Filed Pursuant to Rule 424(b)(5)

Registration No. 333-255152

Prospectus Supplement

(To Prospectus Dated April 9, 2021)

1,418,605 Shares of Common Stock

We are offering 1,418,605 shares of our common stock, par value $0.0001 per share, or “common stock”, to several institutional investors pursuant to this prospectus supplement and accompanying prospectus and a securities purchase agreement with such investors. In a concurrent private placement, we are also selling to the purchasers of shares of our common stock in this offering warrants to purchase an aggregate of 1,418,605 shares of our common stock, or the Purchase Warrants. The Purchase Warrants issued in the private placement and the shares of our common stock issuable upon the exercise of the Purchase Warrants are not being registered under the Securities Act of 1933, as amended, or the Securities Act, at this time, are not being offered pursuant to this prospectus supplement and the accompanying prospectus and are being offered pursuant to the exemption provided in Section 4(a)(2) under the Securities Act and Rule 506(b) promulgated thereunder.

Our common stock is listed on the Nasdaq Capital Market under the symbol “OLB.” On August 18, 2021, the last reported sale price of our common stock on the Nasdaq Capital Market was $5.42 per share.

As of the date of this prospectus, the aggregate market value of our outstanding common stock held by non-affiliates was approximately $18,588,772, which was calculated based on 7,274,427 shares of outstanding Common Stock held by non-affiliates and a price per share of $6.89 on July 13, 2021. Pursuant to General Instruction I.B.6 of Form S-3, in no event will we sell, pursuant to the registration statement of which this prospectus supplement forms a part, securities in a public primary offering with a value exceeding one-third of the aggregate market value of our common stock held by non-affiliates in any 12-month period, so long as the aggregate market value of our outstanding common stock held by non-affiliates remains below $75 million. During the 12 calendar months prior to and including the date of this prospectus supplement, we have not offered or sold any securities pursuant to General Instruction I.B.6 of Form S-3.

We have engaged H.C. Wainwright & Co., LLC, or the placement agent, to act as our exclusive placement agent in connection with this offering. The placement agent has agreed to use its reasonable best efforts to arrange for the sale of the securities offered by this prospectus supplement. The placement agent is not purchasing or selling any of the securities we are offering and the placement agent is not required to arrange the purchase or sale of any specific number of securities or dollar amount. We have agreed to pay to the placement agent the placement agent fees set forth in the table below, which assumes that we sell all of the securities offered by this prospectus supplement. All sales will be evidenced by a securities purchase agreement between us and the investors. There is no arrangement for funds to be received in escrow, trust or similar arrangement. There is no minimum offering requirement. We will bear all costs associated with the offering. See “Plan of Distribution” on page S-19 of this prospectus supplement for more information regarding these arrangements.

Investing in the offered securities involves a high degree of risk. See “Risk Factors” beginning on page S-10 of this prospectus supplement for a discussion of information that you should consider before investing in our securities and in the documents incorporated by reference in this prospectus supplement that we file with the Securities and Exchange Commission.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus supplement or the accompanying prospectus. Any representation to the contrary is a criminal offense.

| | | Per Share | | | Total | |

| Public offering price | | $ | 4.30 | | | $ | 6,100,002 | |

| Placement agent’s fees(1) | | $ | 0.3225 | | | $ | 457,500 | |

| Proceeds, before expenses, to us | | $ | 3.9775 | | | $ | 5,642,502 | |

| (1) | We have agreed to reimburse the placement agent for certain of its expenses. In addition, we have agreed to issue to the placement agent warrants to purchase shares of our common stock. See “Plan of Distribution” on page S-19 of this prospectus supplement for a description of the compensation payable to the placement agent. |

Delivery of the securities is expected on about August 23, 2021, subject to satisfaction of certain conditions.

H.C. Wainwright & Co.

The date of this prospectus supplement is August 18, 2021

TABLE OF CONTENTS

PROSPECTUS SUPPLEMENT

PROSPECTUS

ABOUT THIS PROSPECTUS SUPPLEMENT

This document is in two parts. The first part is the prospectus supplement, including the documents incorporated by reference, which describes the specific terms of this offering. The second part, the accompanying prospectus, including the documents incorporated by reference, provides more general information. Generally, when we refer to this prospectus, we are referring to both parts of this document combined. Before you invest, you should carefully read this prospectus supplement, the accompanying prospectus and all information incorporated by reference herein and therein, as well as the additional information described under “Where You Can Find Additional Information” on page S-20 of this prospectus supplement. These documents contain information you should consider when making your investment decision. This prospectus supplement may add, update or change information contained in the accompanying prospectus. To the extent there is a conflict between the information contained in this prospectus supplement, on the one hand, and the information contained in the accompanying prospectus or any document incorporated by reference therein filed prior to the date of this prospectus supplement, on the other hand, you should rely on the information in this prospectus supplement. If any statement in one of these documents is inconsistent with a statement in another document having a later date—for example, a document filed after the date of this prospectus supplement and incorporated by reference in this prospectus supplement and the accompanying prospectus—the statement in the document having the later date modifies or supersedes the earlier statement.

You should rely only on the information contained or incorporated by reference in this prospectus supplement, the accompanying prospectus and in any free writing prospectuses we may provide to you in connection with this offering. We have not, and the placement agent has not, authorized any other person to provide you with any information that is different. If anyone provides you with different or inconsistent information, you should not rely on it. We are offering to sell, and seeking offers to buy, our securities only in jurisdictions where offers and sales are permitted. The distribution of this prospectus supplement and the offering of securities covered hereby in certain jurisdictions may be restricted by law. Persons outside the United States who come into possession of this prospectus supplement must inform themselves about, and observe any restrictions relating to, the offering of securities covered hereby and the distribution of this prospectus supplement outside the United States. This prospectus supplement does not constitute, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy, any securities offered by this prospectus supplement by any person in any jurisdiction in which it is unlawful for such person to make such an offer or solicitation.

We further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document that is incorporated by reference in this prospectus supplement or the accompanying prospectus were made solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly, such representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

Unless the context otherwise requires, the terms “OLB,” “the Company,” “our company,” “we,” “us,” “our” and similar names refer collectively to The OLB Group, Inc. and its subsidiaries.

All trademarks, trade names and service marks appearing in this prospectus supplement, the accompanying prospectus or the documents incorporated by reference herein or therein are the property of their respective owners. Use or display by us of other parties’ trademarks, trade dress or products is not intended to and does not imply a relationship with, or endorsements or sponsorship of, us by the trademark or trade dress owner. Solely for convenience, trademarks, tradenames and service marks referred to in this prospectus supplement, the accompanying prospectus or the documents incorporated by reference herein or therein appear without the ® and ™ symbols, but those references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or that the applicable owner will not assert its rights, to these trademarks and trade names.

PROSPECTUS SUPPLEMENT SUMMARY

This summary highlights certain information about us, this offering and selected information contained elsewhere in or incorporated by reference into this prospectus supplement, the accompanying prospectus and the information incorporated by reference herein and therein. This summary is not complete and does not contain all of the information that you should consider before deciding whether to invest in our securities. For a more complete understanding of our company and this offering, we encourage you to read and consider carefully the entire prospectus supplement and the accompanying prospectus, including “Risk Factors” beginning on page S-10 of this prospectus supplement, along with our consolidated financial statements and notes to those consolidated financial statements and the other documents incorporated by reference in this prospectus supplement and the accompanying prospectus.

