UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

☑ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2020

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 1-33472

TECHTARGET, INC.

(Exact name of registrant as specified in its charter)

Delaware | 04-3483216 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

275 Grove Street

Newton, Massachusetts 02466

(Address of principal executive offices) (zip code)

(617) 431-9200

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Exchange Act:

Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

Common Stock, $0.001 Par Value | | TTGT | | Nasdaq Global Market |

Securities registered pursuant to Section 12(g) of the Exchange Act:

None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☑ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ☐ No ☑

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer a smaller reporting company or an emerging growth company. See the definitions of the "large accelerated filer," "accelerated filer," "non-accelerated filer," "smaller reporting company" and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large Accelerated Filer | ☑ | Accelerated Filer | ☐ |

Non-Accelerated Filer | ☐ | Smaller reporting company | ☐ |

| Emerging Growth Company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.☑

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☑

The aggregate market value of the registrant’s common stock held by non-affiliates of the registrant was approximately $707.1 million as of June 30, 2020 (based on a closing price of $30.03 per share as quoted by the Nasdaq Global Market as of such date). In determining the market value of non-affiliate common stock, shares of the registrant’s common stock beneficially owned by officers, directors and affiliates have been excluded. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

The registrant had 28,137,116 shares of Common Stock, $0.001 par value per share, outstanding as of February 17, 2021.

DOCUMENTS INCORPORATED BY REFERENCE

Part III of this Annual Report on Form 10-K incorporates by reference certain information from the registrant’s definitive proxy statement for the 2021 annual meeting of stockholders, which the registrant intends to file pursuant to Regulation 14A with the Securities and Exchange Commission not later than 120 days after the registrant’s fiscal year end of December 31, 2020.

TABLE OF CONTENTS

2

Forward-Looking Statements

Certain information included in this Annual Report on Form 10-K may contain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). All statements. All statements, other than statements of historical facts, included or referenced in this Annual Report on Form 10-K that address activities, events or developments which we expect will or may occur in the future are forward-looking statements, including statements regarding the intent, belief or current expectations of the Company and members of our management team. The words “will,” “believe,” “intend,” “expect,” “anticipate,” “project,” “estimate,” “predict” and similar expressions are also intended to identify forward-looking statements. Such statements may include those regarding guidance on our future financial results and other projections or measures of our future performance; our expectations concerning market opportunities and our ability to capitalize on them; and the amount and timing of the benefits expected from acquisitions, new products or services and other potential sources of additional revenues. Such forward-looking statements are not guarantees of future performance and involve risks and uncertainties. These statements speak only as of the date of this Annual Report on Form 10-K and are based on our current plans and expectations, and they involve risks and uncertainties that could cause actual future events or results to be different than those described in or implied by such forward-looking statements. These risks and uncertainties include, but are not limited to, those relating to: market acceptance of our products and services, including continued increased sales of our IT Deal Alert™ offerings and continued increased international growth; relationships with customers, strategic partners and employees; the duration and extent of the COVID-19 pandemic; difficulties in integrating acquired businesses; changes in economic or regulatory conditions or other trends affecting the internet, internet advertising and IT industries; data privacy laws, rules and regulations; and other matters included in our filings with the SEC. The occurrence of any of these risks and uncertainties may cause our actual results to differ materially from those anticipated in our forward-looking statements, which could have a material adverse effect on our business, results of operations and financial condition. We undertake no obligation to update our forward-looking statements to reflect future events or circumstances.

PART I

TechTarget, Inc. (“we” or the “Company”) is a global data and analytics leader and software provider for purchase intent-driven marketing and sales data which delivers business impact for business-to-business (“B2B”) companies. Our solutions enable B2B technology companies to identify, reach, and influence key enterprise technology decision makers faster and with higher efficacy. We improve information technology (“IT”) vendors’ abilities to impact highly targeted audiences for business growth using advanced targeting, first-party analytics and data services complemented with customized marketing programs that integrate demand generation, brand marketing, and advertising techniques.

We enable enterprise technology and business professionals to navigate the complex and rapidly-changing enterprise technology landscape where purchasing decisions can have significant financial and operational consequences. Our content strategy includes three primary sources which enterprise technology and business professionals use to assist them in their pre-purchase research: independent content provided by our professionals, vendor-generated content provided by our customers and member-generated, or peer-to-peer, content. In addition to utilizing our independent editorial content, registered members appreciate the ability to deepen their pre-purchase research by accessing the extensive vendor-supplied content available across our website network. Likewise, these members derive significant additional value from the ability our network provides to seamlessly interact with and contribute to information exchanges in a given field. To advance our ability to provide purchase intent-driven marketing and sales data, we have been acquisitive. During 2020, we acquired BrightTALK Limited, a technology media company that provides customers with a platform to create, host and promote webinar and video content, The Enterprise Strategy Group, Inc., a leading provider of decision support content based on user research and market analysis for global enterprise companies, and Data Science Central, LLC, a digital publishing and media company focused on data science and business analytics.

We had approximately 26.9 million and 20.0 million registered members and users – our “audiences” – as of December 31, 2020 and 2019, respectively. During the second quarter of 2020, the Company ended a partnership with a company covering the Belgium, Netherlands, and Luxembourg (“Benelux”) region. This reduced our member number by 0.5 million. Additionally, we restated our 2019 membership to remove the Benelux member number as of December 31, 2019 (0.5 million). We believe that we have sufficient members within our remaining database to support our business needs within the Benelux region. As a result of the BrightTALK acquisition, we added approximately 6.1 million unique users of the BrightTALK platform to our audiences. While the size of our registered member and user base does not provide direct insight into our customer numbers or our revenues, the value of our services sold to our customers is a direct result of the breadth and reach of this content footprint. This footprint creates the opportunity for our clients to gain business leverage by targeting our audiences through customized marketing programs. Likewise, the behavior exhibited by these audiences enables us to provide our customers with data products to improve their marketing and sales efforts. The targeted nature of our member

3

and user base enables B2B technology companies to reach a specialized audience efficiently because our content is highly segmented and aligned with the B2B technology companies’ specific products.

Through our ability to identify, reach and influence key decision makers, we have developed a broad customer base and, in 2020, delivered marketing and sales services programs to approximately 1,590 customers.

Please refer to the section below titled “Our Strategy” regarding our longer-term growth plans.

Business Trends

Our proprietary purchase intent data and lead generation solutions are attractively positioned to benefit from the rapid adoption of data-driven processes for sales and marketing workflows, especially to navigate the complex and rapidly changing IT buyer landscape where purchasing decisions can have significant financial and operational consequences. Information technology spending is no longer a discretionary item for most companies. Modern organizations see the digital transformation as a necessary investment to remain competitive, a long-term dynamic that has benefitted our customers.

Our business is impacted by macro-economic conditions. Because our customers are B2B technology customers, the success of our business is intrinsically linked to the health and market conditions of the enterprise technology industry. There are multiple trends in our market that we believe will support sustained growth for the solutions we offer. We are seeing our customers shift their marketing budgets from face-to-face event sponsorships to online lead generation as a result of the COVID-19 pandemic. We believe that much of this shift will become permanent as we do not believe the face-to-face business will return to its pre-COVID-19 spending levels. This shift has been evident primarily in our international operations as those markets had significantly more face-to-face events than our customers in North America. Today, most of those deals are short-term, mirroring their marketing campaigns. We see an opportunity to migrate more of our international customers’ budgets from face-to-face event sponsorships to intent-based lead generation and then graduate those customers to annual Priority Engine™ subscriptions. We believe this is achievable as the majority of our customers view the use of data to make their sales and marketing organizations more intelligent, efficient and effective as a strategic priority.

