on or about , 2006.

Sole Book-Runner

Citigroup

| Merrill Lynch & Co. | Morgan Stanley |

The date of this prospectus is January , 2006

You should rely only on the information contained in or incorporated by reference in this prospectus. We have not authorized anyone to provide you with different information. We are not making an offer of these securities in any state where the offer is not permitted. You should not assume that the information contained in this prospectus is accurate as of any date other than the date on the front of this prospectus.

| | Page | |

|---|---|---|

| Incorporation by Reference | ii | |

| Cautionary Statement Regarding Forward-Looking Statements | iv | |

| Presentation of Financial and Other Information | v | |

| Terms Used in this Prospectus | vii | |

| Limitation of Liability | viii | |

| Prospectus Summary | 1 | |

| Risk Factors | 13 | |

| Use of Proceeds | 22 | |

| Exchange Rate Information | 23 | |

| Market Information | 24 | |

| Capitalization | 31 | |

| Unaudited Pro Forma Condensed Combined Financial Information | 32 | |

| Selected Consolidated Financial Information | 36 | |

| Management's Discussion and Analysis of Financial Condition and Results of Operations | 41 | |

| Business | 55 | |

| Management | 75 | |

| The Principal Shareholders and Related Party Transactions | 80 | |

| Selling Shareholders | 84 | |

| Description of Capital Stock | 85 | |

| Description of American Depositary Receipts | 97 | |

| Dividends and Dividend Policy | 106 | |

| Taxation | 107 | |

| Underwriting | 111 | |

| Validity of the Securities | 115 | |

| Experts | 115 | |

| Available Information | 115 | |

| Index to Homex Financial Statements | F-1 | |

| Index to Beta Financial Statements | A-1 | |

| Unaudited Pro Forma Condensed Combined Financial Statements | B-1 | |

| Exhibit I—Unaudited Financial Information as of and for the Nine Month Periods Ended September 30, 2004 and 2005 | I-1 |

We have registered the common shares in Mexico with the Special Section (Sección Especial) and the Securities Section (Sección de Valores) of the Mexican Securities Registry (Registro Nacitonal de Valores) maintained by the Mexican Banking and Securities Commission, or CNBV (Comisión Nacional Bancaria y de Valores). This registration does not imply approval or disapproval of the quality of the securities offered in this prospectus, the adequacy or accuracy of this prospectus, or our solvency.

i

The Securities and Exchange Commission, or the SEC, allows us to "incorporate by reference" information contained in documents we file with them, which means that we can disclose important information to you by referring you to those documents. This prospectus incorporates important business, and financial information about us which is not included in or delivered with this prospectus. The information incorporated by reference is considered to be part of this prospectus, and later information that we file with the SEC, to the extent that we identify such information as being incorporated by reference into this prospectus, will automatically update and supersede this information. Information set forth in this prospectus supersedes any previously filed information that is incorporated by reference into this prospectus. We incorporate by reference into this prospectus the following information and documents:

- •

- our registration statement on Form F-4 dated October 18, 2005 (SEC File No. 333-129100) for the registration and offering of 7.50% Senior Guaranteed Exchange Notes due 2015 in exchange for 7.50% Senior Guaranteed Notes due 2015, which we refer to in this prospectus as the "2005 Form F-4";

- •

- our annual report on Form 20-F for the fiscal year ended December 31, 2004, dated June 28, 2005 (SEC File No. 001-32229), which we refer to in this prospectus as the "2004 Form 20-F"; and

- •

- any future filings on Form 20-F we make under the Securities Exchange Act of 1934, as amended, after the date of this prospectus and prior to the termination of the exchange offer, and any future submissions on Form 6-K during this period that are identified as being incorporated into this prospectus.

Any statement contained in a document, all or a portion of which is incorporated or deemed to be incorporated by reference herein, shall be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained herein or in any other subsequently filed document which also is or is deemed to be incorporated by reference herein modifies or supersedes such statement. Any statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute part of this prospectus.

WE WILL PROVIDE WITHOUT CHARGE TO EACH PERSON TO WHOM A COPY OF THIS PROSPECTUS IS DELIVERED, UPON THE WRITTEN OR ORAL REQUEST OF ANY SUCH PERSON, A COPY OF ANY OR ALL OF THE DOCUMENTS REFERRED TO ABOVE WHICH HAVE BEEN OR MAY BE INCORPORATED HEREIN BY REFERENCE, OTHER THAN EXHIBITS TO SUCH DOCUMENTS (UNLESS SUCH EXHIBITS ARE SPECIFICALLY INCORPORATED BY REFERENCE IN SUCH DOCUMENTS). TO OBTAIN TIMELY DELIVERY, INVESTORS MUST REQUEST THIS INFORMATION NO LATER THAN FIVE BUSINESS DAYS BEFORE THE DATE THEY MUST MAKE THEIR INVESTMENT DECISION. REQUESTS SHOULD BE DIRECTED TO THE FOLLOWING ADDRESS AND PHONE NUMBER:

Investor Relations

Desarrolladora Homex, S.A. de C.V.

Andador Javier Mina 891-B

Colonia Centro Sinaloa

80200 Culiacán, Sinaloa, México

(52 667) 758-5800

ii

You should rely only on the information contained in this prospectus or to which we have referred you. We have not authorized any person to provide you with different information. We are offering to sell the securities only in jurisdictions where offers and sales are permitted. The information in this document may only be accurate on the date of this document.

Homex is subject to the informational requirements of the Exchange Act and in accordance therewith files reports and other information with the SEC. Reports and other information filed by Homex with the SEC can be inspected and copied at the public reference facilities maintained by the SEC at its Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. You may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. Such materials can also be inspected at the offices of the New York Stock Exchange, Inc., 20 Broad Street, New York, New York 10005. Any filings we make electronically will be available to the public over the Internet at the SEC's website at www.sec.gov.

iii

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and the documents incorporated by reference into this prospectus contain forward-looking statements. We may from time to time make forward-looking statements in our periodic reports to the SEC on Form 6-K, in our annual report to shareholders, in prospectuses, press releases and other written materials and in oral statements made by our officers, directors or employees to analysts, institutional investors, representatives of the media and others. Words such as "believe," "anticipate," "plan," "expect," "intend," "target," "estimate," "project," "predict," "forecast," "guideline," "should" and similar expressions are intended to identify forward-looking statements, but are not the exclusive means of identifying these statements. Examples of these forward-looking statements include:

- •

- projections of revenues, net income (loss), earnings per share, capital expenditures, dividends, capital structure or other financial items or ratios;

- •

- statements regarding the anticipated results of our recent acquisition of Controladora Casas Beta, S.A. de C.V. and its subsidiaries;

- •

- statements of our plans, objectives or goals, including those relating to anticipated trends, competition, regulation, government housing policy and rates;

- •

- statements about our future economic performance or that of Mexico; and

- •

- statements of assumptions underlying these statements.

You should not place undue reliance on forward-looking statements, which are based on current expectations. Forward-looking statements are not guarantees of performance. They involve risks, uncertainties and assumptions. Our future results may differ materially from those expressed in forward-looking statements. Many of the factors that will determine these results and values are beyond our ability to control or predict. All forward-looking statements and risk factors included in this prospectus are made as of the date on the front cover of this prospectus, based on information available to us as of such date, and we assume no obligation to update any forward-looking statement or risk factor.

iv

PRESENTATION OF FINANCIAL AND OTHER INFORMATION

Throughout this prospectus, unless the context otherwise requires, the terms "we," "us," "our," "the Company" and "Homex" refer to Desarrolladora Homex, S.A. de C.V. and its subsidiaries, excluding Controladora Casas Beta, S.A. de C.V. and its subsidiaries, which we acquired through a merger on July 1, 2005. In this prospectus, Controladora Casas Beta, S.A. de C.V. is sometimes referred to as "Beta."

Financial Information

This prospectus includes, beginning on page F-1, our audited consolidated financial statements as of December 31, 2003 and 2004 and for each of the three years ended December 31, 2002, 2003 and 2004. This prospectus also includes, beginning on page F-51, our unaudited condensed consolidated financial statements as of June 30, 2005 and for the six-month periods ended June 30, 2004 and 2005. Our consolidated financial statements and other financial information included in this prospectus, unless otherwise specified, are restated in constant pesos as of June 30, 2005.

