Table of Contents

Filed pursuant to General Instruction II.L. of Form F-10;

File No. 333-255798

No securities regulatory authority has expressed an opinion about these securities and it is an offence to claim otherwise. This prospectus supplement (the “Prospectus Supplement”), together with the accompanying short form base shelf prospectus to which it relates, dated May 18, 2021 (the “Prospectus”) and each document incorporated or deemed to be incorporated by reference into this Prospectus Supplement and the accompanying Prospectus, constitutes a public offering of these securities only in those jurisdictions where they may be lawfully offered for sale and therein only by persons permitted to sell such securities.

Information has been incorporated by reference in this Prospectus Supplement and accompanying Prospectus to which it relates from documents filed with securities commissions or similar authorities in Canada. Copies of the documents incorporated herein by reference may be obtained on request without charge from the Secretary of the Company at its head office at 1800 - 925 West Georgia Street, Vancouver, British Columbia, V6C 3L2, telephone (604) 688-3033 and are also available electronically at www.sedar.com.

PROSPECTUS SUPPLEMENT

TO THE SHORT FORM BASE SHELF PROSPECTUS DATED MAY 18, 2021

| New Issue | July 20, 2022 |

Up to US$100,000,000

Common Shares

This Prospectus Supplement, together with the accompanying Prospectus, qualifies the distribution (the “Offering”) of common shares (the “Common Shares” and each Common Share being qualified hereunder, an “Offered Share”) of First Majestic Silver Corp. (“First Majestic” or the “Company”) having an aggregate offering price of up to US$100,000,000. First Majestic has entered into an equity distribution agreement dated July 20, 2022 (the “Equity Distribution Agreement”) with BMO Capital Markets Corp. (“BMO”) and TD Securities (USA) LLC (“TD” and together with BMO, the “Agents”) pursuant to which First Majestic may distribute Offered Shares from time to time through the Agents, as agent or as principal for the distribution of the Offered Shares, in accordance with the terms of the Equity Distribution Agreement. See “Plan of Distribution”.

The outstanding Common Shares are listed for trading on the Toronto Stock Exchange (the “TSX”) under the symbol “FR” and on the New York Stock Exchange (the “NYSE”) under the symbol “AG”. On July 19, 2022, the last trading day on the TSX before the date of this Prospectus Supplement, the closing trading price of the Common Shares on the TSX was C$9.21, per Common Share. On July 19, 2022, the last trading day on the NYSE before the date of this Prospectus Supplement, the closing trading price of the Common Shares on the NYSE was US$7.14, per Common Share. The TSX has conditionally approved the listing of the Offered Shares offered hereunder, subject to the Company fulfilling all of the listing requirements of the TSX. In addition, the NYSE has approved the listing of the Offered Shares offered hereunder.

First Majestic is permitted, under a multi-jurisdictional disclosure system adopted by the securities regulatory authorities in Canada and the United States, to prepare this Prospectus Supplement in accordance with the disclosure requirements of Canada. Prospective investors in the United States should be aware that such requirements are different from those of the United States. The financial statements incorporated by reference herein have been prepared in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board and thus may not be comparable to financial statements of United States companies.

Table of Contents

The enforcement by investors of civil liabilities under the United States federal securities laws may be affected adversely by the fact that the Company is governed by the laws of British Columbia, Canada, that some or all of its officers and directors are residents of a foreign country, that some or all of the experts named in this Prospectus Supplement and the accompanying Prospectus are, and the experts and Agents named herein and in the Prospectus may be, residents of a foreign country, and a substantial portion of the assets of the Company and said persons may be located outside of the United States.

THESE SECURITIES HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION (THE “SEC”) NOR ANY STATE OR CANADIAN SECURITIES COMMISSION OR REGULATORY AUTHORITY NOR HAS THE SEC OR ANY STATE OR CANADIAN SECURITIES COMMISSION OR REGULATORY AUTHORITY PASSED UPON THE ACCURACY OR ADEQUACY OF THIS PROSPECTUS SUPPLEMENT OR THE ACCOMPANYING PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENCE.

Prospective investors should be aware that the acquisition, holding or disposition of the Common Shares may have tax consequences in Canada and the United States. Such consequences for investors who are resident in, or citizens of, the United States may not be described fully herein. Prospective investors should read the tax discussion contained in this Prospectus Supplement under the heading “Certain U.S. Federal Income Tax Considerations” and should consult their own tax advisor with respect to their own particular circumstances.

Sales of Offered Shares, if any, under this Prospectus Supplement and the accompanying Prospectus are anticipated to be made in transactions that are deemed to be “at-the-market distributions” as defined in National Instrument 44-102- Shelf Distributions (“NI 44-102”), including sales made directly on the NYSE or any other recognized marketplace upon which the Common Shares are listed or quoted or where the Common Shares are traded in the United States. No Offered Shares will be offered or sold in Canada on the TSX or any other trading market in Canada. If expressly authorized by the Company, the Agents may also sell Offered Shares in privately negotiated transactions in the United States. The sales, if any, of Offered Shares made under the Equity Distribution Agreement will be made by means of ordinary brokers’ transactions on the NYSE at market prices, or as otherwise agreed upon by the Company and the Agents. As a result, prices may vary as between purchasers and during the period of distribution. There is no minimum amount of funds that must be raised under the Offering. As a result, the Offering could be terminated after only raising a small portion of the offering amount set out above, or none at all. See “Plan of Distribution”.

In connection with the Offering, the Company may be considered to be a “connected issuer” within the meaning of National Instrument 33-105 – Underwriting Conflicts (“NI 33-105”) to each of the Agents, separately. An affiliate of BMO and an affiliate of TD are each members of a syndicate of lenders to the Company pursuant to the Revolving Facility (as defined herein). See “Plan of Distribution”.

The Company will pay each Agent a commission of up to 2.0% of the gross sales price per Offered Share sold through such Agent as the Company’s agent under the Equity Distribution Agreement.

Investing in the Offered Shares is subject to certain risks that should be considered carefully by prospective purchasers. Please see “Risk Factors” in the Prospectus Supplement and the accompanying Prospectus and the risk factors in the Company’s documents which are incorporated by reference herein for a description of risks involved in an investment in Offered Shares.

S-2

Table of Contents

Prospectus Supplement

IMPORTANT NOTICE ABOUT INFORMATION IN THIS PROSPECTUS SUPPLEMENT | S-4 | |||

| S-4 | ||||

| S-4 | ||||

| S-5 | ||||

| S-7 | ||||

| S-7 | ||||

| S-9 | ||||

| S-10 | ||||

| S-12 | ||||

| S-13 | ||||

| S-14 | ||||

| S-14 | ||||

| S-15 | ||||

| S-15 | ||||

| S-17 | ||||

| S-18 | ||||

| S-20 | ||||

| S-20 | ||||

| S-25 | ||||

| S-26 | ||||

| S-26 | ||||

| S-26 | ||||

| S-26 |

Base Shelf Prospectus dated May 18, 2021

| 1 | ||||

| 3 | ||||

| 3 | ||||

| 3 | ||||

| 3 | ||||

| 5 | ||||

| 6 | ||||

| 6 | ||||

| 8 | ||||

| 20 | ||||

| 21 | ||||

| 21 | ||||

| 22 | ||||

| 23 | ||||

| 27 | ||||

| 27 | ||||

| 27 | ||||

| 28 | ||||

| 29 | ||||

| 30 | ||||

| 30 | ||||

| 31 |

S-3

Table of Contents

IMPORTANT NOTICE ABOUT INFORMATION IN THIS PROSPECTUS SUPPLEMENT

This document is in two parts. The first part is this Prospectus Supplement, which describes the specific terms of the Offering and also adds to and updates information contained in the accompanying Prospectus and the documents incorporated by reference herein and therein. The second part is the accompanying Prospectus, which provides more general information. If the description of the Common Shares varies between this Prospectus Supplement and the accompanying Prospectus, investors should rely on the information in this Prospectus Supplement. Before you invest, you should carefully read this Prospectus Supplement, the accompanying Prospectus, all information incorporated by reference herein and therein, as well as the additional information described under “Where You Can Find Additional Information” in this Prospectus Supplement. These documents contain information you should consider when making your investment decision. This Prospectus Supplement may add, update or change information contained in the accompanying Prospectus or any of the documents incorporated by reference therein. To the extent that any statement made in this Prospectus Supplement is inconsistent with statements made in the accompanying Prospectus or any documents incorporated by reference therein filed prior to the date of this Prospectus Supplement, the statements made in this Prospectus Supplement will be deemed to modify or supersede those made in the accompanying Prospectus and such documents incorporated by reference therein.

