UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F/A

Amendment No. 4

| [X] | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| [ ] | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended ____________ |

OR

| [ ] | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from ____________ to ____________ |

Commission file number 0-50971

Blue Earth Refineries Inc.

(Exact name of Registrant as specified in its charter)

Not Applicable

(Translation of Registrant's name into English)

British Virgin Islands

(Jurisdiction of incorporation or organization)

8th Floor, Dina House, Ruttonjee Centre, 11 Duddell Street, Hong Kong SAR, China

(Address of principal executive offices)

Copy of communications to:

Virgil Z. Hlus, Esq.

Clark, Wilson

Barrisiters and Solicitors

Suite 800 - 885 West Georgia Street

Vancouver, British Columbia, Canada V6C 3H1

Telephone: 604-687-5700

Facsimile: 604-687-6314

Securities registered or to be registered pursuant to Section 12(b) of the Act.

| |

|---|

| Title of Class | Name of each exchange on which registered |

| Not Applicable | Not Applicable |

Securities registered or to be registered pursuant to Section 12(g) of the Act.

Ordinary Shares Without Par Value

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

Not Applicable

(Title of Class)

Indicate the number of outstanding shares of each of the issuer's classes of capital or common stock as of the close of the period covered by the annual report.

There were 50,002 Ordinary shares without par value issued and outstanding as at September 30, 2004.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Not Applicable

[ ] YES [ ] NO

Indicate by check mark which financial statement item the registrant has elected to follow.

[ ] ITEM 17 [X] ITEM 18

i

TABLE OF CONTENTS

1

PART I

FINANCIAL INFORMATION AND ACCOUNTING PRINCIPLES

The financial statements and summaries of financial information contained in this document are reported in United States dollars (“$&148;) unless otherwise stated. "CAN$” means Canadian dollars and “€” means Euro, the legal tender used by the majority of European Union member states. A "tonne" is one metric ton or 2204.6 pounds. All such financial statements have been prepared in accordance with United States generally accepted accounting principles, except for the financial information for 4025776 Canada Inc., which has been prepared in accordance with Canadian generally accepted accouting principles.

The consolidated financial statements of Blue Earth for the years ended June 30, 2004 and 2003 have been reported on by Peterson Sullivan PLLC, Independent Registered Public Accounting Firm, of 601 Union Street, Suite 2300, Seattle, Washington 98101 USA.

FORWARD-LOOKING STATEMENTS

Except for the statements of historical fact contained herein, some information presented in this registration statement constitutes forward-looking statements. When used in this registration statement, the words “estimate”, “project”, “believe”, “anticipate”, “intend”, “expect”, “predict”, “may”, “should”, the negative thereof or other variations thereon or comparable terminology are intended to identify forward-looking statements. Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of our company to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors include, among others, changes in project parameters as plans continue to be refined, future prices of cobalt, as well as those factors discussed in the section entitled “Risk Factors”. Although our company has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause actual results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. Accordingly, prospective investors should not place undue reliance on forward-looking statements. The forward-looking statements in this registration statement speak only as to the date hereof. Our company does not undertake any obligation to release publicly any revisions to these forward-looking statements to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

As used in this prospectus, the terms “we”, “us”, “our” and “Blue Earth” mean Blue Earth Refineries Inc., unless otherwise indicated.

2

ITEM 1 - Identity of Directors, Senior Management and Advisers

A. Directors and Senior Management

The Directors and the senior management of our company as of October 31, 2004 are as follows:

| Name | Business Address | Function |

|---|

| Michael J. Smith | 8th Floor, Dina House,

Ruttonjee Centre, 11 Duddell Street,

Central, Hong Kong SAR, China | Director, President and Secretary |

| Shuming Zhao | 22 Hankou Road,

Nanjing, 210093, China | Director |

| Dr. Kelvin K. Yao | 88 Jie Fang Road,

Hangzhou, 310009, China | Director |

| Dr. Stefan Feuerstein | Charlottenstrasse 59, 10117 Berlin,

Germany | Director |

| Silke Brossmann | Sudetenstrausse 3, 63110 Rodgau Hesse,

Germany | Director |

B. Advisers

Our legal advisers are Clark, Wilson, Barristers & Solicitors, with a business address at Suite 800, 885 West Georgia Street, Vancouver, British Columbia, Canada V6C 3H1.

C. Auditors

Our auditors are Peterson Sullivan PLLC, Independent Registered Public Accounting Firm, with a business address at 2300 Two Union Square, 601 Union Street, Seattle, Washington 98101 USA.

ITEM 3 - Key Information

A. Selected Financial Data

The following table summarizes selected consolidated financial data for our company prepared in accordance with United States generally accepted accounting principles for the years ended June 30, 2004 and 2003. The information in the table was extracted from the detailed consolidated financial statements and related notes included in this registration statement and should be read in conjunction with such financial statements and with the information appearing under the heading, “Operating and Financial Review and Prospects”.

3

For the Years Ended June 30

(US dollars, in thousands, except loss per common share)

| | 2004 | 2003 |

|---|

| Sales of cobalt | $ 5,019 | $ 1,048 |

| Sales of power | 404 | 427 |

| Operating loss | (303) | (268) |

| Loss before provision for income taxes | (477) | (2,555) |

| Net loss | (477) | (2,555) |

| Loss per common share (basic and diluted) | (9.54) | (51.10) |

As at June 30

(US dollars, in thousands)

| | 2004 | 2003 |

|---|

| Total assets | $ 55,283 | $ 46,928 |

| Total liabilities | 3,179 | 935 |

| Shareholder's equity | 52,104 | 45,993 |

| Common stock | 50 | 50 |

| Additional paid-in capital | 55,086 | 48,498 |

| Retained deficit | (3,032) | (2,555) |

B. Capitalization and Indebtedness

Our capital consists of 100,000,000 Ordinary shares without par value and 100,000,000 Class A Preferred shares without par value. As of October 31, 2004, we had 50,002 Ordinary shares and no Preferred shares outstanding. Pursuant to the Plan of Arrangement, we will split the 50,002 Ordinary shares into the same number of shares in the common stock of MFC Bancorp Ltd. on that date which is ten business days following the effective date of this registration statement.

The table below sets forth our total indebtedness in US dollars and capitalization as of June 30, 2004. You should read this table in conjunction with the audited consolidated financial statements and accompanying notes, included in this registration statement. The table below also sets forth our total indebtedness in US dollars and capitalization (actual and pro forma reflecting the Plan of Arrangement) as of September 30, 2004, which information is unaudited, has not been reviewed by our auditors and is subject to change.

4

As at June 30, 2004

(US dollars, in thousands)

| |

|---|

| Liabilities | | | | | |

Current, unsecured | | | $ | 2,479 | |

Long term, unsecured | | | | 700 | |

|

| |

| | | | $ | 3,179 | |

|

| |

Shareholders' Equity | | |

Common stock | | | $ | 50 | |

Additional paid-in capital | | | | 55,086 | |

Deficit | | | | (3,032) | |

|

| |

| | | | $ | 52,104 | |

|

| |

As at September 30, 2004 (1)

(Unaudited)

(US dollars, in thousands)

| |

|---|

| | | | | Historical | | Pro Forma

(Completion of

Arrangement) |

| Liabilities | | | | | | |

Current, unsecured | | | $ | 2,680 | $ | 2,680 |

Long term, unsecured | | | | 734 | | 734 |

|

| |

|

| | | | $ | 3,414 | $ | 3,414 |

|

| |

|

Shareholders' Equity | | |

Common stock | | | $ | 50 | $ | 50 |

Additional paid-in capital | | | | 55,086 | | 53,286 |

Deficit | | | | (1,555) | | (1,555) |

|

| |

|

| | | | $ | 53,581 | $ | 51,781(2) |

|

| |

|

| | (1) | This financial information is unaudited, has not been reviewed by the Company's auditors and is subject to change. |

| | (2) | Our shareholders' equity will be reduced by approximately $1.8 million as a result of a dividend distributed to our present shareholder. |

D. Risk Factors

The information included in this registration statement includes, or is based upon, estimates, projections or other “forward-looking statements.” Such forward-looking statements include any projections or estimates made by our company and our management in connection with our business operations. While these forward-looking statements, and any assumptions upon which they are based, are made in good faith and reflect our current judgement regarding the direction of our business, actual results will almost always vary, sometimes significantly, from any estimates, predictions, projections, assumptions or other future performance suggested herein.

