Table of Contents

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

☑ | Annual Report PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2022

or

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number: 001-32347

ORMAT TECHNOLOGIES, INC.

(Exact name of registrant as specified in its charter)

Delaware | 88-0326081 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification Number) |

6140 Plumas Street, Reno, Nevada | 89519-6075 |

(Address of principal executive offices) | (Zip Code) |

(775) 356-9029

(Registrant’s telephone number, including area code)

Securities Registered Pursuant to Section 12(b) of the Act:

Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered |

Common Stock $0.001 Par Value | ORA | New York Stock Exchange |

Securities Registered Pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☑ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ☐ No ☑

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer ☑ | Accelerated filer ☐ | Non-accelerated filer ☐ | Smaller reporting company ☐ | Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report ☑

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☑

As of June 30, 2022 the aggregate market value of the registrant’s common stock held by non-affiliates was $3,521,801,708. As of February 22, 2023, the number of outstanding shares of common stock, par value $0.001 per share was 56,095,918.

Portions of the registrant's definitive proxy statement for its 2022 Annual Meeting of Stockholders are incorporated by reference into Part III of this Form 10-K.

ORMAT TECHNOLOGIES, INC.

FORM 10-K FOR THE YEAR ENDED DECEMBER 31, 2022

TABLE OF CONTENTS

Glossary of Terms

Unless the context otherwise requires, all references in this Annual Report on Form 10-K (this “Annual Report”) to “Ormat”, “the Company”, “we”, “us”, “our company”, “Ormat Technologies”, or “our” refer to Ormat Technologies, Inc. and its consolidated subsidiaries. A glossary of certain terms and abbreviations used in this annual report appears at the beginning of this Annual Report. When the following terms and abbreviations appear in the text of this report, they have the meanings indicated below:

Term | Definition |

AC | Alternating Current |

ACUA | Atlantic County Utilities Authority |

Amatitlan Loan | $42,000,000 in initial aggregate principal amount borrowed by our subsidiary Ortitlan Limitada from Banco Industrial S.A. and Westrust Bank (International) Limited. |

AMM | Administrador del Mercado Mayorista (administrator of the wholesale market — Guatemala) |

ARRA | American Recovery and Reinvestment Act of 2009 |

Auxiliary Power | The power needed to operate a geothermal power plant’s auxiliary equipment such as pumps and cooling towers |

Availability | The ratio of the time a power plant is ready to be in service, or is in service, to the total time interval under consideration, expressed as a percentage, independent of fuel supply (heat or geothermal) or transmission accessibility |

BESS | Battery Energy Storage Systems |

BLM | Bureau of Land Management of the U.S. Department of the Interior |

BOT | Build, operate and transfer |

BPP | PLN's existing average cost of generation |

CAISO | California Independent System Operator |

CalGEM | California Geologic Energy Management |

Capacity | The maximum load that a power plant can carry under existing conditions, less auxiliary power |

Capacity Factor | The ratio of the actual MWh generated and the generating capacity times 8760 hours expressed as a percentage |

CARES | Coronavirus Aid, Relief, and Economic Security Act |

CCA | Community Choice Aggregator |

CDC | Caisse des Dépôts et Consignations, a French state-owned financial organization |

CEO | Chief Executive Officer |

CFO | Chief Financial Officer |

C&I | Refers to the Commercial and Industrial sectors, excluding residential |

CNEE | National Electric Energy Commission of Guatemala |

COD | Commercial Operation Date |

Company | Ormat Technologies, Inc., a Delaware corporation, and its consolidated subsidiaries |

CPA | Clean Power Alliance |

CPI | Consumer Price Index |

CPUC | California Public Utilities Commission |

DEG | Deutsche Investitions-und Entwicklungsgesellschaft mbH |

CREE | The Regulatory Commission of Electric Power in Honduras |

DFC | U.S. International Development Finance Corporation (formerly OPIC) |

DOE | U.S. Department of Energy |

DSCR | Debt Service Coverage Ratio |

EBITDA | Earnings before interest, taxes, depreciation, amortization and accretion |

EDF | Electricite de France S.A. |

EGS | Enhanced Geothermal Systems |

EIB | European Investment Bank |

Eligible Green Projects | Allocations made by the Company or any of its subsidiaries to any of the projects defined below in the 24 months prior to or 24 months following the issuance date of the bonds. Eligible Green Projects include the following (for illustrative purposes only): (i) renewable energy (new geothermal energy generation facilities with GHG emissions less than 100g CO2d/KWh; upgrades to existing geothermal energy generation facilities to increase efficiency, resiliency and reliability; energy storage systems; or solar PV systems); and (ii) eco-efficient and/or circular economy adapted products. |

EMRA | Energy Market Regulatory Authority in Turkey |

ENEE | Empresa Nacional de Energía Eléctrica |

Enthalpy | The total energy content of a fluid; the heat plus the mechanical energy content of a fluid (such as a geothermal brine), which, for example, can be partially converted to mechanical energy in an Organic Rankine Cycle. |

EPA | U.S. Environmental Protection Agency |

EPC | Engineering, procurement and construction |

ERCOT | Electric Reliability Council of Texas, Inc. |

EPRA | Energy and Petroleum Regulatory Authority of Kenya |

| EU | European Union |

EWG | Exempt Wholesale Generators |

Exchange Act | U.S. Securities Exchange Act of 1934, as amended |

FASB | Financial Accounting Standards Board |

FERC | U.S. Federal Energy Regulatory Commission |

FIT | Feed-in Tariff |

FPA | U.S. Federal Power Act, as amended |

GAAP | Generally accepted accounting principles |

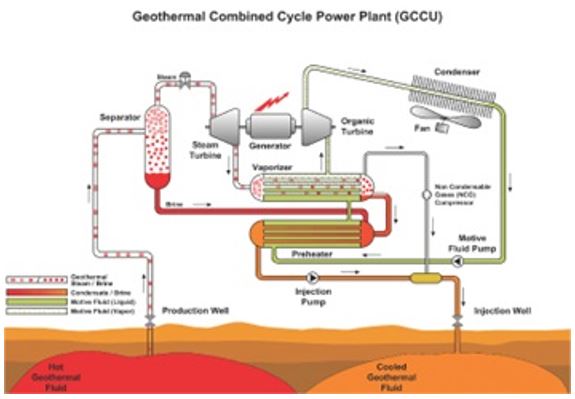

GCCU | Geothermal Combined Cycle Unit |

GDC | Geothermal Development Company |

Geothermal Power Plant | The power generation facility and the geothermal field |

Geothermal Steam Act | U.S. Geothermal Steam Act of 1970, as amended |

GERD | Grand Ethiopian Renaissance Dam |

GHG | Greenhouse gas |

GIS | Geographic Information Systems |

Green bonds or green convertible bonds | Bonds, which the proceeds from, are used to finance and/or refinance, in whole or in part, new or on-going projects in accordance with the Ormat Green Finance Framework. |

GW | Giga watt |

GWh | Giga watt hour |

HELCO | Hawaii Electric Light Company |

IDWR | Idaho Department of Water |

IFM | In Front of the Meter |

IGA | International Geothermal Association |

IID | Imperial Irrigation District |

INDE | Instituto Nacional de Electrification |

IOUs | Investor-Owned Utilities |

IPPs | Independent Power Producers |

IESO | The Independent Electricity System Operator (IESO) works at the heart of Ontario's power system. |

ISO | Independent System Operator |

ISONE | ISO New England |

ITC | Investment Tax Credit |

IRA | Inflation Reduction Act |

JBIC | Japan Bank for International Cooperation |

JOGMEC | Japan state-owned resources agency |

John Hancock | John Hancock Life Insurance Company (U.S.A.) |

JPM | J.P. Morgan Capital Corporation |

KenGen | Kenya Electricity Generating Company Ltd. |

Kenyan Energy Act | Kenyan Energy Act, 2006 |

KETRACO | Kenya Electricity Transmission Company Limited |

KGRA | Known Geothermal Resource Area |

KLP | Kapoho Land Partnership |

KPLC | Kenya Power and Lighting Co. Ltd. |

KRA | Kenya Revenue Authority |

kW | Kilowatt - A unit of electrical power that is equal to 1,000 watts |

kWh | Kilowatt hour(s), a measure of power produced |

LCOE | Levelized Costs of Energy |

Mammoth Pacific | Mammoth-Pacific, L.P. |

MEMR | The Indonesian Minister of Energy and Mineral Resources |

MW | Megawatt - One MW is equal to 1,000 kW or one million watts |

MWh | Megawatt hour(s), a measure of energy produced |

NIS | New Israeli Shekel |

NOA | Notice of Assessments |

NV Energy | NV Energy, Inc. |

NYSE | New York Stock Exchange |

NYISO | New York Independent System Operator, Inc. |

OEC | Ormat Energy Converter |

OFC | Ormat Funding Corp., a wholly owned subsidiary of the Company |

OFC 2 | OFC 2 LLC, a wholly owned subsidiary of the Company |

OFC 2 Senior Secured Notes | Up to $350,000,000 Senior Secured Notes, due 2034 issued by OFC 2 |