You should rely only on the information contained or incorporated by reference in this Prospectus Supplement and the accompanying Prospectus. The Company has not, and the Agents have not, authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. The Company is offering to sell, and seeking offers to buy, Offered Shares only in jurisdictions where offers and sales are permitted. The distribution of this Prospectus Supplement and the Offering in certain jurisdictions may be restricted by law. You should assume that the information contained in this Prospectus Supplement and the accompanying Prospectus, as well as information filed with the SEC and with the securities regulatory authority in each of the provinces of Canada other than Québec that is incorporated by reference herein and in the accompanying Prospectus, is accurate only as of its respective date. The Company’s business, financial condition, results of operations and prospects may have changed since those dates.

This Prospectus Supplement does not constitute, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy, any securities offered by this Prospectus Supplement by any person in any jurisdiction in which it is unlawful for such person to make such an offer or solicitation.

This Prospectus Supplement is deemed to be incorporated by reference into the Prospectus solely for the purposes of the Offering. Other documents are also incorporated or deemed to be incorporated by reference into this Prospectus Supplement and into the Prospectus. See “Documents Incorporated by Reference”.

Unless the context otherwise requires, references in this Prospectus Supplement and the accompanying Prospectus to “First Majestic” or “the Company” refer to First Majestic Silver Corp. and include each of its direct and indirect subsidiaries as the context requires.

Unless otherwise indicated, all financial information included and incorporated by reference in this Prospectus Supplement and the accompanying Prospectus is determined using IFRS, which differs from United States generally accepted accounting principles and therefore may not be comparable in all material respects to financial information prepared in accordance with United States generally accepted accounting principles.

CURRENCY PRESENTATION AND EXCHANGE RATE INFORMATION

The financial statements of the Company incorporated by reference in this Prospectus Supplement and the accompanying Prospectus are reported in United States dollars. In this Prospectus Supplement and the accompanying Prospectus, all dollar amounts referenced, unless otherwise indicated, are expressed in United States dollars and are referred to as “$” or “ US$”. Canadian dollars are referred to as “C$”. The high, low, closing and average exchange rates for Canadian dollars in terms of the United States dollar for each of the indicated periods, as quoted by the Bank of Canada, were as follows:

S-4

Table of Contents

| Three Months Ended March 31, 2022 | Year ended December 31, 2021 | Year ended December 31, 2020 | �� | Year ended December 31, 2019 | ||||||||||||

| (expressed in Canadian dollars) | ||||||||||||||||

High | 1.2867 | 1.2942 | 1.4496 | 1.3600 | ||||||||||||

Low | 1.2470 | 1.2040 | 1.2718 | 1.2988 | ||||||||||||

Closing | 1.2496 | 1.2678 | 1.2732 | 1.2988 | ||||||||||||

Average | 1.2662 | 1.2535 | 1.3415 | 1.3269 | ||||||||||||

On July 19, 2022 the daily average exchange rate for Canadian dollars in terms of the United States dollar, as quoted by the Bank of Canada, was US$1.00 = C$1.2904.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Prospectus Supplement and the accompanying Prospectus, and the documents incorporated by reference herein and therein, contain “forward-looking information” within the meaning of applicable Canadian securities legislation and “forward-looking statements” within the meaning of applicable U.S. securities legislation (collectively, “forward-looking statements”). Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as “seek”, “anticipate”, “plan”, “continue”, “estimate”, “expect”, “may”, “will”, “project”, “predict”, “forecast”, “potential”, “targeting”, “intend”, “could”, “might”, “should”, “believe” and similar expressions) are not statements of historical fact and may be “forward-looking statements”. These statements relate to future events or the Company’s future performance, business prospects or opportunities that are based on forecasts of future results, estimates of amounts not yet determinable and assumptions of management made in light of management’s experience and perception of historical trends, current conditions and expected future developments. Forward-looking statements include, but are not limited to statements with respect to:

| • | future financings; |

| • | the redemption and/or conversion of the Company’s securities; |

| • | the Company’s business strategy; |

| • | future planning processes; |

| • | commercial mining operations, anticipated mineral recoveries, projected quantities of future mineral production, interpretation of drill results and other technical data; |

| • | anticipated development, expansion, exploration activities and production rates and mine plans and mine life; |

| • | the estimated cost and timing of plant improvements at the Company’s operating mines and development of the Company’s development projects; |

| • | the timing of completion of exploration and drilling programs and capital projects and preparation of technical reports; |

| • | viability of the Company’s projects; |

| • | the completion of the sale of the La Guitarra Silver Mine on the terms outlined herein, if at all, and the timing thereof; |

| • | the completion of preliminary economic assessments; |

| • | anticipated reclamation and decommissioning activities; |

| • | conversion of Mineral Resources to Proven and Probable Mineral Reserves; |

S-5

Table of Contents

| • | analyses and other information that are based on forecasts of future results, estimates of amounts not yet determinable; |

| • | the Company’s future financial position including operating efficiencies, cash flow, capital budgets, costs and expenditures, cost savings, allocation of capital, the Company’s share price, payment of dividends and statements with respect to the recovery of value added tax receivables and the tax regime in México; |

| • | the conduct or outcome of outstanding litigation, regulatory proceedings, negotiations or proceedings under the North American Free Trade Agreement or other claims; |

| • | the Company’s plans with respect to enforcement of certain judgments in favour of the Company and the likelihood of collection under those judgments; |

| • | the Company’s ability to comply with future legislation or regulations including amendments to demonopolization legislation and the Company’s intent to comply with future regulatory and compliance matters; |

| • | future regulatory trends, future market conditions, future staffing levels and needs and assessment of future opportunities of the Company; |

| • | payments of dividends by the Company; |

| • | assumptions of management; |

| • | maintaining relations with local communities; |

| • | maintaining relations with employees; |

| • | renewing contracts related to material properties; |

| • | the Share Repurchase Program (as defined in the Annual Information Form (as defined herein)); |

| • | those factors identified under the caption “General Development of the Business—Risk Factors” in the Annual Information Form; |

| • | expectations regarding the continuing effect of COVID-19 (as defined herein) pandemic on the Company’s operations, the global economy and the market for the Company’s products and securities; and |

| • | other statements identified as such in the documents incorporated by reference herein. |

All statements other than statements of historical fact may be forward-looking statements. Statements concerning Proven and Probable Mineral Reserves and Mineral Resource estimates may also be deemed to constitute forward-looking statements to the extent that they involve estimates of the mineralization that will be encountered as and if the property is developed, and in the case of Measured and Indicated Mineral Resources or Proven and Probable Mineral Reserves, such statements reflect the conclusion based on certain assumptions that the mineral deposit can be economically exploited. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as “seek”, “anticipate”, “plan”, “continue”, “estimate”, “expect”, “may”, “will”, “project”, “predict”, “forecast”, “potential”, “targeting”, “intend”, “could”, “might”, “should”, “believe” and similar expressions) are not statements of historical fact and may be “forward-looking statements”.

