Page

| Summary of Prospectus/Proxy Statement | 2 |

| Proposed Reorganization | 21 |

| Voting and Meeting Procedures | 28 |

| General Information | 30 |

| Financial Highlights and Financial Statements | 30 |

| Information Filed with the Securities and Exchange Commission | 30 |

| Appendix A – Sub-Advisory Agreements | A-1 |

| Appendix B -Agreement and Plan of Reorganization | B-1 |

SUMMARY OF PROSPECTUS/PROXY STATEMENT

Investment Managers Series Trust (the “Trust”) is an open-end management investment company (referred to generally as a “mutual fund”). The Trust’s offices are located at 235 West Galena Street, Milwaukee, Wisconsin 53212. The Trust’s phone number is 1-888-558-5851.

The Board of Trustees of the Trust (the “Board”) has called the Meeting to allow shareholders of the EP Emerging Markets Small Companies Fund, EP China Fund and EP Latin America Fund, each a series of the Trust to consider and vote on the following proposals, as applicable.

Appointment of Champlain Investment Partners as Sub-adviser

The EP Emerging Markets Small Companies Fund, EP China Fund and EP Latin America Fund series of the Trust began operation on December 1, 2010, July 31, 2009, and October 31, 2011, respectively. Euro Pacific Asset Management, LLC (“EPAM”), located at 53 Palmeras Street, Suite 801, Puerta de Tierra Ward, San Juan, Puerto Rico 00902, serves as each Fund’s investment advisor. Subject to the general supervision of the Board of Trustees of the Trust, EPAM is responsible for managing each Fund in accordance with the Fund’s investment objective and policies described in the Fund’s current Prospectus. As each Fund’s investment advisor, EPAM has the ability to delegate day-to-day portfolio management responsibilities to one or more sub-advisors, and in that connection is responsible for making recommendations to the Board of Trustees with respect to hiring, termination and replacement of any sub-advisor of the Fund.

New Sheridan Advisors, LLC (“New Sheridan”) served as the sub-advisor to each Fund from the inception of the Fund until June 30, 2015. In April 2015, New Sheridan informed management of the Trust that New Sheridan would be entering into an agreement to be acquired by Champlain Investment Partners (“Champlain”) (such acquisition, the “Transaction”), which was expected to close on June 30, 2015. The Transaction would result in an assignment and termination of New Sheridan’s then-existing sub-advisory agreement with respect to the Funds.

In anticipation of the Transaction and these related events, at an in-person meeting held on June 18-19, 2015, upon the recommendation of EPAM and after careful consideration, the Board of Trustees of the Trust, including those trustees who are not “interested persons” of the Trust (the “Independent Trustees”) as that term is defined in the Investment Company Act of 1940, as amended (the “1940 Act”), unanimously approved the appointment of Champlain to serve as sub-advisor to each Fund pursuant to a new sub-advisory agreement between EPAM and Champlain with respect to each Fund (the “New Agreement”). The terms of the New Agreement are substantially similar to the terms of the prior sub-advisory agreement between EPAM and New Sheridan with respect to each Fund.

The 1940 Act requires a new investment advisory agreement for a registered investment company to be approved by a majority vote of the outstanding voting securities of that investment company. Rule 15a-4 under the 1940 Act provides a temporary exemption from the shareholder approval requirement for an interim period of up to 150 days after termination of an advisory contract provided the advisory compensation paid during the interim period is no greater than the compensation paid under the previous advisory agreement, and provided the investment company’s board of trustees, including a majority of the independent trustees, has approved the interim investment advisory agreement. Pursuant to Rule 15a-4, the Board of Trustees has appointed Champlain to serve as the interim sub-advisor to each Fund and is seeking approval of the New Agreement by the shareholders of the Fund.

In addition to approving the New Agreement, the Board also approved an interim sub-advisory agreement between EPAM and Champlain that would be effective with respect to each Fund for the period after the closing of the Transaction and before the New Agreement is approved by the Fund’s shareholders (the “Interim Agreement”). The Interim Agreement is substantially similar to the previous agreement with New Sheridan and the New Agreement except that (i) the Interim Agreement may be terminated by a Fund with respect to that Fund with ten days’ notice, (ii) the Interim Agreement has a limited term of 150 days with respect to each Fund (or until such earlier date when the New Agreement becomes effective with respect to the Fund), and (iii) compensation earned under the Interim Agreement with respect to a Fund will be held in escrow until shareholders of the Fund approve the New Agreement.

The Transaction closed on June 30, 2015, and Champlain is now serving as the sub-advisor to each Fund pursuant to the Interim Agreement. EPAM is continuing as the investment advisor for each Fund. The former portfolio managers of each Fund have continued to serve as the portfolio managers of the Fund as employees of Champlain. As EPAM compensates Champlain for serving as sub-advisor to each Fund out of EPAM’s advisory fees, the appointment of Champlain as a Fund’s sub-advisor has no effect on the overall fees and expenses of the Fund. Champlain’s sub-advisory fee rate is the same as New Sheridan’s sub-advisory fee rate under the previous sub-advisory agreement.

Proposed Reorganization

At its June 2015 meeting, the Board (including the Independent Trustees) considered and unanimously approved the proposed reorganization of each of the EP China Fund and the EP Latin America Fund (each a “Target Fund” and together the “Target Funds”) into the EP Emerging Markets Small Companies Fund (the “Reorganization”), subject in each case to the approval of the shareholders of the Target Fund.

The proposed Reorganization involves the transfer of substantially all of the assets of each Target Fund to the EP Emerging Markets Small Companies Fund in exchange for shares of the EP Emerging Markets Small Companies Fund and the assumption by it of all liabilities of that Target Fund. The transfer of assets by each Target Fund will occur at its then current market value, and shares of the EP Emerging Markets Small Companies Fund to be issued to each Target Fund will be valued at the EP Emerging Markets Small Companies Fund’s then current net asset value, as determined in accordance with the Trust’s valuation procedures. Following this transfer and issuance, shares of the EP Emerging Markets Small Companies Fund will be distributed to shareholders of each Target Fund and each Target Fund will be dissolved.

The EP Emerging Markets Small Companies Fund and the EP Latin America Fund have two classes of shares -- Class A and Class I. The EP China Fund has one class of shares -- Class A. In the Reorganization, each holder of shares of a class of a Target Fund will receive full and fractional shares of the EP Emerging Markets Small Companies Fund of the same class and equal in aggregate value at the time of the exchange to the aggregate value of such shareholder’s shares of that class of the Target Fund. The transfer of shares of a Target Fund in exchange for (a) shares of the EP Emerging Markets Small Companies Fund and (b) the EP Emerging Markets Small Companies Fund’s assumption of all liabilities of that Target Fund, and the distribution of the shares of the EP Emerging Markets Small Companies Fund to the shareholders of that Target Fund in redemption of the Target Fund shares in the Reorganization will collectively be referred to herein as a “Combination Transaction.” The Reorganization is conditioned on the receipt by the Funds of an opinion from Morgan, Lewis & Bockius LLP substantially to the effect that each Combination Transaction will constitute a “reorganization” within the meaning of Section 368(a) of the Internal Revenue Code of 1986, as amended (the “Code”). Assuming that the Combination Transaction so qualifies, the applicable Target Fund, the shareholders of that Target Fund, and the EP Emerging Markets Small Companies Fund generally will recognize no gain or loss for federal income tax purposes as a result of that Combination Transaction.

EPAM serves as the investment advisor for, and has identical responsibilities with respect to, each Fund. Each Fund other than the EP Latin America Fund is a diversified fund, which means that it is limited as to amounts of issuers it may own with respect to 75% of its assets. Each Fund is required to comply with diversification restrictions under the Code. As described under Proposal 1, EPAM has engaged Champlain to serve as sub-advisor with respect to each Fund.

The Funds have identical investment objectives and similar but not identical strategies. The investment objective of each Fund is to seek long term capital appreciation.