5

Such estimates, projections or other “forward-looking statements” involve various risks and uncertainties as outlined below. We caution the reader that important factors in some cases have affected and could significantly affect actual results in the future, and cause actual results to differ significantly from the results expressed in any such estimates, projections or other “forward-looking statements.” Prospective investors should consider carefully the risk factors set out below.

Risks Associated with Refining

Our subsidiary's cobalt refining operations are subject to market forces beyond our control which could negatively

impact the demand for our cobalt or our operational costs, and reduce the economic viability of our operations.

Currently, we earn revenues exclusively from the sale of cobalt that is refined by our subsidiary Kasese Cobalt Company Limited. The marketability of cobalt is affected by numerous factors beyond our control. These factors include government regulations relating to prices, taxes, royalties, allowable production, imports and exports, any of which can increase our operational costs or reduce our refining capacity. In addition, cobalt prices are volatile, and supply and demand for cobalt fluctuates. Consumers, fearing further price increases, tend to increase their purchases in times of rising prices and, anticipating further price decreases, reduce purchases in times of price decline. If the demand for cobalt were to decline, or if we were to incur significantly higher operational and regulatory compliance costs and taxes, our economic viability would deteriorate and the continuation of our business would be threatened.

Our company's revenues are largely dependent upon cobalt prices that are subject to dramatic and unpredictable fluctuations. A significant drop in cobalt prices could threaten our ability to continue operations or lead us to bankruptcy.

The current demand for and supply of cobalt are the fundamental influences on the metal's prices, as are technical trends, currency exchange rates, inflation rates, changes in global economies, political factors and a number of other factors. The supply of cobalt, in turn, consists of a combination of mine production and existing stock held by governments, producers, financial institutions, and consumers. As a result, cobalt prices are subject to dramatic and unpredictable fluctuations. The following table sets forth, for the calendar years indicated, the average annual spot price in US dollars per pound for cobalt cathodes as reported by the US Geological Survey, Mineral Commodities Summaries (unless otherwise indicated):

| Calendar Year | Cobalt Average Spot Price

(USD/lb) |

|---|

2004 | 25.26(1) |

2003 | 9.40 |

2002 | 6.91 |

2001 | 10.55 |

2000 | 15.16 |

1999 | 17.02 |

(1) The 2004 average weekly price as reported by the Metal Bulletin up until September 30, 2004.

6

We expect that if Kasese Cobalt Company achieves its targeted refining capacity of 60 tonnes of cobalt cathodes per month, the break-even price will be $9 per pound, and at 55 tonnes per month, the break-even price will be $10 per pound. A drop in cobalt prices below these levels will have an adverse impact on our revenues, and threaten our ability to continue operations or lead us to bankruptcy. For example, due to weak cobalt prices in 2002, the Kasese Cobalt Company refinery was placed on a care and maintenance program under which all cobalt production ceased by September 2002. Operations recommenced approximately one year later when cobalt prices improved significantly.

We may not be able to obtain the required permits to continue our refining operations.

The operations of our subsidiary Kasese Cobalt Company require permits and licences from various governmental authorities. Obtaining such permits is a complex and time consuming process involving numerous agencies. The time involved and success in obtaining such permits is contingent upon many variables not within the control of our company or Kasese Cobalt Company. The failure to obtain such permits or a renewal of such permits could limit or bring to a halt our company's business, operations and future prospects, and could significantly reduce our ability to generate revenues and could lead us into bankruptcy. Currently, we have all operating permits and licenses needed to conduct the business of Kasese Cobalt Company. Some licenses and permits are only issued on an annual or multi-annual basis and these must be re-applied for when expired. Examples of such annual permits are those required for electrical generation, electricity sales, explosive st orage and blasting, manufacturing under bond, and a withholding tax exemption for Kasese Cobalt Company. Examples of multi-year (3-5 years) permits are those required for effluent discharge and water extraction by Kasese Cobalt Company from the Mubuku River.

We have a limited operating history on which to base an evaluation of our business and prospects.

Kasese Cobalt Company's cobalt refining plant has only recently recommenced operation, as it was closed for approximately one year due to weak cobalt prices. Accordingly, we have a limited operating history on which to base an evaluation of our prospects. We have only recently acquired an indirect 49.2% interest in 36569 Yukon Inc. 36569 Yukon's cobalt refining plant has never operated commercially and has no operating history. We have no way to evaluate whether we will be able to operate our business successfully. For the financial year ending 2005, we expect to spend approximately $10 million on operational costs plus maintenance on Kasese Cobalt Company's operations. Although we have no plans to dispose of any of our properties at this time, we recognize that if we are unable to generate significant revenues from refining operations, we will not be able to earn profits or continue operations, and we may have to dispose of our assets among other alt ernatives. At this early stage of our operation, we also expect to face the risks, uncertainties, expenses and difficulties frequently encountered by similar companies at the start-up stage of their business. For example, we need to monitor costs in a highly competitive cobalt commodity marketplace with a fluctuating market price, and we must maintain good labour relations with Kasese Cobalt Company's unionized labour force in a remote location in Uganda, a politically and economically unstable country. We cannot be sure that we will be successful in addressing these risks and uncertainties and our failure to do so could have an adverse effect on our financial condition with severe consequences such as a cessation of operations or bankruptcy.

Our Kasese Cobalt Company refinery may not be able to attain the targeted capacity, which could make us more vulnerable to increases in our costs and other risk factors affecting our financial condition. Failure to achieve our targeted capacity or control our costs could result in a cessation of operations or bankruptcy.

Due to design inadequacy and overly optimistic efficiency rate projections, our Kasese Cobalt Company refinery was not capable of achieving its original designed capacity of 1,000 tonnes per year. The revised capacity of 720 tonnes per year means that our operational costs per tonne has increased proportionately. If we do not achieve our revised capacity level, our unit cost of cobalt will be higher, resulting in a higher break-even price. In such case, we might sell our cobalt at a loss. This, in turn, could require us to once again place the Kasese Cobalt Company refinery on a care and maintenance program for an extended period of time followed by a cessation of operations. If we are unable to achieve our revised targeted capacity, or control our costs, we may never be able to achieve profitability and may ultimately be faced with bankruptcy.

7

We are subject to environmental protection legislation with which we must comply or suffer sanctions from regulatory authorities. Changes to existing, or the introduction of, new legislation may prove to be too burdensome to permit us to continue business operations.

Our company's cobalt refining activities are subject to laws and regulations controlling not only the refining of cobalt tailings, but also the possible effects of such activities upon the environment. Environmental legislation provides for restrictions and prohibitions on spills, releases or emissions of various substances produced in association with certain mineral refining operations, such as seepage from tailings disposal areas, which could result in environmental pollution. A violation of such legislation may result in the imposition of substantial fines and penalties. In addition, certain types of operations require the submission and approval of environmental impact statements. Environmental legislation is evolving in a manner which generally means stricter standards and enforcement, increased fines and penalties for non-compliance, more stringent environmental assessments of existing plant and proposed projects and higher legal and social resp onsibility for companies and their officers, directors and employees. Permits from a variety of regulatory authorities are required for many aspects of mineral refining operations. Current and future legislation and regulations could cause additional expense, capital expenditures, restrictions and delays in the exploitation of Kasese Cobalt Company's pyrite stockpile, the extent of which cannot be predicted. It is possible that the costs and delays associated with compliance with such laws and regulations could become such that we may decide to discontinue operations.

The refining industry is highly competitive and there is no assurance that we will achieve success in our refining

operations.

