UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| |

☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2024

OR

| |

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File No.: 000-51826

MERCER INTERNATIONAL INC.

(Exact name of Registrant as specified in its charter)

| | |

Washington | | 47-0956945 |

(State or other jurisdiction | | (IRS Employer Identification No.) |

of incorporation or organization) | | |

| | |

Suite 1120, 700 West Pender Street, | | |

Vancouver, British Columbia, Canada | | V6C 1G8 |

(Address of Principal Executive Office) | | (Zip Code) |

Registrant’s telephone number including area code: (604) 684-1099

Securities registered pursuant to Section 12(b) of the Act:

| | | | |

Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| | | | |

| | | | |

Common Stock, par value $1.00 per share | | MERC | | NASDAQ Global Select Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ☐ Yes ☒ No

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | |

Large accelerated filer | | ☐ | | Accelerated filer | | ☒ |

Non-accelerated filer | | ☐ | | Smaller reporting company | | ☐ |

| | | | Emerging growth company | | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Act). ☐ Yes ☒ No

The aggregate market value of the Registrant’s voting and non-voting common equity held by non-affiliates of the Registrant as of June 30, 2024, the last business day of the Registrant’s most recently completed second fiscal quarter, based on the closing price of the voting stock on the NASDAQ Global Select Market on such date, was approximately $564.2 million.

As of February 18, 2025 the Registrant had 66,870,774 shares of common stock, $1.00 par value per share, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s definitive Proxy Statement to be filed with the Securities and Exchange Commission in connection with its annual meeting of shareholders to be held in 2025 are incorporated by reference into Part III hereof.

TABLE OF CONTENTS

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K includes “forward-looking” statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts. They often include words such as “believes”, “expects”, “anticipates”, “estimates”, “intends”, “plans”, “seeks” or words of similar meaning, or future or conditional verbs, such as “will”, “should”, “could”, “may”, “aims”, “intends” or “projects”. A forward-looking statement is neither a prediction nor a guarantee of future events or circumstances, and those future events or circumstances may not occur. You should not place undue reliance on forward-looking statements, which speak only as of the date of this Annual Report on Form 10-K. These forward-looking statements are all based on currently available operating, financial and competitive information and the current expectations, estimates, forecasts about our business, results of operations, the industry in which we operate, economic and market outlooks and the beliefs and assumptions of our management. These forward-looking statements are subject to various risks and uncertainties, many of which are beyond our control. Our actual future results and trends may differ materially depending on a variety of factors, including, but not limited to, the risks and uncertainties discussed under Item 1. “Business”, Item 1A. “Risk Factors” and Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations”. Given these risks and uncertainties, you should not rely on forward-looking statements as a prediction of actual results. Any or all of the forward-looking statements contained in this Annual Report on Form 10-K and any other public statement made by us, including by our management, may turn out to be incorrect. We are including this cautionary note to make applicable and take advantage of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 for forward-looking statements. We expressly disclaim any obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

INDUSTRY, MARKET AND OTHER DATA

In this Annual Report on Form 10-K, we rely on and refer to information and statistics regarding our market share and the markets in which we compete. We have obtained some of this market share information and industry data from internal surveys, market research, publicly available information and industry publications. Such reports generally state that the information contained therein has been obtained from sources believed to be reliable, but the accuracy or completeness of such information is not guaranteed. Although we believe this information is reliable, we have not independently verified, nor can we guarantee, the accuracy or completeness of that information.

Statements in this Annual Report on Form 10-K concerning the production capacity of our mills are management estimates based primarily on historically achieved levels of production and assumptions regarding maintenance downtime. Statements concerning electrical generating capacity at our mills are also management estimates based primarily on our expected production (which largely determines the amount of electricity we can generate) and assumptions regarding maintenance downtime, in each case within manufacturers’ specifications of capacity.

INTERNET AVAILABILITY AND ADDITIONAL INFORMATION

In this Annual Report on Form 10-K, we incorporate by reference certain information contained in other documents filed with the U.S. Securities and Exchange Commission, referred to as the “SEC”, and we refer you to such information. We file annual, quarterly and current reports and other information with the SEC. The SEC maintains a website at www.sec.gov that contains these filings. You also may access, free of charge, our reports filed with the SEC through our website. Reports filed with the SEC will be available through our website as soon as reasonably practicable after they are filed. The information contained on or connected to our website, www.mercerint.com, is not incorporated by reference into this Annual Report on Form 10-K and should in no way be construed as a part of this or any other report that we filed with the SEC.

CURRENCY

The following table sets out exchange rates, based on the noon buying rates in New York City for cable transfers in foreign currencies as certified for customs purposes by the Federal Reserve Bank of New York, referred to as the “Noon Buying Rate”, for the conversion of dollars to euros and Canadian dollars in effect at the end of the following periods, the average exchange rates during these periods (based on daily Noon Buying Rates) and the range of high and low exchange rates for these periods:

| | | | | | | | | | | | | | | | | | | | |

| | Year Ended December 31, | |

| | 2024 | | | 2023 | | | 2022 | | | 2021 | | | 2020 | |

| | ($/€) | |

End of period | | | 1.0351 | | | | 1.1062 | | | | 1.0698 | | | | 1.1318 | | | | 1.2230 | |

High for period | | | 1.0351 | | | | 1.0453 | | | | 0.9616 | | | | 1.1196 | | | | 1.0682 | |

Low for period | | | 1.1184 | | | | 1.1237 | | | | 1.1487 | | | | 1.2295 | | | | 1.2280 | |

Average for period | | | 1.0820 | | | | 1.0817 | | | | 1.0534 | | | | 1.1830 | | | | 1.1410 | |

| | ($/C$) | |

End of period | | | 0.6944 | | | | 0.7575 | | | | 0.7390 | | | | 0.7827 | | | | 0.7841 | |

High for period | | | 0.6929 | | | | 0.7205 | | | | 0.7208 | | | | 0.7727 | | | | 0.6878 | |

Low for period | | | 0.7513 | | | | 0.7618 | | | | 0.8031 | | | | 0.8312 | | | | 0.7865 | |

Average for period | | | 0.7302 | | | | 0.7412 | | | | 0.7691 | | | | 0.7981 | | | | 0.7457 | |

On February 18, 2025, the most recent weekly publication of the daily Noon Buying Rate before the filing of this Annual Report on Form 10-K reported that the Noon Buying Rate as of February 14, 2025 for the conversion of dollars to euros and Canadian dollars was $1.0498 per euro and $0.7057 per Canadian dollar.

PART I

ITEM 1. BUSINESS

In this document, please note the following:

•references to “we”, “our”, “us”, the “Company” or “Mercer” mean Mercer International Inc. and its subsidiaries, unless the context clearly suggests otherwise, and references to “Mercer Inc.” mean Mercer International Inc. excluding its subsidiaries;

•references to “$” or “dollars” shall mean U.S. dollars, which is our reporting currency, unless otherwise stated; “€” refers to euros; and “C$” refers to Canadian dollars;

•references to “ADMTs” mean air-dried metric tonnes;

•references to “CLT” mean cross-laminated timber;

•references to “glulam” mean glue-laminated timber;

•references to “m3” mean cubic meters;

•references to “Mfbm” mean thousand board feet;

•references to “MMfbm” mean million board feet;

•references to “MW” mean megawatts and “MWh” mean megawatt hours;

•references to “NBHK” mean northern bleached hardwood kraft;

•references to “NBSK” mean northern bleached softwood kraft;

•references to “tonnes” mean metric tonnes; and

•our lumber metrics are converted from m3 to Mfbm using a conversion ratio of 1.6 m3 of lumber equaling one Mfbm, which is the ratio commonly used in the industry.

Due to rounding, numbers presented throughout this report may not add up precisely to totals we provide and percentages may not precisely reflect the absolute figures.

Mercer

General

We are a global forest products company and have two reportable operating segments:

•Pulp – consists of the manufacture, sale and distribution of pulp, electricity and chemicals at our pulp mills.

•Solid Wood – consists of the manufacture, sale and distribution of lumber, manufactured products (including CLT, glulam and finger joint lumber), wood pallets, electricity, biofuels and wood residuals at our sawmills and other facilities in Germany and our mass timber facilities in North America.

We have consolidated annual production capacity of approximately 2.1 million ADMTs of kraft pulp, 960 MMfbm of lumber, 210,000 m3 of CLT, 45,000 m3 of glulam, 17 million pallets, 230,000 tonnes of biofuels (wood pellets and briquettes) and 398 MW of electrical generation.

Pulp Segment

We are one of the world’s largest producers of “market” NBSK pulp, which is pulp that is sold on the open market. Our size provides us with increased presence, better industry information in our markets and close customer relationships with many large pulp consumers.

We operate four modern and highly efficient pulp mills. These include two NBSK mills in Germany and one NBSK mill and one “swing” kraft mill in Western Canada which produces both NBSK and NBHK.

We are the sole NBSK producer, and the only significant market pulp producer in Germany, which is the largest pulp import market in Europe. We supply the growing pulp demand in China both through our Canadian mills’ ready access to the Port of Vancouver and through our German mills’ existing logistics arrangements.

In addition, as a result of the significant investments previously made in cogeneration equipment, all of our mills generate and sell a significant amount of surplus “green” energy. We also produce and sell tall oil from black liquor, a by-product of our production process, which is used as both a chemical additive and as a green energy source.

In 2023, we commissioned the lignin pilot production and research and development facility at our Rosenthal mill. This facility can produce approximately 300 tonnes of lignin per year. We believe lignin has the potential to be a sustainable green alternative to displace fossil fuels and hydrocarbon-based products.

Of our consolidated annual production capacity of approximately 2.1 million ADMTs of kraft pulp, approximately 1.8 million ADMTs, or 86%, is NBSK and the balance is NBHK.

Key operating details for each of our pulp mills are as follows:

•Stendal mill – Our Stendal mill is a modern, efficient ISO 9001, 14001, 38200 and 50001 certified NBSK pulp mill that has an annual production capacity of approximately 740,000 ADMTs and 148 MW of electrical generation. The Stendal mill is located near the town of Arneburg, Germany, approximately 80 miles west of Berlin.

•Rosenthal mill – Our Rosenthal mill is a modern, efficient ISO 9001, 14001, 38200 and 50001 certified NBSK pulp mill that has an annual production capacity of approximately 360,000 ADMTs and 57 MW of electrical generation. The Rosenthal mill is located in the town of Rosenthal am Rennsteig, Germany, approximately 185 miles south of Berlin.

•Celgar mill – Our Celgar mill is a modern, efficient ISO 9001 and 14001 certified NBSK pulp mill that has an annual production capacity of approximately 520,000 ADMTs and 100 MW of electrical generation. The Celgar mill is located near the city of Castlegar, British Columbia, Canada, approximately 375 miles east of Vancouver.