The Board believes that the proposed Reorganization is in the best interests of each Fund and its shareholders for the reasons listed below:

| · | EPAM expects that shareholders of each Fund will pay lower gross total operating expenses after the Reorganization is completed. In addition, shareholders of each Fund will pay the same net total operating expenses after the Reorganization is completed, at least until March 1, 2018, which is the end of the term of the Funds’ current Operating Expenses Limitation Agreement. |

| · | EPAM believes that the combined EP Emerging Markets Small Companies Fund will be better positioned for growth and potential economies of scale than either Target Fund is prior to the Reorganization. |

| · | The Reorganization will provide shareholders of each Target Fund with the opportunity to continue to utilize the services of EPAM and Champlain as investment advisor and sub-advisor, respectively, of their investment portfolios on an uninterrupted basis. |

| · | The investment objective of each Target Fund is the same as the investment objective of the EP Emerging Markets Small Companies Fund. Although the EP Emerging Markets Small Companies Fund invests primarily in equity securities of small capitalization companies, the strategies for the EP Emerging Markets Small Companies Fund will be the same strategies implemented for each Target Fund but will include additional markets in Eastern Europe, Africa and the Middle East. |

| · | EPAM, rather than the shareholders of the Funds, will bear the costs of the Reorganization other than transaction costs associated with the sale of each Target Fund’s investment portfolio, including legal, accounting and transfer agent costs. |

PROPOSAL 1: APPROVAL OF NEW SUB-ADVISORY AGREEMENT

On June 19, 2015, the Board of Trustees approved the New Agreement and appointed Champlain as sub-advisor to each Fund. None of the Trustees is an “interested person” of Champlain, as that term is defined in the 1940 Act. Copies of the New Agreement and the Interim Agreement are included as Appendix A to this Proxy Statement, and all references to the New Agreement and the Interim Agreement are qualified by reference to Appendix A.

The effective date of the previous sub-advisory agreement between EPAM and New Sheridan with respect to each Fund, and the date the agreement was approved by the Fund’s shareholders are set forth in the following table. The sub-advisory agreement for the EP China Fund was approved by shareholder vote at a meeting held on March 14, 2011. For each of the EP Latin America Fund and EP Emerging Markets Small Companies Fund, the sub-advisory agreement was submitted to the Fund’s initial shareholder(s) for approval of the agreement in connection with the Fund’s launch.

| Fund | Effective date of agreement | Date approved by shareholders |

| EP China Fund | March 14, 2011 | March 14, 2011 |

| EP Latin America Fund | November 11, 2011 | November 11, 2011 |

| EP Emerging Markets Small Companies Fund | December 10, 2010 | December 10, 2010 |

Consideration of New Agreement

The Board met on June 18-19, 2015, to consider the terms of the New Agreement and the Interim Agreement. At that meeting, the Board reviewed information regarding Champlain and the acquisition of New Sheridan by Champlain, including information about Champlain’s organization and financial condition; information regarding the background and experience of its personnel who would be providing services to each Fund; reports regarding the investment advisory fees and total expenses of the EP Emerging Markets Small Companies Fund compared with those of a group of comparable funds selected by Morningstar, Inc. (the “Expense Peer Group”) from its Diversified Emerging Markets fund category (the “Expense Universe”); and information about Champlain’s policies and procedures, including its compliance manual and brokerage and trading procedures. The Board also reviewed information about the performance of each Fund for various periods ended March 31, 2015.

The Board considered information included in the meeting materials regarding the performance of each Fund. The Board noted that the materials it reviewed indicated as follows:

| · | Although the EP Asia Small Companies Fund (as the Fund was known at that time) had underperformed relative to the MSCI AC Asia E-Japan Small Cap Index for the one- and two-year periods (by 7.44% and 6.60%, respectively), the Fund’s returns for the three-year and since inception periods were significantly higher than the returns of the Index. |

| · | The returns of the EP China Fund were below the returns of the MSCI China Index for the one-year period (by 17.49%), the two-year period (by 4.36%), the three-year period (by 1.12%) and the five-year period (by 1.97%). |

| · | The returns of the EP Latin America Fund for the one-, two- and three-year periods were higher than the returns of the MSCI EM Latin America Index. |

In reviewing the performance results of the Funds, the Board also considered that it was considering the proposed reorganization of the EP China Fund and the EP Latin America Fund into the EP Asia Small Companies Fund (which would be renamed the EP Emerging Markets Small Companies Fund), and that if the shareholders of the EP China Fund and the EP Latin America Fund approved the reorganization, the renamed EP Asia Small Companies Fund would survive the reorganization and the EP China Fund and the EP Latin America Fund would be liquidated. The Board also considered that it was approving a change in the investment strategies of the EP Asia Small Companies Fund to include investments in emerging markets generally; that beginning in September 2014, New Sheridan served as investment advisor to another mutual fund that invested in emerging market securities; and that such other fund had outperformed its benchmark for the period since inception.

The Board also considered the overall quality of services that would be provided by Champlain, including the Funds’ current portfolio managers, to each Fund. In doing so, the Board considered Champlain’s specific responsibilities in day-to-day management and oversight of each Fund, as well as the qualifications, experience and responsibilities of the personnel who would be involved in the activities of the Fund. The Board also considered the overall quality of Champlain’s organization and operations, and its compliance structure and compliance procedures. Based on its review, the Board concluded that Champlain would have the capabilities, resources and personnel necessary to manage each Fund.

The Board also considered information included in the meeting materials regarding the investment advisory fees and total expenses of the EP Emerging Markets Small Companies Fund. With respect to the advisory fees paid by the Fund, the Board noted that the meeting materials indicated that the investment advisory fees (gross of fee waivers) were below the median of the Fund’s Expense Peer Group and higher than the median of the Expense Universe by 0.08%. In considering the total expenses paid by the Fund, the Board observed that the total expenses (net of fee waivers) were the same as the median expenses for the Expense Peer Group but higher than the median expenses for the Expense Universe by 0.25%. The Board noted, however, that as of May 31, 2015, the Fund’s asset size was significantly smaller than the average net assets of the funds in the Expense Universe.

The Board also considered the proposed sub-advisory fee to be charged by Champlain with respect to each Fund, noting that in each case the sub-advisory fee was the same as the sub-advisory fee previously paid to New Sheridan as sub-advisor. The Board also observed that New Sheridan currently served as advisor to another mutual fund, that Champlain expected to be appointed as advisor to that fund effective upon the closing of the Transaction, and that the advisory fee charged by New Sheridan to manage that fund’s assets was higher than the sub-advisory fee charged by New Sheridan with respect to the Funds. The Board also noted that the advisory fees charged by Champlain to serve as investment advisor to several other mutual funds and Champlain’s standard fee to manage separate accounts were higher than Champlain’s proposed sub-advisory fee with respect to the Funds. Based on its review, including its consideration of the fact that Champlain’s compensation under the proposed New Agreement and Interim Agreement is the same as the compensation of New Sheridan under the previous sub-advisory agreement, the Board concluded that in light of the services to be provided by Champlain to each Fund the compensation to be paid to it under the New Agreement and Interim Agreement is fair and reasonable.

The Board also considered the potential benefits to be received by Champlain as a result of Champlain’s relationship with the Funds (in addition to sub-advisory fees), including any research provided by broker-dealers executing transactions on behalf of the Funds and the intangible benefits of its association with the Funds generally and any favorable publicity arising in connection with the Funds’ performance. They noted that although there were no advisory or sub-advisory fee breakpoints, the asset level of the Funds were not currently likely to lead to significant economies of scale, and that any such economies would be considered in the future, as the Funds’ assets grow.

Conclusion

Based on its review, the Board concluded that approval of the New Agreement and Interim Agreement is in the best interest of each Fund and its shareholders.

Information Regarding Champlain Investment Partners

Champlain Investment Partners, LLC is located at 180 Battery Street, Suite 400 Burlington, Vermont 05401. Champlain is an investment advisor registered with the U.S. Securities and Exchange Commission (the “SEC”). Champlain is indirectly owned by Judith O’Connell, its Managing Partner and Chief Executive Officer, and Scott Brayman, its Managing Partner and Chief Investment Officer. As of March 31, 2015, Champlain had approximately $6.2 billion under management.

The names and principal occupations of each principal executive officer and director of Champlain, all located at 180 Battery Street, Suite 400 Burlington, Vermont 05401, are listed below:

| Name | Principal Occupation/Title | Position(s) with the Fund

(if any) |

| Judith O’Connell | Chief Executive Officer and Managing Partner | None |

| Scott Brayman | Managing Partner | None |

| Wendy Nunez | Chief Operating Officer, Chief Compliance Officer, and Partner | None |

The following information was provided by Champlain regarding the other mutual funds for which it serves as investment advisor or sub-advisor and which have investment objectives similar to those of each Fund.

| Fund (Advised or Sub-Advised) | Fee Rate (Including Fee Waivers

or Expense Reductions) | Total Fund Assets / Net

Assets Sub-Advised by

Champlain

(as of 6/30/2015) |

| New Sheridan Developing World Fund | 1.60% | $2.6 million |

Terms of the New Agreement

The terms of the New Agreement between Champlain and EPAM with respect to each Fund are substantially the same as the terms of the previous sub-advisory agreement between New Sheridan and EPAM with respect to that Fund.