Opal Geo | Opal Geo LLC |

OPC | OPC LLC, a consolidated subsidiary of the Company |

OrCal | OrCal Geothermal Inc., a wholly owned subsidiary of the Company |

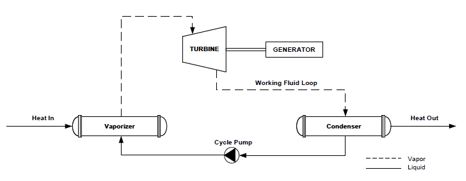

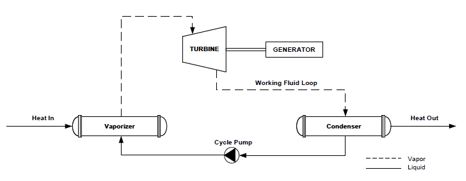

ORC | Organic Rankine Cycle - A process in which an organic fluid such as a hydrocarbon or fluorocarbon (but not water) is boiled in an evaporator to generate high pressure vapor. The vapor powers a turbine to generate mechanical power. After the expansion in the turbine, the low-pressure vapor is cooled and condensed back to liquid in a condenser. A cycle pump is then used to pump the liquid back to the vaporizer to complete the cycle. The cycle is illustrated in the figure below: |

Ormat International | Ormat International Inc., a wholly owned subsidiary of the Company |

Ormat Nevada | Ormat Nevada Inc., a wholly owned subsidiary of the Company |

Ormat Systems | Ormat Systems Ltd., a wholly owned subsidiary of the Company |

Ormat Green Finance Framework | A framework developed in alignment with the Green Bond Principles (2021), as published by the International Capital Markets Association, by which the proceeds of green bonds are used to finance and/or refinance, in whole or in part, one or more Eligible Green Projects. |

ORIX | ORIX Corporation |

ORPD | ORPD LLC, a holding company subsidiary of the Company in which Northleaf Geothermal Holdings, LLC holds a 36.75% equity interest |

OrPower 4 | OrPower 4 Inc., a wholly owned subsidiary of the Company |

Ortitlan | Ortitlan Limitada, a wholly owned subsidiary of the Company |

ORTP | ORTP, LLC, a consolidated subsidiary of the Company |

Orzunil | Orzunil I de Electricidad, Limitada, a wholly owned subsidiary of the Company |

PEC | Portfolio Energy Credits |

PG&E | Pacific Gas and Electric Company |

PGV | Puna Geothermal Venture, a wholly owned subsidiary of the Company |

PJM | PJM Interconnection, LLC |

PLN | PT Perusahaan Listrik Negara |

Power plant equipment | Interconnection equipment, cooling towers for water cooled power plant, etc., including the generating units |

PPA | Power purchase agreement |

PTC | Production Tax Credit |

PUC | Public Utilities Commission |

PUCH | Public Utilities Commission of Hawaii |

PUCN | Public Utilities Commission of Nevada |

PUHCA | U.S. Public Utility Holding Company Act of 1935 |

PUHCA 2005 | U.S. Public Utility Holding Company Act of 2005 |

PURPA | U.S. Public Utility Regulatory Policies Act of 1978 |

Qualifying Facility(ies) | Certain small power production facilities are eligible to be “Qualifying Facilities” under PURPA, provided that they meet certain power and thermal energy production requirements and efficiency standards. Qualifying Facility status provides an exemption from PUHCA 2005 and grants certain other benefits to the Qualifying Facility |

RCEA | Redwood Coast Energy Authority |

REC | Renewable Energy Credit |

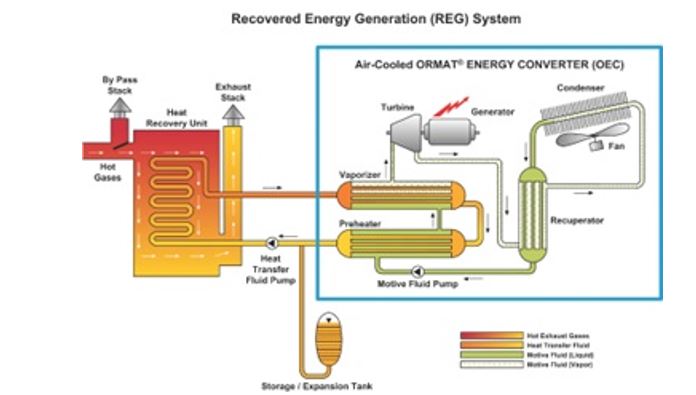

REG | Recovered Energy Generation |

RER | Renewable Energy Resource certificate |

RPS | Renewable Portfolio Standards |

RTO | Regional Transmission Organization |

SCE | Southern California Edison |

SCPPA | Southern California Public Power Authority |

SDG&E | San Diego Gas and Electric |

SEC | U.S. Securities and Exchange Commission |

Securities Act | U.S. Securities Act of 1933, as amended |

SOL | Sarulla Operations Ltd. |

Solar PV | solar photovoltaic |

SOX Act | Sarbanes-Oxley Act of 2002 |

SRAC | Short Run Avoided Costs |

TASE | Tel Aviv Stock Exchange |

Tax Act | Tax Cuts and Jobs Act |

UIC | Underground Injection Control |

| UN | United Nation |

Union Bank | Union Bank, N.A. |

U.S. | United States of America |

U.S. Treasury | U.S. Department of the Treasury |

USG | U.S. Geothermal Inc. |

VAT | Value Added Tax |

VCE | Valley Clean Energy |

Viridity | Viridity Energy Solutions Inc., a wholly owned subsidiary of the Company |

YTL | Turkish Lira |

Cautionary Note Regarding Forward-Looking Statements and Risk Factor Summary

This Annual Report includes “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical facts, included in this report that address activities, events or developments that we expect or anticipate will or may occur in the future, including such matters as our projections of annual revenues, expenses and debt service coverage with respect to our debt securities, future capital expenditures, business strategy, competitive strengths, goals, development or operation of generation assets, market and industry developments and the growth of our business and operations, are forward-looking statements. When used in this Annual Report, the words “may”, “will”, “could”, “should”, “expects”, “plans”, “anticipates”, “believes”, “estimates”, “predicts”, “projects”, “potential”, “target”, “goal”, or “contemplate” or the negative of these terms or other comparable terminology are intended to identify forward-looking statements, although not all forward-looking statements contain such words or expressions. The forward-looking statements in this Annual Report are primarily located in the material set forth under the headings Item 1 — “Business” contained in Part I of this Annual Report, Item 1A — “Risk Factors” contained in Part I of this Annual Report, Item 7 — “Management’s Discussion and Analysis of Financial Condition and Results of Operations” contained in Part II of this Annual Report, and “Notes to Financial Statements” contained in Item 8 — “Financial Statements and Supplementary Data” contained in Part II of this Annual Report, but are found in other locations as well. These forward-looking statements generally relate to our plans, objectives and expectations for future operations and are based upon management’s current estimates and projections of future results or trends. Although we believe that our plans and objectives reflected in or suggested by these forward-looking statements are reasonable, we may not achieve these plans or objectives. You should read this Annual Report completely and with the understanding that actual future results and developments may be materially different from what we expect attributable to a number of risks and uncertainties, many of which are beyond our control.

These forward-looking statements are made only as of the date hereof, and, except as legally required, we undertake no obligation to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise.