•Peace River mill – Our Peace River mill is a modern, efficient ISO 9001 and 14001 certified mill that produces both NBSK and NBHK pulp and has an annual production capacity of approximately 475,000 ADMTs and 65 MW of electrical generation. The Peace River mill is located near the town of Peace River, Alberta, Canada, approximately 305 miles north of Edmonton. Peace River also holds two 20-year renewable governmental forest management agreements and three deciduous timber allocations in Alberta with an aggregate allowable annual cut of approximately 2.9 million m3 of hardwood and softwood allocations totaling 375,000 m3.

Our pulp mills are some of the newest and most modern pulp mills in Europe and North America. We believe the relative age, production capacity and electrical generation capacity of our mills provide us with certain manufacturing cost and other advantages over many of our competitors. We believe our competitors’ older mills do not have the equipment or capacity to produce or sell surplus power or chemicals in a meaningful amount. In addition, as a result of the relative age of our mills, they benefit from lower maintenance capital requirements and higher efficiency relative to many of our competitors’ mills.

The following table sets out our pulp production, sales and revenues for the periods indicated:

| | | | | | | | | | | | |

| | Year Ended December 31, | |

| | 2024(1) | | | 2023 | | | 2022 | |

Pulp production ('000 ADMTs) | | | 1,843.1 | | | | 1,965.6 | | | | 1,878.6 | |

Pulp sales ('000 ADMTs) | | | 1,899.8 | | | | 1,951.2 | | | | 1,917.7 | |

Pulp revenues (in thousands) | | $ | 1,460,460 | | | $ | 1,402,620 | | | $ | 1,686,370 | |

(1)In March 2024, we disposed of our 50% joint venture interest in the Cariboo Pulp & Paper Company (“CPP”).

Our pulp mills generate and sell surplus electricity, providing us with a stable revenue source unrelated to pulp prices. Our German pulp mills also generate tall oil from black liquor, which is sold to third parties for use in numerous applications, including biofuels. Since our energy and chemical production are by-products of our pulp production process, there are minimal incremental costs and our surplus energy and chemical sales are highly profitable. All of our mills generate and sell surplus energy to regional utilities or the regional electrical market. Our German mills sell energy at market prices. Previously, our Stendal mill also had the option to sell energy pursuant to a special tariff under Germany’s Renewable Energy Sources Act, or the “Renewable Energy Act”, which expired in December 2024. In 2024, Stendal primarily sold energy at market prices which were generally higher than the tariff rate. As a result of higher energy prices stemming from the war in Ukraine, in 2022, the European Union adopted a regulation that introduced a mandatory cap on market revenues of inframarginal electricity produced of €180 per MWh. In Germany, this was implemented through a “windfall” profits tax which took effect from December 2022 and expired in June 2023 with respect to electricity producers. See Item 1A. “Risk Factors – We sell surplus green energy in Germany and are subject to changing energy legislation in response to high prices and energy shortages”.

Our Peace River mill sells surplus energy to its regional electrical market. Our Celgar mill is party to a fixed electricity purchase agreement with the regional public utility provider for the sale of surplus power which runs until October 2030.

The following table sets out the amount of surplus energy we produced and sold and revenues from the sale of such surplus energy and chemicals in our pulp segment for the periods indicated:

| | | | | | | | | | | | | | | | | | | | | | | | |

| | Year Ended December 31, | |

| | 2024 | | | 2023 | | | 2022 | |

| | (MWh) | | | ($) | | | (MWh) | | | ($) | | | (MWh) | | | ($) | |

| |

| | | (in thousands) | | | | | | (in thousands) | | | | | | (in thousands) | |

Surplus electricity(1) | | | 797,218 | | | | 72,705 | | | | 832,587 | | | | 89,134 | | | | 751,720 | | | | 167,518 | |

Chemicals | |

| | | | 15,391 | | |

| | | | 24,376 | | |

| | | | 12,229 | |

Total | | | | | | 88,096 | | | | | | | 113,510 | | | | | | | 179,747 | |

(1)Does not include our 50% joint venture interest in CPP, which was accounted for using the equity method. In March 2024, we disposed of this interest.

We serve pulp customers in Europe, Asia and North America. We primarily work directly with customers to capitalize on our geographic diversity, coordinate sales and enhance customer relationships. We believe our ability to deliver high-quality pulp on a timely basis and our customer service makes us a preferred supplier for many customers.

Solid Wood Segment

Our solid wood segment consists of the manufacture, sale and distribution of lumber, manufactured products (including CLT, glulam and finger joint lumber), wood pallets, electricity, biofuels and wood residuals from our sawmills and other facilities located in Germany and our mass timber facilities in North America.

Since 2021, we have invested approximately $396.6 million to expand our solid wood activities and product mix, to acquire the Mercer Spokane Mass Timber facility, referred to as the “Mercer Spokane facility” in 2021, the Torgau facility in 2022 and substantially all of the assets of the Structurlam group of companies, referred to as the “Structurlam Group”, in June 2023 which included a mass timber production facility in Conway, Arkansas, referred to as the “Mercer Conway facility” and three mass timber production facilities

in British Columbia, Canada. We combined the British Columbia facilities into one facility, referred to as the “Mercer Okanagan facility” after completing the acquisition.

In addition, since 2021 we have invested approximately $134.0 million in capital expenditures in our solid wood segment to increase production, lower costs and enhance efficiency.

Our solid wood segment has an aggregate capacity of approximately 960 MMfbm of lumber, 210,000 m3 of CLT, 45,000 m3 of glulam, 17 million pallets, 230,000 tonnes of biofuels and 28 MW of electrical generation.

The following is a description of the mills and facilities comprising our solid wood segment:

•Friesau mill – Our Friesau mill is ISO 50001 and 38200 certified and has an annual production capacity of approximately 550 MMfbm of lumber and 13 MW of electrical generation. The mill is located in Friesau, Germany, approximately 185 miles south of Berlin and 10 miles west of our Rosenthal mill and is one of the Rosenthal mill’s largest fiber suppliers. The mill has a diverse product line ranging from custom rough green and dry lumber for the European market to kiln-dried, dimension lumber for the United States, Japan, United Kingdom and other export markets.

•Torgau facility – Our Torgau facility is ISO 50001 certified and is an integrated sawmill and value-add pallet production facility, with an annual production capacity of approximately 410 MMfbm of lumber, 17 million pallets and 15 MW of electrical generation. The Torgau facility can also produce up to 230,000 tonnes of biofuels, consisting of wood pellets and briquettes, used to generate electricity and thermal energy. The Torgau facility is currently one of the world’s largest producers of Euro-pallets, the standard European shipping pallet. The Torgau facility is located in Torgau, Germany, approximately 70 miles south of Berlin.

•Mercer Spokane facility – The Mercer Spokane facility is a modern, 253,000 square foot manufacturing facility, with an annual production capacity of 140,000 m3 of CLT. We believe that the facility is one of the largest CLT facilities in North America, currently representing approximately 20% of North American CLT capacity. CLT is a wood panel product, made from adhering layers of sawn lumber and is used as a more sustainable alternative to steel and concrete in building projects.

•Mercer Conway facility – The Mercer Conway facility is a modern, state-of-the-art manufacturing facility that was built in 2021 and has an annual combined capacity of approximately 75,000 m3 of CLT and glulam. The Mercer Conway facility includes over 280,000 square feet of manufacturing space, and is strategically located in the Southern United States in proximity to growing construction markets with access to a large high-quality regional wood basket.

•Mercer Okanagan facility – The Mercer Okanagan facility has an annual capacity of approximately 40,000 m3 of glulam and CLT. As glulam is commonly incorporated into mass timber construction projects, these assets complement our other mass timber facilities and enhance our ability to service the growing customer base for our mass timber business.

The European and U.S. lumber markets are very different. In the European market, lumber is generally customized in terms of dimensions and finishing. The U.S. market is driven primarily by demand from new housing starts and home renovation activities and dimensions and finishing are generally standardized. Additionally, lumber production and sales in Europe are commonly measured in m3, whereas in the U.S. they are measured in Mfbm.

The following table sets out our lumber, manufactured products, pallet and biofuels production, sales and revenues for the periods indicated:

| | | | | | | | | | | | |

| | Year Ended December 31, | |

| | 2024 | | | 2023 | | | 2022(1) | |

Lumber production (MMfbm) | | | 475.6 | | | | 462.3 | | | | 442.2 | |

Lumber sales (MMfbm) | | | 470.4 | | | | 500.5 | | | | 409.9 | |

Lumber revenues (in thousands) | | $ | 217,471 | | | $ | 217,939 | | | $ | 288,002 | |

Manufactured products production(2) (‘000 m3) | | | 34.0 | | | | 25.1 | | | | 36.3 | |

Manufactured products sales(2) (‘000 m3) | | | 30.7 | | | | 33.4 | | | | 28.8 | |

Manufactured products revenues(2) (in thousands) | | $ | 100,565 | | | $ | 58,895 | | | $ | 22,759 | |

Pallet production (‘000 units) | | | 10,243.5 | | | | 10,707.2 | | | | 2,568.4 | |

Pallet sales (‘000 units) | | | 10,089.2 | | | | 11,041.2 | | | | 2,646.3 | |

Pallet revenues (in thousands) | | $ | 104,386 | | | $ | 121,424 | | | $ | 36,063 | |

Biofuels production(3) (‘000 tonnes) | | | 160.4 | | | | 167.2 | | | | 45.7 | |

Biofuels sales(3) (‘000 tonnes) | | | 184.4 | | | | 144.8 | | | | 49.8 | |

Biofuels revenues(3) (in thousands) | | $ | 40,082 | | | $ | 40,680 | | | $ | 17,691 | |

(1)Includes results of the Torgau facility since September 30, 2022.

(2)Primarily includes CLT and glulam for the years ended December 31, 2024 and December 31, 2023. Primarily includes finger joint lumber for the year ended December 31, 2022.

(3)Includes pellets and briquettes.

The Friesau mill and Torgau facility generate electricity for minimal incremental costs, all of which is sold, providing a stable revenue source unrelated to lumber prices. Both the Friesau mill and Torgau facility can sell surplus electricity at market prices or pursuant to special tariff rates under the Renewable Energy Act. In 2024, the Friesau mill and Torgau facility primarily sold energy at their special tariff rates which were generally higher than market prices.

The following table sets out the amount of surplus energy we produced and sold and revenues from the sale of surplus energy by our Friesau mill and Torgau facility for the periods indicated.

| | | | | | | | | | | | |

| | Year Ended December 31, |

| | 2024 | | 2023 | | 2022(1) |

| | (MWh) | | ($) | | (MWh) | | ($) | | (MWh) | | ($) |

| |

| | (in thousands) | | | | (in thousands) | | | | (in thousands) |

Surplus electricity | | 126,280 | | 16,512 | | 160,161 | | 21,451 | | 109,582 | | 25,653 |

(1)Includes results of the Torgau facility since September 30, 2022.

Corporate Structure, History and Development of Business

Mercer Inc. is a corporation organized under the laws of the State of Washington whose common stock is quoted and listed for trading on the NASDAQ Global Select Market (MERC).

