As Filed with the Securities and Exchange Commission on February 23, 2021

Registration No. 333-252454

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 1

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

CANNABICS PHARMACEUTICALS LTD.

(Exact name of registrant as specified in its charter)

| Nevada | 20-3373669 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification Number) |

# 3 Bethesda Metro Center, Suite 700

Bethesda, MD 20814

(877) 424-2429

(Address, including zip code, and telephone number, including area code,

of registrant’s principal executive offices)

Law Offices of David E. Price

# 3 Bethesda Metro Center, Suite 700

Bethesda, MD 20814

(202) 536-5191

(Address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

SRK Law Offices

7 Oppenheimer St.

Rabin Science Park

Rehovot, Israel

Telephone No.: (011) (972) 8-936-0999

Facsimile No.: (011) (972) 8-936-6000

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box. o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o | Accelerated filer o |

| Non-accelerated filer o | Smaller reporting company x |

| Emerging growth company o |

CALCULATION OF REGISTRATION FEE

Title of each class of securities to be registered | Amount to be registered (1) | Proposed maximum offering price per share (2) | Proposed maximum aggregate offering price (2) | Amount of registration fee | |||||||||

| Common stock, par value $0.0001 per share | 20,777,779 | $0.395 | $8,207,223 | $895.41 | |||||||||

| (1) | The amount is comprised of (i) 15,277,779 shares of the registrant’s common stock which represent 300% of the shares issuable upon the conversion of convertible notes in the aggregate amount of $1,375,000 at an exercise price of $0.27, and (ii) 5,500,000 shares of the registrant’s common stock issuable upon the exercise of a warrant. The convertible notes and warrant are held by the selling stockholder named in the prospectus contained herein and any supplements thereto. The registrant is not selling any shares of common stock in this offering and therefore will not receive any proceeds from this offering. Pursuant to Rule 416 under the Securities Act of 1933, as amended (the “Securities Act”), there is also being registered hereby such indeterminate number of shares of the registrant’s common stock as may be issued or issuable with respect to the shares being registered hereunder to prevent dilution by reason of any stock dividend, stock split, recapitalization, or other similar transaction. |

| (2) | Estimated solely for the purpose of calculating the amount of the registration fee pursuant to Rule 457(c) of the Securities Act. The proposed maximum offering price per share and proposed maximum aggregate offering price are based upon the average of the high ($0.45) and low ($0.34) sales prices of the registrant’s common stock on February 12, 2021, as reported on the OTCQB. It is not known how many shares will be sold under this registration statement nor at what price or prices such shares will be sold.

|

| (3) | Calculated pursuant to Rule 457(o) based on an estimate of the proposed maximum aggregate offering price. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. The selling stockholder may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and we and the selling stockholder are not soliciting offers to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED _________________, 2021

PROSPECTUS

CANNABICS PHARMACEUTICALS, INC.

20,777,779 SHARES

COMMON STOCK

This prospectus relates to the resale by the selling stockholder named in this prospectus of up to (i) 15,279,779 shares of our common stock, $0.0001 par value per share (“Common Stock”) which represent 300% of the shares issuable upon the conversion of convertible notes in the aggregate amount of $1,375,000 (the “Notes”) at an exercise price of $0.27, and (ii) 5,500,000 shares of Common Stock issuable upon the exercise of a warrant (“Warrant”), acquired by the selling stockholder in a private placement transaction (the shares issuable upon conversion of the Notes and upon exercise of the Warrant, together with the Pre-Delivery Shares, the “Shares”).

The selling stockholder is the holder named in the table under the section entitled “Selling Stockholder” beginning on page 37 of this prospectus or named in a supplement to this prospectus. The description of the issuances of the securities to the Selling Stockholder is set forth below in the section entitled “Prospectus Summary” beginning on page 1 of this prospectus, where the private placement is described.

The selling stockholder may sell the Shares directly, or through underwriters, agents, brokers, or dealers designated from time to time, on terms to be determined at the time of sale. Underwriters, agents, brokers or dealers may receive discounts, commissions, or concessions from the selling stockholders, from the purchasers in connection with sales of the Shares, or from both. The prices at which the selling stockholder may sell the Shares will be determined by the prevailing market price for the Shares or in negotiated transactions. Additional information relating to the distribution of the Shares by the selling stockholder is set forth below in the section entitled “Plan of Distribution.” If underwriters or dealers are involved in the sale of any securities offered by this prospectus, their names, and any applicable purchase price, fee, commission or discount arrangement between or among them, will be set forth, or will be calculable from the information set forth, in a supplement to this prospectus.

We will not receive any of the proceeds from the sale of the Shares by the selling stockholder, although we may receive proceeds from the exercise of the Warrant for shares of our Common Stock. We are registering the Shares on behalf of the selling stockholder, and we will bear the cost of the registration of these Shares.

Our Common Stock is quoted on the OTC Markets OTCQB (“OTCQB”) under the symbol “CNBX.” On February 12, 2021, the last sale of our Common Stock as reported on the OTCQB was $0.38 per share.

Investing in our common stock involves substantial risks. See the section entitled “Risk Factors” beginning on page 10 for a discussion of information and factors that should be considered before investing in our securities.

Neither the Securities and Exchange Commission (the “SEC”) nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is __________, 2021.

TABLE OF CONTENTS

You should rely only on the information contained or incorporated by reference in this prospectus and in any prospectus supplement hereto. We have not authorized, and the selling stockholder may not authorize, any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We are not, and the selling stockholder is not, making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus is accurate only as of the date on the front cover of this prospectus. Our business, financial condition, results of operations and prospectus may have changed since that date.

| i |

This prospectus is part of a registration statement on Form S-1 that we filed with the Securities and Exchange Commission, or SEC, on behalf of the selling stockholder, who is named in the table under the section entitled “Selling Stockholder” beginning on page 37 of this prospectus.

This prospectus provides you with a general description of the securities that the selling stockholder may offer. To the extent required, the number of shares of our Common Stock to be sold, the purchase price, the public offering price, the names of any agent or dealer, and any applicable commission or discount with respect to a particular offering by the selling stockholder may be set forth in an accompanying prospectus supplement. A prospectus supplement may also add, update, or change information contained in this prospectus. You should read both this prospectus and any prospectus supplement together with the additional information described in the section below entitled “Where You Can Find More Information.”

To the extent permitted by applicable law, rules, or regulations, we may add, update, or change the information contained in this prospectus by means of a prospectus supplement or post-effective amendments to the registration statement of which this prospectus forms a part, through filings we make with the SEC that are incorporated by reference into this prospectus or by another method as may then be permitted under applicable law, rules or regulations.

You should rely only on the information contained in this prospectus or any related prospectus supplement, including the content of all documents now or in the future incorporated by reference into the registration statement of which this prospectus forms a part.

PRIOR TO MAKING A DECISION ABOUT INVESTING IN OUR COMMON STOCK, YOU SHOULD CAREFULLY CONSIDER THE SPECIFIC RISKS CONTAINED IN THE SECTION ENTITLED “RISK FACTORS” IN THIS PROSPECTUS, AND ANY APPLICABLE PROSPECTUS SUPPLEMENT, TOGETHER WITH ALL OF THE OTHER INFORMATION CONTAINED IN THIS PROSPECTUS AND ANY PROSPECTUS SUPPLEMENT OR APPEARING IN THE REGISTRATION STATEMENT OF WHICH THIS PROSPECTUS FORMS A PART.

