UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

FOR ANNUAL AND TRANSITION REPORTS

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2009 or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 1-32853

DUKE ENERGY CORPORATION

(Exact name of registrant as specified in its charter)

| | |

| Delaware | | 20-2777218 |

| |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| 526 South Church Street, Charlotte, North Carolina | | 28202-1803 |

| |

| (Address of principal executive offices) | | (Zip Code) |

704-594-6200

(Registrant’s telephone number, including area code)

SECURITIES REGISTERED PURSUANT TO SECTION 12(B) OF THE ACT:

| | |

| | Name of each exchange on which registered |

| Title of each class | | |

| |

| Common Stock, $0.001 par value | | New York Stock Exchange, Inc. |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ¨ Nox

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yesx No¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| | |

Large accelerated filer x | | Accelerated filer ¨ |

| |

Non-accelerated filer ¨ | | Smaller reporting company ¨ |

| |

(Do not check if a smaller reporting company) | | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Securities Exchange Act of 1934). Yes ¨ No x

| | |

Estimated aggregate market value of the common equity held by nonaffiliates of the registrant at June 30, 2009 | | |

| | $ 18,836,000,000 |

| |

Number of shares of Common Stock, $0.001 par value, outstanding at February 22, 2010. | | |

| | 1,309,314,484 |

TABLE OF CONTENTS

DUKE ENERGY CORPORATION

FORM 10-K FOR THE YEAR ENDED

DECEMBER 31, 2009

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

This document includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements are based on management’s beliefs and assumptions. These forward-looking statements are identified by terms and phrases such as “anticipate,” “believe,” “intend,” “estimate,” “expect,” “continue,” “should,” “could,” “may,” “plan,” “project,” “predict,” “will,” “potential,” “forecast,” “target,” and similar expressions. Forward-looking statements involve risks and uncertainties that may cause actual results to be materially different from the results predicted. Factors that could cause actual results to differ materially from those indicated in any forward-looking statement include, but are not limited to:

| | • | | State, federal and foreign legislative and regulatory initiatives, including costs of compliance with existing and future environmental requirements, as well as rulings that affect cost and investment recovery or have an impact on rate structures; |

| | • | | Costs and effects of legal and administrative proceedings, settlements, investigations and claims; |

| | • | | Industrial, commercial and residential growth or decline in Duke Energy Corporation’s (Duke Energy) service territories, customer base or customer usage patterns; |

| | • | | Additional competition in electric markets and continued industry consolidation; |

| | • | | Political and regulatory uncertainty in other countries in which Duke Energy conducts business; |

| | • | | The influence of weather and other natural phenomena on Duke Energy’s operations, including the economic, operational and other effects of storms, hurricanes, droughts and tornados; |

| | • | | The timing and extent of changes in commodity prices, interest rates and foreign currency exchange rates; |

| | • | | Unscheduled generation outages, unusual maintenance or repairs and electric transmission system constraints; |

| | • | | The performance of electric generation and of projects undertaken by Duke Energy’s non-regulated businesses; |

| | • | | The results of financing efforts, including Duke Energy’s ability to obtain financing on favorable terms, which can be affected by various factors, including Duke Energy’s credit ratings and general economic conditions; |

| | • | | Declines in the market prices of equity securities and resultant cash funding requirements for Duke Energy’s defined benefit pension plans; |

| | • | | The level of credit worthiness of counterparties to Duke Energy’s transactions; |

| | • | | Employee workforce factors, including the potential inability to attract and retain key personnel; |

| | • | | Growth in opportunities for Duke Energy’s business units, including the timing and success of efforts to develop domestic and international power and other projects; |

| | • | | Construction and development risks associated with the completion of Duke Energy’s capital investment projects in existing and new generation facilities, including risks related to financing, obtaining and complying with terms of permits, meeting construction budgets and schedules, and satisfying operating and environmental performance standards, as well as the ability to recover costs from customers in a timely manner or at all; |

| | • | | The effect of accounting pronouncements issued periodically by accounting standard-setting bodies; and |

| | • | | The ability to successfully complete merger, acquisition or divestiture plans. |

In light of these risks, uncertainties and assumptions, the events described in the forward-looking statements might not occur or might occur to a different extent or at a different time than Duke Energy has described. Duke Energy undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

PART I

Item 1. Business.

GENERAL

Overview.Duke Energy Corporation (collectively with its subsidiaries, Duke Energy) is an energy company located primarily in the Americas that provides its services through the business segments described below.

Duke Energy Holding Corp. (Duke Energy HC) was incorporated in Delaware on May 3, 2005 as Deer Holding Corp., a wholly-owned subsidiary of Duke Energy Corporation (Old Duke Energy, for purposes of this discussion regarding the merger). In the second quarter of 2006, Duke Energy and Cinergy Corp. (Cinergy) consummated a merger which combined the Duke Energy and Cinergy regulated franchises, as well as deregulated generation in the Midwestern United States. On April 3, 2006, in accordance with the merger agreement, Old Duke Energy and Cinergy merged into wholly-owned subsidiaries of Duke Energy HC, resulting in Duke Energy HC becoming the parent entity. In connection with the closing of the merger transactions, Duke Energy HC changed its name to Duke Energy Corporation (New Duke Energy or Duke Energy) and Old Duke Energy converted into a limited liability company named Duke Power Company LLC (subsequently renamed Duke Energy Carolinas, LLC (Duke Energy Carolinas) effective October 1, 2006). As a result of the merger transaction, each outstanding share of Cinergy common stock was converted into 1.56 shares of common stock of Duke Energy, which resulted in the issuance of approximately 313 million shares of Duke Energy common stock. Additionally, each share of common stock of Old Duke Energy was converted into one share of Duke Energy common stock. Old Duke Energy is the predecessor of Duke Energy for purposes of U.S. securities regulations governing financial statement filing.

On January 2, 2007, Duke Energy completed the spin-off of its natural gas businesses, named Spectra Energy Corp. (Spectra Energy), including its wholly-owned subsidiary Spectra Energy Capital, LLC (Spectra Energy Capital, formerly Duke Capital LLC). The natural gas businesses spun off primarily consisted of Duke Energy’s Natural Gas Transmission business segment and Duke Energy’s 50% ownership interest in DCP Midstream, LLC (DCP Midstream, formerly Duke Energy Field Services, LLC), which was part of the Field Services business segment.

During the third quarter of 2005, Duke Energy’s Board of Directors authorized and directed management to execute the sale or disposition of substantially all of former Duke Energy North America’s (DENA) remaining assets and contracts outside the Midwestern United States and certain contractual positions related to the Midwestern assets. The exit plan was completed in the second quarter of 2006. Certain assets of the former DENA business were transferred to the Commercial Power business segment and certain operations that Duke Energy continues to wind-down are in Other.

Business Segments.At December 31, 2009, Duke Energy operated the following business segments, all of which are considered reportable segments under the applicable accounting rules: U.S. Franchised Electric and Gas, Commercial Power and International Energy. Duke Energy’s chief operating decision maker regularly reviews financial information about each of these business segments in deciding how to allocate resources and evaluate performance. For additional information on each of these business segments, including financial and geographic information about each reportable business segment, see Note 2 to the Consolidated Financial Statements, “Business Segments.”

The following is a brief description of the nature of operations of each of Duke Energy’s reportable business segments, as well as Other.

U.S. Franchised Electric and Gas.U.S. Franchised Electric and Gas generates, transmits, distributes and sells electricity in central and western North Carolina, western South Carolina, southwestern Ohio, central, north central and southern Indiana, and northern Kentucky. U.S. Franchised Electric and Gas also transports and sells natural gas in southwestern Ohio and northern Kentucky. It conducts operations primarily through Duke Energy Carolinas, LLC (Duke Energy Carolinas), the regulated transmission and distribution operations of Duke Energy Ohio, Inc. (Duke Energy Ohio), Duke Energy Indiana, Inc. (Duke Energy Indiana) and Duke Energy Kentucky, Inc. (Duke Energy Kentucky). These electric and gas operations are subject to the rules and regulations of the Federal Energy Regulatory Commission (FERC), the North Carolina Utilities Commission (NCUC), the Public Service Commission of South Carolina (PSCSC), the Public Utilities Commission of Ohio (PUCO), the Indiana Utility Regulatory Commission (IURC) and the Kentucky Public Service Commission (KPSC). The substantial majority of U.S. Franchised Electric and Gas’ operations are regulated and, accordingly, these operations qualify for regulatory accounting treatment.