If approved by the shareholders of a Fund, the New Agreement would continue in force with respect to the Fund for a term of two years following its effective date, unless sooner terminated as provided in the New Agreement. The New Agreement would continue in force from year to year thereafter with respect to the Fund so long as it is specifically approved at least annually in the manner required by the 1940 Act.

The New Agreement would automatically terminate with respect to a Fund in the event of its assignment (as defined in the 1940 Act). The New Agreement may be terminated with respect to a Fund at any time without payment of any penalty by the Board of Trustees of the Trust or by the vote of a majority of the outstanding voting shares of the Fund, or by Champlain or EPAM, upon 60 days’ written notice to the other party. The agreement will automatically terminate with respect to a Fund if the advisory agreement between EPAM and the Trust with respect to the Fund is terminated.

Under each of the New Agreement and New Sheridan’s previous sub-advisory agreement, each Fund’s sub-advisor is entitled to fees at an annual rate of 0.54% of the Fund’s average daily net assets. All sub-advisory fees are paid by EPAM and not the Funds. Because EPAM pays the sub-advisor out of EPAM’s own fees received from a Fund, there is no “duplication” of advisory fees paid. EPAM receives an annual fee of 1.08% of each Fund’s average daily net assets. There will be no increase in advisory fees to any Fund and its shareholders in connection with the appointment of Champlain as sub-advisor to the Fund. For the fiscal year ended October 31, 2014, the sub-advisory fees received by New Sheridan with respect to each Fund are set forth in the following table:

| Fund | Sub-Advisory Fees |

| EP Asia Small Companies Fund | $202,967 |

| EP China Fund | $224,371 |

| EP Latin America Fund | $124,726 |

Required Vote

Approval of the appointment of Champlain as sub-advisor to a Fund will require the vote of a “majority of the outstanding voting securities” of the Fund as defined in the 1940 Act. This means the lesser of (1) 67% or more of the shares of the Fund present at the Meeting if the owners of more than 50% of the Fund’s shares then outstanding are present in person or by proxy, or (2) more than 50% of the outstanding shares of the Fund entitled to vote at the Meeting. If the appointment of Champlain with respect to a Fund is not approved, EPAM and the Board of Trustees will take appropriate action to ensure continuity of management of the Fund after reviewing the available alternatives, which may include EPAM taking over day-to-day management of the Fund’s portfolio or approving another sub-advisor.

THE BOARD OF TRUSTEES RECOMMENDS THAT THE SHAREHOLDERS OF EACH FUND APPROVE THE SUB-AGREEMENT BETWEEN EPAM AND CHAMPLAIN WITH RESPECT TO THE FUND.

PROPOSAL #2: REORGANIZATION OF EP CHINA FUND AND EP LATIN AMERICA FUND

Comparison of Investment Objectives and Principal Strategies

In August 2015, the EP Emerging Markets Small Companies Fund, which was previously named the EP Asia Small Companies Fund, changed its name and investment strategies to the Fund’s current name and strategies, respectively.

The investment objectives and principal strategies of each Fund are set forth in the following table.

| | EP China Fund | EP Latin America Fund | EP Emerging Markets Small Companies Fund |

Investment Objectives | | | |

| | The Fund’s investment objective is to seek long term capital appreciation. | Same | Same |

Principal Strategies | | | |

80% Restriction | Under normal circumstances, the EP China Fund invests at least 80% of its net assets (plus any borrowings for investment purposes) in non-U.S. dollar denominated publicly traded stocks of companies of all capitalizations that are economically tied to China or its special administrative regions. | Under normal market conditions, the EP Latin America Fund seeks to achieve its investment objective by investing at least 80% of its net assets, which include borrowings for investment purposes, in equity securities of Latin American companies. | Under normal market conditions, the EP Emerging Markets Small Companies Fund seeks to achieve its investment objective by investing at least 80% of its net assets, which include borrowings for investment purposes, in equity securities of small capitalization companies that are tied economically to emerging market countries. |

Geographic Restrictions | The Fund’s sub-advisor considers a company to be “economically tied” to China or its special administrative regions if (1) the company is organized under the laws of China or any of its special administrative regions or has its principal office in China or any of its special administrative regions; (2) at the time of investment, the company derived a significant portion (i.e., 50% or more) of its total revenues during its most recently completed fiscal year from business activities in China or any of its special administrative regions; or (3) at the time of investment, the company’s equity securities are traded principally on stock exchanges or over-the-counter markets in China or any of its special administrative regions. In furtherance of its principal investment strategy, the Fund may purchase shares issued by Chinese companies that are listed on the Shanghai Stock Exchange, the Shenzhen Stock Exchange, the Hong Kong Stock Exchange, or the New York Stock Exchange; shares issued by Hong Kong companies that are owned or controlled by Chinese government bodies and listed on the Hong Kong Stock Exchange; and shares of companies that conduct business in China but are listed in overseas markets. | The Fund considers Latin America to include Mexico, Central America and South America. The Fund considers a company to be a Latin American company if the company derives at least 50% of its revenues or profits from business activities in Latin America. There are no limits on the geographic allocation of the Fund’s investments within Latin America. The Fund’s sub-advisor, however, anticipates that a substantial portion of the Fund’s investments will be in companies in Brazil, Mexico, Argentina, Colombia, Peru and Chile. | Emerging market countries are those currently included in the Morgan Stanley Capital International (MSCI) Emerging Markets Index. The Fund’s sub-advisor considers a company to be tied economically to an emerging market country if (1) the company is organized under the laws of an emerging market country, or has its principal office in an emerging market country; (2) at the time of investment, the company derived at least 50% of its total revenues during its most recent completed fiscal year from business activities in an emerging market country; or (3) the company’s equity securities are traded principally on an exchange in an emerging market country. |

| | EP China Fund | EP Latin America Fund | EP Emerging Markets Small Companies Fund |

Market Capitalization | The Fund may invest in securities of companies of all market capitalizations. | Same. | The Fund invests primarily in securities of small capitalization companies, which the sub-advisor defines as those companies with market capitalizations, at the time of investment, of below $3 billion. |

Types of Investments | The Fund invests primarily in non-U.S. dollar denominated publicly traded stocks. In particular, the Fund’s sub-advisor focuses the Fund’s investments in, but does not limit them to, dividend-paying Chinese companies. | The Fund’s equity investments may include common stock, preferred stock, and warrants. The Fund may also invest in American depository receipts (“ADRs”), which are certificates issued by U.S. banks representing specified numbers of shares (or one share) in foreign stocks, that are traded on U.S. exchanges. | The Fund’s sub-advisor focuses the Fund’s investments on what the sub-advisor believes are financially sound, stable but growing, and dividend paying small cap companies. The Fund’s investments in equity securities may include common stock, preferred stocks, convertible stock and warrants. |

Diversification Classification | The Fund is classified as “diversified” under the 1940 Act. | The Fund is classified as “non-diversified” under the 1940 Act, which means that the securities laws do not limit the percentage of its assets that it may invest in any one company (subject to certain limitations under the Internal Revenue Code of 1986, as amended). | The Fund is classified as “diversified” under the 1940 Act. |

Comparison of Principal Investment Risks

Each Fund is subject to “management and strategy” risk, which is the risk that the judgment of the Fund’s advisor or sub-advisor about the quality, relative yield, value or market trends affecting a particular security, industry, sector or region, may prove to be incorrect, resulting in losses or poor performance, and “market” risk, which is the risk that the Fund may expose you to a sudden decline in a holding’s price. As with any fund, the value of your investment in the relevant Fund will fluctuate on a day-to-day and a cyclical basis with movements in the market, as well as in response to the activities of individual companies in which the Fund invests. In addition, individual companies may report poor results or be negatively affected by industry and/or economic trends and developments.

Each Fund is also subject to market risk of equity securities, foreign investment risk, currency risk, and liquidity risk.