A summary of the risks that may cause actual results to differ from our expectations include, but are not limited to the following:

Risks Related to the Company’s Business and Operation

| | • | Our financial performance depends on the successful operation of our geothermal, REG, Solar PV power plants under the Electricity segment as well as, our energy storage facilities, which are subject to various operational risks. |

| | • | Our exploration, development, and operation of geothermal energy resources are subject to geological risks and uncertainties, which may result in decreased performance or increased costs for our power plants. |

| | • | We may decide not to implement, or may not be successful in implementing, one or more elements of our multi-year strategic plan, and the plan may not achieve its goal of enhancing shareholder value. |

| | • | Concentration of customers, specific projects and regions may expose us to heightened financial exposure. |

| | • | Our international operations expose us to risks related to the application of foreign laws and regulations. |

| | • | Political, economic and other conditions in the emerging economies where we operate, including Israel, may subject us to greater risk than in the developed U.S. economy. |

| | • | Our investments in battery energy storage system (BESS) technology involves new technologies with relatively limited history with respect to reliability and performance and may not perform as expected. In addition, our investments may be negatively affected by a number of factors, including increases in storage costs, risk of fire and volatility in electricity pricing. |

| | • | Conditions in and around Israel, where the majority of our senior management and our main production and manufacturing facilities are located, may adversely affect our operations and may limit our ability to produce and sell our products or manage our power plants. |

| | • | Reduction in our Products backlog may affect our ability to fully utilize our main production and manufacturing facilities. |

| | • | Some of our leases will terminate if we do not extract geothermal resources in “commercial quantities”, or if we fail to comply with the terms or stipulations of such leases or any of the provisions of the Geothermal Steam Act or if the lessor under any such lease defaults on any debt secured by the relevant property, thus requiring us to enter into new leases or secure rights to alternate geothermal resources, none of which may be available on terms as favorable to us as any such terminated lease, if at all. |

| | • | Reduced levels of recovered energy required for the operation of our REG power plants may result in decreased performance of such power plants. |

| | • | Our business development activities may not be successful and our projects under construction or facilities undergoing enhancement and repowering may encounter delays. |

| | • | Our future growth depends, in part, on the successful enhancement of a number of our existing facilities. |

| | • | We rely on power transmission facilities that we do not own or control. |

| | • | Our use of joint ventures may limit our flexibility with jointly owned investments. |

| | • | Our operations could be adversely impacted by climate change. |

| | • | We could be negatively impacted by regulatory and other responses to climate change |

| | • | Geothermal projects that we plan to develop in the future, may operate as "merchant" facilities without long-term PPAs and therefore such projects will be exposed to market fluctuations. |

| | • | We may not be able to successfully complete acquisitions, and we may not be able to successfully integrate, or realize anticipated synergies from, companies that we have acquired and may acquire in the future. |

| | • | We may not be able to successfully conclude transactions and integrate companies, which we acquired and may acquire in the future. |

| | • | We encounter intense competition from electric utilities, other power producers, power marketers, developers and third-party investors. |

| | • | Changes in costs and technology may significantly impact our business by making our power plants and products less competitive, resulting in our inability to sign new or recontracted PPAs for our Electricity segment and new supply and EPC contracts for our Products segment. |

| | • | Our intellectual property rights may not be adequate to protect our business. |

| | • | We may experience difficulties implementing and maintaining our new enterprise resource planning system. |

| | • | We may experience a cyber-incident, cyber security breach, severe natural event or physical attack on our operational networks and information technology systems. |

Risks Related to Governmental Regulations, Laws and Taxation

| | • | Our financial performance could be adversely affected by changes in the legal and regulatory environment affecting our operations. |

| | • | Pursuant to the terms of some of our PPAs with investor-owned electric utilities and publicly-owned electric utilities in states that have renewable portfolio standards, the failure to supply the contracted capacity and energy thereunder may result in the imposition of penalties. |

| | • | If any of our domestic power plants loses its current Qualifying Facility status under PURPA, or if amendments to PURPA are enacted that substantially reduce the benefits currently afforded to Qualifying Facilities, our domestic operations could be adversely affected. |

| | • | We may experience a reduction or elimination of government incentives. |

| | • | We are a holding company and our cash depends substantially on the performance of our subsidiaries and the power plants they operate, most of which are subject to restrictions and taxation on dividends and distributions. |

| | • | The costs of compliance with federal, state, local and foreign environmental laws and our ability to obtain and maintain environmental permits and governmental approvals required for development, construction and/or operation may result in liabilities, costs and delays in construction (as well as any fines or penalties that may be imposed upon us in the event of any non-compliance or delays with such laws or regulations). |

| | • | We could be exposed to significant liability for violations of hazardous substances laws because of the use or presence of such substances at our power plants. |

| | • | U.S. federal, state and foreign country income tax reform could adversely affect us. |

Risks Related to Economic and Financial Conditions

| | • | We may be unable to obtain the financing we need on favorable terms to pursue our growth strategy and any future financing we receive may be less favorable to us than our current financing arrangements. |

| | • | We have incurred substantial indebtedness that may decrease our business flexibility, access to capital, and/or increase our borrowing costs, and we may still incur substantially more debt, which may adversely affect our operations and financial results. |

| | • | Our debt obligations may adversely affect our ability to raise additional capital and will be a burden on our future cash resources, particularly if we elect to settle these obligations in cash upon conversion or upon maturity or required repurchase. |

| | • | The Capped Call Transactions may affect the value of the Notes and our common stock and we are subject to counterparty risk with respect to the Capped Call Transactions. |

| | • | Our foreign power plants and foreign manufacturing operations expose us to risks related to fluctuations in currency rates, which may reduce our profits from such power plants and operations. |

| | • | Our power plants have generally been financed through a combination of our corporate funds and limited or non-recourse project finance debt and lease financing. If our project subsidiaries default on their obligations under such limited or non-recourse debt or lease financing, we may be required to make certain payments to the relevant debt holders, and if the collateral supporting such leveraged financing structures is foreclosed upon, we may lose certain of our power plants. |

| | • | We may experience fluctuations in the cost of construction, raw materials, commodities and drilling. |

| | • | Our commodity derivative activity may limit potential gains, increase potential losses, result in earnings volatility and involve other risks. |

| | • | We are exposed to swap counterparty credit risk. |

| | • | We may not be able to obtain sufficient insurance coverage to cover damages resulting from any damages to our assets and profitability including, but not limited to, natural disasters such as volcanic eruptions, lava flows, wind and earthquakes. |

Risks Related to Force Majeure

| | • | The global spread of a public health crisis, including the COVID-19 pandemic may have an adverse impact on our business. |

| | • | The existence of a prolonged force majeure event or a forced outage affecting a power plant, or the transmission systems could reduce our net income. |

| | • | Threats of terrorism may impact our operations in unpredictable ways and could adversely affect our business, financial condition, future results and cash flow. |

Risks Related to Our Stock

| | • | Future equity issuances, including through our current or any future equity compensation plans, could result in dilution, which could cause the price of our shares of common stock to decline. |

| | • | A substantial percentage of our common stock is held by stockholders whose interests may conflict with the interests of our other stockholders. |

| | • | The price of our common stock may fluctuate substantially, and your investment may decline in value. |

| | • | We may issue additional shares of our common stock in connection with conversions of the Notes, and thereby dilute our existing stockholders and potentially adversely affect the market price of our common stock. |

| | • | The fundamental change provisions of the Notes may delay or prevent an otherwise beneficial takeover attempt of us. |

Market and Industry Data

This Annual Report includes market and industry data and forecasts that we have derived from publicly available information, various industry publications, other published industry sources and internal data and estimates. Industry publications and other published industry sources generally indicate that the information contained therein was obtained from sources believed to be reliable. Internal data and estimates are based upon information obtained from trade and business organizations and other contacts in the markets in which we operate and our management’s understanding of industry conditions. Any estimates underlying such market-derived information and other factors could cause actual results to differ materially from those expressed in the independent parties’ estimates and in our estimates.

Company Contact and Sources of Information

Our website is www.ormat.com. Information contained on or accessible via our website, including our Sustainability Reports, is not part of or otherwise incorporated by reference into this Annual Report. Information that we furnish to or file with the U.S. Securities and Exchange Commission (the “SEC”), including our Annual Reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and any amendments to, or exhibits included in, these reports are made available for download, free of charge, through our website as soon as reasonably practicable. Our SEC filings, including exhibits filed therewith, are also available directly on the SEC’s website at www.sec.gov.

We may use our website as a distribution channel of material company information. Financial and other important information regarding the Company is routinely posted on and accessible through our website at www.ormat.com. Accordingly, investors should monitor this channel, in addition to following our press releases, SEC filings and public conference calls and webcasts.

PART I

ITEM 1. BUSINESS

Overview

We are a leading vertically integrated company that is primarily engaged in the geothermal energy power business. We leverage our core capabilities and global presence to expand our activity in recovered energy generation and into different energy storage services and solar PV (including hybrid geothermal and solar PV as well as Solar plus Energy Storage). Our objective is to become a leading global provider of renewable energy and help to mitigate climate change by providing replacement to carbon-intensive energy sources. We have adopted a strategic plan to focus on several key initiatives to expand our business.