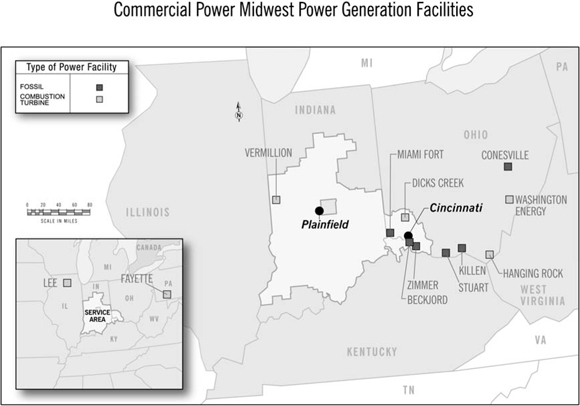

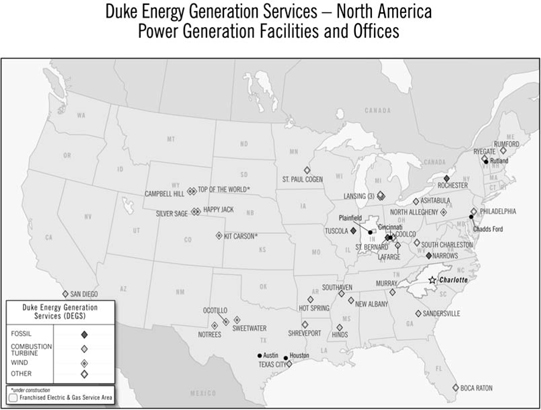

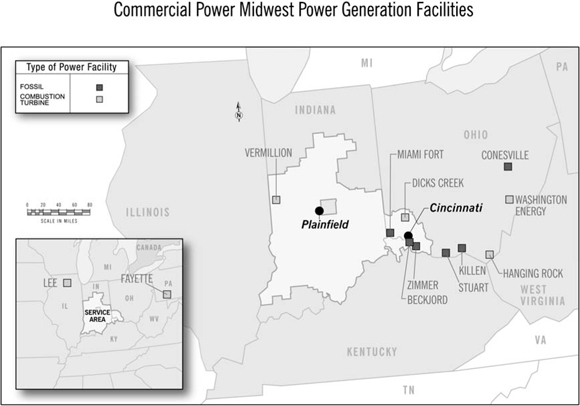

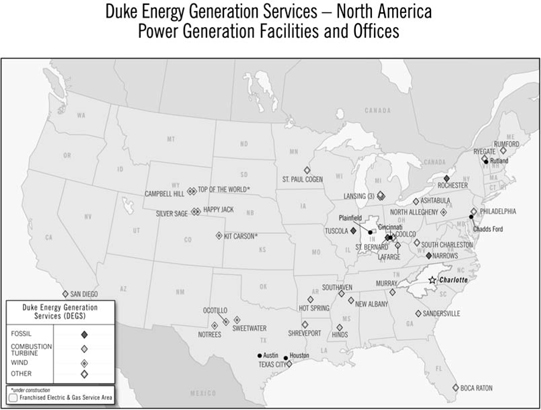

Commercial Power.Commercial Power owns, operates and manages power plants and engages in the wholesale marketing and procurement of electric power, fuel and emission allowances related to these plants as well as other contractual positions. Commercial Power’s generation operations in the Midwest consist of generation assets located in Ohio, acquired from Cinergy in April 2006, which are dedicated under the Electric Security Plan (ESP), and the five Midwestern gas-fired non-regulated generation assets that were a portion of the former DENA operations, which are dispatched into wholesale markets. Commercial Power’s assets, excluding wind energy generation assets, comprise approximately 7,550 net megawatts (MW) of power generation primarily located in the Midwestern U.S. The asset portfolio has a diversified fuel mix with baseload and mid-merit coal-fired units as well as combined cycle and peaking natural gas-fired units. Effective January 1, 2009, approximately half of Commercial Power’s Ohio-based generation assets operate under an ESP, which expires on December 31, 2011. Prior to the ESP, these generation assets had been contracted through the Rate Stabilization Plan (RSP), which expired on December 31, 2008. As a result of the approval of the ESP, certain of Commercial Power’s operations qualified for regulatory accounting treatment effective December 17, 2008. For more information on the RSP and ESP, as well as the reapplication of regulatory accounting to certain of its operations, see the “Commercial Power” section below. Commercial Power also has a retail sales subsidiary, Duke Energy Retail Sales (DERS), which is certified by the PUCO as a Competitive Retail Electric Service (CRES) provider in Ohio. DERS serves retail electric customers in Southwest, West Central and Northern Ohio with generation and other energy services at competitive rates. During 2009, due to increased levels of customer switching as a result of the competitive markets in Ohio, DERS has focused on acquiring customers that had previously been served by Duke Energy Ohio under the ESP, as well as those previously served by other Ohio franchised utilities. Through Duke Energy Generation Services, Inc. and its affiliates (DEGS), Commercial Power develops, owns and operates electric generation for large energy consumers, municipalities, utilities and industrial facilities. DEGS currently manages 6,150 MW of power generation at 21 facilities throughout the U.S. In addition, DEGS engages in the development, construction and operation of wind energy projects. Currently, DEGS has over 5,000 MW of wind energy projects in the development pipeline with approximately 735 net MW of wind generating capacity in operation as of December 31, 2009. DEGS is also developing transmission, solar and biomass projects.

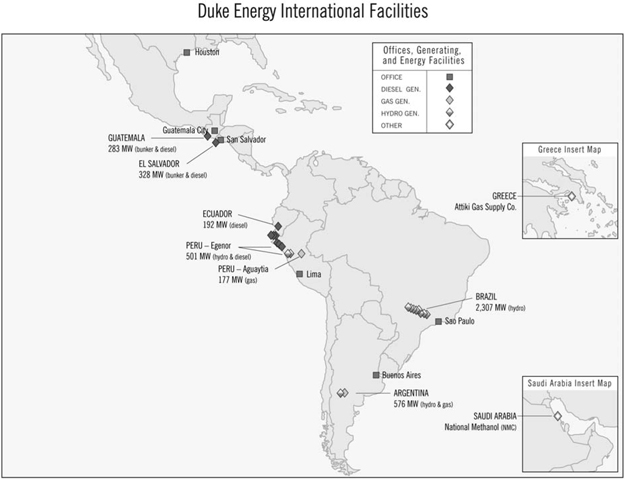

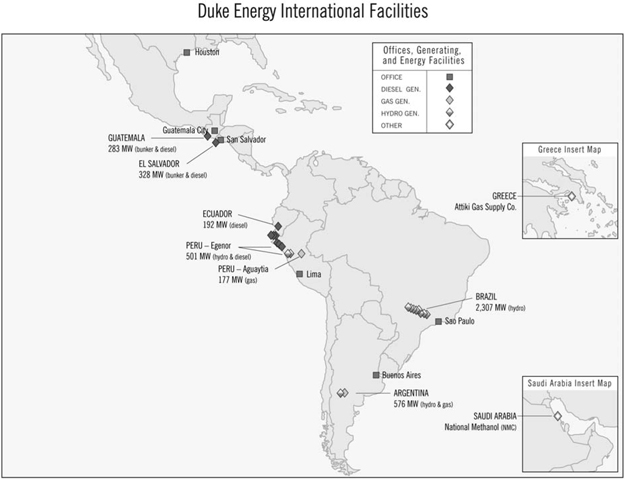

International Energy.International Energy principally owns, operates and manages power generation facilities, and engages in sales and marketing of electric power and natural gas outside the U.S. It conducts operations primarily through Duke Energy International, LLC (DEI) and its affiliates and its activities target power generation in Latin America. Through its wholly-owned subsidiary Aguaytia Energy del Perú S.R.L. Ltda. (Aguaytia) and its equity method investment in National Methanol Company (NMC), which is located in Saudi Arabia, International Energy also engages in the production of natural liquid gas and methanol and methyl tertiary butyl ether (MTBE). Additionally, International Energy had an equity method investment in Attiki Gas Supply S.A. (Attiki), a natural gas distributor in Greece, which it decided to abandon, along with the related non-recourse debt, in December 2009.

3

PART I

Other.The remainder of Duke Energy’s operations is presented as Other. While it is not considered a business segment, Other primarily includes certain unallocated corporate costs, Bison Insurance Company Limited (Bison), Duke Energy’s wholly-owned captive insurance subsidiary, Duke Energy’s effective 50% interest in the Crescent JV (Crescent) and DukeNet Communications, LLC (DukeNet) and related telecom businesses. Additionally, Other includes the remaining portion of Duke Energy’s business formerly known as DENA that was not exited or transferred to Commercial Power, primarily Duke Energy Trading and Marketing, LLC (DETM), which is 60% owned by Duke Energy and 40% owned by Exxon Mobil Corporation and management is currently in the process of winding down.

Unallocated corporate costs include certain costs not allocable to Duke Energy’s reportable business segments, primarily governance costs, costs to achieve mergers and divestitures (such as the Cinergy merger and spin-off of Spectra Energy) and costs associated with certain corporate severance programs. Bison’s principal activities as a captive insurance entity include the insurance and reinsurance of various business risks and losses, such as property, business interruption and general liability of subsidiaries and affiliates of Duke Energy. Crescent, which develops and manages high-quality commercial, residential and multi-family real estate projects primarily in the Southeastern and Southwestern U.S, filed Chapter 11 petitions in a U.S. Bankruptcy Court in June 2009. As a result of recording its proportionate share of impairment charges recorded by Crescent during 2008, the carrying value of Duke Energy’s investment balance in Crescent is zero and Duke Energy discontinued applying the equity method of accounting to its investment in Crescent in the third quarter of 2008 and has not recorded its proportionate share of any Crescent earnings or losses since the third quarter of 2008. DukeNet develops, owns and operates a fiber optic communications network, primarily in the Southeast U.S., serving wireless, local and long-distance communications companies, internet service providers and other businesses and organizations.