In this prospectus, we refer to Cannabics Pharmaceuticals, Inc. as “we,” “us,” “our,” the “Company” or “Cannabics.” References to “selling stockholder” refer to the holder of our Common Stock listed herein under “Selling Stockholder,” who may sell Shares from time to time as described in this prospectus. All trade names used in this prospectus are either our registered trademarks or trademarks of their respective holders.

| ii |

This prospectus relates to the distribution of securities of an entity that is involved in the cannabis industry. Cannabis is classified as an illegal Schedule 1 drug and illegal under the Controlled Substances Act, 21 U.S.C. § 811 (hereafter referred to as the “CSA”). On December 20, 2018, President Donald J. Trump signed into law the Agriculture Improvement Act of 2018, otherwise known as the “Farm Bill.” Prior to its passage, hemp, a member of the cannabis family, was classified as a Schedule 1 controlled substance and also was illegal under the CSA.

The Federal Agricultural Improvement Act of 2018 (the “2018 Farm Bill”) legalized hemp and cannabinoids extracted from hemp in the U.S., but such extracts remain subject to state laws and the regulation by other U.S. federal agencies, such as the Food and Drug Administration (“FDA”) and the U.S. Department of Agriculture (“USDA”). With the passage of the Farm Bill, hemp cultivation is broadly permitted. The Farm Bill explicitly allows the transfer of hemp-derived products across state lines for commercial or other purposes. It also puts no restrictions on the sale, transport, or possession of hemp-derived products, so long as those items are produced in a manner consistent with the law. The hemp plant and the marijuana plant are both part of the same cannabis genus of plant, except that hemp has not more than 0.3% dry weight content of delta-9-tetrahydrocannabinol (“THC”). The same plant, with a higher THC content, is marijuana, which is legal under certain state laws, but which is currently not legal under U.S. federal law. Despite the passage of the Farm Bill, many aspects of the cannabis industry, particularly those not defined as hemp within the Farm Bill, remain illegal under U.S. federal Law.

At this time, we do not manufacture, distribute, dispense, or possess any controlled substances, including cannabis or cannabis-based preparations, in the United States, and we are not engaged in any business that falls outside of what is permissible under the Farm Bill.

In the future, we may become involved in business activities that would fall outside of the Farm Bill, such as the research and development, growth, cultivation and/or processing of cannabis that are not covered under the Farm Bill. Currently, 33 states plus the District of Columbia and Guam, have laws and/or regulations that recognize, in one form or another, legitimate medical and adult uses for cannabis and consumer use of cannabis in connection with medical treatment or for recreational use. Many other states are considering similar legislation. Conversely, under the CSA, the policies and regulations of the federal government and its agencies are that cannabis has no medical benefit and a range of activities including cultivation and the personal use of cannabis is prohibited. Unless and until Congress amends the CSA with respect to cannabis, there is a risk that federal authorities may enforce current federal law against our licensees and distributors, who may be deemed to be producing, cultivating, dispensing and/or aiding or abetting the possession and distribution of cannabis in violation of federal law. Active enforcement of the current CSA on cannabis may thus directly and adversely affect our potential revenues and profits. The risk of strict enforcement of the CSA in light of Congressional activity, judicial holdings, and stated federal policy remains uncertain. See the sections entitled “Risk Factors” and “U.S. Government Regulation of Cannabis.”

| iii |

This summary highlights, and is qualified in its entirety by, the more detailed information and financial statements included elsewhere in this prospectus. This summary does not contain all of the information that may be important to you in making your investment decision. You should read this entire prospectus carefully, especially the “Risk Factors” section beginning on page 10 and our financial statements and the related notes appearing at the end of this prospectus, before deciding to invest in our common stock.

As used in this prospectus, unless the context otherwise requires, references to “we,” “us,” “our” the “Company” and “Cannabics” refer to Cannabics Pharmaceuticals, Inc.

Overview

The Company is a biopharmaceutical corporation specializing in the discovery, development and commercialization of novel cannabinoid-based products and innovative technologies for the treatment of cancer. We combine the power of our proprietary technologies with the expertise of our leading scientists to unlock the medicinal properties of cannabis and its diversity of bioactive compounds. We have conducted thousands of tests on biopsies and cell lines in order to identify the physiologic impact of cannabinoids on cell cycle and cell death. This scientific workflow has generated an ongoing stream of biological data through which we have accumulated in-depth knowledge of the various therapeutic effects of cannabinoids and identified cannabinoid ratios demonstrating anti-tumor potential. We believe that our cannabinoid research coupled with our proprietary technologies and intellectual property positions the Company to play an important role in the rapidly growing medical cannabis marketplace.

Our core technology is a continuously evolving bioinformatics platform that utilizes high-throughput screening technology, advanced data analytics, and proprietary methodologies to rapidly examine the physiologic impact of multiple cannabinoid compounds on tumor cells. This technology enables us to screen thousands of cannabinoid combinations weekly, generating multiple datasets on the anti-tumor properties of different cannabis cultivars, formulations and ratios. We conduct a broad range of preclinical research on cannabinoids through our bioinformatics platform, which informs the development of our product candidates.

Through our research and development activities, we are building a portfolio of intellectual property assets comprised of patents, proprietary technologies, and bioinformatics that have a variety of research, analytic and therapeutic applications.

Our business model is based on technology development and the out-licensing of our intellectual property to strategic partners and to global pharmaceutical and biotechnology companies, but always in accordance with the law of each applicable jurisdiction. Cannabics does not itself manufacture, distribute, dispense, or possess any controlled substances, including cannabis or cannabis-based preparations, in the United States.

U.S. Government Regulation of Cannabis

The United States federal government regulates drugs through the Controlled Substances Act (21 U.S.C. § 811), which places controlled substances, including cannabis, in a schedule. Cannabis is classified as a Schedule I drug, which is viewed as highly addictive and having no medical value. The United States Federal Drug Administration has not approved the sale of cannabis for any medical application. Doctors may not prescribe cannabis for medical use under federal law; however, they can recommend its use under the First Amendment. In 2010, the United States Veterans Affairs Department clarified that veterans using medicinal cannabis will not be denied services or other medications that are denied to those using illegal drugs.

As of October 23, 2019, 33 states, the District of Columbia and Guam have laws legalized cannabis in some form for either medicinal or recreational use governed by state specific laws and regulations.

| 1 |

These state laws are in conflict with the federal Controlled Substances Act, which makes cannabis use and possession illegal on a national level. However, on August 29, 2013, the U.S. Department of Justice issued a memorandum providing that where states and local governments enact laws authorizing cannabis-related use, and implement strong and effective regulatory and enforcement systems, the federal government will rely upon states and local enforcement agencies to address cannabis activity through the enforcement of their own state and local narcotics laws. The memorandum further stated that the U.S Justice Department’s limited investigative and prosecutorial resources will be focused on eight priorities to prevent unintended consequences of the state laws, including distribution of cannabis to minors, preventing the distribution of cannabis from states where it is legal to states where it is not, and preventing money laundering, violence and drugged driving.

On December 11, 2014, the U.S. Department of Justice issued another memorandum with regard to its position and enforcement protocol with regard to Indian Country, stating that the eight priorities in the previous federal memo would guide the United States Attorneys' cannabis enforcement efforts in Indian Country. On December 16, 2014, as a component of the federal spending bill, the Obama administration enacted regulations that prohibits the Department of Justice from using funds to prosecute state-based legal medical cannabis programs.