Business Overview

Overview

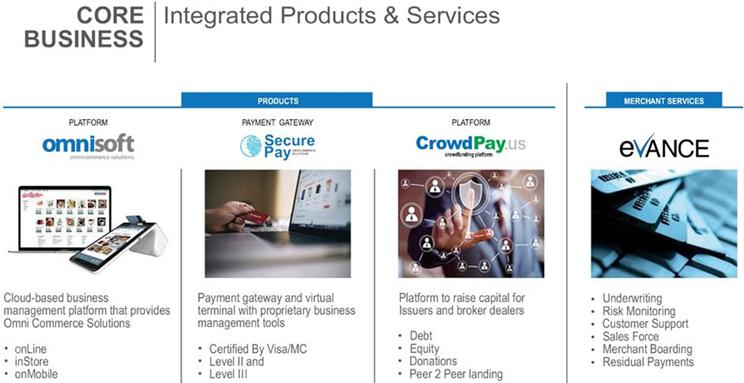

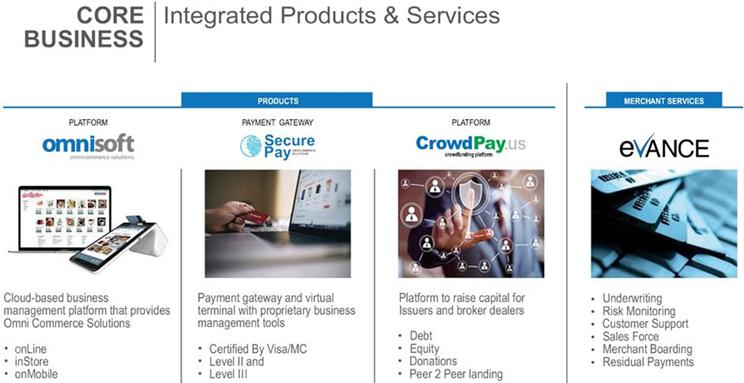

We are a FinTech company and payment facilitator (“PayFac”) that focuses on a suite of products in the merchant services and payment facilitator verticals and seeks to provide integrated business solutions to merchants throughout the United States. We seek to provide merchants with a wide range of products and services through our various online platforms, including financial and transaction processing services. We also have products that provide support for crowdfunding and other capital raising initiatives. We supplement our online platforms with certain hardware solutions that are integrated with our online platforms. Our business functions primarily through three wholly-owned subsidiaries, eVance, Inc., a Delaware corporation (“eVance”), OmniSoft.io, Inc., a Delaware corporation (“OmniSoft”), and CrowdPay.Us, Inc., a New York corporation (“CrowdPay”).

OmniSoft operates a cloud-based business management platform that provides turnkey solutions for merchants to enable them to build and manage their retail businesses, whether online or at a “brick and mortar” location. The OmniSoft platform, which can be accessed by merchants through any mobile and computing device, allows merchants to, among other features, manage and track inventory, track sales and process customer transactions and can provide interactive data analysis concerning sales of products and need for additional inventory. Merchants generally utilize the platform by uploading to the platform information about their inventory (description of units, number of units, price per unit, and related information). Once such information has been uploaded, merchants, either with their own device or with hardware that we sell directly to them, are able to utilize the platform to monitor inventory and process and track sales of their products (including coordinating shipping of their products with third party logistics companies). We manage and maintain the OmniSoft platform through a variety of domain names or a merchant can integrate our platform with their own domain name. Using the OmniSoft platform, merchants can “check-out” their customers at their “brick and mortar” stores or can sell products to customers online, in both cases accepting payment via a simple credit card or debit card transaction (either swiping the credit card or entering the credit card number), a cash payment, or by use of a QR code or loyalty and reward points, and then print or email receipts to the customer. For more information regarding our OmniSoft platform, see “Description of our OmniSoft Business.”

eVance provides competitive payment processing solutions to merchants which enable merchants to process credit and debit card-based internet payments for sales of their products at competitive prices (whether such sales occur online or at a “brick and mortar” location). eVance is an independent sales organization (an “ISO”) that signs up new merchants on behalf of acquiring banks and processors that provides financial and transaction processing solutions to merchants throughout the United States. eVance differentiates itself from other ISOs by focusing on both obtaining and maintaining new merchant contracts for its own account (including, but not limited to, merchants that utilize the OmniSoft platform) and also obtaining and maintaining merchant contracts obtained by third-party ISOs (for which we negotiate a shared fee arrangement) and utilizing our own software and technology to provide merchants and other ISOs differentiating products and software. In particular, we (i) own our own payments gateway, (ii) have proprietary omni-commerce software platform, (iii) have in-house underwriting and customer service, (iv) have in-house sub-ISO management system which offers sub-ISOs and agents tools for online boarding, account management, residual reports among other tools, (v) utilize a Payment Facilitator model and (vi) offer a suite of products in the financial markets (through CrowdPay). Leveraging our relationship with three of the top five merchant processors in the United States (representing a majority of the merchant processing market) and with the use of our proprietary software, our payment gateway (which we call “SecurePay”) enables merchants to reduce the cost of transacting with their customers by removing the need for a third-party payment gateway solution. eVance operates as both a wholesale ISO and a retail ISO depending on the risk profile of the merchant and the applicable merchant processor and acquiring bank. As a wholesale ISO, eVance underwrites the processing transactions for merchants, establishing a direct relationship with the merchant and generating individual merchant processing contracts in exchange for future residual payments. As a retail ISO, eVance primarily gathers the documents and information that our partners (acquiring banks and acquiring processors) need to underwrite merchants’ transactions and as a result receives only residual income as commission for merchants it places with our partners. For more information regarding the electronic payment industry, see “Business — Description of our eVance Business — Our Industry.”

We expect to build out our OmniSoft software business and to rely more on our PayFac model to transition away from our reliance on our eVance business but there is no guarantee that we will be able to do so.

SecurePay

SecurePay is a payment gateway and virtual terminal with proprietary business management tools that is in compliance with the Payment Card Industry (PCI).

SecurePay has been certified by Visa and MasterCard (certified Level II and Level III) and finalized implementation of “3D Secure” in 2019 (a feature that is unique to what we offer in order to provide for more secure environment for E-commerce and mobile payments in-store and online).

CrowdPay.us™ operates a white label capital raising platform that targets small and midsized businesses seeking to raise capital and registered broker-dealers seeking to host capital raising campaigns for such businesses by integrating the platform onto such company’s or broker-dealer’s website. Our CrowdPay platform is tailored for companies seeking to raise money through a crowdfunding offering of between $1 million and $50 million pursuant to Regulation CF under Title III of the Jumpstart Our Business Startups (the “JOBS Act”), offerings pursuant to Rule 506(b) and Rule 506(c) under Regulation D of the Securities Act of 1933, as amended (the “Securities Act”), and offerings pursuant to Regulation A+ of the Securities Act. Our platform, which can be used for multiple offerings at once, provides companies and broker-dealers with an easy-to-use, turnkey solution to support company offerings, allowing companies and broker-dealers to easily present online to potential investors relevant marketing and offering materials and by aiding in the accreditation and background check processes to ensure investors meets the applicable requirements under the rules and regulations of the Securities Exchange Commission (the “SEC”). CrowdPay charges a fee to each company and broker-dealer for the use of its platform under a fee structure that is agreed to between CrowdPay and the Company and/or broker-dealer prior to the initiation of the offering. CrowdPay also generates revenues by providing ancillary services to the companies and broker-dealers utilizing our platform, including running background checks and providing anti-money laundering and know-your-customer compliance. CrowdPay is not a registered funding portal or a registered broker-dealer.