This prospectus also includes, beginning on Page A-1, Beta's audited consolidated financial statements as of December 31, 2003 and 2004 and for each of the three years ended December 31, 2002, 2003 and 2004 and Beta's unaudited condensed consolidated financial statements as of June 30, 2005 and for the six-month periods ended June 30, 2004 and 2005. We acquired Beta on July 1, 2005, as further described under "Prospectus Summary—Recent Developments" in this prospectus.

Also included in this prospectus, beginning on Page B-1, are unaudited pro forma condensed combined financial statements reflecting the combined accounts of Homex and Beta on a pro forma basis for the year ended December 31, 2004 and as of and for the six-month period ended June 30, 2005. All such pro forma financial statements are unaudited and may not be indicative of the results of operations that actually would have been achieved had we acquired Beta at the beginning of the periods presented and do not purport to be indicative of future results.

On October 27, 2005, we announced our unaudited results of operations for the nine months ended September 30, 2005. For a description of these unaudited results, see Exhibit I beginning on page I-1. Since the unaudited financial information set forth in Exhibit I is presented in pesos of constant purchasing power as of September 30, 2005, it is not directly comparable to the financial information presented elsewhere in this prospectus, which unless otherwise stated, is presented in pesos of constant purchasing power as of June 30, 2005. The financial information presented elsewhere in this prospectus stated in pesos of constant purchasing power as of June 30, 2005 would require the application of a restatement factor of 1.007 for such financial information to be comparable with the unaudited financial information presented in Exhibit I. The application of such factor does not represent a material change in the purchasing power of the Mexican peso during this period.

We and Beta prepare our respective financial statements in constant pesos and in accordance with accounting principles generally accepted in Mexico, referred to as Mexican GAAP, which differ in certain significant respects from accounting principles generally accepted in the United States, referred to as U.S. GAAP. See Notes 22 and 23 to our audited consolidated financial statements, and Notes 5 and 6 to our unaudited condensed consolidated financial statements, Notes 17 and 18 to Beta's audited consolidated financial statements and Notes 5 and 6 to Beta's unaudited condensed consolidated financial statements for information relating to the nature and effect of such differences and for a quantitative reconciliation of our majority net income and majority stockholders' equity according to Mexican GAAP to consolidated net income and consolidated stockholders' equity according to U.S. GAAP.

Under Bulletin B-10, issued by the Mexican Institute of Public Accountants, we and Beta are required to present our respective financial information in inflation-adjusted monetary units to allow for more accurate comparisons of financial line items over time and to mitigate the distortive effects of inflation on our financial statements. Unless otherwise indicated, all financial information in this

v

prospectus has been restated in pesos of constant purchasing power as of June 30, 2005. The Mexican National Consumer Price Index, or NCPI, increased 0.8% from December 31, 2004 to June 30, 2005.

We and Beta are also required to determine any gain or loss in our respective monetary positions to reflect the effect of inflation on monetary assets and liabilities under Mexican GAAP. This is done by subtracting monetary liabilities from monetary assets and then adjusting net monetary position by the appropriate inflation rate for the period with the resulting monetary gain or loss reflected in earnings.

Pursuant to Mexican GAAP, we recognize revenues from the sale of homes based on the percentage of completion method of accounting, which requires us to recognize revenues as we incur the cost of construction. In this prospectus, we use "sell" and refer to homes "sold" in connection with homes where:

- •

- we establish that the home buyer will obtain the required financing from the mortgage lender;

- •

- the home buyer has submitted all required documents in order to obtain financing from the mortgage lender;

- •

- the home buyer has signed a purchase agreement (contrato de promesa de compra-venta); and

- •

- the home buyer has made a down payment, if a down payment is required.

We use "deliver" and refer to homes "delivered" in connection with homes for which title has passed to the buyer and for which we have received the sale proceeds.

Currency Information

Unless otherwise specified, references to "US$," "U.S. dollars" and "dollars" are to the lawful currency of the United States. References to "Ps." and "pesos" are to the lawful currency of Mexico. References to "UDI" and "UDIs" are to Unidades de Inversión, units of account whose value in pesos is indexed to inflation on a daily basis by Banco de México, Mexico's central bank and published periodically.

This prospectus contains translations of various peso amounts into U.S. dollars at specified rates solely for the convenience of the reader. You should not construe these translations as representations that the peso amounts actually represent these U.S. dollar amounts or could be converted into U.S. dollars at the rate indicated. Unless otherwise indicated, we have translated U.S. dollar amounts in this prospectus at the exchange rate of Ps.10.7720 to US$1.00, which was the noon buying rate for cable transfers in pesos published by the Federal Reserve Bank of New York, expressed in pesos per U.S. dollar, on June 30, 2005. On January 17, 2006, such noon buying rate was Ps.10.547 to US$1.00.

Unless otherwise indicated, references to UDIs are to UDIs at the Banco de México UDI conversion rate of Ps.3.56 to UDI 1.00 on June 30, 2005. On January 17, 2006, Banco de México's UDI conversion rate was Ps.3.653 to US$1.00.

Industry And Market Data

Market data and other statistical information used throughout this prospectus are based on independent industry publications, government publications, reports by market research firms or other published independent sources. Some data are also based on our estimates, which are derived from our review of internal surveys, as well as independent sources. Although we believe these sources are reliable, we have not independently verified the information and cannot guarantee its accuracy or completeness.

Other Information Presented

The standard measure of area in the real estate market in Mexico is the square meter (m2). Unless otherwise specified, all units of area shown in this prospectus are expressed in terms of square meters, acres or hectares. One square meter is equal to approximately 10.764 square feet. Approximately 4,047 square meters (or 43,562 square feet) are equal to one acre and one hectare is equal to 10,000 square meters (or approximately 2.5 acres).

vi

"Affordable entry-level homes" refers to housing developed by us in Mexico with a sales price per unit between Ps.165,000 and Ps.400,000.

"Canadevi" means Cámara Nacional de la Industria de Desarrollo y Promoción de la Vivienda, the Mexican Home Building and Development Industry Chamber of Commerce, previously known as Provivac.

"Conafovi" means Comisión Nacional de Fomento a la Vivienda, the Housing Development Agency.

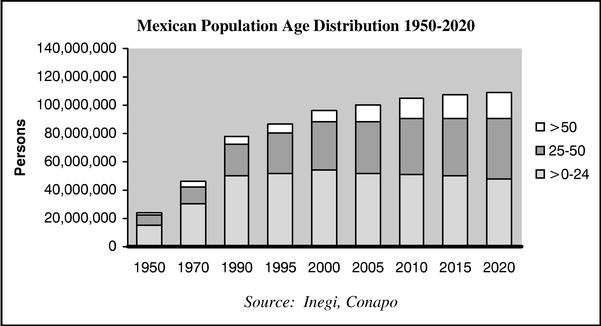

"Conapo" means Consejo Nacional de Población, the Mexican Population Council.

"Fividesu" means Fideicomiso para Promover y Realizar Programas de Vivienda y Desarrollo Social y Urbano, the Mexican Housing and Social and Urban Development Trust Fund.

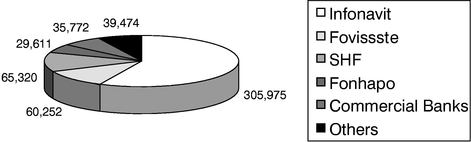

"Fonhapo" means Fideicomiso Fondo Nacional de Habitaciones Populares, the Mexican Fund for Popular Housing.

"Fovissste" means the Fondo de la Vivienda del Instituto de Seguridad y Servicios Sociales de los Trabajadores del Estado, the Mexican Social Security and Services Institute of the Public-Sector Workers' Housing Fund.

"Inegi" means Instituto Nacional de Estadística, Geografía e Informática, the Mexican Institute of Statistics, Geography and Computer Sciences.