Actual results or events may differ materially from those anticipated in such forward-looking statements. These forward-looking statements involve risks and uncertainties relating to, among other things, global and local economic conditions, including inflation, public health threats, changes in commodity prices and, particularly, silver and gold prices, changes in exchange rates, access to skilled mining development and mill production personnel, labour relations, costs of labour, relations with local communities and aboriginal groups, results of exploration and development activities, accuracy of resource estimates, uninsured risks, defects in title, availability and costs of materials and equipment, inability to meet future financing needs on acceptable terms, risks relating to declaration, timing and payment of dividends, availability of strategic alternatives, changes in national or local governments, the impact of the newly adopted Mexican outsourcing legislation, risks associated with the COVID-19 pandemic, changes in applicable legislation or application thereof, timeliness of government approvals, results of litigation including appeals of judgements, resolutions of claims and arbitration proceedings, negotiations and regulatory proceedings, assessments by government agencies, actual performance of facilities, equipment, processes relative to specifications and expectations and unanticipated environmental impacts on operations, and outcomes of tax assessments in México. This is not an exhaustive list of the risks and other factors that may affect any of the Company’s forward-looking statements. Additional factors that could cause actual results to differ materially include, but are not limited to, the risk factors referred to under “Risk Factors” in this Prospectus Supplement and the accompanying Prospectus, as well as those described in the documents incorporated by reference herein, and in particular under the heading “Risk Factors” in the Annual Information Form.

S-6

Table of Contents

The Company believes that the expectations reflected in those forward-looking statements are reasonable, but no assurance can be given that these expectations will prove to be correct and such forward-looking statements included in this Prospectus Supplement or the accompanying Prospectus, including the documents incorporated by reference herein and therein, should not be unduly relied upon. These statements speak only as of the date of this Prospectus Supplement or as of the date specified in the documents incorporated by reference in this Prospectus Supplement, as the case may be. The Company does not intend, and does not assume any obligation, to update these forward-looking statements, except as required by applicable laws. Actual results may differ materially from those expressed or implied by such forward-looking statements.

CAUTIONARY NOTE TO UNITED STATES INVESTORS REGARDING

PRESENTATION OF MINERAL RESERVE AND MINERAL RESOURCE ESTIMATES

This Prospectus Supplement and the accompanying Prospectus, including the documents incorporated by reference herein and therein, have been prepared in accordance with the requirements of the securities laws in effect in Canada which differ from the requirements of United States securities laws. All mining terms used herein but not otherwise defined have the meanings set forth in National Instrument 43-101—Standards of Disclosure for Mineral Projects (“NI 43-101”).

Accordingly, information contained in this Prospectus Supplement and the accompanying Prospectus and the documents incorporated by reference herein and therein containing descriptions of the Company’s mineral deposits may not be comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements of United States federal securities laws and the rules and regulations thereunder.

See “Glossary of Certain Technical Terms” in the Annual Information Form, which is incorporated by reference herein, for a description of certain of the mining terms used in this Prospectus Supplement, the accompanying Prospectus and the documents incorporated by reference herein and therein.

DOCUMENTS INCORPORATED BY REFERENCE

Information has been incorporated by reference in this Prospectus Supplement from documents filed with the securities commissions or similar authorities in each of the provinces of Canada other than Québec (the “Qualifying Provinces”). Copies of the documents incorporated herein by reference may be obtained on request without charge from the Corporate Secretary of the Company at its head office at 1800—925 West Georgia Street, Vancouver, British Columbia, Canada, V6C 3L2, telephone (604) 688-3033, and are also available electronically in Canada through the System for Electronic Document Analysis and Retrieval (“SEDAR”) at www.sedar.com or in the United States through the SEC’s Electronic Data Gathering and Retrieval (“EDGAR”) at the website of the SEC at www.sec.gov. The filings of the Company through SEDAR and EDGAR are not incorporated by reference in this Prospectus Supplement except as specifically set out herein.

As of the date hereof, the following documents, filed by the Company with the securities commissions or similar authorities in each of the Qualifying Provinces, are specifically incorporated by reference into, and form an integral part of, this Prospectus Supplement provided that such documents are not incorporated by reference to the extent that their contents are modified or superseded by a statement contained in this Prospectus Supplement or the accompanying Prospectus or in any other subsequently filed document that is also incorporated by reference in this Prospectus Supplement or the accompanying Prospectus, as further described below:

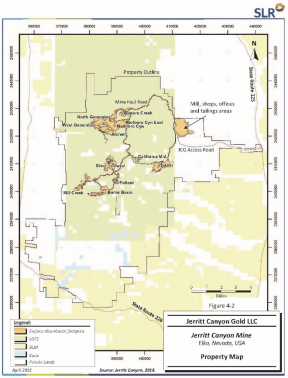

| (a) | the business acquisition report dated April 30, 2021 (the “Business Acquisition Report”) filed in connection with the acquisition of Jerritt Canyon (“Jerritt Canyon”); |

S-7

Table of Contents

| (b) | the annual information form of the Company as of and for the year ended December 31, 2021 dated March 31, 2022 (the “Annual Information Form”); |

| (c) | the audited consolidated financial statements of the Company as of and for the years ended December 31, 2021 and 2020, together with the independent registered public accounting firm’s reports thereon and the notes thereto; |

| (d) | the management’s discussion and analysis of the Company for the year ended December 31, 2021; |

| (e) | the unaudited condensed interim consolidated financial statements of the Company as of March 31, 2022 and for the three months ended March 31, 2022 and March 31, 2021, together with the notes thereto (the “Interim Financial Statements”); |

| (f) | the management’s discussion and analysis of the Company for the three months ended March 31, 2022 (the “Interim MD&A”); and |

| (g) | the management information circular of the Company dated April 20, 2022 prepared in connection with the annual meeting of shareholders of the Company held on May 26, 2022. |

Any document of the type referred to in section 11.1 of Form 44-101F1 of National Instrument 44-101—Short Form Prospectus Distributions filed by the Company with the securities commissions or similar regulatory authorities in the applicable provinces of Canada after the date of this Prospectus Supplement and prior to the termination of any offering of securities hereunder shall be deemed to be incorporated by reference in this Prospectus Supplement and the accompanying Prospectus. In addition, to the extent that any document or information incorporated by reference into this Prospectus Supplement is included in any report on Form 6-K, Form 40-F, Form 20-F, Form 10-K, Form 10-Q or Form 8-K (or any respective successor form) that is filed with or furnished by the Company to the SEC after the date of this Prospectus Supplement and prior to the date that all Offered Shares offered hereunder are sold or the Offering is otherwise terminated, that document or information shall be deemed to be incorporated by reference as an exhibit to the Registration Statement (as defined below) of which this Prospectus Supplement forms a part (in the case of Form 6-K and Form 8-K, if and to the extent set forth therein). The Company may also incorporate other information filed with or furnished to the SEC under the United States Securities Exchange Act of 1934, as amended (the “Exchange Act”), provided that information included in any report on Form 6-K or Form 8-K shall be so deemed to be incorporated by reference only if and to the extent expressly provided in such Form 6-K or Form 8-K.

Any statement contained in this Prospectus Supplement or in the accompanying Prospectus or in a document incorporated or deemed to be incorporated by reference herein or therein is not deemed to be included or incorporated by reference to the extent that any such statement is modified or superseded by a statement contained herein or in any other subsequently filed document that also is or is deemed to be incorporated by reference herein or in the accompanying Prospectus. Any such modifying or superseding statement need not state that it has modified or superseded a prior statement or include any other information set forth in the document that it modifies or supersedes. The making of a modifying or superseding statement shall not be deemed an admission for any purposes that the modified or superseded statement, when made, constituted a misrepresentation, an untrue statement of a material fact or an omission to state a material fact that is required to be stated or that is necessary to make a statement not misleading in light of the circumstances in which it was made. Any statement so modified or superseded shall not be considered in its unmodified or superseded form to constitute part of this Prospectus Supplement or the accompanying Prospectus; rather only such statement as so modified or superseded shall be considered to constitute part of this Prospectus Supplement or the accompanying Prospectus.

Copies of the documents incorporated herein by reference may be obtained on request without charge from the Secretary of the Company at its head office at 1800 - 925 West Georgia Street, Vancouver, British Columbia, V6C 3L2, telephone (604) 688-3033 and are also available electronically at www.sedar.com and www.sec.gov.