The following chart sets out our principal operating subsidiaries, all of which are directly or indirectly 100% owned, their jurisdictions of organization and their principal activities:

| | |

Name | Jurisdiction of Organization | Principal Activities |

Mercer Stendal GmbH | Germany | Pulp, energy and chemical production and sales |

Mercer Rosenthal GmbH | Germany | Pulp, energy and chemical production and sales |

Mercer Celgar Limited Partnership | British Columbia, Canada | Pulp, energy and chemical production and sales |

Mercer Peace River Pulp Ltd. | British Columbia, Canada | Pulp and energy production and sales |

Mercer Timber Products GmbH | Germany | Lumber and energy production and sales |

Mercer Spokane LLC | Washington, U.S.A. | CLT production and sales |

Mercer Torgau GmbH & Co. KG | Germany | Pallets, lumber, biofuels and energy production and sales |

Mercer Holz GmbH | Germany | Wood procurement and logistics |

Mercer Conway Inc. | Delaware,

U.S.A. | CLT and glulam production and sales |

We entered into the pulp business in 1994 by acquiring our Rosenthal mill and in 1999 converted it to the production of kraft pulp. We subsequently expanded our pulp operations by constructing the Stendal mill at a cost of approximately $1.1 billion in 2004 and acquired the Celgar mill in 2005 and the Peace River mill in 2018.

In 2017, we entered into the solid wood business when we acquired the Friesau mill. In 2021, we acquired the Mercer Spokane facility for approximately $51.3 million. In September 2022, we acquired all of the outstanding shares of the parent company of Mercer Torgau GmbH & Co. KG, the owner of the Torgau facility, for approximately $263.2 million, inclusive of working capital. In June 2023, we acquired the Mercer Conway facility and Mercer Okanagan facility from the Structurlam Group for approximately $82.1 million.

Corporate Strategy

Our corporate strategy is designed to, among other things, grow and expand our assets in our areas of expertise in the forest products industry in a sustainable manner. This includes organic growth through targeted capital expenditures focused on enhancing our existing assets, including to diversify our product offering and revenue sources, and acquisitions of complementary or additional assets, while maintaining the integrity of our balance sheet and liquidity. We strive to operate modern world class facilities with a high standard of environmental, social and governance performance.

The maintenance of modern, reliable and energy efficient operations is key to our ability to produce stable returns through the economic cycle. The markets for our principal products are cyclical and subject to global economic influences. Further, our manufacturing operations are capital intensive and complex. Maintaining a high standard of maintenance and strategic capital expenditure programs differentiates us from older, higher cost, lower efficiency competitors. We believe that over time this will reduce our exposure to product price volatility, unexpected downtime and changes in environmental and regulatory conditions.

We seek to have a balance sheet that allows us to advance our objectives through the full economic cycle, while at the same time, gives us the flexibility to take advantage of strategic growth opportunities as they arise. We maintain a foundation of long-term, unsecured, senior notes with expiry dates between 2028 and 2029. In addition to cash on hand, we have a series of revolving credit facilities intended to provide liquidity and flexibility in times of opportunity or economic slowdown.

In furtherance of this strategy, since 2021 we have completed a series of acquisitions that expanded and diversified our product mix in the solid wood segment, including the acquisition of the Mercer Spokane facility in 2021, the Torgau facility in 2022 and the Mercer Conway facility and the Mercer Okanagan facility in 2023. In particular, the acquisition of the Mercer Conway facility, along with its glulam production capabilities, positions us to capitalize on the growing market share of CLT and glulam in North American construction as customers seek more carbon-efficient building alternatives.

Pulp Industry

General

Pulp is used in the production of paper, tissues and paper-related products. Pulp is generally classified according to its fiber type, production process and degree of bleaching. Kraft pulp, a type of chemical pulp, is produced through a sulphate chemical process in which lignin, the component of wood which binds individual fibers, is dissolved in a chemical reaction. Chemically prepared pulp allows the wood’s fiber to retain its length and flexibility, resulting in stronger paper products. Kraft pulp can be bleached to increase its brightness. Softwood kraft pulp is noted for its strength, brightness and absorption properties and is used to produce a variety of products, including lightweight publication grades of paper, tissues and other paper-related products.

Bleached kraft pulp is comprised of either softwood kraft made from coniferous trees or hardwood kraft made from deciduous trees. Softwood species generally have long, flexible fibers which add strength to paper while fibers from species of hardwood contain shorter fibers which lend bulk and opacity.

We primarily produce and sell NBSK pulp manufactured using northern softwood, which is considered a premium grade because of its strength. It generally obtains the highest price relative to other kraft pulps. Our Peace River mill produces both NBSK and NBHK pulp.

Most paper users of market kraft pulp use a mix of softwood and hardwood grades to optimize production and product qualities. In 2024, market kraft pulp consumption was approximately 61% hardwood bleached kraft and 36% softwood bleached kraft, with the remainder comprised of unbleached pulp. Over the last several years, production of hardwood pulp, based on fast growing plantation fiber primarily from Asia and South America, has increased much more rapidly than that of softwood grades, because of longer growth cycles. Hardwood kraft generally has a cost advantage over softwood kraft as a result of lower fiber costs, higher wood yields and, for newer hardwood mills, economies of scale. As a result of this growth in supply and lower costs, kraft pulp customers have substituted some of the pulp content in their products to hardwood pulp.

However, the requirement for strength and formation characteristics in finished goods counters customers’ ability to substitute cheaper hardwood pulp for NBSK. Paper and tissue makers focus on larger paper machines with higher speeds and lower basis weights for certain papers which require the strength characteristics of softwood pulp. Additionally, where paper products are lightweight or specialty papers such as premium tissue or magazine paper, or where strength or absorbency are important, softwood kraft forms a significant proportion of the fiber used. As a result, we believe that the ability of kraft pulp users to further substitute hardwood for softwood pulp is limited by such requirements.

Kraft pulp can be made in different grades, with varying technical specifications, for different end uses. Softwood kraft pulp is an important ingredient for tissue manufacturing and tissue demand tends to increase with living standards in developing countries. Softwood kraft pulp is also valued for its reinforcing role in mechanical printing papers and is sought after by producers of paper for the publishing industry, primarily for magazines and advertising materials.

Markets

We believe that approximately 160 million ADMTs of chemical pulp are converted annually into tissues, printing and writing papers, carton boards and other specialty grades of paper and paperboard around the world. We also believe that approximately 43% of this pulp is sold on the open market as market pulp, while the remainder is produced for internal purposes by integrated paper and paperboard manufacturers.

The pulp business is highly cyclical in nature and markets are characterized by periods of supply and demand imbalance, which in turn affect prices. Pulp markets are highly competitive and are sensitive to cyclical changes in the global economy, industry capacity and foreign exchange rates, all of which can have a significant influence on selling prices and our operating results. The length and magnitude of industry cycles have varied over time but generally reflect changes in macroeconomic conditions and levels of industry

capacity. Pulp is a commodity that is generally available from other producers. As commodity products have few distinguishing qualities from producer to producer, competition is generally based upon price, which is primarily determined by supply relative to demand.

Between 2015 and 2024, overall worldwide demand for chemical market pulp grew at an average rate of approximately 2% annually, with worldwide demand for bleached softwood kraft market pulp generally flat over the same time period.

NBSK pulp demand is significantly impacted by global macroeconomic trends. Certain of such trends have had a positive effect on pulp demand while others have had a negative impact.

A major long-term macro trend has been the increase in demand from emerging markets, and in particular China. In China alone, tissue production capacity has increased by approximately 9.5 million ADMTs over the last five years. In China, imports of chemical softwood market pulp grew overall by approximately 5% per annum for the period from 2015 to 2024 and it is a key driver of pulp demand and consumption. We believe that emerging markets now account for approximately 59% of total global demand for bleached softwood kraft market pulp and China itself now accounts for approximately 33% of such global demand.

Two other macro trends positively affecting pulp demand have been the increase in usage and demand for tissue and hygiene products, particularly in China and emerging markets generally and the global reliance on online delivery of products which has increased demand for packaging and specialty products.

Two macroeconomic trends that have negatively impacted pulp demand are:

•the material decline in graphic and printing and writing paper demand in recent years, with a material portion of such decline not expected to return; and

•paper demand in the historically mature markets of North America, Europe and Japan has been declining or stagnating, which has resulted in Western Europe currently accounting for approximately 20% of global bleached softwood kraft market pulp demand compared to approximately 26% in 2015.