"Infonavit" means the Instituto del Fondo Nacional de la Vivienda para los Trabajadores, the Mexican National Workers' Housing Fund Institute.

"Issfam" means Instituto de Seguridad Social para las Fuerzas Armadas Mexicanas, the Mexican Armed Forces Social Security Institute.

"Middle-income homes" refers to housing developed by us in Mexico with a sales price per unit between Ps.400,000 and Ps.1,300,000.

"Provivac" means Federación Nacional de Promotores Industriales de la Vivienda, the Mexican Federation of Industrial Housing Promoters, now known as Canadevi.

"Residential-level homes" refers to housing developed by us in Mexico with a sales price per unit of more than Ps.1,300,000.

"Sedesol" means Secretaría de Desarrollo Social, the Mexican Ministry of Social Development.

"SHF" means the Sociedad Hipotecaria Federal, S.N.C., Institución de Banca de Desarrollo, the Mexican Federal Mortgage Bank.

"Sofoles" means Sociedades Financieras de Objeto Limitado or limited purpose financial companies.

vii

A majority of our directors, executive officers and controlling persons reside outside of the United States; all or a significant portion of the assets of our directors, executive officers and controlling persons, and substantially all of our assets, are located outside of the United States and some of the experts named in this prospectus also reside outside of the United States. As a result, it may not be possible for you to effect service of process within the United States upon these persons or to enforce against them or us in U.S. courts judgments predicated upon the civil liability provisions of the federal securities laws of the United States. We have been advised by our Mexican counsel, Mijares, Angoitia, Cortés y Fuentes, S.C., that there is doubt as to the enforceability, in original actions in Mexican courts, of liabilities predicated solely on U.S. federal securities laws and as to the enforceability in Mexican courts of judgments of U.S. courts obtained in actions predicated upon the civil liability provisions of U.S. federal securities laws. See "Risk Factors—Risk Factors Related to Our Common Shares and ADSs—It May Be Difficult to Enforce Civil Liabilities Against Us or Our Directors, Executive Officers and Controlling Persons."

viii

You should read the following summary together with the information set forth under the heading "Risk Factors" and in our audited year-end financial statements and the accompanying notes, which are included in this prospectus.

Throughout this prospectus, unless specified otherwise or unless the context otherwise requires, the terms "we," "us," "our," "the Company," and "Homex" refer to Desarrolladora Homex, S.A. de C.V., and its subsidiaries, excluding Controladora Casas Beta, S.A. de C.V. and its subsidiaries, which we acquired through a merger on July 1, 2005. In this prospectus, Controladora Casas Beta, S.A. de C.V. is sometimes referred to as "Beta."

We are a vertically-integrated home development company specializing in affordable entry-level and middle-income housing in Mexico. During 2004 we sold 21,053 homes, an increase of 57.2% over 2003, and during the six-month period ended June 30, 2005 we sold 10,536 homes, an increase of 30.3% over the same period in 2004. As of June 30, 2005 we had 52 developments under construction in 25 cities located in 17 Mexican states. We had total land reserves under title of approximately 10.4 million square meters as of June 30, 2005 on which we estimate we could build approximately 45,000 affordable entry-level homes and approximately 6,800 middle-income homes. As of June 30, 2005, we also had approximately 2.7 million square meters of land for which we had signed purchase agreements and made partial payment, and for which title was in the process of being transferred. We estimate that we could build approximately 12,000 affordable entry-level homes and 1,200 middle-income homes on this land.

Even before taking into account our recent acquisition of Beta described below, we believe that we have grown faster than the three other largest publicly traded Mexican home development companies over the past three-year period ended December 31, 2004, based on:

- •

- number of homes sold, reflected by our compounded annual growth rate of 70.9% versus a 6.0% average compounded annual growth rate for these other three companies;

- •

- revenues, reflected by our compounded annual growth rate of 97.8% versus a 10.3% average compounded annual growth rate for these other three companies; and

- •

- net income, reflected by our compounded annual growth rate of 369.8% versus a 23.5% average compounded annual growth rate for these other three companies.

In addition, we believe our geographic diversity is one of the strongest among home builders in Mexico, reflected by our operations as of June 30, 2005 in 25 cities located in 17 Mexican states. In addition, our sales are not concentrated in a limited number of areas, compared to our competitors, with only one city (Guadalajara) in which we operate providing approximately 23% of our revenues and no other city providing more than 10% of our revenues for the six-month period ended June 30, 2005.

Largest and fastest growing homebuilder in Mexico

- •

- We are the largest homebuilder in Mexico with 35,378 units sold in the last twelve months as of June 30, 2005

- •

- Over the past three years (excluding Beta) our units sold and EBITDA have grown at a compounded annual growth rate of 70.9% and 126.3%, respectively (56.8% and 110%, respectively, giving effect to the acquisition of Beta)

- •

- Beta's acquisition improved our regional platform and will allow us to continue delivering growth and profitability by expanding our presence, with minimum overlap, in key markets such as the State of Mexico, Monterrey and Tijuana

1

Geographically diversified

- •

- We believe that we are one of the most geographically diversified home development companies in Mexico with 66 developments in 25 cities across 17 Mexican states

- •

- Our geographic diversity reduces our risk profile as compared to our less-diversified competitors which allows us to withstand regional political and economic volatility

- •

- We offer both middle income and affordable entry level housing and we believe we are the number one homebuilder in terms of homes sold in approximately 60% of the cities where we currently operate

- •

- We are considering possible joint ventures outside of Mexico, which are not expected to be material. See "Business."

Standardized business processes

- •

- We have scalable and standardized business processes that allow us to enter new markets rapidly and efficiently while remaining one of the most profitable homebuilders in the industry

- •

- Over the past year, we have reduced by 50%, to approximately four months, the time it takes us to enter a new city as measured from the time we open the office to the time we close our first home sale

- •

- Our proprietary information technology systems integrate and monitor every aspect of our operations, including land acquisition, construction, payroll, purchasing, sales, quality control, financing, delivery, and maintenance

Efficient working capital management

- •

- Our standardized processes allow us to time home construction, delivery and supplier payments efficiently, reducing our borrowing needs and minimizing working capital requirements

- •

- Our inventory turnover (the time required to build and deliver a home) is less than ten weeks for affordable entry-level housing (four weeks using state-of-the-art mold technology) and less than fourteen weeks for middle-income housing using traditional block technology

Experienced and committed management team

- •

- Our current executives average 15 years of experience in their respective areas of responsibility

- •

- The Beta acquisition resulted in the addition of key seasoned management resources at the operating and administrative level

Strong corporate governance

- •

- We are the only SEC registered Mexican homebuilder listed on the NYSE

- •

- We have adopted a code of business conduct and ethics in accordance with the U.S. Sarbanes-Oxley Act of 2002 and applicable rules and regulations of the SEC and the New York Stock Exchange

2

Focus on high-growth and high-margin opportunities

- •

- We focus on identifying and targeting high-growth and high-margin opportunities, including expanding our presence in the middle-income sector

- •

- We seek to become the number one homebuilder in every city where we operate and to enter underserved markets quickly and efficiently to take advantage of increased availability of public and private sector mortgage financing

Maintain appropriate and balanced land reserves

- •

- We maintain land reserves for a minimum of 24 to 30 months of future home deliveries, balancing our need for additional land for growth with our desire to minimize leverage and avoid excessive land inventory

- •

- We generally purchase large parcels of land to amortize acquisition and infrastructure costs over a large number of homes, minimize competition, and create economies of scale

Maintain conservative financial structure

- •

- We aim to minimize our leverage in order to reduce our exposure to interest rate and financing risk

- •

- By requiring mortgage approval before commencing construction, we reduce our working capital needs, thereby enhancing our financial flexibility and our ability to respond quickly to market opportunities

Build successful communities

- •

- We foster brand loyalty and enhance the quality and value of our communities by donating public facility buildings, such as schools, day care facilities, parks, and churches, and by providing social services to residents

- •

- Our goal is to become the best employer to our employees, in part by providing training and educational opportunities, and the best customer to our suppliers by offering payment alternatives and opportunities for cooperative growth

Desarrolladora Homex, S.A. de C.V. is a sociedad anónima de capital variable, a limited liability stock corporation organized under the laws of the United Mexican States. Our principal executive offices are located at Andador Javier Mina 891-B, Colonia Centro Sinaloa, 80200 Culiacán, Sinaloa, México. Our telephone number at that address is (52 667) 758-5800.