General.Duke Energy is a Delaware corporation. Its principal executive offices are located at 526 South Church Street, Charlotte, North Carolina 28202-1803. The telephone number is 704-594-6200. Duke Energy electronically files reports with the Securities and Exchange Commission (SEC), including annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, proxies and amendments to such reports. The public may read and copy any materials that Duke Energy files with the SEC at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC also maintains an internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC athttp://www.sec.gov. Additionally, information about Duke Energy, including its reports filed with the SEC, is available through Duke Energy’s Web site athttp://www.duke-energy.com. Such reports are accessible at no charge through Duke Energy’s Web site and are made available as soon as reasonably practicable after such material is filed with or furnished to the SEC.

GLOSSARY OF TERMS

The following terms or acronyms used in this Form 10-K are defined below:

| | |

| Term or Acronym | | Definition |

| |

| AAC | | Annually Adjusted Component |

| |

| ADEA | | Age Discrimination in Employment |

| |

| AEP | | American Electric Power Company, Inc. |

| |

| AFUDC | | Allowance for Funds Used During Construction |

| |

| Aguaytia | | Aguaytia Energy del Perú S.R.L. Ltda. |

| |

| ANEEL | | Brazilian Electricity Regulatory Agency |

| |

| AOCI | | Accumulated Other Comprehensive Income |

| |

| ASC | | Accounting Standards Codification |

| |

| ASU | | Accounting Standards Update |

| |

| Attiki | | Attiki Gas Supply S.A. |

| |

| Bison | | Bison Insurance Company Limited |

| |

| BPM | | Bulk Power Marketing |

| |

| CAA | | Clean Air Act |

| |

| CAIR | | Clean Air Interstate Rule |

| |

| Catamount | | Catamount Energy Corporation |

| |

| CC | | Combined Cycle |

| |

| Cinergy Receivables | | Cinergy Receivables Company, LLC |

4

PART I

| | |

| Term or Acronym | | Definition |

| |

| CMP | | Central Maine Power Company |

| |

| CT | | Combustion Turbine |

| |

| Cinergy | | Cinergy Corp. |

| |

| CO2 | | Carbon Dioxide |

| |

| COL | | Combined Construction and Operating License |

| |

| CPCN | | Certificate of Public Convenience and Necessity |

| |

| Crescent | | Crescent JV |

| |

| CWIP | | Construction Work-in-Progress |

| |

| DAQ | | Division of Air Quality |

| |

| DB | | Defined Benefit Pension Plan |

| |

| DCP Midstream | | DCP Midstream, LLC (formerly Duke Energy Field Services, LLC) |

| |

| DECE | | Duke Energy Commercial Enterprises, Inc. |

| |

| DEGS | | Duke Energy Generation Services, Inc. |

| |

| DEI | | Duke Energy International, LLC |

| |

| DEIGP | | Duke Energy International Geracao Paranapenema S.A. |

| |

| DENA | | Duke Energy North America |

| |

| DENR | | Department of Environment and Natural Resources |

| |

| DERF | | Duke Energy Receivables Finance Company, LLC |

| |

| DERS | | Duke Energy Retail Sales |

| |

| DETM | | Duke Energy Trading and Marketing, LLC |

| |

| DOE | | Department of Energy |

| |

| DRIP | | Dividend Reinvestment Plan |

| |

| DSM | | Demand Side Management |

| |

| Duke Energy | | Duke Energy Corporation (collectively with its subsidiaries) |

| |

| Duke Energy Carolinas | | Duke Energy Carolinas, LLC |

| |

| Duke Energy Indiana | | Duke Energy Indiana, Inc. |

| |

| Duke Energy Kentucky | | Duke Energy Kentucky, Inc. |

| |

| Duke Energy Ohio | | Duke Energy Ohio, Inc. |

| |

| EPA | | Environmental Protection Agency |

| |

| EPS | | Earnings Per Share |

| |

| ERISA | | Employee Retirement Income Security Act |

5

PART I

| | |

| Term or Acronym | | Definition |

| |

| ESP | | Electric Security Plan |

| |

| EWG | | Exempt Wholesale Generator |

| |

| FASB | | Financial Accounting Standards Board |

| |

| FERC | | Federal Energy Regulatory Commission |

| |

| FPP | | Fuel and Purchased Power |

| |

| GAAP | | Generally Accepted Accounting Principles in the United States |

| |

| GWh | | Gigawatt-hours |

| |

| HAP | | Hazardous Air Pollutant |

| |

| IGCC | | Integrated Gasification Combined Cycle |

| |

| IMPA | | Indiana Municipal Power Agency |

| |

| ITC | | Investment Tax Credit |

| |

| IURC | | Indiana Utility Regulatory Commission |

| |

| KPSC | | Kentucky Public Service Commission |

| |

| KV | | Kilovolt |

| |

| kWh | | Kilowatt-hour |

| |

| LIBOR | | London Interbank Offered Rate |

| |

| MACT | | Maximum achievable control technology |

| |

| Mcf | | Thousand cubic feet |

| |

| Midwest ISO | | Midwest Independent Transmission System Operator, Inc. |

| |

| MMBtu | | Million British Thermal Unit |

| |

| Moody’s | | Moody’s Investor Services |

| |

| MRO | | Market Rate Option |

| |

| MTBE | | Methyl tertiary butyl ether |

| |

| MW | | Megawatt |

| |

| MWh | | Megawatt-hour |

| |

| NCUC | | North Carolina Utilities Commission |

| |

| NDTF | | Nuclear Decommissioning Trust Funds |

| |

| NEIL | | Nuclear Electric Insurance Limited |

| |

| NMC | | National Methanol Company |

| |

| NOx | | Nitrogen oxide |

| |

| NPNS | | Normal purchase/normal sale |

6

PART I

| | |

| Term or Acronym | | Definition |

| |

| NRC | | Nuclear Regulatory Commission |

| |

| NSR | | New Source Review |

| |

| OCC | | Office of the Ohio Consumers’ Counsel |

| |

| ORS | | South Carolina Office of Regulatory Staff |

| |

| OUCC | | Indiana Office of Utility Consumer Counselor |

| |

| Pioneer Transmission | | Pioneer Transmission, LLC |

| |

| PSCSC | | Public Service Commission of South Carolina |

| |

| PUCO | | Public Utilities Commission of Ohio |

| |

| PUHCA | | Public Utility Holding Company Act of 1935, as amended |

| |

| QSPE | | Qualifying Special Purpose Entity |

| |

| REPS | | Renewable Energy and Energy Efficiency Portfolio Standard |

| |

| RICO | | Racketeer Influenced and Corrupt Organizations |

| |

| RSP | | Rate Stabilization Plan |

| |

| RTO | | Regional Transmission Organization |

| |

| SB 221 | | Ohio Senate Bill 221 |

| |

| SCEUC | | South Carolina Energy Users Committee |

| |

| sEnergy | | sEnergy Insurance Limited |

| |

| SEC | | Securities and Exchange Commission |

| |

| SHGP | | South Houston Green Power, L.P. |

| |

| SO2 | | Sulfur dioxide |

| |

| SPE | | Special Purpose Entity |

| |

| Spectra Energy | | Spectra Energy Corp. |

| |

| Spectra Capital | | Spectra Energy Capital, LLC (formerly Duke Capital LLC) |

| |

| S&P | | Standard & Poor’s |

| |

| Stimulus Bill | | The American Recovery and Reinvestment Act of 2009 |

| |

| Synfuel | | Synthetic Fuel |

| |

| VDEQ | | Virginia Department of Environmental Quality |

| |

| VIE | | Variable Interest Entity |

| |

| WACC | | Weighted Average Cost of Capital |

| |

| WARN | | North Carolina Waste Awareness Reduction Network |

7

PART I

| | |

| Term or Acronym | | Definition |

| |

| WVPA | | Wabash Valley Power Association, Inc. |

The following sections describe the business and operations of each of Duke Energy’s reportable business segments, as well as Other. (For more information on the operating outlook of Duke Energy and its reportable segments, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations, Introduction—Executive Overview and Economic Factors for Duke Energy’s Business”. For financial information on Duke Energy’s reportable business segments, see Note 2 to the Consolidated Financial Statements, “Business Segments.”)

