UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D. C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year Ended: December 31, 2012

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number: 001-35450

DEMANDWARE, INC.

(Exact name of registrant as specified in its charter)

| | |

| Delaware | | 20-0982939 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| |

| 5 Wall Street, Burlington, MA | | 01803 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (888) 553-9216

Securities Registered pursuant to Section 12(b) of the Act:

| | |

Title of each class | | Name of each exchange on which registered |

| Common Stock, $0.01 par value per share | | The New York Stock Exchange (NYSE) |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act: Yes ¨ No x

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act: Yes ¨ No x

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K, or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| | | | | | |

| Large accelerated filer | | ¨ | | Accelerated filer | | ¨ |

| | | |

| Non-accelerated filer | | x (Do not check if a smaller reporting company) | | Smaller reporting company | | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

As of June 30, 2012, the aggregate market value of the Registrant’s voting common stock held by non-affiliates of the Registrant was approximately $216 million (based on the last reported sale price of the Registrant’s common stock at the close of business on June 29, 2012).

The number of shares outstanding of the Registrant’s Common Stock as of March 5, 2013 was 30,050,142 shares.

Documents Incorporated by Reference

Portions of the Registrant’s definitive proxy statement for its annual meeting of stockholders, which the Registrant intends to file pursuant to Regulation 14A with the Securities and Exchange Commission not later than 120 days after the Registrant’s fiscal year end of December 31, 2012, are incorporated by reference into Part III of this Form 10-K.

DEMANDWARE, INC.

2012 FORM 10-K ANNUAL REPORT

TABLE OF CONTENTS

2

PART I

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act. All statements other than statements relating to historical matters should be considered forward-looking statements. In addition, forward-looking statements may consist of statements including such words as “may,” “believe,” “could,” “anticipate,” “would,” “might,” “plan,” “expect,” and similar expressions or the negative of such terms or other comparable terminology. These forward-looking statements speak only as of the date of this Form 10-K and are subject to business and economic risks. These statements are not guarantees of future performance and involve certain risks, uncertainties, and assumptions that are difficult to predict, and you should not place undue reliance on our forward-looking statements. Our actual results could differ materially from those set forth in the forward-looking statements as a result of a number of important factors, including the factors set forth in Part I, Item 1A, “Risk Factors,” and elsewhere in this Form 10-K and in our other reports filed with the Securities and Exchange Commission, or SEC. We expressly disclaim any obligation to update the forward-looking statements to reflect events or circumstances that arise after the date hereof.

Overview

We are a leading provider of cloud-based digital commerce solutions for retailers and branded manufacturers. Our platform, Demandware Commerce, enables customers to establish and execute complex digital commerce strategies that include global expansion, multi-brand rollouts and omni-channel operations. We enable companies to easily design, implement and manage their own customized digital commerce sites, including websites, mobile applications and other digital storefronts. Through our highly scalable and open Demandware Commerce platform, our customers create seamless brand experiences to reach their consumers across all digital touch points globally. By simplifying access to the complex digital commerce functionality required for effective and engaging consumer experiences and by offering open commerce application program interfaces, or APIs, we provide our customers with increased control to more easily launch, manage and integrate multiple digital commerce sites across geographies and brands, initiate marketing campaigns more quickly, manage product merchandising as well as create highly customized consumer experiences, all of which can lead to increased revenue. As a result, our customers on average have grown their e-commerce, or digital commerce, revenue faster than e-commerce industry benchmarks calculated by ComScore and the U.S. Department of Commerce.

Our cloud-based infrastructure increases processing capacity of our customers’ digital commerce sites to meet surges in demand, minimize page load times and maximize uptime. Our cloud-based platform also offers the high reliability and security required by customers to implement their digital commerce strategies, and we have achieved 99.98% average site availability (excluding planned downtime) since 2005. Through our cloud platform, our customers run the latest version of our software and have access to a steady stream of new and innovative digital commerce functionality as soon as it becomes available.

By using our cloud platform, our customers avoid the need for a large upfront investment in on-premise hardware infrastructure and in customized software that is difficult and expensive to implement, upgrade and maintain. They also avoid the limitations of generic vendor-created digital commerce solutions that typically do not offer the flexibility and functionality necessary for brands and retailers to create, manage and control their own customized online brand presence. Through our cloud-based, multi-tenant delivery model, we combine the functionality, flexibility and customization capabilities of in-house solutions with the lower costs, speed of implementation and other operational benefits of outsourcing.

We have built a marketplace called Demandware LINK that leverages our open development platform to allow our customers to quickly and easily access an extensive library of integrations to third-party applications that can reduce the cost and complexity of adding capabilities, such as campaign management, order management, social commerce and ratings and reviews.

3

Our customers include multinational corporations, large retailers and branded manufacturers, such as adidas, Bestseller, Carter’s, Deckers, Guthy-Renker, House of Fraser, Jewelry Television, L’Oreal, mothercare, s. Oliver, and Tory Burch. We sell our solutions domestically and internationally through both direct and indirect channels. We have direct sales teams throughout North America and Europe and distributor relationships with full service digital commerce vendors that combine our Demandware Commerce platform with a host of complementary services and technologies, such as logistics and warehousing, to provide comprehensive end-to-end e-commerce, or digital commerce, solutions. See Note 2 to the consolidated financial statements included elsewhere in this Form 10-K for information on our operations in different geographic regions.

We have structured our contracts to align our interests with those of our customers by participating in a share of their gross revenue processed on our platform. We derive our subscription revenue from fees paid to us by our customers for their access to Demandware Commerce for a specified period of time. Our fees are based on a percentage of the total gross revenue our customers process through their digital commerce sites operating on our platform, and include a committed level of annual gross revenue from which a minimum subscription fee is derived. If a customer exceeds that baseline subscription amount, we are paid a percentage of the gross revenue processed by that customer on our platform in excess of its committed minimum subscription. Our customer contract terms average approximately three years and range up to seven years.

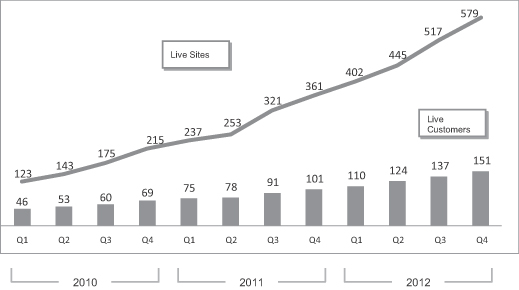

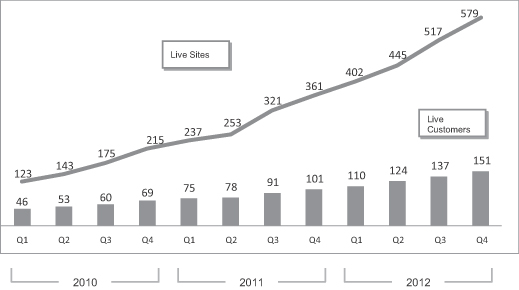

Since our inception, we have expanded our offerings and customer base through organic growth. The following chart shows the aggregate number of customers using Demandware Commerce and the aggregate number of their digital commerce sites operating on our platform from March 31, 2010 to December 31, 2012.