The following are significant developments since December 31, 2004:

Management Changes

On December 29, 2005, our Compensation Committee announced the appointment of Mario Alberto Gonzalez Padilla as our Chief Financial Officer effective January 30, 2006. Mr. Gonzalez replaces Roberto Carrillo Herrera who has continued to serve in an interim capacity while we searched for a new CFO. Mr. Carrillo was the CFO of Beta prior to our acquisition of Beta and has contributed to the integration of the operations of the two companies. Mr. Carrillo will remain employed by the

3

Company until the end of January in order to help in the transition of the new CFO. See "Management—Management Changes"

Acquisition of Controladora Casas Beta, S.A. de C.V.

On July 1, 2005, we acquired Beta, which prior to its acquisition by us, was the sixth-largest homebuilder in Mexico measured by units sold in 2004. After giving effect to the acquisition, we believe we are now the largest homebuilder in Mexico in terms of operating income on a pro forma basis for 2004.

We believe that our acquisition of Beta will provide significant economies of scale and further expand our geographic reach. Together with Beta, we believe we now have approximately a 7.8% share of the Mexican housing market in terms of units sold in 2004. Our Beta acquisition also strengthens our presence in the top four Mexican home-building markets: Estado de México, Guadalajara, Monterrey and Tijuana.

As of June 30, 2005, Beta had 12 developments under construction in Estado de México, Nuevo León, Baja California and Mexico City, areas that together represent approximately 28.7% of the population of Mexico. Additionally, as of such date, Beta had land reserves under title of approximately 4.6 million square meters, with an estimated capacity to build approximately 23,300 affordable entry-level houses and 6,200 middle-income homes. As of June 30, 2005, Beta was in the process of acquiring additional land of approximately 870,000 square meters, with an estimated capacity to build approximately 6,200 affordable entry-level homes.

The purchase price for Beta was approximately Ps.2,041.5 million (US$188.9 million). The acquisition of Beta involved the purchase of 53.0% of Beta's stock for approximately Ps.1,063.9 million (US$98.4 million) in cash and the purchase of the remaining 47.0% of Beta's stock in exchange for 22.0 million of our common shares valued at Ps.977.6 million (US$90.5 million). On the date of the acquisition, we incurred acquisition financing of Ps.1,081.0 million (US$100.4 million). Following the acquisition, Beta was merged into Homex, with Homex being the surviving entity. As a result of the Beta acquisition, former Beta shareholders own approximately 6.6% of Homex's capital stock.

Beta was a housing development company located in the Mexico City area that focused on affordable entry-level and middle-income housing. During 2004, Beta sold 11,055 homes, an increase of 79.5% over 2003 and during the six-month period ended June 30, 2005, Beta sold 5,846 homes, an increase of 16.4% over the same period in 2004.

For the year ended December 31, 2004, Beta had revenues of Ps.2,497.7 million (US$231.9 million), an increase of 51.4% from the previous year. Its revenues for the six-month period ended June 30, 2005 were Ps.1,240.1 million (US$115.1 million), an increase of 19.3% over the same period in 2004. For 2004, 97.0% of Beta's revenue was attributable to affordable entry-level home sales, with 3.0% of revenue attributable to sales of residential-level homes. For the six-month period ended June 30, 2005, 100% of Beta's revenue was attributable to affordable entry-level home sales.

For the year ended December 31, 2004, Beta had operating income of Ps.498.4 million (US$46.3 million), an increase of 132.4% from the previous year. Its operating income for the six-month period ended June 30, 2005 was Ps.197.1 million (US$18.3 million), an increase of 27.5% over the same period in 2004.

For the year ended December 31, 2004, Beta had net income of Ps.331.0 million (US$30.7 million), an increase of 185.5% from the previous year. Its net income for the six-month period ended June 30, 2005 was Ps.152.7 million (US$14.2 million), an increase of 57.4% over the same period in 2004.

4

At December 31, 2004, Beta had total indebtedness of Ps.478.3 million (US$44.5 million), an increase of 68.1% compared to December 31, 2003. Its total indebtedness at June 30, 2005 was Ps.612.2 million (US$56.8 million), an increase of 28.0% compared to June 30, 2004.

The following table sets forth certain historical and pro forma information that we believe illustrates important contributions we expect the acquisition of Beta will make to our operations. The pro forma information shows the combined companies as if our acquisition of Beta had taken place as of January 1, 2004 and conforms certain of Beta's financial information to our accounting policies. As such, the pro forma information differs from a simple addition of Homex and Beta figures. See "Presentation of Financial and Other Information—Financial Information."

| | Homex 2004 | Pro Forma 2004(1) | Homex Six Months Ended June 30, 2005 | Pro Forma Six Months Ended June 30, 2005(1) | ||||

|---|---|---|---|---|---|---|---|---|

| | (thousands of pesos except homes sold) | |||||||

| Revenues | 5,369,428 | 7,720,212 | 2,863,328 | 4,079,188 | ||||

| Income from Operations | 1,192,749 | 1,620,010 | 616,501 | 813,634 | ||||

| Net Income | 723,181 | 856,867 | 390,797 | 455,275 | ||||

| Homes Sold | 21,053 | 32,108 | 10,536 | 16,382 | ||||

- (1)

- Pro forma information is derived from the Unaudited Pro Forma Condensed Combined Financial Statements that begin on page B-1 of this prospectus.

For a further discussion of our acquisition of Beta, see "Business—Recent Developments—Acquisition of Controladora Casas Beta, S.A. de C.V." Additionally, Beta's recent financial statements as of and for the years ended December 31, 2002, 2003 and 2004 and as of June 30, 2005 and for the six-month periods ended June 30, 2004 and 2005 are included in this prospectus beginning on page A-1. Unaudited pro forma condensed combined financial statements reflecting the combined accounts of Homex and Beta on a pro forma basis for the year ended December 31, 2004 and as of and for the six-month period ended June 30, 2005 are also included in this prospectus, beginning on page B-1.

For a further discussion of our acquisition of Beta, see "Business—Recent Developments—Acquisition of Controladora Casas Beta, S.A. de C.V."

Note Offering and Exchange Offering

On September 28, 2005, we consummated our offering of US$250 million aggregate principal amount of 7.50% Senior Guaranteed Notes due September 28, 2015, the "September 2005 Note Offering." The Senior Guaranteed Notes were entitled to registration rights. Pursuant to the registration rights agreement covering the Senior Guaranteed Notes, we will commence an exchange offer substantially contemporaneously with this offering whereby the 7.50% Senior Guaranteed Exchange Notes due 2015 were registered and offered in exchange for the 7.50% Senior Guaranteed Notes. The terms of the registered Senior Guaranteed Exchange Notes are more fully described in our 2005 Form F-4.

Third Quarter Results

On October 27, 2005, we announced our unaudited results of operations for the nine months ended September 30, 2005. For a description of these unaudited results, see Exhibit I beginning on page I-1. Financial information in Exhibit I is presented in pesos of purchasing power as of September 30, 2005. Since the unaudited financial information set forth in Exhibit I is presented in pesos of constant purchasing power as of September 30, 2005, it is not directly comparable to the financial information presented elsewhere in this prospectus, which unless otherwise stated, is presented in pesos of constant purchasing power as of June 30, 2005. The financial information presented elsewhere in this prospectus stated in pesos of constant purchasing power as of June 30, 2005 would require the application of a restatement factor of 1.007 for such financial information to be comparable with the unaudited financial information presented in Exhibit I. The application of such factor does not represent a material change in the purchasing power of the Mexican peso during this period.