On January 4, 2018, Attorney General Jeff Sessions issued a memorandum for all United States Attorneys concerning cannabis enforcement. Mr. Sessions rescinded all previous prosecutorial guidance issued by the Department of Justice regarding cannabis, including the August 29, 2013 memorandum. Mr. Sessions stated that U.S. Attorneys must decide whether or not to pursue prosecution of cannabis activity based upon factors including: the seriousness of the crime, the deterrent effect of criminal prosecution, and the cumulative impact of particular crimes on the community. Mr. Sessions reiterated that the cultivation, distribution and possession of cannabis continues to be a crime under the U.S. Controlled Substances Act.

U.S. Government Regulation of Hemp

On December 20, 2018, President Donald J. Trump signed into law the Agriculture Improvement Act of 2018, otherwise known as the “Farm Bill”. Prior to its passage, hemp, a member of the cannabis family, was classified as a Schedule 1 controlled substance, and so illegal under the Controlled Substances Act. The hemp plant and the marijuana plant are both part of the same cannabis genus of plant, except that hemp has not more than 0.3% dry weight content of delta-9-tetrahydrocannabinol (“THC”). The same plant, with a higher THC content, is marijuana, which is legal under certain state laws, but which is currently not legal under U.S. federal law.

With the passage of the Farm Bill, hemp cultivation is broadly permitted. The Farm Bill explicitly allows the transfer of hemp-derived products across state lines for commercial or other purposes. It also puts no restrictions on the sale, transport, or possession of hemp-derived products, so long as those items are produced in a manner consistent with the law.

Additionally, there will be significant, shared state-federal regulatory power over hemp cultivation and production. Under Section 10113 of the Farm Bill, state departments of agriculture must consult with the state’s governor and chief law enforcement officer to devise a plan that must be submitted to the United States Department of Agriculture (“USDA”). A state’s plan to license and regulate hemp can only commence once the USDA approves that state’s plan. In states opting not to devise a hemp regulatory program, USDA will construct a regulatory program under which hemp cultivators in those states must apply for licenses and comply with a federally run program. This system of shared regulatory programming is similar to options states had in other policy areas such as health insurance marketplaces under Affordable Care Act, or workplace safety plans under Occupational Health and Safety Act—both of which had federally-run systems for states opting not to set up their own systems.

The Farm Bill outlines actions that are considered violations of federal hemp law (including such activities as cultivating without a license or producing hemp with more than 0.3 percent THC, the psychoactive agent in cannabis).

| 2 |

The 2018 Farm Bill extends the protections for hemp research and the conditions under which such research can and should be conducted. Further, Section 7501 of the Farm Bill extends hemp research by including hemp under the Critical Agricultural Materials Act. This provision recognizes the importance, diversity, and opportunity of the plant and the products that can be derived from it, but also recognizes that there is a still a lot to learn about hemp and its products from commercial and market perspectives.

About this Prospectus

This prospectus relates to the resale by the selling stockholder of up to 20,777,779 Shares, which are comprised of 15,277,779 shares of our Common Stock which represent 300% of the shares issuable upon the conversion of the Notes and 5,500,000 shares of our Common Stock issuable upon the exercise of the Warrant. An initial Note in the amount of $825,000 (the “Initial Note”) and the Warrant were issued at the initial closing of a private placement transaction held on December 21, 2020, pursuant to a Securities Purchase Agreement entered into with us on December 16, 2020 (the “Private Placement”). A second Note in the amount of $550,000 was issued on February 22, 2021 (the “Second Note”). The number of Shares being registered pursuant to this registration statement is based on a good faith estimate of the number of shares issuable to the selling stockholder predicated on the following facts and assumptions:

| Face value of the Initial Note and the Second Note: | $1,375,000 |

| Per share market price as of February 12, 2021: | $0.38 |

| Per share conversion price as of February 12, 2021: | $0.27 |

| Total number of shares underlying the Initial Note and the Second Note: | 5,092,593 |

| 300% of the number of shares issuable upon conversion: | 15,277,779 |

| Number of shares issuable upon exercise of the Warrant: | 5,500,000 |

| Total number of shares being registered: | 20,777,779 |

The conversion price for the Notes is equal to the lower of (a) $0.35 per share or (b) eighty percent (80%) of the average of the two lowest daily volume-weighted average price for the Company’s Common Stock during the ten (10) consecutive trading days preceding the conversion date.

The Private Placement

On December 16, 2020, we entered into a securities purchase agreement with an institutional investor to sell a new series of senior secured convertible notes in a three tranche private placement to the investor, with an aggregate principal amount of $2,750,000 having an aggregate original issue discount of 10%, and ranking senior to all outstanding and future indebtedness. Pursuant to the securities purchase agreement, one note (the “Initial Note”) in an aggregate original principal amount of $825,000 was issued to the investor in the first tranche closing on December 21, 2020. On February 22, 2021, we entered into an amendment and restated securities purchase agreement pursuant to which a second Note in an aggregate principal amount of $550,000 was issued (the “Second Note”). Both Notes were issued in reliance upon the exemption from securities registration afforded by Section 4(a)(2) of the Securities Act of 1933, and Rule 506(b) of Regulation D as promulgated by the United States Securities and Exchange Commission under the Securities Act of 1933, together with the issuance of the warrant to acquire our common stock, as described below. The Initial Note has a face amount of $825,000 for which we received cash proceeds of $750,000. The Second Note has a face amount of $550,000 for which we received cash proceeds of $500,000. Subject to the satisfaction of customary closing and equity conditions, at any time prior to December 31, 2021 (or such later date as the parties shall mutually agree), we have the right to require an additional closing of an additional note in the aggregate principal amount of $1,375,000 (the “Additional Note”, and together with the Initial Note and the Second Note, the “Notes”) on the twentieth trading day after the date this registration statement is declared effective by the Securities and Exchange Commission. The Convertible Notes are being sold with an original issue discount of 10% and do not bear interest except upon the occurrence of an event of default.

Our Business

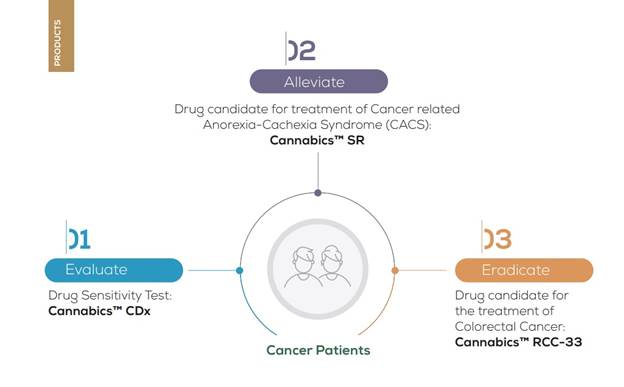

We are a biopharmaceutical company that focuses on the discovery, development, and commercialization of innovative cannabinoid-based products and services for the treatment of cancer. We have developed a proprietary cannabinoid bioinformatics platform that we believe enables us to unlock the medicinal properties of cannabis and its diverse bioactive compounds to create personalized natural therapeutics that may be tailored to specific cancers and the genetics of individual patients for improved clinical outcomes.

The Company’s main focus is the development and marketing of various new and innovative anti-cancer and palliative products, therapies, and biotechnological tools aimed at treating cancer and providing relief from diverse ailments that respond to the active ingredients sourced from the cannabis plant. These advanced tools include innovative delivery systems for cannabinoids, personalized medicine therapies and procedures based on cannabis originated compounds, and bioinformatics tools.

| 3 |

Our core technology is a continuously evolving bioinformatics platform utilizing high throughput screening technology, advanced data analytics, and proprietary methodologies to rapidly examine the physiologic impact of multiple cannabinoid compounds on tumor cells. This technology enables us to screen thousands of compounds simultaneously to measure their therapeutic effects, generating mega-data with respect to the anti-tumor properties of different cannabis chemovars, formulations, and ratios. The data produced by our platform informs our development of novel cannabinoid preparations, drug candidates, and related technologies that may be optimized to treat cancers for which current treatment options are ineffective, costly, or cause unwanted side effects.

