Liquidity and Financial Condition

Though we have raised capital at the corporate level to primarily assist in the funding of acquisitions and lease fleet expenditures, as well as for general purposes, our operating units substantially fund their operations through secured bank credit facilities that require compliance with various covenants. These covenants require our operating units to, among other things; maintain certain levels of interest or fixed charge coverage, EBITDA (as defined), utilization rate and overall leverage.

Asia-Pacific Leasing Senior Credit Facility

Our operations in the Asia-Pacific area had an AUS$150,000,000 secured senior credit facility, as amended, under a common terms deed arrangement with the Australia and New Zealand Banking Group Limited (“ANZ”) and Commonwealth Bank of Australia (“CBA”) (the “ANZ/CBA Credit Facility”). On October 26, 2017, RWH and its subsidiaries, Deutsche Bank AG, Sydney Branch (“Deutsche Bank”), CSL Fund (PB) Lux Sarl II, Aiguilles Rouges Lux Sarl II, Perpetual Corporate Trust Limited and P.T. Limited entered into a Syndicated Facility Agreement (the “Syndicated Facility Agreement”). Pursuant to the Syndicated Facility Agreement, the parties entered into a three-year, $92,637,500 (AUS$125,000,000) senior secured credit facility (the “Deutsche Bank Credit Facility”) and repaid the ANZ/CBA Credit Facility on November 3, 2017. The Deutsche Bank Credit Facility initially consisted of a $14,822,000 (AUS$20,000,000) Facility A that will amortize semi-annually; a $62,993,500 (AUS$85,000,000) Facility B that has no scheduled amortization; and a $14,822,000 (AUS$20,000,000) revolving Facility C that is used for working capital, capital expenditures and general corporate purposes. On June 25, 2018, RWH and its subsidiaries amended the Deutsche Bank Credit Facility to increase by approximately $6,784,700 (NZ$10,000,000) the amount that can be borrowed under Facility B. The Deutsche Bank Credit Facility is secured by substantially all of the assets and by the pledge of all the capital stock of the subsidiaries of RWH and matures on November 3, 2020.

Bison Capital Notes

On September 19, 2017, Bison Capital, GFN, GFN U.S., GFNAPH and GFNAPF, entered into that certain Amended and Restated Securities Purchase Agreement dated September 19, 2017 (the “Amended Securities Purchase Agreement”). On September 25, 2017, pursuant to the Amended Securities Purchase Agreement, GFNAPH and GFNAPF issued and sold to Bison an 11.9% secured senior convertible promissory note dated September 25, 2017 in the original principal amount of $26,000,000 (the “Convertible Note”) and an 11.9% secured senior promissory note dated September 25, 2017 in the original principal amount of $54,000,000 (the “Senior Term Note” and collectively with the Convertible Note, the “Bison Capital Notes”). Net proceeds from the sale of the Bison Capital Notes were used to repay in full all principal, interest and other amounts due under the term loan to Credit Suisse (see Note 5 of Notes to Consolidated Financial Statements), to acquire the 49,188,526 publicly-traded shares of RWH not owned by the Company (see Note 4 of Notes to consolidated Financial Statements) and to pay all related fees and expenses. The Bison Capital Notes have a maturity of five years and are secured by a first priority security interest over all of the assets of GFN U.S., GFNAPH and GFNAPF, by the pledge by GFN U.S. of the capital stock of GFNAPH and GFNAPF and by of all of the capital stock of RWH.

North America Senior Credit Facility

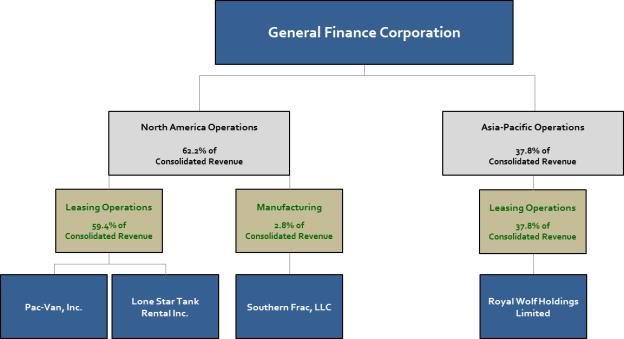

Our North America leasing(Pac-Van and Lone Star) and manufacturing operations (Southern Frac) have a combined $237,000,000 senior secured revolving credit facility, as amended, with a syndicate led by Wells Fargo Bank, National Association (“Wells Fargo”) that also includes East West Bank, CIT Bank, N.A., the Canadian Imperial Bank of Commerce (“CIBC”), KeyBank, National Association, Bank Hapoalim B.M. and Associated Bank, N.A. (the “Wells Fargo Credit Facility”). The Wells Fargo Credit Facility matures on March 24, 2022, assuming our publicly-traded senior notes due July 31, 2021(see below) are extended at least 90 days past this scheduled maturity date; otherwise the Wells Fargo Credit Facility would mature on March 24, 2021. There is also a separate loan agreement with Great American Capital Partners (“GACP”), where GACP provided a First In Last Out Term Loan (”FILO Term Loan”) within the Wells Fargo Credit Facility in the amount of $20,000,000, and inclusive in the $237,000,000 total amount.

The Wells Fargo Credit Facility is secured by substantially all of the rental fleet, inventory and other assets of our North American leasing and manufacturing operations. The FILO Term Loan also contains a first priority lien on the same collateral, but on a “last out basis,” after all of the outstanding obligations to the primary lenders in the Wells Fargo Credit Facility have been satisfied. The Wells Fargo Credit Facility effectively not only finances our North American operations, but also the funding requirements for the Series C Preferred Stock and the publicly-traded unsecured senior notes (see below). The maximum amount of intercompany dividends thatPac-Van and Lone Star are allowed to pay in each fiscal year to GFN for the funding requirements of GFN’s senior and other debt and the Series C Preferred Stock are (a) the lesser of $5,000,000 for the Series C Preferred Stock or the amount equal to the dividend rate of the Series C Preferred Stock and its aggregate liquidation preference and the actual amount of dividends required to be paid to the Series C Preferred Stock; and (b) $6,300,000 for the public offering of unsecured senior notes or the actual amount

II-13