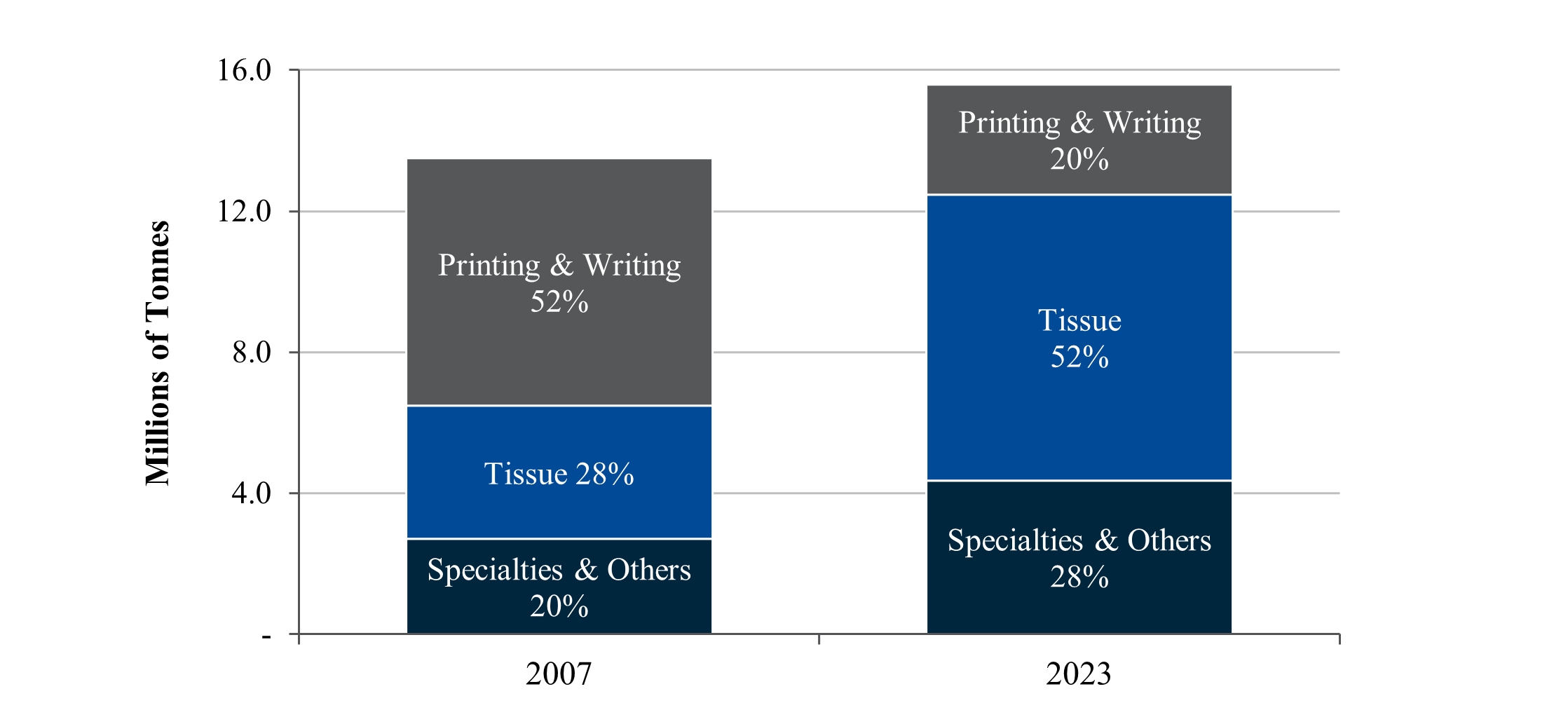

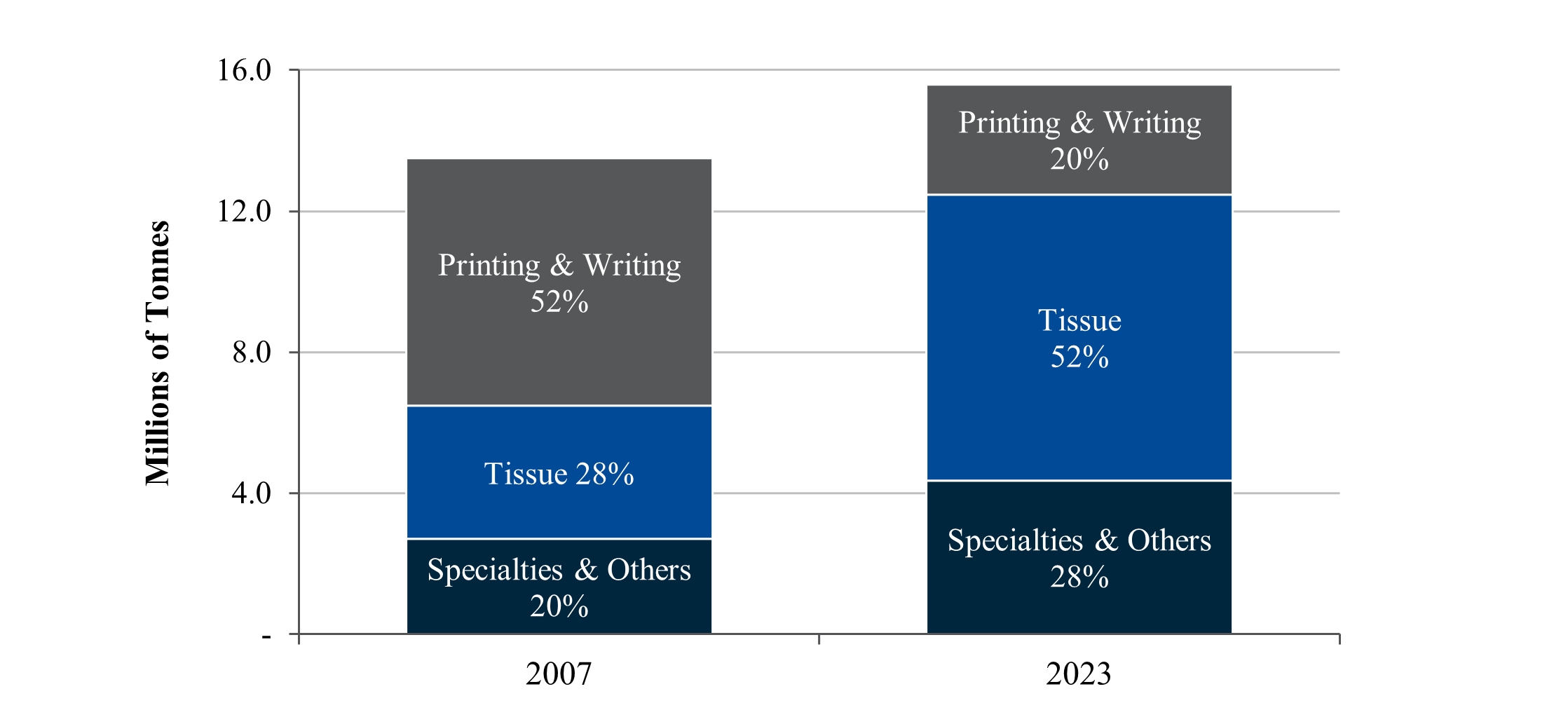

The trends and changes in NBSK pulp demand by end use are reflected in the following chart which compares worldwide NBSK pulp demand by end use for the periods indicated:

NBSK Pulp Demand by End Use

We believe 2024 NBSK demand by end use was generally consistent with the trend in the chart above.

Oversupply of our products can result from producers introducing new capacity in response to favorable pricing trends. In 2024, there was a net increase in pulp capacity of approximately 2.5 million ADMTs, primarily of hardwood kraft pulp. Currently, we are aware of approximately 0.4 million ADMTs of

announced net capacity increases primarily of softwood kraft pulp scheduled to come online in 2025.

NBSK Pulp Pricing

Kraft pulp is a globally traded commodity and prices are highly cyclical. Kraft pulp prices are generally quoted in dollars. Pricing is primarily influenced by the balance between supply and demand, as affected by global macroeconomic conditions, changes in consumption and capacity, the level of customer and producer inventories and fluctuations in exchange rates. Generally, we and other producers consider global NBSK pulp supply and demand to be evenly balanced when world inventory levels are at about 36 days’ supply.

As the majority of market NBSK pulp is produced and sold by Canadian and Northern European producers, while the price of NBSK pulp is generally quoted in dollars, pricing is often affected by fluctuations in the currency exchange rates for the dollar versus the euro and the Canadian dollar. As NBSK pulp producers generally incur costs in their local currency, while pulp is quoted in dollars, a dollar strengthening generally benefits producers’ businesses and operating margins. Conversely, a weakening of the dollar versus the local currency of producers generally adversely affects producers’ businesses and operating margins.

As a corollary to changes in exchange rates between the dollar and the euro and Canadian dollar, a stronger dollar generally increases costs to customers of NBSK pulp producers and results in downward pressure on prices. Conversely, a weakening dollar generally supports higher pulp pricing. However, there is invariably a time lag between changes in currency exchange rates and pulp prices. This lag can vary and is not predictable with any certainty.

Although China is now the largest market globally for pulp, Europe has also historically been a significant market. As NBSK pulp is a premium grade of pulp, the European market NBSK list price is at times used by the industry as a benchmark reference price. The third-party industry quoted average European list prices for NBSK pulp since 2015 have fluctuated between a low of approximately $790 per ADMT in 2016 and a high of $1,635 per ADMT in 2024.

Our pulp sales realizations in Europe and North America are based on third-party industry quoted list prices, net of customer discounts, rebates and other selling concessions. Our sales to China and Asia are generally based closer to third-party industry quoted prices, which are quoted on a net basis, inclusive of discounts, allowances, rebates and other selling concessions. As a result, our net sales realizations in China are generally similar to other markets. The following table sets out third-party industry quoted list prices (before discounts and rebates) for NBSK pulp in Europe and North America and net prices for NBSK pulp in China as of the dates indicated:

| | | | | | | | |

| | December 31, | |

| | 2024 | | | 2023 | |

| | ($/ADMT) | |

Europe (List Price) | | | 1,485 | | | | 1,300 | |

North America (List Price) | | | 1,675 | | | | 1,350 | |

China (Net Price) | | | 770 | | | | 730 | |

Seasonality

We are exposed to fluctuations in quarterly sales volumes and expenses due to seasonal factors. These factors are common in the kraft pulp industry. We generally have weaker pulp demand in China in the period relating to the lunar new year and in Europe during the summer holiday months. We typically have a seasonal build-up in raw material inventories in the early winter months as our mills build up their fiber supply for the winter when there is reduced availability.

Competition

The pulp market is highly fragmented and competitive with many producers competing globally. Producers ranging from small independent manufacturers to large integrated companies produce pulp worldwide. In recent years there has been a trend for industry consolidation and the creation of larger competitors. Pulp is generally a commodity product and our pulp competes with similar products manufactured and distributed

by many other producers. While many factors influence our competitive position, particularly in weak economic times, a primary factor is price. Other factors include quality, service, access to reasonably priced fiber and convenience of location. Some of our competitors are larger than we are in certain markets and have substantially greater financial resources. These resources may afford those competitors more purchasing power, increased financial flexibility, more capital resources for expansion and improvement and enable them to compete more effectively. Our key NBSK pulp competitors are principally located in Northern Europe and Canada and currently include Metsä Fibre, Södra Cell, Ilim, Domtar, UPM, SCA, Stora Enso and Canfor Pulp.

Solid Wood Industry

General

Our solid wood segment consists of the manufacture, sale and distribution of lumber, manufactured products (including CLT, glulam and finger joint lumber), wood pallets, electricity, biofuels and wood residuals from our sawmills and other facilities in Germany and North America.

Products and Markets

Our Friesau mill has two high-volume Linck sawlines and has the ability to produce both rough and planed products. The sawmill principally manufactures finished sawn lumber milled from spruce and pine, including European metric and specialty lumber, U.S. dimensional lumber and J-grade lumber, in various sizes and grades.

The Torgau facility is an integrated sawmill and value-add pallet production facility. The facility produces, among other products, lumber, wood pallets and biofuels. The lumber produced at the facility is used for, among other things, pallet production and also for dimensional lumber for the European, U.S. and Asian markets.

Demand for lumber is cyclical and influenced by factors that affect consumer confidence and drive demand for residential construction, such as interest rates, disposable income, unemployment rates, perceived job security and other indicators of general economic conditions. Demand is also affected by the availability of skilled construction trades and construction finishing products, transportation costs, exchange rates, government tariffs and the competitiveness of substitute products. Demand can vary from region to region within a country and seasonal factors that determine optimal building conditions can also affect demand.

The process for manufacturing lumber results in a significant percentage of each sawlog ending up as by-products or residuals such as wood chips, trim blocks, sawdust shavings and bark. Due to the close proximity of the German pulp mills to the Friesau mill and Torgau facility, we are able to achieve fiber utilization and fiber logistics synergies. By-products at the Friesau mill are typically used as fuel for our cogeneration power plant or sold to a wide variety of customers. In addition, we utilize a significant portion of the chips from the Friesau mill at our Rosenthal mill. At the Torgau facility sawmill residuals are used by our pulp mills or used to produce heating pellets and briquettes. Bark is used to generate electricity and thermal energy.

The main markets for our lumber products are in the United States and Europe. Our Friesau mill and Torgau facility lumber sales are to a diverse customer base. Customers include national and regional distributors, large construction firms, secondary manufacturers, retail yards and home centers.