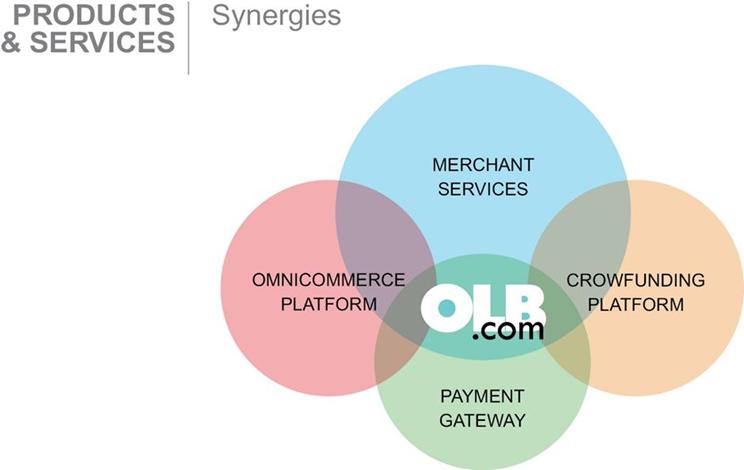

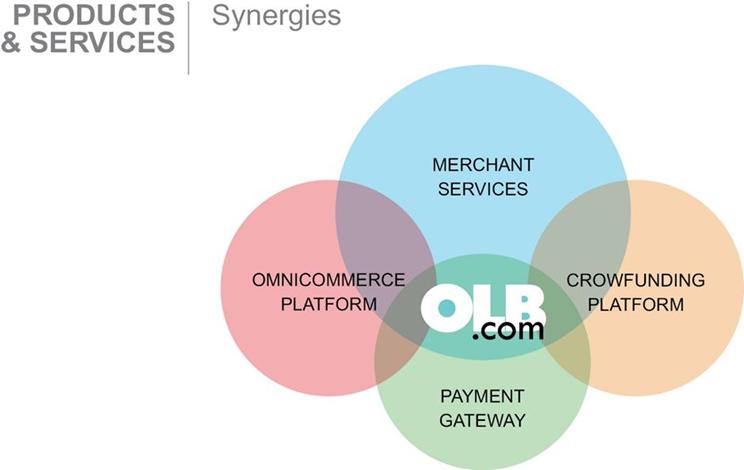

Synergies between the subsidiaries

The success of our business model is dependent on the synergies between the business segments operated by our subsidiaries. We have created and developed products that we believe, form an ecosystem of e-commerce to provide a variety of clients, from online equity financing companies or merchants selling online or in brick and mortar stores, with multiple product offerings and ancillary services from underwriting with the banks and merchant billing from the cloud software. We expect that these synergies will create additional revenue by charging transaction fees on each service provided to clients by our partnerships with Merchant Acquiring Banks and PCI Compliance.

We believe that our wholly-owned subsidiaries combine to create an ecosystem where each subsidiary benefits the other. Starting with the services provided by eVance, we enable each of our products and platforms to communicate with each other and create an ecosystem among our products and, potentially, third-party products.

The product environment created with a new registered merchant or issuer enables all merchant information to be stored in a single, centralized location but utilized by all subsidiaries. For example, merchant services utilizing eVance provide electronic payment processing services that can be utilized for payments on the Crowdfunding platform. The platform is used by merchant services to allow mobile and online processing to merchants.

The Omni commerce platform will be offered to all of the merchant services clients. The offered Merchant Services products we provide will enable all processing needs for the Omni-commerce system. The gateway will allow merchants that are using the platform to accept online E-commerce transactions.

Recent Developments

On May 22, 2020, we purchased certain assets from POSaBIT Inc., including its contracts and arrangements with the Doublebeam merchant payment processing platform. The assets included, but were not limited to, software source codes, customer lists, customer contracts, hardware and website domains.

On July 23, 2021, we formed DMINT, Inc., a wholly owned subsidiary (“DMINT”) to operate in the cryptocurrency mining industry. DMint has initiated the first phase of the cryptocurrency mining operation by placing purchase orders for data centers and ASIC-based Antminer S19J Pro mining computers specifically configured to mine Bitcoin. The first lot of equipment will be used to establish a proof of concept before DMint expands the number of computers in operation. As configured, it is expected that the computers purchased will have a combined computing power of approximately 100 petahash per second. If the initial mining operation results are as anticipated, DMint plans to expand the number of mining computers every quarter, whereby it would aim to have the computing power of 500 petahash per second by the end of 2022.

On July 1, 2021, we also signed a non-binding letter of intent to acquire a portfolio of Cannabidiol (or “CBD”) merchants and other merchants that will utilize our SecurePay Payment Gateway to process payments. The group of merchants to be acquired have reported annual transaction volume of greater than $300 million. The transaction is anticipated to add an accomplished and experienced sales channel to the OLB team, enabling further penetration into this growing sector in the United States. The transaction is expected to close in the fourth quarter of 2021, but there can be no assurance that we will close this acquisition on that timeline or at all.

Competitive Advantages

We believe that our platform of services will provide the following key advantages.

| | ● | Time to Market — we can create a customized website for retailers within days and have it fully operational in less than 2 weeks. |

| | ● | Cost — we believe that we are the only content service provider that does not charge a setup fee. |

| | ● | Flexibility — our platform has the flexibility to provide customized solutions for partners. |

| | ● | Pricing — we provide partners with a price comparison feature which they can utilize if they wish to set prices for products or run promotions. |

| | ● | Payment processing — we can provide financial service companies with the ability to have their customers’ accounts directly debited for payment. |

| | ● | We can assist existing “brick & mortar” businesses that have inventory and fulfilment capability but do not wish to create and maintain an e-commerce website and infrastructure to sell their products. |

| | ● | We can provide a platform for early-stage companies looking for an effective and less costly way to raise capital. |

Risks Associated with our Business

Our business and ability to execute our business strategy are subject to a number of risks of which you should be aware before you decide to buy our securities. In particular, you should consider the following risks, which are discussed more fully in the section entitled “Risk Factors” in this prospectus:

| | ● | Our acquisition of eVance and share exchange with OmniSoft and CrowdPay has collectively formed a new business platform that we are continuing to integrate into our overall operations, which may create certain risks and may adversely affect our business, financial condition or results of operations; |

| ● | Our failure to pay our outstanding indebtedness will result in a substantial loss of our assets; |

| ● | We operate in a regulatory environment that is evolving and uncertain and any changes to regulations could have a material impact on our business and financial condition; |

| ● | We rely on a combination of confidentiality clauses, assignment agreements and license agreements with employees and third parties, trade secrets, copyrights and trademarks to protect our intellectual property and competitive advantage, all of which offer only limited protection meaning that we may be unable to maintain and protect our intellectual property rights and proprietary information or prevent third-parties from making unauthorized use of our technology; and |

| ● | Our growth may not be sustainable and depends on our ability to attract new merchants, retain existing merchants and increase sales to both new and existing merchants. |

Corporate Information

We were incorporated in the State of Delaware on November 18, 2004 for the purpose of merging with OLB.com, Inc., a New York corporation incorporated in 1993 (“OLB.com”), in order to change our state of incorporation from New York to Delaware. In April 2018, we completed an acquisition of substantially all of the assets of Excel Corporation and its subsidiaries--Payprotec Oregon, LLC, Excel Business Solutions, Inc. and eVance Processing, Inc. (such assets are the foundation of our eVance business). In May 2018, we entered into share exchange agreements with CrowdPay and OmniSoft, affiliate companies owned by Mr. Yakov and John Herzog, an affiliate of our company, pursuant to which each of CrowdPay and OmniSoft became wholly owned subsidiaries of our company.

Our headquarters are located at 200 Park Avenue, Suite 1700, New York, NY 10166. Our telephone number is (212) 278-0900.

