UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

☒ ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended October 31, 2024

☐ TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission file number: 001-38154

CODA OCTOPUS GROUP, INC.

(Exact name of registrant as specified in its charter)

| Delaware | | 34-2008348 |

| (State or other jurisdiction of | | (I.R.S. Employer |

| incorporation or organization) | | Identification Number) |

3300 S Hiawassee Rd, Suite 104-105, Orlando, Florida, 32835

(Address, Including Zip Code of Principal Executive Offices)

407 735 2406

(Issuer’s telephone number)

Securities registered under Section 12(b) of the Exchange Act:

COMMON STOCK, $0.001 PAR VALUE PER SHARE

Securities registered under Section 12(g) of the Exchange Act:

NONE

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Date File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

| ● | Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer or a smaller reporting company. |

| | Large accelerated filer ☐ | Accelerated filer ☐ |

| | Non-accelerated filer ☒ | Smaller reporting company ☒ |

| | Emerging growth company ☐ | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C.7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive offers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

| ● | State issuer’s revenues for its most recent fiscal year: $20,316,161 |

| | |

| ● | State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of April 30, 2024 representing the last business day of the registrant’s most recently completed second fiscal quarter: approximately $41,343,000. |

| | |

| ● | State the number of shares outstanding of each of the issuer’s classes of common equity, as of the latest practicable date: 11,218,804 as of January 25, 2025. |

TABLE OF CONTENTS

FORWARD-LOOKING STATEMENTS

This annual report on Form 10-K (this “Annual Report”) contains forward-looking statements, which are subject to the safe harbor provisions created by the Private Securities Litigation Reform Act of 1995. Forward-looking statements are not statements of historical fact but rather reflect our current expectations, estimates and predictions about future results and events. These statements may use words such as “anticipate,” “believe,” “estimate,” “expect,” “intend,” “predict,” “project” and similar expressions or variations of such words are intended to identify forward-looking statements but are not the exclusive means of identifying forward-looking statements in this Annual Report. The identification of certain statements as “forward-looking” is not intended to mean that other statements not specifically identified are not forward-looking. All statements other than statements about historical facts are statements that could be deemed forward-looking statements, including, but not limited to, statements that relate to our future revenue, product development, customer demand, market share, growth rate, competitiveness, gross margins, levels of research, development and other related costs, expenditures, tax expenses, cash flows, our management’s plans and objectives for our current and future operations, the levels of customer spending or research and development activities, and related events, general economic conditions, and the sufficiency of financial resources to support future operations and capital expenditures.

When we make forward-looking statements, we are basing them on our management’s beliefs and assumptions, using information currently available to us. These forward-looking statements are subject to risks, uncertainties, and assumptions, including but not limited to, risks, uncertainties and assumptions discussed in this Annual Report. Factors that can cause or contribute to these differences include those described under the heading “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

If one or more of these or other risks or uncertainties materialize, or if our underlying assumptions prove to be incorrect, actual results may vary materially from what we projected. Any forward-looking statement you read in this Annual Report reflects our current views with respect to future events and is subject to these and other risks, uncertainties and assumptions relating to our operations, results of operations, growth strategy and liquidity. All subsequent written and oral forward-looking statements attributable to us, or individuals acting on our behalf are expressly qualified in their entirety by this paragraph. You should specifically consider the factors identified in this Annual Report, which would cause actual results to differ before making an investment decision. We are under no duty to update any of the forward-looking statements after the date of this Annual Report or to conform these statements to actual results.

PART I

ITEM 1. BUSINESS

Corporate Information

Our principal executive offices are located at 3300 S. Hiawassee Rd, Orlando, FL 32835. Our telephone number is +1 (407) 735-2406. We maintain a corporate website at www.codaoctopusgroup.com. The reference to the Company’s website address does not constitute incorporation by reference of the information on the Company’s website into this Form 10-K.

Overview

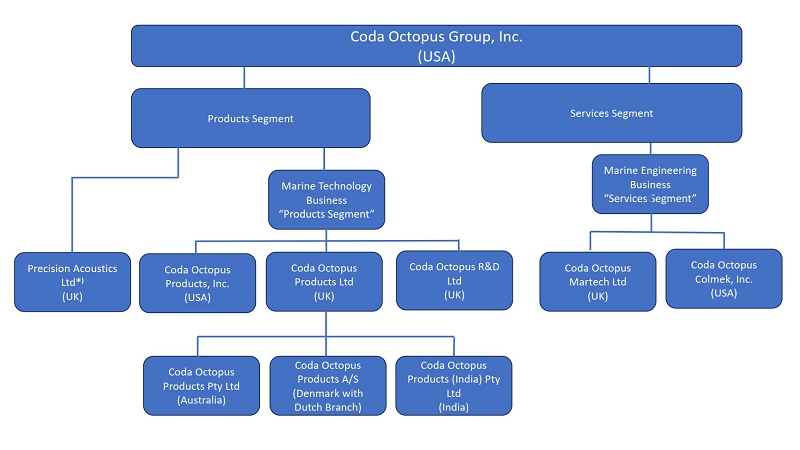

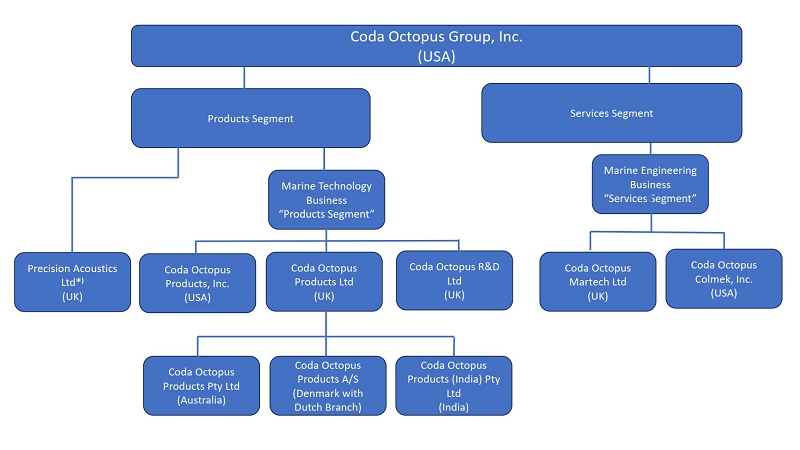

Coda Octopus Group, Inc. (“Coda” “the Company” or “we”), through its wholly owned subsidiaries, operates two distinct segments:

| | ● | the Marine Technology Business (also referred to in this Form 10-K as “Products Business”, “Products Operations” or “Products Segment”); and |

| | | |

| | ● | the Marine Engineering Business (also referred to in this Form 10-K as “Engineering Business”, “Engineering Operations”, or “Services Segment”). |

Marine Technology Business (Products Segment)

Our Marine Technology Business is a technology solution provider to the underwater market. It owns key proprietary and unique technology comprising its real time volumetric imaging sonar technology (Echoscope® technology) and diving technology (Diver Augmented Vision Display - “DAVD”), both of which are applicable to the underwater market, and which are used in the commercial offshore and defense sectors. It also sells other proprietary subsea products such as its geophysical hardware and software solutions and inertial navigation systems. All innovations, design, development and manufacturing of our products are performed within the Company. As part of our patent strategy, we endeavor to actively protect our innovations by seeking patent protection where appropriate.

Our imaging sonar series is marketed under the name Echoscope® and Echoscope PIPE® and are used primarily in the underwater construction, offshore renewables, and offshore oil and gas, complex underwater mapping, salvage operations, dredging, bridge inspection, navigation of underwater hazard, port and harbor security, mining, commercial and defense diving, marine sciences sectors and more broadly applications for real time 3D monitoring, inspection and visualization underwater. Uniquely, the Echoscope® technology is a single sensor for multiple underwater applications that can be used to image in 3D, moving objects in zero visibility water conditions. Competing technologies such as the multibeam primary function is for mapping the seabed and are not real time 3D sonars.

