0001296445ora:KenyaPowerAndLightingCoLTDMember2024-01-012024-12-31

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K | | | | | |

| ☑ | Annual Report PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

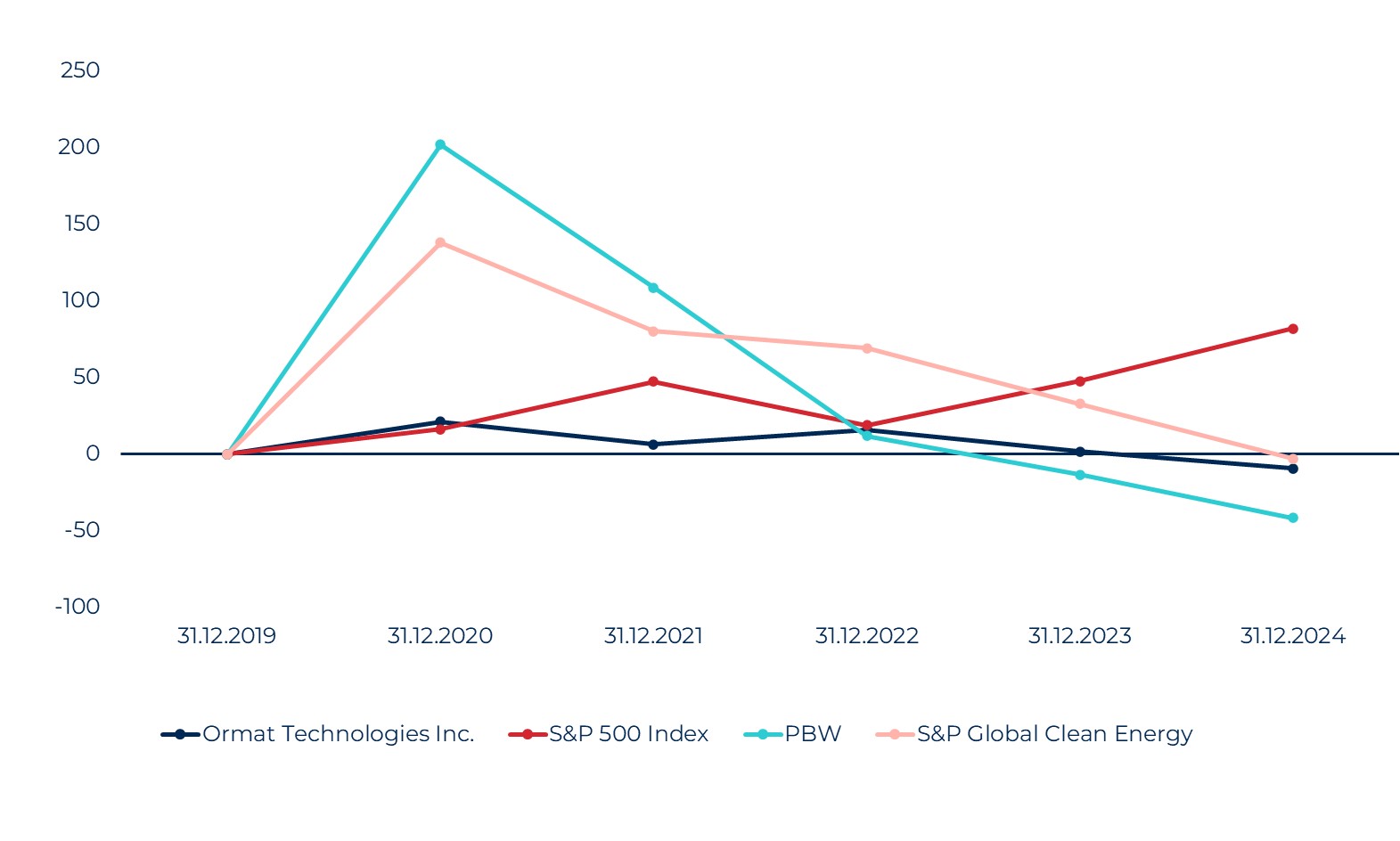

For the fiscal year ended December 31, 2024

or | | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number: 001-32347

ORMAT TECHNOLOGIES, INC.

(Exact name of registrant as specified in its charter) | | | | | | | | | | | |

| Delaware | 88-0326081 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification Number) |

| 6884 Sierra Center Parkway, | Reno, | Nevada | 89511-2210 |

| (Address of principal executive offices) | (Zip Code) |

(775) 356-9026

(Registrant’s telephone number, including area code)

Securities Registered Pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered |

| Common Stock $0.001 Par Value | ORA | New York Stock Exchange |

Securities Registered Pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes þ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ☐ No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes þ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one): | | | | | | | | | | | | | | | | | | | | | | | |

| Large accelerated filer | ☑ | Accelerated filer ☐ | Non-accelerated filer ☐ | Smaller reporting company | ☐ | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. þ

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No þ

As of June 30, 2024 the aggregate market value of the registrant’s common stock held by non-affiliates was $3,855,815,632. As of February 20, 2025, the number of outstanding shares of common stock, par value $0.001 per share was 60,500,580.

Portions of the registrant's definitive proxy statement for its 2025 Annual Meeting of Stockholders are incorporated by reference into Part III of this Form 10-K.

ORMAT TECHNOLOGIES, INC.

FORM 10-K FOR THE YEAR ENDED DECEMBER 31, 2024

TABLE OF CONTENTS

| | | | | | | | |

| | Page

No |

| PART I |

| ITEM 1. | BUSINESS | |

| ITEM 1A. | RISK FACTORS | |

| ITEM 1B. | UNRESOLVED STAFF COMMENTS | |

| ITEM 1C. | CYBERSECURITY | |

| ITEM 2. | PROPERTIES | |

| ITEM 3. | LEGAL PROCEEDINGS | |

| ITEM 4. | MINE SAFETY DISCLOSURES | |

| PART II |

| ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES | |

| ITEM 6. | RESERVED | |

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | |

| ITEM 7A. | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | |

| ITEM 8. | FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA | |

| ITEM 9. | CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE | |

| ITEM 9A. | CONTROLS AND PROCEDURES | |

| ITEM 9B. | OTHER INFORMATION | |

| ITEM 9C. | DISCLOSURE REGARDING FOREIGN JURISDICTIONS THAT PREVENT INSPECTIONS | |

| PART III |

| ITEM 10. | DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE | |

| ITEM 11. | EXECUTIVE COMPENSATION | |

| ITEM 12. | SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS | |

| ITEM 13. | CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE | |

| ITEM 14. | PRINCIPAL ACCOUNTANT FEES AND SERVICES | |

| PART IV |

| ITEM 15. | EXHIBITS, FINANCIAL STATEMENT SCHEDULES | |

| ITEM 16. | FORM 10-K SUMMARY | |

| | |

| SIGNATURES | |

| | |

| | |

Glossary of Terms

Unless the context otherwise requires, all references in this Annual Report on Form 10-K (this “Annual Report”) to “Ormat”, “the Company”, “we”, “us”, “our company”, “Ormat Technologies”, or “our” refer to Ormat Technologies, Inc. and its consolidated subsidiaries. A glossary of certain terms and abbreviations used in this annual report appears at the beginning of this Annual Report. When the following terms and abbreviations appear in the text of this report, they have the meanings indicated below:

| | | | | |

| Term | Definition |

| ACC | Air-cooled Condenser |

| ACUA | Atlantic County Utilities Authority |

| AMM | Administrador del Mercado Mayorista (administrator of the wholesale market — Guatemala) |

| ARRA | American Recovery and Reinvestment Act of 2009 |

| Auxiliary Power | The power needed to operate a geothermal power plant’s auxiliary equipment such as pumps and cooling towers |

| Availability | The ratio of the time a power plant is ready to be in service, or is in service, to the total time interval under consideration, expressed as a percentage, independent of fuel supply (heat or geothermal) or transmission accessibility |

| BESS | Battery Energy Storage Systems |

| BLM | Bureau of Land Management of the U.S. Department of the Interior |

| BOT | Build, operate and transfer |

| BPP | PLN's existing average cost of generation |

| CAISO | California Independent System Operator |

| CalGEM | California Geologic Energy Management |

| Capacity | The maximum load that a power plant can carry under existing conditions, less auxiliary power |

| Capacity Factor | The ratio of the actual MWh generated and the generating capacity times 8760 hours expressed as a percentage |

| CARES | Coronavirus Aid, Relief, and Economic Security Act |

| CCA | Community Choice Aggregator

|

| CDC | Caisse des Dépôts et Consignations, a French state-owned financial organization |

| CEO | Chief Executive Officer |

| CFO | Chief Financial Officer |

| C&I | Refers to the Commercial and Industrial sectors, excluding residential |

| CNEE | National Electric Energy Commission of Guatemala |

| COD | Commercial Operation Date |

| Company | Ormat Technologies, Inc., a Delaware corporation, and its consolidated subsidiaries |

| CPA | Clean Power Alliance |

| CPI | Consumer Price Index |

| CPUC | California Public Utilities Commission |

| DEG | Deutsche Investitions-und Entwicklungsgesellschaft mbH |

| CREE | The Regulatory Commission of Electric Power in Honduras |

| DFC | U.S. International Development Finance Corporation (formerly OPIC) |

| DOE | U.S. Department of Energy |

| DOMLEC | Dominica Electricity Services Ltd. |

| DSCR | Debt Service Coverage Ratio |

| EBITDA | Earnings before interest, taxes, depreciation, amortization and accretion |