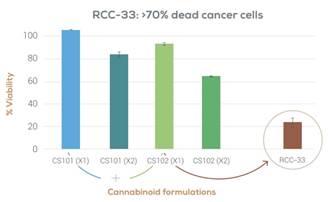

Our lead product candidate is RCC-33, an oral capsule for the treatment of colorectal cancer, or CRC. RCC-33 contains high concentrations of the cannabinoids CBDV and CBGA, which have demonstrated in our laboratory testing complex synergistic anti-tumor activity in vitro with minimal psychoactive effects. We are currently in the early planning stage of a clinical development pathway for RCC-33. We plan to conduct further preclinical studies to establish the safety and efficacy of RCC-33 in an in vivo murine model of colorectal cancer.

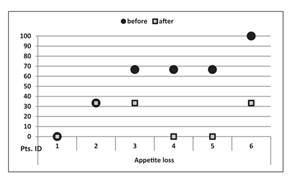

Cannabics SR is a lipid-based capsule containing a standardized formulation of cannabinoids that we are developing as a product candidate for the treatment of cancer anorexia-cachexia syndrome, or CACS. With a rapid onset of action and sustained effects for up to 6-8 hours, we believe that the convenience of once or twice daily oral dosing of Cannabics SR may improve quality of life and increase patient compliance with treatment regimens, leading to better health outcomes. A two-year pilot study of Cannabics SR led by Dr. Gil Bar-Sela of the Rambam Hospital Health Care Campus, Division of Oncology, in Haifa, Israel, demonstrated a clinically significant weight increase in CACS patients treated with Cannabics SR capsules (Source: https://www.ncbi.nlm.nih.gov/pmc/articles/PMC6785913/). In the second half of 2021, we intend to commence an additional pilot study in Israel to assess the pharmacokinetics and pharmacodynamics of Cannabics SR in humans. Data from the study will inform our clinical development plan for Cannabics SR.

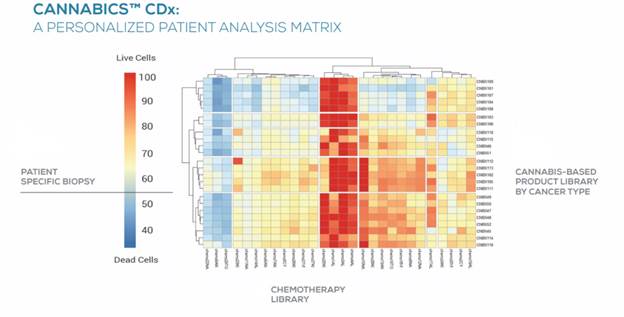

Another product candidate we are developing is Cannabics CDx, a drug sensitivity test designed to provide innovative decision support to healthcare providers interested in personalizing cannabinoid-based cancer therapies. Cannabics CDx applies data analytics and high-content drug sensitivity screening integrated with our proprietary database to measure the effectiveness of cannabinoid compounds on a patient’s biopsy, suggest preferred alternatives, and alert healthcare providers to cannabinoids that may be contraindicated. We believe that Cannabics CDx will meet a significant unmet need of the growing population of cancer patients being treated with cannabis by enabling healthcare providers to more precisely tailor cannabinoid treatments to a patient’s cancer and clinical profile. We are currently seeking strategic partners for a clinical validation study expected to commence in 2022 to assess the sensitivity and specificity of Cannabics CDx with a view towards commercializing Cannabics CDx in Europe, the United States, and other territories.

Business Strategy

Our goal is to capitalize on our pioneering work in the field of plant-derived cannabinoid therapeutics to become a leading developer of personalized cannabinoid-based medicines and diagnostics. Our business model focuses on the research and development of anti-cancer drugs by leveraging the expertise of our multiplex database to provide innovative biopharmaceutical products that offer the potential for superior efficacy and safety over existing therapies. To achieve this goal, the key elements of our strategy include:

| · | Leveraging Our Bioinformatics Platform. | |

| · | In-House Pre-Clinical Research. | |

| · | Commercialization Partnerships. | |

| · | Strategic Out-Licensing. |

| 4 |

Corporate Information

The Company was originally incorporated as Thrust Energy Corp. on September 15, 2004, under the laws of the State of Nevada, for the purpose of acquiring oil and gas exploration properties and non-operating interests. In April 2011, the Company expanded its business to include the acquisition of mineral exploration rights. On May 5, 2011, the name of the Company was changed to American Mining Corporation. On April 25, 2014, Cannabics Inc., a Delaware corporation, acquired 99.1% voting control of the Company. On June 19, 2014, the Company changed its name to Cannabics Pharmaceuticals Inc., and redirected its business focus towards its current operations.

All of our research and development in Israel is conducted by our wholly-owned subsidiary, G.R.I.N. Ultra Ltd., which was incorporated under the laws of Israel on August 25, 2014.

On November 15, 2020, we established a majority-owned subsidiary, Digestix Bioscience, Inc., incorporated under the laws of Delaware, to engage in the development of medical devices and pharmaceutical compositions for the treatment of precancerous and early-stage neoplastic local tumors, and in particular, adenomatous colorectal polyps. The other shareholders of Digestix are Professor Eitan Scapa, Dr. Erez Scapa, and Gabriel Yariv. Mr. Yariv, who currently serves as Director and COO of Cannabics, also serves as interim Chairman and CEO of Digestix. We do not have any other subsidiaries.

Our principal executive offices are located at #3 Bethesda Metro Center, Suite 700, Bethesda, Maryland, 20814, and our telephone number is (877) 424-2429. Our website address is http://www.cannabics.com. The information on, or that can be accessed through, our website is not incorporated by reference into this prospectus and should not be considered to be a part of this prospectus. We have included our website address as an inactive textual reference only. Any website references (URL’s) in this Registration Statement are inactive textual references only and are not active hyperlinks.

| 5 |

The Offering

The following is a brief summary of some of the terms of the offering and is qualified in its entirety by reference to the more detailed information appearing elsewhere in this prospectus. For a more complete description of the terms of our common stock, see “Description of Our Capital Stock – Common Stock” on page 91.

| Issuer | Cannabics Pharmaceuticals, Inc. | |

| Common Stock outstanding prior to offering | 135,237,584 shares of Common Stock (1) | |

| Common Stock to be outstanding after the offering | 156,015,363 shares of Common Stock (2) | |

| Securities offered by us | Shares issuable upon the conversion of up to $1,375,000 in original principal amount of Notes, and upon exercise of the Warrant (3) | |

| Maturity of Notes | Unless earlier converted or redeemed, the Notes will mature on the one year anniversary of the date on which they are issued. | |

| Original Issue Discount; Default Interest | The Notes will be issued with a 10% original issue discount. The Notes shall not bear interest except upon the occurrence (and during the continuance) of an event of default. After the occurrence and during the continuance of an event of default, the notes will accrue interest at the rate of 18.0% per annum. | |

| Conversion Rights | All amounts due under the Notes are convertible at any time, in whole or in part, at the option of the holders into shares of our common stock at a conversion price equal to the lower of (i) an initial conversion price of $0.35 per share, which conversion price is subject to adjustment pursuant to the terms of the Notes, or (ii) eighty percent (80%) of the average of the two lowest daily volume-weighted average price for the Company’s Common Stock during the ten (10) consecutive trading days preceding the conversion date. The conversion price is subject to customary adjustments upon an event of default or upon any stock dividend, stock split, stock combination, reclassification, or similar transaction that proportionately decreases or increases the price of our shares of common stock. | |

| Events of Default | The Notes include standard customary events of default, subject to any cure periods set forth in the Notes, where applicable.