We generated revenue of $36.7 million, $56.5 million and $79.5 million in 2010, 2011 and 2012, respectively. We had net income of $0.3 million in 2010 and net losses of $1.4 million and $8.1 million in 2011 and 2012, respectively.

Industry Overview

Digital Commerce is a Key Driver of Growth for the Retail Industry

We believe our total addressable market is at the center of three large and growing sectors: retail, digital commerce and cloud computing. The double-digit growth of the e-commerce, or the digital commerce, market is being driven by several factors, including widespread broadband internet connectivity across an increasing

4

number of devices including smart phones and tablets, growing consumer familiarity and comfort with and preference for online shopping and new online shopping models such as social networks, group buying and flash sales. The recent proliferation of the smartphone and broad market acceptance of the tablet has helped accelerate the growth of digital commerce as the mobile channel has become a more conventional mode of shopping.

The increase in the number of manufacturers seeking to market their brands directly to consumers through their own digital commerce sites has also been a major contributor to this growth. In addition, traditional retailers are facing increasing competition from online marketplaces and as a result are focusing on the strategic direction of the digital channel as a more strategic growth vehicle.

Increasing Complexity of Digital Commerce

While the digital commerce market is expanding, it is also becoming more complex, particularly for global multi-channel retailers and branded consumer product manufacturers trying to reach consumers with consistent storefronts across multiple channels, geographies and digital touch points. Several trends are driving this increased complexity:

| | • | | Rapid Pace of Innovation. Technology to facilitate digital commerce is rapidly evolving. For example, new internet-enabled devices are continually developed, updated and made available to consumers at low cost. As the switching costs for consumers adopting the newest technologies remain low and new shopping models evolve, the pressure for companies to keep up with the pace of innovation increases. Companies must invest in and implement new innovative technologies quickly and cost-effectively to be able to reach consumers through new devices or channels, or risk losing them. |

| | • | | Need to Maintain Scale and Global Presence. Companies that are unable to maintain the quality and functionality of their digital commerce sites as they grow risk losing both existing and prospective consumers. Significant infrastructure can be required to provide a reliable online presence that can be quickly and easily scaled to meet growing worldwide consumer demands. |

| | • | | Increasing Consumer Demand for Compelling Content and Commerce. As the speed, functionality and sophistication of internet applications continue to improve, consumers increasingly expect a rich, interactive and personalized digital commerce experience, with features such as active merchandising, social commerce and dynamic product imaging. In order for businesses to remain competitive, they must be able to dynamically update and personalize their product offerings to stay current with emerging consumer trends and rising consumer expectations. |

| | • | | Proliferation of Retail Channels. Digital commerce is expanding beyond traditional web storefronts viewed on a personal computer or lap top due to the rapid proliferation of internet-enabled devices, including smart phones, tablets, endless aisle applications, and other devices, allowing consumers to access information and shop through an increasing number of digital retail channels. Consumers increasingly expect a consistent, high-quality and relevant experience across all digital retail channels. |

| | • | | Integration of Systems and Business Processes. Businesses have dramatically recast their online presence from static digital commerce sites focused mainly on presentation of basic product information or simple purchasing to dynamic, interactive hubs for consumer marketing, transactions, communications and services. Businesses require robust, scalable and global digital commerce solutions that can integrate with other enterprise solutions, such as enterprise resource planning, or ERP, customer relationship management, order management, call centers, supply chain management and business intelligence systems. |

5

Limitations of Traditional Digital Commerce Solutions

Traditionally, there have been two common solutions for the creation and management of a digital commerce business: on-premise enterprise software, which is built, customized and maintained by the merchant itself, and outsourcing, where the digital commerce platform for a retailer or branded manufacturer is outsourced to a third-party provider. While traditional on-premise enterprise software solutions offer the benefits of in-house control and differentiation through custom development, they typically have the following disadvantages:

| | • | | Higher Upfront Cost. On-premise software implementations are typically architected to be deployed with large information technology, or IT, teams and require significant upfront investments. These solutions can be ineffective for today’s retailers and branded consumer product manufacturers, who prefer to focus on their core competencies, such as managing their brands and merchandising their products, rather than maintaining IT infrastructure and digital commerce performance. |

| | • | | Difficult to Maintain, Upgrade and Scale. Maintenance of traditional on-premise solutions requires ongoing software implementations and on-premise customizations that necessitate significant IT investment before, during and after the upgrade. These internal customizations make it time-consuming and expensive to enhance functionality and also make it difficult for retailers and branded manufacturers to easily upgrade to the newest release from a software provider. It is also challenging and expensive to scale the required infrastructure, particularly to meet surges in demand. |

While outsourcing a digital commerce operation offers the benefits of minimal required resources for internal infrastructure management and ongoing support, it has the following disadvantages:

| | • | | Limited Customization and Functionality. Vendor-created outsourced solutions offer limited platform flexibility, making it difficult to change functionality or to control merchandising. This can be unacceptable for retailers and branded manufacturers, who prefer to proactively manage and control their online brand presence given the critical nature of brand as a key differentiator in today’s retail environment. |

| | • | | Lack of Integration with Business Processes. The online presence of many retailers and branded manufacturers has evolved from a simple website to a cross-channel hub for marketing, transactions, communications and services. The lack of innovation and extendibility of a fully outsourced solution, in addition to the lack of integration with business processes, can limit a retailer’s or branded manufacturer’s ability to effectively manage their brands across multiple channels. |

Opportunity for Cloud-based Digital Commerce Solutions

A cloud delivery model combines the lower costs, speed of implementation and other operational benefits of outsourcing with the functionality, flexibility and customization capabilities of on-premise enterprise software solutions. As a result, the adoption of cloud-based solutions across industries including salesforce management, ERP, human resource management, and marketing solutions, has grown significantly and outpaced the growth of traditional on-premise enterprise software product delivery.

Digital commerce is a critical component of growth strategies for a significant number of branded consumer product manufacturers and retailers worldwide. In the digital commerce market, we believe there is a significant opportunity for a company that can offer a comprehensive cloud-based solution designed to address the increasingly complex requirements of retailers and brands seeking to attract and satisfy consumers in the digital world.