S-8

Table of Contents

DOCUMENTS FILED AS PART OF THE REGISTRATION STATEMENT

In addition to the documents specified in this Prospectus Supplement and in the accompanying Prospectus under “Documents Incorporated by Reference”, the Equity Distribution Agreement will be filed with the SEC as part of the registration statement on Form F-10 (the “Registration Statement”) filed by the Company under the United States Securities Act of 1933, as amended (the “U.S. Securities Act”), of which this Prospectus Supplement forms a part.

S-9

Table of Contents

This summary highlights certain information about the Company, the Offering and selected information contained elsewhere in or incorporated by reference into this Prospectus Supplement or the accompanying Prospectus. This summary is not complete and does not contain all of the information that you should consider before deciding whether to invest in the Offered Shares. For a more complete understanding of the Company and the Offering, the Company encourages you to read and consider carefully the more detailed information in this Prospectus Supplement and the accompanying Prospectus, including the information incorporated by reference in this Prospectus Supplement and the accompanying Prospectus, and in particular, the information under the heading “Risk Factors” in this Prospectus Supplement. All capitalized terms used in this summary refer to definitions contained elsewhere in this Prospectus Supplement or the accompanying Prospectus, as applicable.

Overview

First Majestic is in the business of the production, development, exploration and acquisition of mineral properties with a focus on precious metals production in North America. As such, the Company’s business is dependent on foreign operations in México and the United States.

The Company currently owns and operates four producing mines:

| 1. | the San Dimas Silver/Gold Mine in Durango State, Mexico; |

| 2. | the Santa Elena Silver/Gold Mine in Sonora State, Mexico; |

| 3. | the La Encantada Silver Mine in Coahuila State, Mexico; and |

| 4. | the Jerritt Canyon Gold Mine located in Elko County, Nevada. |

| The | Company also owns several non-material mines which are under care and maintenance: |

| 1. | the San Martín Silver Mine in Jalisco State; |

| 2. | the La Parrilla Silver Mine in Durango State; |

| 3. | the Del Toro Silver Mine in Zacatecas State; and |

| 4. | the La Guitarra Silver Mine in México State. |

The Company also owns two advanced-stage silver development projects in México: the La Luz Silver Project in San Luis Potosi State and La Joya Silver Project in Durango State (currently under option), as well as a number of exploration projects in México. On May 24, 2022, the Company entered into a share purchase agreement with Sierra Madre Gold & Silver Ltd. pursuant to which it agreed to sell all of the shares of La Guitarra Compaňia S.A. de C.V., its wholly owned subsidiary which owns the La Guitarra Silver Mine. See “Recent Developments” below.

The Company does not consider its mines under care and maintenance or its advanced-stage silver development projects to be material properties for the purposes of National Instrument 51-102 – Continuous Disclosure Obligations or NI 43-101. The Mineral Resources and Reserves reported in this Prospectus and the documents incorporated by reference herein represent the most up to date estimates completed for the Company’s operations and properties. Investors are cautioned against relying on such Mineral Resource and Reserve estimates since these estimates are based on certain assumptions regarding future events and performance such as: commodity prices, operating costs, taxes, metallurgical performance and commercial terms. Interpretations and Resource and Reserve estimates are based on limited sampling information that may not be representative of the mineral deposits.

S-10

Table of Contents

Further information regarding the business of the Company, its operations and its mineral properties can be found in the Annual Information Form and the documents incorporated by reference into this Prospectus Supplement and the accompanying Prospectus. See “Documents Incorporated by Reference”.

S-11

Table of Contents

| Offered Shares | Common Shares having an aggregate offering price of up to US$100,000,000. | |

| Manner of offering | Sales of Offered Shares, if any, under this Prospectus Supplement and the accompanying Prospectus may be made in transactions that are deemed to be “at-the-market distributions” as defined in NI 44-102, including sales made directly on the NYSE or other trading markets for the Common Shares in the United States. No Offered Shares will be offered or sold in Canada on the TSX or other trading markets in Canada. The sales, if any, of Offered Shares made under the Equity Distribution Agreement will be made by means of ordinary brokers’ transactions on the NYSE at market prices, or as otherwise agreed upon by the Company and the Agents. See “Plan of Distribution”. | |

| Use of proceeds | The principal business objectives that the Company expects to accomplish using the net proceeds from the Offering, if any, together with the Company’s current cash resources, are to develop and/or improve the Company’s existing mines and to add to the Company’s working capital. See “Use of Proceeds”. | |

| Risk factors | See “Risk Factors” in this Prospectus Supplement and the accompanying Prospectus and the risk factors discussed or referred to in the documents which are incorporated by reference into this Prospectus Supplement and the accompanying Prospectus for a discussion of factors that should be read and considered before investing in the Offered Shares. | |

| Tax considerations | Purchasing Offered Shares may have tax consequences. This Prospectus Supplement and the accompanying Prospectus may not describe these consequences fully for all investors. Investors should read the tax discussion in this Prospectus Supplement and the accompanying Prospectus and consult with their tax advisor. See “Certain U.S. Federal Income Tax Considerations” in this Prospectus Supplement. | |

| Listing symbol | The Common Shares are listed for trading on the TSX under the symbol “FR” and the NYSE under the symbol “AG”. | |

S-12

Table of Contents

Before deciding to invest in the Offered Shares, prospective purchasers of the Offered Shares should consider carefully the risk factors and the other information contained in this Prospectus Supplement and the accompanying Prospectus and the documents incorporated by reference herein and therein before purchasing the Offered Shares. An investment in the Offered Shares is speculative and involves a high degree of risk. Information regarding the risks affecting the Company and its business is provided in the documents incorporated by reference in this Prospectus Supplement and the accompanying Prospectus, including in the Annual Information Form under the heading “General Development of the Business—Risk Factors”. Additional risks and uncertainties not known to the Company or that management currently deems immaterial may also impair the Company’s business, financial condition, results of operations or prospects. See “Documents Incorporated by Reference”.

No Assurance of Active or Liquid Market

No assurance can be given that an active or liquid trading market for the Common Shares will be sustained. If an active or liquid market for the Common Shares fails to be sustained, the prices at which such shares trade may be adversely affected. Whether or not the Common Shares will trade at lower prices depends on many factors, including the liquidity of the Common Shares, precious metals prices, prevailing interest rates and the markets for similar securities, general economic conditions and the Company’s financial condition, historic financial performance and future prospects.

If the Offered Shares are traded after their initial issue, they may trade at a discount from their initial offering prices depending on the market and other factors including general economic conditions and the Company’s financial condition. There can be no assurance as to the liquidity of the trading market for the Common Shares.

Public Markets and Share Prices

The market price of the Offered Shares that become listed and posted for trading on the TSX, NYSE or any other stock exchange could be subject to significant fluctuations in response to variations in the Company’s financial results or other factors. In addition, fluctuations in the stock market may adversely affect the market price of the Offered Shares that become listed and posted for trading on a stock exchange regardless of the financial performance of the Company. Securities markets have also experienced significant price and volume fluctuations from time to time. In some instances, these fluctuations have been unrelated or disproportionate to the financial performance of issuers. Market fluctuations may adversely impact the market price of the Offered Shares that become listed and posted for trading on a stock exchange. There can be no assurance of the price at which the Offered Shares that become listed and posted for trading on a stock exchange will trade.

Additional Issuances and Dilution

The Company may issue and sell additional securities of the Company from time to time. The Company cannot predict the size of future issuances of securities of the Company or the effect, if any, that future issuances and sales of securities will have on the market price of any securities of the Company that are issued and outstanding from time to time. Sales or issuances of substantial amounts of securities of the Company, or the perception that such sales could occur, may adversely affect prevailing market prices for the securities of the Company that are issued and outstanding from time to time. With any additional sale or issuance of securities of the Company, holders will suffer dilution with respect to voting power and may experience dilution in the Company’s earnings per share. Moreover, this Prospectus Supplement and the accompanying Prospectus may create a perceived risk of dilution resulting in downward pressure on the price of the Company’s issued and outstanding Common Shares, which could contribute to progressive declines in the prices of such securities.