If an event of default occurs, a holder may force us to redeem, within a specified time as further described in the Notes (regardless of whether such event of default has been timely cured), all or any portion of its note at a price equal to 125% of the greater of (i) the conversion amount being redeemed and (ii) the market value of the shares of our common stock underlying such conversion amount being redeemed, as determined in accordance with the Notes. See “Description of Notes” for additional information. |

| 6 |

| Use of proceeds | We will not receive any proceeds from the sale of the Shares offered by the selling stockholder under this prospectus. However, we will receive up to $2,750,000 in the aggregate from the selling stockholder if it exercises in full, on a cash basis, all of its unexercised Warrant. We will use such proceeds from the exercise of the Warrant for working capital and other corporate purposes. | |

| Risk Factors | You should carefully read the “Risk Factors” beginning on page 10 and the other information included in this prospectus for a discussion of factors you should consider carefully before deciding to invest in our common stock. | |

| No Listing of Notes | We do not intend to apply for listing of the notes on any securities exchange. | |

| OTCQB Symbol | “CNBX” |

_______________

(1) As of February 21, 2021. Does not include the Pre-Delivery Shares.

(2) Assumes the full conversion of the Notes held by the selling stockholder to acquire 15,277,779 shares of our Common Stock, the full exercise of the unexercised Warrant held by the selling stockholder to acquire 5,500,000 shares of our Common Stock, and that all other outstanding warrants and options are not exercised. We pre-delivered 3,913,663 shares of our Common Stock of the conversion shares under the Notes on the issuance date of the Initial Note (the “Pre-Delivery Shares”).

(3) The Initial Note in the amount of $825,000 was issued on December 21, 2020, and the Second Note in the amount of $550,000 was issued on February 22, 2021.

The selling stockholder may sell the Shares subject to this prospectus from time to time and may also decide not to sell all the Shares they are allowed to sell under this prospectus. The selling stockholder will act independently of us in making decisions with respect to the timing, manner, and size of each sale. Furthermore, the selling stockholder may effectuate such transactions by selling the securities to or through broker-dealers, and such broker-dealers may receive compensation in the form of discounts, concessions or commissions from the selling stockholder and/or the purchasers of the securities for whom such broker-dealers may act as agent or to whom they sell as principal, or both. The selling stockholder may be deemed to be an “underwriter,” as defined in the Securities Act. If any broker-dealers are used by the selling stockholder, any commissions paid to broker-dealers and, if broker-dealers purchase the selling stockholder’s securities as principals, any profits received by such broker-dealers on the resale of the selling stockholder’s securities may be deemed to be underwriting discounts or commissions under the Securities Act. In addition, any profits realized by the selling stockholder may be deemed to be underwriting commissions.

All costs, expenses and fees in connection with the registration of the selling stockholder’s securities offered by selling stockholder will be borne by us. Brokerage commission, if any, attributable to the sale of the selling stockholders’ securities will be borne by the selling stockholder. Based on information provided to us by the selling stockholder, to our knowledge, the selling stockholders does not have an existing short position in our common stock as of the date of this prospectus.

See the section entitled “Plan of Distribution” beginning on page 38.

Our common stock is quoted on the OTCQB under the symbol “CNBX.”

| 7 |

Summary Financial Data

The following tables set forth a summary of our financial data as of, and for the periods ended on, the dates indicated. We have derived the summary statement of operations data for the years ended August 31, 2020 and 2019, and balance sheet data as of August 31, 2020 and August 31, 2019, from our audited financial statements appearing at the end of this prospectus. We have derived the summary statement of operations data for the quarter ended November 30, 2020, and balance sheet data as of November 30, 2020, from our unaudited financial statements appearing at the end of this prospectus. Our historical results are not necessarily indicative of the results that should be expected in the future. You should read the following summary financial data together with our financial statements and the related notes appearing at the end of this prospectus and the “Selected Financial Data” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of this prospectus.

| November 30, | August 31, | August 31, | ||||||||||

| 2020 | 2020 | 2019 | ||||||||||

| Unaudited | Audited | Audited | ||||||||||

| ASSETS | ||||||||||||

| Current assets: | ||||||||||||

| Cash and cash equivalents | $ | 184,031 | $ | 777,611 | $ | 265,982 | ||||||

| Prepaid expenses and other receivables | 168,574 | 152,299 | 284,496 | |||||||||

| Held for trading Investments | – | – | 3,256,456 | |||||||||

| Current royalties | – | – | 500,000 | |||||||||

| Total current assets | 352,605 | 929,910 | 4,306,934 | |||||||||

| Available for sale Investment | 539,609 | 426,522 | 6,010,946 | |||||||||

| Long term royalties | – | – | 3,863,000 | |||||||||

| Equipment, net | 806,317 | 862,879 | 1,002,286 | |||||||||

| Total assets | $ | 1,698,531 | $ | 2,219,311 | $ | 15,183,166 | ||||||

| LIABILITIES AND STOCKHOLDERS' EQUITY | ||||||||||||

| Current liabilities: | ||||||||||||

| Accounts payable and accrued liabilities | $ | 219,042 | $ | 231,141 | $ | 215,229 | ||||||

| Due to a related party | 223,645 | 223,645 | 223,645 | |||||||||

| Total current liabilities | 442,687 | 454,786 | 438,874 | |||||||||

| Stockholders' equity (deficit): | ||||||||||||

| Preferred stock, $.0001 par value, 5,000,000 shares authorized no shares issued and outstanding. | – | – | – | |||||||||

| Common stock, $.0001 par value, 900,000,000 shares authorized, 135,237,584, 135,080,441 and 134,498,775 shares issued and outstanding at November 30, 2020, August 31, 2020 and August 31, 2019 respectively. | 13,524 | 13,508 | 13,450 | |||||||||

| Additional paid-in capital | 15,405,295 | 15,372,311 | 15,300,250 | |||||||||

| issuance of warrants | 2,784,387 | 2,784,387 | 2,784,387 | |||||||||

| Other comprehensive income | (2,661,324 | ) | (2,774,411 | ) | 2,810,013 | |||||||

| Accumulated deficit | (14,286,038 | ) | (13,631,271 | ) | (6,163,807 | ) | ||||||

| Total stockholders' equity (deficit) | 1,255,844 | 1,764,524 | 14,744,292 | |||||||||

| Total liabilities and stockholders' equity | $ | 1,698,531 | $ | 2,219,311 | $ | 15,183,166 | ||||||

| 8 |

Balance Sheet Data

Quarter Ended November 30, 2020 | Year Ended August 31, 2020 | Year Ended August 31, 2019 | ||||||||||

| Unaudited | Audited | Audited | ||||||||||

| Cash and cash equivalents | $ | 184,031 | $ | 777,611 | $ | 265,982 | ||||||

| Working capital (deficit) | $ | (90,082 | ) | $ | 475,123 | $ | 3,868,060 | |||||

| Total assets | $ | 1,698,531 | $ | 2,219,311 | $ | 15,183,166 | ||||||

| Total current liabilities | $ | 442,687 | $ | 454,787 | $ | 438,874 | ||||||

| Total long-term liabilities | $ | – | $ | – | $ | – | ||||||

| Shareholders’ equity | $ | 1,255,844 | $ | 1,764,524 | $ | 14,744,292 | ||||||

| Number of Ordinary Shares outstanding | 135,237,584 | 135,080,441 | 134,498,775 | |||||||||

| 9 |

An investment in our common stock involves a high degree of risk. Before investing in our common stock, you should consider carefully the specific risks and uncertainties detailed in this “Risk Factors” section, together with all of the other information contained in this prospectus. If any of these risks occurs, our business, results of operations and financial condition could be harmed, the price of our common stock could decline, and you may lose all or part of your investment. This prospectus also contains forward-looking statements that involve risks and uncertainties. See “Cautionary Statement Regarding Forward-Looking Statements.” Our actual results could differ materially and adversely from those anticipated in these forward-looking statements as a result of certain factors, including those set forth below.