U.S. FRANCHISED ELECTRIC AND GAS

Service Area and Customers

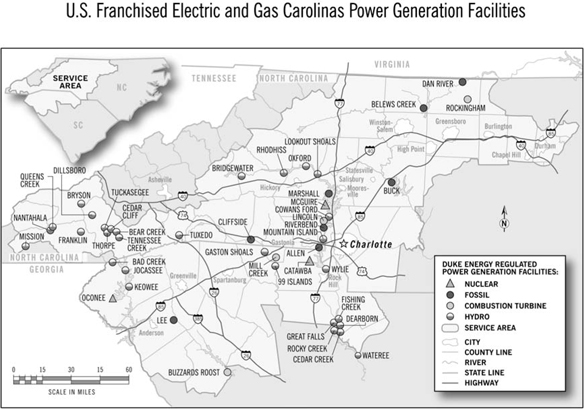

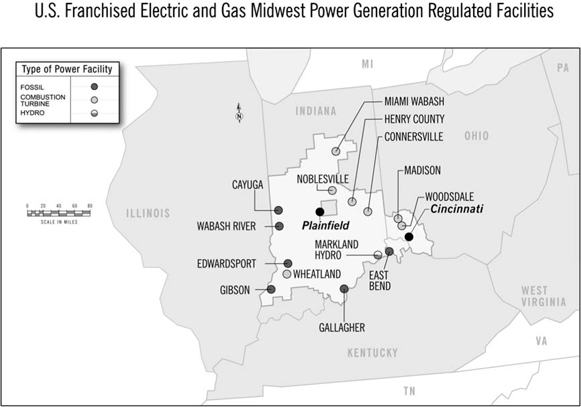

U.S. Franchised Electric and Gas generates, transmits, distributes and sells electricity and transports and sells natural gas. It conducts operations primarily through Duke Energy Carolinas, the regulated transmission and distribution operations of Duke Energy Ohio, Duke Energy Indiana and Duke Energy Kentucky (Duke Energy Ohio, Duke Energy Indiana and Duke Energy Kentucky collectively referred to as Duke Energy Midwest). Its service area covers about 50,000 square miles with an estimated population of 11 million in central and western North Carolina, western South Carolina, southwestern Ohio, central, north central and southern Indiana, and northern Kentucky. U.S. Franchised Electric and Gas supplies electric service to approximately 4 million residential, commercial and industrial customers over 151,600 miles of distribution lines and a 20,900 mile transmission system. U.S. Franchised Electric and Gas provides domestic regulated transmission and distribution services for natural gas to approximately 500,000 customers in southwestern Ohio and northern Kentucky via approximately 7,200 miles of gas mains (gas distribution lines that serve as a common source of supply for more than one service line) and approximately 6,000 miles of service lines. Electricity is also sold wholesale to incorporated municipalities and to public and private utilities. In addition, municipal and cooperative customers who purchased portions of the power generated by the Catawba Nuclear Station may also buy power from a variety of suppliers, including Duke Energy Carolinas, through contractual agreements. For more information on the Catawba Nuclear Station joint ownership, see Note 5 to the Consolidated Financial Statements, “Joint Ownership of Generating and Transmission Facilities.”

Duke Energy Carolinas’ service area has a diversified commercial and industrial presence. Manufacturing continues to be one of the largest contributors to the economy in the region. Other sectors such as finance, insurance, real estate services, and local government also constitute key components of the states’ gross domestic product. Chemicals, rubber and plastics, textile and motor vehicle manufacturing industries were among the most significant contributors to the Duke Energy Carolinas’ industrial sales.

Duke Energy Ohio’s and Duke Energy Kentucky’s service area both have a diversified commercial and industrial presence. Major components of the economy include manufacturing, real estate and rental leasing, wholesale trade, financial and insurance services, retail trade, education, healthcare and professional/business services.

The primary metals industry, transportation equipment, chemicals, and paper and plastics were the most significant contributors to the area’s manufacturing output and Duke Energy Ohio’s and Duke Energy Kentucky’s industrial sales revenue for 2009. Food and beverage manufacturing, fabricated metals, and electronics also have a strong impact on the area’s economic growth and the region’s industrial sales.

Industries of major economic significance in Duke Energy Indiana’s service territory include food products, stone, clay and glass, primary metals, and transportation. Other significant industries operating in the area include chemicals, fabricated metal, and other manufacturing. Key sectors among general service customers include education and retail trade.

The number of residential and general service customers within the U.S. Franchised Electric and Gas’ service territory, as well as sales to these customers, is expected to increase over time. However, growth in the near-term is being hampered by the current economic conditions. Industrial sales declined in 2009 when compared to 2008. While the decline in the sales volumes to industrial customers began to stabilize in the second half of 2009, the level of sales to industrial customers is expected to remain a smaller, yet still significant, portion of U.S. Franchised Electric and Gas sales in the foreseeable future.

U.S. Franchised Electric and Gas’ costs and revenues are influenced by seasonal patterns. Peak sales of electricity occur during the summer and winter months, resulting in higher revenue and cash flows during those periods. By contrast, fewer sales of electricity occur during the spring and fall, allowing for scheduled plant maintenance during those periods. Peak gas sales occur during the winter months.

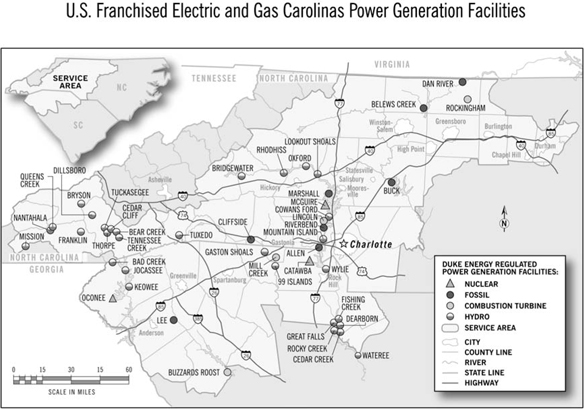

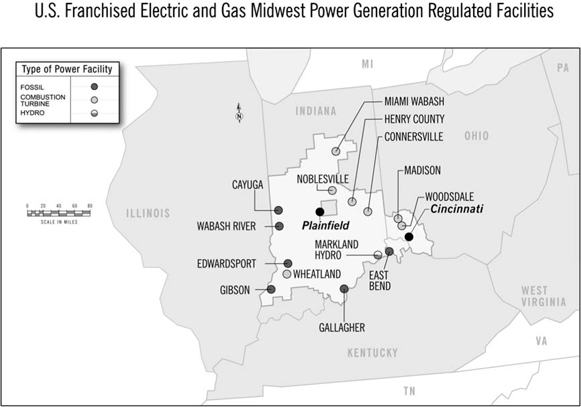

The following maps show the U.S. Franchised Electric and Gas’ service territories and operating facilities.

8

PART I

9

PART I

Energy Capacity and Resources

Electric energy for U.S. Franchised Electric and Gas’ customers is generated by three nuclear generating stations with a combined owned capacity of 5,173 MW (including Duke Energy’s approximate 19% ownership in the Catawba Nuclear Station), fifteen coal-fired stations with an overall combined owned capacity of 13,189 MW (including Duke Energy’s 69% ownership in the East Bend Steam Station and 50.05% ownership in Unit 5 of the Gibson Steam Station), thirty-one hydroelectric stations (including two pumped-storage facilities) with a combined owned capacity of 3,263 MW, fifteen combustion turbine (CT) stations burning natural gas, oil or other fuels with an overall combined owned capacity of 5,047 MW and one combined cycle (CC) station burning natural gas with an owned capacity of 285 MW. Energy and capacity are also supplied through contracts with other generators and purchased on the open market. Factors that could cause U.S. Franchised Electric and Gas to purchase power for its customers include generating plant outages, extreme weather conditions, generation reliability during the summer, growth, and price. U.S. Franchised Electric and Gas has interconnections and arrangements with its neighboring utilities to facilitate planning, emergency assistance, sale and purchase of capacity and energy, and reliability of power supply.

U.S. Franchised Electric and Gas’ generation portfolio is a balanced mix of energy resources having different operating characteristics and fuel sources designed to provide energy at the lowest possible cost to meet its obligation to serve native-load customers. All options, including owned generation resources and purchased power opportunities, are continually evaluated on a real-time basis to select and dispatch the lowest-cost resources available to meet system load requirements. The vast majority of customer energy needs are met by large, low-energy-production-cost nuclear and coal-fired generating units that operate almost continuously (or at baseload levels). In 2009, approximately 98.1% of the total generated energy came from U.S. Franchised Electric and Gas’ low-cost, efficient nuclear and coal units (59.6% coal and 38.5% nuclear). The remaining energy needs were supplied by hydroelectric, CT and CC generation or economic purchases from the wholesale market.

Hydroelectric (both conventional and pumped storage) in the Carolinas and gas/oil CT and CC stations in both the Carolinas and Midwest operate primarily during the peak-hour load periods (at peaking levels) when customer loads are rapidly changing. CT’s and CC’s produce energy at higher production costs than either nuclear or coal, but are less expensive to build and maintain, and can be rapidly started or stopped as needed to meet changing customer loads. Hydroelectric units produce low-cost energy, but their operations are limited by the availability of water flow.

U.S. Franchised Electric and Gas’ major pumped-storage hydroelectric facilities offer the added flexibility of using low-cost off-peak energy to pump water that will be stored for later generation use during times of higher-cost on-peak generation periods. These facilities allow U.S. Franchised Electric and Gas to maximize the value spreads between different high- and low-cost generation periods.