The cobalt refining business is competitive. Our company will continue to compete with other refinery companies, many of which have greater financial and technical resources than our company, in the production of cobalt and the acquisition of attractive cobalt properties. There is increasing competition for a limited number of cobalt refining opportunities within Canada, Africa and elsewhere and, as a result of this competition, we may be unable to produce cobalt on terms acceptable to us, resulting in a halt to our business or bankruptcy.

We are a single-metal producer and a prolonged drop in the market price for cobalt may force us to discontinue our operations.

We are a single-metal producer, so if the market price of cobalt falls below the cost of production, we will be required to cease operations and again place the Kasese Cobalt Company refinery on a care and maintenance program until the market price of cobalt improves. Most companies produce cobalt in concert with the production of one or more other metals. In such cases, cobalt is usually the secondary metal and as long as the production of the major metal is economic, cobalt will continue to be produced and sold as a contribution to overheads, without absorbing an economic share of production and overhead costs. This is not the case with our company. Our dependence on the refining of a single metal means that if cobalt market prices fall and remain depressed for a sustained period of time, we may be unable to fund a care and maintenance program, in which case we may be forced to dispose of our cobalt refineries at a loss or become bankrupt.

8

The supply of pyrite at the Kasese Cobalt Company refinery is limited. Once the supply of pyrite is exhausted, we will discontinue our operations at Kasese.

The feedstock at Kasese Cobalt Company is limited to the stockpiles. There is no alternative supply contemplated. Once the current pyrite stockpile is exhausted, which we anticipate will be in approximately eight years based on the current targeted capacity, we will discontinue our operations at Kasese. Without an operating refinery, we will not be able to continue our business.

Seasonality affects our power source. Interruptions to our power source may adversely affect our production rate and cobalt quality, and could therefore adversely affect our financial condition.

The cobalt production of Kasese Cobalt Company is subject to seasonal variation in the wet and dry seasons in Uganda. During the two dry seasons of the year, low water levels in the Mubuku River may preclude the generation of the seven to eight megawatts of power necessary to operate the Kasese Cobalt Company refinery. During these periods the refinery must rely to some extent on the Ugandan electrical grid to supply the shortfall. The refinery is equipped with a diesel generator, but the high cost of diesel-generated power makes it an unsustainable power source, except in times of very high cobalt prices. Ugandan electrical grid power failures are common, especially during the peak hours of consumption between 6 PM and 10 PM. If interruptions to our power supply are prolonged or frequent enough to adversely affect the production rate and quality of Kasese Cobalt Company cobalt, we may be forced to halt our business, which could ultimately result in our bankruptcy.

Our proprietary right to license the cobalt extraction process used at the Kasese Cobalt Company refinery is uncertain.

Our proprietary right to license the cobalt extraction process used at the Kasese Cobalt Company refinery is uncertain. The Bureau de Recherches Géologiques et Minères, who were instrumental in the early stages of the process development, could potentially claim a proprietary interest in the cobalt extraction process if an outside third party attempts to use this process technology. If this were to occur, we would assert our rights to a royalty and, as a last resort, attempt to negotiate an agreement with the Bureau de Recherches Géologiques et Minères to share any royalty extracted. The ownership of the cobalt extraction process technology rights do not affect our operations, but may affect any royalty rights to which we become entitled.

The distribution contract between Kasese Cobalt Company and Danzas, and the cobalt sales contract between a third party and MFC Commodities, as sales agent for Danzas, provide for the sale of 360 tonnes of cobalt at a price that may, from time to time, be below market price, which limits our revenues on such sale.

Kasese Cobalt Company has entered into a distribution agreement with Danzas, pursuant to which Danzas has been granted exclusive rights to sell Kasese Cobalt Company's entire production of cobalt metal broken cathodes at a purchase price of $12 per pound, plus 50% of the difference between $12 per pound and the net selling price per pound attained by Danzas from its customers. The entitlement of Danzas to receive 50% of the net selling price of the cobalt in excess of $12 per pound will cease upon assignment of the distribution agreement to our company upon consummation of the plan of arrangement involving our company and MFC Bancorp that is described in detail in Item 4, "Information on our Company," under the heading "The Plan of Arrangement". On January 28, 2004, MFC Commodities, as sales agent for Danzas, has entered into a cobalt sales contract pursuant to which a third party has agreed to purchase a total of 360 tonnes of cobalt metal broken cathodes of Kasese Cobalt Company production, or equivalent, between March 1, 2004 and March 31, 2005 at a price of $17.20 per pound. The sale of this cobalt below its market price will prevent us from maximizing the revenues that we might otherwise have earned while the market price of cobalt remained high, and effectively prevents us from participating in any additional increases in the market price of cobalt until March 31, 2005. If MFC Commodities enters into similar contracts as sales agent, we may be similarly prevented from fully participating in any future increases in the market price of cobalt.

9

There are significant shortcomings in the design of the 36569 Yukon refinery that need to be addressed before it can be restarted, and it is too early to predict with certainty when the refinery will start operating profitably.

A recent study commissioned by 36569 Yukon and performed by a professional process engineering firm has confirmed that the 36569 Yukon refinery will require significant modifications costing an estimated CAN$3.1 million to CAN$4.1 million before it can be placed into operation. The required upgrades include new feed preparation, product drying and vent scrubbing equipment, and changes to the refinery's existing leaching, purification and precipitation systems. Considering the variability of the feedstocks that may become available, the engineering firm recommended a budget of approximately CAN$5.0 million for the necessary upgrades over a nine to twelve-month period, including contingencies. 36569 Yukon approved a business plan for its cobalt refinery and expects operations to commence at the refinery in the latter part of 2005. While 36569 Yukon is committed to this business plan, and it is expected that 36569 Yukon will start to generate positive cash flows from operation in the fiscal year 2006, it is unable to predict with certainty when the 36569 Yukon refinery will start operating profitably at this early stage. It is also expected, according to the business plan and the terms of the debentures, 36569 Yukon will start to pay interest on the debentures in the fiscal year 2007 and pay off the debentures in the fiscal year 2014.

Political Risks

Our company may be adversely affected by political or economic instability, or threat of expropriation in Uganda, where our subsidiary, Kasese Cobalt Company, is located.

Our company's operating subsidiary, Kasese Cobalt Company, is located in Uganda where business activities may be affected by corruption, political instability, economic instability and threat of expropriation. Any changes in political or economic conditions which may adversely affect our business are beyond the control of our company. The risks include, but are not limited to, terrorism, military repression, expropriation, and high rates of inflation. Any one or more of these factors could compromise Kasese Cobalt Company's ability to achieve its targeted cobalt refining capacity and control its operating costs, or otherwise interfere with normal operation of the Kasese Cobalt Company refinery, and could force us to discontinue operations or into bankruptcy.

Financing Risks

We generate limited cash flow and may require additional funds to maintain business operations.

We currently generate limited cash flow from operations and there can be no assurance that future operations will generate sufficient cash flow to satisfy our ongoing cash requirements. In the past, Kasese Cobalt Company has relied on working capital loans from MFC Bancorp. Given current high market prices for cobalt, we anticipate that we will realize sufficient cash flow from the sale of cobalt by Kasese Cobalt Company to cover our cash requirements for the next twelve months. If our revenues prove to be insufficient to meet our cash requirements, we may be required to issue additional shares or seek debt financing to finance our operations. We currently do not have a relationship with an investment bank, and there are no assurances that MFC Bancorp or its subsidiaries will continue to provide us with working capital loans or any credit facilities. Without adequate cash flow from operations, and if we fail to obtain equity or debt financing when need ed, there is a substantial risk that our business operations would be significantly reduced or our business would fail.

10

Our international operations make us subject to fluctuations in foreign currency exchange rates which in turn may affect

our results.

While engaged in the business of processing and refining, our international operations make us subject to foreign currency fluctuations. Such fluctuations may adversely affect our financial positions and results. Our management may not take any steps to address foreign currency fluctuations that will eliminate all adverse effects and any steps taken may not be effective to eliminate all adverse effects. Accordingly, we may suffer losses due to adverse foreign currency fluctuations that could bring a halt to our operations.