| | | | | |

| EDF | Electricite de France S.A. |

| EGL | Eastland Generation Limited |

| EGS | Enhanced Geothermal Systems |

| EIB | European Investment Bank |

| Eligible Green Projects | Allocations made by the Company or any of its subsidiaries to any of the projects defined below in the 24 months prior to or 24 months following the issuance date of the bonds. Eligible Green Projects include the following (for illustrative purposes only): (i) renewable energy (new geothermal energy generation facilities with GHG emissions less than 100g CO2d/KWh; upgrades to existing geothermal energy generation facilities to increase efficiency, resiliency and reliability; energy storage systems; or solar PV systems); and (ii) eco-efficient and/or circular economy adapted products. |

| ENEE | Empresa Nacional de Energía Eléctrica |

| Enthalpy | The total energy content of a fluid; the heat plus the mechanical energy content of a fluid (such as a geothermal brine), which, for example, can be partially converted to mechanical energy in an Organic Rankine Cycle. |

| EPA | U.S. Environmental Protection Agency |

| EPC | Engineering, procurement and construction |

| ERCOT | Electric Reliability Council of Texas, Inc. |

| EPRA | Energy and Petroleum Regulatory Authority of Kenya |

| EU | European Union |

| EWG | Exempt Wholesale Generators |

| Exchange Act | U.S. Securities Exchange Act of 1934, as amended |

| FASB | Financial Accounting Standards Board |

| FERC | U.S. Federal Energy Regulatory Commission |

| FIT | Feed-in Tariff |

| FPA | U.S. Federal Power Act, as amended |

| GAAP | Generally accepted accounting principles |

| GCCU | Geothermal Combined Cycle Unit |

| GDC | Geothermal Development Company |

| Geothermal Power Plant | The power generation facility and the geothermal field |

| Geothermal Steam Act | U.S. Geothermal Steam Act of 1970, as amended |

| GHG | Greenhouse gas |

| GIS | Geographic Information Systems |

| Green bonds or green convertible bonds | Bonds, which the proceeds from, are used to finance and/or refinance, in whole or in part, new or on-going projects in accordance with the Ormat Green Finance Framework. |

| GW | Gigawatt |

| GWh | Gigawatt hour |

| HELCO | Hawaii Electric Light Company |

| IDWR | Idaho Department of Water |

| IESO | The Independent Electricity System Operator. |

| IFM | In Front of the Meter |

| IGA | International Geothermal Association |

| IID | Imperial Irrigation District |

| INDE | Instituto Nacional de Electrification |

| IOUs | Investor-Owned Utilities |

| IPCC | Intergovernmental Panel on Climate Change |

| IPPs | Independent Power Producers |

| | | | | |

| IRA | Inflation Reduction Act of 2022 |

| ISO | Independent System Operator |

| ISO-NE | ISO New England |

| ITC | Investment Tax Credit |

| JBIC | Japan Bank for International Cooperation |

| John Hancock | John Hancock Life Insurance Company (U.S.A.) |

| JPM | J.P. Morgan Capital Corporation |

| KenGen | Kenya Electricity Generating Company Ltd. |

| Kenyan Energy Act | Kenyan Energy Act, 2006 |

| KETRACO | Kenya Electricity Transmission Company Limited |

| KGRA | Known Geothermal Resource Area |

| KLP | Kapoho Land Partnership |

| KPLC | Kenya Power and Lighting Co. Ltd. |

| KRA | Kenya Revenue Authority |

| kW | Kilowatt - A unit of electrical power that is equal to 1,000 watts |

| kWh | Kilowatt hour(s), a measure of power produced |

| LCOE | Levelized Costs of Energy |

| LSE | Load Serving Entity |

| Mammoth Pacific | Mammoth-Pacific, L.P. |

| MEMR | The Indonesian Minister of Energy and Mineral Resources |

| MW | Megawatt - One MW is equal to 1,000 kW or one million watts |

| MWh | Megawatt hour(s), a measure of energy produced |

| | | | | |

| NIS | New Israeli Shekel |

| NOA | Notice of Assessments |

| Notes | Convertible notes from 2022 |

| NV Energy | NV Energy, Inc. |

| NYSE | New York Stock Exchange |

| NYISO | New York Independent System Operator, Inc. |

| OEC | Ormat Energy Converter |

| Opal Geo | Opal Geo LLC |

| OPC | OPC LLC, a consolidated subsidiary of the Company |

| OrCal | OrCal Geothermal Inc., a wholly owned subsidiary of the Company |

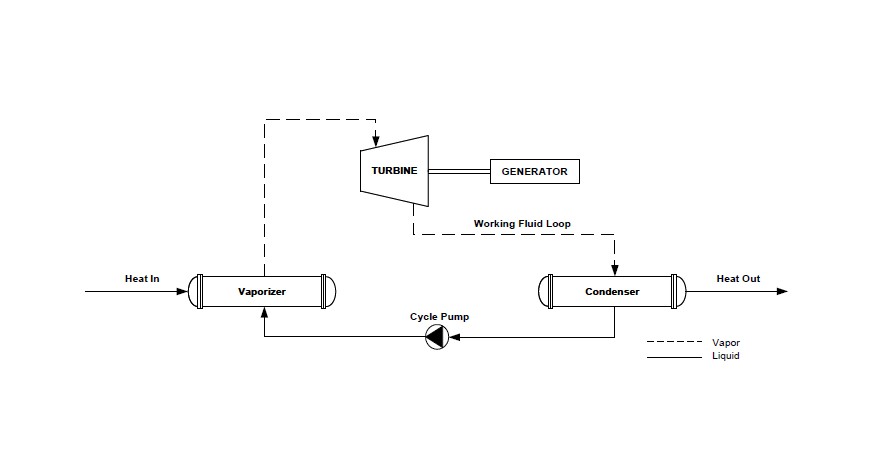

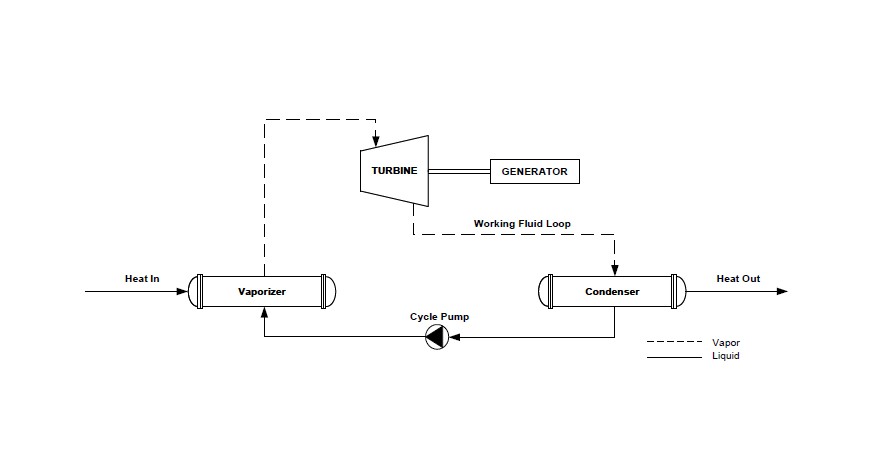

| ORC | Organic Rankine Cycle - A process in which an organic fluid such as a hydrocarbon or fluorocarbon (but not water) is boiled in an evaporator to generate high pressure vapor. The vapor powers a turbine to generate mechanical power. After the expansion in the turbine, the low-pressure vapor is cooled and condensed back to liquid in a condenser. A cycle pump is then used to pump the liquid back to the vaporizer to complete the cycle. The cycle is illustrated in the figure below: |

| | | | | |

| Ormat International | Ormat International Inc., a wholly owned subsidiary of the Company |

| Ormat Nevada | Ormat Nevada Inc., a wholly owned subsidiary of the Company |

| Ormat Systems | Ormat Systems Ltd., a wholly owned subsidiary of the Company |

| Ormat Green Finance Framework | A framework developed in alignment with the Green Bond Principles (2021), as published by the International Capital Markets Association, by which the proceeds of green bonds are used to finance and/or refinance, in whole or in part, one or more Eligible Green Projects. |

| ORIX | ORIX Corporation |

| ORPD | ORPD LLC, a holding company subsidiary of the Company in which Northleaf Geothermal Holdings, LLC holds a 36.75% equity interest |

| OrPower 4 | OrPower 4 Inc., a wholly owned subsidiary of the Company |

| Ortitlan | Ortitlan Limitada, a wholly owned subsidiary of the Company |

| ORTP | ORTP, LLC, a consolidated subsidiary of the Company |

| Orzunil | Orzunil I de Electricidad, Limitada, a wholly owned subsidiary of the Company |

| PG&E | Pacific Gas and Electric Company |

| PGV | Puna Geothermal Venture, a wholly owned subsidiary of the Company |

| PJM | PJM Interconnection, LLC |

| PLN | PT Perusahaan Listrik Negara |

| Power plant equipment | Interconnection equipment, cooling towers for water-cooled power plant, etc., including the generating units |

| PPA | Power purchase agreement |

| PTC | Production Tax Credit |

| PUC | Public Utilities Commission |

| PUCH | Public Utilities Commission of Hawaii |

| PUCN | Public Utilities Commission of Nevada |

| PUHCA | U.S. Public Utility Holding Company Act of 1935 |

| PUHCA 2005 | U.S. Public Utility Holding Company Act of 2005 |

| PURPA | U.S. Public Utility Regulatory Policies Act of 1978 |

| | | | | |

| QF | Qualifying Facilities - (Certain small power production facilities are eligible to be “Qualifying Facilities” under PURPA, provided that they meet certain power and thermal energy production requirements and efficiency standards. Qualifying Facility status provides an exemption from PUHCA 2005 and grants certain other benefits to the Qualifying Facility) |

| RCEA | Redwood Coast Energy Authority |

| REC | Renewable Energy Credit |

| REG | Recovered Energy Generation |

| RER | Renewable Energy Resource certificate |

| RPS | Renewable Portfolio Standards |

| RTE | Round Trip Efficiency |

| RTO | Regional Transmission Organization |

| SCE | Southern California Edison |

| SCPPA | Southern California Public Power Authority |

| SDCP | San Diego Community Power |

| SDG&E | San Diego Gas and Electric |

| SEC | U.S. Securities and Exchange Commission |

| Securities Act | U.S. Securities Act of 1933, as amended |

| SOL | Sarulla Operations Ltd. |

| Solar PV | Solar photovoltaic |

| SOX Act | Sarbanes-Oxley Act of 2002 |

| SRAC | Short Run Avoided Costs |

| TASE | Tel Aviv Stock Exchange |

| Tax Act | Tax Cuts and Jobs Act |

| UIC | Underground Injection Control |

| UN | United Nation |

| Union Bank | Union Bank, N.A. |

| U.S. | United States of America |

| U.S. Treasury | U.S. Department of the Treasury |

| USG | U.S. Geothermal Inc. |

| VAT | Value Added Tax |

| VCE | Valley Clean Energy |

| Viridity | Viridity Energy Solutions Inc., a wholly owned subsidiary of the Company |