In addition, a migration to subscription-based business models has built in more resilience and predictability to most of our customers’ business and financial profiles, which in turn has kept their spending levels on sales and marketing relatively stable as compared to past economic downturns. We have been at the forefront of these trends as reflected by the significant growth of revenues from our flagship Priority Engine™ subscriptions.

Available Information

Our website address is www.techtarget.com. We make our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, and amendments to these reports, available free of charge through our website as soon as reasonably practicable after we electronically file such material with, or furnish such material to, the Securities and Exchange Commission (“SEC”). The SEC maintains a website, at www.sec.gov, that contains reports, proxy and information statements and other information regarding issuers that are filed electronically. Our Code of Business Conduct and Ethics, and any amendments to our Code of Business Conduct and Ethics, Corporate Governance Guidelines and Board Committee Charters, are also available on our website. The information contained on our website is not a part of, or incorporated by reference into, this Annual Report on Form 10-K.

Industry Background

Enterprise technology and business professionals’ reliance on online content to research major purchase decisions, and the transition by B2B technology companies of marketing expenditures from offline to online channels, have been consistent trends that have benefitted us. Going forward, there are some important related trends that we believe our business strategy is well positioned to benefit from:

| • | Technology Marketers and Sales Organizations are Increasingly Using Audience Data to Drive Decisions. In the enterprise technology market in particular, companies are increasingly using data to help them determine which prospective accounts should be prioritized for marketing or sales follow-up. We believe we are uniquely positioned to provide data around the purchase intent of specific prospective accounts and potential buyers because of the nature of content we create and our product focus in these data-driven areas. |

| • | There is a Continued Focus on the Ability to Measure and Improve Return on Investment (“ROI”). Our customers are increasingly focused on measuring and improving their ROI in marketing and sales. Before the advent of internet-based marketing, there were limited tools for accurately measuring the results of such activities in a timely fashion. The internet |

4

| | has enabled B2B technology companies to track individual members and their responses to marketing. With the appropriate technology, vendors now have the ability to assess and benchmark the efficacy of their online programs cost-effectively and in real-time. We believe our offerings benefit as our customers continue to leverage insights gained from this measurement, and that the data and related services we are providing will assist them to optimize their marketing programs going forward. |

Enterprise Technology Purchasing

Over the past two decades, enterprise technology purchases have grown in size and complexity. The enterprise technology market comprises multiple large sectors such as storage, security and networking. Each of these sectors can be further divided into sub-sectors addressing more granular areas of specialization within an enterprise’s technology environment. For example, within the multi-billion-dollar storage sector, there are numerous sub-sectors such as storage area networks, storage management software and backup software. Furthermore, the products – and therefore the enterprise technology – in each sub-sector may represent entirely independent markets. For example, the market around backup software for use in Windows® environments can be completely distinct from that addressing Linux® environments.

In view of the complexities, high cost and importance of enterprise technology decision-making, enterprise technology purchasing decisions are increasingly being researched by teams of functional experts with specialized knowledge in their particular areas, rather than by one central enterprise technology professional, such as a Chief Information Officer (“CIO”). For these reasons and more, the enterprise technology purchasing process typically requires a lengthy sales cycle. The “sales cycle” is the sequence of stages that a typical customer goes through when deciding to purchase a product or service from a particular vendor. Key stages of a sales cycle typically consist of a customer recognizing or identifying a need; identifying possible solutions and vendors through research and evaluation; and finally, making a decision to purchase the product or service. Through various stages of this sales cycle, enterprise technology and business professionals rely upon multiple inputs from independent experts, and peers. Although there is a vast amount of information available, the aggregation and validation of these inputs from various sources can be difficult and time-consuming.

The long sales cycle for enterprise technology purchases, as well as customers’ need for significant information support, requires substantial investment on the part of B2B technology companies. These realities drive the significant marketing expenditures observable in the enterprise technology market. In addition, given the continued acceleration of technological change, at any given time, there are often multiple solution possibilities to any enterprise technology or business need. With each new product or product enhancement, B2B technology companies implement new marketing outreach, and as a result, enterprise technology and business professionals are required to continuously engage in research to stay abreast of the latest developments that could benefit their companies.

The Opportunity

Prior to widespread internet adoption, enterprise technology buyers researching purchases relied largely on traditional enterprise technology media, consisting of broad print publications and large industry trade shows. Today, enterprise technology and business professionals are demanding specialized online content tailored to the specialized sub-sectors of enterprise technology solutions that they must understand. As enterprise technology, vendors and business professionals have all become much more specialized, the internet has become a preferred purchase research medium, which has dramatically increased research activity, accelerated information consumption and improved professional decision-making.

B2B technology companies seek high-ROI marketing opportunities that can provide them access to the specific sectors of enterprise technology buyers aligned with the solutions they sell. To be more efficient and effective, they need to distinguish these prospective buyers from accounts or individuals who are not yet ready to engage in the buying process. Thus, they look for assistance in identifying the specific accounts and individuals who are actively researching upcoming purchases. To more quickly and successfully position their respective solutions against alternatives being considered, they also seek assistance from marketing service providers to help influence these audiences by utilizing data driven insights to enable advanced demand-generating content marketing and targeted branding.

Enterprise technology and business professionals rely on our content for decision support information tailored to their specific purchasing needs. Our specialized content strategy and comprehensive services enable B2B technology companies to better identify, understand, reach and influence enterprise technology and business professionals who are actively researching purchases in specific enterprise technology sectors. Our solutions benefit from the following competitive advantages:

| • | Large and Growing Community of Registered Members and Users. We had approximately 26.9 million registered members and users as of December 31, 2020. With our acquisition of BrightTALK Limited, we added approximately 6.1 million unique users of the BrightTALK platform, which is included in our total number of registered members and users. The targeted nature of our member and user base enables B2B technology companies to reach a specialized audience efficiently because our content is highly segmented and aligned with the B2B technology companies' specific products and services. |

5

| • | Strong Customer Relationships. We have developed a broad customer base. During 2020, we delivered marketing services programs for approximately 1,590 companies, who are our customers. |

| • | Substantial Experience in Online Content and Purchase Intent Data. We have over 20 years of experience in developing our online information content, with a focus on providing targeted information to enterprise technology and business professionals and a highly refined audience to technology vendors. Our experience enables us to develop relevant new online properties rapidly and to acquire and efficiently integrate select properties to further serve enterprise technology and business professionals. We have also developed an expertise in implementing integrated, targeted marketing campaigns designed to maximize the measurability of, and improvement in, ROI. |

| • | Proprietary Data on the Research Behavior of our Registered Members, Site Visitors and Users. Through our analytical platforms, we collect information on millions of interactions that our members, users and visitors (and the companies, or accounts, that they are associated with) have with the content on our websites and that we send to them via email. Collection and analysis of this information allows us to increase the relevance of our informational offerings to our members and improves our customers’ ROI by allowing us to deliver better prospects to them more efficiently. This analytics platform not only guides everything we do on our own properties; it is also available to our customers in a variety of forms to aid them in directly optimizing their efforts. |

| • | Significant Brand Recognition among B2B technology companies and Enterprise Technology and Business Professionals. Our brands are well-recognized by B2B technology companies who value our integrated marketing capabilities and comprehensive high-ROI services. At the same time, our sector-specific offerings command brand recognition among enterprise technology and business professionals, who rely on these websites because of their specificity and depth of content. |