5

| Issuer | Desarrolladora Homex, S.A. de C.V. | |

Offering price per ADS | ||

Offering price per common share | ||

Selling shareholders | EIP Investment Holdings LLC BVBA, Eugenia Guakil Aben, Estrella Dabah Kanan and Elaine Sandra Klineberg Craster. | |

Common shares offered | 40,491,106 | |

International offering | The selling shareholders are offering an aggregate of common shares or ADSs representing common shares, in the United States and other countries outside of Mexico, principally in Canada and countries of the European Union. | |

Mexican offering | Simultaneously with the international offering, the selling shareholders are offering an aggregate of common shares in a public offering in Mexico. | |

ADSs | Each ADS represents six common shares. The ADSs will be evidenced by American Depositary Receipts, or ADRs, issued by the depositary. ADRs are certificates that evidence ADSs, just as share certificates evidence a holding of shares in a company. Please see "Description of American Depositary Receipts" for further information. | |

Trading market for common shares | The common shares are listed on the Mexican Stock Exchange under the symbol "HOMEX." | |

Trading market for ADSs | The ADSs are listed on the New York Stock Exchange under the symbol "HXM." | |

Use of proceeds | We will not receive any proceeds from the sale of common shares. The selling shareholders will receive all of the net proceeds from the sale of the ADSs and common shares. | |

Depositary | JPMorgan Chase Bank | |

Over-allotment options | The selling shareholders will offer up to an additional 5,671,954 common shares, or the equivalent in ADSs, if the underwriters exercise their over-allotment option in full. | |

Expected offering timetable | Marketing commenced: January 9, 2006 Expected pricing date: January , 2006 Expected closing date: January , 2006 | |

Settlement | Settlement of the common shares will be made on January , 2006 through the book-entry system of S.D. Indeval, S.A. de C.V., Institución para el Depósito de Valores, or INDEVAL. Settlement of the ADSs will be made through the book-entry system of The Depository Trust Company, or DTC. | |

Lock-up provision | We, our officers and directors, the selling shareholders and our other principal shareholders have agreed that, for a period of 180 days from the date of this prospectus, we and they will not, without the prior written consent of the representative of the underwriters, dispose of or hedge any common shares or any securities convertible into or exchangeable for our common shares. The representative of the underwriters, in its sole discretion, may release any of the securities subject to these lock-up agreements at any time without notice. Please see "Underwriting" for more information. | |

6

Voting Rights | Each common share will entitle the holder to one vote at any shareholders' meeting. ADS holders may instruct the depositary how to exercise the voting rights of the shares represented by the ADSs. For the benefit of ADS holders, we have agreed to notify the depositary of any shareholders' meetings, and the depositary has agreed to mail notices of these meetings to ADS holders and explain the procedures necessary to exercise voting rights. Please see "Description of American Depositary Receipts" and "Description of Capital Stock" of this prospectus for a discussion of the depositary's role, our agreement with the depositary and your voting rights. | |

Dividend Policy | We have not paid dividends since we were formed and we do not currently expect to pay dividends. Please see "Dividends and Dividend Policy" for further information. | |

Taxation | Under current Mexican law, dividends paid to holders who are not residents of Mexico for tax purposes, and sales of ADSs by ADS holders who are not residents of Mexico for tax purposes, are not subject to any Mexican withholding or other similar tax. Please see "Taxation" of this prospectus for a discussion of Mexican tax issues related to payment of dividends and disposition of the common shares or ADSs. |

7

Summary Consolidated Financial Information

The following tables present our summary consolidated financial information as of and for the periods indicated. The information presented in these tables does not include our Beta subsidiary, which we acquired on July 1, 2005. Information as of December 31, 2003 and 2004 and for each of the three years ended December 31, 2002, 2003 and 2004 are derived from and should be read together with our audited consolidated financial statements provided in this prospectus beginning on page F-1. The information as of June 30, 2005 and for each of the six-month periods ended June 30, 2004 and 2005 are derived from our unaudited condensed consolidated financial statements provided in this prospectus beginning on page F-51 and should be read together with both such unaudited consolidated financial statements and our audited consolidated financial statements. The information in the following tables should also be read together with "Management's Discussion and Analysis of Financial Condition and Results of Operations."

Our consolidated financial statements are prepared in accordance with Mexican GAAP, which differs in certain significant respects from U.S. GAAP. See Notes 22 and 23 to our audited consolidated financial statements for information relating to the nature and effect of such differences and for a quantitative reconciliation of our majority net income and majority stockholders' equity according to Mexican GAAP to consolidated net income and consolidated stockholders' equity according to U.S. GAAP.

Pursuant to Mexican GAAP, our consolidated financial statements and the summary consolidated financial data set forth below restate the components of stockholders' equity using NCPI factors and record gains and losses in purchasing power from holding monetary assets or liabilities. Under Mexican GAAP, non-monetary assets, with the exception of inventories and fixed assets of non-Mexican origin, are restated using the NCPI factors. Inventories are restated at current replacement costs while fixed assets of foreign origin are restated by the inflation rate of the country of origin prior to translation to pesos at the period-end exchange rate. Mexican GAAP also requires restatement of all financial statements to pesos of constant purchasing power as of the date of the most recent balance sheet presented, and accordingly all data in the consolidated financial statements and in the summary consolidated financial data set forth below have been restated in pesos of constant purchasing power as of June 30, 2005. The effects of inflation accounting under Mexican GAAP, other than for the use of a specific index for the restatement of fixed assets of foreign origin, have not been reversed in the reconciliation to U.S. GAAP. See Notes 22 and 23 to our consolidated financial statements.

On May 15, 2004, one of our affiliates, Econoblock, S.A. de C.V., merged with one of our subsidiaries, Desarrolladora de Casas del Noroeste, S.A. de C.V., or DECANO, with DECANO assuming all the rights and obligations of the merged company. Because the companies were under common control, the merger was recorded by recognizing the assets and liabilities transferred at their carrying amounts in the accounts of the transferring entity at the date of transfer, in a manner similar to a pooling of interests, based on the guidance provided by Statement of Financial Accounting Standards No. 141, "Business Combinations," issued by the Financial Accounting Standards Board, and in accordance with Bulletin A-8, "Supplemental Application of International Accounting Standards" issued by the Mexican Institute of Public Accountants. Therefore, the accompanying financial statements of the merged company are included as if the merger had taken place as of the beginning of the earliest period presented. See Note 2 to our consolidated financial statements.

For unaudited selected consolidated financial information as of and for the nine month periods ended September 30, 2004 and 2005, and a discussion of our unaudited financial results for the nine month periods ended September 30, 2004 and 2005, which are presented in pesos of constant purchasing power as of September 30, 2005, see Exhibit I to this prospectus. Since the unaudited financial information set forth in Exhibit I is presented in pesos of constant purchasing power as of September 30, 2005, it is not directly comparable to the financial information presented elsewhere in

8

this prospectus, which unless otherwise stated, is presented in pesos of constant purchasing power as of June 30, 2005. The financial information presented elsewhere in this prospectus stated in pesos of constant purchasing power as of June 30, 2005 would require the application of a restatement factor of 1.007 for such financial information to be comparable with the unaudited financial information presented in Exhibit I. The application of such factor does not represent a material change in the purchasing power of the Mexican peso during this period. The financial information in our 2004 Form 20-F, which is incorporated herein, is presented in pesos of constant purchasing power as of December 31, 2004.

Except for ratios, percentages, per share, per ADS, and operating data, all amounts are presented in thousands of U.S. dollars or constant pesos. Unless otherwise indicated, we have translated U.S. dollar amounts at the exchange rate of Ps.10.7720 to US$1.00, which was the noon buying rate for cable transfers in pesos published by the Federal Reserve Bank of New York, expressed in pesos per U.S. dollar, on June 30, 2005. On January 17, 2006, the noon buying rate for pesos was Ps.10.547 to US$1.00.

For additional information regarding financial information presented in this prospectus, see "Presentation of Financial and Other Information."