We currently conduct our business activities in three business segments:

| | • | Electricity Segment. In the Electricity segment, we develop, build, own and operate geothermal, solar PV and recovered energy-based power plants in the United States and geothermal power plants in other countries around the world and sell the electricity they generate. In 2022 we commenced commercial operation of 78 MW of geothermal power plants including the 35MW CD4 power plant in the Mammoth complex and the 13MW Tungsten 2 plant, both in the U.S. In addition, we commenced commercial operation of 30MW of Solar PV projects, including the 20MW Wister solar power plant as well as the 5MW Steamboat Hills and the 5MW Tungsten Solar power plants. |

| | • | Product Segment. In the Product segment, we design, manufacture and sell equipment for geothermal and recovered energy-based electricity generation and provide services relating to the engineering, procurement and construction of geothermal and recovered energy-based power plants. Since the beginning of 2022, we signed new contracts that were added to our backlog and secured $155.5 million of revenues to be recognized over the next two years. |

| | • | Energy Storage Segment. In the Energy Storage segment, we own and operate grid connected In Front of the Meter (IFM) BESS facilities, which provide capacity, energy and ancillary services directly to the electric grid.In 2022, we commissioned one energy storage facility with a total of 5MW/20 MWh in California. |

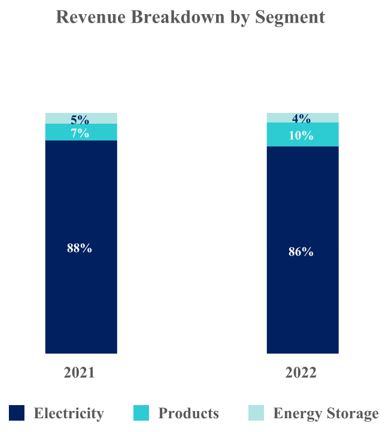

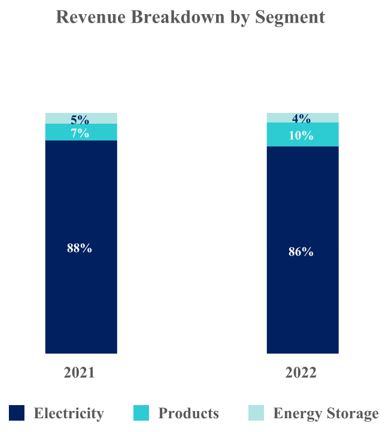

The charts below show the relative contributions of each of our segments to our consolidated revenues and the geographical breakdown of our segment revenues for the fiscal year ended December 31, 2022.

The following chart sets forth a breakdown of our revenues for each of the years ended December 31, 2021 and 2022:

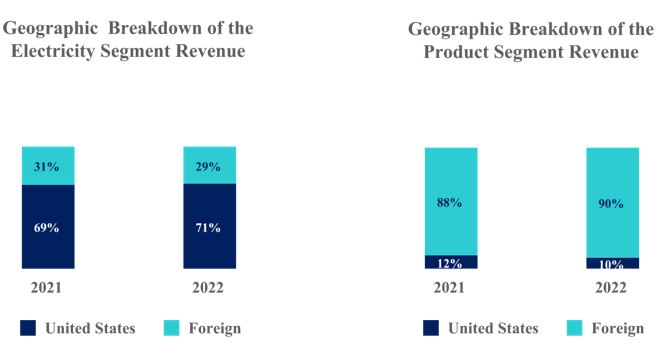

The following chart sets forth the geographical breakdown of revenues attributable to our Electricity and Product segments for each of the years ended December 31, 2021 and 2022:

The revenues attributable to our Energy Storage segment for each of the years ended December 31, 2021 and 2022 were 100% generated in the United States.

Our Power Generation Business (Electricity Segment)

Our company-owned power plants include both power plants that we have built and power plants that we have acquired. The substantial majority of the power plants that we currently own or operate produce electricity from geothermal energy sources. Geothermal energy is a clean, renewable and generally sustainable form of energy derived from the natural heat of the earth. Unlike electricity produced by burning fossil fuels, electricity produced from geothermal energy sources is produced without emissions of certain pollutants such as nitrogen oxide, and with far lower emissions of other pollutants such as carbon dioxide. As a result, electricity produced from geothermal energy sources contributes significantly less to climate change and local and regional incidences of acid rain than energy produced by burning fossil fuels. In addition, compared to power plants that utilize other renewable energy sources, such as wind or solar, geothermal power plants are generally available all year-long and all day-long and can therefore provide base-load electricity services. Geothermal power plants can also be custom built to provide a range of electricity services such as baseload, voltage regulation, reserve and flexible capacity.

We own and operate geothermal and solar PV hybrid projects and have similar projects currently under construction, in which the electricity generated from a solar PV power plant is used to offset the equipment’s energy use at the geothermal facility, thus increasing the geothermal energy delivered by the project to the grid. In 2022 we commenced operations in a 20MW stand-alone Solar PV project in California.

We also construct, own, and operate recovered energy-based power plants. We have built all of the recovered energy-based plants that we operate. Recovered energy comes from residual heat that is generated as a by-product of gas turbine-driven compressor stations, solar thermal units and a variety of industrial processes, such as cement manufacturing. Such residual heat, which would otherwise be wasted, may be captured in the recovery process and used by recovered energy power plants to generate electricity without burning additional fuel and without additional emissions.

Each of our current geothermal power plants sells substantially all of its output pursuant to long-term, and in most of the cases, fixed price PPAs to various counterparties denominated in or linked to the U.S. dollar or Euro. These contracts had a total weighted average remaining term, based on contributions to segment revenue, of approximately 15 years at December 31, 2022. In addition, the counterparties to our PPAs in the United States had a credit rating of between A3 to Baa2 by Moody's and BB- to A by S&P. The purchasers of electricity from our foreign power plants are mainly state-owned entities in countries with below investment grade rating.

Power Plants in Operation

We own and operate 28 geothermal, REG and solar sites globally with an aggregate generating capacity of 1,070 MW. Geothermal comprised 92% of our generating capacity. In 2022, our geothermal and REG power plants generated at a capacity factor of 83% and 66%, respectively, which is much higher than the 20%-30% capacity factor typically generated in wind and solar projects.

The table below summarizes certain key non-financial information relating to our power plants and complexes as of February 22, 2023. The generating capacity of certain of our power plants and complexes listed below has been updated from our 2021 disclosure to reflect changes in the resource temperature and other factors that impact resource capabilities:

Type | Region | Plant | | Ownership(1) | | | Generating capacity (MW) (2) | | | PPA Tenor | | | Capacity Factor | |

Geothermal | California | Ormesa Complex | | | 100% | | | | 36 | | | | 20 | | | | | |

| | | Heber Complex | | | 100% | | | | 81 | | | | 11 | | | | 83%(3) | |

| | | Mammoth Complex | | | 100% | | | | 65(4) | | | | 14 | | | | | |

| | | Brawley | | | 100% | | | | 7(5) | | | | 9 | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | West Nevada | Steamboat Complex | | | 100% | | | | 79 | | | | 20 | | | | 81% | |

| | | Brady Complex | | | 100% | | | | 24 | | | | 27 | | | | | |

| | East Nevada | Tuscarora | | | 100% | | | | 18 | | | | 10 | | | | | |

| | | Jersey Valley | | | 100% | | | | 8 | | | | 10 | | | | | |

| | | McGinness Hills | | | 100% | | | | 146(6) | | | | 16 | | | | | |

| | | Don A. Campbell | | | 63.3% | | | | 32 | | | | 13 | | | | 88% | |

| | | Tungsten Mountain | | | 100% | | | | 42(7) | | | | 21 | | | | | |

| | | Dixie Valley | | | 100% | | | | 58 | | | | 16 | | | | | |

| | | Beowawe | | | 100% | | | | 14 | | | | 32 | | | | | |

| | North West Region | Neal Hot Springs | | | 60% | | | | 24(8) | | | | 16 | | | | | |

| | | Raft River | | | 100% | | | | 12 | | | | 10 | | | | 86% | |

| | | San Emidio | | | 100% | | | | 11 | | | | 16 | | | | | |

| | Hawaii | Puna | | | 63.3% | | | | 38(9) | | | | 30 | | | | 62% | |

| | International | Amatitlan (Guatemala) | | | 100% | | | | 20 | | | | 6 | | | | | |

| | | Zunil (Guatemala) | | | 97% | | | | 20 | | | | 12 | | | | | |

| | | Olkaria III Complex (Kenya) | | | 100% | | | | 150 | | | | 12 | | | | 76%(10) | |

| | | Bouillante (Guadeloupe Island, France) | | | 63.75%(11) | | | | 15 | | | | 8 | | | | | |

| | | Platanares (Honduras) | | | 100% | | | | 38 | | | | 10 | | | | | |

| | | | | | | | | | | | | | | | | | | |

Total Consolidated Geothermal | | | | | | | 938 | | | | | | | | 83%(12) | |

| | | | | | | | | | | | | | | | | | | |

REG | | OREG 1 | | | 63.3% | | | | 22 | | | | 9 | | | | | |

| | | OREG 2 | | | 63.3% | | | | 22 | | | | 12 | | | | | |

| | | OREG 3 | | | 63.3% | | | | 5.5 | | | | 7 | | | | | |

| | | OREG 4 | | | 100% | | | | 3.5(13) | | | | 7 | | | | | |

Total REG | | | | | | | 53 | | | | | | | | 66% | |

| | | | | | | | | | | | | | | | | | | |

Solar | | Tungsten Mountain | | | 100% | | | | 12 | | | | 21 | | | | | |

| | | Wister | | | 100% | | | | 20(14) | | | | 20 | | | | | |

| | | Steamboat Solar | | | 100% | | | | 5(15) | | | | 21 | | | | | |

Total Solar | | | | | | | 37 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