Our Solutions

Our solutions consist of:

| • | IT Deal AlertTM. A suite of data and services for B2B technology companies that leverages the detailed purchase intent data that we collect on enterprise technology organizations and professionals researching IT purchases on our network of websites. Through proprietary scoring methodologies, we use this insight to help our customers identify and prioritize accounts and contacts whose content consumption around specific enterprise technology topics indicates that they are “in-market” for a particular product or service. The suite of products and services include Priority Engine™, Qualified Sales Opportunities™, and Deal Data™. Priority Engine™ is a subscription service powered by our Activity Intelligence™ platform, which integrates with customer relationship management and marketing automation platforms from salesforce.com, Marketo, Eloqua, Pardot, and Integrate. The service delivers lead generation workflow solutions that enable marketers and sales forces to identify and understand accounts and individuals actively researching new technology purchases and then to engage those active prospects. Qualified Sales Opportunities™ is a product that profiles specific in-progress purchase projects, including information on scope and purchase considerations. Deal Data™ is a customized solution aimed at sales intelligence and data scientist functions within our customer organizations. It renders our Activity Intelligence data into one-time offerings directly consumable by the customer’s internal applications. |

| • | Demand Solutions. Our offerings enable our customers to reach and influence prospective buyers through content marketing programs, such as white papers, webcasts, podcasts, videocasts, virtual trade shows, and content sponsorships, designed to generate demand for their solutions, and through display advertising and other brand programs that influence consideration by prospective buyers. We believe this allows B2B technology companies to maximize ROI on marketing and sales expenditures by capturing sales leads from the distribution and promotion of content to our audience of enterprise technology and business professionals. |

| • | Brand Solutions. Our suite of brand solution offerings provide B2B technology companies with direct exposure to targeted audiences of enterprise technology and business professionals actively researching information related to their products and services. We leverage our Activity Intelligence™ platform to enable significant segmentation and targeting of specific audiences that can be accessed through these programs. Components of brand programs may include on-network branding, off-network branding, and microsites and related formats. |

| • | Custom Content Creation. We also at times create white papers, case studies, webcasts or videos to our customers’ specifications. These customized content assets are then promoted to our audience within both demand solutions and brand solutions programs. |

As a result of our recent acquisition of BrightTALK we are now able to provide a platform that allows our customers to create, host and promote webinar, virtual event and video content.

6

Our solutions benefit enterprise technology and business professionals and B2B technology companies in the following ways:

Benefits to Enterprise Technology and Business Professionals

| • | Provide Access to Integrated, Sector-Specific Content. Our offerings provide enterprise technology and business professionals with sector-specific content from the three fundamental sources they value when researching enterprise technology purchasing decisions: industry experts, peers and vendors. Our independent staff creates content specific to the sectors we serve and the key sub-sectors within them. This content is integrated with other content generated by our network of third party industry experts, member-generated content and content from B2B technology companies. The reliability, breadth, depth, and accessibility of our content offerings enable enterprise technology and business professionals to make more informed purchases. |

| • | Increase Efficiency of Purchasing Decisions. By accessing targeted and specialized information, enterprise technology and business professionals are able to research important purchasing decisions more effectively. Our integrated content offering minimizes the time spent searching for and evaluating content and maximizes the time available for assimilating quality information. To support enterprise technology and business professionals’ information consumption preferences, we provide this specialized, targeted content through a variety of media types matching the critical stages within the purchase decision process. |

Benefits to B2B technology companies

| • | Provide Unique Data About In-Market Prospects. Our Activity Intelligence™ analytical product platform captures and interprets the content consumption behaviors of our large base of targeted enterprise technology and business professional members as they research technology needs. This allows us to provide B2B technology companies with powerful behavioral insight to help them more effectively identify and pursue prospective buyers. Vendors who are increasingly making use of data to drive their marketing and sales strategies make use of our offerings as a key input to driving their progress against this objective. |

| • | Target Active Buyers Efficiently. Our highly targeted content attracts specific, targeted audiences who are actively researching purchasing decisions. Using our database of registered members and users and information we collect about their product interests, we are able to accurately target those registered members and users most likely to be of value to B2B technology companies, and support vendor-customer’s execution with scalable marketing services programs that help influence these prospective buyers. |

| • | Generate Measurable Results. Our targeted online content offerings enable us to generate and collect valuable business information about each member and user and their technology preferences. As registered members and users access content, we are able to build a profile of their technology interests, and their companies’ interests, as they evolve over time. Through experience, we have identified patterns that are indicative of purchase intent. We leverage this insight to improve ROI on the programs we execute for our clients by focusing specifically where active demand exists. We provide this intelligence directly to B2B technology companies for their own use. This helps them drive continuous improvement in their own marketing and sales workflows and outcomes, whether focused specifically on prospects we provide them or on those they have otherwise obtained, which our information enriches and makes more actionable. |

| • | Maximize Awareness. As a leading distributor of B2B enterprise technology white papers, webcasts, videocasts, virtual events and podcasts, we offer B2B technology companies the opportunity to educate enterprise technology and business professionals during the research process, prior to any direct interaction with vendor salespeople. By distributing proprietary content and reaching their target audiences via our platform, B2B technology companies can educate audiences, demonstrate much of their product capabilities and proactively brand themselves as specific product leaders. As a result, enterprise technology and business professionals are more aware of, and more knowledgeable about, the vendor’s specifications and product and therefore more likely to consider the vendor. Increased consideration of our B2B technology customers’ offerings combined with accurate purchase intent insight around those prospects who are actively researching a purchase significantly reduces vendor prospecting costs and time expended on inactive accounts. |

7

Our Strategy

Our goal is to deliver superior performance by continuously enhancing our position as a global leader in purchase intent driven marketing and sales services that deliver business impact for B2B technology companies by strengthening our offerings in our three core capability areas: – our specialized content that connects enterprise technology and business professionals with B2B technology companies in the sectors and sub-sectors that we serve, the purchase intent insight analytics and data services our content and member traffic enables, and the marketing services we provide to clients to help meet their business growth objectives.

In order to achieve this goal, we intend to:

| • | Continue to Innovate in the Area of Data-Enabled Marketing Services. We believe our ability to leverage our content and audience to identify in-market prospective buyers is a core competency and a key driver of our future growth. Our IT Deal Alert™ suite of offerings, built on our Activity Intelligence™ analytic product platform, consists of multiple recently developed products and services that provide B2B technology companies with data-enabled optimization solutions. We intend to further develop our existing product offerings with new features and launch additional offerings that extend our capabilities based on our customers’ requirements. |

| • | Expand Long-term Contractual Relationships with Customers. Several of our newly introduced data-enabled marketing products are being offered to our customers on a subscription basis, on multiple quarter, annual or longer agreements, subject to our customers’ right of termination. We intend to expand the number of subscription contracts with our customers, which allows us to work more closely with them in achieving their marketing objectives over an extended period and provides us with stable revenue streams from the continued growth of these products and our successful renewal efforts. |

| • | Expand into Complementary Sectors. We intend to complement our current offerings and content by continuing to expand our business in order to capitalize on strategic opportunities in existing, adjacent, or new sectors that we believe to be well-suited to our business model and core competencies. Based on our experience, we believe we are able to capitalize rapidly and cost-effectively on new market opportunities. |

| • | Continue to Expand Our International Presence. We intend to continue to expand our reach into our addressable market by increasing our presence in countries outside the U.S. We have pursued this strategy by launching our own websites directed at members in the United Kingdom, India, Spain, France, China, Australia, and Singapore, and by acquiring specific properties or companies with attractive properties. We previously expanded by acquiring the Computer Weekly and MicroScope online properties in the United Kingdom and E-Magine Médias SAS, which we call LeMagIT, in France. More recently, we launched German and Portuguese language websites, as well as websites directed towards members in Latin America. We expect to further penetrate foreign markets by directly launching additional sector-specific websites directed at these foreign locales and at additional international markets and by making strategic acquisitions and investments in overseas entities. We believe that our integrated product offering across regions continues to resonate with international marketers and is contributing to our success. We plan to continue investing in these capabilities as we seek opportunities to increase our global reach. |

| • | Selectively Acquire or Partner with Complementary Businesses. Historically, we have used acquisitions as a means of expanding our content and product and service offerings, web traffic and registered members. Our acquisitions to date can be classified into three categories: content-rich blogs or other individually published sites, typically generating less than $1 million in annual revenues; early stage revenue sites, typically generating between $1 million and $20 million in annual revenues; and later stage revenue sites, typically generating greater than $20 million in annual revenues. As we evaluate companies within these ranges, we consider the following attributes: operations primarily in the enterprise IT market; provides original content which enables us to obtain additional first party purchase intent data; has a registration-based model; has different or complementary product offerings primarily sold on a subscription basis; provides significant cross-sell and upsell opportunities; can be acquired as a reasonable price. A company does not have to have all of the attributes, but has to have some of the above attributes. We intend to continue to pursue selected acquisition or partnership opportunities in our core markets and in adjacent markets for products with similar characteristics. |