Our Torgau facility also sells pallets and biofuels to a diverse customer base that is primarily located within a 185 mile range of the facility. The facility is one of the world’s largest producers of Euro-pallets, the standard European shipping pallet.

The Mercer Spokane facility, Mercer Conway facility and Mercer Okanagan facility produce CLT, a wood panel product, made from adhering layers of sawn lumber that is used as a more sustainable alternative to steel and concrete in building projects. We believe the facilities currently represent approximately 30% of North American CLT capacity. The facilities’ customers are mainly building contractors or property owners. The Mercer Conway facility and Mercer Okanagan facility are also able to produce glulam, a stress-rated,

engineered wood product comprised of wood laminations that are bonded together. It is commonly used for support structures such as columns, beams, floor-joints and trusses, offering a high degree of customization and pre-fabrication. The Mercer Spokane facility, Mercer Conway facility and Mercer Okanagan facility also produce finger joint lumber, a product which joins short pieces of wood together to form pieces of greater length.

Competition

The markets for our lumber products are highly competitive with many producers competing globally. Producers range from small independent mills to very large global producers, including integrated forest products companies. In recent years, there has been significant consolidation in the solid wood industry that has resulted in the creation of even larger global competitors. Producers compete generally on price, quality and service. With respect to lumber and certain solid wood products, these are commodities with few distinguishing features and producers primarily compete based on delivered price. Factors influencing our competitive position include, among others, the availability, quality and cost of raw materials, including fiber, energy and labor, the efficiency and productivity of our facilities and our ability to utilize or sell by-products from the lumber manufacturing process. The Friesau mill and Torgau facility lumber sales also compete in international markets subject to currency fluctuations and global business conditions. Our key competitors in the segment currently include West Fraser, Canfor, Interfor, Domtar, Weyerhaeuser, Binderholz, Stora Enso and Ilim.

The Torgau facility’s pallets compete with other European pallet producers. The German pallet market is dominated by wood pallet producers. Since most pallets are standardized, there is limited room for product differentiation, implying that logistical organization, production capacity, and the ability to meet just-in-time demand form regional competitive advantages.

Our mass timber facilities compete with other producers of CLT, glulam and alternative building materials such as concrete and steel. These building alternatives can be competitive on a cost basis, and have the added benefit of being in wide use for multiple years, as opposed to CLT and glulam which are relatively new in its North American adoption. These alternatives, however, lack the environmental attributes of CLT and glulam, in addition to its aesthetic appearance.

Generation and Sales of Green Energy and Chemicals

General

Our pulp mills are large scale bio-refineries that, in addition to pulp, also produce surplus “carbon neutral” or green energy. As part of the pulp production process, our mills generate green energy using carbon neutral biofuels such as black liquor and wood waste in a cogeneration process. Through the incineration of biofuels in the recovery and power boilers, our mills produce sufficient steam to cover all of our steam requirements and allow us to produce surplus electricity which we sell to third-party utilities or into the regional electricity market. As a result, we have benefited from green energy legislation, incentives and commercialization that have developed over the last decades in Europe and Canada along with strong electricity prices. In addition, in recent years we have applied considerable resources to increasing our capacity to produce and sell chemicals, primarily tall oil for use in numerous applications including biofuels.

Our Friesau mill and Torgau facility also generate and sell green energy produced from their biomass cogeneration power plants. Our surplus energy and chemical sales provide us with a stable revenue source unrelated to pulp or lumber prices. Since our energy and chemical production are by-products of our production processes, there are minimal incremental costs resulting in our surplus energy and chemical sales being highly profitable. We believe that this revenue source gives our mills a competitive advantage over other older mills which do not have the equipment or capacity to produce and/or sell surplus power and/or chemicals in a meaningful amount.

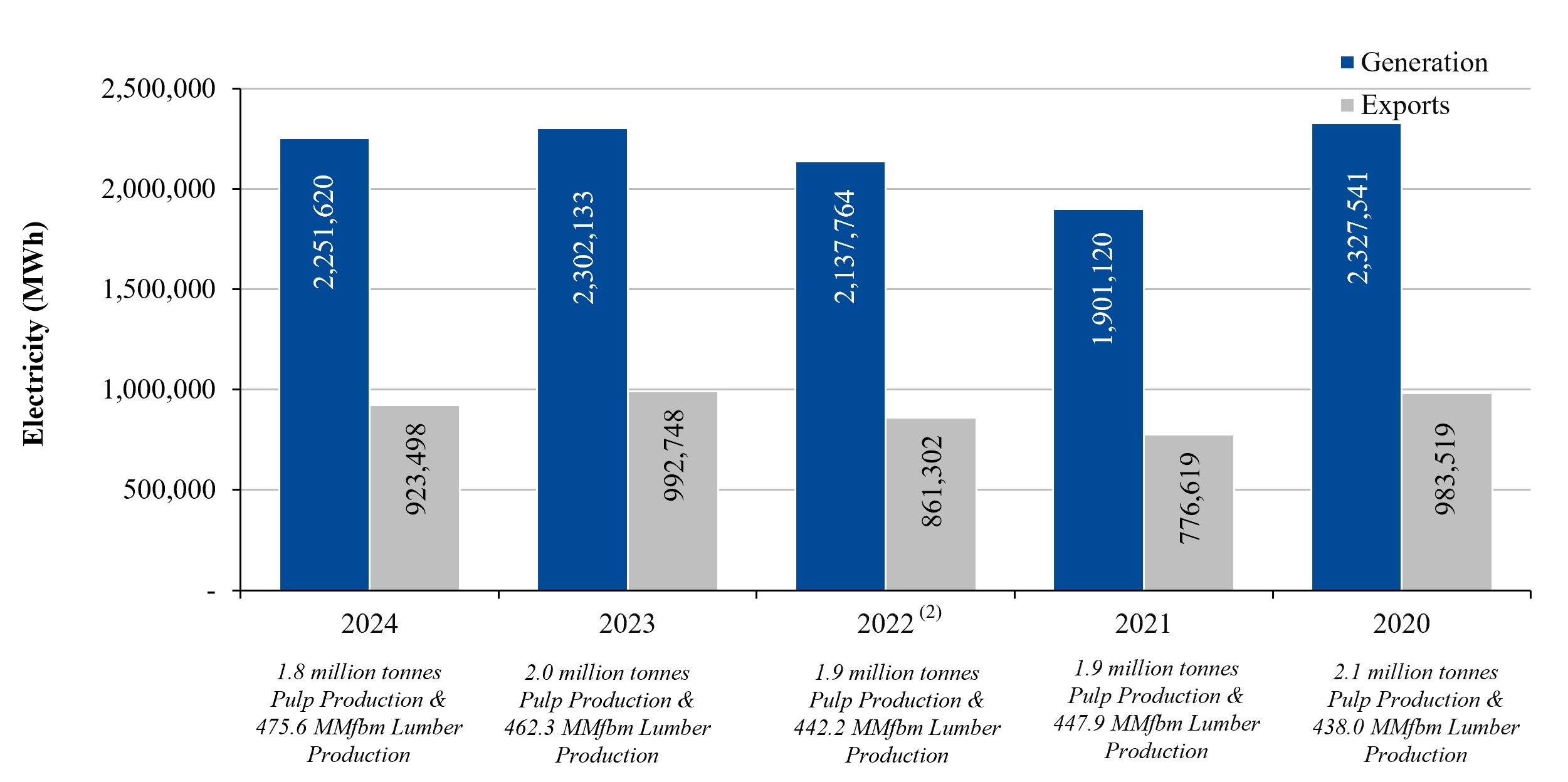

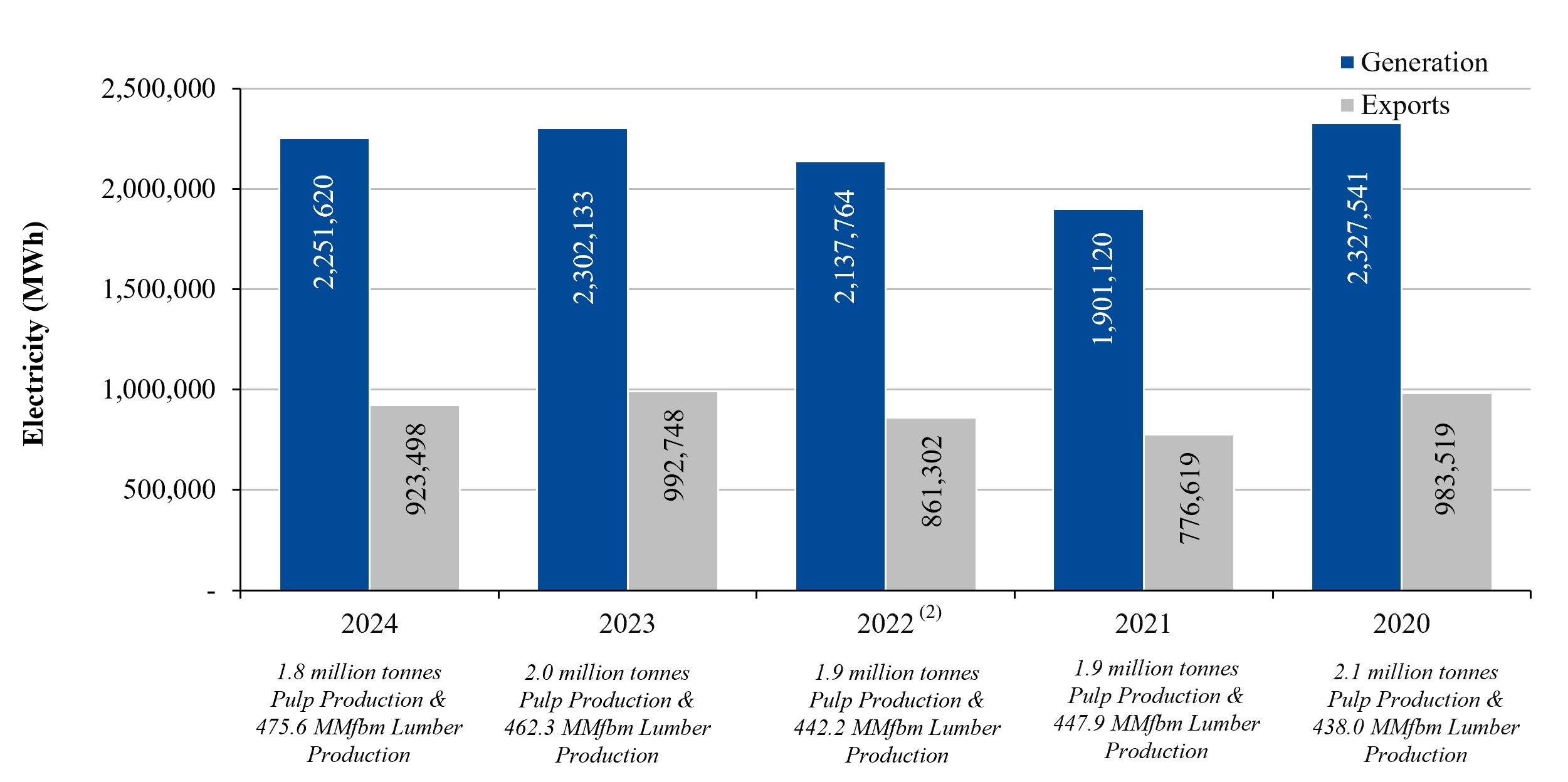

The following chart sets out our electricity generation and surplus electricity sales for the periods indicated:

Electricity Generation and Exports(1)

(1)Does not include our 50% joint venture interest in CPP, which was accounted for using the equity method. In March 2024, we disposed of this interest.

