SELLING SECURITYHOLDERS

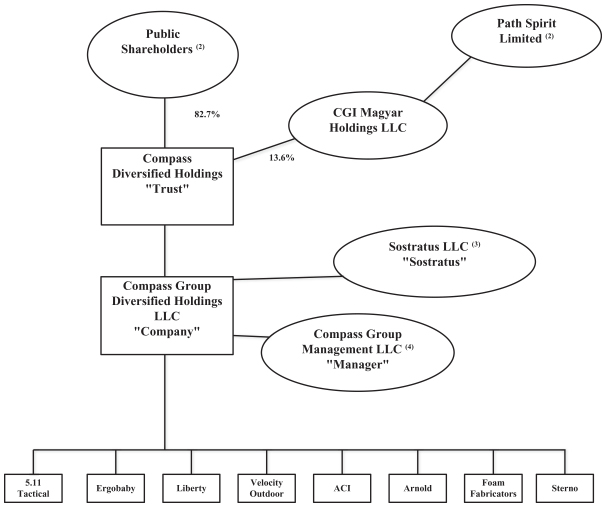

This prospectus covers (i) 7,264,333 common shares held by CGI Magyar Holdings, LLC, which is ultimately controlled by Path Spirit Limited, (ii) 1,544,000 common shares held by Concord Equity, Inc., (iii) 64,000.08 common shares held by Alan B. Offenberg, a former chief executive officer and a former director of the company and a former partner of Compass Group Management LLC, or CGM, our manager, (iv) 64,000.08 common shares held by Elias J. Sabo, the chief executive officer and a director of the company, a regular trustee of the trust and a partner of CGM, and (v) 10,666.68 common shares held by David P. Swanson, a partner of CGM. Elias J. Sabo serves as the manager of CGM. These selling securityholders acquired such common shares, directly or indirectly, in conjunction with the closing of our IPO, upon the closing of our acquisition of a controlling interest in Anodyne Medical Device, Inc., in conjunction with the closing of ourfollow-on offering in May 2007, and upon the closing of our acquisition of CamelBak Products, LLC on August 25, 2011.

Additional information about the above selling securityholders and additional selling securityholders, where applicable, including their respective beneficial ownership of our securities, the number of securities being offered and sold, and the number of securities beneficially owned after the applicable offering, will be set forth in a prospectus supplement, in a post-effective amendment, or in filings we make with the SEC under the Exchange Act which are incorporated by reference.

PLAN OF DISTRIBUTION

We and/or any selling securityholders may sell securities in any one or more of the following ways from time to time: (i) through agents; (ii) to or through underwriters; (iii) through brokers or dealers; (iv) directly by us and/or the selling securityholders to purchasers, including through a specific bidding, auction or other process; or (v) through a combination of any of these methods of sale. The applicable prospectus supplement or term sheet will contain the terms of the transaction, name or names of any underwriters, dealers, agents and the respective amounts of securities underwritten or purchased by them, the public offering price of the securities, and the applicable agent’s commission, dealer’s purchase price or underwriter’s discount. Any dealers or agents participating in the distribution of the securities may be deemed to be underwriters, and compensation received by them on resale of the securities may be deemed to be underwriting discounts.

Any initial offering price, dealer purchase price, discount or commission may be changed from time to time.

The securities may be distributed from time to time in one or more transactions, at negotiated prices, at a fixed price or fixed prices (that may be subject to change), at market prices prevailing at the time of sale, at various prices determined at the time of sale or at prices related to prevailing market prices.

Offers to purchase securities may be solicited directly by us and/or the selling securityholders or by agents designated by us or them from time to time. Any such agent may be deemed to be an underwriter, as that term is defined in the Securities Act, of the securities so offered and sold.

If underwriters are utilized in the sale of any securities in respect of which this prospectus is being delivered, such securities will be acquired by the underwriters for their own account and may be resold from time to time in one or more transactions, including negotiated transactions, at fixed public offering prices or at varying prices determined by the underwriters at the time of sale. Securities may be offered to the public either through underwriting syndicates represented by managing underwriters or directly by one or more underwriters. If any underwriter or underwriters are utilized in the sale of securities, unless otherwise indicated in the applicable prospectus supplement, the obligations of the underwriters are subject to certain conditions precedent and the underwriters will be obligated to purchase all such securities if any are purchased.

If a dealer is utilized in the sale of securities in respect of which this prospectus is delivered, we and/or the selling securityholders will sell securities to the dealer as principal. The dealer may then resell such securities to

4