The non-overlapping risks to which investments in the Funds are subject are set forth below. In general, the investments of the EP Emerging Markets Small Companies Fund are concentrated in securities of small capitalization companies rather than large and mid-cap companies, and are more diversified across countries and geographic regions than the Target Funds, which means that the EP Emerging Markets Small Companies Fund is subject to the risks related to investment in more geographical regions than either Target Fund.

| EP China Fund | EP Latin America Fund | EP Emerging Markets Small Companies Fund |

Risks of Concentrating Investments in China. Because the Fund’s investments are concentrated in China, the Fund’s performance is expected to be closely tied to social, political and economic conditions within China and to be more volatile than the performance of more geographically diversified funds. Political, social or economic disruptions in China and surrounding countries, even in countries in which the Fund is not invested, may adversely affect security values in China and thus the Fund’s investments. Unanticipated political, social or economic developments may result in sudden and significant investment losses. At times, religious, cultural and military disputes within and outside China have caused volatility in the China securities markets and such disputes could adversely affect the value and liquidity of the Fund’s investments in the future. China remains a totalitarian country with continuing risk of nationalization, expropriation, or confiscation of property. The legal system is still developing, making it more difficult to obtain and/or enforce judgments. Further, the government could at any time alter or discontinue economic reforms. Military conflicts, either internal or with other countries, are also a risk. In addition, inflation, currency fluctuations and fluctuations in inflation and interest rates have had, and may continue to have, negative effects on the economy and securities markets of China. China’s economy may be dependent on the economies of other Asian countries, many of which are developing countries. In addition, investments in Taiwan could be adversely affected by its political and economic relationship with China. Each of these risks could increase the fund’s volatility. Investing through Stock Connect Risk. The Fund may invest in eligible securities (“Stock Connect Securities”) listed and traded on the SSE through the Stock Connect program. Investors in Stock Connect Securities are generally subject to Chinese securities regulations and SSE listing rules, among other restrictions. In addition, Stock Connect Securities generally may not be sold, purchased or otherwise transferred other than through Stock Connect in accordance with applicable rules. While Stock Connect is not subject to individual investment quotas, daily and aggregate investment quotas apply to all Stock Connect participants, which may restrict or preclude the Fund’s ability to invest in Stock Connect Securities. Trading in the Stock Connect Program is subject to trading, clearance and settlement procedures that are untested in China. The withholding tax treatment of dividends and capital gains payable to overseas investors currently is unsettled. | Latin America Region Risk. Because the Fund’s investments are focused in the Latin America region with a focus in Brazil, Mexico, Argentina, Colombia, Peru and Chile, the Fund’s performance is expected to be closely tied to social, political, and economic conditions within these countries and may be more volatile than the performance of funds that invest in more developed countries and regions. In addition, the economy of each of these countries is generally characterized by high interest, inflation, and unemployment rates. Currency fluctuations or devaluations in any country can have a significant effect on the entire region. Because commodities such as agricultural products, minerals, oil, and metals represent a significant percentage of exports of many Latin American countries, the economies of those countries are particularly sensitive to fluctuations in commodity prices, currencies and global demand for commodities. | Geographic Concentration Risk. The economies and financial markets of certain regions, such as Latin America, Asia or Eastern Europe, can be interdependent and may decline all at the same time. However, a fund that is more diversified across countries or geographic regions is generally less risky than a less geographically diversified fund. Investments in a single region, even though representing a number of different countries within the region, may be affected by common economic forces and other factors. This vulnerability to factors affecting the value of investments is significantly greater for a fund that concentrates its investment in a particular region or regions than a more geographically diversified fund, and may result in greater losses and volatility. Asia Region Risk. There are specific risks associated with investing in the Asia region, including the risk of political, economic, social and religious instability. The Asian region, and particularly China, Japan and South Korea, may be adversely affected by political, military, economic and other factors related to North Korea. In addition, China’s long running conflict over Taiwan, border disputes with many of its neighbors and historically strained relations with Japan could adversely impact economies in the region. The economies of Asian countries differ from the economies of more developed countries in many respects. Latin America Region Risk. The risks associated with the Fund’s investments in the Latin America region are the same as those of the EP Latin America Fund. |

| EP China Fund | EP Latin America Fund | EP Emerging Markets Small Companies Fund |

Small-Cap or Mid-Cap Company Risk. The securities of small-capitalization and mid-capitalization companies may be subject to more abrupt or erratic market movements and may have lower trading volumes or more erratic trading than securities of larger, more established companies or market averages in general. In addition, such companies typically are more likely to be adversely affected than large capitalization companies by changes in earning results, business prospects, investor expectations or poor economic or market conditions. Large-Cap Company Risk. Larger, more established companies may be unable to attain the high growth rates of successful, smaller companies during periods of economic expansion. | Small-Cap or Mid-Cap Company Risk. The securities of small-capitalization and mid-capitalization companies may be subject to more abrupt or erratic market movements and may have lower trading volumes or more erratic trading than securities of larger, more established companies or market averages in general. In addition, such companies typically are more likely to be adversely affected than large capitalization companies by changes in earning results, business prospects, investor expectations or poor economic or market conditions. | Small Company Risk. Investments in securities of small capitalization companies may involve greater risks than investing in large and mid-capitalization companies because small sized companies generally have limited track records and their shares tend to trade infrequently or in limited volumes. Additionally, investment in common stocks, particularly small sized company stocks, can be volatile and cause the value of the Fund’s shares to go up and down, sometimes dramatically. |

| | Preferred Stock Risk. Preferred stock represents an equity interest in a company that generally entitles the holder to receive, in preference to the holders of other stocks such as common stock, dividends and a fixed share of the proceeds resulting from a liquidation of the company. The market value of preferred stock is subject to company specific and market risks applicable generally to equity securities and is also sensitive to changes in the company’s creditworthiness, the ability of the company to make payments on the preferred stock, and changes in interest rates, typically declining in value if interest rates rise. | Preferred Stock Risk. Preferred stock represents an equity interest in a company that generally entitles the holder to receive, in preference to the holders of other stocks such as common stock, dividends and a fixed share of the proceeds resulting from a liquidation of the company. The market value of preferred stock is subject to company specific and market risks applicable generally to equity securities and is also sensitive to changes in the company’s creditworthiness, the ability of the company to make payments on the preferred stock, and changes in interest rates, typically declining in value if interest rates rise. |

| | Warrants Risk. Warrants may lack a liquid secondary market for resale. The prices of warrants may fluctuate as a result of speculation or other factors. Warrants can provide a greater potential for profit or loss than an equivalent investment in the underlying security. Prices of warrants do not necessarily move in tandem with the prices of their underlying securities and therefore are highly volatile and speculative investments. | Warrants Risk. Warrants may lack a liquid secondary market for resale. The prices of warrants may fluctuate as a result of speculation or other factors. Warrants can provide a greater potential for profit or loss than an equivalent investment in the underlying security. Prices of warrants do not necessarily move in tandem with the prices of their underlying securities and therefore are highly volatile and speculative investments. |

| EP China Fund | EP Latin America Fund | EP Emerging Markets Small Companies Fund |

| | | Convertible Securities Risk. Convertible securities are subject to market and interest rate risk and credit risk. When the market price of the equity security underlying a convertible security decreases the convertible security tends to trade on the basis of its yield and other fixed income characteristics, and is more susceptible to credit and interest rate risks. When the market price of such equity security rises, the convertible security tends to trade on the basis of its equity conversion features and be more exposed to market risk. Convertible securities are typically issued by smaller capitalized companies whose stock prices may be more volatile than those of other companies. |

| | Non-Diversification Risk. The Fund is classified as “non-diversified”, which means the Fund may invest a larger percentage of its assets in the securities of a smaller number of issuers than a diversified fund. Investment in securities of a limited number of issuers exposes the Fund to greater market risk and potential losses than if its assets were diversified among the securities of a greater number of issuers. | |

Comparison of Shareholder Rights

Because each Fund is a series of the Trust, the Reorganization will not affect the rights and privileges of shareholders of any class of either Target Fund. For instance, after the Reorganization shareholders of each class of the EP Emerging Markets Small Companies Fund will have the same exchange, purchase and redemption privileges as shareholders of the same class of each Target Fund prior to the Reorganization.

Comparison of Distribution

Because each Fund is a series of the Trust, shares of each class of the EP Emerging Markets Small Companies Fund are distributed in the same way as shares of the same class of each Target Fund, and the method of their distribution will not be affected by the Reorganization. Class I shares of the EP Emerging Markets Small Companies Fund will not be subject to a 12b-1 fee.