Our Solution

Demandware Commerce combines enterprise-class digital commerce capabilities and functionality with a cloud-based multi-tenant delivery model. We deliver our solutions on-demand to enable our customers to more easily launch, manage and integrate multiple digital commerce sites across brands and geographies, initiate

6

marketing campaigns more quickly, manage product merchandising and create highly customized consumer experiences, all of which can lead to increased revenue. We believe that our cloud-based solutions provide the following benefits to our customers:

| | • | | Broad Marketing and Merchandising Functionality. Our platform uses a web-based interface to provide one central location for our customers to control and manage their digital commerce operation – from products to pricing to placement to content. A robust set of sophisticated, yet easy-to-use marketing and merchandising tools, including catalog management, customer profiling, pricing, promotions and digital commerce search, provides customers with enhanced functionality and increased control to help optimize the efficiency, growth and profitability of their digital commerce business. Our solutions are able to easily categorize, price, and display products, while efficiently presenting multiple cross-channel promotions, enabling merchandisers to optimize the digital shopping experience of their consumers while driving greater revenue. Our functionality also helps retailers and brands strengthen consumer loyalty by delivering tailored user experiences across all digital channels. |

| | • | | High Reliability and Security. We provide high uptime, robust security and disaster recovery through our network of state-of-the-art data centers. We have provided 99.98% average availability (excluding planned downtime) since 2005. Our flexible cloud platform allows us to quickly and seamlessly increase the processing capacity of our customers’ digital commerce sites to meet surges in demand. We also provide 24/7 monitoring of the environment in which our customers’ digital commerce sites operate, measuring for performance and availability of content delivery. Our platform is supported by a dynamic cloud-based architecture and complies with the Payment Card Industry, or PCI, Security Standards, which is generally referred to as being PCI-compliant. Our platform has been benchmarked to handle at least 1,400 dynamic page views per second. |

| | • | | Ease of Deployment and Reduced Time To Market. Using our Demandware Commerce platform, customers can easily deploy new digital commerce sites without the need to install or integrate their own hardware and software infrastructure. In addition, customers can leverage our platform to quickly and easily add new sites without the need to expand their own infrastructure. Through Demandware LINK, our customers can access an extensive library of integrations to third-party applications to expand the capabilities and functionality of their digital commerce operation. These features enable our existing customers to accelerate their time-to-market for new sites, quickly implement new functionality and explore emerging technologies. In addition, we believe that our typical six month platform implementation cycle for new customers is shorter than the period generally required for the development and deployment of comparable on-premise digital commerce software solutions. |

| | • | | Customizable Digital Commerce Sites. Demandware Commerce allows our customers to quickly and easily customize and deliver highly flexible digital storefronts, using our powerful and intuitive tools based on procedural programming languages such as JavaScript. This gives our customers the flexibility and control of a custom development environment with the convenience, scalability and security of on-demand, multi-tenant delivery. Our open development environment allows our customers’ developers to customize the front-end of their digital commerce sites while sharing our multi-tenant on-demand merchandising platform. As a result, developers and IT professionals can focus their efforts and resources on innovation rather than infrastructure. |

| | • | | Continual Innovation. Consumers increasingly expect greater functionality and relevance from their online experience. Through our cloud-based platform, we are able to provide a steady stream of new and innovative digital commerce functionality through multiple product upgrades each year, which provides our customers with access to the latest technologies for their digital commerce business. Our customization and integration changes are implemented through automatic upgrades with minimal or no effort required by our customers so they can avoid the time and expense associated with repeatedly upgrading to new versions with traditional providers. When we enhance our enterprise-class platform, our entire customer community benefits from our latest innovations by being on the same release cycle. In addition to our internal product development work, we work collaboratively with our customers on an ongoing basis to enhance and improve our solutions based on their specific functional requests. |

7

| | • | | Lower Total Cost of Ownership. With our transparent pricing model and our cloud-based platform, retailers and branded manufactures benefit from a lower total cost of ownership compared to traditional on-premise software license models. With on-premise licenses models, retailers and branded manufacturers incur costs and require investments for software licenses, annual maintenance and upgrades, hardware, hosting, redundancy and security. We provide customers with a transparent pricing model that is directly aligned with the growth of their digital commerce business. |

Our Strategy

Our mission is to extend our position as a leading provider of cloud-based solutions to become the global backbone for digital commerce between retailers and branded consumer product manufacturers and their consumers. Key elements of our strategy include:

Retaining and Expanding Business with Existing Customers. As our solutions become increasingly integral to our customers’ digital commerce success, we expect to maintain our strong retention rates by providing our customers with high levels of service and support as well as new digital commerce solutions and enhanced functionality. We have structured our contracts to align our interests with those of our customers by participating in a share of our customers’ gross revenue processed on our platform. We believe we have the following opportunities to grow our business with our customers:

| | • | | Increasing Customers’ Gross Revenue. Because we share in the gross revenue processed by customers on our platform, we also share an interest in optimizing the effectiveness, engagement and performance of our customers’ digital commerce sites. Early in the site implementation process, we assign a digital commerce strategist to engage with our customers to enable them to meet their goals. Once our customers’ sites are operating on our platform, the assigned strategist works hand-in-hand with our customers’ digital commerce teams to help grow their revenue by taking full advantage of the functionality of Demandware Commerce. |

| | • | | Increasing the Number of Customers’ Digital Commerce Sites. We intend to expand the adoption of Demandware Commerce within our existing customers’ organizations. After initial deployments, many of our customers seek to expand their digital commerce presence by launching additional distinct revenue-generating sites for different geographies, brands and channels on our Demandware Commerce platform. Our single instance code base allows our customers to launch sites for multiple brands and in multiple geographies cost-effectively and with minimal involvement from their internal IT staff. |

| | • | | Extending the Platform Across Channels. The internet is a central hub for our customers’ digital commerce strategies. We have and will continue to extend Demandware Commerce to support multiple channels to reach more consumers, including smart phones, tablets, social networks, and in-store solutions. A significant part of our strategy includes keeping up-to-date on emerging trends in how consumers shop and making sure we have the functionality on our platform to enable that type of activity. |

Growing Our Customer Base. A significant element of our strategy involves winning new customers. We believe that managing a successful digital commerce operation is more demanding and complex than ever and companies will increasingly migrate to cloud-based solutions like ours. We believe the continued growth of digital commerce as a strategic and differentiated sales channel provides us with a significant opportunity to acquire new customers by:

| | • | | Investing in Direct Sales. A significant portion of our market includes companies that are currently using on-premise or outsourced platforms for digital commerce that were not designed for advanced merchandising, marketing and customer experience innovation and that do not offer the benefits of a cloud-based solution. There are also companies that have an online presence but do not facilitate digital commerce transactions. As a result, we plan to grow our direct sales team to win more of these customers in the United States and internationally. |

| | • | | Enhancing Brand Awareness. We are investing in marketing and building brand awareness of our cloud-based solutions, particularly in Europe and with large enterprise accounts. |

8

| | • | | Significantly Growing our European Operations. We believe a substantial opportunity exists to continue to grow sales of our solutions internationally, particularly in Europe. We intend to continue to grow our European operations by further investing in direct sales, strategic alliances, services and support in the region. |

| | • | | Expanding and Strengthening Our Strategic Alliances. We have strategic relationships with companies such as eCommera, NETRADA and PFSweb that provide full-service end-to-end digital commerce solutions by combining our Demandware Commerce platform with a host of complementary services and technologies, such as logistics and warehousing. We intend to continue to grow our distribution channels through these key alliances, as well as build new alliances. |