THE OFFERING

| Securities offered by us: | 1,418,605 shares of our common stock |

| | |

| Common stock outstanding after this offering | 8,692,482 shares of common stock. |

| | |

| Use of proceeds | We intend to use the net proceeds from this offering to invest in or acquire companies or technologies that are synergistic with or complimentary to our business, to expand and market our current products and for working capital and general corporate purposes. See “Use of Proceeds” on page S-16 of this prospectus supplement. |

| | |

| Concurrent Private Placement | In a concurrent private placement, we are selling to the purchasers of our common stock offered under this prospectus supplement, warrants to purchase up to an aggregate of 1,418,605 shares of our common stock. The warrants will be exercisable starting six months after issuance at an exercise price of $5.42 per share and will expire on the five year anniversary of the date that the warrants initially become exercisable. The warrants and the shares of our common stock issuable upon the exercise of the warrants, are not being offered pursuant to this prospectus supplement and the accompanying prospectus and are being offered pursuant to the exemption provided in Section 4(a)(2) under the Securities Act and Rule 506(b) promulgated thereunder. See “Private Placement Transaction.” |

| | |

| Risk factors | See “Risk Factors” beginning on page S-10 of this prospectus supplement and the other information included or incorporated by reference elsewhere in this prospectus supplement and the accompanying prospectus, for a discussion of factors you should carefully consider before deciding to invest in our securities. |

| | |

| Nasdaq Capital Market symbol | Our common stock is listed on the Nasdaq Capital Market under the symbol “OLB.” |

The number of shares of common stock to be outstanding immediately after this offering is based on 7,273,877 shares of our common stock outstanding as of June 30, 2021, and excludes:

| ● | 2,333,938 shares of common stock issuable upon the exercise of warrants outstanding as of June 30, 2021 at a weighted average exercise price of $6.75 per share; |

| ● | 132,737 shares of common stock issuable upon the exercise of options at a weighted average exercise price of $0.03 per share pursuant to our stock incentive plans, which we refer to collectively as the Incentive Plans; and |

| ● | 230,000 shares of common stock available for future awards under the Incentive Plans. |

RISK FACTORS

An investment in our securities involves a high degree of risk. Before deciding whether to invest in our securities, you should consider carefully the risks and uncertainties described below and under the section captioned “Risk Factors” contained in our most recent Annual Report on Form 10-K for the year ended December 31, 2020 and other filings we make with the Securities and Exchange Commission, or SEC, from time to time, which are incorporated by reference herein in their entirety, together with other information in this prospectus supplement, the accompanying prospectus and the information incorporated by reference herein and therein and in any free writing prospectus that we may authorize for use in connection with this offering. If any of these risks actually occurs, our business, financial condition, results of operations or cash flow could suffer materially. In such event, the trading price of our common stock could decline and you might lose all or part of your investment.

Risks Related to This Offering

Our management has broad discretion as to the use of the net proceeds from this offering.

We expect to use the net proceeds in this offering to invest in or acquire companies or technologies that are synergistic with or complimentary to our business, to expand and market our current products and for working capital and general corporate purposes, however we cannot specify with certainty the particular uses of the net proceeds we will receive from this offering. Our management will have broad discretion in the application of the net proceeds, including for any of the purposes described in “Use of Proceeds.” Accordingly, you will have to rely upon the judgment of our management with respect to the use of the proceeds. Our management may spend a portion or all of the net proceeds from this offering in ways that holders of our common stock may not desire or that may not yield a significant return or any return at all. The failure by our management to apply these funds effectively could harm our business. Pending their use, we may also invest the net proceeds from this offering in a manner that does not produce income or that loses value.

We could issue additional common stock, which might dilute the book value of our capital stock.

We may issue all or a part of our authorized but unissued shares of common stock. Any such stock issuance could be made at a price that reflects a discount or a premium to the then-current trading price of our common stock. In addition, in order to raise future capital, we may need to issue securities that are convertible into or exchangeable for a significant amount of our common stock. These issuances, if any, would dilute your percentage ownership interest in the Company, thereby having the effect of reducing your influence on matters on which stockholders vote. You may incur additional dilution if holders of stock options or warrants, whether currently outstanding or subsequently granted, exercise their options, or if warrant holders exercise their warrants to purchase shares of our common stock. As a result, any such issuances or exercises would dilute your interest in the Company and the per share book value of the common stock that you own, either of which could negatively affect the trading price of our common stock and the value of your investment.

Future equity offerings may be at lower prices than this offering.

In order to raise additional capital, we may in the future offer additional shares of our common stock or other securities convertible into or exchangeable for our common stock at prices that may not be the same as the public offering price for the shares in this offering. We may sell shares or other securities in any other offering at prices that are less than the price paid by investors in this offering, and investors purchasing shares or other securities in the future could have rights superior to existing stockholders.

Cryptocurrency Risks

We have an evolving business model.

Cryptocurrencies and blockchain technologies are relatively new and highly speculative. Cryptocurrencies and blockchain technologies have limited history, and their risks cannot be fully known at this time. As cryptocurrency assets and blockchain technologies become more widely available, we expect the services and products associated with them to evolve. In order to stay current with the industry, our business model may need to evolve as well. From time to time, we may modify aspects of our business model relating to our product mix and service offerings. We cannot offer any assurance that these or any other modifications will be successful or will not result in harm to our business. We may not be able to manage growth effectively, which could damage our reputation, limit our growth and negatively affect our operating results. Such circumstances could have a material adverse effect on our ability to continue as a going concern or to pursue our new strategy at all, which could have a material adverse effect on our business, prospects or operations.

We may not be able to compete with other companies, some of which have greater resources and experience.

We may not be able to compete successfully against present or future competitors. We do not have the resources to compete with larger providers of similar services at this time. The cryptocurrency industry has attracted various high-profile and well-established operators, some of which have substantially greater liquidity and financial resources than we do. With the limited resources we have available, we may experience great difficulties in building our network of computers and creating an exchange. Competition from existing and future competitors could result in our inability to secure acquisitions and partnerships that we may need to expand our business. This competition from other entities with greater resources, experience and reputations may result in our failure to maintain or expand our business, as we may never be able to successfully execute our business plan.

The properties included in our mining network may experience damages.

Our initial cryptocurrency mining farm in Pennsylvania is, and any future mining farms we establish will be, subject to a variety of risks relating to physical condition and operation, including:

| ● | the presence of construction or repair defects or other structural or building damage; |

| ● | any noncompliance with or liabilities under applicable environmental, health or safety regulations or requirements or building permit requirements; |

| ● | any damage resulting from natural disasters, such as hurricanes, earthquakes, fires, floods and windstorms; and |

| ● | claims by employees and others for injuries sustained at our properties. |

For example, a mine could be rendered inoperable, temporarily or permanently, as a result of a fire or other natural disaster or by a terrorist or other attack on the mine. The security and other measures we take to protect against these risks may not be sufficient. Additionally, our mines could be materially adversely affected by a power outage or loss of access to the electrical grid or loss by the grid of cost-effective sources of electrical power generating capacity. Given the power requirement, it would not be feasible to run miners on back-up power generators in the event of a power outage or damage to our primary generators.

Cryptocurrency exchanges and other trading venues are relatively new and, in most cases, largely unregulated and may therefore be the subject of fraud and failures.

When cryptocurrency exchanges or other trading venues are involved in fraud or experience security failures or other operational issues, such events could result in a reduction in cryptocurrency prices or confidence and impact our success and have a material adverse effect on our ability to continue as a going concern or to pursue this segment at all, which would have a material adverse effect on our business, prospects and operations.

Cryptocurrency market prices depend, directly or indirectly, on the prices set on exchanges and other trading venues, which are new and, in most cases, largely unregulated as compared to established, regulated exchanges for securities, commodities or currencies. For example, during the past several years, a number of Bitcoin exchanges have closed due to fraud, business failure or security breaches. In many of these instances, the customers of the closed exchanges were not compensated or made whole for partial or complete losses of their account balances. While smaller exchanges are less likely to have the infrastructure and capitalization that may provide larger exchanges with some stability, larger exchanges may be more likely to be appealing targets for hackers and “malware” (i.e., software used or programmed by attackers to disrupt computer operation, gather sensitive information or gain access to private computer systems) and may be more likely to be targets of regulatory enforcement action. We do not maintain any insurance to protect from such risks, and do not expect any insurance for customer accounts to be available (such as federal deposit insurance) at any time in the future, putting customer accounts at risk if any such events occur. In the event we experience fraud, security failures, operational issues or similar events such factors would have a material adverse effect on our ability of to continue as a going concern or to pursue this segment at all, which would have a material adverse effect on our business, prospects and operations.