Comparison of Purchase and Redemption Procedures

Because each Fund is a series of the Trust, the Reorganization will not affect the purchase and redemption procedures of any class of either Target Fund. After the Reorganization, shareholders of the EP Emerging Markets Small Companies Fund will be able to exchange their shares for shares of other series of the Trust managed by EPAM.

Comparison of Fees and Expenses

The types of fees and expenses of the EP Emerging Markets Small Companies Fund are the same as those of each Target Fund. EPAM receives investment advisory fees of 1.08% of average daily net assets from each Fund for serving as its investment adviser. The fees are accrued daily and paid monthly. The gross total operating expense ratios borne by the Class A shareholders of the EP China Fund and the Class A and Class I shareholders of the EP Latin America Fund are expected to decrease in the long term as a result of the Reorganization. The net total operating expense ratios borne by shareholders of each class of each Target Fund are expected to remain the same after the Reorganization, as each Fund is subject to the same expense caps of 1.75% and 1.50% of the average daily net assets of Class A and Class I shares, respectively, as applicable.

The following tables show the fees and expenses for each Target Fund and the EP Emerging Markets Small Companies Fund, and the fees and expenses of the EP Emerging Markets Small Companies Fund on a pro forma basis after giving effect to the proposed Reorganization, as of April 30, 2015. As shown in the table, the fees and expenses of the EP Emerging Markets Small Companies Fund, on a pro forma basis after giving effect to the proposed Reorganization, are expected to stay the same as or be lower in comparison with the current fees of the EP Emerging Markets Small Companies Fund.

| | EP China Fund | EP Emerging Markets Small Companies Fund | Pro Forma EP Emerging Markets Small Companies Fund |

| Class A | Class A | Class A |

Shareholder Fees (fees paid directly from your investment) |

Maximum sales charge (load) imposed on purchases

(as a percentage of offering price) | 4.50% | 4.50% | 4.50% |

| Maximum deferred sales charge (load) imposed on purchases | None | None | None |

Redemption fee if redeemed within 30 days of purchase

(as a percentage of amount redeemed) | 2.00% | 2.00% | 2.00% |

| Wire fee | $20 | $20 | $20 |

| Overnight check delivery fee | $25 | $25 | $25 |

| Retirement account fees (annual maintenance fee) | $15 | $15 | $15 |

| |

Annual Fund Operating Expenses (expenses that are deducted from Fund assets) |

| Management fees | 1.08% | 1.08% | 1.08% |

| Distribution (12b-1) fees | 0.25% | 0.25% | 0.25% |

| Other expenses (includes shareholder service fee of 0.08%) | 0.85% | 1.24% | 0.73% |

| Total annual fund operating expenses | 2.18% | 2.57% | 2.06% |

Fees waived and/or expenses reimbursed1 | (0.43%) | (0.82%) | (0.31%) |

| Total annual fund operating expenses after waiving fees and/or reimbursing expenses | 1.75% | 1.75% | 1.75% |

| 1 | The Fund’s advisor has contractually agreed to waive its fees and/or pay for operating expenses of the Fund to ensure that total annual fund operating expenses (excluding any taxes, leverage interest, brokerage commissions, dividend and interest expenses on short sales, acquired fund fees and expenses (as determined in accordance with SEC Form N-1A), expenses incurred in connection with any merger or reorganization, and extraordinary expenses such as litigation expenses) do not exceed 1.75% and 1.50% of the average daily net assets of Class A and Class I shares of the Fund, respectively. This agreement is in effect until March 1, 2018, and it may be terminated before that date only by the Trust’s Board of Trustees. The Fund’s advisor is permitted to seek reimbursement from the Fund, subject to certain limitations, of fees waived or payments made to the Fund for a period of three years from the date of the waiver or payment. |

| | EP Latin

America Fund | EP Emerging Markets Small Companies Fund | Pro Forma EP Emerging Markets Small Companies Fund |

| Class A | Class I | Class A | Class I | Class A | Class I |

Shareholder Fees (fees paid directly from your investment) |

Maximum sales charge (load) imposed on purchases

(as a percentage of offering price) | 4.50% | None | 4.50% | None | 4.50% | None |

| Maximum deferred sales charge (load) imposed on purchases | None | None | None | None | None | None |

Redemption fee if redeemed within 30 days of purchase

(as a percentage of amount redeemed) | 2.00% | 2.00% | 2.00% | 2.00% | 2.00% | 2.00% |

| Wire fee | $20 | $20 | $20 | $20 | $20 | $20 |

| Overnight check delivery fee | $25 | $25 | $25 | $25 | $25 | $25 |

| Retirement account fees (annual maintenance fee) | $15 | $15 | $15 | $15 | $15 | $15 |

| |

Annual Fund Operating Expenses (expenses that are deducted from Fund assets) |

| Management fees | 1.08% | 1.08% | 1.08% | 1.08% | 1.08% | 1.08% |

| Distribution (12b-1) fees | 0.25% | None | 0.25% | None | 0.25% | None |

| Other expenses (includes shareholder service fee of 0.08%) | 1.58% | 1.58% | 1.24% | 1.24% | 0.73% | 0.73% |

| Total annual fund operating expenses | 2.91% | 2.66% | 2.57% | 2.32% | 2.06% | 1.81% |

Fees waived and/or expenses reimbursed1 | (1.16%) | (1.16%) | (0.82%) | (0.82%) | (0.31%) | (0.31%) |

| Total annual fund operating expenses after waiving fees and/or reimbursing expenses | 1.75% | 1.50% | 1.75% | 1.50% | 1.75% | 1.50% |

| 1 | The Fund’s advisor has contractually agreed to waive its fees and/or pay for operating expenses of the Fund to ensure that total annual fund operating expenses (excluding any taxes, leverage interest, brokerage commissions, dividend and interest expenses on short sales, acquired fund fees and expenses (as determined in accordance with SEC Form N-1A), expenses incurred in connection with any merger or reorganization, and extraordinary expenses such as litigation expenses) do not exceed 1.75% and 1.50% of the average daily net assets of Class A and Class I shares of the Fund, respectively. This agreement is in effect until March 1, 2018, and it may be terminated before that date only by the Trust’s Board of Trustees. The Fund’s advisor is permitted to seek reimbursement from the Fund, subject to certain limitations, of fees waived or payments made to the Fund for a period of three years from the date of the waiver or payment. |

| | EP

China Fund | EP Latin America Fund | EP Emerging Markets Small Companies Fund | Pro Forma

EP Emerging Markets Small Companies Fund |

| Class A | Class A | Class I | Class A | Class I | Class A | Class I |

Shareholder Fees (fees paid directly from your investment) |

Maximum sales charge (load) imposed on purchases

(as a percentage of offering price) | 4.50% | 4.50% | None | 4.50% | None | 4.50% | None |

| Maximum deferred sales charge (load) imposed on purchases | None | None | None | None | None | None | None |

Redemption fee if redeemed within 30 days of purchase

(as a percentage of amount redeemed) | 2.00% | 2.00% | 2.00% | 2.00% | 2.00% | 2.00% | 2.00% |

| Wire fee | $20 | $20 | $20 | $20 | $20 | $20 | $20 |

| Overnight check delivery fee | $25 | $25 | $25 | $25 | $25 | $25 | $25 |

| Retirement account fees (annual maintenance fee) | $15 | $15 | $15 | $15 | $15 | $15 | $15 |

| |

Annual Fund Operating Expenses (expenses that are deducted from Fund assets) |

| Management fees | 1.08% | 1.08% | 1.08% | 1.08% | 1.08% | 1.08% | 1.08% |

| Distribution (12b-1) fees | 0.25% | 0.25% | None | 0.25% | None | 0.25% | None |

| Other expenses (includes shareholder service fee of 0.08%) | 0.85% | 1.58% | 1.58% | 1.24% | 1.24% | 0.67% | 0.67% |

| Total annual fund operating expenses | 2.18% | 2.91% | 2.66% | 2.57% | 2.32% | 2.00% | 1.75% |

Fees waived and/or expenses reimbursed1 | (0.43%) | (1.16%) | (1.16%) | (0.82%) | (0.82%) | (0.25%) | (0.25%) |

| Total annual fund operating expenses after waiving fees and/or reimbursing expenses | 1.75% | 1.75% | 1.50% | 1.75% | 1.50% | 1.75% | 1.50% |

| 1 | The Fund’s advisor has contractually agreed to waive its fees and/or pay for operating expenses of the Fund to ensure that total annual fund operating expenses (excluding any taxes, leverage interest, brokerage commissions, dividend and interest expenses on short sales, acquired fund fees and expenses (as determined in accordance with SEC Form N-1A), expenses incurred in connection with any merger or reorganization, and extraordinary expenses such as litigation expenses) do not exceed 1.75% and 1.50% of the average daily net assets of Class A and Class I shares of the Fund, respectively. This agreement is in effect until March 1, 2018, and it may be terminated before that date only by the Trust’s Board of Trustees. The Fund’s advisor is permitted to seek reimbursement from the Fund, subject to certain limitations, of fees waived or payments made to the Fund for a period of three years from the date of the waiver or payment. |

The examples set forth below are intended to help you compare the cost of investing in each Target Fund, in the EP Emerging Markets Small Companies Fund, and on a pro forma basis in the EP Emerging Markets Small Companies Fund after giving effect to the Reorganization, and also to help you compare these costs with the cost of investing in other mutual funds. The examples assume that you invest $10,000 in the relevant Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The examples also assume that your investment has a 5% return each year and that the Fund’s total operating expenses remain the same.