The royalty payments we are required to make to Newmont Australia reduces the free cash flow available to our company by 10%, and may adversely affect the viability of our operations.

We are required to pay royalties to Newmont Australia Limited of 10% of the free cash flow generated by our Kasese Cobalt Company operation, net of capitalized maintenance costs, up to $10.0 million. The absolute amount of the royalty to be paid to Newmont Australia will depend on the level of free cash flow and this will depend on the price of cobalt. Due to the on-going royalty payments, the free cash flow available to our company is reduced by 10% until an aggregate of $10.0 million is paid. This may adversely affect the viability of our operations.

Risks Relating to Company Personnel

We are dependent on the services of qualified employees with experience in cobalt refining operations, and the loss of such employees may result in discontinuance of our operations and possible bankruptcy.

Our company will continue to compete with other refinery companies in connection with the recruitment and retention of qualified employees with the skills and experience necessary for cobalt refining operations. At the present time, a sufficient supply of qualified workers is available for operations at our Kasese Cobalt Company refinery. The continuation of such supply depends upon a number of factors, including, principally, the demand occasioned by other projects. In the case of our operations in Uganda, due to the remoteness and terrorism, new qualified workers may be difficult to find. With respect to terrorism, there is unrest due to the presence of the Lords Revolutionary Army in the northern part of Uganda. The atrocities committed by this group receive worldwide exposure and may deter some qualified candidates from applying for any vacant position at Kasese Cobalt Company. The civil wars in the eastern part of the Democratic Republic of Congo and in the Dafur region of Sudan are in close proximity to Uganda and may have the same deterrent effect. Without qualified employees, we will not be able to operate the refinery, which could lead to our bankruptcy.

If we cannot locate qualified personnel as required, we may have to suspend or cease operations which will result in

the loss of your investment.

Other than Kasese Cobalt Company's directors and officers, our directors and officers have no direct training or experience in cobalt processing or refining. As a result, they may not be fully aware of any of the specific requirements related to working within the cobalt refining industry. Their decisions and choices may not take into account standard engineering or managerial approaches that cobalt refining and processing companies commonly use. Consequently, our operations, earnings and ultimate financial success could suffer irreparable harm due to the lack of experience of our management in this industry. As a result, we may have to suspend or cease operations which could lead to our bankruptcy.

11

Conflicts of interest may arise as a result of our directors and officers being directors and officers of other natural

resource companies.

The following persons are directors, officers and/or shareholders of other natural resource companies: Fred Nyakana, the Chairman of the board of directors of Kasese Cobalt Company is also the Chairman of the board of directors of Kilembe Mines Limited; and Bob Makoma, a director of Kasese Cobalt Company is also the President and Chief Operating Officer of Kilembe Mines Limited. While we are engaged in the business of cobalt processing and refining, such associations may give rise to conflicts of interest from time to time. Our directors are required by law to act honestly and in good faith with a view to our best interests and to disclose any interest that they may have in any project or opportunity of ours. If a conflict of interest arises at a meeting of our board of directors, any director in a conflict must disclose his interest and abstain from voting on such matter. Conflicts may cause lost opportunities for our company. In determining whether or not our company will participate in any project or opportunity, our directors will primarily consider the degree of risk to which our company may be exposed and our financial position at the time. Our directors and officers are free to accept other positions either as directors or employees of other companies, in which case these other positions may impact on the amount of time they are able to focus on the operations of our company. Officers of our subsidiary Kasese Cobalt Company are full-time employees of that company and do not devote any significant time to other commercial activities. Pradeep Gupta is the only full-time employee of Kasese Cobalt Company who is a director of the same company. Conflicts, if any, will be dealt with in accordance with the applicable law.

Our company lacks technical training and experience with operating a metals refinery.

The directors of our company lack technical training and experience with operating a cobalt refinery plant. With no direct training or experience in this area, our directors may not be fully aware of many of the specific requirements related to working within this industry. While the management of our operating subsidiary, Kasese Cobalt Company, has training and experience with operating a cobalt refinery, the decisions and choices of our company's management may not take into account standard engineering or managerial approaches refining companies commonly use. Consequently, our operations, earnings, and ultimate financial success could suffer irreparable harm or we may be forced into bankruptcy due to our directors' lack of experience in this industry.

Kilembe Mines Ltd. may, through its sole right to appoint three of the eight directors of Kasese Cobalt Company, exert influence in the business decisions of Kasese Cobalt Company.

The board of directors of Kasese Cobalt Company consists of eight members. Of these members, Kilembe Mines Ltd. may appoint three members and we may appoint four members to this board of directors. The eighth member is appointed by the remaining board members. If required, the Managing Director has an extra deciding vote. Accordingly, Kilembe Mines Ltd. may be able to exert some influence in the business decisions of Kasese Cobalt Company in a manner contrary to our company's strategic plans. Our directors have a duty to act in the best interests of our company.

A change in control of our company is made more difficult due to the classification of directors and the staggered nature of their terms.

Each of our directors have been elected for a five-year term and commencing with the 2009 annual meeting of shareholders, our directors are required to be divided into five classes: Class I, Class II, Class III, Class IV and Class V, as equal in number as possible. At each annual meeting of shareholders held after 2009, the successors to the class of directors whose terms then expire must be identified as being of the same class as the directors they succeed, and will be elected to hold office for a term expiring at the fifth succeeding annual meeting of shareholders. As a result of this classification of our board of directors and staggered nature of their terms, shareholders may not easily affect a change in control of our company.

12

The operations at our Kasese Cobalt Company refinery may be adversely affected due to a work stoppage by the unionized workforce.

Kasese Cobalt Company has approximately 255 employees, of which 140 employees belong to a non-compulsory Ugandan national union, Uganda Mines Metal and Allied Workers Union. With a unionized workforce, we need to enter into collective bargaining and any unresolved issues in negotiations could lead to work stoppages that would adversely affect our business by bringing our refinery operations to a halt. A prolonged labour dispute could ultimately force us into bankruptcy as Kasese Cobalt Company is currently our only source of revenue.

Risks Relating to an Investment in our Securities

Our Articles of Association contain provisions indemnifying our officers and directors against all costs, charges and

expenses incurred by them.

Our Articles of Association contain provisions that state, subject to applicable law, our company shall indemnify every director or officer of our company against all losses or liabilities which our director or officer may sustain or incur in the execution of their duties. Our Articles of Association further state that no director of officer shall be liable for any loss, damage or misfortune which may happen to, or be incurred by our company in the execution of their duties. Such limitations on liability may reduce the likelihood of litigation against our officers and directors and may discourage or deter our shareholders from suing our officers and directors based upon breaches of their duties to our company, though such an action, if successful, might otherwise benefit our company and our shareholders.

Investors' interests in our company will be diluted and investors may suffer dilution in their net book value per share

if we issue additional shares or raise funds through the sale of equity securities.

In the event that we are required to issue additional shares in order to raise financing through the sale of equity securities or convertible debt securities, investors' interests in our company will be diluted and investors may suffer dilution in their net book value per share, depending on the price at which such securities are sold. Such issuances will also cause a reduction in the proportionate ownership and voting power of all other shareholders.

Investors of our company may not be able to sell their shares, as our shares are not publicly traded.

Our shares are not listed or quoted for trading on any securities exchange or securities quotation system. Accordingly, our shareholders may be unable to sell their shares. We currently have no intention to list or otherwise qualify the Ordinary shares of our company for trading on any securities exchange or securities quotation system.

US investors may not be able to enforce their civil liabilities against us or our directors, controlling persons and

officers.

It may be difficult to bring and enforce suits against us. We were incorporated under the International Business Companies Act (British Virgin Islands). All of our directors and officers are residents of countries other than the United States and Canada, and all of our assets are located outside of the United States. Consequently, it may be difficult for United States investors to effect service of process in the United States upon our directors or officers, or to realize in the United States upon judgments of United States courts predicated upon civil liabilities under the United States Securities Exchange Act of 1934, as amended. There is substantial doubt whether an action could be brought successfully outside the United States against any of such persons or our company predicated solely upon such civil liabilities.