Unconsolidated Geothermal | Indonesia | Sarulla Complex | | | 12.75% | | | | 42 | | | | 25 | | | | | |

| | | | | | | | | | | | | | | | | | | |

Total Unconsolidated Geothermal | | | | | | | 42 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

Total | | | | | | | 1,070 | | | | | | | | | |

1. | We have a controlling interest and we operate all of our power plants, except for Sarulla. Financial institutions hold equity interests in four of our subsidiaries: (i) Opal Geo subsidiaries, which own the McGinness Hills Phases 1 and 2 geothermal power plants, the Tuscarora and Jersey Valley power plants and the second phase of the Don A. Campbell power plant, all located in Nevada; (ii) ORNI 41, which owns McGinness Hills Phase 3 located in Nevada; (iii) ORNI 43, which owns the Tungsten Mountain geothermal power plant located in Nevada; (iv) Steamboat Hills, LLC, which owns the Steamboat Hills power plant located in Nevada; and (v) CD4 partnership that owns the CD4 power plant, under Mammoth Complex, in California. In the table above, we list these power plants as being 100% owned because all of the generating capacity is owned by these subsidiaries and we control the operation of the power plants. The nature of the equity interests held by the financial institution is described below in Item 8 — “Financial Statements and Supplementary Data" under Note 13. |

We own a 63.75% equity interest in the Bouillante power plant, a 60% equity interest in the Neal Hot Spring power plant and a 63.25% direct equity interest in each of the Puna plant, the first phase of Don A. Campbell, OREG 1, OREG 2 and OREG 3 power plants as well as the indirect interest in the second phase of the Don A. Campbell complex owned by our subsidiary, ORPD. We list 100% of the generating capacity of the Bouillante power plant, the Neal Hot Springs power plant and the power plants in the ORPD portfolio in the table above because we control their operations. We list our 12.75% share of the generating capacity of the Sarulla complex as we own a 12.75% minority interest. Revenues from the Sarulla complex are not consolidated and are presented under “Equity in earnings (losses) of investees, net” in our consolidated financial statements.

2. | References to generating capacity generally refer to gross generating capacity less auxiliary power. We determine the generating capacity of these power plants by taking into account resource and power plant capabilities. In any given year, the actual power generation of a particular power plant may differ from that power plant’s generating capacity due to variations in ambient temperature, the availability of the geothermal resource, and operational issues affecting performance during that year. In 2022 the capacity factors of Brawley, Olkaria, Puna, Heber and Sarulla complexes were significantly impacted by operational and resource issues, as discussed further under "Description of our power plants". |

3. | Capacity factor excludes the Heber 1 plant that was shutdown following a fire in early 2022, as discussed further under "Description of our power plants". |

4. | The Mammoth complex includes 35MW from CD4 that commenced commercial operation in July 2022. |

5. | The generating capacity of the Brawley complex is reduced due to lower performance of the wellfield. |

6. | Generating capacity reduced by 14MW to reflect the cooling we are experiencing in the resource. We are evaluating our alternatives to mitigate the cooling. |

7. | The Tungsten Mountain complex includes the 13MW second phase that commenced commercial operation in April 2022. Tungsten Mountain is a hybrid geothermal and solar power plant that uses the solar energy for geothermal power plant auxiliary power. The solar power plant's capacity increased in the third quarter of 2022 by 5MW to a total of 12 MW and is presented separately in the table above. |

8. | We own 60% and Enbridge owns 40% of the Neal Hot Springs power plant. |

9. | The Puna geothermal power plant shut down on May 3, 2018 when the Kilauea volcano erupted following a significant increase in seismic activity in the area. The Puna power plant resumed operations in November 2020 and during 2022 operated at a level of 23-25 MW. We are currently negotiating an amendment to the economic terms of the PPA. |

10. | Capacity factor was mainly impacted by lower performance of Olkaria complex, as further discussed below under "Description of our Power plants". |

11. | We own 63.75%, CDC owns 21.25% and Sageos owns 15.0% of the Bouillante power plant. |

12. | The total availability of the geothermal power plants excludes the Puna and Heber 1 power plants that are not in full operation, as discussed above. |

13. | The OREG 4 power plant is not operating at full capacity due to low run time of the compressor station that serves as the power plant’s heat source. This has resulted in lower power generation. |

14. | The 20MW Wister Solar power plant commenced commercial operation in July 2022. |

15. | The 5MW Steamboat Solar project commenced commercial operation in the second half of 2022. |

New Power Plants

We are currently in various stages of construction of new power plants and expansion of existing power plants. We have released for construction of 91 MW in generating capacity from geothermal and solar PV in the United States and Guatemala. In addition, we have several geothermal and solar PV projects in various stages of development. These projects are primarily located in the United States, Guadeloupe and Indonesia,

We hold substantial land positions across 28 prospects in the United States and 11 prospects in Ethiopia, Guatemala, Honduras, Indonesia, Madagascar and New Zealand that we expect will support future geothermal development. These land positions are comprised of various leases, exploration concessions for geothermal resources, and options to enter into leases. We have started or plan to start exploration activity on many of these prospects.

We expect to add between 230MW to 260MW by the end of 2025 and to reach a total generating capacity of approximately 1.3 GW in the Electricity Segment by that time.

Our Product Segment

We design, manufacture and sell products for electricity generation and provide the related services described below. In addition, we provide cementing services for well drilling to third parties. We primarily manufacture products to fill customer orders, but in some situations, we manufacture products as inventory for future projects that we will own or for future third party projects.

Power Units for Geothermal Power Plants

We design, manufacture and sell power units for geothermal electricity generation, which we refer to as OECs. In geothermal power plants using OECs, geothermal fluid (either hot water, also called brine, steam, or both) is extracted from the underground reservoir and flows from the wellhead to a vaporizer that heats a secondary working fluid, which is vaporized and used to drive the turbine. The secondary fluid is then condensed in a condenser, which may be cooled directly by air through an air cooling system or by water from a cooling tower and sent back to the vaporizer. The cooled geothermal fluid is then reinjected back into the reservoir. Our customers include contractors, geothermal power plant developers, owners and operators.

Power Units for Recovered Energy-Based Power Generation

We design, manufacture and sell power units used to generate electricity from recovered energy, or so-called “waste heat”. This heat is generated as a residual by-product of gas turbine-driven compressor stations, solar thermal units, biomass facilities and a variety of industrial processes, such as cement manufacturing, and is not otherwise used for any purpose. Our existing and target customers include interstate natural gas pipeline owners and operators, gas processing plant owners and operators, cement plant owners and operators, and other companies engaged in other energy-intensive industrial processes.

EPC of Power Plants

We serve as an EPC contractor for geothermal and recovered energy power plants on a turnkey basis, using power units we design and manufacture. Our customers are geothermal power plant owners as well as our target customers for the sale of our recovered energy-based power units. Unlike many other companies that provide EPC services, we believe our competitive advantage is in using equipment that we manufacture, which allows us better quality and control over the timing and delivery of required equipment and its related costs.

Our Energy Storage Segment

Our Energy Storage segment has grown consistently since 2019 and we expect even stronger growth over the coming years. We have targeted the Energy Storage segment as one of our major segments for investment and growth.