Targeting New Markets. We believe substantial demand for our solutions exists in industry sectors, customer segments and geographic regions beyond those on which we are currently focused, including:

| | • | | Large Enterprise Accounts. We are targeting strategic large enterprise accounts processing more than $150 million in gross merchandise value through the digital channel. Traditionally these large customers have utilized on-premise software solutions or highly customized, internally developed solutions, but we believe there is a significant opportunity to expand our cloud based solution into this market segment. |

| | • | | Asia Pacific. We are currently assisting customers to launch and manage digital commerce sites for their consumers in the Asia Pacific region. Our solution enables customers to create locally branded digital commerce sites that reach consumers in the various Asia Pacific markets. We have extended our Demandware Commerce platform to optimize the content and application delivery in Asia Pacific markets. We are also building our sales and service operations in the Asia Pacific region and we plan to expand our strategic alliances in that region. |

Continuing to Innovate, Add New Functionality and Extend Our Platform. We believe we have developed a deep understanding of the digital commerce challenges faced by our customers. We continually collaborate with our customers to build extensive product functionality that addresses the rapidly changing digital commerce environment, including technology requirements, shifts in consumer preferences, changes in social networks, the introduction of new channels as well as the convergence of in-store and online shopping. We plan to use our expertise in digital commerce to develop new applications, features and functionality that will enhance our solutions and expand our addressable market. We also are currently working on solutions to extend the Demandware Commerce platform to include in-store solutions. We also plan to add incremental functionality to our solutions opportunistically through acquisitions. We intend to invest in our Demandware LINK technology program by adding new partners and expanding our relationship with current partners so that our customers have access to a growing library of integrations to third-party applications.

Products and Services

Demandware Commerce Platform

We offer a comprehensive cloud-based, digital commerce platform, a network of alliance partners that extends the value of the platform, and a business model designed for sustained customer revenue growth. We deliver our solutions on-demand to our customers who can access and can manage their digital commerce businesses over the internet using a standard web browser. We have built our solutions using a single code base and a multi-tenant, multi-user architecture that we host.

9

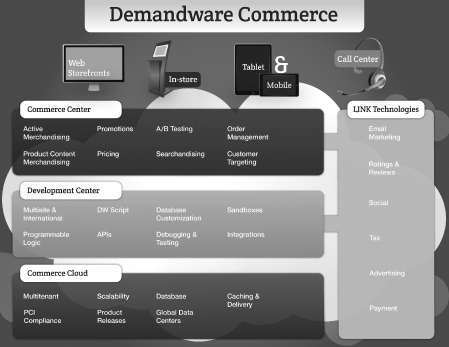

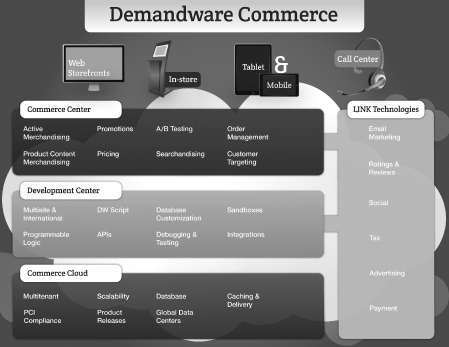

The following diagram illustrates the key interactive channels and various components of our Demandware Commerce platform:

Omni-channel Consumer Experiences. Demandware Commerce provides a single platform that our customers can use to manage consumer interactions across all digital touch points worldwide, enabling a seamless and consistent brand experience on any channel. Our reference applications are based on digital commerce best practices and can be customized to individual needs, with full access to a sophisticated omni-channel marketing and merchandising engine and open development environment. By leveraging the power of the Demandware Commerce platform, customers can create omni-channel consumer experiences that include:

| | • | | Web Storefronts. With Demandware Commerce, a customer can build a new web storefront front from scratch or leverage our pre-built storefront, called Site Genesis, to gain quicker time to market. The Site Genesis storefront provides merchandisers with best practice examples of how to manage promotions, dynamic search tools, synonym dictionaries and price books. It also includes a multi-site blueprint for technical architects. The Site Genesis storefront can be used as is with out-of-the-box functionality or can be leveraged as a starting point for a digital commerce site that could then be further customized using the UX Studio application to meet a customer’s unique requirements. |

| | • | | In-store. Our customers can create in-store consumer experiences on the Demandware Commerce platform. Our customers are using Demandware Commerce to extend their in-store inventory to capture sales that may otherwise have been lost by developing endless aisle applications. Through our intuitive web interface, customers can create compelling consumer experiences such as mobile point of sale (mPOS), kiosks, and endless aisle applications. Our customers can also create more compelling, personalized in-store consumer experiences by leveraging the consumer information that is collected across other digital channels on the Demandware Commerce platform. |

| | • | | Mobile & Tablet. Customers can build compelling shopping experiences for consumers on all mobile devices including smartphones and tablets. Our Demandware Commerce platform provides a unified development environment between the mobile storefront and our customers’ other digital commerce sites for ease of customization and site management. We recently introduced Responsive Web Design into the platform which allows for dynamic formatting of consumer experiences for various devices, including desktop computer, tablets and smartphones. The Demandware Commerce platform creates |

10

| | mobile experiences in all major browsers and with popular smart phones, such as the iPhone, Android and BlackBerry and tablets including iPad, Galaxy and Chrome-based tablets. |

| | • | | Call Center. By using Demandware Commerce to facilitate consumer experiences in the call center, our customers’ call center agents can quickly access order, consumer and product information through a single web-based interface, enabling a more efficient and engaging experience for the consumer. Agents are able to easily search for products using advanced search techniques and guided navigation. In addition to providing improved customer service, agents can use this software to gain a single view into a consumer’s entire order history and recommend products using rules established by our merchandising tools. |

Demandware Commerce Center. Demandware Commerce Center is a centralized and unified application for control and management of all consumer digital commerce experiences across multiple geographies, branded sites and channels. Unlike traditional work environments that require multiple interfaces to manage processes across products, marketing, merchandising, consumers, orders and sites, Demandware Commerce Center provides one central access point. In addition, users are able to create customized dashboards to display the most commonly used activities and thus increase their efficiency and enhance their ability to manage and change consumer experiences.

Our sophisticated, yet easy-to-use marketing and merchandising capabilities enable retailers to deliver tailored user experiences across all digital channels, launch and manage multiple sites across geographies and brands, initiate marketing campaigns more quickly, manage product merchandising, improve site traffic and increase revenue. Our capabilities include the following:

| | • | | Active Merchandising, which is a metrics-driven online selling engine that controls merchandising interactions across search, personalization, analytics, promotions and catalog according to rules created by each of our customers. |

| | • | | Product Content Merchandising, which enables merchants to manage seasonal, branded and future product offerings across categories, catalogs and sites. |

| | • | | Promotions, which consists of multiple configuration options for creating and controlling product promotions, including over 50 commonly used promotions that can be combined for desired results. |

| | • | | Pricing, which consists of a flexible pricing model that allows the merchant to control pricing across multiple catalogs and sites. |

| | • | | A/B Testing, which allows merchants to perform comparison tests to determine which merchandise is more frequently selected, which advertisements are the more appealing and which promotions inspire more customers to buy. |

| | • | | Searchandising, which consists of rules that can easily be configured by the merchant to feature products in search results that deliver the best inventory turn, conversion rates and average order size. |

| | • | | Order Management, which provides users the ability to access, modify and cancel orders. |

| | • | | Customer Targeting, which provides the capability to create rules that include and exclude conditions for triggering different merchandising offers, promotions and products. |

Development Center. Demandware Commerce offers the flexibility and control of a development environment based on a procedural language with the convenience, scalability and security of cloud-based, multi-tenant delivery. With Demandware Commerce, developers and IT professionals can focus on innovation rather than infrastructure. Developers can build, customize, test, debug, deploy, integrate and extend their digital commerce sites, all on-demand. Our Development Center includes access to an extensive library of pre-built business processes and contains all the necessary tools to edit them. Business processes within the development platform are graphically illustrated as pipelines and are edited through simple drag-and-drop, making it easy for

11

web developers to quickly integrate to other applications and modify the customer experience as necessary. In Development Center, customers can leverage the Open Commerce APIs to create highly customized shopping experiences to reach consumers.