Regulatory changes or actions may alter the nature of an investment in us or restrict the use of cryptocurrencies in a manner that adversely affects our business, prospects or operations.

As cryptocurrencies have grown in both popularity and market size, governments around the world have reacted differently to cryptocurrencies, with certain governments deeming them illegal while others have allowed their use and trade.

Governments may in the future curtail or outlaw the mining, acquisition, use, trading or redemption of cryptocurrencies. Ownership of, holding or trading in cryptocurrencies may then be considered illegal and subject to sanction. Governments may also take regulatory action that may increase the cost and/or subject cryptocurrency companies to additional regulation. The effect of any future regulatory change on our business or any cryptocurrency that may impact our business is impossible to predict, but such change could be substantial and may have a material adverse effect on our business, prospects and operations.

The development and acceptance of cryptographic and algorithmic protocols governing the issuance of and transactions in cryptocurrencies is subject to a variety of factors that are difficult to evaluate.

The use of cryptocurrencies to, among other things, buy and sell goods and services and complete transactions, is part of a new and rapidly evolving industry that employs digital assets based upon a computer-generated mathematical and/or cryptographic protocol. Cryptocurrencies are not recognized as legal tender by any U.S. or foreign governmental authority, and they are not backed by the full faith and credit of, or endorsed by, any government. The value of cryptocurrency in respect of any specific transaction is based on the agreement of the parties thereto, and the value of such cryptocurrency more broadly is based on the agreement of market participants. Currently, a significant portion of cryptocurrency demand is generated by speculators seeking to profit from short- or long-term price fluctuations. It is doubtful that any given cryptocurrency has any intrinsic value.

The growth of this industry in general, and the use of cryptocurrencies in particular, is subject to a high degree of uncertainty, and the slowing or stopping of the development or acceptance of developing protocols may occur and is unpredictable. The factors include, but are not limited to:

| | ● | Continued worldwide growth in the adoption and use of cryptocurrencies; |

| | ● | Governmental and quasi-governmental regulation of cryptocurrencies and their use, or restrictions on or regulation of access to and operation of the network or similar cryptocurrency systems; |

| | ● | Changes in consumer demographics and public tastes and preferences; |

| | ● | Our ability to hire and retain employees or engage third-parties with experience in the cryptocurrency industry; |

| | ● | The maintenance and development of the open-source software protocol of the network; |

| | ● | The availability and popularity of other forms or methods of buying and selling goods and services, including new means of using fiat currencies; |

| | ● | General economic conditions and the regulatory environment relating to digital assets; and |

| | ● | Negative consumer sentiment and perception of bitcoin specifically and cryptocurrencies generally. |

If any of those events occur, it may have a material adverse effect on our ability to pursue this business segment, which would have a material adverse effect on our business, prospects or operations and potentially the value of any cryptocurrencies we hold or expect to acquire for our own account and harm investors in our securities.

Banks and financial institutions may not provide banking services, or may cut off services, to businesses that provide cryptocurrency-related services or that accept cryptocurrencies as payment, including financial institutions of investors in our securities.

A number of companies that provide bitcoin and/or other cryptocurrency-related services have been unable to find banks or financial institutions that are willing to provide them with bank accounts and other services. Similarly, a number of companies and individuals or businesses associated with cryptocurrencies have had and may continue to have their existing bank accounts closed or services discontinued with financial institutions. We also may be unable to obtain or maintain these services for our business. The difficulty that many businesses that provide bitcoin and/or other cryptocurrency-related services have and may continue to have in finding banks and financial institutions willing to provide them services may be decreasing the usefulness of cryptocurrencies as a payment system and harming public perception of cryptocurrencies and could decrease its usefulness and harm its public perception in the future. Similarly, the usefulness of cryptocurrencies as a payment system and the public perception of cryptocurrencies could be damaged if banks or financial institutions were to close the accounts of businesses providing bitcoin and/or other cryptocurrency-related services. This could occur as a result of compliance risk, cost, government regulation or public pressure. The risk applies to securities firms, clearance and settlement firms, national stock and commodities exchanges, the over the counter market and the Depository Trust Company, which, if any of such entities adopts or implements similar policies, rules or regulations, could result in the inability of our investors to open or maintain stock or commodities accounts, including the ability to deposit, maintain or trade our securities. Such factors would have a material adverse effect on our ability to continue as a going concern or to pursue this segment at all, which would have a material adverse effect on our business, prospects or operations and harm investors.

The impact of geopolitical events on the supply and demand for cryptocurrencies is uncertain.

Crises may motivate large-scale purchases of cryptocurrencies which could increase the price of cryptocurrencies rapidly. This may increase the likelihood of a subsequent price decrease as crisis-driven purchasing behavior wanes, adversely affecting the value of any cryptocurrencies we hold or expect to acquire for our own account. Such risks are similar to the risks of purchasing commodities in general uncertain times, such as the risk of purchasing, holding or selling gold.

As an alternative to gold or fiat currencies that are backed by central governments, cryptocurrencies, which are relatively new, are subject to supply and demand forces. How such supply and demand will be impacted by geopolitical events is uncertain but could be harmful to us and investors in our securities. Nevertheless, political or economic crises may motivate large-scale acquisitions or sales of cryptocurrencies either globally or locally. Such events would have a material adverse effect on our ability to continue as a going concern or to pursue this segment at all, which would have a material adverse effect on our business, prospects or operations and potentially the value of any cryptocurrencies we hold or expect to acquire for our own account.

Acceptance and/or widespread use of cryptocurrency is uncertain.

Currently, there is a relatively small use of bitcoins and/or other cryptocurrencies in the retail and commercial marketplace for goods or services. In comparison there is relatively large use by speculators, which contributes to price volatility.

The relative lack of acceptance of cryptocurrencies in the retail and commercial marketplace limits the ability of end-users to use them to pay for goods and services. Such lack of acceptance or decline in acceptances would have a material adverse effect on our ability to pursue this business segment at all, which would have a material adverse effect on our business, prospects or operations and potentially the value of any cryptocurrencies we hold or expect to acquire for our own account.

Transactional fees may decrease demand for bitcoin and prevent expansion.

As the number of Bitcoin awarded for solving a block in a blockchain decreases, the incentive for miners to continue to contribute to the bitcoin network will transition from a set reward to transaction fees. Either the requirement from miners of higher transaction fees in exchange for recording transactions in a blockchain or a software upgrade that automatically charges fees for all transactions may decrease demand for bitcoin and prevent the expansion of the bitcoin network to retail merchants and commercial businesses, resulting in a reduction in the price of bitcoin that could adversely impact an investment in our securities.

In order to incentivize miners to continue to contribute to the Bitcoin network, the Bitcoin network may either formally or informally transition from a set reward to transaction fees earned upon solving a block. This transition could be accomplished by miners independently electing to record in the blocks they solve only those transactions that include payment of a transaction fee. If transaction fees paid for bitcoin transactions become too high, the marketplace may be reluctant to accept bitcoin as a means of payment and existing users may be motivated to switch from bitcoin to another cryptocurrency or to fiat currency. Decreased use and demand for Bitcoin may adversely affect its value and result in a reduction in the price of bitcoin and the value of our securities.

Cryptocurrency inventory, including that maintained by or for us, may be exposed to cybersecurity threats and hacks.