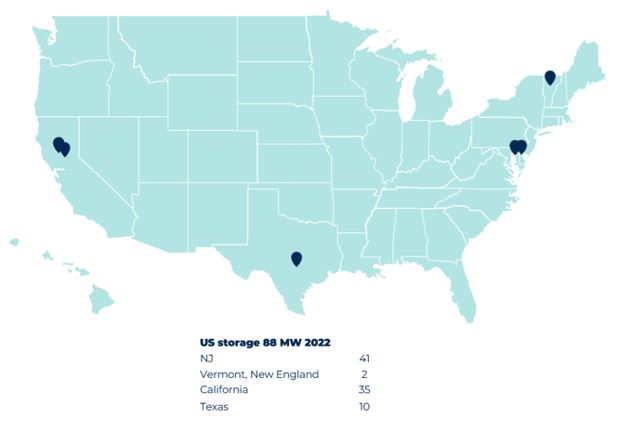

In 2022, we successfully brought on line one new Ormat-owned BESS project, the 5 MW/20 MWh Tierra Buena project in California, which increased our operating portfolio at the end of 2022 to approximately 88 MW / 196 MWh within the footprint of 4 RTOs or ISOs: CAISO, PJM Interconnect, ERCOT and ISONE.

We are currently in the process of constructing eight energy storage projects with a total capacity of 204 MW / 464 MWh in California, Texas, New Jersey and Ohio.

In addition, we have an approximate 3GW/10GWh pipeline of potential projects, in different stages of development across the United States that will support our target to reach an energy storage portfolio of 352MW by the end of 2024 and between 500MW and 530MW by 2025. The development of such projects is dependent, inter alia, on site permitting, interconnection agreement, supply of Lithium- Ion batteries and economic viability, which are not certain. We plan to continue leveraging our experience in project development and finance, our engineering, procurement and construction know-how and our relationships with utilities and other market participants, to develop additional BESS projects.

Business Strategy

Our business strategy reiterates and supports our position that climate change is among the most important issues of our time. A large part of our business involves bringing baseload energy to parts of the world that lack access to affordable renewable energy. Our Company recognizes the importance of the fight against climate change and the imperative of lowering global greenhouse gas emissions, and our core business actively works to counteract these existential threats. We are focused on helping to create a sustainable energy infrastructure, and further an alternative energy future, where greenhouse gas emissions are significantly reduced and the ability to access and store renewable sourced power will enable electricity grids to become more responsive, more stable, and more environmentally friendly.

Our goals include continuing our leading position in the geothermal energy market and becoming a leading global provider of renewable energy. Our strategy focuses on three main elements:

| | • | Developing our renewable geothermal business in the United States and globally; |

| | • | Establishing a strong market position in the IFM energy storage market; and |

| | • | Exploring opportunities in new areas by looking for synergistic growth opportunities utilizing our core competencies, strong market reputation, and new market opportunities focused upon environmental solutions. |

We intend to implement this strategy through:

| | • | Development and Construction of New Geothermal Power Plants - seeking out commercially viable renewable geothermal resources, to accelerate the development and construction of new zero emission geothermal power plants by entering into long-term PPAs providing stable and sustainable cash flows. |

| | • | Expanding our Geographical Reach — increasing our business development activities in an effort to grow our business in the global markets in all business segments. While we continue to evaluate global opportunities, we currently see the United States, Indonesia, Central America and Greece as attractive markets for our Electricity Segment. We see New Zealand, Philippines, Turkey, Chile, Indonesia, keep in United States and China as attractive markets for our Product Segment. We are actively looking at ways to expand our presence in these countries to offer and provide replacement to carbon-intensive power alternatives. |

| | • | Accelerating the Development and Construction of New Energy Storage Assets - increasing our business development activities seeking potential sites for development and construction of energy storage facilities (including hybrid storage and solar PV facilities) in an effort to significantly grow our energy storage market and provide efficient solutions to the grid. |

| | • | Acquisition of New Geothermal Assets - expanding and accelerating growth through acquisition activities globally, aiming to acquire additional geothermal assets as well as operating and development assets that can support our geothermal business. |

| | • | Acquisition of Energy Storage Projects and Assets – expanding and accelerating growth through acquisition activities of operating assets, shovel ready projects and projects in various stages of development. |

| | • | Using Our Operational Capabilities to Increase Output from our Existing Geothermal Power Plants - increasing output from our existing geothermal power plants by adding additional generating capacity, upgrading plant technology, and improving geothermal reservoir operations, including improving methods of heat source supply and delivery. |

| | • | Creating Cost Savings Through Increased Operating Efficiency - increasing efficiencies in our operating power plants and manufacturing facility including procurement by adding new technologies, restructuring of management control, automating part of our manufacturing work and centralizing our operating power plants. |

| | • | Diversifying our Customer Base - evaluating a number of strategies for expanding our customer base to the CCA's markets. In the near term, however, we expect that the substantial majority of our revenues will continue to be generated from our traditional electrical utility customer base for the Electricity segment. |

| | • | Maintaining a Prudent and Flexible Capital Structure - we have various financing structures in place, including non-recourse project financings, green convertible bonds, the sale of differential membership interests and equity interests in certain subsidiaries, as well as revolving credit facilities and term loans. We believe our cash flow profile, the long-term nature of our contracts, and our ability to raise capital provide greater flexibility for optimizing our capital structure. |

| | • | Improving our Technological Capabilities — investing in research and development of renewable energy technologies and leveraging our technological expertise to continuously improve power plant components, reduce operations and maintenance costs, develop competitive, eco-efficient and low-carbon products for electricity generation and target new service opportunities. In addition, we are expanding our core geothermal competencies to provide high efficiency solutions for high enthalpy applications by utilizing our binary enhanced cycle and technology. |

| | • | Manufacturing and Providing Products and EPC Services Related to Renewable Energy - designing, manufacturing and contracting power plants for our own use and selling to third parties power units and other generation equipment for geothermal and recovered energy-based electricity generation. |

| | • | Expanding into New Technologies - leveraging our technological capabilities over a variety of renewable energy platforms, including solar power generation, energy storage and recovered energy generation. We may acquire companies with integration and technological capabilities that we do not currently have, or develop new technology ourselves, where we can effectively leverage our expertise to implement this part of our strategic plan. |

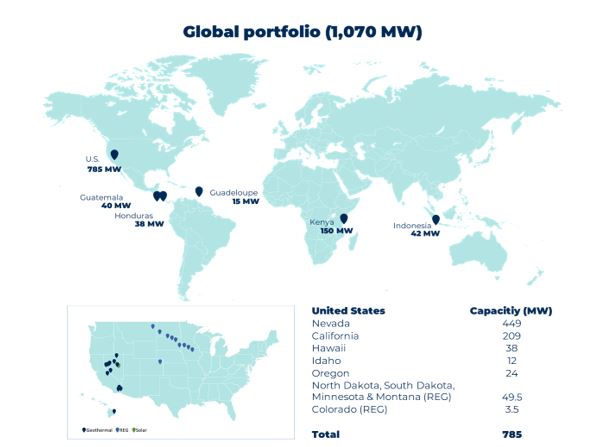

The map below shows our worldwide portfolio of operating geothermal, solar PV and recovered energy power plants as of February 22, 2023.

We believe our activities as a provider of renewable energy and our continued investment in clean and renewable assets help reduce greenhouse gas emissions .

* In the Sarulla complex, we include our 12.75% share only.

The map below shows our portfolio of operating storage facilities as of February 22, 2023.

Sustainability Strategy

We are committed to engaging with stakeholders on, and strengthening our commitment to, sustainability issues, including environmental, social and governance (“ESG”) matters. We endorse external initiatives and partner with national and international associations that we believe assist us in meeting our ESG commitments and values, in particular, relating to geothermal, energy and health and safety issues. We strive to provide recent, credible and comparable data to ESG agencies while engaging institutional investors and investor advocacy organizations around ESG issues.

As a renewable energy solution provider, we are motivated to identify opportunities and risks with respect to climate change and take efforts to reduce our greenhouse gas (“GHG”) emissions and improve our energy efficiency. In addition to meeting our regulatory requirements, we report our annual GHG emissions to global organizations, including CDP and the Israeli Ministry of Environmental Protection’s voluntary business reporting initiative.

We report our progress on environmental goals and commitments annually in our Sustainability Reports, including, but not limited to, our climate change mitigation measures, biodiversity conservation, and water management efforts. A copy of our most recent Sustainability Report is accessible, free-of-charge, on our website at https://investor.ormat.com/sustainability-report. The contents of our website, including the Sustainability Reports, are not part of or otherwise incorporated by reference into this Form 10-K.