Our diving technology marketed under the name “CodaOctopus® DAVD” addresses the global defense and commercial diving markets. We have two variants of the DAVD: the tethered and untethered variant. The tethered variant is used with a connection to a surface vessel and the untethered variant is not connected to a surface mothership for air supply.

The DAVD solution has the potential to radically change how diving operations are performed globally because it delivers real time information simultaneously to the divers underwater and their surface-based dive supervisors. The DAVD Head- Up Display (“HUD”) is used as a data portal for the diver while underwater. Various types of information are displayed to the diver in the HUD in real time and there by obviating the need for voice instructions.

The DAVD untethered solution (“DUS”) is designed for the Defense and Military market where diving is performed without connection to a surface vessel. These divers are typically military divers performing special forces operations, mine detection and clearance or reconnaissance and surveillance. Similar to the tethered variant, the DAVD HUD is used for displaying a range of mission-related information to the diver.

DAVD’s concept of using a pair of glasses, which is capable of augmented reality display, inside the face mask, helmet or other diving suits is protected by patent. The Company has an exclusive license to exploit this utility patent.

The Marine Technology Business operates through our wholly owned subsidiaries Coda Octopus Products, Inc., (Orlando), Coda Octopus Products Ltd (UK), Coda Octopus Products A/S (Denmark) and branch office Coda Octopus Products A/S in The Netherlands)), and Coda Octopus Products (India) Private Limited (India).

Marine Engineering Business (Services Segment)

Our Marine Engineering Businesses are suppliers of embedded solutions and sub-assemblies which they design and manufacture and sell as a component of mission critical integrated defense systems. The Services Segment established its business in 1977 and has been supporting a number of significant defense programs of record for over 40 years, including Raytheon’s Close in Weapon Support (CIWS) and Northrop Grumman’s Mine Hunting Systems Program (AQS-24) Program. The Services Segment’s business model entails engineering components for integration into broader defense programs, such as the CIWS program. Typically, they supply prototypes units which are validated for integration and thereafter, subject to meeting the acceptance criteria, these lead to contracts for manufacture, repair and upgrade for the life of the program, which can span decades. We enjoy sole source status for the parts that we design and supply into these programs. This business model ensures recurring and long tail revenues. Coda Octopus Colmek, Inc. and Coda Octopus Martech Ltd, qualify as small businesses. This opens opportunities under state requirements to collaborate with Prime Defense Contractors on these programs. A significant part of the revenues generated by the Marine Engineering Business is highly concentrated and are usually derived from a small number of prime defense contractors such as Raytheon or Northrop. In any one financial year, between 20% to 30% of our consolidated revenues may be derived from these customers either alone or collectively.

The Services Segment operates through our wholly owned subsidiaries, Coda Octopus Colmek, Inc (“Colmek”), which is based in Salt Lake City, Utah and which we acquired in 2007, and Coda Octopus Martech Limited (“Martech”), which is based in Portland, United Kingdom and which we acquired in 2006.

Newly Acquired Third Business Unit into the Group’s Products Segment

On October 29, 2024 we acquired Precision Acoustics Limited (hereinafter referred to as “PAL”), a company established under the laws of England. This Company is a recognized leader in the ultrasound and acoustic measurement field. Specializing in acoustic hydrophone design and innovative acoustic materials, they provide a comprehensive range of products and solutions, with a primary focus on medical imaging and Non-Destructive Testing (NDT). NDT is used to validate the viability of structures such as aircraft, ship hulls, wellheads and other subsea structures. Their expertise extends to working closely with national and global standard-setting bodies (such as the National Physical Laboratory of the UK), contributing to the establishment of the primary measurement standards in the industry. This business was acquired to gain access to their expertise and leverage this across the group including in the area of advancing the Echoscope® technology. We believe the addition of their expertise and capabilities positions the Group to qualify to compete for larger Defense contracts.

For segment reporting purposes this newly acquired Company will be reported within our Products Segment.

Therefore, our Products Segment will now comprise PAL and our Marine Technology Business.

Cross-Group Synergies

Our Marine Technology Business and Marine Engineering Services Business both have established synergies in terms of customers, technologies and specialized engineering skills for robust, rugged, and repeated engineering solutions relating to data acquisition, data computation and display of the data. Increasingly drawing on each part of the business strengths, the Marine Technology Business and Marine Engineering Business work jointly on projects including responding jointly for responding to invitations to tender for new projects with broader scope. We believe the Services Business is important to our overall growth strategy as it brings significant engineering depth for the development of the technology solutions offered by the Marine Technology Business. This also ensures tighter control over our intellectual property rights, which are important for our market position. The addition of the expertise of PAL in the field of acoustics and NDT positions the Group to consolidate its capabilities and therefore jointly compete for larger Defense contracts.

Key Pillars for our Growth Plans

Our Echoscope® and DAVD technologies are our most promising products and solutions for the Company’s near-term growth.

We believe that our real time 3D/4D/5D/6D imaging sonars are the only acoustic imaging sonars capable of providing real time 4D imaging of moving objects in zero visibility water conditions and making real time 3D physical measurements of objects underwater. Competing acoustic imaging sonars such as the multibeam sonars are primarily seabed mapping tools which are not designed to perform complex seabed mapping or imaging of moving objects in 3D underwater. The Echoscope® technology therefore is a key sensor for underwater construction activities, inspection and monitoring in real time 3D. We also believe that our new generation of Echoscope PIPE® is the only sonar that can generate concurrently multiple real time 3D/4D/5D/6D acoustic images using different acoustic parameters in real time such as field of view, pulse length, filters, beam density and various beamforming modes. This has the potential to reduce the number of underwater sensors that are required on a project at any one time and therefore improve the efficiency of these underwater operations.

In our industry we are widely considered the leading solution provider for underwater real time 3D visualization.

We also believe that the DAVD solution is poised to radically change the way diving operations are performed by providing a fully integrated suite of sensor data which can be shared in real time by the dive supervisor on the surface vessel and the diver by displaying the required data in the DAVD HUD. Current diving is done largely by poor analog voice command missions (with the diver supervisor on the surface providing verbal instructions to the diver underwater) using a disparate suite of systems for video data, communications, and positioning, which is not available to the diver firsthand. Furthermore, by combining the DAVD with our real time 3D sonars, (Echoscope®), it allows diving to be performed in difficult water conditions (turbidity or zero visibility issues) and thus addresses the common problem of underwater operations having to be aborted due to visibility issues.

The DAVD tethered version, which has now been moved from the customer’s research and development phase into its operational phase, is now in early-stage adoption and is currently operational across nine naval commands within the US Navy. This means that the DAVD tethered version is now a standard item available for purchase and for which budget lines can be established within the various user commands within the Navy.

In the Current FY we continued our global marketing campaigns for the adoption of the DAVD tethered system outside of the US Navy. We believe we have made significant progress with these campaigns. Due to funding shortage on US Defense Programs during the Fiscal Year 2024, funds were not allocated for the DAVD tethered system. We are aware that a number of commands have requested DAVD systems, but these are awaiting budget approval. We do not believe these opportunities have gone away but until the Federal Budget is in place by the new Administration, we expect that US Defense Programs will continue to be funded through continuing resolutions under which there is limited funding available. This may result in a shift of spending priorities which may impact on the level of allocation of funding to programs like the DAVD.

We continue to see great interest in the technology from the marketplace and as we introduce the new generation of the DAVD Augmented Reality HUD, this has galvanized solid interest in the technology.