As with any computer code generally, flaws in cryptocurrency codes may be exposed by malicious actors. Cryptocurrencies are held in software wallets, which may be subject to cyberattacks. Several errors and defects have been found previously, including those that disabled some functionality for users and exposed users’ information. Exploitations of flaws in the source code that allow malicious actors to take or create money have previously occurred. If a malicious actor or botnet (a volunteer or hacked collection of computers controlled by networked software coordinating the actions of the computers) obtains control of more than 50% of the processing power on a distributed ledger network, such actor or botnet could manipulate the network to adversely affect the associated cryptocurrency and its users. If a malicious actor or botnet obtains a majority of the processing power dedicated to mining a cryptocurrency, it may be able to alter the distributed ledger network on which transactions of cryptocurrency reside and rely by constructing fraudulent blocks or preventing certain transactions from completing in a timely manner, or at all.

Despite our efforts and processes to prevent breaches, our devices, as well as our servers, computer systems and those of third parties that we use in our operations, are vulnerable to cyber security risks, including cyber-attacks such as viruses and worms, phishing attacks, denial-of-service attacks, physical or electronic break-ins, employee theft or misuse, and similar disruptions from unauthorized tampering with our servers and computer systems or those of third parties that we use in our operations. Such events could have a material adverse effect on our ability to continue as a going concern or to pursue our new strategy at all, which could have a material adverse effect on our business, prospects or operations and potentially the value of any bitcoin or other cryptocurrencies we mine or otherwise acquire or hold for our own account.

It may be illegal now, or in the future, to acquire, own, hold, sell or use Bitcoin or other cryptocurrencies, participate in the blockchain or utilize similar digital assets in one or more countries, the ruling of which would adversely affect us.

Although currently Bitcoin and other cryptocurrencies, the blockchain and digital assets generally are not regulated or are lightly regulated in most countries, including the United States, one or more countries such as China and Russia may take regulatory actions in the future that could severely restrict the right to acquire, own, hold, sell or use these digital assets or to exchange for fiat currency. Such restrictions may adversely affect us. Such circumstances would have a material adverse effect on our ability to continue as a going concern or to pursue this segment at all, which would have a material adverse effect on our business, prospects or operations and potentially the value of any cryptocurrencies we hold or expect to acquire for our own account and harm investors.

If regulatory changes or interpretations require the regulation of bitcoins or other digital assets under the securities laws of the United States or elsewhere, including the Securities Act of 1933, the Securities Exchange Act of 1934 and the Investment Company Act of 1940 or similar laws of other jurisdictions and interpretations by the SEC, CFTC, IRS, Department of Treasury or other agencies or authorities, we may be required to register and comply with such regulations, including at a state or local level. To the extent that we decide to continue operations, the required registrations and regulatory compliance steps may result in extraordinary expense or burdens to us. We may also decide to cease certain operations. Any disruption of our operations in response to the changed regulatory circumstances may be at a time that is disadvantageous to us.

Current and future legislation and SEC and CFTC rulemaking and other regulatory developments, including interpretations released by a regulatory authority, may impact the manner in which bitcoin or other cryptocurrencies are viewed or treated for classification and clearing purposes. In particular, bitcoin and other cryptocurrencies may not be excluded from the definition of “security” by SEC rulemaking or interpretation requiring registration of all transactions, unless another exemption is available, including transacting in bitcoin or cryptocurrency amongst owners and require registration of trading platforms as “exchanges”. We cannot be certain as to how future regulatory developments will impact the treatment of bitcoin and other cryptocurrencies under the law. If we determine not to comply with such additional regulatory and registration requirements, we may seek to cease certain of our operations in this business segment or be subjected to fines, penalties and other governmental action. Any such action may adversely affect an investment in us. Such circumstances would have a material adverse effect on our ability to continue as a going concern or to pursue this segment at all, which would have a material adverse effect on our business, prospects or operations and potentially the value of any cryptocurrencies we hold or expect to acquire for our own account and harm investors.

Lack of liquid markets, and possible manipulation of blockchain/cryptocurrency-based assets may adversely affect us.

Digital assets that are represented and trade on a ledger-based platform may not necessarily benefit from viable trading markets. Stock exchanges have listing requirements and vet issuers, requiring them to be subjected to rigorous listing standards and rules and monitoring investors transacting on such platform for fraud and other improprieties. These conditions may not necessarily be replicated on a distributed ledger platform, depending on the platform’s controls and other policies. The more lax a distributed ledger platform is about vetting issuers of digital assets or users that transact on the platform, the higher the potential risk for fraud or the manipulation of digital assets. These factors may decrease liquidity or volume, or increase volatility of digital securities or other assets trading on a ledger-based system. Such circumstances may have a material adverse effect on our ability to continue as a going concern or to pursue this segment at all, which would have a material adverse effect on our business, prospects or operations and potentially the value of any cryptocurrencies we hold or expect to acquire for our own account and harm investors.

If federal or state legislatures or agencies initiate or release tax determinations that change the classification of bitcoins as property for tax purposes (in the context of when such bitcoins are held as an investment), such determination could have a negative tax consequence on our Company or our shareholders.

Current IRS guidance indicates that digital assets such as Bitcoin should be treated and taxed as property, and that transactions involving the payment of Bitcoin for goods and services should be treated as barter transactions. While such treatment would create a potential tax reporting requirement for any circumstance where the ownership of bitcoin passes from one person to another, usually by means of bitcoin transactions (including off-blockchain transactions), it preserves the right to apply capital gains treatment to those transactions. Any change to such tax treatment may adversely affect an investment in our Company.

Our dependence on third-party software and personnel may leave us vulnerable to price fluctuations and rapidly changing technology.

Competitive conditions within the cryptocurrency industry require that we use sophisticated technology in the operation of our future cryptocurrency mining business segment. We plan to utilize third-party software applications in our mining operations. Further, we that some of our operations may be conducted through collaboration with software providers. The industry for blockchain technology is characterized by rapid technological changes, new product introductions, enhancements and evolving industry standards. New technologies, techniques or products could emerge that might offer better performance than the software and other technologies we plan to utilize, and we may have to manage transitions to these new technologies to remain competitive. We may not be successful, generally or relative to our competitors in the cryptocurrency industry, in timely implementing new technology into our systems, or doing so in a cost-effective manner. During the course of implementing any such new technology into our operations, we may experience the system interruptions and failures discussed above. Furthermore, there can be no assurances that we will recognize, in a timely manner or at all, the benefits that we may expect as a result of our implementing new technology into our operations.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus supplement, the accompanying prospectus and the information incorporated by reference herein and therein, contain and incorporate “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act. These statements include statements made regarding our commercialization strategy, future operations, cash requirements and liquidity, capital requirements, and other statements on our business plans and strategy, financial position, and market trends.

This prospectus supplement contains “forward-looking statements” within the meaning of the federal securities laws, and that involve significant risks and uncertainties. Words such as “may,” “should,” “could,” “would,” “predicts,” “potential,” “continue,” “expects,” “anticipates,” “future,” “intends,” “plans,” “believes,” “estimates,” and similar expressions, as well as statements in future tense, identify forward-looking statements. Forward-looking statements should not be read as a guarantee of future performance or results and may not be accurate indications of when such performance or results will be achieved. Forward-looking statements are based on information we have when those statements are made or management’s good faith belief as of that time with respect to future events, and are subject to significant risks and uncertainties that could cause actual performance or results to differ materially from those expressed in or suggested by the forward-looking statements. Forward-looking statements are subject to a number of risks, uncertainties and assumptions in other documents we file from time to time with the SEC, specifically our most recent Annual Report on Form 10-K, our Quarterly Reports on Form 10-Q and our Current Reports on Form 8-K.