Our Proprietary Technology

Our proprietary technology involves original designs of turbines, pumps, and heat exchangers, as well as formulation of organic motive fluids (all of which are non-ozone-depleting substances) and may be used either in power plants operating according to the ORC alone or in combination with various other commonly used thermodynamic technologies that convert heat to mechanical power, such as gas and steam turbines. It can be used with a variety of thermal energy sources, such as geothermal, recovered energy, biomass, solar energy and fossil fuels. By using advanced computational fluid dynamics techniques and other computer aided design software as well as our test facilities, we continuously seek to improve power plant components, reduce operations and maintenance costs, and increase the range of our equipment and applications. We examine ways to increase the output of our plants by utilizing evaporative cooling, cold reinjection, configuration optimization, and topping turbines.

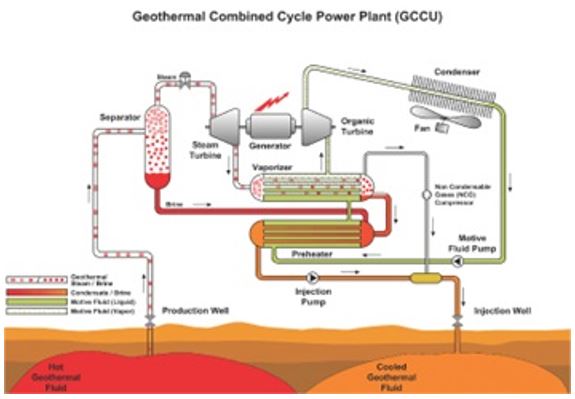

We also developed, patented and constructed GCCU power plants in which the steam first produces power in a backpressure steam turbine and is subsequently condensed in a vaporizer of a binary plant, which produces additional power. Our Geothermal Combined Cycle technology is depicted in the diagram below.

In the conversion of geothermal energy into electricity, our technology has a number of advantages over conventional geothermal steam turbine plants. A conventional geothermal steam turbine plant consumes significant quantities of water, causing depletion of the aquifer and requiring cooling water treatment with chemicals and consequently a need for the disposal of such chemicals. A conventional geothermal steam turbine plant also creates a significant visual impact in the form of an emitted plume from the cooling towers, especially during cold weather. By contrast, our binary and combined cycle geothermal power plants have a low profile with minimal visual impact and do not emit a plume when they use air-cooled condensers. Our binary and combined cycle geothermal power plants reinject all of the geothermal fluids utilized in the respective processes into the geothermal reservoir. Consequently, such processes generally have no emissions.

Other advantages of our technology include simplicity of operation and maintenance and higher yearly availability. For instance, the OEC employs a low speed and high efficiency organic vapor turbine directly coupled to the generator, eliminating the need for reduction gear. In addition, with our binary design, there is no contact between the turbine blade and geothermal fluids, which can often be very erosive and corrosive. Instead, the geothermal fluids pass through a heat exchanger, which is less susceptible to erosion and can adapt much better to corrosive fluids. In addition, with the organic vapor condensed above atmospheric pressure, no vacuum system is required.

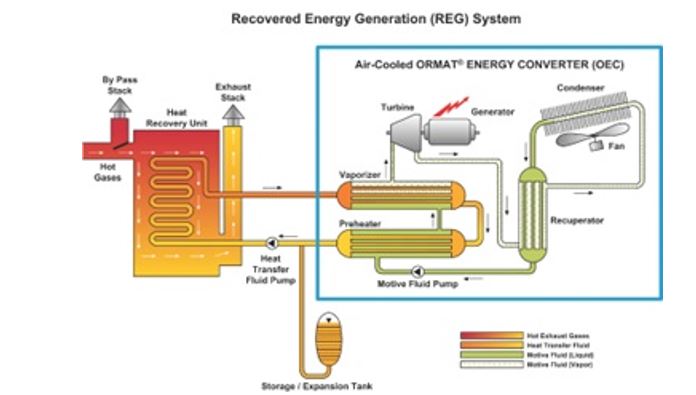

We use the same elements of our technology in our recovered energy products. The heat source may be exhaust gases from a Brayton cycle gas turbine, low-pressure steam, or medium temperature liquid found in the process industries such as oil refining and cement manufacturing. In most cases, we attach an additional heat exchanger in which we circulate thermal oil or water to transfer the heat into the OEC’s own vaporizer in order to provide greater operational flexibility and control. Once this stage of each recovery is completed, the rest of the operation is identical to that of the OECs used in our geothermal power plants and enjoys the same advantages of using the ORC. In addition, our technology allows for better load following than conventional steam turbines, requires no water treatment (since it is air cooled and organic fluid motivated), and does not require the continuous presence of a licensed steam boiler operator on site.

Our REG technology is depicted in the diagram below.

Patents

As of December 31, 2022, we have 225 patents and patent applications worldwide, including 63 patents issued in the US and 35 pending U.S. patent applications. These patents and patent applications cover our products (mainly power units based on the ORC) and systems (mainly geothermal power plants and industrial waste heat recovery plants for electricity production). The product-related patents cover components that include turbines, heat exchangers, air coolers, seals and controls as well as control of operation of geothermal production well pumps. The system-related patents cover not only particular components but also the overall energy conversion system from the “fuel supply” (e.g., geothermal fluid, waste heat, biomass or solar) to electricity production.

The system-related patents also cover subjects such as waste heat recovery related to gas pipeline compressors and industrial waste heat, solar power systems, disposal of non-condensable gases present in geothermal fluids, reinjection of other geothermal fluids ensuring geothermal resource sustainability, power plants for very high-pressure geothermal resources, two-phase fluids, low temperature geothermal brine as well as processes related to EGS. Fifty-five of our patents cover combined cycle geothermal power plants, in which the steam first produces power in a backpressure steam turbine and is subsequently condensed in a vaporizer of a binary plant, which produces additional power. The remaining terms of our issued patents range from one year to 16 years. The loss of any single patent would not have a material effect on our business or results of operations.

Research and Development

We conduct research and development activities intended to improve plant performance, reduce costs, and increase the breadth of our product offerings. The primary focus of our research and development efforts is targeting power plant conceptual thermodynamic cycle and major equipment including continued performance, cost and land usage improvements to our condensing equipment, and development of new higher efficiency and higher power output turbines and brine production pumps. New realms for innovation include implementation of predictive maintenance software and automation of power plants performance analysis.

We also devote resources to research and development related to our energy storage segment. Our engineering and R&D teams are working to optimize the dispatch strategy of a battery energy storage system (BESS), develop and deploy capabilities to self-integrate BESS and test different battery cell and inverter technologies under simulated operating criteria of various energy markets to allow us to bring to market cost-effective BESS more rapidly and more optimized to the specific use cases and target revenue streams. Additionally, we hold patents in other energy storage solutions and continue to evaluate investment opportunities in companies with innovative technology or product offerings for renewable energy and energy storage solutions.

Market Opportunities

Geothermal Market Opportunities

Renewable energy provides a sustainable alternative to the existing solutions to two major global issues: climate change and volatile commodity costs. Renewable energy solutions are sustainable, clean and decarbonizes the grid. These environmental benefits have led numerous countries to focus their efforts on the development of renewable energy sources in general and geothermal specifically.

Based on data provided by ThinkGeo Energy in January 2023, the total installed geothermal power generation capacity at year-end 2022 stood at 16,128 MW, an increase of 274 MW over 2021. The leading countries with installed geothermal power generation are the U.S., Indonesia, the Philippines, Turkey, Mexico and New Zealand. The largest growth in 2022 happened in Indonesia and the U.S., which had an addition of 152 MW.

Realizing the importance of renewable energy alternatives, including geothermal alternatives providing firm baseload non-weather-dependent resource, various governments have instituted or have been preparing regulatory frameworks and policies to achieve emission reduction targets, and provide incentives to develop the sector and maximize renewable energy resources, create jobs, and improve energy reliability.

United States

Interest in geothermal energy in the United States continues to grow based on supportive legislation and regulation at the local, state, and federal levels. Policy makers and regulators are becoming increasingly aware of the comparatively high value of geothermal energy in contrast to intermittent renewable technology, as seen through individual state’s renewable portfolio standard (RPS) goals (as described below) accounting for more baseload energy than ever before as coal, natural gas and nuclear power plants reach retirement.

Today, electricity generation from geothermal resources is concentrated primarily in California, Nevada, Hawaii, Idaho, Oregon, and Utah, and we believe there are opportunities for geothermal expansion in other states such as New Mexico and Colorado. New Mexico recently passed legislation increasing its renewable energy goals to 100% by 2045 for investor-owned utilities and Colorado is introducing new tax incentives for geothermal development.

