solely own. In addition, this family includes a recent patent in China (CN 108883086) that was granted on October 26, 2021 and that we previously assigned to Newsoara to support our co-development agreement with Newsoara (as discussed in the section entitled “License Agreements and Collaborations”). The expected expiration date of any patents (or patents that may issue from pending applications) is 2037, excluding any adjustments or any extensions of patent term that may apply.

The Fourth Family, which we solely own, consists of a U.S. patent application with claims covering the use of LB1148 in methods of controlling glucose levels in diabetic patients in hospital and non-hospital settings. The expected expiration date of any patents that may issue from pending applications is 2038, excluding any adjustments or any extensions of patent term that may apply.

License Agreements and Collaborations

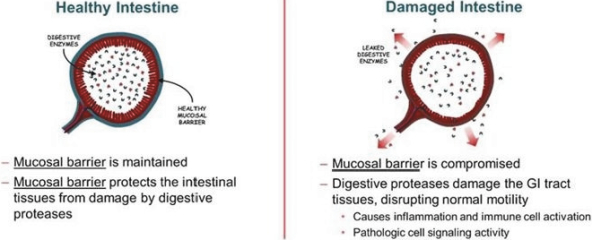

2015 License Agreement with the Regents of the University of California

In August 2015, Leading Biosciences, Inc. (“LBS”) entered into a license agreement with the Regents of the University of California (the “Regents”), as amended in December 2019 (the “2015 UC License”). Pursuant to the 2015 UC License, LBS has an exclusive, sublicensable, worldwide license under certain patent rights to make, use, sell, offer for sale and import products and practice methods covered by the claims of the licensed patent rights in the field of the direct administration of protease inhibitors to the gastrointestinal tract via a tube, as well as oral administration of protease inhibitor, for therapeutic indications including, among others, uses in surgery generally, and the treatment of shock, sepsis, inflammatory disease and post-surgical ileus and adhesions, diabetes, glucose- and insulting mediated disorders, and related metabolic disorders, damage to the gastro- intestinal tract caused by radiation damage, and other gastrointestinal tract-related disorders, including chronic conditions resulting from digestive enzyme leak. LBS utilizes these licensed patent rights in certain compositions comprising components of LB1148, including the active ingredient, tranexamic acid.

Upon the execution of the 2015 UC License, LBS paid a one-time license issue fee of $3,500 and is obligated to pay an annual license maintenance fee in the mid four-digit dollar range until such time that we are commercially selling a licensed product. LBS is also obligated to make: (i) payments up to $250,000 in the aggregate upon achievement of certain regulatory milestones and (ii) tiered royalty payments in the low single-digit percentage range on annual net sales of licensed products by LBS, its affiliates, or its sublicensees. Upon commencement of commercial sales, LBS will become subject to a minimum annual royalty in the low five-digit dollar range. Further, LBS is obligated to pay a percentage of non-royalty licensing revenue LBS receives from our sublicensees under the 2015 UC License to the Regents.

Under the 2015 UC License, LBS is required, either directly or through its affiliates, to diligently proceed with the development, manufacture, regulatory approval, and sale of licensed products and is subject to a number of diligence obligations relating to developmental, regulatory and commercialization milestones for the licensed products. For the first three years of the 2015 UC License, LBS was subject to a minimum annual spend requirement in the low six-digit dollar range. If LBS fails to meet any milestones, the Regents will have the right to either terminate the license or convert the license to a nonexclusive commercial license. Additionally, LBS is subject to certain progress and royalty reporting obligations.

The 2015 UC License will expire upon the later of the expiration date of the longest-lived patent right licensed under the 2015 UC License. The Regents may terminate the 2015 UC License if: (i) a material breach by LBS is not cured within 60 days, (ii) LBS files a claim asserting the Regents licensed patent rights are invalid or unenforceable, or (iii) LBS files for bankruptcy. LBS has the right to terminate the 2015 UC License at any time upon at least 90 days’ written notice.

2020 License Agreement with the Regents of the University of California

In April 2020, LBS entered into another license agreement with the Regents (the “2020 UC License”). Pursuant to the 2020 UC License Agreement, which extends to LBS’s affiliates, LBS has an exclusive, sublicensable,

9