We are actively working on the DAVD untethered system under a funded joint program with the US Navy and a Foreign Navy, (the “DUS Hardening Program”) where the DAVD technology is being hardened for adoption by the special forces. We have made solid progress under this program and have received positive feedback by these customers. In the Fiscal Year 2024, we did not receive the level of funding anticipated for the DUS Hardening Program due to the reduced funding available under continuing resolutions. Until the Federal Budget is adopted by the new Administration, we anticipate reduced funding for US Defense Programs which may impact the allocation of funding to the DUS Hardening Program and affect the time scales to which we are working for completing the deliverables under this program. Despite this reduced level of funding in the FY 2024, we have achieved a critical milestone (a major pre-requisite for the success of the DUS Hardening Program and we delivered the new generation of the DAVD HUD solution. This next-generation DAVD HUD technology platform boasts a more compact design, a 200% increase in resolution, and an expanded field of view. These enhancements significantly improve compatibility with specialized dive helmets and masks, unlocking new possibilities for previously underutilized applications and markets. This accomplishment represents a major milestone in the success of the DUS Hardening Program. We continue to believe that the DUS variant represents the biggest market opportunity for the DAVD technology in the USA with the addressable market including defense, law enforcement and first responders.

The concept of utilizing a pair of transparent glasses in the HUD underwater for this purpose, is protected by patent. All component parts of the DAVD system are proprietary to the Company and include software (4G USE® DAVD Edition), Diver Processing Pack – telemetry system (DPP), topside Supervisor Console Controller and real time 3D Sonar. The Company benefits from the exclusive license from the U.S. Department of the Navy at Naval Surface Warfare Center Panama City Division to utilize the utility patent covering the concept of using the pair of transparent glasses as a data hub underwater. The DAVD tethered variant is classified as an “Authorization for Navy Use” item and also benefits from CE marking certifying that the DAVD system meets the essential health, safety and environmental requirements of the UK and European Union. The untethered variant is currently going through validation process.

Our corporate structure is as follows:

* For operational purposes, although the newly acquired PAL will, for segment reporting purposes, be reported as part of the Products Segment, this will continue to be a separate business unit from the Marine Technology Business, as it operates in a different market sector from the Marine Technology Business.

Corporate History

The Company began as Coda Technologies Limited. This company now operates under the name Coda Octopus Products Limited, a United Kingdom corporation formed in 1994 as a start-up company with its origins as a research group at Heriot-Watt University, Edinburgh, Scotland. Initially, its operations consisted primarily of developing software for subsea mapping and visualization using sidescan sonar (a technology widely used in commercial offshore geophysical survey and naval mine-hunting to detect objects on, and textures of, the surface of the seabed).

In June 2002, we acquired Octopus Marine Systems Ltd, a UK corporation, and changed our name to Coda Octopus Limited. At the time of its acquisition, Octopus Marine Systems was producing geophysical products broadly similar to those of Coda, but targeted at the less sophisticated, easy-to-use, “workhorse” market.

In December 2002, Coda Octopus Ltd acquired OmniTech AS, a Norwegian corporation, which became a wholly owned subsidiary of the Company, and which subsequently changed its name to Coda Octopus R&D A/S. At the time of acquisition, this company had been engaged for over ten years in developing a revolutionary imaging sonar technology capable of producing real time three-dimensional (“3D”) underwater images for use in subsea activities. Coda Octopus Products Limited (Edinburgh based) then developed our visualization software (Underwater Survey Explorer) to control and display the images from the real time 3D sonar device. This patented technology is now marketed by us under the brand name “Echoscope®” and Echoscope PIPE®. All activities of this now-defunct Norwegian subsidiary, Coda Octopus R&D A/S, have been transferred to Coda Octopus Products Limited (Edinburgh).

On July 13, 2004, the Company effected a reverse merger pursuant to the terms of a share exchange agreement between The Panda Project, Inc. (“Panda”), a Florida corporation, and a now defunct entity affiliated with Coda Octopus Ltd. (“Coda Parent”). Panda acquired the shares of Coda Octopus Limited, a UK corporation and a wholly-owned subsidiary of Coda Parent, in consideration for the issuance of a total of 1,432,143 shares of common stock to Coda Parent and other shareholders of Coda Octopus Limited. The shares issued represented approximately 90.9% of the issued and outstanding shares of Panda. The share exchange was accounted for as a reverse acquisition of Panda by Coda. Subsequently, Panda was reincorporated in Delaware and changed its name to Coda Octopus Group, Inc.

In June 2006, we acquired Coda Octopus Martech Limited, which is part of our Services Segment or Marine Engineering Business. This is an English corporation.

In April 2007, we acquired Coda Octopus Colmek, Inc., which is part of our Services Segment or Marine Engineering Business. This is a Utah corporation.

Both Martech and Colmek largely have the same business model, provide similar engineering services and sell to a similar customer base (Martech is UK focused and Colmek is US focused).

In December 2013 Coda Octopus Products Limited established Coda Octopus Products Pty Ltd (Australia) to grow our presence in Australia and New Zealand. These activities were interrupted by the Coronavirus Pandemic in 2020 and since then has been slow to regain momentum.

In 2017 Coda Octopus Products Limited established a subsidiary Coda Octopus Products A/S in Denmark as part of the mitigation strategy relating to the UK withdrawal from the European Union.

In November 2021 Coda Octopus Products Limited established a subsidiary Coda Octopus Products (India) Private Limited intended to gain access to this market and to recruit critical resources for software development.

On October 29, 2024, we acquired into the Group, Precision Acoustics Limited, a company established under the laws of England. This company was acquired to gain access to its expertise and expand our capabilities and offering to the market. It was also acquired to leverage its existing technologies and expertise, which are used in other market sectors, into one of our main markets, the subsea market.

Coda Octopus Group, Inc., is organized under the laws of the State of Delaware as a holding company that conducts its business through its subsidiaries, several of which are organized under the laws of foreign jurisdictions, including England, Scotland, Denmark, The Netherlands, Australia and India. This may have an adverse impact on the ability of U.S. investors to enforce a judgment obtained in U.S. courts against these entities, or to effect service of process on the officers and directors managing the foreign subsidiaries. These companies’ operations must comply with the laws of the countries under which they are incorporated, and these laws are likely to be different from the equivalent laws of the United States.

Marine Technology Business (“Products Segment”)

Our Marine Technology Business develops proprietary solutions for both the commercial and defense subsea market. The range of solutions which it offers to the market are complementary and include:

| Product | | Family | | Composition |

| Real time volumetric imaging sonar | | Echoscope®/ Echoscope PIPE® range | | Hardware and Software |

| Diving Technology | | Diver Augmented Vision Display (DAVD) range | | Hardware and Software |

Digital Audio Communications System | | Voice HUB_4 | | Hardware and Software |

| GNSS-Aided Navigation Systems (providing heading, pitch, yaw and roll data at sea) | | F280 Series® | | Hardware and Software |

Geophysical Solutions (used in conjunction with sidescan and sub-bottom data acquisition) | | DA4G®, GeoSurvey® and Survey Engine | | Hardware and software |

These products and/or solutions are sold, rented or leased into various marine sectors such as:

| | ● | Marine geophysical survey |

| | ● | Offshore Renewables (“Wind Energy”) |

| | ● | Underwater construction, inspection and monitoring |

| | ● | Diving Companies |

| | ● | Commercial and Defense Diving |

| | ● | Salvage and decommissioning |

| | ● | Oil and Gas (O&G”) |

| | ● | Robotics |

| | ● | Commercial fisheries |

| | ● | Environmental, mammal and habitat monitoring |

| | ● | Underwater Defense Applications |

| | ● | Marine vehicles and robotics |

| | ● | Port and Harbor Security, law enforcement and first responders |

| | ● | Research and education |

1. Geophysical Range of Products

The Geophysical range of products is marketed under the brands DA4G®, GeoSurvey® and Survey Engine®. We started our business in 1994 designing and developing the GeoSurvey® software and hardware package for acquisition and processing of sidescan sonar and sub-bottom profiler data. For over two decades, our GeoSurvey has been an industry leading software package in the market for data acquisition and interpretation and provides feature rich solutions and productivity enhancing tools for the most exacting survey requirements. Designed specifically for sidescan and sub-bottom data acquisition, GeoSurvey® has been purchased by numerous leading survey companies throughout the world and has been the workhorse for processing data for Oil & Gas companies for many years. The DA4G® is the hardware acquisition system and both GeoSurvey® and Survey Engine® are complementary software packages which are used for processing the data post-acquisition.