Although your actual costs may be higher or lower, based on these assumptions, your costs would be:

| Class A | 1 Year | 3 Years | 5 Years | 10 Years |

| EP China Fund: | $620 | $1,062 | $1,529 | $2,818 |

| EP Latin America Fund: | $620 | $1,206 | $1,816 | $3,458 |

| EP Emerging Markets Small Companies Fund: | $620 | $1,139 | $1,648 | $3,166 |

| Pro Forma Combined EP Emerging Markets Small Companies Fund: | $620 | $1,038 | $1,481 | $2,709 |

| Class I | 1 Year | 3 Years | 5 Years | 10 Years |

| EP Latin America Fund: | $153 | $716 | $1,306 | $2,907 |

| EP Emerging Markets Small Companies Fund: | $153 | $646 | $1,166 | $2,593 |

| Pro Forma Combined EP Emerging Markets Small Companies Fund: | $153 | $527 | $926 | $2,042 |

Comparison of Performance Information

The following past performance information for each Fund is set forth below: (1) a bar chart showing changes in the Fund’s performance for Class A shares from year to year for the calendar years since the Fund’s inception, and (2) a table detailing how the average annual total returns of the Fund, both before and after taxes, compared to those of broad-based market indices. The after-tax returns are shown for Class A shares only and are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state or local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns for Class I shares will vary from the after-tax returns shown above for Class A shares. The after-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts.

The bar chart and table below provide some indication of the risks of investing in each Fund by showing changes in the Fund’s performance from year to year for Class A shares and by showing how the average annual total returns of Class A shares of the Fund compare with the average annual total returns of a broad-based market index. Performance for classes other than those shown may vary from the performance shown to the extent the expenses for those classes differ. Updated performance information is available at the Funds’ website, www.europacificfunds.com, or by calling the Trust at 1-888-558-5851. A Fund’s past performance, before and after taxes, is not necessarily an indication of how the Fund will perform in the future. Sales loads are not reflected in the bar chart, and if those charges were included, returns would be less than those shown.

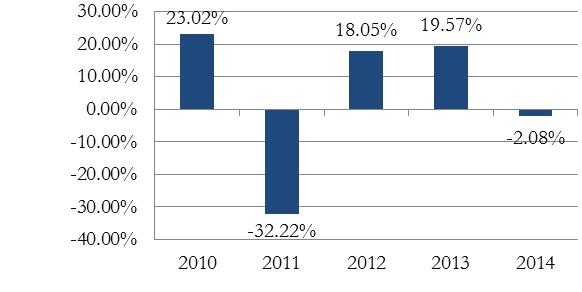

EP China Fund

This bar chart shows the performance of the EP China Fund’s Class A shares based on a calendar year.

Calendar Year Total Return (before taxes) for Class A Shares

For each calendar year at NAV

| Highest Calendar Quarter Return at NAV | 18.78% | Quarter Ended 9/30/2010 |

| Lowest Calendar Quarter Return at NAV | (26.82)% | Quarter Ended 9/30/2011 |

The EP China Fund’s total return from January 1, 2015, to June 30, 2015, was 7.09%.

This table shows the average annual total returns of Class A shares of the EP China Fund for the periods ended December 31, 2014. The table also shows how the Fund’s performance compares with the returns of an index comprised of companies similar to those held by the Fund.

Average Annual Total Returns as of December 31, 2014

| | One Year | Five Years | Since Inception (Annualized) | Inception Date |

| Class A | | | | |

| Return Before Taxes | (6.51)% | 1.93% | 5.41% | 7/31/09 |

| Return After Taxes on Distributions | (6.60)% | 1.58% | 5.04% | 7/31/09 |

| Return After Taxes on Distributions and Distributions of Fund Shares | (3.64)% | 1.53% | 4.26% | 7/31/09 |

| MSCI China Index (Reflects no deduction for fees, expenses or taxes) | 7.96% | 3.23% | 4.20% | 7/31/09 |

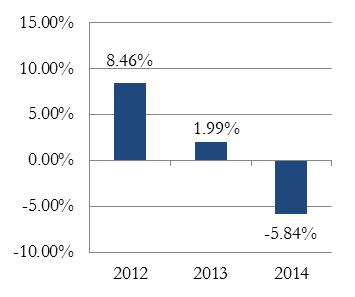

EP Latin America Fund

This bar chart shows the performance of the EP Latin America Fund’s Class A shares based on a calendar year.

Calendar Year Total Return (before taxes) for Class A Shares

For each calendar year at NAV

| Highest Calendar Quarter Return at NAV | 11.81% | Quarter Ended 6/30/2014 |

| Lowest Calendar Quarter Return at NAV | (13.65)% | Quarter Ended 12/31/2014 |

The EP Latin America Fund’s total return from January 1, 2015, to June 30, 2015, was (6.01)%.

This table shows the average annual total returns of Class A shares of the EP Latin America Fund for the periods ended December 31, 2014. The table also shows how the Fund’s performance compares with the returns of an index comprised of companies similar to those held by the Fund.

Average Annual Total Returns as of December 31, 2014

| | One Year | Five Years | Since Inception (Annualized) | Inception Date |

| Class A | | | | |

| Return Before Taxes | (10.11)% | (0.18)% | (0.23)% | 11/1/11 |

| Return After Taxes on Distributions | (10.11)% | (0.19)% | (0.25)% | 11/1/11 |

| Return After Taxes on Distributions and Distributions of Fund Shares | (5.72)% | (0.09)% | (0.13)% | 11/1/11 |

| Class I | (5.58)% | 1.60% | 1.47% | 7/16/13 |

Return Before Taxes1 | (5.58)% | 1.60% | 1.47% | 7/16/13 |

| MSCI EM Latin America Index (Reflects no deduction for fees, expenses or taxes) | (14.79)% | (8.85)% | (9.58%) | 11/1/11 |

| 1 | Class A started on November 1, 2011. Class I started on July 16, 2013. The performance figures for Class I include the performance for the Class A shares for the periods prior to the start date of Class I. Class A imposes higher expenses than Class I. |

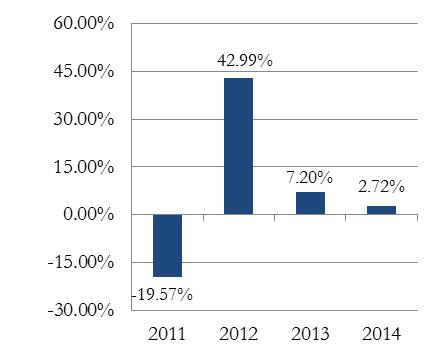

EP Emerging Markets Small Companies Fund

This bar chart shows the performance of the EP Emerging Markets Small Companies Fund’s Class A shares based on a calendar year. Prior to August 31, 2015, the Fund was named the EP Asia Small Companies Fund.

Calendar Year Total Return (before taxes) for Class A Shares

For each calendar year at NAV

| Highest Calendar Quarter Return at NAV | 19.92% | Quarter Ended 3/31/2012 |

| Lowest Calendar Quarter Return at NAV | (22.86)% | Quarter Ended 9/30/2011 |

The EP Emerging Markets Small Companies Fund’s total return from January 1, 2015, to June 30, 2015, was 0.99%.

This table shows the average annual total returns of Class A shares of the EP Emerging Markets Small Companies Fund for the periods ended December 31, 2014. The table also shows how the Fund’s performance compares with the returns of an index comprised of companies similar to those held by the Fund.