Demandware LINK. Through the Demandware LINK marketplace and Demandware LINK technology partners, merchants and developers have access to an extensive library of integrations to third-party applications. These applications include email marketing, campaign management, order management, payment management, personalization, social commerce, tax applications and ratings and reviews. We support our partners in the development of third-party integrations and undertake a rigorous approval process to evaluate quality and compatibility before the application is made available for downloading through Demandware LINK.

Commerce Cloud. Web traffic is global and not linked to brick and mortar store operational hours. Consumers expect online stores to be open and functional at all times, even when they are serving millions of other consumers during the busiest shopping season. With legacy in-house systems, retailers and brands have to plan for demand, buy resources for the peak season and create a disaster recovery back-up strategy. The Demandware Commerce Cloud is comprised of our network of state-of-the-art data centers, as well as our cloud-based architecture, which enables our customers to offer a reliable, high-performance, secure online shopping environment that is PCI-compliant. Our cloud-based platform allows us to quickly and seamlessly increase the processing capacity of the environment in which our customers’ digital commerce sites operate to meet surges in demand. Through our Commerce Cloud, we also provide high uptime, robust security and disaster recovery.

Retail Practice

We have developed a comprehensive customer success program as a key component of our engagement model, which is designed to enable our customers to achieve sustained customer revenue growth and is delivered within the context of a shared success business relationship. In this program, we assign to customers a digital commerce strategist who works hand-in-hand with our customers’ executives to maximize the value of their investment. These digital commerce strategists are focused on growing our customers’ revenue by taking full advantage of the marketing and merchandising features and functionality of Demandware Commerce and providing our customers with a deep understanding of industry practices in site design, merchandising, analytics, interactive marketing, personalization and multi-channel integration. In addition, these strategists work with our customers to implement complex digital commerce strategies including global expansion, multi-brand businesses and omni-channel operations.

We monitor customer satisfaction internally as part of formalized programs and at regular intervals during the customer lifecycle, including during the transition from sales to implementation, at the completion of an implementation project and on an on-going basis based on interactions with the account services team.

Client Services

Our customer enablement methodology includes templates and processes to help project teams focus on the key tactical and strategic areas to maximize returns on our customers’ online investments and minimize business risk. Our customer enablement methodology guides our tactical process to successfully build and deploy a digital commerce site utilizing our Demandware Commerce platform. Our services include:

| | • | | Enablement services: Our services professionals work with customers to clearly define the goals of the project. We conduct a series of in-depth enablement sessions to educate our customers on our model, technology, methodology and approach to organizational planning. The enablement services include targeted education services and consulting programs to prepare customers with the tools and training needed to successfully execute their digital commerce strategy. |

| | • | | Partner alignment services: The majority of our implementations are led by partners. We work with each of our customers to align the customer’s implementation needs with the expertise in our growing ecosystem of partners across technology, solutions and end-to-end solutions. We have programs for partner enablement and developer certification that support scaling the capacity to deliver quality implementations of our platform through our partner ecosystem. |

12

| | • | | Ongoing training services: We offer a broad range of training classes to educate the individuals—digital commerce managers, web developers, application developers and IT professionals—who are part of our customers’ implementation, maintenance and optimization teams. |

| | • | | Support services: We offer support in multiple languages and through multiple channels, including global support coverage available 24 hours a day, seven days a week. |

We also provide customer support engineers who are experts in our products, industry technologies and platforms, making them a trusted resource for timely issue assessment and resolution. Periodic system maintenance and continual feature additions are also included in product support coverage, which is included in the subscription fee.

We also leverage our Demandware Collaboration Center XChange user community across our customer, partner ecosystem and employee base to help optimize the digital commerce environment and create a virtual community to collaborate on product design, release management and best practices. In the Demandware Collaboration Center XChange user community, customers also have the opportunity to influence product roadmap.

Customers

We have a wide variety of customers across various industries and geographies. As of December 31, 2012 we had 151 customers using our Demandware Commerce platform, up from 69 and 101 as of December 31, 2010 and 2011, respectively. Some of our customers have multiple revenue generating sites, either through multiple geographies or multiple brands within a larger organization. As of December 31, 2012, there were 579 live revenue-generating sites on our platform, up from 215 and 361 as of December 31, 2010 and 2011, respectively.

Some of our significant customers for the year ended December 31, 2012 include the following, arranged alphabetically by category:

| | |

| Apparel and Footwear | | Health & Beauty |

adidas Barneys New York Bestseller Carter’s Crocs Deckers House of Fraser Lands’ End New Balance s. Oliver Tory Burch Home & Garden CPO Commerce Lifetime Brands Michaels Stores General Merchandise ASDA Procter & Gamble | | Bare Escentuals Guthy-Renker L’Oreal Other Hanover Direct Jewelry Television mothercare TDC Sporting Goods Brooks Sports Burton Snowboards Callaway Golf |

| |

| |

| |

| |

| |

Revenue from customers in apparel and footwear represented approximately 55% of our total revenue for the year ended December 31, 2012.

13

Sales and Marketing

We sell our cloud based solutions primarily through our direct sales force, which includes field sales representatives, sales engineers, sales management, digital commerce strategists and account development representatives. Our direct sales force is organized by geographic region. Our direct sales force targets primarily enterprise customers, larger retailers and branded consumer product manufacturers that seek to implement more advanced digital commerce merchandising platforms across multiple channels and geographies. Our sales cycle can vary substantially from customer to customer, but typically requires six to nine months depending on the size and complexity of the opportunity. From the time a contract is signed, it typically takes six months to implement and launch a digital commerce site for a new customer. In 2012, the majority of our implementations were done by third party LINK solutions partners including companies like Amblique, Astound Commerce, Be Excellent, Fluid, Itelios, Lyons Group, Sapient Nitro and SinnerSchrader.

We also sell through selected LINK end-to-end partners, such as eCommera, NETRADA and PFSweb, that combine our Demandware Commerce platform with a host of complementary services and technologies, such as logistics and warehousing, to provide comprehensive end-to-end digital commerce solutions.

Our marketing efforts and lead generation activities consist primarily of customer referrals, internet advertising, telemarketing, e-mail marketing, social marketing, trade shows, industry events and press releases. Our marketing programs target our prospective customers’ digital commerce executives, senior business leaders and c-suite executives. We also host frequent conferences in which customers participate, including an annual global customer conference, and we present a variety of programs with our LINK partners designed to help accelerate cross-channel digital commerce success with our integrated platform.