13

We may not be able to declare and pay dividends or distribute cash by way of a return of capital.

We have not declared or paid any dividends on our common stock to date. With the recent recommencement of production at Kasese Cobalt Company, we have realized a cash flow. We intend to distribute a portion of this cash flow of approximately $1.8 million (representing approximately 50% of our cash flow for the calendar year 2004) to our present sole shareholder, MFC Bancorp, prior to the distribution of our Ordinary shares to the shareholders of MFC Bancorp. This dividend payment to MFC Bancorp could impair our ability to pay cash dividends or distributions on our shares in the future, as our financial condition could unexpectedly deteriorate subsequent to the dividend payment. As our subsidiary, Kasese Cobalt Company, owes us debt of approximately $140.0 million, it is unlikely that dividends will be paid by Kasese Cobalt Company to its shareholders in the future. However, we do not anticipate that this will affect our ability to pay dividends to our shareholders. Any future payment of dividends or distributions will be determined by the board of directors of our company on the basis of our company's earnings, debt collection, financial requirements and other factors relevant to cash availability.

We may be determined to be a passive foreign investment company in which case our shareholders may be subject to certain adverse tax consequences.

There has not been a determination as to whether our company is considered a passive foreign investment company. If our company is determined to be a passive foreign investment company and, if a US shareholder disposes of any of our shares, any resultant gain will be subject to a tax that is determined by apportioning the gain pro rata over the entire holding period of the shares. These rules apply similarly to distributions from a passive foreign investment company that would be considered excess distributions. Holders and prospective holders of common shares of a passive foreign investment company will need to consult their own tax advisor regarding their individual circumstances as complex rules govern their tax treatment.

ITEM 4 - Information on our Company

A. History and Development of our Company

We were incorporated in the Territory of the British Virgin Islands under the International Business Companies Act on November 25, 2003, under the name Nature Extrac Limited. We formally changed our corporate name to Blue Earth Refineries Inc. effective July 8, 2004.

Our registered office is located at Akara Building, 24 De Castro Street, Wickhams Cay I, Road Town, Tortola, British Virgin Islands. Our registered agent is Mossack Fonseca & Co. (B.V.I.) Ltd., P.O. Box 3136, Road Town, Tortola, British Virgin Islands.

In December 2003, the board of directors of MFC Bancorp, our ultimate parent company, resolved to effect a plan of arrangement pursuant to section 195 of the Business Corporations Act (Yukon Territory, Canada), whereby, among other things:

| 1. | MFC Bancorp would reorganize and consolidate its non-core superfluous cobalt assets in our company; and |

14

| 2. | distribute all of our issued and outstanding shares to the holders of MFC Bancorp common shares, by way of a reduction in stated capital of MFC Bancorp. |

At that time, MFC Bancorp's directly and indirectly held cobalt assets included:

| (i) | a 75% equity interest in Kasese Cobalt Company held through Sutton Park International Limited which is, in turn, a wholly-owed subsidiary of MFC Bancorp; |

| (ii) | a debt owed by Kasese Cobalt Company to Sutton Park, the principal amount of which stood at approximately $140.0 million as at December 31, 2003; |

| (iii) | a 49.2% equity interest in 4025776 Canada Inc. which in turn holds all of the issued and outstanding shares of 36569 Yukon; |

| (iv) | an account receivable of Sutton Park due from 36569 Yukon which stood at approximately CAN$1.7 million as at June 30, 2004; and |

| (v) | an income debenture of 36569 Yukon due 2013 and payable to Sutton Park, the principal amount of which stood at approximately €4,242,000 as at December 31, 2003. |

Kasese Cobalt Company operates a cobalt refinery in Kasese, Uganda. 36569 Yukon holds a cobalt extraction facility in Lorrain Township, Ontario, Canada. Prior to the effectiveness of the plan of arrangement, MFC Bancorp held its 49.2% equity interest in 4025776 Canada, which in turn owned all of the shares of 36569 Yukon, indirectly through Sutton Park (as to 26.2%) and 4025750 Canada Inc. (as to 23.0%), a wholly-owned subsidiary of MFC Bancorp incorporated under the Canada Business Corporation Act.

In anticipation of MFC Bancorp's plan of arrangement, Sutton Park transferred the following assets to us effective December 31, 2003, in exchange for 49,500 shares, with a par value of US$1, of our company: (i) Sutton Park's 75% equity interest in Kasese Cobalt Company; (ii) the debt in the principal amount of approximately $140.0 million owed by Kasese Cobalt Company; and (iii) the income debenture in the principal amount of €4,242,000. In addition, in order to facilitate the plan of arrangement, New Nature Canco Inc. was incorporated as our wholly-owned subsidiary and New Sutton Canco Inc. was incorporated as a wholly-owned subsidiary of Sutton Park. Both of these new corporations were incorporated under the Business Corporations Act (Yukon Territory, Canada).

Following the transfer, we altered our share capital to 100,000,000 Ordinary shares without par value and 100,000,000 Class A Preferred shares without par value. Sutton Park continued to hold all of the 50,000 issued and outstanding Ordinary shares of our company until September 2004 when, under the plan of arrangement, all of these shares were transferred to MFC Bancorp. We have not issued any Preferred shares.

The Plan of Arrangement

Our company entered into an arrangement agreement dated as of July 13, 2004 with MFC Bancorp, Sutton Park, 4025750 Canada, New Nature Canco and New Sutton Canco in order to implement MFC Bancorp's plan of arrangement. As indicated above, New Nature Canco was our wholly-owned subsidiary, New Sutton Canco was a wholly-owned subsidiary of Sutton Park, and 4025750 Canada was a wholly-owned subsidiary of MFC Bancorp through which MFC Bancorp held its 23.0% of its indirect 49.2% equity interest in 36569 Yukon.

15

The plan of arrangement contemplated, among other things: (i) a series of inter-corporate transactions among the parties to the arrangement agreement to consolidate the balance of the cobalt assets in our company; (ii) the transfer from Sutton Park to MFC Bancorp of all of our issued and outstanding Ordinary shares together with certain accounts receivable of Sutton Park (or its subsidiary) due from 36569 Yukon of approximately CAN$1.7 million as at June 30, 2004, in exchange for CAN$2.0 million in cash, a CAN$63.0 million promissory note, and a set-off of approximately CAN$20.0 million in intercorporate debt owing from Sutton Park to MFC Bancorp; (iii) a split of our Ordinary shares such that the number of our issued and outstanding Ordinary shares will equal the number of issued and outstanding common shares in the capital of MFC Bancorp; and (iv) a post-split distribution of our Ordinary shares to the holders of MFC Bancorp common shares by way of a reduction of MFC Bancorp's stated capital, on a pro rata basis.

The holders of record of MFC Bancorp common shares on the date that is ten business days following the effective date of this registration statement will be entitled to participate in the distribution of our Ordinary shares by MFC Bancorp. Each holder of MFC Bancorp common shares will receive one Ordinary share of our company for each common share of MFC Bancorp held as at such record date.

Pursuant to the Business Corporations Act (Yukon Territory, Canada), MFC Bancorp may, by special resolution, reduce its stated capital for any purpose, including the purpose of distributing to the holders of the issued shares of any class an amount not exceeding the stated capital of that class. Under the proposed arrangement, the stated capital of MFC Bancorp will be decreased by an amount equal to the fair value, which is not less than the book value, of the cobalt assets (including the interest that we hold in Kasese Cobalt Company). This reduction will be effected through the distribution of all of our issued and outstanding shares to the holders of record of MFC Bancorp common shares. No consideration will be payable by MFC Bancorp's shareholders in connection with the distribution.