Cautionary Note Regarding Forward-Looking Statements and Risk Factor Summary

This Annual Report includes “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical facts, included in this report that address activities, events or developments that we expect or anticipate will or may occur in the future, including such matters as our projections of annual revenues, expenses and debt service coverage with respect to our debt securities, future capital expenditures, business strategy, competitive strengths, goals, development or operation of generation assets, market and industry developments and the growth of our business and operations, are forward-looking statements. When used in this Annual Report, the words “may”, “will”, “could”, “should”, “expects”, “plans”, “anticipates”, “believes”, “estimates”, “predicts”, “projects”, “potential”, “target”, “goal”, or “contemplate” or the negative of these terms or other comparable terminology are intended to identify forward-looking statements, although not all forward-looking statements contain such words or expressions. The forward-looking statements in this Annual Report are primarily located in the material set forth under the headings Item 1 — “Business” contained in Part I of this Annual Report, Item 1A — “Risk Factors” contained in Part I of this Annual Report, Item 7 — “Management’s Discussion and Analysis of Financial Condition and Results of Operations” contained in Part II of this Annual Report, and “Notes to Financial Statements” contained in Item 8 — “Financial Statements and Supplementary Data” contained in Part II of this Annual Report, but are found in other locations as well. These forward-looking statements generally relate to our plans, objectives and expectations for future operations and are based upon management’s current estimates and projections of future results or trends. Although we believe that our plans and objectives reflected in or suggested by these forward-looking statements are reasonable, we may not achieve these plans or objectives. You should read this Annual Report completely and with the understanding that actual future results and developments may be materially different from what we expect attributable to a number of risks and uncertainties, many of which are beyond our control.

These forward-looking statements are made only as of the date hereof, and, except as legally required, we undertake no obligation to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise.

A summary of the risks that may cause actual results to differ from our expectations include, but are not limited to the following:

Risks Related to the Company’s Business and Operation

•Our financial performance depends on the successful operation of our geothermal, REG, solar PV power plants under the Electricity segment as well as our energy storage facilities which are subject to various operational risks.

•Our exploration, development, and operation of geothermal energy resources are subject to geological risks and uncertainties, which may result in insufficient prospects to support our growth, decreased performance or increased costs for our power plants.

•We may decide not to implement, or may not be successful in implementing, one or more elements of our multi-year strategic plan, and the plan may not achieve its goal of enhancing shareholder value.

•Our investments in BESS technology involves new technologies and expected advanced technologies with relatively limited history with respect to reliability and performance and may not perform as expected. In addition, our investments and profitability may be negatively affected by a number of factors, including increases in storage costs, expanded trade restrictions, risk of fire and volatility in merchant prices.

•Concentration of customers, specific projects and regions may expose us to heightened financial exposure.

•Our international operations expose us to risks related to the application of foreign laws and regulations.

•Political, economic and other conditions in the emerging economies where we operate, including Israel, may subject us to greater risk than in the developed U.S. economy.

•Conditions in and around Israel, where the majority of our senior management and our main production and manufacturing facilities are located, may adversely affect our operations and may limit our ability to produce and sell our products, and support our Electricity segment.

•Responses in various countries where we have business operations to Israel’s ongoing military conflicts on some of its borders or future similar conflicts may adversely affect our operations and may limit our ability to produce and sell our products.

•Some of our leases will terminate if we do not extract geothermal resources in “commercial quantities”, or if we fail to comply with the terms or stipulations of such leases or any of the provisions of the Geothermal Steam Act or if the lessor under any such lease defaults on any debt secured by the relevant property, thus requiring us to enter into new leases or secure rights to alternate geothermal resources, none of which may be available on terms as favorable to us as any such terminated lease, if at all.

•Our business development activities may not be successful and our projects under construction or facilities undergoing enhancement and repowering may encounter delays.

•Our future growth depends, in part, on the successful enhancement of a number of our existing facilities.

•We rely on power transmission facilities that we do not own or control.

•Our use of joint ventures may limit our flexibility with jointly owned investments.

•Our operations could be adversely impacted by climate change and other extreme weather events.

•We could be impacted by regulatory and other responses to climate change.

•We may not be able to successfully complete acquisitions, and we may not be able to successfully integrate, or realize anticipated synergies from, companies that we have acquired and may acquire in the future.

•We encounter intense competition from electric utilities, other power producers, power marketers, developers and third-party investors.

•Changes in costs and technology may significantly impact our business by making our power plants and products less competitive, resulting in our inability to sign new or recontracted PPAs for our Electricity segment and new supply and EPC contracts for our Products segment.

•Our intellectual property rights may not be adequate to protect our business.

•We may experience a cyber-incident, cyber security breach, severe natural event or physical attack on our operational networks and information technology systems.

•Our financial performance could be adversely affected by changes in the legal and regulatory environment affecting our operations.

•Pursuant to the terms of some of our PPAs with investor-owned electric utilities and publicly-owned electric utilities in states that have renewable portfolio standards, the failure to supply the contracted capacity and energy thereunder may result in the imposition of penalties.

•If any of our domestic power plants lose their current Qualifying Facility status under PURPA, or if amendments to PURPA are enacted that substantially reduce the benefits currently afforded to Qualifying Facilities, our domestic operations could be adversely affected.

•The reduction, elimination or inability to monetize government incentives could adversely affect our business, financial condition, future results and cash flows.

•We are a holding company and our cash depends substantially on the performance of our subsidiaries and the power plants they operate, most of which are subject to restrictions and taxation on dividends and distributions.

•The costs of compliance with federal, state, local and foreign environmental laws and our ability to obtain and maintain environmental permits and governmental approvals required for development, construction and/or operation may result in liabilities, costs and delays in construction (as well as any fines or penalties that may be imposed upon us in the event of any non-compliance or delays with such laws or regulations).

•We could be exposed to significant liability for violations of hazardous substances laws because of the use or presence of such substances at our power plants.

•U.S. federal, state and foreign country income tax reform could adversely affect us.

•We may be unable to obtain the financing we need on favorable terms to pursue our growth strategy and any future financing we receive may be less favorable to us than our current financing arrangements.

•We have incurred substantial indebtedness that may decrease our business flexibility, access to capital, and/or increase our borrowing costs, and we may still incur substantially more debt, which may adversely affect our operations and financial results.

•Our debt obligations may adversely affect our ability to raise additional capital and will be a burden on our future cash resources, particularly if we elect to settle these obligations in cash upon conversion or upon maturity or required repurchase.

•The capped call transactions, into which we entered in connection with the issuance of June 2022 convertible notes, (the "Notes") may affect the value of the Notes and our common stock and we are subject to counterparty risk with respect to the capped call transactions.

•Our foreign power plants and foreign manufacturing operations expose us to risks related to fluctuations in currency rates, which may reduce our profits from such power plants and operations.

•Our power plants have generally been financed through a combination of our corporate funds and limited or non-recourse project finance debt and lease financing. If our project subsidiaries default on their obligations under such limited or non-recourse debt or lease financing, we may be required to make certain payments to the relevant debt holders, and if the collateral supporting such leveraged financing structures is foreclosed upon, we may lose certain of our power plants.

•We may experience fluctuations in the costs of construction, raw materials, commodities and drilling.

•Our commodity derivative activity may limit potential gains, increase potential losses, result in earnings volatility and involve other risks.

•We are exposed to swap counterparty credit risk.

•The existence of a prolonged force majeure event or a forced outage affecting a power plant, or the transmission systems could reduce our net income.

•Threats of terrorism may impact our operations in unpredictable ways and could adversely affect our business, financial condition, future results and cash flow.

•Future equity issuances, including through our current or any future equity compensation plans, could result in dilution, which could cause the price of our shares of common stock to decline.

•The price of our common stock has in the past and may in the future fluctuate substantially, and your investment may decline in value.

•We may issue additional shares of our common stock in connection with conversions of the Notes, and thereby dilute our existing stockholders and potentially adversely affect the market price of our common stock.

•The fundamental change provisions of the Notes may delay or prevent an otherwise beneficial takeover attempt of us.

Market and Industry Data

This Annual Report includes market and industry data and forecasts that we have derived from publicly available information, various industry publications, other published industry sources and internal data and estimates. Industry publications and other published industry sources generally indicate that the information contained therein was obtained from sources believed to be reliable. Internal data and estimates are based upon information obtained from trade and business organizations and other contacts in the markets in which we operate and our management’s understanding of industry conditions. Any estimates underlying such market-derived information and other factors could cause actual results to differ materially from those expressed in the independent parties’ estimates and in our estimates.