Technology, Operations and Development

Technology

Since inception, we have designed our solutions in a cloud-based architecture, which our customers can access through a standard web browser. Our solutions use a single code base, with all of our customers running on the current version of our platform. Our technology platform has several key design elements:

| | • | | Scalability. The on-demand platform architecture of Demandware Commerce handles sudden spikes in traffic by allocating capacity. We proactively deliver updates and feature upgrades so our customers’ sites operate at peak efficiency. Demandware Commerce allocates computing power to each digital commerce site as needed to minimize page load times. Our platform has been benchmarked to handle at least 1,400 dynamic page views per second. |

| | • | | Reliability. Our state-of-the-art data centers in North America, Europe and Asia ensure high performance and redundancy for our customer base. We support large transaction volumes and seasonal peaks in site traffic and have provided 99.98% average site availability (excluding planned down time) since 2005. |

| | • | | Security. Our platform secures millions of transactions per year and has met the PCI-DSS Level 1 Service Provider set of comprehensive requirements for enhancing payment account data security. The PCI-DSS is a multi-faceted security standard that includes requirements for security management, policies, procedures, network architecture, software design and other critical protective measures. Our platform has been PCI-DSS-compliant since June 2007 and undergoes an annual assessment conducted by a PCI Council Qualified Security Assessor. |

| | • | | Ease of Deployment. Our customers run on a shared infrastructure, creating scalability and redundancy not possible with typical single-tenant providers. In a typical single-tenant environment, every new stack must be separately purchased, provisioned, managed, scaled and backed-up. In our multi-tenant channel, we can quickly and easily create new environments for development, testing, staging, and production, thus delivering significant cost and time savings for our customers. |

14

| | • | | Flexibility. Our standards-based open framework allows our customers to develop, build, and integrate third-party technologies. Our customers can innovate their site experience using the Eclipse-based open development environment and our UX Studio application to create a unique and relevant branded experience. Using a standards-based server-side scripting language, users can quickly create new logic to business processes, new custom objects, web services calls, integrations to back-end systems and XML data processing. |

| | • | | Extendibility. Our Commerce Cloud consists of multiprocessor nodes with large amounts of memory and network capacity, as well as digital commerce databases. The processor nodes are provisioned as web, application or database servers with dynamic isolated network connectivity only to other members in the particular merchant’s environment. In this way, a logical cluster is assembled with a variable number of processor nodes for web, application and database processing. Each merchant environment is logically isolated from all other merchant environments through multiple levels of security for network, port, processor, database and storage systems. Databases can hold product, consumer and order information. Our current data model can be extended by a configuration task performed through a web user interface and does not need a database administrator to manipulate the data model directly. |

Operations

We physically host our cloud-based solutions for our customers in secure data center facilities located in North America, Europe and Asia. We contract for use of these data center facilities primarily from Equinix Operating Co. and NaviSite. We engineer and architect the actual computer, storage and network systems upon which our platform operates, which we call our grid computing points of delivery, or PODs, and deploy them to the data center facilities, which provide physical security, including manned security, 24 hours a day, 365 days a year. We currently operate 13 PODs. The data center facilities also have biometric access controls, redundant power and environmental controls. We provide system security, including firewalls and encryption technology, and we conduct regular system tests and vulnerability assessments. In the event of a failure, we have engineered our computing grid with back-up and redundancy capabilities designed to provide for business continuity.

Research and Development

Our research and development organization is focused on developing new solutions and enhancing existing solutions, conducting software and quality assurance testing and improving our core technology. We continually enhance our existing software platform and develop new applications to meet our customers’ digital commerce needs. Our research and development organization is located primarily in our Burlington, Massachusetts headquarters. We also employ a team of engineers in our Jena, Germany office.

Our development methodology, in combination with our on-demand delivery model, allows us to release new and enhanced software features multiple times a year. We patch our software on a regular basis. Based on feedback from our customers and prospects, we continually develop new merchandising functionality while enhancing and maintaining our existing solutions. We do not need to maintain multiple engineering teams to support different versions of the code because all of our customers are running on the current version of our solutions.

Competition

The market for digital commerce platform software, services and solutions is intensely competitive, subject to rapid technological change and significantly affected by new product introductions and other market activities.

15

We expect competition to persist and intensify in the future. Our primary sources of competition include:

| | • | | in-house development efforts by potential customers or their web consultants; |

| | • | | licensed application vendors, such as IBM, Oracle/ATG, eBay/Magento and hybris; |

| | • | | full-service e-commerce business process outsourcers, such as Digital River and eBay/GSI Commerce; and |

| | • | | providers of hosted on-demand subscription and SaaS services, such as MarketLive and Venda. |

We compete primarily on the basis of our robust set of merchandising capabilities and features, the reliability and scalability of our solutions, our speed of deployment, the customization of our platform, our continual innovation, our omni-channel capabilities and the extendibility of our Demandware Commerce platform.

Our current and potential competitors may have significantly greater financial, technical, marketing and other resources than we do, and there is no assurance we will be able to continue to compete effectively.

Intellectual Property and Proprietary Rights

Our intellectual property and proprietary rights are important to our business. To safeguard them, we rely on a combination of patent, copyright, trade secret, trademark and other rights in the United States and other jurisdictions, as well as confidentiality procedures and contractual provisions to protect our proprietary technology, processes and other intellectual property. We have two issued U.S. patents. We have confidentiality and license agreements with employees, contractors, customers, distributors and other third parties, which limit access to and use of our proprietary information and software. Though we rely in part upon these legal and contractual protections, we believe that factors such as the skills and ingenuity of our employees and the functionality and frequent enhancements to our solutions are larger contributors to our success in the marketplace.

Despite our efforts to preserve and protect our intellectual property and proprietary rights, unauthorized third parties may attempt to copy, reverse engineer, or otherwise obtain portions of our solutions. Competitors may attempt to develop similar products that could compete in the same market as our product. Unauthorized disclosure of our confidential information by our employees or third parties could occur. Laws of other jurisdictions may not protect our intellectual property and proprietary rights from unauthorized use or disclosure in the same manner as the United States. The risk of unauthorized use of our proprietary and intellectual property rights may increase as our company continues to expand outside of the United States.

Third-party infringement claims are also possible in our industry, especially as software functionality and features expand, evolve, and overlap with other industry segments. Third parties, including non-practicing patent holders, have from time to time claimed, and could claim in the future, that our customers’ sites infringe patents they now hold or might obtain or be issued in the future, and, in most cases, we have agreed to indemnify our customers against claims that our products infringe the intellectual property rights of third parties. See “Risk Factors–We could incur substantial costs as a result of any claim of infringement of another party’s intellectual property rights.”

Seasonality

Our subscription revenue fluctuates as a result of seasonal variations in our business, principally due to our customers’ revenue peaks during the holiday season, which correspondingly results in higher subscription revenue in the fourth quarter than in other quarters. As a result, we have historically had higher subscription revenue in our fourth quarter than other quarters in a given year. Revenue for the fourth quarter represented 34.1%, 32.9%, and 33.1% of our total revenue in 2010, 2011 and 2012, respectively.