Homex Summary Consolidated Financial Information

| | Six Months Ended June 30, | Year Ended December 31, | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | 2005(1) | 2005(1) | 2004(1) | 2004 | 2004 | 2003 | 2002 | ||||||||

| | (US$) | (Ps.) | (Ps.) | (US$) | (Ps.) | (Ps.) | (Ps.) | ||||||||

| | (in thousands, except per share/ADS data, percentages and ratios) | ||||||||||||||

| Statement of operations data: | |||||||||||||||

| Mexican GAAP: | |||||||||||||||

| Revenues(2) | 265,812 | 2,863,328 | 1,990,806 | 498,462 | 5,369,428 | 2,942,067 | 1,372,113 | ||||||||

| Costs | 183,145 | 1,972,835 | 1,363,267 | 347,077 | 3,738,718 | 2,104,408 | 961,584 | ||||||||

| Gross profit | 82,667 | 890,493 | 627,539 | 151,385 | 1,630,710 | 837,659 | 410,529 | ||||||||

| Selling and administrative expenses | 25,436 | 273,992 | 186,586 | 40,657 | 437,961 | 269,526 | 169,330 | ||||||||

| Income from operations | 57,232 | 616,501 | 440,953 | 110,728 | 1,192,749 | 568,133 | 241,199 | ||||||||

| Other income (expense) | 1,544 | 16,623 | 46,221 | 4,037 | 43,486 | 78,668 | (1,785 | ) | |||||||

| Net comprehensive financing cost(3) | 6,363 | 68,545 | 57,366 | 14,972 | 161,286 | 128,907 | 150,880 | ||||||||

| Income before income tax and employee statutory profit-sharing expense | 52,412 | 564,579 | 429,808 | 99,793 | 1,074,949 | 517,894 | 88,534 | ||||||||

| Income tax expense | 16,133 | 173,782 | 133,192 | 31,859 | 343,157 | 185,269 | 54,185 | ||||||||

| Employee statutory profit-sharing expense | — | — | 1,501 | 799 | 8,611 | 279 | 1,580 | ||||||||

| Consolidated net income | 36,279 | 390,797 | 295,115 | 67,135 | 723,181 | 332,346 | 32,770 | ||||||||

| Net income of majority stockholders | 36,655 | 394,849 | 295,875 | 66,285 | 714,022 | 326,987 | 31,390 | ||||||||

| Net income (loss) of minority stockholders | (376 | ) | (4,052 | ) | (760 | ) | 850 | 9,159 | 5,359 | 1,380 | |||||

| Weighted average shares outstanding | 313,856 | 313,856 | 249,962 | 281,997 | 281,997 | 241,521 | 191,896 | ||||||||

| Basic and diluted earnings per share | 0.12 | 1.26 | 1.18 | 0.23 | 2.53 | 1.35 | 0.16 | ||||||||

| Basic and diluted earnings per ADS(4) | 0.72 | 7.56 | 7.08 | 1.38 | 15.18 | 8.10 | 0.96 | ||||||||

U.S. GAAP: | |||||||||||||||

| Revenues(2) | 225,457 | 2,428,624 | 1,314,253 | 370,140 | 3,987,147 | 2,752,825 | 1,230,640 | ||||||||

| Costs | 169,534 | 1,826,220 | 993,008 | 279,017 | 3,005,574 | 2,111,305 | 973,826 | ||||||||

| Gross profit | 55,923 | 602,404 | 321,245 | 91,123 | 981,573 | 641,520 | 256,814 | ||||||||

| Operating income(5)(6) | 29,969 | 322,823 | 122,694 | 48,984 | 527,660 | 371,670 | 87,107 | ||||||||

| Net income | 24,771 | 266,837 | 147,645 | 39,605 | 426,628 | 248,918 | 65,000 | ||||||||

| Weighted average shares outstanding | 313,856 | 313,856 | 249,962 | 281,997 | 281,997 | 241,521 | 191,896 | ||||||||

| Basic and diluted earnings per share | 0.08 | 0.85 | 0.59 | 0.14 | 1.51 | 1.03 | 0.34 | ||||||||

| Basic and diluted earnings per ADS(4) | 0.47 | 5.10 | 3.54 | 0.84 | 9.08 | 6.18 | 2.03 | ||||||||

9

| | As of and for Six Months Ended June 30, | As of and for Year Ended December 31, | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | 2005 | 2005(1) | 2004(1) | 2004 | 2004 | 2003 | 2002 | ||||||||

| | (US$) | (Ps.) | (Ps.) | (US$) | (Ps.) | (Ps.) | (Ps.) | ||||||||

| | (in thousands, except for percentages and ratios) | ||||||||||||||

| Balance sheet data: | |||||||||||||||

| Mexican GAAP: | |||||||||||||||

| Cash and temporary investments | 37,649 | 405,555 | 47,948 | 516,500 | 222,458 | 69,349 | |||||||||

| Trade accounts receivable | 351,139 | 3,782,471 | 297,415 | 3,203,752 | 1,864,249 | 1,283,045 | |||||||||

| Total current assets | 620,467 | 6,683,669 | 552,674 | 5,953,400 | 3,142,448 | 1,724,579 | |||||||||

| Land held for future development | 61,554 | 663,065 | 47,279 | 509,294 | 242,443 | 88,742 | |||||||||

| Property and equipment | 24,250 | 261,219 | 23,586 | 254,072 | 57,863 | 27,385 | |||||||||

| Total assets | 712,960 | 7,680,001 | 635,506 | 6,845,673 | 3,488,320 | 1,851,107 | |||||||||

| Notes payable to financial institutions | 103,727 | 1,117,348 | 37,252 | 401,276 | 679,079 | 421,390 | |||||||||

| Total current liabilities | 252,633 | 2,721,352 | 204,921 | 2,207,402 | 1,749,362 | 703,927 | |||||||||

| Long-term notes payable to financial institutions | 4,379 | 47,167 | 15,020 | 161,800 | — | — | |||||||||

| Land purchases—long-term | 1,885 | 20,300 | — | — | |||||||||||

| Total long-term liabilities | 69,772 | 751,577 | 76,309 | 821,996 | 359,176 | 200,719 | |||||||||

| Total liabilities | 322,405 | 3,472,929 | 281,230 | 3,029,398 | 2,108,538 | 904,646 | |||||||||

| Common stock | 20,367 | 219,398 | 20,367 | 219,398 | 175,096 | 169,150 | |||||||||

| Total stockholders' equity | 390,555 | 4,207,072 | 354,276 | 3,816,275 | 1,379,782 | 946,460 | |||||||||

U.S. GAAP: | |||||||||||||||

| Cash and cash equivalents | 37,649 | 405,555 | 47,948 | 516,500 | 222,458 | 69,622 | |||||||||

| Restricted cash | — | — | 10,921 | 20,692 | — | — | |||||||||

| Accounts receivable | 83,708 | 901,702 | 67,471 | 726,793 | 587,595 | 188,953 | |||||||||

| Total current assets | 540,030 | 5,817,205 | 520,298 | 5,604,654 | 2,875,696 | 1,549,906 | |||||||||

| Land held for future development | 61,554 | 663,065 | 47,279 | 509,294 | 238,683 | 88,741 | |||||||||

| Property and equipment | 24,250 | 261,219 | 23,586 | 254,072 | 57,910 | 27,385 | |||||||||

| Total assets | 639,769 | 6,891,587 | 603,131 | 6,496,927 | 3,210,139 | 1,676,435 | |||||||||

| Total current liabilities | 302,244 | 3,255,771 | 277,475 | 2,988,964 | 2,033,375 | 854,923 | |||||||||

| Total stockholders' equity | 331,146 | 3,531,635 | 303,082 | 3,264,798 | 1,130,257 | 816,266 | |||||||||