(2)Includes results of the Torgau facility since September 30, 2022.

The following chart sets out our consolidated revenues from electricity and chemical sales for the periods indicated:

Energy and Chemical Revenue(1)

(1)Does not include our 50% joint venture interest in CPP, which was accounted for using the equity method. In March 2024, we disposed of this interest.

(2)Includes results of the Torgau facility since September 30, 2022.

Germany

Certain of our German mills have the option to sell their surplus electricity at special tariffs under the Renewable Energy Act. The special tariffs expire in 2029 for our Friesau mill and between 2029 and 2034 for the four cogeneration power plants at our Torgau facility. The special tariff for our Stendal mill expired in December 2024.

In 2024, our Friesau mill and Torgau facility primarily sold energy at their special tariff rates which were generally higher than market prices. In 2024, our Stendal mill primarily sold energy at market prices, which were generally higher than the special tariff rate.

In 2024, energy sales at our German mills were approximately $78.1 million or 770,303 MWh.

In connection with our focus on the growing bio-energy market, we sell tall oil, a by-product of our pulp production process, which is used as both a chemical additive and as a green energy source. In 2024, we generated approximately $15.4 million from the sale of tall oil and other chemicals from our pulp segment.

Canada

Our Celgar mill is party to an electricity sales agreement with the provincial energy utility for a ten-year term that expires in October 2030. Pursuant to the agreement, the mill agreed to supply a maximum of approximately 127,000 MWh of surplus electrical energy annually to the utility.

Our Peace River mill sells its surplus electricity into the Alberta market at market prices.

In 2024, energy sales at our Canadian mills were approximately $11.1 million or 153,195 MWh.

Production Costs

Our major costs of production are fiber, labor, chemicals and energy.

Fiber

General

Fiber, comprised of wood chips and pulp logs, is our most significant operating expense for our pulp segment, representing about 55% of our pulp cash production costs in 2024. Further, fiber, in the form of sawlogs, represented about 75% of lumber cash production costs in 2024.

Given the significance of fiber to our total operating expenses and our limited ability to control its cost compared with our other operating costs, volatility in fiber costs can materially affect our margins and results of operations.

Our mills are situated in regions which generally provide a relatively stable supply of fiber. The fiber consumed by our pulp mills consists of wood chips produced by sawmills as a by-product of the sawmilling process and pulp logs. Wood chips are small pieces of wood used to make pulp and are either wood residuals from the sawmilling process or pulp logs chipped especially for this purpose. Pulp logs consist of lower quality logs not used in the production of lumber.

The Friesau mill and Torgau facility consume sawlogs and waste wood. The Mercer Spokane facility, Mercer Conway facility and Mercer Okanagan facility consume lumber. Sawlogs, waste wood and lumber are all cyclical in both price and supply.

Generally, the cost of wood chips, pulp logs and sawlogs is primarily affected by the supply and demand for lumber. Additionally, regional factors including harvesting levels, weather conditions and insect infestations can also have a material effect on the supply, demand and price for fiber.

While fiber costs and supply are subject to cyclical changes, we generally expect that we will be able to continue to obtain an adequate supply of fiber on reasonably satisfactory terms for our mills due to their locations and our long-term relationships with suppliers.

During the past few years, certain customers have endeavored to purchase pulp that is produced using fiber that meets certain recognized wood certification requirements from forest certification agencies like the Forest Stewardship Council (FSC), the Programme for the Endorsement of Forest Certification (PEFC), the Sustainable Forestry Initiative (SFI) and the Canadian Standards Association (CSA). If the fiber we purchase does not meet certain wood certifications required by customers, it may make it more difficult to, or prevent us from, selling our pulp to such customers. The chain of custody wood certification process is a voluntary process which allows a company to demonstrate that they use forest resources in accordance with strict principles and standards in the areas of sustainable forest management practices and environmental management. In an effort to procure wood only from sustainably managed sources, we employ an FSC Chain of Custody protocol and PEFC certification, which requires tracking of fiber origins and preparing risk based assessments regarding the region and operator. In the areas where we operate, we are actively engaged in the further development of certification processes. However, there is competition among private certification systems along with efforts by supporters to further these systems by having customers of forest products require products to be certified to their preferred system. Such wood certification standards continue to evolve and are not consistent from jurisdiction to jurisdiction or in how they are interpreted and applied. We currently do not expect certification requirements to have a material adverse impact on our fiber procurement and sales. However, if sufficient marketplace demand requires fiber to be sourced from standards that are inconsistent with those in our fiber supply regions, it could increase our operating costs and reduce available harvest levels.

Germany

With approximately 3.7 billion m3, Germany has the largest timber reserves in Europe. The principal species are spruce, pine, beech and oak. Many of the German forest areas have been certified according to PEFC or FSC standards.

We believe we are the largest consumer of wood chips and pulp logs in Germany and often provide the best long-term economic outlet for the sale of wood chips in Germany. We coordinate the wood procurement activities for our German mills to reduce overall personnel and administrative costs, provide greater purchasing power and coordinate buying and trading activities. This coordination and integration of fiber flows also allows us to optimize transportation costs, and the species and fiber mix for our mills. We are also party to joint wood purchasing arrangements with one of the largest wood consumers in Europe.

In 2024, our German pulp mills consumed an aggregate of approximately 5.1 million m3 of fiber. Approximately 61% was in the form of pulp logs and approximately 39% was in the form of sawmill wood chips.

In 2024, our pulp segment per unit fiber costs in Germany decreased compared to 2023 primarily due to softening demand in Germany from other wood consumers.

The core wood supply region for the Stendal mill includes most of Northeastern and Western Germany, primarily within an approximate 400 kilometer radius of the mill. We also purchase wood chips from Southwestern and Southern Germany as well as the Baltic Sea region. The fiber consumed by the Stendal mill consisted of approximately 52% spruce, 45% pine and 3% other species in 2024. The Stendal mill has sufficient chipping capacity to almost fully operate solely using pulp logs, if required. We source pulp logs from private and municipal forest owners and from state forest agencies. Our Stendal mill has historically also imported fiber from Poland and the Baltic Sea region.

Our Rosenthal mill sources wood chips from approximately 29 sawmills located primarily in the German states of Bavaria, Baden-Württemberg and Thuringia and primarily within a 300 kilometer radius of the Rosenthal mill. Within this radius, the Rosenthal mill is the largest consumer of wood chips. Given its location and size, the Rosenthal mill is often the best economic outlet for the sale of wood chips in the area. In 2024, approximately 90% of the fiber consumed by the Rosenthal mill was spruce and the remainder was pine.

Wood chips for the Rosenthal mill are normally sourced from sawmills under one-year contracts with quarterly adjustments for market pricing. Substantially all of our chip supply is sourced from suppliers with which we have long-standing relationships. Pulp logs are sourced from the state forest agencies in Thuringia, Saxony and Bavaria and from private and municipal forest owners. In addition, the Rosenthal mill buys relevant volumes via imports from the Czechia.

Our Friesau mill and Torgau facility are each dependent on the consistent supply of sawlog fiber. Our Friesau mill is located in an area where there is a significant amount of high-quality fiber within economic reach. The wood fiber requirements of the Friesau mill and Torgau facility are met primarily through open market purchases and contract purchases from state forestry agencies and private and municipal forest owners.

In Germany, over the last several years, the price and supply of wood chips has been affected from time to time by increasing demand from alternative or renewable energy producers and government initiatives for carbon neutral energy. In 2022 and early 2023, increasing energy prices as a result of energy supply shortages caused by the war in Ukraine increased the demand for wood chips and industrial logs for energy production.

Additionally, for several years leading to the first half of 2023, there was a material increase in the availability of harvestable wood as a result of beetle infestation of German forests. Generally, beetle-infested wood is harvested more rapidly so as to be useable before deterioration makes the wood unsuitable for its intended purposes.

While such beetle-infested wood increased fiber supply and led to lower prices in the short-term, such increased harvest levels can lead to challenges in maintaining a sustainable harvest level over the long-term and can lead to periods of reduced harvest levels in the future.

North America

In 2024, our Celgar and Peace River mills consumed approximately 4.2 million m3 of fiber. Approximately 55% of such fiber was in the form of sawmill wood chips and the remaining 45% came from pulp logs processed through their wood rooms or chipped by a third party. Our Canadian mills’ wood rooms are able to process about 47% of their fiber needs. The source of fiber at the mills is characterized by a mixture of species (aspen, spruce, douglas fir, hemlock, pine and cedar) and they source fiber from a number of Canadian and U.S. suppliers.

In British Columbia, a combination of high harvesting rates during a past beetle endemic, subsequent governmental initiatives to reduce harvest levels and weaker lumber prices in recent years resulted in lower sawlog availability and sawmill activity. This resulted in lower wood chip availability which increased fiber costs in British Columbia. However, in 2024, our Canadian pulp mills’ per unit fiber costs decreased compared to 2023, primarily due to the benefits from our wood room upgrades and generally stable supply.

The availability of fiber for our mills is in large part influenced by the strength of the lumber market. Lumber markets are primarily driven by U.S. housing starts, home renovation activities and, to a lesser degree, demand from China.

In 2024, our Canadian mills had access to approximately 25 different chip suppliers, most of whom are in Canada and, in the case of the Celgar mill, are also in the United States. Chips are purchased in Canada and the United States in accordance with chip purchase agreements. Generally, pricing is reviewed and adjusted periodically to reflect market conditions. The contracts for the Celgar mill are generally for one-year terms with quarterly adjustments or on three-month terms. The chip contracts for the Peace River mill are generally for three to five years with monthly adjustments indexed to the average pulp price.

To secure the volume of pulp logs required by its wood room and field chippers, the Celgar mill has entered into pulp log supply agreements. Such agreements can range from one-month to one-year terms, with a number of different suppliers, many of whom are also contract chip suppliers for the mill. All of the pulp log agreements can be terminated by the Celgar mill upon seven days’ written notice. The Celgar mill also bids on British Columbia timber sales from time to time.

Peace River holds two 20-year renewable governmental forest management agreements and three deciduous timber allocations in Alberta with an aggregate allowable annual cut of approximately 2.9 million m3 of hardwood, of which it currently harvests approximately 44%, and 375,000 m3 of softwood, which it sells or trades to sawmills surrounding the Peace River mill in exchange for wood chips. The forest management agreements were last renewed for a 20-year term expiring in 2029. While our Peace River mill can satisfy all of its hardwood fiber requirements from its forest management agreements and timber allocations, in order to optimize its fiber flow, it satisfies a small portion of its needs from third-party owned timberlands. Softwood fiber supply is from residual sawmill chips from local surrounding sawmills.