On September 23, 2004, pursuant to the plan of arrangement, we filed our Articles of Arrangement with the Yukon Registrar of Corporations and the following, as set out in the plan of arrangement, was made effective:

1. Sutton Park transferred its 26.2% equity interest in 4025776 Canada to New Sutton Canco, in consideration for additional common shares of New Sutton Canco, resulting in 4025750 Canada, New Sutton Canco, and New Nature Canco having no assets or liabilities, except that 4025750 Canada and New Sutton Canco holding approximately 23.0% and 26.2%, respectively, of the common shares of 4025776 Canada, which in turn holds all of the issued and outstanding shares of 36569 Yukon;

2. 4025750 Canada, New Sutton Canco and New Nature Canco amalgamated under Section 195 of the Business Corporations Act (Yukon Territory, Canada) to form Blue Earth Refineries (Canada) Inc., an amalgamated corporation under the Business Corporations Act (Yukon Territory, Canada);

3. Sutton Park transferred to our company one common share in the amalgamated corporation in exchange for one Ordinary share of our company;

4. MFC Bancorp transferred to our company one common share in the amalgamated corporation in consideration of one Ordinary share of our company; and

5. Sutton Park transferred to MFC Bancorp (a) all of the issued and outstanding shares of our company, and (b) certain accounts receivable of Sutton Park (or its subsidiary) due from 36569 Yukon of approximately CAN$1.7 million, in consideration of (i) CAN$2.0 million in cash, (ii) a CAN$63.0 million promissory note, and (iii) a set-off of approximately CAN$20.0 million in intercorporate debt owing from Sutton Park to MFC Bancorp.

16

On the date which is ten business days following the effective date of this registration statement, the following steps will be completed in order to accomplish the consolidation of the cobalt assets in our company:

1. Our company will complete a stock split that will result in us having issued and outstanding Ordinary shares equal in number to MFC Bancorp's issued and outstanding common shares on the distribution record date; and

2. MFC Bancorp will distribute all the issued and outstanding Ordinary shares of our company by way of a reduction of stated capital in the amount of approximately CAN$85,076,241, subject to such adjustments as may be necessary to reflect any operational changes in our financial position to the date of the distribution, to the holders of record of MFC Bancorp common shares on a pro rata basis.

The following diagrams illustrate the re-organization steps under the plan of arrangement:

17

18

19

20

21

22

23

24

Effects of the Plan of Arrangement

As at August 12, 2004, being the date of MFC Bancorp's most recent annual and special meeting, none of the shareholders of MFC Bancorp had exercised their dissent rights in respect of the plan of arrangement. Accordingly, the consummation of the plan of arrangement will not, in and of itself, change the overall economic interests of the holders of MFC Bancorp common shares in the assets of MFC Bancorp, although the form of ownership will change, as for each common share of MFC Bancorp, the holder of such will receive one Ordinary share in our company. Upon completion of our proposed stock split and the distribution of our shares pursuant to the plan of arrangement, all of our company's issued and outstanding Ordinary shares will be owned by the common shareholders of MFC Bancorp on the same pro rata basis as their respective shareholdings in MFC Bancorp. The current shareholders of MFC Bancorp include a subsidiary which is 83% owned by MFC Bancorp and will participate in the distribution of our Ordinary shares on a pro rata basis with the other shareholders of MFC Bancorp.

Currently, there is no intention to list or otherwise qualify our Ordinary shares for trading on a stock exchange or stock quotation system in Canada, the United States or elsewhere. The proposed distribution of our Ordinary shares by way of a reduction of stated capital of MFC Bancorp will not create a public market for our Ordinary shares in Canada, the United States or elsewhere.

The plan of arrangement has been structured and is regulated under applicable corporate and tax laws in Canada. The tax implications on MFC Bancorp's shareholders will depend on their particular circumstances, residential domiciles and jurisdictions. As a matter of Canadian tax law, the distribution of all of the issued and outstanding shares of our company is expected to be tax-free. MFC Bancorp has been advised by its Canadian tax counsel that the distribution should not give rise to significant Canadian tax liabilities for MFC Bancorp or any of the holders of MFC Bancorp common shares. While MFC Bancorp expects that the distribution should not give rise to a taxable dividend for US tax purposes, the distribution might result in tax liabilities for certain US shareholders of MFC Bancorp. See “Taxation - United States Federal Income Taxation”.

Conditions of the Arrangement

In connection with MFC Bancorp's plan of arrangement, an application was made to the Supreme Court of the Yukon Territory, Canada, for an interim order with respect to the voting procedures and dissent rights of the holders of MFC Bancorp common shares and the holders of MFC Bancorp's 4.4% convertible unsecured subordinated bonds due December 31, 2009. In issuing the interim order, the Court set the voting procedures of the holders of MFC Bancorp common shares and bonds, including the respective level of approval required.

Consummation of the plan of arrangement was subject, among other things, to: (i) approval of the plan of arrangement by the affirmative vote of not less than 66-2/3% of the votes cast by the holders of MFC Bancorp common shares at MFC Bancorp's annual and special meeting held on August 12, 2004; (ii) approval of the plan of arrangement by the affirmative vote of not less than 66-2/3% of the votes cast by MFC Bancorp's bondholders at the bondholders' meeting held on August 12, 2004; and (iii) court approval of the plan of arrangement by the Court after a hearing in regard to the fairness of the plan of arrangement.

The requisite number of affirmative votes to approve the plan of arrangement was cast by the holders of MFC Bancorp common shares at the annual and special meeting and by MFC Bancorp's bondholders at the bondholders' meeting. As the conditions to consummation of the plan of arrangement were satisfied, including the approvals by MFC Bancorp's shareholders and bondholders described above, an application was made to the Court on August 24, 2004 for a final order approving the plan of arrangement as proposed in the application. The Court held a hearing at which the Court considered, among other things, the fairness of the terms and conditions of the plan of arrangement, including the fairness of the number and the terms and conditions of the securities to be distributed pursuant to the plan of arrangement, to the holders of MFC Bancorp common shares. The final order of the Court was granted on August 24, 2004.

25

B. Business Overview

Present Operations of Our Company

Our company's business assets are comprised of: (1) our 75% interest in Kasese Cobalt Company, a company which holds and operates a cobalt refinery in Kasese, Uganda; and (2) our 49.2% interest in 36569 Yukon, a corporation which holds a cobalt refinery. Details concerning Kasese Cobalt Company are set forth below under the heading “Information Concerning Kasese Cobalt Company” and details concerning 36569 Yukon are set forth below under the heading “Information Concerning 36569 Yukon”.

Information Concerning Kasese Cobalt Company

Name and Incorporation

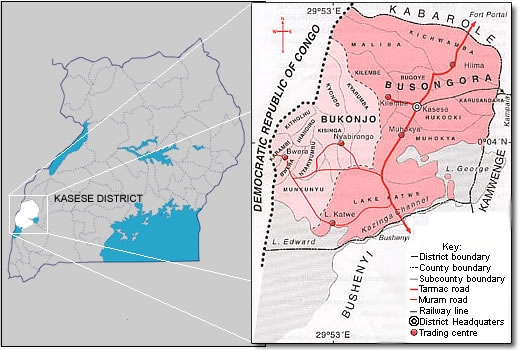

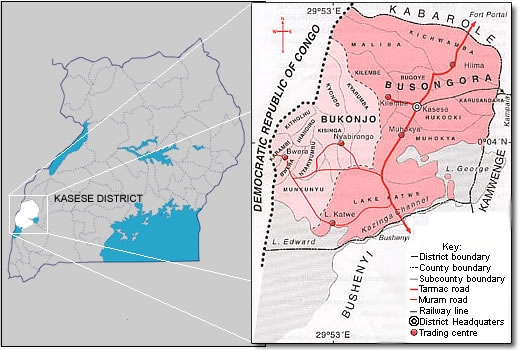

Kasese Cobalt Company was incorporated in the Republic of Uganda on June 24, 1992. The head office of Kasese Cobalt Company is located at the cobalt refinery located at Kasese/Mbarara Road, PO Box 524, Kasese, Uganda. The registered office of Kasese Cobalt Company is located at c/o Livingstone Registrars (U), Rwenzori House, PO Box 10314, Kampala, Uganda. Kasese Cobalt Company's business is administered principally from its head office and a logistics office at Suite WI, 3 Mukwasi House, Lumumba Avenue, Kampala.