2. Inertial Positioning and Attitude Measurement Systems (“Motion Products”)

We have been selling our GNSS Aided Inertial Measurement Systems for over 15 years. Our current generation of F280 Series® was released to the market in 2021 and is used to provide data on accurate positioning, heading, pitch, roll and yaw at sea. The F280 Series® is an advancement of our F180® series and is highly complementary to our real time Echoscope® sonar series and they are packaged together to provide a more comprehensive solution. The products within the F280 Series ® range can be sold with or without our Echoscope®.

3. Real Time Volumetric Imaging Sonars (ranging from 3D/4D, 5D and 6D)

We design, develop and supply what we believe is the world’s most advanced series of real time volumetric imaging sonar (Echoscope® and Echoscope PIPE®). This is the culmination of over 25 years of research and development. Our sonar innovations are multi-tiered and extend to hardware, firmware and software, all of which co-exist and are co-dependent on each other. In other words, hardware, firmware and software operate as sub-systems to each other. We believe that the highly complex nature of this new technology will make it extremely difficult to reverse engineer our sonar products.

Prior to 2018, we were selling our third generation of Echoscope imaging sonar (3G Sonar Series). In January 2018, we launched our 4G Sonar Series which were largely form factor revisions, and removed several barriers to adoption, (size, weight, power and price). Building on 4G developments, we continued our innovation and in 2021 released our latest generation of sonar, Echoscope PIPE® to the market which advanced the capabilities of the technology and antecedent sonar products significantly.

We believe that the Echoscope PIPE® technology is superior to the other imaging sonars in the market as it generates real time 3D, 4D, 5D and 6D images of the underwater environment irrespective of low or zero visibility conditions and, unlike conventional sonars, can image a volume of data (as opposed to a slice of data). The capability of our volumetric imaging sonars covers a broad breadth of activities underwater particularly for any form of real time monitoring in 3D, underwater construction, salvaging, placements, decommissioning, obstacle avoidance, complex underwater mapping and real time 3D navigation in zero visibility conditions. Uniquely also, using a single sensor (our Echoscope PIPE®) range we can provide different data outputs to the various parts of the survey team, thus reducing the number of different sensors required on these underwater projects, and ultimately reducing the costs associated with these operations.

About the Company’s 5D and 6D Sonars Innovations

5D and 6D imaging sonars are new to the subsea market and constitute an innovation by the Company. We have several patent applications pending for these innovations.

5D Sonars (Echoscope PIPE®)

The advancement that the Company has made with its 5D Sonars is the ability to process and utilize much more of the data that is acquired and processed by our volumetric imaging sonars. Prior to this, due to limitation of processing technologies, there was an upper limit to the amount of data our antecedent sonars could acquire and process. This meant that in the previous generation of sonars (3G and 4G series) when a signal was emitted, they returned a single range and intensity value per beam. In our 5D Sonars we return multiple range and intensity values per beam (Full Time Series data). This new capability provides more information about the underwater environment.

6D Sonars (Echoscope PIPE®)

The Company’s 6D Sonars process and utilize much more of the data acquired by the sonar. 6D Sonars generate multiple real time 3D full time series images. In the previous generation of sonars (3G and 4G series), we could image and display one 3D image in real time. Our PIPE technology generates multiple 3D images simultaneously in real time using different sonar/acoustic parameters (such as different beamforming methods, frequency, range, field of view, pulse length and other acoustic filters or shading). This allows for different data sets to be provided to different parts of the survey team in real time (thus consolidating the sensors and the associated costs and effectiveness of the solution). We are not aware of any sonars that offer either 5D or 6D Capability.

Echoscope® Sonar Hardware

We believe our 5D and 6D series of sonars herald a significant leap forward in real time subsea imaging as this inventive capability allows a single sonar to provide different parts of the survey operations with multiple real time 3D data sets (as opposed to one 3D dataset) for each part of the survey teams’ requirements.

Current competing imaging technologies such as the single beam, multibeam and scanning sonars are either real time 2D imaging sonars or 3D imaging sonars which are not capable of real time 3D imaging, that is to generate a 3D image underwater of moving objects. The competing 3D technology, the multibeam, which is the current standard bearer for imaging sonars in the market is for mapping of the seabed. The Echoscope® technology can also map the seabed (and is superior to the multibeam for complex mapping and inspection of complex underwater structures) and in addition can image moving objects underwater in 3D. The Echoscope® is therefore the primary tool of choice for inspecting and monitoring in real time 3D all types of underwater operations and is the only choice in poor visibility conditions. In addition, the Echoscope® in many instances enables the user to monitor underwater operations from a surface vessel replacing the Remotely Operated Vehicles (ROVs) thus bringing considerable cost savings to our customers.

Echoscope® Software

The Echoscope® technology is used in conjunction with our internally developed software (USE, Construction Monitoring System (CMS), 4G USE® and 4G USE® DAVD Edition). The software is a critical component of the capabilities and features of our sonar series.

Our software development capability is an important part of our strategy to maintain our lead in designing, manufacturing, and selling state-of-the-art real time volumetric imaging sonars and our DAVD System. It also allows us to be responsive to our customers’ requirements for new features and capabilities around our solutions.

We have now launched our fourth-generation multi-sensor software platform which is marketed under the name “4G USE®”. We have also filed several provisional patents around our 4G USE® which is a multi-sensor platform allowing users to bring in and utilize a variety of sensor data including sonar, positioning, camera, lidar, video processing and other sources of point cloud data and seamlessly merging above and below the water data captured from the sonar and camera. It is also the platform for our DAVD software, and this module is marketed under the brand 4G USE® DAVD Edition.

Diver Augmented Vision Display (DAVD) System – Diving Technology

Funded by the Office of Naval Research (“ONR”) through its Future Naval Capabilities (FNC) program, and in close collaboration with NAVSEA 00C3 and Naval Surface Warfare Center, Panama City Division (“NSWC PCD”) we have developed a diver see-through integrated information display system (DAVD).

DAVD is a complete end-to-end diver management solution incorporating as a key element a high-resolution, fully transparent glass head-up display, HUD, integrated directly inside the diving helmet (for hard hat surface air supply diving) or full-facemask (for tethered and untethered defense, commercial and recreational diving applications) or diving suits. In October 2024, we released to the US Navy for evaluation our new generation of Augmented Reality DAVD HUD. The new generation of the DAVD HUD is much smaller and has a higher resolution and therefore offers great flexibility for use in helmets and facemasks for diving. This new generation removes some of the form factor barriers which limited the types of helmets or masks that could be used with our previous generation of the DAVD HUD. The delivery of the new generation of DAVD HUD is a key milestone under the funded DUS Hardening Program.

Problem In Context

The concept of using a pair of transparent glasses in the HUD to render real time information for underwater applications is protected by patent and Coda Octopus has an exclusive license from United States Department of the Navy at NSWC PCD to exploit this patent for all underwater diving activities.

The US Government as represented by Secretary of the Navy (Arlington, VA), describes the challenge for divers in their patent application as follows:

“By their very nature, underwater dive missions are difficult and inherently dangerous. Furthermore, the complexity of underwater missions can make it difficult or impossible for a diver to retain all pre-mission briefing information. For these reasons, it is critical for underwater divers to have access to environmental data and mission data while in the water. However, in low visibility water environments, divers can rarely see handheld displays or gauges. Accordingly, divers are generally supplied with audio-communicated information from a topside location. The topside-supplied information can include descriptions of sonar images, blueprints, maps, pictures, etc. Unfortunately, it can be very difficult and confusing for a diver to interpret a topside personnel’s audio description of the topside personnel’s visual interpretation. Combining this with unreliable audio communication can lead to mission failures or disasters.”