Platform and Content

Our content platform consists of a network of specialized websites and webinar and video offerings that serve the needs of enterprise technology and business professionals who are making corporate purchase decisions. At critical stages of the purchase decision process, these content offerings through different channels meet enterprise technology and business professionals’ needs for expert, peer and B2B technology company information and provide a platform on which B2B technology companies can launch targeted marketing campaigns that generate measurable, high ROI.

8

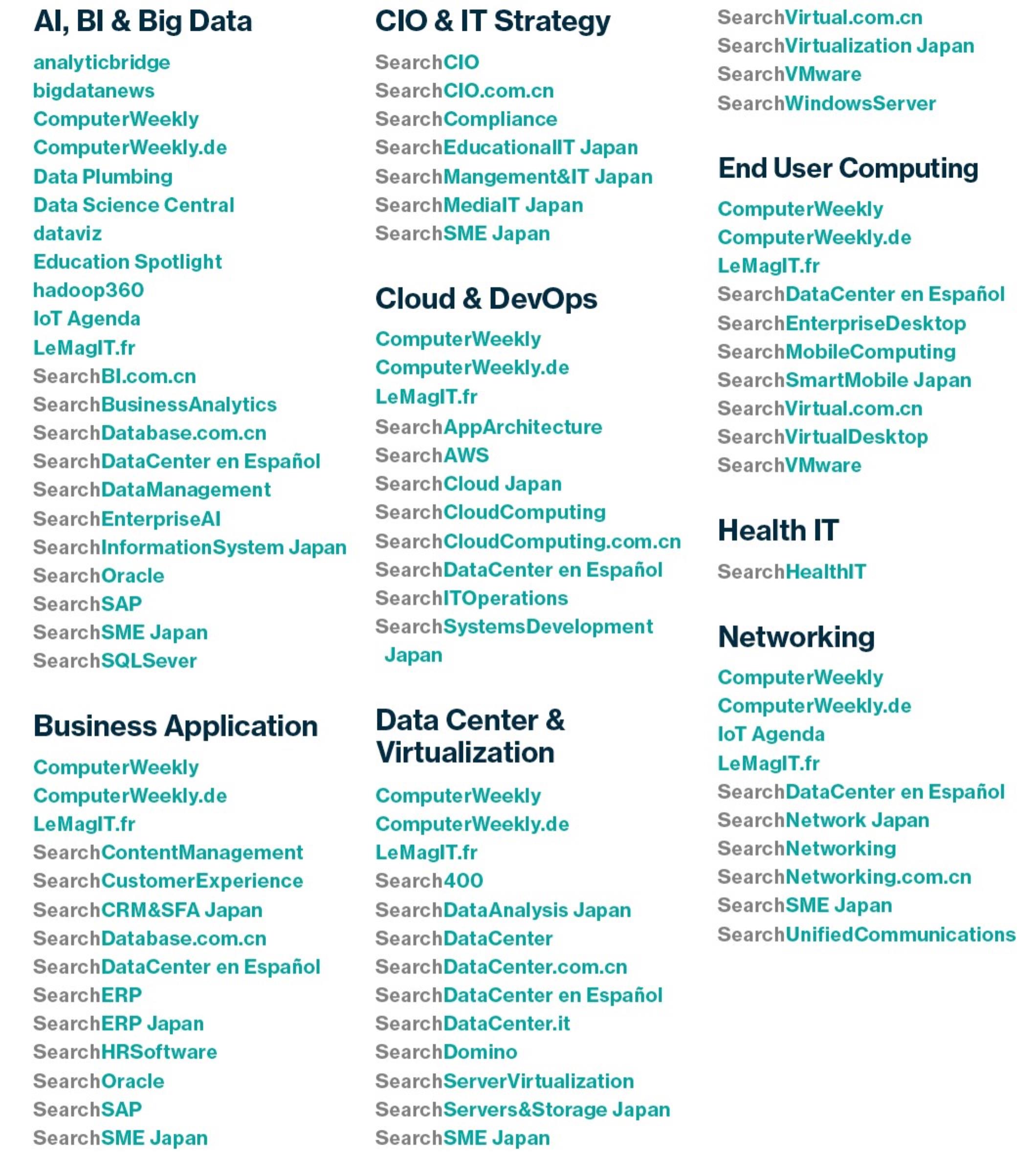

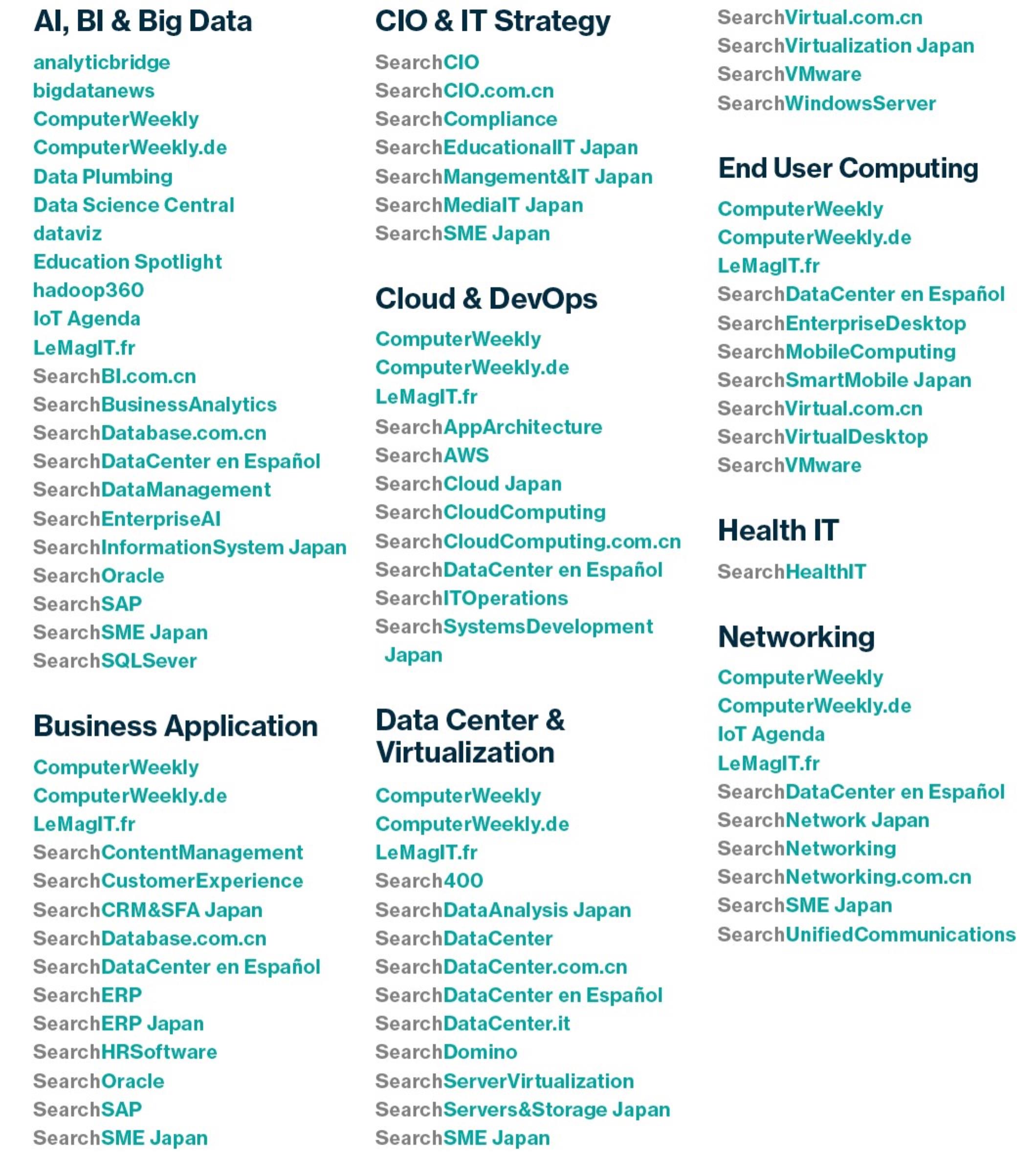

The table below provides a representation of the key market opportunities we address for our B2B technology company customers.

Audience: Market Categories Sites

9

Audience: Market Categories Sites (cont.)

Market Categories

Based upon the logical clustering of our members’ respective job responsibilities and the marketing focus of the products being promoted by our customers, we currently categorize our content offerings to address the key market opportunities and audience extensions across a portfolio of distinct market categories. Each of these marketing categories services a wide range of enterprise technology sectors and sub-sectors and is driven by the key areas of enterprise technology and business professionals’ interests described below:

| • | Security. Every aspect of enterprise computing now depends on secure connectivity, data and applications. The security sector is constantly growing to adapt to new forms of threats and to secure new technologies such as mobile devices, wireless networks, virtualized systems and cloud computing solutions. Compliance regulations, cloud computing adoption, and highly publicized identity and intellectual property thefts are driving interest and investment in increasingly sophisticated security solutions that supplement common “perimeter” security solutions such as firewalls and antivirus software. Our online properties in this sector, which include SearchSecurity.com, SearchCloudSecurity.com, SearchFinancialSecurity.com, and SearchMidMarketSecurity.com, offer navigable and structured guides on B2B technology companies and enterprise technology solutions in key sub-sectors such as network security, intrusion defense, identity management and authentication, data and application security, security-as-a-service, cloud security and security information management software. |

| • | Networking. Broadly defined, the networking market includes the hardware, software and services involved in the infrastructure and management of both enterprise and carrier voice and data networks. As new sub-sectors of networking have emerged and grown in importance, technology networking professionals have increasingly focused their investments in such technologies as VoIP, wireless and mobile computing, social networking and collaboration, application performance, data center fabrics, convergence, software-defined networking (“SDN”) and providing cloud services. Our online properties in this sector, which include SearchNetworking.com, and SearchUnifiedCommunications.com aim to address the specialized needs of these technology networking professionals by offering content targeted specifically to these emerging growth areas. |

| • | Storage. The storage sector consists of the market for disk storage systems and tape hardware and software that store and manage data. Growth is fueled by trends inherent in the industry, such as the ongoing need to maintain and supplement data |

10

| | stores, and by external factors, such as expanded compliance regulations and increased focus on disaster recovery solutions. Recent trends reflect an increased emphasis on solid state storage and cloud storage. At the same time, established storage sub-sectors, such as backup and Storage Area Networks (“SANs”) have been invigorated by new technologies such as disk-based backup, continuous data protection, data deduplication and storage virtualization. Our online properties in this sector, which include SearchStorage.com, SearchDataBackup.com, and SearchDisasterRecovery.com, address enterprise technology and business professionals seeking solutions in key sub-sectors such as fibre channel SANs, solid state storage, virtualization IP & iSCSI SANs, Network Attached Storage (“NAS”), backup hardware and software, and storage management software. |