Other financial data: | |||||||||||||||

| Mexican GAAP: | |||||||||||||||

| Depreciation | 2,402 | 25,877 | 5,058 | 2,274 | 24,498 | 11,182 | 6,843 | ||||||||

| Gross margin(7) | 31.1 | % | 31.1 | % | 31.5 | % | 30.4 | % | 30.4 | % | 29.9 | % | 29.5 | % | |

| Operating margin(8) | 21.5 | % | 21.5 | % | 22.1 | % | 22.2 | % | 22.2 | % | 19.3 | % | 17.6 | % | |

| Net margin(9) | 13.8 | % | 13.8 | % | 14.9 | % | 13.3 | % | 13.3 | % | 11.1 | % | 2.3 | % | |

| Other financial data computed from Mexican GAAP financial information: | |||||||||||||||

| EBITDA(10) | 61,177 | 659,001 | 492,232 | 117,038 | 1,260,733 | 657,983 | 246,257 | ||||||||

| Net debt(11) | 70,457 | 758,960 | 4,324 | 46,576 | 456,620 | 352,041 | |||||||||

| Ratio of notes payable to financial institutions to total stockholders' equity | 27.7 | % | 27.7 | % | 15.3 | % | 15.3 | % | 49.2 | % | 44.5 | % | |||

| Ratio of notes payable to financial institutions to total assets | 15.2 | % | 15.2 | % | 8.5 | % | 8.5 | % | 19.5 | % | 22.8 | % | |||

U.S. GAAP: | |||||||||||||||

| Gross margin(7) | 24.8 | % | 24.8 | % | 24.6 | % | 24.6 | % | 23.3 | % | 20.9 | % | |||

| Operating margin(8) | 13.3 | % | 13.3 | % | 13.2 | % | 13.2 | % | 13.5 | % | 7.1 | % | |||

| Net margin(9) | 11.0 | % | 11.0 | % | 10.7 | % | 10.7 | % | 33.1 | % | 5.3 | % | |||

| Other financial data derived from U.S. GAAP financial information: | |||||||||||||||

| EBITDA(10) | 35,151 | 378,643 | 195,599 | 58,494 | 630,102 | 442,957 | 92,038 | ||||||||

- (1)

- Financial information as of and for the six-month periods ended June 30, 2004 and 2005 is unaudited. The financial information as of and for the years ended December 31, 2002, 2003 and 2004 have been derived from our audited consolidated financial statements.

- (2)

- For U.S. GAAP purposes, sales are recognized when title passes to the home buyer, as opposed to the percentage-of-completion method of accounting used for Mexican GAAP purposes, under which we recognize income from homes we sell as we incur the cost of their construction.

10

- (3)

- Represents interest income, interest expense, monetary position gains and losses, and foreign exchange gains and losses.

- (4)

- Assumes all common shares are represented by ADSs. Each ADS represents six common shares. Any discrepancies between per share and per ADS amounts in the table are due to rounding.

- (5)

- Employee statutory profit-sharing expense is classified as an operating expense under U.S. GAAP.

- (6)

- Interest capitalized as part of the cost of inventories is included in operating expense under U.S. GAAP.

- (7)

- Represents gross profit divided by total revenues.

- (8)

- Represents operating income divided by total revenues.

- (9)

- Represents net income divided by total revenues.

- (10)

- EBITDA is not a financial measure computed under Mexican or U.S. GAAP. EBITDA derived from our Mexican GAAP financial information means Mexican GAAP net income (loss) excluding (i) depreciation, (ii) net comprehensive financing costs (which is composed of net interest expense, foreign exchange gain or loss and monetary position gain or loss), and (iii) income tax expense and employee statutory profit-sharing expense.

- EBITDA derived from our U.S. GAAP financial information means U.S. GAAP net income excluding (i) depreciation, (ii) interest expense and monetary position gain or loss, and (iii) income tax expense.

- We believe that EBITDA can be useful to facilitate comparisons of operating performance between periods and with other companies in our industry because it excludes the effect of (i) depreciation, which represents a non-cash charge to earnings, (ii) certain financing costs, which are significantly affected by external factors, including interest rates, foreign currency exchange rates, and inflation rates, which have little or no bearing on our operating performance, and (iii) income tax expense and, for EBITDA derived from our Mexican GAAP financial information, employee statutory profit-sharing expense.

- EBITDA is also a useful basis of comparing our results with those of other companies because it presents operating results on a basis unaffected by capital structure. You should review EBITDA, along with net income (loss) and cash flow from operating activities, investing activities and financing activities, when trying to understand our operating performance. While EBITDA may provide a useful basis for comparison, our computation of EBITDA is not necessarily comparable to EBITDA as reported by other companies, as each is calculated in its own way and must be read in conjunction with the explanations that accompany it. While EBITDA is a relevant and widely used measure of operating performance, it does not represent cash generated from operating activities in accordance with Mexican or U.S. GAAP and should not be considered as an alternative to net income (loss), determined in accordance with Mexican or U.S. GAAP, as an indication of our financial performance, or to cash flow from operating activities, determined in accordance with Mexican or U.S. GAAP, as a measure of our liquidity, nor is it indicative of funds available to fund our cash needs.

- EBITDA has certain material limitations as follows: (i) it does not include interest expense, which, because we have borrowed money to finance some of our operations, is a necessary and ongoing part of our costs and assisted us in generating revenue; (ii) it does not include taxes, which are a necessary and ongoing part of our operations; and (iii) it does not include depreciation, which, because we must utilize property and equipment in order to generate revenues in our operations, is a necessary and ongoing part of our costs. Therefore, any measure that excludes any or all of interest expense, taxes and depreciation has material limitations. For further discussion of EBITDA, including a reconciliation to GAAP, see "Management's Discussion and Analysis of Financial Condition and Results of Operations—EBITDA Reconciliation."

- (11)

- Net debt is not a financial measure computed under Mexican GAAP. We compute net debt as the sum of all notes payable to financial institutions less cash and temporary investments, each of which is computed in accordance with Mexican GAAP. Management uses net debt as a measure of our total amount of leverage, as it gives effect to cash accumulated on our balance sheets. Management believes net debt provides useful information to investors because it reflects our actual debt as well as our available cash and temporary investments that could be used to reduce this debt. Net debt has certain material limitations in that it assumes the use of our cash and temporary investments to repay debt that is actually still outstanding and not to fund operating activities or for investment. For a reconciliation to GAAP, see "Management's Discussion and Analysis of Financial Condition and Results of Operations—EBITDA Reconciliation."

11

Homex Summary Operating Information

| | Six Months Ended June 30, | Year Ended December 31, | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | 2005 | 2004 | 2004 | 2003 | 2002 | ||||||||||||

| | (in thousands, except for percentages and ratios) | ||||||||||||||||

| Homes Sold | |||||||||||||||||

| Affordable entry-level | 9,284 | 7,645 | 19,141 | 12,933 | 7,206 | ||||||||||||

| Middle-income | 1,252 | 443 | 1,912 | 463 | — | ||||||||||||

| Total | 10,536 | 8,088 | 21,053 | 13,396 | 7,206 | ||||||||||||

| Affordable entry-level as percentage of homes sold | 88.1 | % | 94.5 | % | 90.9 | % | 96.5 | % | 100.0 | % | |||||||

| Middle-income as percentage of homes sold | 11.9 | % | 5.5 | % | 9.1 | % | 3.5 | % | — | ||||||||

| Total | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | |||||||

| Average Price | |||||||||||||||||

| Affordable entry-level | Ps. | 234 | Ps. | 225 | Ps. | 219 | Ps. | 205 | Ps. | 190 | |||||||

| Middle-income | 551 | 695 | 613 | 639 | — | ||||||||||||

| Weighted average | Ps. | 272 | Ps. | 246 | Ps. | 225 | Ps. | 255 | Ps. | 220 | |||||||

| Revenues | |||||||||||||||||

| Affordable entry-level | Ps. | 2,173,900 | Ps. | 1,682,934 | Ps. | 4,197,926 | Ps. | 2,646,226 | Ps. | 1,372,113 | |||||||

| Middle-income | 689,428 | 307,872 | 1,171,502 | 295,841 | — | ||||||||||||

| Total | Ps. | 2,863,328 | Ps. | 1,990,806 | Ps. | 5,369,428 | Ps. | 2,942,067 | Ps. | 1,372,113 | |||||||

| Affordable entry-level as percentage of all revenues | 75.9 | % | 84.5 | % | 78.2 | % | 89.9 | % | 100.0 | % | |||||||

| Middle-income homes as percentage of all revenues | 24.1 | 15.5 | 21.8 | 10.1 | — | ||||||||||||

| Total | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | |||||||

12

An investment in the securities involves risk. You should consider carefully the following factors, as well as all other information in this prospectus, before deciding to participate in the offering.