It further describes the objective of the Invention as:

“Accordingly, it is an object of the present invention to provide an underwater diver with real-time visual information available to topside personnel.

Another object of the present invention is to provide real-time visual information to an underwater diver for viewing in water environments irrespective of water visibility levels.

Other objects and advantages of the present invention will become more obvious hereinafter in the specification and drawings.”

How does DAVD Change this?

The DAVD system addresses all the challenges described above including removing the interpretation of the underwater scene to the topside by providing the diver with real time data and first-person interpretation. The DAVD technology benefits not only the diver and direct supervisor on the surface, but also engineers, end-clients, rescue workers and support personnel who all have a vested interest in a successful and safe diving mission. DAVD provides the location of the diver, the dive support vessel, work site assets and any hazards that are known or discovered in real-time. Real-time compass and depth are also displayed to the diver to reduce disorientation. Visibility for the diver and team is significantly enhanced with both real-time camera and 3D sonar data (providing underwater night-vision) and also high-resolution maps and models of the entire work site and surroundings. Communication is transformed from low quality audio speech to high quality digital audio and video, text messaging, visual alerts and automated navigation guidance. The safety of the diver and team is paramount. DAVD ensures the Diver and Supervisor are visually synchronized and can safely coordinate movement, tasks and instructions with full health monitoring and logging of the entire mission. Using the current method of diving, data and information sharing end when the diver leaves the surface.

The DAVD is a significant technology for both defense and commercial underwater diving applications, and we believe that we have the opportunity to standardize this technology globally. The DAVD comprises both hardware comprising the HUD, Diver Processing Pack (DPP), cables and topside Control Unit (DAVD Control Panel) along with 4G USE® DAVD Edition real time visualization software. These developments and products have been performed by the Company.

The DAVD is currently in early-stage adoption with the US Navy and enjoys the benefit of the classification Authorization for Navy Use (ANU) item. DAVD also is certified for CE markings which covers compliance with the European Union and the United Kingdom health environmental and health and safety requirements.

We are marketing the DAVD (through live demonstrations) globally to navies and the commercial diving market. We have significant interest from a number of reputable global commercial offshore service providers and are working with them for the early adoption of the technology and also a number of European friendly Navies including the UK Ministry of Defense (MOD).

Marine Technology Business Accreditations

Coda Octopus Products Limited has the requisite accreditations for its business including being Lloyds Register accredited to ISO 9001:2015 and Cyber Essentials Plus certification.

Newly Acquired Business Unit - Precision Acoustics Limited (“PAL”)

PAL, which is UK based, was acquired into the Group on October 29, 2024. This Company is a recognized leader in the ultrasound and acoustic measurement field. Specializing in acoustic hydrophone design and innovative acoustic materials, they provide a comprehensive range of products and solutions, with a primary focus on medical imaging and Non-Destructive Testing (NDT). NDT is used to validate the viability of structures such as aircraft, ship hulls, wellheads and other subsea structures. Their expertise extends to working closely with national and global standard-setting bodies (such as the National Physical Laboratory of the UK), contributing to the establishment of the primary measurement standards in the industry. For segment reporting purposes, this Company financial results will be reported as a third unit under the Products Segment.

PAL has the requisite accreditations for its business including being Lloyds Register accredited to ISO 9001:2015 and Cyber Essentials certification.

Marine Engineering Businesses (“Services Segment”)

Our Marine Engineering Businesses comprise Coda Octopus Colmek, Inc. which is based in Salt Lake City and Coda Octopus Martech Limited which is based in the United Kingdom.

They largely operate as sub-contractors to prime defense contractors, and their engineering solutions typically constitute sub-components designed for integration into larger defense programs of record where high levels of reliability and quality are essential pre-requisites for securing and maintaining these agreements with their customers. Typically, they prototype subassemblies for their customers and after going through various acceptance tests, including first article inspection approvals, they are then awarded the manufacturing contracts. Many of these manufacturing contracts have a repeat orders profile which typically follows the life cycle of the defense program that is using the subassembly component within the broader program.

These arrangements often give the Marine Engineering Business long term preferred/sole supplier status for the sub-components they supply into these programs and provide them with opportunity to participate in any requirements for technology refresh or obsolescence management for the components supplied. They generally use these long-standing relationships to win more contracts with these customers.

In order to grow, the Marine Engineering Business relies on increasing the number of new programs it attracts annually.

In addition, we are increasingly combining our engineering capabilities with our product offerings. This enables us to offer systems which are complete with installation and support to maximize the utilization of our collective expertise to advance our technologies.

Coda Octopus Martech Limited (“Martech”)

Martech, which is UK-based, operates in the specialized niche of bespoke design and manufacturing services mainly to the United Kingdom defense and subsea industries. Its services are provided on a custom subcontract basis where high quality and high integrity devices are required in small quantities. Their skill set includes both hardware and software design.

Martech enjoys pre-approvals to allow it to be short-listed for certain types of government contracts. Much of the more significant business secured by Martech is through the formal government or government contractor tendering process. Martech has the requisite accreditations for its business including being Lloyds Register accredited to ISO 9001:2015 and Cyber Essentials Plus certification.

Coda Octopus Colmek, Inc. (“Colmek”)

Colmek, which is USA-based, are suppliers of embedded solutions and sub-assemblies which they design and manufacture and sell into mission critical integrated defense systems such as the Close-In-Weapons System (CIWS). This business was established 1977 and has been supporting several significant US defense programs for over 40 years, including Raytheon’s CIWS and Northrop Grumman’s Mine Hunting Systems Program (AQS-24). Colmek’s business model entails designing sub-assemblies which are components of broader defense programs. Colmek is the sole source for the parts that they supply to these programs. This business model ensures recurring and long tail revenues since we continue to supply parts, typically for the life of the program, which can span decades. Their work scope typically extends to both hardware and software design.

Colmek has the requisite accreditations for its business including being Lloyds Register accredited to ISO 9001:2015 and NIST (National Institute of Science and Technology) 800-171 certification.

Sales and Marketing

The Marine Technology Business markets its products through its internal sales team, website, industry events such as trade shows, webinars, live demonstrations of the technology, industry relationships and a network of non-exclusive agents in foreign countries such as Japan, China, Korea and South Africa.

PAL markets its products through its internal sales team, its website and a network of non-exclusive agents in Japan, China, India and Korea.

Colmek markets its products through its internal sales team, website, industry events and agents in the US and Canada.

Martech markets its products through its internal sales team, website and industry events.

Competition

In our Marine Technology Business (Products Business), we are exposed to the following competitive challenges:

Data Acquisition Products (Geophysical Products)

A small percentage of our revenue is generated from our geophysical range of products.

The industry for data acquisition and processing systems for sidescan and sub-bottom profiler data is fragmented with several companies occupying niche areas, and we face competition from different companies with respect to our different products.

In the field of geophysical products, Triton Imaging Inc., a US-based company, now part of the ECA Group (Toulon, France), Chesapeake, a US-based company, and Oceanic Imaging Consultants, Hawaii, USA, dominate the market.

GNSS Aided Inertial Positioning and Attitude Measurement Systems (“Motion Products”)

A small percentage of our revenue is generated from our F280 Series®.

In the field of GNSS-aided inertial positioning and attitude sensing equipment, where our product addresses a small segment of the overall market, we believe that we have several principal competitors: Teledyne Technologies Inc.; Kongsberg Gruppen, iXblue, Applanix and SBG Systems. We believe that our market share in this market segment of motion sensing equipment is relatively small. We sell our MOTION range as part of our equipment suite to complement our Echoscope® real time 3D sonar range as well as supplying it individually. The development and introduction of our F280 Series® of GNSS Aided Inertial Positioning and Attitude Measurement System® constitutes our new generation of Motion Products and gives us the opportunity to increase our market share.