U.S. Franchised Electric and Gas is engaged in planning efforts to meet projected load growth in its service territories. Long-term projections indicate a need for capacity additions, which may include new nuclear, integrated gasification combined cycle (IGCC), coal facilities or gas-fired generation units. Because of the long lead times required to develop such assets, U.S. Franchised Electric and Gas is taking steps now to ensure those options are available. Significant current or potential future capital projects are discussed below.

10

PART I

South Carolina passed new energy legislation South Carolina Senate Bill 431 (S 431) which became effective May 3, 2007. This legislation includes provisions to provide assurance of cost recovery related to a utility’s incurrence of project development costs associated with nuclear baseload generation, cost recovery assurance for construction costs associated with nuclear or coal baseload generation, and the ability to recover financing costs for new nuclear baseload generation in rates during construction through a rider. The North Carolina General Assembly also passed comprehensive energy legislation North Carolina Senate Bill 3 (SB 3) in July 2007 that was signed into law by the Governor on August 20, 2007. Like the South Carolina legislation, the North Carolina legislation provides cost recovery assurance, subject to prudency review, for nuclear project development costs as well as baseload generation construction costs. A utility may include financing costs related to construction work in progress for baseload plants in a rate case.

William States Lee III Nuclear Station. On December 12, 2007, Duke Energy Carolinas filed an application with the Nuclear Regulatory Commission (NRC), which has been docketed for review, for a combined Construction and Operating License (COL) for two Westinghouse AP1000 (advanced passive) reactors for the proposed William States Lee III Nuclear Station at a site in Cherokee County, South Carolina. Each reactor is capable of producing approximately 1,117 MW. Submitting the COL application does not commit Duke Energy Carolinas to build nuclear units. The NRC review of the COL application continues and the estimated receipt of the COL is in mid 2013. Duke Energy Carolinas filed with the U.S. Department of Energy (DOE) for a federal loan guarantee, which has the potential to significantly lower financing costs associated with the proposed William States Lee III Nuclear Station; however, it was not among the four projects selected by the DOE for the final phase of due diligence for the federal loan guarantee program. The project could be selected in the future if the program funding is expanded or if any of the current finalists drop out of the program.

Cliffside Unit 6.On June 2, 2006, Duke Energy Carolinas filed an application with the NCUC for a Certificate of Public Convenience and Necessity (CPCN) to construct two 800 MW state of the art coal generation units at its existing Cliffside Steam Station in North Carolina. On March 21, 2007, the NCUC issued an Order allowing Duke Energy Carolinas to build one 800 MW unit. On February 20, 2008, Duke Energy Carolinas entered into an amended and restated engineering, procurement, construction and commissioning services agreement, valued at approximately $1.3 billion, with an affiliate of The Shaw Group, Inc., of which approximately $950 million relates to participation in the construction of Cliffside Unit 6, with the remainder related to a flue gas desulfurization system on an existing unit at Cliffside. On February 27, 2009, Duke Energy Carolinas filed its latest updated cost estimate of $1.8 billion (excluding up to approximately $0.6 billion of allowance for funds used during construction (AFUDC)) for the approved new Cliffside Unit 6. Duke Energy Carolinas believes that the overall cost of Cliffside Unit 6 will be reduced by approximately $125 million in federal advanced clean coal tax credits. Construction of Cliffside Unit 6 is underway and is approximately 55% complete as of December 31, 2009.

Dan River and Buck Combined Cycle Facilities.On June 29, 2007, Duke Energy Carolinas filed with the NCUC preliminary CPCN information to construct a 620 MW combined cycle natural gas-fired generating facility at its existing Dan River Steam Station, as well as updated preliminary CPCN information to construct a 620 MW combined cycle natural gas-fired generating facility at its existing Buck Steam Station. On December 14, 2007, Duke Energy Carolinas filed CPCN applications for the two combined cycle facilities. The NCUC consolidated its consideration of the two CPCN applications and held an evidentiary hearing on the applications on March 11, 2008. On May 5, 2008, Duke Energy Carolinas entered into an engineering, construction and commissioning services agreement for the Buck combined cycle project, valued at approximately $275 million, with Shaw North Carolina, Inc. On November 5, 2008, Duke Energy Carolinas notified the NCUC that since the issuance of the CPCN Order, recent economic factors have caused increased uncertainty with regard to forecasted load and near-term capital expenditures, resulting in a modification of the construction schedule. On September 1, 2009, Duke Energy Carolinas filed with the NCUC further information clarifying the construction schedule for the two projects. Under the revised schedule, the Buck Project is expected to begin operation in combined cycle mode by the end of 2011, but without a phased-in simple cycle commercial operation. The Dan River Project is expected to begin operation in combined cycle mode by the end of 2012, also without a phased-in simple cycle commercial operation. On December 21, 2009, Duke Energy Carolinas entered into a First Amended and Restated engineering, construction and commissioning services agreement with Shaw North Carolina, Inc. for $322 million which reflects the revised schedule. Based on the most updated cost estimates, total costs (including AFUDC) for the Buck and Dan River projects are approximately $660 million and $710 million, respectively.

On October 15, 2008, the Division of Air Quality (DAQ) issued a final air construction permit authorizing construction of the Buck combined cycle natural gas-fired generating units, and on August 24, 2009, the DAQ issued a final air permit authorizing construction of the Dan River combined cycle natural gas-fired generation units.

Edwardsport IGCC.On September 7, 2006, Duke Energy Indiana and Southern Indiana Gas and Electric Company d/b/a Vectren Energy Delivery of Indiana (Vectren) filed a joint petition with the IURC seeking a CPCN for the construction of a 630 MW IGCC power plant at Duke Energy Indiana’s Edwardsport Generating Station in Knox County, Indiana. The facility was initially estimated to cost approximately $2 billion (including approximately $120 million of AFUDC). In August 2007, Vectren formally withdrew its participation in the IGCC plant and a hearing was conducted on the CPCN petition based on Duke Energy Indiana owning 100% of the project. On November 20, 2007, the IURC issued an order granting Duke Energy Indiana a CPCN for the proposed IGCC Project, approved the cost estimate of $1.985 billion and approved the timely recovery of costs related to the project. On January 25, 2008, Duke Energy Indiana received the final air permit from the Indiana Department of Environmental Management.

On May 1, 2008, Duke Energy Indiana filed its first semi-annual IGCC Rider and ongoing review proceeding with the IURC as required under the CPCN Order issued by the IURC. In its filing, Duke Energy Indiana requested approval of a new cost estimate for the IGCC Project of $2.35 billion (including approximately $125 million of AFUDC) and for approval of plans to study carbon capture as required by the IURC’s CPCN Order. On January 7, 2009, the IURC approved Duke Energy Indiana’s request, including the new cost estimate of $2.35 billion, and cost recovery associated with a study on carbon capture. Duke Energy Indiana was required to file its plans for studying carbon storage related to the project within 60 days of the order. On November 3, 2008 and May 1, 2009, Duke Energy Indiana filed its second and third semi-annual IGCC riders, respectively, both of which were approved by the IURC in full.

On November 24, 2009, Duke Energy Indiana filed a petition for its fourth semi-annual IGCC rider and ongoing review proceeding with the IURC. Duke Energy has experienced design modifications and scope growth above what was anticipated from the preliminary engineering design, adding capital costs to the IGCC project. Duke Energy Indiana forecasted that the additional capital cost items would use the remaining contingency and escalation amounts in the current $2.35 billion cost estimate and add approximately $150 million, or about 6.4% to the total IGCC Project cost estimate, excluding the impact associated with the need to add more contingency. Duke Energy Indiana did not request approval of an increased cost estimate in the fourth semi-annual update proceeding; rather, Duke Energy Indiana requested the IURC to establish a subdocket proceeding in which Duke Energy will present additional evidence regarding an updated estimated cost for the IGCC project and in which a more comprehensive review of the IGCC project could occur. On January 27, 2010, the IURC approved Duke Energy Indiana’s request for a subdocket proceeding regarding the cost estimate issues and accepted procedural schedules for the fourth semi-annual update proceeding and the subdocket proceeding. The evidentiary hearing for the fourth semi-annual update proceeding is scheduled for April 6, 2010. In the cost estimate subdocket proceeding, Duke Energy Indiana will be filing a new cost estimate for the IGCC project on April 7, 2010, with its case-in-chief testimony, and a hearing is scheduled to begin August 10, 2010. Duke Energy Indiana continues to work with its

11

PART I

vendors to update and refine the forecasted increased cost to complete the Edwardsport IGCC project, and currently anticipates that the total cost increase it submits in the cost estimate subdocket proceeding will be significantly higher than the $150 million previously identified.