Company Contact and Sources of Information

Our website is www.ormat.com. Information contained on or accessible via our website, including our Sustainability Report, is not part of or otherwise incorporated by reference into this Annual Report. Information that we furnish to or file with the U.S. Securities and Exchange Commission (the “SEC”), including our Annual Reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and any amendments to, or exhibits included in, these reports are

made available for download, free of charge, through our website as soon as reasonably practicable. Our SEC filings, including exhibits filed therewith, are also available directly on the SEC’s website at www.sec.gov.

We may use our website as a distribution channel of material Company information. Financial and other important information regarding the Company is routinely posted on and accessible through our website at www.ormat.com. Accordingly, investors should monitor this channel, in addition to following our press releases, SEC filings and public conference calls and webcasts.

PART I

ITEM 1. BUSINESS

Overview

We are a leading vertically integrated company that is primarily engaged in the geothermal energy power business. We leverage our core capabilities and global presence to expand our activity in recovered energy generation and into different energy storage services and solar PV (including hybrid geothermal and solar PV as well as solar plus Energy Storage). Our objective is to become a leading global provider of renewable energy and help to mitigate climate change by providing a replacement to carbon-intensive energy sources. We have adopted a strategic plan to focus on several key initiatives to expand our business.

We currently conduct our business activities in three business segments:

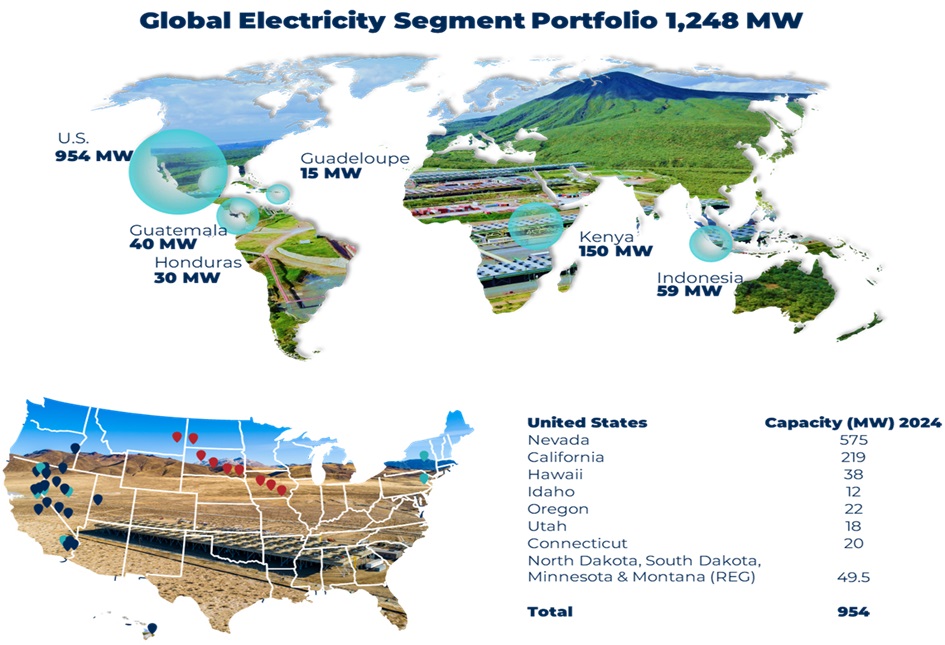

•Electricity Segment. In the Electricity segment, we develop, build, own and operate geothermal, solar PV and recovered energy-based power plants in the United States and geothermal power plants in other countries around the world and sell the electricity they generate. Since the beginning of 2024, we commenced or expanded commercial operation of 41MW of geothermal and solar PV power plants, including the 6MW Beowawe geothermal repowering, 17MW of Ijen geothermal power plant in Indonesia, the 5MW Steamboat Hills solar power plant (as part of the Steamboat Complex), the 7MW North Valley solar PV power plant and 6MW Beowawe solar PV power plant. In addition, we added 99MW of geothermal and solar PV assets from an acquisition we completed in January 2024 from Enel Green Power North America (“EGPNA”), a subsidiary of Enel SpA (ENEL.MI, LLC).

•Product Segment. In the Product segment, we design, manufacture and sell equipment for geothermal and recovered energy-based electricity generation and provide services relating to the engineering, procurement and construction of geothermal and recovered energy-based power plants. Since the beginning of 2024, we signed new contracts that were added to our backlog, and secured $313 million of anticipated Product revenues of which the majority will be recognized over the next two years.

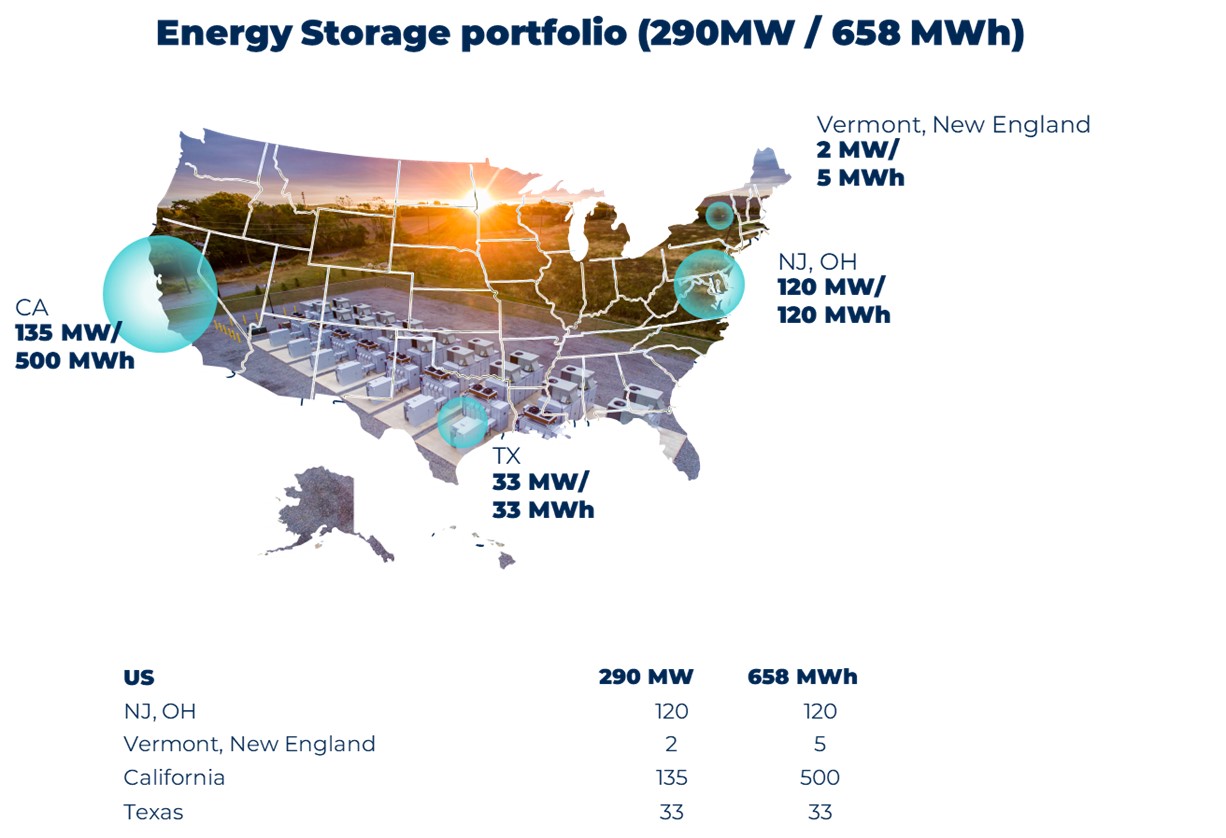

•Energy Storage Segment. In the Energy Storage segment, we own and operate grid-connected In Front of the Meter (IFM) BESS facilities, which provide capacity, energy and ancillary services directly to the electric grid. We operate our facilities in three main areas in the U.S., California, Texas and the East Coast and generate our revenues mainly from the sale of ancillary services in the merchant market and /or tolling agreements and RA contracts. Since the beginning of 2024, we commissioned three energy storage facilities with a total capacity of 120MW/360 MWh in California and New Jersey.