Description of our Interest in Kasese Cobalt Company

We own 75% of the outstanding share capital in Kasese Cobalt Company and will continue to own such interest upon consummation of MFC Bancorp's plan of arrangement. MFC Bancorp originally acquired its indirect equity interest in Kasese Cobalt Company by purchasing approximately 85% equity interest in Banff Resources Ltd. (which held a 75% equity interest in Kasese Cobalt Company) from Newmont Australia Limited in August 2002. In December 2003, Sutton Park acquired the 75% equity interest in Kasese Cobalt Company from Banff Resources, in exchange for a partial settlement of certain debt owed to Sutton Park by Banff Resources. Newmont Australia retains a 10% royalty of free cash flow from Kasese Cobalt Company which is capped at $10.0 million.

Kilembe Mines Ltd., which is 100% owned by the government of the Republic of Uganda, owns 25% of the outstanding share capital in Kasese Cobalt Company. Under the development agreement between the Ugandan Government and Kasese Cobalt Company, Kilembe Mines has the right to appoint three members to the board of directors and Blue Earth has the right to appoint four members.

Kilembe Mines is indebted to Kasese Cobalt Company in the amount of $1,634,256 and this amount has been fully reserved as a doubtful debt in the accounts of Kasese Cobalt Company. This debt is only to be repaid out of dividends received by Kilembe Mines from Kasese Cobalt Company and, since Kasese Cobalt Company owes us a debt in the principal amount of approximately $140.0 million as at December 31, 2003, it is unlikely that dividends will be paid by Kasese Cobalt Company to its shareholders in the near future. However, it is expected that Kasese Cobalt Company will pay down the debt owed to us when Kasese Cobalt Company generates surplus cash from its operations.

26

We intend to distribute to our shareholder(s) cash that we will receive from Kasese Cobalt Company as loan payments, net of any expenses, expenditures, and funding for the refinery operations, by way of dividends and/or distributions.

Description of Business of Kasese Cobalt Company

Kasese Cobalt Company operates a cobalt project located in southwest Uganda and recovers the cobalt contained in a pyrite stockpile from a former copper mine. The metal refining operations involve the bioleaching of pyrite concentrate, solvent extraction of the dissolved cobalt and recovery through electro-winning. The Kasese Cobalt Company project, which is located approximately 420 kilometres west of Kampala, includes the Mubuku III hydro-electric power station that has a maximum deliverable capacity of about 9.9 megawatts. While the cobalt refinery was on care and maintenance status prior to recommencing operations in early 2004, electricity generated at Mubuku was sold to the state-owned grid of the Ugandan Electrical Transmission Company Limited.

The project grew out of a feasibility study on the reopening of the Kilembe copper mine that had operated from 1956 to 1978. While it was not economic to recommence copper mining operations, an alternative was to produce cobalt from a pyrite stockpile using bio-leaching technology. The stockpile near Kasese graded 1.38% cobalt. Kasese Cobalt Company subsequently acquired the rights to the pyrite stockpile from Kilembe Mines under an agreement, which is set to expire in June 2012 unless Kasese Cobalt Company elects to extend it for an additional maximum of 25 years. Kasese Cobalt Company may terminate the agreement at any time, if the refinery operation is not considered commercially viable.

The original cost estimate for the cobalt refining plant and facilities arrived at a capital cost of $110 million for the Kasese Cobalt Company project. The capital estimate included provision for a captive hydro-power plant on the nearby Mubuku River, because Uganda is deficient in electrical transmission and generating capacity. Demands for electricity on the western Ugandan power grid were, and continue to be, in excess of generating capacity at heavy load periods. The Mubuku hydro-power plant is approximately 22 kilometres from the cobalt refinery. Electricity generation is achieved without a dam, instead using an 8.7 kilometres canal from the river intake to the power station.

When operating, the power requirements of the Kasese Cobalt Company refinery range between seven and eight megawatts. There are three power sources available to the refinery: the plant is connected to the Ugandan power grid, on site equipment at the plant includes four diesel generators with a capacity of one Megawatt each, and the plant is serviced by a river fed hydro-electric facility owned by our company comprising of three generation units with a capacity of 3.3 Megawatts each. Excess power, when available, can be sold into Ugandan Electrical Transmission Company's power grid for local use. At times of low water volumes or plant breakdowns, any shortfall from the power grid can be supplemented by four on-site diesel powered generators capable of supplying one megawatt of power each.

Financing of $110 million for the Kasese Cobalt Company project was originally provided by five international institutions in the amount of about $66 million in debt financing and $44 million in equity financing. Construction commenced in November 1997, but the commissioning process was longer than expected and, although five tonnes of cobalt was produced in June 1999, the initial commissioning period was extended from July to October 1999 and identified some limitations in both the processing and power plants.

The second phase of commissioning lasted from November 1999 to June 2000. By the end of May 2000, three primary and one secondary bioleach tanks were in continuous operation. The third phase of commissioning ended in September 2000 when Ugandan President Yoweri Museveni officially opened the Kasese Cobalt Company plant. The construction and mobilization costs were incurred by the previous owner and aggregated approximately $180 million. No further capital expenditures are contemplated.

27

In the fiscal year ended June 30, 2001, cobalt production increased on a quarter to quarter basis and reached a total of 575 tonnes for the year. A total of 670 tonnes of cobalt was produced in fiscal 2002. Plant throughput was lower than expected in the bio-leach area and metal recovery also proved to be below expectations.

The problems encountered in the commissioning of the Kasese Cobalt Company project combined with other operational issues resulted in a cost overrun of approximately 54%. The original design parameters of the project included a cobalt price assumption of $15 a pound, estimated cash operating costs of $4 a pound and annual production rate of 1,000 tonnes of cobalt. However, as the Kasese Cobalt Company plant was not able to attain the targeted production efficiency, actual per pound costs were higher.

Kasese Cobalt Company's cash operating cost in fiscal 2001 amounted to $12.01 a pound of cobalt produced. Cash operating cost for fiscal 2002 were $10.23 a pound, although in the last quarter to June 30, 2002, average cash operating cost declined to $9.20 a pound. The average cash operating cost achieved in April 2002 was $7.70 a pound. MFC Bancorp placed the Kasese Cobalt Company operations on a care and maintenance status in September 2002. The cost (net cost after electricity sales) of operating the plant on a care and maintenance mode was approximately $85,000 per month. Electricity from the Mubuku power plant continued to be sold into the Ugandan Electrical Transmission Company's power grid. The cash requirement to restart the plant to normal operations following a period of care and maintenance is estimated at approximately $2.5 million.

Kasese Cobalt Company resumed normal operations and produced metal in the circuit by February 2004. Kasese Cobalt Company committed one half of its annual production to a buyer at $17.20 a pound in December 2003. Cobalt output at full capacity is 60 tonnes a month or 720 tonnes annually (approximately 1,587,000 pounds). The build-up in production is gradual due to the required increase in bacteria in the bio-leach tanks.

The Kasese Cobalt Company property is currently a fully operational cobalt bio-leach, solvent extraction and electro-winning refinery.

Description of the Feedstock and Refining Process of Kasese Cobalt Company

The feedstock of the refinery is a cobalt rich pyrite stockpile which was the result of 26 years and 16 million tonnes of copper mining by Kilembe Mines Ltd. The average grade of the stockpile was initially determined by Kilembe Mines, based on concentrator records between 1956 and 1982, as 1.36% cobalt. This average grade of cobalt was confirmed with the further analysis completed by Seltrust in 1982 (1.35% cobalt) and by Kilembe Mines in 1987 (1.4% cobalt). These results were further confirmed by Bureau de Recherches Géologiques et Minères in the original pre-feasibility study (1.27%) and the feasibility study (1.34%). These grades were further confirmed by OMAC Laboratories Ltd. of Galway, Ireland by in an analysis of 41 samples for an average of 1.43% cobalt. The samples in the studies and work programs were analyzed using methodologies that included atomic absorption and induced coupled plasma to determine the content of cobalt and other 2; lements.