Risks Related to Our Company and Business

1. Our independent auditors have expressed substantial doubt about our ability to continue operating as a going concern, which could prevent us from obtaining new financing on reasonable terms or at all.

Our independent registered public accountants have expressed substantial doubt about our ability to continue as a going concern. This opinion could materially limit our ability to raise additional funds by issuing new debt or equity securities or otherwise. If we fail to raise sufficient capital when needed, we will not be able to complete our proposed business. As a result we may have to liquidate our business and investors may lose their investments. Our ability to continue as a going concern is dependent upon our ability to successfully accomplish our plan of operations described in this prospectus, obtain financing and eventually attain profitable operations. Investors should consider our independent registered public accountant’s comments when deciding whether to invest in the Company.

2. We have not generated any significant revenue since our inception and we may never achieve profitability.

We are an early stage biotechnology company and have not generated any significant revenue since we commenced our present operations in April 2014. At the present time, Cannabics SR is the only product that we have commercialized. To date, we have financed our operations primarily through private placements of common stock, warrants, and direct equity investments. As we continue our research and development of cannabinoid-based treatments, our expenses are expected to increase significantly. Accordingly, we will need to generate significant revenue to achieve profitability. Even as we begin to commercialize our technologies, we expect our losses to continue as a result of ongoing research and development expenses. These losses, among other things, have had and will continue to have an adverse effect on our working capital, total assets and stockholders’ equity. Because of the numerous risks and uncertainties associated with product development and commercialization efforts, we are unable to predict at what stage the Company will become profitable. We may never become profitable. Even if we do achieve profitability, we may not be able to sustain or increase profitability on a quarterly or annual basis. If we are unable to achieve and then maintain profitability, our business, financial condition and results of operations will be negatively affected and the market value of our common stock will decline.

3. Since we have a limited operating history in our business, it is difficult for potential investors to evaluate our business.

We commenced operations as a biotechnology company in April 2014, and therefore have a relatively short operating history upon which an evaluation of our future success or failure can objectively be made. Our business is a highly speculative undertaking and involves a substantial degree of risk. We have not demonstrated an ability to successfully overcome many of the risks and uncertainties frequently encountered by early-stage companies in new and rapidly evolving competitive fields, including under-capitalization, cash shortages, limitations with respect to personnel, financial, and other resources and lack of revenue. The likelihood of our success must be considered in light of the early stage of our operations. There is no assurance that our business will ever be successful or that we will be able to attain profitability. Any failure by the Company to report profits may adversely affect the price of our common stock.

| 10 |

4. We will need to raise additional capital to meet our business requirements in the future, which may be costly or difficult to obtain and could dilute our stockholders’ ownership interests.

The Company has not yet generated significant revenue and will require additional capital to continue its research and development activities, conduct clinical trials, commercialize its products and otherwise fund its operations. Our ability to secure required financing will depend in part upon investor perception of our ability to create a successful business. Capital market conditions and other factors beyond our control may also play important roles in our ability to raise capital. There can be no assurance that debt or equity financing will be available or sufficient for our requirements or for other corporate purposes, or if debt or equity financing is available, that it will be on terms acceptable to us. Moreover, future activities may require us to alter our capitalization significantly. Our inability to access sufficient capital for our operations could have a material adverse effect on our financial condition, results of operations and prospects. If we are unable to obtain additional funding as needed, we may be required to reduce the scope of our research and development activities, which could harm our business plan, financial condition and operating results, or we may be required to cease our operations entirely, in which case, our investors will lose all of their investment.

Any additional capital raised through the sale of equity or equity-backed securities may dilute our stockholders’ ownership percentages and could also result in a decrease in the market value of our equity securities. The terms of any securities issued by us in future capital transactions may be more favorable to new investors, and may include preferences, superior voting rights and the issuance of warrants or other derivative securities, which may have a further dilutive effect on the holders of our securities then outstanding. Any debt financing secured in the future could involve restrictive covenants relating to capital raising activities and other financial and operational matters, which may make it more difficult for us to obtain additional capital and to pursue business opportunities.

In addition, we may incur substantial costs in pursuing future capital financing, including investment banking fees, legal fees, accounting fees, securities law compliance fees, printing and distribution expenses and other costs. We may also be required to recognize non-cash expenses in connection with certain securities we issue, such as convertible notes and warrants, which may have an adverse impact on our financial condition.

5. We are highly dependent on the success of cannabinoid technology, and we may not be able to develop the technology, successfully obtain regulatory or marketing approval for, or successfully commercialize, our products or product candidates.

Our business is focused entirely upon the research, development and commercialization of cannabinoid-based technologies and products for the treatment of cancer. Our success is dependent upon the viability of this technology and the development of cancer therapies.

Neither we nor any other company has received regulatory approval from the United States Food and Drug Administration (the “FDA”) to market any therapeutics based on botanical cannabinoids, though the FDA has approved two drugs that contain a synthetic substance that acts similarly to cannabis compounds but is not present in the cannabis plant.

The scientific evidence underlying the feasibility of developing cannabinoid-based technologies for the treatment of cancer is both preliminary and limited. In 2017, an ad hoc committee of the National Academies of Sciences, Engineering, and Medicine determined that while there is conclusive or substantial evidence that oral cannabinoids are effective antiemetics in the treatment of chemotherapy-induced nausea and vomiting, there was insufficient evidence to make any statement about the efficacy of cannabinoids as a treatment for cancer. The ad hoc committee went on to state that further clinical research into the anti-cancer effects of cannabinoids needs to be conducted.

If our cannabinoid technology is found to be ineffective or unsafe in humans, or if it never receives regulatory approval for commercialization, we may never be able bring our product candidates to market and may never become profitable. Further, our current business strategy, including all of our research and development, is focused on utilizing cannabinoid technology to treat cancer. This lack of diversification increases the risk associated with the ownership of our common stock. If we are unsuccessful in developing and commercializing our cannabinoid-based technology and its application to the treatment of cancer, we may be required to alter our scope and direction and steer away from the intellectual property we have developed as well as the core capabilities of our management team and advisory board. Without successful commercialization of our products and product candidates, we may never become profitable, which would have a material adverse effect on our business, results of operations and financial condition.

| 11 |

6. Our success depends upon our ability to retain our senior management and our ability to attract, retain and motivate other qualified personnel.

We are an early stage biopharmaceutical company. As of the date of this prospectus, we had nine employees and several consultants. Our success materially depends upon the efforts of our management and other key personnel, including but not limited to Dr. Eyal Ballan, our Chief Technology Officer. If we lose the services of Dr. Ballan or any other executive officers or significant employees, our business would likely be materially and adversely affected. At this time, we do not currently have “key man” life insurance for Dr. Ballan or any other executive officer.