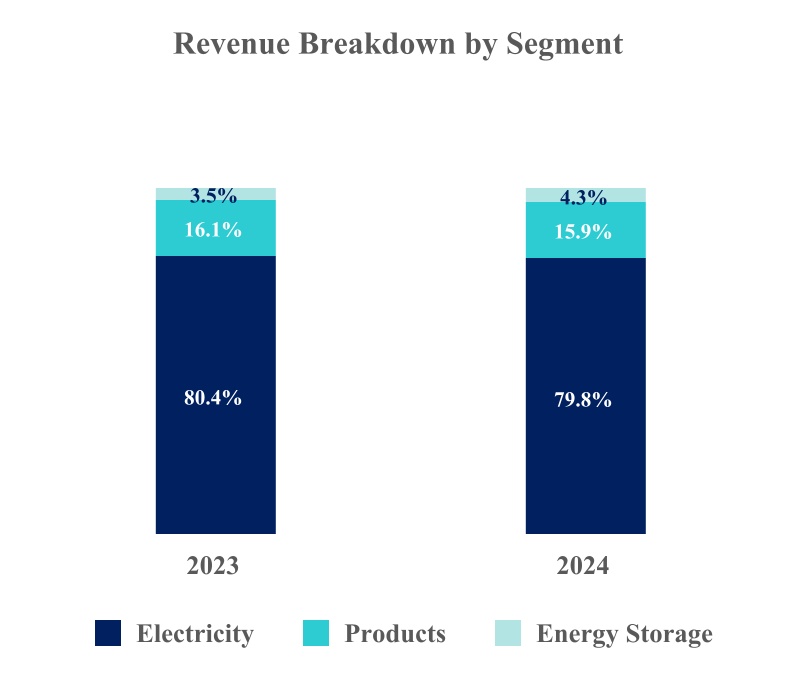

The following chart sets forth a breakdown of our revenues for each of the years ended December 31, 2024 and 2023:

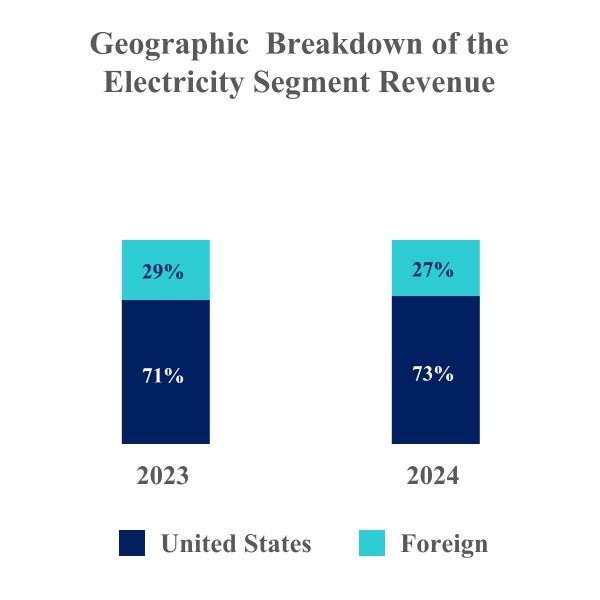

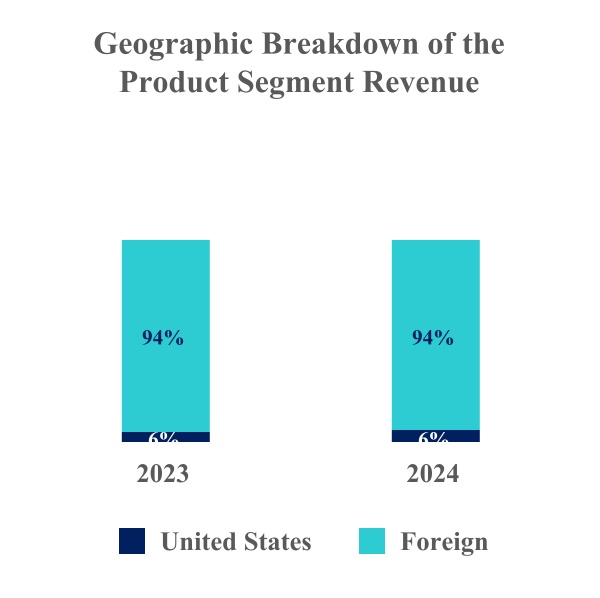

The following chart sets forth the geographical breakdown of revenues attributable to our Electricity and Product segments for each of the years ended December 31, 2024 and 2023:

The revenues attributable to our Energy Storage segment for each of the years ended December 31, 2024 and 2023 were 100% generated in the United States.

Our Electricity Segment

Our Company-owned power plants include both power plants that we have built and power plants that we have acquired. The substantial majority of the power plants that we currently own or operate produce electricity from geothermal energy sources. Geothermal energy is a clean, renewable and generally sustainable form of energy derived from the natural heat of the earth. Unlike electricity produced by burning fossil fuels, electricity produced from geothermal energy sources is produced without emissions of certain pollutants such as nitrogen oxide, and with far lower emissions of other pollutants such as carbon dioxide. As a result, electricity produced from geothermal energy sources contributes significantly less to climate change and local and regional incidences of acid rain than energy produced by burning fossil fuels. In addition, compared to power plants that utilize other renewable energy sources, such as wind or solar, geothermal power plants are generally available all year-long and all day-long and can therefore provide base-load electricity services. Geothermal power plants can also be custom built to provide a range of electricity services such as baseload, voltage regulation, reserve and flexible capacity.

We own and operate geothermal and solar PV hybrid projects and have similar projects currently under construction, in which the electricity generated from a solar PV power plant is used to offset the equipment’s energy use at the geothermal facility, thus increasing the geothermal energy delivered by the project to the grid. In addition, we own and operate standalone solar PV power plants that sell their output under long term contracts.

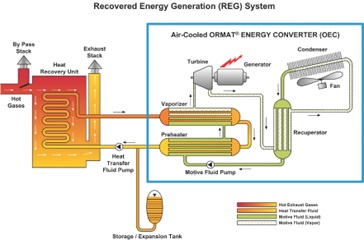

We also construct, own, and operate 50MW of recovered energy-based power plants. We have built all of the recovered energy-based plants that we operate. Recovered energy comes from residual heat that is generated as a by-product of gas turbine-driven compressor stations, solar thermal units and a variety of industrial processes, such as cement manufacturing. Such residual heat, which would otherwise be wasted, may be captured in the recovery process and used by recovered energy power plants to generate electricity without burning additional fuel and without additional emissions.

Each of our current geothermal power plants sells substantially all of their output pursuant to long-term, and in most cases, fixed price PPAs to various counterparties denominated in or linked to the U.S. dollar or Euro. These contracts had a total weighted average remaining term, based on contributions to segment revenue, of approximately 15 years as of December 31, 2024. In addition, the counterparties to our PPAs in the United States have a credit rating of between Ba1 to Baa2 (stable) by Moody's and AA+ to B- by S&P. The purchasers of electricity from our foreign power plants are mainly state-owned entities in countries with below investment grade rating.

Power Plants in Operation

We own and operate 35 power plants and complexes globally, as listed below, with an aggregate generating capacity of 1,248 MW. They include geothermal, REG and solar sites. Geothermal comprised 86% of our Electricity Segment generating capacity. In 2024, our geothermal and REG power plants generated at a capacity factor of 84%% and 70%%, respectively, which is higher than the 20%-30% capacity factor typically generated in wind and solar projects.

The table below summarizes certain key non-financial information relating to our power plants and complexes as of February 25, 2025. The generating capacity of certain of our power plants and complexes listed below has been updated from our 2023 disclosure to reflect changes in the resource temperature and other factors that impact resource capabilities:

| | | | | | | | | | | | | | | | | | | | |

| Type | Region | Plant | Ownership(1) | Generating capacity (MW) (2) | PPA Tenure | Capacity Factor(3) |

| Geothermal | California | Ormesa Complex | 100% | 36 | 18 | 86% |

| | Heber Complex | 100% | 91 | 18 |

| | Mammoth Complex | 100% | 65 | 14 |

| | Brawley | 100% | 7 | 7 |

| West Nevada | Steamboat Complex (5) | 100% | 79 | 22 | 83% |

| | Brady Complex(5) | 100% | 24 | 25 |

| | | | | | | | | | | | | | | | | | | | |

| Type | Region | Plant | Ownership(1) | Generating capacity (MW) (2) | PPA Tenure | Capacity Factor(3) |

| East Nevada | Tuscarora | 100% | 17 | 9 | 81%(13) |

| | Jersey Valley | 100% | 8 | 8 |

| | McGinness Hills | 100% | 146 | 14 |

| | Don A. Campbell | 100% | 28(4) | 10 |

| | Tungsten Mountain (5) | 100% | 41 | 19 |

| | Dixie Valley | 100% | 64 | 14 |

| | Beowawe(5) | 100% | 20 | 30 |

| North West Region | Neal Hot Springs(6) | 60% | 22 | 13 | 90% |

| | Raft River | 100% | 12 | 9 |

| | San Emidio(7),(5) | 100% | 39 | 19 |

| | Still Water Complex(8),(5) | 100% | 12 | 5 |

| | Salt Wells(8) | 100% | 9 | 5 |

| Hawaii | Puna(9) | 63.3% | 38 | 28 | 78% |

| Utah | Cove Fort(8) | 100.0% | 18 | 9 | 77% |

| International | Amatitlan (Guatemala) | 100% | 20 | 4 | 84%(10) |

| | Zunil (Guatemala) | 97% | 20 | 10 |

| | Olkaria III Complex (Kenya) | 100% | 150 | 10 |

| | Bouillante (Guadeloupe, France) | 63.75%(11) | 15 | 6 |

| | Platanares (Honduras) | 100% | 30(4) | 8 |

| | | | | | |

| Total Consolidated Geothermal | | | | 1,011 | | 84% |

| | | | | | |

| REG | | OREG 1 | 100.0% | 22 | 7 | |

| | OREG 2 | 100.0% | 22 | 10 | |

| | OREG 3 | 100.0% | 5.5 | 6 | |

| | | | | | |

| Total REG | | | | 50 | | 70% |

| | | | | | |

| Solar | | Tungsten Mountain | 100% | 12 | NA | |

| | Wister | 100% | 20 | 18 | |

| | Steamboat Solar | 100% | 17 | NA | |

| | Stillwater Solar PV(8) | 100% | 20 | NA | |

| | Stillwater Solar PV II (8) | 100% | 20 | 1 | |

| | Woods Hill(8) | 100% | 20 | 14 | |

| | North Valley | 100% | 7 | NA | |

| | Beowawe | 100% | 6 | NA | |

| | Brady | 100% | 6 | NA | |

| Total Solar | | | | 128 | | |

| Unconsolidated Geothermal | Indonesia | Sarulla Complex | 12.75% | 42 | 23 | |

| Indonesia | Ijen(14) | 49% | 17 | | |

| Total Unconsolidated Geothermal | | | | 57 | | |

| | | | | | |

| Total | | | | 1,248 | | |

1.We have a controlling interest in and we operate all of our power plants, except for Sarulla and Ijen both in Indonesia. Financial institutions hold equity interests in five of our subsidiaries: (i) ORNI 41, which owns McGinness Hills Phase 3 located in Nevada; (ii) ORNI 43, which owns the Tungsten Mountain geothermal power plant located in Nevada; (iii) Steamboat Hills, LLC, which owns the Steamboat Hills power plant located in Nevada; (iv) CD4 partnership that owns the CD4 power plant, under Mammoth Complex, in California; (v) ORNI 36, which owns North Valley power plant, under San Emidio complex, located in Nevada. In the table above, we list these power plants as being 100% owned because all of the generating capacity is owned by these subsidiaries and we control the operation of the power plants. The nature of the equity interests held by the financial institution is described below in Item 8 — “Financial Statements and Supplementary Data" under Note 12.