| • | Data Center and Virtualization Technologies. Data centers house the systems and components, such as servers, storage devices, routers and switches, utilized in large-scale, mission-critical computing environments. A variety of trends and new technologies have reinvigorated the data center as a priority among IT and business professionals. Technologies, such as blade servers, server virtualization, converged infrastructure and cloud computing, have driven renewed investment in data center-class computing solutions. Server consolidation is a focus, driven by the decline in large-scale computing prices relative to distributed computing models. These trends have put pressure on existing data center infrastructure and are driving demand for solutions that address this. For example, the deployment of high-density servers has led to increased heat output and energy consumption in data centers. Power and cooling have thus become a significant cost in enterprise technology budgets, making data center energy efficiency a priority. Our key online properties in this sector provide targeted information on the B2B technology companies technologies and solutions that serve these sub-sectors. Our properties in this sector include sites such as SearchDataCenter.com, covering disaster recovery, power and cooling, mainframe and UNIX® servers, systems management, and server consolidation, and SearchCloudComputing.com and SearchAWS.com, which cover private, public and hybrid cloud infrastructure. SearchServerVirtualization.com covers the decision points and alternatives for implementing server virtualization, while SearchVMware.com focuses on managing and building out virtual environments on the most widely installed server virtualization platform. SearchConvergedInfrastructure.com covers converged and hyper-converged infrastructure solutions. SearchITOperations.com covers DevOps, the impact of Agile Development, containers, microservices and event-driven computing upon enterprise technology operations, as well as the deployment of hybrid cloud architectures and multi-cloud management. |

We also cover servers, application and desktop solutions deployed in distributed computing environments. The dominant platform, Windows, no longer represents an offering of discrete operating systems but rather a diverse computing environment with its own areas of specialization around enterprise technology. As Windows servers have become more stable and scalable, they have taken share in data centers and currently represent one of the largest server sub-sectors. Given the breadth of the Windows market, we have segmented our Windows-focused media based on enterprise technology and business professionals’ infrastructure responsibilities and purchasing focus. Our online properties in this sector include SearchWindowsServer.com, covering servers, storage, and systems management; and SearchDomino.com, targeted toward senior management for distributed computing environments. This network of sites provides resources and advice to enterprise technology and business professionals pursuing solutions related to such topics as Windows backup and storage, server consolidation, and upgrade planning. SearchEnterpriseDesktop.com focuses on the deployment and management of end-user computing environments. SearchMobileComputing.com covers the enterprise technology management issues surrounding the increasing deployment of personal technologies such as tablets and smartphones in the workplace. Combined with our two properties that focus on server virtualization, SearchVirtualDesktop.com and BrianMadden.com, each focusing on desktop virtualization, this gives us a comprehensive offering addressing the fast-growing area of virtualization technologies.