Important factors that could cause such differences include, but are not limited to:

| | ● | We operate in a regulatory environment that is evolving and uncertain and any changes to regulations could have a material impact on our business and financial condition; |

| | ● | We are entering into new lines of business within the cryptocurrency transactional and mining marketplaces which involve emerging technologies, lack of regulations and oversight and a dynamic marketplace with extreme volatility that may have a material impact on the our success of the new lines of business; |

| | ● | We rely on a combination of confidentiality clauses, assignment agreements and license agreements with employees and third parties, trade secrets, copyrights and trademarks to protect our intellectual property and competitive advantage, all of which offer only limited protection meaning that we may be unable to maintain and protect our intellectual property rights and proprietary information or prevent third-parties from making unauthorized use of our technology; |

| | ● | Our growth may not be sustainable and depends on our ability to attract new merchants, retain existing merchants and increase sales to both new and existing merchants; and |

| | ● | we may require additional capital to continue our operations which may not be available, or if available, may not be available on reasonable terms. |

The foregoing does not represent an exhaustive list of matters that may be covered by the forward-looking statements contained herein or risk factors that we are faced with. Forward-looking statements necessarily involve risks and uncertainties, and our actual results could differ materially from those anticipated in the forward-looking statements due to a number of factors, including those set forth above under “Risk Factors” and elsewhere in this prospectus supplement. The factors set forth under “Risk Factors” and other cautionary statements made in this prospectus supplement should be read and understood as being applicable to all related forward-looking statements wherever they appear in this prospectus. The forward-looking statements contained in this prospectus represent our judgment as of the date of this prospectus supplement. We caution readers not to place undue reliance on such statements. Except as required by law, we undertake no obligation to update publicly any forward-looking statements for any reason, even if new information becomes available or other events occur in the future. All subsequent written and oral forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the cautionary statements contained above and throughout this prospectus supplement.

USE OF PROCEEDS

We estimate that the net proceeds from this offering, after deducting placement agent’s fees and commissions and estimated offering expenses payable by us will be approximately $5,449,802 (excluding the proceeds we may receive from the exercise of the Purchase Warrants or placement agent warrants).

We intend to use the net proceeds from this offering for purchasing cryptocurrency mining computers, to invest in or acquire companies or technologies that are synergistic with or complimentary to our business, working capital and general corporate purposes. We cannot predict with certainty all of the particular uses for the net proceeds to be received upon the completion of this offering. Accordingly, our management will have broad discretion and flexibility in applying the net proceeds from the sale of securities sold pursuant to this prospectus supplement. Pending the uses described above, we intend to invest the net proceeds from this offering in a variety of capital preservation investments, including short-term, investment-grade and interest-bearing instruments.

DIVIDEND POLICY

We have never declared or paid cash dividends. We do not intend to pay cash dividends on our common stock for the foreseeable future, but currently intend to retain any future earnings to fund the development and growth of our business. The payment of cash dividends, if any, on our common stock, will rest solely within the discretion of our board of directors and will depend, among other things, upon our earnings, capital requirements, financial condition, and other relevant factors.

CAPITALIZATION

The following table sets forth our cash and cash equivalents, as well as our capitalization, as of June 30, 2021 as follows:

| ● | on an as adjusted basis to reflect the issuance and sale in this offering of 1,418,605 shares of common stock at a public offering price of $4.30 per share of common stock, after deducting placement agent fees and estimated offering expenses payable by us. |

You should read this information together with our consolidated financial statements and related notes incorporated by reference in this prospectus supplement and the accompanying prospectus.

| | | As of June 30,

2021 | |

| | | (Unaudited) | |

| | | Actual | | | As Adjusted | |

| | | (in thousands, except | |

| | | share amounts) | |

| Cash and cash equivalents | | $ | 2,051,057 | | | | 18,367,348 | |

| Stockholders’ equity | | | | | | | | |

| Common stock, $0.0001 par value—200,000,000 shares authorized; 7,273,877 shares issued and outstanding, actual; 8,692,482 shares issued and outstanding as adjusted | | | 727 | | | | 2,146 | |

| Series A Preferred stock, $0.01 par value 10,000 shares authorized, 4,633 shares issued and outstanding, actual and as adjusted | | | 46 | | | | 46 | |

| Additional paid-in capital | | | 33,694,458 | | | | 39,793,041 | |

| Accumulated deficit | | | (22,394,599 | ) | | | (23,044,799 | ) |

| Total stockholders' equity | | | 11,300,632 | | | | 17,400,634 | |

| Total capitalization | | $ | 11,300,632 | | | | 17,400,634 | |

The information above is based on 7,273,877 shares of our common stock outstanding as of June 30, 2021, and excludes:

| ● | 2,333,938 shares of common stock issuable upon the exercise of warrants outstanding as of June 30, 2021 at a weighted average exercise price of $6.75 per share; |

| ● | 132,737 shares of common stock issuable upon the exercise of options at a weighted average exercise price of $0.03 per share pursuant to our stock incentive plans, which we refer to collectively as the Incentive Plans; and |

| ● | 230,000 shares of common stock available for future awards under the Incentive Plans. |

DILUTION

If you purchase our common stock in this offering, you will experience dilution to the extent of the difference between the amount per share paid by purchasers of shares of common stock in this offering and our as adjusted net tangible book value per share immediately after this offering. Net tangible book value (deficit) per share is equal to the amount of our total tangible assets, less total liabilities (other than deferred tax liabilities), divided by the number of outstanding shares of our common stock. As of June 30, 2021, our net tangible book value was $11.3 million, or approximately $1.55 per share.

After giving effect to the sale of 1,418,605 shares of our common stock at the offering price of $4.30 per share and after deducting placement agent fees and estimated offering expenses payable by us, our net tangible book value as of June 30, 2021 would have been approximately $17.4 million, or approximately $2.00 per share of common stock. This represents an immediate increase in the net tangible book value of approximately $0.45 per share to existing stockholders and an immediate dilution in net tangible book value of approximately $2.30 per share to new investors purchasing shares of common stock in this offering. The following table illustrates this per share dilution:

| Public offering price per share | | | | | $ | 4.30 |

| Net tangible book value per share as of June 30, 2021 | | $ | 1.55 | | | |

| Increase in net tangible book value per share after giving effect to this offering | | $ | 0.45 | | | |

| As adjusted net tangible book value per share after giving effect to this offering | | $ | 2.00 | | | |

| Dilution per share to new investors in the offering | | | | | $ | 2.30 |

The information above is based on 7,273,877 shares of our common stock outstanding as of June 30, 2021, and excludes:

| ● | 2,333,938 shares of common stock issuable upon the exercise of warrants outstanding as of June 30, 2021 at a weighted average exercise price of $6.75 per share; |

| ● | 132,737 shares of common stock issuable upon the exercise of options at a weighted average exercise price of $0.03 per share pursuant to our stock incentive plans, which we refer to collectively as the Incentive Plans; and |

| ● | 230,000 shares of common stock available for future awards under the Incentive Plans. |

DESCRIPTION OF SECURITIES WE ARE OFFERING

Common Stock

Our certificate of incorporation authorizes the issuance of up to 200,000,000 shares of common stock, par value $0.0001 per share, and 50,000,000 shares of preferred stock, par value $0.01 per share. As of the date of this prospectus supplement, we have 7,273,877 shares of common stock issued and outstanding, and 4,633 shares of preferred stock issued and outstanding.

Holders of our common stock are entitled to one vote for each share held on all matters submitted to a vote of stockholders and do not have cumulative voting rights. An election of directors by our stockholders is determined by a plurality of the votes cast by the stockholders entitled to vote on the election. Subject to the supermajority votes for some matters, other matters are decided by the affirmative vote of our stockholders having a majority in voting power of the votes cast by the stockholders present or represented and voting on such matter. Our amended and restated bylaws also provide that our directors may be removed with or without cause by the affirmative vote of a majority of the votes that all our stockholders would be entitled to cast in any annual election of directors. In addition, the affirmative vote of the holders of at least sixty-six and two-thirds percent (66 2/3%) of the votes that all of our stockholders would be entitled to cast in any annual election of directors is required to amend or repeal or to adopt any provisions inconsistent with any of the provisions of our amended and restated bylaws; provided, however, that no such change to any bylaw may alter, modify, waive, abrogate or diminish the our obligation to provide the indemnity called for by Article 10 thereunder. Holders of common stock are entitled to receive proportionately any dividends as may be declared by our board of directors, subject to any preferential dividend rights of outstanding preferred stock.