We own a 63.75% equity interest in the Bouillante power plant, a 60% equity interest in the Neal Hot Spring power plant and a 63.25% direct equity interest in the Puna plant. We list 100% of the generating capacity of the Bouillante power plant, the Neal Hot Springs power plant and the Puna power plant in the table above because we control their operations. We list our 12.75% share of the generating capacity of the Sarulla complex and 49% of the generating capacity of the Ijen power plant as we own minority interests in these projects. Revenues from the Sarulla complex and from the Ijen power plant are not consolidated and are presented under “Equity in earnings (losses) of investees, net” in our consolidated financial statements.

2.References to generating capacity generally refer to gross generating capacity less auxiliary power. We determine the generating capacity of these power plants by taking into account resource and power plant capabilities. In any given year, the actual power generation of a particular power plant may differ from that power plant’s generating capacity due to variations in ambient temperature, the availability of the geothermal resource, and operational issues affecting performance during that year. In 2024 the capacity factors of Olkaria, Puna, and Dixie Valley complexes were significantly impacted by operational and resource issues, as discussed further under "Description of our power plants".

3.Capacity factor is generally calculated as the actual MWh generation divided by the maximum potential generation (generating capacity multiplied by 8,760 hours). In the case of curtailments by the grid operator the generated MWh are taken into account in our calculation although the curtailed MWh were not sold to the grid.

4.Generating capacity reduced to reflect cooling experienced in the resource.

5.This is a hybrid geothermal and solar power plant that uses the solar energy for geothermal power plant auxiliary power. The solar PV facilities are presented separately in the table above.

6.We own 60% and Enbridge owns 40% of the Neal Hot Springs power plant.

7.The San Emidio complex includes 25MW from North Valley that commenced commercial operation in May 2023.

8.Acquired and added to our portfolio in January 2024.

9.The Puna geothermal power plant shut down on May 3, 2018 when the Kilauea volcano erupted following a significant increase in seismic activity in the area. The Puna power plant resumed operations in November 2020 and during 2024 operated at a level of approximately 30 MW.

10.Capacity factor was mainly impacted by lower performance of the Olkaria complex in the first half of the year, as further discussed below under "Description of our Power plants”.

11.We own 63.75%, CDC owns 21.25% and Sageos owns 15.0% of the Bouillante power plant.

12.The OREG power plants are not operating at full capacity due to low run time of the compressor stations that serves as the power plants heat source. This has resulted in lower power generation.

13.Capacity factor was mainly impacted by the lower performance of the Dixie Valley power plant, as further discussed below under "Description of our Power plants."

14.The 35MW Ijen power plant in Indonesia commenced operation in February 2025. Our share is 17MW (49%)

New Power Plants

We are currently in various stages of construction of new power plants and expansion of existing power plants. We have released for construction projects with generating capacity of 134MW from geothermal and solar PV worldwide. In addition, we have several geothermal and solar PV projects in various stages of development. These projects are located in the United States.

We hold substantial land positions across 31 prospects in the United States and 13 prospects in Ethiopia, Guatemala, Honduras, Indonesia and New Zealand that we expect will support future geothermal development. These land positions are comprised of various leases, exploration concessions for geothermal resources, and options to enter into leases. We have started or plan to start exploration activity on many of these prospects.

We expect to add between 400MW to 500MW and to reach by the end of 2028 a total generating capacity of between 1.65 to 1.75 GW in the Electricity Segment.

Our Product Segment

We design, manufacture and sell products for electricity generation and provide the related services described below. In addition, we provide cementing services for well drilling to third parties. We primarily manufacture products to fill customer orders, but in some situations, we manufacture products as inventory for future projects that we will own or for future third-party projects.

Power Units for Geothermal Power Plants

We design, manufacture and sell power units for geothermal electricity generation, which we refer to as OECs. In geothermal power plants using OECs, geothermal fluid (either hot water/brine, steam, or both) is extracted from the underground reservoir and flows from the wellhead to a vaporizer that heats a secondary working fluid, which is vaporized and used to drive the turbine. The secondary fluid is then condensed in a condenser, which may be cooled directly by air through an air-cooling system or by water from a cooling tower and sent back to the vaporizer. The cooled geothermal fluid is then reinjected back into the reservoir. Our customers include contractors, geothermal power plant developers, owners and operators.

Power Units for Recovered Energy-Based Power Generation

We design, manufacture and sell power units used to generate electricity from recovered energy, or so-called “waste heat”. This heat is generated as a residual by-product of gas turbine-driven compressor stations, solar thermal units, biomass facilities and a variety of industrial processes, such as cement manufacturing, and is not otherwise used for any purpose. Our existing and target customers include interstate natural gas pipeline owners and operators, gas processing plant owners and operators, cement plant owners and operators, and other companies engaged in other energy-intensive industrial processes.

EPC of Power Plants

We serve as an EPC contractor for geothermal and recovered energy power plants on a turnkey basis, using power units we design and manufacture. Our customers are geothermal power plant owners as well as our target customers for the sale of our recovered energy-based power units. Unlike many other companies that provide EPC services, we believe our competitive advantage is in using equipment that we manufacture, which allows us better quality in and control over the timing and delivery of required equipment and its related costs.

Our Energy Storage Segment

Our Energy Storage segment has grown consistently since 2019 and we expect strong growth in the coming years. We have targeted the Energy Storage segment as one of our major segments for investment and growth.

We own and operate 16 BESS projects in the U.S, as listed below, with an aggregate generating capacity of 290MW/658MWh. The table below summarizes certain key non-financial information relating to our BESS projects as of February 25, 2025:

| | | | | | | | | | | | | | | | | |

| Project Name | Customer | Location | Size (MW) | MWh | Type of contract |

| ACUA | PJM | NJ | 1 | 1 | Merchant |

| Plumsted | PJM | NJ | 20 | 20 | Merchant |

| Stryker | PJM | NJ | 20 | 20 | Merchant |

| Hinesburg | ISONE | VT | 2 | 5 | Merchant |

| Rabbit Hill | ERCOT | TX | 10 | 10 | Merchant |

| Pomona | SCE/CAISO | CA | 20 | 80 | Capacity PPA and Merchant |

| Vallecito | CAISO and SCE | CA | 10 | 40 | Capacity PPA and Merchant |

| Tierra Buena | CAISO, RCEA and VCE | CA | 5 | 20 | Capacity PPA and Merchant |

| Upton | ERCOT | TX | 23 | 23 | Merchant |

| Andover | PJM | NJ | 20 | 20 | Merchant |

| Howell | PJM | NJ | 7 | 7 | Merchant |

| Bowling Green | PJM | OH | 12 | 12 | Capacity and Merchant |

| Pomona 2 | SCE/CAISO | CA | 20 | 40 | Full Tolling |

| East Flemington | PJM | NJ | 20 | 20 | Merchant |

| Bottleneck | SDG&E | CA | 80 | 320 | Full Tolling |

| Montague | PJM | NJ | 20 | 20 | Merchant |

| Total | | | 290 | 658 | |

New BESS Projects

We are currently in the process of constructing six additional energy storage projects with a total capacity of 385MW/1,300MWh in California, Texas and New Jersey.

In addition, we have an approximate 2.9GW/10.7GWh pipeline of potential projects, in different stages of development across the United States that will support our target to reach an energy storage portfolio of between 950-1050MW/2,500-2,900MWh by the end of 2028.We plan to continue leveraging our experience in project development and finance, our engineering, procurement and construction know-how and our relationships with utilities and other market participants, to develop additional BESS projects.

Business Strategy

Our strategy is focused on further developing a geographically balanced portfolio of geothermal, energy storage, solar PV and recovered energy assets and continuing our leading position in the geothermal energy market with the objective of becoming a leading global provider of renewable energy. We are focused on helping to create a sustainable energy infrastructure and further an alternative energy future where greenhouse gas emissions are reduced and the ability to access and store renewable sourced power, including geothermal energy, will enable electricity grids to become more responsive, more stable, and more environmentally friendly.

Business Goals

Our goals include continuing our leading position in the geothermal energy market and becoming a leading global provider of renewable energy. Our strategy focuses on three main elements:

•Developing our low carbon renewable geothermal business in the United States and globally;

•Growing our market position in the IFM energy storage market; and

•Exploring opportunities in new areas by looking for synergistic growth opportunities utilizing our core competencies, strong market reputation, and new market opportunities focused upon environmentally responsible solutions in the energy sector.

We intend to implement this strategy through:

•Development and Construction of New Geothermal Power Plants — identifying new commercially viable renewable geothermal resources, and significantly expanding and expediting our exploration drilling to accelerate the development and construction of new zero emission geothermal power plants by entering into long-term PPAs providing stable and sustainable cash flows.