Real Time 3D/4D/5D and 6D Volumetric Sonar

A significant portion of our revenue is generated from our Echoscope® technology.

In the field of Real Time 3D/4D/5D imaging, we are unaware of other companies offering a similar product. In this context it is important to understand some of the intellectual property including know how and capabilities we bring to this field include:

| | - | Acoustic Projector/Transmitter design, manufacturing, and testing |

| | - | Acoustic Receiver Array design, manufacturing, and testing |

| | - | Acoustic encapsulation and sensitivity measurement |

| | - | Acoustic Projector/Transmitter beam pattern and sensitivity measurement |

| | - | Pressure housing Design and Manufacture (sonar systems) |

| | - | 3D/5D/6D Real-Time digital beamforming (on-device) |

| | - | 1D and 2D Digital Beamforming |

| | - | Broadband Beamforming |

| | - | Signal Processing |

| | - | Active High Frequency Sonar Systems |

| | - | Passive Mid Frequency Sonar Systems |

| | - | Data acquisition and recording hardware and software |

| | - | Real-time 2D and 3D sonar visualization rendering and processing software |

Any entry into this market depends upon specialized marine electronics, acoustic and software development skills. The learning curve, which has resulted in the advancement of our real time 3D sonar device, is the culmination of two decades of research and development in this field.

Companies such as Kongsberg Gruppen, R2Sonic, LLC, Tritech International Ltd., United Kingdom, BlueView Technologies Inc., USA (now a part of Teledyne Technologies Incorporated), and Norbit Group AS Norway and Kraken Robotics are examples of companies offering imaging sonar solutions (such as multibeam sonars, SAS sonars and/or 2D scanning sonars), but none of these sonar offerings are directly comparable or competitors to our real time volumetric 3D/4D/5D and 6D sonar solutions as their scanning sonar, single beam or multibeam sonars are not real time 3D imaging sonars and therefore cannot image moving targets underwater.

Specifically, we believe that they do not have the same capabilities as our Echoscope® technology in terms of real time inspection and monitoring by generating 3D, 4D, 5D and 6D images of moving objects underwater including in environments in low or zero visibility conditions. Notwithstanding it should be noted that Teledyne has acquired a significant number of substantial subsea companies (examples are Reson and BlueView). Teledyne has much greater resources, liquidity and market reach than our Company and has many operating verticals. We therefore can give no assurance that companies such as these will not enter this market. Furthermore, companies such as Kongsberg Gruppen and Teledyne can expend significantly more in any one fiscal year on R&D and Business Development, key pillars for increasing market share of underwater imaging sonars, than the Company. Notwithstanding, we believe that our recent development and introduction of 5D/6D - Echoscope PIPE® sonar capability in conjunction with our software (4G USE® a multi-sensor platform) further distinguishes our volumetric sonars and significantly extends our lead in real time 3D/4D/5D and 6D Imaging of moving objects underwater over competitors in the subsea imaging market. Furthermore, we believe that the addition of Precision Acoustic’s expertise in this area will help the Company in maintaining its lead in this area. We are not aware of any other imaging sonars in the market capable of generating real time 5D and 6D imagery underwater, which are Coda Octopus inventions. The innovations around Echoscope PIPE® are the subject of numerous patent applications. We have been awarded US 10,718,865 and US 10,816,652 which concerns a method of compressing beamformed data and method of compressing sonar data, respectively. These two patents are important method patents since we are handling significantly more data than in our previous generation of sonars.

We seek to compete on the basis of producing high quality products employing cutting edge technology that is easy to use by the operators without specialized skills in sonar technology. We intend to continue our research and development activities to continually improve our products, seek new applications for our existing products, develop new innovative products and grow the market for our products and expertise.

Diver Augmented Vision Display System (“DAVD”)

A material portion of our revenue is generated from our DAVD technology.

There are various diving systems in the market that provide a combination of different aspects of our DAVD system but no systems that directly compete in the form of embedded fully transparent glasses mounted internally within the diver helmet or mask for visual display of a range of data and augmented reality information which can be directly consumed by the diver underwater. This concept is protected by US Patent 10,877,282.

The DAVD system provides a unique diver centric system with localized and external sensors to provide increased safety, scene awareness and vital communication in the form of Digital Audio, Ultra-Low-Light Video, Text and technical instruction and access to a complete media hub for effective communication between diver and supervisor. The DAVD system provides the following capabilities:

| | ● | Fully Transparent High-Definition Head-Up Display mounted internally within supported Dive Helmets and Dive Masks, including Kirby Morgan KM37, KM37SS, KM97 and SL17 Helmets, as well as the Interspiro Divator MK II, OTS Guardian and Dräger Panorama Nova Dive |

| | ● | Fully integrated 1st person perspective digital low-light camera with advanced video processing and real-time edge enhancement for Diver and Dive Supervisor |

| | ● | Fully integrated noise-cancelling Digital Audio at source, replacing legacy communications |

| | ● | Integrated Diver Head Tracking for accurate 3D scene visualization with full support for subsea positioning systems for accurate Diver positioning |

| | ● | Telemetry Information on demand including Dive Timers, Depth and Compass Heading, Live position Lat/Long (when connected to external diving positioning system), Waypoint Range and Bearing as well as external Dive Computer data |

| | ● | Instant Digital Voice and Text Communication between Dive Supervisor and Diver, including auto and pre-defined messaging |

| | ● | Transmit unlimited on-demand media to Diver including Images, Instructional Videos, Technical Drawings and other assets to assist in live operations |

| | ● | Creation and transfer of unlimited step-by-step mission instructions with text, video and image support for common diver tasks and operations |

| | ● | Full Mixed-Reality 3D Display for Diver using live Sonar, pre-surveyed Sonar data and 3D models |

| | ● | Divers HUD Display fully adjustable between 2D Mode, and 3D Mode with 1st person and 3rd person perspective |

There are several diver related products and sensors that can be worn by the diver such as telemetry systems, navigational aids, dive computers, video and sonar systems and probes and sensors such as magnetic and thickness. Each of these systems typically have an independent display, typically on the device or wrist worn.

Video systems generally provide no direct benefit to the diver and are intended for top-side visualization. The DAVD provides video data to the diver directly.

More recent advances in technology have introduced head mounted display (HMD) as either replacement or as additional display close to the divers’ eyes. These are typically presented in the form of a monocular display mounted externally to the divers’ mask in which the diver must look at this display through a single eye. These are not intended for long term use and more for occasional glance at data for reference. Dual HMDs are also provided in certain products to replace what the diver can see through the mask with a computer display.

The drawback of such HMD is that the diver loses all sense of the natural surrounding and the real environment is placed using the computer display. Examples of monocular and dual lens HMD include Shearwater Nerd 2, Tritech DMD (Diver Mounted Display) and Blueprint Subsea Artemis HMD.

Furthermore, a significant challenge for diving is the operating environment where zero visibility conditions typically prevail. Combining our DAVD with our Echoscope® removes this barrier for diving operations.

In our Services Segment, we are exposed to the following competitive challenges:

Newly acquired business unit, PAL

PAL sells several products some of which are customized for the customer’s specific application. It is exposed to the following competitive challenges:

Needle and Membrane Hydrophones and Fibre-Optic Hydrophones Market.

For its needle and membrane hydrophone ranges, which are a highly specialized range of products, competition is limited. The principal competitors offering both needle and membrane hydrophones are Onda Corporation, Sunnyvale, CA, USA and Gampt, Merseberg, Germany. For its fibre-optic hydrophones range of products, its main competitors are Onda Corporation, Sunnyvale, CA, USA, RP Acoustics, Stuttgart, Germany and Muller Instruments, Oberursel, Germany.