In the event of our liquidation or dissolution, the holders of common stock are entitled to receive proportionately all assets available for distribution to stockholders after the payment of all debts and other liabilities and subject to the prior rights of any outstanding preferred stock. Holders of common stock have no preemptive, subscription, redemption or conversion rights. The rights, preferences and privileges of holders of common stock are subject to and may be adversely affected by the rights of the holders of shares of any series of preferred stock that we may designate and issue in the future.

The foregoing description summarizes important terms of our capital stock, but is not complete. For the complete terms of our common stock, please refer to our certificate of incorporation, as amended, and our amended and restated bylaws, as may be amended from time to time.

The transfer agent and registrar for our common stock is Transfer Online, Inc. Our common stock is listed on the Nasdaq Capital Market under the symbol “OLB.”

PRIVATE PLACEMENT TRANSACTION

In a concurrent private placement, or the Private Placement Transaction, we are selling to purchasers of our common stock in this offering the Purchase Warrants to purchase an aggregate of 1,418,605 shares of our common stock.

The Purchase Warrants and the shares of our common stock issuable upon the exercise of the Purchase Warrants are not being registered under the Securities Act, are not being offered pursuant to this prospectus supplement and the accompanying prospectus and are being offered pursuant to the exemption provided in Section 4(a)(2) under the Securities Act and Rule 506(b) promulgated thereunder. Accordingly, purchasers may only sell shares of common stock issued upon exercise of the Purchase Warrants pursuant to an effective registration statement under the Securities Act covering the resale of those shares, an exemption under Rule 144 under the Securities Act, if available, or another applicable exemption under the Securities Act.

Exercisability. The Purchase Warrants are exercisable on the date that is six months after the date on which the Purchaser Warrants initially become exercisable, and at any time thereafter up to five years from the date of issuance, at which time any unexercised Purchase Warrants will expire and cease to be exercisable. The Purchase Warrants will be exercisable, at the option of each holder, in whole or in part by delivering to us a duly executed exercise notice and, at any time a registration statement registering the issuance of the shares of common stock underlying the Purchase Warrants under the Securities Act is effective and available for the issuance of such shares, or an exemption from registration under the Securities Act is available for the issuance of such shares, by payment in full in immediately available funds for the number of shares of common stock purchased upon such exercise. If a registration statement registering the issuance of the shares of common stock underlying the Purchase Warrants under the Securities Act is not effective or available and an exemption from registration under the Securities Act is not available for the issuance of such shares, the holder may, in its sole discretion, elect to exercise the Purchase Warrant through a cashless exercise, in which case the holder would receive upon such exercise the net number of shares of common stock determined according to the formula set forth in the Purchase Warrant. No fractional shares of common stock will be issued in connection with the exercise of a Purchase Warrant. In lieu of fractional shares, we will pay the holder an amount in cash equal to the fractional amount multiplied by the exercise price.

Exercise Limitation. A holder will not have the right to exercise any portion of the warrant if the holder (together with its affiliates) would beneficially own in excess of 4.99% (or, upon election of the holder, 9.99%) of the number of shares of our common stock outstanding immediately after giving effect to the exercise, as such percentage ownership is determined in accordance with the terms of the Purchase Warrants. However, any holder may increase or decrease such percentage, provided that any increase will not be effective until the 61st day after such election.

Exercise Price. The Purchase Warrants will have an exercise price of $5.42 per share. The exercise price is subject to appropriate adjustment in the event of certain stock dividends and distributions, stock splits, stock combinations, reclassifications or similar events affecting our common stock and also upon any distributions of assets, including cash, stock or other property to our stockholders.

Transferability. Subject to applicable laws, the Purchase Warrants may be offered for sale, sold, transferred or assigned without our consent.

Exchange Listing. There is no established trading market for the Purchase Warrants and we do not expect such a market to develop. In addition, we do not intend to apply for the listing of the Purchase Warrants on any national securities exchange or other trading market. Without an active trading market, the liquidity of the Purchase Warrants will be limited.

Fundamental Transactions. If a fundamental transaction occurs, then the successor entity will succeed to, and be substituted for us, and may exercise every right and power that we may exercise and will assume all of our obligations under the Purchase Warrants with the same effect as if such successor entity had been named in the Purchase Warrant itself. If holders of our common stock are given a choice as to the securities, cash or property to be received in a fundamental transaction, then the holder shall be given the same choice as to the consideration it receives upon any exercise of the Purchase Warrant following such fundamental transaction. Notwithstanding anything to the contrary, in the event of a fundamental transaction, the holder will have the right to require us or a successor entity to repurchase its warrants at the Black Scholes value; provided, however, that if the Fundamental Transaction is not within the Company’s control, including not approved by the Company’s Board of Directors, then the holder shall only be entitled to receive the same type or form of consideration (and in the same proportion), at the Black Scholes value of the unexercised portion of its warrants, that is being offered and paid to the holders of our common stock in connection with the fundamental transaction.

Rights as a Stockholder. Except as otherwise provided in the Purchase Warrants or by virtue of such holder’s ownership of shares of our common stock, the holder of a Purchase Warrant does not have the rights or privileges of a holder of our common stock, including any voting rights, until the holder exercises the Purchase Warrant.

PLAN OF DISTRIBUTION

We engaged H.C. Wainwright & Co., LLC to act as our exclusive placement agent to solicit offers to purchase the shares of our common stock offered by this prospectus supplement and the accompanying base prospectus. Wainwright is not purchasing or selling any such shares, nor is it required to arrange for the purchase and sale of any specific number or dollar amount of such shares, other than to use its “reasonable best efforts” to arrange for the sale of such shares by us. Therefore, we may not sell all of the shares of our common stock being offered. The terms of this offering were subject to market conditions and negotiations between us, Wainwright and prospective investors. Wainwright will have no authority to bind us. We have entered into securities purchase agreements directly with certain institutional and accredited investors who have agreed to purchase shares of our common stock in this offering. We will only sell to investors who have entered into securities purchase agreement.

Delivery of the shares of common stock offered hereby is expected to take place on or about August 23, 2021, subject to satisfaction of certain customary closing conditions.

We have agreed to pay the placement agent (i) a total cash fee equal to 7.5% of the aggregate gross proceeds of this offering, (ii) accountable expense allowance of $100,000, and (iii) $15,950 for the clearing expenses of the placement agent in connection with this offering.

We estimate the total expenses of this offering paid or payable by us will be approximately $76,750. After deducting the fees due to the placement agent and our estimated expenses in connection with this offering, we expect the net proceeds from this offering will be approximately $5,449,802.

Placement Agent Warrants

In addition, we have agreed to issue to the placement agent or its designees as compensation warrants (the “Placement Agent Warrants”) to purchase up to 106,395 shares of common stock (representing 7.5% of the aggregate number of shares of common stock sold in this offering), at an exercise price of $5.375 per share (representing 125% of the offering price for a share of common stock to be sold in this offering). The Placement Agent Warrants will be exercisable immediately and will expire five years from the commencement of sales under this offering.

Tail Financing Payments

In the event that any investors that were contacted by the placement agent or were introduced to us by the placement agent during the term of our engagement agreement with the placement agent provide any capital to us in a public or private offering or capital-raising transaction within 12 months following the expiration or termination of the engagement of the placement agent, we shall pay the placement agent the cash and warrant compensation provided above on the gross proceeds from such investors.

Indemnification