Duke Energy Indiana filed a petition with the IURC requesting approval of its plans for studying carbon storage, sequestration and/or enhanced oil recovery for the carbon dioxide (CO2) from the Edwardsport IGCC facility on March 6, 2009. On July 7, 2009, Duke Energy Indiana filed its case-in-chief testimony requesting approval for cost recovery of a $121 million site assessment and characterization plan for CO2 sequestration options including deep saline sequestration, depleted oil and gas sequestration and enhanced oil recovery for the CO2 from the Edwardsport IGCC facility. The Indiana Office of Utility Consumer Counselor (OUCC) filed testimony supportive of the continuing study of carbon storage, but recommended that Duke Energy Indiana break its plan into phases, recommending approval of only approximately $33 million in expenditures at this time and deferral of expenditures rather than cost recovery through a tracking mechanism as proposed by Duke Energy Indiana. Intervenor CAC recommended against approval of the carbon storage plan stating customers should not be required to pay for research and development costs. Duke Energy Indiana’s rebuttal testimony was filed October 30, 2009, wherein it amended its request to seek deferral of approximately $42 million to cover the carbon storage site assessment and characterization activities scheduled to occur through approximately the end of 2010, with further required study expenditures subject to future IURC proceedings. An evidentiary hearing was held on November 9, 2009, and an order is expected in the first half of 2010.

Under the Edwardsport IGCC CPCN order and statutory provisions, Duke Energy Indiana is entitled to recover the costs reasonably incurred in reliance on the CPCN Order. In December 2008, Duke Energy Indiana entered into a $200 million engineering, procurement and construction management agreement with Bechtel Power Corporation. Construction of Edwardsport is underway and is approximately 50% complete as of December 31, 2009.

See Note 4 to the Consolidated Financial Statements, “Regulatory Matters,” for further discussion on the above in-process or potential construction projects.

Fuel Supply

U.S. Franchised Electric and Gas relies principally on coal and nuclear fuel for its generation of electric energy. The following table lists U.S. Franchised Electric and Gas’ sources of power and fuel costs for the three years ended December 31, 2009.

| | | | | | | | | | | | |

| | | Generation by Source

(Percent) | | Cost of Delivered Fuel per Net

Kilowatt-hour Generated (Cents) |

| | | 2009 | | 2008 | | 2007 | | 2009 | | 2008 | | 2007 |

Coal(a) | | 59.6 | | 66.9 | | 66.5 | | 2.88 | | 2.59 | | 2.20 |

Nuclear(b) | | 38.5 | | 32.1 | | 31.2 | | 0.48 | | 0.44 | | 0.38 |

Oil and gas(c) | | 0.4 | | 0.7 | | 1.1 | | 7.71 | | 13.47 | | 9.32 |

| | | | | | | | | | | | |

All fuels (cost-based on weighted average)(a)(b) | | 98.5 | | 99.7 | | 98.8 | | 1.96 | | 1.97 | | 1.71 |

Hydroelectric(d) | | 1.5 | | 0.3 | | 1.2 | | | | | | |

| | | | | | | | | | | | |

| | 100.0 | | 100.0 | | 100.0 | | | | | | |

| | | | | | | | | | | | |

| (a) | Statistics related to coal generation and all fuels reflect U.S. Franchised Electric and Gas’ 69% ownership interest in the East Bend Steam Station and 50.05% ownership interest in Unit 5 of the Gibson Steam Station. |

| (b) | Statistics related to nuclear generation and all fuels reflect U.S. Franchised Electric and Gas’ 12.5% interest in the Catawba Nuclear Station through September 30, 2008 and an approximate 19% ownership interest in the Catawba Nuclear Station from October 1, 2008 and thereafter. |

| (c) | Cost statistics include amounts for light-off fuel at U.S. Franchised Electric and Gas’ coal-fired stations. |

| (d) | Generating figures are net of output required to replenish pumped storage facilities during off-peak periods. |

Coal. U.S. Franchised Electric and Gas meets its coal demand in the Carolinas and Midwest through a portfolio of purchase supply contracts and spot agreements. Large amounts of coal are purchased under supply contracts with mining operators who mine both underground and at the surface. U.S. Franchised Electric and Gas uses spot-market purchases to meet coal requirements not met by supply contracts. Expiration dates for its supply contracts, which have various price adjustment provisions and market re-openers, range from 2010 to 2014. U.S. Franchised Electric and Gas expects to renew these contracts or enter into similar contracts with other suppliers for the quantities and quality of coal required as existing contracts expire, though prices will fluctuate over time as coal markets change. The coal purchased for the Carolinas is primarily produced from mines in eastern Kentucky, West Virginia and southwestern Virginia. The coal purchased for the regulated Midwest entities is primarily produced in Indiana, Illinois, and Kentucky. U.S. Franchised Electric and Gas has an adequate supply of coal under contract to fuel its projected 2010 operations and a significant portion of supply to fuel its projected 2011 operations.

The current average sulfur content of coal purchased by U.S. Franchised Electric and Gas for the Carolinas is approximately 1%; however, as Carolinas coal plants continue to bring on scrubbers over the next several years, the sulfur content of coal purchased could increase as higher sulfur coal options are considered. The current average sulfur content of coal purchased by U.S. Franchised Electric and Gas for the Midwest is approximately 2%. Coupled with the use of available sulfur dioxide (SO2) emission allowances on the open market, this satisfies the current emission limitations for SO2 for existing facilities in the Carolinas and Midwest.

Gas. U.S. Franchised Electric and Gas is responsible for the purchase and the subsequent delivery of natural gas to native load customers in its Ohio and Kentucky service territories. U.S. Franchised Electric and Gas’ natural gas procurement strategy is to buy firm natural gas supplies (natural gas intended to be available at all times) and firm interstate pipeline transportation capacity during the winter season (November through March) and during the non-heating season (April through October) through a combination of firm supply and transportation capacity along with spot supply and interruptible transportation capacity. This strategy allows U.S. Franchised Electric and Gas to assure reliable natural gas supply for its high priority (non-curtailable) firm customers during peak winter conditions and provides U.S. Franchised Electric and Gas the flexibility to reduce its contract commitments if firm customers choose alternate gas suppliers under U.S. Franchised Electric and Gas’ customer choice/gas transportation programs. In 2009, firm supply purchase commitment agreements provided approximately 99% of the natural gas supply, with the remaining gas purchased on the spot market. These firm supply agreements feature two levels of gas supply, specifically (1) base load, which is a continuous supply to meet normal demand requirements, and (2) swing load, which is gas available on a daily basis to accommodate changes in demand due primarily to changing weather conditions.

12

PART I

U.S. Franchised Electric and Gas also owns two underground caverns with a total storage capacity of approximately 16 million gallons of liquid propane. In addition, U.S. Franchised Electric and Gas has access to 5.5 million gallons of liquid propane storage and product loan through a commercial services agreement with a third party. This liquid propane is used in the three propane/air peak shaving plants located in Ohio and Kentucky. Propane/air peak shaving plants vaporize the propane and mix with natural gas to supplement the natural gas supply during peak demand periods and emergencies.

U.S. Franchised Electric and Gas manages natural gas procurement-price volatility mitigation programs for Duke Energy Ohio and Duke Energy Kentucky. These programs pre-arrange between 10-25% of total winter heating season gas requirements for Duke Energy Ohio, between 10-35% of total winter heating season gas requirements for Duke Energy Kentucky and between 10-50% of total summer season gas requirements for both Duke Energy Ohio and Duke Energy Kentucky for up to three years in advance of the delivery month. Duke Energy Ohio and Duke Energy Kentucky use primarily fixed-price forward contracts and contracts with a ceiling and floor on the price. As of December 31, 2009, Duke Energy Ohio and Duke Energy Kentucky, combined, had locked in pricing for approximately 22% of their winter 2009/2010 system load requirements.

U.S. Franchised Electric and Gas is also responsible for the purchase and the subsequent delivery of natural gas to the gas turbine generators to serve native electric load customers in the Duke Energy Carolinas, Duke Energy Indiana and Duke Energy Kentucky service territories. The natural gas procurement strategy is to contract with one or several suppliers who buy spot market natural gas supplies along with firm or interruptible interstate pipeline transportation capacity for deliveries to the site. This strategy allows for competitive pricing, flexibility of delivery, and reliable natural gas supplies to each of the natural gas plants. Many of the natural gas plants can be served by several supply zones and multiple pipelines.

Duke Energy Indiana hedges a percentage of its winter and summer expected native gas burn from Indiana gas turbine units using financial swaps tied to the New York Mercantile Exchange (NYMEX)-Henry Hub natural gas futures.

Nuclear. The industrial processes for producing nuclear generating fuel generally involve the mining and milling of uranium ore to produce uranium concentrates, the services to convert uranium concentrates to uranium hexafluoride, the services to enrich the uranium hexafluoride, and the services to fabricate the enriched uranium hexafluoride into usable fuel assemblies.

Duke Energy Carolinas has contracted for uranium materials and services to fuel the Oconee, McGuire and Catawba Nuclear Stations in the Carolinas. Uranium concentrates, conversion services and enrichment services are primarily met through a diversified portfolio of long-term supply contracts. The contracts are diversified by supplier, country of origin and pricing. Duke Energy Carolinas staggers its contracting so that its portfolio of long-term contracts covers the majority of its fuel requirements at Oconee, McGuire and Catawba in the near-term and decreasing portions of its fuel requirements over time thereafter. Due to the technical complexities of changing suppliers of fuel fabrication services, Duke Energy Carolinas generally sources these services to a single domestic supplier on a plant-by-plant basis using multi-year contracts.