| • | CIO/IT Strategy. Our CIO/IT Strategy sites provide content targeted at CIOs, and senior enterprise technology executives, enabling them to make informed enterprise technology purchases throughout the critical stages of the purchase decision process. CIOs’ areas of interest generally align with the major sectors of the IT market; however, CIOs increasingly are focused on the alignment between enterprise technology and their businesses’ operations. Data center consolidation, compliance, ITIL/IT service management, disaster recovery/business continuity, risk management and outsourcing as well as including Software as a Service (“SaaS”) and cloud computing have all drawn the attention of IT executives who need to understand the operational and strategic implications of these issues and technologies on their businesses. Accordingly, our targeted information resources for senior IT executives focus on ROI, implementation strategies, best practices and comparative assessment of vendor solutions related to these initiatives. Our online properties in this sector include SearchCIO.com, which provides CIOs in large enterprises with strategic information focused on critical purchasing decisions; and SearchCompliance.com, which provides advice on enterprise technology-focused regulations and standards to enterprise technology and business executives and other senior enterprise technology managers. The CIO/IT Strategy category also includes online resources and events targeted to IT decision makers in prominent vertical industries. SearchHealthIT.com provides strategic IT purchasing information and advice to senior IT and clinical professionals in hospitals, medical centers, university health centers and other care delivery organizations, as well as organizations in the life sciences sector. InternetofThingsAgenda.com covers the implications of the emergence of the Internet of Things upon IT infrastructure and strategy. |

11

| • | Business Applications and Analytics. Our Business Applications and Analytics market category focuses on mission critical software such as enterprise resource planning (“ERP”), databases and business intelligence, content management enterprise resource planning, and customer facing applications such as customer relationship management (“CRM”) software for mid-sized and large companies. Because these applications are critical to the overall success of the businesses that use them, there is a high demand for specialized information by IT and business professionals involved in their purchase, implementation, and ongoing support. Our applications-focused properties in this sector include sites such as SearchCustomerExperience.com, SearchOracle.com, SearchSAP.com, SearchHRSoftware.com, SearchSQLServer.com, and SearchERP.com. These sites are leading online resources that provide this specialized information to support mission critical business applications such as CRM, sales force automation, databases and ERP software. The information produced by these applications is seen as a corporate asset that is essential for gaining competitive advantage through informed, data-driven decisions that can help improve operational efficiency, enable business agility, and improve sales effectiveness and customer service. As a result, business intelligence and analytics have become pervasive as various organizations increasingly rely on mission critical information to optimize their businesses. SearchBusinessAnalytics.com, SearchDataManagement.com, and SearchContentManagement.com, cover the business intelligence, data management, content management and collaboration disciplines associated with such initiatives. SearchCloudComputing.com focuses on cloud-based or SaaS deployments of key business applications. |

| • | Application Architecture and Development. The application architecture and development sector is comprised of a broad landscape of tools and languages that enable developers, architects and project managers to build, customize and integrate software for their businesses. Our application architecture and development online properties focus on development in enterprise environments, the underlying languages such as .NET, Java and XML as well as related application development tools and integrated development environments (“IDEs”). Several trends have had a profound impact on this sector and are driving growth. The desire for business agility with more flexible and interoperable applications architecture continues to propel interest in microservices. Application integration, application testing and security, as well as internet and mobile applications are also key areas of continuing focus for vendors and developers Our online properties in this sector include sites such as TheServerSide.com, which hosts independent communities of developers and architects, SearchSoftwareQuality.com, which offers content focused on application testing and quality assurance, and SearchAppAchitechture.com, which serves Architects, IT Managers and Line of Business Executives who are interested in adapting existing architectures to meet the speed, scale and agility needs of today’s modern applications. |

| • | Channel. Our Channel sites address the information needs of channel professionals—which we have classified as resellers, value added resellers, solution providers, systems integrators, service providers, managed service providers, and consultants—in the enterprise technology market. As enterprise technology and business professionals have become more specialized, B2B technology companies have actively sought resellers with specific expertise in the vendors’ sub-sectors. Like enterprise technology and business professionals, channel professionals require more focused technical content in order to operate successful businesses in the markets in which they compete. The resulting dynamics in the B2B technology channel are well-suited to our integrated, targeted content strategy. Our online properties in this sector include SearchITChannel.com. In addition to these websites, TechTarget channel media is able to profile channel professionals accessing information on any website within the TechTarget Network. As channel professionals resell, service and support hardware, software and services from vendors in a particular enterprise technology sector, the key areas of focus tend to parallel those for the sub-sectors addressed by our IT-focused properties: for storage, backup, storage virtualization and network storage solutions such as fibre channel SANs, NAS and IP SANs; for security, intrusion defense, compliance and identity management; for networking, wireless, network security and VoIP; for systems, consolidation, cloud, converged infrastructure and server virtualization. |

Customers

We market to B2B technology companies targeting specific audiences who are actively researching purchasing decisions. We maintain multiple points of contact with our customers in order to provide support throughout their organization and during critical stages of the sales cycle. As a result, individual customers often run multiple marketing programs with us in order to reach discrete portions of our targeted audience. Our products and services are delivered under both short-term contracts that run for the length of a given marketing program, typically less than six months, and via integrated, longer-term contracts covering various client needs across approximately a year or longer. We have developed a broad customer base and delivered campaigns to approximately 1,590 customers in 2020. During 2020, 2019, and 2018, no single customer represented 10% or more of total revenues.

12

Sales and Marketing

We have an internal direct sales department that works closely with existing and potential customers to develop customized marketing programs that provide highly targeted access to enterprise technology and business professionals. We organize the sales force by the sector-specific market categories that we operate and have a global accounts team that works with our largest customers. Additionally, we organize certain individuals into Customer Success Teams. Those teams facilitate the usage and renewal of certain of the Company’s products. We believe that our sector-specific sales organization and integrated approach to our product and service offerings allows our sales personnel to develop a high level of expertise in the specific sectors they cover and to create effective marketing programs tailored to the customer’s specific objectives. As of December 31, 2020, our sales and marketing staff (including the sales and marketing staff of our acquired companies) consisted of approximately 440 people. The majority of our sales staff and marketing staff is located in our Newton, Massachusetts headquarters and our offices in San Francisco, California, London, England and Sydney, Australia. The majority of the BrightTALK sales and marketing staff is located in London, England, Denver, Colorado, New York, New York and San Francisco, California.

We pursue a variety of marketing initiatives designed to support our sales activities by building awareness of our brand with B2B technology companies and positioning ourselves as a “thought leader” in ROI-based marketing. These initiatives include purchasing online sponsorships in media vehicles that reach technology marketers, as well as engaging in direct communications with the database of relevant contacts we have built since inception. Examples of our direct communications include selected e-mail updates on new product launches and initiatives. We also produce videocasts, blogs and white papers for technology marketers where we provide information on the latest best practices in the field of online B2B technology marketing.

Through our Press and Public Relations activities, we develop and maintain relationships with key analysts, publications and influencers covering B2B marketing and sales topics.

Online Member and User Acquisition

Our primary source of traffic to our websites is through non-paid traffic sources, such as our existing registered member and user base and organic search engine traffic. Organic search engine traffic is also a key source of new registered members for our sites. Because our sites focus on specific sectors of the enterprise technology market, our content is highly targeted and is an effective means for attracting search engine traffic and from this, growing our membership. We also make marketing expenditures designed to supplement our non-paid traffic and registered members. We employ a variety of other marketing vehicles such as keyword advertising on the major search engines and targeted list rentals of e-mail subscribers from a variety of targeted partners, media sources, and data providers.

Technological Infrastructure

We have developed an expandable operations infrastructure using leading Cloud infrastructure providers and an off-site data center to maintain our websites and online offerings. All of the critical components of the system are redundant, allowing us to withstand unexpected component failure and to undergo maintenance and upgrades. Our infrastructure is scalable, enabling us to make additions that fit into the existing environment as our system requirements grow based on traffic, member, and customer growth. Our critical data is copied daily to an online backup storage solution. We maintain a quality assurance process to constantly monitor our servers, processes, and network connectivity. We leverage industry standard network and perimeter defense technologies, DDoS protection systems, web application firewalls, and enterprise grade DNS services across multiple vendors. We believe that continued development of our technological infrastructure is critical to our success. We have made, and will continue to make, technological improvements and investments in this infrastructure to improve our ability to service our members and customers.