Because of the specialized scientific and managerial nature of our business, we rely heavily on our ability to attract and retain qualified scientific, technical and managerial personnel. The competition for qualified personnel in the biotechnology industry is intense. Due to this intense competition, we may be unable to continue to attract and retain qualified personnel necessary for the development of our business or to recruit suitable replacement personnel. Any difficulties in obtaining and retaining qualified officers, employees and consultants could have a material adverse effect on our operations.

7. The relative lack of public company experience by our management team may put us at a competitive disadvantage.

As a company with a class of securities registered under the United States Securities Exchange Act of 1934, as amended (the “Exchange Act”), we are subject to reporting and other legal, accounting, corporate governance, and regulatory requirements imposed by the Exchange Act and rules and regulations promulgated under the Exchange Act. With the exception of our CFO, Uri Ben-Or, our management team lacks significant public company experience, which could impair our ability to comply with these legal, accounting, and regulatory requirements. Such responsibilities include complying with federal securities laws and making required disclosures on a timely basis. Our senior management may not be able to implement and effect programs and policies in an effective and timely manner that adequately respond to such increased legal and regulatory compliance and reporting requirements. Our failure to do so could lead to the imposition of fines and penalties and further result in the deterioration of our business.

8. If we are unable to enter into acceptable sales, marketing and distribution arrangements with third parties or establish sales, marketing and distribution capabilities, we may not be successful in commercializing any product candidate that we develop if and when a product candidate is approved.

We do not have any sales, marketing or distribution infrastructure and have no experience in the commercialization of biotechnology. To achieve commercial success for any product, we must develop a sales and marketing organization, outsource these functions to third parties or license our products to others.

In the United States, we intend to commercialize our products solely by licensing the right to produce and distribute them to organizations having greater resources and experience than we do. There can be no assurance that our licensing efforts will be successful, or that we will be able to license any future products on satisfactory terms, or at all. We do not presently have any other agreement or arrangement for the commercialization of our products in the United States or elsewhere.

While we generally intend to adopt a licensing model for the commercialization of our products, we may also seek one or more strategic partners for commercialization of our products outside the United States. As a result of entering into arrangements with third parties to perform sales, marketing and distribution services, our product revenue or the profitability of our product revenue may be lower, perhaps substantially lower, than if we were to directly market and sell products in those markets. Furthermore, we may be unsuccessful in entering into the necessary arrangements with third parties or may be unable to do so on terms that are favorable to us. In addition, we may have little or no control over such third parties and any of them may fail to devote the necessary resources and attention to sell and market our product candidates effectively.

| 12 |

If we do not license our products or outsource our commercialization efforts, we will be required to develop our own sales, marketing and distribution capabilities, which will require substantial resources and will be time-consuming, and could delay any product launch. Moreover, we may not be able to hire or retain a sales force that is sufficient in size or has adequate expertise in the consumer health markets that we plan to target. If we are unable to establish or retain a sales force and marketing and distribution capabilities, our operating results may be adversely affected.

If we do not successfully license our products or establish sales and marketing capabilities, either on our own or in collaboration with third parties, it is likely that we will be unable to commercialize any of our products.

9. We face intense competition, often from companies with greater resources and experience than we have, which may result in others developing or commercializing competing products before us or more successfully.

The market for cancer therapies is intensely competitive, subject to rapid change and significantly affected by new product introductions and other market activities of industry participants. Our competitors include large multinational corporations and their operating units, including GW Pharms, Abbott Laboratories Inc., Cepheid Inc., Philips, GE Healthcare, Siemens, Gen-Probe Incorporated, MDxHealth SA, EpiGenomics AG, Roche Diagnostics, Exact Sciences Corporation, Sequenom, Inc. and several others. We also compete against pharmaceutical companies, specialty pharmaceutical companies and biotechnology companies worldwide, as well as smaller and other early-stage companies. Other potential competitors include academic institutions, government agencies and other public and private research organizations that conduct research, seek patent protection and establish collaborative arrangements for research, development, manufacturing and commercialization.

Many of our competitors and potential competitors have or will have substantially greater financial, technological, managerial and research and development resources and experience than we have, and many have been engaged in the biotechnology industry for a much longer time than we have. Many of our competitors spend significantly more funds on research, development, promotion and sale of new and existing products than we do, and may therefore be able to react more quickly to new or emerging technologies, shifting market conditions and regulatory changes.

There can be no assurance that any of our current or future products and technologies will have a competitive advantage in the marketplace, or that they will remain competitive following the introduction of competing products or technologies. Our commercial opportunity could be reduced or eliminated if our competitors develop and commercialize products that are safer, more effective, more convenient or less expensive. There can be no assurance that we will be successful in the face of increasing competition from new technologies or products introduced by existing companies in the industry or by new companies entering the market.

If we are unable to compete successfully, there may be a material and adverse effect on our business, financial condition and results of operations.

10. If the marketplace does not accept the products in our development pipeline or any other products we might develop, we may be unable to generate sufficient revenue to sustain and grow our business.

Even if we are able to successfully develop and obtain regulatory approval of a product candidate, our ability to generate significant revenue will depend on the acceptance of our products by physicians and patients. Physicians, hospitals, clinical laboratories, researchers or others in the healthcare industry may not use our current or future product candidates unless they are determined to be an effective and cost-efficient means of treating cancer. Market acceptance of our current or future therapeutic products will depend on a number of factors, including the indication statement and warnings approved by regulatory authorities in the product label, continued demonstration of efficacy and safety in commercial use, physicians’ willingness to prescribe the product, reimbursement from third-party payers such as government healthcare systems and insurance companies, the price of the product, the nature of any post-approval risk management plans mandated by regulatory authorities, competition, marketing and distribution support. In addition, we will need to expend a significant amount of resources on marketing and educational efforts to create awareness of our products and to encourage their acceptance and adoption. If the market for our products does not develop sufficiently or the products are not accepted, our revenue potential will be harmed.

| 13 |

11. We do not presently have any product liability insurance coverage and there is no assurance that we will be able to obtain such insurance at an affordable price or that it will be sufficient to cover all liabilities that we may incur.

We are exposed to potential product liability risks that are inherent in the testing, manufacturing and marketing of cancer treatments, pharmaceuticals and dietary supplements. While we do not presently carry any product liability insurance coverage, we intend to obtain such insurance in amounts we believe to be commercially reasonable for our current level of activity and exposure. There is no assurance, however, that we will be able to obtain or maintain insurance coverage that will be adequate to cover our potential liabilities, or that premiums will be commercially justifiable. Furthermore, insurance that might otherwise be readily available, may be more difficult for us to find and more expensive because we work with medicinal cannabis. If we are the subject of a successful product liability claim that exceeds the limits of, or is not otherwise covered by our insurance, or if we incur such liability at a time when we are not able to obtain liability insurance, we may incur substantial charges that adversely affect our earnings and require the commitment of capital resources that might otherwise be available for the development and commercial launch of our product programs.

12. If we fail to protect our intellectual property rights, our ability to pursue the development of our technologies and products would be negatively affected.

Our success will depend in part on our ability to protect our intellectual property. This is done, in part, by obtaining patents and trademarks and then maintaining adequate protection of our technologies, tradenames and products. If we do not adequately protect our intellectual property, competitors may be able to use our technologies to produce and market products in direct competition with us and erode our competitive advantage. Some foreign countries lack rules and methods for defending intellectual property rights and do not protect proprietary rights to the same extent as the United States. Many companies have had difficulty protecting their proprietary rights in these foreign countries. We may not be able to prevent misappropriation of our proprietary rights.