Average Annual Total Returns as of December 31, 2014

| | One Year | Three Years | Since Inception (Annualized) | Inception Date |

| Class A | | | | |

| Return Before Taxes | (1.92)% | 14.55% | 4.69% | 12/1/10 |

| Return After Taxes on Distributions | (2.46)% | 14.23% | 4.52% | 12/1/10 |

| Return After Taxes on Distributions and Distributions of Fund Shares | (0.65)% | 11.43% | 3.70% | 12/1/10 |

Class I1 | 2.96% | 16.64% | 6.15% | 7/16/13 |

| Return Before Taxes | 2.96% | 16.64% | 6.15% | |

MSCI All Country Asia Ex-Japan Small Cap Index

(Reflects no deduction for fees, expenses or taxes) | 2.26% | 10.19% | 0.67% | 12/1/10 |

| 1 | Class A started on December 1, 2010. Class I started on July 16, 2013. The performance figures for Class I include the performance for the Class A shares for the periods prior to the start date of Class I. Class A imposes higher expenses than Class I. |

Investment Advisor and Sub-advisor

Euro Pacific Asset Management, LLC is the Funds’ investment advisor and provides investment advisory services to each Fund pursuant to an investment advisory agreement between the Advisor and the Trust (the “Advisory Agreement”). The Advisor was founded in 2009 and its principal address is 53 Palmeras Street, Suite 801, Puerta de Tierra Ward, San Juan, Puerto Rico, 00902. The Advisor is an investment advisor registered with the SEC. As of December 31, 2014, the Advisor’s total assets under management were approximately $735 million.

The Advisor provides investment advisory services to each Fund, including: (i) providing research and economic insight to the Sub-advisor; (ii) providing overall supervision for the general management and operations of the Fund; (iii) monitoring and supervising the activities of the Sub-advisor; and (iv) providing related administrative services. The Advisor also furnishes the Funds with office space and certain administrative services.

Champlain Investment Partners, the Funds’ sub-advisor (subject to approval by the shareholder of each Fund), is located at 180 Battery Street, Suite 400 Burlington, Vermont 05401. Champlain is an investment advisor registered with the SEC. Champlain is responsible for the day-to-day management of each Fund’s portfolio, selection of the Fund’s portfolio investments and supervision of the Fund’s portfolio transactions subject to the general oversight of the Board and EPAM. As of March 31, 2015 Champlain had approximately $6.2 billion under management.

Section 15(f) of the Investment Company Act

Section 15(f) of the Investment Company Act establishes a non-exclusive safe harbor for the receipt of any amount or benefit by an investment advisor or sub-advisor to a registered investment company (a “fund”) in connection with the sale of securities of, or a sale of any other interest in, the investment advisor or sub-advisor that results in an assignment of the fund’s advisory contract, provided that the following two conditions are satisfied: a) at least 75% of the trustees of the fund’s board must not be interested persons of either the fund’s investment advisor or its predecessor advisor for three years following the transaction that results in an assignment of the fund’s advisory contract, and b) an “unfair burden” may not be imposed on the fund as a result of the transaction for a two-year period. The acquisition of New Sheridan by Champlain and the Reorganization comply with the provisions of Section 15(f). None of the Trustees of the Trust are interested persons of any of EPAM, New Sheridan and Champlain, and EPAM has agreed to maintain the expense cap for the EP Emerging Markets Small Companies Fund for a period of at least two years following the closing of the Reorganization.

Portfolio Managers

Russell E. Hoss is portfolio manager of the EP China Fund and is responsible for its day-to-day management. Russell E. Hoss and Richard W. Hoss are the portfolio managers of the EP Emerging Markets Small Companies Fund and the EP Latin America Fund and are jointly and primarily responsible for the day-to-day management of each of those Funds. The portfolio managers work as a team in considering securities for selection and implementing each of those Funds’ portfolio strategies. However, Russell Hoss has final approval of the selection of any company to be included in the EP Emerging Markets Small Companies Fund’s and the EP Latin America Fund’s portfolios.

Russell E. Hoss, CFA, has served as the portfolio manager of the EP China Fund and a portfolio manager of the EP Emerging Markets Small Companies Fund and the EP Latin America Fund since each Fund’s inception. From February 2009 to June 2015, he was President and portfolio manager of New Sheridan. From 2002 through 2007, Mr. Hoss was employed at Roth Capital Partners, LLC. During his time at Roth Capital Partners, he was a Senior Research Analyst from 2002 to 2005, Director of Equity Research from 2005 to 2006, and Director of Institutional Sales during 2007. Mr. Hoss then served as an Analyst for Alder Capital, LLC in 2008. In 2009, he left to form New Sheridan Advisors, Inc.

Richard W. Hoss has served as a portfolio manager of the EP Latin America Fund since its inception, and as a portfolio manager of the EP Emerging Markets Small Companies Fund since August 2015. From September 2011 to June 2015, he was co-portfolio manager of New Sheridan. From 2007 to 2011, Mr. Hoss was a Senior Research Analyst at Roth Capital Partners where he led research coverage on the Industrials sector. From 1999 to 2006, Mr. Hoss was an aircraft commander for the U.S. Air Force. Mr. Hoss holds a Master of Business Administration degree from the University of Maryland and a Bachelor of Science degree from the United States Air Force Academy.

Comparison of Investment Restrictions

Each Fund has adopted the following restrictions as fundamental policies, which may not be changed without the favorable “vote of the holders of a majority, of the outstanding voting securities” of the Fund. Under the 1940 Act, the “vote of the holders of a majority of the outstanding voting securities” of the Fund means the vote of the holders of the lesser of (i) 67% of the shares of the Fund represented at a meeting at which the holders of more than 50% of its outstanding shares are represented or (ii) more than 50% of the outstanding shares of the Fund. Each Fund’s investment objective is a non-fundamental policy and may be changed without shareholder approval.

No Fund may:

| 1. | Issue senior securities, borrow money or pledge its assets, except that (i) each Fund may borrow from banks in amounts not exceeding one-third of its net assets (including the amount borrowed); and (ii) this restriction shall not prohibit a Fund from engaging in options transactions or short sales and in investing in financial futures and reverse repurchase agreements; |

| 2. | Act as underwriter, except to the extent a Fund may be deemed to be an underwriter in connection with the sale of securities in its investment portfolio; |

| 3. | Invest 25% or more of its total assets, calculated at the time of purchase and taken at market value, in any one industry or related group of industries. This limit does not apply to securities issued or guaranteed by the U.S. government, its agencies or instrumentalities. |

| 4. | Purchase or sell real estate or interests in real estate or real estate limited partnerships (although the Fund may purchase and sell securities which are secured by real estate and securities of companies which invest or deal in real estate such as real estate investment trusts (REITs); |

| 5. | Make loans of money, except (a) for purchases of debt securities consistent with the investment policies of the Fund, (b) by engaging in repurchase agreements or, (c) through the loan of portfolio securities in an amount up to 331/3% of the Fund’s net assets; or |

| 6. | Purchase or sell commodities or commodity futures contracts (although each Fund may invest in financial futures and in companies involved in the production, extraction, or processing of agricultural, energy, base metals, precious metals, and other commodity-related products). |

Each Fund observes the following restriction as a matter of operating but not fundamental policy, pursuant to positions taken by federal regulatory authorities:

No Fund may invest, in the aggregate, more than 15% of its net assets in securities with legal or contractual restrictions on resale, securities that are not readily marketable and repurchase agreements with more than seven days to maturity.

Except with respect to borrowing, if a percentage or rating restriction on investment or use of assets set forth herein is adhered to at the time a transaction is effected, later changes in percentage resulting from any cause other than actions by a Fund will not be considered a violation.

PROPOSED REORGANIZATION

The Board of Trustees of the Trust has approved a plan to reorganize each Target Fund into the EP Emerging Markets Small Companies Fund. To proceed, we need the approval of the shareholders of the each Target Fund. The following pages outline the important details of the proposed Reorganization.

Why Do We Want to Reorganize the Funds?

EPAM proposed the Reorganization to the Board, and the Board is recommending the Reorganization to you, because, among other reasons, EPAM does not expect significant future in-flows to either Target Fund and anticipates the assets of the Target Funds may decrease in the future. EPAM believes that the asset levels of the Funds on an individual basis do not adequately support the costs associated with managing and operating the Funds. In addition, EPAM believes that market demand for regional funds is limited, and that a broader strategy, focusing on emerging market small companies, has a much larger potential market which is currently underserved.