The Mercer Spokane facility, Mercer Conway facility and Mercer Okanagan facility primarily source lumber through open market purchases or short-term contracts with regional producers in the U.S. Pacific Northwest, Western Canada and the U.S. South.

Labor

Our labor costs have increased over time due to inflation in wages and health care costs.

Energy

Our energy is primarily generated from renewable carbon neutral sources, such as black liquor and wood waste. Our mills produce all of our electrical energy requirements and generate excess energy which we sell to third-party utilities and to regional electrical markets. We utilize fossil fuels, such as natural gas, primarily in our lime kilns and we use a limited amount for start-up and shut-down operations. Additionally, from time to time, mill process disruptions occur and we consume small quantities of purchased electricity and fossil fuels to maintain operations. As a result, all of our mills are subject to fluctuations in the prices for electricity and fossil fuels. Our per unit energy costs decreased in 2024.

Chemicals

Our pulp mills use certain chemicals which are generally available from several suppliers and sourcing is primarily based upon pricing and location. After a period of several years of increases in chemical costs, our per unit chemical costs decreased in 2024.

Sales, Marketing and Distribution

Our global sales and marketing group is responsible for conducting all sales and marketing of the pulp produced at our mills and currently has approximately 20 employees. This group largely handles all European and North American sales directly. Sales to Asia are made directly or through commission agents overseen by our sales group. The global sales and marketing group handles sales to approximately 250 customers. We coordinate and integrate the sales and marketing activities of our German mills to realize on a number of synergies between them. These include reduced overall administrative and personnel costs and coordinated selling, marketing and transportation activities. We also coordinate pulp sales across our mills on a global basis, thereby providing our larger customers with seamless service across all major geographies. In marketing our pulp, we seek to establish long-term relationships by providing a competitively priced, high-quality, consistent product and excellent service. In accordance with customary practice, we maintain long-standing relationships with our customers, pursuant to which we periodically reach agreements on specific volumes and prices.

Our solid wood segment sales are handled by our sales teams in Germany and Vancouver. We also sell lumber through commissioned agents in certain markets.

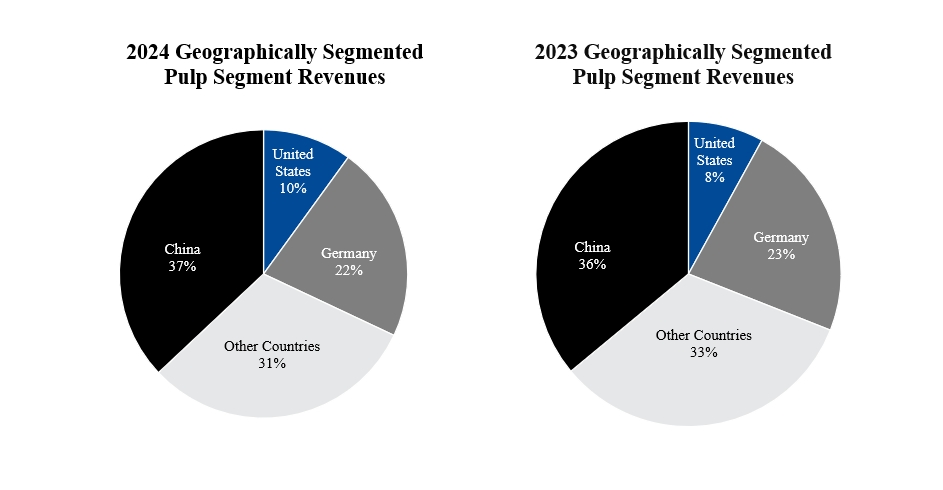

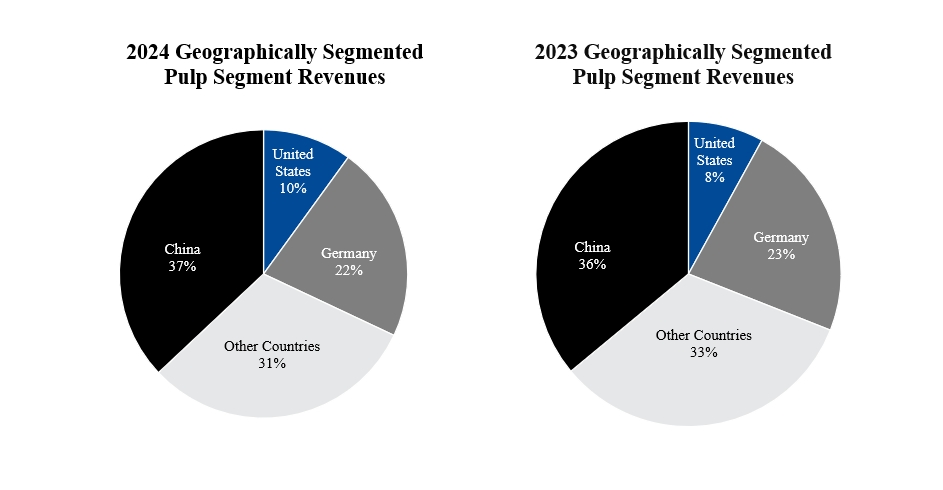

The following table sets out our pulp segment revenues by geographic area for the periods indicated:

| | | | | | | | |

| | Year Ended December 31, | |

| | 2024 | | | 2023 | |

| | (in thousands) | |

United States | | $ | 151,053 | | | $ | 123,818 | |

Germany | | | 334,361 | | | | 349,685 | |

China | | | 574,264 | | | | 551,945 | |

Other countries | | | 488,878 | | | | 490,682 | |

Total(1) | | $ | 1,548,556 | | | $ | 1,516,130 | |

(1)Excludes intercompany sales.

The following charts set out the geographic distribution of our pulp segment revenues as a percentage of our total pulp segment revenues for the periods indicated:

(1)Excludes intercompany sales.

The following table sets out the distribution of our pulp sales volumes by end use for the periods indicated:

| | | | | | | | |

| | Year Ended December 31, | |

| | 2024 | | | 2023 | |

| | (in thousands of ADMTs) | |

Tissue | | | 821 | | | | 778 | |

Specialty | | | 328 | | | | 333 | |

Printing & Writing | | | 708 | | | | 700 | |

Other | | | 43 | | | | 140 | |

Total | | | 1,900 | | | | 1,951 | |

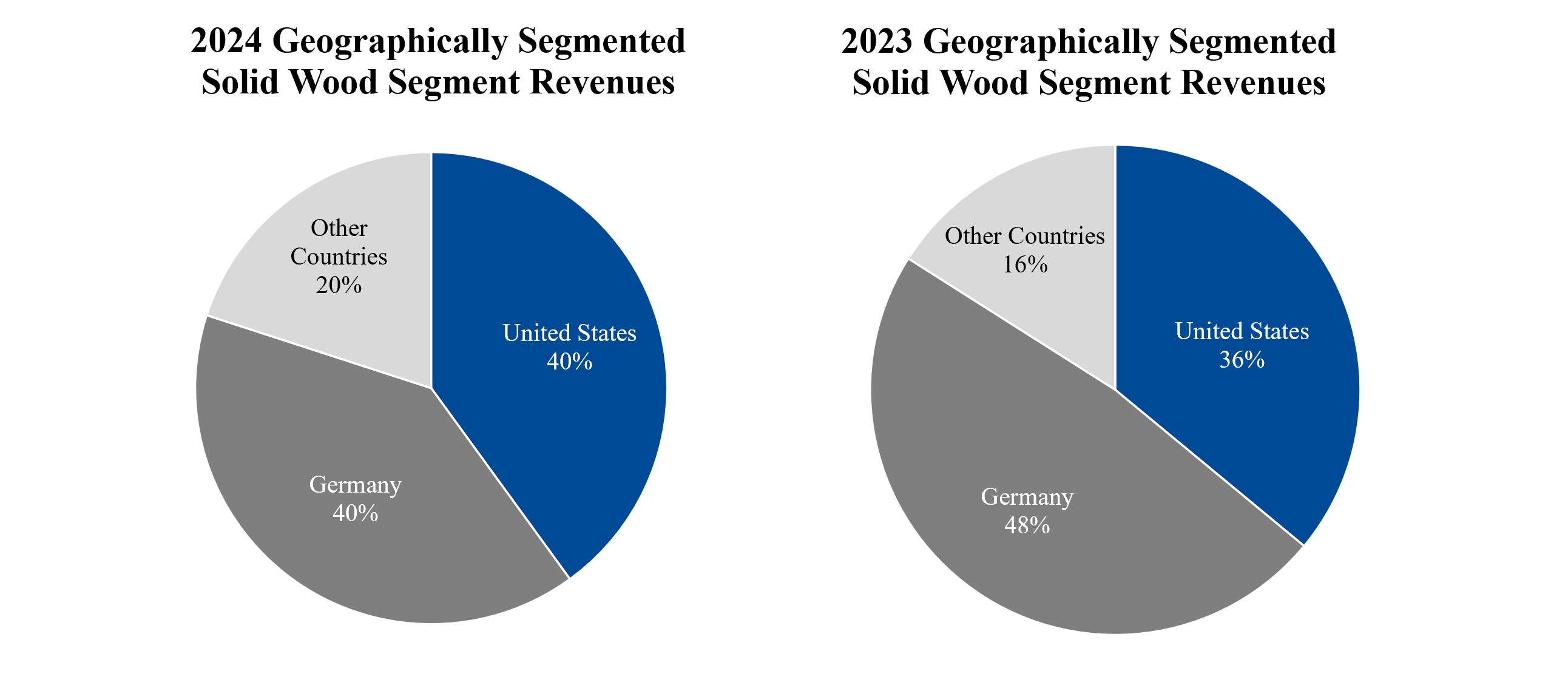

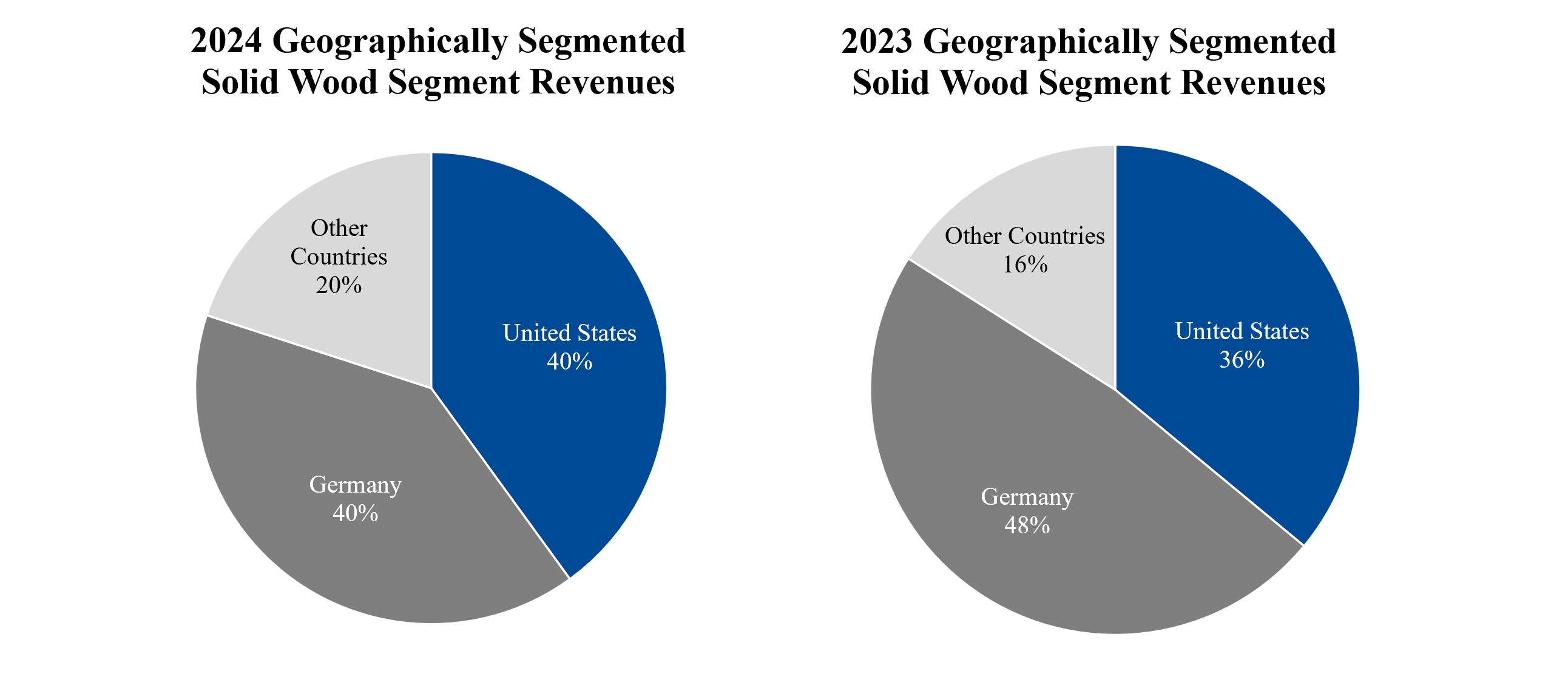

The following table sets out our solid wood segment revenues by geographic area for the periods indicated:

| | | | | | | | |

| | Year Ended December 31, | |

| | 2024 | | | 2023 | |

| | (in thousands) | |

United States | | $ | 194,880 | | | $ | 169,883 | |

Germany | | | 195,867 | | | | 224,741 | |

Other countries | | | 95,244 | | | | 77,430 | |

Total(1) | | $ | 485,991 | | | $ | 472,054 | |

(1)Excludes intercompany sales.

The following charts set out the geographic distribution of our solid wood segment revenues as a percentage of our total solid wood segment revenues for the periods indicated:

(1)Excludes intercompany sales.

Our pulp segment and solid wood segment sales are on customary industry terms. As of December 31, 2024, we had no material payment delinquencies. In 2024 and 2023, no customer accounted for 10% or more of our revenues. We do not believe our pulp segment or solid wood segment sales are dependent upon the activities of any single customer and the loss of any single customer would not have a material adverse effect on us.

Transportation

We transport our pulp and solid wood products generally by rail, ocean carrier and truck through third-party carriers. We have a small fleet of trucks in Germany that deliver some of our German mills’ pulp. In Germany, we also lease a significant number of railcars for inbound transport of fiber and outbound shipping of products.

Our German pulp mills are currently the only market kraft pulp producers in Germany, which is the largest import market for kraft pulp in Europe. We therefore have a competitive transportation cost advantage compared to Canadian and Northern European pulp producers when shipping to customers in Europe. Due to the location of our German mills, we are able to deliver pulp to many of our customers by rail and truck.

Our Canadian mills’ pulp is transported to customers by truck, rail and ocean carrier through third-party carriers. The majority of our Canadian mills’ pulp for overseas markets is initially delivered by rail to the Port of Vancouver for shipment overseas by ocean carrier. Based in Western Canada, our Canadian mills are well positioned to service Asian customers. The majority of our Canadian mills’ pulp for domestic markets is shipped by rail directly to the customer or to third-party warehouses in the United States. We also operate a logistics and reload center near Trail, British Columbia to provide us with additional warehouse space and greater transportation flexibility in terms of access to rail and trucking options.

The Friesau mill’s lumber is transported to customers by rail, ocean carrier and truck through third-party carriers.

The Torgau and mass timber facilities’ products are primarily transported by truck.

In both 2024 and 2023, outbound transportation costs comprised approximately 10% of each years' total consolidated costs and expenses.

Capital Expenditures

We have continued to make capital investments designed to increase pulp, green energy and chemical production, reduce costs and improve efficiency and environmental performance at our pulp mills. The improvements made over the years have increased the competitive position of our pulp mills. Since the acquisitions, we have also made capital investments to optimize sawmill production at the Friesau mill and Torgau facility.

The following table sets out the total capital expenditures by segment (excluding any related governmental grants) for the periods indicated:

| | | | | | | | | |

| | Year Ended December 31, | | |

| | 2024 | | | 2023 | | |

| | (in thousands) | | |

Pulp segment | | $ | 46,400 | | | $ | 90,126 | | (1) |

Solid wood segment | | | 37,732 | | | | 45,707 | | |

Total | | $ | 84,132 | | | $ | 135,833 | | |

(1)Includes expenditures to rebuild the wood chip conveying systems at the Stendal mill which were damaged by a fire in 2022. The rebuild was financed with insurance proceeds, of which $12.2 million was received in 2023.

In our pulp segment, capital investments at the Stendal mill in 2024 and 2023 primarily related to completing the rebuild of the wood chip conveying systems that were damaged by fire in 2022 and other maintenance projects.

Capital investments at the Rosenthal mill in 2024 primarily related to the purchase of a digester evaporator and maintenance projects. In 2023, capital investments at the Rosenthal mill primarily related to completion of the lignin plant and maintenance projects.

Capital investments at our Canadian pulp mills in 2024 primarily related to enhancements to soot blowers at the Peace River mill and for both mills, improvements to the wood rooms and maintenance projects. In 2023, capital investments at the Peace River and Celgar mills primarily related to wood room upgrades and maintenance projects.

In our solid wood segment, capital investments in 2024 at our Torgau facility primarily related to log yard improvements and sawing and planer machine upgrades. For the Friesau facility, capital investments in 2024 primarily related to sorter line upgrades and maintenance projects. For our mass timber facilities, capital investments in 2024 primarily related to production and sorter line upgrades. In 2023, capital investments primarily related to optimization projects, including sorter line upgrades at our Friesau mill and Mercer Spokane facility, log yard improvements at our Torgau facility and other maintenance projects.

Qualifying capital investments at industrial facilities in Germany that reduce pollutants in the effluent discharge can be used to offset wastewater fees that would otherwise be required to be paid. For more information about our environmental capital expenditures, see “– Environmental”.

In 2025, excluding amounts being financed through government grants, we currently expect our total capital expenditures to be approximately $100.0 million to $120.0 million, principally comprised of maintenance projects at our pulp mills and sawmills and optimization projects, including upgrades to the wood room at the Celgar mill, the digester evaporator at the Rosenthal mill, the sorter line at the Mercer Spokane facility and log yard improvements at both the Friesau facility and Torgau facility.

Innovation

We utilize our expertise with wood, its processing and by-products to expand our product mix. As a result, we seek to develop new products based on our expertise in wood processing and working with derivatives of the kraft pulping process. Currently these processes are focused on:

•the production and sale of CLT and glulam at our Mercer Spokane facility, Mercer Conway facility and Mercer Okanagan facility;

•the further refinement of materials contained in black liquor, the extractive chemical and lignin containing compounds that are a result of the kraft pulping process; and

•the further refinement of cellulose materials that are currently the basis of pulp.

We are working on some of these initiatives on our own, with others and in conjunction with industry associations or joint venture partners.

In an effort to further grow our chemical sales and bring additional value to our by-product stream, we invested in a pilot lignin plant at our Rosenthal mill. This plant will allow us to research the commercial opportunities of this product. Lignin has many potential uses in the manufacture of green alternative products such as adhesives and carbon black.

Environmental

Our operations are subject to a wide range of environmental laws and regulations, dealing primarily with:

•solid and hazardous waste management;

•remediation and contaminated sites; and

Compliance with these laws and regulations generally involves capital expenditures as well as additional operating costs. We cannot easily quantify the future amounts of capital expenditures we might have to make to comply with these laws and regulations or the effects on our operating costs because in some instances compliance standards have not been developed, have not become final or definitive or may be amended in the future. In addition, it is difficult to isolate the environmental component of most manufacturing capital projects.

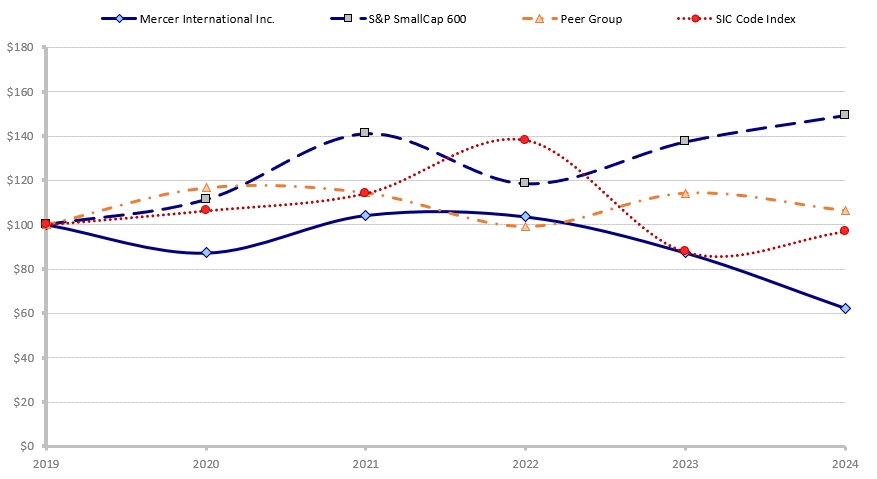

We devote significant management and financial resources to comply with all applicable environmental laws and regulations. In particular, the operation of our plants is subject to permits, authorizations and approvals and we must comply with prescribed emission limits. Compliance with these requirements is monitored by local authorities and non-compliance may result in administrative orders, fines or closures of the non-compliant mill. Our total capital expenditures on environmental projects at our mills were approximately $3.9 million in 2024 and approximately $2.8 million in 2023. In 2025, capital expenditures for environmental projects are expected to be approximately $7.0 million.