There is No Certainty Regarding the Net Proceeds to the Company

There is no certainty that US$100,000,000 will be raised under the Offering. The Agents have agreed to use their commercially reasonable efforts to sell the Offered Shares when and to the extent requested by the Company, but the Company is not required to request the sale of the maximum amount offered or any amount and, if the Company requests a sale, the Agents are not obligated to purchase any Offered Shares that are not sold. As a result of the Offering being made on a commercially reasonable efforts basis with no minimum, and only as requested by the Company, the Company may raise substantially less than the maximum total offering amount or nothing at all.

S-13

Table of Contents

The Company has Broad Discretion in the Use of the Net Proceeds from the Offering and May Use Them in Ways Other than as Described Herein

Management of the Company will have broad discretion with respect to the application of net proceeds received by the Company under the Offering, if any, and may spend such proceeds in ways that do not improve the Company’s results of operations or enhance the value of the Common Shares or its other securities issued and outstanding from time to time. Any failure by management to apply these funds effectively could result in financial losses that could have a material adverse effect on the Company’s business or cause the price of the securities of the Company issued and outstanding from time to time to decline. Because of the number and variability of factors that will determine the Company’s use of such proceeds, if any, the Company’s ultimate use might vary substantially from its planned use. You may not agree with how the Company allocates or spend the proceeds from the Offering, if any.

On July 20, 2022, the Company announced that the total production in the second quarter of 2022 from the Company’s four producing mines reached 7.7 million silver equivalent (AgEq) ounces consisting of 2.8 million ounces of silver and 59,391 ounces of gold.

At the Company’s annual general meeting held on May 26, 2022, Raymond Polman was newly elected as a director of the Company.

On May 25, 2022, the Company announced that it had entered into a definitive agreement for the sale of all of the shares of La Guitarra Compaňia S.A. de C.V, the wholly owned subsidiary which owns and operates the La Guitarra Silver Mine, to Sierra Madre Gold & Silver Ltd. (“Sierra Madre”). The La Guitarra Silver Mine is currently on care and maintenance. Under the terms of the agreement, Sierra Madre has agreed to issue the Company 69,063,076 Sierra Madre common shares, with a deemed value of $35 million. In addition, the Company will be granted a 2% net smelter royalty on all mineral production from the La Guitarra concessions. Half (1%) of the net smelter royalty may be repurchased by Sierra Madre for $2 million. Closing of the transaction is subject to customary closing conditions and is anticipated to occur in Q4 2022.

The following table sets forth the Company’s cash, indebtedness and shareholders’ equity as of March 31, 2022, the date of the Company’s most recent financial statements, and as of the date of the Prospectus Supplement. Other than the subsequent events set out below and detailed in footnote (2), there has been no material change in the share and loan capital of the Company on a consolidated basis, since March 31, 2022. This table should be read in conjunction with the Company’s Interim Financial Statements and Interim MD&A.

Description of Capital | As of March 31, 2022 | As of March 31, 2022 after giving effect to the Subsequent Events(2) | ||||||

Cash and cash equivalents | $ | 192,801,000 | $ | 210,215,000 | ||||

Restricted Cash - current | $ | 12,760,000 | nil | |||||

Indebtedness(1) | $ | 222,127,000 | $ | 222,127,000 | ||||

Number of Common Shares outstanding | 261,384,058 | 262,844,560 | ||||||

Shareholders’ Equity | ||||||||

Share Capital | 1,677,077,000 | 1,694,491,000 | ||||||

Equity Reserves | 103,442,000 | 103,442,000 | ||||||

Deficit | (342,524,000 | ) | (342,524,000 | ) | ||||

|

|

|

| |||||

Total Shareholders’ Equity | 1,437,995,000 | 1,455,409,000 | ||||||

|

|

|

| |||||

| (1) | Indebtedness includes the book value of debt facilities and lease liabilities. |

| (2) | Subsequent events include the share issuances through the Company’s prior “at the market offering” in the month of April 2022 for net proceeds of $17.4 million and the release of the restricted cash held in escrow as part of the Company’s acquisition of Jerritt Canyon. |

S-14

Table of Contents

The net proceeds from the Offering, if any, are not determinable in light of the nature of the distribution. The net proceeds of any given distribution of Offered Shares through the Agents in an “at-the-market distribution” will represent the gross proceeds after deducting the applicable compensation payable to the Agents under the Equity Distribution Agreement and the expenses of the distribution.

The principal business objectives that the Company expects to accomplish using the net proceeds from the Offering, if any, together with the Company’s current cash resources, are to develop and/or improve the Company’s existing mines and to add to the Company’s working capital.

The Company has entered into the Equity Distribution Agreement with the Agents, as sales agents, under which the Company may offer and sell Offered Shares having an aggregate offering price of up to US$100,000,000 from time to time. Sales of Offered Shares, if any, will be made in transactions that are deemed to be “at the market distributions” as defined in NI 44-102, including sales made directly on the NYSE or other trading markets for the Common Shares in the United States. No Offered Shares will be offered or sold in Canada on the TSX or on any other trading market in Canada. The sales, if any, of Offered Shares made under the Equity Distribution Agreement will be made by means of ordinary brokers’ transactions on the NYSE at market prices, or as otherwise agreed upon by the Company and the Agents. As a result, price may vary as between purchasers and during the period of distribution. The Agents will not engage in any transactions that stabilize the price of the Common Shares.

Under the terms of the Equity Distribution Agreement, the Company also may sell Common Shares to the Agents as principals for their own accounts at a price agreed upon at the time of sale. If the Company sells Common Shares to the Agents as principals, the Company will enter into a separate terms agreement with the Agents and the Company will describe this terms agreement in a separate prospectus supplement or pricing supplement.

The Company will designate the maximum amount of Offered Shares to be sold through an Agent on a daily basis or otherwise as the Company and such Agent agree and the minimum price per Offered Share at which such Offered Shares may be sold. Subject to the terms and conditions of the Equity Distribution Agreement, the applicable Agent will use its reasonable efforts to sell on the Company’s behalf all of the designated Offered Shares. The Company may instruct the applicable Agent not to sell any Offered Shares if the sales cannot be effected at or above the price designated by the Company in any such instruction. The Company or the applicable Agent may suspend the offering of the Offered Shares at any time and from time to time by notifying the other party.

Each of the Company and the Agents has the right, by giving written notice as specified in the Equity Distribution Agreement, to terminate the Equity Distribution Agreement in its sole discretion at any time.

The applicable Agent will provide to the Company written confirmation following the close of trading on the NYSE each day in which Offered Shares are sold under the Equity Distribution Agreement. Each confirmation will include the number of Offered Shares sold on that day, the gross sales proceeds and the net proceeds to the Company (after transaction fees, if any, but before other expenses). The Company will report at least quarterly the number of Offered Shares sold through the Agents under the Equity Distribution Agreement, the net proceeds to the Company (before expenses) and the commissions of the Agents in connection with the sales of the Offered Shares.

S-15

Table of Contents

The Company will pay each Agent a commission of up to 2.0% of the gross sales price per Offered Share sold through such Agent as the Company’s agent under the Equity Distribution Agreement. The Company has agreed to reimburse the Agents for certain of their expenses.

Settlement for sales of Offered Shares will occur, unless the parties agree otherwise, on the second business day following the date on which any sales were made in return for payment of the net proceeds to the Company. There is no arrangement for funds to be received in an escrow, trust or similar arrangement. Sales of Offered Shares will be settled through the facilities of The Depository Trust Company or by such other means as the Company and the applicable Agent may agree upon.

The Agents are not registered as a dealer in any Canadian jurisdiction and, accordingly, are not permitted and will not, directly or indirectly, advertise or solicit offers to purchase any of the Offered Shares in Canada.