16

Business Segment and Geographical Information

We operate in a single operating segment. For geographical financial information, see Note 2 to our consolidated financial statements, which are incorporated herein by reference.

Employees

At December 31, 2012 we had 298 employees, including 120 in sales and marketing and 65 in research and development. Except in France, none of our employees is represented by a labor union or covered by a collective bargaining agreement. We have never experienced a strike or similar work stoppage, and we believe that our relations with our employees are good.

Corporate Information

We were incorporated in Delaware in February 2004. Our principal executive office is located at 5 Wall Street, Burlington, Massachusetts 01803 and our telephone number is (888) 553-9216.

Information Available on the Internet

We maintain an internet website atwww.demandware.com. The information on our website is not incorporated by reference into this Annual Report on Form 10-K and should not be considered to be a part of this Annual Report on Form 10-K. Our website address is included in this Annual Report on Form 10-K as an inactive technical reference only. Our reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act, including our Annual Reports on Form 10-K, our Quarterly Reports on Form 10-Q and our Current Reports on Form 8-K, and amendments to those reports, are accessible through our website, free of charge, as soon as reasonably practicable after these reports are filed electronically with, or otherwise furnished to, the SEC. We also make available on our website the charters of our audit committee, compensation committee and nominating and corporate governance committee, as well as our corporate governance guidelines and our code of business conduct and ethics. In addition, we intend to disclose on our website any amendments to, or waivers from, our code of business conduct and ethics that are required to be disclosed pursuant to the SEC rules.

The following risk factors could materially affect our business, consolidated financial condition and results of operations. The risks and uncertainties described below are those that we have identified as material, but are not the only risks and uncertainties we face. Our business is also subject to general risks and uncertainties that affect many other companies, including overall economic and industry conditions. Additional risks and uncertainties not currently known to us or that we currently believe are not material also may impair our business, consolidated financial condition and results of operations.

Risks Related to Our Business and Our Industry

We have had a history of losses, and we may be unable to achieve or sustain profitability.

We have experienced net losses in each year since our inception, except for the year ended December 31, 2010. We experienced net losses of $8.1 and $1.4 million in 2012 and 2011, respectively, and net income of $0.3 million in 2010. At December 31, 2012, our accumulated deficit was $76.7 million and total stockholders’ equity was $94.6 million. We expect to incur operating losses as a result of expenses associated with the continued development and expansion of our business. Our expenses include sales and marketing, research and development and other costs relating to the development, marketing and sale of our solution and consulting services that may not generate revenue until later periods, if at all. Any failure to increase revenue or manage our

17

cost structure as we implement initiatives to grow our business could prevent us from achieving or sustaining profitability. In addition, our ability to achieve profitability is subject to a number of the risks and uncertainties discussed below, many of which are beyond our control. We cannot be certain that we will be able to achieve or sustain profitability on a quarterly or annual basis.

Our limited operating history makes it difficult to evaluate our current business and future prospects.

We have been in existence since 2004, and much of our growth has occurred in recent periods. Our limited operating history may make it difficult for you to evaluate our current business and our future prospects. We have encountered and will continue to encounter risks and difficulties frequently experienced by growing companies in rapidly changing industries, including increasing and unforeseen expenses as we continue to grow our business. If we do not manage these risks successfully, our business will be harmed.

We depend on a limited number of customers for a substantial portion of our revenue. The loss of a key customer or the significant reduction of business from one of our largest customers could significantly reduce our revenue.

We have derived, and we believe that we will continue to derive, a substantial portion of our revenue from a limited number of customers. For example, for the year ended December 31, 2012, our largest ten customers by revenue accounted for an aggregate of approximately 33% of our revenue. If we were to lose one or more of our key customers, there is no assurance that we would be able to replace such customers with new customers that generate comparable revenue, which would materially adversely affect our financial condition and results of operations. Our operating results for the foreseeable future will continue to depend on our ability to sell our digital commerce solutions to a limited number of prospective customers. Any revenue growth will depend on our success in growing our customers’ online revenue processed on our platform and expanding our customer base to include additional customers.

Fluctuations in the exchange rate of foreign currencies could result in currency transactions losses.

We currently have foreign sales denominated in Euros, British pound sterling, Australian and Canadian dollars and may, in the future, have sales denominated in other foreign currencies. In addition, we incur a portion of our operating expenses in Euros, British pound sterling and, to a lesser extent, other foreign currencies. Any fluctuation in the exchange rate of these foreign currencies may negatively impact our business, financial condition and operating results. We have not previously engaged in foreign currency hedging. If we decide to hedge our foreign currency exposure, we may not be able to hedge effectively due to lack of experience, unreasonable costs or illiquid markets.

The seasonality of our business creates significant variance in our quarterly revenue.

Our customers are retailers and branded consumer product manufacturers that typically realize a significant portion of their online sales in the fourth quarter of each year, specifically during the holiday season. As a result of this seasonal variation, our subscription revenue fluctuates, with additional fees in excess of committed annual levels, called overage fees, being higher in the fourth quarter than in other quarters and with revenue generally declining in the first quarter sequentially from the fourth quarter.

We recognize revenue from customer subscriptions over the term of the subscription agreement and, therefore, a significant downturn in our business may not be immediately reflected in our operating results.

We recognize revenue from subscription agreements monthly over the terms of these agreements, which is typically three years. As a result, a significant portion of the revenue we report in each quarter is generated from customer agreements entered into during previous periods. Consequently, a decline in new or renewed subscriptions in any one quarter may not impact our financial performance in that quarter, but might negatively affect our revenue in future quarters. If a number of contracts expire and are not renewed in the same quarter, our revenue may decline significantly in that quarter and subsequent quarters. In addition, we may be unable to

18

adjust our fixed costs in response to reduced revenue. Accordingly, the effect of significant declines in sales or renewals and market acceptance of our solutions may not be reflected in our short-term results of operations.

Our business is substantially dependent upon the continued growth of the market for cloud-based software solutions.

We derive, and expect to continue to derive, substantially all of our revenue from the sale of our cloud-based digital commerce solutions. As a result, widespread acceptance and use of the on-demand business model is critical to our future growth and success. Under the perpetual or periodic license model for software procurement, users of the software would typically run the applications on their hardware. Because many companies are generally predisposed to maintaining control of their information technology, or IT, systems and infrastructure, there may be resistance to the concept of accessing software functionality as a service provided by a third party. In addition, the market for cloud-based software solutions is still evolving, and competitive dynamics may cause pricing levels to change, as the market matures and as existing and new market participants introduce new types of solutions and different approaches to enable organizations to address their digital commerce needs. As a result, we may be forced to reduce the prices we charge for our solutions and may be unable to renew existing customer agreements or enter into new customer agreements at the same prices and upon the same terms as we have historically. If the market for cloud-based software solutions fails to grow, grows more slowly than we currently anticipate or evolves and forces us to reduce the prices we charge for our solutions, demand for our solutions and our revenue, gross margin and other operating results could be materially adversely affected.