Duke Energy Carolinas has entered into fuel contracts that, based on its current need projections, cover 100% of the uranium concentrates, conversion services, and enrichment services requirements of the Oconee, McGuire and Catawba Nuclear Stations through at least 2011 and cover fabrication services requirements for these plants through at least 2018. For subsequent years, a portion of the fuel requirements at Oconee, McGuire and Catawba are covered by long-term contracts. For future requirements not already covered under long-term contracts, Duke Energy Carolinas believes it will be able to renew contracts as they expire, or enter into similar contractual arrangements with other suppliers of nuclear fuel materials and services. Near-term requirements not met by long-term supply contracts have been and are expected to be fulfilled with uranium spot market purchases.

Energy Efficiency.Several factors have led to increased focus on energy efficiency, including environmental constraints, increasing costs of generating plans and legislative mandates regarding building codes and appliance efficiencies. As a result of these factors, Duke Energy has developed various programs designed to promote the efficient use of electricity by its customers. These programs, collectively called save-a-watt, have been filed with various state commissions over the past several years.

Save-a-watt was approved by the PUCO on December 17, 2008, in conjunction with the ESP, and Duke Energy Ohio began offering programs and billing a rate rider effective January 1, 2009. Save-a-watt is approved to continue through December 31, 2011.

On February 26, 2009, the NCUC approved Duke Energy Carolinas’ energy efficiency programs and authorized Duke Energy Carolinas to implement its rate rider pending approval of a final compensation mechanism by the NCUC. Duke Energy Carolinas began offering energy conservation programs to North Carolina retail customers and billing a conservation-program only rider on June 1, 2009. In October 2009, Duke Energy Carolinas also began offering demand response programs in North Carolina. On December 14, 2009, the NCUC approved the save-a-watt compensation model and, effective January 1, 2010, Duke Energy Carolinas began billing a rate rider reflecting both conservation and demand response programs. The save-a-watt programs and compensation approach in North Carolina are approved through December 31, 2013.

Duke Energy Carolinas began offering demand response and conservation programs to South Carolina retail customers effective June 1, 2009. On January 20, 2010, the PSCSC approved a save-a-watt rider for Duke Energy Carolinas’ energy efficiency programs. Duke Energy Carolinas began billing this rider to retail customers February 1, 2010. The save-a-watt programs and compensation approach in South Carolina are approved through December 31, 2013.

In October 2007, Duke Energy Indiana filed its petition with the IURC requesting approval of save-a-watt. Duke Energy Indiana reached a settlement with all intervenors except one, the CAC, and filed the settlement agreement with the IURC. An evidentiary hearing with the IURC was held on February 27, 2009 and March 2, 2009. On February 10, 2010, the IURC approved the request.

The KPSC approved Duke Energy Kentucky’s current energy efficiency programs in 2009. The KPSC is reviewing Duke Energy Kentucky’s proposed adjustment for 2010 and a decision is expected by May 2010. On December 1, 2008, Duke Energy Kentucky filed an application for the save-a-watt compensation model. On January 27, 2010, Duke Energy Kentucky withdrew the application to implement save-a-watt and plans to file a revised portfolio in the future.

SmartGrid and Distributed Renewable Generation Demonstration Project. Duke Energy Indiana filed a petition in May 2008, and case-in-chief testimony in September 2008, supporting its request to build an intelligent distribution grid in Indiana. The proposal requested approval of distribution formula rates or, in the alternative, a SmartGrid Rider to recover the return on and of the capital costs of the build-out and the recovery of incremental operating and maintenance expenses and lost revenues. The petition also included a pilot program for the installation of small solar photovoltaic and wind generation on customer sites, for approximately $10 million over a three-year period. Duke Energy Indiana filed supplemental testimony in January 2009 to reflect the impacts of new favorable tax treatment on the cost/benefit analysis for SmartGrid. After various filings by interveners, on June 4, 2009, Duke Energy Indiana filed with the IURC a settlement agreement with the OUCC, the CAC, Nucor Corporation, and the Duke Energy Indiana Industrial Group which provided for a full deployment of Duke Energy Indiana’s SmartGrid initiative at a slower pace, including cost recovery through a tracking mechanism. The settlement also included increased reporting and monitoring requirements, approval of Duke Energy Indiana’s renewable distributed generation pilot and the creation of a collaborative design to initiate several time differentiated pricing pilots, an electric vehicle pilot and a home area network pilot. Additionally, the settlement agreement provided for tracker recovery of the costs associated with the SmartGrid initiative, subject to cost recovery caps and a termination date for the tracker. The tracker would also include a reduction in costs associated with the adoption of a new depreciation study. An evidentiary hearing was held on June 29, 2009. On November 4, 2009, the IURC issued an order that rejected

13

PART I

the settlement agreement as incomplete and not in the public interest. The IURC cited a lack of defined benefits of the programs and encouraged the parties to continue the collaborative process outlined in the settlement or to consider smaller scale pilots or phased-in options. The IURC required the parties to present a procedural schedule within 10 days to address the underlying relief requested in the cause, and to supplement the record to address issues regarding the American Recovery and Reinvestment Act (the Stimulus Bill) funding recently awarded by the DOE. Duke Energy Indiana is considering its next steps, including a review of the implications of this Order on the Stimulus Bill SmartGrid Investment Grant award from the DOE. A technical conference was held at the IURC on December 1, 2009, wherein a procedural schedule was established for the IURC’s continuing review of Duke Energy Indiana’s smart grid proposal. Duke Energy is currently scheduled to file supplemental testimony in support of a revised SmartGrid proposal by April 1, 2010, with an evidentiary hearing scheduled for May 5, 2010.

Duke Energy Ohio received approval to recover expenditures incurred to deploy the SmartGrid infrastructure in December 2008 in conjunction with the approval of Duke Energy Ohio’s ESP filing. On June, 30, 2009, Duke Energy Ohio filed an application to establish rates for return of its SmartGrid net costs incurred for gas and electric distribution service through the end of 2008. Duke Energy Ohio proposed its gas SmartGrid rider as part of its most recent gas distribution rate case. A Stipulation and Recommendation was entered into by Duke Energy Ohio, Staff of the PUCO, Kroger Company, and Ohio Partners for Affordable Energy, which provides for a revenue increase of approximately $4.2 million under the electric rider and $590,000 under the natural gas rider. Approval of the Stipulation and Recommendation is expected in the first quarter 2010.

Duke Energy Business Services, on behalf of Duke Energy Indiana and Duke Energy Ohio, was awarded a $200 million SmartGrid investment grant from the DOE in October 2009. Duke Energy is currently evaluating the terms and conditions of the grant in conjunction with regulatory activities described above that are ongoing in Indiana and Ohio.

See Note 4 to the Consolidated Financial Statements, “Regulatory Matters,” for additional information.

Renewable Energy. Climate change concerns, as well as the oil price volatility, have sparked rising government support in driving increasing renewable energy legislation at both the federal and state level. For example, as discussed further below, the North Carolina legislation (SB 3) passed in 2007 established a renewable energy and energy efficiency portfolio standard (REPS) for electric utilities, and in 2008, the state of Ohio also passed legislation that included renewable energy and advanced energy targets. Duke Energy Carolinas, Duke Energy Ohio and Duke Energy Indiana have issued Request for Proposals (RFP) seeking bids for power generated from renewable energy sources, including sun, wind, water, organic matter and other sources.

With the passage of Senate Bill 221 (SB 221) in Ohio in 2008, Duke Energy Ohio is required to secure renewable energy and include an increasing percentage of renewables as part of its resource portfolio. The compliance percentages are based on a three-year historical average of its standard service offer load. The requirements are 0.25% of the baseline load from non-solar and 0.004% from solar beginning in 2009, increasing to 12.5% non-solar and 0.5% solar by 2024. Of these percentages, at least 50% of each resource type must come from resources located within the state of Ohio. To address this legislation, Duke Energy Ohio initiated several acquisition activities including comprehensive renewable RFPs in June 2008. Duke Energy Ohio evaluated the bids and selected both solar and non-solar bids to begin negotiations aimed toward final contract executions. Initial objectives were focused on meeting the specific near-term 2009, 2010 and 2011 requirements. Duke Energy Ohio is also working with regulators to seek clarifications on points of the SB 221 renewable guidelines. Effective December 10, 2009, the PUCO adopted a set of reporting standards known as “Green Rules” which will regulate energy efficiency, alternative energy generation requirements and emission reporting for activities mandated by SB 221. Duke Energy Ohio will continue its renewable efforts with bidders, suppliers and the community in Ohio to meet the increasing renewable obligations.

With the passage of SB 3 in North Carolina in 2007, Duke Energy Carolinas was required to include an increasing percentage of renewables as part of its generation portfolio. SB 3 requires solar compliance at 0.02% of retail sales beginning in 2010 and 3% of total portfolio to comply with solar, swine and poultry requirements beginning 2012. Total North Carolina renewable energy resource compliance increases to 12.5% by 2021. SB 3 granted the NCUC authority to approve an energy efficiency rate rider to compensate utilities for new energy efficiency programs that they implement, as well as a REPS rider to recover incremental costs incurred to comply with the renewable portfolio standard. To address this legislation, Duke Energy Carolinas initiated a comprehensive renewable RFP in April 2007 to address the 2010 through 2014 renewable portfolio standards requirements. As a result of the 2007 renewable energy RFP, Duke Energy Carolinas has executed a contract with a solar bidder and several landfill gas contracts which will be added to the hydro facilities portfolio to meet future compliance requirements. Duke Energy Carolinas is working with regulators to seek clarifications on points of the SB 3 renewable guidelines. Duke Energy Carolinas will continue to meet its growing renewable efforts with bidders, suppliers and the community in the Carolinas to meet the increasing renewable obligations.