Risk Factors Related to Our Business

Decreases in the Amount of Mortgage Financing Provided by Mexican Government-Sponsored Agencies on which We Depend, or Disbursement Delays, Could Result in a Decrease in Our Sales and Revenues

The home building industry in Mexico has been and continues to be characterized by a significant shortage of mortgage financing. Historically, the limited availability of financing has restricted home building and contributed to the current shortage of affordable entry-level housing. Substantially all financing for affordable entry-level housing in Mexico is provided by government-sponsored housing funds such as:

- •

- the National Workers' Housing Fund Institute, or Infonavit (Instituto del Fondo Nacional para la Vivienda de los Trabajadores), which is financed primarily through mandatory contributions from the gross wages of private sector workers;

- •

- the Social Security and Services Institute Public Sector Workers' Housing Fund, or Fovissste (Fondo para la Vivienda y la Seguridad y Servicios Sociales para los Trabajadores del Estado), which is financed primarily through mandatory contributions from the gross wages of public sector workers; and

- •

- public mortgage providers such as the Federal Mortgage Society, or SHF (Sociedad Hipotecaria Federal, S.N.C., Institución de Banca de Desarrollo), which is financed through its own funds as well as funds provided by the World Bank and a trust managed by Banco de México.

See "Business—The Mexican Housing Market."

The amount of funding available and the level of mortgage financing from these sources is limited and may vary from year to year.

These government-sponsored entities have significant discretion in terms of the allocation and timing of disbursement of mortgage funds. We depend on the availability of mortgage financing provided by these government-sponsored entities for substantially all of our sales of affordable entry-level housing, which sales represented 78.2% of our revenues and 67.6% of our operating income for 2004 and 75.9% of our revenues and 53.8% of our operating income for the six-month period ended June 30, 2005.

Accordingly, our financial results are affected by policies and administrative procedures of Infonavit, Fovissste, and SHF, as well as by the Mexican government's housing policy. The availability of mortgage financing granted by these government-sponsored entities has increased significantly during the past four years as compared to historical levels. From 2001 through 2004, the amount of mortgage financing granted in terms of number of homes by these government-sponsored entities increased by 56.4% according to Softec, S.C. ("Softec"). However, future Mexican government housing finance policy may limit or delay the availability of mortgage financing provided by these agencies or otherwise institute changes, including changes in the methods by which these agencies grant mortgages and, in the case of Infonavit, the geographic allocation of mortgage financing, that could result in a decrease in our sales and revenues.

Additionally, in 2001 we experienced delays of up to three months in the disbursement of mortgage funds for homes that were financed by Infonavit. Due to the change in the presidential administration following the 2000 elections in Mexico and the resulting change in the administration of

13

Infonavit, the agency suspended processing mortgages pending the appointment of its new general director. Although we have not experienced delays of this magnitude since 2001, there is a possibility of delays at the end of 2006 and in early 2007 as a result of the upcoming 2006 presidential election. Disruptions in the operations of government-sponsored lenders, for any reason, may occur and result in a decrease in our sales and revenues.

Decreases or delays in the amount of funds available from Infonavit, Fovissste, SHF or other sources, or substantially increased competition for these funds, could result in a decrease in our sales and revenues. These funds may not continue to be allocated at their current levels or in regions in which we have or can quickly establish a significant presence.

A Slowdown in the Mexican Economy Could Limit the Availability of Private-Sector Financing in Mexico, on which We Depend for Our Sales of Middle-Income Housing, which Could Result in a Decrease in Our Sales and Revenues

One of our principal strategies is to expand our operations in the middle-income housing sector. Our expansion into this market depends on private sector lenders, such as commercial banks and Limited Purpose Financial Companies (Sociedades Financieras de Objeto Limitado, or "sofoles"), which provide a substantial majority of mortgage financing for the middle-income sector. The availability of private sector mortgage financing in Mexico has been severely constrained in the past as a result of volatile economic conditions in Mexico, the level of liquidity and stability of the Mexican banking system, and the resulting adoption of more stringent lending criteria and bank regulations. From 1995 through 2001, commercial bank mortgage lending was generally unavailable in Mexico. However, during the same period a number of sofoles were formed, serving the mostly middle-income market. Since 2002, private sector lenders have gradually increased their mortgage financing activities as a result of improved economic conditions and increasing consumer demand. However, it is possible that the amount of mortgage financing provided by private sector entities for the middle-income housing market will not increase or be maintained at current levels.

SHF Will Limit the Amount of Funding It Provides to Commercial Banks and Sofoles for Individual Mortgage Loans, which Could Result in a Decrease in Our Sales and Revenues

SHF is a public mortgage provider that makes financing available to commercial banks and sofoles for the purpose of providing individual home mortgages for affordable entry-level and middle-income homes. Historically, SHF has financed mortgages for amounts up to approximately UDI 500,000 (approximately US$166,000 as of June 30, 2005). Since January 1, 2005, however, SHF replaced its financing of mortgages for homes with a purchase price greater than UDI 150,000 (approximately US$50,000 as of June 30, 2005) with credit enhancements and loan guarantees for commercial banks and sofoles to support their capital-raising efforts for the financing of such individual home mortgages. Commercial banks and sofoles may not be able to raise enough capital to provide additional loans and to compensate for the reduced SHF funding and this reduction in SHF's funding of mortgages could result in a decrease in our sales and revenues.

We Experience Significant Seasonality in Our Results of Operations

The Mexican affordable entry-level housing industry experiences significant seasonality during the year, principally due to the operational and lending cycles of Infonavit and Fovissste. The programs, budgets, and changes in the authorized policies of these mortgage lenders are approved during the first quarter of the year. Payment by these lenders for home deliveries is slow at the beginning of the year and increases gradually through the second and third quarters with a rapid acceleration in the fourth quarter. We build and deliver affordable entry-level homes based on the seasonality of this cycle because we do not begin construction of these homes until a mortgage provider commits mortgage financing to a qualified home buyer in a particular development. Accordingly, we also tend to recognize

14

significantly higher levels of revenue in the third and fourth quarters and our debt levels tend to be highest in the first and second quarters. We anticipate that our quarterly results of operations and our level of indebtedness will continue to experience variability from quarter to quarter in the future.

We May Experience Difficulty in Finding Desirable Land Tracts or Increases in the Price of Land May Increase Our Cost of Sales and Decrease Our Earnings

Our continued growth depends in large part on our ability to continue to be able to acquire land and to do so at a reasonable cost. As more developers enter or expand their operations in the Mexican home building industry, land prices could rise significantly and suitable land could become scarce due to increased demand or decreased supply. A resulting rise in land prices may increase our cost of sales and decrease our earnings. We may not be able to continue to acquire suitable land at reasonable prices in the future.

Increases in the Price of Raw Materials May Increase Our Cost of Sales and Reduce Our Net Earnings

The basic raw materials used in the construction of our homes include concrete, concrete block, steel, bricks, windows, doors, roof tiles and plumbing fixtures. Increases in the price of raw materials, including increases that may occur as a result of shortages, duties, restrictions, or fluctuations in exchange rates, could increase our cost of sales and reduce our net earnings to the extent we are unable to increase our sales prices. It is possible that the prices of our raw materials will increase in the future.

Because We Recognize Income From Sales of Homes Under the Percentage-of-Completion Method of Accounting Before Receiving Cash Revenue, Failed Closings Could Result in a Shortfall of Actual Cash Received and Require an Adjustment to Revenue Previously Recorded

In accordance with Mexican GAAP, and consistent with industry practice in Mexico, we recognize income from the sale of homes based on the percentage-of-completion method of accounting, which in Mexico requires us to recognize income as we incur the cost of construction. See Note 3 to our consolidated financial statements for a discussion of the percentage-of-completion method. However, we do not receive the proceeds from these sales until the homes are delivered. As a result, there is a risk that revenue in respect of the income recognized for accounting purposes will not be received due to the failure of a sale to close. Historically, an immaterial amount of our home sales have failed to close.