Single element Transducers Market

PAL supplies single element transducers. There are many suppliers of ultrasonic transducers including Olympus, USA, Imasonic, Besancon, France; Vermon, France; Sonatest, UK; Waygate Technologies, USA as well as numerous smaller organizations in China. However, these competitors offer commercial-off-the-shelf (COTs) products whereas PAL offers custom design single element transducers based on its customers’ specifications and therefore competition is limited for this specialist customization capability).

Automated Measurement Systems Market

PAL supplies Automated Measurement Systems. Its main competitors in this area are Onda Corporation, Sunnyvale, CA, USA; Acertara Acoustic Laboratories, Longmont, CO, USA and Gampt, Merseberg, Germany. These companies offer acoustic measurement systems which are comparable with the PA UMS system. However, PAL faces less competition for its Automated Measurement Systems since its focus is on customization to their customers’ specifications.

Passive Acoustic materials Market

PAL supplies passive acoustic materials. Competition is limited as it has a license from the UK National Physical Laboratory to distribute a wide range of ultrasonic absorbers and encapsulants incorporating NPL’s intellectual property.

Measurements and Calibration Market

As a provider of measurements and calibration services in the UK, PAL’s main competitor is National Physical Laboratory (NPL), UK who is the only provider of ISO17025 accredited hydrophone calibration services, in addition to the ultrasonic power calibration service. They also provide ultrasonic and underwater acoustic field characterization services. However, there is a long-established collaboration between PAL and NPL, and both organizations act as supplier and customer of each other. Elsewhere, numerous notified bodies or national measurement institutions (TuV, Germany; SGS, France; GUM Poland; PTB, Germany) offer some specific measurement services.

Marine Engineering Businesses

Through our marine engineering operations, Coda Octopus Colmek, Inc. and Coda Octopus Martech Limited, we are involved in custom engineering for the defense industry in the United States and in the United Kingdom and are dependent on subcontract from the major prime contractors. Martech and Colmek compete with larger contractors, such as the primes, in the defense industry. Typical among these are Ultra Electronics, BAE Systems, Thales, Raytheon and Northrop Grumman, all of whom are also partners on various projects. The strongest competitors are often the prime contractors themselves as they predominantly have the option to execute the work package internally as opposed to subcontracting these.

Intellectual Property

We operate in an industry in which innovation, investment in new ideas and protection of our intellectual property rights are critical for our continued success. When we can, we protect our innovations and inventions through a variety of means, including, but not limited to, applying for patent, copyright, and trademark protection domestically and internationally, and protecting our trade secrets. We incentivize our employees to innovate through our Patent Reward Scheme. In the last 3 years we have advanced our existing sonar technology and have filed several significant patents applications pertaining to these inventions including our 5D and 6D innovations. Furthermore, we have recently been awarded a patent which concerns a method of predicting and adjusting the laying of cable using sonar imaging. This is a significant patent for the Offshore Renewables Market, which as the world makes the energy transition is set to expand globally. Our Echoscope® technology is used for real time monitoring of cable installations for many of these offshore renewable projects. This recent patent covers a method which automatically predicts the cable touchdown point and removes the need for the Echoscope® operator to manually determine and log the cable touchdown point.

Patents

Our patented inventions along with our strategy to enhance these inventions are at the heart of the Company’s strategy for growth and development. We expend a material part of our resources in building our Patent Portfolio. We also incentivize our staff to contribute to our Patent Portfolio by having in place a competitive Patent Reward Scheme.

Our patent portfolio consists of the following:

| Patent No. | | Description | | Expiration Date |

| US 7,466,628 | | Concerns a method of constructing mathematical representations of objects from reflected sonar signals | | January 1, 2027 |

| US 7,489,592 | | Concerns a method of automatically performing a patch test for a sonar system, where data from a plurality of overlapping three-dimensional (3D) sonar scans of a surface, as the platform is moved, are used to compensate for biases in mounting the sonar system on the platform | | March 5, 2027 |

| US 7,898,902 | | Concerns a method of representation of sonar images allowing 3D sonar data to be represented by a two-dimensional image | | June 13, 2028 |

| US 8,059,486 | | Concerns a method of rendering volume representation of sonar images. | | April 16, 2028 |

| Japan 5565964 | | Concerns a method for drilling/levelling by an underwater drilling/levelling construction device | | January 13, 2031 |

| Japan 5565957 | | Concerns a method of construction management for a 3D sonar device | | October 13, 2030 |

| US 8,854,920 | | Concerns a method of volumetric rendering of 3D sonar data sets | | June 22, 2033 |

| US 9,019,795 | | Concerns a method of object tracking using sonar imaging through point matching between 3D data sets | | November 30, 2033 |

| US 10,088,566 | | Concerns a method of object tracking using sonar imaging using a bounding sphere for object tracking | | November 25, 2036 |

| US 10,718,865 | | Concerns a method of compressing beamformed sonar data | | March 1, 2039 |

| US 10,816,652 | | Concerns a method of compressing sonar data | | October 28, 2038 |

| US 11,061,136 | | Concerns a method of tracking unknown possible objects with sonar | | March 28, 2039 |

| **US 11,204,108 | | Concerns a method of predicting and adjusting the laying of cable using sonar imaging. | | March 22, 2039 |

| *US 11,448,755 | | Concerns a method of correcting beamformed data through split aperture beamforming | | June 3, 2041 |

| US11,579,288 | | Concerns a method of pseudo random frequency sonar ping generation for the purposes of data and hardware cost reduction | | April 14, 2038 |

| JP7224959 | | Concerns a method of compressing sonar data | | February 28, 2038 |

| US10, 877,282 | | Head Up Display System for Underwater Face Plate (within an underwater dive helmet or dive mask) | | License for exclusive use granted to Coda Octopus. |

| US 11,846,733 | | Concerns a method of stabilizing sonar images | | October 30, 2035 |

| JP 7403226 | | Concerns a method of pseudo random frequency sonar ping generation to reduce data and hardware cost | | April 14, 2038 |

| US 11,874,407 | | Concerns technologies for dynamic, real time, four-dimensional volumetric multi-object underwater scene segmentation | | February 19, 2040 |

| US11,789,146 | | Concerns a combined method of location of sonar detection device | | August 5, 2039 |

Trademarks

We own the registered trademarks listed below and they are used in conjunction with the products that we market and sell:

Coda®, Octopus®, CodaOctopus®, CodaOctopus & Design®, Octopus & Design®, F180®, F280®, F280 Series®, Echoscope®, Echoscope 4G®, Echoscope 5D®, 5D Echoscope®, Echoscope 6D®, 6D Echoscope®, Echoscope PIPE® Ping-Pong Echoscope Sonar®, Ping-Pong Echoscope®, Ping-Pong Sonar®, Echoscope Sequencer® 4G Underwater Survey Explorer®, 4G USE®, Echoscope Sequencer®, Survey Engine®, Dimension®, DAseries®, GeoSurvey® CodaOctopus® Air, CodaOctopus® Vantage®; CodaOctopus® UIS; CodaOctopus® USE, Sentiris® , Thermite®; PA and PA Precision Acoustics.

In addition, we have registered several internet domain names including www.codaoctopus.com; www.codaoctopusgroup.com; www.colmek.com and www.martechsystems.co.uk; www.codaoctopusmartech.com; and www.acoustics.co.uk.

Research and Development (“R&D”)

Research and Development is foundational to our business strategy to ensure our growth strategy and maintain our competitiveness. The main costs that are incurred in this area are wages and salaries, researching, prototyping, and validation and testing. The acquisition of PAL into the Group on October 29, 2024, may result in an increase in R&D expenditures as we seek to take advantage of PAL’s expertise with a view to bringing more products and solutions to the market.

Our products are complex and therefore we can give no assurance that even with spending a significant part of our resources on R&D, we will be successful in our development goals or realize significant monetization of these developments. Furthermore, even following the launch of any product we may not succeed. Moreover, we may incur significant research and development expenditures without realizing viable products.