We rely on a variable pricing model and any change in that model could adversely affect our financial results.

We have adopted a variable pricing model whereby we participate in a share of our customers’ gross revenue processed on our platform. This pricing model aligns our interests with those of our customers and reflects the need for us to expand our own processing and support infrastructure as activity on our customers’ digital commerce sites increases. All of our customer contracts are based on a variable pricing model. If customers were to demand a fixed pricing model that did not provide for variability based on their level of usage of our platform, our financial results could be adversely affected.

Our lengthy sales and implementation cycles make it difficult to predict our future revenue and causes variability in our operating results.

Our sales cycle can vary substantially from customer to customer, but typically requires six to nine months depending on the size and complexity of the opportunity. From the time a new contract is signed, approximately six months are typically required to implement and launch an digital commerce site for a new customer. A number of factors influence the length and variability of our sales and implementation cycles, including, for example:

| | • | | the need to educate potential customers about the uses and benefits of our solutions; |

| | • | | the relatively long duration of the commitment customers make in their agreements with us; |

| | • | | the nature of potential customers’ purchasing and budget cycles and decisions; |

| | • | | the competitive nature of potential customers’ evaluation and purchasing processes; |

| | • | | evolving digital commerce needs and functionality demands of potential customers; |

| | • | | announcements or planned introductions of new products by us or our competitors; and |

| | • | | lengthy purchasing approval processes of potential customers. |

Lengthy sales and implementation cycles make it difficult to predict the quarter in which revenue from a new customer may first be recognized. We may incur significant sales and marketing expenses in anticipation of selling our products, and if we do not achieve the level of revenue we expected, our operating results will suffer

19

and our stock price may decline. Further, our potential customers frequently need to obtain approvals from multiple decision makers before making purchase decisions. Delays in our sales or implementation cycles could cause significant variability in our revenue and operating results for any particular period.

If we are unable to retain our existing customers, our revenue and results of operations would be adversely affected.

We sell our solutions pursuant to agreements that are approximately three years in duration. Our customers have no obligation to renew their subscriptions after their subscription period expires, and these subscriptions may not be renewed on the same or on more profitable terms. As a result, our ability to grow depends in part on subscription renewals. We may not be able to accurately predict future trends in customer renewals, and our customers’ renewal rates may decline or fluctuate because of several factors, including their satisfaction or dissatisfaction with our services, the cost of our services and the cost of services offered by our competitors or reductions in our customers’ spending levels. If our customers do not renew their subscriptions for our services or renew on less favorable terms, our revenue may grow more slowly than expected or decline, and our profitability and gross margins may be harmed.

Security and privacy breaches may hurt our business.

Any security breaches, unauthorized access, unauthorized usage, virus or similar breach or disruption could result in loss of confidential information, damage to our reputation, early termination of our contracts, litigation, regulatory investigations or other liabilities. If our, our customers’ or our partners’ security measures are breached as a result of third-party action, employee error, malfeasance or otherwise and, as a result, someone obtains unauthorized access to customer data, our reputation will be damaged, our business may suffer and we could incur significant liability.

Techniques used to obtain unauthorized access or to sabotage systems change frequently and often are not recognized until after launched against a target. As a result, we may be unable to anticipate these techniques or to implement adequate preventative measures. If an actual or perceived security breach occurs, the market perception of our security measures could be harmed and we could lose sales and customers. Any significant violations of data privacy could result in the loss of business, litigation and regulatory investigations and penalties that could damage our reputation and adversely impact our results of operations and financial condition. Moreover, if a high profile security breach occurs with respect to another software-as-a-service, or SaaS, provider, our customers and potential customers may lose trust in the security of the SaaS, or cloud-based, business model generally, which could adversely impact our ability to retain existing customers or attract new ones.

Our business and operations have experienced rapid growth and organizational change in recent periods, which has placed, and may continue to place, significant demands on our management and infrastructure. If we fail to manage our growth effectively, we may be unable to execute our business plan, maintain high levels of service or address competitive challenges adequately.

Our growth has placed, and may continue to place, a significant strain on our managerial, administrative, operational, financial and other resources. We intend to further expand our overall business, customer base, headcount and operations both domestically and internationally, with no assurance that our business or revenue will continue to grow. Creating a global organization and managing a geographically dispersed workforce will require substantial management effort, the allocation of valuable management resources and significant additional investment in our infrastructure. We will be required to continue to improve our operational, financial and management controls and our reporting procedures and we may not be able to do so effectively. As such, we may be unable to manage our expenses effectively in the future, which may negatively impact our gross margins or operating expenses in any particular quarter. If we fail to manage our anticipated growth and change in a manner that preserves the key aspects of our corporate culture, the quality of our solutions may suffer, which could negatively affect our brand and reputation and harm our ability to retain and attract customers.

20

Failure to effectively maintain and expand our direct sales teams and develop and expand our indirect sales channel will impede our growth.

We will need to continue to expand our sales and marketing infrastructure in order to grow our customer base and our business. Identifying, recruiting and training these sales and marketing personnel will require significant time, expense and attention. Our business will be seriously harmed and our financial resources will be wasted if our efforts to expand our direct and indirect sales channels do not generate a corresponding increase in revenue. In particular, if we are unable to hire, develop and retain talented sales personnel or if our new direct sales personnel are unable to achieve expected productivity levels in a reasonable period of time, we may not be able to significantly increase our revenue and grow our business.

The global economic conditions may continue to adversely affect our business and results of operations.

The U.S., Europe, and other global economies have experienced a recession that has affected all sectors of the economy, resulting in declines in economic growth and consumer confidence, increases in the level of unemployment and uncertainty about economic stability. Global credit and financial markets, including those in Europe, have also experienced extreme disruptions, including diminished liquidity and credit availability and rapid fluctuations in market valuations. Our business has been affected by these conditions, and there is no certainty that economic conditions will not deteriorate further. These uncertainties may affect our business in a number of ways, making it difficult to accurately forecast and plan our future business activities. Weak economic conditions may lead consumers and retailers to postpone spending, which may cause our customers to decrease or delay their purchases of our solutions. In addition, the inability of consumers to obtain credit could negatively affect our revenue. Financial difficulties experienced by third parties with whom we have entered relationships and upon whom we depend in order to grow our business could detract from the quality or timeliness of the products or professional services they provide to us, which could adversely affect our reputation and relationships with our customers.

If the current uncertain economic conditions continue or further deteriorate, we could be required to record charges relating to restructuring costs or the impairment of assets, and our business and results of operations could be materially adversely affected.

We are dependent upon consumers’ willingness to use the internet for commerce.

Our success depends upon the general public’s continued willingness to use the internet as a means to purchase goods, communicate, and conduct and research commercial transactions. If consumers became unwilling or less willing to use the internet for commerce for any reason, including lack of access to high-speed communications equipment, congestion of traffic on the internet, internet outages or delays, disruptions or other damage to users’ computers, increases in the cost of accessing the internet and security and privacy risks or the perception of such risks, our business could be materially adversely affected.

Even if demand for digital commerce products and services increases generally, there is no guarantee that demand for cloud-based solutions like ours will increase to a corresponding degree.