On August 16, 2022, the Inflation Reduction Act of 2022 ("IRA") was signed, which is effective for taxable years beginning after December 31, 2022. The IRA includes several tax incentives to promote climate change mitigation and clean energy, electric vehicles, battery and energy storage manufacture or purchase. Some highlights of the IRA include production tax credits (“PTCs”) or investment tax credits (“ITCs”) for wind and solar projects (including geothermal and hydropower) beginning construction before January 1, 2025. The PTCs and ITCs, as amended by the IRA, will apply to facilities placed in service after December 31, 2022. We expect the IRA will enable us to enter into tax equity transactions and fund a higher percentage of our investment. This should reduce our capital needs and increase the project economics. We expect that our geothermal projects starting operation in next five to six years should be eligible for these credits.

Geothermal energy provides numerous benefits to the U.S. grid and economy. Geothermal development and operation bring economic benefits in the form of tax incentives and long term high-paying jobs, and it currently has one of the lowest LCOE of all power sources in the United States, according to the U.S. Energy Information Administration - EIA - Independent Statistics and Analysis report published in February 2019. Additionally, improvements in geothermal production make it possible to provide ancillary and on-demand services. This helps load serving entities avoid additional costs from purchasing and then balancing intermittent resources with storage or new transmission.

State level legislation

Many state governments have enacted an RPS program under which utilities are required to include renewable energy sources as part of their energy generation portfolio. Under an RPS, participating states have set targets to produce their energy from renewable sources with specific deadlines. Renewable energy generation under an RPS program is tracked through the production of RECs. Load serving entities track the RECs to ensure they are meeting the mandate prescribed by the RPS.

Currently in the United States, 42 states plus the District of Colombia and four territories have enacted an RPS, renewable portfolio goals, or similar laws or incentives (such as clean energy standards or goals) requiring or encouraging load serving entities in such states to generate or buy a certain percentage of their electricity from renewable energy or recovered heat sources. The vast majority of Ormat’s geothermal projects are in California, Nevada, and Hawaii which have some of the most stringent RPS programs in the country. We see the impact of RPS and climate legislation as a significant driver for us to expand existing power plants and to build new renewable projects.

States also provide incentives to geothermal energy producers. Nevada provides a property tax abatement of up to 55% for real and tangible personal property used to generate electricity from geothermal sources. The abatement may extend up to twenty years if certain job creation requirements are met. In Idaho, geothermal energy producers are exempt from property tax and, in lieu, pay a tax of 3% of gross energy earnings. The California Energy Commission provides favorable grants and loans to promote the development of new or existing geothermal resources and technologies within the state. Also in California, the CPUC has required Electric Load Service Entities (LSEs) to procure 11.5 GW of new clean electricity by 2028, 1 GW of this procurement must deliver firm power with an 80% capacity factor, produce zero on-site emissions, and be weather independent. With a high capacity factor and firm and flexible generation, geothermal energy addresses these requirements and is the natural replacement for baseload fossil fuels and nuclear generation.

In 2022, Ormat announced two additional PPAs for up to 160 MW of geothermal energy with Nevada Energy, and another power purchase agreement for up to 125 MW portfolio of geothermal projects with California Community Power.

Global

We believe the global markets continue to present growth and expansion opportunities in both established and emerging markets.

We believe several global Climate Change initiatives are likely to create business expansion opportunities for us and support the global growth of the renewable sector, such as the Paris Agreement approved by the Twenty-first Conference of the Parties to the UN Framework Convention on Climate Change (2015) and subsequent UN Climate Change Conferences which reaffirmed the commitments of the Paris Agreement.

Outside of the United States, the majority of power generating capacity has historically been owned and controlled by governments. Since the early 1990s, however, many foreign governments have privatized their power generation industries through sales to third parties encouraging new capacity development and/or refurbishment of existing assets by independent power developers. These foreign governments have taken a variety of approaches to encourage the development of competitive power markets, including awarding long-term contracts for energy and capacity to independent power generators and creating competitive wholesale markets for selling and trading energy, capacity, and related products. Some foreign regions and countries have also adopted active government programs designed to encourage clean renewable energy power generation such as the following countries in which we operate, sell products and/or are conducting business development activities:

Europe

Europe has the fourth largest geothermal power capacity, the majority of which stems from Italy and Turkey and recently small scale projects in Germany. A significant part of our European operations is in Turkey. We are looking for opportunities to expand in Europe, primarily in our Product segment.

A significant part of our European operations is in Turkey, and since 2004, we have established strong business relationships in the Turkish geothermal market and provided our wide range of solutions including our binary systems, to over 40 geothermal power plants with a total capacity of approximately 900 MW. We believe the potential for geothermal growth in Turkey is still high, specifically in center-south and east areas of the country, however, due to the ongoing economic crisis in Turkey, new projects and investments are at a standstill.

Latin America

Several Latin American countries have renewable energy programs and have pursued development in the geothermal market.

In Guatemala, where our Zunil and Amatitlan power plants are located, the government approved and adopted the Energy Policy 2013-2027 that secures, among other things, a supply of electricity at competitive prices by diversifying the energy mix with an 80% renewable energy share target for 2027.

In Honduras, where we operate our Platanares power plant, the government set a target to reach at least 80% renewable energy production by 2034.

New Zealand

In New Zealand, where we have been actively providing geothermal power plant solutions since 1988, the government’s policies to fight climate change include a net zero GHG emissions reduction target by 2050 and a renewable electricity generation target of 90% of New Zealand’s total electricity generation by 2035. We continue selling power plants and products to our New Zealand customers and cooperate with other potential customers for adding geothermal power generation capacity within the coming years. In 2022, we signed an EPC contract to build the 59MW Tehuka 3 geothermal project. We are currently exploring an opportunity to build and own a power plant in New Zealand.

Asia

The Electricity Law of 2009 (in conjunction with Job Creation Act No. 11 of 2020/Omnibus Law) is the principal regulation for the electricity industry in Indonesia which divides the industry into two broad categories: (1) electrical power provision, covering electric power generation, transmission, distribution and sales and (2) electrical power support such as services (consulting, construction, installation, operation & maintenance, certification & training, testing etc.) and manufacture (tools, power plant equipment, cables, electrical equipment, etc.). The electrical power provision business is dominated by PLN (a state-owned enterprise), which is the sole owner of transmission and distribution assets and 70% of the power generation assets. Private sector participation in power generation is allowed through an IPP scheme, mostly done through tenders or direct appointment for some power sources such as geothermal. Geothermal power is regulated by The Geothermal Law issued in 2014 (as also amended by the Indonesian Omnibus Law in 2020), that endorses private participation as a geothermal IPP. The central government conducts tenders for geothermal fields, awarding a Geothermal Business License for the winner. Geothermal Business License holders can conduct exploration and feasibility studies within five years and subject to two times one-year extensions, conduct well development and power plant construction and sell the electricity generated to PLN for a maximum of 30 years. Prior to the expiration of the Geothermal License, the IPP can propose to extend the license for an additional 20 years. In 2021, Presidential Regulation No. 112 was enacted with the aim of accelerating Renewable Energy. This regulation replaces the basis of the renewable energy tariff from the average electricity generation basic cost to a ceiling price. In this scheme, the tariff is negotiated between IPP and PLN and must not be higher than the ceiling tariff set for particular type of renewable energy power plant, which is then multiplied by a factor based on location.

East Africa

In East Africa the geothermal potential along the Rift Valley is estimated at several thousand MW. The countries along the Rift Valley are at different stages of development of their respective geothermal potential.

In Kenya, there are already several geothermal power plants, including our 150 MW Olkaria III complex. The Kenyan government has identified the country's untapped geothermal potential as the most suitable indigenous source of electricity.

The Kenyan government is aiming to reach 10 GW of power generating capacity by 2037, pursuant to the Least-Cost Power Development Plan 2017-37, which had a target of 62% of such capacity generated from renewable energy sources (including large hydro and solar).

Energy Storage

In the U.S., the IRA provides direct incentives to our Energy Storage segment by making projects eligible for ITCs. We also expect to see our Energy Storage segment benefit from the incentives available to other renewable energy technologies, which we believe will increase the need for energy storage.

In Europe, impacts from the war in Ukraine increased the demand for renewable energy. The IEA estimates, in its 2022 Renewable Analysis and Forecast, that global renewable energy deployment between 2022-2027 will be 2,400GW, which represents an increase of 85% over the previous five years. This increase can place strain on the electric grid as adding intermittent renewables such as wind and solar can create situations where a significant amount of capacity must be available to ramp up and down to accommodate these resource’s daily output cycles and variations due to weather conditions. Furthermore, the output from wind and solar PV power plants can change significantly over short periods of time due to environmental conditions like cloud movement and fog burn off and can cause instability on the electric grid. As a result, we believe that energy storage is positioned to become a key component of the grid to provide flexibility and reliability.