After considering the viability of each Target Fund in light of its current size and the limited prospects for future asset growth, EPAM and the Board believe that maintaining the status quo would not be in the shareholders’ best interests. Immediately following the Reorganization, the net total expenses of the EP Emerging Markets Small Companies Fund will be the same as that of each Target Fund immediately preceding the Reorganization, as EPAM is currently limiting its fees or reimburse each Fund for expenses to the extent necessary to keep the total annual fund operating expenses for Class A and Class I shares at or below 1.75% and 1.50% of the Fund’s current daily net assets, respectively. However, because certain operating expenses of the EP Emerging Markets Small Companies Fund will be shared across a larger pool of assets than is currently the case, EPAM and the Board anticipate that if the Reorganization is approved, over time shareholders of each Target Fund will bear lower expense ratios as shareholders of the EP Emerging Markets Small Companies Fund than they did as shareholders of the Target Fund.

The Reorganization is not expected to result in the recognition of gain or loss by the Funds or their shareholders for federal income tax purposes, and the receipt by the Funds of an opinion of counsel substantially to this effect is a condition the closing of the Reorganization.

Based upon their evaluation of the relevant information presented to them, and in light of their fiduciary duties under federal and state law, the Board has determined that the Reorganization is in the best interests of shareholders of each Fund. In approving the Reorganization, the Board considered the terms and conditions of the proposed Agreement and Plan of Reorganization among the Trust on behalf of each Fund (the “Reorganization Agreement”) and the following factors, among others:

| (1) | The assets of each Fund are small (as of May 8, 2015, the EP Asia Small Companies Fund, which would be renamed the EP Emerging Markets Small Companies Fund, had $29 million in assets, the EP China Fund had $35 million in assets and the EP Latin America Fund had $19 million in assets.) and its prospects for further growth are not good. EPAM expects that after the consummation of the Reorganization, the combined EP Emerging Markets Small Companies Fund will be better positioned for growth than any Fund is on its own. |

| (2) | EPAM expects that the total operating expenses of each Target Fund (as a percentage of the Fund’s average net assets) will increase as fixed costs are spread over a shrinking asset base. Because operating expenses will be shared across a larger pool of assets as a result of the Reorganization, EPAM expects that over time shareholders of each Target Fund will bear lower expense ratios as shareholders of the EP Emerging Markets Small Companies Fund than is currently the case. |

| (3) | The investment objective of the EP Emerging Markets Small Companies Fund is the same as that of each Target Fund. The investment strategies of the EP Emerging Markets Small Companies Fund are similar to those of each Target Fund except that the geographic focus of the EP Emerging Markets Small Companies Fund is broader than those of each Target Fund, and the EP Emerging Markets Small Companies Fund focuses on small cap companies. The Reorganization will provide shareholders of the EP Emerging Markets Small Companies Fund with the continued opportunity to utilize the services of EPAM as manager and the Funds’ current portfolio managers. |

| (4) | The interests of the Funds’ shareholders will not be diluted as a result of the Reorganization. The assets and liabilities of each Target Fund will be transferred to the EP Emerging Markets Small Companies Fund in exchange for shares of beneficial interest of the EP Emerging Markets Small Companies Fund having a total value equal to the value of the assets the Target Fund transferred to the EP Emerging Markets Small Companies Fund (net of any liabilities). However, all known liabilities of each Target Fund will be paid before the closing of the Reorganization, and the Trust therefore anticipates that no liabilities of the Target Fund will be transferred to the EP Emerging Markets Small Companies Fund. The exchange will take place at net asset value and there will be no sales charge or other charge imposed as a result of the Reorganization. Each Fund is subject to the same pricing and valuation procedures. |

| (5) | No adverse federal income tax consequences are expected to result from the Reorganization, as each Combination Transaction is expected to qualify as a “reorganization” for federal income tax purposes. |

| (6) | Each Fund is managed by the same investment advisor, EPAM, and (after the closing of the Transaction) the same sub-advisor, Champlain. Furthermore, the other services and privileges available to the shareholders of the EP Emerging Markets Small Companies Fund will be the same as those available to shareholders of each Target Fund. |

| (7) | EPAM will bear the costs of the Reorganization (which are estimated to be $72,000) other than transaction costs associated with any sale of the Target Funds’ investment portfolios, including legal, accounting and transfer agent costs. |

After consideration of the factors mentioned above and other relevant information, at a meeting held on June 18-19, 2015, the Board determined that the Reorganization is in the best interests of each of the Funds and its shareholders, and that the interests of each Target Fund’s shareholders will not be diluted as a result of the Reorganization, and unanimously approved the Reorganization Agreement and directed that it be submitted to shareholders for approval. The Board unanimously recommends that shareholders vote “FOR” approval of the Reorganization.

How Will We Accomplish the Reorganization?

The Reorganization Agreement, a copy of which is attached to this Prospectus/Proxy Statement as Appendix B, spells out the terms and conditions of the Reorganization. If the shareholders of each Target Fund approve the Reorganization, the Reorganization essentially will involve the following steps, which will occur substantially simultaneously:

| · | First, each Target Fund will transfer all of its assets and liabilities to the EP Emerging Markets Small Companies Fund. |

| · | Second, in exchange for its assets transferred to the EP Emerging Markets Small Companies Fund and liabilities assumed, each Target Fund will receive shares of beneficial interest of the EP Emerging Markets Small Companies Fund having a total value, on a class by class basis, equal to the value of the assets that the Target Fund transferred to the EP Emerging Markets Small Companies Fund (net of any liabilities). |

| · | Third, each Target Fund will distribute to each holder of a class of its shares a number of shares of the same class of the EP Emerging Markets Small Companies Fund having an aggregate net asset value equal to the aggregate net asset value of that shareholder’s shares of that class of the Target Fund, and the Target Fund will dissolve. |

| · | Fourth, the EP Emerging Markets Small Companies Fund will open an account for each shareholder of each Target Fund and will credit the shareholder with shares of the EP Emerging Markets Small Companies Fund of the same class and having the same total value as the Target Fund shares that he or she owned on the date of the Reorganization. Share certificates will not be issued. |

In essence, shareholders of each Target Fund who vote their shares in favor of the Reorganization are electing to exchange their shares of the Target Fund at net asset value for shares of the corresponding class of the EP Emerging Markets Small Companies Fund in a transaction that is not expected to result in a taxable gain or loss for federal income tax purposes.

Pursuant to the Reorganization Agreement, the number of EP Emerging Markets Small Companies Fund shares to be issued to each Target Fund will be computed as of 4:00 PM Eastern time on the date preceding the closing date of the Reorganization in accordance with the regular practice of the Funds. The effectiveness of the Reorganization with respect to each Target Fund is contingent upon, among other things, obtaining approval of the shareholders of the Target Fund. If the shareholders of only one Target Fund approve the Reorganization, that Target Fund and the EP Emerging Markets Small Companies Fund may but are not required to complete the Reorganization with respect only to that Target Fund.

EPAM will bear the costs of the proposed Reorganization other than transaction costs associated with any sale of the Target Funds’ investment portfolios, including legal, accounting and transfer agent costs. These costs will not be borne by the shareholders of any Fund.

If the Reorganization is approved by a Target Fund’s shareholders, it will take place as soon as feasible. Management of the Trust believes this should be accomplished by late in the fourth quarter of 2015. However, at any time before the closing the Board may decide not to proceed with the Reorganization of one or both Target Funds if, in the judgment of the Board, termination of the Reorganization would not have a material adverse effect on the shareholders of any Fund. At any time prior to or after approval of the Reorganization by a Target Fund’s shareholders, the President of the Trust may, with Board approval, amend any provision of the Reorganization Agreement, including substantive as well as ministerial changes, without the approval of shareholders, so long as such approval is not required by law and any such amendment will not have a material adverse effect on the benefits intended under the Reorganization Agreement to the shareholders of any Fund. Similarly, any of the terms or conditions of the Reorganization Agreement may be waived by the Board if, in its judgment such action or waiver will not have a material adverse effect on the benefits intended under the Reorganization Agreement to the shareholders of any Fund. In approving any such amendment, granting any such waiver or terminating the Reorganization, the Board will be subject to its fiduciary duties to, and will consider the best interests of, the Funds’ shareholders.

Are There Other Material Differences Between the Target Funds and the EP Emerging Markets Small Companies Fund?