•Expanding our Geographical Reach — increasing our business development activities in an effort to grow our business in the global markets in all business segments. While we continue to evaluate global opportunities, we currently see the United States, Indonesia, Central America and New Zealand as attractive markets for our Electricity Segment. We see New Zealand, the Philippines, Indonesia, and the United States as attractive markets for our Product Segment. We are actively looking at ways to expand our presence in these countries to offer and provide replacement to carbon-intensive power alternatives. In the Energy Storage segment we continue focusing on the U.S. where all of our operating assets are located, however, as described below, we recently won a tender in Israel relating to two Energy Storage facilities, and plan also to expand our activity to that country.

•Accelerating the Development and Construction of New Energy Storage Assets — increasing our business development activities seeking potential sites for development and construction of energy storage facilities (including hybrid storage and solar PV facilities) in an effort to significantly grow our energy storage market and provide efficient solutions to the grid, while combining both long term fixed price contracts, known as tolling agreements, together with merchant exposure.

•Acquisition of Geothermal Assets — expanding and accelerating growth through acquisition activities globally, aiming to acquire additional geothermal assets as well as operating and developing assets that can support our geothermal business.

• Acquisition of Energy Storage Projects and Assets — expanding and accelerating growth through acquisition of operating assets, shovel ready projects and projects in various stages of development.

•Using Our Operational and Resource Management Capabilities to Increase Output from our Existing Geothermal Power Plants — increasing output from our existing geothermal power plants by adding additional generating capacity, upgrading plant technology, drilling new wells or redrilling existing wells as well as improving geothermal reservoir operations, including improving methods of heat source supply and delivery.

•Creating Cost Savings Through Increased Operating Efficiency — increasing efficiencies in our operating power plants and manufacturing facility including procurement by adding new technologies, restructuring of management control, automating part of our manufacturing work and centralizing our operating power plants by using, among others, remote operation.

•Diversifying our Customer Base — evaluating a number of strategies for expanding our customer base to hypers-calers, corporations and CCA markets. In the near term, however, we expect that the majority of our revenues will continue to be generated from our traditional electrical utility customer base for the Electricity segment.

•Maintaining a Prudent and Flexible Capital Structure — we have various financing structures in place, including non-recourse project financings, green convertible bonds, the sale of differential membership interests and equity interests in certain subsidiaries, the sale and/or transfer of tax credits available to our projects, as well as revolving credit facilities and term loans. We believe our cash flow profile, the long-term nature of our contracts, and our ability to raise capital provide greater flexibility for optimizing our capital structure.

•Improving our Technological Capabilities — investing in research and development of renewable energy technologies and leveraging our technological expertise to continuously improve power plant components, reduce operations and maintenance costs, develop competitive, eco-efficient and low-carbon products for electricity generation and target new service opportunities. In addition, we are expanding our core geothermal competencies to provide high efficiency solutions for high enthalpy applications by utilizing our binary enhanced cycle and technology.

•Manufacturing and Providing Products and EPC Services Related to Renewable Energy — designing, manufacturing and contracting power plants for our own use and selling to third parties power units and other generation equipment for geothermal and recovered energy-based electricity generation.

•Expanding into New Technologies — leveraging our technological capabilities over a variety of renewable energy platforms, including enhanced geothermal systems (EGS), solar power generation, energy storage and recovered energy generation. Involvement in continuous innovation by research and development efforts aimed at enhancing the efficiency of our operations, including through the use of AI technologies. In addition, we recognize the importance of corporate venture capital in acquiring or investing in companies with integration and technological capabilities that complement our existing expertise. Moreover, developing new technologies internally or in collaboration with third parties, where necessary (including EGS), to fill gaps and capitalize on market opportunities in alignment with our strategic plan.

The map below shows our worldwide portfolio of operating geothermal, solar PV and recovered energy power plants as of February 25, 2025.

* In the Sarulla (Indonesia) complex, Indonesia, we include our 12.75% share only.

The map below shows our portfolio of operating storage facilities as of February 25, 2025.

Sustainability Strategy

We are committed to engaging with stakeholders on, and strengthening our commitment to, sustainability issues, including environmental, social and governance (“ESG”) matters. We endorse external initiatives and partner with national and international associations that we believe assist us in adhering to our ESG values, in particular, relating to geothermal, energy, health and safety issues and human rights issues. We strive to provide up-to-date, credible and comparable data to ESG agencies while engaging institutional investors and investor advocacy organizations around ESG issues.

As a renewable energy solution provider, we are motivated to identify opportunities and risks with respect to climate change and take efforts to reduce our GHG emissions and improve our energy efficiency. In addition to meeting our regulatory requirements, we report our annual GHG emissions to several organizations, including the Carbon Disclosure Project and the Israeli Ministry of Environmental Protection’s voluntary business reporting initiative.

We report our progress on environmental goals and commitments annually in our sustainability reports, including, but not limited to, our climate change mitigation measures, biodiversity conservation, and water management efforts. A copy of our most recent Sustainability Report is accessible, free-of-charge, on our website at https://www.ormat.com/en/company/engagement. The contents of our website, including the sustainability reports, are not part of or otherwise incorporated by reference into this Form 10-K.

Our Proprietary Technology

Our proprietary technology involves original designs of turbines, pumps, and heat exchangers, as well as formulation of organic motive fluids (all of which are non-ozone-depleting substances) and may be used either in power plants operating according to the ORC alone or in combination with various other commonly used thermodynamic technologies that convert heat to mechanical power, such as gas and steam turbines. It can be used with a variety of thermal energy sources, such as geothermal, recovered energy, biomass, solar energy and fossil fuels. By using advanced computational fluid dynamics techniques and other computer aided design software as well as our test facilities, we continuously seek to improve power plant components, reduce operations and maintenance costs, and increase the range of our equipment and

applications. We examine ways to increase the output of our plants by utilizing evaporative cooling, cold reinjection, configuration optimization, and topping turbines.

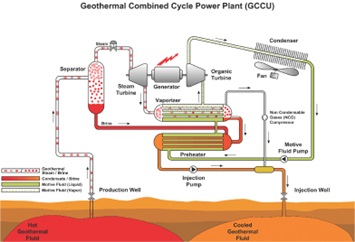

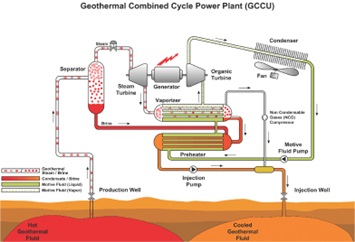

We also developed, patented and constructed GCCU power plants in which the steam first produces power in a backpressure steam turbine and is subsequently condensed in a vaporizer of a binary plant, which produces additional power. Our Geothermal Combined Cycle technology, that we have deployed in previous years, is depicted in the diagram below.

In the conversion of geothermal energy into electricity, our technology has a number of advantages over conventional geothermal steam turbine plants. A conventional geothermal steam turbine plant consumes significant quantities of water, causing depletion of the aquifer and requiring cooling water treatment with chemicals and consequently a need for the disposal of such chemicals. A conventional geothermal steam turbine plant also creates a visual impact in the form of an emitted plume from the cooling towers, especially during cold weather. By contrast, our binary and combined cycle geothermal power plants have a low profile with minimal visual impact and do not emit a plume when they use air-cooled condensers. Our binary and combined cycle geothermal power plants reinject all of the geothermal fluids utilized in the respective processes into the geothermal reservoir. Consequently, such processes generally have no emissions.

Other advantages of our technology include simplicity of operation and maintenance and higher yearly availability. For instance, the OEC employs a low speed and high efficiency organic vapor turbine directly coupled to the generator, eliminating the need for reduction gear. In addition, with our binary design, there is no contact between the turbine blade and geothermal fluids, which can often be very erosive and corrosive. Instead, the geothermal fluids pass through a heat exchanger, which is less susceptible to erosion and can adapt much better to corrosive fluids. In addition, with the organic vapor condensed above atmospheric pressure, no vacuum system is required.

We use the same elements of our technology in our recovered energy products. The heat source may be exhaust gases from a Brayton cycle gas turbine, low-pressure steam, or medium temperature liquid found in the process industries such as oil refining and cement manufacturing. In most cases, we attach an additional heat exchanger in which we circulate thermal oil or water to transfer the heat into the OEC’s own vaporizer in order to provide greater operational flexibility and control. Once this stage of each recovery is completed, the rest of the operation is identical to that of the OECs used in our geothermal power plants and enjoys the same advantages of using the ORC. In addition, our technology allows for better load following than conventional steam turbines, requires no water treatment (since it is air-cooled and organic fluid motivated), and does not require the continuous presence of a licensed steam boiler operator on site.

Our REG technology is depicted in the diagram below.

Patents

As of December 31, 2024, we had 190 patents and patent applications worldwide, including 55 patents issued in the U.S. and 28 pending patent applications worldwide with 2 of them U.S. patent applications.These patents and patent applications cover our products (mainly power units based on the ORC) and systems (mainly geothermal power plants and industrial waste heat recovery plants for electricity production). The product-related patents cover components that include turbines, pumps, heat exchangers, air coolers, seals and controls as well as control of operation of geothermal production well pumps. The system-related patents cover not only particular components but also the overall energy conversion system from the “fuel supply” (e.g., geothermal fluid, waste heat, biomass or solar) to electricity production.