Competition

The market for B2B technology companies marketing spend is highly competitive, and in each of the sectors we serve, as well as across the products and services we offer, our primary competitors include media companies that produce content specifically for enterprise technology and business professionals, providers of technology-based point solutions for data analysis and other service providers. Our primary media competitors, each of which possesses substantial resources to compete, are J2 Global, Madison Logic, and International Data Group. In the online market we generally compete on the basis of target audience, quality and uniqueness of information content, ease of use of our websites for IT and business professionals, and the quality and quantity of sales leads generated for B2B technology companies. We also compete for the members who comprise our target audiences primarily with the media companies that produce content specifically for enterprise technology and business professionals such as J2 Global, and International Data Group. In the data-oriented businesses, we compete with providers of predictive analytics and internet-based analysis including companies like 6sense, Infer, Bombora and Aberdeen. In general marketing services, we compete with list and lead providers of various types such as ZoomInfo Technologies Inc. As a result of our acquisition of BrightTALK, we expect to compete with a number of web-based meeting, webinar and virtual event providers and physical event providers, such as LogMeIn, Intrado and ON24. Many of these

13

providers possess substantially more resources to compete. As we continue to expand internationally, we expect to compete with many of the competitors mentioned above, as well as with established media companies based in particular countries or geographical regions.

Member and User Privacy

We gather in-depth business information about our registered members and users who provide us or our partners with such information through e-mail, telephone, or other means, including through the submission of webforms displayed on our websites. We also gather information about visitors of certain content on our websites by tracking their content consumption or the content consumption of the companies they work for. We post our privacy policy on our websites so that our members, users and others who visit our websites can access and understand the terms and conditions applicable to the collection and use of their information. Our privacy policy discloses the types of information we gather, how we use it, and how a member or user can correct or change this information, including how a member or user can unsubscribe to our communications and those of our partners. Our privacy policy also explains the circumstances under which we share a member's or user’s information and with whom. Members and users who register receive offers via e-mail, telephone, and other means, such as targeted advertising online or on mobile devices regarding areas of specific interest to them and that are relevant to their professional interests; these offers contain content created either by us or our third party B2B technology customers. To uphold our obligations to our members and users, we impose constraints that are consistent with our privacy policy on the customers and third parties to whom we provide member and user data, including through the use of contractual terms and conditions or data processing agreements, where applicable, that are generally consistent with our obligations to members and users and as set forth in our privacy policies.

Consumer Protection and Privacy Regulation

General. Advertising and promotional activities presented to members and visitors to our websites are subject to federal and state consumer protection laws that regulate unfair and deceptive practices. We are also subject to various other federal and state consumer protection laws, including the ones described below. We are also subject to the laws and regulations of various other jurisdictions in which we target members and website visitors.

CAN-SPAM Act. The Controlling the Assault of Non-Solicited Pornography and Marketing Act of 2003 (the “CAN-SPAM Act”) regulates commercial e-mails and provides a right on the part of the recipient to request the sender to stop sending commercial electronic marketing messages (“commercial e-mails”), and establishes penalties for the sending of e-mail messages that are intended to deceive the recipient as to source or content. Under the CAN-SPAM Act, senders of commercial e-mails (and other persons who initiate those e-mails) are required to make sure that those e-mails do not contain false or misleading transmission information. Commercial e-mails are required to include a valid return e-mail address and other subject heading information so that the sender and the internet location from which the message has been sent are accurately identified. Recipients must be furnished with an electronic method of informing the sender of the recipient’s decision not to receive further commercial e-mails. In addition, the e-mail must include a postal address of the sender and notice that the e-mail is an advertisement. The CAN-SPAM Act may apply to the e-newsletters that our websites distribute to registered members and to some of our other commercial e-mail communications. The U.S. Federal Trade Commission (the “FTC”) has issued regulations related to the CAN-SPAM Act, including interpretations of such act that indicate that e-newsletters, such as those we distribute to our registered members, will be exempt from most of the provisions of the CAN-SPAM Act, provided that they do not contain predominantly marketing content. The CAN-SPAM Act and the FTC’s CAN-SPAM trade regulation rule allow for civil penalties that run into the millions of dollars. Several states have enacted additional, more restrictive and punitive laws regulating commercial email. Foreign legislation exists as well, including Canada’s Anti-Spam Legislation and the European laws that have been enacted pursuant to the General Data Protection Regulation “(GDPR)” and European Union Directive 2002/58/EC and its amendments. We use email as a significant means of communicating with our existing members as well as potential website visitors and members. At this time, we are applying the applicable legal requirements to e-newsletters and all other e-mail communications and believe that our e-mail practices comply with the requirements of the CAN-SPAM Act, state laws and applicable foreign legislation.

Telemarketing Rules. Laws regulating telemarketing in the U.S., including the Telephone Consumer Protection Act (the “TCPA”), the Federal Communications Commission (“FCC”) rules thereunder, the Telemarketing and Consumer Fraud and Abuse Prevention Act and the FTC’s Telemarketing Sales Rule, including their do-not call provisions, and in the other jurisdictions where we do business, could apply to our calls to members and individuals who visit our websites. If any of these laws apply to our telemarketing, and we are found liable for violating them, we could be subject to financial penalties.

Other Consumer Protection Regulation. The FTC and many state attorneys general are applying federal and state consumer protection laws to require that the online collection, use and dissemination of data, and the presentation of web site content, comply with certain standards for notice, choice, security and access. In many cases, the specific limitations imposed by these standards are subject to interpretation by courts and other governmental authorities, and courts may adopt these developments as law. In addition, the FTC has published self-regulatory principles to address consumer privacy issues that may arise from so-called “behavioral targeting” (i.e. the

14

tracking of a member’s or user’s online activities in order to deliver advertising tailored to their interests) and to encourage industry self-regulation for public content. Although the FTC excluded from the principles contextual advertising, with respect to other types of behavioral targeting that include the storage of more, and potentially sensitive, data or that collects information outside of the “traditional Web site context” (such as through a mobile device or by an ISP), the FTC has stated that it will continue to evaluate self-regulatory programs and bring law enforcement actions where appropriate. Further, the FTC has indicated that it is considering regulations regarding behavioral advertising, which may include implementation of a more rigorous opt-in regime. An opt-in policy would prohibit businesses from collecting and using information obtained through behavioral targeting activities from individuals who have not voluntarily consented. The FTC has also issued further clarifying guidance regarding consumer privacy and data collection with a particular focus on the mobile environment. A few states have also introduced legislation that, if enacted, would restrict or prohibit behavioral advertising within the state. In the absence of a federal law pre-empting their enforcement, such state legislation would likely have the practical effect of regulating behavioral advertising nationwide because of the difficulties behind implementing state-specific policies. In addition, states (including California) are considering and/or implementing new comprehensive privacy laws (such as the California Consumer Privacy Act) which may have an impact on how we can conduct our business.

Privacy. In addition, the European Union (“EU”) and its member states, the United Kingdom, Canada and numerous other countries have laws, rules and/or regulations dealing with the collection and use of personal information obtained from their citizens. Regulations have focused on, among other things, the collection, use, disclosure and security of information that may be used to identify or that actually identifies an individual, such as an e-mail address, a name, or in some cases, an IP address. These laws also provide consumers the right to access the information a company has collected on them, correct it, request that it be deleted, or to stop the sale of such information to third parties. Additionally, the EU requires informed consent for the placement of a cookie on a user device.

While we believe that we are operating our business in compliance with the laws and regulations that apply to us, such laws and regulations continue to be the focus of legislative bodies, courts, and regulators at the state and federal level as well as in other countries. This enhanced focus may result in amendments to existing laws and regulations, the enactment of new laws and regulations, and new guidance and interpretation by governmental agencies or the courts. All of these factors could materially impact our business and results of operations.