Kasese Cobalt Company monitors the cobalt contained in the refinery plant feed on a daily basis and although such testing indicate a 1.40% cobalt feed since the beginning of operations, it continues to use the assayed test average of 1.38% in the calculation of reserves. The composition of the Kasese Cobalt Company refinery pyrite stockpile as determined by daily leach feed testing was as follows for July 2004:

28

| | High (%) | Low (%) |

Cobalt

Copper

Nickel

Iron

Sulphur | 1.635

0.65559

0.1902

37.736

50.21 | 1.172

0.2615

0.1382

17.066

33.47 |

A detailed drilling and survey program in November 2000 established the volume of the remaining stockpiles as 709,000 tonnes at that time. Through process consumption, this volume had been reduced to 570,000 tonnes by July 31, 2004.

The stockpile is located on the higher elevation of the company's 74 hectare site which is leased from Kilembe Mines Ltd. It is consumed by the application of high pressure water using two water cannons operating at 70 cubic metres per hour. The resulting slurry flows by gravity through a series of control trenches to a sump pump from where it is pumped to the processing plant through stainless steel trenches.

The processing steps to produce saleable material are as follows: (1) a limestone slurry is added to the incoming pyrite slurry to adjust the pH factor to between 4 and 5; (2) the pH adjusted slurry is fed through a mill to reduce particle size and the resultant slurry is transferred to the pyrite stock tank which feeds the four primary reactor tanks. These tanks have a working capacity of 12,800 cubic metres each; (3) bacterial culture with appropriate nutrients: mono ammonium phosphate, ammonium sulphate, and potassium phosphate are used to break down and separate the metal components of the pyrite. This process requires agitation, aeration and cooling during this process; (4) the cobalt containing solution is fed to a neutralization tank where a fine limestone slurry is added to increase the pH to 7.0 and as high as 9.0 or 10.0; (5) the slurry from the neutralization circuit is filtered to remove solids and the filtrate then enters the iron removal section where all t he residual iron is removed; (6) the iron free solution is then processed through several solvent extraction stages to remove the remaining contaminating metals. All of these stages are pH sensitive so sodium hydroxide is used for pH adjustment; (7) the hydroxides are stored for future sale and the remaining effluent is treated with slaked lime to adjust pH to permitted levels and allow discharge to the tailings dams; (8) cobalt in solution is piped to the electro-winning tank house where it is recovered on cathodes in six separate cells containing 36 cathodes each. Cathodes from two cells are stripped each day yielding between 1.5 and 2 tonnes of cathode cobalt; and (9) this cobalt is crushed and burnished before being packed in metal drums for shipment.

Extensive sample testing is a continual part of each phase of the refining process. A full monitoring system is used to control and measure flows and densities. A complete laboratory provides continual analyses of chemical solutions in the reclamation process and each lot comprised of six drums (from 160 kg to 250 kg each) of finished Kasese crushed cobalt is assayed for levels of cobalt, copper, iron, zinc, lead, nickel, cadmium, manganese, chromium, arsenic, carbon and sulphur.

The stockpile is the sole source of feedstock to the refinery plant. The stockpile was measured and assayed for the original feasibility study. A further more extensive survey was conducted by Surlink (Pty) Ltd. (an independent surveyor from South Africa) in November 2000 utilizing closer drill core samples to determine the depth of the stockpile and these core samples were assayed to confirm the metallic composition of the stockpile. The pyrite feed to the processing plant is assayed regularly to confirm the stockpile content. No variations were found in the composition of the core assays but the total volume of the stockpiles was reduced by 150,000 tonnes to 709,000 tonnes from the estimated volume in the original feasibility report. The bulk density estimate for the pyrite stockpile was 2.65 tonnes per cubic metre and the average moisture content was determined to be 10.72%.

29

The purpose of the topographical survey completed in November 2000 was to obtain an accurate model of the existing stockpiles, to compare the existing survey to a prior survey to determine the quantity removed, and using borehole information, determine the volume in the stockpiles. The survey was done and then transformed using survey points from the earlier survey. A digital model of the stockpiles with computer-assisted design drawing was then created. Using the borehole information, a pre-stockpile model was also generated. Ground points surveyed on the perimeter of the stockpile were also incorporated into this model. The smooth flow of the contours indicated a generally accurate original ground model. The stockpile was then broken down into six distinct areas for the purpose of quantifying. The total quantity obtained was approximately 267,000 cubic metres. The accuracy is governed by two main factors, which are as follows: (a) accuracy of the previous survey - c are was taken in the survey to ensure an accurate model of the stockpile could be produced. To this end, in excess of two thousand three hundred points were generated over the stockpiles. The only area where the model will be incomplete is on the longer perimeter banks where some deep erosion gulleys have formed. As far as possible, a mean point was surveyed to allow for this; (b) accuracy of borehole data - the impact of any inaccuracy is probably best understood when related to the total area of the stockpiles, which is 65,564 square metres. An overall error of one metre in the borehole depths would represent approximately 65,000 cubic metres of error in the quantity.

Uganda Economic Profile

The following economic information is taken from The World Factbook 2004, a publication of the US Central Intelligence Agency.

Uganda has substantial natural resources, including fertile soils, regular rainfall, and sizeable mineral deposits of copper and cobalt. Agriculture is the most important sector of the economy, employing over 80% of the work force. Coffee accounts for the bulk of export revenues. Since 1986, the government - with the support of foreign countries and international agencies - has acted to rehabilitate and stabilize the economy by undertaking currency reform, raising producer prices on export crops, increasing prices of petroleum products, and improving civil service wages. The policy changes are especially aimed at dampening inflation and boosting production and export earnings. During 1990 to 2001, the economy turned in a solid performance based on continued investment in the rehabilitation of infrastructure, improved incentives for production and exports, reduced inflation, gradually improved domestic security, and the return of exiled Indian-Ugandan entrepreneurs. Corruption within the government and slippage in the government's determination to press reforms raise doubts about the continuation of strong growth. In 2000, Uganda qualified for enhanced Highly Indebted Poor Countries debt relief worth $1.3 billion and Paris Club debt relief worth $145 million. These amounts combined with the original Highly Indebted Poor Countries debt relief added up to about $2 billion. Growth for 2001 to 2002 was solid, despite continued decline in the price of coffee, Uganda's principal export. Solid growth in 2003 reflected an upturn in Uganda's export markets.

Principal Holders of Voting Securities of Kasese Cobalt Company

Our company owns 1,674 B class shares or 75% of the share capital of Kasese Cobalt Company. The Government of the Republic of Uganda, through its stake in Kilembe Mines, owns 566 A class shares or 25% of the share capital of Kasese Cobalt Company.

30

Information Concerning 36569 Yukon

Name and Incorporation

36569 Yukon was incorporated in the Yukon Territory, Canada on July 15, 2003. The registered office of 36569 Yukon is located at Suite 300, 204 Black Street, Whitehorse, Yukon, Canada Y1A 2M9.

Description of our Company's Interest in 36569 Yukon

We own 100% of Blue Earth Refineries (Canada) Inc., the Yukon corporation formed by the amalgamation of 4025750 Canada, New Sutton Canco and New Nature Canco. Blue Earth Refineries (Canada) holds 49.2% of the issued and outstanding common shares of 4025776 Canada, which in turn owns all of the issued and outstanding common shares of 36569 Yukon.

This position was originally acquired by MFC Bancorp through its subsidiaries as a result of MFC Bancorp having been a debenture holder in Canmine Resources Corporation and facilitating the restructuring and refinancing of the company. Canmine Resources sought protection under the Companies' Creditors Arrangement Act (Canada) when it had failed to make required interest and sinking fund payments in June 2002. Debtor in possession financing was provided to allow the company to attempt an orderly reorganization. The company was placed in court appointed interim receivership on February 26, 2003.

Description of Business of 36569 Yukon