The system-related patents also cover subjects such as waste heat recovery related to gas pipeline compressors and industrial waste heat, solar power systems, disposal of non-condensable gases present in geothermal fluids, reinjection of other geothermal fluids ensuring geothermal resource sustainability, power plants for very high-pressure geothermal resources, two-phase fluids, low temperature geothermal brine as well as processes related to EGS. The remaining terms of our issued patents range from one year to 16 years. The loss of any single patent would not have a material effect on our business or results of operations.

Research and Development

We conduct research and development activities intended to improve plant performance, reduce costs, and increase the breadth of our product offerings. The primary focus of our research and development efforts is targeting power plant conceptual thermodynamic cycle and major equipment including continued performance, cost and land usage improvements to our condensing equipment, and development of new higher efficiency and higher power output turbines and brine production pumps. New realms for innovation include implementation of predictive maintenance software and automation of power plants performance analysis.

As part of our continuous cost reduction and performance enhancement, we developed and patented the extraction ORC, extraction and injection turbines that allow bleed or injection of motive fluid between stages from or to the organic turbine. As the ACC is a significant piece of equipment involved in the ORC process, we focus our efforts on improving ACC performance and reduce its cost, such as the wind guiding vanes for wind effects mitigation, inclined ACC and tubes geometry variation.

We also devote resources to research and development related to our energy storage segment. Our engineering and R&D teams are working to optimize the dispatch strategy of a BESS, develop and deploy capabilities to self-integrate BESS and test different battery cell and inverter technologies under simulated operating criteria of various energy markets to allow us to bring to market cost-effective BESS more rapidly and more optimized to the specific use cases and target revenue streams. Additionally, we hold patents in other energy storage solutions, including a mechanical energy storage system, which is currently under design and feasibility examination. A preliminary trial of this system in a small-scale unit

was performed, and testing remains ongoing. Initial results obtained high RTE values compared to other mechanical energy storage solutions.

We continue to evaluate investment opportunities in companies with innovative technology or product offerings for renewable energy and energy storage solutions

Market Opportunities

Geothermal Market Opportunities

Renewable energy offers a sustainable solution to several global issues: climate change, grid volatility, and unpredictable commodity costs. Due to its environmental benefits, many countries are now prioritizing the development of clean, decarbonized baseload renewable sources, with a particular interest in geothermal energy production.

At the end of 2024, the total installed geothermal power generation capacity stood at 16,873 MW, an increase of 389 MW in 2024. The United States, Indonesia, the Philippines, Turkey, Kenya and New Zealand are the leading countries in geothermal power generation with New Zealand seeing the largest growth in 2024, adding 174 MW.

Many governments have recognized the need for alternatives to fossil fuels. As a result, they have implemented or are preparing regulatory frameworks and policies necessary to achieve emission reduction targets.

United States

Federal

Interest in geothermal energy in the United States continues to grow based on supportive legislation and regulation at the local, state, and federal levels. Policymakers and regulators are increasingly aware of the value of geothermal energy. For example, in January 2025, President Trump issued multiple Executive Orders focused on energy, including declaring a national energy emergency and seeking to increase domestic energy production, including geothermal energy.

Geothermal power is currently generated in several states across the U.S., including California, Nevada, Hawaii, Idaho, Oregon, and Utah. Ormat believes there are opportunities for geothermal expansion in other western states, such as New Mexico and Colorado. New Mexico recently passed legislation increasing its renewable energy goals to 100% by 2045 for investor-owned utilities, and Colorado’s Energy and Carbon Management Commission recently adopted streamlined geothermal permitting regulations.

At the federal level, the Bureau of Land Management recently adopted a new categorical exclusion for geothermal resource confirmation activities on federal geothermal resource leases. This will significantly reduce the permitting burden for geothermal energy, facilitating faster development of clean and reliable energy on public lands.

Likewise, existing IRA tax incentives, including PTCs or ITCs for wind and solar projects (such as geothermal and hydropower) starting construction before January 1, 2025, enable the Company to transfer credits earned to unrelated third parties or to enter tax equity transactions to fund a higher percentage of the Company investment. These incentives have the potential to reduce our capital needs and increase project economics. The new U.S. presidential administration and/or current U.S. Congress may, within the scope of their authority, take action to revise, repeal, or otherwise modify existing rules and regulations, including various tax incentives, and the impact of such on the Company remains uncertain at this time. The IRA and its tax credits remain in place as of the date of this Annual Report and would require an act of Congress to be repealed, and any changes to federal agency rules would require administrative action. For more information, see Part I of this Annual Report, Item 1A “Risk Factors—Risks Related to the Company’s Business and Operation—We could be impacted by regulatory and other responses to climate change” and “—Risks Related to Governmental Regulations, Laws and Taxation—The reduction, elimination or inability to monetize government incentives could adversely affect our business, financial condition, future results and cash flows.”

Geothermal energy provides numerous benefits to the U.S. grid and economy. Geothermal development and operation can produce economic benefits by providing tax incentives and long-term high-paying jobs. According to the U.S. Energy Information Administration (EIA), it currently has one of the lowest LCOE of all power sources in the United States. Additionally, improvements in geothermal production make it possible to provide ancillary and on-demand services. This helps load-serving entities avoid additional costs of storage or new transmission in order to balance intermittent resources providers such as solar and wind.

Other Growing Demand for Renewable Energy in the U.S.

The growing demand for renewable energy in the U.S. is driven by several other factors, including the increasing number of data centers, decarbonization efforts, and electrification. Data centers are significant energy consumers, and as

companies strive to cut emissions and boost sustainability, they are securing renewable energy through PPAs to meet carbon-free targets. The demand for renewable energy is further amplified by the need to decarbonize various sectors, including transportation and industrial processes, which are increasingly relying on electrification.

High PPA Prices

The high PPA prices are a result of the growing demand for renewable energy and the direct demand from hyper-scalers. The gap between energy supply and demand in the U.S. has driven up power and capacity prices. Ormat is already negotiating over 200 MWs of capacity on its geothermal fleet for prices above $100 per MWh, compared to PPAs that Ormat closed at levels between $60 per MWh and $80 per MWh in the prior five years.

State legislation

Many state governments have implemented a RPS program, which requires utilities to incorporate renewable energy sources into their energy generation portfolio. The participating states set targets for generating energy from renewable sources within specific deadlines. Renewable energy generation under the RPS program is monitored through the production of RECs. Load-serving entities track these RECs to ensure that they are meeting RPS mandates.

Currently, in the United States, 30 states plus the District of Colombia and two U.S. territories have enacted an RPS, renewable portfolio goals, or similar laws or incentives (such as clean energy standards or goals) requiring or encouraging load-serving entities in such states to generate or buy a certain percentage of their electricity from renewable energy or recovered heat sources. Additionally, three states and one territory have set voluntary renewable energy goals. The vast majority of Ormat’s geothermal projects are in California, Nevada, and Hawaii, all of which have the most stringent RPS programs in the country. Ormat sees the impact of RPS and climate legislation as a significant driver to expanding existing power plants and building new renewable projects.

States also provide incentives to geothermal energy producers. Nevada provides a property tax abatement of up to 55% for real and tangible personal property used to generate electricity from geothermal sources. This abatement may extend up to twenty years if job creation requirements are met. In 2024, Colorado added two new incentive programs to support geothermal development including a grant program as well as investment and production tax credits. In Idaho, geothermal energy producers are exempt from property tax and, in lieu, pay a 3% tax on gross energy earnings. The California Energy Commission provides favorable grants and loans to promote the development of new or existing geothermal resources and technologies within the state. Also, in California, the CPUC has required LSEs to procure 11.5GW of new clean electricity by 2028, 1GW of this procurement must deliver firm power with an 80% capacity factor, produce zero on-site emissions, and be weather independent. In 2023, the CPUC ordered utilities to procure 4GW of clean electricity in addition to the 11.5GW required under the original bill. With a high-capacity factor and firm and flexible generation, geothermal energy addresses these requirements and is the natural replacement for baseload fossil fuels and nuclear generation.

Global

We believe the global markets continue to present growth and expansion opportunities in both established and emerging markets.

We believe several global climate-related initiatives are likely to create business expansion opportunities for us and support the global growth of the renewable sector. Although in January 2025 President Trump signed an Executive Order to withdraw the United States from the Paris Agreement, it was initially adopted by the Twenty-first Conference of the Parties to the United Nations (UN) Framework Convention on Climate Change (2015) and subsequent UN Climate Change Conferences have reaffirmed the commitments of the Paris Agreement.

Outside of the U.S., the majority of power-generating capacity has historically been owned and controlled by governments. Since the early 1990s, however, many foreign governments have privatized their power generation industries through sales to third parties encouraging new capacity development and/or refurbishment of existing assets by independent power developers. These foreign governments have taken a variety of approaches to encourage the development of competitive power markets, including awarding long-term contracts for energy and capacity to independent power generators and creating competitive wholesale markets for selling and trading energy, capacity, and related products. Some foreign regions and countries have also adopted active government programs designed to encourage clean renewable energy power generation such as the following countries in which we operate, sell products and/or are conducting business development activities:

Europe

Europe has the fourth largest geothermal power capacity, the majority of which stems from Italy and Turkey and recently small-scale projects in Germany. We are looking for opportunities to expand in Europe, primarily in our Product segment.

Since 2004, we have established strong business relationships in the Turkish geothermal market and provided our wide range of solutions, including our binary systems, to over 40 geothermal power plants with a total capacity of over 900MW. We believe the potential for geothermal growth in Turkey is high, specifically in center-south and east areas of the country. However, due to the ongoing economic crisis in Turkey, new projects and investments are at a standstill.

We are also experiencing growing interest and believe there are opportunities in Greece, Croatia and Hungary.

Latin America

Several Latin American countries have renewable energy programs and have pursued development in the geothermal market.