Intellectual Property

We regard our copyrights, domain names, trademarks, trade secrets and similar intellectual property as important to our success, and we rely upon copyright, trademark and trade secrets laws, as well as confidentiality agreements with our employees and others, and protective contractual provisions, to protect the proprietary technologies and content that we have developed. We pursue the registration of our material trademarks in the U.S. and elsewhere. Currently, our TechTarget trademark and logo, as well as certain other marks and logos, are registered in the U.S. with the U.S. Patent and Trademark Office and in select foreign jurisdictions and we have applied for U.S. and foreign registrations for various other marks. In addition, we have registered over 1,600 domain names that are, or may be, relevant to our business, including “www.techtarget.com,” “www.knowledgestorm.com,” “www.bitpipe.com,” and those leveraging the “search” prefix used in the branding of many of our websites. We also incorporate a number of third party software products into our technology platform pursuant to relevant licenses. We use third party software to maintain and enhance, among other things, the content generation and delivery, and support our technology infrastructure. We are not substantially dependent upon these third party software licenses, and we believe the licensed software is generally replaceable, by either licensing or purchasing similar software from another vendor or building the software functions ourselves.

Human Capital Resources

As of December 31, 2020, we had approximately 940 full-time employees worldwide, which includes employees from our recent acquisitions. Other than a small number of employees in the United Kingdom and France, none of our current employees are represented by a labor union or are the subject of a collective bargaining agreement. TechTarget is an innovative company in a dynamic environment that fosters a collaborative culture among its energetic, driven and workforce. We value our employees, let them know the objectives and goals, challenge them, equip them with the right tools and resources to succeed, and then empower them to get the job done. At TechTarget, we give employees direct responsibility for generating results while allowing their ideas to be the catalyst for entirely new areas of opportunity. Our key human capital objectives in managing our business include attracting, developing and retaining top talent while integrating diversity, equity and inclusion principles and practices into our culture.

We strive to attract a pool of diverse and exceptional candidates and support their career growth once they become employees. Our efforts begin during the recruitment process by offering candidates an outstanding, comfortable and welcoming candidate experience where they are able to learn as much about our company and culture as we are able to learn about them. Once hired, we ensure that employees are rewarded, recognized and engaged based on their contributions. We also emphasize in our performance evaluation and career development efforts internal mobility opportunities for employees to drive professional development and we consistently promote approximately 25% of our workforce to positions with increased responsibility each year. Our goal is a long-term, upward-bound career at TechTarget for every employee, which we believe also drives our retention efforts.

15

Our ability to retain our workforce is also dependent on our ability to foster an environment that is safe, respectful, fair and inclusive of everyone and promotes diversity, equity and inclusion inside and outside of our business. We accomplish this with the strong culture we have built over the past 20+ years and through the efforts of our active culture committees – Women in Business at TechTarget, Health & Fitness at TechTarget, TechTarget Gives and TechTarget Diversity & Inclusion Committee. Each committee has their own distinct mission, but all look to cultivate leadership skills, develop best business practices, encourage knowledge sharing, give back to the community, and provide personal growth and development opportunities while allowing for a wide range of perspectives and experiences.

Seasonality

The timing of our revenues is affected by seasonal factors. Our revenues are seasonal primarily as a result of the annual budget approval process of many of our customers, the normal timing at which our customers introduce new products, and the historical decrease in marketing activity in summer months. The timing of revenues in relation to our expenses, much of which do not vary directly with revenues, has an impact on the cost of revenues, selling and marketing, product development and general and administrative expenses as a percentage of revenues in each calendar quarter during the year.

The majority of our expenses are personnel-related and include salaries, stock-based compensation, benefits and incentive-based compensation plan expenses. As a result, we have not experienced significant seasonal fluctuations in the timing of our expenses period to period.

Risks Relating to Our Business and Operations

The risks and uncertainties set forth below, as well as other risks and uncertainties described elsewhere in this Annual Report on Form 10-K including in our consolidated financial statements and accompanying notes and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” or in other filings with the SEC, could materially and adversely affect our business, financial condition, operating results and the trading price of our common stock. Additional risks and uncertainties that are not currently known to us or that are not currently believed by us to be material may also harm our business operations and financial results. Because of the following risks and uncertainties, as well as other factors affecting our financial condition and operating results, past financial performance should not be considered to be a reliable indicator of future performance, and investors should not use historical trends to anticipate results or trends in future periods.

Risks Related to our Business and Operations

Because we depend on our ability to generate revenues from the sale and support of purchase intent driven advertising campaigns, fluctuations in advertising spending could have an adverse effect on our revenues and operating results.

The primary source of our revenues is the sale and support of purchase intent-driven advertising campaigns to our customers. Any reduction in advertising expenditures could have an adverse effect on the Company’s revenues and operating results. We believe that advertising spending on the internet, as in traditional media, fluctuates significantly as a result of a variety of factors, many of which are outside of our control. Some of these factors include:

| • | variations in expenditures by advertisers due to budgetary constraints; |

| • | the cancellation or delay of projects by advertisers or by one or more significant customers; |

| • | the cyclical and discretionary nature of advertising spending; |

| • | the relocation of advertising expenditures to competitors or other media; |

| • | general global economic conditions and the availability of capital, as well as economic conditions specific to the internet and online and offline media industry; and |

| • | the occurrence of extraordinary events, such as natural disasters, disease outbreaks (such as the novel coronavirus), acts of terrorism and international or domestic political and economic unrest. |

16

We have been adversely impacted by the new coronavirus disease (“COVID-19”) pandemic and could experience additional adverse impacts that could be material to the Company’s business, operating results, financial condition and liquidity.

Our business was adversely impacted by the effects of the spread of the new coronavirus disease (“COVID-19”). We are witnessing the far-reaching impact that COVID-19 is having on our employees, customers, vendors, members, stockholders, and other stakeholders, as well as the global economy and society at large. While we have responded proactively to address the effects of COVID-19 and to mitigate its potential impacts to our business, including through the elimination of all non-essential travel, transitioning our entire workforce to a remote work environment, and enhancing access to certain health and safety resources for our employees, beginning in March 2020 we saw certain customers extend their normal sales cycles and budget shifts as some customers moved from long-term commitments to shorter-term marketing campaigns as they began to navigate through the pandemic. New customer acquisition has become harder as some potential customers have been less apt to spend on new products or services.

We believe our strong financial position provides us with the flexibility to weather this period of economic uncertainty and the opportunity to respond quickly to our customers with the content and services they expect. However, the restrictive measures local, state, and federal governments (including in the countries outside the U.S. in which we operate) have implemented to prevent the spread of COVID-19, including restrictions on the operation of non-essential businesses, shelter in place orders, travel restrictions, quarantines, school closures, and other community response and social distancing policies and guidelines, will continue to affect the way we and our customers conduct and operate our respective businesses. We remain open and continue to provide the content and services that are important to our customers. Moreover, our dedicated employees continue to collaborate with each other and our customers and their sales and marketing teams, to deliver high quality, impactful campaigns. While we will continue to actively monitor government restrictions impacting our business and remain focused on business continuity, including reducing expenses and managing liquidity, given the fluid nature of COVID-19, the uncertainty of the pandemic’s duration location, extent and severity of resurgences, and the unknown effects of potential future government actions in response to COVID-19, we cannot estimate the duration or magnitude of its impact on the global economy, our business or our financial results.

Because most of our customers are in the enterprise technology industry, our revenues are subject to characteristics of the enterprise technology industry that can affect advertising spending by B2B technology companies.