If the Company or any Agent has reason to believe that the Offered Shares are no longer “actively-traded securities” as defined under Rule 101(c)(l) of Regulation M under the Exchange Act, such party will promptly notify the others and sales of Offered Shares pursuant to the Equity Distribution Agreement or any terms agreement will be suspended until in the Company and Agents’ collective judgment Rule 101(c)(1) or another exemptive provision has been satisfied.

The offering of Offered Shares pursuant to the Equity Distribution Agreement will terminate upon the earlier of (i) the sale of all Offered Shares subject to the Equity Distribution Agreement; (ii) the termination of the Equity Distribution Agreement by the Company or by the Agents; or (iii) June 18, 2023.

In connection with the sale of the Offered Shares on the Company’s behalf, each Agent will be deemed to be an “underwriter” within the meaning of the U.S. Securities Act, and the compensation paid to the Agents may be deemed to be underwriting commissions or discounts. The Company has agreed to provide indemnification and contribution to the Agents against certain liabilities, including liabilities under the U.S. Securities Act. The Agents will not engage in any transactions that stabilize the price of the Common Shares. No underwriter or dealer involved in the distribution, no affiliate of such an underwriter or dealer and no person or company acting jointly or in concert with such an underwriter or dealer has over-allotted, or will over allot, Common Shares in connection with the distribution or effect any other transactions that are intended to stabilize or maintain the market price of the Common Shares.

The TSX has conditionally approved the listing of the Offered Shares offered hereunder, subject to the Company fulfilling all of the listing requirements of the TSX. In addition, the NYSE has approved the listing of the Offered Shares offered hereunder.

Selling Restrictions Outside of the United States

No action has been taken by the Company that would permit a public offering of the Offered Shares in any jurisdiction outside the United States where action for that purpose is required. The Offered Shares may not be offered or sold, directly or indirectly, nor may this Prospectus Supplement or any other offering material or advertisements in connection with the offer and sale of any such Offered Shares be distributed or published in any jurisdiction, except under circumstances that will result in compliance with the applicable rules and regulations of that jurisdiction. Persons into whose possession this Prospectus Supplement comes are advised to inform themselves about and to observe any restrictions relating to the Offering and the distribution of this Prospectus Supplement. This Prospectus Supplement does not constitute an offer to sell or a solicitation of an offer to buy any Offered Shares in any jurisdiction in which such an offer or a solicitation is unlawful.

Relationship between the Company and the Agents (Conflicts of Interest)

The Agents and their affiliates have performed investment banking, lending, commercial banking and advisory services for the Company from time to time for which they have received customary fees and expenses. From time to time, the Agents and/or their affiliates may in the future engage in investment banking and other commercial dealings in the ordinary course of business with the Company for which they would expect to receive customary fees and commissions.

S-16

Table of Contents

In connection with the Offering, the Company may be considered to be a “connected issuer” (as defined in NI 33-105) to BMO under applicable Canadian securities legislation.

Bank of Montreal and The Toronto-Dominion Bank (together, the “Lender Affiliates”) are “related issuers” (as defined in NI 33-105) of BMO and TD, respectively, and are members of a syndicate of lenders which extended the Company a revolving term credit facility in the principal amount of US$100,000,000 (the “Revolving Facility”) pursuant to a second amended and restated credit agreement dated as of March 31, 2022. As of the date of this Prospectus Supplement the Company has not drawn on the Revolving Facility and there are no amounts owing thereunder. The Company is in compliance with the Revolving Facility and there have been no waivers granted since execution. The financial position of the Company has not materially changed since the Revolving Facility was entered into. The obligations under the Revolving Facility are secured. In the event the Company elects to draw down under the Revolving Facility in the future, it reserves the right to use certain proceeds of the Offering to reduce any indebtedness under the Revolving Facility.

The decision to distribute the Offered Shares, including the determination of the terms of the Offering, was made through arm’s length negotiations between the Company and the Agents. The Lender Affiliates did not have any involvement in such decision or determination. As a consequence of the Offering, the Agents will receive their commission and, to the extent any of the proceeds of the Offering are applied to reduce any future indebtedness under the Revolving Facility, the Lender Affiliates will receive their proportionate share of the repaid indebtedness.

As a result, the Agents or their Lender Affiliates may receive more than 5% of the net proceeds from the sale of the Offered Shares in the form of the repayment of any future indebtedness. Accordingly, the Offering is being made pursuant to Rule 5121 of the Financial Industry Regulatory Authority, Inc. Pursuant to this rule, the appointment of a qualified independent underwriter is not necessary in connection with the Offering, because the conditions of Rule 5121(a)(1)(B) are satisfied. The Agents and the Lender Affiliates may also make investment recommendations and/or publish or express independent research views in respect of the Company’s securities or financial instruments related to the Company’s securities and may hold, or recommend to clients that they acquire, long and/or short positions in such securities and instruments.

DESCRIPTION OF SECURITIES BEING DISTRIBUTED

Common Shares

The Company is authorized to issue an unlimited number of Common Shares, without par value, of which 262,853,168 are issued and outstanding as of July 19, 2022. There are also options outstanding to purchase up to 6,572,618 Common Shares at prices ranging from C$7.13 to C$21.90, 752,953 restricted share units (the “RSUs”), 489,308 performance share units (“PSUs”) and 50,601 deferred share units (“DSUs”) outstanding as of July 19, 2022, each of which may settled in certain circumstances, for one Common Share as well as 5,000,000 common share purchase warrants each exercisable into one Common Share until April 30, 2024 for an exercise price of $20.00. The number of DSUs listed above does not include 9,143 DSUs which may only be settled in cash. In addition, as set out in more detail below, the Company has an aggregate of $230,000,000 principal amount outstanding pursuant to the 2027 Notes (as defined below) which is convertible into Common Shares.

Holders of Common Shares are entitled to one vote per Common Share at all meetings of the Company’s shareholders, to receive dividends as and when declared by the directors of the Company and to receive a pro rata share of the assets of the Company available for distribution to the shareholders in the event of the liquidation, dissolution or winding-up of the Company. There are no pre-emptive, conversion or redemption rights attached to the Common Shares.

S-17

Table of Contents

Common Shares

During the 12-month period prior to the date of this Prospectus Supplement the Company issued an aggregate of 1,396,168 Common Shares pursuant to the exercise of stock options at prices ranging from C$7.13 and C$15.93 and an aggregate of 123,357 Common Shares on the settlement of outstanding RSUs.

In addition, pursuant to the prior equity distribution agreement dated May 28, 2021 entered into by the Company and the Agents, the Company issued an aggregate of 2,318,499 Common Shares at prices ranging from US$12.92 to US$14.14 per Common Share, for gross aggregate proceeds of US$31.3 million.

Options

The following table summarizes details of the stock options issued by the Company during the 12-month period prior to the date of this Prospectus Supplement:

Date of Grant | Number of Options Granted | Exercise Price (C$) | ||

August 3, 2021 | 5,000 | 17.06 | ||

August 20, 2021 | 164,000 | 15.03 | ||

September 28, 2021 | 15,000 | 15.02 | ||

November 15, 2021 | 75,000 | 17.38 | ||

December 20, 2021 | 25,000 | 13.97 | ||

January 5, 2022 | 100,000 | 13.96 | ||

January 7, 2022 | 514,250 | 13.06 | ||

January 12, 2022 | 421,500 | 13.63 | ||

January 18, 2022 | 25,000 | 13.37 | ||

February 16, 2022 | 486,750 | 14.61 | ||

March 28, 2022 | 200,000 | 17.26 | ||

April 17, 2022 | 2,500 | 17.94 | ||

June 28, 2022 | 15,000 | 10.42 | ||

July 1, 2022 | 25,000 | 9.23 | ||

July 4, 2022 | 15,000 | 9.23 |

Restricted Share Units

The following table summarizes details of the RSUs issued by the Company during the 12-month period prior to the date of this Prospectus Supplement:

Date of Grant | Number of RSUs Granted | |

August 20, 2021 | 11,547 | |

January 4, 2022 | 21,324 | |

January 5, 2022 | 2,507 | |

January 7, 2022 | 454,000 | |

March 28, 2022 | 13,384 | |

May 26, 2022 | 2,791 |

S-18

Table of Contents

Deferred Share Units

The following table summarizes details of the DSUs issued by the Company during the 12-month period prior to the date of this Prospectus Supplement:

Date of Grant | Number of DSUs Granted | |

January 4, 2022 | 37,312 | |

April 12, 2022 | 4,399(1) | |

May 26, 2022 | 4,744(1) |

| (1) | May be settled for cash only (no Common Shares issuable). |

Performance Share Units

The following table summarizes details of the PSUs issued by the Company during the 12-month period prior to the date of this Prospectus Supplement:

Date of Grant | Number of PSUs Granted | |

August 20, 2021 | 3,849 | |

January 5, 2022 | 2,507 | |

January 7, 2022 | 248,330 | |

March 28, 2022 | 13,384 |

Other Securities

On December 2, 2021, the Company completed a private placement offering (the “Note Offering”) of $230,000,000 aggregate principal amount of 0.375% unsecured convertible senior notes due 2027 (the “2027 Notes”). Upon conversion, holders of the 2027 Notes will receive Common Shares based on an initial conversion rate, subject to adjustment, of 60.3865 Common Shares per $1,000 principal amount of 2027 Notes (which represents an initial conversion price of approximately $16.56 per share). The 2027 Notes are governed by an indenture (the “Note Indenture”) entered into between the Company and Computershare Trust Company, N.A. on December 2, 2021. A copy of the Note Indenture is available under the Company’s profile at www.sedar.com.

The Company used a portion of the proceeds of the Note Offering to complete the repurchase, in separate privately negotiated transactions, of $125.2 million aggregate principal amount of its outstanding 1.875% convertible senior notes (the “2023 Notes”) due 2023 for an aggregate purchase price of $164.9 million. On November 30, 2021, in connection with the announcement of the Note Offering, the Company provided notice that it would redeem the remaining 2023 Notes that were not repurchased in connection with the Note Offering effective December 31, 2021. Holders of the 2023 Notes were entitled to convert the 2023 Notes into Common Shares prior to such redemption. On December 31, 2021, the Company completed the redemption of $6.9 million aggregate principal amount of 2023 Notes. In addition, the Company issued an aggregate of 2,579,093 Common Shares to holders who elected to convert their 2023 Notes prior to the redemption date. As a result of such transactions, all the 2023 Notes were either repurchased, redeemed or converted into Common Shares and no 2023 Notes remain outstanding.

S-19

Table of Contents

The Common Shares trade on the TSX under the symbol “FR”. On July 19, 2022, being the last trading day on the TSX prior to the date of this Prospectus Supplement, the closing price of the Common Shares on the TSX was C$9.21. The price range and trading volume of the Common Shares for each month from July 2021 to July 2022, as reported by the TSX, are set out below:

Month | High (C$) | Low (C$) | Total Volume | |||

July 1- 19, 2022 | 9.52 | 8.525 | 7,297,047 | |||

June 2022 | 11.64 | 9.13 | 13,841,332 | |||

May 2022 | 13.73 | 9.46 | 17,681,026 | |||

April 2022 | 18.41 | 13.16 | 15,146,651 | |||

March 2022 | 18.32 | 14.36 | 21,984,159 | |||

February 2022 | 15.79 | 12.235 | 15,792,569 | |||

January 2022 | 15.12 | 11.87 | 13,973,950 | |||

December 2021 | 15.47 | 12.74 | 12,596,643 | |||

November 2021 | 18.2 | 14.69 | 15,115,292 | |||

October 2021 | 17.01 | 13.14 | 12,084,667 | |||

September 2021 | 17.09 | 14.07 | 11,399,603 | |||

August 2021 | 17.68 | 14.84 | 10,738,711 | |||

July 2021 | 19.93 | 15.72 | 11,532,473 |

The Common Shares are listed on the NYSE in the United States under the symbol “AG”. On July 19, 2022, being the last trading day on the NYSE prior to the date of this Prospectus Supplement, the closing price of the Common Shares on the NYSE was US$7.14. The price range and trading volume of the Common Shares for each month from May 2021 to May 2022, as reported by the NYSE, are set out below:

Month | High (US$) | Low (US$) | Total Volume | |||

July 1- 19, 2022 | 7.54 | 6.475 | 12,754,166 | |||

June 2022 | 9.27 | 7.06 | 23,364,141 | |||

May 2022 | 10.76 | 7.24 | 27,561,040 | |||

April 2022 | 14.58 | 10.235 | 20,255,622 | |||

March 2022 | 14.48 | 11.34 | 34,568,591 | |||

February 2022 | 12.29 | 9.65 | 21,489,413 | |||

January 2022 | 12.115 | 9.29 | 19,465,695 | |||

December 2021 | 12.16 | 9.865 | 21,440,081 | |||

November 2021 | 14.67 | 11.5 | 20,729,274 | |||

October 2021 | 13.79 | 10.46 | 17,322,457 | |||

September 2021 | 13.655 | 11.03 | 19,829,202 | |||

August 2021 | 14.095 | 11.53 | 15,819,655 | |||

July 2021 | 16.09 | 12.341 | 15,762,113 |

CERTAIN U.S. FEDERAL INCOME TAX CONSIDERATIONS

The following is a general summary of certain material U.S. federal income tax considerations applicable to a U.S. Holder (as defined below) arising from and relating to the acquisition, ownership, and disposition of Offered Shares acquired pursuant to the Offering.

This summary is for general information purposes only and does not purport to be a complete analysis or listing of all potential U.S. federal income tax considerations that may apply to a U.S. Holder arising from and relating to the acquisition, ownership, and disposition of Offered Shares. In addition, this summary does not take into account the individual facts and circumstances of any particular U.S. Holder that may affect the U.S. federal income tax consequences to such U.S. Holder, including, without limitation, specific tax consequences to a U.S. Holder under an applicable income tax treaty. Accordingly, this summary is not intended to be, and should not be construed as, legal or U.S. federal income tax advice with respect to any U.S. Holder. This summary does not address the U.S. federal alternative minimum, U.S. federal net investment income, U.S. federal estate and gift, U.S. state and local, and non-U.S. tax consequences to U.S. Holders of the acquisition, ownership, and disposition of Offered Shares. In addition, except as specifically set forth below, this summary does not discuss applicable tax reporting requirements. Each prospective U.S. Holder should consult its own tax advisor regarding the U.S. federal income, U.S. federal alternative minimum, U.S. federal net investment income, U.S. federal estate and gift, U.S. state and local, and non-U.S. tax consequences relating to the acquisition, ownership, and disposition of Offered Shares.

S-20

Table of Contents

No ruling from the Internal Revenue Service (the “IRS”) has been requested, or will be obtained, regarding the U.S. federal income tax consequences of the acquisition, ownership, and disposition of Offered Shares. This summary is not binding on the IRS, and the IRS is not precluded from taking a position that is different from, and contrary to, the positions taken in this summary. In addition, because the authorities on which this summary are based are subject to various interpretations, the IRS and the U.S. courts could disagree with one or more of the conclusions described in this summary.

Scope of this Summary

Authorities

This summary is based on the Internal Revenue Code of 1986, as amended (the “Code”), Treasury Regulations (whether final, temporary, or proposed), published rulings of the IRS, published administrative positions of the IRS, the Convention Between Canada and the United States of America with Respect to Taxes on Income and on Capital, signed September 26, 1980, as amended (the “Canada-U.S. Tax Convention”), and U.S. court decisions that are applicable, and, in each case, as in effect and available, as of the date of this document. Any of the authorities on which this summary is based could be changed in a material and adverse manner at any time, and any such change could be applied retroactively. This summary does not discuss the potential effects, whether adverse or beneficial, of any proposed legislation.