Inventory

Generation of electricity is capital-intensive. U.S. Franchised Electric and Gas must maintain an adequate stock of fuel, materials and supplies in order to ensure continuous operation of generating facilities and reliable delivery to customers. As of December 31, 2009, the inventory balance for U.S. Franchised Electric and Gas was approximately $1,278 million. See Note 1 to the Consolidated Financial Statements, “Summary of Significant Accounting Policies,” for additional information.

Nuclear Insurance and Decommissioning

Duke Energy Carolinas owns and operates the McGuire and Oconee Nuclear Stations and operates and has a partial ownership interest in the Catawba Nuclear Station. The McGuire and the Catawba Nuclear Stations each have two nuclear reactors and the Oconee Nuclear Station has three. Nuclear insurance includes: liability coverage; property, decontamination and premature decommissioning coverage; and business interruption and/or extra expense coverage. The other joint owners of the Catawba Nuclear Station reimburse Duke Energy Carolinas for certain expenses associated with nuclear insurance premiums. The Price-Anderson Act requires Duke Energy to provide for public liability claims resulting from nuclear incidents to the maximum total financial protection liability, which was approximately $12.5 billion and increased to approximately $12.6 billion effective January 1, 2010. See Note 16 to the Consolidated Financial Statements, “Commitments and Contingencies—Nuclear Insurance,” for more information.

In 2005, the NCUC and PSCSC approved a $48 million annual amount for contributions and expense levels for decommissioning. In each of the years ended December 31, 2009, 2008 and 2007, Duke Energy Carolinas expensed approximately $48 million and contributed cash of approximately $48 million to the Nuclear Decommissioning Trust Funds (NDTF) for decommissioning costs. The entire amount of these contributions were to the funds reserved for contaminated costs as contributions to the funds reserved for non-contaminated costs have been discontinued since the current estimates indicate existing funds to be sufficient to cover projected future costs. The balance of the external NDTF was approximately $1,765 million as of December 31, 2009 and $1,436 million as of December 31, 2008.

As the NCUC and the PSCSC require that Duke Energy Carolinas update its cost estimate for decommissioning its nuclear plants every five years, new site-specific nuclear decommissioning cost studies were completed in January 2009 that showed total estimated nuclear decommissioning costs, including the cost to decommission plant components not subject to radioactive contamination, of approximately $3 billion in 2008 dollars. This estimate includes Duke Energy Carolinas’ 19.25% ownership interest in the Catawba Nuclear Station. The other joint owners of the Catawba Nuclear Station are responsible for decommissioning costs related to their ownership interests in the station. Both the NCUC and the PSCSC have allowed Duke Energy Carolinas to recover estimated decommissioning costs through retail rates over

14

PART I

the expected remaining service periods of Duke Energy Carolinas’ nuclear stations. Duke Energy Carolinas believes that the decommissioning costs being recovered through rates, when coupled with the existing fund balance and expected fund earnings, will be sufficient to provide for the cost of future decommissioning.

Duke Energy Carolinas filed these site-specific nuclear decommissioning cost studies with the NCUC and the PSCSC in April 2009. In addition to the decommissioning cost studies, a new funding study was completed and indicates the current annual funding requirement of approximately $48 million is sufficient to cover the estimated decommissioning costs. Duke Energy Carolinas received an order from the NCUC on its rate case filing on December 7, 2009, and from the PSCSC on Duke Energy Carolinas’ rate case on January 27, 2010. Both the NCUC and the PSCSC approved the existing $48 million annual funding level for nuclear decommissioning costs. See Note 7 to the Consolidated Financial Statements, “Asset Retirement Obligations,” for more information.

After used fuel is removed from a nuclear reactor, it is cooled in a spent-fuel pool at the nuclear station. Under provisions of the Nuclear Waste Policy Act of 1982, Duke Energy Carolinas contracted with the DOE for the disposal of used nuclear fuel. The DOE failed to begin accepting used nuclear fuel on January 31, 1998, the date specified by the Nuclear Waste Policy Act and in Duke Energy’s contract with the DOE. Duke Energy Carolinas will continue to safely manage its used nuclear fuel until the DOE accepts it. In 1998, Duke Energy Carolinas filed a claim with the U.S. Court of Federal Claims against the DOE related to the DOE’s failure to accept commercial used nuclear fuel by the required date. Damages claimed in the lawsuit were based upon Duke Energy Carolinas’ costs incurred as a result of the DOE’s partial material breach of its contract, including the cost of securing additional used fuel storage capacity. On March 5, 2007, Duke Energy Carolinas and the U.S. Department of Justice reached a settlement resolving Duke Energy Carolinas’ used nuclear fuel litigation against the DOE. The agreement provided for an initial payment to Duke Energy Carolinas for certain storage costs incurred through July 31, 2005, with additional amounts reimbursed annually for future storage costs.

Asbestos Related Injuries and Damages Claims

Duke Energy has experienced numerous claims for indemnification and medical reimbursements relating to damages for bodily injuries alleged to have arisen from the exposure to or use of asbestos in connection with construction and maintenance activities conducted by Duke Energy Carolinas on its electric generation plants prior to 1985.

Duke Energy has third-party insurance to cover certain losses related to Duke Energy Carolinas’ asbestos-related injuries and damages above an aggregate self insured retention of $476 million. Reserves recorded on Duke Energy’s Consolidated Balance Sheets are based upon the minimum amount in Duke Energy’s best estimate of the range of loss for current and future asbestos claims through 2027. Management believes that it is possible there will be additional claims filed against Duke Energy Carolinas after 2027. In light of the uncertainties inherent in a longer-term forecast, management does not believe they can reasonably estimate the indemnity and medical costs that might be incurred after 2027 related to such potential claims. Asbestos-related loss estimates incorporate anticipated inflation, if applicable, and are recorded on an undiscounted basis. These reserves are based upon current estimates and are subject to greater uncertainty as the projection period lengthens. A significant upward or downward trend in the number of claims filed, the nature of the alleged injury, and the average cost of resolving each such claim could change management’s estimated liability, as could any substantial adverse or favorable verdict at trial. A federal legislative solution, further state tort reform or structured settlement transactions could also change the estimated liability. Given the uncertainties associated with projecting matters into the future and numerous other factors outside Duke Energy’s control, management believes it is reasonably possible that Duke Energy Carolinas may incur asbestos liabilities in excess of its recorded reserves.

Duke Energy Indiana and Duke Energy Ohio have also been named as defendants or co-defendants in lawsuits related to asbestos at their electric generating stations. The impact on Duke Energy’s consolidated results of operations, cash flows, or financial position of these cases to date has not been material. Based on estimates under varying assumptions, concerning uncertainties, such as, among others: (i) the number of contractors potentially exposed to asbestos during construction or maintenance of Duke Energy Indiana and Duke Energy Ohio generating plants; (ii) the possible incidence of various illnesses among exposed workers and (iii) the potential settlement costs without federal or other legislation that addresses asbestos tort actions, Duke Energy estimates that the range of reasonably possible exposure in existing and future suits over the foreseeable future is not material. This estimated range of exposure may change as additional settlements occur and claims are made and more case law is established.

See Note 16 to the Consolidated Financial Statements, “Commitments and Contingencies-Litigation-Asbestos Related Injuries and Damages Claims,” for more information.

Competition

U.S. Franchised Electric and Gas competes in some areas with government-owned power systems, municipally owned electric systems, rural electric cooperatives and other private utilities. By statute, the NCUC and the PSCSC assign service areas outside municipalities in North Carolina and South Carolina, respectively, to regulated electric utilities and rural electric cooperatives. Substantially all of the territory comprising Duke Energy Carolinas’ service area has been assigned in this manner. In unassigned areas, Duke Energy Carolinas’ business remains subject to competition. A decision of the North Carolina Supreme Court limits, in some instances, the right of North Carolina municipalities to serve customers outside their corporate limits. In South Carolina, competition continues between municipalities and other electric suppliers outside the municipalities’ corporate limits, subject to the regulation of the PSCSC. In Kentucky, the right of municipalities to serve customers outside corporate limits is subject to court approval. In Ohio, certified suppliers may offer retail electric generation service to residential, commercial and industrial customers. In Indiana, the state is divided into certified electric service areas for municipal utilities, rural cooperatives and investor owned utilities. There are limited circumstances where the certified electric service areas can be modified, with approval of the IURC. U.S. Franchised Electric and Gas also competes with other utilities and marketers in the wholesale electric business. In addition, U.S. Franchised Electric and Gas continues to compete with natural gas providers.

Regulation

State