We are currently seeking patent protection for several processes and finished products. However, the patent process is subject to numerous risks and uncertainties, and there can be no assurance that we will be successful in protecting our products by obtaining and defending patents. These risks and uncertainties include the following:

| · | patents that may be issued or licensed may be challenged, invalidated, or circumvented, or otherwise may not provide any competitive advantage; |

| · | our competitors, many of which have substantially greater resources than us and many of which have made significant investments in competing technologies, may seek, or may already have obtained, patents that will limit, interfere with, or eliminate our ability to make, use, and sell our products and product candidates either in the United States or in international markets; |

| · | there may be significant pressure on the United States government and other international governmental bodies to limit the scope of patent protection both inside and outside the United States for treatments that prove successful as a matter of public policy regarding worldwide health concerns; |

| · | countries other than the United States may have less restrictive patent laws than those upheld by United States courts, allowing foreign competitors the ability to exploit these laws to create, develop, and market competing products. |

| 14 |

Any patents issued to us may not provide us with meaningful protection, and third parties may challenge, circumvent or narrow them. Third parties may also independently develop products similar to our products or product candidates, duplicate our unpatented product or product candidates, and design around any patents on product candidates we may develop.

Additionally, extensive time is required for development, testing and regulatory review of product candidates. While extension of a patent term due to regulatory delays may be available, it is possible that before any of our product candidates can be commercialized, any related patent, even with an extension, may expire or remain in force for only a short period following commercialization, thereby reducing any advantages of the patent.

In addition, the United States Patent and Trademark Office (the “USPTO”), and patent offices in other jurisdictions have often required that patent applications concerning biotechnology-related inventions be limited or narrowed substantially to cover only the specific innovations exemplified in the patent application, thereby limiting the scope of protection against competitive challenges. Thus, even if we or our licensors are able to obtain patents, the patents may be substantially narrower than anticipated.

In addition to patents, we rely on a combination of trade secrets, confidentiality, nondisclosure and other contractual provisions, and security measures to protect our confidential and proprietary information. These measures may not adequately protect our trade secrets or other proprietary information. If they do not adequately protect our rights, third parties could use our technology, and we could lose any competitive advantage we may have. In addition, others may independently develop similar proprietary information or techniques or otherwise gain access to our trade secrets, which could impair any competitive advantage we may have.

13. Costly litigation may be necessary to protect our intellectual property rights and we may be subject to claims alleging the violation of the intellectual property rights of others.

We may face significant expense and liability as a result of litigation or other proceedings relating to patents and other intellectual property rights of others. If another party has also filed a patent application or been issued a patent relating to an invention or technology claimed by us in pending applications, we may be required to participate in an interference proceeding declared by the USPTO to determine priority of invention, which could result in substantial uncertainties and costs, even if the eventual outcome were favorable to us. We could also be required to participate in interference proceedings involving issued patents and pending applications of another entity. An adverse outcome in an interference proceeding could require us to cease using the technology or to license rights from prevailing third parties.

The cost to us of any patent litigation or other proceeding relating to our patents or patent applications, even if resolved in our favor, could be substantial. Our ability to enforce our patent protection could be limited by our financial resources, and may be subject to lengthy delays.

A third party might claim that we are using inventions claimed by their patents and might go to court to stop us from engaging in our normal operations and activities, such as research, development and the sale of any future products. Such lawsuits are expensive and would consume time and other resources. There is a risk that the court will decide that we are infringing the third party’s patents and will order us to stop the activities claimed by the patents, redesign our products or processes to avoid infringement or obtain licenses (which may not be available on commercially reasonable terms). In addition, there is a risk that a court will order us to pay the other party damages for having infringed their patents.

There is no guarantee that any prevailing patent owner would offer us a license so that we could continue to engage in activities claimed by the patent, or that such a license, if made available to us, could be acquired on commercially acceptable terms. In addition, third parties may, in the future, assert other intellectual property infringement claims against us with respect to our products, technologies or other matters.

| 15 |

14. Failure in our information technology or storage systems could significantly disrupt our operations and our research and development efforts, which could adversely impact our revenues, as well as our research, development and commercialization efforts.

Our ability to execute our business strategy depends, in part, on the continued and uninterrupted performance of our information technology (“IT”), systems, which support our operations and our research and development efforts, as well as our storage systems. Due to the sophisticated nature of the technology we use in our products and service offerings, we are substantially dependent on our IT systems. IT systems are vulnerable to damage from a variety of sources, including telecommunications or network failures, malicious human acts and natural disasters. Moreover, despite network security and back-up measures, some of our servers are potentially vulnerable to physical or electronic break-ins, computer viruses and similar disruptive problems. Despite the precautionary measures we have taken to prevent unanticipated problems that could affect our IT systems, sustained or repeated system failures that interrupt our ability to generate and maintain data, could adversely affect our ability to operate our business.

15. We will need to grow the size of our organization, and we may experience difficulties in managing any growth we may achieve.

As of the date of this prospectus, we have nine full-time employees. As our development and commercialization plans and strategies progress, we expect to need additional research, development, managerial, operational, sales, marketing, financial, accounting, legal and other resources. Future growth would impose significant added responsibilities on our management, which may not be able to accommodate those added responsibilities. If we fail to effectively manage our future growth, it could delay the execution of our business plan and disrupt our operations.

16. We are subject to financial reporting and other requirements that place significant demands on our resources.

We are subject to reporting and other obligations under the Securities Exchange Act of 1934, as amended, including the requirements of Section 404 of the Sarbanes-Oxley Act of 2002. Section 404 requires us to conduct an annual management assessment of the effectiveness of our internal controls over financial reporting. These reporting and other obligations place significant demands on our management, administrative, operational, internal audit and accounting resources. The costs of preparing and filing annual and quarterly reports, proxy statements and other information with the SEC and furnishing audit reports to stockholders causes our expenses to be higher than they would be if we had remained a privately-held company. The increased costs associated with operating as a public company may decrease our net income or increase our net loss, and may cause us to reduce costs in other areas of our business or increase the prices of our product to offset the effect of such increased costs. Additionally, if these requirements divert our management’s attention from other business concerns, they could have a material adverse effect on our business, financial condition and results of operations.

17. Our disclosure controls and procedures and internal controls over financial reporting were determined not to be effective for the prior fiscal year ended August 31, 2020, and may not be effective in future periods.

Effective internal controls are necessary for us to provide reasonable assurance with respect to our financial reports and to effectively prevent fraud. If we cannot provide reasonable assurance with respect to our financial reports and effectively prevent fraud, our reputation and operating results could be harmed. Pursuant to the Sarbanes-Oxley Act of 2002, we are required to furnish a report by management on internal control over financial reporting, including management’s assessment of the effectiveness of such control. Internal control over financial reporting may not prevent or detect misstatements because of its inherent limitations, including the possibility of human error, the circumvention or overriding of controls, or fraud. Therefore, even effective internal controls can provide only reasonable assurance with respect to the preparation and fair presentation of financial statements. In addition, projections of any evaluation of effectiveness of internal control over financial reporting to future periods are subject to the risk that the control may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate. If we fail to maintain the adequacy of our internal controls, including any failure to implement required new or improved controls, or if we experience difficulties in their implementation, our business and operating results could be adversely impacted, we could fail to meet our reporting obligations, and our business and stock price could be adversely affected.

| 16 |