U.S. Holders

For purposes of this summary, the term “U.S. Holder” means a beneficial owner of Offered Shares acquired pursuant to the Offering that is for U.S. federal income tax purposes:

| • | an individual who is a citizen or resident of the United States; |

| • | a corporation (or other entity treated as a corporation for U.S. federal income tax purposes) organized under the laws of the United States, any state thereof or the District of Columbia; |

| • | an estate whose income is subject to U.S. federal income taxation regardless of its source; or |

| • | a trust that (i) is subject to the primary supervision of a court within the United States and the control of one or more U.S. persons for all substantial decisions or (ii) has a valid election in effect under applicable Treasury Regulations to be treated as a U.S. person. |

U.S. Holders Subject to Special U.S. Federal Income Tax Rules Not Addressed

This summary does not address the U.S. federal income tax considerations applicable to U.S. Holders that are subject to special provisions under the Code, including, but not limited to, U.S. Holders that: (a) are tax-exempt organizations, qualified retirement plans, individual retirement accounts, or other tax-deferred accounts; (b) are financial institutions, underwriters, insurance companies, real estate investment trusts, or regulated investment companies; (c) are broker-dealers, dealers, or traders in securities or currencies that elect to apply a mark-to-market accounting method; (d) have a “functional currency” other than the U.S. dollar; (e) own Offered Shares as part of a straddle, hedging transaction, conversion transaction, constructive sale, or other integrated transaction; (f) acquire Offered Shares in connection with the exercise of employee stock options or otherwise as compensation for services; (g) hold Offered Shares other than as a capital asset within the meaning of Section 1221 of the Code (generally, property held for investment purposes); (h) are partnerships or other flow-through entities (and partners or other owners thereof); (i) are S corporations (and shareholders thereof); (j) are subject to taxing jurisdictions other than, or in addition to, the United States or otherwise hold Offered Shares in connection with a trade or business, permanent establishment, or fixed base outside the United States; (k) are subject to the alternative minimum tax; (l) are U.S. expatriates or former long-term residents of the United States; (m) are subject to special tax accounting rules; or (n) own, have owned or will own (directly, indirectly, or by attribution) 10% or more of the total combined voting power or value of the outstanding shares of the Company. U.S. Holders that are subject to special provisions under the Code, including, but not limited to, U.S. Holders described immediately above, should consult their own tax advisor regarding the U.S. federal income, U.S. federal alternative minimum, U.S. federal net investment income, U.S. federal estate and gift, U.S. state and local, and non-U.S. tax consequences relating to the acquisition, ownership and disposition of Offered Shares.

S-21

Table of Contents

If an entity or arrangement that is classified as a partnership (or other “pass-through” entity) for U.S. federal income tax purposes holds Offered Shares, the U.S. federal income tax consequences to such entity and the partners (or other owners) of such entity generally will depend on the activities of the entity and the status of such partners (or owners). This summary does not address the tax consequences to any such partner (or owner). Partners (or other owners) of entities or arrangements that are classified as partnerships or as “pass-through” entities for U.S. federal income tax purposes should consult their own tax advisors regarding the U.S. federal income tax consequences arising from and relating to the acquisition, ownership, and disposition of Offered Shares.

Ownership and Disposition of Offered Shares

The following discussion is subject in its entirety to the rules described below under the heading “Passive Foreign Investment Company Rules”.

Taxation of Distributions

A U.S. Holder that receives a distribution, including a constructive distribution, with respect to an Offered Share will be required to include the amount of such distribution in gross income as a dividend (without reduction for any Canadian income tax withheld from such distribution) to the extent of the current or accumulated “earnings and profits” of the Company, as computed for U.S. federal income tax purposes. To the extent that a distribution exceeds the current and accumulated “earnings and profits” of the Company, such distribution will be treated first as a tax-free return of capital to the extent of a U.S. Holder’s tax basis in the Offered Shares and thereafter as gain from the sale or exchange of such Offered Shares (see “Sale or Other Taxable Disposition of Offered Shares” below). However, the Company may not maintain the calculations of its earnings and profits in accordance with U.S. federal income tax principles, and each U.S. Holder may have to assume that any distribution by the Company with respect to the Offered Shares will constitute dividend income. Dividends received on Offered Shares by corporate U.S. Holders generally will not be eligible for the “dividends received deduction” allowed to corporations under the Code with respect to dividends received from domestic corporations. Subject to applicable limitations and provided the Company is eligible for the benefits of the Canada-U.S. Tax Convention or the Offered Shares are readily tradable on a United States securities market, dividends paid by the Company to non-corporate U.S. Holders, including individuals, generally will be eligible for the preferential tax rates applicable to long-term capital gains for dividends, provided certain holding period and other conditions are satisfied, including that the Company not be classified as a PFIC (as defined below) in the tax year of distribution or in the preceding tax year. The dividend rules are complex, and each U.S. Holder should consult its own tax advisor regarding the application of such rules.

Sale or Other Taxable Disposition of Offered Shares

A U.S. Holder will generally recognize gain or loss on the sale or other taxable disposition of Offered Shares in an amount equal to the difference, if any, between (a) the amount of cash plus the fair market value of any property received and (b) such U.S. Holder’s tax basis in such Offered Shares sold or otherwise disposed of. Any such gain or loss generally will be capital gain or loss, which will be long-term capital gain or loss if, at the time of the sale or other disposition, such Offered Shares are held for more than one year.

Preferential tax rates apply to long-term capital gains of a U.S. Holder that is an individual, estate, or trust. There are currently no preferential tax rates for long-term capital gains of a U.S. Holder that is a corporation. Deductions for capital losses are subject to significant limitations under the Code.

Passive Foreign Investment Company Rules

If the Company were to constitute a “passive foreign investment company” (“PFIC”) for any year during a U.S. Holder’s holding period, then certain potentially adverse rules would affect the U.S. federal income tax consequences to a U.S. Holder resulting from the acquisition, ownership and disposition of Offered Shares. The Company believes that it was not a PFIC for the prior tax year, and based on current business plans and financial expectations, the Company expects that it will not be a PFIC for the current tax year and expects that it will not be a PFIC for the foreseeable future. No opinion of legal counsel or ruling from the IRS concerning the status of the Company as a PFIC has been obtained or is currently planned to be requested. However, PFIC classification is fundamentally factual in nature, generally cannot be determined until the close of the tax year in question, and is determined annually. In addition, the analysis depends, in part, on the application of complex U.S. federal income tax rules, which are subject to differing interpretations. Consequently, there can be no assurance that the Company has never been and will not become a PFIC for any tax year during which U.S. Holders hold Offered Shares.

S-22

Table of Contents

In any year in which the Company is classified as a PFIC, a U.S. Holder will be required to file an annual report with the IRS containing such information as Treasury Regulations and/or other IRS guidance may require. In addition to penalties, a failure to satisfy such reporting requirements may result in an extension of the time period during which the IRS can assess a tax. U.S. Holders should consult their own tax advisors regarding the requirements of filing such information returns under these rules, including the requirement to file an IRS Form 8621 annually.

The Company generally will be a PFIC if, after the application of certain “look-through” rules with respect to subsidiaries in which the Company holds at least 25% of the value of such subsidiary, for a tax year, (a) 75% or more of the gross income of the Company for such tax year is passive income (the “income test”) or (b) 50% or more of the value of the Company’s assets either produce passive income or are held for the production of passive income (the “asset test”), based on the quarterly average of the fair market value of such assets. “Gross income” generally includes all sales revenues less the cost of goods sold, plus income from investments and from incidental or outside operations or sources, and “passive income” generally includes, for example, dividends, interest, certain rents and royalties, certain gains from the sale of stock and securities, and certain gains from commodities transactions. Active business gains arising from the sale of commodities generally are excluded from passive income if substantially all of a foreign corporation’s commodities are stock in trade or inventory, depreciable property used in a trade or business or supplies regularly used or consumed in the ordinary course of its trade or business, and certain other requirements are satisfied.