Government Regulation

We sell our products and services internationally and therefore we are subject to numerous laws concerning general business regulations in the various jurisdictions in which we operate. Governmental actions (such as trade protection measures, including export duties and quotas and custom duties and tariffs) may have a material impact on our business and directly affect our revenue. We are also subject to compliance with the U.S. Foreign Corrupt Practices Act and other applicable U.S. and foreign laws prohibiting corrupt payments to government officials and other third parties. We are subject to laws and policies of the U.S. and other jurisdictions affecting trade, foreign investment, loans, and taxes.

Furthermore, many of our products are subject to export control regimes including in the United States, United Kingdom, Denmark, and Australia. Where our products are subject to such export control requirements, they may only be exported to our customers if there is a valid export license granted by the relevant government body. Moreover, these regulations may change from time to time in these jurisdictions, including the United States, depending on the existing relationship with the country to which the goods are exported. Our international activities are significant to our revenues and profits (see Note 16 Disaggregation of revenue). We are therefore dependent on obtaining, on a timely basis, export licenses to many foreign jurisdictions including China.

In addition, as a provider for the US Government, we may be subject to numerous laws and regulations relating to the award, administration, Defense Federal Acquisition Regulations (“DFARs”) and performance of US Government contracts, including the False Claims Act. Non-compliance found by any one agency could result in fines, penalties, debarment, or suspension from receiving additional contracts with all US Government agencies. Given our dependence on US Government business, suspension or debarment could have a material adverse effect on our business and results of operations. In addition, the costs of complying with some of the regulations including DFARS may be prohibitive.

We are dependent on Government funding for a significant part of our revenue generation. To secure certain types of Defense contracts, we need as a pre-requisite to meet Defense Federal Acquisition Regulations on security (including regulations on the type of IT system which must be in place, receiving, handling and storing certain classes of materials). In many instances we do not hold these credentials, and we may therefore not qualify to compete for such contracts.

We are also required to maintain certain accreditations including ISO 900 accreditation, Cyber Essentials, Cyber Essential Plus and NIST (National Institute Science and Technology).

Employees

As of the date hereof, we employ approximately 103 employees worldwide, of which 15 hold management positions. A large majority of our employees have a background in science, technology, software and hardware engineering, with a substantial part being educated to a degree level. A number of our employees hold PhD’s in the area of their specialization. None of our employees are employed under a collective agreement and we have not experienced any organized labor difficulties in the past.

Available Information

Our internet address is www.codaoctopusgroup.com, where we make available, free of charge, our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and any amendments to those reports, as soon as reasonably practicable after we electronically file such material with, or furnish it to, the Securities Exchange Commission (“SEC”). Our SEC reports can be accessed through the investor relations section of our website. With the exception of our annual and periodic reports (Form 10-K and Form 10-Q), the information found on the Company’s website is not intended to be incorporated by reference into this or any other report we file with or furnish to the SEC and are expressly excluded from any such form or reporting.

ITEM 1A. RISK FACTORS

Not required for smaller reporting companies.

ITEM 1B. UNRESOLVED STAFF COMMENTS.

None.

ITEM 1C. CYBERSECURITY.

Risk Management

The Company has designed and implemented processes to identify, address and mitigate risks from cybersecurity threats. Our current processes, which are subject to change as best practices evolve, include:

| | (I) | maintenance of cyber security certifications (such as Cyber Essential Plus). The Cyber essential scheme is a certification scheme designed to show that an organization has a minimum level of protection in cyber security through annual assessments to maintain the certification. This certification is issued by third party service providers who review annually the Company’s security controls around its Information Technology Infrastructure (“ITI”) and business practices to determine the Company’s vulnerability to cyber security threats. We also implement all recommendations which may come out of the certification assessments process. |

| | | |

| | (II) | As part of our day-to-day management of our business, we perform ongoing monitoring of ITI for access violations to our IT systems, weaknesses, changes or other threats. |

| | | |

| | (III) | We actively monitor the bulletins that may be issued by National Cyber Security Bodies, which are a good source of information on current trends and methods relating to cyber-attacks. We review this information and adapt our business practices as may be prudent and feasible. |

| | | |

| | (IV) | We have established an internal cross-group committee (Cyber Security Management Committee (“CSMC”) designating the area of cyber security risk management as “business critical”. The CSMC, under the guidance of the Board of Directors, is responsible for the risk management strategy and governance of this critical business area. Under the CSMC, a formal monthly reporting on cyber security related matters has been implemented and this is provided to the Management of Company for ongoing review. The monthly reporting covers: (i) the outcome of random testing designed to identify threats, access violations and risks; (ii) compliance with the Company’s ITI access protocol; (iii) confirmation that in the reporting period that there were no cyber security incidents; (iv) the assessment and identification of any gaps in the Company’s cyber security risk management protocol; and (v) confirmation that we continue to be compliant with our cyber security certifications and no action or omission has caused this certification to be invalid. |

| | | |

| | (V) | We run monthly cybersecurity awareness training with our employees, and this is documented in our internal periodic reporting. |

Governance

Our Board of Directors holds oversight over the Company’s cyber security risk management strategy and protocols and has amongst its composition an expert on this subject who has been appointed as having the lead in this area. The Company’s internal CSMC works closely with the Board’s expert appointee. All ITI changes, proposed through the CSMC, are routed through approval processes, and testing before implementation.

Our business strategy, results of operations, and financial condition have not been materially affected by risks from cybersecurity threats, but we cannot provide assurance that they will not be materially affected in the future by such risks or any future material incidents.

ITEM 2. PROPERTIES

Orlando, Florida

Our corporate offices are co-located with our subsidiary Coda Octopus Products, Inc. in Orlando. We own these business premises comprising 3,000 square feet, that include office space, training center and light manufacturing facilities.

Salt Lake City, Utah, USA

Coda Octopus Colmek operates from its premises which comprises 16,000 square feet and includes manufacturing, R&D Facilities, and office space. These premises are owned by Coda Octopus Colmek.

Edinburgh, Scotland, UK

Coda Octopus Products Limited (Edinburgh based) operates from its premises comprising 21,313 square feet of internal space and includes office space, R&D Facilities, and manufacturing. These premises are owned by Coda Octopus Products Limited.

Copenhagen, Denmark

Coda Octopus Products A/S, a Danish Subsidiary was established as a mitigation strategy in relation to the UK leaving the European Union which has limited trade relations with EU member states. It leases business premises comprising 1,450 square feet for its operations. The lease is subject to 6 months’ notice of termination.

Annual rent is DKK 142,893 plus Value Added Tax (being an equivalent of $22,903) per annum) with an annual increase of 3%.

Portland, Dorset, UK

Martech uses premises owned by Coda Octopus Products Limited. These premises are located in the Marine Center in Portland, Dorset, United Kingdom, and comprise 9,890 square feet. The building comprises both office space and manufacturing and testing facilities. The rent paid to Coda Octopus Products Limited is $59,109 per annum.

Higher Bockhampton, Dorset, United Kingdom

Precision Acoustics Limited leases business premises comprising 6,501 square feet used for both office space, manufacturing and testing facilities. The lease is for a fixed period (with no provision for early termination) and expires on March 31, 2033. The annual rent for these premises is $58,350 per annum.

All non-US Dollar denominated rents are stated according to prevailing exchange rates as of the date of each respective lease agreement.

ITEM 3. LEGAL PROCEEDINGS.

From time to time, we may become involved in various lawsuits and legal proceedings which arise in the ordinary course of business. However, litigation is subject to inherent uncertainties, and an adverse result in these or other matters may arise from time to time that may harm our business. We are currently not aware of any such legal proceedings that we believe will have, individually or in the aggregate, a material adverse effect on our business, financial condition or operating results.

ITEM 4. MINE SAFETY DISCLOSURES.

Not Applicable.

PART II